UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the year ended

For the transition period from __________ to __________

Commission File Number:

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Address of principal executive offices

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| None | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The aggregate market value of the voting and non-voting

common equity held by non-affiliates as of June 30, 2022 was $

State the number of shares outstanding of each of the registrant’s classes of common equity, as of the latest practicable date: shares of common stock as of April 14, 2023.

Table of Contents

| i |

PART I

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “projects,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Other uncertainties that could affect the accuracy of forward-looking statements include:

| · | Technological changes in the solar energy industry; | |

| · | Our operating costs and other costs of doing business; | |

| · | Access to and availability of materials, equipment, supplies, labor and supervision, power and water; | |

| · | Results of current and future feasibility studies; | |

| · | The level of demand for our solar energy systems; | |

| · | Changes in our business strategy, plans and goals; | |

| · | Acts of God such as floods, earthquakes, and any other natural disasters; and | |

| · | The impact of the COVID-19 Coronavirus. |

This list, together with the factors identified in the Risk Factors section of this report, is not exhaustive of the factors that may affect any of our forward-looking statements. You should read this report completely and with the understanding that our actual future results may be materially different from what we expect. These forward-looking statements represent our beliefs, expectations, and opinions only as of the date of this report. We do not intend to update these forward-looking statements except as required by law. We qualify all of our forward-looking statements by these cautionary statements.

| 1 |

| ITEM 1. | BUSINESS |

We were incorporated in Colorado on December 2, 2020. We acquired all rights to the GSP system on March 9, 2021 from Fourth Wave Energy, Inc (“FWAV”) in return for the issuance of up to 10,000,000 shares of our common stock to FWAV.

We also assumed all liabilities (approximately $380,000) associated with seven consulting agreements previously signed by FWAV. The agreements with the consultants generally provided that the consultants would advise FWAV in matters concerning the development of natural energy systems, referred to as the “GSP system”, in newly built and existing residences as well as new apartments and commercial buildings. Although these consulting agreements have since expired, we still owe $380,000 to the former consultants.

We plan to install natural energy systems, referred to as the GeoSolar Plus System (the “GSP system”) in newly built and existing residences as well as green new apartments and commercial buildings. The GSP System is based on combining solar power, geothermal ground sourced energy and other clean energy technologies into one fully integrated system. Our GSP system is designed to significantly reduce energy consumption and associated carbon emissions and improve the atmospheric and indoor air quality in residences.

Our business strategy is to form strategic dealership/licensing agreements with local solar power and plumbing companies making them our installation partners for the sale and installation of the GSP system.

Through our strategic dealership/licensing agreements we plan to grant all homeowners that purchase a GSP system a 25-year warranty and 100% financing through our anticipated licensees, of which we currently do not have any and we cannot guarantee that we will find any licensees that will be adequate to our business plans.

The Company through research and testing has developed, successfully tested, and is preparing to launch its first commercial product, a patent pending new system called GeoSolar Plus for powering homes that creates all the energy a homeowner uses with no carbon emissions or utility bills.

Solar Energy Overview

Solar power is energy from the sun that is converted into thermal or electrical energy. Solar energy is the cleanest and most abundant renewable energy source available. Solar technologies can harness this energy for a variety of uses, including generating electricity, providing light or a comfortable interior environment, and heating water for domestic, commercial, or industrial use.

There are three main ways to harness solar energy: photovoltaic, solar heating and cooling, and concentrating solar power. Photovoltaics generate electricity directly from sunlight via an electronic process and can be used to power anything from small electronics such as calculators and road signs up to homes and large commercial businesses. Solar heating and cooling (SHC) and concentrating solar power (CSP) applications both use the heat generated by the sun to provide space or water heating in the case of SHC systems, or to run traditional electricity-generating turbines in the case of CSP power plants.

Solar energy is a very flexible energy technology: it can be built as distributed generation (located at or near the point of use) or as a central-station, utility-scale solar power plant (similar to traditional power plants). Both of these methods can also store the energy they produce for distribution after the sun sets, using new solar and storage technologies.

In the last decade alone, solar has experienced an average annual growth rate of 48%. Thanks to strong federal policies like the solar Investment Tax Credit, rapidly declining costs, and increasing demand across the private and public sector for clean electricity, there are now nearly 100 gigawatts (GW) of solar capacity installed nationwide, enough to power 18.9 million homes.

| 2 |

The cost to install solar has dropped by more than 70% over the last decade, leading the industry to expand into new markets and deploy thousands of systems nationwide. Prices as of Q4 2021 are at their lowest levels in history across all market segments. An average-sized residential system has dropped from a pre-incentive price of $40,000 in 2010 to roughly $20,000 for average 8 kilowatts (KW) system today.

Solar has ranked first or second in new electric capacity additions in each of the last years. In 2019, 40% of all new electric capacity added to the grid came from solar, the largest such share in history. Solar's increasing competitiveness against other technologies has allowed it to quickly increase its share of total U.S. electrical generation - from just 0.1% in 2010 to more than 3.0% today.

Homeowners and businesses are increasingly demanding solar systems that are paired with battery storage. While this pairing is still relatively new, the growth over the next five years is expected to be significant. By 2025, more than 25% of all behind-the-meter solar systems will be paired with storage, compared to under 5% in 2019.

The residential solar market experienced a record year in 2019 as costs continued to fall and solar expanded into more state markets. While California had its strongest year ever due to the emergence of solar storage as a remedy for disruptive power shutoffs, emerging markets also enjoyed strong growth. Future growth is expected across the country as prices continue to fall and combined solar + storage systems become increasingly viable.

GSP System

Our patent pending and proprietary GeoSolar Plus SmartGreen™ (GSP) all electric home energy system that will provide all the energy required for heating, cooling, cooking, powering, electric vehicle charging, and air purification within either existing or new homes. We are preparing to launch an aggressive rollout of the system targeting the new home and retrofit residential markets in the first quarter of 2022.

Our SmartGreen™ home system combines the powerful natural energy from solar and geothermal sources - energy radiated from the earth’s core - with electric heat pumps, air purification and monitoring, backup battery storage, all electric appliances, electric vehicle charging and a home automation central software system that operates every component for powering the home.

Potential benefits include:

| · | Little to no utility bills for life | |

| · | No carbon emissions from operation of home | |

| · | Increased home value | |

| · | Significantly healthier living environment | |

| · | Clean, quiet and efficient living | |

| · | Saves money and provides tax benefits |

The entire system installs quickly and improves the home value from day one. We know of no other company that has the complete turnkey whole home system that the Company is launching.

