UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

OR

For the fiscal year ended

OR

OR

Commission File No.:

(Exact name of registrant as specified in its charter)

Translation of registrant’s name into English: Not applicable

State

of

(Jurisdiction of incorporation or organization)

Tel:

+

(Address of principal executive offices)

Tel:

+

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Warrant to purchase one Ordinary Share | IINNW |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐

Indicate by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Emerging Growth Company |

If an emerging growth company that prepares its financial statements

in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes ☐ No

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP ☐

☒

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company.

Yes ☐ No

TABLE OF CONTENTS

i

ii

Inspira Technologies Oxy B.H.N. Ltd.

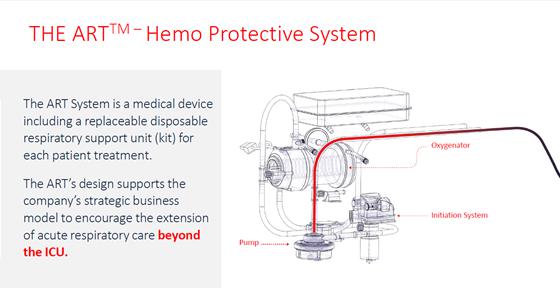

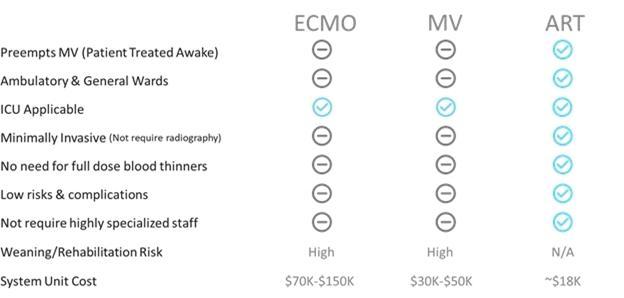

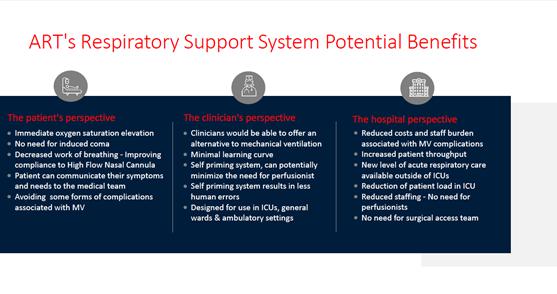

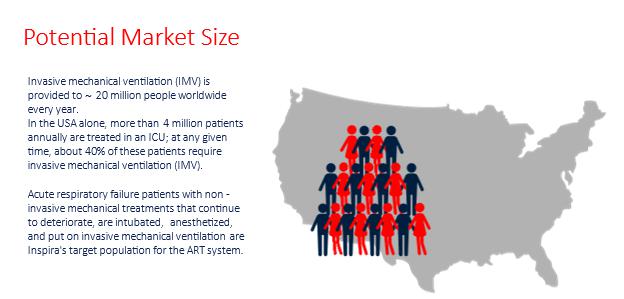

INTRODUCTION

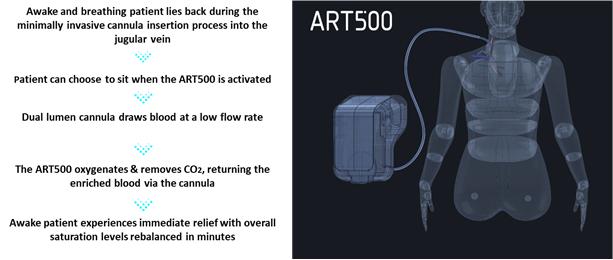

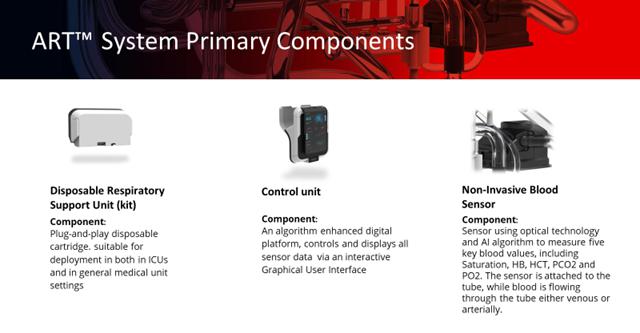

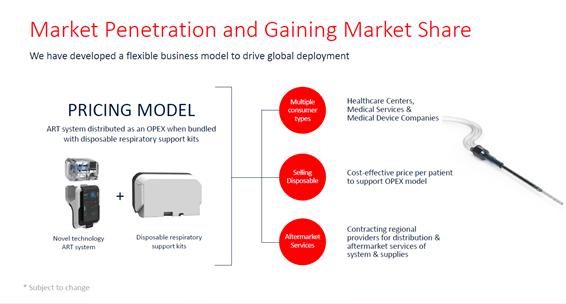

We are a specialty medical device company engaged in the research, development, manufacturing related activities, and go to market activities of proprietary respiratory support technology. We are developing the ART device (previously known as the ART500), described herein as the “ART,” “ART device” or “ART system,” a cost effective early extracorporeal respiratory support system intended to function as an external “artificial lung” for deteriorating respiratory patients. The ART device is designed to utilize a hemo-protective flow approach aimed to rebalance saturation levels while patients are awake and breathing, potentially minimizing the patient’s need for mechanical ventilation, or MV, which is the standard of care today for the treatment of respiratory failure. Although it may be considered lifesaving, MV is associated with increased costs of care, extended lengths of stay in the hospital, frequent incidence of infections, ventilator dependence and mortality. Using our state-of-the-art respiratory support technology, our goal is to set a new standard of care and to provide patients with respiratory insufficiency/failure an opportunity to remain awake, maintain spontaneous breathing and avoid the various risks associated with the use of MV. As part of our strategy to reach this goal, and in parallel to pursuing regulatory approvals, we are actively working to establish collaborations with strategic partners and globally ranked health centers, to provide endorsement and clinical adoption for regional deployments of our respiratory support technology. We plan to target intensive care units, or ICUs, general medical units, emergency medical services and small urban and rural hospitals.

