UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————

Form 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended June 30 , 2022

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from _______ to _______

Commission file number 001-40640

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | ||||||||||

(800 ) 381-0053

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

(Nasdaq Global Select Market) | ||||||||

Securities registered pursuant to section 12(g) of the Act: None

————————

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o | ||||||||

| x | Smaller reporting company | ||||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of voting stock held by non-affiliates of the registrant as of December 31, 2021, the last day of registrant’s most recently completed second fiscal quarter, was $1.35 billion (based on the closing price for shares of the registrant’s common stock as reported by the NASDAQ Global Select Market on that date).

As of August 19, 2022, the number of shares of the Registrant’s Common Stock outstanding was 175,643,109 shares.

1

Table of Contents

2

Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K, including the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors,” contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, our objectives for future operations, and any statements of a general economic or industry specific nature, are forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. Words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely,” “outlook,” “potential,” “targets,” “contemplates,” or the negative or plural of these words and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe, based on information currently available to our management, may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, related to our operations, financial results, financial condition, business, prospects, growth strategy, and liquidity. Accordingly there are, or will be, important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to:

•Our ability to manage our growth effectively.

•The resulting effects of any potential breach of our security measures or any unauthorized access to our customers’ or their employees’ personal data, including by way of computer viruses, worms, phishing and ransomware attacks, malicious software programs, and other data security threats.

•The expansion and retention of our direct sales force with qualified and productive persons and the related effects on the growth of our business.

•The impact on customer expansion and retention if implementation, user experience, customer service, or performance relating to our solutions is not satisfactory.

•The timing of payments made to employees and taxing authorities relative to the timing of when a customer’s electronic funds transfers are settled to our account.

•Future acquisitions of other companies’ businesses, technologies, or customer portfolios.

•The continued service of our key executives.

•Our ability to innovate and deliver high-quality, technologically advanced products and services.

•Our ability to attract and retain qualified personnel, including software developers and skilled IT, sales, marketing, and operation personnel.

•The proper operation of our software.

•Our relationships with third parties.

•Damage, failure, or disruption of our Software-as-a-Service (“SaaS”) delivery model, data centers, or our third-party providers’ services.

•Our ability to protect our intellectual and proprietary rights.

•The use of open source software in our applications.

•The growth of the market for cloud-based human capital management and payroll software among small and medium- sized businesses (“SMBs”).

•The competitiveness of our market generally.

•The effects of inflation, supply chain disruptions, labor shortages and other ongoing macroeconomic impacts from the novel coronavirus pandemic (“COVID-19 pandemic”).

•The impact of an economic recession in the United States (“U.S.”) or global economy.

•Our customers’ dependence on our solutions to comply with applicable laws.

•Our ability to comply with anti-corruption, anti-bribery and similar laws.

3

•Changes in laws, regulations, or requirements applicable to our software and services.

•The impact of privacy, data protection, tax and other laws and regulations.

•Our ability to maintain effective internal controls over financial reporting.

•The other risk factors set forth under Item 1A. of Part I of this Annual Report on Form 10-K.

Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations and assumptions reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We undertake no obligation to publicly update any forward-looking statement after the date of this report, whether as a result of new information, future developments or otherwise, or to conform these statements to actual results or revised expectations, except as may be required by law.

4

Part I

Item 1. Business

Paycor HCM, Inc., a Delaware corporation (“Paycor HCM”), was incorporated in August 2018 to serve as a holding company in connection with the acquisition of the Company (the “Apax Acquisition”) by Apax Partners L.P. (“Apax Partners”) in 2018. Paycor HCM completed an initial public offering (“IPO”) of its common stock in July 2021. Paycor HCM, Inc. and its subsidiaries are referred to collectively as the “Company,” “Paycor HCM,” “we,” “us,” or “our,” unless the context requires otherwise.

Mission

Paycor empowers leaders to develop winning teams.

Overview

We are a leading Software-as-a-Service (“SaaS”) provider of human capital management solutions for small and medium-sized businesses. Our unified, cloud-native platform is built to empower people leaders by producing actionable, real-time insights to drive workforce optimization. Our comprehensive suite of solutions enables organizations to streamline human capital management (“HCM”) and payroll workflows and achieve regulatory compliance while serving as the single, secure system of record for all employee data. Our highly flexible, scalable, and extensible platform offers award-winning ease-of-use with an intuitive user experience and deep third-party integrations, and all augmented by industry-specific domain expertise. Over 29,000 customers across all 50 states trust us to help their leaders develop winning teams.

Since our founding in 1990 we have achieved several key milestones, including:

•2004: Completed first business acquisition and developed web-based version of our software.

•2006 – 2008: Expanded product offerings beyond payroll services, adding human resources and time and attendance functionalities.

•2012: Launched new flagship SaaS platform, “Perform”, which was built to provide ease-of-use and depth of functionality for SMBs.

•2014: Released Perform Time and Onboarding solutions and surpassed $100 million in annual revenue.

•2015: Completed the acquisition of Newton Software, adding applicant tracking software to the portfolio, and surpassed 1,000,000 employees on platform.

•2017: Surpassed $200 million in annual revenue.

•2018: Received majority investment from Apax Partners and launched research-based resource hub, HR Center of Excellence.

•2019: Hired Raul Villar Jr. as CEO and acquired Nimble Scheduling Software.

•2020: Surpassed $300 million in annual revenue, launched GUIDE Elite implementation, released Pulse surveys tool, and completed the acquisition of 7Geese talent management software.

•2021: Consummated the IPO of Paycor HCM, Inc. and began trading publicly on the Nasdaq Global Select Market.

•2022: Surpassed $400 million in annual revenue, released Expense Management providing people leaders with one location to easily review, reimburse, and report on employee expenses, and launched the Paycor Developer Portal making it simple for our customers to connect the power of their people data across their business through improved integrations.

People management has evolved significantly over the last 30 years from an administrative, payroll-centric cost center to a highly strategic function focused on talent management and employee engagement. To be competitive in today’s environment, organizations are increasingly reliant on this function as they seek to leverage people analytics to identify trends and track performance across their workforce. However, most existing HCM solutions lack the comprehensive functionality, ease-of-use, and integration capabilities needed to facilitate effective people management. These limitations are particularly problematic for SMBs which often lack the technical, financial, and people resources of larger organizations.

5

Our unified, cloud-native platform is purpose-built for leaders and configured by industry with the tools they need to optimize all aspects of people management. See “Our Solution and Key Strengths” section below, within Item 1. Business, for what we believe are the key strengths of our platform.