The GSP system is based on combining solar power and other energy efficient technologies into one fully integrated system. The GSP system is designed to significantly reduce energy consumption and associated carbon emissions in residences and commercial buildings.

| 3 |

The GSP system is:

| · | Powered by solar photovoltaics and is managed with direct current advanced energy management controls | |

| Uses: |

| o | Geothermal heating and cooling |

| - | Efficient HVAC; | |

| - | LED lighting; | |

| - | Solar energy for hot water heating; | |

| - | Improved insulation; and | |

| - | Advanced air filtration and ventilation. |

We plan to use a national network of solar installers and home improvement contractors throughout the US to market and install the GSP system directly to homeowners. The Company will retain the rights to the sales and installation of the GSP system in Colorado

We plan to use independent subcontractors to replace a home’s existing heating and air conditioning system with the GSP system. We estimate that the removal of an existing HVAC system and the installation of the GSP system will require approximately 30 days to complete.

It is believed the installation of the GSP system will result in a more valuable, cleaner and healthier home and is highly economic for the homeowner.

The GSP system will symbolize an important advancement in the way homes are cooled, heated and powered and that the market for the GSP system will be substantial.

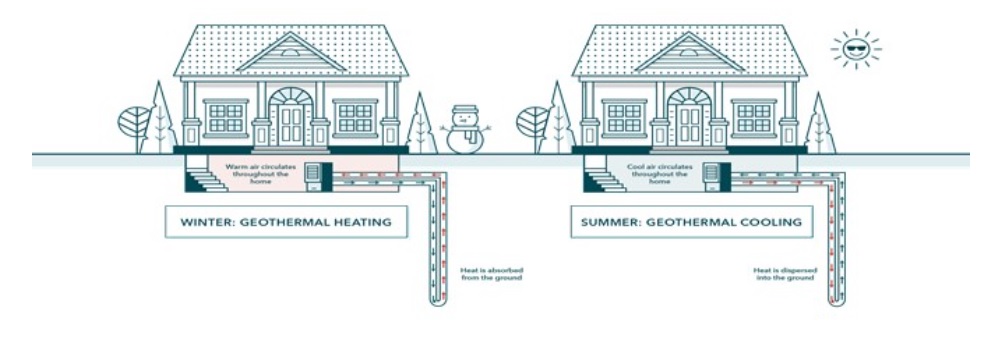

A rendering of the GSP system follows:

| 4 |

Tiered Installation Levels

We plan to offer the GSP system installation packages in three tiers (Silver, Gold, and Platinum). This way we can tailor to the specific needs of each individual homeowner. The average new or existing home installation costs approximately $59,500 after 26% federal tax credits and potential state tax credits that could be available on a state by state basis.

The system can be 100% financed at low interest rates or added to a mortgage. We estimate that the payments will likely be less than the homeowner’s current utility bills.

As of the date of this filing, the Company has installed one GSP system and had contracts, which will provide us with gross revenue of approximately $20,000, for the installation of other GSP systems. During the year ended December 31, 2021, the one GSP system we installed was to test the system in a "live" environment and the amount we received for installing the system was credited to research and development expenses. There have been 29 GSP systems installed, 28 of the GSP systems were installed by the inventor of the GSP system that we acquired.

Geothermal Heat Pump Overview

Description

A geothermal heat pump system is an electrically powered heating and cooling system that transfers heat between your house and the earth using fluid circulated through long loops of underground pipes. In principle, a geothermal heat pump functions like a conventional heat pump, by using high-pressure refrigerant to capture and move heat between indoors and out. The difference is that conventional systems gather their heat—and get rid of it—through the outside air. Geothermal systems, in contrast, transfer heat through long loops of liquid-filled pipes buried in the ground.

As with ordinary heat pumps, the refrigerant in a geothermal heat pump runs in a loop through a compressor, condenser, expansion valve, and evaporator, collecting heat at one end and giving it up at the other. The direction of refrigerant flow, which is controlled by the reversing valve, determines whether heat is moving into the house in winter or being pulled out of it in summer. With the addition of a desuperheater, residual warmth from the system can also supplement a conventional water heater, further reducing energy bills.

We believe that the GSP system will be an integral part of making homes more efficient, as this will potentially cut home heating and cooling bills by an estimated 30 to 70 percent. Further benefits will include the elimination of noisy outdoor compressors and fans. Lastly, and for the benefit of the earth, the geothermal heating and cooling will reduce greenhouse gas emissions by greatly reducing the amount of gas and energy people use to heat and cool homes.

| 5 |

Installation

We will install an indoor heat pump which will use a basic refrigeration cycle—evaporation, compression, condensation, and expansion—to capture and disburse heat from and to the ground to warm the house in winter and cool it in summer. We estimate that it will cost around $15,000–$20,000 to install each system, including ground loops, heat pump, and controls.

A geothermal heating system is not difficult to retrofit with a standard heating ventilation and air conditioning system to a ground-source system, as long as burying the ground loop is feasible. A house will need air ducts to distribute cool air on hot days. Those same ducts can provide warm air in winter.

Some geothermal heat pumps can hook up to an existing air handler, other units come with their own integral air handler. Houses with hot-water heating can use geothermal systems, too, although additional radiators may be needed because these systems do not reach the higher temperatures of fuel-fired boilers.

Upon installation we will need to bury approximately 1,500 to 1,800 feet for a typical 2,000-square-foot home. This can be done generally in several ways. The first set up would be for a house on a large property where we could bury the pipes horizontally in approximately four-foot-deep trenches around the property, the second method would be used for houses on smaller properties or properties that are not good for trenching, in that instance we would need to drill several holes approximately three hundred feet straight down into the ground, and a third method would be available if there was an adequate sized body of water close to the home, in that situation we could run the pipes and coil them at the bottom of the pond. In the second method the drilling of the holes would add approximately 50% to the cost of installation.

Efficiency

We plan to use super-efficient geothermal heat pumps. These heat pumps will provide clean, quiet heating and cooling while potentially cutting utility bills by up to 70 percent.

It is estimated that it takes only one kilowatt-hour of electricity for a geothermal heat pump to produce nearly 12,000 Btu of cooling or heating. (To produce the same number of Btus, a standard heat pump on a 95-degree day consumes 2.2 kilowatt-hours.) Geothermal systems are twice as efficient as the top-rated air conditioners and almost 50 percent more efficient than the best gas furnaces, all year round.