We are an Israeli corporation based in Ra’anana, Israel and were incorporated in Israel in 2018 under the name Clearx Medical Ltd. On April 10, 2018, our name was changed to Insense Medical Ltd. and on July 30, 2020, our name was changed to our current name, Inspira Technologies Oxy B.H.N. Ltd. Our principal executive offices are located at 2 Ha-Tidhar St., Ra’anana, 4366504 Israel. Our telephone number in Israel is 972 996 644 88. Our website address is www.inspira-technologies.com. The information contained on, or that can be accessed through, our website is not part of this annual report on Form 20-F. We have included our website address in this annual report on Form 20-F solely as an inactive textual reference. Our ordinary shares, or “Ordinary Shares” and warrants to purchase one Ordinary Share, or “Warrants,” are listed on the Nasdaq Capital Market, or Nasdaq, under the symbols “IINN” and “IINNW,” respectively.

iii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included or incorporated by reference in this annual report on Form 20-F may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements are often characterized by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “estimate,” “continue,” “believe,” “predict,” “should,” “intend,” “project” or other similar words, but are not the only way these statements are identified.

These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

Important factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking statements include, among other things:

| ● | our expectation regarding the sufficiency of our existing cash and cash equivalents to fund our current operations; | |

| ● | our ability to advance the development of our products and future potential product candidates; | |

| ● | our ability to commercialize our products and future potential product candidates and future sales of our products or any other future potential product candidates; | |

| ● | our assessment of the potential of our products and future potential product candidates to treat certain indications; | |

| ● | our planned level of capital expenditures and liquidity; | |

| ● | our plans to continue to invest in research and development to develop technology for new products; | |

| ● | anticipated actions of the FDA, state regulators, if any, or other similar foreign regulatory agencies, including approval to conduct clinical trials, the timing and scope of those trials and the prospects for regulatory approval or clearance of, or other regulatory action with respect to our products or services; | |

| ● | the regulatory environment and changes in the health policies and regimes in the countries in which we intend to operate, including the impact of any changes in regulation and legislation that could affect the medical device industry; |

iv

| ● | our ability to meet our expectations regarding the commercial supply of our products and future product candidates; | |

| ● | our ability to retain key executive members; | |

| ● | our ability to internally develop new inventions and intellectual property; |

| ● | the overall global economic environment; | |

| ● | the impact of COVID-19 and resulting government actions on us; | |

| ● | the impact of competition and new technologies; | |

| ● | general market, political and economic conditions in the countries in which we operate; | |

| ● | the impact of competition and new technologies; | |

| ● | our ability to internally develop new inventions and intellectual property; | |

| ● | changes in our strategy; and | |

| ● | litigation. | |

Readers are urged to carefully review and consider the various disclosures made throughout this annual report on Form 20-F which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue reliance on any forward-looking statements. Any forward-looking statements in this annual report on Form 20-F are made as of the date hereof, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, the section of this annual report on Form 20-F entitled “Item 4. Information on the Company” contains information obtained from independent industry sources and other sources that we have not independently verified.

Unless otherwise indicated, all references to the “Company,” “we,” “our” and “Inspira” refer to Inspira Technologies Oxy B.H.N. Ltd. References to “U.S. dollars, “dollars,” and “$” are to currency of the United States of America, references to A$ are to Australian dollars, and references to “NIS” are to New Israeli Shekels. We report under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

All trademarks or trade names referred to in this Form 20-F are the property of their respective owners. Solely for convenience, the trademarks and trade names in this annual report on Form 20-F are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

v

Summary Risk Factors

The risk factors described below are a summary of the principal risk factors associated with an investment in us. These are not the only risks we face. You should carefully consider these risk factors, together with the risk factors set forth in Item 3D. of this annual report on Form 20-F and the other reports and documents filed by us with the SEC.

| ● | We have a limited operating history, and we have incurred significant operating losses since our inception, and anticipate that we will incur continued losses for the foreseeable future. | |

| ● | We have not generated any revenue from product sales and may never be profitable. | |

| ● | We will need to raise substantial additional funding, which may not be available on acceptable terms, or at all. Failure to obtain funding on acceptable terms and on a timely basis may require us to curtail, delay or discontinue our product development efforts or other operations; | |

| ● | Raising additional capital would cause dilution to our existing shareholders, and may adversely affect the rights of existing shareholders; | |

| ● | We are highly dependent on the successful development, marketing and sale of our products and on receiving the required regulatory approvals; |

| ● | We face business disruption and related risks resulting from the outbreak of the COVID-19 pandemic, which could have a material adverse effect on our business and results of operations;

| |

| ● | Our success depends upon market acceptance of our products, our ability to develop and commercialize new products and generate revenues and our ability to identify new markets for our technology; | |

| ● | Medical device development is costly and involves continual technological change which may render our current or future products obsolete; |

| ● | Our customer acquisition strategy may not succeed; | |

| ● | We are dependent upon third-party service providers. If such third-party service providers fail to maintain a high quality of service, the utility of our products could be impaired, which could adversely affect the penetration of our products, our business, operating results and reputation; | |

| ● | We expect to be exposed to fluctuations in currency exchange rates, which could adversely affect our results of operations; | |

| ● | We manage our business through a small number of employees and key consultants; | |

| ● | We may need to expand our organization and we may experience difficulties in recruiting needed additional employees and consultants, which could disrupt our operations; | |

| ● | International expansion of our business exposes us to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the United States or Israel; | |

| ● | If third-party payors do not provide adequate coverage and reimbursement for the use of our products or services or any future product candidates, our revenue will be negatively impacted; | |

| ● | Our product candidates and operations are subject to extensive government regulation and oversight both in the United States and abroad and our failure to comply with applicable requirements could harm our business; |

vi

| ● | We may not receive, or may be delayed in receiving, the necessary clearances or approvals for our products and failure to timely obtain necessary clearances or approvals for our products would adversely affect our ability to grow our business; | |

| ● | Failure to comply with post-marketing regulatory requirements could subject us to enforcement actions, including substantial penalties, and might require us to recall or withdraw a product from the market; | |

| ● | our products may cause or contribute to adverse medical events or be subject to failures or malfunctions that we are required to report to the FDA, and if we fail to do so, we would be subject to sanctions that could harm our reputation, business, financial condition and results of operations. The discovery of serious safety issues with our products, or a recall of our products either voluntarily or at the direction of the FDA or another governmental authority, could have a negative impact on us; | |

| ● | Healthcare legislative and regulatory reform measures may have a material adverse effect on our business and results of operations; |

| ● | Legislative or regulatory reforms in the United States or the European Union may make it more difficult and costly for us to obtain regulatory clearances or approvals for our products or to manufacture, market or distribute our products after clearance or approval is obtained; | |

| ● | If we are unable to obtain and maintain effective patent rights for our products and services, we may not be able to compete effectively in our markets. If we are unable to protect the confidentiality of our trade secrets or know-how, such proprietary information may be used by others to compete against us; | |

| ● | The market price of our securities may be highly volatile, and you may not be able to resell your Ordinary Shares or Warrants at or above the price that you paid; | |

| ● | Our principal shareholders, officers and directors currently beneficially own approximately 30% of our Ordinary Shares and Warrants and may therefore be able to exert control over matters submitted to our shareholders for approval; | |

| ● | We may be subject, directly or indirectly, to federal and state healthcare fraud and abuse laws, false claims laws and health information privacy and security laws. If we are unable to comply, or have not fully complied, with such laws, we could face substantial penalties; | |

| ● | Our business and operations might be adversely affected by security breaches, including any cybersecurity incidents; and | |

| ● | Potential political, economic and military instability in the State of Israel, where our headquarters, members of our management team and our research and development facilities are located, may adversely affect our results of operations. |

vii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | [Reserved] |

[Reserved]

| B. | Capitalization and Indebtedness. |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds. |

Not applicable.

| D. | Risk Factors |

You should carefully consider the risks described below, together with all of the other information in this annual report on Form 20-F. If any of these risks actually occurs, our business and financial condition could suffer and the price of our Ordinary Shares and Warrants could decline.