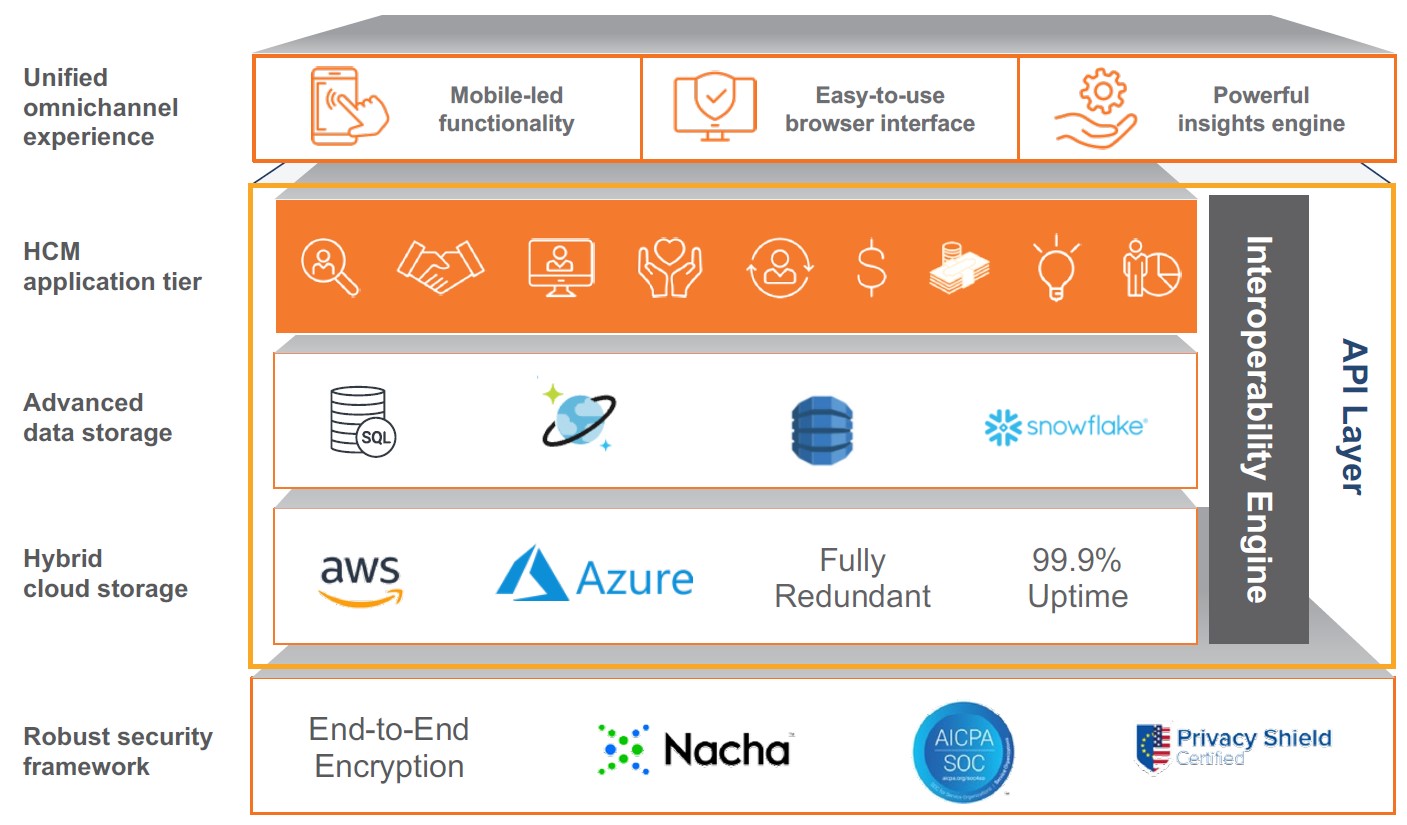

Our easy-to-use platform incorporates intuitive analytics functionality, enabling SMBs to automate and simplify mission-critical people management processes and enhance visibility into their business operations. Our platform is architected for extensibility and features an open application programming interface (“API”) led interoperability engine that allows customers to easily connect their people data with third-party applications to create a seamlessly integrated digital ecosystem. Our products are supported by a differentiated implementation process and vibrant community of users, which together ensure customers can take full advantage of our platform.

We market and sell our solutions through direct sales teams, leveraging our strong demand generation engine and broker partnerships. We primarily target companies with 10 to 1,000 employees. We intend to grow our customer base by accelerating the expansion of our sales coverage and broker networks in both new and existing markets, with a focus on the 15 most populous metropolitan statistical areas in the United States (“Tier 1 markets”), which encompasses 33% of the U.S. population and where we see substantial opportunity. We also intend to grow our customer base through our industry focused product and go-to-market strategy. We market our products via a bundled pricing strategy where we charge customers on a per-employee-per-month (“PEPM”) basis and have demonstrated success at driving growth through the expansion of our Cor HCM and Payroll product bundle. We intend to continue to expand our product suite and further cross-sell products into our existing customer base.

Industry Background

Human capital management is an evolving necessity for organizations, with several key trends that have shaped today’s environment.

The Evolution of People Management

Over the last 30 years, the demands of people leaders and people management strategies have significantly evolved in response to shifting demographics, employee expectations, and technological capabilities. As a result, the importance of people management has been elevated from a payroll-centric cost center to a highly strategic function focused on talent management as a critical component of business competitiveness.

In the 1990s and early 2000s, HCM systems focused on moving paper-based Human Resources (“HR”) processes to software-based processes. The initial benefit was around the elimination of paper trails, but there was limited focus on modernizing the work. In the mid-to-late 2000s, the emergence of SaaS brought a focus on improving the old paper processes that had been converted to software. Numerous point solutions evolved to tackle each of the key HCM functions. This led to greater system fragmentation, an overcomplicated user experience, and increased costs. At the same time, the separation between work and life began to blur, driving an increased need for employee engagement tools. HCM became a strategic business function and the tools to support it are now mission critical for companies.

The COVID-19 pandemic further reinforced this strategic shift as the HR function proved vital to companies striving to maintain morale and productivity for both remote workforces and essential employees. Following on the heels of the pandemic, the “Great Resignation” forced companies to evolve their people management practice yet again, creating a need for employee engagement in every industry, including blue-collar fields. These evolving demands have accelerated the trend of modern HCM technology replacing manual processes and outdated systems with strategic platforms that surface business insights, enabling leaders to make data-driven decisions.

To address this lack of engagement, many HCM solution providers targeted their product development efforts at enhancing the employee experience. But the solutions were surface-level employee portals, similar to social media platforms, to drive engagement. Companies quickly found that their employees were not looking for another social platform, especially one provided by their employer. Other unsuccessful attempts to drive engagement included adding gamification attributes to influence behavior, such as encouraging employees to complete compliance training. These product features failed to address the top factor that impacts employee engagement, an employee’s leader.

6

One of the top drivers of employment engagement is driven by an employee’s direct manager. Employers have long known employee engagement leads to higher productivity and decreased risk of attrition. Even so, a 2022 study conducted by Gallup revealed that only 32% of employees in the U.S. are engaged by their work. Given this, it is not surprising that a 2019 Gartner study showed employee engagement to be the need least met by existing HCM solutions. We believe the next evolution of HCM software will be empowering leaders with the tools to effectively strengthen engagement, manage career development, and enhance the employee experience in order to drive business results.

Complex Regulatory Environment

The ever-evolving regulatory landscape continues to place a burden on small businesses. For example, the 2020 Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) has required small businesses to quickly adapt to complex requirements. In addition, businesses are forced to navigate thousands of state and local tax codes and industry-specific labor laws. As a result, demand has increased for HCM platforms that enable them to maintain a robust compliance framework and abstract the complexity of regulatory changes, such as responding to special employee leave provisions.