Another advantage is that there is no need for a noisy outdoor fan to move air through the compressor coils. Geothermal units simply pump liquid, so they can be placed indoors, safe from the elements. Most geothermal units come with 10-year warranties, but they can last much longer.

Arvada, Colorado 4-plex

On July 1, 2022, the Company entered into an agreement with Norbert Klebl to collaborate on the development of the 4-plex in Arvada, Colorado. Mr. Klebl is a co-founder of the GSP technology and is the Development Director for the Company. Per the agreement, the Company or its newly formed subsidiary, Sustainable Housing Development Corporation, will be named developer of the property and Mr. Klebl will be the primary manager of the project. Mr. Klebl paid for the land on which the project will be built and contributed the property to the Company’s subsidiary. The Company will arrange for a construction loan on the project. Upon sale of the 4-plex which is to be built on the property, Mr. Klebl will receive the price paid for the property and any advances toward the project. The profits from the sale of the 4-plex, if any, will be allocated 75% to Mr. Klebl and 25% to the Company. The advance is secured by the property, bears interest at 8% per annum and is repayable when the development is sold. As of December 31, 2022, Mr. Klebl is owed $464,741, which is repayable when the development is sold . If the Company does not arrange for a construction loan on the project by April 30, 2023, the property on which the 4-plex is to be built will revert to Mr. Klebl.

Markets and Marketing

The renewable energy and efficiency market involves suppliers, distributors, manufacturers, and contractors; therefore, we plan to establish and maintain a loyal business relationships with all parties.

| 6 |

Technology for solar modules, battery storage, and energy efficiency products is constantly advancing, making it more affordable to create a more clean and sustainable energy. Renewable energy is one of the fastest growing industries worldwide. Showing continued growth from solar photovoltaic systems to electrification of vehicles. Due to the ever-changing climate, we will strive to stay relevant and adapt to ongoing environmental and regulatory changes and continuing to expand our business model to branch out with complimentary services.

Some new potential products, services and markets are as follows:

| · | Bidirectional charge controllers using electric vehicles | |

| · | Holistic approach to residential decarbonization through integration of envelope improvements, electrification and transitioning to heat pumps | |

| · | JV with builders on development of electric zero carbon apartments | |

| · | Warehouse conversions to electric | |

| · | Neighborhood community green energy retrofits |

Sales and Marketing

Our business strategy is to form strategic dealership/licensing agreements with local solar power and plumbing companies making them our installation partners for the sale and installation of the GSP system.

Through our strategic dealership/licensing agreements we plan to grant all homeowners that purchase a GSP system a 25-year warranty and 100% financing through our partners. We are particularly excited about the Arizona and Colorado markets and plan to have a major presence in both states. Additionally, we plan to expand rapidly to Texas, California, New Mexico, Utah and Nevada, where solar power is currently most prevalent.

We will potentially seek mergers and/or acquisitions with solar installers, geothermal installers and potentially product manufacturers to integrate our technology and application with their services and product line. This way, we do not need to spend as many funds on customer acquisition to expand into new territories, as we can use existing local providers and their existing customer base, which should save time and money.

Renewable Energy

Renewable energy is defined as energy supplies that derive from non-depleting sources such as solar, wind and certain types of biomass. Renewable energy reduces dependence on imported and increasingly expensive oil and natural gas. In addition, growing environmental pressures, increasing economic hurdles of large power generation facilities and U.S. National Security interests are favorable drivers for renewable energy. Renewable energy, including solar and wind power, is the fastest growing segment of the energy industry worldwide.

Solar power, subsequent to installation, is an environmentally benign, locally sourced renewable energy source that can play an immediate and significant role in assisting global economic development, forging sustainable global environmental and energy policies, and protecting national security interests.

| 7 |

Competition

The markets we plan to serve are highly fragmented with numerous small and regional participants and several large nationally based companies. Competition in the markets we plan to serve will be based on a number of considerations, including our ability to excel at timeliness of delivery, technology, applications experience, know-how, reputation, product warranties, service and price. Demand for our products can vary period over period depending on conditions in the markets we serve. We believe our future product quality reliability, and safety supported by advanced manufacturing and operational excellence will differentiate us from many of our competitors, including those competitors who often offer products at a lower price.

Overall, the competitive environment of the renewable energy industry is very tense despite its market size. The Company competes with other distributors, installers such as Vivint, Tesla, SunPower, Sunnova, and many companies that install geothermal pumps and piping such as WaterFurnace and Dandelion Energy, to name some of the other renewable energy companies that are currently in our industry. These competitors possess significantly greater financial and non-financial resources, manufacturing capacity, well established business models and distribution channels and branding.

Patents and Trademarks

The trademarks currently owned by the Company, and for which it intends to seek federal transaction registration are the marks, GeoSolar Technologies, SmartGreen™ and Leading the Clean Electric Home Revolution™. The Company may federally register other trademarks in the future as the need arises. The Company on May 17, 2021, applied for a United States Patent on its System to Decarbonize, Ventilate and Electrify a Dwelling. This application is currently in provisional status and is application number 63/189,629.

Regulation

We face extensive government regulation both within and outside the U.S. relating to the development, installation, marketing, sale and distribution of our renewable energy products, software and services. The following sections describe certain significant regulations that we are subject to. These are not the only regulations that our businesses must comply with. For a description of risks related to the regulations that our businesses are subject to, please refer to the section entitled “Risk Factors".

We are not a “regulated utility” in the United States under applicable national, state or other local regulatory regimes where we conduct business.

To operate our systems we obtain interconnection agreements from the applicable local primary electricity utility. Depending on the size of the solar energy system and local law requirements, interconnection agreements are between the local utility and either us or our customer. In almost all cases, interconnection agreements are standard form agreements that have been pre-approved by the local public utility commission or other regulatory body with jurisdiction over interconnection agreements. As such, no additional regulatory approvals are required once interconnection agreements are signed. We maintain a utility administration function, with primary responsibility for engaging with utilities and ensuring our compliance with interconnection rules.

Our operations are subject to stringent and complex federal, state and local laws and regulations governing the occupational health and safety of our employees and wage regulations. For example, we are subject to the requirements of the federal Occupational Safety and Health Act, as amended, or OSHA, and comparable state laws that protect and regulate employee health and safety.

Federal and/or state prevailing wage requirements, which generally apply to any “public works” construction project that receives public funds, may apply to installations of our solar energy systems on government facilities. The prevailing wage is the basic hourly rate paid on public works projects to a majority of workers engaged in a particular craft, classification or type of work within a particular area. Prevailing wage requirements are established and enforced by regulatory agencies. Our Sole Officer and Director monitor and coordinate our continuing compliance with these regulations.

| 8 |

Seasonality

We do not expect any seasonality in our business.