1

Risks Related to Our Financial Condition and Capital Requirements

We have a limited operating history, have incurred significant operating losses since our inception and anticipate that we will incur continued losses for the foreseeable future.

We are a development-stage medical device company with a limited operating history. To date, we have focused almost exclusively on developing our ART system followed by our ECLS system. We have funded our operations to date primarily through convertible loans and royalty-bearing and non-royalty bearing grants that we received from the Israeli Innovation Authority, or the IIA, formerly known as the Office of the Chief Scientist of the Ministry of Economy and Industry.

We have only a limited operating history upon which you can evaluate our business and prospects. In addition, we have limited experience and have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the medical device industry. To date, we have not generated revenue from the sale of our product candidate (see “Item 5. Operating and Financial Review and Prospects.”)for additional information). We have incurred losses in each year since our inception, including net losses of approximately $17 million and $7.2 million for the years ended December 31, 2021 and 2020, respectively . As of December 31, 2021, we had an accumulated deficit of approximately $28.8 million. Substantially all of our operating losses resulted from costs incurred in connection with our development of our products and from general and administrative costs associated with our operations.

We expect our research and development expenses to increase in connection with our planned expanded studies. In addition, if we obtain marketing approval for our products, we will likely incur significant sales, marketing and outsourced manufacturing expenses, as well as continued research and development expenses and costs associated with operating as a public company. As a result, we expect to continue to incur significant and increasing operating losses for the foreseeable future. Because of the numerous risks and uncertainties associated with developing a medical device, we are unable to predict the extent of any future losses or when we will become profitable, if at all.

We expect to continue to incur significant losses until we are able to commercialize our products, which we may not be successful in achieving. We anticipate that our expenses will increase substantially if and as we:

| ● | continue the research and development of our products; | |

| ● | seek regulatory and marketing approvals for our products; | |

| ● | establish a sales, marketing, and distribution infrastructure to commercialize our products; | |

| ● | seek to identify, assess, acquire, license, and/or develop other product candidates and subsequent generations of our current product candidate; | |

| ● | seek to maintain, protect, and expand our intellectual property portfolio; |

| ● | seek to attract and retain skilled personnel; | |

| ● | create additional infrastructure to support our operations as a public company and our product candidate development and planned future commercialization efforts; and | |

| ● | experience any delays or encounter issues with respect to any of the above, including, but not limited to, failed studies, complex results, safety issues or other regulatory challenges that require longer follow-up of existing studies or additional supportive studies in order to pursue marketing approval. |

The amount of our future operating losses will depend, in part, on the rate of our future expenditures. Even if we obtain regulatory approval to market our products or any future product candidates, our future revenue will depend upon the size of any markets in which our products or any future product candidates receive approval and our ability to achieve sufficient market acceptance, pricing, reimbursement from third-party payors for our products or any future product candidates. Further, the operating losses that we incur may fluctuate significantly from quarter to quarter and year to year, such that a period-to-period comparison of our results of operations may not be a good indication of our future performance. Other unanticipated costs may also arise.

2

We have not generated any revenue from product sales and may never be profitable.

We have no products approved for marketing in any jurisdiction and we have never generated any revenue from product sales. Our ability to generate revenue and achieve profitability depends on our ability, alone or with strategic collaboration partners, to successfully complete the development of, and obtain the regulatory and marketing approvals necessary to commercialize our products or any future product candidates. We do not know when, or if, we will generate any such revenue. Our ability to generate future revenue from product sales will depend heavily on our success in many areas, including but not limited to:

| ● | complete research and development of our products and any future product candidates in a timely and successful manner; | |

| ● | obtain regulatory and marketing approval for any product candidates; | |

| ● | maintain and enhance a commercially viable, sustainable, scalable, reproducible and transferable manufacturing process for our products and any future product candidates that is compliant with current good manufacturing practices, or cGMPs; | |

| ● | establish and maintain supply and, if applicable, manufacturing relationships with third parties that can provide, in both amount and quality, adequate products to support development and the market demand for our products and any future product candidates, if and when approved; | |

| ● | identifying, assessing, acquiring and/or developing new product candidates; | |

| ● | launch and commercialize any product candidates for which we obtain regulatory and marketing approval, either directly by establishing a sales force, marketing and distribution infrastructure, and/or with collaborators or distributors; | |

| ● | accurately identifying demand for our products or any future product candidates; | |

| ● | expose and educate physicians and other medical professionals to use our products; | |

| ● | obtain market acceptance, if and when approved, of our products and any future product candidates from the medical community and third-party payors; | |

| ● | ensure our product candidates are approved for reimbursement from governmental agencies, health care providers and insurers in jurisdictions where they have been approved for marketing; |

| ● | address any competing technological and market developments that impact our products and any future product candidates or their prospective usage by medical professionals; | |

| ● | negotiate favorable terms in any collaboration, licensing or other arrangements into which we may enter and perform our obligations under such collaborations; | |

| ● | maintain, protect and expand our portfolio of intellectual property rights, including patents, patent applications, trade secrets and know-how; | |

| ● | avoid and defend against third-party interference or infringement claims; | |

| ● | attract, hire and retain qualified personnel; and | |

| ● | locate and lease or acquire suitable facilities to support our clinical development, manufacturing facilities and commercial expansion. |

Even if our products or any future product candidates are approved for marketing and sale, we anticipate incurring significant incremental costs associated with commercializing such product candidates. Our expenses could increase beyond expectations if we are required by the FDA, or other regulatory agencies, domestic or foreign, to change our manufacturing processes or assays or to perform studies in addition to those that we currently anticipate. Even if we are successful in obtaining regulatory approvals to market our products or any future product candidates, our revenue earned from such product candidates will be dependent in part upon the size of the markets in the territories for which we gain regulatory approval for such products, the accepted price for such products, our ability to obtain reimbursement for such products at any price, whether we own the commercial rights for that territory in which such products have been approved and the expenses associated with manufacturing and marketing such products for such markets. Therefore, we may not generate significant revenue from the sale of such products, even if approved. Further, if we are not able to generate significant revenue from the sale of our approved products, we may be forced to curtail or cease our operations. Due to the numerous risks and uncertainties involved in product development, it is difficult to predict the timing or amount of increased expenses, or when, or if, we will be able to achieve or maintain profitability.

