UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended September 24 , 2022

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 001-40175

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

( | |||||

| (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices) | |||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||

| ☑ | Smaller reporting company | |||||||||||||

Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of March 26, 2022, the aggregate market value of the common equity of the registrant held by non-affiliates was $319,895,200 (based on the closing sales price of the Class A ordinary shares on March 25, 2022 of $9.92). On June 7, 2022, upon completion of the Business Combination (as described in this Annual Report on Form 10-K), the registrant changed its fiscal year end to the last Saturday of September. Accordingly, this aggregate market value of common equity of the registrant held by non-affiliates is presented as of the last business day of the most recently completed second fiscal quarter of the registrant’s current fiscal calendar.

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

As of December 5, 2022, the following shares of common stock were outstanding:

DOCUMENTS INCORPORATED BY REFERENCE

Symbotic Inc.

Table of Contents

| Page | ||||||||

i

As used in this Annual Report on Form 10-K, unless otherwise indicated or the context otherwise requires, references to “we,” “us,” “our,” “Symbotic” and the “Company” refer Symbotic Inc. (f/k/a SVF Investment Corp. 3), a Delaware corporation, and its consolidated subsidiaries following the effective time of the business combination between SVF and Symbotic (the “Business Combination”) pursuant to that certain Agreement and Plan of Merger, dated December 12, 2021 (the “Merger Agreement”), by and among SVF, Warehouse Technologies LLC, Symbotic Holdings LLC and Saturn Acquisition (DE) Corp. that closed on June 7, 2022. Unless the context otherwise requires, references to “SVF” refer to SVF Investment Corp. 3, a Delaware corporation, prior to the effective time of the Merger Agreement, and references to “Warehouse” refer to Warehouse Technologies LLC. (currently known as Symbotic Holdings LLC.), prior to the effective time of the Merger Agreement.

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, our expectations or predictions of future financial or business performance or conditions. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning our possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” or “intends” or similar expressions.

Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about our ability to, or expectations that we will:

•meet the technical requirements of existing or future supply agreements with our customers, including with respect to existing backlog;

•expand our target customer base and maintain our existing customer base;

•anticipate industry trends;

•maintain and enhance our platform;

•maintain the listing of the Symbotic Class A Common Stock on NASDAQ;

•develop, design, and sell systems that are differentiated from those of competitors;

•execute our research and development strategy;

•acquire, maintain, protect, and enforce intellectual property;

•attract, train, and retain effective officers, key employees, or directors;

•comply with laws and regulations applicable to our business;

•stay abreast of modified or new laws and regulations applicable to our business;

•successfully defend litigation;

•issue equity securities in connection with future transactions;

•meet future liquidity requirements and, if applicable, comply with restrictive covenants related to long-term indebtedness;

•timely and effectively remediate any material weaknesses in our internal control over financial reporting;

•anticipate rapid technological changes; and

•effectively respond to general economic and business conditions

Forward-looking statements made in this Annual Report on Form 10-K also include, but are not limited to, statements with respect to:

•the future performance of our business and operations;

•expectations regarding revenues, expenses, Adjusted EBITDA and anticipated cash needs;

•expectations regarding cash flow, liquidity and sources of funding;

•expectations regarding capital expenditures;

1

•the anticipated benefits of Symbotic’s leadership structure;

•the effects of pending and future legislation;

•business disruption;

•risks related to the impact of the COVID-19 pandemic on the financial condition and results of operations of Symbotic;

•disruption to the business due to our dependency on certain customers;

•increasing competition in the warehouse automation industry;

•any delays in the design, production or launch of our systems and products;

•the failure to meet customers' requirements under existing or future contracts or customer's expectations as to price or pricing structure;

•any defects in new products or enhancements to existing products; and

•the fluctuation of operating results from period to period due to a number of factors, including the pace of customer adoption of our new products and services and any changes in our product mix that shift too far into lower gross margin products.

Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in other sections of this Annual Report on Form 10-K, including Part I, Item 1A “Risk Factors” and Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations. These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward-looking statements are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that the events, results or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements are provided for the purposes of assisting the reader in understanding our financial performance, financial position and cash flows as of and for periods ended on certain dates and to present information about management’s current expectations and plans relating to the future, and the reader is cautioned not to place undue reliance on these forward-looking statements because of their inherent uncertainty and to appreciate the limited purposes for which they are being used by management. While we believe that the assumptions and expectations reflected in the forward-looking statements are reasonable based on information currently available to management, there is no assurance that such assumptions and expectations will prove to have been correct.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made and are based on the beliefs, estimates, expectations and opinions of management on that date. We are not under any obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statements made in this Annual Report on Form 10-K, whether as a result of new information, future events or otherwise, except as required by law.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

2

PART I

Item 1. Business

Company Overview

At Symbotic, our vision is to make the supply chain work better for everyone. We do this by developing, commercializing, and deploying innovative, end-to-end technology solutions that dramatically improve supply chain operations. We currently automate the processing of pallets and cases in large warehouses or distribution centers for some of the largest retail and wholesale companies in the world. Our systems enhance operations at the front end of the supply chain, and therefore benefit all supply partners further down the chain, irrespective of fulfillment strategy.

