alti-202403310001838615false12-312024Q1P5YP2YP1Yhttp://fasb.org/us-gaap/2023#QualifiedPlanMemberxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purealti:segmentalti:categoryalti:fundalti:entityutr:Dalti:anniversaryalti:installment00018386152024-01-012024-03-310001838615us-gaap:CommonClassAMember2024-05-100001838615us-gaap:CommonClassBMember2024-05-1000018386152024-03-3100018386152023-12-310001838615alti:FeesReceivableMemberus-gaap:RelatedPartyMember2024-03-310001838615alti:FeesReceivableMemberus-gaap:RelatedPartyMember2023-12-310001838615alti:FeesReceivableMember2024-03-310001838615alti:FeesReceivableMember2023-12-310001838615us-gaap:CommonClassAMember2023-12-310001838615us-gaap:CommonClassAMember2024-03-310001838615us-gaap:CommonClassBMember2024-03-310001838615us-gaap:CommonClassBMember2023-12-310001838615alti:ManagementAdvisoryFeesMember2024-01-012024-03-310001838615alti:ManagementAdvisoryFeesMember2023-01-012023-03-310001838615alti:IncentiveFeesMember2024-01-012024-03-310001838615alti:IncentiveFeesMember2023-01-012023-03-310001838615alti:DistributionsFromInvestmentsMember2024-01-012024-03-310001838615alti:DistributionsFromInvestmentsMember2023-01-012023-03-310001838615alti:OtherFeesIncomeMember2024-01-012024-03-310001838615alti:OtherFeesIncomeMember2023-01-012023-03-3100018386152023-01-012023-03-3100018386152023-01-032023-03-310001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001838615us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310001838615us-gaap:AdditionalPaidInCapitalMember2023-12-310001838615us-gaap:RetainedEarningsMember2023-12-310001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001838615us-gaap:NoncontrollingInterestMember2023-12-310001838615us-gaap:RetainedEarningsMember2024-01-012024-03-310001838615us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001838615us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-03-310001838615us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-01-012024-03-310001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-03-310001838615us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-03-310001838615us-gaap:AdditionalPaidInCapitalMember2024-03-310001838615us-gaap:RetainedEarningsMember2024-03-310001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001838615us-gaap:NoncontrollingInterestMember2024-03-310001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001838615us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001838615us-gaap:AdditionalPaidInCapitalMember2022-12-310001838615us-gaap:RetainedEarningsMember2022-12-310001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001838615us-gaap:NoncontrollingInterestMember2022-12-3100018386152022-12-310001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-310001838615us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001838615us-gaap:RetainedEarningsMember2023-01-012023-03-310001838615us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-03-310001838615us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-03-310001838615us-gaap:AdditionalPaidInCapitalMember2023-03-310001838615us-gaap:RetainedEarningsMember2023-03-310001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001838615us-gaap:NoncontrollingInterestMember2023-03-3100018386152023-03-310001838615alti:ShareholderLoanMember2024-01-012024-03-310001838615alti:ShareholderLoanMember2023-01-012023-03-310001838615alti:UmbrellaMember2023-01-030001838615alti:TWMHAndTIGShareholdersMemberalti:UmbrellaMember2023-01-030001838615alti:UmbrellaMemberalti:TWMHTIGAndAlvariumMember2023-01-0300018386152023-01-020001838615us-gaap:CommonClassAMember2023-01-032023-03-310001838615us-gaap:CommonClassAMember2023-04-032023-04-0300018386152023-06-070001838615us-gaap:CommonClassAMember2023-06-0700018386152023-01-032023-06-300001838615alti:SeriesCCumulativeConvertiblePreferredStockMember2024-01-012024-03-310001838615alti:SeriesCCumulativeConvertiblePreferredStockMembersrt:MaximumMember2024-01-012024-03-310001838615alti:SeriesCCumulativeConvertiblePreferredStockMember2024-03-310001838615alti:ConstellationWarrantMemberus-gaap:CommonClassAMember2024-03-310001838615alti:ConstellationWarrantMember2024-03-310001838615alti:ConstellationWarrantMemberus-gaap:CommonClassAMember2024-01-012024-03-310001838615alti:WealthManagementSegmentMember2024-03-310001838615alti:WealthManagementSegmentMember2023-12-310001838615alti:AlternativesPlatformMemberalti:StrategicAlternativesSegmentMember2024-03-310001838615alti:AlternativesPlatformMemberalti:StrategicAlternativesSegmentMember2023-12-310001838615alti:CoInvestmentMemberalti:StrategicAlternativesSegmentMember2024-01-012024-03-310001838615alti:CoInvestmentMemberalti:StrategicAlternativesSegmentMember2023-01-012023-12-310001838615alti:StrategicAlternativesSegmentMemberalti:RealEstatePublicAndPrivateMember2024-03-310001838615alti:StrategicAlternativesSegmentMemberalti:RealEstatePublicAndPrivateMember2023-12-310001838615alti:FundManagementMemberalti:StrategicAlternativesSegmentMember2024-01-012024-03-310001838615us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberalti:LXiReitAdvisorsLimitedLRAMemberalti:FundManagementMemberalti:LondonMetricPropertyPlcMemberalti:StrategicAlternativesSegmentMember2024-01-090001838615us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberalti:LXiReitAdvisorsLimitedLRAMemberalti:FundManagementMemberalti:LondonMetricPropertyPlcMemberalti:StrategicAlternativesSegmentMember2024-03-060001838615us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberalti:LXiReitAdvisorsLimitedLRAMemberalti:FundManagementMemberalti:LondonMetricPropertyPlcMemberalti:StrategicAlternativesSegmentMember2023-12-312023-12-310001838615us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberalti:LXiReitAdvisorsLimitedLRAMemberalti:FundManagementMemberalti:LondonMetricPropertyPlcMemberalti:StrategicAlternativesSegmentMember2024-01-012024-03-310001838615alti:AlvariumRELimitedAREMemberalti:AlvariumHomeREITAdvisorsLtdAHRAMemberalti:FundManagementMemberalti:StrategicAlternativesSegmentMemberalti:EntityOwnedByManagementOfAlvariumHomeREITAdvisorsLtdAHRAMember2022-12-310001838615alti:AlvariumRELimitedAREMemberalti:AlvariumHomeREITAdvisorsLtdAHRAMemberalti:FundManagementMemberalti:StrategicAlternativesSegmentMemberalti:EntityOwnedByManagementOfAlvariumHomeREITAdvisorsLtdAHRAMember2024-01-012024-03-310001838615alti:AlvariumRELimitedAREMemberalti:StrategicAlternativesSegmentMemberalti:EntityOwnedByManagementOfAlvariumHomeREITAdvisorsLtdAHRAMember2023-01-012023-12-310001838615srt:RestatementAdjustmentMember2023-12-310001838615srt:RestatementAdjustmentMember2024-01-012024-03-310001838615alti:MappingChangesAccountsPayableAndAccruedExpensesToAccruedCompensationAndProfitSharingMember2023-12-310001838615alti:MappingChangesOtherLiabilitiesToAccruedCompensationAndProfitShariingMember2023-12-310001838615srt:MinimumMember2024-03-310001838615srt:MaximumMember2024-03-310001838615srt:MinimumMember2024-01-012024-03-310001838615srt:MaximumMember2024-01-012024-03-3100018386152023-01-012023-12-310001838615srt:MinimumMemberus-gaap:PropertyPlantAndEquipmentOtherTypesMember2024-03-310001838615srt:MaximumMemberus-gaap:PropertyPlantAndEquipmentOtherTypesMember2024-03-310001838615us-gaap:CommonClassAMember2023-08-312023-08-310001838615us-gaap:CommonClassAMember2023-08-310001838615us-gaap:CommonClassAMember2024-03-112024-03-110001838615us-gaap:CommonClassAMember2024-03-110001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutSecuritiesMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberus-gaap:CommonClassAMember2024-01-012024-03-310001838615us-gaap:CommonClassBMemberalti:AlvariumTWMHAndTIGMemberalti:EarnoutSecuritiesMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMember2024-01-012024-03-310001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutSecuritiesMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberalti:ClassBUnitsMember2024-01-012024-03-310001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutSharesTrancheOneMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberus-gaap:CommonClassAMember2024-03-310001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutSharesTrancheOneMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberus-gaap:CommonClassAMember