The information in this preliminary proxy statement/prospectus is not complete and may be changed. The registrant may not sell the securities described in this preliminary proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/PROSPECTUS—SUBJECT TO COMPLETION, DATED SEPTEMBER 9, 2021

PROXY STATEMENT FOR

EXTRAORDINARY GENERAL MEETING OF AUSTERLITZ ACQUISITION CORPORATION I

AND

PROSPECTUS FOR

398,571,430 CLASS A ORDINARY SHARES, 27,783,333 WARRANTS AND 300,000,000 CLASS V ORDINARY SHARES OF AUSTERLITZ ACQUISITION CORPORATION I (AFTER ITS DOMESTICATION AS AN EXEMPTED COMPANY LIMITED BY SHARES REGISTERED BY CONTINUATION IN BERMUDA, WHICH WILL BE RENAMED WYNN INTERACTIVE LIMITED IN CONNECTION WITH THE BUSINESS COMBINATION DESCRIBED HEREIN)

Dear Austerlitz Acquisition Corporation I Shareholders:

You are cordially invited to attend the extraordinary general meeting (the “

Extraordinary General Meeting

”) of Austerlitz Acquisition Corporation I, a Cayman Islands exempted company (“Austerlitz

”) at [●], at [●] Eastern Time, on [●], 2021. Rather than attending in person, you may also attend via live webcast on the internet by visiting [●]. As further described in the accompanying proxy statement/prospectus, in connection with the Domestication (as defined below), on the Closing Date prior to the Effective Time (as described below), among other things, (i) Austerlitz will change its name to “Wynn Interactive Limited” (“

WBET

”), (ii) all of the issued and outstanding shares of Austerlitz will be converted into common shares of a Bermuda exempted company limited by shares and (iii) the governing documents of Austerlitz will be amended and restated. As used in the accompanying proxy statement/prospectus, “WBET” refers to Austerlitz after giving effect to the Domestication and the Business Combination. At the Extraordinary General Meeting, Austerlitz shareholders will be asked to consider and vote upon a proposal to approve and adopt that certain business combination agreement (as may be amended, supplemented or otherwise modified from time to time, the “

Business Combination Agreement

”), dated as of May 10, 2021, by and among Austerlitz, Wave Merger Sub Limited, an exempted company limited by shares incorporated in Bermuda and a direct wholly owned subsidiary of Austerlitz (“Merger Sub

”), and Wynn Interactive Ltd., an exempted company limited by shares incorporated in Bermuda (the “Company

”), a copy of which is attached to the accompanying proxy statement/prospectus as Annex A

, including the transactions contemplated thereby (collectively, the “Business Combination Proposal

”). As further described in the accompanying proxy statement/prospectus, subject to the terms and conditions of the Business Combination Agreement, the following transactions will occur:

(a) |

On the Closing Date, prior to the time at which the Effective Time occurs, Austerlitz will change its jurisdiction of incorporation by transferring by way of continuation from the Cayman Islands to Bermuda and registering as an exempted company limited by shares in accordance with Part XA of the Bermuda Companies Act and Part XII of the Cayman Islands Companies Act (As Revised) (the “ Domestication ”), upon which Austerlitz will change its name to “Wynn Interactive Limited” (for further details, see the section entitled “Proposal No. 2—The Domestication Proposal WBET .” |

(b) |

Merger Sub will merge with and into the Company (the “ Merger, ” and together with the Domestication, the “Business Combination ”), with the Company as the surviving company in the |

Merger and, after giving effect to such Merger, the Company will become a wholly-owned subsidiary of WBET. In accordance with the terms and subject to the conditions of the Business Combination Agreement, at the Effective Time, each outstanding share of the Company (other than treasury shares and any dissenting shares under the Bermuda Companies Act) will be exchanged for WBET Class A common shares (“WBET Class A Shares”) or Class V common shares (“WBET Class V Shares”), and outstanding Company options to purchase shares of the Company (whether vested or unvested) will be exchanged for comparable options to purchase WBET Class A Shares. The Current Company Equityholders (as defined in the following proxy statement/prospectus) will not receive any of the WBET Class C common shares (“WBET Class C Shares”), which will be held solely by Sponsor and certain Sponsor Persons. As of the date of this proxy statement/prospectus, there are 14,785,715 Austerlitz Class C ordinary shares issued and outstanding, which are held solely by Sponsor and certain Sponsor Persons, and will be converted into WBET Class C Shares (subject to the Class C Forfeiture, as defined below) on a one-for-one basis on the Closing Date. For further details see the section entitled “ Proposal No. 1—The Business Combination Proposal—Consideration to the Company Equityholders in the Business Combination |

