alti-202306300001838615false12-312023Q2P5YP2YP3Yhttp://fasb.org/us-gaap/2023#QualifiedPlanMember00018386152023-01-012023-06-300001838615us-gaap:CommonClassAMember2023-08-11xbrli:shares0001838615us-gaap:CommonClassBMember2023-08-1100018386152023-06-30iso4217:USD00018386152022-12-310001838615alti:FeesReceivableMember2023-06-300001838615alti:FeesReceivableMember2022-12-310001838615alti:OtherReceivableMember2023-06-300001838615alti:OtherReceivableMember2022-12-310001838615us-gaap:CommonClassAMember2023-06-30iso4217:USDxbrli:shares0001838615us-gaap:CommonClassAMember2022-12-310001838615us-gaap:CommonClassBMember2023-06-300001838615us-gaap:CommonClassBMember2022-12-310001838615alti:ManagementAdvisoryFeesMember2023-04-012023-06-300001838615alti:ManagementAdvisoryFeesMember2022-04-012022-06-300001838615alti:ManagementAdvisoryFeesMember2023-01-032023-06-300001838615alti:ManagementAdvisoryFeesMember2022-01-012022-06-300001838615alti:IncentiveFeesMember2023-04-012023-06-300001838615alti:IncentiveFeesMember2022-04-012022-06-300001838615alti:IncentiveFeesMember2023-01-032023-06-300001838615alti:IncentiveFeesMember2022-01-012022-06-300001838615alti:DistributionsFromInvestmentsMember2023-04-012023-06-300001838615alti:DistributionsFromInvestmentsMember2022-04-012022-06-300001838615alti:DistributionsFromInvestmentsMember2023-01-032023-06-300001838615alti:DistributionsFromInvestmentsMember2022-01-012022-06-300001838615alti:OtherFeesIncomeMember2023-04-012023-06-300001838615alti:OtherFeesIncomeMember2022-04-012022-06-300001838615alti:OtherFeesIncomeMember2023-01-032023-06-300001838615alti:OtherFeesIncomeMember2022-01-012022-06-3000018386152023-04-012023-06-3000018386152022-04-012022-06-3000018386152023-01-032023-06-3000018386152022-01-012022-06-300001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-03-310001838615us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310001838615us-gaap:AdditionalPaidInCapitalMember2023-03-310001838615us-gaap:RetainedEarningsMember2023-03-310001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001838615us-gaap:NoncontrollingInterestMember2023-03-3100018386152023-03-310001838615us-gaap:RetainedEarningsMember2023-04-012023-06-300001838615us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001838615us-gaap:NoncontrollingInterestMemberalti:AlvariumHomeREITAdvisorsLtdAHRAMember2023-04-012023-06-300001838615alti:AlvariumHomeREITAdvisorsLtdAHRAMember2023-04-012023-06-300001838615us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001838615us-gaap:AdditionalPaidInCapitalMemberalti:AlvariumHomeREITAdvisorsLtdAHRAMember2023-04-012023-06-300001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-04-012023-06-300001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-06-300001838615us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-06-300001838615us-gaap:AdditionalPaidInCapitalMember2023-06-300001838615us-gaap:RetainedEarningsMember2023-06-300001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001838615us-gaap:NoncontrollingInterestMember2023-06-300001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-020001838615us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-01-020001838615us-gaap:AdditionalPaidInCapitalMember2023-01-020001838615us-gaap:RetainedEarningsMember2023-01-020001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-020001838615us-gaap:NoncontrollingInterestMember2023-01-0200018386152023-01-020001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-032023-06-300001838615us-gaap:AdditionalPaidInCapitalMember2023-01-032023-06-300001838615us-gaap:RetainedEarningsMember2023-01-032023-06-300001838615us-gaap:NoncontrollingInterestMember2023-01-032023-06-300001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-032023-06-300001838615us-gaap:NoncontrollingInterestMemberalti:AlvariumHomeREITAdvisorsLtdAHRAMember2023-01-032023-06-300001838615alti:AlvariumHomeREITAdvisorsLtdAHRAMember2023-01-032023-06-300001838615us-gaap:AdditionalPaidInCapitalMemberalti:AlvariumHomeREITAdvisorsLtdAHRAMember2023-01-032023-06-300001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-03-310001838615us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-03-310001838615alti:MemberCapitalMember2022-03-310001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001838615us-gaap:NoncontrollingInterestMember2022-03-3100018386152022-03-310001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-04-012022-06-300001838615us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-04-012022-06-300001838615alti:MemberCapitalMember2022-04-012022-06-300001838615us-gaap:NoncontrollingInterestMember2022-04-012022-06-300001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-06-300001838615us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-06-300001838615alti:MemberCapitalMember2022-06-300001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001838615us-gaap:NoncontrollingInterestMember2022-06-3000018386152022-06-300001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001838615us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310001838615alti:MemberCapitalMember2021-12-310001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001838615us-gaap:NoncontrollingInterestMember2021-12-3100018386152021-12-310001838615us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-06-300001838615us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-01-012022-06-300001838615alti:MemberCapitalMember2022-01-012022-06-300001838615us-gaap:NoncontrollingInterestMember2022-01-012022-06-300001838615us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001838615alti:ShareholderLoanMember2023-01-032023-06-300001838615alti:ShareholderLoanMember2022-01-012022-06-300001838615alti:MemberNotesReceivableMember2023-01-032023-06-300001838615alti:MemberNotesReceivableMember2022-01-012022-06-300001838615alti:UmbrellaMember2023-01-03xbrli:pure0001838615alti:TWMHAndTIGShareholdersMemberalti:UmbrellaMember2023-01-030001838615alti:UmbrellaMemberalti:TWMHTIGAndAlvariumMember2023-01-030001838615us-gaap:CommonClassAMember2023-01-032023-03-310001838615us-gaap:CommonClassAMember2023-04-032023-04-0300018386152023-06-07alti:segmentalti:category0001838615alti:WealthManagementSegmentMember2023-06-300001838615alti:AssetManagementSegmentMemberalti:AlternativesPlatformMember2023-06-300001838615alti:RealEstatePublicAndPrivateMemberalti:AssetManagementSegmentMember2023-06-300001838615alti:AssetManagementSegmentMemberalti:FundManagementMember2023-01-012023-06-30alti:fund0001838615alti:AlvariumRELimitedAREMemberalti:AssetManagementSegmentMemberalti:EntityOwnedByManagementOfAlvariumHomeREITAdvisorsLtdAHRAMemberalti:AlvariumHomeREITAdvisorsLtdAHRAMemberalti:FundManagementMember2022-12-310001838615alti:AlvariumRELimitedAREMemberalti:AssetManagementSegmentMemberalti:EntityOwnedByManagementOfAlvariumHomeREITAdvisorsLtdAHRAMemberalti:AlvariumHomeREITAdvisorsLtdAHRAMemberalti:FundManagementMember2023-01-032023-06-300001838615alti:AssetManagementSegmentMemberalti:CoInvestmentMember2023-01-032023-06-300001838615alti:ManagementAdvisoryFeesMember2023-06-300001838615alti:ManagementAdvisoryFeesMember2022-12-31alti:entity0001838615srt:MinimumMember2023-06-300001838615srt:MaximumMember2023-06-300001838615srt:MinimumMember2023-01-032023-06-300001838615srt:MaximumMember2023-01-032023-06-300001838615us-gaap:PropertyPlantAndEquipmentOtherTypesMembersrt:MinimumMember2023-06-300001838615us-gaap:PropertyPlantAndEquipmentOtherTypesMembersrt:MaximumMember2023-06-300001838615us-gaap:CommonClassAMember2023-06-070001838615alti:EarnoutSecuritiesMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassAMember2023-01-032023-06-300001838615alti:EarnoutSecuritiesMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassBMember2023-01-032023-06-300001838615alti:EarnoutSecuritiesMemberalti:ClassBUnitsMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberalti:AlvariumTWMHAndTIGMember2023-01-032023-06-300001838615alti:EarnoutSharesTrancheOneMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassAMember2023-06-300001838615alti:EarnoutSharesTrancheOneMemberalti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassAMember2023-01-032023-06-300001838615alti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassAMemberalti:EarnoutSharesTrancheTwoMember2023-06-300001838615alti:SponsorAndSellingShareholdersOfTWMHTIGAndAlvariumMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassAMemberalti:EarnoutSharesTrancheTwoMember2023-01-032023-06-300001838615alti:TiedemannInternationalHoldingsAGTIHMemberalti:TiedemannWealthManagementHoldingsLLCMember2022-12-310001838615alti:TiedemannInternationalHoldingsAGTIHMemberalti:TiedemannWealthManagementHoldingsLLCMember2022-01-012022-12-310001838615alti:RealEstatePublicAndPrivateMemberalti:AssetManagementSegmentMember2023-01-012023-06-300001838615us-gaap:CommonClassAMember2023-01-030001838615alti:CGCSponsorLLCMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassAMemberalti:TheFounderSharesMember2023-01-032023-01-030001838615alti:CGCSponsorLLCMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassBMemberalti:TheFounderSharesMember2023-01-032023-01-030001838615alti:CGCSponsorLLCMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassBMemberalti:TheFounderSharesMember2023-01-030001838615alti:CGCSponsorLLCMemberalti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassAMemberalti:TheFounderSharesMember2023-01-030001838615alti:AlvariumTWMHAndTIGMember2023-01-012023-03-3100018386152022-01-012022-03-310001838615alti:AlvariumTWMHAndTIGMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:LongTermDebtMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:OtherAssetsMember2023-01-030001838615alti:AlvariumTWMHAndTIGMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassAMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:CommonClassBMember2023-01-032023-01-030001838615us-gaap:WarrantMemberalti:AlvariumTWMHAndTIGMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:ManagementAdvisoryFeesMember2023-01-030001838615alti:AlvariumTWMHAndTIGMember2023-01-012023-06-300001838615alti:AlvariumTWMHAndTIGMember2023-04-012023-06-300001838615alti:WealthManagementSegmentMemberalti:AlvariumTWMHAndTIGMember2023-01-030001838615alti:AssetManagementSegmentMemberalti:AlvariumTWMHAndTIGMember2023-01-030001838615us-gaap:TradeNamesMemberalti:AlvariumTWMHAndTIGMember2023-01-030001838615us-gaap:TradeNamesMemberalti:AlvariumTWMHAndTIGMember2023-01-032023-01-030001838615us-gaap:CustomerRelationshipsMemberalti:AlvariumTWMHAndTIGMember2023-01-030001838615us-gaap:CustomerRelationshipsMemberalti:AlvariumTWMHAndTIGMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:InvestmentManagementAgreementsMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:InvestmentManagementAgreementsMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:InvestmentManagementAgreementsMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:DevelopedTechnologyMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberalti:DevelopedTechnologyMember2023-01-032023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:OrderOrProductionBacklogMember2023-01-030001838615alti:AlvariumTWMHAndTIGMemberus-gaap:OrderOrProductionBacklogMember2023-01-032023-01-030001838615alti:ALWealthPartnersPteLtdALWealthPartnersMember2023-04-062023-04-060001838615alti:ALWealthPartnersPteLtdALWealthPartnersMember2023-04-060001838615alti:ALWealthPartnersPteLtdALWealthPartnersMemberalti:ManagementAdvisoryFeesMember2023-04-060001838615us-gaap:CustomerRelationshipsMemberalti:ALWealthPartnersPteLtdALWealthPartnersMember2023-04-060001838615us-gaap:CustomerRelationshipsMemberalti:ALWealthPartnersPteLtdALWealthPartnersMember2023-04-062023-04-060001838615alti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-06-300001838615alti:ManagementAdvisoryFeesMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001838615alti:ManagementAdvisoryFeesMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001838615alti:ManagementAdvisoryFeesMemberus-gaap:OperatingSegmentsMember2023-01-032023-06-300001838615alti:ManagementAdvisoryFeesMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001838615alti:IncentiveFeesMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001838615alti:IncentiveFeesMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001838615alti:IncentiveFeesMemberus-gaap:OperatingSegmentsMember2023-01-032023-06-300001838615alti:IncentiveFeesMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001838615alti:DistributionsFromInvestmentsMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001838615alti:DistributionsFromInvestmentsMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001838615alti:DistributionsFromInvestmentsMemberus-gaap:OperatingSegmentsMember2023-01-032023-06-300001838615alti:DistributionsFromInvestmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2023-01-032023-06-300001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001838615us-gaap:OperatingSegmentsMember2023-04-012023-06-300001838615us-gaap:OperatingSegmentsMember2022-04-012022-06-300001838615us-gaap:OperatingSegmentsMember2023-01-032023-06-300001838615us-gaap:OperatingSegmentsMember2022-01-012022-06-300001838615alti:ManagementAdvisoryFeesMemberus-gaap:OperatingSegmentsMember2023-01-030001838615alti:ManagementAdvisoryFeesMemberus-gaap:OperatingSegmentsMember2021-12-310001838615alti:ManagementAdvisoryFeesMemberus-gaap:OperatingSegmentsMember2023-06-300001838615alti:ManagementAdvisoryFeesMemberus-gaap:OperatingSegmentsMember2022-12-310001838615alti:IncentiveFeesMemberus-gaap:OperatingSegmentsMember2023-01-030001838615alti:IncentiveFeesMemberus-gaap:OperatingSegmentsMember2021-12-310001838615alti:IncentiveFeesMemberus-gaap:OperatingSegmentsMember2023-06-300001838615alti:IncentiveFeesMemberus-gaap:OperatingSegmentsMember2022-12-310001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2023-01-030001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2021-12-310001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2023-06-300001838615alti:OtherFeesIncomeMemberus-gaap:OperatingSegmentsMember2022-12-310001838615us-gaap:RestrictedStockUnitsRSUMember2023-01-032023-06-300001838615alti:AlvariumEmployeeAwardsMember2023-01-032023-06-300001838615alti:AlvariumEmployeeAwardsBenefitingAcquirerMember2023-01-032023-06-300001838615us-gaap:CommonClassAMemberalti:NasdaqAwardsMember2023-01-032023-06-300001838615us-gaap:CommonClassAMemberalti:NasdaqAwardsMember2023-06-300001838615us-gaap:CommonClassAMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-032023-06-300001838615us-gaap:CommonClassAMemberus-gaap:RestrictedStockUnitsRSUMember2023-06-300001838615us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615us-gaap:MutualFundMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-06-300001838615us-gaap:FairValueInputsLevel3Memberus-gaap:MutualFundMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615us-gaap:MutualFundMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-06-300001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615alti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615alti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-06-300001838615us-gaap:FairValueInputsLevel3Memberalti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615alti:InvestmentsExternalStrategicManagersMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615alti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615alti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-06-300001838615us-gaap:FairValueInputsLevel3Memberalti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615alti:InvestmentsAffiliatedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-06-300001838615us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615us-gaap:FairValueMeasurementsRecurringMember2023-06-300001838615us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001838615us-gaap:MutualFundMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:MutualFundMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001838615us-gaap:MutualFundMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001838615us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001838615us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001838615us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001838615us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001838615us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001838615us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001838615us-gaap:FairValueMeasurementsRecurringMember2022-12-310001838615alti:TaxReceivableAgreementLiabilityMember2023-01-020001838615alti:EarnoutLiabilityMember2023-01-020001838615alti:EarnInConsiderationPayableMember2023-01-020001838615alti:TaxReceivableAgreementLiabilityMember2023-01-032023-06-300001838615alti:EarnoutLiabilityMember2023-01-032023-06-300001838615alti:EarnInConsiderationPayableMember2023-01-032023-06-300001838615alti:TaxReceivableAgreementLiabilityMember2023-06-300001838615alti:EarnoutLiabilityMember2023-06-300001838615alti:EarnInConsiderationPayableMember2023-06-300001838615alti:EarnInConsiderationPayableMember2021-12-310001838615alti:PayoutRightMember2021-12-310001838615alti:EarnInConsiderationPayableMember2022-01-012022-12-310001838615alti:PayoutRightMember2022-01-012022-12-3100018386152022-01-012022-12-310001838615alti:EarnInConsiderationPayableMember2022-12-310001838615alti:PayoutRightMember2022-12-310001838615alti:InvestmentUnaffiliatedManagementCompaniesMember2023-01-020001838615alti:InvestmentUnaffiliatedManagementCompaniesMember2023-01-032023-06-300001838615alti:InvestmentUnaffiliatedManagementCompaniesMember2023-06-300001838615us-gaap:FairValueInputsLevel3Memberalti:InvestmentsExternalStrategicManagersMember2023-06-300001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:InvestmentsExternalStrategicManagersMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2023-06-300001838615us-gaap:FairValueInputsLevel3Membersrt:MaximumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:InvestmentsExternalStrategicManagersMemberus-gaap:MeasurementInputDiscountRateMember2023-06-300001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:InvestmentsExternalStrategicManagersMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMember2023-06-300001838615us-gaap:FairValueInputsLevel3Member2023-06-300001838615alti:ValuationTechniqueMonteCarloMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMember2023-06-300001838615alti:ValuationTechniqueMonteCarloMemberus-gaap:FairValueInputsLevel3Memberalti:MeasurementInputCorrelationMember2023-06-300001838615alti:ValuationTechniqueMonteCarloMemberus-gaap:FairValueInputsLevel3Memberalti:MeasurementInputCostOfDebtRangeMembersrt:MinimumMember2023-06-300001838615alti:ValuationTechniqueMonteCarloMemberus-gaap:FairValueInputsLevel3Memberalti:MeasurementInputCostOfDebtRangeMembersrt:MaximumMember2023-06-300001838615alti:ValuationTechniqueMonteCarloMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputEntityCreditRiskMembersrt:MinimumMember2023-06-300001838615alti:ValuationTechniqueMonteCarloMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMemberus-gaap:MeasurementInputEntityCreditRiskMember2023-06-300001838615alti:ValuationTechniqueMonteCarloMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-06-300001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberalti:MeasurementInputRevenueDiscountRateMember2023-06-300001838615us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001838615alti:ValuationTechniqueMonteCarloMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001838615us-gaap:MutualFundMember2023-06-300001838615us-gaap:MutualFundMember2022-12-310001838615us-gaap:ExchangeTradedFundsMember2023-06-300001838615us-gaap:ExchangeTradedFundsMember