Growing Importance of People Analytics

In recent years, businesses have begun to appreciate the value they could derive from stronger data analytics capabilities. SMB leaders are increasingly willing to invest in data-driven decision-making tools to improve their business performance. An IDC survey found that analyzing data and employee engagement had the highest level of third-party investment. In addition, a survey by Gartner showed that 64% of participants ranked improvement of reporting quality and people analytics as their main HR objective when evaluating HCM solutions. SMBs have a particular need for all-in-one solutions considering their unique capacity constraints, such as single person HR departments and limited in-house legal and information technology (“IT”) support.

Unique Needs of SMBs

SMBs prefer solutions that have the following key characteristics:

• Ease of Implementation. The ability to get mission critical solutions up and running seamlessly and successfully without overburdening company resources.

• Ease of Use. Intuitive design and simple workflows for leaders and their teams.

• Full Suite of Solutions. Fully integrated platform to serve as a single system of record for all HCM functions with built-in critical capabilities such as compliance, mobility, analytics, and security.

• Highly Scalable Cloud-based Platform. Flexible solutions built to meet the needs of organizations as they grow in size and complexity.

• Industry-specific Focus. Product, customer experience, and community tailored to unique industry needs.

• Interoperability. The ability to connect the power of people data across entire business through public APIs, events, and notifications.

Limitations of Existing Solutions

The vast majority of SMBs still rely on legacy solutions to fulfill their HCM technology requirements. These product offerings are typically provided by national and regional payroll service bureaus or in-house solutions built on top of generic enterprise resource planning (“ERP”) systems. In addition to these legacy solutions, advancements in cloud technology have led to the emergence of other competing SaaS-based HCM offerings. Both legacy and other competing SaaS offerings possess significant limitations in addressing the full HCM needs of SMBs. These limitations include:

•Incomplete HCM Solutions Lacking in Product Breadth and Depth. Many existing HCM platforms offer incomplete product suites that deliver only a portion of the capabilities required by SMBs or offer ‘full suites’ comprised of products with limited functionality, capable of addressing only the most basic use cases. Often these solutions rely on archaic technologies such as batch payroll processing engines and lack robust compliance and security features. Users of these incomplete platforms are often forced to use multiple products from multiple vendors or continue to manage processes manually outside of their HCM solution.

7

•Lack a Unified Approach. Many existing HCM ‘suites’ are comprised of a patchwork of stand-alone applications with limited integration. This lack of unification inhibits the real-time synchronization of data across multiple HCM applications and makes it difficult for SMBs to maintain a single, uniform system of record for employee data. As a result, SMBs are forced to rely on manual, redundant, and error-prone processes to manage and track employee data, which can often lead to untimely payroll, poor employee engagement, and significant compliance issues such as incomplete reporting, and inadequate data security.

•Difficult to Integrate with Third-Party Systems. Most existing HCM solutions are built on inflexible, closed technology architectures, and are not designed to communicate with external applications. These rigid systems make it difficult for SMBs to integrate HCM tools with other key systems of record such as ERP and POS applications and often require significant manual work to extract and port data to execute routine functions. This inhibits organizations’ ability to establish flexible digital ecosystems capable of addressing the evolving needs of a growing business.

•Lack Robust Analytics Capabilities. Many existing SMB solutions lack tools which are both sophisticated and easy-to-use to access, aggregate, analyze, and act on employee data in real-time. As a result, SMBs are unable to efficiently derive actionable workforce insights and make critical, informed decisions to improve the way they hire, manage, and develop people, such as uncovering turnover trends based on demographics, location, and tenure.

•‘One Size Fits All’ Approach. Certain industry verticals have unique people management requirements, such as job costing for manufacturing companies and blended overtime calculations for healthcare employees who work shifts at different pay rates. However, most existing HCM solutions provide generic out-of-the-box functionality and limited configurability, with professional service teams that often lack vertical expertise. As a result, SMBs struggle to address evolving industry-specific people management needs and reporting requirements with existing HCM solutions.

•Difficult to Use. Many existing solutions have arcane, inflexible user interfaces that lack the intuitive, consumer-like feel of modern SaaS applications. These solutions are often difficult for both employees and leaders to use effectively without significant training. Additionally, many existing HCM suites typically lack consistent functionality and user experience across different devices, and typically require multiple logins to traverse between applications. As a result, people leaders are often forced to revert to time-consuming manual processes to execute simple HR tasks and assist with tedious employee troubleshooting.

•Not Designed for People Leaders. Many existing HCM solutions were built with engagement functionality specifically designed for employees, not people leaders who have the most influence over employee engagement. These solutions often lack the end-to-end functionality and powerful analytics required by people leaders for effective people management. As a result, people leaders are incapable of fully leveraging their HCM solution to hire and retain the right talent, optimize routine functions, and transform people management into a strategic driver of business performance.

Our Solution and Key Strengths

8

We offer a unified, cloud-native platform, purpose-built to address the comprehensive people management needs of SMB leaders. Our intuitive, easy-to-use platform enables SMBs to easily automate and simplify the most mission-critical people management processes and enhance visibility into organizations’ human capital to drive employee engagement and data-driven decisions. The key strengths of our platform include:

•Comprehensive Suite of HCM Solutions Architected to Meet the Full Range of an SMB’s Needs. Our comprehensive HCM suite delivers industry-leading functionality. This empowers leaders to achieve strategic goals through differentiated people management. The key components of our HCM solutions include:

•Cor HCM including Payroll Suite and Employee Experience. A complete suite of HCM tools spanning HR, onboarding, payroll, compensation management, employee surveys, expenses, reporting and analytics. Our powerful calculation engine enables real-time changes to drive fast and accurate payroll processing. Robust workflows and approval capabilities assist leaders with expediting and automating their most common tasks. AI-powered surveys use natural language processing to surface actionable, easy-to-understand insights from feedback enabling leaders to solve issues like turnover and low morale. Recognition tools allow employees to feel valued and visible within their organization.

•Benefits Administration. Advanced decision support to help leaders streamline and optimize their company’s benefits administration and spend with superior carrier connectivity and the ability to set up complex plans.

•Talent Management. Powerful recruiting, talent management and learning management suite. Intuitive, configurable recruiting built for leaders with deep email integration, job board connectivity, and employee referral capabilities. Performance management capabilities, including advanced goal management paired with employee-manager one-on-ones, empowering leaders to drive employee professional growth and corporate alignment through ongoing conversations. In addition, tools for career planning help leaders conduct critical growth conversations with each member of their team while learning management powers continued employee development.

•Workforce Management. Flexible time entry, overtime calculations, and scheduling capabilities with real-time payroll synchronization allowing leaders to manage costs and increase productivity.

9

•Uniquely Unified Platform Enabling Seamless Customer Experience. Our platform leverages a modern cloud architecture and robust API led interoperability engine. We deliver a unified user and data experience that serves as the single source of truth for our customers’ employee data. Our platform allows for seamless access to people data across applications and the visibility to extract meaningful business insights from employee information in real-time. This unified data architecture automates error-prone manual processes, empowering leaders to shift their focus to strategic initiatives that drive long term business value.