Employees

We have one full-time employee, that being our sole officer. We anticipate adding additional employees in the next 12 months, as needed. We do not feel that we would have any unmanageable difficulty in locating needed staff in large part because of our Remote Work corporate structure that allows for location and time flexibility.

Intellectual Property

We may rely on a combination of patent, trademark, copyright, and trade secret laws in the United States as well as confidentiality procedures and contractual provisions to protect our proprietary technology, databases, and our brand.

We plan to have a policy of requiring key employees and consultants to execute confidentiality agreements upon the commencement of an employment or consulting relationship with us. Our employee agreements also require relevant employees to assign to us all rights to any inventions made or conceived during their employment with us. In addition, in the future we will have a policy requiring individuals and entities with which we discuss potential business relationships to sign non-disclosure agreements.

Legal Proceedings

We may from time to time be involved in various claims and legal proceedings of a nature we believe are normal and incidental to our business. These matters may include product liability, intellectual property, employment, personal injury caused by our employees, and other general claims. We are not presently a party to any legal proceedings that, in the opinion of our management, are likely to have a material adverse effect on our business. Regardless of outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources and other factors.

Offices

Our offices are located at 1400 16th Street, Ste. 400, Denver, CO 80202 under a renewable month to month lease at a cost of approximately $300 per month.

| ITEM 1A. | RISK FACTORS |

The price of our common stock may be materially affected by a number of risk factors, including those summarized below:

The Company has only a limited operating history with respect to its new business and may never be profitable.

Since the Company only recently began its new business, it is difficult for potential investors to evaluate the Company’s future prospects. The Company will need to raise enough capital to be able to fund its operations. There can be no assurance that the Company will be profitable or that the Company's securities will have any value.

Any forecasts the Company makes concerning its operations may prove to be inaccurate. The Company’s prospects must be considered in light of the risks, expenses, and difficulties frequently encountered by companies in the early stage of development.

| 9 |

As of December 31, 2022 the Company had installed one GSP system to test the system in a "live" environment and the amount we received for installing the system was credited to research and development expenses. The Company has installed one unit as a test bed, but the inventor of our system has installed twenty eight units using our system. There can be no assurance that the Company will generate any material revenue from the sale of the Company's GSP systems.

We have a history of losses and have not generated revenue.

During the year ended December 31, 2022, we had a net loss of $3,464,765. There can be no assurance that we will ever be profitable.

The Company needs capital to implement its business plan.

The Company needs capital in order to operate. The Company will not receive any capital from this offering and as a result, will need to raise the capital it needs in future offerings of its securities. The Company does not know what the terms of any future capital raising may be, but any future sale of the Company’s equity securities will dilute the ownership of existing stockholders and could be at prices substantially below the market price of the Company's common stock, should be a public market ever develop for the Company's common stock. The failure of the Company to obtain the capital which it requires may result in the slower implementation of the Company’s business plan.

Expiration of Tax Credits

The sale of solar and geothermal energy system has benefitted from federal investment tax credits which lowers the effective cost of these systems to homeowners. However, these tax credits are set to expire in 2024. Although there is hope that these tax credits will be extended, there can be no assurance that they will be extended in which case the net cost of the GSP system to the homeowner will increase significantly.

Our business and results of operations are dependent on the availability, skill and performance of subcontractors.

We will use subcontractors and licensees to install our GSP systems. Accordingly, the timing and quality of our installations will depend on the availability and skill of our subcontractors. While we anticipate being able to obtain sufficient materials and reliable subcontractors, we do not have any contractual commitments with any subcontractors, and we can provide no assurance that skilled subcontractors will be available at reasonable rates. The inability to contract with skilled subcontractors at reasonable rates on a timely basis could have a material adverse effect on our business.

We may discover that our subcontractors have engaged in improper construction practices or have installed defective materials. When we discover these issues, we will use other subcontractors to make repairs as required by law. The costs of repairs in these instances may be significant and we may be unable to recover the costs of repairs from subcontractors, suppliers and insurers, which could have a material impact on our business. We may also suffer damage to our reputation from the actions of subcontractors, which are beyond our control.

The clean energy industry is highly competitive and if our competitors are more successful or offer better value to our customers, our business could decline.

We will operate in a very competitive environment. Additionally, there are relatively low barriers to entry into our business. We will compete with large national and regional companies, almost all of which have greater financial and operational resources than we have, and with smaller local companies. We may be at a competitive disadvantage with regard to certain large national and regional competitors whose operations are more geographically diversified than ours, as these competitors may be better able to withstand any regional economic downturn. All of our competitors have longer operating histories and longstanding relationships with subcontractors and suppliers. This may give our competitors an advantage in marketing their products and securing materials and labor at lower prices.

If we are unable to compete effectively, our results of operations and financial condition will be adversely affected. We can provide no assurance that we will be able to compete successfully.

| 10 |

We will be subject to warranty and liability claims arising in the ordinary course of business, so our new model is that we are licensing our technology to others who will be performing the work and issuing the warranties.

We will be subject to construction defect, product liability and home and other warranty claims, including moisture intrusion and related claims, arising in the ordinary course of business. These claims are common to the construction industry and can be costly. There can be no assurance that the installation of our GSP systems will be free from defects once completed and any defects attributable to us may lead to significant contractual or other liabilities. We will maintain, and require our subcontractors to maintain, general liability insurance (including construction defect and bodily injury coverage) and workers’ compensation insurance and generally seek to require our subcontractors to indemnify us for liabilities arising from their work. While these insurance policies, subject to deductibles and other coverage limits, and indemnities protect us against a portion of our risk of loss from claims related to our activities, we cannot provide assurance that these insurance policies and indemnities will be adequate to address all our warranty, product liability and construction defect claims in the future, or that any potential inadequacies will not have an adverse effect on our business. Additionally, the coverage offered by and the availability of general liability insurance for construction defects are currently limited and costly. We cannot provide assurance that coverage will not be further restricted, increasing our risks and financial exposure to claims, and/or become costlier.

Potential competitors could duplicate our business model.

There is no aspect of our business which is protected by patents, copyrights, trademarks, or trade names at this time. As a result, potential competitors could duplicate our business model with little effort. Although we plan to file for federal patent protection on the GSP system, there are no assurances the patents will be issued.

We may not be able to effectively manage our growth, which would impair our results of operations.