In connection with the signing of the Business Combination Agreement, Austerlitz and Cannae Holdings, Inc. (“

Cannae

”) entered into a Backstop Agreement whereby Cannae has agreed, subject to the terms and conditions included therein, immediately prior to the closing of the transactions contemplated by the Business Combination Agreement (the “Closing

”), to subscribe for Austerlitz Class A ordinary shares in order to fund redemptions by shareholders of Austerlitz in connection with the Business Combination, in an amount of up to $690,000,000 (the “Cannae Backstop

”). In addition to the Business Combination Proposal, you will also be asked to consider and vote upon (a) a proposal to approve that the Amended and Restated Memorandum and Articles of Association of Austerlitz currently in effect (the “”), (b) the proposals to approve certain governance provisions in the WBET ”), (c) a proposal to approve, for the purposes of complying with the applicable provisions of Section 312.03 of the NYSE’s Listed Company Manual, the issuance of ordinary shares of Austerlitz in connection with the consummation of the transactions contemplated by the Business Combination Agreement (the “

Austerlitz Organizational Documents

”) be amended and restated by the deletion in their entirety and the substitution in their place of the WBET Memorandum of Continuance and the WBET Bye-Laws

(a copy of which is attached to the accompanying proxy statement/prospectus as Annex B

, the “WBET

”)) including the authorization of the change of name to ‘Wynn Interactive Limited’, in each case effective upon the Domestication (the “Bye-Laws

Bye-Laws

ProposalBye-Laws

, which are being separately presented in accordance with SEC requirements and which will be voted upon on a non-binding

advisory basis (the “Non-Binding

Governance ProposalsShare Issuance Proposal

”), (d) a proposal to approve the Wynn Interactive Limited 2021 Omnibus Incentive Plan, a copy of which is attached to the accompanying proxy statement/prospectus as Annex L (the “Omnibus Incentive Plan Proposal”) and (e) a proposal to approve the adjournment of the Extraordinary General Meeting to a later date or dates (A) to the extent necessary to ensure that any required supplement or amendment to the accompanying proxy statement/prospectus is provided to Austerlitz Shareholders (as defined herein) or, if as of the time for which the Extraordinary General Meeting is scheduled, there are insufficient ordinary shares of Austerlitz represented (either in person or by proxy) to constitute a quorum necessary to conduct business at the Extraordinary General Meeting, or (B) in order to solicit additional proxies from Austerlitz Shareholders in favor of one or more of the proposals at the Extraordinary General Meeting (the “Adjournment Proposal

”). Certain shareholders of Austerlitz will also be asked to consider and vote upon (x) a proposal to approve that Austerlitz be transferred by way of continuation from the Cayman Islands to Bermuda and registered as an exempted company limited by shares in accordance with Part XA of the Bermuda Companies Act and Part XII of the Cayman Islands Companies Act and, immediately upon being de-registered

in the Cayman Islands, Austerlitz be continued and registered as an exempted company limited by shares under the laws of Bermuda (the “Domestication Proposal

”) and (y) a proposal to approve the election of nine directors as described in the accompanying proxy statement/prospectus (the “Director Election Proposal

”). The Business Combination will be consummated only if the Business Combination Proposal, the Domestication Proposal, the

Bye-Laws

Proposal, the Omnibus Incentive Plan Proposal, and the Share Issuance Proposal (collectively, the “Required Austerlitz Approvals

”) are approved at the Extraordinary General Meeting. The

Non-Binding

Governance Proposals and the Director Election Proposal are conditioned on the approval of the Requisite Austerlitz Proposals. The Adjournment Proposal is not conditioned upon the approval of any other proposal. Each of these proposals is more fully described in the accompanying proxy statement/prospectus, which each shareholder is encouraged to read carefully and in its entirety. In connection with the signing of the Business Combination, certain related agreements were entered into, including the Sponsor Agreement, the Backstop Agreement and the Company Support Agreement (each as defined in the accompanying proxy statement/prospectus). Certain additional agreements will be entered in connection with the Closing of the Business Combination, including the Investor Rights Agreement, the Amended and Restated Registration Rights Agreement, the Statutory Merger Agreement and the Amended and Restated Commercial Intercompany Agreements (each as defined in the accompanying proxy statement/prospectus). See the section entitled “” in the accompanying proxy statement/prospectus for more information.