Symbotic was established to develop technologies to improve operating efficiencies in modern warehouses. Significant funds and resources have been devoted to date in developing the Symbotic platform and related applications, to create complete systems with the ability to fundamentally change how the supply chain functions. Symbotic’s intellectual property is protected by a portfolio of over 490 issued and/or pending patents.

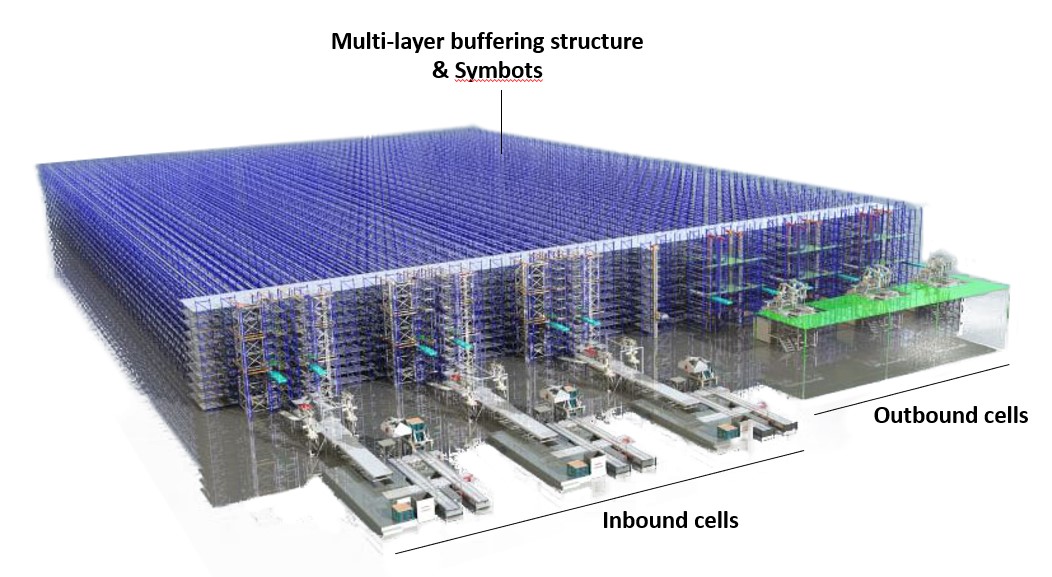

Our revolutionary platform accelerates the movement of goods through the supply chain, improves SKU agility, fulfills orders with 99.9999% accuracy and does this all with less inventory and operating cost. The underlying architecture of our platform and applications differentiates our system from everyone else in the marketplace. The system uses high-speed, fully autonomous mobile robots that travel up to 25 miles-per-hour (mph), controlled by our A.I.-enabled system software, to move goods through our proprietary buffering structure.

Proprietary modular applications such as our inbound atomizing and outbound palletizing applications plug into the Symbotic platform to achieve compelling, real world supply chain improvements at scale. Adding other Symbotic modular applications under development will allow our customers to support all omni-channel strategies, such as brick and mortar retail and e-commerce with in-store pickup or home delivery, from a single centralized warehouse/fulfillment facility.

Our systems vary in size and price. Systems can be as small as a single football field sized footprint (48,000 square feet) serving 25 or more stores and can scale to meet the needs of the world’s largest retailers. Our platform’s modular design and greater storage density enables installation in existing, and active warehouses, with limited interruption to ongoing operations.

Symbotic systems atomize inbound freight (divide it to a common unit), from pallets-to-cases and cases-to-items (currently in development), digitize the attributes of these units without re-labeling, and move the units to buffering in their original (or native) packaging with bottom lift technology on our autonomous mobile robots instead of re-transferring goods to trays, shuttles, or cranes. As the distribution center receives replenishment orders from stores, our autonomous robots retrieve the desired units in specified sequence to facilitate orderly fulfillment.

Fulfillment often incorporates our automated pallet-building application. This application builds pallets with goods ordered specific to a given store and store aisle to facilitate rapid and sequential provisioning of the goods from the pallets to a specific store’s shelves (known as store plan-o-grammed pallets). The application also builds the pallets with improved structural integrity, which in turn leads to denser, taller pallets that improve truck packing density while reducing product damage.

We believe that the global supply chain has reached a point of critical stress, driving an inflection in demand for warehouse automation across all industries. As the labor force shifts toward an older, more highly educated demographic, the warehouse labor pool is shrinking and becoming more expensive, while most well-located distribution centers are either operating manually or utilizing outdated, static mechanized conveyor systems. The dramatic growth in e-commerce has increased supply chain complexity by putting pressure on retailers to support multiple sales channels and orders of individual items in addition to cases and pallets. Meanwhile, consumer expectations have evolved to demand a larger variety of items to be delivered quickly and seamlessly. This has placed significant strain on the traditional supply chain and the people who support it. We help our customers to thrive in this increasingly challenging environment.

Our systems are actively deployed in the warehouses of a number of the world’s largest retailers including Walmart, Albertsons, Target, Giant Tiger, and C&S Wholesale Grocers, which is one of the largest grocery wholesalers in the United States and an affiliate of Symbotic. We have spent significant time working closely with our customers to develop, test, and refine our technology, and our success has translated into a $11.1 billion contracted backlog as of September 24, 2022 to deliver systems from 2022 through 2028, of which $6.1 billion was added to our contracted backlog on May 20, 2022 when we amended and restated the Walmart MAA as described below in “—Customers—Walmart.”