2022-12-310001838615alti:TIGArbitrageAssociatesMasterFundMember2023-06-300001838615alti:TIGArbitrageAssociatesMasterFundMember2022-12-310001838615alti:TIGArbitrageEnhancedMasterFundMember2023-06-300001838615alti:TIGArbitrageEnhancedMasterFundMember2022-12-310001838615alti:TIGArbitrageEnhancedMember2023-06-300001838615alti:TIGArbitrageEnhancedMember2022-12-310001838615alti:ArkkanOpportunitiesFeederFundMember2023-06-300001838615alti:ArkkanOpportunitiesFeederFundMember2022-12-310001838615alti:ArkkanCapitalManagementLimitedMember2023-06-300001838615alti:ArkkanCapitalManagementLimitedMember2022-12-310001838615alti:ZebedeeAssetManagementMember2023-06-300001838615alti:ZebedeeAssetManagementMember2022-12-310001838615alti:RomspenInvestmentCorporationMember2023-06-300001838615alti:RomspenInvestmentCorporationMember2022-12-310001838615us-gaap:CustomerRelationshipsMember2023-06-300001838615us-gaap:CustomerRelationshipsMember2023-01-012023-06-300001838615us-gaap:CustomerRelationshipsMemberalti:FamilyOfficeServiceFOSMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-06-300001838615alti:InvestmentManagementAgreementsMember2023-06-300001838615alti:InvestmentManagementAgreementsMember2023-01-012023-06-300001838615alti:FamilyOfficeServiceFOSMemberalti:InvestmentManagementAgreementsMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-06-300001838615us-gaap:TradeNamesMember2023-06-300001838615us-gaap:TradeNamesMember2023-01-012023-06-300001838615alti:FamilyOfficeServiceFOSMemberus-gaap:TradeNamesMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-06-300001838615us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-06-300001838615us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-01-012023-06-300001838615alti:FamilyOfficeServiceFOSMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-06-300001838615us-gaap:OtherIntangibleAssetsMember2023-06-300001838615us-gaap:OtherIntangibleAssetsMember2023-01-012023-06-300001838615alti:FamilyOfficeServiceFOSMemberus-gaap:OtherIntangibleAssetsMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-06-300001838615alti:InvestmentManagementAgreementsMember2023-06-300001838615us-gaap:CustomerRelationshipsMember2022-12-310001838615us-gaap:TradeNamesMember2022-12-310001838615us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-12-310001838615us-gaap:LeaseholdImprovementsMember2023-06-300001838615us-gaap:LeaseholdImprovementsMember2022-12-310001838615alti:OfficeEquipmentAndFurnitureMember2023-06-300001838615alti:OfficeEquipmentAndFurnitureMember2022-12-310001838615us-gaap:RelatedPartyMemberus-gaap:OtherAssetsMember2023-06-300001838615alti:AssetManagementSegmentMember2022-12-310001838615alti:WealthManagementSegmentMember2022-12-310001838615alti:AssetManagementSegmentMember2023-01-012023-06-300001838615alti:WealthManagementSegmentMember2023-01-012023-06-300001838615alti:AssetManagementSegmentMember2023-06-300001838615us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMember2023-06-300001838615us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMember2023-06-300001838615alti:PromissoryNotesMember2023-06-300001838615us-gaap:LineOfCreditMember2023-06-300001838615us-gaap:LineOfCreditMemberalti:CreditFacilityMember2023-01-030001838615us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMember2023-01-030001838615us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMember2023-01-030001838615us-gaap:BaseRateMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembersrt:MinimumMemberalti:CreditFacilityMember2023-01-032023-01-030001838615us-gaap:BaseRateMembersrt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberalti:CreditFacilityMember2023-01-032023-01-030001838615us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberalti:CreditFacilityMember2023-01-032023-01-030001838615srt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberalti:CreditFacilityMember2023-01-032023-01-030001838615us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMember2022-12-310001838615us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMember2022-12-310001838615alti:PromissoryNotesMember2022-12-310001838615alti:LondonInterbankOfferedRateLIBOR1Memberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMember2022-01-012022-12-310001838615us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMember2020-12-310001838615us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMemberalti:BloombergShortTermBankYieldIndexRateBSBYMember2022-01-012022-12-310001838615us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberalti:CreditFacilityMember2022-01-012022-12-310001838615us-gaap:RelatedPartyMemberalti:TMWHTIGGPAndTIGMGMTMembersMemberus-gaap:OtherAssetsMember2023-06-300001838615us-gaap:RelatedPartyMemberalti:TMWHTIGGPAndTIGMGMTMembersMemberus-gaap:OtherAssetsMember2022-12-310001838615us-gaap:EquityMethodInvesteeMemberus-gaap:OtherAssetsMember2023-06-300001838615us-gaap:EquityMethodInvesteeMemberus-gaap:OtherAssetsMember2022-12-310001838615us-gaap:RelatedPartyMemberalti:NonControllingInterestHoldersTaxReceivableAgreementsMemberalti:TaxReceivableAgreementLiabilityMember2023-06-300001838615us-gaap:RelatedPartyMemberalti:NonControllingInterestHoldersTaxReceivableAgreementsMemberalti:TaxReceivableAgreementLiabilityMember2022-12-310001838615us-gaap:RelatedPartyMemberalti:TWMHTIGGPAndTIGMGMTMembersAndAlvariumShareholdersEarnOutMemberalti:BusinessCombinationContingentConsiderationLiabilityMember2023-06-300001838615us-gaap:RelatedPartyMemberalti:TWMHTIGGPAndTIGMGMTMembersAndAlvariumShareholdersEarnOutMemberalti:BusinessCombinationContingentConsiderationLiabilityMember2022-12-310001838615us-gaap:EquityMethodInvesteeMemberus-gaap:OtherLiabilitiesMember2023-06-300001838615us-gaap:EquityMethodInvesteeMemberus-gaap:OtherLiabilitiesMember2022-12-310001838615alti:TWMHMembersMemberus-gaap:RelatedPartyMemberalti:PromissoryNotesMember2022-12-310001838615alti:TWMHMembersMemberus-gaap:RelatedPartyMemberalti:PromissoryNotesMember2022-01-012022-12-31alti:anniversary0001838615alti:TWMHMembersMemberus-gaap:RelatedPartyMemberalti:PromissoryNotesMember2023-04-012023-06-300001838615alti:TWMHMembersMemberus-gaap:RelatedPartyMemberalti:PromissoryNotesMember2022-04-012022-06-300001838615alti:TWMHMembersMemberus-gaap:RelatedPartyMemberalti:PromissoryNotesMember2023-01-032023-06-300001838615alti:TWMHMembersMemberus-gaap:RelatedPartyMemberalti:PromissoryNotesMember2022-01-012022-06-300001838615alti:TWMHMembersMemberus-gaap:RelatedPartyMemberalti:PromissoryNotesMember2023-06-300001838615us-gaap:RelatedPartyMemberalti:TIGGPAndTIGMGMTMembersMember2023-06-300001838615us-gaap:EquityMethodInvesteeMemberalti:ManagementAdvisoryFeesMember2023-01-032023-06-300001838615us-gaap:EquityMethodInvesteeMember2023-01-032023-06-300001838615us-gaap:EquityMethodInvesteeMemberalti:OtherFeesIncomeMember2023-01-032023-06-300001838615alti:TMWHTIGGPAndTIGMGMTMembersMember2023-06-300001838615alti:AssetManagementSegmentMemberalti:ManagementAdvisoryFeesMember2023-04-012023-06-300001838615alti:WealthManagementSegmentMemberalti:ManagementAdvisoryFeesMember2023-04-012023-06-300001838615alti:AssetManagementSegmentMemberalti:IncentiveFeesMember2023-04-012023-06-300001838615alti:WealthManagementSegmentMemberalti:IncentiveFeesMember2023-04-012023-06-300001838615alti:DistributionsFromInvestmentsMemberalti:AssetManagementSegmentMember2023-04-012023-06-300001838615alti:WealthManagementSegmentMemberalti:DistributionsFromInvestmentsMember2023-04-012023-06-300001838615alti:AssetManagementSegmentMemberalti:OtherFeesIncomeMember2023-04-012023-06-300001838615alti:WealthManagementSegmentMemberalti:OtherFeesIncomeMember2023-04-012023-06-300001838615alti:AssetManagementSegmentMember2023-04-012023-06-300001838615alti:WealthManagementSegmentMember2023-04-012023-06-300001838615alti:AssetManagementSegmentMemberalti:ManagementAdvisoryFeesMember2023-01-032023-06-300001838615alti:WealthManagementSegmentMemberalti:ManagementAdvisoryFeesMember2023-01-032023-06-300001838615alti:AssetManagementSegmentMemberalti:IncentiveFeesMember2023-01-032023-06-300001838615alti:WealthManagementSegmentMemberalti:IncentiveFeesMember2023-01-032023-06-300001838615alti:DistributionsFromInvestmentsMemberalti:AssetManagementSegmentMember2023-01-032023-06-300001838615alti:WealthManagementSegmentMemberalti:DistributionsFromInvestmentsMember2023-01-032023-06-300001838615alti:AssetManagementSegmentMemberalti:OtherFeesIncomeMember2023-01-032023-06-300001838615alti:WealthManagementSegmentMemberalti:OtherFeesIncomeMember2023-01-032023-06-300001838615alti:AssetManagementSegmentMember2023-01-032023-06-300001838615alti:WealthManagementSegmentMember2023-01-032023-06-300001838615alti:ClassBCommonStockAndClassBUnitsMember2023-04-012023-06-300001838615alti:ClassBCommonStockAndClassBUnitsMember2023-01-032023-06-300001838615us-gaap:WarrantMember2023-04-012023-06-300001838615us-gaap:WarrantMember2023-01-032023-06-300001838615alti:EarnOutsMember2023-04-012023-06-300001838615alti:EarnOutsMember2023-01-032023-06-300001838615alti:ShareAwardsMember2023-04-012023-06-300001838615alti:ShareAwardsMember2023-01-032023-06-300001838615us-gaap:CommonClassBMember2023-01-030001838615us-gaap:SubsequentEventMember2023-07-142023-07-140001838615alti:AlvariumInvestmentManagersUKLLPMemberus-gaap:DiscontinuedOperationsHeldforsaleMemberus-gaap:SubsequentEventMember2023-07-18alti:subsidiary0001838615alti:AlvariumInvestmentManagersUKLLPMemberus-gaap:DiscontinuedOperationsHeldforsaleMemberus-gaap:SubsequentEventMember2023-07-182023-07-180001838615us-gaap:SubsequentEventMemberalti:AlvariumInvestmentManagersSuisseSAAIMSMember2023-08-020001838615alti:AlvariumInvestmentManagersSuisseSAAIMSMember2023-06-300001838615alti:AlvariumInvestmentManagersSuisseSAAIMSMember2023-06-300001838615us-gaap:SubsequentEventMemberalti:AlvariumInvestmentManagersSuisseSAAIMSMember2023-08-022023-08-02alti:installment