The Company intends to expand the scope of its operating activities significantly. If the Company is successful in executing its business plan, it will experience business growth that could place a significant strain on operations, finances, management, and other resources.

The ability to effectively manage growth may require the Company to substantially expand the capabilities of administrative and operational resources and to attract, train, manage, and retain qualified management and other personnel. There can be no assurance that the Company will be successful in recruiting and retaining new employees or retaining existing employees.

The Company cannot provide assurances that management will be able to manage this growth effectively. The failure to successfully manage growth could materially adversely affect its business, financial condition or results of operations.

The Company is dependent on its management and the loss of any of its officers could harm the Company’s business.

The Company’s future success depends largely upon the experience, skill, and contacts of the Company’s officers. The loss of the services of these officers may have a material adverse effect upon the Company’s business.

We may face business disruption and related risks from the recent pandemic of the novel coronavirus 2019 (COVID-19) which could have a material adverse effect on our business.

Our business could be disrupted and materially adversely affected by the recent outbreak of COVID-19. As a result of measures imposed by the governments in affected regions, businesses and schools have been suspended due to quarantines intended to contain this outbreak. The spread of SARS CoV-2 from China to other countries has resulted in the Director General of the World Health Organization declaring COVID-19 a pandemic on March 11, 2020. International stock markets reflect the uncertainty associated with the slow-down in the economy. The reduced levels of international travel experienced since the beginning of January and the significant declines in the Dow Industrial Average were largely attributed to the effects of COVID-19. We are still assessing the impact COVID-19 may have on our business, but there can be no assurance that this analysis will enable us to avoid part or all of any impact from the spread of COVID-019 or its consequences, including downturns in business sentiment generally or in our sector in particular. The extent to which the COVID-19 pandemic and global efforts to contain its spread will impact our operations will depend on future developments, which are highly uncertain and cannot be predicted at this time, and include the duration, severity and scope of the pandemic and the actions taken to contain or treat the COVID-19 pandemic.

| 11 |

We may become subject to litigation, which could materially and adversely affect us.

In the future, we may become subject to litigation or enforcement actions, including claims relating to our operations, securities offerings and otherwise in the ordinary course of business. Some of these claims may result in significant defense costs and potentially significant judgments against us, some of which are not, or cannot be, insured against. We cannot be certain of the ultimate outcomes of any claims that may arise in the future. Resolution of these types of matters against us may result in our having to pay significant fines, judgments, or settlements, which, if uninsured, or if the fines, judgments and settlements exceed insured levels, could adversely impact our earnings and cash flows. Certain litigation or the resolution of certain litigation may affect the availability or cost of some of our insurance coverage, expose us to increased risks that would be uninsured, and materially and adversely impact our ability to attract directors and officers.

As of April 14, 2023, there was no public market for our common stock.

As a result, you may be unable to sell your shares of our common stock.

Disclosure requirements pertaining to penny stocks may reduce the level of trading activity for our common stock if and when it is publicly-traded.

Trades of the Company’s common stock, should a market ever develop, may be subject to Rule 15g-9 of the Securities and Exchange Commission, which rule imposes certain requirements on broker/dealers who sell securities subject to the rule to persons other than established customers and accredited investors. For transactions covered by the rule, brokers/dealers must make a special suitability determination for purchasers of the securities and receive the purchaser's written agreement to the transaction prior to sale. The Securities and Exchange Commission also has rules that regulate broker/dealer practices in connection with transactions in "penny stocks". Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in that security is provided by the exchange or system). The penny stock rules require a broker/ dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the Commission that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker/dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker/dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker/dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation.

You may have difficulty depositing your shares with a broker or selling shares of our common stock which you acquire in this offering.

Many securities brokers will not accept securities for deposits and will not sell securities which:

| · | are considered penny stocks or | |

| · | trade in the over-the-counter market |

Further, for a securities broker which will, under certain circumstances, sell securities which fall under any or all of the categories listed above, the customer, before the securities broker will accept the shares for deposit, must often complete a questionnaire detailing how the customer acquired the shares, provide the securities broker with an opinion of an attorney concerning the ability of the shares to be sold in the public market, and pay a “legal review” fee which in some cases can exceed $1,000.

For these reasons, investors in this offering may have difficulty selling shares of our common stock.

| 12 |

We are an Emerging Growth Company, subject to less stringent reporting and regulatory requirements of other publicly held companies and this status may have an adverse effect on our ability to attract interest in our common stock.

We are an Emerging Growth Company as defined in the JOBS Act. As long as we remain an Emerging Growth Company, we may take advantage of certain exemptions from various reporting and regulatory requirements that are applicable to other public companies that are not emerging growth companies. We cannot predict if investors will find our common stock less attractive if we choose to rely on these exemptions. If some investors find our common stock less attractive as a result of any choices to reduce future disclosure, there may be a less active trading market for our common stock and our stock price may be more volatile.

| ITEM 2. | PROPERTIES |

None.

| ITEM 3. | LEGAL PROCEEDINGS |

None.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| 13 |

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

As of April 14, 2023, there was no public market for our common stock.

Holders of our common stock are entitled to receive dividends as may be declared by the Board of Directors. The Board of Directors is not restricted from paying any dividends but is not obligated to declare a dividend. No cash dividends have ever been declared and it is not anticipated that cash dividends will ever be paid.

Our Articles of Incorporation authorize our Board of Directors to issue up to 20,000,000 shares of preferred stock. The provisions in the Articles of Incorporation relating to the preferred stock allow directors to issue preferred stock with multiple votes per share and dividend rights which would have priority over any dividends paid with respect to the holders of common stock. The issuance of preferred stock with these rights may make the removal of management difficult even if the removal would be considered beneficial to shareholders generally and will have the effect of limiting shareholder participation in certain transactions such as mergers or tender offers if these transactions are not favored by our management. As of April 14, 2023, no preferred shares were outstanding.

| ITEM 6. | SELECTED FINANCIAL DATA |

Not applicable.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

We were incorporated in Colorado on December 2, 2020. We are currently in the development stage and have not earned any revenues.

Results of Operations

Operating expenses for the years ended December 31, 2022 and 2021 were $3,378,584 and $6,692,323, respectively. Operating expenses during the year ended December 31, 2022 decreased primarily due to a decrease in stock based compensation.

Interest expense for the years ended December 31, 2022 and 2021 were $86,181 and $2,587. Interest expense increased as a result of an increase in convertible notes payable.

