Name of Investor: | |||

By: | | | |

Name: | | | |

Title: | | | |

| | | ||

Name in which Shares are to be registered (if different): | |||

Investor’s EIN: | |||

Business Address-Street: | |||

City, State, Zip: | |||

Attn: | | | |

Telephone No.: | |||

Facsimile No.: | |||

Number of Shares subscribed for: | |||

Aggregate Subscription Amount: $ | |||

Cayman Islands* | | | 6770 | | | 98-1575727 |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification Number) |

Paul T. Schnell, Esq. Gregg A. Noel, Esq. Maxim O. Mayer-Cesiano, Esq. Michael J. Schwartz, Esq. Skadden, Arps, Slate, Meagher & Flom LLP One Manhattan West New York, NY 10001 (212) 735-3000 | | | R. Scott Shean, Esq. B. Shayne Kennedy. Esq. Andrew Clark, Esq. Phillip S. Stoup, Esq. Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, CA 92626 (714) 540-1235 | | | Daniel J. Espinoza, Esq. W. Stuart Ogg, Esq. Goodwin Procter LLP 601 Marshall Street Redwood City, California 94062 (650) 752-3100 |

Large accelerated filer | | | ☐ | | | Accelerated filer | | | ☐ |

Non-accelerated filer | | | ☒ | | | Smaller reporting company | | | ☐ |

Emerging growth company | | | ☒ | | | | |

Title of each class of securities to be registered | | | Amount to be registered(1)(2) | | | Proposed maximum offering price per share security | | | Proposed maximum aggregate offering price | | | Amount of registration fee |

Common stock, $[•] par value | | | | | $ | | | $ | | | $ | |

Warrants | | | | | $ | | | $ | | | $ | |

Common stock issuable upon exercise of the warrants | | | | | — | | | — | | | — | |

Common stock | | | | | $ | | | $ | | | $ | |

Total | | | | | $ | | | $ | | |

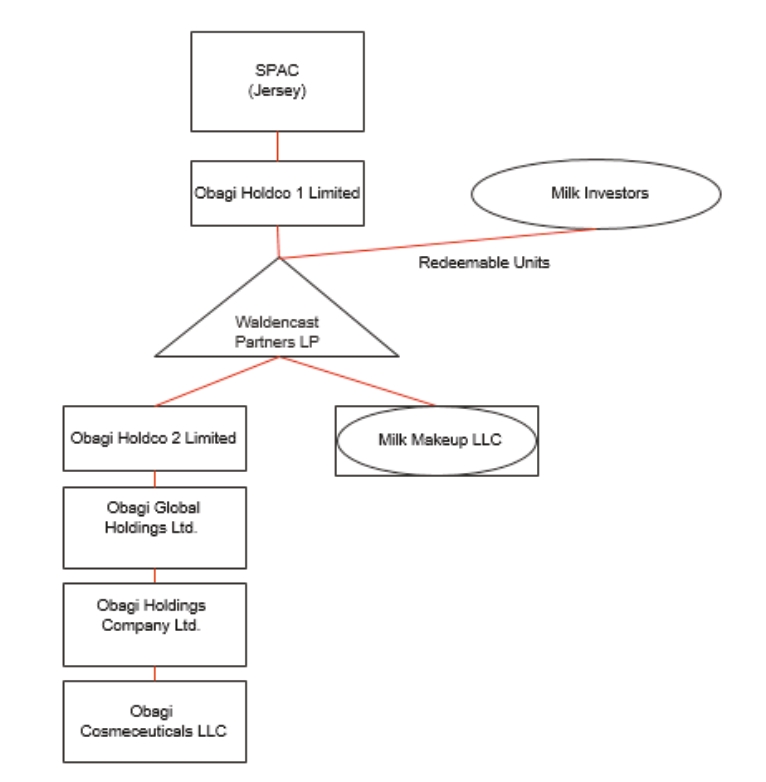

(1) | Immediately prior to the consummation of the Obagi Merger and the Milk Transaction described in the proxy statement/prospectus forming part of this registration statement (the “proxy statement/prospectus”), Waldencast Acquisition Corp., a Cayman Islands exempted company (“Waldencast”), intends to effect a deregistration under Section 206 of the Cayman Islands Companies Act (as Revised) and a domestication by way of continuance under Part 18C of the Companies (Jersey) Law 1991, pursuant to which Waldencast’s jurisdiction of incorporation will be changed from the Cayman Islands to Jersey (the “Domestication”). All securities being registered will be issued by Waldencast (after the Domestication), the continuing entity following the Domestication, which will be renamed “Waldencast plc” (“Waldencast plc”), as further described in the proxy statement/prospectus. As used herein, “Waldencast plc” refers to Waldencast after the Domestication, including after such change of name. |

(2) | Pursuant to Rule 416(a) of the Securities Act, there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

* | Prior to the consummation of the Obagi Merger and the Milk Transaction described herein, Waldencast intends to effect the Domestication. All securities being registered will be issued by the Registrant (after the Domestication), which is the continuing entity following the Domestication, which will be renamed “Waldencast plc” in connection with the Domestication described herein. |

• | Proposal No. 1(a) — The Obagi Merger Proposal — to consider and vote upon a proposal to approve by ordinary resolution and adopt the Agreement and Plan of Merger, dated as of November 15, 2021, by and among Waldencast, Merger Sub and Obagi, a copy of which is attached to this proxy statement/prospectus statement as Annex A (as may be amended from time to time, the “Obagi Merger Agreement”). The Obagi Merger Agreement provides, among other things, for the merger of Merger Sub with and into Obagi (the “Obagi Merger”), with Obagi surviving the Obagi Merger as a wholly owned subsidiary of Holdco 2 and an indirect wholly owned subsidiary of Waldencast plc, in accordance with the terms and subject to the conditions of the Obagi Merger Agreement as more fully described elsewhere in this proxy statement/prospectus (the “Obagi Merger Proposal”); |

• | Proposal No. 1(b) — The Milk Transaction Proposal — to consider and vote upon a proposal to approve by ordinary resolution and adopt the Equity Purchase Agreement, dated as of November 15, 2021, by and among Waldencast, the Milk Purchasers, Milk, the Milk Members and the Equityholder Representative, a copy of which is attached to this proxy statement/prospectus statement as Annex B (as may be amended from time to time, the “Milk Equity Purchase Agreement”). The Milk Equity Purchase Agreement provides, among other things, for the purchase of all of the issued and outstanding membership interests of Milk by the Milk Purchasers (the “Milk Transaction”), in accordance with the terms and subject to the conditions of the Milk Equity Purchase Agreement as more fully described elsewhere in this proxy statement/prospectus (the “Milk Transaction Proposal” and together with the Obagi Merger Proposal, the “BCA Proposal”); |

• | Proposal No. 2 — The Domestication Proposal — to consider and vote upon a proposal to approve by special resolution, the change of Waldencast’s jurisdiction of incorporation by deregistering as an exempted company in the Cayman Islands and continuing and domesticating as a public limited company under the laws of Jersey (the “Domestication” and, together with the Obagi Merger and Milk Transaction, the “Business Combination”) (the “Domestication Proposal”); |

• | Organizational Documents Proposals — to consider and vote upon the following four separate proposals (collectively, the “Organizational Documents Proposals”) to approve by special resolution, in the case of Organizational Documents Proposals A and D, and by ordinary resolution in the case of Organizational Documents Proposals B and C, the following material differences between Waldencast’s Amended and Restated Memorandum and Articles of Association (as may be amended from time to time, the “Cayman Constitutional Documents”) and the proposed new memorandum and articles of association (“Proposed Constitutional Document”) of Waldencast plc (a public limited company incorporated in Jersey following the Domestication), and the filing with and acceptance by the Registrar of Companies in Jersey of the Proposed Constitutional Document and accompanying documentation in accordance with Part 18C of the |

(A) | Proposal No. 3 — Organizational Documents Proposal A — to authorize the change in the authorized share capital of Waldencast from 500,000,000 Class A ordinary shares, par value $0.0001 per share (the “Waldencast Class A ordinary shares”), 50,000,000 Class B ordinary shares, par value $0.0001 per share (the “Waldencast Class B ordinary shares” and, together with the Class A ordinary shares, the “ordinary shares”), and 5,000,000 preferred shares, par value $0.0001 per share (the “Waldencast preferred shares”), to Class A ordinary shares, par value $0.0001 per share, of Waldencast plc (the “Waldencast plc Class A ordinary shares”), Class B ordinary shares, par value $0.0001 per share, of Waldencast plc (the “Waldencast plc Non-Economic ordinary shares”) and preference shares of a par value of $0.0001 per share of Waldencast plc (the “Waldencast plc preferred stock”) (“Organizational Documents Proposal A”); |

(B) | Proposal No. 4 — Organizational Documents Proposal B — to provide that the Waldencast plc Board be divided into three classes, with each class made up of, as nearly as may be possible, of one-third of the total number of directors constituting the entire Waldencast plc Board, with only one class of directors being elected in each year and each class serving a three-year term (“Organizational Documents Proposal B”); |

(C) | Proposal No. 5 — Organizational Documents Proposal C — to provide that certain provisions of the Proposed Constitutional Document will be subject to the Investor Rights Agreement, including provisions governing the appointment, removal and replacement of directors, with respect to which the Requisite Obagi Stockholder will have certain rights pursuant to the Investor Rights Agreement (“Organizational Documents Proposal C”); |

