|

Cayman Islands*

|

6770

|

98-1574672

|

|

(State or other Jurisdiction of Incorporation Or Organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

|

Christian O. Nagler

Peter Seligson

Kirkland & Ellis LLP

601 Lexington Avenue

New York, New York 10022

Tel: (212) 446-4800

Fax: (212) 446-4900

|

Graham Robinson

Katherine D. Ashley

Skadden, Arps, Slate, Meagher & Flom LLP

1440 New York Avenue, N.W.

Washington, D.C. 20005

Tel: (202) 371-7000

Fax: (202) 661-8251

|

|

Large accelerated filer

|

☐ |

Accelerated filer

|

☐ | |

|

Non-accelerated filer

|

☒ |

Smaller reporting company

|

☒ | |

|

Emerging growth company

|

☒ |

|

Title of Each Class of Securities to be Registered

|

Amount to be

Registered

|

Proposed Maximum

Offering Price

Per Security

|

Proposed Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

|

||||||||||||

|

New Caritas Class A Common Stock(1)

|

19,186,500

|

(2)

|

$

|

9.95

|

(3)

|

$

|

190,905,675

|

$

|

17,697

|

(4)

|

||||||

|

Total

|

$

|

17,697

|

||||||||||||||

| (1) |

The number of shares of common stock of New Caritas (as defined below) being registered represents (i) 14,950,000 Class A ordinary shares issued in the initial public offering of ARYA (as

defined below), which will be converted by operation of law into shares of Class A common stock, par value $0.0001 per share, of New Caritas (the “New Caritas Class A Common Stock”) in the Domestication (as defined below) (ii) 499,000 Class A

ordinary shares issued in a private placement simultaneously with the closing of ARYA’s initial public offering which will be converted by operation of law into shares of New Caritas Class A Common Stock in the Domestication, and (iii)

3,737,500 Class B ordinary shares held by ARYA’s initial shareholders which will be converted by operation of law into shares of New Caritas Class A Common Stock in the Domestication.

|

| (2) |

Pursuant to Rule 416(a) of Securities Act of 1933, as amended (the “Securities Act”), there are also being registered an indeterminable number of additional securities as may be issued to

prevent dilution resulting from stock splits, stock dividends or similar transactions.

|

| (3) |

Estimated solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the Class A ordinary shares of ARYA on the Nasdaq Capital Market

on October 25, 2021 ($9.95 per Class A ordinary share). This calculation is in accordance with Rule 457(f)(1) of the Securities Act.

|

| (4) |

Calculated by multiplying the proposed maximum aggregate offering price of securities to be registered by 0.0000927.

|

| * |

Immediately prior to the consummation of the Business Combination described in the proxy statement/prospectus forming part of this registration statement, ARYA Sciences Acquisition Corp

IV, a Cayman Islands exempted company (“ARYA”), intends to effect a deregistration under the Cayman Islands Companies Act (2021 Revision) and a domestication under Section 388 of the Delaware General Corporation Law, pursuant to which ARYA’s

jurisdiction of incorporation will be changed from the Cayman Islands to the State of Delaware (the “Domestication”). All securities being registered will be issued by the continuing entity following the Domestication, which will be renamed

“Caritas Therapeutics, Inc.” upon the consummation of the Domestication. As used herein, “New Caritas” refers to ARYA after giving effect to the Domestication.

|

|

Sincerely,

|

|

|

Joseph Edelman

|

|

|

Chairman of the Board of Directors

|

| • |

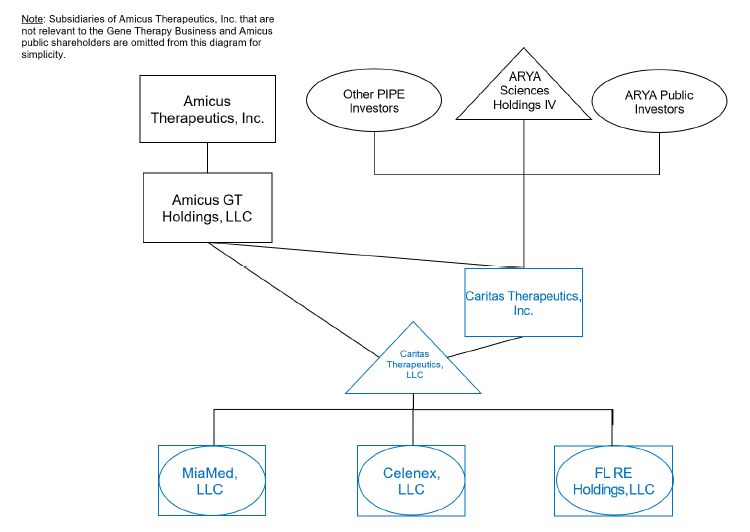

Proposal No. 1—The Business Combination Proposal—RESOLVED, as an ordinary resolution, that ARYA’s entry into the Business Combination Agreement,

dated as of September 29, 2021 (as may be amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement”), by and among ARYA, Amicus

Therapeutics, Inc., a Delaware corporation (“Amicus”), Amicus GT Holdings, LLC, a Delaware limited liability company and wholly-owned subsidiary of Amicus (“Amicus GT”) and Caritas Therapeutics, LLC, a Delaware limited liability company and wholly-owned subsidiary of Amicus GT (“Caritas”), a copy of which is attached to the proxy statement/prospectus as Annex A, pursuant to which, among other things,” (a) a pre-closing reorganization of Amicus will be effected pursuant to which

the entities and assets constituting Amicus’ gene therapy business will be transferred to Caritas (the “Pre-Closing Reorganization), (b) on the Closing Date (as defined in the accompanying proxy statement/prospectus), (A) ARYA will change its

jurisdiction of incorporation by deregistering as a Cayman Islands exempted company and continuing and domesticating under the laws of the State of Delaware (the “Domestication”)

upon which ARYA will change its name to “Caritas Therapeutics, Inc.” (“New Caritas” , provided that if such name is not available in Delaware or ARYA is otherwise unable

to change its name to “Caritas Therapeutics, Inc.” in Delaware, it shall cause its name to be changed to such other name mutually agreed to by ARYA and Amicus), (B) each outstanding Class A ordinary share, par value $0.0001 per share of ARYA

(the “Class A ordinary shares”) and each outstanding Class B ordinary share, par value $0.0001 per share of ARYA (the “Class B ordinary shares”) will become one share of Class A common stock, par value $0.0001 per share of New Caritas (the “New Caritas Class A

Common Stock”), and (C) ARYA will amend and restate its memorandum and articles of association in connection with the Domestication, (c) (A) Amicus will cause the existing limited liability company agreement of Caritas to be

amended and restated, (B) Amicus will cause all of the limited liability company interests of Caritas existing immediately prior to the Closing (as defined in the accompanying proxy statement/prospectus) to be re-classified into a number of

common units (“Units”) equal to the Transaction Equity Security Amount (as defined in the accompanying proxy statement/prospectus) based on a pre-transaction equity value

for Caritas of $175,000,000, (C) Amicus will make an additional cash contribution of $50 million (the “Amicus Contribution Amount”) in exchange for a number of Units

equal to Amicus Contribution Equity Amount (as defined in the accompanying proxy statement/prospectus), (D) ARYA will contribute the Closing Date Contribution Amount (as defined in the accompanying proxy statement/prospectus) to Caritas in

exchange for a number of Units equal to the Net Outstanding ARYA Class A Shares (as defined in the accompanying proxy statement/prospectus) and (E) New Caritas will issue to Amicus GT a number of shares of Class B common stock, par value

$0.0001 per share of New Caritas (the “New Caritas Class B Common Stock”) (which will have no economic value but will entitle the holder thereof to one vote per share),

equal to the number of Units held by Amicus GT such that following the Business Combination, the combined company will be organized in an “Up-C” structure, in which substantially all of the assets and business of New Caritas will be held by

Caritas and will operate through Caritas and the subsidiaries of Caritas, and New Caritas will be a publicly listed holding company that will hold equity interests in Caritas, on the terms and subject to the conditions set forth in the

Business Combination Agreement, certain related agreements (including the A&R Company LLC Agreement, the Tax Receivable Agreement, the Subscription Agreements, the Sponsor Letter Agreement, the Investor Rights Agreement, the Director

Nomination Agreement, the Co-Development and Commercialization Agreement and the Transition Services Agreement, each in the form attached to the proxy statement/prospectus as Annex N, Annex O, Annex F, Annex E, Annex G, Annex H, Annex L and

Annex M, respectively), and the transactions contemplated thereby, be approved, ratified and confirmed in all respects.

|

| • |

Proposal No. 2—The Domestication Proposal—RESOLVED, as a special resolution, that ARYA be transferred by way of continuation to Delaware pursuant

to Part XII of the Companies Act (Revised) of the Cayman Islands and Section 388 of the General Corporation Law of the State of Delaware and, immediately upon being de-registered in the Cayman Islands, ARYA be continued and domesticated as a

corporation under the laws of the state of Delaware and, conditional upon, and with effect from, the registration of ARYA as a corporation in the State of Delaware, the name of ARYA be changed from “ARYA Sciences Acquisition Corp IV” to