•Open, Cloud-native Architecture Enables Differentiated Platform Extensibility. Our SaaS platform is flexible, scalable, and extensible, allowing us to continuously expand the breadth and depth of our product suite without compromising the unified user experience for both employers and employees. Our single instance, multi-tenant deployment enables us to deliver frequent, silent updates to maintain a consistent user experience on the latest version of our software. The extensibility of our platform allows for easy integrations to various technologies both within and outside of the HCM ecosystem, such as connections to benefits platforms to support our broker partnerships and integrations to industry-specific ERP systems.

•Industry-specific Functionality and Expertise. We provide SMBs with a combination of industry-specific product configurations, pre-built integrations with sought-after third-party solutions, and served by professionals with industry-specific training. Our HCM platform is configurable and flexibly designed to address a broad cross-section of vertical-specific use cases. Our solutions are supported by a proprietary implementation program and vibrant community of users, which together ensure customers can take full advantage of our industry-specific functionality.

•Powerful Analytics to Deliver Actionable Insights. We enable real-time visibility into an organization’s people data through a comprehensive set of out-of-the-box analytics capabilities. Our powerful analytics allow SMBs to cost-effectively transform data into trends and predictions to benchmark, understand, and easily report on their workforce. With predictive analytics and robust benchmarking tools, our platform enables SMBs to make strategic, data-driven decisions to improve recruiting, labor cost management, employee performance, diversity and inclusion, and employee retention.

•Designed for People Leaders. Effective business leadership is critical to maximizing employee engagement and successful business performance. Our platform is purpose-built to provide people leaders with the tools they need to optimize every aspect of people management. With our end-to-end HCM functionality and deep analytics capabilities, people leaders can streamline people management functions, surface actionable insights, facilitate successful hiring, meaningfully engage their employees, and focus people management on strategic initiatives that drive business value.

Our Market Opportunity

We estimate our current annual recurring market opportunity is $29 billion in the U.S. and we expect the opportunity to grow as the number of SMBs increase and we continue to expand our product portfolio. To estimate our market opportunity, we identified the number of companies in the U.S. with an employee count between 10 and 1,000. Based on data from the U.S. Bureau of Labor Statistics released in December 2021, there were approximately 1.3 million businesses with between 10 to 1,000 employees, totaling 57.6 million employees within our target demographic. We then applied our $42 total list PEPM rate as of June 30, 2022 for our full suite of products including Cor HCM, Workforce Management, Benefits Administration, and Talent Management to derive our current total addressable market opportunity of $29 billion.

Growth Strategy

We intend to capitalize on our market opportunity with the following key growth strategies:

•Expand Sales Coverage. We believe there is substantial opportunity to continue to broaden our customer base. As of June 30, 2022, we had approximately 29,800 customers, which represented a small percentage of the U.S. market for HCM and payroll solutions. As a result of our historical footprint, a significant majority of our revenue is derived from the Great Lakes and Southeast regions of the United States. We focus our sales resources in the top 50 most densely populated United States cities. We intend to drive new customer additions by expanding our sales coverage, primarily in Tier 1 markets, where there is a substantial opportunity to grow our sales coverage and customer base. Sales coverage in Tier 1 markets increased from 20% to 28% in the last fiscal year. This is compared to 32% coverage in Tier 2 markets, or the subsequent 15 most populous U.S. metropolitan markets and 59% coverage in Tier 3 markets, or the 20 subsequent most populous U.S. metropolitan markets. We believe that our go-to-market strategy positions us well to scale our business efficiently and effectively into these markets.

10

•Accelerate Broker Channel Partnerships. Benefits brokers are trusted advisors to SMBs and are influential in the HCM selection process. We will continue to work with our existing broker partners and intend to expand our broker network through regional and national partnerships to drive customer acquisition.

•Expand Industry-specific Functionality and Leadership. SMBs in certain industries require unique functionality for their people management needs. We designed our platform to be easily configurable for industry-specific applications in key verticals such as manufacturing, healthcare, restaurants, and professional services. We will continue to expand our solutions and expertise in both existing and new key industries.

•Expand Product Penetration within Existing Customer Base. Our PEPM is increasing as we continue to grow our HCM suite. Our customers typically start with our Cor HR and Payroll solution, eventually expanding their usage of our platform over time. Because our product offerings have expanded significantly over the last few years, we have a significant opportunity to further penetrate our existing customer base.

•Continue to Innovate and Add New Solutions. Given our customer centric approach, we collaborate with our clients in the future development of our product offerings. We have a robust product roadmap that is specifically focused on enhancing our ability to address the unmet needs of our customers and prospective customers. We intend to continue to invest significantly in research and development, particularly regarding the functionality of our platform, to sustain and advance our product leadership.

•Pursue Strategic M&A. We have successfully acquired and integrated several businesses that complement and enhance our software and technology capabilities. We will continue to take a disciplined approach to identifying and evaluating potential acquisitions, ensuring we pursue strategies that expand the depth of our product portfolio and drive revenue synergies through cross sale opportunities. Our focused M&A strategy will help us to continue to drive growth and expand our market footprint and product leadership.

Our Products

Our comprehensive portfolio of SaaS-based people management products includes:

Cor HCM including Payroll Suite and Employee Experience

•Onboarding: Enables customers to digitize the onboarding process by helping them to automate the collection of necessary new employee data, complete compliance forms, set up direct deposit, acknowledge company documents, and engage their new hires with necessary content such as training videos. Additionally, employees can complete the Work Opportunity Tax Credit (“WOTC”) information, and use electronic signatures to complete the onboarding process.

•HR: Includes functionality allowing leaders to set up and manage the organizational structure such as company departments and locations; employee lifecycle actions such as promotions, transfers, and terminations; create a dynamic and digital company organizational chart; workflows and approvals; immunization tracking; and document storage.

•Payroll: Fully-featured payroll and tax compliance engine with federal, state, and local tax support. Enables users to manage the entire payroll process including set up, payroll processing, reporting, direct deposit, check print, pay cards, and on-demand pay access. Provides payroll administrators with flexibility to make updates on the fly to current and future payroll cycles and see the results in real time. The solution is accompanied by services to assist leaders with filing compliance forms with multiple levels of government to fulfill company obligations.

•Expense Management: A unified expense management system allows employees to create and manage expense reports, leaders to review and approve, and employees to get reimbursed quickly and efficiently.

•Recognition: Enables employees to engage with their peers by recognizing great work and giving them a public “shout out” for their achievements. Recognition is tied to a company’s core values so employees understand how their work drives the company mission.

•Time Off Manager: Enables customers to manage time off administration with functionality for key users. Administrators can set up and monitor accrual policies while empowering employees to request time off and view balances directly from the web or mobile app. Managers can approve time off via the web or mobile app and see a holistic view of their team via a time off dashboard and calendar view.

11

•Mobile: Native iOS and Android app designed for employees and managers to have access to the HCM system from their preferred mobile device. Includes the ability for managers and employees to process workflow approvals, manage time and attendance, view paystubs, manage benefits, provide peer recognition, access company learning, access company news, view the employee directory, and view employee documents.