Liquidity and Capital Resources

As of December 31, 2022, we had cash of $14,320 and we had working capital deficit of $2,496,979. We have financed our cash requirements from the sale of common stock and by loans from non-affiliated third parties. During the year ended December 31, 2022, we received $845,000 in proceeds from the sale of convertible notes and repaid $30,000 of advances.

Contractual Obligations

As of December 31, 2022, we did not have any material capital commitments.

| 14 |

Significant Accounting Policies

For a discussion of our significant accounting policies please see Note 2 to the audited financial statements included as part of this report. Management determined there were no critical accounting policies.

Critical Accounting Policies

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets, liabilities and contingencies at the date of the financial statements as well as the reported amounts of expenses during the reporting period. As a result, management is required to routinely make judgments and estimates about the effects of matters that are inherently uncertain. Actual results may differ from these estimates under different conditions or assumptions. Management determined there were no critical accounting estimates.

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Not applicable.

| 15 |

| ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

GeoSolar Technologies, Inc.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Years Ended December 31, 2022 and 2021

| 16 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

GeoSolar Technologies, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of GeoSolar Technologies, Inc. and its subsidiary (collectively, the “Company”) as of December 31, 2022 and 2021, and the related statements of operations, stockholders’ deficit, and cash flows for the years then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Going Concern Matter

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has not yet achieved profitable operations and expects to incur further losses in the development of its business both of which that raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/

www.malonebailey.com

We have served as the Company's auditor since 2021.

April 14, 2023

| F-1 |

GeoSolar Technologies, Inc.

Consolidated Balance Sheets

| December 31, 2022 | December 31, 2021 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | $ | ||||||

| Subscription receivable | ||||||||

| Prepaid expenses | ||||||||

| Total current assets | ||||||||

| Noncurrent assets: | ||||||||

| Deferred offering costs | ||||||||

| Land | ||||||||

| Total noncurrent assets | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued compensation | ||||||||

| Accrued expenses | ||||||||

| Related party advances | ||||||||

| Advances | ||||||||

| Note payable | ||||||||

| Senior convertible notes payable | ||||||||

| Total current liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies | ||||||||

| STOCKHOLDERS' DEFICIT | ||||||||

| Preferred stock, $ par value, shares authorized, shares issued and outstanding | ||||||||

| Common stock, $ par value, shares authorized, and shares issued and outstanding, respectively | ||||||||

| Additional paid in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders' deficit | ( | ) | ( | ) | ||||

| Total liabilities and stockholders' deficit | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-2 |

GeoSolar Technologies, Inc.

Consolidated Statements of Operations

For the years ended December 31, 2022 and 2021

| December 31, 2022 | December 31, 2021 | |||||||

| Operating expenses: | ||||||||

| General and administrative | $ | $ | ||||||

| Research and development | ||||||||

| Total operating expenses | ||||||||

| Other expenses: | ||||||||

| Interest expense | ( | ) | ( | ) | ||||

| Total other expenses | ( | ) | ( | ) | ||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Net loss per common share: | ||||||||

| Basic | $ | ( | ) | $ | ( | ) | ||

| Diluted | $ | ( | ) | $ | ( | ) | ||

| Weighted average common shares outstanding: | ||||||||

| Basic | ||||||||

| Diluted | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-3 |

GeoSolar Technologies, Inc.

Consolidated Statements of Changes in Stockholders’ Deficit

For the years ended December 31, 2022 and 2021

| Common Stock | Additional | Accumulated | ||||||||||||||||||

| Shares | Amount | paid-in capital | Deficit | Total | ||||||||||||||||

| Balance, December 31, 2020 | – | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||

| Founder shares issued for cash | ||||||||||||||||||||

| Common shares issued for cash ($ | ||||||||||||||||||||

| Common shares issued for subscription receivable ($ | ||||||||||||||||||||

| Units issued for cash | ||||||||||||||||||||

| Common shares issued to Fourth Wave Energy, Inc. | ||||||||||||||||||||

| Common shares issued for deferred offering cost | ||||||||||||||||||||

| Stock based compensation | – | |||||||||||||||||||

| Net loss | – | ( | ) | ( | ) | |||||||||||||||

| Balance, December 31, 2021 | ( | ) | ( | ) | ||||||||||||||||

| Common shares issued for cash, net | ||||||||||||||||||||

| Common shares issued for cash ($ | ||||||||||||||||||||

| Stock based compensation | ||||||||||||||||||||

| Net loss | – | ( | ) | ( | ) | |||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-4 |

GeoSolar Technologies, Inc.

Consolidated Statements of Cash Flows

For the years ended December 31, 2022 and 2021

| December 31, 2022 | December 31, 2021 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustment to reconcile net loss to cash used in operating activities: | ||||||||

| Stock based compensation | ||||||||

| Write off of deferred offering costs | ||||||||

| Net change in: | ||||||||

| Prepaid expenses | ||||||||

| Accounts payable | ( | ) | ||||||

| Accounts payable, related party | ||||||||

| Accrued expenses | ( | ) | ||||||

| CASH FLOWS USED IN OPERATING ACTIVITIES | ( | ) | ( | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Repayment of advances | ( | ) | ( | ) | ||||

| Proceeds from advances, related party | ||||||||

| Repayment of advances, related party | ( | ) | ||||||

| Proceeds from advances | ||||||||

| Repayment of note payable | ( | ) | ( | ) | ||||

| Proceeds from senior convertible notes payable | ||||||||

| Proceeds from subscription receivable | ||||||||

| Proceeds from issuance of common stock and warrants | ||||||||

| CASH FLOWS PROVIDED BY FINANCING ACTIVITIES | ||||||||

| NET CHANGE IN CASH | ( | ) | ||||||

| Cash, beginning of period | ||||||||

| Cash, end of period | $ | $ | ||||||

| SUPPLEMENTAL CASH FLOW INFORMATION | ||||||||

| Cash paid on interest expense | $ | $ | ||||||

| Cash paid for income taxes | $ | $ | ||||||

| NON-CASH TRANSACTIONS | ||||||||

| Financing of prepaid insurance premiums | $ | $ | ||||||

| Non-cash increase in prepaid expenses | $ | $ | ||||||

| Land acquired with advance | $ | $ | ||||||

| Expenses paid on the Company's behalf | $ | $ | ||||||

| Common shares issued for subscription receivable | $ | $ | ||||||

| Common shares issued for deferred financing cost | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-5 |

GeoSolar Technologies, Inc.