“Caritas Therapeutics, Inc.”

|

| • |

Proposal No. 3—The Charter Proposal—RESOLVED, as a special resolution, that, upon the Domestication, the amended and restated memorandum and

articles of association of ARYA (“Existing Governing Documents”) be amended and restated by the deletion in their entirety and the substitution in their place of the

proposed new certificate of incorporation of “Caritas Therapeutics, Inc.” upon the Domestication, a copy of which is attached to the proxy statement/prospectus as Annex C (the “Proposed

Certificate of Incorporation”).

|

| • |

Advisory Governing Documents Proposals—to consider and vote upon, on a non-binding advisory basis, the following governance proposals regarding

the Proposed Certificate of Incorporation (such proposals, collectively, the “Advisory Governing Documents

Proposals”) and the following material differences between the Existing Governing Documents and the Proposed Certificate of Incorporation:

|

| o |

Proposal No. 4—Advisory Governing Documents Proposal A—RESOLVED, that an amendment to change the authorized share capital of ARYA from US$50,000

divided into (i) 479,000,000 Class A ordinary shares, par value $0.0001 per share, (ii) 20,000,000 Class B ordinary shares, par value $0.0001 per share and (iii) 1,000,000 preference shares, par value $0.0001 per share, to (a) 250,000,000

shares of New Caritas Class A Common Stock, par value $0.0001 per share, (b) 70,000,000 shares of New Caritas Class B Common Stock, par value $0.0001 per share and (c) 12,500,000 shares of preferred stock, par value $0.0001 per share, of New

Caritas (“New Caritas Preferred Stock”) be approved on a non-binding advisory basis.

|

| o |

Proposal No. 5—Advisory Governing Documents Proposal B—RESOLVED, that an amendment to authorize the New Caritas Board to issue any or all shares

of New Caritas Preferred Stock in one or more series, with such terms and conditions as may be expressly determined by the New Caritas Board and as may be permitted by the Delaware General Corporation Law be approved on a non-binding advisory

basis.

|

| o |

Proposal No. 6—Advisory Governing Documents Proposal C—RESOLVED, that an amendment to remove the ability of New Caritas stockholders to take

action by written consent in lieu of a meeting be approved on a non-binding advisory basis.

|

| o |

Proposal No. 7—Advisory Governing Documents Proposal D—RESOLVED, that certain other changes in connection with the replacement of the Existing

Governing Documents with the Proposed Certificate of Incorporation as part of the Domestication (a copy of which is attached to the proxy statement/prospectus as Annex C), including (i) changing the post-Business Combination corporate name

from “ARYA Sciences Acquisition Corp IV” to “Caritas Therapeutics, Inc.” (which is expected to occur upon the consummation of the Domestication), (ii) making New Caritas’ corporate existence perpetual, (iii) electing for New Caritas to not be

governed by Section 203 of the DGCL relating to business combinations with interested stockholders, and (iv) removing certain provisions related to our status as a blank check company that will no longer be applicable upon consummation of the

Business Combination be approved on a non-binding advisory basis.

|

| • |

Proposal No. 8—The Nasdaq Proposal—RESOLVED, as an ordinary resolution, that for the purposes of complying with the applicable provisions of

Nasdaq Stock Exchange Listing Rule 5635, the issuance of shares of New Caritas Class A Common Stock be approved.

|

| • |

Proposal No. 9—The Incentive Award Plan Proposal—RESOLVED, as an ordinary resolution, that the Caritas Therapeutics, Inc. 2021 Incentive Equity

Plan, a copy of which is attached to the proxy statement/prospectus as Annex I, be adopted and approved.

|

| • |

Proposal No. 10—The Employee Stock Purchase Plan Proposal—RESOLVED,

as an ordinary resolution, that the Caritas Therapeutics, Inc. 2021 Employee Stock Purchase Plan, a copy of which is attached to the proxy statement/prospectus as Annex J, be adopted and approved.

|

| • |

Proposal No. 11—The Adjournment Proposal—RESOLVED, as an ordinary resolution, that the adjournment of the extraordinary general meeting to a

later date or dates (A) to the extent necessary to ensure that any required supplement or amendment to the proxy statement/prospectus is provided to ARYA shareholders or, if as of the time for which the extraordinary general meeting is

scheduled, there are insufficient ARYA ordinary shares represented (either in person or by proxy) to constitute a quorum necessary to conduct business at the extraordinary general meeting, (B) in order to solicit additional proxies from ARYA

shareholders in favor of one or more of the proposals at the extraordinary general meeting or (C) if ARYA shareholders redeem an amount of the public shares such that the condition to consummation of the Business Combination that the

aggregate cash proceeds to be received by ARYA from the trust account in connection with the Business Combination, together with aggregate gross proceeds from the PIPE Financing and the Amicus Contribution Amount, equal no less than

$300,000,000 after deducting any amounts paid to ARYA shareholders that exercise their redemption rights in connection with the Business Combination would not be satisfied, at the extraordinary general meeting be approved.

|

|

i

|

|

|

i

|

|

| ii | |

|

x

|

|

|

29

|

|

| 48 | |

| 50 | |

| 52 | |

| 55 | |

| 116 | |

|

123

|

|

| 165 | |

| 168 | |

| 169 | |

| 181 | |

| 183 | |

| 190 | |

| 194 | |

| 195 | |

| 206 | |

| 217 | |

| 233 | |

| 240 | |

| 260 | |

| 271 | |

| 277 | |

| 278 | |

| 284 | |

| 286 | |

| 294 | |

| 296 | |

| 303 | |

| 304 | |

| 304 | |

| 305 | |

| 305 | |

| 305 | |

| 305 | |

| 305 | |

| 305 | |

|

FINANCIAL STATEMENTS

|

| • |

“A&R Company LLC Agreement” are to the amended and restated limited liability company agreement of Caritas, amended and restated by Caritas and Amicus GT at the Closing, that, among

other things, provides Caritas unitholders (other than New Caritas) with the right to redeem all or a portion of their Units (together with an equal number of shares of New Caritas Class B Common Stock) for

cash, or, at New Caritas’ option, to exchange such Units (together with an equal number of shares of New Caritas Class B Common Stock) for shares of New Caritas Class A Common Stock or cash of equivalent value, in each case subject to

certain restrictions set forth therein;

|

| • |

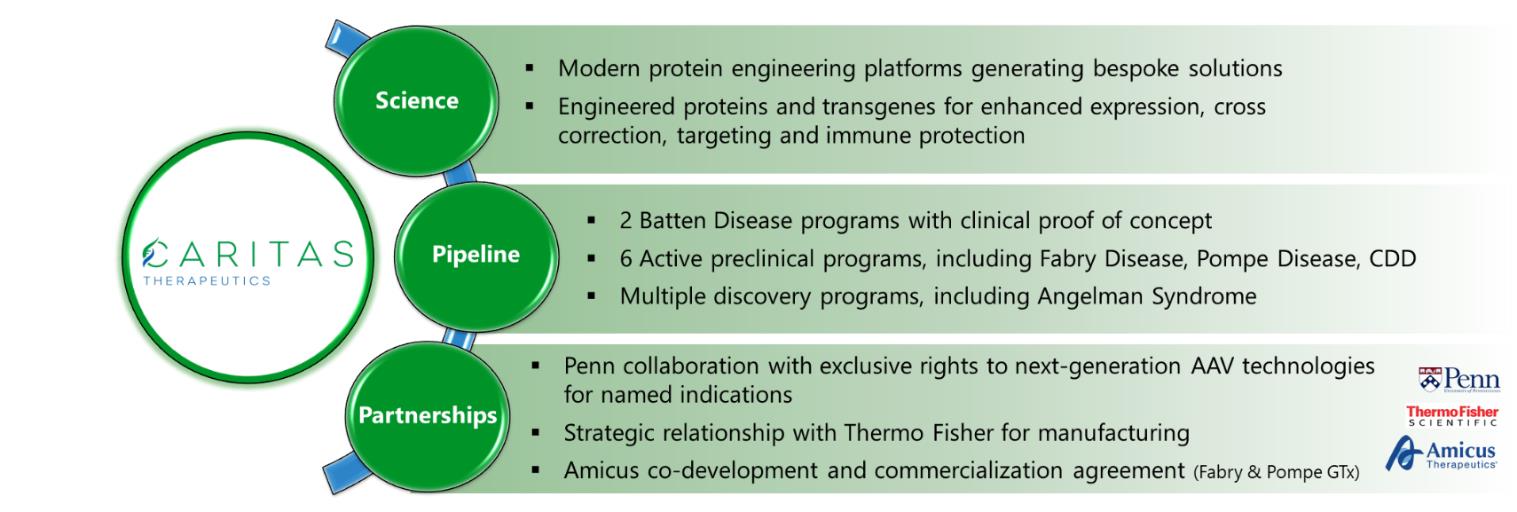

“AAV” are to adeno-associated viral;

|

| • |

“AE” are to adverse event;

|

| • |

“Amicus” are to Amicus Therapeutics, Inc., a Delaware corporation;

|

| • |

“Amicus 2007 Plan” are to Amicus’ Amended and Restated 2007 Equity Incentive Plan;

|

| • |

“Amicus Biologics” are to Amicus Biologics Inc., a Delaware corporation and wholly-owned subsidiary of Amicus;

|

| • |

“Amicus Contribution Amount” are to an amount in cash equal to $50,000,000;

|

| • |

“Amicus Contribution Equity Amount” are to a number of Company Units (as defined in the Business Combination Agreement) or ARYA Class B Shares (as defined in the Business Combination