3

We believe the potential market opportunity for our systems is large and expanding. We are initially targeting the ten largest brick-and-mortar companies across five verticals: general merchandise, ambient grocery, ambient food distribution, consumer packaged food, and apparel. Based on identified North American warehouses of the ten largest companies in each of these five verticals, we believe that our strategically addressed market opportunity is approximately $126 billion. When considering deeper penetration in our initial verticals, adding additional adjacent verticals, and entering the European market, our total addressable market increases to $373 billion.

Industry Background

First Principles of the Supply Chain

The first principles of the supply chain are to align three mismatches that arise between producers and users of goods in a cost-effective manner. These three mismatches relate to the quantity, timing, and location of goods and arise because a small number of producers concentrate resources to serve many consumers in the pursuit of economies of scale.

The first mismatch relates to the quantity of goods, as a relatively small number of producers generate a greater quantity of goods than any single consumer desires. The supply chain aligns this mismatch by “atomizing” (dividing into a common unit) production quantities into quantities desired by consumers, meaning pallets are atomized into cases, and then cases into individual items, known as “eaches.”

The second mismatch relates to the timing of when goods are produced versus needed. Producers generate goods continuously, but end users purchase and consume goods at a much slower or cyclical rate. This mismatch is aligned by what is known as “buffering” (storing goods in inventory), achieving an effect between producer and user that is like the way a water reservoir manages variation between precipitation and household water consumption.

Location is the final mismatch, as goods are needed at the point of consumption rather than the point of production. Thus, movement of goods is a critical function of the supply chain.

Types of Warehouses

Modern warehouses are a node in the supply chain where atomizing, buffering and movement activities align these mismatches. Two common types of warehouses are distribution centers and e-commerce fulfillment centers. Finished goods from manufacturers almost always enter the supply chain packaged in either pallets or cases, and flow downstream to end users. Since our systems automate pallet-to-case activities up stream in the supply chain, our systems benefit all downstream users throughout the supply chain. With this advantage, and because the majority of supply chain cost resides in the distribution center, it is easier to integrate systems downstream, rather than upstream (see “Our Competitive Strengths”).

| Distribution Centers | E-Commerce Fulfillment | |||||||||||||

| Flow of Goods | Upstream | Downstream | ||||||||||||

| Typical Function | Atomization and buffering between producers and next node | Items selection Packing and shipping | ||||||||||||

| Typical Location | Rural, Suburban | Suburban, Urban | ||||||||||||

| Common Fulfillment Unit | Pallets, Cases | Items/Eaches | ||||||||||||

| Optimized for | Low cost per case | Speed of fulfillment & delivery | ||||||||||||

| Volume | High | Low to moderate | ||||||||||||

| SKU count/variety | Low to Moderate | High | ||||||||||||

Current supply chain operations are generally manual, inflexible, expensive, require significant investments in inventory, and require goods to be manually handled multiple times before being shipped to stores or consumers. The supply chain is expensive because it tends to be slow, labor intensive, and leads to significant damage and waste. In a typical supply chain operation, single-SKU pallets are delivered to a distribution center where hundreds, or thousands, of people are required to move and store pallets of goods, select individual cases from them, combine those individual cases into either store-ready pallets or, in the case of e-commerce fulfillment, unpack those cases so that individual items can be stored in totes or other storage structures before selecting and combining individual items for individual customer order fulfillment. Even mechanized warehouses require significant human intervention, are very inflexible and face disruption from numerous single points of failure. These factors contribute to high maintenance costs and damage, resulting in limited total cost savings.

4

Retail and Supply Chain Trends

Several trends within the retail industry and the supply chains that serve them have exacerbated the costs and inflexibility of today’s supply chains:

•Labor Scarcity and Cost—As the labor force matures and becomes more highly educated, warehouse labor is becoming increasingly scarce and expensive. According to InsightQuote’s 2021 Warehousing & Fulfillment Costs & Pricing Survey, average salaries for warehouse management increased to nearly $56,000 in 2021, up 18% from approximately $47,500 in 2017, and average wages for warehouse staff in the U.S. increased to $14.00 per hour in 2021, up 22% from $11.44 per hour in 2017. Transportation, warehousing and utilities employment turnover increased 48% from 2016 to 2020, compared to a 35% increase for all workers during the same timeframe, according to the U.S. Bureau of Labor Statistics.

•Omni-Channel Strategies—As online shopping has become more popular with consumers, brick-and-mortar retailers must support multiple distribution channels: traditional brick-and-mortar, online with home delivery, buy online pick up in store (BOPIS), as well as support for channel-related reverse logistics. Not only does the growth of distribution channels increase complexity, but the e-commerce channel itself is more complex than traditional brick-and-mortar because of the need to deliver a continuously changing and increasingly diverse range of items to a broader range of locations, faster and in an increasing variety of ways.

•Growing Consumer Expectations and SKU Proliferation—The internet has made the world’s goods available to more consumers, so now shoppers expect retailers to offer increased product diversity. At the same time, manufacturers continue to adopt mass personalization product strategies, adding to a growing number of new SKUs and accelerating the frequency and speed of SKU transitions. These trends require retailers to find a way to efficiently store, handle, and make available a wider variety of SKUs while managing seasonal and geographic variability. This requires either a greater number of specialized supply chain processes or greater flexibility of existing processes.