2024-01-012024-03-310001838615alti:EarnoutSharesTrancheTwoMemberalti:AlvariumTWMHAndTIGMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberus-gaap:CommonClassAMember2024-03-310001838615alti:EarnoutSharesTrancheTwoMemberalti:AlvariumTWMHAndTIGMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberus-gaap:CommonClassAMember2024-01-012024-03-310001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-08-020001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-08-010001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-08-022023-08-020001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMember2024-03-310001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-12-310001838615alti:TiedemannWealthManagementHoldingsLLCMemberalti:TiedemannInternationalHoldingsAGTIHMember2022-12-310001838615alti:TiedemannWealthManagementHoldingsLLCMemberalti:TiedemannInternationalHoldingsAGTIHMember2023-07-282023-07-280001838615alti:TiedemannWealthManagementHoldingsLLCMemberus-gaap:CommonClassAMemberalti:TiedemannInternationalHoldingsAGTIHMember2023-07-282023-07-280001838615alti:EmployeeRelatedLiabilitiesMember2023-12-310001838615us-gaap:AdditionalPaidInCapitalMember2023-12-310001838615alti:StrategicAlternativesSegmentMemberalti:RealEstatePublicAndPrivateMember2024-01-012024-03-310001838615alti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-11-062023-11-060001838615us-gaap:CommonClassAMember2023-01-030001838615alti:CGCSponsorLLCMemberalti:AlvariumTWMHAndTIGMemberalti:TheFounderSharesMemberus-gaap:CommonClassAMember2023-01-032023-01-030001838615alti:CGCSponsorLLCMemberus-gaap:CommonClassBMemberalti:AlvariumTWMHAndTIGMemberalti:TheFounderSharesMember2023-01-032023-01-030001838615alti:CGCSponsorLLCMemberus-gaap:CommonClassBMemberalti:AlvariumTWMHAndTIGMemberalti:TheFounderSharesMember2023-01-030001838615alti:CGCSponsorLLCMemberalti:AlvariumTWMHAndTIGMemberalti:TheFounderSharesMemberus-gaap:CommonClassAMember2023-01-030001838615alti:AlvariumTWMHAndTIGMember2023-01-012023-03-310001838615alti:AlvariumTWMHAndTIGMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:LongTermDebtMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:OtherAssetsMember2023-01-030001838615alti:AlvariumTWMHAndTIGMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassAMember2023-01-032023-01-030001838615us-gaap:CommonClassBMemberalti:AlvariumTWMHAndTIGMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:WarrantMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:ManagementAdvisoryFeesMember2023-01-0300018386152023-01-032024-03-310001838615alti:AlvariumTWMHAndTIGMemberalti:WealthManagementSegmentMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:StrategicAlternativesSegmentMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:TradeNamesMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:TradeNamesMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:CustomerRelationshipsMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:CustomerRelationshipsMember2023-01-032023-01-030001838615alti:InvestmentManagementAgreementsMemberalti:AlvariumTWMHAndTIGMember2023-01-030001838615alti:InvestmentManagementAgreementsMemberalti:AlvariumTWMHAndTIGMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:InvestmentManagementAgreementsMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:DevelopedTechnologyMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:DevelopedTechnologyMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:OrderOrProductionBacklogMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:OrderOrProductionBacklogMember2023-01-032023-01-030001838615alti:ALWealthPartnersPteLtdALWealthPartnersMember2023-04-062023-04-060001838615alti:ALWealthPartnersPteLtdALWealthPartnersMember2023-04-060001838615alti:ALWealthPartnersPteLtdALWealthPartnersMemberalti:ManagementAdvisoryFeesMember2023-04-060001838615alti:ALWealthPartnersPteLtdALWealthPartnersMemberus-gaap:CustomerRelationshipsMember2023-04-060001838615alti:ALWealthPartnersPteLtdALWealthPartnersMemberus-gaap:CustomerRelationshipsMember2023-04-062023-04-060001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMember2022-12-310001838615alti:AlvariumInvestmentManagersSuisseSAAIMSMember2023-08-022023-08-020001838615alti:AlvariumInvestmentManagersSuisseSAAIMSMember2023-08-020001838615us-gaap:CustomerRelationshipsMemberalti:AlvariumInvestmentManagersSuisseSAAIMSMember2023-08-020001838615us-gaap:CustomerRelationshipsMemberalti:AlvariumInvestmentManagersSuisseSAAIMSMember2023-08-022023-08-020001838615alti:AlvariumInvestmentManagersSuisseSAAIMSMember2023-12-310001838615us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberalti:FamilyOfficeServiceFOSMember2024-03-310001838615us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberalti:FamilyOfficeServiceFOSMember2023-12-310001838615us-gaap:OperatingSegmentsMemberalti:ManagementAdvisoryFeesMember2024-01-012024-03-310001838615us-gaap:OperatingSegmentsMemberalti:ManagementAdvisoryFeesMember2023-01-012023-03-310001838615us-gaap:OperatingSegmentsMemberalti:IncentiveFeesMember2024-01-012024-03-310001838615us-gaap:OperatingSegmentsMemberalti:IncentiveFeesMember2023-01-012023-03-310001838615us-gaap:OperatingSegmentsMemberalti:DistributionsFromInvestmentsMember2024-01-012024-03-310001838615us-gaap:OperatingSegmentsMemberalti:DistributionsFromInvestmentsMember2023-01-012023-03-310001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001838615us-gaap:OperatingSegmentsMember2024-01-012024-03-310001838615us-gaap:OperatingSegmentsMember2023-01-012023-03-310001838615us-gaap:OperatingSegmentsMemberalti:ManagementAdvisoryFeesMember2023-12-310001838615us-gaap:OperatingSegmentsMemberalti:ManagementAdvisoryFeesMember2022-12-310001838615us-gaap:OperatingSegmentsMemberalti:ManagementAdvisoryFeesMember2024-03-310001838615us-gaap:OperatingSegmentsMemberalti:IncentiveFeesMember2023-12-310001838615us-gaap:OperatingSegmentsMemberalti:IncentiveFeesMember2022-12-310001838615us-gaap:OperatingSegmentsMemberalti:IncentiveFeesMember2024-03-310001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2023-12-310001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2022-12-310001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2024-03-310001838615us-gaap:RelatedPartyMemberus-gaap:OperatingSegmentsMemberalti:ManagementAdvisoryFeesMember2024-03-310001838615us-gaap:RelatedPartyMemberus-gaap:OperatingSegmentsMemberalti:ManagementAdvisoryFeesMember2023-12-310001838615us-gaap:RelatedPartyMemberus-gaap:OperatingSegmentsMemberalti:IncentiveFeesMember2024-03-310001838615us-gaap:RelatedPartyMemberus-gaap:OperatingSegmentsMemberalti:IncentiveFeesMember2023-12-310001838615us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2024-03-310001838615us-gaap:RestrictedStockUnitsRSUMember2024-03-310001838615us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001838615us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001838615alti:EarnInAwardsMember2024-01-012024-03-310001838615alti:EarnInAwardsMember2023-01-012023-03-310001838615alti:DelayedSharePurchaseAgreementTIHSPAMember2024-01-012024-03-310001838615alti:DelayedSharePurchaseAgreementTIHSPAMember2023-01-012023-03-310001838615alti:RevenueShareEmployeeArrangementsMember2024-01-012024-03-310001838615alti:RevenueShareEmployeeArrangementsMember2023-01-012023-03-310001838615alti:DeferredCompensationAwardsMember2024-01-012024-03-310001838615alti:DeferredCompensationAwardsMember2023-01-012023-03-310001838615us-gaap:RestrictedStockUnitsRSUMember2023-12-310001838615us-gaap:RestrictedStockUnitsRSUMember2022-12-310001838615us-gaap:RestrictedStockUnitsRSUMember2023-03-310001838615alti:TWMHRestrictedStockUnitsRSUsMember2023-01-012023-03-310001838615alti:AlvariumEmployeeAwardsMember2023-01-012023-03-310001838615alti:AlvariumEmployeeAwardsBenefitingAcquirerMember2023-01-012023-03-310001838615us-gaap:CommonClassAMemberalti:NasdaqAwardsMember2023-01-012023-03-310001838615us-gaap:CommonClassAMemberalti:NasdaqAwardsMember2023-03-310001838615alti:BuyOutEquityAwardsAsRestrictedStockUnitsRSUsMemberus-gaap:CommonClassAMember2023-01-012023-03-310001838615alti:BoardOfDirectorsMemberus-gaap:CommonClassAMemberalti:NasdaqAwardsMember2023-03-232023-03-230001838615alti:BoardOfDirectorsMemberus-gaap:CommonClassAMemberalti:NasdaqAwardsMember2023-03-230001838615alti:BoardOfDirectorsMemberus-gaap:CommonClassAMemberalti:NasdaqAwardsMember2024-03-012024-03-010001838615alti:BoardOfDirectorsMemberus-gaap:CommonClassAMemberalti:NasdaqAwardsMember2024-03-010001838615alti:BoardOfDirectorsMemberus-gaap:CommonClassAMemberalti:NasdaqAwardsMember2024-01-012024-03-310001838615us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2023-05-312023-05-310001838615us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2023-05-310001838615us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2024-01-012024-03-310001838615us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2023-05-312024-03-310001838615us-gaap:CommonClassAMemberalti:BuyOutEquityAwardsAsRestrictedStockUnitsRSUsFirstGrantDateMember2023-01-012023-12-310001838615alti:BuyOutEquityAwardsAsRestrictedStockUnitsRSUsSecondGrantDateMemberus-gaap:CommonClassAMember2023-01-012023-12-310001838615srt:MinimumMemberalti:BuyOutEquityAwardsAsRestrictedStockUnitsRSUsMemberus-gaap:CommonClassAMember2023-01-012023-12-310001838615alti:BuyOutEquityAwardsAsRestrictedStockUnitsRSUsMembersrt:MaximumMemberus-gaap:CommonClassAMember2023-01-012023-12-310001838615us-gaap:CommonClassAMemberalti:BuyOutEquityAwardsAsRestrictedStockUnitsRSUsFirstGrantDateMember2023-03-310001838615alti:BuyOutEquityAwardsAsRestrictedStockUnitsRSUsSecondGrantDateMemberus-gaap:CommonClassAMember2023-03-310001838615alti:BuyOutEquityAwardsAsRestrictedStockUnitsRSUsMemberus-gaap:CommonClassAMember2024-01-012024-03-3100018386152022-01-0700018386152023-07-142023-07-1400018386152023-07-140001838615us-gaap:CommonClassAMemberalti:DelayedSharePurchaseAgreementTIHSPAMember2023-08-012023-08-010001838615us-gaap:CommonClassAMemberalti:DelayedSharePurchaseAgreementTIHSPAMember2023-08-010001838615us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2024-03-310001838615us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2024-03-310001838615us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2024-03-310001838615us-gaap:FairValueInputsLevel1Memberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel2Memberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel1Memberalti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel2Memberalti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615alti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel1Memberalti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel2Memberalti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615alti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615alti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueMeasurementsRecurringMember2024-03-310001838615us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2023-12-310001838615us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2023-12-310001838615us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2023-12-310001838615us-gaap:FairValueInputsLevel1Memberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel2Memberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel1Memberalti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel2Memberalti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615alti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel1Memberalti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel2Memberalti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615alti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615alti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel1Memberalti:AlvariumTWMHAndTIGMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel2Memberalti:AlvariumTWMHAndTIGMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:AlvariumTWMHAndTIGMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615alti:AlvariumTWMHAndTIGMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001838615alti:TaxReceivableAgreementLiabilityMember2023-12-310001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutLiabilityMember2023-12-310001838615alti:EarnoutLiabilityMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-12-310001838615alti:WarrantLiabilitiesMember2023-12-310001838615alti:TaxReceivableAgreementLiabilityMember2024-01-012024-03-310001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutLiabilityMember2024-01-012024-03-310001838615alti:EarnoutLiabilityMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2024-01-012024-03-310001838615alti:WarrantLiabilitiesMember2024-01-012024-03-310001838615alti:TaxReceivableAgreementLiabilityMember2024-03-310001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutLiabilityMember2024-03-310001838615alti:EarnoutLiabilityMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2024-03-310001838615alti:WarrantLiabilitiesMember2024-03-310001838615alti:TaxReceivableAgreementLiabilityMember2022-12-310001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutLiabilityMember2022-12-310001838615alti:EarnoutLiabilityMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2022-12-310001838615alti:EarnInConsiderationPayableMember2022-12-310001838615alti:TaxReceivableAgreementLiabilityMember2023-01-012023-12-310001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutLiabilityMember2023-01-012023-12-310001838615alti:EarnoutLiabilityMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-01-012023-12-310001838615alti:EarnInConsiderationPayableMember2023-01-012023-12-310001838615alti:EarnInConsiderationPayableMember2023-12-310001838615alti:InvestmentUnaffiliatedManagementCompaniesMember2023-12-310001838615us-gaap:DerivativeFinancialInstrumentsAssetsMember2023-12-310001838615alti:InvestmentUnaffiliatedManagementCompaniesMember2024-01-012024-03-310001838615us-gaap:DerivativeFinancialInstrumentsAssetsMember2024-01-012024-03-310001838615alti:InvestmentUnaffiliatedManagementCompaniesMember2024-03-310001838615us-gaap:DerivativeFinancialInstrumentsAssetsMember2024-03-310001838615alti:InvestmentUnaffiliatedManagementCompaniesMember2022-12-310001838615alti:InvestmentUnaffiliatedManagementCompaniesMember2023-01-012023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:InvestmentsExternalStrategicManagersMember2024-03-310001838615srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:InvestmentsExternalStrategicManagersMemberus-gaap:MeasurementInputDiscountRateMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:InvestmentsExternalStrategicManagersMembersrt:MaximumMemberus-gaap:MeasurementInputDiscountRateMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputLongTermRevenueGrowthRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:InvestmentsExternalStrategicManagersMember2024-03-310001838615us-gaap:FairValueInputsLevel3Member2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberus-gaap:MeasurementInputPriceVolatilityMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberus-gaap:MeasurementInputCreditSpreadMember2024-03-310001838615alti:MeasurementInputCorrelationMemberus-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMember2024-03-310001838615srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:MeasurementInputCostOfDebtRangeMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:MeasurementInputCostOfDebtRangeMembersrt:MaximumMember2024-03-310001838615srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberus-gaap:MeasurementInputEntityCreditRiskMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMembersrt:MaximumMemberus-gaap:MeasurementInputEntityCreditRiskMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:AlvariumTWMHAndTIGMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:AlvariumTWMHAndTIGMemberus-gaap:MeasurementInputPriceVolatilityMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:AlvariumTWMHAndTIGMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:MeasurementInputRevenueVolatilityMemberalti:ValuationTechniqueMonteCarloMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:MeasurementInputRevenueDiscountRateMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2024-03-310001838615alti:MeasurementInputLiabilityDiscountRateMemberus-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMemberalti:ValuationTechniqueBlackScholesMertonMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueBlackScholesMertonMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-310