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission file number 001-40103

AlTi Global, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware | 92-1552220 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

520 Madison Avenue, 26th Floor New York, New York | 10022 |

(Address of Principal Executive Offices) | (Zip Code) |

(212) 396-5904

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | ALTI | Nasdaq Capital Market |

| | |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The registrant had outstanding 62,957,660 shares of Class A Common Stock (as defined herein) and 55,032,961 shares of Class B Common Stock (as defined herein) as of August 11, 2023.

Table of Contents

Defined Terms

Capitalized terms used herein but not otherwise defined herein shall have the respective meanings ascribed to them in the Amended and Restated Business Combination Agreement, a copy of which is attached to our Annual Report on Form 10-K filed April 17, 2023 (the “Annual Report”).

•“Alvarium” means AlTi Asset Management Holdings 2 Limited, formerly known as Alvarium Investments Limited, an English private limited company.

•“Alvarium Contribution” means the contribution by Cartesian of all the issued and outstanding shares of AlTi Global Topco that it holds to Umbrella.

•“Alvarium Contribution Agreement” means the Contribution Agreement, dated as of January 3, 2023, by and among Cartesian and Umbrella.

•“Alvarium Exchange” means the exchange by each shareholder of AlTi Global Topco of his, her or its (a) ordinary shares of AlTi Global Topco and (b) class A shares of AlTi Global Topco for Class A Common Stock.

•“AlTi” means AlTi Global, Inc., together with its consolidated subsidiaries.

•“Alvarium Reorganization” means a reorganization such that Alvarium is the wholly owned indirect subsidiary of AlTi Global Topco, and AlTi Global Topco is owned solely by the shareholders of Alvarium.

•“Alvarium Shareholders” means the shareholders of Alvarium.

•“Alvarium Tiedemann” means the Company, prior to being renamed “AlTi Global, Inc.”

•“AlTi Global Topco” means AlTi Global Topco Limited, formerly known as Alvarium Topco, an Isle of Man entity which was established by Alvarium and owned by the Alvarium Shareholders.

•“Asset Management” means the Segment that includes the Company's alternatives platform, public and private real estate, co-investment, and strategic advisory (formerly known as merchant banking) businesses.

•“AUA” means assets under advisement.

•“AUM” means assets under management.

•“Board” means the board of directors of the Company.

•“Business Combination” means the transactions contemplated by the Business Combination Agreement.

•“Business Combination Agreement” means the Amended and Restated Business Combination Agreement, dated as of October 25, 2022, by and among Cartesian, Umbrella Merger Sub, TWMH, TIG GP, TIG MGMT, Alvarium and Umbrella.

•“Cartesian” means Cartesian Growth Corporation, a Cayman Islands exempted company, prior to the Business Combination.

•“Cayman Islands Companies Act” means the Cayman Islands Companies Act (as revised) of the Cayman Islands, as the same may be amended from time to time.

•“Charter” means the certificate of incorporation of the Company.

•“Class A Common Stock” means the Class A Common Stock, par value $0.0001 per share, of the Company, including any shares of such Class A Common Stock issuable upon the exercise of any warrant or other right to acquire shares of such Class A Common Stock.

•“Class B Common Stock” means the Class B Common Stock, par value $0.0001 per share, of the Company, including any shares of such Class B Common Stock issuable upon the exercise of any warrant or other right to acquire shares of such Class B Common Stock.

•“Class B Units” means the limited liability company interests in Umbrella designated as Class B Common Units in the Umbrella LLC Agreement.

•“Closing” means the closing of the Business Combination.

•“Closing Date” means January 3, 2023, the date on which the Closing occurred.

•“Code” means the Internal Revenue Code of 1986, as amended.

•“Common Stock” refers to shares of the Class A Common Stock and the Class B Common Stock, collectively.

•“Company,” “our,” “we” or “us” means, prior to the Business Combination, Cartesian, as the context suggests, and, following the Business Combination, AlTi.

•“Condensed Consolidated Statement of Financial Position” refers to the consolidated balance sheet of AlTi Global, Inc.

•“Condensed Consolidated Statement of Operations” refers to the consolidated income statement of AlTi Global, Inc.

•“DGCL” refers to the Delaware General Corporation Law, as amended.

•“DLLCA” means the Delaware Limited Liability Company Act, as amended.

•“dollars” or “$” refers to U.S. dollars.

•“Domestication” means the continuation of Cartesian by way of domestication into a Delaware corporation, with the ordinary shares of Cartesian becoming shares of common stock of the Delaware corporation under the applicable provisions of the Cayman Islands Companies Act and the DGCL; the term includes all matters and necessary or ancillary changes in order to effect such Domestication, including the adoption of the Charter consistent with the DGCL and changing the name and registered office of Cartesian.

•"Earn-out” means the contingent additional equity consideration issued by the Company to the Sponsor and the Target Companies’ legacy equityholders.

•“Earn-out Period” means the five years immediately after the Closing Date.

•“Earn-out Securities” means the earn-out shares of Class A Common Stock in the Company and Class B Common Units that may be issued or become tradeable upon the achievement of certain stock price-based vesting conditions in accordance with the terms of the Business Combination Agreement.

•“Employee Stock Purchase Plan” means the AlTi Global, Inc. 2023 Employee Stock Purchase Plan.

•“Equity Incentive Plan” means the AlTi Global, Inc. 2023 Stock Incentive Plan.

•“ESG” means environmental, social and governance.

•“ETFs” means Exchange Traded Funds.

•“EU” means European Union.

•“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

•“External Strategic Managers” means global alternative asset managers with whom we partner by making strategic investments in which we actively participate in seeking to leverage the collective resources and synergies of the businesses to facilitate their growth.

•“FINRA” means the Financial Industry Regulatory Authority, Inc.

•“FOS” means Family Office Service.

•“HNWI” means high net worth individual, being an individual having investable assets of $1 million or more, excluding primary residence, collectibles, consumables, and consumer durables.

•“Impact Investing” means investment practices seeking to generate various levels of financial performance together with the generation of positive measurable environmental and social impacts.

•“Investment Company Act” means the Investment Company Act of 1940, as amended, and the rules and regulations promulgated thereunder.

•“Managed Funds” means mutual funds, ETFs, hedge funds, private equity, real estate or other funds.