Notes to the Financial Statements

Note 1. Basis of Presentation

The accompanying audited financial statements of GeoSolar Technologies, Inc. (“we”, “our”, “GeoSolar” or the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission (“SEC”)

On June 6, 2022, the Company formed a new subsidiary in Colorado, Sustainable Housing Development Corporation, to build a four-plex. As of December 31, 2022, Sustainable Housing Development Corporation, has not begun operations.

Note 2. Summary of Significant Accounting Policies

The financial statements have, in management's opinion, been properly prepared within the framework of the significant accounting policies summarized below:

Principles of Consolidation

Our consolidated financial statements include our accounts and the accounts of our 100% owned subsidiary, Sustainable Housing Development Corporation. All intercompany transactions and balances have been eliminated. Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Basis of Presentation

The basis of accounting applied is United States generally accepted accounting principles (“US GAAP”).

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original purchase

maturity of three months or less to be cash equivalents. As of December 31, 2022 and 2021, there were

Use of Estimates

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates in the accompanying financial statements involving the valuation of common stock and stock based compensation.

Impairment of Long-lived Assets

We continually monitor events and changes in circumstances that could indicate that our carrying amounts of long-lived assets, including land, may not be recoverable. When such events or changes in circumstances occur, we assess the recoverability of long-lived assets by determining whether the carrying value of such assets will be recovered through their undiscounted expected future cash flow. If the future undiscounted cash flow is less than the carrying amount of these assets, we recognize an impairment loss based on the excess of the carrying amount over the fair value of the assets.

| F-6 |

Related Parties

The Company follows ASC 850, “Related Party Disclosures,” for the identification of related parties and disclosure of related party transactions.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are determined based on the differences between the financial reporting and the tax bases of reported assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company must then assess the likelihood that the resulting deferred tax assets will be realized. A valuation allowance is provided when it is more likely than not that some portion or all of a deferred tax asset will not be realized.

Fair Value of Financial Instruments

The Company’s financial instruments consist primarily of cash and accounts payable. The carrying values of these financial instruments approximate their respective fair values as they are short-term in nature or carry interest rates that approximate market rate.

Basic loss per common share is computed by dividing net loss available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted loss per common share is determined using the weighted-average number of common shares outstanding during the period, adjusted for the dilutive effect of common stock equivalents. In periods when losses are reported, the weighted-average number of common shares outstanding excludes common stock equivalents, because their inclusion would be anti-dilutive. Accordingly, the number of weighted average shares outstanding, as well as the amount of net loss per share are presented for basic and diluted per share calculations for the years ended December 31, 2022 and 2021. During the year ended December 31, 2022, of stock warrants and of stock options and shares issuable upon the conversion of senior convertible notes were considered for their dilutive effects but were determined to be anti-dilutive due to the Company’s net loss. During the year ended December 31, 2021, of stock warrants, of stock options and shares issuable upon the conversion of senior convertible note were considered for their dilutive effects but were determined to be anti-dilutive due to the Company’s net loss.

Stock-based Compensation

The Company determines the fair value of stock option awards granted to employees and nonemployees in accordance with FASB ASC Topic 718 – 10. Compensation cost is measured at the grant date based on the value of the award and is recognized over the service period, which is usually the vesting period.

Leases

The Company elected to adopt a package of practical expedients

under Accounting Standards Update (“ASU”) 2016-02, “Leases (Topic 842) which removes the requirement to reassess whether

expired or existing contracts contain leases and removes the requirement to reassess the lease classification for any existing leases

prior to the adoption date of January 1, 2019. Additionally, the Company has made a policy election not to capitalize leases with

a term of 12 months or less. Rent expense for the years ended December 31, 2022 and 2021, was $

| F-7 |

Recent Accounting Pronouncements

In August 2020, the FASB issued ASU 2020-06—Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and edging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity (“ASU 2020-06”) to simplify the accounting for convertible instruments by removing certain separation models in Subtopic 470- 20, Debt with Conversion and Other Options, for convertible instruments. Under the amendments in ASU 2020-06, the embedded conversion features no longer are separated from the host contract for convertible instruments with conversion features that are not required to be accounted for as derivatives under Topic 815, Derivatives and Hedging, or that do not result in substantial premiums accounted for as paid-in capital. Consequently, a convertible debt instrument will be accounted for as a single liability measured at its amortized cost and a convertible preferred stock will be accounted for as a single equity instrument measured at its historical cost, as long as no other features require bifurcation and recognition as derivatives. By removing those separation models, the interest rate of convertible debt instruments typically will be closer to the coupon interest rate when applying the guidance in Topic 835, Interest. The amendments in ASU 2020-06 provide financial statement users with a simpler and more consistent starting point to perform analyses across entities. The amendments also improve the operability of the guidance and reduce, to a large extent, the complexities in the accounting for convertible instruments and the difficulties with the interpretation and application of the relevant guidance. Additionally, for convertible debt instruments with substantial premiums accounted for as paid-in capital, amendments in ASU 2020-06 added disclosures about (1) the fair value amount and the level of fair value hierarchy of the entire instrument for public business entities and (2) the premium amount recorded as paid-in capital. The amendments in ASU 2020-06 are effective for public business entities, excluding entities eligible to be smaller reporting companies, as defined by the SEC, for fiscal years beginning after December 15, 2021, including interim periods within those fiscal years. For all other entities, the amendments are effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. Early adoption is permitted, but no earlier than fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. Entities should adopt the guidance as of the beginning of its annual fiscal year and are allowed to adopt the guidance through either a modified retrospective method of transition or a fully retrospective method of transition. In applying the modified retrospective method, entities should apply the guidance to transactions outstanding as of the beginning of the fiscal year in which the amendments are adopted. Transactions that were settled (or expired) during prior reporting periods are unaffected. The cumulative effect of the change should be recognized as an adjustment to the opening balance of retained earnings at the date of adoption. If an entity elects the fully retrospective method of transition, the cumulative effect of the change should be recognized as an adjustment to the opening balance of retained earnings in the first comparative period presented. The Company early adopted ASU 2020-06 on January 1, 2022. The adoption of ASU 2020-06 did not have an impact on the Company’s consolidated financial statements.

The Company does not believe that any recently issued effective pronouncements, or pronouncements issued but not yet effective, if adopted, would have a material effect on the accompanying consolidated financial statements.

Reclassification

Certain reclassifications may have been made to our prior year’s financial statements to conform to our current year presentation. These reclassifications had no effect on our previously reported results of operations or accumulated deficit.

| F-8 |

Note 3. Going Concern

These financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations for its next fiscal year. Realization values may be substantially different from carrying values as shown and these financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern. At December 31, 2022, the Company had not yet achieved profitable operations and expects to incur further losses in the development of its business, all of which raise substantial doubt about the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that the Company will be able to obtain additional funds by equity financing and/or related party advances, however, there is no assurance of additional funding being available.