Agreement), as applicable, equal to (a) the Amicus Contribution Amount, divided by (b) $10.00;

|

| • |

“Amicus Entities” are to Amicus, Amicus GT and prior to the Closing, Caritas;

|

| • |

“Amicus GT” are to Amicus GT Holdings, LLC, a Delaware limited liability corporation and wholly-owned subsidiary of Amicus;

|

| • |

“Amicus Indemnified Parties” are to Amicus, its affiliates, and their respective directors, officers, agents, employees, successors and assigns;

|

| • |

“Articles of Association” are to the amended and restated articles of association of ARYA;

|

| • |

“ARYA,” “we,” “us” or “our” are to ARYA Sciences Acquisition Corp IV, a Cayman Islands exempted company, prior to the consummation of the Business Combination;

|

| • |

“ARYA Acquisition Proposal” are to (a) any direct or indirect acquisition (or other business combination), in one or a series of related transactions under which ARYA

or any of its controlled affiliates, directly or indirectly, (i) acquires or otherwise purchases any other person(s), (ii) engages in a business combination with any other person(s) or (iii) acquires or otherwise purchases all or a material

portion of the assets, equity securities or businesses of any other Persons(s) (in the case of each of clause (i), (ii) and (iii), whether by merger, consolidation, recapitalization, purchase or issuance of equity securities, tender offer or

otherwise), (b) any equity, debt or similar investment in ARYA or any of its controlled affiliates or (c) any other “Business Combination” as defined in ARYA’s organizational documents;

|

| • |

“ARYA Board” are to ARYA’s board of directors;

|

| • |

“ARYA Material Adverse Effect” are to any change, event, effect or occurrence that, individually or in the aggregate with any other change,

event, effect or occurrence, has had or would reasonably be expected to have a material adverse effect on the ability of ARYA to consummate the transactions contemplated by the Business Combination Agreement in accordance with its terms;

|

| • |

“Assumed Business Liabilities” are to the collective liabilities set forth in Section 1.50 of the Business Combination Agreement;

|

| • |

“AT-GTX-701” are to Caritas’ engineered hGLA transgene;

|

| • |

“BBA” are to Bipartisan Budget Act of 2018;

|

| • |

“BLA” are to biologic product license application;

|

| • |

“Business Combination” are to the Domestication and other transactions contemplated by the Business Combination Agreement, collectively, including the PIPE Financing;

|

| • |

“Business Combination Agreement” are to that certain Business Combination Agreement, dated September 29,

2021, by and among ARYA, Amicus, Amicus GT and Caritas;

|

| • |

“Business Entities” are to Caritas, MiaMed, Amicus Biologics and Celenex;

|

| • |

“Caritas” are to Caritas Therapeutics, LLC, a Delaware limited liability company and prior, to the consummation of the Business Combination, a wholly-owned subsidiary

of Amicus GT, the entity that will hold all of the assets and entities that constitute the Gene Therapy Business;

|

| • |

“Caritas Acquisition Proposal” are to (a) any direct or indirect acquisition (or similar transaction), in one or a series of transactions, (i) of or with any of the

Business Entities or all or a material portion of the equity securities, either individually or in the aggregate, of any of the Business Entities or (ii) of all or a material portion of the assets, properties or rights, either individually or

in the aggregate, related to or arising out of the Business (in the case of each of clause (i) and (ii), whether by merger, consolidation, recapitalization, sale, transfer or license of assets, properties or rights, purchase or issuance of

equity securities, tender offer or otherwise), or (b) any equity or similar investment in any of the Business Entities (in each case of clauses (a) and (b) other than pursuant to the Business Combination Agreement, the other agreements

entered into in connection with the Business Combination of the transactions contemplated by the Business Combination Agreement);

|

| • |

“Caritas unitholders” are to the holders of Units;

|

| • |

“Cayman Islands Companies Act” are to the Companies Act (2021 Revision) of the Cayman Islands as the same may be amended from time to time;

|

| • |

“CBER” are to Center for Biologics Evaluation and Research;

|

| • |

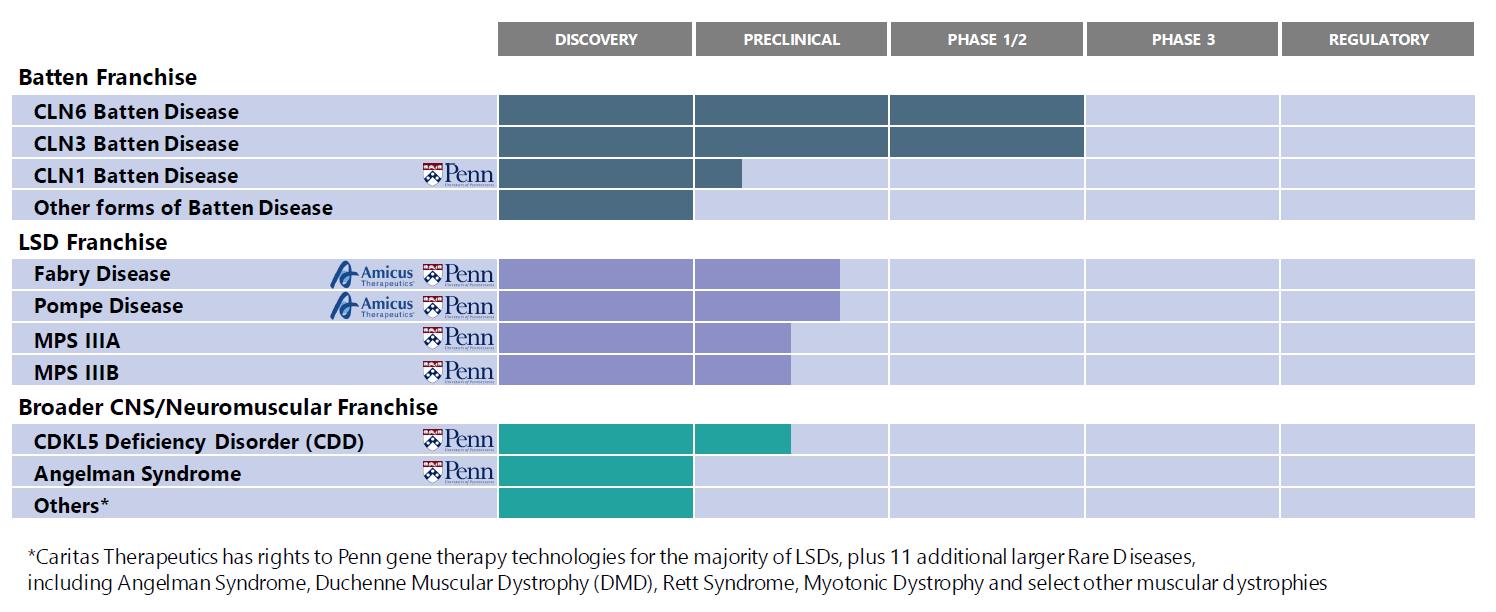

“CDD” are to CDKL5 deficiency disorder;

|

| • |

“Celenex” are to Celenex Inc., a Delaware corporation;

|

| • |

“Class A ordinary shares” are to the Class A ordinary shares, par value $0.0001 per share, of ARYA, which will automatically convert, on a one-for-one basis, into

shares of New Caritas Class A Common Stock in connection with the Domestication;

|

| • |

“Class B ordinary shares” or “founder shares” are to the 3,737,500 Class B ordinary shares, par value $0.0001 per share, of ARYA outstanding as of the date of this

proxy statement/prospectus that were initially issued to our Sponsor in a private placement prior to our initial public offering and of which 90,000 were transferred to Messrs. Wider and Henderson and Ms. Trigg (30,000 shares each) in

February 2021, and, in connection with the Domestication, will automatically convert, on a one-for-one basis, into shares of New Caritas Class A Common Stock;

|

| • |

“CLN1” are to CLN1 Batten disease;

|

| • |

“CLN3” are to CLN3 Batten disease;

|

| • |

“CLN6” are to CLN6 Batten disease;

|

| • |

“Closing” are to the closing of the Business Combination;

|

| • |

“Closing Date” are to that date that is in no event later than the third (3rd) business day, following the satisfaction (or, to the extent permitted by

applicable law, waiver) of the conditions described under the section entitled “Business Combination Proposal—The Business Combination Agreement—Conditions to Closing of the