•ACA: Reporting and filing tool to ensure customer compliance with the Affordable Care Act (“ACA”) to help leaders understand workforce compliance, comply with measurement periods, and both generate and file necessary forms.

•Reporting: Provides customers with a robust library of standard reports for their most common needs including federal and state compliance, employee rosters, and payroll reporting, such as pre and post journals. Additionally, the reporting engine gives customers the ability to do ad hoc reporting by enabling leaders to query their people data and design reports to suit their own needs.

•Compensation Management: Facilitates compensation strategy to reduce turnover and reward the right talent by automating compensation events in one system, taking the complexity out of planning. The tool enables leaders to create salary plans and associated budgets, distribute salary worksheets to managers for planning and what-if scenarios within defined budgets, view calculations and compensation metrics (such as compa-ratios), roll up plans for executive approval, and create new pay records upon completion – all fully integrated with performance management.

•Analytics: Provides real-time data insights to help leaders make critical business decisions. It provides a broad set of templates including retention, compensation, diversity, benchmarking capabilities, predictive insights, and comparison tools. Leaders can run what-if analyses, create easily accessible, personalized dashboards of key business metrics, and create presentations on their people data.

•Employee Surveys: Pulse, the employee survey tool, gives leaders an accurate way to gather and convert employee feedback into insights for actionable plans. Designed to help leaders regularly gauge what employees are thinking and feeling in real time, the tool facilitates both light-weight pulse surveys and in-depth engagement surveys through a combination of quantitative and qualitative questions. Results are put through the natural language processing and sentiment analysis engines that use the power of AI to quickly categorize unstructured feedback by theme and positive/negative sentiment, so leaders do not have to spend precious time manually parsing results.

•Wallet: Allows employees to access their earned wages directly from the mobile app before their payday without fees when using their Visa card, giving leaders more flexible pay options for their employees.

•Developer Portal: Our innovative Developer Portal makes it even easier for clients and partners to seamlessly integrate and sync data between HR and third-party systems. Leveraging powerful APIs, Paycor’s modern, extensible platform enables rapid development and partner integrations.

Workforce Management

•Scheduling: Enables leaders to plan and optimize schedules to budgets and easily create schedules based on templates. Employees can set their own availability, see when they are scheduled to work, and swap shifts with other employees, facilitated by built-in chat capabilities.

•Time and Labor Management: Delivers a unified system of record with HR and Payroll. Facilitates time punching, timecard entry, timecard submittal, and timecard approval. Managers can proactively monitor hours and overtime via dashboards, providing leaders the visibility needed to control labor costs. Employees can interact with the software via the web, their phone, or a timeclock device. The software is designed to handle the various overtime, scheduling, and break rules required across the jurisdictions where employees work.

Benefits Administration

•Benefits: Benefits Advisor is a rules-based platform that simplifies benefit administration tasks while empowering employees to make smart, cost-effective decisions. The tool provides benefit administration capabilities for plan set up and management, open enrollment with built in decision support for employees, life event-based enrollment for employees, and carrier connectivity to seamlessly pass enrollment information to benefit carriers.

12

Talent Management

•Recruiting: Helps customers to streamline the recruiting process by fully managing both the requisition and candidate lifecycles. Recruiting allows leaders to communicate with candidates the way they want via both text message and email, schedule interviews, extend offers, and seamlessly begin the employee onboarding experience. Recruiters can gamify the referral process and reward employees who make referrals via our Gravity referral app. Additionally, the product can integrate with popular job boards, which helps to ease the frequent struggles of creating a healthy candidate pipeline. The Recruiting product also allows customers to create a fully branded careers site that matches the look and feel of their primary corporate site.

•Performance Management and Goal Setting: Enables leaders to improve the quality of work by facilitating meaningful conversation and coaching that allow employees to feel heard, helping them better understand what they need to do to succeed. Customers can build customizable reviews for both the ongoing review process and the annual process, enable peer-to-peer feedback, and keep parties up-to-date with event and approver notifications and workflows. Additionally, specific, measurable, achievable, relevant and time-bound goals and objectives and key results can be created, tracked, and managed throughout the year, enabling regular manager-employee one-on-one check-ins to ensure goal alignment, progress, and completion.

•Learning Management: Combines virtual, classroom, mobile, and social capabilities on one platform, so employees can learn at their own pace – whether in a curated course or in a self-paced, on-demand environment. It includes a robust delivered content library, a course builder for customers to create their own content and learning assessments, quizzes to ensure learner proficiency, and real-time course-completion data for leaders.

Our Technology

Our technology is based on a multi-tenant SaaS framework and utilizes automated build-and-deploy processes to release updates to customers. This gives us an advantage over many disparate traditional systems which are less flexible and require longer and costly development and upgrade cycles. Our technology is powered by a hybrid cloud configuration leveraging geographically dispersed co-located data centers hosted through Microsoft Azure and Amazon Web Services. Our platform is designed to be flexible, scalable, and highly configurable and is built on a layer of cloud-native micro services, which supports the platform’s ability to easily integrate with other technologies in our customers’ digital ecosystems. In addition, customer data is stored in a modern database layer and accessed through a unified reporting system.

13

The platform is designed with security as a top consideration and employs a defense-in-depth strategy through administrative, physical, and technical safeguards to ensure the protection, confidentiality, and integrity of our customers’ data. The Company is NACHA certified, a voluntary accreditation program from the National Automated Clearing House Association which governs the nation’s automated clearing house (“ACH”) network and payment system. We also routinely complete SOC 1 and SOC 2 examinations. Service Organization Controls (“SOC”) are standards established by the American Institute of Certified Public Accountants for reporting on internal control environments implemented within an organization. We continuously monitor our network and endpoint-based security threats along with antivirus software to guard against trojans, worms, viruses, and other malware.

Our Customers

As of June 30, 2022, we served approximately 47,100 clients from over 29,800 parent customers. Our target customers are companies with 10 to 1,000 employees and we specialize in manufacturing, healthcare, restaurants, and professional service industries. We currently have more than 2.3 million active employees on our platform.

Sales and Marketing

We sell our solutions through a direct sales team, comprised of field sales, insides sales and client sales, each organized by customer size, geography, and industry. Our field sales team focuses on generating new sales to prospects with more than 50 employees, while our inside sales team drives new sales to organizations with less than 50 employees. Our client sales team cross-sells additional bundles to existing customers. Our sales professionals are trained to take a consultative approach to uncover the specific challenges and industry-specific nuances faced by customers and ensure the right solutions are provided. Our sales footprint has historically been concentrated in Tier 2 and Tier 3 markets. We believe there is an attractive opportunity to grow our sales teams in Tier 1 markets.

A core component of our sales and marketing strategy is our partnerships with key centers of influence (“COIs”), which include benefits brokers, financial advisors, financial institutions, and HR consultants. These partnerships enhance our sales motion by generating high quality referrals and providing credibility to our product offerings.