Note 4. Related Party Transactions

On January 5, 2021, the Company entered into an

employment agreement with Mr. Stone Douglass pursuant to which Mr. Douglass agreed to serve as Chief Executive Officer commencing on

January 1, 2021, for an initial term of three years. The term will be extended automatically for one year on January 1, 2024 and

each annual anniversary thereof (the “Extension Date”) unless, and until, at least ninety days prior to the applicable

Extension Date either Mr. Douglass or the Company provides written notice to the other party that the employment agreement is not to

be extended (the later of January 1, 2024 or the last date to which the term is extended will be the end of the term). Mr. Douglass

will receive a base annual salary of $180,000. During the years ended December 31, 2022 and 2021, the Company recognized $

During the year ended December 31, 2022, the

Company received $

During the year ended December 31, 2021, Mr. Douglass and a family member purchased and shares of common stock at par value of $0.0001 per share, respectively. See Note 6.

Note 5. Advances, Notes Payable and Senior Convertible Notes

Advances

During the year December 31, 2022, the Company

received $

As of December 31, 2022, the Company owes Mr.

Klebl $

As of December 31, 2022 and 2021, the advances totaled

$

| F-9 |

Note Payable

In June 2022, the Company entered into a Premium Finance

Agreement related to various insurance policies. The policy premiums total $

Senior Convertible Notes

In November and December 2021, the Company issued

three senior convertible notes in the principal amount of $

In June 2022, the Company issued a senior convertible

note in the principal amount of $

Note 6. Equity

The Company is currently authorized to issue up to shares of common stock with a par value of $. In addition, the Company is authorized to issue shares of preferred stock with a par value of $. The specific rights of the preferred stock, when so designated, shall be determined by the board of directors.

2022

On February 8, 2022, the Board approve the issuance

of shares of common stock at $0.0001 to a private group of investors. Based on the $0.15 per share estimated fair value using the

cash selling price at the time of issuance, the Company recognized an expense of $

On June 19, 2022, the Company entered into a one-year

contract with SRAX, Inc. (“SRAX”). In exchange for the right to use the SRAX Sequire platform, in connection with the Company’s

Regulation A Offering, the Company will issue SRAX 1,250,000

shares of its restricted common stock. Per the agreement, the shares are subject to a price adjustment if the Company issues any

common stock or common stock equivalents less than $1.00 per share. On July 13, 2022, the Company issued shares to SRAX. The Company recorded the $

On December 14, 2022, the Board approved the issuance of shares of the Company common stock at $0.0001 to consultants for services. The shares vested upon issuance. Based on the $1.00 per share fair value using the cash selling price at the time of issuance, the Company recognized an expense of $ related to the issuance of shares.

During the year ended December 31, 2022, the

Company issued

shares of common stock for cash proceeds of $

| F-10 |

2021

During the year ended December 31, 2021, the Company

issued shares of its common stock to founders at par value of $0.0001 per share. The Company received proceeds of $

During the year ended December 31, 2021, the Company issued shares of its common stock to Fourth Wave related to the transfer of their technology at par value of $0.0001 per share. This transaction was contemplated at the founding of our Company and valued at $0.0001 which was the same price the founders paid for common stock.

During the year ended December 31, 2021, the Company

issued shares of its common stock valued at $0.15 per share. The Company received proceeds of $

During the year ended December 31, 2021, the Company

sold

On December 1, 2021, the Company entered into an

agreement with Manhattan Street Capital (“MSC”) to provide management, technology, administrative services, and

assistance with and introduction to resources need to conduct a Reg A+ offering. MSC with be paid $5,000 monthly in advance for a

9-month period and $2,500 per month while the offering is ongoing. In addition, MSC will receive shares

of the Company stock at a price of $0.0001 per share. The shares were valued at approximately $

Stock Warrants

The following table summarizes the stock warrant activity for the years ended December 31, 2022 and 2021:

| Number of Warrants | Weighted Average Exercise Price Per Share | |||||||

| Outstanding at December 31, 2020 | $ | |||||||

| Granted | ||||||||

| Exercised | ||||||||

| Forfeited and expired | ||||||||

| Outstanding at December 31, 2021 | ||||||||

| Granted | ||||||||

| Exercised | ||||||||

| Forfeited and expired | ||||||||

| Outstanding at December 31, 2022 | $ | |||||||

As of December 31, 2022, all outstanding warrants

are exercisable and have a weighted average remaining term of

| F-10 |

Stock Options

The following table summarizes the stock option activity for the years ended December 31, 2022 and 2021:

| Number of Options | Weighted Average Exercise Price Per Share | |||||||

| Outstanding at December 31, 2020 | $ | |||||||

| Granted | ||||||||

| Exercised | ||||||||

| Forfeited and expired | ||||||||

| Outstanding at December 31, 2021 | ||||||||

| Granted | ||||||||

| Exercised | ||||||||

| Forfeited and expired | ||||||||

| Outstanding at December 31, 2022 | $ | |||||||

On December 14, 2022, the Company granted options to a consultant of the Company. The options have a ten-year term and have an exercise price of $ per share. The fair value of the options at issuance was $. The Company valued the options using the Black-Scholes model with the following key assumptions ranging from: fair value stock price, $, Exercise price, $, Term years, Volatility %, and Discount rate % and a dividend yield of %.

On August 1, 2021, the Company granted options to Stone Douglass, the Company’s Chief Executive Officer, and options to various employees and consultants of the Company. The options have a ten-year term and have an exercise price of $ per share. The fair value of the options at issuance was $. The Company valued the options using the Black-Scholes model with the following key assumptions ranging from: fair value stock price, $, Exercise price, $, Term years, Volatility %, and Discount rate % and a dividend yield of %.

During the year ended December 31, 2022, the Company recognized $ of expense related to outstanding stock options leaving $ of unrecognized expenses related to options. As of December 31, 2022, the outstanding stock options have a weighted average remaining term of years and an aggregate intrinsic value of $.

During the year ended December 31, 2021, the Company recognized $ of expense related to outstanding stock options leaving $ of unrecognized expenses related to options.

Note 7. Commitments

On May 17, 2022, the Company engaged Rialto Markets,

LLC (“Rialto”), to act as the broker-dealer of record in connection with the Company’s Regulation A Offering, but not