•“Nasdaq” means The Nasdaq Capital Market.

•“NAV” means net asset value.

•“PIPE Investors” means the subscribers that agreed to purchase shares of Class A Common Stock at the Closing pursuant to the private placements, including without limitation, as reflected in the subscription agreements between Cartesian and each of the PIPE Investors.

•“SEC” means the United States Securities and Exchange Commission.

•“Segment” means collectively, or individually, how the Company manages its business including products and services.

•“Successor” means AlTi.

•“Sponsor” means CGC Sponsor LLC, a Cayman Islands limited liability company.

•“Target Companies” means, collectively, TWMH, TIG GP, TIG MGMT, and Alvarium.

•“Tax Receivable Agreement” means that certain Tax Receivable Agreement, dated as of January 3, 2023, between the Company and the TWMH Members, the TIG GP Members, and the TIG MGMT Members.

•“TIG” means, collectively, the TIG Entities and their subsidiaries and their predecessor entities where applicable.

•“TIG Entities” means, collectively, TIG GP and TIG MGMT and their predecessor entities where applicable.

•“TIG GP” means TIG Trinity GP, LLC, a Delaware limited liability company.

•“TIG GP Members” means the former members of TIG GP.

•“TIG MGMT” means TIG Trinity Management, LLC, a Delaware limited liability company.

•“TIG MGMT Members” means the former members of TIG MGMT.

•“TIH” means Tiedemann International Holdings, AG.

•“Transfer Agent” means Continental Stock Transfer & Trust Company.

•“TRA Recipients” means the TWMH Members, the TIG GP Members and the TIG MGMT Members (including certain of our directors and officers) party to the Tax Receivable Agreement.

•“TWMH” means, collectively, Tiedemann Wealth Management Holdings, LLC, a Delaware limited liability company, and its subsidiaries, and their predecessor entities where applicable.

•“TWMH Members” means the former members of TWMH.

•“Warrant Agreement” means the Amended and Restated Warrant Agreement, dated January 3, 2023, by and between the Company and Continental Stock Transfer & Trust Company.

•“Warrants” means the warrants, which were initially issued in the Initial Public Offering, entitling the holder thereof to purchase one of Cartesian’s Class A ordinary shares at an exercise price of $11.50, subject to adjustment.

•“Wealth Management” means the Segment that consists of the Company’s investment management and advisory services, trusts and administrative services, and family office services.

•“Umbrella” means AlTi Global Capital, LLC (formerly known as Alvarium Tiedemann Capital, LLC), a Delaware limited liability company.

•“Umbrella LLC Agreement” means the Third Amended and Restated Limited Liability Company Agreement of AlTi Global Capital, LLC, effective as of July 31, 2023.

•“US GAAP” means United States generally accepted accounting principles, consistently applied.

Available Information

We file annual, quarterly and current reports, proxy statements and other information required by the Exchange Act with the SEC. We make available free of charge on our website (www.alti-global.com) our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other filing as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. We also use our website to distribute company information, including assets under management and performance information, and such information as may be deemed material. Accordingly, investors should monitor our website, in addition to our press releases, SEC filings and public conference calls and webcasts.

Also posted on our website in the “Investor Relations” section are the charters for our Audit, Finance and Risk Committee, Environmental, Social, Governance and Nominating Committee, and Human Capital and Compensation Committee, as well as our Corporate Governance Guidelines and Code of Business Conduct governing our directors, officers, and employees. Information on or accessible through our website is not a part of or incorporated into this Quarterly Report on Form 10-Q for the period ended June 30, 2023 (the “Quarterly Report”) or any other SEC filing. Copies of our SEC filings or corporate governance materials are available without charge upon written request to the Company at its principal place of business. Any materials we file with the SEC are also publicly available through the SEC’s website (www.sec.gov).

No statements herein, available on our website, or in any of the materials we file with the SEC constitute or should be viewed as constituting an offer to sell, or a solicitation of an offer to buy, securities in any jurisdiction.

Cautionary Note Regarding Forward-Looking Statements

This Quarterly Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, which reflect our current views with respect to, among other things, future events, operations and financial performance. You can identify these forward-looking statements by the use of forward-looking words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “projects,” “intends,” “plans,” “estimates,” “anticipates,” “target” or the negative version of those words, other comparable words or other statements that do not relate to historical or factual matters. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward-looking statements are subject to various risks, uncertainties (some of which are beyond our control) or other assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Some of these factors are described under the headings “Part II. Item 1A. Risk Factors” and “Part 1. Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These factors should not be construed as exhaustive and should be read in conjunction with the risk factors and other cautionary statements that are included in this Quarterly Report and in our other periodic filings. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from those indicated in these forward-looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. We do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

AlTi Global, Inc.

Condensed Consolidated Statement of Financial Position (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

| | | | | | | | | | | | | | |

| (Dollars in Thousands, except share data) | As of June 30,

2023 (Successor) | | | As of December 31,

2022 (Predecessor) |

| | | | |

| Assets | | | | |

| Cash and cash equivalents | $ | 24,106 | | | | $ | 7,131 | |

| Fees receivable, net | 29,589 | | | | 19,540 | |

| | | | |

| Other receivable, net | — | | | | 5,167 | |

| | | | |

| Investments at fair value | 164,789 | | | | 145 | |

| Equity method investments | 38,733 | | | | 52 | |

| | | | |

| Intangible assets, net of accumulated amortization | 499,479 | | | | 20,578 | |

| Goodwill | 561,188 | | | | 25,464 | |

| Operating lease right-of-use assets | 27,788 | | | | 10,095 | |

| | | | |

| | | | |

| Other assets | 49,023 | | | | 3,817 | |

| Assets held for sale | 11,050 | | | | — | |

| Total assets | $ | 1,405,745 | | | | $ | 91,989 | |

| | | | |

| Liabilities | | | | |

| Accounts payable and accrued expenses | $ | 38,724 | | | | $ | 8,073 | |

| Accrued compensation and profit sharing | 15,245 | | | | 15,660 | |

| Accrued member distributions payable | 11,302 | | | | 11,422 | |

| | | | |

| | | | |

| Earn-out liability, at fair value | 54,884 | | | | — | |

| TRA liability | 15,092 | | | | — | |

| Delayed share purchase agreement | 1,818 | | | | 1,818 | |

| Earn-in consideration payable | 1,675 | | | | 1,519 | |

| Operating lease liabilities | 28,925 | | | | 10,713 | |

| | | | |

| Debt, net of unamortized deferred financing cost | 169,094 | | | | 21,187 | |

| Deferred tax liability, net | 29,895 | | | | 82 | |

| Deferred income | 458 | | | | — | |

| Other liabilities | 12,883 | | | | 3,662 | |

| Liabilities held for sale | 2,694 | | | | — | |

| Total liabilities | $ | 382,689 | | | | $ | 74,136 | |

| | | | |

| Commitments and contingencies (Note 19) | | | | |

| | | | |

| Shareholders' Equity | | | | |

Common stock, Class A, $0.0001 par value, 792,149,819 authorized 62,957,671 outstanding | 6 | | | | 3 | |

Common Stock, Class B, $0.0001 par value, 94,967,039 authorized 55,032,961 outstanding | — | | | | 18,607 | |

| Additional paid-in capital | 516,262 | | | | — | |

| Retained earnings (accumulated deficit) | (53,244) | | | | — | |

| | | | |

| | | | |

| Accumulated other comprehensive income (loss) | 9,182 | | | | (1,077) | |

| Total AlTi Global, Inc. shareholders' equity | 472,206 | | | | 17,533 | |

| Non-controlling interest in subsidiaries | 550,850 | | | | 320 | |

| Total shareholders' equity | 1,023,056 | | | | 17,853 | |

| Total liabilities and shareholders' equity | $ | 1,405,745 | | | | $ | 91,989 | |

The accompanying notes are an integral part of these condensed unaudited financial statements.

AlTi Global, Inc.

