As filed with the U.S. Securities and Exchange Commission on November 3, 2021

Registration No. 333-259069

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ROTH CH ACQUISITION III CO.*

(Exact Name of Registrant as Specified in its Charter)

Delaware | 6770 | 83-3584928 |

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

incorporation or organization) | Classification Code Number) | Identification No.) |

888 San Clemente Drive, Suite 400

Newport Beach, CA 92660 (949) 720-5700

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Gordon Roth

Co-Chief Financial Officer

Roth CH Acquisition III Co.

888 San Clemente Drive, Suite 400

Newport Beach, CA 92660

(949) 720-5700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Mitchell Nussbaum, Esq. | Tim Cruickshank, Esq. |

Janeane R. Ferrari, Esq. | Kirkland & Ellis LLP |

Loeb & Loeb LLP | 601 Lexington Avenue |

345 Park Avenue | New York, New York 10022 |

New York, NY 10154 | (212) 446-4800 |

Phone: (212) 407-4000 |

Approximate date of commencement of proposed sale to public: From time to time after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

CALCULATION OF REGISTRATION FEE

Title of Each Class of Security Being Registered(1) | Amount Being Registered(2) | Proposed Maximum Offering Price Per Security | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

Shares of Class A common stock, $0.0001 par value (“Class A Common Stock”) | 12,160,000 | $9.87(3) | $120,019,200 | $13,094.10(4) |

(1) | All securities being registered will be issued by Roth CH Acquisition III Co., a Delaware corporation (“ROCR”), in connection with ROCR’s previously announced proposed initial business combination (the “Business Combination”) with BCP QualTek HoldCo, LLC (“QualTek”), pursuant to which (i) Roth CH III Blocker Merger Sub, LLC (“Blocker Merger Sub”) will be merged with and into BCP QualTek Investors, LLC (“Blocker”), with the Blocker surviving as a wholly owned subsidiary of ROCR, (ii) immediately thereafter, Blocker will be merged with and into ROCR, with ROCR as the surviving company, and (iii) immediately thereafter, Roth CH III Merger Sub, LLC (“Company Merger Sub”) will be merged with and into QualTek, with QualTek as the surviving company. |

(2) | Represents the resale of 5,550,000 shares of Class A Common Stock underlying convertible notes of QualTek (the “Pre-PIPE Notes”) issued to certain accredited investors (the “Pre-PIPE Investors”) in a private placement (the “Pre-PIPE Investment”) and 6,610,000 shares of Class A Common Stock to be issued to certain accredited investors (the “PIPE Investors”) in a private placement (the “PIPE Investment”) upon the closing of the Business Combination. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the registrant is also registering an indeterminate number of additional shares of Common Stock that may become issuable as a result of any stock dividend, stock split, recapitalization or other similar transaction. |

(3) | Pursuant to Rule 457(c) under the Securities Act, and solely for the purpose of calculating the registration fee, the proposed maximum offering price per share is $9.87, which is the average of the high and low prices of shares of ROCR Common Stock on August 24, 2021 (such date being within five business days of the date that this registration statement was filed with the U.S. Securities and Exchange Commission (the “SEC”)) on The Nasdaq Capital Market. |

(4) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the SEC, acting pursuant to Section 8(a) of the Securities Act, may determine.

* | Upon the closing of the Business Combination, the name of Roth CH Acquisition III Co. is expected to change to QualTek Services Inc. |

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED NOVEMBER 3, 2021 |

ROTH CH ACQUISITION III CO.

12,160,000 Shares

Class A Common Stock

This prospectus relates to the resale from time to time of Class A common stock, $0.0001 par value, of QualTek Services Inc. (“Class A Common Stock”) issued pursuant to the terms of (a) those certain Note Purchase Agreements entered into by and among QualTek, ROCR and the Pre-PIPE Investors dated as of June 16, 2021 (the “Note Purchase Agreement”), pursuant to which QualTek issued to such subscribers $44.4 million of Pre-PIPE Notes that automatically convert into the Class A Common Stock at $8.00 per share upon consummation of the Business Combination, and (b) subscription agreements with the PIPE Subscribers dated as of June 16, 2021, pursuant to which, among other things, ROCR agreed to issue and sell, in a private placement to close immediately prior to the Closing, an aggregate of 6,610,000 shares of ROCR Common Stock for $10.00 per share for a total of $66.1 million.

As described herein, the selling securityholders named in this prospectus or their permitted transferees (collectively, the “Selling Stockholders”), may sell from time to time up to 12,160,000 shares of Class A Common Stock, including 5,550,000 shares of Class A Common Stock issuable upon the automatic conversion of the Pre-PIPE Notes issued to certain accredited investors in the Pre-PIPE Investment and 6,610,000 shares of Class A Common Stock issued to certain accredited investors in the PIPE Investment upon the Closing of the Business Combination.

The Pre-PIPE Investment and PIPE Investment are being conducted in connection with a Business Combination by and among (i) ROCR, Roth CH III Blocker Merger Sub, LLC, a Delaware limited liability company and wholly-owned subsidiary of ROCR (“Blocker Merger Sub”), (iii) BCP QualTek Investors, LLC, a Delaware limited liability company (the “Blocker”), (iv) Roth CH III Merger Sub, LLC, a Delaware limited liability company and wholly-owned subsidiary of the Buyer (“Company Merger Sub”, and together with ROCR and the Blocker Merger Sub, the “Buyer Parties”), (v) BCP QualTek HoldCo, LLC, a Delaware limited liability company ( “QualTek” or the “Company”), and (vi) BCP QualTek, LLC, a Delaware limited liability company, solely in its capacity as representative of the Blocker’s equityholders and QualTek’s equityholders (the “Equityholder Representative”), pursuant to which (i) the Blocker Merger Sub will be merged with and into the Blocker, with the Blocker as the surviving company (the “Blocker Merger”), (ii) immediately after the Blocker Merger, the Blocker will be merged with and into ROCR, with ROCR as the surviving company (the “Buyer Merger”), and (iii) immediately after the Buyer Merger, the Company Merger Sub will be merged with and into the Company, with the Company as the surviving company (the “QualTek Merger”) and (b) such mergers and the other transactions contemplated by the Business Combination Agreement (the “Business Combination”). It is anticipated that the Business Combination will be consummated on or about the date of effectiveness of the registration statement of which this prospectus forms a part. Upon consummation of the Business Combination described herein, ROCR will be renamed QualTek Services Inc. (“QSI”).

We will bear all costs, expenses and fees in connection with the registration of Class A Common Stock and will not receive any proceeds from the sale of Class A Common Stock. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their respective sales of Class A Common Stock.

Upon the consummation of the Business Combination, our Class A Common Stock and warrants will begin trading on The Nasdaq Global Market (“Nasdaq”) under the proposed symbols “QTEK” and “QTEKW,” respectively.

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our Class A Common Stock is highly speculative and involves a high degree of risk. See “Risk Factors.”

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of Class A Common Stock or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. By using a shelf registration statement, the Selling Stockholders may sell up to 12,160,000 shares of Class A Common Stock from time to time in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale of Class A Common Stock by the Selling Stockholders.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case may be, may add, update or change information contained in this prospectus with respect to such offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any of the Class A Common Stock, you should carefully read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information described under “Where You Can Find More Information.”