Business Combination,” (other than those conditions that by their nature are to be satisfied at the Closing, but subject to satisfaction or waiver of such conditions) or at such other date as ARYA

and Amicus may agree in writing;

|

| • |

“Closing Date Contribution Amount” are to an amount equal to (a) the amount of cash in the trust account as of immediately prior to the Closing (and before, for the

avoidance of doubt, giving effect to the ARYA Share Redemptions and the payment of the Deferred Underwriting Commission payable to Goldman Sachs & Co. LLC and Jefferies LLC), less (b) the aggregate amount of cash required to fund ARYA

Share Redemptions from the trust account and the Deferred Underwriting Commission payable to Goldman Sachs & Co. LLC and Jefferies LLC, plus (c) the Aggregate Closing PIPE Proceeds;

|

| • |

“CNS” are to central nervous system;

|

| • |

“Code” are to the Internal Revenue Code of 1986, as amended;

|

| • |

“Co-Development and Commercialization Agreement” are to the co-development and commercialization agreement entered into by Amicus and Caritas concurrently with the Closing pursuant to which, among other things, (i) Amicus and Caritas will collaborate in the research and development of gene therapy product candidates for the treatment of Fabry disease and Pompe diseases, (ii)

Caritas will grant Amicus an exclusive license under Caritas’ intellectual property to clinically develop and commercialize certain existing and future gene therapy candidates and (iii) Caritas will grant Amicus a right of first negotiation

for Amicus to negotiate an exclusive license to develop and commercialize therapeutic products incorporating gene therapy technologies being developed by Caritas for certain muscular dystrophy indications, in each case, subject to the terms

and conditions therein;

|

| • |

“Condition Precedent Proposals” are to the Business Combination Proposal, the Domestication Proposal, the Charter Proposal, the Nasdaq Proposal and the Incentive

Award Plan Proposal, collectively;

|

| • |

“Continental” are to Continental Stock Transfer & Trust Company;

|

| • |

“Contributed Business Assets” are to, collectively, all of Amicus’ and its affiliates’ respective right, title and interest, free and clear of any liens, in and to the assets, properties,

claims and rights set forth in Section 1.92 of the Business Combination Agreement;

|

| • |

“DGCL” are to the Delaware General Corporation Law.

|

| • |

“Director Nomination Agreement” are to the director nomination agreement entered into by ARYA, Sponsor and Amicus concurrently with the Closing pursuant to which,

among other things, (i) Amicus will be entitled to ongoing director designation rights with respect to the two director positions for which the Amicus initially designated directors in connection with the Closing, subject to customary

fall-away thresholds based on Amicus’ continued ownership of New Caritas and (ii) Sponsor will be entitled to ongoing director designation rights with respect to the one director position for which Sponsor initially designated a director in

connection with the Closing, subject to customary fall-away thresholds based on Sponsor’s continued ownership of New Caritas;

|

| • |

“Domestication” are to the transfer by way of continuation and deregistration of ARYA from the Cayman Islands and the continuation and domestication of ARYA as a

corporation incorporated in the State of Delaware;

|

| • |

“engineered hGAA” are to an engineered hGAA transgene with a Lysosomal-Targeting Cell receptor binding motif;

|

| • |

“ERTs” are to enzyme replacement therapies;

|

| • |

“ESPP” are to the New Caritas 2021 Employee Stock Purchase Plan to be considered for adoption and approval by the shareholders pursuant to the Employee Stock

Purchase Plan Proposal;

|

| • |

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

|

| • |

“extraordinary general meeting” are to the extraordinary general meeting of ARYA at 9:00 a.m., Eastern Time, on , 2021, at the offices of

Kirkland & Ellis LLP located at 601 Lexington Avenue, New York, New York 10022, or at such other time, on such other date and at such other place to which the meeting may be adjourned;

|

| • |

“Existing Governing Documents” are to the Memorandum of Association and the Articles of Association;

|

| • |

“FCPA” are to U.S. Foreign Corrupt Practices Act;

|

| • |

“FDA” are to U.S. Food and Drug Administration;

|

| • |

“FL RE Holdings, LLC” are to Amicus Biologics after its conversion into a Delaware limited liability company in accordance with the DGCL and the Delaware Limited Liability Company Act

whereupon it shall become a disregarded entity for U.S. federal income tax purposes, and, in connection therewith, its name shall be changed to a name to be mutually agreed by ARYA and Amicus;

|

| • |

“Gene Therapy Business” are to the business of investigating, manufacturing, researching, developing, testing, seeking, applying for and maintaining regulatory permits, commercializing,

selling and marking products, product candidates, platforms or services arising out of Amicus’ gene therapy portfolio as operated by Amicus and its subsidiaries prior to the consummation of the Business Combination;

|

| • |

“GCP” are to Good Clinical Practice;

|

| • |

“GLP” are to Good Laboratory Practice;

|

| • |

“IND” are to Investigational New Drug application;

|

| • |

“initial public offering” are to ARYA’s initial public offering that was consummated on March 2, 2021;

|

| • |

“initial shareholders” are to Sponsor and each of Messrs. Wider and Henderson and Ms. Trigg;

|

| • |

“Insiders” are to the initial shareholders and each of Joseph Edelman, Adam Stone, Michael Altman and Konstantin Poukalov;

|

| • |

“Intermediate HoldCo” are to Amicus GT Intermediate Holdings, LLC, a Delaware limited liability company and wholly-owned subsidiary of Amicus, which shall be formed immediately prior to

the Closing for the purposes of effecting the Pre-Closing Reorganization;

|

| • |

“Investor Rights Agreement” are to the investor rights agreement entered into by ARYA, Caritas, the Perceptive PIPE Investor, the initial shareholders and Amicus GT

concurrently with the execution of the Business Combination Agreement pursuant to which, among other things, the Perceptive PIPE Investor, Amicus and the initial shareholders (i) each agreed not to effect any sale or distribution of any

equity securities of New Caritas (and, in the case of Amicus GT, the Units) held by any of them during the one-year lock-up period described therein and (ii) were granted certain registration rights with respect to their Registrable

Securities (as defined in the Investor Rights Agreement), in each case, on the terms and subject to the conditions set forth therein;

|

| • |

“IPO” are to initial public offering;

|

| • |

“IRB” are to Institutional Review Board;

|

| • |

“IRS” are to the U.S. Internal Revenue Service;

|

| • |

“LDs” are to lysosomal disorders;

|

| • |

“Memorandum of Association” are to the amended and restated memorandum of association of ARYA;

|

| • |

“MiaMed” are to MiaMed, Inc., a Delaware corporation;

|

| • |

“MPSIIIA” are to Mucopolysaccharidosis Type IIIA;

|

| • |

“MPSIIIB” are to Mucopolysaccharidosis Type IIIB;

|

| • |

“Nasdaq” are to the Nasdaq Capital Market;

|

| • |

“NCE” are to New Chemical Entity;

|

| • |

“NDA” are to new drug application;

|

| • |

“NCH” are to Nationwide Children's Hospital;

|

| • |

“New Caritas” are to Caritas Therapeutics, Inc. (f.k.a. ARYA Sciences Acquisition Corp IV) upon and after the Domestication;

|

| • |

“New Caritas Board” are to the board of directors of New Caritas;

|

| • |

“New Caritas Common Stock” are to the New Caritas Class A Common Stock and the New Caritas Class B Common Stock;

|

| • |

“New Caritas Class A Common Stock” are to the Class A common stock, par value $0.0001 per share, of New Caritas;

|

| • |

“New Caritas Class B Common Stock” are to the Class B common stock, par value $0.0001 per share of New Caritas;

|

| • |

“New Caritas Preferred Stock” are to the shares of preferred stock, par value $0.0001 per share of New Caritas;

|

| • |

“Net Outstanding Class A Shares” means a number equal to (a) the sum of (i) the number of New Caritas Class A Common Stock outstanding as of immediately prior to the