Existing warehouse automation systems are largely engineered to solve single challenges in the supply chain with discrete applicability focused on a particular niche in the warehouse automation value chain (for example, specific pick and pack / e-commerce fulfillment robotics) or are older manufacturing technologies that serve to automate high-volume, lower-value repetitive tasks (such as conveyor belts and sensors). We believe the Symbotic system is unique in its ability to serve as a comprehensive end-to-end warehouse automation system.

Advances in Core Technologies

We benefit from advances in robotics, sensors, visual systems, processing power, machine learning, and artificial intelligence that have been developed and commercialized over the last decade. For example, we are beneficiaries of the tens of billions of dollars that have been invested in attempts to advance autonomous vehicle technology.

Symbotic Platform Overview

Reasoning from first principles, we have re-conceived the purpose and needs of the supply chain. From that perspective, we have completely re-designed and re-engineered the warehouse, unencumbered by legacy thinking and the resulting narrowly targeted technologies aimed at reducing fragments of cost in the warehouse.

Our systems manage every aspect of warehouse logistics, from the time merchandise is off-loaded from a producer’s truck or container until that merchandise is ready to be delivered to a store, pick-up location, or individual. Our platform has an approximate useful life of 25 to 30 years and is so space efficient that it can be installed in phases in operating distribution centers with minimal impact to operations. The platform is composed of atomizing robotics, a buffering structure, autonomous mobile robots that handle product, robotic palletizing cells and software that coordinates and optimizes the movements of all these systems to maximize the throughput of goods while reducing cost of the system.

Unique Platform Architecture

5

Our innovative platform architecture differentiates our system from alternative warehouse systems. Eight pillars of that architecture combine synergistically to deliver the benefits of our systems. Those pillars are:

•A.I.-Powered Software: Our platform is enhanced by our A.I.-powered autonomous hardware and system software.

•Atomizing: Atomizing goods is the process of dividing quantities of goods to the lowest common fulfillment unit (e.g., from pallets-to-cases and cases-to-items). Our platform atomizes incoming pallets to the case level and handles those original (or “native”) cases throughout our system. We are prototyping the ability to atomize cases to the item level to handle toted items in our platform just like we currently handle cases which would allow both cases and toted items to be integrated into a single platform. Competing warehouse systems handle pallets and more frequently partial pallets of goods. Pallets and partial pallets represent an increased level of on hand inventory and partial pallets leave unused volume within the warehouse. Volume adds expense because it has its own cost and because volume adds movement distance, slowing down the transport of goods through the supply chain. By managing goods at the case and toted item level, rather than at the pallet level, our systems remove unused space from the distribution center, allowing merchandise to be stored more densely and increasing the speed of product throughput. These space saving efforts are increased by the storage density of our platform, which allows us to retrofit our systems into our customers’ existing warehouse operations without interrupting ongoing supply chain operations or requiring capital to build new greenfield warehouse space.

•Randomizing: Our platform function is analogous to that of a random-access computer hard drive. By effectively “digitizing” each individual case and toted item and spreading them throughout the buffering structure, we create optionality for our picking and routing optimization algorithms. Merchandise is opportunistically placed throughout the buffering structure, similar to the way a random-access hard drive handles data. This minimizes movement to increase throughput, enhance SKU agility and reduce the number of autonomous mobile robots required to distribute product.

•Autonomous Movement: Fully autonomous mobile robots allow our systems to have superior flexibility, speed, mobility, and inventory handling capabilities. Like fully autonomous cars operating in a smart city, our robots operate independently but act collectively to transport, sequence, and move cases through a warehouse. Our algorithms consider robot proximity, travel distance and other factors to solve for optimal overall performance while dynamically adjusting as anomalies arise. In addition, because each robot can travel anywhere in a two-dimensional plane and moves like a car that can make radius turns, our robots are comparatively fast, traveling up to 25 miles-per-hour (mph). Faster movement enhances throughput and efficiency by clearing aisles more quickly and allowing for more storage and retrieval transactions per hour compared to tray, shuttle or crane-based systems. Finally, our use of automation and software means our systems can approach true “lights-out” operation (100% up-time with zero human intervention).

6

•Original (Native) Package Handling: In our current applications, we handle cases by lifting them from the bottom using an automated fork system. This approach allows our platform to manipulate a wide range of case sizes, types and weights in a variety of packaging formats. This allows our platform to handle and be configurable to a wider range of goods and verticals. Unlike some of our competitors, we do not handle goods with grippers, which can crush products, or suction cups, which can drop goods. We also do not transfer goods to standardized trays, eliminating this additional handling of goods. Instead, bottom-lift handling reduces case damage and system rejection rates, thereby decreasing waste and cost.

•End-to-End Integration: By being an integrated end-to-end system, we are able to comprehensively change a warehouse and a customer’s supply chain to maximize its efficiency.

•System-of-Systems Design: Our system-of-systems architecture philosophy eliminates single points of failure, enhancing system resiliency. Utilizing a redundant array of autonomous robots, lifts and inbound and outbound palletizing systems allows any part of our system to assume the task load of another system part, in the event any sub-system ever fails. In addition, our hardware and software systems are engineered for rapid serviceability utilizing field replaceable components wherever possible.