Neither we, nor the Selling Stockholders, have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf of us or to which we have referred you. We and the Selling Stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Stockholders will not make an offer to sell the Class A Common Stock in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the respective cover. Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus contains, and any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

ii

FREQUENTLY USED TERMS

Unless otherwise stated in this prospectus, the terms “we,” “us,” “our” or “ROCR” refer to Roth CH Acquisition III Co., a Delaware corporation. In addition, in this prospectus:

“Amended and Restated Bylaws” means the Amended and Restated Bylaws of the Combined Company.

“Blocker” refers to BCP QualTek Investors, LLC, a Delaware limited liability company.

“Board” means the board of directors of ROCR prior to the Business Combination, and following the Business Combination, of the Combined Company.

“Business Combination” means the business combination pursuant to the Business Combination Agreement.

“Class A Common Stock” means the Class A common stock, $0.0001 par value, of the Combined Company.

“Class B Common Stock” means the Class B common stock, $0.0001 par value, of the Combined Company.

“Closing” means the closing of the Business Combination.

“Charter” means the Second Amended and Restated Certificate of Incorporation of the Combined Company.

“Code” means the Internal Revenue Code of 1986, as amended.

“Combined Company” or “QSI” means ROCR after the Business Combination, renamed QualTek Services Inc., and, as the context requires, its consolidated subsidiaries.

“Combined Company’s Common Stock” means the Class A Common Stock and the Class B Common Stock.

“Craig-Hallum” means Craig-Hallum Capital Group LLC.

“DGCL” means the Delaware General Corporation Law, as amended.

“Effective Time” means the time at which the Business Combination became effective pursuant to its terms.

“Founder Shares” means the outstanding shares of our Common Stock held by the Sponsor, our directors and affiliates of our management team since February 13, 2019.

“Initial Stockholders” or ‘ROCR’s Initial Stockholders’ means the holders of ROCR shares prior to the IPO.

“Investor Rights Agreement” means the investor rights agreement to be entered at Closing by and between ROCR (and subsequent to the Business Combination, the Combined Company), certain Sellers as set forth therein, the Equity Representative, the Sponsors, Sponsor Representative, and certain Other Holders (all as defined therein), a form of which is attached hereto as Exhibit 10.11.

“Notes Issuer” refers to BCP QualTek Holdco, LLC.

“Note Purchase Agreements” means the Note Purchase Agreements, dated June 16, 2021, among the Notes Issuer, ROCR and the Pre-PIPE Investors.

“PIPE Investment” has the meaning ascribed to such term in the Business Combination Agreement.

“Pre-PIPE Notes” refers to the convertible notes of BCP QualTek Holdco, LLC, as the issuer in an aggregate principal amount of $44.4 million in the Pre-PIPE Investment.

1

“PIPE Registration Rights Agreement” means the registration rights agreement, dated June 16, 2021, between ROCR and the PIPE Investors.

“Pre-PIPE Investment” refers to the private placement of convertible notes of QualTek, as Notes Issuer, in an aggregate principal amount of $44.4 million (“Pre-PIPE Notes”), issuable pursuant to the Note Purchase Agreement.

“Pre-PIPE Registration Rights Agreement” means the registration rights agreement, dated June 16, 2021, between ROCR and the Pre-PIPE Investors.

“Private Placement” refers to the private placements described in ROCR’s Registration Statement on Form S-1 (as amended) (SEC File No. 333-252044), initially filed by ROCR with the SEC on January 12, 2021.

“Private Units” refers to the 408,000 units sold by ROCR at a price of $10.00 per unit, in the Private Placement.

“Public Shares” means Common Stock underlying the Units sold in the ROCR IPO.

“public stockholders” means the public stockholders in the ROCR IPO.

“QualTek” means BCP QualTek HoldCo, LLC, a Delaware limited liability company, and, as the context requires, its consolidated subsidiaries.

“QualTek Equityholders” refers to the Company Equityholders (as defined in the Business Combination Agreement).

“QualTek Common Units” refers to the Common Units as defined in the Third Amended and Restated LLCA.

“Redemption” means the right of the holders of Public Shares to have their shares redeemed in accordance with the procedures set forth in this prospectus.

“Reorganization Transactions” refers to the Reorganization Transactions as defined in the Tax Receivable Agreement.

“ROCR” means ROTH CH Acquisition III Co.

“ROCR Common Stock” or “Common Stock” means, prior to the Business Combination, the common stock of ROCR, $0.0001 par value per share, and following the Business Combination, Combined Company’s Common Stock.

“ROCR IPO” or “IPO” means ROCR’s initial public offering registered on ROCR’s Form S-1 (as amended) (SEC File No. 333-252044), initially filed by ROCR with the SEC on January 12, 2021.

“Roth” means Roth Capital Partners, LLC.

“SEC” means the United States Securities and Exchange Commission.

“Sponsor” means CR Financial Holdings, Inc., an entity affiliated with Roth Capital Partners, LLC.

“Subscription Agreements” means the subscription agreements, dated June 16, 2021, by and between certain accredited investors and ROCR.

“Tax Receivable Agreement” refers to that certain Tax Receivable Agreement to be entered into at the Closing of the Business Combination.

“Third Amended and Restated LLCA” refers to that certain Third Amended and Restated Limited Liability Company Operating Agreement of QualTek.

“TRA Holder Representative” refers to the TRA Holder Representative as defined in the Tax Receivable Agreement.

“TRA Holders” refers to the TRA Holders as defined in the Tax Receivable Agreement.

2

“Trust Account” means the Trust Account of ROCR, which held the net proceeds of the ROCR IPO and the sale of the Private Units, together with interest earned thereon, less amounts released to pay franchise and income tax obligations.

“Unit” means a unit consisting of one share of Common Stock and one-quarter of one redeemable warrant.

“Warrant” means a warrant to purchase one share of Common Stock at a price of $11.50 per whole share, (subject to adjustment).

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995, including statements about the anticipated benefits of the Business Combination and the financial condition, results of operations, earnings outlook and prospects of QualTek and may include statements for the period following the consummation of the Business Combination. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of ROCR and QualTek, as applicable and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made with the SEC by ROCR and include, but are not limited to, the following:

| ● | expectations regarding QualTek’s strategies and future financial performance, including its future business plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and QualTek’s ability to invest in growth initiatives and pursue acquisition opportunities; |

| ● | the highly competitive industries that QualTek serves, which are also subject to rapid technological and regulatory changes, as well as customer consolidation; |

| ● | unfavorable market conditions, market uncertainty, public health outbreaks such as the COVID-19 pandemic and/or economic downturns; |

| ● | failure to properly manage projects, or project delays; |

| ● | failure to recover adequately on charges against project owners, subcontractors or suppliers for payment or performance; |

| ● | the loss of one or more key customers, or a reduction in their demand for QualTek’s services; |

| ● | QualTek’s backlog being subject to cancellation and unexpected adjustments; |

| ● | the seasonality of QualTek’s business, which is affected by the spending patterns of QualTek’s customers and timing of governmental permitting, as well as weather conditions and natural catastrophes; |

| ● | system and information technology interruptions and/or data security breaches; |

| ● | failure to comply with environmental laws; |

| ● | QualTek’s significant amount of debt, which could adversely affect its business, financial condition and results of operations or could affect its ability to access capital markets in the future, and may prevent QualTek from engaging in transactions that might benefit it due to its debt’s restrictive covenants; |

3

| ● | QualTek’s status as a “controlled company” within the meaning of the Nasdaq rules and, as a result, qualifying for exemptions from certain corporate governance requirements, as a result of which you will not have the same protections afforded to stockholders of companies that are subject to such requirements; and |

| ● | other factors described under “Risk Factors.” |

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of ROCR and QualTek prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the Business Combination or other matters addressed in this prospectus and attributable to ROCR, QualTek or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus. Except to the extent required by applicable law or regulation, ROCR and QualTek undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus to reflect the occurrence of unanticipated events.