We generate customer leads, accelerate sales opportunities, and build brand awareness through our direct marketing programs and robust network of COIs. We believe that our sales success is attributable to our differentiated unified platform, our ability to generate high customer return on investment, and our reputation for superior customer service. Our principal marketing efforts consist of paid, owned, and earned marketing strategies, including robust organic search engine optimization, paid digital media, account based marketing, channel partner marketing, and live and virtual events. Additionally, our HR Center of Excellence is an award-winning resource hub that provides existing and prospective customers with white papers, webinars, and industry research to help organizations optimize human capital management.

As of June 30, 2022, our sales and marketing organization included approximately 460 sales professionals.

Research and Development

We invest significantly in research and development to continuously introduce new applications, technologies, features, and functionality. We are organized in small product-centric teams that utilize an agile development methodology. We focus our efforts on developing new applications and core technologies as well as further enhancing the usability, functionality, reliability, performance, and flexibility of existing applications.

We expensed research and development costs through our consolidated statements of operations of $43.1 million and $36.0 million for the fiscal years ended June 30, 2022 and 2021, respectively. Additionally, we capitalized research and development costs on our consolidated balance sheets of $29.8 million and $21.2 million for the fiscal years ended June 30, 2022 and 2021, respectively. Our research and development personnel are principally located in Ohio and Texas, although many of our associates operate virtually. We seek to hire highly experienced personnel wherever they are located.

Our Service Model

GUIDE Implementation Model

• GUIDE is our differentiated implementation methodology, where we work to Gather, Understand, Import, Deliver, and Evaluate (“GUIDE”), ensuring a successful and seamless transition to our products.

14

• GUIDE Elite is a service that offers our larger prospective customers and all broker-referred clients a project manager who serves as the single point of contact and go-to implementation expert throughout the process. With GUIDE Elite, customers are offered extended implementation support of between six weeks to six months following product activation with a focus on training, utilization, and adoption to maximize the value of our technology and expertise.

Personalized Support Model

• Our personalized support model is based on matching customers with the specialist that has the skill set needed to answer their inquiry. Our customer experience team is based in the United States and delivers a responsive, consultative customer service experience. We have invested to enhance our client service, now providing omni-channel support spanning our self-service support center, live chat with a Customer Advocate, enhanced knowledge base with industry-specific knowledge and customer trainings, and online case management in addition to our traditional customer support phone line. Our larger customers are assigned a dedicated Customer Success Manager who is focused on driving the value of existing solutions, conducting Executive Business Reviews for strategic planning, and serving as a trusted advisor.

Seasonality

Our revenues are seasonal in nature. Recurring revenues include revenues relating to the annual processing of payroll forms, such as Form W-2, Form 1099, and Form 1095 and revenues from processing unscheduled payroll runs (such as bonuses) for our clients. Because payroll forms are typically processed in the third quarter of our fiscal year, third quarter revenue and margins are generally higher than in subsequent quarters. These seasonal fluctuations in revenues can also have an impact on gross profits. Historical results impacted by these seasonal trends should not be considered a reliable indicator of our future results of operations.

Intellectual Property

Our success is dependent, in part, on our ability to protect our proprietary technology and other intellectual property rights. We rely on a combination of laws and intellectual property rights, including trade secrets, copyrights, and trademarks, as well as contractual protections to establish and protect our intellectual property rights. We require our associates and other employees, consultants and other third parties to enter into confidentiality and proprietary rights agreements and control access to software, documentation, and other proprietary information. In addition, we believe that factors such as the technological and creative skills of our personnel, creation of new modules, features and functionality and frequent enhancements to our applications are also essential to establishing and maintaining our technology leadership position in our industry.

Despite our efforts to protect our proprietary technology and our intellectual property rights, unauthorized parties may attempt to misappropriate our rights or to copy or obtain and use our proprietary technology to develop applications with the same functionality as our applications. Policing unauthorized use of our technology and intellectual property rights is difficult and costly, and we may not be successful in detecting or preventing unauthorized activities.

We expect that providers of HCM and payroll solutions such as ours may be subject to third-party infringement claims as the market and the number of competitors grows and the functionality of applications in different industry segments overlaps. Any of our competitors or other third parties might make a claim of infringement against us, which would require us to defend ourselves regardless of the merits of such claim, and could divert the attention of management and cause us to incur costs.

Segment Information

We operate in a single operating segment and a single reporting segment. Since we operate as one segment, all required financial information is presented at the consolidated financial statement level.

Competition

The market for HCM and payroll solutions is fragmented, highly competitive, and rapidly changing. Our competitors vary for each of our solutions and include both enterprise and micro-focused software providers, such as legacy payroll service bureaus (ADP, Paychex, UKG), cloud HCM software providers (Paylocity, Paycom), and other regional service bureaus and in-house ERP software providers that offer limited functionality.

15

We believe the principal competitive factors in our market include the following:

• Benefits of a cloud-based technology platform.

• Breadth and depth of product functionality.

• Configurability and ease of use of our solutions.

• Modern, intuitive user experience.

• Ability to innovate and respond to customer needs rapidly.

• Domain expertise in HCM and payroll.

• Ease of implementation.

• Quality of implementation and customer service.

• Real-time web-based payroll processing.

• Integration with a wide variety of third-party applications and systems.

• Interoperability and data access.

We believe that we compete favorably on these factors within the SMB market. We believe our ability to remain competitive will depend on the success of our continued investment in sales and marketing, research and development, and implementation and customer services.

Regulation

As a provider of payroll and HCM solutions, our systems contain a significant amount of sensitive data related to clients, employees of our clients, vendors and our employees. Data privacy has become a significant issue in the United States and in other countries. The regulatory framework for privacy issues worldwide is rapidly evolving and is likely to remain uncertain for the foreseeable future. Many federal and state government bodies and agencies have adopted or are considering adopting laws and regulations affecting or regarding the collection, use and disclosure of personal information. These include, for example, rules and regulations promulgated under the authority of the Federal Trade Commission, the Health Insurance Portability and Accountability Act of 1996, the Family Medical Leave Act, the Affordable Care Act, state breach notification laws and state privacy laws, such as the California Consumer Privacy Act of 2018, the California Privacy Rights Act and the Illinois Biometric Information Privacy Act. Further, because some of our clients have international operations, the European Union’s General Data Protection Regulation (“GDPR”) and other foreign data privacy laws may impact our processing of certain client and employee information.

In addition, many of our solutions are designed to assist clients with their compliance with certain U.S. federal, state and local laws and regulations that apply to them. As such, our products and services may become subject to increasing and/or changing regulatory requirements, including changes in tax, benefit and other laws, and as these requirements proliferate, we may be required to change or adapt our products and services to comply. Changing regulatory requirements might reduce or eliminate the need for some of our products and services, block us from developing new products and services or have an adverse effect on the functionality and acceptance of our solution. This might in turn impose additional costs upon us to comply, modify or further develop our products and services. It might also make introduction of new products and services more costly or more time-consuming than we currently anticipate or prevent introduction of such new products and services. For example, the adoption of new money transmitter or money services business statutes in jurisdictions or changes in regulators’ interpretation of existing state and federal money transmitter or money services business statutes or regulations, could subject us to registration or licensing or limit business activities until we are appropriately licensed.