(D) | Proposal No. 6 — Organizational Documents Proposal D — to authorize all other changes in connection with the replacement of Cayman Constitutional Documents with the Proposed Constitutional Document in connection with the consummation of the Business Combination (copies of which are attached to this proxy as Annex G), including (1) changing the corporate name from “Waldencast Acquisition Corp.” to “Waldencast plc,” (2) making Waldencast plc’s existence for an unlimited duration and (3) removing certain provisions related to Waldencast plc’s status as a blank check company that will no longer be applicable upon consummation of the Business Combination, all of which Waldencast’s board of directors believes is necessary to adequately address the needs of Waldencast plc after the Business Combination (“Organizational Documents Proposal D”); |

• | Proposal No. 7 — The Director Election Proposal — to consider and vote upon a proposal to approve by ordinary resolution of the holders of Waldencast Class B ordinary shares, assuming the BCA Proposal, the Domestication Proposal and the Organizational Documents Proposals are approved, to elect nine directors who, upon consummation of the Business Combination, will be the directors of Waldencast plc (the “Director Election Proposal”); |

• | Proposal No. 8 — The Stock Issuance Proposal — to consider and vote upon a proposal to approve by ordinary resolution for purposes of complying with the applicable provisions of The Nasdaq Stock Market Listing Rule 5635, the issuance of (a) Waldencast plc Class A ordinary shares to the PIPE Investors, pursuant to the PIPE Investment and the Obagi Shareholders, pursuant to the Obagi Merger Agreement and (b) Waldencast plc Units to the Forward Purchasers, pursuant to the Forward Purchase Transaction (the “Stock Issuance Proposal”); |

• | Proposal No. 9 — The Milk Issuance Proposal – to consider and vote upon a proposal to approve by ordinary resolution the issuance of Waldencast plc Non-Economic ordinary shares and the reservation for issue of Waldencast plc Class A ordinary shares in exchange for Waldencast LP common units, in each case, to the Milk Members (the “Milk Issuance Proposal”); |

• | Proposal No. 10 — The Incentive Award Plan Proposal — to consider and vote upon a proposal to approve by ordinary resolution, the Waldencast plc 2022 Incentive Award Plan (the “Incentive Award Plan Proposal”); and |

• | Proposal No. 11 — The Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the extraordinary general meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for the approval of one or more proposals at the extraordinary general meeting (the “Adjournment Proposal”). |

(i) | (a) hold public shares, or (b) if you hold public shares through units, you elect to separate your units into the underlying public shares and public warrants prior to exercising your redemption rights with respect to the public shares; |

(ii) | submit a written request to Continental Stock Transfer & Trust Company (“Continental”), Waldencast’s transfer agent, that Waldencast plc redeem all or a portion of your public shares for cash; and |

(iii) | deliver your public shares to Continental, Waldencast’s transfer agent, physically or electronically through The Depository Trust Company (“DTC”). |

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | |

• | “affiliate” or “Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is controlled by, or is under common control with, such specified Person, whether through one or more intermediaries or otherwise. The term “control” (including the terms “controlling,” “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise; |

• | “Affiliate Agreements” means contracts (other than offer letters, employment agreements, bonus agreements, severance agreements, separation agreements, employee non-competition agreements, employee confidentiality and invention assignment agreements, non-competition agreements, separation agreements, severance agreements, or any other agreement entered into in the ordinary course or equity or incentive equity documents and Governing Documents) between Obagi and its Subsidiaries, on the one hand, and Affiliates of Obagi or any of Obagi’s Subsidiaries (other than Obagi Hong Kong, Clinactiv or any of their respective Subsidiaries), the officers and managers (or equivalents) of Obagi or any of Obagi’s Subsidiaries, the shareholders of Obagi or any of Obagi’s Subsidiaries, any employee of Obagi or any of Obagi’s Subsidiaries, a member of the immediate family of the foregoing Persons, or Obagi Hong Kong, Clinactiv or any of their respective Subsidiaries; |

• | “Aggregate Fully Diluted Milk Common Units” means, without duplication, the aggregate number of shares of Milk Common Units that are (i) issued and outstanding immediately prior to the Milk Transaction Effective Time, (ii) issuable upon the exchange of Milk Preferred Units that are outstanding immediately prior to the Milk Transaction Effective Time, (iii) issuable upon the exercise of Milk Options and Milk UARs (whether or not then vested or exercisable) that are outstanding immediately prior to the Milk Transaction Effective Time and (iv) issuable upon the exercise of the Milk Warrants that are outstanding immediately prior to the Milk Transaction Effective Time; provided that any Milk Option and Milk UAR with an exercise or strike price, as applicable, equal to or greater than the Milk Per Unit Transaction Consideration shall not be counted for purposes of determining the number of Aggregate Fully Diluted Milk Common Units; |

• | “Aggregate Fully Diluted Obagi Common Shares” means, without duplication, (a) the aggregate number of shares of Obagi Common Stock that are (i) issued and outstanding immediately prior to the Obagi Merger Effective Time, or (ii) issuable upon the exercise of Obagi Options (whether or not then vested or exercisable) that are outstanding immediately prior to the Obagi Merger Effective Time or (iii) issuable upon the settlement of Obagi RSUs (whether or not then vested) that are outstanding immediately prior to the Obagi Merger Effective Time, minus (b) any shares of Obagi Common Stock held in the treasury of Obagi as of immediately prior to the Obagi Merger Effective Time; provided that any Obagi Option with an exercise price equal to or greater than the product obtained by multiplying (A) the Obagi Exchange Ratio by (B) $10.00 (the “Obagi Per Share Merger Consideration”) shall not be counted for purposes of determining the number of Aggregate Fully Diluted Obagi Common Shares; |

• | “Aggregate Milk Option Exercise Price” means the aggregate amount that would have been received by Milk if each Milk Option outstanding immediately prior to the Milk Transaction Effective Time had been exercised as of such time; |

• | “Aggregate Milk Transaction Consideration” means the Milk Equity Consideration plus the Milk Cash Consideration plus the Waldencast plc Non-Economic ordinary shares; |

• | “Aggregate Milk UAR Strike Price” means the aggregate grant date fair market value of shares subject to the Milk UARs; |

• | “Aggregate Milk Warrant Exercise Price” means the aggregate amount that would have been received by Milk if each Milk Warrant outstanding immediately prior to the Milk Transaction Effective Time had been exercised as of such time; |

• | “Aggregate Obagi Option Exercise Price” means the aggregate amount that would have been received by Obagi if each Obagi Option outstanding immediately prior to the Obagi Merger Effective Time had been exercised as of such time; |

• | “Amended and Restated Waldencast Partners LP Agreement” means the amended and restated limited partnership agreement of Waldencast LP; |

• | “Antitrust Authorities” means the Antitrust Division of the United States Department of Justice, the United States Federal Trade Commission or the antitrust or competition Law authorities of any other jurisdiction (whether United States, foreign or multinational); |

• | “Balance Sheet Cash” means $89,000,000; |

• | “Business Combination” means the Obagi Merger, the Milk Transaction and the Domestication; |

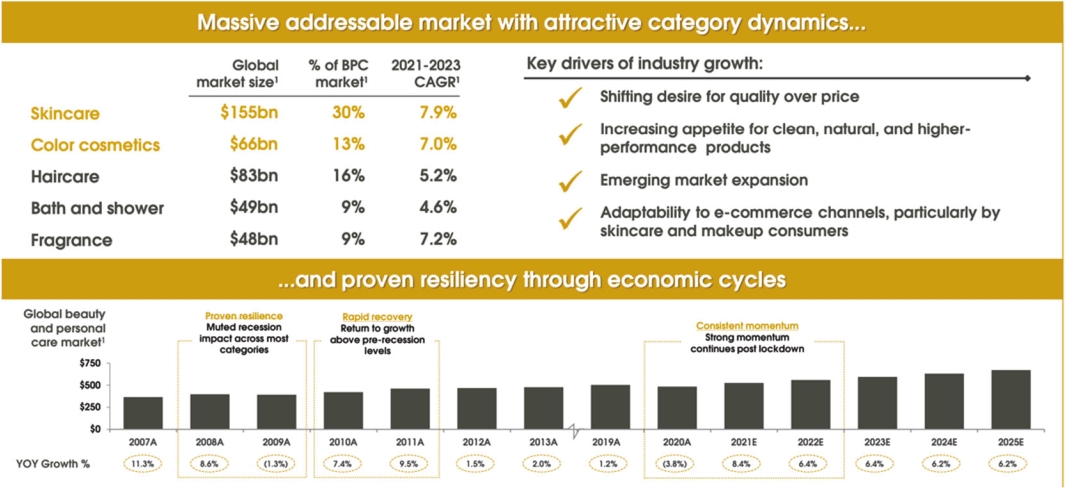

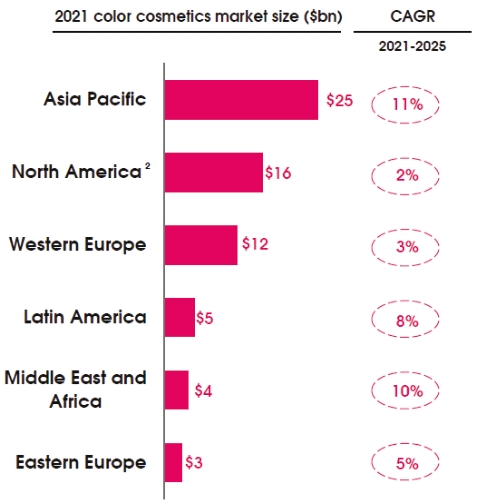

• | “CAGR” means compound annual growth rate; |

• | “Cayman Constitutional Documents” means Waldencast’s amended and restated memorandum and articles of association (as the same may be amended from time to time as permitted hereby prior to the Domestication); |