In addition, statements that ROCR or QualTek “believes” and similar statements reflect such party’s beliefs and opinions on the relevant subject. These statements are based upon information available to such party as of the date of this prospectus, and while such party believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and these statements should not be read to indicate that either ROCR or QualTek has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

4

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of Class A Common Stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in Class A Common Stock , you should read the entire prospectus carefully, including “Risk Factors” and the financial statements of ROCR and QualTek and related notes thereto included elsewhere in this prospectus.

Parties to the Business Combination

Roth CH Acquisition III Co.

ROCR is a blank check company formed under the laws of the State of Delaware on February 13, 2019 for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or other similar business combination with one or more businesses. Although our efforts to identify a prospective target business are not limited to a particular geographic region or industry, we have focused on the business services, consumer, healthcare, technology, wellness and sustainability sectors. ROCR has until March 5, 2023 to consummate a business combination.

On March 5, 2021, ROCR consummated the IPO of 11,500,000 Units at a price of $10.00 per Unit, generating gross proceeds of $115,000,000, which included the full exercise by the underwriters of their over- allotment option in the amount of 1,500,000 units. Simultaneously with the closing of the IPO, ROCR consummated the sale of 408,000 units (the “Private Units”) at a price of $10.00 per Private Unit in a private placement to its stockholders, generating gross proceeds of $4,080,000.

After deducting the underwriting discounts, offering expenses, and commissions from the ROCR IPO and the sale of the Placement Warrants, a total of $115,000,000 was deposited into the Trust Account established for the benefit of ROCR’s public stockholders, and the remaining proceeds became available to be used to provide for business, legal and accounting due diligence on prospective business combinations and continuing general and administrative expenses.

In accordance with ROCR’s amended and restated certificte of incorporation, the amounts held in the Trust Account may only be used by ROCR upon the consummation of a business combination, except that there can be released to ROCR, from time to time, any interest earned on the funds in the Trust Account that it may need to pay its tax obligations. The remaining interest earned on the funds in the Trust Account will not be released until the earlier of the completion of a business combination and ROCR’s liquidation. ROCR executed the Business Combination Agreement on June 16, 2021 and it must liquidate unless a business combination is consummated by March 5, 2023.

ROCR’s principal executive offices are located at 888 San Clemente Drive, Suite 400, Newport Beach, CA 92660, and its telephone number is (949) 720-5700.

Blocker Merger Sub and Merger Subs

Blocker Merger Sub will be merged with and into Blocker, with Blocker surviving such merger as a wholly-owned subsidiary of ROCR, and Blocker thereafter will be merged into ROCR with ROCR surviving such merger. Company Merger Sub will be merged with and into the Company, with the Company surviving the merger as a wholly-owned subsidiary of ROCR.

QualTek

QualTek , through its subsidiaries, is a leading provider of communication infrastructure services including engineering, installation, fulfillment and program management, renewable energy solutions, and business continuity and disaster recovery support, delivering a full suite of critical services to the North American telecommunications and power sectors. QualTek was formed as a Delaware limited liability company on May 15, 2018 in connection with the acquisition by Brightstar Capital Partners of QualTek LLC.

QualTek’s principal executive offices are located at 475 Sentry Parkway E, Suite 200 Blue Bell, PA 19422 and the Company’s phone number is (484) 804-4500.

5

The Business Combination

On June 16, 2021, ROCR and QualTek agreed to the Business Combination under the terms the Business Combination Agreement. Pursuant to the terms set forth in the Business Combination Agreement, (i) a direct, wholly owned subsidiary of the Company will be merged with and into BCP QualTek Investors, LLC, a Delaware limited liability company (the “Blocker”), with the Blocker surviving as a wholly owned subsidiary of the Company (the “Blocker Merger”), (ii) immediately after the Blocker Merger, the Blocker will be merged with and into the Company, with the Company as the surviving company (the “Buyer Merger”), and (iii) immediately after the Buyer Merger, a direct, wholly owned subsidiary of the Buyer will be merged with and into BCP QualTek HoldCo, LLC, a Delaware limited liability company (“QualTek”), with QualTek as the surviving company (the “QualTek Merger”).

Business Combination Agreement

The Business Combination Agreement provides for among other things, the following:

| ● | immediately following the Closing, on the Closing Date, ROCR will change its name to “QualTek Services Inc.”; |

| ● | Blocker Merger Sub will merge with and into the Blocker (the “Blocker Merger”), resulting in the equity interests of the Blocker being converted into the right to receive a portion of the merger consideration under the Business Combination Agreement (as further described below), and the owners of such equity interests in the Blocker (the “Blocker Owners”) being entitled to a portion of the merger consideration under the Business Combination Agreement (as further described below) at the Closing, and thereafter, the surviving blocker will merge with and into ROCR, with ROCR as the surviving company (the “Buyer Merger”), resulting in the cancellation of the equity interests of the surviving blocker and ROCR directly owning all of the QualTek Units previously held by the Blocker; |

| ● | immediately following the Buyer Merger, Company Merger Sub will be merged with and into QualTek, with QualTek as the surviving company (the “QualTek Merger,” and together with the Blocker Merger and the Buyer Merger, the “Mergers”), resulting in (i) QualTek becoming a subsidiary of ROCR, the QualTek Units (excluding those held by the Blocker and ROCR) being converted into the right to receive a portion of the merger consideration under the Business Combination Agreement (as further described below) and the holders of QualTek Units being entitled to a portion of the merger consideration under the Business Combination Agreement (as further described below) at the Closing, (iii) the QualTek Units held by ROCR being converted into the right to receive a number of Common Units (as defined herein) equal to the number of shares of Class A Common Stock issued and outstanding, less the number of Common Units received in connection with the contribution described immediately below; |