Closing and (ii) the number of New Caritas Class A Common Stock to be issued pursuant to the Subscription Agreements, minus (b) the number of New Caritas Class A Common Stock redeemed and cancelled in connection with the accompanying proxy

statement/prospectus;

|

| • |

“NME” are to new molecular entity;

|

| • |

“ordinary shares” are to ARYA’s Class A ordinary shares and ARYA’s Class B ordinary shares;

|

| • |

“Orphan Drug Exclusivity” are to the seven-year exclusive marketing period in the U.S. for that product for that indication;

|

| • |

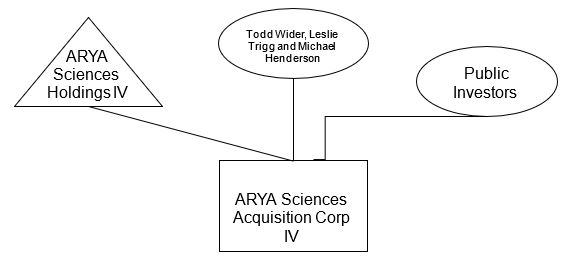

“Other Class B Shareholders” are to Todd Wider, Leslie Trigg and Michael Henderson;

|

| • |

“Other PIPE Investors” are to certain other investors in the PIPE Financing;

|

| • |

“Penn” are to the University of Pennsylvania;

|

| • |

“Perceptive Advisors” are to Perceptive Advisors, LLC, an affiliate of our Sponsor;

|

| • |

“Perceptive PIPE Investor” are to Perceptive Life Sciences Master Fund Ltd, a Cayman Islands exempted company;

|

| • |

“Perceptive Shareholders” are to the Sponsor and the Perceptive PIPE Investor;

|

| • |

“PFIC” are to passive foreign investment company;

|

| • |

“Philadelphia Facility Sublease” are to the sublease agreement to be entered into between Amicus and Caritas at the Closing with respect to the property leased by

Amicus pursuant to that certain Lease, dated as of February 23, 2019, by and between Amicus and Wexford-SCEC 3675 Market Street, LLC, with commercial and other terms substantially consistent with the terms of the most recent drafts of such

sublease agreement shared between Amicus and ARYA prior to the date hereof and with such changes or modifications thereto as mutually agreed to by Amicus and ARYA (such agreement not to be unreasonably withheld, conditioned or delayed by

either Amicus or ARYA);

|

| • |

“PIPE Financing” are to the transactions contemplated by the Subscription Agreements, pursuant to which the PIPE Investors have collectively committed to subscribe

for an aggregate of 20,000,000 shares of New Caritas Class A Common Stock for an aggregate purchase price of $200,000,000 to be consummated in connection with Closing;

|

| • |

“PIPE Investors” are to the Perceptive PIPE Investor and the Other PIPE Investors, collectively;

|

| • |

“PREA” are to Pediatric Research Equity Act of 2007;

|

| • |

“Pre-Closing Reorganization” are to the pre-closing reorganization of Amicus pursuant to which the entities and assets constituting Amicus’ gene therapy business will be transferred to

Caritas immediately prior to the Closing;

|

| • |

“private placement shares” are to the 499,000 private placement shares outstanding as of the date of this proxy statement/prospectus that were issued to our Sponsor

in a private placement simultaneously with the closing of our initial public offering, which are identical to the Class A ordinary shares sold in our initial public offering, subject to certain limited exceptions;

|

| • |

“pro forma” are to giving pro forma effect to the Business Combination, including the PIPE Financing;

|

| • |

“Proposed Bylaws” are to the proposed bylaws of New Caritas to be effective upon the Domestication attached to this proxy statement/prospectus as Annex D;

|

| • |

“Proposed Certificate of Incorporation” are to the proposed certificate of incorporation of New Caritas to be effective upon the Domestication attached to this proxy

statement/prospectus as Annex C;

|

| • |

“Proposed Governing Documents” are to the Proposed Certificate of Incorporation and the Proposed Bylaws;

|

| • |

“PRSUs” are to RSUs that are subject to one or more performance goals;

|

| • |

“public shareholders” are to holders of public shares, whether acquired in ARYA’s initial public offering or acquired in the secondary market;

|

| • |

“public shares” are to the currently outstanding 14,950,000 Class A ordinary shares of ARYA, whether acquired in ARYA’s initial public offering or acquired in the

secondary market;

|

| • |

“R&D” are to research and development;

|

| • |

“redemption” are to each redemption of public shares for cash pursuant to the Existing Governing Documents;

|

| • |

“REMS” are to risk evaluation and mitigation strategy;

|

| • |

“ROU” are to right-of-use;

|

| • |

“RSUs” are to restricted stock units;

|

| • |

“SARs” are to stock appreciation rights;

|

| • |

“SEC” are to the Securities and Exchange Commission;

|

| • |

“Securities Act” are to the Securities Act of 1933, as amended;

|

| • |

“SPC” are to Supplemental Protection Certificate;

|

| • |

“Sponsor” are to ARYA Sciences Holdings IV, a Cayman Islands exempted limited company;

|

| • |

“Sponsor Letter Agreement” are to the sponsor letter agreement entered into by ARYA, the Insiders and Amicus GT concurrently with the execution

of the Business Combination Agreement pursuant to which, among other things, (i) each initial shareholder agreed to vote in favor of each of the transaction proposals to be voted upon at the meeting of ARYA

shareholders, including approval of the Business Combination Agreement and the transactions contemplated thereby, (ii) each initial shareholder agreed to waive any adjustment to the conversion ratio set forth in the governing documents of

ARYA or any other anti-dilution or similar protection with respect to the Class B ordinary shares (whether resulting from the transactions contemplated by the Subscription Agreements, (iii) each of the Insiders and ARYA agreed to terminate

certain existing agreements or arrangements and (iv) each initial shareholder agreed to be bound by certain transfer restrictions with respect to his, her or its shares in ARYA prior to the Closing, in each case, on the terms and subject to

the conditions set forth in the Sponsor Letter Agreement;

|

| • |

“Subscription Agreements” are to the subscription agreements, entered into by ARYA and each of the PIPE Investors in connection with the PIPE Financing;

|

| • |

“Tax Receivable Agreement” are to the tax receivable agreement entered into concurrently with the Closing by New Caritas, Caritas, Amicus GT and the other persons from time to time that

become a party thereto pursuant to which, among other things, New Caritas will be required to pay the TRA Participants 85% of the amount of savings, if any, in U.S. federal, state and local income tax that

New Caritas actually realizes (computed using certain simplifying assumptions) as a result of the increases in New Caritas’ allocable share of tax basis of the tangible and intangible assets of Caritas and its subsidiaries related to any

redemptions of Units or exchanges of Units for cash or shares of New Caritas Class A Common Stock, as well as certain other tax benefits related to entering into the Tax Receivable Agreement, including tax benefits attributable to

payments under the Tax Receivable Agreement;

|

| • |

“ThermoFisher” are to ThermoFisher Scientific;

|

| • |

“TRA Participants” are to Amicus GT and the other persons (other than New Caritas and Caritas) from time to time that become a party to the Tax Receivable Agreement;

|

| • |

“Transaction Equity Security Amount” means a number of Units or New Caritas Class B Common Stock, as applicable, equal to (a) $175,000,000 divided by (b) $10.00;

|

| • |

“Transition Services Agreement” are to the transition services agreement entered into by Amicus and Caritas concurrently with the Closing pursuant to

which, among other things, (i) Amicus and/or one or more of its affiliates will provide certain transitional services to Caritas and/or one or more of its affiliates and (ii) Caritas and/or one or more its affiliates will provide certain

transitional services to Amicus and/or one or more of its affiliates, in each case in order to facilitate the orderly transition of Amicus’ gene therapy business to Caritas.

|

| • |

“transfer agent” are to Continental, ARYA’s transfer agent;

|

| • |

“trust account” are to the trust account established at the consummation of ARYA’s initial public offering that holds the proceeds of the initial public offering and

is maintained by Continental, acting as trustee;

|

| • |

“Units” are, collectively, to (i) the limited liability company interests of Caritas that will be reclassified prior to the Closing into a number of common units

equal to the Transaction Equity Security Amount (as defined in the Business Combination Agreement) based on a pre-transaction equity value for Caritas of $175,000,000 (ii) the common units of Caritas that will be issued to Amicus GT in

exchange for the Amicus Contribution Amount (as defined in the Business Combination Agreement) and (iii) the common units of Caritas that will be issued to New Caritas in exchange for the Closing Date Contribution Amount (as defined in the

Business Combination Agreement);

|

| • |

“Unmodified hGAA” are to unmodified wild-type hGAA; and

|

| • |

“U.S. GAAP” are the U.S. generally accepted accounting principles;

|

| • |

“2021 Plan” are to the Caritas Therapeutics, Inc. 2021 Incentive Equity Plan to be considered for adoption and approval by the shareholders pursuant to the Incentive

Award Plan Proposal.

|

| A. |

ARYA shareholders are being asked to consider and vote upon, among other proposals, a proposal to approve and adopt the Business Combination Agreement and approve the transactions

contemplated thereby, including the Business Combination. In accordance with the terms and subject to the conditions of the Business Combination Agreement, among other things, following the Pre-Closing Reorganization and on the Closing Date,

(i) (A) the Domestication will occur and ARYA’s name will be changed to “Caritas Therapeutics, Inc.”, (B) each outstanding Class A ordinary share and each outstanding Class B ordinary share will become one share of New Caritas Class A Common

Stock, and (C) ARYA will amend and restate its Existing Governing Documents by the deletion in their entirety and the substitution in their place of the Proposed Certificate of Incorporation in connection with the Domestication and (ii) (A)