• | “Cayman Islands Companies Act” means the Cayman Islands Companies Act (As Revised); |

• | “Cayman Registrar” means the Cayman Registrar of Companies under the Companies Act (As Revised) of the Cayman Islands; |

• | “Cedarwalk” means Cedarwalk Skincare Ltd., a Cayman Islands exempted company limited by shares; |

• | “cGMP” means current good manufacturing practices; |

• | “Clinactiv” means Clinactiv Technology Limited, a Cayman Islands exempted company limited by shares; |

• | “Clinactiv Consent” means any consent required under the Obagi Existing Credit Agreement in order for Obagi to consummate the Clinactiv Distribution without causing an event of default or mandatory prepayment event occurring thereunder; |

• | “Clinactiv Distribution” means the distribution of all of the outstanding equity interests of Clinactiv to Cedarwalk in accordance with a distribution agreement in a customary form by and among Obagi, Cedarwalk and Waldencast; |

• | “Closing” means the Milk Closing and the Obagi Closing, together; |

• | “Closing Date” means the Obagi Closing Date and the Milk Closing Date, together; |

• | “Code” means the U.S. Internal Revenue Code of 1986, as amended; |

• | “Condition Precedent Proposals” means, collectively, the BCA Proposal, the Domestication Proposal, the Organizational Documents Proposals, the Director Election Proposal, the Stock Issuance Proposal, the Milk Issuance Proposal and the Incentive Award Plan Proposal; |

• | “Continental” means Continental Stock Transfer & Trust Company; |

• | “Contracts” means all legally binding contracts, agreements, arrangements or undertakings (including memorandums of understanding and letters of understanding), subcontracts, leases, licenses, subleases, deeds, commitments, mortgages, purchase orders, work orders, task orders and guaranties, in each case, whether written or oral; |

• | “COVID-19” means SARS-CoV-2 or COVID-19, and any evolutions or mutations thereof or related or associated epidemics, pandemic or disease outbreaks; |

• | “Dai Family” means Yumin Dai, Sijue (Steven) Dai, Sicong (Simon) Dai, any of their spouses, lineal descendants or ancestors, and the respective heirs, executors and controlled investment affiliates of each of the foregoing; |

• | “Distribution Agreements” means the distribution agreement between Obagi Holdings and Obagi, and the distribution agreement between Obagi and the Requisite Obagi Stockholder, in each case, pursuant to the Obagi China Distribution; |

• | “Dollars” or “$” means lawful money of the United States; |

• | “Domestication” means the domestication by way of continuance of Waldencast as a Jersey public limited company and deregistration in the Cayman Islands in accordance with Part 18C of the Jersey Companies Law and the Cayman Islands Companies Act; |

• | “DTC” means The Depository Trust Company; |

• | “Equityholder Representative” means Shareholder Representative Services LLC, a Colorado limited liability company; |

• | “Exchange Act” means the Securities Exchange Act of 1934, as amended; |

• | “Financing Expenses” has the meaning specified in the definition of Waldencast Transaction Expenses; |

• | “Forward Purchaser” means each of Burwell Mountain Trust, Dynamo Master Fund, and the Third-Party FPA Investor; |

• | “Forward Purchase Agreements” means the Third-Party Forward Purchase Agreement and the Sponsor Forward Purchase Agreement, together; |

• | “Forward Purchase Amount” means the Sponsor Forward Purchase Investment Amount and the Third-Party Forward Purchase Investment Amount; |

• | “Forward Purchase Transaction” means the transactions pursuant to the Third-Party Forward Purchase Agreement and the Sponsor Forward Purchase Agreement, together; |

• | “founder shares” means the Waldencast Class B ordinary shares purchased by the Sponsor in a private placement prior to the initial public offering, and the Waldencast Class A ordinary shares that will be issued upon the conversion thereof; |

• | “GAAP” means generally accepted accounting principles in the United States of America; |

• | “Governing Documents” means the legal document(s) by which any Person (other than an individual) establishes its legal existence or which govern its internal affairs. For example, the “Governing Documents” of a corporation are its certificate of incorporation and by-laws, the “Governing Documents” of a limited partnership are its limited partnership agreement and certificate of limited partnership, the “Governing Documents” of a limited liability company are its operating agreement and certificate of formation, the “Governing Documents” of an exempted company are its memorandum and articles of association and the “Governing Documents” of a Jersey company are its memorandum and articles of association; |

• | “Governmental Authority” means any federal, state, provincial, municipal, local or foreign government, governmental authority, regulatory or administrative agency, governmental commission, department, board, bureau, agency or instrumentality, court or tribunal, or arbitrator; |

• | “Governmental Order” means any order, judgment, injunction, decree, writ, stipulation, determination or award entered by or with any Governmental Authority; |

• | “Holdco 1” means Obagi Holdco 1 Limited, a private limited company incorporated under the Laws of Jersey; |

• | “Holdco 2” means Obagi Holdco 2 Limited, a private limited company incorporated under the Laws of Jersey; |

• | “HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder; |

• | “Indebtedness” means with respect to any Person, without duplication, any obligations, contingent or otherwise, in respect of (a) the principal of and premium (if any) in respect of any indebtedness for borrowed money, including accrued interest and any per diem interest accruals or cost associated with prepaying any such indebtedness solely to the extent such indebtedness is prepaid, (b) amounts drawn on letters of credit, bank guarantees, bankers’ acceptances and other similar instruments (solely to the extent such amounts have actually been drawn), (c) the principal of and premium (if any) in respect of obligations evidenced by bonds, debentures, notes and similar instruments, (d) the termination value of interest rate protection agreements and currency obligation swaps, hedges or similar arrangements (without duplication |

• | “Initial PIPE Investment” means the purchase of shares of Waldencast plc Class A ordinary shares pursuant to the Initial Subscription Agreements; |

• | “initial public offering” means Waldencast’s initial public offering that was consummated on March 18, 2021; |

• | “Initial Subscription Agreements” means the subscription agreements executed on or prior to November 14, 2021, pursuant to which the Initial PIPE Investment will be consummated; |

• | “Investor Directors” means Sarah Brown, Juliette Hickman, Lindsay Pattison and Zach Werner; |

• | “Investor Rights Agreement” means the Investor Rights Agreement, to be entered into by and among Waldencast, Cedarwalk, the Sponsor and the guarantor of Cedarwalk’s obligations thereunder; |

• | “IP License Agreement” means the intellectual property license agreement, and side letter to the same agreement, to be entered by and among Obagi China Distribution, Obagi Worldwide and Obagi Hong Kong; |

• | “IPO Registration Statement” means the Registration Statement on Form S-1 (333-253370) filed by Waldencast in connection with its initial public offering, which became effective on March 15, 2021; |

• | “IRS” means the U.S. Internal Revenue Service; |

• | “Jersey Companies Law” means the Companies (Jersey) Law 1991, as amended; |

• | “Jersey Registrar” means the Registrar of Companies in Jersey under the Jersey Companies Law; |

• | “JOBS Act” means the Jumpstart Our Business Startups Act of 2012; |

• | “Lock-Up Agreements” means the Obagi Lock-Up Agreement and the Milk Lock-Up Agreement, together; |

• | “Merger Sub” means Obagi Merger Sub, Inc., a Cayman Islands exempted company limited by shares; |

• | “Milk” means Milk Makeup LLC, a Delaware limited liability company; |

• | “Milk Appreciation Rights Plan” means the Milk Makeup LLC Appreciation Rights Plan; |

• | “Milk Award” means a Milk Option or a Milk UAR; |

• | “Milk Base Purchase Price” means $340,000,000.00; |

• | “Milk Cash Consideration” means an amount equal to the difference of (a) the Total Implied Milk Cash Consideration Amount, minus the Milk Cash Consideration Reduction Amount, if any, minus the Milk Closing Cash Bonus Reduction Amount, minus the amount of the Milk Expense Fund, to the extent actually paid at Closing; provided that in no event will the Milk Cash Consideration equal less than zero dollars ($0.00); |

• | “Milk Cash Consideration Reduction Amount” means: |

(a) | if the Milk Closing Available Cash is equal to or greater than $630,000,000.00, an amount equal to zero dollars ($0.00); or |

(b) | if the Milk Closing Available Cash is less than $630,000,000.00 and greater than $615,000,000.00, an amount equal to (i) $630,000,000.00 minus (ii) the Milk Closing Available Cash; or |

(c) | if the Milk Closing Available Cash is equal to or less than $615,000,000.00 and greater than $565,000,000.00, an amount equal to (i) $15,000,000.00, plus (ii) 25% of the amount equal to (A) $615,000,000.00, minus (B) the Milk Closing Available Cash; or |

(d) | if the Milk Closing Available Cash is equal to or less than $565,000,000.00, an amount equal to (i) $27,500,000.00, plus (ii) 50% of the amount equal to (A) $565,000,000.00, minus (B) the Milk Closing Available Cash; provided, however, that under no circumstance shall the Milk Cash Consideration Reduction Amount be negative; |