001838615us-gaap:FairValueInputsLevel3Memberalti:InvestmentsExternalStrategicManagersMember2023-12-310001838615srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:InvestmentsExternalStrategicManagersMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:InvestmentsExternalStrategicManagersMembersrt:MaximumMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputLongTermRevenueGrowthRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:InvestmentsExternalStrategicManagersMember2023-12-310001838615us-gaap:FairValueInputsLevel3Member2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberus-gaap:MeasurementInputPriceVolatilityMember2023-12-310001838615alti:MeasurementInputCorrelationMemberus-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMember2023-12-310001838615srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:MeasurementInputCostOfDebtRangeMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:MeasurementInputCostOfDebtRangeMembersrt:MaximumMember2023-12-310001838615srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberus-gaap:MeasurementInputEntityCreditRiskMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMembersrt:MaximumMemberus-gaap:MeasurementInputEntityCreditRiskMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:AlvariumTWMHAndTIGMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:AlvariumTWMHAndTIGMemberus-gaap:MeasurementInputPriceVolatilityMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:AlvariumTWMHAndTIGMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:MeasurementInputRevenueVolatilityMemberalti:ValuationTechniqueMonteCarloMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:MeasurementInputRevenueDiscountRateMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-12-310001838615alti:MeasurementInputLiabilityDiscountRateMemberus-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-12-310001838615us-gaap:FairValueInputsLevel3Memberalti:ValuationTechniqueMonteCarloMemberalti:MeasurementInputDeferredPaymentLiabilityDiscountRateMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-12-310001838615us-gaap:MutualFundMember2024-03-310001838615us-gaap:MutualFundMember2023-12-310001838615us-gaap:ExchangeTradedFundsMember2024-03-310001838615us-gaap:ExchangeTradedFundsMember2023-12-310001838615alti:TIGArbitrageAssociatesMasterFundMember2024-03-310001838615alti:TIGArbitrageAssociatesMasterFundMember2023-12-310001838615alti:TIGArbitrageEnhancedMasterFundMember2024-03-310001838615alti:TIGArbitrageEnhancedMasterFundMember2023-12-310001838615alti:TIGArbitrageEnhancedMember2024-03-310001838615alti:TIGArbitrageEnhancedMember2023-12-310001838615alti:ArkkanOpportunitiesFeederFundMember2024-03-310001838615alti:ArkkanOpportunitiesFeederFundMember2023-12-310001838615alti:ArkkanCapitalManagementLimitedMember2024-03-310001838615alti:ArkkanCapitalManagementLimitedMember2023-12-310001838615alti:ZebedeeAssetManagementMember2024-03-310001838615alti:ZebedeeAssetManagementMember2023-12-310001838615alti:RomspenInvestmentCorporationMember2024-03-310001838615alti:RomspenInvestmentCorporationMember2023-12-310001838615us-gaap:RealEstateInvestmentMember2024-03-310001838615us-gaap:RealEstateInvestmentMember2023-12-310001838615alti:WealthManagementInvestmentAdvisoryInvestmentMember2024-03-310001838615alti:WealthManagementInvestmentAdvisoryInvestmentMember2023-12-310001838615alti:CarriedInterestVehiclesMember2024-03-310001838615alti:CarriedInterestVehiclesMember2023-12-310001838615us-gaap:CustomerRelationshipsMember2024-03-310001838615alti:InvestmentManagementAgreementsMember2024-03-310001838615us-gaap:TradeNamesMember2024-03-310001838615us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-03-310001838615alti:InvestmentManagementAgreementsMember2024-03-310001838615us-gaap:CustomerRelationshipsMember2023-12-310001838615us-gaap:CustomerRelationshipsMember2023-01-012023-12-310001838615alti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupNotDiscontinuedOperationsMemberus-gaap:CustomerRelationshipsMember2023-12-310001838615us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberalti:FamilyOfficeServiceFOSMemberus-gaap:CustomerRelationshipsMember2023-12-310001838615alti:InvestmentManagementAgreementsMember2023-12-310001838615alti:InvestmentManagementAgreementsMember2023-01-012023-12-310001838615alti:InvestmentManagementAgreementsMemberalti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupNotDiscontinuedOperationsMember2023-12-310001838615alti:InvestmentManagementAgreementsMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberalti:FamilyOfficeServiceFOSMember2023-12-310001838615us-gaap:TradeNamesMember2023-12-310001838615us-gaap:TradeNamesMember2023-01-012023-12-310001838615alti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupNotDiscontinuedOperationsMemberus-gaap:TradeNamesMember2023-12-310001838615us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberalti:FamilyOfficeServiceFOSMemberus-gaap:TradeNamesMember2023-12-310001838615us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001838615us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-01-012023-12-310001838615us-gaap:SoftwareAndSoftwareDevelopmentCostsMemberalti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupNotDiscontinuedOperationsMember2023-12-310001838615us-gaap:SoftwareAndSoftwareDevelopmentCostsMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberalti:FamilyOfficeServiceFOSMember2023-12-310001838615us-gaap:OtherIntangibleAssetsMember2023-12-310001838615us-gaap:OtherIntangibleAssetsMember2023-01-012023-12-310001838615us-gaap:OtherIntangibleAssetsMemberalti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupNotDiscontinuedOperationsMember2023-12-310001838615us-gaap:OtherIntangibleAssetsMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberalti:FamilyOfficeServiceFOSMember2023-12-310001838615alti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupNotDiscontinuedOperationsMember2023-12-310001838615alti:InvestmentManagementAgreementsMember2023-12-310001838615us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberalti:LXiReitAdvisorsLimitedLRAMemberalti:FundManagementMemberalti:LondonMetricPropertyPlcMemberalti:StrategicAlternativesSegmentMember2023-01-012023-12-310001838615us-gaap:LeaseholdImprovementsMember2024-03-310001838615us-gaap:LeaseholdImprovementsMember2023-12-310001838615alti:OfficeEquipmentAndFurnitureMember2024-03-310001838615alti:OfficeEquipmentAndFurnitureMember2023-12-310001838615us-gaap:OtherAssetsMemberus-gaap:RelatedPartyMember2024-03-310001838615us-gaap:OtherAssetsMemberus-gaap:RelatedPartyMember2023-12-310001838615srt:ScenarioPreviouslyReportedMemberalti:AlTiWealthManagementSwitzerlandSAAWMSMember2023-12-310001838615srt:ScenarioPreviouslyReportedMember2023-12-310001838615us-gaap:RelatedPartyMember2024-03-310001838615us-gaap:RelatedPartyMember2023-12-310001838615alti:StrategicAlternativesSegmentMember2023-12-310001838615alti:StrategicAlternativesSegmentMember2024-01-012024-03-310001838615alti:WealthManagementSegmentMember2024-01-012024-03-310001838615alti:StrategicAlternativesSegmentMember2024-03-310001838615alti:StrategicAlternativesSegmentMember2022-12-310001838615alti:WealthManagementSegmentMember2022-12-310001838615alti:StrategicAlternativesSegmentMember2023-01-012023-12-310001838615alti:WealthManagementSegmentMember2023-01-012023-12-310001838615srt:ScenarioPreviouslyReportedMemberalti:StrategicAlternativesSegmentMember2023-12-310001838615srt:ScenarioPreviouslyReportedMemberalti:WealthManagementSegmentMember2023-12-3100018386152023-07-012023-09-300001838615alti:CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2024-03-310001838615alti:CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-12-310001838615alti:CreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-03-310001838615alti:CreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001838615us-gaap:LineOfCreditMember2024-03-310001838615us-gaap:LineOfCreditMember2023-12-310001838615alti:CreditFacilityMemberus-gaap:LineOfCreditMember2023-01-030001838615alti:CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-01-030001838615alti:CreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-030001838615srt:MinimumMemberalti:CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberus-gaap:BaseRateMember2023-01-032023-01-030001838615alti:CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberus-gaap:BaseRateMembersrt:MaximumMember2023-01-032023-01-030001838615srt:MinimumMemberalti:CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-032023-01-030001838615alti:CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-032023-01-030001838615alti:CreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-11-100001838615alti:CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2024-02-222024-02-220001838615us-gaap:OtherAssetsMemberus-gaap:RelatedPartyMemberalti:TMWHTIGGPAndTIGMGMTMembersMember2024-03-310001838615us-gaap:OtherAssetsMemberus-gaap:RelatedPartyMemberalti:TMWHTIGGPAndTIGMGMTMembersMember2023-12-310001838615us-gaap:OtherAssetsMemberus-gaap:EquityMethodInvesteeMember2024-03-310001838615us-gaap:OtherAssetsMemberus-gaap:EquityMethodInvesteeMember2023-12-310001838615alti:FeesReceivableMemberus-gaap:RelatedPartyMemberalti:ContractWithCustomerReceivableAfterAllowanceForCreditLossMember2024-03-310001838615alti:FeesReceivableMemberus-gaap:RelatedPartyMemberalti:ContractWithCustomerReceivableAfterAllowanceForCreditLossMember2023-12-310001838615alti:FeesReceivableMemberalti:TIGMemberus-gaap:RelatedPartyMemberalti:ContractWithCustomerReceivableAfterAllowanceForCreditLossMember2024-03-310001838615alti:FeesReceivableMemberalti:TIGMemberus-gaap:RelatedPartyMemberalti:ContractWithCustomerReceivableAfterAllowanceForCreditLossMember2023-12-310001838615alti:TWMHMembersTIGGPMembersAndTIGMGMTMembersMemberus-gaap:RelatedPartyMemberus-gaap:OtherLiabilitiesMember2024-03-310001838615alti:TWMHMembersTIGGPMembersAndTIGMGMTMembersMemberus-gaap:RelatedPartyMemberus-gaap:OtherLiabilitiesMember2023-12-310001838615alti:NonControllingInterestHoldersTaxReceivableAgreementsMemberus-gaap:RelatedPartyMemberalti:TaxReceivableAgreementLiabilityMember2024-03-310001838615alti:NonControllingInterestHoldersTaxReceivableAgreementsMemberus-gaap:RelatedPartyMemberalti:TaxReceivableAgreementLiabilityMember2023-12-310001838615alti:DelayedSharePurchaseAgreementMemberus-gaap:RelatedPartyMember2024-03-310001838615alti:DelayedSharePurchaseAgreementMemberus-gaap:RelatedPartyMember2023-12-310001838615alti:EmployeeRelatedLiabilitiesMemberus-gaap:RelatedPartyMember2024-03-310001838615alti:EmployeeRelatedLiabilitiesMemberus-gaap:RelatedPartyMember2023-12-310001838615alti:TWMHTIGGPAndTIGMGMTMembersAndAlvariumShareholdersEarnOutMemberus-gaap:RelatedPartyMemberalti:BusinessCombinationContingentConsiderationLiabilityMember2024-03-310001838615alti:TWMHTIGGPAndTIGMGMTMembersAndAlvariumShareholdersEarnOutMemberus-gaap:RelatedPartyMemberalti:BusinessCombinationContingentConsiderationLiabilityMember2023-12-310001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMemberus-gaap:RelatedPartyMemberalti:BusinessCombinationContingentConsiderationLiabilityMember2024-03-310001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMemberus-gaap:RelatedPartyMemberalti:BusinessCombinationContingentConsiderationLiabilityMember2023-12-310001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMemberus-gaap:RelatedPartyMemberus-gaap:OtherLiabilitiesMember2024-03-310001838615alti:AlTiWealthManagementSwitzerlandSAAWMSMemberus-gaap:RelatedPartyMemberus-gaap:OtherLiabilitiesMember2023-12-310001838615us-gaap:OtherLiabilitiesMemberus-gaap:EquityMethodInvesteeMember2024-03-310001838615us-gaap:OtherLiabilitiesMemberus-gaap:EquityMethodInvesteeMember2023-12-310001838615alti:PromissoryNotesMemberus-gaap:RelatedPartyMemberalti:TWMHMembersMember2022-12-310001838615alti:PromissoryNotesMemberus-gaap:RelatedPartyMemberalti:TWMHMembersMember2022-01-012022-12-310001838615alti:PromissoryNotesMemberus-gaap:RelatedPartyMemberalti:TWMHMembersMember2024-01-012024-03-310001838615alti:PromissoryNotesMemberus-gaap:RelatedPartyMemberalti:TWMHMembersMember2023-01-012023-03-310001838615alti:PromissoryNotesMemberus-gaap:RelatedPartyMemberalti:TWMHMembersMember2024-03-310001838615alti:PromissoryNotesMemberus-gaap:RelatedPartyMemberalti:TWMHMembersMember2023-12-310001838615alti:TiedemannWealthManagementHoldingsLLCMemberalti:TiedemannInternationalHoldingsAGTIHMember2023-07-272023-07-270001838615us-gaap:EquityMethodInvesteeMemberalti:ManagementAdvisoryFeesMember2024-01-012024-03-310001838615alti:OtherFeesIncomeMemberus-gaap:EquityMethodInvesteeMember2024-01-012024-03-310001838615us-gaap:EquityMethodInvesteeMember2024-01-012024-03-310001838615us-gaap:EquityMethodInvesteeMemberalti:ManagementAdvisoryFeesMember2023-01-012023-03-310001838615us-gaap:EquityMethodInvesteeMember2023-01-012023-03-310001838615alti:OtherFeesIncomeMemberus-gaap:EquityMethodInvesteeMember2023-01-012023-03-310001838615alti:TMWHTIGGPAndTIGMGMTMembersMember2024-03-310001838615alti:AlvariumTWMHAndTIGMemberalti:EarnoutLiabilityMember2023-01-012023-03-310001838615alti:StrategicAlternativesSegmentMemberalti:ManagementAdvisoryFeesMember2024-01-012024-03-310001838615alti:WealthManagementSegmentMemberalti:ManagementAdvisoryFeesMember2024-01-012024-03-310001838615alti:StrategicAlternativesSegmentMemberalti:ManagementAdvisoryFeesMember2023-01-012023-03-310001838615alti:WealthManagementSegmentMemberalti:ManagementAdvisoryFeesMember2023-01-012023-03-310001838615alti:StrategicAlternativesSegmentMemberalti:IncentiveFeesMember2024-01-012024-03-310001838615alti:IncentiveFeesMemberalti:WealthManagementSegmentMember2024-01-012024-03-310001838615alti:StrategicAlternativesSegmentMemberalti:IncentiveFeesMember2023-01-012023-03-310001838615alti:IncentiveFeesMemberalti:WealthManagementSegmentMember2023-01-012023-03-310001838615alti:StrategicAlternativesSegmentMemberalti:DistributionsFromInvestmentsMember2024-01-012024-03-310001838615alti:DistributionsFromInvestmentsMemberalti:WealthManagementSegmentMember2024-01-012024-03-310001838615alti:StrategicAlternativesSegmentMemberalti:DistributionsFromInvestmentsMember2023-01-012023-03-310001838615alti:DistributionsFromInvestmentsMemberalti:WealthManagementSegmentMember2023-01-012023-03-310001838615alti:OtherFeesIncomeMemberalti:StrategicAlternativesSegmentMember2024-01-012024-03-310001838615alti:OtherFeesIncomeMemberalti:WealthManagementSegmentMember2024-01-012024-03-310001838615alti:OtherFeesIncomeMemberalti:StrategicAlternativesSegmentMember2023-01-012023-03-310001838615alti:OtherFeesIncomeMemberalti:WealthManagementSegmentMember2023-01-012023-03-310001838615alti:StrategicAlternativesSegmentMember2023-01-012023-03-310001838615alti:WealthManagementSegmentMember2023-01-012023-03-310001838615alti:ClassBCommonStockAndClassBUnitsMember2024-01-012024-03-310001838615alti:ClassBCommonStockAndClassBUnitsMember2023-01-012023-03-310001838615us-gaap:WarrantMember2024-01-012024-03-310001838615us-gaap:WarrantMember2023-01-012023-03-310001838615alti:EarnOutsMember2024-01-012024-03-310001838615alti:EarnOutsMember2023-01-012023-03-310001838615alti:AlvariumTWMHAndTIGMember2024-03-310001838615alti:AlvariumTWMHAndTIGMember2023-12-310001838615us-gaap:SubsequentEventMember2024-04-1200018386152022-06-302023-12-310001838615us-gaap:SubsequentEventMemberalti:EastEndAdvisorsLLCMemberalti:EEAHoldingCompanyLLCMember2024-04-010001838615us-gaap:SubsequentEventMemberalti:EastEndAdvisorsLLCMemberalti:EEAHoldingCompanyLLCMember2024-04-012024-04-010001838615us-gaap:SubsequentEventMemberalti:PointwisePartnersLimitedPointwiseMember2024-05-090001838615alti:PointwisePartnersLimitedPointwiseMember2024-03-310001838615us-gaap:SubsequentEventMemberalti:PointwisePartnersLimitedPointwiseMember2024-05-092024-05-090001838615alti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberalti:WealthManagementSegmentMember2023-11-060001838615us-gaap:SubsequentEventMemberalti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberalti:WealthManagementSegmentMember2024-05-082024-05-080001838615us-gaap:SubsequentEventMemberalti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberalti:WealthManagementSegmentMember2024-05-100001838615alti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberalti:WealthManagementSegmentMember2024-01-012024-03-310001838615alti:EnvoiLLCEnvoiMembersrt:ScenarioForecastMember2024-07-012024-07-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission file number 001-40103