3

We will need to raise substantial additional funding, which may not be available on acceptable terms, or at all. Failure to obtain funding on acceptable terms and on a timely basis may require us to curtail, delay or discontinue our product development efforts or other operations.

As of December 31, 2021, our cash and cash equivalents were approximately $23,749,000, not including restricted cash of $120,000, and we had a working capital of approximately $20,194,000 and an accumulated deficit of approximately $28,791,000. Based upon our currently expected level of operating expenditures, we expect that our existing cash and cash equivalents, will only be sufficient to fund operations through July 2023. We expect that we will require substantial additional capital to commercialize our products. In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Our future funding requirements will depend on many factors, including but not limited to:

| ● | the progress, results and costs of our ongoing and planned studies and, if applicable, clinical trials of products and any future product candidates; | |

| ● | the cost, timing and outcomes of regulatory review of products and any future product candidates; | |

| ● | the costs of maintaining our own commercial-scale cGMP manufacturing facility, including costs related to obtaining and maintaining regulatory compliance, and/or engaging third-party manufacturers therefor; | |

| ● | the scope, progress, results and costs of product development, testing, manufacturing, preclinical development and, if applicable, clinical trials for any other product candidates that we may develop or otherwise obtain in the future; |

| ● | the cost of our future activities, including establishing sales, marketing and distribution capabilities for any product candidates in any particular geography where we receive marketing approval for such product candidates | |

| ● | the terms and timing of any collaborative, licensing and other arrangements that we may establish; | |

| ● | the costs of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending intellectual property-related claims; and | |

| ● | the level of revenue, if any, received from commercial sales of any product candidates for which we receive marketing approval. |

Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our products and any future product candidates. In addition, future financing may not be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of holders of our securities and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our Ordinary Shares or Warrants to decline. The incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the development or commercialization, if any, of our products or any other product candidates or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

Raising additional capital would cause dilution to our existing shareholders, and may adversely affect the rights of existing shareholders.

We may seek additional capital through a combination of private and public equity offerings, debt financings and collaborations and strategic and licensing arrangements. To the extent that we raise additional capital through the issuance of equity or otherwise including through convertible debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a shareholder. Future sales of our Ordinary Shares or of securities convertible into our Ordinary Shares, or the perception that such sales may occur, could cause immediate dilution and adversely affect the market price of our Ordinary Shares.

4

Risks Related to Our Business and Industry

We are highly dependent on the successful development, marketing and sale of our products and on receiving the required regulatory approvals.

Our products, focused on the treatment of respiratory failure, is the basis of our business. As a result, the success of our business plan is highly dependent on our ability to develop, manufacture and commercialize our products, and our failure to do so could cause our business to fail. Successful commercialization of medical devices is a complex and uncertain process, dependent on the efforts of management, manufacturers, local operators, integrators, medical professionals, third-party payors, as well as general economic conditions, among other factors. Any factor that adversely impacts the development and commercialization of our products, will have a negative impact on our business, financial condition, results of operations and prospects. We have limited experience in commercializing our products and we may face several challenges with respect to our commercialization efforts, including, among others, that:

| ● | we may not have adequate financial or other resources to complete the development of our products; | |

| ● | we may not be able to manufacture our products in commercial quantities, at an adequate quality or at an acceptable cost; | |

| ● | we may not be able to establish adequate sales, marketing and distribution channels; | |

| ● | healthcare professionals and patients may not accept our products; | |

| ● | we may not be aware of possible complications from the continued use of our products since we have limited clinical experience with respect to the actual use of our products; | |

| ● | we may not be able to compete with existing solutions for respiratory failure; | |

| ● | technological breakthroughs in the respiratory support solutions may reduce the demand for our products; | |

| ● | third-party payors may not agree to reimburse patients for any or all of the purchase price of our products, which may adversely affect patients’ willingness to use our products; | |

| ● | we may face third-party claims of intellectual property infringement; and | |

| ● | we may fail to obtain or maintain regulatory clearance or approvals in our target markets or may face adverse regulatory or legal actions even if regulatory approval is obtained. |

If we are unable to meet any one or more of these challenges successfully, our ability to effectively commercialize our products and services could be limited, which in turn could have a material adverse effect on our business, financial condition and results of operations.

We face business disruption and related risks resulting from the outbreak of the COVID-19 pandemic, which could have a material adverse effect on our business and results of operations.

Our operations and business have been disrupted and could be materially adversely affected by the outbreak of COVID-19. The pandemic has caused states of emergency to be declared in various countries, travel restrictions imposed globally, quarantines established in certain jurisdictions and various institutions and companies being closed. The COVID-19 pandemic has also adversely affected our ability to conduct our business effectively due to disruptions to our capabilities, availability and productivity of personnel, while we simultaneously attempt to comply with rapidly changing restrictions, such as travel restrictions and curfews. In particular, in November 2021, the Ministry of Health in the State of Israel issued guidelines requiring a Green Pass for indoor gatherings of more than 50 people. Employers (including us) are also required to prepare and increase as much as possible the capacity and arrangement for employees to work remotely. While certain COVID-19 mitigation actions have since been relaxed, no assurance can be made that such actions, or other measures, will not be reimposed in the future. In addition, the U.S. government has restricted travel to the United States from foreign nationals who have not been vaccinated against COVID-19. Although to date these restrictions have not materially impacted our operations other than the ability to travel which resulted in delays in our trials, demonstrations and installations, the effect on our business from the spread of COVID-19 and the COVID-19 mitigation actions implemented by the governments of the State of Israel, the United States and other countries may worsen over time.

Authorities around the world have and may continue implementing similar restrictions on business and individuals in their jurisdictions. To date, we have taken action to enable our employees to work remotely from home but there can be no assurance that these measures will enable us to avoid part or all of any impact from the spread of COVID-19 or its consequences, including downturns in business sentiment generally or in our sector in particular.

5

Our success depends upon market acceptance of our products, our ability to develop and commercialize new products and generate revenues and our ability to identify new markets for our technology.