• | “Milk Closing” means the closing of the transactions contemplated by the Milk Equity Purchase Agreement; |

• | “Milk Closing Available Cash” means the sum of (w) the cash remaining in the Trust Account (after giving effect to the Waldencast/Milk Share Redemptions (if any)), plus (x) the PIPE Investment Amount actually received by Waldencast prior to or substantially concurrently with the Closing, plus (y) the Forward Purchase Amount actually received by Waldencast prior to or substantially concurrently with the Milk Closing, plus (z) the cash and cash equivalents of Waldencast, Milk and Obagi and their respective Subsidiaries, including the proceeds of any indebtedness incurred after the date hereof (other than any indebtedness of up to $125,000,000.00 to refinance the Obagi Existing Credit Agreement) or convertible note or other offering (in the case of Waldencast and its Subsidiaries, excluding any cash already covered by clauses (w), (x) or (y) above), in each case, as of the Milk Closing; |

• | “Milk Closing Cash Bonus Reduction Amount” means $2,500,000; |

• | “Milk Closing Date” means the date on which the Milk Closing actually occurs; |

• | “Milk Common Units” means the authorized issued and outstanding common units of Milk; |

• | “Milk Confidentiality Agreement” means the Confidentiality Agreement, dated as of June 27, 2021, between Waldencast and Milk, as amended by the Confidentiality Agreement Side Letter, dated as of August 11, 2021, between Waldencast and Milk; |

• | “Milk Equity Consideration” means a number of Waldencast LP Common Units equal to (x) the Total Implied Milk Equity Consideration, minus (y) a number of units of Waldencast LP Common Units equal to the quotient obtained by dividing (A) the Milk Cash Consideration by (B) $10.00; |

• | “Milk Equity Interests” means the Milk Awards, Milk Membership Units and the Milk Warrants, collectively; |

• | “Milk Equity Purchase Agreement” means the Equity Purchase Agreement, dated as of November 15, 2021, by and among Waldencast, Waldencast LP, Holdco 1, Milk, the Milk Members and the Equityholder Representative, a copy of which is attached to this proxy statement/prospectus as Annex B; |

• | “Milk Exchange Ratio” means the ratio equal to (i) the number of Waldencast ordinary shares equal to the number of Waldencast LP Common Units constituting the Total Implied Milk Equity Consideration divided by (ii) the number of Aggregate Fully Diluted Milk Common Units; |

• | “Milk Existing Credit Agreement” means the Loan and Security Agreement, dated as of October 10, 2019 (as amended by that certain First Amendment and Waiver to Loan and Security Agreement, dated as of May 4, 2020, that certain Second Amendment to Loan and Security Agreement, dated as of November 27, 2020, that certain Third Amendment to Loan and Security Agreement, dated as of February 25, 2021, and that certain Fourth Amendment to Loan and Security Agreement, dated as of April 8, 2021), by and between Milk, as borrower, and PWB; |

• | “Milk Expense Fund” means $50,000; |

• | “Milk LLC Agreement” means the Fifth Amended and Restated Operating Agreement of Milk, dated as of November 5, 2021; |

• | “Milk Lock-Up Agreement” means each of the lock-up agreements to be entered into between Waldencast plc and the Lock-Up Members; |

• | “Milk Members” means the preferred and common members of Milk; |

• | “Milk Membership Units” means the Milk Common Units and the Milk Preferred Units, collectively; |

• | “Milk Option” means an option to purchase a Milk Common Unit; |

• | “Milk Per Unit Transaction Consideration” means the product obtained by multiplying (i) the Milk Exchange Ratio by (ii) $10.00; |

• | “Milk Pre-Closing Restructuring” means certain distribution by direct and indirect holders of certain Milk Membership Units to occur prior to the Milk Closing; |

• | “Milk Preferred Units” means the authorized preferred units of Milk, comprised of the Milk Series A Preferred Units, Milk Series B Preferred Units, Milk Series C Preferred Units and Milk Series D Preferred Units; |

• | “Milk Purchasers” means Waldencast LP and Holdco 1 together; |

• | “Milk Series A Preferred Units” means the authorized, issued and outstanding Milk Preferred Units designated as Series A Preferred Units pursuant to the Milk LLC Agreement; |

• | “Milk Series B Preferred Units” means the authorized, issued and outstanding Milk Preferred Units designated as Series B Preferred Units pursuant to the Milk LLC Agreement; |

• | “Milk Series C Preferred Units” means the authorized, issued and outstanding Milk Preferred Units designated as Series C Preferred Units pursuant to the Milk LLC Agreement; |

• | “Milk Series D Preferred Units” means the authorized, issued and outstanding Milk Preferred Units designated as Series D Preferred Units pursuant to the Milk LLC Agreement; |

• | “Milk Sponsor Support Agreement” means that certain Sponsor Support Agreement, dated as of the date of the Milk Equity Purchase Agreement, by and among the Sponsor, Waldencast and Milk, as amended or modified from time to time; |

• | “Milk Transaction” means the Milk Purchasers’ acquisition from the Milk Members, and the Milk Members’ sale to the Milk Purchasers, of all of the issued and outstanding Milk Membership Units representing all of the issued and outstanding membership interests of Milk in exchange for the Milk Cash Consideration, the Milk Equity Consideration and the Waldencast plc Non-Economic ordinary shares; |

• | “Milk Transaction Effective Time” means the time at which the Milk Closing shall be deemed effective; |

• | “Milk Transaction Expenses” means the following out-of-pocket fees and expenses paid or payable by Milk or any of its Subsidiaries (whether or not billed or accrued for) as a result of or in connection with the negotiation, documentation and consummation of the transactions contemplated hereby: (a) all documented fees, costs, expenses, brokerage fees, commissions, finders’ fees and disbursements of financial advisors, investment banks, data room administrators, attorneys, accountants and other advisors and service providers, (b) change-in-control payments, transaction bonuses, retention payments, severance or similar compensatory payments payable by Milk or any of its Subsidiaries to any current or former employee, independent contractor, officer or director of Milk or any of its Subsidiaries as a result of the transactions contemplated hereby (and not tied to any subsequent event or condition, such as a termination of employment), including the employer portion of payroll taxes arising therefrom, (c) the filing fees payable by Milk or any of its Subsidiaries to the Antitrust Authorities specified in Section 8.1(e) of the Milk Equity Purchase Agreement and (d) amounts owing or that may become owed, payable or otherwise due, directly or indirectly, by Milk or any of its Subsidiaries to any Affiliate of Milk or any of its Subsidiaries in connection with negotiation, documentation or the consummation of the transactions contemplated hereby, including fees, costs and expenses related to the termination of any Affiliate Agreement. For the avoidance of doubt, Milk Transaction Expenses shall not include any fees and expenses of the Milk Members or any expenses of Milk or its Subsidiaries to the extent attributable to advice solely for the benefit of Milk’s direct or indirect equityholders (rather than Milk or its Subsidiaries); |

• | “Milk UARs” means a unit appreciation right in respect of Milk Common Units issued pursuant to the Milk Appreciation Rights Plan; |

• | “Milk Warrants” means (i) the warrants to purchase the series of units issued on October 10, 2019, by Milk to PWB (as the warrantholder), pursuant to which PWB was provided the right to exercise such warrants for 10,297 Milk Series C Preferred Units and (ii) the warrant to purchase the series of units issued on October 10, 2019, by Milk to PWB (as the warrantholder), pursuant to which PWB was provided the right to exercise such warrants for 6,139 Milk Series D Preferred Units; |

• | “Minimum Available Waldencast Cash Amount” means $50,000,000.00; |

• | “Nasdaq” means The Nasdaq Stock Market LLC; |

• | “Obagi” means Obagi Global Holdings Limited, a Cayman Islands exempted company limited by shares; |

• | “Obagi Cash Consideration” means an amount equal to the difference of (a) the Total Implied Obagi Cash Consideration Amount minus the Obagi Cash Consideration Reduction Amount; |

• | “Obagi Cash Consideration Reduction Amount” means |

(a) | if (i) the Obagi Closing Available Cash is greater than $670,000,000.00 and (ii) the amount of Obagi Transaction Expenses exceeds $26,000,000.00 (any excess, the “Obagi Transaction Expenses Overage”), an amount equal to the Obagi Transaction Expenses Overage; |

(b) | if the Obagi Closing Available Cash is equal to or less than (i) $670,000,000.00, and greater than (ii) $630,000,000.00, an amount equal to (A) $380,000,000.00, minus (B) the Obagi Closing Available Cash, plus (C) the Total Obagi Transaction Expenses, minus (D) the sum of the Waldencast Transaction Expenses and the Milk Transaction Expenses, plus (E) $35,000,000.00, plus (F) Balance Sheet Cash, plus (G) the Total Implied Milk Cash Consideration Amount, plus (H) the amount by which the Obagi Transaction Expenses are less than $26,000,000.00, if any; |

(c) | if the Obagi Closing Available Cash is equal to or less than $630,000,000.00 and greater than $615,000,000.00, an amount equal to (i) $40,000,000.00, plus (ii) the Obagi Transaction Expenses Overage; |