AlTi Global, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware | 92-1552220 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

520 Madison Avenue, 26th Floor New York, New York | 10022 |

(Address of Principal Executive Offices) | (Zip Code) |

(212) 396-5904

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | ALTI | Nasdaq Capital Market |

| | |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The registrant had outstanding 71,742,444 shares of Class A Common Stock (as defined herein) and 48,265,195 shares of Class B Common Stock (as defined herein) as of May 10, 2024.

Table of Contents

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

Condensed Consolidated Statement of Comprehensive Income (Loss) (Unaudited) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 77 |

| |

| |

Defined Terms

Capitalized terms used herein but not otherwise defined herein shall have the respective meanings ascribed to them in the Amended and Restated Business Combination Agreement, a copy of which is attached as Exhibit 2.1 to our Current Report on Form 8-K filed October 26, 2022.

•“AFM UK” means Alvarium Fund Managers (UK) Limited, an English private limited company.

•“AHRA” means “Alvarium Home REIT Advisors Limited”, an English private limited company.

•“Alvarium” means AlTi Asset Management Holdings 2 Limited, formerly known as Alvarium Investments Limited, an English private limited company.

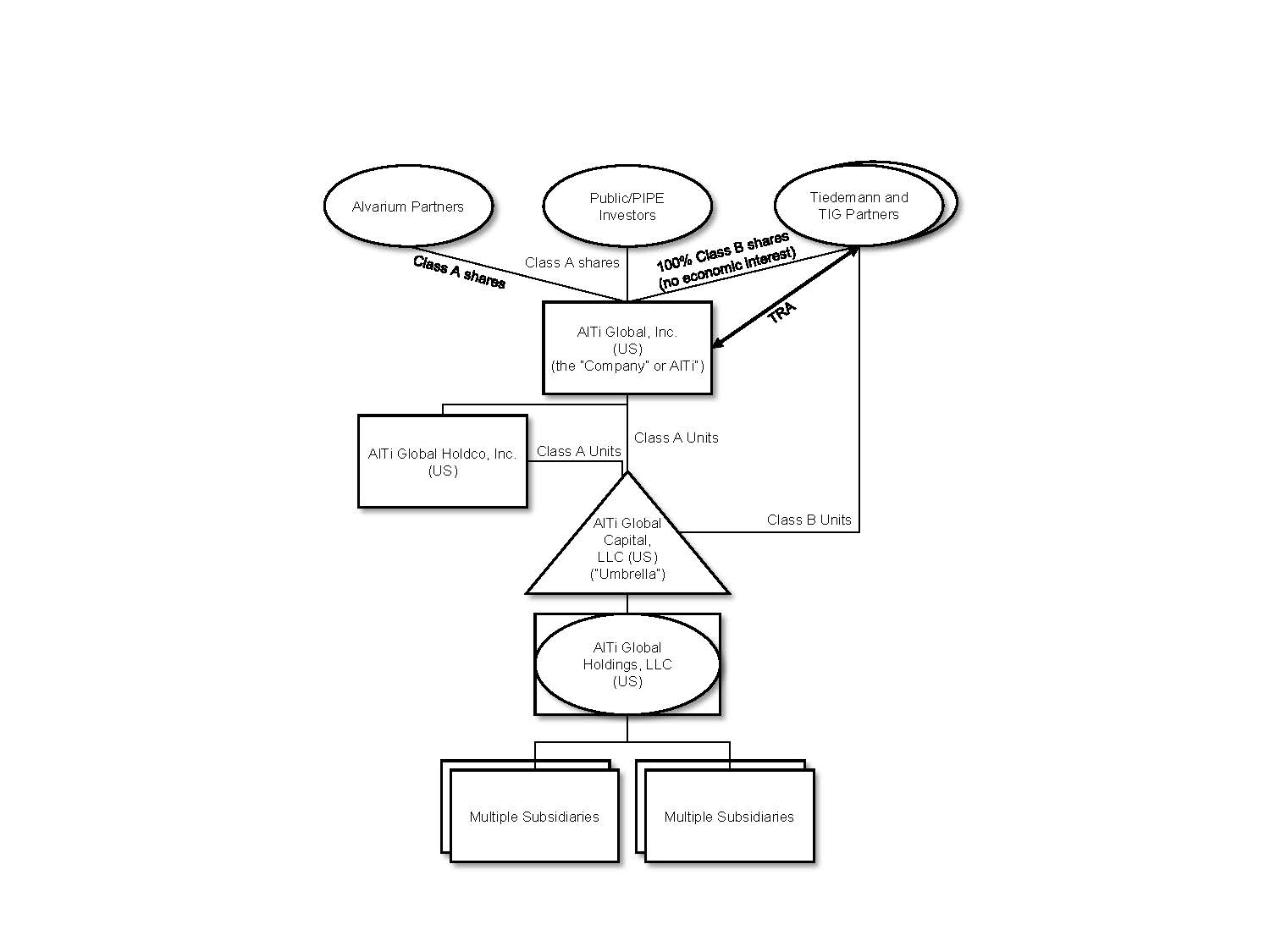

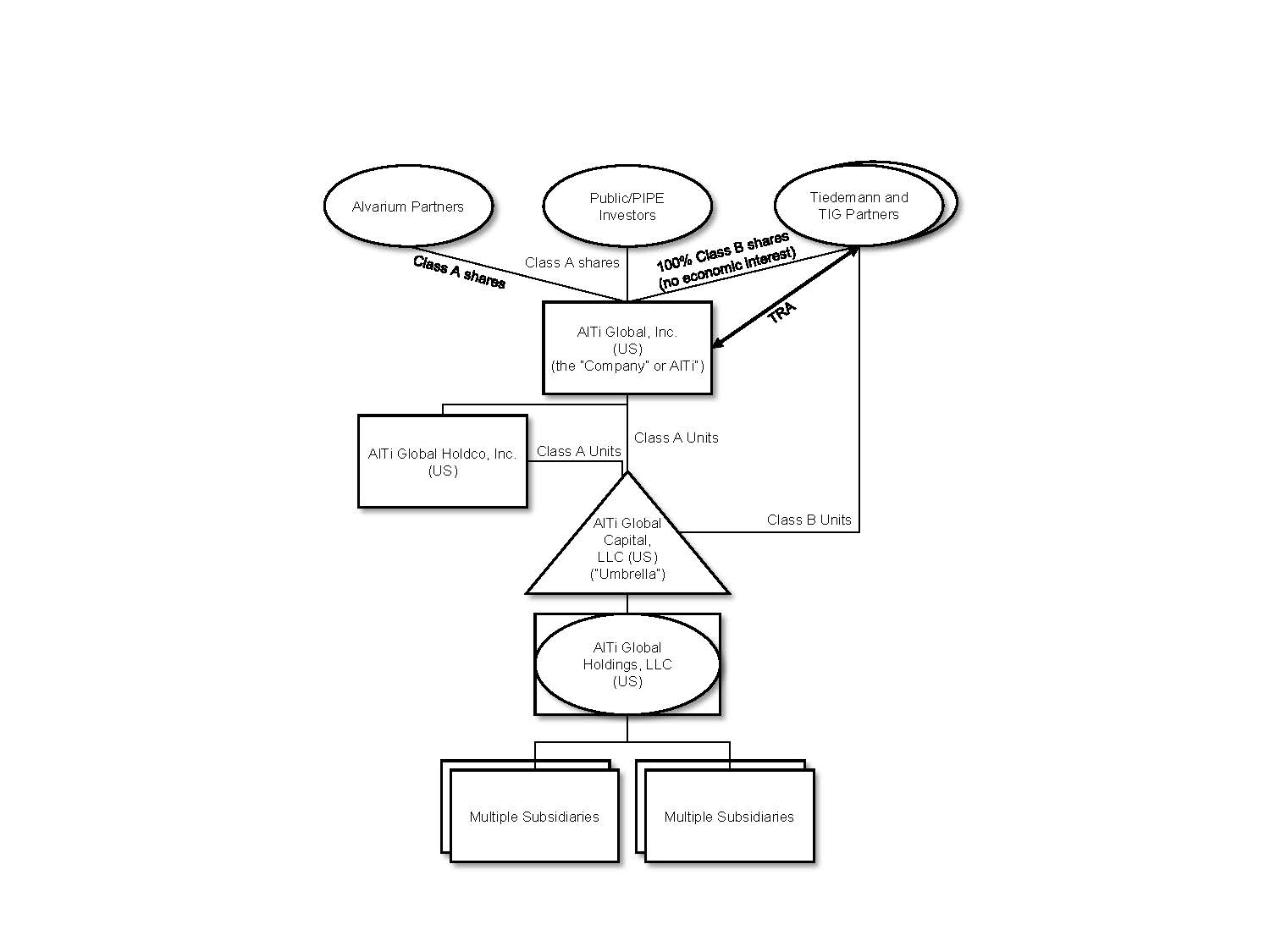

•“AlTi” means AlTi Global, Inc., together with its consolidated subsidiaries.

•“Alvarium Shareholders” means the shareholders of Alvarium.

•“Alvarium Tiedemann” means the Company, prior to being renamed “AlTi Global, Inc.”

•“AlTi Global Topco” means AlTi Global Topco Limited, formerly known as Alvarium Topco, an Isle of Man entity which was established by Alvarium and owned by the Alvarium Shareholders.

•“ARE” means AlTi RE Limited, formerly known as Alvarium RE Limited, an English private limited company.

•“AUA” means assets under advisement.

•“AUM” means assets under management.

•“Business Combination” means the transactions contemplated by the Business Combination Agreement.

•“Business Combination Agreement” means the Amended and Restated Business Combination Agreement, dated as of October 25, 2022, by and among Cartesian, Umbrella Merger Sub, TWMH, TIG GP, TIG MGMT, Alvarium and Umbrella.

•“Business Combination Earn-out” means the Sponsor and the selling shareholders of TWMH, TIG, and Alvarium became entitled to receive earn-out shares contingent on various share price milestones upon Closing under the terms of the Business Combination.

•“Business Combination Earn-out Period” means the five years immediately after the Closing Date.

•“Business Combination Earn-out Securities” means the earn-out shares of Class A Common Stock in the Company and Class B Common Units that may be issued or become tradeable upon the achievement of certain stock price-based vesting conditions in accordance with the terms of the Business Combination Agreement.

•“Cartesian” means Cartesian Growth Corporation, a Cayman Islands exempted company, prior to the Business Combination.

•“Cayman Islands Companies Act” means the Cayman Islands Companies Act (as revised) of the Cayman Islands, as the same may be amended from time to time.

•“Class A Common Stock” means the Class A Common Stock, par value $0.0001 per share, of the Company, including any shares of such Class A Common Stock issuable upon the exercise of any warrant or other right to acquire shares of such Class A Common Stock.

•“Class B Common Stock” means the Class B Common Stock, par value $0.0001 per share, of the Company, including any shares of such Class B Common Stock issuable upon the exercise of any warrant or other right to acquire shares of such Class B Common Stock.

•“Class B Paired Interest” means a Class B Unit together with a share of Class B Common Stock.

•“Class B Units” means the limited liability company interests in Umbrella designated as Class B Common Units in the Umbrella LLC Agreement.

•“Closing” means the closing of the Business Combination.

•“Closing Date” means January 3, 2023, the date on which the Closing occurred.

•“Common Stock” refers to shares of the Class A Common Stock and the Class B Common Stock, collectively.

•“Company,” “our,” “we” or “us” means, prior to the Business Combination, Cartesian, as the context suggests, and, following the Business Combination, AlTi.

•“Condensed Consolidated Statement of Financial Position” refers to the consolidated balance sheet of AlTi Global, Inc.

•“Condensed Consolidated Statement of Operations” refers to the consolidated income statement of AlTi Global, Inc.

•“DGCL” refers to the Delaware General Corporation Law, as amended.

•“dollars” or “$” refers to U.S. dollars.

•“Domestication” means the continuation of Cartesian by way of domestication into a Delaware corporation, with the ordinary shares of Cartesian becoming shares of common stock of the Delaware corporation under the applicable provisions of the Cayman Islands Companies Act and the DGCL; the term includes all matters and necessary or ancillary changes in order to effect such Domestication, including the adoption of the Company’s certificate of incorporation consistent with the DGCL and changing the name and registered office of Cartesian.

•“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

•“External Strategic Managers” means global alternative asset managers with whom we partner by making strategic investments in which we actively participate in seeking to leverage the collective resources and synergies of the businesses to facilitate their growth.

•“Federal Reserve” means the Board of Governors of the Federal Reserve System.

•“FOS” means Family Office Service.

•"HLIF” means “Home Long Income Fund”, a private fund regulated by the UK FCA.

•“HNWI” means high net worth individual, being an individual having investable assets of $1 million or more, excluding primary residence, collectibles, consumables, and consumer durables.

•“Holbein” means Holbein Partners, LLP.

•“Home REIT” means “Home REIT plc”, a real estate investment trust listed on the London Stock Exchange.

•“Impact Investing” means investment practices seeking to generate various levels of financial performance together with the generation of positive measurable environmental and social impacts.

•“Nasdaq” means the Nasdaq Capital Market.

•“NAV” means net asset value.

•“PIPE Investors” means the subscribers that agreed to purchase shares of Class A Common Stock at the Closing pursuant to the private placements, including without limitation, as reflected in the subscription agreements between Cartesian and each of the PIPE Investors.

•“SEC” means the United States Securities and Exchange Commission.