We have developed, and are engaged in the development of, respiratory support technology. Our success will depend on the approval and acceptance of our products and any future products in the healthcare market. We are faced with the risk that the marketplace will not be receptive to our products or any future products over competing products and that we will be unable to compete effectively. Factors that could affect our ability to successfully commercialize our current and any potential future products:

| ● | the challenges of developing (or acquiring externally-developed) technology solutions that are adequate and competitive in meeting the requirements of next-generation design challenges; and | |

| ● | the dependence upon referrals from physicians for the sale of our products and provision of our service. |

We cannot assure that our products or any future products will gain broad market acceptance. If the market for our products fails to develop or develops more slowly than expected, our business and operating results would be materially and adversely affected.

Medical device development is costly and involves continual technological change which may render our current or future products obsolete.

The market for medical device technologies and products is characterized by factors such as rapid technological change, medical advances, changing consumer requirements, short device lifecycles, changing regulatory requirements and evolving industry standards. Any one of these factors could reduce the demand for our devices or require substantial resources and expenditures for, among other things, research, design and development, to avoid technological or market obsolescence.

Our success will depend on our ability to enhance our current technology and develop or acquire new technologies to keep pace with technological developments and evolving industry standards, while responding to changes in customer needs. A failure to adequately develop or acquire device enhancements or new devices that will address changing technologies and customer requirements adequately, or to introduce such devices on a timely basis, may have a material adverse effect on our business, financial condition and results of operations.

We might have insufficient financial resources to improve our products, advance technologies and develop new devices at competitive prices. Technological advances by one or more competitors or future entrants into the field may result in our present services or devices becoming non-competitive or obsolete, which may decrease revenues and profits and adversely affect our business and results of operations.

We may encounter significant competition across our product lines and in each market in which we will sell our products and services from various companies, some of which may have greater financial and marketing resources than we do. Our competitors may include any companies engaged in the research, development, manufacture, and marketing of respiratory support solutions and technologies, as well as a wide range of medical device companies that sell a single or limited number of competitive products and services or participate in only a specific market segment.

Our customer acquisition strategy may not succeed.

Our business will be dependent upon success in our customer acquisition strategy. If we fail to maintain a high quality of device technology, we may fail to retain or add new customers. If we fail, our revenue, financial results and business may be significantly harmed. Our future success depends upon expanding our commercial operations in the United States, Israel and Europe, as well as entering additional markets to commercialize our products and any future products. We believe that our expanded growth will depend on the further development, regulatory approval and commercialization of our products. If we fail to expand the use of our products in a timely manner, we may not be able to expand our markets or to grow our revenue, and our business may be adversely impacted. If people do not perceive our products to be useful and reliable, we may not be able to attract or retain new customers. A decrease in costumer growth could render less attractive to developers, which may have a material and adverse impact on our revenue, business, financial condition and results of operations.

Our business and operations would suffer in the event of computer system failures, cyber attacks or a deficiency in our cybersecurity.

Despite the implementation of security measures intended to secure our data against impermissible access and to preserve the integrity and confidentiality of our data, our internal computer systems, and those of third parties on which we rely, are vulnerable to damage from computer viruses, malware, natural disasters, terrorism, war, telecommunication and electrical failures, cyber-attacks or cyber-intrusions over the Internet, attachments to emails, persons inside our organization, or persons with access to systems inside our organization. The risk of a security breach or disruption, particularly through cyber attacks or cyber intrusion, including by computer hackers, foreign governments, and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. If such an event were to occur and cause interruptions in our operations, it could result in a material disruption of our drug development programs. For example, the loss of clinical trial data from completed or ongoing or planned clinical trials could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. To the extent that any disruption or security breach was to result in a loss of or damage to our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur material legal claims and liability, including under data privacy laws such as the General Data Protection Regulation, or the GDPR, damage to our reputation, and the further development of our drug candidates could be delayed.

6

We are dependent upon third-party manufacturers and suppliers, which makes us vulnerable to potential supply shortages and problems, increased costs and quality or compliance issues, any of which could harm our business.

Our products are comprised of a number of components. We are planning to sell an assembled product as well as its disposable respiratory support unit. The components of the assembled product and the disposable unit consist of both proprietary and off the shelf components. Proprietary components will be manufactured on our behalf at good manufacturing practices, or GMP, approved production plant to adhere to regulatory requirements, whereas off the shelf components will be sourced and manufactured by GMP suppliers. GMP sub-contractors will assemble proprietary and off the shelf components together to create our products.

Therefore, we rely on third parties to manufacture and supply us with proprietary custom components. Although we rely on a number of suppliers who provide us materials and components as well as manufacture and assemble certain components of our products, we do not rely on single-source suppliers. Our suppliers may encounter problems during manufacturing for a variety of reasons, including, for example, failure to follow specific protocols and procedures, failure to comply with applicable legal and regulatory requirements, equipment malfunction and environmental factors, failure to properly conduct their own business affairs, and infringement of third-party intellectual property rights, any of which could delay or impede their ability to meet our requirements. Our reliance on these third-party suppliers also subjects us to other risks that could harm our business, including:

| ● | we are not currently a major customer of many of our suppliers, and these suppliers may therefore give other customers’ needs higher priority than ours; | |

| ● | we may not be able to obtain an adequate supply in a timely manner or on commercially reasonable terms; | |

| ● | our suppliers, especially new suppliers, may make errors in manufacturing that could negatively affect the efficacy or safety of our products or cause delays in shipment; | |

| ● | we may have difficulty locating and qualifying alternative suppliers; | |

| ● | switching components or suppliers may require product redesign and possibly submission to the FDA or other similar foreign regulatory agencies, which could impede or delay our commercial activities; | |

| ● | one or more of our suppliers may be unwilling or unable to supply components of our products; | |

| ● | the occurrence of a fire, natural disaster or other catastrophe impacting one or more of our suppliers may affect their ability to deliver products to us in a timely manner; and | |

| ● | our suppliers may encounter financial or other business hardships unrelated to our demand, which could inhibit their ability to fulfill our orders and meet our requirements. |

We may not be able to quickly establish additional or alternative suppliers if necessary, in part because we may need to undertake additional activities to establish such suppliers as required by the regulatory approval process. Any interruption or delay in obtaining products from our third-party suppliers, or our inability to obtain products from qualified alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our customers and cause them to switch to competing products. Given our reliance on certain suppliers, we may be susceptible to supply shortages while looking for alternate suppliers.

We may be exposed to geopolitical risks related to the geopolitical and military tensions between Russia and Ukraine in Europe.