(d) | if the Obagi Closing Available Cash is equal to or less than $615,000,000.00 and greater than $565,000,000.00, an amount equal to (i) $40,000,000.00, plus (ii) the Obagi Transaction Expenses Overage, if any, plus (iii) 25% of the amount equal to (A) $340,000,000.00, minus (B) the Obagi Transaction Expenses Overage, if any, minus (C) the Obagi Closing Available Cash, plus (D) the Total Obagi Transaction Expenses, plus (E) Balance Sheet Cash, plus (F) the Total Implied Milk Cash Consideration Amount, minus (G) $15,000,000.00, minus (H) the sum of the Waldencast Transaction Expenses and the Milk Transaction Expenses, plus (I) $35,000,000.00, plus (J) the amount by which the Obagi Transaction Expenses are less than $26,000,000.00, if any; or |

(e) | if the Obagi Closing Available Cash is equal to or less than $565,000,000.00, an amount equal to (i) $52,500,000.00, plus (ii) the Obagi Transaction Expenses Overage, if any, plus (iii) 50% of the amount equal to (A) $327,500,000.00, minus (B) the Obagi Transaction Expenses Overage, if any, minus (C) the Obagi Available Cash, plus (D) the Total Obagi Transaction Expenses, plus (E) Balance Sheet Cash, plus (F) the Total Implied Milk Cash Consideration Amount, minus (G) $52,500,000.00, minus (H) the sum of the Waldencast Transaction Expenses and the Milk Transaction Expenses, plus (I) $35,000,000.00, plus (J) the amount by which the Obagi Transaction Expenses are less than $26,000,000.00, if any; |

• | “Obagi China Distribution” means the transactions contemplated by the Distribution Agreements, Transition Services Agreement, the Supply Agreement, the Investor Rights Agreement and the IP License Agreement; |

• | “Obagi Closing” means the closing of the transactions contemplated by the Obagi Merger Agreement; |

• | “Obagi Closing Available Cash” means the sum of (w) the cash remaining in the Trust Account (after giving effect to the Waldencast/Obagi Share Redemption (if any)), plus (x) the PIPE Investment Amount actually received by Waldencast prior to or substantially concurrently with the Obagi Closing, plus (y) the Forward Purchase Amount actually received by Waldencast prior to or substantially concurrently with the Obagi Closing, plus (z) the cash and cash equivalents of Waldencast and its Subsidiaries, including the proceeds of any indebtedness incurred after the date hereof (other than any indebtedness of up to $125,000,000.00 to refinance the Obagi Existing Credit Agreement) or convertible note or other offering (in the case of Waldencast and its Subsidiaries, excluding any cash already covered by clauses (x), (y) or (z) above), in each case, as of the Obagi Closing; |

• | “Obagi Closing Date” means the date on which the Obagi Closing actually occurs; |

• | “Obagi Common Stock” means the shares in the capital of Obagi of par value US $0.50 each per share; |

• | “Obagi Cosmeceuticals” means Obagi Cosmeceuticals LLC, a Delaware limited liability company; |

• | “Obagi Exchange Ratio” means the ratio equal to (i) the number of Waldencast plc Class A ordinary shares constituting the Total Implied Obagi Equity Consideration divided by (ii) the number of Aggregate Fully Diluted Obagi Common Shares; |

• | “Obagi Existing Credit Agreement” means the Financing Agreement, dated as of March 16, 2021, by and among Obagi, as ultimate parent, Obagi Holdco, as parent, Obagi Cosmeceuticals, as borrower, the subsidiary guarantors party thereto, the lenders from time to time party thereto and TCW Asset Management Company LLC, as collateral agent and administrative agent; |

• | “Obagi Existing Credit Agreement Consent” means the consent to financing agreement, dated as of the date of Obagi Merger Agreement, by and among, inter alia, the lenders party thereto, TCW Asset Management Company LLC, as collateral agent and administrative agent, Obagi Holdings, as parent, and Obagi Cosmeceuticals, as borrower; |

• | “Obagi Group” means the shareholders or holders of other equity interests of Obagi and/or any of their respective directors, members, partners, officers, employees or affiliates (other than Obagi); |

• | “Obagi Holdco” means Obagi Holdings Company Limited, a Cayman Islands exempted company limited by shares; |

• | “Obagi Hong Kong” means Obagi Hong Kong Limited; |

• | “Obagi Lock-Up Agreement” means each of the lock-up agreements to be entered into between Waldencast plc and the Obagi Lock-Up Shareholders; |

• | “Obagi Merger” means the merger of Merger Sub with and into Obagi, with Obagi surviving the merger as a wholly owned subsidiary of Holdco 2; |

• | “Obagi Merger Agreement” means that certain Agreement and Plan of Merger, dated as of November 15, 2021, by and among Waldencast, Merger Sub and Obagi, a copy of which is attached to this proxy statement/prospectus as Annex A; |

• | “Obagi Merger Effective Time” means the date and time the Obagi Merger becomes effective; |

• | “Obagi Netherlands” means Obagi Netherlands B.V., a Netherlands private limited company (besloten vennootschapand); |

• | “Obagi Option” means an option to purchase Obagi Common Stock granted under the Obagi Stock Plan; |

• | “Obagi Per Share Merger Consideration” means the product obtained by multiplying (i) the Obagi Exchange Ratio by (ii) $10.00; |

• | “Obagi Pre-Closing Restructuring” means the Obagi China Distribution and the Clinactiv Distribution; |

• | “Obagi RSU” means a restricted stock unit issued in respect of Obagi Common Stock granted pursuant to the Obagi Stock Plan; |

• | “Obagi Shareholders” means the shareholders of Obagi; |

• | “Obagi Sponsor Support Agreement” means that certain Sponsor Support Agreement, dated November 15, 2021, by and among the Sponsor, Waldencast, the Investor Directors and Obagi, as amended and modified from time to time; |

• | “Obagi Stock Consideration” means a number of shares of Waldencast plc ordinary shares equal to (x) the Total Implied Obagi Equity Consideration, minus (y) a number of shares of Waldencast plc ordinary shares equal to the quotient obtained by dividing (A) the Obagi Cash Consideration by (B) $10.00; |

• | “Obagi Stock Plan” means the Obagi Global Holdings Limited 2021 Stock Incentive Plan to be assumed by Waldencast at the Obagi Merger Effective Time; |

• | “Obagi Transaction Expenses” means the following out-of-pocket fees and expenses paid or payable by the Obagi or any of its Subsidiaries (whether or not billed or accrued for) as a result of or in connection with the negotiation, documentation or consummation of the transactions contemplated by the Obagi Merger Agreement: (a) all documented fees, costs, expenses, brokerage fees, commissions, finders’ fees and disbursements of financial advisors, investment banks, data room administrators, attorneys, accountants and other advisors and service providers; (b) change-in-control payments, transaction bonuses, retention payments, severance or similar compensatory payments payable by Obagi or any of its Subsidiaries to any current or former employee, independent contractor, officer or director of Obagi or any of its Subsidiaries as a result of the transactions contemplated by the Obagi Merger Agreement (and not tied to any subsequent event or condition, such as a termination of employment), including the employer portion of payroll taxes arising therefrom; (c) the filing fees payable by Obagi or any of its Subsidiaries to the Antitrust Authorities specified in Section 8.1(e) of the Obagi Merger Agreement; and (d) amounts owing or that may become owed, payable or otherwise due, directly or indirectly, by Obagi or any of its Subsidiaries to any affiliate of Obagi or any of its Subsidiaries in connection with the negotiation, documentation or consummation of the transactions contemplated hereby, including fees, costs and expenses related to the termination of any Affiliate Agreement. For the avoidance of doubt, Obagi Transaction Expenses shall not include any fees and expenses of Obagi’s Shareholders, any Up-C Transaction Expenses, any Financing Expenses or any expenses of Obagi or its Subsidiaries to the extent attributable to advice solely for the benefit of Obagi’s direct or indirect shareholders (rather than Obagi or its Subsidiaries); |

• | “ordinary shares” means the Waldencast Class A ordinary shares and the Waldencast Class B ordinary shares, collectively; |

• | “Osibao Note” means the promissory noted dated July 30, 2021, of Osibao Cosmetics International Limited payable to the order of Obagi Cosmeceuticals, LLC in the principal amount of US$2,5000,000; |

• | “Person” means any individual, firm, corporation, partnership, exempted limited partnership, limited liability company, exempted company, incorporated or unincorporated association, joint venture, joint stock company, governmental authority or instrumentality or other entity of any kind; |

• | “PFIC” means a passive foreign investment company; |

• | “PIPE Investment” means the purchase of shares of Waldencast plc pursuant to the Subscription Agreements; |

• | “PIPE Investment Amount” means the aggregate gross purchase price received by Waldencast substantially concurrently with or immediately following Closing for the shares in the PIPE Investment; |

• | “PIPE Investors” means those certain investors participating in the PIPE Investment pursuant to the Subscription Agreements; |

• | “private placement warrants” means the Waldencast plc private placement warrants outstanding as of the date of this proxy statement/prospectus and the warrants of Waldencast plc issued as a matter of law upon the conversion thereof at the time of the Domestication; |

• | “Proposed Constitutional Document” means the proposed memorandum and articles of association of Waldencast plc upon the effective date of the Domestication attached to this proxy statement/prospectus as Annex G; |

• | “public shareholders” means holders of public shares, whether acquired in Waldencast’s initial public offering or acquired in the secondary market; |

