ACTIVE/129298489.2 ALTI GLOBAL, INC. 2023 STOCK INCENTIVE PLAN NOTICE OF GRANT OF PERFORMANCE-BASED RESTRICTED STOCK UNITS AND AWARD AGREEMENT FOR SWISS PARTICIPANTS AlTi Global, Inc., pursuant to its 2023 Stock Incentive Plan (the “Plan”), hereby grants to the individual listed below (the “Participant”) this award of Restricted Stock Units. The Restricted Stock Units described in this Notice of Grant of Performance-Based Restricted Stock Units for Swiss Participants (the “Notice”) are subject to the terms and conditions set forth in the Performance-Based Award Agreement, including all schedules and exhibits thereto, attached as Exhibit A hereto (the “Agreement”) and the Plan, each of which is incorporated herein by reference. Unless otherwise defined herein, capitalized terms used in this Notice and the Agreement will have the meanings defined in the Plan. Participant: Grant Date: Total Number of Restricted Stock Units: Vesting Conditions: See Schedule 1 to the Agreement. By signing below, the Participant agrees to be bound by the terms and conditions of the Plan, the Agreement and this Notice. This document may be executed, including by electronic means, in multiple counterparts, each of which will be deemed an original, and all of which together will be deemed a single instrument. ALTI GLOBAL, INC. Sign: _______________________________ Name: ______________________________ Title: _______________________________ Date: _______________________________ PARTICIPANT Sign: _______________________________ Name: ______________________________ Date: _______________________________

ACTIVE/129298489.2 1 EXHIBIT A PERFORMANCE-BASED RESTRICTED STOCK UNITS AWARD AGREEMENT FOR SWISS PARTICIPANTS UNDER THE ALTI GLOBAL, INC. 2023 STOCK INCENTIVE PLAN 1. Definitions. The following terms shall have the following respective meanings, provided that the Participant resides and/or works in Switzerland. “Affiliate” means an entity that directly or indirectly controls, is controlled by, or is under common control with the Company. “Cause” shall include, but not be limited to, all reasons entitling to a summary dismissal pursuant to article 337 of the Swiss Code of Obligations (CO) and all justified reasons pursuant to article 340c para. 2 CO, without limiting the definition of Cause as set out in the Plan. The Participant expressly acknowledges that the definition of Cause as set out in the Plan shall include any crime or felony under Swiss laws and any breaches against their duties and in respect of the Company or the Affiliate employing the Participant and not only in respect of the Company. “Disability” as used in the Plan and this Agreement shall include, but not be limited to, any permanent disability pursuant to the social security laws of Switzerland. “Tax Liability” shall mean a liability to account for any tax, social security contributions (including for the avoidance of doubt, any employee or employer’s social security contributions, where legally permitted), or other levies in respect of: (i) the Restricted Stock Units (whether by reason of grant, vesting, transfer or otherwise); (ii) the transfer or issue of Shares to the Participant on vesting of the Restricted Stock Units or any other benefit on vesting of the Restricted Stock Units; (iii) any restrictions applicable to the Restricted Stock Units ceasing to apply; and (iv) the disposal of the Shares. 2. Award of Restricted Stock Units. Effective as of the Grant Date set forth in the Notice, the Company has granted to the Participant the number of Restricted Stock Units set forth in the Notice (the “Award”), subject to the restrictions and on the terms and conditions set forth in the Notice, the Plan and this Agreement. Each Restricted Stock Unit represents the right to receive one Share at the times and subject to the conditions set forth below and in Schedule 1. 3. Vesting of Restricted Stock Units. (a) Subject to the continued service of the Participant with the Company through the relevant vesting date(s) or event(s), the Restricted Stock Units will become vested in such amounts and at such times as set forth in Schedule 1. The continued service will be deemed to end on the date when a termination notice is received (and not at the end of any notice period) with regard to the Participant’s employment with the Company or any Affiliate, regardless of whether the cessation of the employment was lawful, and shall not include any period of notice of termination or any period of salary continuance or deemed employment or contractual relationship. As a result, if a Participant receives notice of termination, the continued service will end on the date the Participant receives such notice from the Company or the Affiliate employing them. (b) Solely for purposes of this Agreement, service with the Company will be deemed to include service with an Affiliate of the Company (for only so long as such entity remains an Affiliate of the Company).