•Scalable Modularity: Our architecture is highly modular and scalable, allowing us to install our systems in existing warehouse facilities while achieving full performance benefits. We are also able to install our systems in phases, allowing the existing warehouse facility to continue to operate while the transition to our systems is underway. Finally, we can easily reconfigure and expand our systems to accommodate SKU proliferation as our customers’ needs and strategies evolve.

Platform Functional Flow Overview

Generally, manufacturers create their products in batches by SKU (Stock Keeping Unit, or individual type of item, like cans of chicken noodle soup). Manufacturers then aggregate and package the goods in manageable quantities for efficient and safe shipping. Usually, products are batched in cardboard or plastic cases. Cases may then be stacked on 4-foot by 4-foot pallets as high as safely possible and then shrink-wrapped so the pallets retain integrity while in transit and the goods can be transported without damage.

A pallet may commonly contain anywhere between 40 and 120 cases depending on the size and weight of the product inside and, therefore, could contain dozens to hundreds of individual items that will ultimately be sold to consumers. Some manufacturers produce homogeneous pallets with one SKU. Others may combine multiple SKUs on heterogeneous pallets if the cases are the same size and the manufacturer is able to do so efficiently in their production process.

Other products may be shipped un-palletized because a manufacturer does not produce or sell enough of one item to make full pallet shipping efficient. Products may also travel through the supply chain unpalletized because the goods have been combined with other products for more efficient shipping. This often happens for products coming from international destinations given the desire to fill a shipping container with multiple items and/or from multiple manufacturers to reduce overall shipping costs. Un-palletized products generally come stacked randomly in a truck trailer or shipping container.

Symbotic’s system can uniquely handle homogeneous and heterogeneous palletized and un-palletized products.

•Palletized Inbound: When palletized product reaches a warehouse, the pallets are placed into our automated system where our large de-palletizing robots use state of the art vision technology and our proprietary end-of-arm tools to pick up entire layers of product and transfer them to our “singulating” robots. Our singulating robots also use vision technology and other proprietary end-of-arm tools to orient each individual case optimally for storage and handling in the system’s buffering structure. The cases then enter the scan tunnel.

•Other Inbound: When unpalletized product reaches our system, the individual cases enter the scan tunnel just like palletized inbound product.

•Scan Tunnel: On the way to the buffering structure, each case proceeds through a short scan tunnel where we use vision technology and sensors to “digitize” the dimensions and attributes of each inbound case. Simultaneously, the system performs an integrity check of the case to screen for damage. Case damage can compromise the movement of the goods through our system, and it may indicate damaged product inside the case. Any case that our system determines is non-conforming or damaged is rejected by the system. An associate will either repair the case before re-induction into the system or reject the damaged goods.

•Buffering Structure: The buffering structure of our platform, where goods are placed, stored, and retrieved, is composed of a number of levels stacked on top of each other. Each level is approximately three feet tall, allowing

7

a typical thirty-two-foot-tall warehouse to have ten levels of storage for optimized space utilization. Each individual level has a transfer deck that spans the width of the structure and connects several dozen aisles that extend horizontally at a 90-degree angle from the transfer deck. This gives us approximately 200,000 linear feet of storage in our average sized platform. The levels are connected vertically by a series of lifts.

•Lifts: Upon exit from the scan tunnel, the case moves to a collection of lifts that function like a bank of elevators in a building. Simultaneously, our A.I.-enabled software determines the optimal randomized location in the structure for storage of that case. When a case reaches the lift to which it is assigned, the lift extends its finger lift system and picks up the case. The lift then brings the case to the appropriate level in the structure and places it onto a buffer shelf where the case will be picked up by a Symbot. The Symbot will then bring the case to the aisle storage position for that level.

•Symbots: Symbots are our fully autonomous mobile goods handling robots. They are powered by rapid-charging ultracapacitors, so charging takes a matter of seconds as the Symbots drive over charge plates integrated into the floor of the buffering structure. This eliminates the need for Symbots to come out of service for charging, allowing them to operate all day for weeks at a time. If required, an individual Symbot can be removed from the system by remote instruction when it needs maintenance. Our Symbots are interchangeable and hand off tasks to other Symbots in a live operating system without productivity loss should a Symbot need maintenance.

The Symbots lift each case from the bottom using fingers that extend under the case, rather than gripping and pulling, enabling case handling without the need to put them on trays. Trayless handling allows us to store cases randomly throughout our storage structure within five millimeters of another case.

The Symbot picks up a case from the lift and enters the transfer deck on its way to the appropriate aisle. The Symbots are routed by our proprietary artificial intelligence software to the aisle and location where a case is to be placed. Once in the appropriate aisle, the Symbot accelerates rapidly up to 25 mph towards the specific location where it has been instructed to place the case.

When the Symbot reaches the appropriate placement location it extends its finger lift system and places the case on the aisle position and is ready for its next task. In a typical size and configuration system, a Symbot can reach any location in our structure and return to our inbound or outbound cells in under four minutes.

Retrieving a case is simply the reverse process of placing a case.