Proposal No. 1—Business Combination Proposal—Related Agreements

Pursuant to the Austerlitz Organizational Documents, a holder of Austerlitz’s public shares (a “ If the Business Combination is not consummated, the public shares will be returned to the respective holder, broker or bank. If the Business Combination is consummated, and if a public shareholder properly exercises its right to redeem all or a portion of the public shares that it holds and timely delivers its shares to Continental, Austerlitz will redeem such public shares for a ” in the accompanying proxy statement/prospectus for a detailed description of the procedures to be followed if you wish to redeem your public shares for cash.

public shareholder

”) may request that Austerlitz redeem all or a portion of such public shares for cash if the Business Combination is consummated. The redemption rights include the requirement that a holder must identify itself in writing as a beneficial holder and provide its legal name, phone number and address to Continental Stock Transfer & Trust Company (“Continental

”) in order to validly redeem its shares. Public shareholders may elect to redeem their public shares even if they vote “FOR” the Business Combination Proposal.

per-share

price, payable in cash, equal to the pro rata portion of the Trust Account established at the consummation of Austerlitz’s initial public offering, calculated as of two business days prior to the consummation of the Business Combination. For illustrative purposes, as of [•], 2021, this would have amounted to approximately $10.00 per issued and outstanding public share. If a public shareholder exercises its redemption rights in full, then it will be electing to exchange its public shares for cash and will no longer own public shares. The redemption will take place following the Domestication and, accordingly, it is shares of WBET that will be redeemed immediately after consummation of the Business Combination. See “Extraordinary General Meeting of Austerlitz Shareholders—Redemption Rights

Notwithstanding the foregoing, a public shareholder, together with any affiliate of such public shareholder or any other person with whom such public shareholder is acting in concert or as a “group” (as defined in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (“

Exchange Act

”)), will be restricted from redeeming its public shares with respect to more than an aggregate of 15% of the public shares. Accordingly, if a public shareholder, alone or acting in concert or as a group, seeks to redeem more than 15% of the public shares, then any such shares in excess of that 15% limit would not be redeemed for cash. In connection with the execution of the Business Combination Agreement and the Backstop Agreement, Austerlitz amended and restated that certain letter agreement, dated March 2, 2021, between Austerlitz and Austerlitz Acquisition Sponsor, LP I, a Cayman Islands exempted limited partnership (the “

Sponsor

”), and certain of its directors and officers (the “Insiders

”), and entered into the Sponsor Agreement with the Sponsor, Cannae and certain of the Insiders (together, the “Sponsor Persons

”). Pursuant to the Sponsor Agreement, among other things, the Sponsor Persons agreed (i) to vote any Austerlitz securities in favor of the Business Combination and other Austerlitz shareholder matters, (ii) not to seek redemption of any Austerlitz shares and (iii) not to transfer any Austerlitz securities for the period beginning on the Closing Date until the earlier of (x) one (1) year following the Closing Date or (y) if the volume weighted average price of the WBET Class A Shares equals or exceeds $12.00 per share for any 20 trading days within a 30 trading day period commencing 150 days after the Closing Date, and (iv) to be bound to certain other obligations as described therein. Additionally, (i) the Sponsor and certain Insiders have also agreed to forfeit up to 3,696,429 Austerlitz Class B ordinary shares and up to 3,696,429 Austerlitz Class C ordinary shares (“Class C Forfeiture”), in accordance with the terms of the Sponsor Agreement (subject, in each case, to a reduction in the number of shares to be forfeited if the Cannae Backstop is utilized), and (ii) in the event that the Austerlitz transaction expenses exceed $34,150,000 (such excess the “