Condensed Consolidated Statement of Operations (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Period | | For the Period |

| (Dollars in Thousands) | April 1, 2023 – June 30,

2023 (Successor) | | | April 1, 2022 – June 30,

2022 (Predecessor) | | January 3, 2023 – June 30,

2023 (Successor) | | | January 1, 2022 – June 30,

2022 (Predecessor) |

| Revenue | | | | | | | | | |

| Management/advisory fees | $ | 47,440 | | | | $ | 18,892 | | | $ | 93,910 | | | | $ | 38,862 | |

| Incentive fees | 469 | | | | — | | | 1,046 | | | | — | |

| Distributions from investments | 2,203 | | | | — | | | 12,233 | | | | — | |

| Other income/fees | 1,769 | | | | — | | | 2,739 | | | | — | |

| Total income | 51,881 | | | | 18,892 | | | 109,928 | | | | 38,862 | |

| Operating Expenses | | | | | | | | | |

| Compensation and employee benefits | 32,636 | | | | 11,861 | | | 95,808 | | | | 25,421 | |

| Systems, technology and telephone | 4,110 | | | | 1,418 | | | 7,939 | | | | 2,858 | |

| Sales, distribution and marketing | 568 | | | | 219 | | | 1,094 | | | | 437 | |

| Occupancy costs | 3,352 | | | | 1,135 | | | 6,532 | | | | 2,103 | |

| Professional fees | 15,459 | | | | 1,668 | | | 38,343 | | | | 3,083 | |

| Travel and entertainment | 1,306 | | | | 570 | | | 3,252 | | | | 837 | |

| Depreciation and amortization | 3,655 | | | | 597 | | | 8,172 | | | | 1,207 | |

| Impairment loss on intangible assets | 29,393 | | | | — | | | 29,393 | | | | — | |

| General, administrative and other | 2,538 | | | | 345 | | | 3,971 | | | | 663 | |

| Total operating expenses | 93,017 | | | | 17,813 | | | 194,504 | | | | 36,609 | |

| Total operating income (loss) | (41,136) | | | | 1,079 | | | (84,576) | | | | 2,253 | |

| Other Income (Expenses) | | | | | | | | | |

| Gain (loss) on investments | (5,154) | | | | 44 | | | (1,704) | | | | 25 | |

| Gain (loss) on TRA | (1,792) | | | | — | | | (2,092) | | | | — | |

| Gain (loss) on warrant liability | 76 | | | | — | | | (12,866) | | | | — | |

| Gain (loss) on earn-out liability | 66,083 | | | | — | | | 36,877 | | | | — | |

| Interest and dividend income (expense) | (3,371) | | | | (105) | | | (6,632) | | | | (179) | |

| Other income (expense) | (706) | | | | 5 | | | (647) | | | | 2 | |

| Income (loss) before taxes | 14,000 | | | | 1,023 | | | (71,640) | | | | 2,101 | |

| Income tax (expense) benefit | 15,446 | | | | (110) | | | 10,796 | | | | (303) | |

| Net income (loss) | 29,446 | | | | 913 | | | (60,844) | | | | 1,798 | |

| Net income (loss) attributed to non-controlling interests in subsidiaries | (13,996) | | | | (52) | | | (35,546) | | | | (65) | |

| Net income (loss) attributable to AlTi Global, Inc. | $ | 43,442 | | | | $ | 965 | | | $ | (25,298) | | | | $ | 1,863 | |

| | | | | | | | | |

| | | | | | | | | |

| Other Comprehensive (Loss) Income | | | | | | | | | |

| | | | | | | | | |

| Foreign currency translation adjustments | 8,237 | | | | (687) | | | 17,908 | | | | (962) | |

| Other comprehensive income | (682) | | | | — | | | (682) | | | | — | |

| Total comprehensive income (loss) | 37,001 | | | | 226 | | | (43,618) | | | | 836 | |

| Other income (loss) attributed to non-controlling interests in subsidiaries | (10,681) | | | | (52) | | | (27,501) | | | | (65) | |

| Comprehensive income (loss) attributable to AlTi Global, Inc. | 47,682 | | | | 278 | | | (16,117) | | | | 901 | |

| | | | | | | | | |

| Net Income (Loss) Per Share | | | | | | | | | |

| Basic | $ | 0.73 | | | | $ | 137.72 | | | $ | (0.43) | | | | $ | 265.88 | |

| Diluted | $ | 0.26 | | | | $ | 137.72 | | | $ | (0.43) | | | | $ | 265.88 | |

| Weighted Average Shares of Class A Common Stock Outstanding | | | | | | | | | |

| Basic | 59,286,346 | | | | 7,007 | | | 58,425,916 | | | | 7,007 | |

| Diluted | 114,319,307 | | | | 7,007 | | | 58,454,342 | | | | 7,007 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

The accompanying notes are an integral part of these condensed unaudited financial statements.

AlTi Global, Inc.

Condensed Consolidated Statement of Changes in Shareholders’ Equity (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in Thousands, except share data) | | Class A Common Stock | | Class B Common Stock | | Additional paid-in-capital | | Retained earnings (accumulated deficit) | | Accumulated other comprehensive income | | Non-controlling interest in subsidiaries | | Total Shareholders' Equity |

| | Shares | | Amount | | Shares | | Amount | | | | | | | | | | |

| Balance at March 31, 2023 (Successor) | | 57,916,649 | | | $ | 6 | | | 55,032,961 | | | $ | — | | | $ | 462,275 | | | $ | (96,686) | | | $ | 4,941 | | | $ | 590,169 | | | $ | 960,705 | |

| | | | | | | | | | | | | | | | | | |

| Net income (loss) | | — | | | — | | | — | | | — | | | — | | | 43,442 | | | — | | | (13,996) | | | 29,446 | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | — | | | — | | | 4,605 | | | 3,632 | | | 8,237 | |

| Cancellation of AHRA call option | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 154 | | | 154 | |

| Other comprehensive income | | — | | | — | | | — | | | — | | | — | | | — | | | (364) | | | (318) | | | (682) | |

| Payment for partner’s tax | | — | | | — | | | — | | | — | | | (998) | | | — | | | — | | | — | | | (998) | |

| Share based compensation | | — | | | — | | | — | | | — | | | 2,131 | | | — | | | — | | | — | | | 2,131 | |

| AHRA deconsolidation | | — | | | — | | | — | | | — | | | 28,791 | | | — | | | — | | | (28,791) | | | — | |

| Issuance of shares - exercise of warrants | | 5,041,022 | | | — | | | — | | | — | | | 24,063 | | | — | | | — | | | — | | | 24,063 | |

| Balance at June 30, 2023 (Successor) | | 62,957,671 | | | $ | 6 | | | 55,032,961 | | | $ | — | | | $ | 516,262 | | | $ | (53,244) | | | $ | 9,182 | | | $ | 550,850 | | | $ | 1,023,056 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in Thousands, except share data) | | Class A Common Stock | | Class B Common Stock | | Additional paid-in-capital | | Retained earnings (accumulated deficit) | | Accumulated other comprehensive income | | Non-controlling interest in subsidiaries | | Total Shareholders' Equity |

| | Shares | | Amount | | Shares | | Amount | | | | | | | | | | |

| Balance at January 3, 2023 (Successor) | | 55,388,023 | | | $ | 6 | | | 55,032,961 | | | $ | — | | | $ | 435,859 | | | $ | (27,946) | | | $ | — | | | $ | 606,989 | | | $ | 1,014,908 | |

Issuance of shares to Alvarium Employee Benefit Trust

| | 2,100,000 | | | — | | | — | | | — | | | 21,000 | | | — | | | — | | | — | | | 21,000 | |

| Net income (loss) | | — | | | — | | | — | | | — | | | — | | | (25,298) | | | — | | | (35,546) | | | (60,844) | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | — | | | — | | | 9,546 | | | 8,362 | | | 17,908 | |

Cancellation of AHRA call option

| | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 154 | | | 154 | |

| Other comprehensive income | | — | | | — | | | — | | | — | | | — | | | — | | | (364) | | | (318) | | | (682) | |

| Payment for partner’s tax | | — | | | — | | | — | | | — | | | (998) | | | — | | | — | | | — | | | (998) | |

| AHRA deconsolidation | | — | | | — | | | — | | | — | | | 28,791 | | | — | | | — | | | (28,791) | | | — | |

| Share based compensation | | — | | | — | | | — | | | — | | | 2,131 | | | — | | | — | | | — | | | 2,131 | |

| Issuance of shares - exercise of warrants | | 5,469,648 | | | — | | | — | | | — | | | 29,479 | | | — | | | — | | | — | | | 29,479 | |

| Balance at June 30, 2023 (Successor) | | 62,957,671 | | | $ | 6 | | | 55,032,961 | | | $ | — | | | $ | 516,262 | | | $ | (53,244) | | | $ | 9,182 | | | $ | 550,850 | | | $ | 1,023,056 | |

AlTi Global, Inc.