•Outbound: Our outbound lifts retrieve cases delivered by Symbots and transfers them to the outbound level of the system. Our software utilizes the Symbots and lifts to sequence cases in an optimal order for outbound processing. A typical system creates what we call a “rainbow pallet” comprising a variety of different products and SKUs. Our system can also create a rainbow pallet based upon a customer’s store plan that contains products for a specific store aisle, which can be delivered directly from a truck to the end of an aisle so that store employees can unpack the cases from the pallet and replenish shelves quickly and reduce store labor costs.

•Palletizing: Our system uses A.I.-based software that enables us to palletize cases using two robotic arms on opposite sides of a pallet. These two robotic arms work together placing a case onto a pallet in less than three seconds.

Our Competitive Strengths

Our people, technologies, and experience, underpinned by decades of leadership in supply chain operations and innovation provide us with significant advantages over our competitors. Specifically, we benefit from the following competitive advantages:

Experienced, Founder-Led Leadership Team

Symbotic is a founder-led company. Our Chairman, Chief Executive Officer and significant shareholder, Richard B. Cohen, started Symbotic in 2006, to develop advanced technologies to make the supply chain work better for everyone. This vision was inspired by Mr. Cohen’s experiences building C&S Wholesale Grocers.

Mr. Cohen is an accomplished business builder, as evidenced by his helping lead sales growth at C&S Wholesale Grocers from $14 million in 1974 to $27 billion in 2018. Effectively running warehouse operations for the low margin grocery industry, Mr. Cohen has been building, running, and innovating warehouses for two generations. We believe our founder’s deep industry and operational expertise is a core competitive advantage for Symbotic.

8

Mr. Cohen has built a team of experienced board members and executives with a diverse range of technology expertise acquired at industry leading companies and institutions such as Flex, Fortna, IBM, Intuit, Manhattan Associates, MIT, Netezza, RealPage, SoftBank, Staples, Tesla and Walmart.

Unique Team Culture

Our team has harnessed first principles thinking to help us understand complex systems like supply chains and automation in simple, elemental ways. This approach unburdens our creativity from the constraints of legacy problem solving. First principles thinking also leads us to constantly question our established approaches to problems, freeing us to invent new technologies to improve the supply chain. Approximately half of the Symbotic team is composed of software, mechanical, electrical, and systems engineers and scientists who have been conducting research and development focused on our core technology. As a result, we have developed or created a significant amount of intellectual property protecting our core technology, including a patent portfolio with over 490 patent filings.

First Mover Advantage with Differentiated Platform Architecture

We believe we have developed highly unique platform architecture utilizing fully autonomous robots, at scale and in real world supply chain applications. The advantages of this approach are so compelling, as quantifiably measured by performance data in real world applications, that we believe our approach can become the de facto standard approach for how warehouses operate.

Superior System Return on Investment

Because of the quantifiable metrics related to our platform, our systems can provide our customers with a rapid recovery of investment costs and a compelling return on investment.

•Superior Product Throughput: The high density of our platform, the optimized and randomized storage of our architecture, and the speed and agility of our autonomous mobile robots minimizes movement to increase throughput, enhancing SKU agility and reducing the number of robots required to distribute product.

•High Density System & Storage: Partial pallets represent an increased level of on hand inventory and leave unused volume within the warehouse. Volume adds expense because it has a storage cost and adds movement distance that slows down the movement of goods through the supply chain. By managing goods at the case and tote level, rather than at the pallet level, our systems remove unused space from the distribution center, store merchandise more densely and increase the speed of product throughput.

•No Compromise Retrofit: The modularity and scalability of our systems allows us to install our systems in existing warehouse facilities while achieving full performance benefits. We are also able to install our systems in phases, allowing the warehouse facility to continue to operate while the transition to our system is underway. Finally, we can easily reconfigure and expand our systems to accommodate SKU proliferation as our customers’ needs and strategies evolve.

•Inventory Reduction & SKU Agility: The accuracy, throughput speed, and density of our platform allow our customers to achieve a higher level of availability and a wider range of SKU variety with less inventory.

•Fulfillment Accuracy: Our digitization strategy, artificial intelligence enabled store/retrieve software and other automated systems contribute to the 99.9999% fulfillment accuracy of our platform.

9

•System Resilience: Our system-of-systems architecture philosophy eliminates single points of failure, enhancing system resiliency. Utilizing a redundant array of autonomous robots, lifts and inbound and outbound palletizing systems allows any part of our system to assume the task load of another system part, should any sub-system ever fail. In addition, our hardware and software systems are engineered for rapid serviceability utilizing field-replaceable components wherever possible.

•System Scalability: Our platform can be scaled to fit the needs of our customers and scale of their facilities. We are also able to install our systems in phases, allowing the warehouse facility to continue to operate while the transition to our systems is underway. Finally, we can easily reconfigure and expand our systems to accommodate SKU proliferation as our customers’ needs and strategies evolve.

Remaining Performance Obligations (“Backlog”)

As of September 24, 2022, Symbotic had a $11.1 billion backlog of orders from its customers, of which approximately 8% is expected to be recognized as revenue in the following twelve months.

The backlog is largely structured on a cost-plus fixed profit basis. This allows Symbotic to maintain its gross profit targets even in times of high inflation or supply chain related price increases. For example, in most cases rising integrated circuit chip costs or increases in steel prices are passed on to the customer, preserving Symbotic’s gross profit.