Expenses Overage

”), certain Sponsor Persons shall forfeit and surrender to Austerlitz a number of Austerlitz Class B ordinary shares equal to the Expenses Overage divided by 10. The Business Combination Agreement is subject to the satisfaction or waiver of certain other closing conditions as described in the accompanying proxy statement/prospectus. There can be no assurance that the parties to the Business Combination Agreement would waive any such provision of the Business Combination Agreement. In addition, in no event will Austerlitz redeem public shares in an amount that would cause WBET’s net tangible assets (as determined in accordance with Rule

3a51-1(g)(1)

of the Exchange Act) to be less than $5,000,001 after giving effect to the transactions contemplated by the Business Combination Agreement and the Cannae Backstop. Concurrently with the consummation of the Business Combination, WBET, WSI Investment, LLC (“Wynn Investment”), Sponsor and Cannae (if applicable) will enter into an investor rights agreement (the, “Investor Rights Agreement”), relating to among other things, the composition of the WBET board of directors (the “WBET Board”) and certain consent rights for Wynn Investments. Pursuant to the terms of the Investor Rights Agreement, effective as of the Closing Date, it is anticipated that the WBET Board will be comprised of nine directors as follows: (i) one director designated by Sponsor, (ii) five directors designated by Wynn Investment, and (iii) three directors designated by the Company after consultation with Austerlitz.

In addition, for so long as Wynn Resorts, Limited (“Wynn Parent”) and its affiliates have a “Continuing Ownership Percentage” (as described in the proxy statement/prospectus) of 50% or more, WBET will not take, and will not permit WBET’s subsidiaries to take, and the WBET Board shall not authorize or approve, certain actions without the prior written approval of Wynn Investment, including increasing or decreasing the size of the WBET Board, amending or changing WBET’s organizational documents in any manner that modifies any specific rights of Wynn Parent or certain of its affiliates or materially and adversely affects Wynn Parent or certain of its affiliates in their capacity as shareholders of WBET, acquiring equity, assets, properties or business or disposing assets or properties of up to a certain threshold, incurring indebtedness that would increase the leverage beyond a certain threshold, terminating or replacing certain executive officers of WBET, declaring and paying dividend and redeeming, repurchasing or acquiring any shares of WBET. For additional details, see

“

Proposal

No.

1—Business Combination Proposal—Related Agreements—Approval Rights

.

”

Austerlitz’s units trade on the New York Stock Exchange (“

NYSE

”) (each of which consists of one share of Austerlitz Class A ordinary share and one-fourth

of one redeemable warrant to acquire a share of Austerlitz Class A ordinary share) and are currently listed and trade under the symbol “AUS.U” while the Austerlitz Class A ordinary shares and warrants are listed under the symbols “AUS” and “AUS.WS,” respectively. Austerlitz intends to apply for listing on the NASDAQ, effective upon the completion of the Business Combination, of the WBET Class A Shares and WBET warrants under the proposed symbols “WBET” and “WBET.WS” respectively. WBET will have three classes of shares: (i) WBET Class A Shares, (ii) WBET Class C Shares, and (iii) WBET Class V Shares. In accordance with the terms and subject to the conditions of the Business Combination Agreement, at the effective time of the Merger, the consideration to be paid to the existing shareholders of the Company will be, in the aggregate, a number of WBET Class A Shares and WBET Class V Shares (the “Merger Consideration”) equal to (a) the quotient obtained by dividing (i) the agreed company equity value of $3,000,000,000 by (ii) ten dollars ($10.00), minus (b) a number equal to the nearest whole number (rounded up or down, as applicable) obtained by multiplying (i) the number of WBET Class A Shares purchased by Cannae pursuant to the Backstop Agreement divided by sixty-nine million (69,000,000), by (ii) 3,696,429; provided that in no event will the number of shares deducted pursuant to clause (b) exceed 3,696,429. At the effective time of the Merger, the common shares of the Company will be converted into the right to receive, in the aggregate, the Merger Consideration.