| ● | with respect to the portion of merger consideration under the Business Combination Agreement at the Closing to which the Blocker Owners and holders of QualTek Units are entitled as described above, the cumulative value of merger consideration to which they are together entitled equals the Equity Value. The “Equity Value” is the sum of (i) $294,318,543.75, plus (ii) the value of any Equity Interests of the Company issued as consideration for any acquisitions by the Company prior to the Closing plus (iii) the amount of interest accrued on that certain convertible promissory note in an aggregate principal amount of $30,557,501.68 issued by the Company to BCP QualTek II in exchange for all of BCP QualTek II’s Class B Units. The exact amount allocated between the Blocker Owners and holders of QualTek Units is determined by their respective governing documents, including the distribution waterfalls therein. As of the date hereof, it is anticipated that, as of the Closing, approximately 60% of the Equity Value will be allocated to the holders of QualTek Units and 40% of the Equity Value will be allocated to the Blocker Owners; |

| ● | ROCR will contribute, as a capital contribution in exchange for a portion of the QualTek Units it acquired in the QualTek Merger, an amount of cash available after payment of the merger consideration under the Business Combination Agreement (as further described below), which will be used by QualTek or its Subsidiaries to pay the transaction expenses under the Business Combination Agreement; |

| ● | the amount of cash ROCR will contribute equals the sum (without duplication) of (i) the cash in the trust account ROCR established with Continental Stock Transfer & Trust (after reduction by any redemptions thereof by ROCR equity holders), plus (ii) the amount of Pre-PIPE Proceeds and PIPE Proceeds; |

| ● | the limited liability company agreement of QualTek will be amended and restated to, among other things, reflect the QualTek Merger and admit ROCR as the managing member of QualTek; and |

6

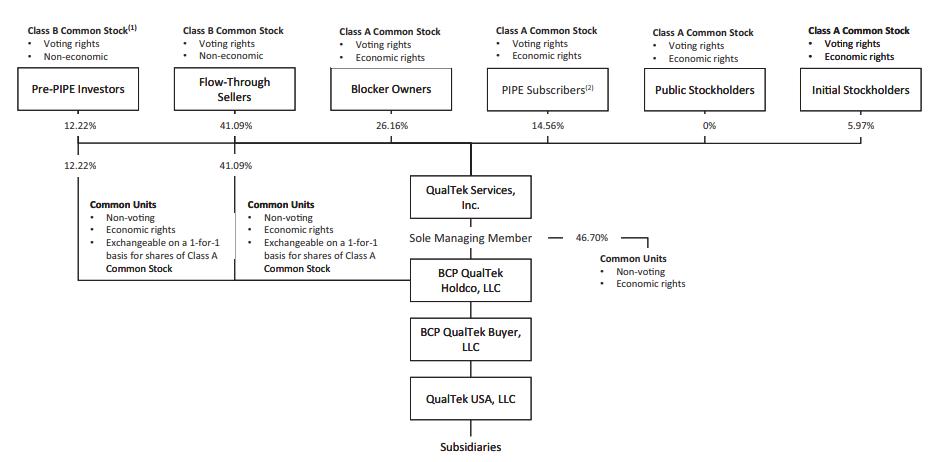

| ● | following the completion of the Business Combination, as described above, our organizational structure will be what is commonly referred to as an umbrella partnership corporation (or Up-C) structure. This organizational structure will allow the former equityholders of QualTek (other than the Blocker) (the “Flow-Through Sellers”) to retain their equity ownership in QualTek, an entity that is classified as a partnership for U.S. federal income tax purposes, in the form of common units of QualTek issued pursuant to the Business Combination (“Common Units”). Each Flow-Through Seller will also hold a number of shares of Class B Common Stock equal to the number of Common Units held by such Flow-Through Seller, which have no economic value, but which will entitle the holder thereof to one (1) vote per share at any meeting of the shareholders of ROCR. The Blocker Owners, by contrast, hold their equity ownership in ROCR, a Delaware corporation that is a domestic corporation for U.S. federal income tax purposes. The parties agreed to structure the Business Combination in this manner for tax and other business purposes, and we do not believe that our Up-C organizational structure will give rise to any significant business or strategic benefit or detriment. |

Organizational Structure

Prior to the Business Combination

| ● | The diagrams below depict simplified versions of the current organizational structures of ROCR and QualTek, respectively. |

7

8

The diagram below depicts the steps involved in the Business Combination.

9

The diagrams below depict a simplified version of our organizational structure immediately following the completion of the Business Combination under both the minimum and maximum redemption scenarios.

Minimum Redemption Scenario

(1) For the purposes of this diagram, it is assumed that the Pre-PIPE Notes are amended and any other agreements deemed necessary are entered into such that upon the consummation of the Business Combination, the Pre-PIPE Notes automatically convert into Common Units (along with a corresponding number of shares of Class B Common Stock) in lieu of converting into Class A Common Stock.

(2) 1.30% of the shares of Class A Common Stock held by the PIPE Subscribers will be held by an entity affiliated with Brightstar.

10

Maximum Redemption Scenario

(1) For the purposes of this diagram, it is assumed that the Pre-PIPE Notes are amended and any other agreements deemed necessary are entered into such that upon the consummation of the Business Combination, the Pre-PIPE Notes automatically convert into Common Units (along with a corresponding number of shares of Class B Common Stock) in lieu of converting into Class A Common Stock.

(2) 1.65% of the shares of Class A Common Stock held by the PIPE Subscribers will be held by an entity affiliated with Brightstar.

Pre-PIPE Convertible Notes Offering, PIPE Subscription Agreements and PIPE Registration Rights Agreement

Pre-PIPE Convertible Notes Offering and Pre-PIPE Registration Rights Agreement

In connection with the Business Combination, accredited investors (each a “Pre-PIPE Investor”) purchased convertible notes of QualTek, as issuer (the “Notes Issuer”), in an aggregate principal amount of $44.4 million (the “Pre-PIPE Notes”) in a private placement, issuable pursuant to Note Purchase Agreements (the “Note Purchase Agreements”), among the Notes Issuer, ROCR and the Pre-PIPE Investors (the “Pre-PIPE Investment”). The Pre-PIPE Notes are senior unsecured unsubordinated obligations of the Notes Issuer and are not transferable without the consent of the Notes Issuer (other than customary exceptions for transfers to affiliates). The Notes Issuer intends to use the proceeds from the sale of the Pre-PIPE Notes for general working capital or to fund acquisitions of accretive business targets.

Unless earlier converted or redeemed in accordance with the terms of the Pre-PIPE Notes, the Pre-PIPE Notes have a perpetual maturity. The Pre-PIPE Notes will not bear interest and are subject to certain customary information rights.

Pursuant to the current terms of the Pre-PIPE Notes, upon consummation of the Business Combination, the Pre-PIPE Notes will automatically convert into Class A Common Stock at $8.00 per share, subject to certain adjustments. However, the Note Purchase Agreements provide that the parties will use commercially reasonable efforts to amend the Pre-PIPE Notes and any other agreements deemed necessary such that upon the consummation of the Business Combination, the Pre-PIPE Notes automatically convert into Common Units (along with a corresponding number of shares of Class B Common Stock) in lieu of converting into Class A Common Stock. The number of Common Units and Class B Common Stock will be equal to the quotient that results from dividing the aggregate principal amount of the Note by $8.00, subject to certain adjustments.