Condensed Consolidated Statement of Changes in Shareholders’ Equity (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

The accompanying notes are an integral part of these condensed unaudited financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| (Dollars in Thousands, except share data) | | Class A | | Class B | | Total Members' Capital | | Accumulated other comprehensive income (loss) | | Non-controlling interest | | Total Equity |

| Balance at March 31, 2022 (Predecessor) | | $ | 5 | | | $ | 35,152 | | | $ | 35,157 | | | $ | (275) | | | $ | 420 | | | $ | 35,302 | |

| Member capital distributions | | (1) | | | (2,149) | | | (2,150) | | | — | | | — | | | (2,150) | |

| Member tax distributions | | — | | | (1,358) | | | (1,358) | | | — | | | — | | | (1,358) | |

| | | | | | | | | | | | |

| Restricted unit compensation | | — | | | 591 | | | 591 | | | — | | | — | | | 591 | |

| Net income (loss) for the period | | — | | | 965 | | | 965 | | | — | | | (52) | | | 913 | |

| Other comprehensive income (loss) for the period | | — | | | — | | | — | | | (687) | | | — | | | (687) | |

| Balance at June 30, 2022 (Predecessor) | | $ | 4 | | | $ | 33,201 | | | $ | 33,205 | | | $ | (962) | | | $ | 368 | | | $ | 32,611 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| (Dollars in Thousands, except share data) | | Class A | | Class B | | Total Members' Capital | | Accumulated other comprehensive income (loss) | | Non-controlling interest | | Total Equity |

| Balance at January 1, 2022 | | $ | 6 | | | $ | 39,582 | | | $ | 39,588 | | | $ | — | | | $ | 433 | | | $ | 40,021 | |

| Member capital distributions | | (1) | | | (4,299) | | | (4,300) | | | — | | | — | | | (4,300) | |

| Member tax distributions | | (1) | | | (5,128) | | | (5,129) | | | — | | | — | | | (5,129) | |

| | | | | | | | | | | | |

| Restricted unit compensation | | — | | | 1,183 | | | 1,183 | | | — | | | — | | | 1,183 | |

| Net income (loss) for the period | | — | | | 1,863 | | | 1,863 | | | — | | | (65) | | | 1,798 | |

| Other comprehensive income (loss) for the period | | — | | | — | | | — | | | (962) | | | — | | | (962) | |

| Balance at June 30, 2022 (Predecessor) | | $ | 4 | | | $ | 33,201 | | | $ | 33,205 | | | $ | (962) | | | $ | 368 | | | $ | 32,611 | |

The accompanying notes are an integral part of these condensed unaudited financial statements.

AlTi Global, Inc.

Condensed Consolidated Statement of Cash Flows (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

| | | | | | | | | | | | | | |

| For the Period |

| (Dollars in Thousands) | January 3, 2023 – June

30, 2023

(Successor) | | | January 1, 2022 – June

30, 2022

(Predecessor) |

| Cash Flows from Operating Activities | | | | |

| Net income (loss) | $ | (60,844) | | | | $ | 1,798 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | |

| Depreciation and amortization | 8,172 | | | | 1,207 | |

| Amortization of debt discounts and deferred financing costs | (2,816) | | | | — | |

| Unrealized (gain) loss on investments | 170 | | | | 54 | |

| Impairment loss on intangible assets | 29,393 | | | | — | |

| Gain (loss) on TRA | 2,092 | | | | — | |

| (Income) loss on equity method investments | 1,654 | | | | (32) | |

| Restricted unit compensation | — | | | | 1,183 | |

| Fair value of warrant liability | 12,866 | | | | — | |

| Fair value of earn-out liability | (36,877) | | | | — | |

| Deferred income tax (benefit) expense | (16,392) | | | | (64) | |

| Equity-settled share-based payments | 31,821 | | | | — | |

| Unrealized foreign currency (gains)/losses | 1,189 | | | | — | |

| (Gain) loss from retirement of debt | (73) | | | | — | |

| Forgiveness of debt shareholder loan | 117 | | | | 619 | |

| Forgiveness of debt of notes receivable from members | — | | | | 146 | |

| Fair value of interest rate swap | 33 | | | | (230) | |

| Cash flows due to changes in operating assets and liabilities | | | | |

| Fees receivable | 8,476 | | | | 1,350 | |

| Other assets | (4,366) | | | | (1,285) | |

| Operating cash flow from operating leases | 555 | | | | 642 | |

| Accounts payable and accrued expenses | (22,484) | | | | (619) | |

| Accrued compensation and profit sharing | (10,056) | | | | (3,310) | |

| Distributions due to former TIG members | — | | | | — | |

| Other liabilities | (9,090) | | | | 183 | |

| Other operating activities | (31) | | | | — | |

| Net cash provided by (used in) operating activities | (66,491) | | | | 1,642 | |

| | | | |

| (Continued on the following page) | | | | |

AlTi Global, Inc.

Condensed Consolidated Statement of Cash Flows (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

| | | | | | | | | | | | | | |

| (Continued from the previous page) | For the Period |

| (Dollars in Thousands) | January 3, 2023 – June

30, 2023

(Successor) | | | January 1, 2022 – June

30, 2022

(Predecessor) |

| Cash Flows from Investing Activities | | | | |

| Cash acquired from consolidation of variable interest entity | — | | | | 471 | |

| Cash payment for acquisition of TWMH and TIG historical equity | (99,999) | | | | — | |

| Receipt of payments of notes receivable from members | 216 | | | | 345 | |

| Loans to members | — | | | | (301) | |

| Cash receipts from the repayment of advances and loans | 302 | | | | — | |

| Purchases of investments | (15,435) | | | | (159) | |

| Distributions from investments | — | | | | 1 | |

| Purchase of TIH shares | — | | | | (382) | |

| Purchase of Holbein | — | | | | (8,097) | |

| Payment of Payout Right | (760) | | | | — | |

| Acquisition of AL Wealth Partners, net of cash acquired | (14,430) | | | | — | |

| Sales of investments | 1,812 | | | | 470 | |

| Purchases of fixed assets | (254) | | | | (3) | |

| Net cash provided by (used in) investing activities | (128,548) | | | | (7,655) | |

| Cash Flows from Financing Activities | | | | |

| Member contribution (distribution) | (5,305) | | | | (8,429) | |

| Payments on term notes and lines of credit | (141,950) | | | | (1,280) | |

| Borrowings on term notes and lines of credit | 188,660 | | | | 12,300 | |

| Increase (decrease) in distributions due to former TIG members | (13,355) | | | | — | |

| Cash payment for purchase of shares to be transferred as part of Alvarium share compensation | (4,215) | | | | — | |

| Cash receipts from exercise of Warrants | 5,836 | | | | — | |

| Other financing activities | 1 | | | | — | |

| Net cash provided by (used in) financing activities | 29,672 | | | | 2,591 | |

| Effect of exchange rate changes on cash | (1,565) | | | | (110) | |

| Net increase (decrease) in cash | (166,932) | | | | (3,532) | |

| Cash and cash equivalents at beginning of the period | 194,037 | | | | 8,040 | |

| Cash and cash equivalents at end of the period | $ | 27,105 | | | | $ | 4,508 | |

| | | | |

| Reconciliation of balance sheet cash and cash equivalents to cash flows: | | | | |

| Cash and cash equivalents on balance sheet | $ | 24,106 | | | | $ | 4,508 | |

| Cash and cash equivalents included in Assets held for sale (Note 3) | 2,999 | | | | $ | — | |

| Cash and cash equivalents, including cash in Assets held for sale | $ | 27,105 | | | | $ | 4,508 | |

| | | | |

| Supplemental Disclosure of Cash Flow Information | | | | |

| Cash Paid During the Period for: | | | | |

| Income taxes | 842 | | | | $ | 399 | |

| Interest payments on term notes and lines of credit | 4,086 | | | | 187 | |

The accompanying notes are an integral part of these condensed unaudited financial statements.

AlTi Global, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

(1)Description of the Business

AlTi Global, Inc. (the “Registrant”), a Delaware corporation, together with its consolidated subsidiaries (collectively, the “Company”, “AlTi” or “Successor”) is a multi-disciplinary financial services business, with a diverse array of investment, advisory, and administrative capabilities. The Company is a global organization that manages or advises approximately $68.9 billion in combined assets as of June 30, 2023 (Successor). The Company provides holistic solutions for Wealth Management clients through a full spectrum of Wealth Management services, including discretionary investment management services, non-discretionary investment advisory services, trust services, administration services, and family office services. It also structures, arranges, and provides a network of investors with co-investment opportunities in a variety of alternative assets which are either managed intra-group or by carefully selected managers in the relevant asset class. The Company manages and advises both public and private investment funds and also provides strategic advisory, corporate advisory, brokerage and placement agency services to entrepreneurs, “late stage” companies (particularly in the media, technology and innovation sectors), asset managers, private equity sponsors, and investment funds.

Business Combination

The Registrant was initially incorporated in the Cayman Islands as Cartesian Growth Capital, a special purpose acquisition company (“Cartesian SPAC”). In anticipation of the business combination:

•The holders of the equity of Tiedemann Wealth Management Holdings, LLC, a Delaware limited liability company (“TWMH” or “Predecessor”), TIG Trinity GP, LLC, a Delaware limited liability company (“TIG GP”), TIG Trinity Management, LLC, a Delaware limited liability company (“TIG MGMT” and, together with TIG GP, the “TIG Entities”) contributed their TWMH and TIG equity to AlTi Global Capital, LLC, formerly known as Alvarium Tiedemann Capital, LLC, (“Umbrella”) making TWMH and the TIG wholly owned subsidiaries of Umbrella.

•AlTi Asset Management Holdings 2 Limited, formerly known as Alvarium Investments Limited, an English private limited company (“Alvarium”) reorganized such that it became the wholly owned indirect subsidiary of AlTi Global Topco Limited (“AlTi Global Topco”).