ACTIVE/129298489.2 2 (c) Upon the cessation of the Participant’s service with the Company due to the Participant’s death, any Restricted Stock Units that are outstanding and unvested immediately prior to the Participant’s death shall vest as to 100% of the Target Number of Restricted Stock Units assuming the performance metrics had been achieved at target levels. (d) Unless otherwise set forth in this Section 3 or otherwise provided in the Participant’s employment agreement or in the discretion of the Committee, upon the cessation of the Participant’s service with the Company for any other reason, any then unvested portion of the Restricted Stock Units will be forfeited automatically. 4. Settlement of Restricted Stock Units. (a) One Share will be delivered with respect to each vested Restricted Stock Unit within sixty (60) days following the applicable vesting date or event, subject to the requirements of the Plan and this Agreement. (b) The Restricted Stock Units constitute an unfunded and unsecured obligation of the Company. The Participant shall not have any rights of a stockholder of the Company with respect to the Shares underlying the Restricted Stock Units unless and until the Restricted Stock Units become vested and are settled by the issuance of Shares. (c) Notwithstanding the foregoing, to the extent provided in Treas. Reg. § 1.409A-1(b)(4)(ii) or any successor provision, the Company may delay settlement of Restricted Stock Units if it reasonably determines that such settlement would violate federal securities laws or any other Applicable Law. (d) The Participant acknowledges and confirms that the grant of the Restricted Stock Units is entirely at the discretion of the Company and is subject to the vesting and other conditions set out in the Plan, the Notice and this Agreement, without limitation and/or such other conditions as the Company may at any time in its absolute discretion determine. The Participant explicitly acknowledges and confirms that even after the Restricted Stock Units have vested that the grant is still fully discretionary and the Company may in its sole discretion provide further conditions for the Restricted Stock Units. The Restricted Stock Units granted are a voluntary gratuity (Gratifikation; gratification) within the meaning of Article 322d Swiss Code of Obligations “CO”) as determined at the Company's sole discretion to which the Participant has no entitlement and which does not constitute an entitlement for a grant of further Restricted Stock Units or other equities in the future. 5. Securities Law Information. The Restricted Stock Unit is not intended to be publicly offered in or from Switzerland. On that basis, it is considered a private offering and it is not subject to securities registration in Switzerland. Neither this document nor any other materials relating to the Restricted Stock Units and/or the underlying shares: (i) constitutes a prospectus according to articles 35 et seq. of the Swiss Federal Act on Financial Services (“FinSA”); (ii) may be publicly distributed or otherwise made publicly available in Switzerland to any person other than a Participant; or (iii) has been or will be filed with, approved or supervised by any Swiss reviewing body according to article 51 FinSA or any Swiss regulatory authority, including the Swiss Financial Market Supervisory Authority (“FINMA”). 6. Non-Transferability of Restricted Stock Units. The Restricted Stock Units are subject to restrictions on transfer as set forth in Section 13 of the Plan. 7. No Continuation of Service. Neither the Plan nor this Agreement will confer upon the Participant any right to continue in the employment or service of the Company or any of its Affiliates, or limit in any