Our significant contracts do not contain termination for convenience clauses. Outside of insolvency, or specific change in control provisions, most of our backlog can only be terminated if Symbotic does not deliver the systems ordered at their defined performance standards, which we believe to be unlikely. In addition, because our systems significantly reduce our customers’ costs, contract termination by our customers would be costly and disruptive, enhancing our ability to retain our customers.

Backbone of Commerce

Our expertise has been established at the front end of the supply chain because our systems “handshake” directly with producers and manufacturers who are the first node in the supply chain. We describe our platform as the backbone of commerce, because with our optimized case handling capability, all downstream nodes in the supply chain benefit. This means our systems have a strategic level impact for our customers and are mission critical for daily operations, that we believe will result in high rates of customer retention.

We are also prototyping a full-scale, individual unit handling application, that can be integrated into our case handling platform, and be installed in the distribution center. We believe this capability is unique and will drive stronger supply chain efficiency through reduced handling and the ability to buffer inventory at either the precise unit, or case count.

We believe our competitive positioning is highly differentiated because our upstream expertise facilitates our integration with other downstream applications, including our own in prototype development. Our systems reside upstream in the supply chain from systems for e-commerce fulfillment centers. Our competitors have not established automated case level buffering infrastructure or distribution center expertise, making their upstream integration significantly more challenging than our downstream integration.

Our Market Opportunity

We define our primary strategically addressed market as the total potential spend on our systems over the next 15 years for U.S. warehouses in the general merchandise, ambient grocery, ambient food distribution, consumer packaged food, and apparel verticals. We estimate the size of our initial strategically addressed market to be $126 billion based on the number of warehouses in each of those verticals, our estimates of the percent of warehouses in each vertical that are addressable (over 1,500), and the expected average price of our system and associated recurring revenue.

We estimate that there is an additional $112 billion in market opportunity from our secondary verticals (non-food consumer packaged goods, home improvement, auto parts, third-party logistics, and refrigerated and frozen foods), implying a $238 billion total addressable market in the United States.

Over time we plan to expand beyond our primary and secondary target verticals, into additional verticals such as pharmaceuticals and electronics. To capture the size of this broader market opportunity, we estimate the size of these additional verticals in the United States at an additional $51 billion (using the same methodology we use for our primary and secondary verticals).

10

We also plan to expand to Canada and Europe, so we define our total addressable market as our total U.S. market opportunity of $289 billion plus our market opportunity in Canada and Europe, which we estimate to be an additional $83 billion. This implies a total addressable market of $373 billion (over 6,500 distribution centers). To estimate our market opportunity in foreign countries, we currently exclude Asia, but for the remaining countries we assume the number of warehouses in each country relative to the number of warehouses in the U.S. is proportionate to their relative GDPs. We then multiply the resulting number of warehouses by our estimate for the percent of those warehouses that are addressable and by our estimate for the average price of our system and associated recurring revenue outside the U.S.

Our Growth Strategy

The key elements of our strategy for growth include the following:

•Further penetrate existing customers’ operations: Our existing customers are large companies, many of which have thousands of stores and hundreds of warehouses and distribution centers. Under our current contracts with these customers, we are fully converting a portion of these customers’ distribution centers in the United States. We fully expect that the value these customers receive in the contracted distribution centers will translate to winning full deployments at the remainder of their distribution centers and therefore, we expect to grow our market share.

•Win additional customers in existing verticals: Given the size of our primary serviceable addressable market relative to the size of our current customer base, there is significant room for us to expand within existing verticals. We have numerous other potential customers in various stages of the sales cycle and expect to win new customers in our existing verticals.

•Expand into new verticals: We believe that every vertical that involves the physical distribution of goods through a distribution center is a potential customer. We currently have the intention and technological capability to expand to the non-food consumer packaged goods, auto parts, and third-party logistics verticals. Additionally, as we build out our refrigerated and frozen capabilities, we intend to expand to the refrigerated and frozen food verticals.

•Expand product offerings: We intend to expand our product suite to increase our potential value to existing customers and to attract new customers. For example, by building out our integrated item handling application, we can help our existing customers manage an increasing variety of SKUs and optimize their e-commerce operations. We can also increase our appeal to pure-play e-commerce retailers. Because our Symbotic platform is designed to integrate such third-party applications, we also are exploring opportunities to expand our product suite through partnerships, investments in companies, and acquisitions. Finally, we are exploring new business models, specifically by adding reverse logistics and warehousing-as-a-service offerings. These future anticipated products are not included in our current support and maintenance arrangements.

•Geographic Expansion: Working with our existing customers and by adding new customers, we intend to expand our operations beyond the United States and Canada. We are currently evaluating opportunities in Europe, Latin America, and the Middle East.

Competition

Most of our target market currently relies on conventional manual and semi-mechanized systems that are labor intensive. There are several point solutions available in the market that automate certain components of the warehouse or distribution center, but few offer end-to-end systems. Those that do typically require a significant greenfield real estate investment.

Some point solutions such as specific goods-to-people robotics or pick and pack robotic arm solutions address only specific supply chain functions but do not maximize the efficiency of the supply chain as a whole. These solutions also must be integrated with other disparate technologies, which often comes at significant cost and time and adds latency to operations.