The Company will have the right to determine the allocation of the aggregate equity consideration as between WBET Class A Shares and WBET Class V Shares (including the determination that the aggregate equity consideration may consist solely of WBET Class V Shares). The Company will give all Current Company

Equityholders WBET Class V Shares unless a Current Company Equityholder requests delivery of a WBET Class A Share and agrees to a twelve-month post-closing contractual lock-up. The Company does not currently expect any Current Company Equityholder to request WBET Class A Shares. The WBET Class A Shares are voting and economic interests in the Company and will be entitled to one vote per share. The WBET Class V Shares are voting and economic interests in the Company and will be entitled to ten votes per share.

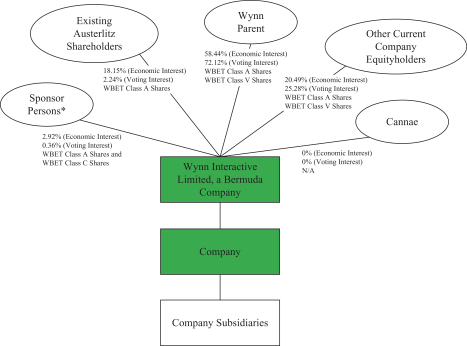

Immediately following the completion of the Business Combination, the ownership of WBET shall be as follows in a No Redemptions scenario (excluding Dilutive Securities (as defined herein) and assuming that all Current Company Equityholders receive WBET Class V Shares): (i) Sponsor is expected to have a 2.92% economic interest and 0.36% voting interest; (ii) Existing Austerlitz Shareholders are expected to have a 18.15% economic interest and 2.24% voting interest; (iii) Wynn Parent is expected have a 58.44% economic interest and 72.12% voting interest; (iv) other current Company equityholders (other than Wynn Parent) are expected to have a 20.49% economic interest and 25.28% voting interest; and (v) Cannae is expected to have a 0% economic interest and 0% voting interest. Based on the voting power held by Wynn Parent immediately following the completion of the Business Combination, Wynn Parent will control all decisions put to stockholders of WBET. For additional information and details regarding the assumptions made in calculating the foregoing interests, see “.”

Proposal No. 1—The Business Combination Proposal—Ownership of WBET Immediately Following the Business Combination

Austerlitz is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “

JOBS Act

”) and has elected to comply with certain reduced public company reporting requirements. Austerlitz (and WBET, following the Business Combination) will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of the Austerlitz IPO, (b) in which Austerlitz or WBET, as applicable, has total annual gross revenue of at least $1.07 billion, or (c) in which Austerlitz or WBET, as applicable, is deemed to be a large accelerated filer, which means the market value of Austerlitz Shares or WBET Shares, as applicable, that is held by

non-affiliates

exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date on which Austerlitz or WBET, as applicable, has issued more than $1.00 billion in non-convertible

debt during the prior three-year period. References herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act. Following the Business Combination, Wynn Parent will own a majority of the voting power of WBET’s Shares. As a result, WBET will be a “controlled company” under NASDAQ rules. As a controlled company, WBET will be exempt from certain corporate governance requirements, including those that would otherwise require the WBET Board to have a majority of independent directors and require that WBET either establish compensation and nominating and corporate governance committees, each comprised entirely of independent directors, or otherwise ensure that the compensation of WBET’s executive officers and nominees of directors are determined or recommended to the WBET Board by independent members of the WBET Board. Because WBET intends to avail itself of the “controlled company” exception under the NASDAQ rules, WBET may choose to rely upon these exemptions and, as a result, holders of WBET Shares will not have the same protections afforded to shareholders of companies that are subject to all of the NASDAQ corporate governance requirements.

Austerlitz is providing the accompanying proxy statement/prospectus and accompanying proxy card to Austerlitz’s shareholders in connection with the solicitation of proxies to be voted at the Extraordinary General Meeting and at any adjournments of the Extraordinary General Meeting. Information about the Extraordinary General Meeting, the Business Combination and other related business to be considered by Austerlitz’s shareholders at the Extraordinary General Meeting is included in the accompanying proxy statement/prospectus. ”

Whether or not you plan to attend the Extraordinary General Meeting, all of Austerlitz’s shareholders are urged to read the accompanying proxy statement/prospectus, including the Annexes and other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in “

beginning on page 56 of the accompanying proxy statement/prospectus.