Amicus will cause the existing limited liability company agreement of Caritas to be amended and restated, (B) Amicus will cause all of the limited liability company interests of Caritas existing immediately prior to the Closing to be

re-classified into a number of Units equal to the Transaction Equity Security Amount based on a pre-transaction equity value for Caritas of $175,000,000, (C) Amicus will make the Amicus Contribution Amount in exchange for a number of Units

equal to Amicus Contribution Equity Amount, (D) ARYA will contribute the Closing Date Contribution Amount to Caritas in exchange for a number of Units equal to the Net Outstanding ARYA Class A Shares and (E) New Caritas will issue to Amicus

GT a number of New Caritas Class B Common Stock (which will have no economic value but will entitle the holder thereof to one vote per share), equal to the number of Units held by Amicus GT. See “Business

Combination Proposal.”

|

| A. |

At the extraordinary general meeting, ARYA is asking holders of its ordinary shares to consider and vote upon eleven (11) separate proposals:

|

| • |

a proposal to approve by ordinary resolution and adopt the Business Combination Agreement, and the transactions contemplated thereby;

|

| • |

a proposal to approve by special resolution the Domestication;

|

| • |

a proposal to approve by special resolutions the amendment and restatement in their entirety and substitution in their place of the Existing Governing Documents with

the Proposed Certificate of Incorporation;

|

| • |

the following governance proposals to approve, on a non-binding advisory basis, the following material differences between the Existing Governing Documents and the

Proposed Certificate of Incorporation:

|

| • |

an amendment to change the authorized share capital of ARYA from US$50,000 divided into (i) 479,000,000 Class A ordinary shares, par value $0.0001 per share, (ii)

20,000,000 Class B ordinary shares, par value $0.0001 per share, and (iii) 1,000,000 preference shares, par value $0.0001 per share, to (a) 250,000,000 shares of New Caritas Class A Common Stock, (b) 70,000,000 shares of New Caritas Class B

Common Stock and (c) 12,500,000 shares of New Caritas Preferred Stock;

|

| • |

an amendment to authorize the New Caritas Board to issue any or all shares of New Caritas Preferred Stock in one or more series, with such terms and conditions as may

be expressly determined by the New Caritas Board and as may be permitted by the DGCL;

|

| • |

an amendment to remove the ability of New Caritas stockholders to take action by written consent in lieu of a meeting; and

|

| • |

certain other changes in connection with the replacement of Existing Governing Documents with the Proposed Certificate of Incorporation as part of the Domestication;

|

| • |

a proposal to approve by ordinary resolution shares of New Caritas Class A Common Stock in connection with the Business Combination and the PIPE Financing in

compliance with the Nasdaq Listing Rules;

|

| • |

a proposal to approve and adopt by ordinary resolution the 2021 Plan;

|

| • |

a proposal to approve and adopt by ordinary resolution the ESPP; and

|

| • |

a proposal to approve by ordinary resolution the adjournment of the extraordinary general meeting to a later date or dates, if necessary, to, among other things,

permit further solicitation and vote of proxies in the event that there are insufficient votes for the approval of one or more proposals at the extraordinary general meeting.

|

| A. |

ARYA is a blank check company incorporated on August 24, 2020 as a Cayman Islands exempted company and incorporated for the purpose of effecting a merger, share exchange, asset

acquisition, share purchase, reorganization or similar business combination with one or more businesses. Although ARYA may pursue an acquisition opportunity in any business, industry, sector or geographical location for purposes of

consummating an initial business combination, ARYA has focused on North American companies in the life sciences and medical technology sectors. ARYA is not permitted under its Existing Governing Documents to effect a business combination

solely with another blank check company or a similar type of company with nominal operations.

|

| A. |

No. The ARYA Board did not obtain a third-party valuation or fairness opinion in connection with its determination to approve the Business Combination. However, ARYA’s management, the

members of the ARYA Board and the other representatives of ARYA have substantial experience in evaluating the operating and financial merits of companies similar to the Gene Therapy Business, including in connection with the business

combinations of ARYA Sciences Acquisition Corp., ARYA Sciences Acquisition Corp II and ARYA Acquisition Corp III. In addition, the ARYA Board considered financial and product data of a group of publicly traded gene therapy companies selected

based on the experience and professional judgement of ARYA’s management team, which included Taysha Gene Therapies, Inc., Passage Bio, Inc. and other companies that were similar to the Gene Therapy Business. Investors will be relying solely

on the judgment of the ARYA Board in valuing the Gene Therapy Business and assuming the risk that the ARYA Board may not have properly valued such business. For purposes of determining the ultimate valuation reflected in the non-binding term

sheet, ARYA considered the disruptive nature of the Gene Therapy Business’ technology as well as the potential market opportunity and relied principally on the information received from Amicus, the comparable gene therapy businesses and the

precedent gene therapy transactions that the ARYA Board reviewed. For a more detailed description of the process by which the parties to the transaction agreed to a $175 million valuation for Caritas and the ARYA Board’s consideration of

Caritas’ projected financial information and other data in connection with ultimately approving the transaction and determining that the transaction satisfied the 80% test, see “Business Combination

Proposal—Background to the Business Combination” and “—The ARYA Board’s Reasons for the Business Combination”.

|

| A. |

Following the Business Combination, the combined company will be organized in an “Up-C” structure, in which substantially all of the assets and business of New Caritas will be held by

Caritas and will operate through Caritas and the subsidiaries of Caritas, and New Caritas will be a publicly listed holding company that will hold equity interests in Caritas. In accordance with the terms and subject to the conditions of the

Business Combination Agreement, all of the limited liability company interests of Caritas existing immediately prior to the Closing (as defined in the Business Combination Agreement) will be re-classified into a number of Units equal to the

Transaction Equity Security Amount (as defined in the Business Combination Agreement) based on a pre-transaction equity value for Caritas of $175,000,000.

|

|

Security

|

Voting Rights

|

Dividend and

Distribution Rights

|

Rights Upon

Liquidation

|

Conversion/

Exchange Rights

|

|

New Caritas Class A Common Stock

|

One vote per share

|

Ratable

|

Ratable

|

N/A

|

|

New Caritas Class B Common Stock

|

One vote per share

|

None

|

None

|

N/A

|

|

Units

|

None

|

Ratable

|

Ratable

|

Reedemable, together with an equal number of shares of New Caritas Class B Common Stock, or, at New Caritas' option, exchangeable, together with an equal number of shares of New Caritas Class B Common Stock,

shares of New Caritas Class A Common Stock or cash of equivalent value (subject to certain adjustments and restrictions)

|

| A. |

Concurrently with the completion of the Business Combination, New Caritas will enter into the Tax Receivable Agreement with Caritas and the TRA Participants. Pursuant

to the Tax Receivable Agreement, New Caritas will be required to pay the TRA Participants 85% of the amount of savings, if any, in U.S. federal, state and local income tax that New Caritas actually realizes (computed using certain simplifying

assumptions) as a result of the increases in New Caritas’ allocable share of tax basis of the tangible and intangible assets of Caritas and its subsidiaries related to any redemptions of Units or exchanges of Units for cash or shares of New

Caritas Class A Common Stock, as well as certain other tax benefits related to entering into the Tax Receivable Agreement, including tax benefits attributable to payments under the Tax Receivable Agreement. All such payments to the TRA

Participants will be New Caritas’ obligation, and not that of Caritas. The term of the Tax Receivable Agreement will continue until all such tax benefits have been utilized or expired unless New Caritas exercises its right to terminate the

Tax Receivable Agreement for an amount representing the present value of anticipated future tax benefits under the Tax Receivable Agreement (computed using certain simplifying assumptions) or certain other acceleration events occur (including

upon a change of control). For more information on the Tax Receivable Agreement, please see the section entitled “Business Combination Proposal — Related Agreements — Tax Receivable Agreement.”

|

| A. |

Following the Closing, it is expected that the current management of Caritas will become the management of New Caritas, and the New Caritas Board will consist of seven (7) directors,

which will be divided into three classes (Class I, II and III) with Class I and Class II each initially consisting of two (2) directors and Class III initially consisting of three (3) directors. Pursuant to the Business Combination Agreement,

the New Caritas Board will consist of two (2) individuals designated by Amicus, one of whom will be a Class I director and the other a Class II director, one (1) individual determined by Sponsor to serve as a Class III director, and four

other individuals which will be mutually agreed by ARYA and Amicus and will be designated to such other class positions as mutually agreed by ARYA and Amicus. Please see the section entitled “Management

Following the Business Combination” for further information.

|

| A. |

As of the date of this proxy statement/prospectus, there are (i) 14,950,000 Class A ordinary shares outstanding and issued in ARYA’s initial public offering, (ii) 499,000 Class A ordinary

shares outstanding and issued in a private placement simultaneously with the closing of ARYA’s initial public offering, and (iii) 3,737,500 Class B ordinary shares outstanding and issued to ARYA’s initial shareholders. Therefore, as of the

date of this proxy statement/prospectus (without giving effect to the Business Combination and assuming that none of ARYA’s outstanding public shares are redeemed in connection with the Business Combination), ARYA’s fully-diluted share

capital would be 19,186,500 ordinary shares.