11

In addition, the ROCR Common Stock was originally sold in the ROCR IPO as a component of the Units for $10.00 per Unit. The Units consist of one share of ROCR Common Stock and one-quarter of one Warrant. As of [●], 2021, the closing price on Nasdaq of ROCR Common Stock was $[●] per share, and the closing price of the Warrants was $[●] per Warrant. The conversion price of $8.00 per share of Class A Common Stock to the Pre-PIPE Investors for their Pre-PIPE Notes, upon consummation of the Business Combination, reflects a $2.00 discount to the purchase price of $10.00 per share for the PIPE Shares, and a $2.00 discount to the price per Unit sold to investors in the ROCR IPO. The Class A Common Stock the Pre-PIPE Investors received for their Pre-PIPE Notes will be identical to the shares of Class A Common Stock that will be held by ROCR’s public stockholders at the time of the Closing, except that such Class A Common Stock will not be entitled to any redemption rights and will not be registered with the SEC at Closing. Should the Pre-PIPE Notes be amended such that upon consummation of the Business Combination, the Pre-PIPE Notes automatically convert into Common Units (along with a corresponding number of shares of Class B Common Stock) in lieu of converting into Class A Common Stock, the conversion price will reflect a similar conversion price as described above, and the Common Units and Class B Common Stock will be identical to the Common Units and Class B Common Stock to be issued in connection with the Business Combination. None of the Sponsor or ROCR’s officers, directors or their affiliates, is a Pre-PIPE Investor in the Pre-PIPE Investment.

ROCR also entered into a registration rights agreement with the Pre-PIPE Investors (the “Pre-PIPE Registration Rights Agreement”). Pursuant to the Pre-PIPE Registration Rights Agreement, ROCR has agreed to file (at ROCR’s sole cost and expense) a registration statement registering the resale of the shares of Class A Common Stock to be received upon automatic conversion of the Pre-PIPE Notes (the “Pre- PIPE Resale Registration Statement”) with the SEC no later than the 10th business day following the date ROCR first filed the proxy statement with the SEC, or August 25, 2021. ROCR will use its commercially reasonable efforts to have the Pre-PIPE Resale Registration Statement declared effective no later than the 60th calendar day following the Closing Date (or, in the event the SEC notifies ROCR that it will “review” the PIPE Resale Registration Statement, the 90th calendar day following the Closing Date (as defined in the Pre-PIPE Registration Rights Agreement)).

12

PIPE Subscription Agreements and PIPE Registration Rights Agreement

In connection with the proposed Business Combination, ROCR has obtained commitments from certain accredited investors (each a “Subscriber”), including BCP QualTek LLC, Roth, Craig-Hallum, and certain officers and directors of ROCR, to purchase shares of Class A Common Stock which will be issued in connection with the Closing (the “PIPE Shares”), for an aggregate cash amount of $66.1 million at a purchase price of $10.00 per share, in a private placement (the “PIPE Investment”). Certain offering-related expenses are payable by ROCR, including customary fees payable to the placement agents, Roth and Craig-Hallum, aggregating $5,150,000. Such commitments were made by way of the subscription agreements, by and between each Subscriber and ROCR (collectively, the “Subscription Agreements”). The purpose of the sale of the PIPE Shares was to raise additional capital for use in connection with the Business Combination and to meet the minimum cash requirements provided in the Business Combination Agreement.

The PIPE Shares are identical to the shares of Class A Common Stock that will be held by ROCR’s public stockholders at the time of the Closing, except that the PIPE Shares will not be entitled to any redemption rights and will not be registered with the SEC at Closing.

The closing of the sale of the PIPE Shares (the “PIPE Closing”) is contingent upon the substantially concurrent consummation of the Business Combination. It is anticipated that the PIPE Closing will occur immediately prior to the consummation of the Business Combination. The PIPE Closing is subject to customary conditions, including:

| ● | ROCR filing with Nasdaq an application for the listing of the PIPE Shares and Nasdaq having not raised objection with respect thereto; |

| ● | all representations and warranties of ROCR and the Subscriber contained in the relevant Subscription Agreement must be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or Material Adverse Effect (as defined in the Subscription Agreements), which representations and warranties must haver been true in all respects) at, and as of, the PIPE Closing (except that representations and warranties expressly made as of an earlier date shall be true and correct in all material respects as of such date); and |

| ● | all conditions precedent to the Closing of the Business Combination, including the approval by ROCR’s stockholders, shall have been satisfied or waived. |

Each Subscription Agreement will terminate upon the earliest to occur of (i) such date and time as the Business Combination Agreement is validly terminated in accordance with its terms, (ii) upon the mutual written agreement of each of the parties to the Subscription Agreement and QualTek, (iii) if the conditions to the PIPE Closing are not capable of being satisfied or waived on or prior to February 16, 2022 and, as a result thereof, the transactions contemplated by each Subscription Agreement are not consummated at the PIPE Closing or (iv) if the PIPE Closing does not occur by February 16, 2022.

ROCR also entered into a registration rights agreement with the PIPE Investors (the “PIPE Registration Rights Agreement”). Pursuant to the PIPE Registration Rights Agreement, ROCR agreed to file (at ROCR’s sole cost and expense) a registration statement registering the resale of the shares of Class A Common Stock to be purchased in the private placement PIPE Investment (the “PIPE Resale Registration Statement”) with the SEC no later than the 10th business day following the date ROCR first filed the proxy statement with the SEC, or August 25, 2021. ROCR will use its commercially reasonable efforts to have the PIPE Resale Registration Statement declared effective no later than the 60th calendar day following the Closing Date (or, in the event the SEC notifies ROCR that it will “review” the PIPE Resale Registration Statement, the 90th calendar day following the Closing Date (as defined in the PIPE Registration Rights Agreement)).

Emerging Growth Company Status

QualTek qualifies as an emerging growth company (“EGC”) pursuant to the provisions of the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). For as long as QualTek is an EGC, it may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not EGCs including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in QualTek’s periodic reports and proxy statements, exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and shareholder advisory votes on golden parachute compensation.

13

In addition, under the JOBS Act, EGCs can delay adopting new or revised accounting standards until such time as those standards apply to private companies. QualTek intends to take advantage of the longer phase-in periods for the adoption of new or revised financial accounting standards under the JOBS Act until it is no longer an EGC. QualTek’s election to use the phase-in periods permitted by this election may make it difficult to compare its financial statements to those of non-EGCs and other EGCs that have opted out of the longer phase-in periods permitted under the JOBS Act and who will comply with new or revised financial accounting standards. If QualTek were to subsequently elect instead to comply with public company effective dates, such election would be irrevocable pursuant to the JOBS Act.