•“SHIA” means Social Housing Income Advisors Limited, an English private limited company.

•“Sponsor” means CGC Sponsor LLC, a Cayman Islands limited liability company.

•“Strategic Alternatives” means the segment that includes the Company's alternatives platform, public and private real estate, and co-investment business, formerly known as Asset Management.

•“Target Companies” means, collectively, TWMH, TIG GP, TIG MGMT, and Alvarium.

•“Tax Receivable Agreement” or “TRA” means that certain Tax Receivable Agreement, dated as of January 3, 2023, by and among the Company and the TWMH Members, the TIG GP Members, and the TIG MGMT Members.

•“TIG” means, collectively, the TIG Entities and their subsidiaries and their predecessor entities where applicable.

•“TIG Entities” means, collectively, TIG GP and TIG MGMT and their predecessor entities where applicable.

•“TIG GP” means TIG Trinity GP, LLC, a Delaware limited liability company.

•“TIG GP Members” means the former members of TIG GP.

•“TIG MGMT” means TIG Trinity Management, LLC, a Delaware limited liability company.

•“TIG MGMT Members” means the former members of TIG MGMT.

•“TIH” means Tiedemann International Holdings, AG.

•“TRA Exchange” means the series of transactions in which certain holders of Class B Units and Class B Common Stock exchanged a portion of such interests to the Company, in exchange for Class A Common Stock.

•“TWMH” means, collectively, Tiedemann Wealth Management Holdings, LLC, a Delaware limited liability company, and its subsidiaries, and their predecessor entities where applicable.

•“TWMH Members” means the former members of TWMH.

•“UHNW” means ultra high net worth individual, being an individual having investable assets of $30 million or more, excluding primary residence, collectibles, consumables, and consumer durables.

•“UK FCA” means the United Kingdom’s Financial Conduct Authority.

•“Umbrella” means AlTi Global Capital, LLC (formerly known as Alvarium Tiedemann Capital, LLC), a Delaware limited liability company.

•“Umbrella LLC Agreement” means the Third Amended and Restated Limited Liability Company Agreement of AlTi Global Capital, LLC, effective as of July 31, 2023.

•“Umbrella Merger Sub” means Rook MS, LLC, a Delaware limited liability company.

•“US GAAP” means United States generally accepted accounting principles, consistently applied.

•“Warrants” means the warrants, which were initially issued in Cartesian’s initial public offering of its units pursuant to its registration statement on Form S-1 declared effective by the SEC on February 23, 2021, entitling the holder thereof to purchase one of Cartesian’s Class A ordinary shares at an exercise price of $11.50, subject to adjustment.

•“Wealth Management” means the segment that consists of the Company’s investment management and advisory services, trusts and administrative services, and family office services.

Available Information

We file annual, quarterly and current reports, proxy statements and other information required by the Exchange Act with the SEC. We make available free of charge on our website (www.alti-global.com) our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other filings as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. We also use our website to distribute company information, including assets under management and performance information, and such information as may be deemed material. Accordingly, investors should monitor our website, in addition to our press releases, SEC filings and public conference calls and webcasts.

Also posted on our website in the “Investor Relations” section are the charters for our Audit, Finance and Risk Committee, Environmental, Social, Governance and Nominating Committee, and Human Capital and Compensation Committee, as well as our Corporate Governance Guidelines and Code of Business Conduct governing our directors, officers, and employees. Information on or accessible through our website is not a part of or incorporated into this Quarterly Report on Form 10-Q for the period ended March 31, 2024 (the “Quarterly Report”) or any other SEC filing. Copies of our SEC filings or corporate governance materials are available without charge upon written request to the Company at its principal place of business. Any materials we file with the SEC are also publicly available through the SEC’s website (www.sec.gov).

No statements herein, available on our website, or in any of the materials we file with the SEC constitute or should be viewed as constituting an offer to sell, or a solicitation of an offer to buy, securities in any jurisdiction.

Cautionary Note Regarding Forward-Looking Statements

This Quarterly Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, which reflect our current views with respect to, among other things, future events, operations and financial performance. You can identify these forward-looking statements by the use of forward-looking words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “projects,” “intends,” “plans,” “estimates,” “anticipates,” “target” or the negative version of those words, other comparable words or other statements that do not relate to historical or factual matters. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward-looking statements are subject to various risks, uncertainties (some of which are beyond our control) or other assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Some of these factors are described under the headings “Part II. Item 1A. Risk Factors” and “Part I. Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These factors should not be construed as exhaustive and should be read in conjunction with the risk factors and other cautionary statements that are included in this Quarterly Report and in our other periodic filings. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from those indicated in these forward-looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. We do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

AlTi Global, Inc.

Condensed Consolidated Statement of Financial Position (Unaudited)

| | | | | | | | | | | |

| (Dollars in Thousands, except share data) | As of March 31,

2024 | | As of December 31,

2023 |

| | | |

| Assets | | | |

| Cash and cash equivalents | $ | 134,237 | | | $ | 15,348 | |

Fees receivable, net (includes $1,199 and $16,069 of related party receivables, respectively) | 35,087 | | | 70,421 | |

| | | |

| | | |

| | | |

| Investments at fair value | 160,469 | | | 165,894 | |

| Equity method investments | 12,137 | | | 14,194 | |

| | | |

| Intangible assets, net of accumulated amortization | 432,247 | | | 435,677 | |

| Goodwill | 408,209 | | | 411,634 | |

| Operating lease right-of-use assets | 48,851 | | | 48,313 | |

| | | |

| | | |

| Other assets, net | 53,740 | | | 48,182 | |

| Contingent consideration receivable | 1,931 | | | — | |

| Assets held for sale | 13,030 | | | 56,634 | |

| Total assets | $ | 1,299,938 | | | $ | 1,266,297 | |

| | | |

| Liabilities | | | |

| Accounts payable and accrued expenses | $ | 31,930 | | | $ | 37,156 | |

| Accrued compensation and profit sharing | 36,016 | | | 61,768 | |

| Accrued member distributions payable | 4,618 | | | 7,271 | |

| Warrant liabilities, at fair value | 2,820 | | | — | |

| Earn-out liability, at fair value | 23,920 | | | 63,444 | |

| | | |

TRA liability (includes $7,300 and $13,233 at fair value, respectively) | 24,933 | | | 17,607 | |

| Delayed share purchase agreement | — | | | 1,818 | |

| Earn-in consideration payable | 1,711 | | | 1,830 | |

| Operating lease liabilities | 57,476 | | | 56,123 | |

| | | |

| Debt, net of unamortized deferred financing cost | 183,663 | | | 186,353 | |

| Deferred tax liability, net | 7,785 | | | 14,109 | |

| Deferred income | 48 | | | 66 | |

| Other liabilities, net | 23,208 | | | 22,467 | |

| Liabilities held for sale | 3,467 | | | 13,792 | |

| Total liabilities | $ | 401,595 | | | $ | 483,804 | |

| | | |

| Commitments and contingencies (Note 19) | | | |

| | | |

| Mezzanine Equity | | | |

Series C Redeemable Cumulative Convertible Preferred stock, $0.0001 par value, 150,000 authorized, 115,000 and 0 shares issued and outstanding, respectively | 115,093 | | | — | |

| | | |

| Shareholders' Equity | | | |

| | | |

Common stock, Class A, $0.0001 par value, 875,000,000 authorized, 71,064,411 and 65,110,875 issued and outstanding, respectively | 7 | | | 7 | |

Common stock, Class B, $0.0001 par value, 150,000,000 authorized, 48,265,195 and 53,219,713 issued and outstanding, respectively | — | | | — | |

| Additional paid-in capital | 553,717 | | | 536,509 | |

| Retained earnings (accumulated deficit) | (164,178) | | | (193,527) | |

| | | |

| | | |

| Accumulated other comprehensive income (loss) | 6,299 | | | 9,155 | |

| Total AlTi Global, Inc. shareholders' equity | 510,938 | | | 352,144 | |

| Non-controlling interest in subsidiaries | 387,405 | | | 430,349 | |

| Total shareholders' equity | 898,343 | | | 782,493 | |

| Total liabilities, mezzanine equity, and shareholders' equity | $ | 1,299,938 | | | $ | 1,266,297 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

AlTi Global, Inc.