|

|

Share Ownership in

New Caritas

|

||||||||

|

No redemptions

|

Maximum

redemptions(1)

|

|||||||

|

Percentage of

Outstanding

Shares

|

Percentage of

Outstanding

Shares

|

|||||||

|

ARYA public shareholders(2)

|

24.2

|

% | 9.7 |

% | ||||

|

Perceptive PIPE Investor and our initial shareholders(3)(4)

|

15.0 |

% |

17.9

|

% | ||||

|

Other PIPE Investors(5)

|

24.3

|

%

|

29.0

|

%

|

||||

|

Amicus and its affiliates(6)

|

36.5

|

%

|

43.5

|

%

|

||||

| (1) |

Assumes that 9,950,000 of ARYA’s outstanding public shares are redeemed in connection with the Business Combination, which is the estimated maximum number of shares that may be redeemed

while still enabling the Aggregate Transaction Proceeds Condition to be met.

|

| (2) |

Excludes shares acquired by certain public investors in connection with the PIPE Financing.

|

| (3) |

Includes 5,000,000 shares acquired by the Perceptive PIPE Investor in the PIPE Financing. The Perceptive PIPE Investor, which holds 26,559,443 shares of Amicus’ common stock, does not

have beneficial ownership over the securities in New Caritas held by Amicus and its affiliates.

|

| (4) |

Includes 4,236,500 shares held by the initial shareholders originally acquired prior to or in connection with ARYA’s initial public offering (including 30,000 shares held by each of Todd

Wider, Leslie Trigg and Michael Henderson).

|

| (5) |

Excludes shares acquired by the Perceptive PIPE Investor in the PIPE Financing.

|

| (6) |

Excludes shares held by the Perceptive Shareholders. Assumes exchange of Units for shares of New Caritas Class A Common Stock on a 1-for-1 basis and the concurrent cancellation of an

equal number of shares of voting, non-economic shares of New Caritas Class B Common Stock. For further details, see “Business Combination Proposal—Consideration to Amicus GT in the Business Combination.”

|

| A. |

Our board of directors believes that there are significant advantages to us that will arise as a result of a change of our domicile to Delaware. Further, our board of directors believes

that any direct benefit that the DGCL provides to a corporation also indirectly benefits its stockholders, who are the owners of the corporation. The board of directors believes that there are several reasons why transfer by way of

continuation to Delaware is in the best interests of ARYA and its shareholders, including, (i) the prominence, predictability and flexibility of the DGCL, (ii) Delaware’s well-established principles of corporate governance and (iii) the

increased ability for Delaware corporations to attract and retain qualified directors, each of the foregoing are discussed in greater detail in the section entitled “Domestication Proposal—Reasons for the

Domestication.”

|

| A. |

The consummation of the Business Combination is conditional, among other things, on the Domestication. Accordingly, in addition to voting on the Business Combination, ARYA’s shareholders

also are being asked to consider and vote upon a proposal to approve the Domestication, and replace ARYA’s Existing Governing Documents, in each case, under Cayman Islands law with the Proposed Certificate of Incorporation, in each case,

under the DGCL, which differ from the Existing Governing Documents in the following material respects:

|

|

Existing Governing Documents

|

Proposed Certificate of

Incorporation

|

|||

|

Authorized Shares

(Advisory Governing Documents Proposal A)

|

The share capital under the Existing Governing Documents is US$50,000 divided into 479,000,000 Class A ordinary shares of par value US$0.0001 per share, 20,000,000

Class B ordinary shares of par value US$0.0001 per share and 1,000,000 preference shares of par value US$0.0001 per share.

|

The Proposed Certificate of Incorporation authorizes 250,000,000 shares of New Caritas Class A common stock, 70,000,000

New Caritas Class B Common Stock and 12,500,000 shares of New Caritas Preferred Stock.

|

||

|

See paragraph 8 of the Memorandum of Association.

|

See Article IV, Section A of the Proposed Certificate of Incorporation.

|

|

Existing Governing Documents

|

Proposed Certificate of

Incorporation

|

|||

|

Authorize the Board of Directors to Issue Preferred Stock Without Stockholder Consent

(Advisory Governing Documents Proposal B)

|

The Existing Governing Documents authorize the issuance of 1,000,000 preference shares with such designation, rights and preferences as may be determined from time to

time by our board of directors. Accordingly, our board of directors is empowered under the Existing Governing Documents, without shareholder approval, to issue preference shares with dividend, liquidation, redemption, voting or other rights

which could adversely affect the voting power or other rights of the holders of ordinary shares.

|

The Proposed Certificate of Incorporation authorizes the board of directors to issue shares of preferred stock from time to time in one or more series and to fix the

designations, powers, preferences, and rights, and the qualifications, limitations or restrictions thereof. These designations, powers, preferences and rights could include dividend rights, conversion rights, voting rights, redemption rights

(including sinking fund provisions), liquidation preferences and the number of shares constituting any series or the designation of such series, any or all of which may be greater than the rights of common stock.

|

||

|

See paragraph 8 of the Memorandum of Association and Article 3 of the Articles of Association.

|

See Article IV, Section C of the Proposed Certificate of Incorporation.

|

|||

|

Shareholder/Stockholder Written Consent In Lieu of a Meeting

(Advisory Governing Documents Proposal C)

|

The Existing Governing Documents provide that resolutions may be passed by a vote in person, by proxy at a general meeting, or by unanimous written resolution.

|

The Proposed Certificate of Incorporation allows stockholders to vote in person or by proxy at a meeting of stockholders, but prohibits the ability of stockholders to

act by written consent in lieu of a meeting.

|

||

|

See Articles 14 and 15 of our Articles of Association.

|

See Article V, Section A and Article VI, Section A of the Proposed Certificate of Incorporation.

|

|||

|

Corporate Name

(Advisory Governing Documents Proposal D)

|

The Existing Governing Documents provide the name of the company is “ARYA Sciences Acquisition Corp IV”

|

The Proposed Certificate of Incorporation will provide that the name of the corporation will be “Caritas Therapeutics, Inc.”

|

||

|

See paragraph 1 of our Memorandum of Association.

|

See Article I of the Proposed Certificate of Incorporation.

|

|||

|

Perpetual Existence

(Advisory Governing Documents Proposal D)

|

The Existing Governing Documents provide that if we do not consummate a business combination (as defined in the Existing Governing Documents) by March 2, 2023

(twenty-four months after the closing of ARYA’s initial public offering), ARYA will cease all operations except for the purposes of winding up and will redeem the shares issued in ARYA’s initial public offering and liquidate its trust

account.

|

The Proposed Certificate of Incorporation does not limit the duration of the corporation’s existence to a specified date. Therefore, the corporation will have

perpetual existence, which is the default under the DGCL.

|

||

|

See Article 38 of our Articles of Association.

|

This is the default rule under the DGCL.

|

|

Existing Governing Documents

|

Proposed Certificate of

Incorporation

|

|||

|

Takeovers by Interested Stockholders

(Advisory Governing Documents Proposal D)

|

The Existing Governing Documents do not provide restrictions on takeovers of ARYA by a related shareholder following a business combination.

|

The Proposed Certificate of Incorporation contains a provision opting out of Section 203 of the DGCL, and therefore, New Caritas will not be governed by Section 203

of the DGCL relating to business combinations with interested stockholders.

|

||

|

This is the default rule under the DGCL.

|

||||

|

Provisions Related to Status as Blank Check Company

(Advisory Governing Documents Proposal D)

|

The Existing Governing Documents set forth various provisions related to our status as a blank check company prior to the consummation of a business combination.

|

The Proposed Certificate of Incorporation does not include such provisions related to our status as a blank check company, which no longer will apply upon

consummation of the Business Combination, as we will cease to be a blank check company at such time.

|

||

|

See Article 38 of our Articles of Association.

|

| A. |

In connection with the Domestication, on the Closing Date prior to Closing, each issued and outstanding Class A ordinary share and each issued and outstanding Class B ordinary share of

ARYA will be converted, on a one-for-one basis, into shares of New Caritas Class A Common Stock. See “Domestication Proposal.”

|

| A. |

As discussed more fully under “U.S. Federal Income Tax Considerations,” the Domestication generally should constitute a tax-deferred

reorganization within the meaning of Section 368(a)(l)(F) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”). However, due to the absence of direct guidance on the application of Section 368(a)(1)(F) to a statutory

conversion of a corporation holding only investment-type assets such as ARYA, this result is not entirely free from doubt. In the case of a transaction, such as the Domestication, that should qualify as a tax-deferred reorganization within

the meaning of Section 368(a)(1)(F), and subject to the discussion of the “passive foreign investment company” (“PFIC”) rules below, U.S. Holders (as defined in “U.S. Federal Income Tax