Although we do not currently conduct business in Russia and Ukraine, the escalation of geopolitical instability in Russia and Ukraine as well as currency fluctuations in the Russian Ruble has had a negative impact on worldwide markets. Such impact may negatively impact our supply chain, our operations and future growth prospects in that region. As a result of the crisis in Ukraine, both the U.S. and other countries have implemented sanctions against certain Russian individuals and entities. Our global operations expose us to risks that could adversely affect our business, financial condition, results of operations, cash flows or the market price of our securities, including the potential for increased tensions between Russia and other countries resulting from the current situation involving Russia and Ukraine, tariffs, economic sanctions and import-export restrictions imposed, and retaliatory actions, as well as the potential negative impact on our potential business and sales in the region. Current geopolitical instability in Russia and Ukraine and related sanctions by the U.S. and other governments against certain companies and individuals may hinder our ability to conduct business with potential customers and vendors in these countries.

7

We have limited manufacturing history on which to assess the prospects for our business and we anticipate that we will incur significant losses once we initiate our in-house manufacturing until we are able to successfully commercialize our products globally.

If our future manufacturing operation or any current or future contracted manufacturing operations become unreliable or unavailable, we may not be able to move forward with our intended business operations and our entire business plan could fail. There is no assurance that our manufacturing operation or any third-party manufacturers will be able to meet commercialized scale production requirements in a timely manner or in accordance with applicable standards.

We may not be able to replace our manufacturing capabilities in a timely manner.

If our future manufacturing facility or any current or future contracted manufacturing operations suffer any type of prolonged interruption, whether caused by regulator action, equipment failure, critical facility services (such as water purification, clean steam generation or building management and monitoring system), fire, natural disaster or any other event that causes the cessation of manufacturing activities, we may be exposed to long-term loss of sales and profits. There are limited facilities which are capable of contract manufacturing some of our products and product candidates. Replacement of our current manufacturing capabilities may have a material adverse effect on our business and financial condition.

We are dependent upon third-party service providers. If such third-party service providers fail to maintain a high quality of service, the utility of our products could be impaired, which could adversely affect the penetration of our products, our business, operating results and reputation.

The success of certain services and products that we provide are dependent upon third-party service providers. Such service providers include manufacturers of proprietary custom components for our products. As we expand our commercial activities, an increased burden will be placed upon the quality of such third-party providers. If third-party providers fail to maintain a high quality of service, our products, business, reputation and operating results could be adversely affected. In addition, poor quality of service by third-party service providers could result in liability claims and litigation against us for damages or injuries.

We expect to be exposed to fluctuations in currency exchange rates, which could adversely affect our results of operations.

We incur expenses mainly in NIS and U.S. dollars, but our financial statements are denominated in U.S. dollars. Accordingly, we face exposure to adverse movements in currency exchange rates. Our foreign operations will be exposed to foreign exchange rate fluctuations as the financial results are translated from the functional currency into U.S. dollars. Specifically, the U.S. dollar cost of our operations in Israel is influenced by any movements in the currency exchange rate of the NIS. Such movements in the currency exchange rate may have a negative effect on our financial results. If the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions will result in increased operating expenses and net losses. Similarly, if the U.S. dollar strengthens against foreign currencies, the translation of these foreign currency denominated transactions will result in decreased operating expenses and net losses. As exchange rates vary, sales and other operating results, when translated, may differ materially from our or the capital market’s expectations.

Non-U.S. governments often impose strict price controls, which may adversely affect our future profitability.

We may be subject to rules and regulations in the United States and non-U.S. jurisdictions relating to our products or any future products. In some countries, including countries of the European Union, or the EU, each of which has developed its own rules and regulations, pricing may be subject to governmental control under certain circumstances. In these countries, pricing negotiations with governmental agencies can take considerable time after the receipt of marketing approval for a medical device candidate. To obtain reimbursement or pricing approval in some countries, we may be required to conduct a clinical trial that compares the cost-effectiveness of our product to other available products. If reimbursement of our products is unavailable or limited in scope or amount, or if pricing is set at unsatisfactory levels, we may be unable to achieve or sustain profitability.

8

We manage our business through a small number of employees and key consultants.

As of March 13, 2022, we had twenty-one full-time employees (including our senior management team), four part-time employees, and three additional independent contractors and consultants. Our future growth and success depend to a large extent on the continued services of members of our current management including, in particular, Dagi Ben-Noon, our Chief Executive Officer, and Joe Hayon, our President and Chief Financial Officer. Any of our employees and consultants may leave our company at any time, subject to certain notice periods. The loss of the services of any of our executive officers or any key employees or consultants would adversely affect our ability to execute our business plan and harm our operating results. Our operational success will substantially depend on the continued employment of senior executives, technical staff and other key personnel. The loss of key personnel may have an adverse effect on our operations and financial performance.

We may need to expand our organization and we may experience difficulties in recruiting needed additional employees and consultants, which could disrupt our operations.

As our development and commercialization plans and strategies develop and because we are leanly staffed, we may need additional managerial, operational, sales, marketing, financial, legal and other resources. The competition for qualified personnel in the medical device industry is intense. Due to this intense competition, we may be unable to attract and retain qualified personnel necessary for the development of our business or to recruit suitable replacement personnel.

Our management may need to divert its attention away from our day-to-day activities and devote a substantial amount of time to managing these growth activities. We may not be able to effectively manage the expansion of our operations, which may result in weaknesses in our infrastructure, operational mistakes, loss of business opportunities, loss of employees and reduced productivity among remaining employees. Our expected growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of additional medical device products. If our management is unable to effectively manage our growth, our expenses may increase more than expected, our ability to generate and/or grow revenue could be reduced and we may not be able to implement our business strategy. Our future financial performance and our ability to commercialize medical device products and services and compete effectively will depend, in part, on our ability to effectively manage any future growth.

International expansion of our business exposes us to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the United States or Israel.

Other than our headquarters and other operations which are located in Israel (as further described below), our business strategy incorporates significant international expansion, particularly in anticipated expansion of regulatory approvals of our products. Doing business internationally involves a number of risks, including but not limited to:

| ● | multiple, conflicting and changing laws and regulations such as privacy regulations, tax laws, export and import restrictions, employment laws, regulatory requirements and other governmental approvals, permits and licenses; | |

| ● | failure by us to obtain regulatory approvals for the use of our products and services in various countries; | |

| ● | additional potentially relevant third-party patent rights; | |

| ● | complexities and difficulties in obtaining protection and enforcing our intellectual property; |

| ● | difficulties in staffing and managing foreign operations; | |

| ● | complexities associated with managing multiple regulatory, governmental and reimbursement regimes; | |

| ● | limits in our ability to penetrate international markets; | |

| ● | financial risks, such as longer payment cycles, difficulty collecting accounts receivable, the impact of local and regional financial crises on demand and payment for our products and exposure to foreign currency exchange rate fluctuations; | |

| ● | natural disasters, political and economic instability, including wars, terrorism and political unrest, outbreak of disease, boycotts, curtailment of trade and other business restrictions; |

| ● | certain expenses including, among others, expenses for travel, translation and insurance; and | |

| ● | regulatory and compliance risks that relate to maintaining accurate information and control over sales and activities that may fall within the purview of the U.S. Foreign Corrupt Practices Act, or the FCPA, its books and records provisions or its anti-bribery provisions. |

Any of these factors could significantly harm our future international expansion and operations and, consequently, our results of operations.