After careful consideration, the board of directors of Austerlitz has approved the Business Combination Agreement and the transactions contemplated thereby, including the Merger, and recommends that shareholders vote “FOR” the adoption of the Business Combination Agreement and approval of the transactions contemplated thereby, including the Merger, and “FOR” all other proposals presented to Austerlitz’s shareholders in the accompanying proxy statement/prospectus. When you consider the recommendation of these proposals by the board of directors of Austerlitz, you should keep in mind that Austerlitz’s directors and officers have interests in the Business Combination that may conflict with your interests as a shareholder. See the section entitled “

Proposal No. 1—Business Combination Proposal-—Interests of Certain Persons in the Business Combination

” in the accompanying proxy statement/prospectus for a further discussion of these considerations.

The approval of each of the Domestication Proposal and the

Bye-Laws

Proposal requires a special resolution under Cayman Islands law, being the affirmative vote of at least a two-thirds

(2/3) majority of the votes cast by the holders of the issued ordinary shares present in person or represented by proxy at the Extraordinary General Meeting and entitled to vote on such matter. The approval of each of the Business Combination Proposal, the Share Issuance Proposal, the Omnibus Incentive Plan Proposal, the Director Election Proposal, the Non-Binding

Governance Proposals and the Adjournment Proposal requires an ordinary resolution under Cayman Islands law, being the affirmative vote of at least a majority of the votes cast by the holders of the issued ordinary shares present in person or represented by proxy at the Extraordinary General Meeting and entitled to vote on such matter. In accordance with the Austerlitz Organizational Documents, prior to the consummation of Austerlitz’s initial business combination only the holders of Austerlitz Class

B ordinary shares and Austerlitz Class

C ordinary shares are entitled to vote on the Domestication Proposal and the Director Election Proposal.

Your vote is very important.

Whether or not you plan to attend the Extraordinary General Meeting, please vote as soon as possible by following the instructions in the accompanying proxy statement/prospectus to make sure that your shares are represented at the Extraordinary General Meeting. If you hold your shares in “street name” through a bank, broker or other nominee, you will need to follow the instructions provided to you by your bank, broker or other nominee to ensure that your shares are represented and voted at the Extraordinary General Meeting.

If you sign, date and return your proxy card without indicating how you wish to vote, your proxy will be voted FOR each of the proposals presented at the Extraordinary General Meeting. If you fail to return your proxy card or fail to instruct your bank, broker or other nominee how to vote, and do not attend the Extraordinary General Meeting in person, the effect will be, among other things, that your shares will not be counted for purposes of determining whether a quorum is present at the Extraordinary General Meeting. If you are a shareholder of record and you attend the Extraordinary General Meeting and wish to vote in person, you may withdraw your proxy and vote in person.

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST DEMAND IN WRITING THAT YOUR PUBLIC SHARES ARE REDEEMED FOR A PRO RATA PORTION OF THE FUNDS HELD IN THE TRUST ACCOUNT AND TENDER YOUR SHARES TO AUSTERLITZ’S TRANSFER AGENT AT LEAST TWO BUSINESS DAYS PRIOR TO THE VOTE AT THE EXTRAORDINARY GENERAL MEETING. IN ORDER TO EXERCISE YOUR REDEMPTION RIGHT, YOU NEED TO IDENTIFY YOURSELF AS A BENEFICIAL HOLDER AND PROVIDE YOUR LEGAL NAME, PHONE NUMBER AND ADDRESS IN YOUR WRITTEN DEMAND. YOU MAY TENDER YOUR SHARES BY EITHER DELIVERING YOUR SHARE CERTIFICATE TO THE TRANSFER AGENT OR BY DELIVERING YOUR SHARES ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT WITHDRAWAL AT CUSTODIAN) SYSTEM. IF THE BUSINESS COMBINATION IS NOT COMPLETED, THEN THESE SHARES WILL BE RETURNED TO YOU OR YOUR ACCOUNT. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS.

On behalf of Austerlitz’s board of directors, I would like to thank you for your support and look forward to the successful completion of the Business Combination.

Sincerely, |

|

Richard N. Massey |

Chief Executive Officer and Director |

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES OR GAMING AUTHORITY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE

.

The accompanying proxy statement/prospectus is dated , 2021 and is first being mailed to shareholders on or about , 2021.