ACTIVE/129298489.2 3 respect the right of the Company or its Affiliates to discharge the Participant at any time with or without Cause. 8. Not Part of Employment and No Right from Employment. The Participant acknowledges that the Restricted Stock Units, the Notice, this Agreement and the participation in the Plan do not form part of the employment and the granted Restricted Stock Units do not form part of the contractual compensation. The Participant expressly acknowledges that any right or claim under the Plan, the Notice and this Agreement (if at all) are not employment related but will solely depend upon the provisions in the Notice, this Agreement and the Plan. The Participant’s sole contract and sole contractual partner regarding the Plan and the granted Restricted Stock Units is the Company and not any Affiliate employing the Participant. The Participant expressly acknowledges that they shall not have any right or claim under the Plan, the Notice and the Agreement against the Affiliate employing them. The Participant expressly acknowledges and agrees that they only have any right and claim against the Company as set out under the Plan and the Agreement. 9. Tax Liability (a) The Participant hereby agrees that he or she is liable for any Tax Liability owed in connection with the Restricted Stock Units and the underlying Shares, regardless of any action the Affiliate employing the Participant takes with respect to such tax withholding obligations that arise in connection with the Restricted Stock Units and the underlying Shares. The Participant hereby covenants to pay any such Tax Lability, as and when requested by the Affiliate employing the Participant or by the competent tax authority (or any other tax authority or any other relevant authority in any other jurisdiction (as applicable)). Where, in relation to the Restricted Stock Units and the underlying Shares, the Affiliate employing the Participant is liable, or is in accordance with current practice believed to be liable under any statute or regulation or otherwise, to account to any revenue or other authority in any jurisdiction for sums in respect of a Tax Liability, the Participant shall indemnify and shall keep indemnified the Affiliate for the Tax Liability that they are required to pay or withhold on the Participant’s behalf or have paid or will pay to the competent tax authority (or any other tax authority or any other relevant authority in any other jurisdiction (as applicable)) and the Participant shall pay the Affiliate a sum equal to the Tax Liability immediately upon written notice of the quantum of the said liability. (b) Notwithstanding the above, the Affiliate employing the Participant may impose such conditions upon the vesting of the Restricted Stock Units as are necessary to ensure that the Affiliate is able to meet any or all of such liabilities, including, without limitation, a condition that no vesting may take place unless the Participant has provided the Affiliate with cash funds sufficient to meet such Tax Liability, or has entered into arrangements acceptable to the Affiliate to secure that such cash funds are available, or to allow the Affiliate employing the Participant to deduct the amount of such Tax Liability from any cash amounts (including salary and bonuses) which may become payable to the Participant by any Affiliate. (c) The Company or the Affiliate employing the Participant does not make any representation or undertaking of the treatment of any tax withholding in connection with the award, vesting of the Restricted Stock Units or issue of the Shares or the subsequent sale of such Shares. The Company or the Affiliate does not commit and is under no obligation to structure the Shares to reduce or eliminate the Participant’s Tax Liability. 10. The Plan. The Participant has received a copy of the Plan, has read the Plan and is familiar with its terms, and hereby accepts the Restricted Stock Units subject to the terms and provisions of the Plan. Pursuant to the Plan, the Committee is authorized to construe and interpret the Plan, and to prescribe rules and regulations not inconsistent with the Plan as it deems appropriate. The Participant hereby agrees