9

We face intense competition and we may be unable to effectively compete in our industry.

The major market players within the respiratory care market and our primary competitors in the United States include Boston Scientific Corporation (NYSE: BSX), ResMed Inc., (NYSE: RMD), Masimo Corporation (Nasdaq: MASI), Becton, Dickinson and Company (NYSE: BDX), Chart Industries, Inc. (Nasdaq: GTLS). Other competitors outside the United states include Philips Healthcare, headquartered in the Netherlands, Medtronic plc, headquartered in Ireland (NYSE: MDT), Fisher & Paykel Healthcare Corporation Limited, headquartered in New Zealand, Drägerwerk AG & Co. KGaA, Drägerwerk AG, headquartered in Germany, Hamilton Medical AG, headquartered in Switzerland, Smiths Medical Inc., headquartered in Minnesota, the United States, Siemens Healthineers AG ADR (Nasdaq: SMMNY), headquartered in Germany, Baxter International (NYSE: BAX), headquartered in Illinois, the United States, Getinge, headquartered in Sweden, GE Healthcare, headquartered in Illinois, the United States and Terumo Corporation (TYO: 4543, Nikkei 225 Component), headquartered in Shibuya City, Tokyo, Japan. Some of these companies hold significant market share. Their dominant market position and significant control over the market could significantly limit our ability to introduce or effectively market and generate sales of our products.

Many of our competitors have long histories and strong reputations within the industry. They have significantly greater brand recognition, financial and human resources than we do. They also have more experience and capabilities in researching and developing testing devices, obtaining and maintaining regulatory clearances and other requirements, manufacturing and marketing those products than we do. There is a significant risk that we may be unable to overcome the advantages held by our competition, and our inability to do so could lead to the failure of our business. In addition, we may be unable to develop additional products in the future or to keep pace with developments and innovations in the market and lose market share to our competitors.

Competition in the medical devices and more specifically respiratory support technologies and solutions markets is intense, which can lead to, among other things, price reductions, longer selling cycles, lower product margins, loss of market share and additional working capital requirements. To succeed, we must, among other critical matters, gain consumer acceptance for our products, as compared to other solutions currently available in the market for the treatment of respiratory failure and potential future medical devices incorporating our principal technology or offering other advanced respiratory support solutions. If our competitors offer significant discounts on certain products and solutions, we may need to lower our prices or offer other favorable terms in order to compete successfully. Moreover, any broad-based changes to our prices and pricing policies could make it difficult to generate revenues or cause our revenues to decline. Moreover, if our competitors develop and commercialize products and solutions that are more effective or desirable than products and solutions that we may develop, we may not convince our customers to use our products and solutions. Any such changes would likely reduce our commercial opportunity and revenue potential and could materially adversely impact our operating results.

If third-party payors do not provide adequate coverage and reimbursement for the use of our products or any future products, our revenue will be negatively impacted.

Our products are not yet approved for third-party payor coverage or reimbursement. Such reimbursement may vary based on the particular device used in providing services and is based on the identity of the third-party. Our ability to obtain and maintain a leading position in the medical device market, and specifically in the respiratory care market, depends on our relationships with private third parties.

We expect to engage with private third parties to allow our customers to receive reimbursement from insurance companies for our products. The loss of a significant number of private third-party contracts may have an adverse effect on our revenues, which could have an adverse effect on our business, financial condition and results of operations. Over the past few years, reimbursement rates from certain third parties have declined, in some cases significantly. There can be no assurance that this trend will not continue or apply on more third parties.

In addition, private third parties may not reimburse any new products offered by us or reimburse those new products at commercially viable rates. The failure to receive reimbursement at adequate levels for our existing or future products may adversely affect demand for those products, our revenues and expected growth. This could have an adverse effect on our business, financial condition and results of operations.

We may be subject to litigation for a variety of claims, which could adversely affect our results of operations, harm our reputation or otherwise negatively impact our business.

We may be subject to litigation for a variety of claims arising from our normal business activities. These may include claims, suits, and proceedings involving labor and employment, wage and hour, commercial and other matters. The outcome of any litigation, regardless of its merits, is inherently uncertain. Any claims and lawsuits, and the disposition of such claims and lawsuits, could be time-consuming and expensive to resolve, divert management attention and resources, and lead to attempts on the part of other parties to pursue similar claims. Any adverse determination related to litigation could adversely affect our results of operations, harm our reputation or otherwise negatively impact our business. In addition, depending on the nature and timing of any such dispute, a resolution of a legal matter could materially affect our future operating results, our cash flows or both.

10

We could become subject to product liability, warranty or similar claims and product recalls that could be expensive, divert management’s attention and harm our business reputation and financial results.

Our business exposes us to an inherent risk of potential product liability, warranty or similar claims and product recalls. The medical device industry has historically been litigious, and we face financial exposure to product liability, warranty or similar claims if the use of any of our products were to cause or contribute to injury or death. There is also the possibility that defects in the design or manufacture of any of our products might necessitate a product recall. Although we plan to maintain product liability insurance, the coverage limits of these policies may not be adequate to cover future claims. In the future, we may be unable to maintain product liability insurance on acceptable terms or at reasonable costs and such insurance may not provide us with adequate coverage against potential liabilities. A product liability claim, regardless of merit or ultimate outcome, or any product recall could result in substantial costs to us, damage to our reputation, customer dissatisfaction and frustration and a substantial diversion of management attention. A successful claim brought against us in excess of, or outside of, our insurance coverage could have a material adverse effect on our business, financial condition and results of operations.

Our business may be impacted by changes in general economic conditions.

Our business is subject to risks arising from changes in domestic and global economic conditions, including adverse economic conditions in markets in which we operate, which may harm our business. For example, the current COVID-19 pandemic has caused significant volatility and uncertainty in U.S. and international markets. If our future customers significantly reduce spending in areas in which our technology and products are utilized, or prioritize other expenditures over our technology and products, our business, financial condition, results of operations and prospects would be materially adversely affected.