• | “public shares” means the Waldencast Class A ordinary shares (including those underlying the units) that were offered and sold by Waldencast in its initial public offering and registered pursuant to the IPO Registration Statement or the shares of Waldencast plc Class A ordinary shares issued as a matter of law upon the conversion thereof at the time of the Domestication, as context requires; |

• | “public warrants” means the redeemable warrants (including those underlying the units) that were offered and sold by Waldencast in its initial public offering and registered pursuant to the IPO Registration Statement or the redeemable warrants of Waldencast plc issued as a matter of law upon the conversion thereof at the time of the Domestication, as context requires; |

• | “PWB” means Pacific Western Bank; |

• | “Record Date” means , 2022; |

• | “redemption” means each redemption of public shares for cash pursuant to the Cayman Constitutional Documents and the Proposed Constitutional Document; |

• | “Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement to be entered into by and among Waldencast plc, Sponsor, the Target Holders, the Investor Directors and the parties set forth on Schedule 2 thereto; |

• | “Requisite Obagi Stockholder” means Cedarwalk; |

• | “Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002, as amended; |

• | “SEC” means the United States Securities and Exchange Commission; |

• | “Securities Act” means the Securities Act of 1933, as amended; |

• | “Sponsor” means Waldencast Long-Term Capital LLC, a Cayman Islands limited liability company; |

• | “Sponsor Forward Purchase Agreement” means the Forward Purchase Agreement initially entered into on February 22, 2021, by and among Waldencast, the Sponsor and Dynamo Master Fund (a member of the Sponsor). On December 20, 2021, the Sponsor and Burwell Mountain Trust (a member of the Sponsor) entered into an assignment and assumption agreement, pursuant to which the Sponsor assigned, and Burwell Mountain Trust assumed, all of the Sponsor’s rights and benefits as purchaser under the Sponsor Forward Purchase Agreement, including the right to purchase the Waldencast plc Units subscribed for by the Sponsor; |

• | “Sponsor Forward Purchase Investment Amount” means $160,000,000; |

• | “Sponsor Support Agreements” means the Obagi Sponsor Support Agreement and the Milk Sponsor Support Agreement, together; |

• | “Stockholder Support Agreement” means that certain Support Agreement, dated November 15, 2021, by and among Waldencast, the Requisite Obagi Stockholder and Obagi, as amended and modified from time to time; |

• | “Subscription Agreements” means the Initial Subscription Agreements and Subsequent Subscription Agreements pursuant to which the PIPE Investment will be consummated; |

• | “Subsequent PIPE Investment” means the purchase of shares of Waldencast plc Class A ordinary shares pursuant to the Subsequent Subscription Agreements; |

• | “Subsequent Subscription Agreements” means the subscription agreements, if any, executed after November 15, 2021, and on or prior to the Closing Date pursuant to which the Subsequent PIPE Investment will be consummated; |

• | “subsidiary” or “Subsidiary” means, with respect to any Person, any corporation, company, exempted company, limited liability company, partnership, exempted limited partnership, association or other business entity of which the first Person: (a) owns, directly or indirectly, more than fifty percent (50%) of the equity securities or equity interests; (b) owns, directly or indirectly, a majority of the total voting power of the equity securities or equity interests entitled to vote in the election of directors, managers or trustees thereof or other Persons performing similar functions; or (c) has a right to appoint fifty percent (50%) or more of the directors or managers. |

• | “Supply Agreement” means the Global Supply Services Agreement substantially in the form attached to the Obagi Merger Agreement as Exhibit D (with such changes as may be agreed in writing by Obagi and Waldencast), to be entered into by and between Obagi Cosmeceuticals and Obagi Hong Kong; |

• | “Target Holders” means, as of the date of the Registration Rights Agreement, the former shareholders and members, respectively, of Obagi and Milk as set forth on Schedule 1 thereto; |

• | “Third-Party Forward Purchase Agreement” means the Forward Purchase Agreement by and between Waldencast and the Third-Party FPA Investor whereby, among other things, the Third-Party FPA Investor agreed to acquire Waldencast plc Units; |

• | “Third-Party Forward Purchase Investment Amount” means $173,000,000; |

• | “Third-Party FPA Investor” means Beauty Ventures LLC; |

• | “Total Implied Milk Cash Consideration Amount” means $140,000,000.00; |

• | “Total Implied Milk Equity Consideration” means a number of Waldencast LP Common Units equal to the quotient obtained by dividing (i) the Milk Base Purchase Price plus the Aggregate Milk Option Exercise Price plus the Aggregate Milk UAR Strike Price plus the Aggregate Milk Warrant Exercise Price by (ii) $10.00; |

• | “Total Implied Obagi Cash Consideration Amount” means $380,000,000; |

• | “Total Implied Obagi Equity Consideration” means a number of Waldencast plc ordinary shares equal to the quotient obtained by dividing (i) $655,000,000 plus the Aggregate Obagi Option Exercise Price by (ii) $10.00; |

• | “Total Obagi Transaction Expenses” means the Waldencast Transaction Expenses plus the Obagi Transaction Expenses plus the Milk Transaction Expenses; |

• | “Transaction Agreements” means the Obagi Merger Agreement together with the Milk Equity Purchase Agreement; |

• | “Transaction Proposals” means, collectively, the Condition Precedent Proposals and the Adjournment Proposal; |

• | “Transactions” means the Obagi Merger together with the Milk Transaction; |

• | “Transfer Agent” means Continental, acting as transfer agent; |

• | “Transition Services Agreement” means the transition services agreement to be entered by and among Obagi Cosmeceuticals, certain of its affiliates, and Obagi Hong Kong; |

• | “trust account” or “Trust Account” means the trust account established at the consummation of Waldencast’s initial public offering at J.P. Morgan Chase Bank, N.A. and maintained by Continental, acting as trustee; |

• | “Trust Agreement” means the Investment Management Trust Agreement, dated as of March 15, 2021, between Waldencast and Continental, as trustee; |

• | “Up-C Contributions” means Holdco 1’s contribution of its equity interests in (a) Milk to Waldencast LP in exchange for limited partnership units in Waldencast LP and (b) Holdco 2 in exchange for limited partnership units in Waldencast LP; |

• | “Up-C Transaction” means any action required to collectively structure the Obagi Merger and the Milk Transaction as what is commonly referred to as an “Up-C transaction”; |

• | “Up-C Transaction Expenses” has the meaning specified in the definition of Waldencast Transaction Expenses; |

• | “U.S. Holder” means a beneficial owner of Waldencast Class A ordinary shares or Waldencast plc Class A ordinary shares (as the case may be) who or that is, for U.S. federal income tax purposes: (a) an individual citizen or resident of the United States, (b) a corporation (or other entity that is treated as a corporation for U.S. federal income tax purposes) that is created or organized (or treated as created or organized) in or under the laws of the United States or any state thereof or the District of Columbia, (c) an estate whose income is subject to U.S. federal income tax regardless of its source, or (d) a trust if (i) a U.S. court can exercise primary supervision over the administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (ii) it has a valid election in place to be treated as a U.S. person; |

• | “Waldencast” and the “Registrant” mean Waldencast Acquisition Corp., a Cayman Islands exempted company limited by shares, prior to its migration and domestication as a public limited company incorporated under the Laws of Jersey; |

• | “Waldencast Class A ordinary shares” means Waldencast’s Class A ordinary shares, par value $0.0001 per share; |

• | “Waldencast Class B ordinary shares” means Waldencast’s Class B ordinary shares, par value $0.0001 per share; |

• | “Waldencast LP” means Waldencast Partners LP, a Cayman Islands exempted limited partnership; |

• | “Waldencast LP Common Units” means limited partnership units of Waldencast LP that, in the case of such units issued as part of, or in respect of, the Milk Equity Consideration, are redeemable at the option of the holder of such units and, if such option is exercised, exchangeable at the option of Waldencast plc for Waldencast plc Class A ordinary shares or cash in accordance with the terms of the Amended and Restated Waldencast Partners LP Agreement; |

• | “Waldencast/Milk Share Redemptions” means the election of an eligible (as determined in accordance with the Cayman Constitutional Documents) holder of Waldencast Class A ordinary shares to redeem all or a portion of the ordinary shares held by such holder at a per-share price, payable in cash, equal to a pro rata share of the aggregate amount on deposit in the Trust Account (including any interest earned on the funds held in the Trust Account) (as determined in accordance with the Cayman Constitutional Documents) in connection with the Transaction Proposals; |

• | “Waldencast/Obagi Share Redemptions” means the election of an eligible (as determined in accordance with the Cayman Constitutional Documents) holder of Waldencast Class A ordinary shares to redeem all or a portion of the ordinary shares held by such holder at a per-share price, payable in cash, equal to a pro rata share of the aggregate amount on deposit in the Trust Account (including any interest earned on the funds held in the Trust Account) (as determined in accordance with the Cayman Constitutional Documents) in connection with the Transaction Proposals; |

• | “Waldencast plc” means Waldencast after the Domestication and its name change from Waldencast Acquisition Corp. to Waldencast plc; |

• | “Waldencast plc 2022 Incentive Award Plan” means the omnibus equity incentive plan of Waldencast plc to be approved and adopted by the board of directors of Waldencast, subject to the shareholders of Waldencast approving the BCA Proposal and the Domestication Proposal at the extraordinary general meeting to be effective prior to the Closing Date; |