ACTIVE/129298489.2 4 to accept as binding, conclusive and final all decisions or interpretations of the Committee with respect to questions arising under the Plan, the Notice or this Agreement. 11. Clawback Provisions. In consideration for the grant of this Award, the Participant agrees to be subject to (i) any compensation, clawback, recoupment or similar policies of the Company or its Affiliates covering the Participant that may be in effect from time to time, whether adopted before or after the Grant Date, and (ii) to such other clawbacks as may be required by Applicable Law ((i) and (ii) together, the “Clawback Provisions”). The Participant understands that the Clawback Provisions are not limited in their application to the Award, or to equity or cash received in connection with the Award. 12. Data Privacy. The Participant explicitly and unambiguously acknowledges and consents to the collection, use, transfer and other processing of their personal data as described in this paragraph by the Company and its Affiliates for the purpose of implementing, administering and managing the participation in the Plan. The Participant understands that the Company and its Affiliates hold certain personal data about them, including, but not limited to, the name, home address, telephone number, date of birth, social security number (or other identification number), salary, nationality, job title, details of all Restricted Stock Units awarded, cancelled, vested, unvested or outstanding for the purpose of implementing, managing and administering the Plan. The Participant understands that this personal data may be transferred to any third parties assisting in the implementation, administration and management of the Plan. 13. Other Company Policies. The Participant agrees, in consideration for the grant of this Award, to be subject to any policies of the Company and its Affiliates regarding securities trading and hedging or pledging of securities that may be in effect from time to time, or as may otherwise be required by Applicable Law. 14. Entire Agreement. The Notice and this Agreement, together with the Plan, represent the entire agreement between the parties with respect to the subject matter hereof and supersede any prior agreement, written or otherwise, relating to the subject matter hereof. 15. Acknowledgment of Non-Reliance. Except for those representations and warranties expressly set forth in this Agreement, the Participant hereby disclaims reliance on any and all representations, warranties, or statements of any nature or kind, express or implied, including, but not limited to, the accuracy or completeness of such representations, warranties, or statements. 16. Amendment. This Agreement may only be amended by a writing signed by each of the parties hereto; provided that the Company may amend this Agreement without the Participant’s consent, if the amendment does not materially and adversely affect the Participant’s rights hereunder. 17. Choice of Law. This Agreement, the interpretation and enforcement thereof and all claims arising out of or relating to this Agreement or the transactions contemplated by this Agreement, whether sounding in tort, contract or otherwise, shall be governed solely and exclusively by, and construed in accordance with, the laws and judicial decisions of the State of Delaware without giving effect to any choice or conflict of law provision or rule that would cause the application of the laws and judicial decisions of any jurisdiction other than the State of Delaware. The Participant expressly acknowledges and agrees to the Choice of Law and accepts that Swiss law does not apply. 18. Forum Selection. All actions and proceedings arising out of or relating to this Agreement, or the transactions contemplated by this Agreement, shall be heard and determined solely and exclusively in the Delaware Court of Chancery and any state appellate court therefrom within the State of Delaware (unless the Delaware Court of Chancery shall decline to accept jurisdiction over a particular matter, in