Disruption to the global economy could also result in a number of follow-on effects on our business, including a possible slow-down resulting from lower customer expenditures; inability of customers to pay for products, solutions or services on time, if at all; more restrictive export regulations which could limit our potential customer base; negative impact on our liquidity, financial condition and share price, which may impact our ability to raise capital in the market, obtain financing and secure other sources of funding in the future on terms favorable to us.

In addition, the occurrence of catastrophic events, such as hurricanes, storms, earthquakes, tsunamis, floods, medical epidemics and other catastrophes that adversely affect the business climate in any of our markets could have a material adverse effect on our business, financial condition and results of operations. Some of our operations are located in areas that have been in the past, and may be in the future, susceptible to such occurrences.

Unstable market and economic conditions may have serious adverse consequences on our business, financial condition and share price.

The global economy, including credit and financial markets, has experienced extreme volatility and disruptions, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates, increases in inflation rates and uncertainty about economic stability. For example, the COVID-19 pandemic resulted in widespread unemployment, economic slowdown and extreme volatility in the capital markets. Similarly, the current conflict between Ukraine and Russia has created extreme volatility in the global capital markets and is expected to have further global economic consequences, including disruptions of the global supply chain and energy markets. Any such volatility and disruptions may have adverse consequences on us or the third parties on whom we rely. If the equity and credit markets deteriorate, including as a result of political unrest or war, it may make any necessary debt or equity financing more difficult to obtain in a timely manner or on favorable terms, more costly or more dilutive. Further, inflation can adversely affect us by increasing our costs. Increased cost of living around the world has caused and may cause increased costs, such as higher wages, increase direct service costs, increased freight costs and costs of components, and higher manufacturing costs. Any significant increases in inflation and related increase in interest rates could have a material adverse effect on our business, results of operations and financial condition.

Our management team has limited experience managing a public company.

Most members of our management team have limited experience managing a publicly traded company, interacting with public company investors and complying with the increasingly complex laws pertaining to public companies in the United States. Our management team may not successfully or efficiently manage our transition to being a public company subject to significant regulatory oversight and reporting obligations under the U.S. federal securities laws and the continuous scrutiny of securities analysts and investors. These new obligations and constituents will require significant attention from our senior management and could divert their attention away from the day-to-day management of our business, which could adversely affect our business, financial condition, results of operations and prospects.

We incur significant increased costs as a result of the listing of our securities for trading on Nasdaq. Our management is required to devote substantial time to new compliance initiatives as well as compliance with ongoing U.S. requirements.

As a public company in the United States, we incur additional significant accounting, legal and other expenses that we did not incur prior to being a public company in the United States. We also incur costs associated with corporate governance requirements of the SEC, as well as requirements under Section 404 and other provisions of the Sarbanes-Oxley Act. These rules and regulations increase our legal and financial compliance costs, introduce new costs such as investor relations, stock exchange listing fees and shareholder reporting, and make some activities more time consuming and costly. The implementation and testing of such processes and systems may require us to hire outside consultants and incur other significant costs. Any future changes in the laws and regulations affecting public companies in the United States, including Section 404 and other provisions of the Sarbanes-Oxley Act, and the rules and regulations adopted by the SEC, for so long as they apply to us, will result in increased costs to us as we respond to such changes. These laws, rules and regulations could make it more difficult or more costly for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. The impact of these requirements could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees, or as executive officers.

11

If we are not able to attract and retain highly skilled managerial, scientific, technical and marketing personnel, we may not be able to implement our business model successfully.

Our success depends in part on our continued ability to attract, retain and motivate highly qualified management, clinical and scientific personnel. We are highly dependent upon our senior management as well as other employees, consultants and scientific and medical collaborators. Our management team must be able to act decisively to apply and adapt our business model in the rapidly changing markets in which we will compete. In addition, we will rely upon technical and scientific employees or third-party contractors to effectively establish, manage and grow our business. Consequently, we believe that our future viability will depend largely on our ability to attract and retain highly skilled managerial, sales, scientific and technical personnel. In order to do so, we may need to pay higher compensation or fees to our employees or consultants than currently expected and such higher compensation payments may have a negative effect on our operating results. Competition for experienced, high-quality personnel in the medical device field is intense. We may not be able to hire or retain the necessary personnel to implement our business strategy. Our failure to hire and retain quality personnel on acceptable terms could impair our ability to develop new products and services and manage our business effectively.

If we engage in future acquisitions or strategic partnerships, this may increase our capital requirements, dilute our stockholders, cause us to incur debt or assume contingent liabilities, and subject us to other risks.

We may evaluate various acquisition opportunities and strategic partnerships, including licensing or acquiring complementary products, intellectual property rights, technologies or businesses. Any potential acquisition or strategic partnership may entail numerous risks, including:

| ● | increased operating expenses and cash requirements; |

| ● | the assumption of additional indebtedness or contingent liabilities; |

| ● | the issuance of our equity securities; |

| ● | assimilation of operations, intellectual property and products of an acquired company, including difficulties associated with integrating new personnel; |

| ● | the diversion of our management’s attention from our existing product programs and initiatives in pursuing such a strategic merger or acquisition; |

| ● | retention of key employees, the loss of key personnel and uncertainties in our ability to maintain key business relationships; |

| ● | risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing products or product candidates and marketing approvals; and |

| ● | our inability to generate revenue from acquired technology and/or products sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance costs. |

We are subject to certain U.S. and foreign anticorruption, anti-money laundering, export control, sanctions and other trade laws and regulations. We can face serious consequences for violations.

Among other matters, U.S. and foreign anticorruption, anti-money laundering, export control, sanctions and other trade laws and regulations, which are collectively referred to as Trade Laws, prohibit companies and their employees, agents, clinical research organizations, legal counsel, accountants, consultants, contractors and other partners from authorizing, promising, offering, providing, soliciting or receiving, directly or indirectly, corrupt or improper payments or anything else of value to or from recipients in the public or private sector. Violations of Trade Laws can result in substantial criminal fines and civil penalties, imprisonment, the loss of trade privileges, debarment, tax reassessments, breach of contract and fraud litigation, reputational harm, and other consequences. We have direct or indirect interactions with officials and employees of government agencies or government-affiliated hospitals, universities and other organizations. We also expect our non-U.S. activities to increase over time. We plan to engage third parties for clinical trials and/or to obtain necessary permits, licenses, patent registrations and other regulatory approvals, and we can be held liable for the corrupt or other illegal activities of our personnel, agents or partners, even if we do not explicitly authorize or have prior knowledge of such activities.

Our business and operations might be adversely affected by security breaches, including any cybersecurity incidents.

We depend on the efficient and uninterrupted operation of our computer and communications systems, and those of our consultants, contractors and vendors, which we use for, among other things, sensitive company data, including our intellectual property, financial data and other proprietary business information.

12