Condensed Consolidated Statement of Operations (Unaudited)

| | | | | | | | | | | | | | | |

| | | For the Three Months Ended |

| (Dollars in Thousands) | | | | | March 31, 2024 | | March 31, 2023 |

| Revenue | | | | | | | |

| Management/advisory fees | | | | | $ | 46,224 | | | $ | 46,470 | |

| Incentive fees | | | | | 163 | | | 577 | |

| Distributions from investments | | | | | 4,170 | | | 10,030 | |

| Other income/fees | | | | | 255 | | | 970 | |

| Total income | | | | | 50,812 | | | 58,047 | |

| Operating Expenses | | | | | | | |

| Compensation and employee benefits | | | | | 39,557 | | | 63,172 | |

| Systems, technology and telephone | | | | | 4,314 | | | 3,828 | |

| Sales, distribution and marketing | | | | | 765 | | | 526 | |

| Occupancy costs | | | | | 3,477 | | | 3,180 | |

| Professional fees | | | | | 11,370 | | | 22,884 | |

| Travel and entertainment | | | | | 1,411 | | | 1,946 | |

| Depreciation and amortization | | | | | 2,567 | | | 4,517 | |

| General, administrative and other | | | | | 2,019 | | | 1,432 | |

| Total operating expenses | | | | | 65,480 | | | 101,485 | |

| Total operating income (loss) | | | | | (14,668) | | | (43,438) | |

| Other Income (Expenses) | | | | | | | |

| | | | | | | |

| Gain (loss) on investments | | | | | (3,661) | | | 3,068 | |

| Gain (loss) on TRA | | | | | 5,933 | | | 81 | |

| Loss on warrant liability | | | | | (340) | | | (12,942) | |

| | | | | | | |

| Gain (loss) on earnout liability | | | | | 39,454 | | | (29,206) | |

| Interest expense | | | | | (4,840) | | | (3,261) | |

| Interest income | | | | | 260 | | | — | |

| Other income (expense) | | | | | (30) | | | 58 | |

| Income (loss) before taxes | | | | | 22,108 | | | (85,640) | |

| Income tax (expense) benefit | | | | | (363) | | | (4,650) | |

| Net income (loss) | | | | | 21,745 | | | (90,290) | |

| Net loss (income) attributed to non-controlling interests in subsidiaries | | | | | (7,604) | | | (21,550) | |

| Net income (loss) attributable to AlTi Global, Inc. | | | | | $ | 29,349 | | | $ | (68,740) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net Income (Loss) Per Share | | | | | | | |

| Basic | | | | | $ | 0.38 | | | $ | (1.19) | |

| Diluted | | | | | $ | 0.18 | | | $ | (1.19) | |

| Weighted Average Shares of Class A Common Stock Outstanding | | | | | | | |

| Basic | | | | | 66,718,427 | | | 57,546,811 | |

| Diluted | | | | | 120,561,316 | | | 57,546,811 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

AlTi Global, Inc.

Condensed Consolidated Statement of Comprehensive Income (Loss) (Unaudited)

| | | | | | | | | | | | | | | |

| | | For the Three Months Ended |

| (Dollars in Thousands) | | | | | March 31, 2024 | | March 31, 2023 |

| Net income (loss) | | | | | 21,745 | | | (90,290) | |

| Other Comprehensive Income (Loss) | | | | | | | |

| | | | | | | |

| Foreign currency translation adjustments | | | | | (3,989) | | | 9,671 | |

| Other comprehensive income (loss) | | | | | (88) | | | — | |

| Total comprehensive income (loss) | | | | | 17,668 | | | (80,619) | |

| Other loss attributed to non-controlling interests in subsidiaries | | | | | (9,640) | | | (16,820) | |

| Comprehensive income (loss) attributable to AlTi Global, Inc. | | | | | 27,308 | | | (63,799) | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

AlTi Global, Inc.

Condensed Consolidated Statement of Changes in Mezzanine Equity and Shareholders’ Equity (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mezzanine Equity | | Shareholders’ Equity |

| (Dollars in Thousands, except share data) | | Preferred Stock | | Class A Common Stock | | Class B Common Stock | | Additional paid-in-capital | | Retained earnings (accumulated deficit) | | Accumulated other comprehensive income | | Non-controlling interest in subsidiaries | | Total Shareholders' Equity |

| | Shares | | Amount

| | Shares | | Amount | | Shares | | Amount | | | | | | | | | | |

| Balance at January 1, 2024 | | — | | | — | | | 65,110,875 | | | $ | 7 | | | 53,219,713 | | | $ | — | | | $ | 536,509 | | | $ | (193,527) | | | $ | 9,155 | | | $ | 430,349 | | | $ | 782,493 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 29,349 | | | — | | | (7,604) | | | 21,745 | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,989) | | | (2,000) | | | (3,989) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (52) | | | (36) | | | (88) | |

| Payment for partner's tax | | — | | | — | | | — | | | — | | | — | | | — | | | (29) | | | — | | | — | | | — | | | (29) | |

| Issuance of preferred shares, net of issuance costs | | 115,000 | | | 111,158 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 111,158 | |

| Preferred share dividend | | | | 3,935 | | | — | | | — | | | — | | | — | | | (3,935) | | | — | | | — | | | — | | | — | |

| Issuance of shares for business combination | | — | | | — | | | — | | | — | | | — | | | — | | | (686) | | | — | | | — | | | — | | | (686) | |

| Share based compensation | | — | | | — | | | — | | | — | | | — | | | — | | | 2,624 | | | — | | | — | | | — | | | 2,624 | |

| Shares issued to employees on vesting of equity awards | | — | | | — | | | 999,018 | | | — | | | — | | | — | | | (4,037) | | | — | | | — | | | — | | | (4,037) | |

| TRA Exchange | | — | | | — | | | 4,954,518 | | | — | | | (4,954,518) | | — | | — | | | 23,271 | | | — | | | — | | | (32,749) | | | (9,478) | |

| LXi deconsolidation | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (815) | | | (555) | | | (1,370) | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Balance at March 31, 2024 | | 115,000 | | | $ | 115,093 | | | 71,064,411 | | | $ | 7 | | | 48,265,195 | | | $ | — | | | $ | 553,717 | | | $ | (164,178) | | | $ | 6,299 | | | $ | 387,405 | | | $ | 898,343 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shareholders’ Equity |

| (Dollars in Thousands, except share data) | | Class A Common Stock | | Class B Common Stock | | Additional paid-in-capital | | Retained earnings (accumulated deficit) | | Accumulated other comprehensive income | | Non-controlling interest in subsidiaries | | Total Shareholders' Equity |

| | Shares | | Amount | | Shares | | Amount | | | | | | | | | | |

| Balance at January 1, 2023 | | 55,388,023 | | | $ | 6 | | | 55,032,961 | | | $ | — | | | $ | 435,859 | | | $ | (27,946) | | | $ | — | | | $ | 606,989 | | | $ | 1,014,908 | |

Issuance of shares to Alvarium Employee Benefit Trust

| | 2,100,000 | | | — | | | — | | | — | | | 21,000 | | | — | | | — | | | — | | | 21,000 | |

| Net income (loss) | | — | | | — | | | — | | | — | | | — | | | (68,740) | | | — | | | (21,550) | | | (90,290) | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | — | | | — | | | 4,941 | | | 4,730 | | | 9,671 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Issuance of shares - exercise of warrants | | 428,626 | | | — | | | — | | | — | | | 5,416 | | | — | | | — | | | — | | | 5,416 | |

| | | | | | | | | | | | | | | | | | |

| Balance at March 31, 2023 | | 57,916,649 | | | $ | 6 | | | 55,032,961 | | | $ | — | | | $ | 462,275 | | | $ | (96,686) | | | $ | 4,941 | | | $ | 590,169 | | | $ | 960,705 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

AlTi Global, Inc.

Condensed Consolidated Statement of Cash Flows (Unaudited)

| | | | | | | | | | | |

| For the Three Months Ended |

| (Dollars in Thousands) | March 31, 2024 | | March 31, 2023 |

| Cash Flows from Operating Activities | | | |

| Net income (loss) | $ | 21,745 | | | $ | (90,290) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 2,567 | | | 4,517 | |

| Amortization of debt discounts and deferred financing costs | 330 | | | 2,364 | |

| Unrealized (gain) loss on investments | 3,661 | | | (3,472) | |

| Impairment loss on goodwill and intangible assets | — | | | 172 | |

| Gain (loss) on TRA | (5,933) | | | (81) | |

| | | |

| (Income) loss on equity method investments | (2) | | | — | |

| | | |

| Fair value of warrant liability | 340 | | | 12,942 | |

| Fair value of earn-out liability | (39,454) | | | 29,206 | |

| | | |

| Deferred income tax (benefit) expense | (4,666) | | | 3,119 | |

| Equity-settled share-based payments | 2,579 | | | 28,953 | |

| Unrealized foreign currency (gains)/losses | 1 | | | 58 | |

| | | |

| (Gain) loss from retirement of debt | — | | | (73) | |

| Forgiveness of debt shareholder loan | 53 | | | 66 | |

| | | |

| Fair value of interest rate swap | — | | | 54 | |

| Cash flows due to changes in operating assets and liabilities | | | |

| Fees receivable | 34,361 | | | 11,147 | |

| Other assets | (4,702) | | | (8,220) | |

| Operating cash flow from operating leases | 572 | | | 290 | |

| Accounts payable and accrued expenses | (5,203) | | | (27,102) | |

| Accrued compensation and profit sharing | (27,430) | | | (13,357) | |

| | | |

| Other liabilities | 5,706 | | | (11,524) | |

| Other operating activities | 3 | | | 186 | |

| Net cash provided by (used in) operating activities | (15,472) | | | (61,045) | |

| | | |

| (Continued on the following page) | | | |

AlTi Global, Inc.

Condensed Consolidated Statement of Cash Flows (Unaudited)

| | | | | | | | | | | |