•Cartesian SPAC formed Rook MS, LLC, a Delaware limited liability company (“Umbrella Merger Sub”)

Pursuant to the Business Combination on January 3, 2023 (“Business Combination Date”):

•The Registrant was redomiciled as a Delaware corporation and changed its name to Alvarium Tiedemann Holdings, Inc. Effective April 19, 2023, Alvarium Tiedemann Holding, Inc. changed its name to AlTi Global, Inc.

•The Registrant acquired all the outstanding share capital of AlTi Global Topco.

•Umbrella Merger Sub, LLC merged into Umbrella with AlTi Global Capital, LLC, formerly known as Alvarium Tiedemann Capital, LLC as the surviving entity.

•The Company acquired 51% of the equity interests of Umbrella, while the existing TWMH and TIG rollover shareholders hold a 49% economic interest in Umbrella. Umbrella holds 100% of the equity interests of TWMH, TIG, and Alvarium.

AlTi Global, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

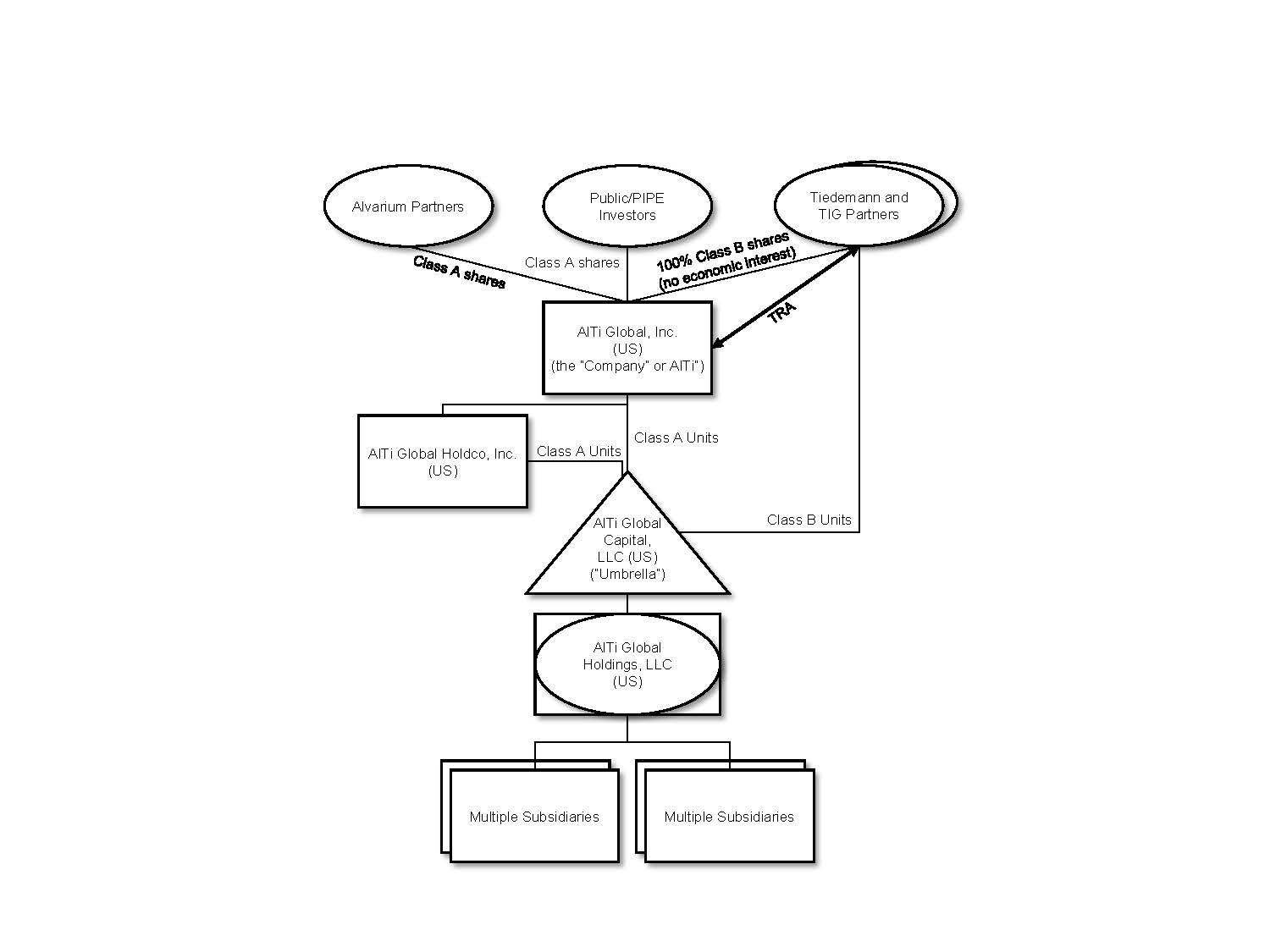

•Through a series of intercompany transactions, AlTi was restructured to reflect the final structure depicted below:

Capital Structure

The Registrant has the following classes of shares and other instruments outstanding:

•Class A Shares – Shares of Class A common stock that are publicly traded. Class A Shareholders are entitled to declared dividends from Class A shares. As of June 30, 2023 (Successor), the Class A Shares represent 53% of the total voting power of all shares.

•Class B Shares – Shares of Class B common stock that are not publicly traded. Class B shareholders are entitled to distributions declared by the Board. As of June 30, 2023 (Successor), the Class B Shares represent 47% of the total voting power of all shares.

•Warrants – Prior to the Business Combination, the Company issued warrants to purchase Class A Shares at a price of $11.50 per share. Throughout the period from January 3, 2023 to March 31, 2023 (Successor), 428,626 warrants were exercised. On April 3, 2023, 78,864 warrants were exercised. On June 7, 2023, the Company closed an offer and consent solicitation and entered into a warrant amendment, pursuant to which the remaining 19,892,387 warrants were exchanged for Class A Shares. The exercises and exchanges throughout the period from January 3, 2023 to June 30, 2023 (Successor)

AlTi Global, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

resulted in an increase in Additional Paid-in-Capital amount of $29.5 million. Following the exchanges, none of the warrants were outstanding as of June 30, 2023 (Successor).

The following table presents the number of shares of the Registrant that were outstanding as of June 30, 2023 (Successor):

| | | | | |

| As of June 30,

2023 (Successor) |

| Class A shares | 62,957,671 |

| Class B shares | 55,032,961 |

| |

| |

Segments

Our business is organized into two operating segments: Wealth Management and Asset Management. Described below are the segments and the revenue generated by each, which broadly fall into three categories: recurring management, advisory, or administration fees; performance or incentive fees; and transaction fees.

Wealth Management

Our Wealth Management services principally consist of investment management and advisory services, trusts and administrative services, and family office services. Our Wealth Management client base includes high net worth individuals, families, single family offices, foundations, and endowments globally. Investment management or advisory fees are the primary source of revenue in our Wealth Management segment. These fees are generally calculated based on a percentage of the value of each client’s billable assets under management (“AUM”) or assets under advisement (“AUA”) (as applicable). As of June 30, 2023 (Successor), this segment had $48.6 billion in AUM/AUA.

Investment Management and Advisory Services

In our investment management and advisory services teams, we diversify our clients’ portfolios across risk factors, geographies, traditional asset classes such as money markets, equities and fixed income, and alternative asset classes including private equity, private debt, hedge funds, real estate, and other assets through highly experienced, and hard to access, third-party managers.

Trusts and Administration Services

The trusts and administration services that we provide include entity formation and management, creating or modifying trust instruments and/or administrative practices to meet beneficiary needs, full corporate, trustee-executor, and fiduciary services. We also offer provision of directors and company secretarial services, administering entity ownership of intellectual property (“IP”) rights, advice and administration services in connection with investments in marine and aviation assets, and administering entity ownership of fine art and collectibles.

Family Office Services (FOS)

Our family office services are tailored outsourced family office solutions and administrative services which we provide primarily to our larger clients. These services include bookkeeping and back-office services, private foundation management and grantmaking, oversight of trust administration, financial tracking and reporting, cash flow management and bill pay, and other financial services.

AlTi Global, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(Prior to January 3, 2023, Tiedemann Wealth Management Holdings)

Asset Management

Our Asset Management services include alternatives platform, public and private real estate (including co-investment), and strategic advisory businesses.

Alternatives Platform

Our alternatives platform represents our legacy TIG business which is an alternative asset manager. This platform includes our TIG Arbitrage strategy and funds managed by our External Strategic Managers. Our alternatives platform client base is predominantly comprised of institutional investors. The TIG Arbitrage strategy is our event-driven strategy based in New York through which management fees and incentive fees based on performance are received from the underlying funds and accounts. The strategies of our External Strategic Managers include Real Estate Bridge Lending, European Equities and Asian Credit and Special Situations. We receive distributions from our External Strategic Managers through our profit or revenue sharing arrangements that are generated through their management and incentive fees based on performance of the underlying investments. As of June 30, 2023 (Successor), this platform had $7.9 billion in AUM/AUA.