Risk Factor Summary

Risks Related to QualTek

| ● | Many of the industries QualTek serves are highly competitive and subject to rapid technological and regulatory changes, as well as customer consolidation, any of which could result in decreased demand for QualTek’s services and adversely affect its results of operations, cash flows and liquidity. |

| ● | Unfavorable market conditions, market uncertainty, public health outbreaks such as the COVID-19 pandemic and/or economic downturns could reduce capital expenditures in the industries QualTek serves or could adversely affect its customers, which could result in decreased demand or impair its customers’ ability to pay for QualTek’s services. |

| ● | QualTek’s failure to properly manage projects, or project delays, could result in additional costs or claims or failure to achieve actual revenue or profits when anticipated or at all, which could have a material adverse effect on QualTek’s operating results, cash flows and liquidity. |

| ● | QualTek’s failure to recover adequately on charges against project owners, subcontractors or suppliers for payment or performance could have a material adverse effect on QualTek’s financial results. |

| ● | QualTek derives a significant portion of its revenue from a few customers, and the loss of one or more of these customers, or a reduction in their demand for QualTek’s services, could impair QualTek’s financial performance. In addition, many of QualTek’s contracts, including its service agreements, do not obligate QualTek’s customers to undertake any infrastructure projects or other work with QualTek, and most of QualTek’s contracts may be canceled on short or no advance notice. |

| ● | Amounts included in QualTek’s backlog may not result in actual revenue or translate into profits. QualTek’s backlog is subject to cancellation and unexpected adjustments and is, therefore, an uncertain indicator of future operating results. |

| ● | QualTek’s business is seasonal and affected by the spending patterns of QualTek’s customers and timing of governmental permitting, as well as weather conditions and natural catastrophes, which exposes QualTek to variations in quarterly results. |

| ● | QualTek relies on information, communications and data systems in its operations. System and information technology interruptions and/or data security breaches could adversely affect QualTek’s ability to operate and its operating results or could result in harm to its reputation. |

| ● | A failure to comply with environmental laws could result in significant liabilities or harm QualTek’s reputation, and new environmental laws or regulations could adversely affect QualTek’s business. |

| ● | QualTek has a significant amount of debt, which could adversely affect its business, financial condition and results of operations or could affect its ability to access capital markets in the future. In addition, QualTek’s debt contains restrictive covenants that may prevent it from engaging in transactions that might benefit the Company. |

Risk Related to the Class A Common Stock

| ● | The market price of the Class A Common Stock is likely to be highly volatile, and you may lose some or all of your investment. |

14

| ● | The Combined Company’s business and operations could be negatively affected if it becomes subject to any securities litigation or shareholder activism, which could cause the Combined Company to incur significant expense, hinder execution of business and growth strategy and impact its stock price. |

| ● | Following the Business Combination, we will be a “controlled company” within the meaning of the applicable rules of Nasdaq and, as a result, may qualify for exemptions from certain corporate governance requirements. To the extent we rely on such exemptions, our shareholders will not have the same protections afforded to stockholders of companies that are not controlled companies. |

| ● | QualTek is an emerging growth company within the meaning of the Securities Act, and QualTek has taken advantage of certain exemptions from disclosure requirements available to emerging growth companies; this could make QualTek’s securities less attractive to investors and may make it more difficult to compare QualTek’s performance with other public companies. |

Risks Related to Tax

| ● | Our only principal asset following the Business Combination will be our interest in QualTek, and accordingly we will depend on distributions from QualTek to pay dividends, taxes, other expenses, and make any payments required to be made under the Tax Receivable Agreement. |

| ● | The Tax Receivable Agreement will require us to make cash payments to the TRA Holders in respect of certain tax benefits and such payments may be substantial. In certain cases, payments under the Tax Receivable Agreement may (i) exceed any actual tax benefits the Tax Group realizes or (ii) be accelerated. |

| ● | We could be adversely affected by changes in applicable tax laws, regulations, or administrative interpretations thereof in the United States or other jurisdictions. |

15

THE OFFERING

Issuer | Roth CH Acquisition III Co., to be renamed QualTek Services Inc. in connection with the Business Combination |

Shares that may be offered and sold from time to time by the Selling Stockholders named herein | 12,160,000 shares of Class A Common Stock. |

ROCR Common Stock issued and outstanding prior to the consummation of the Business Combination and any exercise of warrants | [] shares of ROCR Common Stock |

Class A Common Stock to be issued and outstanding following the consummation of the Business Combination (assuming no redemptions and excluding shares issuable upon exercise of outstanding warrants)(1) | [] shares of Class A Common Stock |

Use of proceeds | All of the shares of Class A Common Stock offered by the Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders for their respective accounts. We will not receive any of the proceeds from these sales. |

Proposed NASDAQ Capital Market symbol | “QTEK” |

Risk Factors | Investing in Class A Common Stock involves a high degree of risk. See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider carefully before you decide to invest in Class A Common Stock. |

| (1) | Represents the number of shares of ROCR Common Stock outstanding at the Closing assuming that none of ROCR’s public stockholders exercise their redemption rights in connection with the special meeting of the ROCR’s stockholders. |

16

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA OF QUALTEK

The selected historical financial data presented below is derived from our unaudited consolidated financial statements and audited consolidated financial statements as of and for the six months ended July 3, 2021 and July 4, 2020 and as of and for the years ended December 31, 2020 and 2019 included elsewhere in this registration statement. The unaudited consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and, in our opinion, have included all adjustments necessary to present fairly in all material respects our financial position and results of operations.

The historical results presented below are not necessarily indicative of the results that may be expected in any future periods. You should read the following selected historical financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations of QualTek” and our consolidated financial statements and accompanying footnotes included elsewhere in this registration statement.

For the Six Months Ended, December 31, | For the Years Ended | |||||||||||

(in thousands except unit and per unit data) | July 3, 2021 | July 4, 2020 | 2020 | 2019 | ||||||||

Statements of Operations and Comprehensive Loss Data |

|

|

|

|

|

|

|

| ||||

Revenue | $ | 255,118 | $ | 347,448 | $ | 674,005 | $ | 620,829 | ||||

Costs and expenses |

|

|

|

|

|

|

|

| ||||

Cost of revenues |

| 222,668 |

| 316,734 |

| 615,914 |

| 545,208 | ||||

General and administrative |

| 24,065 |

| 23,004 |

| 47,853 |

| 43,606 | ||||

Transaction expense |

| 1,452 |

| 170 |

| 988 |

| 4,257 | ||||

Change in fair value of contingent consideration |

| — |

| — |

| (7,081) |

| 5,883 | ||||

Impairment of long-lived assets |

| — |

| — |

| — |

| 840 | ||||

Impairment of goodwill |

| — |

| — |

| 28,802 |

| 13,251 | ||||

Depreciation and amortization |

| 26,622 |

| 24,037 |

| 48,497 |

| 42,115 | ||||

Total costs and expenses |

| 274,807 |

| 363,945 |

| 734,973 |

| 655,160 | ||||

Loss from operations |

| (19,689) |

| (16,497) |

| (60,968) |

| (34,331) | ||||

Other income (expense): |

|

|

|

|

|

|

|

| ||||

Gain on sales/disposal of property and equipment |

| 304 |

| 46 |

| 729 |

| 130 | ||||

Interest expense |

| (21,215) |

| (19,208) |

| (37,848) |

| (33,593) | ||||

Loss on extinguishment of convertible notes. |

| (2,436) |

| — |

| — |

| — | ||||

Total other expense |

| (23,347) |

| (19,162) |

| (37,119) |

| (33,463) | ||||

Net loss | $ | (43,036) | $ | (35,659) | $ | (98,087) | $ | (67,794) | ||||

Accrued preferred return | $ | — | $ | 1,621 | $ | 3,287 | $ | 742 | ||||

Net loss attributable to Class A units | $ | (43,036) | $ | (37,280) | $ | (101,374) | $ | (68,536) | ||||