ACTIVE/129298489.2 5 which case, exclusively in any state or federal court within the State of Delaware). The Participant expressly acknowledges and agrees that the Swiss courts do not have any jurisdiction with regards to any claims in connection or under the Plan and the Agreement. 19. Waiver of Jury Trial. Each party hereby waives its right to a jury trial of any and all claims or cause of actions based upon or arising out of this Agreement or the transactions contemplated by this Agreement. Each party hereby acknowledges and agrees that the waiver contained in this Section 19 is made knowingly and voluntarily. 20. Headings. The headings in this Agreement are for convenience only. They form no part of the Agreement and will not affect its interpretation. 21. Tax Withholding and Social Security. The Participant acknowledges that the issuance of Shares hereunder will give rise to taxable income which may be subject to required withholding and social security and insurance deductions. In accordance with Section 15 of the Plan, the obligations of the Company hereunder are conditioned on the Participant timely paying, or otherwise making arrangements satisfactory to the Company regarding the timely satisfaction of, any such required withholding. The Participant herewith authorizes the Company and/or the Affiliate employing them to make all (if any) applicable deductions resulting from the issuance of Shares from any compensation owed to them by the Company or the Affiliate employing the Participant, subject to any statutory limitations. If the Participant’s compensation shall not be sufficient to cover such social security, insurance and tax liabilities, the Participant will indemnify the Company and/or the Affiliate employing them upon first demand. 22. Electronic Delivery of Documents. The Participant authorizes the Company to deliver electronically any prospectuses or other documentation related to the Restricted Stock Units and any other compensation or benefit plan or arrangement in effect from time to time (including, without limitation, reports, proxy statements or other documents that are required to be delivered to participants in such arrangements pursuant to federal or state laws, rules or regulations). For this purpose, electronic delivery will include, without limitation, delivery by means of e-mail or e-mail notification that such documentation is available on the Company’s intranet site or the website of a third-party administrator designated by the Company. Upon written request, the Company will provide to the Participant a paper copy of any document also delivered to the Participant electronically. The authorization described in this paragraph may be revoked by the Participant at any time by written notice to the Company. 23. Further Assurances. The Participant agrees, upon demand of the Company, to do all acts and execute, deliver and perform all additional documents, instruments and agreements which may be reasonably required by the Company to implement the provisions and purposes of this Agreement and the Plan. 24. Language Acknowledgement. The Participant confirms that they have read and understood the documents relating to the Plan, including the Agreement, with all terms and conditions included therein, which were provided in English language only. The Participant confirms that they have sufficient language capabilities to understand these terms and conditions in full: Sie bestätigen, dass Sie den Plan sowie die dazugehörigen Dokumente, inklusive der Vereinbarung, mit all den darin enthaltenen Bedingungen und Voraussetzungen, welche in englischer Sprache verfasst sind, gelesen und verstanden haben. Sie bestätigen, dass Ihre Sprachkenntnisse genügend sind, um die Bedingungen und Voraussetzungen zu verstehen. Vous confirmez que vous avez lu et compris les documents relatifs au plan, y compris la convention d'attribution, avec toutes les conditions qui y sont incluses, qui ont été fournies en langue anglaise