• | “Waldencast plc Board” means the board of directors of Waldencast plc; |

• | “Waldencast plc Class A ordinary shares” means shares of Waldencast plc common stock, par value $0.0001 per share; |

• | “Waldencast plc Non-Economic ordinary shares” means, after the Milk Closing, Class B ordinary fully paid shares in the capital of Waldencast plc, par value $0.0001 per share, with such shares entitled to one vote per share, and no additional rights, including no economic rights; |

• | “Waldencast plc Option” means an option to purchase Waldencast plc Class A ordinary shares; |

• | “Waldencast plc ordinary shares” means the Waldencast plc Class A ordinary shares and the Waldencast plc Non-Economic ordinary shares; |

• | “Waldencast plc RSU” means a restricted stock unit with respect to Waldencast plc Class A ordinary shares; |

• | “Waldencast plc SAR” means a stock appreciation right with respect to Waldencast plc Class A ordinary shares; |

• | “Waldencast plc Units” means units of Waldencast plc; |

• | “Waldencast plc warrant” means a warrant to acquire one Waldencast plc Class A ordinary share; |

• | “Waldencast Transaction Expenses” means the following out-of-pocket fees and expenses paid or payable by Waldencast or any of its affiliates (whether or not billed or accrued for) as a result of or in connection with the negotiation, documentation or consummation of the Obagi Merger: (a) all fees, costs, expenses, brokerage fees, commissions, finders’ fees and disbursements of financial advisors, investment banks, data room administrators, attorneys, accountants and other advisors and service providers; (b) the filing fees payable by Waldencast or any of its subsidiaries to the Antitrust Authorities as specified in Section 8.1(e) of the Obagi Merger Agreement; (c) all fees and expenses incurred in connection with preparing and filing this registration statement/proxy statement and obtaining approval of the Nasdaq under Section 7.3 of the Obagi Merger Agreement; (d) repayment of any Working Capital Loans; (e) any fees and expenses incurred in connection with the PIPE Investment; (f) any deferred underwriting commissions and other fees and expenses relating to Waldencast’s initial public offering or operations; (g) any other fees and expenses as a result of or in connection with the negotiation, documentation or consummation of the transactions contemplated hereby; (h) any documented fees and expenses, both internal or external, including those payable to consultants, advisors (financial or otherwise), accountants, attorneys and service providers, incurred by the Company in connection with the Up-C Transaction (such expenses in this clause (h), the “Up-C Transaction Expenses”); and (i) any other fees and expenses incurred in connection with (x) obtaining the consent of TCW Asset Management Company LLC and any other parties required under the terms of the Obagi Existing Credit Agreement to (A) enter into and consummate the Obagi Merger and the transactions contemplated thereby or (B) permit any Indebtedness outstanding under the Obagi Existing Credit Agreement to remain outstanding following the Closing, (y) any amendment to, or refinancing of, the Obagi Existing Credit Agreement or (z) the incurrence of any new Indebtedness, if requested by Waldencast (the “Financing Expenses”). Waldencast Transaction Expenses shall not include any fees and expenses of Waldencast’s shareholders (other than Working Capital Loans); |

• | “Waldencast units” and “units” mean the units of Waldencast, each unit representing one Waldencast Class A ordinary share and one-third of one redeemable warrant to acquire one Waldencast Class A ordinary share, that were offered and sold by Waldencast in its initial public offering and registered pursuant to the IPO Registration Statement (less the number of units that have been separated into the underlying public shares and underlying warrants upon the request of the holder thereof); |

• | “warrants” means the public warrants and the private placement warrants; and |

• | “Working Capital Loans” means any loan made to Waldencast by any of the Sponsor, an affiliate of the Sponsor, or any of Waldencast’s officers or directors, and evidenced by a promissory note, for the purpose of financing costs incurred in connection with a Business Combination. |

• | Waldencast’s ability to complete the Business Combination or, if Waldencast does not consummate such Business Combination, any other initial business combination; |

• | satisfaction or waiver (if applicable) of the conditions to the Obagi Merger, including, among other things: |

• | the satisfaction or waiver of certain customary closing conditions, including, among others, (i) approval of the Obagi Merger and related agreements and transactions by the respective shareholders of Waldencast and Obagi; (ii) effectiveness of the registration statement of which this proxy statement/prospectus forms a part (the “Registration Statement”); (iii) obtainment, expiration or termination of the waiting period under the HSR Act, as applicable; (iv) the absence of any Governmental Order (as defined in the Obagi Merger Agreement) enjoining or otherwise prohibiting the consummation of the Obagi Merger in the certain specified governing jurisdictions; provided that the Governmental Authority (as defined in the Obagi Merger Agreement) issuing such Governmental Order has jurisdiction over the parties thereto with respect to the transactions contemplated thereby, or any law or regulation in such governing jurisdictions that would result in the consummation of the Obagi Merger being illegal or otherwise prohibited; (v) the satisfaction of all closing conditions in the Milk Equity Purchase Agreement and the completion of the transactions contemplated thereby; (vi) that Waldencast have at least $5,000,001 of net tangible assets (inclusive of the PIPE Investment Amount and the Forward Purchase Amount, in each case, actually received by Waldencast prior to or substantially concurrently with the Closing) upon Closing; (vii) the completion of the Domestication; (viii) the completion of the Obagi China Distribution and (ix) customary bringdown of the representations, warranties and covenants of the parties therein; |

• | the Obagi Cash Consideration equals or exceeds $327,500,000, minus the Obagi Transaction Expenses Overage; and |

• | the Minimum Available Cash Amount equals or exceeds $50 million; |

• | satisfaction or waiver (if applicable) of the conditions to the Milk Equity Purchase Agreement, including, among other things: |

• | the satisfaction or waiver of certain customary closing conditions, including, among others, (i) approval of the Milk Transaction and related agreements and transactions by the shareholders of Waldencast; (ii) effectiveness of the Registration Statement (iii) obtainment, expiration or termination of the waiting period under the HSR Act and any other required regulatory approval set forth in the Milk Members Disclosure Letter, and the Milk Ancillary Agreements, as applicable; (iv) the absence of any Governmental Order (as defined in the Milk Equity Purchase Agreement) enjoining or otherwise prohibiting the consummation of the Milk Equity Purchase Agreement in certain specified governing jurisdictions; provided that the Governmental Authority (as defined in the Milk Equity Purchase Agreement) issuing such Governmental Order has jurisdiction over the parties thereto with respect to the transactions contemplated thereby, or any Law or regulation that would result in the consummation of the Milk Equity Purchase Agreement being illegal or otherwise prohibited; (v) the |

• | the Milk Cash Consideration equals or exceeds $112,500,000; and |

• | the Minimum Available Cash Amount equals or exceeds $50,000,000; |

• | the occurrence of any other event, change or other circumstances that could give rise to the termination of the Obagi Merger Agreement or the Milk Equity Purchase Agreement; |

• | the amount of redemptions by Waldencast’s public shareholders; |

• | our ability to raise financing in the future; |

• | the Sponsor and Waldencast’s directors and executive officers potentially having conflicts of interest with regard to the Business Combination with Obagi and Milk; |

• | exposure to unknown or contingent liabilities associated with Obagi and/or Milk; |

• | the Sponsor’s election to purchase shares or warrants from public shareholders prior to the consummation of the Business Combination; |

• | the impact of the COVID-19 pandemic on our, Obagi’s and Milk’s ability to consummate the Business Combination, and on Waldencast plc’s operations following the Business Combination; |

• | our ability to develop and maintain an effective system of internal control over financial reporting and accurately report our financial results in a timely manner; |

• | the ability of Obagi and Milk to maintain and enhance their products and brands and to attract customers; |

• | the ability of Obagi and Milk to execute their business models, including market acceptance of their planned products and sufficient production volumes at acceptable quality levels and prices, protecting their proprietary rights and the success of strategic relationships with third parties; and |

• | other factors detailed in the section entitled “Risk Factors.” |

Q: | Why am I receiving this proxy statement/prospectus? |

A: | Waldencast shareholders are being asked to consider and vote upon, among other proposals, a proposal to approve and adopt the Transaction Agreements and approve the Business Combination. The Obagi Merger Agreement provides for, among other things, the merger of Merger Sub with and into Obagi, with Obagi surviving the merger as wholly owned subsidiary of Holdco 2 and an indirect wholly owned subsidiary of Waldencast plc, in accordance with the terms and subject to the conditions of the Obagi Merger Agreement as more fully described elsewhere in this proxy statement/prospectus. The Milk Equity Purchase Agreement provides, among other things, for the purchase of all of the issued and outstanding membership interests of Milk by the Milk Purchasers, in accordance with the terms and subject to the conditions of the Milk Equity Purchase Agreement as more fully described elsewhere in this proxy statement/prospectus. See the section entitled “BCA Proposal” for more detail. |

Q: | What proposals are shareholders of Waldencast being asked to vote upon? |

A: | At the extraordinary general meeting, Waldencast is asking holders of ordinary shares to consider and vote upon: |

• | proposals to approve by ordinary resolution and adopt the Transaction Agreements; |

• | a proposal to approve by special resolution the Domestication; |

• | the following four separate proposals to approve by special resolution and ordinary resolution, as applicable and as more fully described elsewhere in this proxy statement/prospectus, the following material differences between the Cayman Constitutional Documents and the Proposed Constitutional Document: |