Net loss per unit: |

|

|

|

|

|

|

|

| ||||

Basic | $ | (20.78) | $ | (18.59) | $ | (50.54) | $ | (34.93) | ||||

Non-GAAP financial data: |

|

|

|

|

| |

|

| ||||

Adjusted EBITDA(1) | $ | 9,311 | $ | 8,018 | $ | 11,485 | $ | 32,686 | ||||

As of July 3, | As of December 31, | ||||||||

(in thousands) | 2021 | 2020 | 2019 | ||||||

Balance Sheet Data | |||||||||

Cash |

| $ | 37,797 |

| $ | 169 |

| $ | 328 |

Working capital(2) |

| (9,944) |

| 15,775 |

| 71,316 | |||

Total assets |

| 674,514 |

| 640,868 |

| 747,230 | |||

Total liabilities |

| 683,904 |

| 611,234 |

| 613,072 | |||

Total (deficit) equity |

| (9,390) |

| 29,634 |

| 134,158 | |||

| (1) | Adjusted EBITDA is a non-GAAP measure. Refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations of QualTek — Key Financial and Operating Measures — Non-GAAP Financial Measures” for definitions, additional discussion of management’s use of non-GAAP measures as supplemental financial measures and reconciliations of net loss to Adjusted EBITDA. Adjusted EBITDA may not be comparable to similarly titled non-GAAP measures of other companies as other companies may have calculated the measures differently. |

| (2) | QualTek defines working capital as total current assets minus total current liabilities. |

12

RISK FACTORS

You should carefully review and consider the following risk factors and the other information contained in this prospectus, including the consolidated financial statements and the accompanying notes and matters addressed in the section titled “Cautionary Note Regarding Forward-Looking Statements,” in evaluating an investment in Class A Common Stock. The following risk factors apply to the business and operations of QualTek and also apply to the business and operations of the Combined Company following the consummation of the Business Combination. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may adversely affect the ability to realize the anticipated benefits of the Business Combination and may have an adverse effect on the business, cash flows, financial condition and results of operations of the Combined Company following the consummation of the Business Combination. We may face additional risks and uncertainties that are not presently known to us or that we currently deem immaterial, which may also impair our business, cash flows, financial condition and results of operations.

Risks Related to QualTek

Unless the context otherwise requires, all references in this section to “we,” “us,” or “our” refer to QualTek and its subsidiaries prior to the consummation of the Business Combination and the Combined Company and its subsidiaries after the consummation of the Business Combination.

Risks Related to the Industries We Serve

Changes to laws, governmental regulations and policies, including governmental permitting processes and tax incentives, could affect demand for our services. Additionally, demand for construction services depends on industry activity and expenditure levels, which can be affected by a variety of factors. Our inability or failure to adjust to such changes or activity could result in decreased demand for our services and adversely affect our results of operations, cash flows and liquidity.

The industries we serve are subject to effects of governmental regulation, climate change initiatives and political or social activism, any of which could result in reduced demand for our services, delays in timing of construction of projects or cancellations of current or planned future projects. Many of our customers face stringent regulatory and environmental requirements and permitting processes, including governmental regulations and policies. Most of our communications customers are regulated by the Federal Communications Commission, and our utility customers are regulated by state public utility commissions. These agencies or governments could change their interpretation of current regulations and/or may impose additional regulations, which could have an adverse effect on our customers, reduce demand for our services and adversely affect our results of operations, cash flows and liquidity. We build renewable energy infrastructure, including wind, solar and other renewable energy facilities, for which the development may be partially dependent upon federal tax credits, existing renewable portfolio standards and other tax or state incentives. Elimination of, or changes to, existing renewable portfolio standards, tax incentives or similar environmental policies could negatively affect demand for our services.

All of the above factors could result in fewer projects than anticipated or a delay in the timing of construction of these projects and the related infrastructure, which could negatively affect demand for our services, and have a material adverse effect on our results of operations, cash flows and liquidity.

Many of the industries we serve are highly competitive and subject to rapid technological and regulatory changes, as well as customer consolidation, any of which could result in decreased demand for our services and adversely affect our results of operations, cash flows and liquidity.

Our industry is highly fragmented, and we compete with other companies in most of the markets in which we operate, ranging from small independent firms servicing local markets to larger firms servicing regional and national markets. We also face competition from existing and prospective customers that employ in-house personnel to perform some of the services we provide. There are relatively few barriers to entry into certain of the markets in which we operate and, as a result, any organization that has adequate financial resources and access to technical expertise and skilled personnel may become a competitor. Most of our customers’ work is awarded through bid processes, and our project bids may not be successful. Our results of operations, cash flows and liquidity could be materially and adversely affected if we are unsuccessful in bidding for projects or renewing our master service agreements, or if our ability to win such projects or agreements requires that we accept lower margins.

13

We derive a substantial portion of our revenue from customers in industries that are subject to rapid changes in technology, governmental regulation, changing consumer demands and consolidation, such as the telecommunications industry. Technological advances in the markets we serve could render existing projects or technologies uncompetitive or obsolete and/or could alter our customers’ existing operating models. Our failure to rapidly adopt and master new technologies as they are developed or adapt to changing customer requirements could reduce demand for our services. Additionally, consolidation among our customers could result in the loss of customer revenue or could negatively affect customer demand for the services we provide and have a material adverse effect on our results of operations, cash flows and liquidity.

Unfavorable market conditions, market uncertainty, public health outbreaks such as the COVID-19 pandemic and/or economic downturns could reduce capital expenditures in the industries we serve or could adversely affect our customers, which could result in decreased demand or impair our customers’ ability to pay for our services.

Demand for our services has been, and will likely continue to be, cyclical in nature and vulnerable to general downturns in the U.S. and Canadian economies. Unfavorable market conditions, market uncertainty, public health outbreaks such as the COVID-19 pandemic and/or economic downturns could have a negative effect on demand for our customers’ services or the profitability of their services. We continually monitor our customers’ industries and their relative health compared to the economy as a whole. Our customers may not have the ability to fund capital expenditures for infrastructure or may have difficulty obtaining financing for planned projects during economic downturns. Uncertain or adverse economic conditions or the lack of availability of debt or equity financing for our customers could reduce their capital spending and/or result in project cancellations or deferrals. Any of these conditions could materially and adversely affect our results of operations, cash flows and liquidity, and could add uncertainty to our backlog determinations. Other economic factors can also negatively affect demand for our services, including economic downturns affecting our communications and customer fulfillment customers, if services are ordered at a reduced rate, or not at all. A decrease in demand for the services we provide from any of the above factors, among others, could materially and adversely affect our results of operations, cash flows and liquidity.

An impairment of the financial condition of one or more of our customers due to economic downturns, or due to the potential adverse effects of the COVID-19 pandemic on economic activity, could hinder their ability to pay us on a timely basis. In difficult economic times, some of our clients may find it difficult to pay for our services on a timely basis, increasing the risk that our accounts receivable could become uncollectible and ultimately be written off. In certain cases, our clients are project-specific entities that do not have significant assets other than their interests in the project. From time to time, it may be difficult for us to collect payments owed to us by these clients. Delays in client payments may require us to make a working capital investment, which could negatively affect our cash flows and liquidity. Our results of operations, cash flows and liquidity could be materially and adversely affected if a client fails to pay us on a timely basis or defaults in making payments on a project for which we have devoted significant resources.