Our ability to comply with and address the continuously evolving requirements and regulations applicable to our business depends on a variety of factors, including the functionality and design of our solutions and the manner in which our clients and their employees utilize them. We have implemented operating policies and procedures to protect the accuracy, privacy and security of our clients’ and their employees’ information and voluntarily undergo certain periodic audits and examinations and maintain certain certifications to demonstrate our commitment to regulatory compliance.

The foregoing description does not include an exhaustive list of the laws and regulations governing or impacting our business. See the discussion contained in Item 1.A “Risk Factors” of this Annual Report on Form 10-K for information regarding changes in laws and regulations that could have a materially adverse effect on our business, operating results or financial condition.

16

Human Capital

As of June 30, 2022, we had approximately 2,300 associates, primarily located in the United States, with the majority working virtually. We add temporary workers for business peaks and engage consultants for specialized functions. Our associates are not represented by labor unions, nor have we experienced a work stoppage.

We were recognized as a Top Workplace USA in 2022 and 2021 by Energage, LLC. In 2021, we were also recognized as a Top Workplace for Diversity, Equity and Inclusion (DE&I) Practices by Energage, LLC, the results of which have not yet been released for 2022.

Our Guiding Principles

Our culture is guided by principles that encourage our associates to thrive and bring their whole selves to work. Our guiding principles are designed to act as a North Star for our associates in how they work with a colleague, for a client, and in the community:

• Take Care of Customers First. Our customers are our heroes. When they win, we win.

• Take Care of Each Other. There’s nothing better than working with friends who look out for you.

• Do the Right Thing. It’s not always the easy way—but it’s what really matters.

• Think Big, Dream Big. Never say never! Solve problems, invent a better way, disrupt the status quo.

• Compete to Win. We embody the spirit of success in everything we do, in our habits and routines, our relationships, and in the energy and accountability we bring to the game.

• Have Fun Along the Way. Buckle up, it’s a fast-paced business! That’s why we celebrate the wins, laugh in the face of adversity, and enjoy the ride.

Talent Acquisition and Development

We strive to provide best-in-class benefits, performance rewards, and career development opportunities to attract and retain top talent. We recently expanded benefit options to include domestic partner coverage. In an effort to further invest in our associates, bolster associate engagement and align our associates’ interests with shareholders’ objectives, we provide a one-time, new hire equity grant to all eligible full-time associates that vests over time. We support professional development through tuition reimbursement, industry credential support, career coaching, 100+ classes covering technical, leadership, and professional skills, and tailored development plans.

17

Diversity, Equity and Inclusion

We are actively committed to diversity, equity, and inclusion (“DE&I”). We embrace the diverse mosaic of our associates and build high-performing teams dedicated to success and belonging. The table below summarizes our workforce demographics as of June 30, 2022:

| Total | |||||

| Gender: | |||||

| Female | 50.3% | ||||

| Male | 49.7% | ||||

| 100.0% | |||||

| Ethnicity: | |||||

| Native American or Alaska Native | 0.3% | ||||

| Asian | 6.7% | ||||

| Black or African American | 10.0% | ||||

| Hispanic or Latinx | 4.8% | ||||

| Native Hawaiian or other Pacific Islander | 0.1% | ||||

| Two or More Races | 3.3% | ||||

| White | 70.4% | ||||

| Undisclosed* | 4.4% | ||||

| 100.0% | |||||

* Individuals preferred not to disclose ethnicity

Our DE&I strategy is guided by four pillars:

1.Strategic Education and Awareness

2.Transparency in our Data

3.Equity of Pay, Hiring and Treatment of Targeted Populations

4.Purpose and Perspective

These pillars outline the foundation of our action steps as they relate to the goals of the entire organization. We established corporate goals to increase the inclusion and belonging of, and the number of associates and leaders from underrepresented groups and plan to continue to evolve these goals over time to improve representation. In developing these goals, we conducted an internal needs assessment and concluded that our opportunities are to focus on educating our associates, clients and partners, providing transparency to our stakeholders, and recruiting, retaining and promoting diverse leadership and perspectives across the Company.

We have incorporated our DE&I strategy and learning into associate onboarding and leader trainings as our associates play a key role in fostering a culture of inclusion. Additionally, our commitment to DE&I is reflected through our seven employee resource groups (“ERGs”). We believe our ERGs create a community of inclusion and belonging, and create a safe space for learning and dialogue around the celebrations and challenges that diverse communities face. Each ERG has an executive sponsor and is supported by senior leaders across the Company.

Community Giving

Giving back is in our DNA. We empower our associates to make a difference in a way that we believe is meaningful to them. We dedicate several days each year for Paycor It Forward, where our associates give back to the communities where we live and work. Our Community Partners program is a grassroots organization funded by associates who choose to give their own time and resources to serve. The Paycor Community Impact Fund provides project grants to local philanthropic organizations.

18

Corporate Information

We are a Delaware corporation incorporated in August 2018. We completed our IPO in July 2021 and our common stock is listed on the Nasdaq Global Select Market under the ticker symbol “PYCR.” Our principal executive offices are located at 4811 Montgomery Road, Cincinnati, Ohio 45212, and our telephone number is (800) 381-0053. Our website is www.paycor.com.

Available Information

We are subject to the informational and reporting requirements of the Exchange Act. Therefore, we file periodic reports, proxy statements, and other information with the SEC. The public may read and copy materials we file with the SEC via its website (www.sec.gov), which includes our annual and quarterly reports, proxy statements, and other information.

Our corporate website is www.paycor.com, and our investor relations website is located at investors.paycor.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports can be found on our investor relations website, free of charge, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained on our website is not incorporated by reference into or part of this Annual Report on Form 10-K.

19

Item 1A. Risk Factors

In addition to the other information in this report and our other filings with the SEC, you should carefully consider the risks and uncertainties described below, which could materially and adversely affect our business operations, financial condition and results of operations. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, financial condition, operating results, and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose all or part of your investment.

Risk Factor Summary

The following summary description sets forth an overview of the material risks we are exposed to in the normal course of our business activities. The summary does not purport to be complete and is qualified in its entirety by reference to the full risk factor discussion immediately following this summary description.

•Our ability to manage our growth effectively.

•The resulting effects of any potential breach of our security measures or any unauthorized access to our customers’ or their employees’ personal data, including by way of computer viruses, worms, phishing and ransomware attacks, malicious software programs, and other data security threats.

•The expansion and retention of our direct sales force with qualified and productive persons and the related effects on the growth of our business.

•The impact on customer expansion and retention if implementation, user experience, customer service, or performance relating to our solutions is not satisfactory.

•The timing of payments made to employees and taxing authorities relative to the timing of when a customer’s electronic funds transfers are settled to our account.

•Future acquisitions of other companies’ businesses, technologies, or customer portfolios.

•The continued service of our key executives.

•Our ability to innovate and deliver high-quality, technologically advanced products and services.

•Our ability to attract and retain qualified personnel, including software developers and skilled IT, sales, marketing, and operation personnel.

•The proper operation of our software.

•Our relationships with third parties.

•Damage, failure, or disruption of our Software-as-a-Service (“SaaS”) delivery model, data centers, or our third-party providers’ services.