• | to authorize the change in the authorized share capital of Waldencast from (i) 500,000,000 Waldencast Class A ordinary shares, 50,000,000 Waldencast Class B ordinary shares and 5,000,000 preferred shares, par value $0.0001 per share, to (ii) Waldencast plc Class A ordinary shares, Waldencast plc Non-Economic ordinary shares and shares of Waldencast plc preferred stock, respectively; |

• | to provide that the Waldencast plc Board be divided into three classes, with each class made up of, as nearly as may be possible, one-third of the total number of directors constituting the entire Waldencast plc Board, with only one class of directors being elected in each year and each class serving a three-year term; |

• | to provide that certain provisions of the Proposed Constitutional Document will be subject to the Investor Rights Agreement, including provisions governing the appointment, removal and replacement of directors, with respect to which the Requisite Obagi Stockholder will have certain rights pursuant to the Investor Rights Agreement; and |

• | to authorize all other changes in connection with the replacement of the Cayman Constitutional Documents with the Proposed Constitutional Document as part of the Domestication, including (1) changing the corporate name from “Waldencast Acquisition Corp.” to “Waldencast plc,” (2) making Waldencast plc’s existence for an unlimited duration and (3) removing certain provisions related to Waldencast’s status as a blank check company that will no longer be applicable upon consummation of the Business Combination, all of which Waldencast’s board of directors believes is necessary to adequately address the needs of Waldencast plc after the Business Combination; |

• | a proposal to approve by ordinary resolution the election of nine directors to serve staggered terms, who, upon consummation of the Business Combination, will be the directors of Waldencast plc; |

• | proposals to approve by ordinary resolution, for purposes of complying with applicable listing rules of Nasdaq, the issuance of (a) Waldencast plc Class A ordinary shares to the PIPE Investors, pursuant to the PIPE Investment, and to the Obagi Shareholders, pursuant to the Obagi Merger Agreement and (b) Waldencast plc Units to the Forward Purchasers, pursuant to the Forward Purchase Transaction; |

• | a proposal to approve by ordinary resolution the issuance of Waldencast plc Non-Economic ordinary shares and the reservation for issue of Waldencast plc Class A ordinary shares in exchange for Waldencast LP common units, in each case, to the Milk Members; |

• | a proposal to approve by ordinary resolution the Waldencast plc 2022 Incentive Award Plan; and |

• | a proposal to approve the adjournment of the extraordinary general meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for the approval of one or more proposals at the extraordinary general meeting. |

Q: | Are the proposals conditioned on one another? |

A: | Yes. The Business Combination is conditioned on the approval of each of the Condition Precedent Proposals at the extraordinary general meeting. Each of the Condition Precedent Proposals is cross-conditioned on the approval of each other. The Adjournment Proposal is not conditioned upon the approval of any other proposal. |

Q: | Why is Waldencast proposing the Business Combination? |

A: | Waldencast was organized to effect a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination, with one or more businesses or entities. |

Q: | What will Obagi Shareholders and Milk Members receive in return for Waldencast’s acquisition of all of the issued and outstanding equity interests of Obagi and Milk? |

A: | At the Obagi Merger Effective Time (after giving effect to the Obagi Pre-Closing Restructuring, as defined herein and as more fully described in the Obagi Merger Agreement and elsewhere in this proxy statement/prospectus), among other things, each outstanding share of Obagi Common Stock as of immediately |

Q: | What equity stake will current Waldencast shareholders, Obagi Shareholders and Milk Members hold in Waldencast plc immediately after the consummation of the Business Combination? |

A: | As of the date of this proxy statement/prospectus, there are (i) 43,125,000 ordinary shares issued and outstanding, which includes the 8,545,000 founder shares held by the Sponsor, 80,000 founder shares held by the Investor Directors and the 34,500,000 public shares, and (ii) 17,433,333 warrants issued and outstanding, which includes the 5,933,333 private placement warrants held by the Sponsor and the 11,500,000 public warrants. Each whole warrant entitles the holder thereof to purchase one Waldencast Class A ordinary share and, following the Domestication, will entitle the holder thereof to purchase one Waldencast plc Class A ordinary share. Therefore, as of the date of this proxy statement/prospectus (without giving effect to the Business Combination), the Waldencast fully diluted share capital would be 60,558,333 common stock equivalents. |

| | | Assuming No Redemptions | | | Assuming Maximum Redemptions(1) | |||||||

| | | Shares | | | Ownership % | | | Shares | | | Ownership % | |

Waldencast Public Shareholders | | | 34,500,000 | | | 27.0% | | | 12,665,362 | | | 11.3% |

Burwell National Trust and Dynamo Master Fund(2) | | | 16,000,000 | | | 12.5% | | | 16,000,000 | | | 14.1% |

Third-Party FPA Investor(3) | | | 17,300,000 | | | 13.5% | | | 17,300,000 | | | 15.2% |

Founder Shares(4) | | | 8,625,000 | | | 6.7% | | | 8,625,000 | | | 7.6% |

PIPE Investors(5) | | | 10,500,000 | | | 8.2% | | | 10,500,000 | | | 9.2% |

Cumulative Waldencast shareholders | | | 86,925,000 | | | 67.9% | | | 65,090,362 | | | 57.4% |

Existing Obagi Owners interest in Waldencast(6) | | | 22,852,077 | | | 17.8% | | | 28,102,077 | | | 24.7% |

Existing Milk Owners interest in Waldencast(7) | | | 18,343,322 | | | 14.3% | | | 20,341,250 | | | 17.9% |

Shares from Milk Warrants(8) | | | 24,166 | | | 0.0% | | | 24,166 | | | 0.0% |

Total | | | 128,144,565 | | | 100.0% | | | 113,557,855 | | | 100.0% |

1) | Assumes that 21,834,638 Class A ordinary shares are redeemed in connection with the Business Combination which is the maximum number of shares that may be redeemed without causing the Minimum Cash Condition to the Closing of the Business Combination to be unsatisfied. The net cash consideration payable to the existing Obagi owners would decrease from $380.0 million to $327.5 million and to the existing Milk owners from $140.0 million to $120.0 million, and the economic ownership and voting power via shares of the existing Obagi and Milk owners would increase proportionally following the Business Combination. |

2) | 16,000,000 Class A ordinary shares acquired pursuant to the Sponsor Forward Purchase Agreement for an investment of $160.0 million by Burwell Mountain Trust and Dynamo Master Fund (members of our Sponsor) in exchange for a portion of the Forward Purchase Amount. |

3) | 17,300,000 Class A ordinary shares acquired pursuant to the Third-Party Forward Purchase Agreement for an investment of $173.0 million by the Third-Party FPA Investor in exchange for a portion of the Forward Purchase Amount. |

4) | 8,625,000 Class A ordinary shares, including 80,000 shares held by the Investor Directors issued upon conversion of the existing Waldencast Class B ordinary shares. Waldencast Class A ordinary shares are issued upon the automatic conversion of the Waldencast Class B ordinary shares concurrently with the consummation of the Business Combination. |

5) | Represents the private placement pursuant to which Waldencast entered into Subscription Agreements with certain PIPE Investors whereby such investors have agreed to subscribe for Class A ordinary shares at a purchase price of $10.00 per share. The PIPE Investors participating in the PIPE Investment, have agreed to purchase an aggregate of 10,500,000 Class A ordinary shares. |

6) | Represents Obagi owners’ interest in 22,852,077 shares of Waldencast plc Class A ordinary shares, which will increase in the Maximum Redemption scenario to 28,102,077 due to the reduction in net cash consideration payable. |

7) | Represents the Milk Members’ noncontrolling economic interest in Waldencast LP common units, which will be exchangeable (together with the cancellation of an equal number of shares of voting, Waldencast plc Non-Economic ordinary shares) into Waldencast plc Class A ordinary shares on a 1-for-1 basis and which will increase in the Maximum Redemption scenario due to the reduction in net cash consideration payable. |

8) | Represents Class A ordinary shares that were converted from Milk Warrants at the Closing of the Business Combination. |

| | | Assuming No Redemptions | | | Assuming Maximum Redemptions | |||||||

| | | Shares | | | Ownership % | | | Shares | | | Ownership % | |

Waldencast Public Shareholders(1) | | | 51,933,333 | | | 30.8% | | | 30,098,695 | | | 19.6% |

Burwell Mountain Trust and Dynamo Master Fund(2) | | | 22,333,333 | | | 13.3% | | | 22,333,333 | | | 14.5% |

Third-Party FPA Investor(3) | | | 23,066,667 | | | 13.7% | | | 23,066,667 | | | 15.0% |

Founder Shares | | | 8,625,000 | | | 5.1% | | | 8,625,000 | | | 5.6% |

PIPE Investors | | | 10,500,000 | | | 6.2% | | | 10,500,000 | | | 6.8% |

Cumulative Waldencast shareholders | | | 116,458,333 | | | 69.2% | | | 94,623,695 | | | 61.5% |

Existing Obagi Owners interest in Waldencast(4) | | | 30,788,000 | | | 18.3% | | | 36,038,000 | | | 23.4% |

Existing Milk Owners interest in Waldencast(5) | | | 21,093,664 | | | 12.5% | | | 23,091,593 | | | 15.0% |

Shares from Milk Warrants | | | 24,166 | | | 0.0% | | | 24,166 | | | 0.0% |