Risks Related to Our Business and Operations

Our failure to properly manage projects, or project delays, including those resulting from difficult work sites and environments or delays, could result in additional costs or claims or failure to achieve actual revenue or profits when anticipated or at all, which could have a material adverse effect on our operating results, cash flows and liquidity.

Certain of our engagements involve large-scale, complex projects that may occur over extended time periods. The quality of our performance on such a project depends in large part upon our ability to manage our client relationship and the project itself, such as the timely deployment of appropriate resources, including third-party contractors and our own personnel. Our results of operations, cash flows and liquidity could be adversely affected if we miscalculate the resources or time needed to complete a project with capped or fixed fees, or the resources or time needed to meet contractual milestones.

14

We perform work under a variety of conditions, including, but not limited to, challenging and hard to reach terrain and difficult site conditions. Performing work under such conditions can result in project delays or cancellations, potentially causing us to incur unanticipated costs, reductions in revenue or the payment of liquidated damages. In addition, some of our contracts require that we assume the risk should actual site conditions vary from those expected. Some of our projects involve challenging engineering, procurement and construction phases, which may occur over extended time periods. We may encounter difficulties in engineering, delays in designs or materials provided by the customer or a third party, equipment and material delivery delays, permitting delays, schedule changes, delays from customer failure to timely obtain rights-of- way, weather-related delays, delays by subcontractors in completing their portion of projects and governmental, market and political or other factors, some of which are beyond our control and could affect our ability to complete a project as originally scheduled. For instance, in the second quarter of 2021, we experienced delays in certain renewables and recovery logistics projects in Texas because of heavy rains, which is expected to delay or reduce our anticipated revenue or profits from these projects. In the first half of 2021, we have also experienced delays in certain 5G rollout projects, including equipment delays, which is expected to delay or reduce our anticipated revenue or profits from these projects. In some cases, delays and additional costs may be substantial, and/or we may be required to cancel or defer a project and/or compensate the customer for the delay. We may not be able to recover any of such costs. Any such delays, cancellations, errors or other failures to meet customer expectations could result in damage claims substantially in excess of the revenue associated with a project. Delays or cancellations could result in additional costs or claims or failure to achieve actual revenue or profits when anticipated or at all, which could have a material adverse effect on our operating results, cash flows and liquidity, and could also negatively affect our reputation or relationships with our customers, which could adversely affect our ability to secure new contracts.

We could also encounter project delays due to local opposition, including political and social activism, which could include injunctive actions or public protests related to the siting of our projects, and such delays could adversely affect our project margins. In addition, some of our agreements require that we pay liquidated damages or other charges if we do not meet project deadlines; therefore, any failure to properly estimate or manage cost, or delays in the completion of projects, could subject us to penalties, which could adversely affect our results of operations, cash flows and liquidity. Further, any defects or errors, or failures to meet our customers’ expectations, could result in large damage claims against us. Due to the substantial cost of, and potentially long lead-times necessary to acquire certain of the materials and equipment used in our complex projects, damage claims could substantially exceed the amount we can charge for our associated services.

Our failure to recover adequately on charges against project owners, subcontractors or suppliers for payment or performance could have a material adverse effect on our financial results.

We occasionally seek reimbursement from project owners for additional costs that exceed the contract price or for amounts not included in the original contract price. Similarly, we present change orders and charges to our subcontractors and suppliers. We could incur reduced profits, cost overruns or project losses if we fail to properly document the nature of change orders or charges or are otherwise unsuccessful in negotiating an expected settlement. These types of charges can often occur due to matters such as owner- caused delays or changes from the initial project scope, which result in additional costs, both direct and indirect, or from project or contract terminations. From time to time, these charges can be the subject of lengthy and costly proceedings, and it is often difficult to accurately predict when these charges will be fully resolved. When these types of events occur and unresolved charges are pending, we may invest significant working capital in projects to cover cost overruns pending the resolution of the relevant charges. A failure to promptly recover on these types of charges could have a material adverse effect on our liquidity and financial results.

Additionally, we generally warrant the work we perform following substantial completion of a project. Warranty claims have historically not been material, but such claims could potentially increase. The costs associated with such warranties, including any warranty-related legal proceedings, could have a material adverse effect on our results of operations, cash flows and liquidity.

15

We may not accurately estimate the costs associated with services provided under fixed price contracts, which could impair our financial performance. Additionally, we recognize revenue for certain projects using the cost-to- cost method of accounting; therefore, variations of actual results from our assumptions could reduce our profitability.

We derive a significant portion of our revenue from fixed price master service and other service agreements. Under these contracts, we typically set the price of our services on a per unit or aggregate basis and assume the risk that costs associated with our performance may be greater than what we estimated. We also enter into contracts for specific projects or jobs that require the installation or construction of an entire infrastructure system or specified units within an infrastructure system, many of which are priced on a fixed price or per unit basis. Our profitability will be reduced if actual costs to complete a project exceed our original estimates. Our profitability is therefore dependent upon our ability to accurately estimate the costs associated with our services and our ability to execute in accordance with our plans. A variety of factors could negatively affect these estimates, including delays resulting from weather and the COVID-19 pandemic, changes in expected productivity levels, conditions at work sites differing materially from those anticipated at the time we bid on the contract and higher than expected costs of labor and/or materials. These variations, along with other risks inherent in performing fixed price contracts, could cause actual project results to differ materially from our original estimates, which could result in lower margins than anticipated, or losses, which could reduce our profitability, cash flows and liquidity.

In addition, we recognize revenue from fixed price contracts, as well as for certain projects pursuant to master and other service agreements, over time utilizing the cost-to-cost measure of progress, or the “cost-to- cost” method of accounting, under which the percentage of revenue to be recognized in a given period is measured by the percentage of costs incurred to date on the contract to the total estimated costs for the contract. The cost-to-cost method, therefore, relies on estimates of total expected contract costs. Contract revenue and total contract cost estimates are reviewed and revised on an ongoing basis as the work progresses. Adjustments arising from changes in the estimates of contract revenue or costs are reflected in the fiscal period in which such estimates are revised. Estimates are based on management’s reasonable assumptions, judgment and experience, but are subject to the risks inherent in estimates, including unanticipated delays or technical complications, changes in job performance, job conditions and management’s assessment of expected variable consideration. Variances in actual results from related estimates on a large project, or on several smaller projects, could be material. The full amount of an estimated loss on a contract is recognized in the period such losses are determined. Any such adjustments could result in reduced profitability and negatively affect our results of operations.

We derive a significant portion of our revenue from a few customers, and the loss of one or more of these customers, or a reduction in their demand for our services, could impair our financial performance. In addition, many of our contracts, including our service agreements, do not obligate our customers to undertake any infrastructure projects or other work with us, and most of our contracts may be canceled on short or no advance notice.