•Our ability to protect our intellectual and proprietary rights.

•The use of open source software in our applications.

•The growth of the market for cloud-based human capital management and payroll software among small and medium- sized businesses (“SMBs”).

•The competitiveness of our market generally.

•The effects of inflation, supply chain disruptions, labor shortages and other ongoing macroeconomic impacts from the novel coronavirus pandemic (“COVID-19 pandemic”).

•The impact of an economic recession in the United States (“U.S.”) or global economy.

•Our customers’ dependence on our solutions to comply with applicable laws.

•Our ability to comply with anti-corruption, anti-bribery and similar laws.

•Changes in laws, regulations, or requirements applicable to our software and services.

•The impact of privacy, data protection, tax and other laws and regulations.

20

•Our ability to maintain effective internal controls over financial reporting.

Risks Relating to Our Business, Products, and Operations

Failure to manage our growth effectively could increase our expenses, decrease our revenue, and prevent us from implementing our business strategy, and sustaining our revenue growth rates.

We have been rapidly growing our revenue and number of customers, and we will seek to do the same for the foreseeable future. However, the growth in our number of customers puts significant strain on our business, requires significant capital expenditures, and increases our operating expenses. To manage this growth effectively, we must attract, train, and retain a substantial number of qualified sales, implementation, customer service, software development, information technology, and management personnel. We also must maintain and enhance our technology infrastructure and our financial and accounting systems and controls. If we fail to effectively manage our growth, or we over-invest or under-invest in our business, our business and results of operations could suffer from the resultant weaknesses in our infrastructure, systems, or controls. We could also suffer operational mistakes, a loss of business opportunities, and employee losses. If our management is unable to effectively manage our growth, our expenses might increase more than expected, our revenue could decline or might grow more slowly than expected, and we might be unable to implement our business strategy. In addition, our revenue growth rates may decline in future periods because of several factors, including our failure to manage our growth effectively, our increased market penetration and the maturation of our business, slowing demand for our services, reductions in the number of employees by our customers, reductions in the number of our customers, public health issues such as the COVID-19 pandemic, or a decrease in the growth of the overall market, among other factors.

Additionally, we rely on the expansion of our relationships with our third-party partners as we grow our solutions. Our agreements with third parties are typically non-exclusive and do not prohibit them from working with our competitors. Our competitors may be effective in providing incentives to these same third parties to favor their products or services. In addition, acquisitions of our partners by our competitors could result in a reduction in the number of our current and potential customers, as our partners may no longer facilitate the adoption of our applications by potential customers after an acquisition by any of our competitors.

If we are unsuccessful in establishing or maintaining our relationships with third parties, our ability to compete in the marketplace or to grow our revenues could be impaired, which could have a material adverse effect on our business, financial condition, and results of operations. Even if we are successful, we cannot assure you that these relationships will result in increased customer usage of our applications or increased revenues.

If our security measures are breached, or unauthorized access to our customers’ or their employees’ personal data is otherwise obtained, we may be subject to lawsuits, fines, or other regulatory action, causing us to incur significant costs related to remediation, our solutions may not be perceived as being secure, customers may reduce the use of or stop using our solutions, our ability to attract new customers may be harmed, and we may incur significant liabilities.

Our solutions involve the collection, processing, storage, use, disclosure, and transmission of customers’ and their employees’ confidential and proprietary information, including personal data, as well as financial and payroll data. We rely on the efficient and uninterrupted operation of complex information technology systems and networks to operate our business. Attempts by others to gain unauthorized access to information technology systems and the data contained therein are becoming increasingly sophisticated and difficult to prevent. In particular, HCM software such as ours may be specifically targeted in cyber-attacks, including by way of computer viruses, worms, phishing attacks, ransomware, malicious software programs, and other data security threats, which could result in the unauthorized release, access, gathering, monitoring, encryption, misuse, loss, or destruction of our customers’ sensitive and/or confidential data (including personal data), or otherwise disrupt our customers’ or other third parties’ business operations. If cybercriminals, including those working in the capacity of hackers, State actors, inside threats, or cybercrime groups, can circumvent our security measures, or if we are unable to detect an intrusion into or misuse of our systems and contain such intrusion or misuse in a reasonable amount of time, our information and our customers’ personal data, including confidential and personal data, may be compromised. We seek to detect and investigate all security incidents and to prevent their recurrence, but, in some cases, we might be unaware of an incident or its magnitude and effects. There can be no assurance that our Information Technology (“IT”) security and recovery system will be sufficient to prevent or limit the damage from any future cyber-attack or disruptions or to allow us to reinstate any operations that were affected by such attack or disruption. Additionally, customers or other third parties may seek monetary damages from us in connection with any such breaches or other incidents.

21

Certain of our employees have access to personal data about our customers’ employees. While we conduct background checks of our employees and limit access to systems and data, it is possible that one or more of these individuals may circumvent these controls, resulting in a security breach. Outside parties have in the past, and may also attempt in the future to fraudulently induce our employees to disclose personal data via illegal electronic spamming, phishing, or other tactics. In addition, some of our third-party service providers and other vendors have access to certain portions of our IT system. Any failures or negligence on the part of these service providers may cause material disruptions in our business.

Although we have security measures in place to protect regulated and personal data, and to prevent data loss and other security breaches, these measures could be breached because of third-party action, employee error, third-party or employee malfeasance, or otherwise. Because the techniques used to obtain unauthorized access or to sabotage systems change frequently, we may not be able to anticipate these techniques and implement adequate preventative or protective measures. While we currently maintain a cyber-liability insurance policy, our cyber liability insurance coverage may be inadequate or may not be available in the future on acceptable terms, or at all. In addition, our cyber liability insurance policy may not cover all claims made against us, and defending a suit, regardless of its merit, could be costly and divert management’s attention from our business and operations.

We have experienced data security incidents in the past, and expect to experience additional incidents in the future, however, to date no such incidents have been material. Any actual or perceived data security breach or incident could require notifications to data subjects, data owners, and/or other third parties (including regulators) under applicable data breach notification laws, damage our reputation, cause existing customers to discontinue the use of our solutions, prevent us from attracting new customers, or subject us to third-party lawsuits, regulatory fines, or other actions or liabilities, any of which could adversely affect our business, operating results or financial condition.

If our systems, or the systems at our third-party service providers, were breached or attacked, the proprietary and confidential information of our company and our customers as well as personal data could be disclosed, and we may be required to incur substantial costs and liabilities, including the following:

• Expenses to rectify the consequences of the security breach or cyber-attack.

• Claims by customers or their employees related to stolen information, including personal data.

• Costs of repairing damage to our systems.

• Lost revenue and income resulting from any system downtime caused by such breach or attack.

• Loss of competitive advantage if our proprietary information is obtained by competitors as a result of such breach or attack.

• Increased costs of cyber security insurance or other security risk mitigation tools.

• Damage to our reputation.

As a result, any compromise of security of our systems or cyber-attack could have a material adverse effect on our business, reputation, financial condition, and operating results.

If we fail to adequately expand and retain our direct sales team with qualified and productive persons, or if our direct sales efforts are not successful, we may not be able to grow our business effectively.