ACTIVE/129298489.2 6 uniquement. Vous confirmez que vous avez des capacités linguistiques suffisantes pour comprendre ces termes et conditions dans leur intégralité. Confermate di aver letto e compreso i documenti relativi al Piano, compreso l'Accordo di opzione, con tutti i termini e le condizioni ivi inclusi, che sono stati forniti solo in lingua inglese. Confermate di avere capacità linguistiche sufficienti per comprendere appieno questi termini e condizioni.

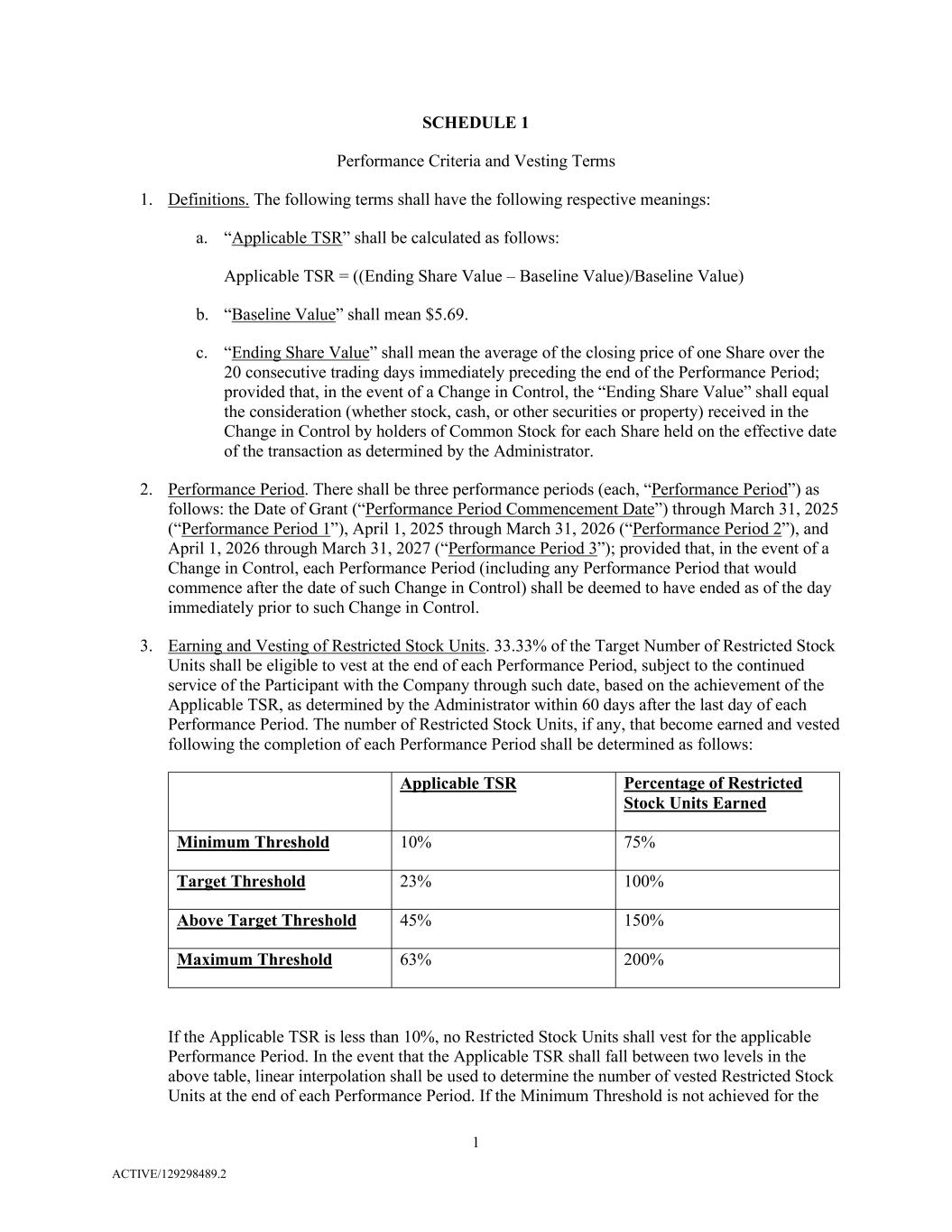

ACTIVE/129298489.2 1 SCHEDULE 1 Performance Criteria and Vesting Terms 1. Definitions. The following terms shall have the following respective meanings: a. “Applicable TSR” shall be calculated as follows: Applicable TSR = ((Ending Share Value – Baseline Value)/Baseline Value) b. “Baseline Value” shall mean $5.69. c. “Ending Share Value” shall mean the average of the closing price of one Share over the 20 consecutive trading days immediately preceding the end of the Performance Period; provided that, in the event of a Change in Control, the “Ending Share Value” shall equal the consideration (whether stock, cash, or other securities or property) received in the Change in Control by holders of Common Stock for each Share held on the effective date of the transaction as determined by the Administrator. 2. Performance Period. There shall be three performance periods (each, “Performance Period”) as follows: the Date of Grant (“Performance Period Commencement Date”) through March 31, 2025 (“Performance Period 1”), April 1, 2025 through March 31, 2026 (“Performance Period 2”), and April 1, 2026 through March 31, 2027 (“Performance Period 3”); provided that, in the event of a Change in Control, each Performance Period (including any Performance Period that would commence after the date of such Change in Control) shall be deemed to have ended as of the day immediately prior to such Change in Control. 3. Earning and Vesting of Restricted Stock Units. 33.33% of the Target Number of Restricted Stock Units shall be eligible to vest at the end of each Performance Period, subject to the continued service of the Participant with the Company through such date, based on the achievement of the Applicable TSR, as determined by the Administrator within 60 days after the last day of each Performance Period. The number of Restricted Stock Units, if any, that become earned and vested following the completion of each Performance Period shall be determined as follows: Applicable TSR Percentage of Restricted Stock Units Earned Minimum Threshold 10% 75% Target Threshold 23% 100% Above Target Threshold 45% 150% Maximum Threshold 63% 200% If the Applicable TSR is less than 10%, no Restricted Stock Units shall vest for the applicable Performance Period. In the event that the Applicable TSR shall fall between two levels in the above table, linear interpolation shall be used to determine the number of vested Restricted Stock Units at the end of each Performance Period. If the Minimum Threshold is not achieved for the

ACTIVE/129298489.2 2 Performance Period 1 or Performance Period 2, such Restricted Stock Units will remain eligible to vest during Performance Period 3. Notwithstanding the foregoing, in no event will the total number of Restricted Stock Units earned for any Performance Period exceed 200% of the number of Restricted Stock Units eligible to vest for such Performance Period.