Considerations—U.S. Holders” below) generally will be subject to Section 367(b) of the Code and, as a result of the Domestication:

|

| • |

a U.S. Holder who on the day of the Domestication beneficially owns (actually and constructively) public shares with a fair market value of less than $50,000 generally should not recognize any gain or loss and will not be required to include any part of ARYA’s earnings in income;

|

| • |

a U.S. Holder who on the day of the Domestication beneficially owns (actually and constructively) public shares with a fair market value of $50,000 or more, which represent less than 10%

of the total combined voting power of all classes of our stock entitled to vote and less than 10% of the total value of all classes of our stock, generally should recognize gain (but not loss) in respect of the Domestication. As an alternative to recognizing gain, such U.S. Holder may file an election to include in income as a deemed dividend the “all earnings and profits amount” (as defined in the Treasury Regulations under

Section 367(b) of the Code) attributable to its public shares provided certain other requirements are satisfied; and

|

| • |

a U.S. Holder who on the day of the Domestication beneficially owns (actually and constructively) public shares with a fair market value of $50,000 or more, which represent 10% or more of

the total combined voting power of all classes of our stock entitled to vote or 10% or more of the total value of all classes of our stock, generally should be required to include in income as a deemed dividend the “all earnings and profits

amount” attributable to the public shares held directly by such U.S. Holder provided certain other requirements are satisfied. Any such U.S. Holder that is a corporation may, under certain circumstances, effectively be exempt from taxation on

a portion or all of the deemed dividend as a result of the application of Section 245A of the Code (participation exemption).

|

| A. |

If you are a holder of public shares, you have the right to request that we redeem all or a portion of your public shares for cash provided that you follow the procedures and deadlines

described elsewhere in this proxy statement/prospectus. Public shareholders may elect to redeem all or a portion of the public shares held by them regardless of if or how they vote in respect of the Business

Combination Proposal. If you wish to exercise your redemption rights, please see the answer to the next question: “How do I exercise my redemption rights?”

|

| A. |

If you are a public shareholder and wish to exercise your right to redeem the public shares, you must:

|

| A. |

We expect that a U.S. Holder (as defined in “U.S. Federal Income Tax Considerations—U.S. Holders”) that exercises its redemption rights to receive

cash from the trust account in exchange for its shares of New Caritas Class A Common Stock will be treated as selling such shares of New Caritas Class A Common Stock resulting in the recognition of capital gain or capital loss. There may be

certain circumstances in which the redemption may be treated as a distribution for U.S. federal income tax purposes depending on the amount of shares of New Caritas Class A Common Stock that such U.S. Holder owns or is deemed to own prior to

and following the redemption. For a more complete discussion of the U.S. federal income tax considerations of an exercise of redemption rights, see “U.S. Federal Income Tax Considerations.”

|

| A. |

Following the closing of our initial public offering, an amount equal to $149,500,000 ($10.00 per Class A ordinary share) of the net proceeds from our initial public offering and the sale

of the private placement shares was placed in the trust account. As of June 30, 2021, funds in the trust account totaled approximately $149,519,811 and were held in money market funds. These funds will remain in the trust account, except for

the withdrawal of interest to pay taxes, if any, until the earliest of (i) the completion of a business combination (including the closing of the Business Combination) or (ii) the redemption of all of the public shares if we are unable to

complete a business combination by March 2, 2023, subject to applicable law.

|

| A. |

Our public shareholders are not required to vote “FOR” the Business Combination in order to exercise their redemption rights. Accordingly, the Business Combination may be consummated even

though the funds available from the trust account and the number of public shareholders are reduced as a result of redemptions by public shareholders.

|

| A. |

The consummation of the Business Combination is conditioned upon, among other things, (i) the approval by our shareholders of the Condition Precedent Proposals being obtained; (ii) the

applicable waiting period under the HSR Act relating to the Business Combination Agreement having expired or been terminated; (iii) ARYA having at least $5,000,001 of net tangible assets (as determined in accordance with Rule 3a51-1(g)(1) of

the Exchange Act) after giving effect to the transactions contemplated by the Business Combination Agreement and the PIPE Financing; (iv) the Aggregate Transaction Proceeds Condition; (v) the approval by Nasdaq of our initial listing

application in connection with the Business Combination (also see “Risk Factors—Nasdaq may not list New Caritas’ securities on its exchange, which could limit investors’ ability to make transactions in New

Caritas’ securities and subject New Caritas to additional trading restrictions.”); (vi) the absence of any law or order of an authority of competent jurisdiction or other legal restraint or

prohibition that prohibits or prevents the consummation of the transactions contemplated by the Business Combination Agreement and (vii) the effectiveness of the registration statement of which this registration statement/proxy

statement forms a part. Therefore, unless these conditions are waived by both ARYA and Amicus, the Business Combination Agreement could terminate and the Business Combination may not be consummated.

|

| A. |

It is currently expected that the Business Combination will be consummated in the fourth quarter of 2021 or early 2022. This date depends, among other things, on the approval of the

proposals to be put to ARYA shareholders at the extraordinary general meeting. However, such extraordinary general meeting could be adjourned if the Adjournment Proposal is adopted by our shareholders at the extraordinary general meeting and

we elect to adjourn the extraordinary general meeting to a later date or dates to consider and vote upon a proposal to approve by ordinary resolution the adjournment of the extraordinary general meeting to a later date or dates (A) to the

extent necessary to ensure that any required supplement or amendment to the accompanying proxy statement/prospectus is provided to ARYA shareholders or, if as of the time for which the extraordinary general meeting is scheduled, there are

insufficient ARYA ordinary shares represented (either in person or by proxy) to constitute a quorum necessary to conduct business at the extraordinary general meeting, (B) in order to solicit additional proxies from ARYA shareholders in favor

of one or more of the proposals at the extraordinary general meeting or (C) if ARYA shareholders redeem an amount of public shares such that the Aggregate Transaction Proceeds Condition would not be satisfied. For a description of the

conditions for the completion of the Business Combination, see “Business Combination Proposal—Conditions to Closing of the Business Combination.”

|

| A. |

ARYA will not complete the Domestication to Delaware unless all other conditions to the consummation of the Business Combination have been satisfied or waived by the parties in accordance

with the terms of the Business Combination Agreement. If ARYA is not able to consummate the Business Combination with Caritas nor able to complete another business combination by March 2, 2023, in each case, as such date may be extended

pursuant to our Existing Governing Documents, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a

per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of taxes payable, and less up to $100,000 of interest to pay dissolution expenses), divided

by the number of then-outstanding public shares, which redemption will completely extinguish public shareholders’ rights as shareholders (including the right to receive further liquidating distributions, if any), subject to applicable law,

and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining shareholders and our board of directors, liquidate and dissolve, subject in each case to our obligations under Cayman Islands law

to provide for claims of creditors and the requirements of other applicable laws.

|

| A. |

Our shareholders have no appraisal rights in connection with the Business Combination or the Domestication under the Cayman Islands Companies Act or under the DGCL.

|

| A. |

We urge you to read this proxy statement/prospectus, including the Annexes and the documents referred to herein, carefully and in their entirety and to consider how the Business

Combination will affect you as a shareholder. Our shareholders should then vote as soon as possible in accordance with the instructions provided in this proxy statement/prospectus and on the enclosed proxy card.

|

| A. |

If you are a holder of record of ordinary shares on the record date for the extraordinary general meeting, you may vote in person at the extraordinary general meeting or by submitting a

proxy for the extraordinary general meeting. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope. If you hold

your shares in “street name,” which means your shares are held of record by a broker, bank or nominee, you should contact your broker to ensure that votes related to the shares you beneficially own are properly counted. In this regard, you

must provide the broker, bank or nominee with instructions on how to vote your shares or, if you wish to attend the extraordinary general meeting and vote in person, obtain a proxy from your broker, bank or nominee.

|

| A. |

No. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial holder” of the shares held for you in what is known as “street

name.” If this is the case, this proxy statement/prospectus may have been forwarded to you by your brokerage firm, bank or other nominee, or its agent. As the beneficial holder, you have the right to direct your broker, bank or other nominee

as to how to vote your shares. If you do not provide voting instructions to your broker on a particular proposal on which your broker does not have discretionary authority to vote, your shares will not be voted on that proposal. This is

called a “broker non-vote.” Abstentions and broker non-votes, while considered present for the purposes of establishing a quorum, will not count as votes cast at the extraordinary general meeting, and otherwise will have no effect on a

particular proposal. If you decide to vote, you should provide instructions to your broker, bank or other nominee on how to vote in accordance with the information and procedures provided to you by your broker, bank or other nominee.

|

| A. |

The extraordinary general meeting will be held at 9:00 a.m., Eastern Time, on , 2021, at the offices of Kirkland & Ellis LLP, located at 601 Lexington Avenue,

New York, New York 10022, unless the extraordinary general meeting is adjourned.

|

| A. |

We intend to hold the extraordinary general meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public