Those companies that do offer end-to-end systems, most notably Witron, Honeywell, Dematic, Vanderlande, SSI Schaefer and Swisslog, have systems that are composed of a disparate set of mechanically complex point solutions, with numerous single points of failure. These systems are challenging to implement and expensive to adapt to changing customer needs and SKU variation. Even these end-to-end mechanical systems require significant manual labor. They are frequently based on pallet and partial pallet storage techniques, requiring additional inventory and warehouse space.

There are also systems such as Amazon Kiva, Exotec, Ocado, and AutoStore that focus exclusively on individual order fulfillment. We do not consider these to be direct competitors at present because we are focused initially on fulfillment to physical stores; however, they will potentially become partners or competitors as we expand into e-commerce, or if they

11

expand to brick-and-mortar retail. Today, however, these four companies focus primarily on e-commerce, lack case picking technology, and therefore cannot support large retailers with both online and offline operations.

Customers

Customer Base

We have a strong blue chip customer base that includes some of the world’s largest retailers and wholesale grocers, including Walmart, Albertsons, UNFI, Target and Giant Tiger, and our affiliate, C&S Wholesale Grocers.

Since inception, our customers have ordered approximately $12.1 billion of systems from us, and as of September 24, 2022, we had orders of approximately $11.1 billion in backlog that we expect to deliver and install over approximately the next eight years. A substantial majority of the $11.1 billion in backlog relates to the Walmart MAA.

Walmart

We have worked with Walmart since 2015 and entered into the initial Walmart MAA in 2017 and restated and amended that agreement in January 2019. On April 30, 2021, we amended the Walmart MAA to expand our commercial relationship with Walmart and the scope of the Walmart MAA to the implementation of systems, which for purposes of the Walmart MAA are apportioned into 80 “modules,” across 25 of Walmart’s 42 regional distribution centers. On May 20, 2022, we again amended and restated the Walmart MAA to further expand our commercial relationship with Walmart and the scope of the Walmart MAA to the implementation of 188 modules, 20 of which are contingent on the satisfaction of certain conditions described in the Walmart MAA, across all of Walmart’s 42 regional distribution centers. The amendment and restatement added an additional $6.1 billion to our backlog.

The implementation of the modules under the Walmart MAA began in 2021 and will continue based upon an agreed-upon timeline, subject to limited adjustment, with the implementation of all modules to begin by the end of 2028. For each module, Walmart pays us:

•the cost of implementation, including the cost of material and labor, plus a specified net profit amount;

•for software maintenance and support for a minimum of 15 years following preliminary acceptance of the module and with annual renewals thereafter; and

•for spare parts.

Walmart also pays us for operation services for modules installed in the first four buildings for an operation service period for each module that ends on the third anniversary of preliminary acceptance of the final module installed in a building.

The initial term of the Walmart MAA expires on May 20, 2034 with annual renewals of the term thereafter. At any time, either party may terminate the Walmart MAA in the event of insolvency of the other party or a material breach of the other party that has not been cured. Walmart may also terminate the Walmart MAA at any time if we fail to meet certain performance standards or undergo certain change of control transactions.

Pursuant to the Walmart MAA, we must provide Walmart notice in certain circumstances, including if we explore transactions other than the Business Combination that would reasonably be expected to result in a change of control or sale of 25% or more of the voting power of Symbotic. Such transactions are prohibited for specified time periods following such notice, and we must allow Walmart to participate on terms and conditions substantially similar to those of other third-party participants. We have also agreed to certain restrictions on our ability to sell or license our products and services to a specified company or its subsidiaries, affiliates or dedicated service providers.

On December 12, 2021, we entered into an Investment and Subscription Agreement (the “Investment and Subscription Agreement”) with Walmart. Pursuant to such agreement, in connection with the amendment and restatement of the Walmart MAA on May 20, 2022, Walmart exercised a warrant to purchase 267,281 units of Warehouse, or 3.7% of the total outstanding units of Warehouse as calculated following the exercise of the warrant and issuance of units thereunder, at an aggregate purchase price of $103,980,327. We also issued Walmart a new warrant to purchase 258,972 units of Warehouse, or 3.5% of the total outstanding units of Warehouse as calculated on a pro forma basis at the time of the issuance of the warrant, subject to customary adjustments, at an exercise price of $614.34 per unit, which is the estimated value of a unit of Warehouse on the date of the Merger Agreement based on the Exchange Ratio assuming one share of Class A Common Stock is $10.00.

12

Pursuant to the Investment and Subscription Agreement and as a result of the warrant exercise, Walmart has the right to designate a Walmart employee of a certain seniority level to attend all meetings of the Board in a nonvoting observer capacity, except in certain circumstances, including where such observer’s attendance may be inconsistent with the directors’ fiduciary duties to the Company or where such meetings may involve attorney-client privileged information, a conflict of interest between the Company and Walmart or information that the Company determines is competitively or commercially sensitive. Additionally, pursuant to the Investment and Subscription Agreement and subject to certain exceptions described therein, Walmart is subject to a standstill agreement that limits Walmart’s ability to pursue certain transactions with respect to Warehouse and the Company until the earlier of (i) December 12, 2025 and (ii) the later of (a) the date on which Walmart owns less than 5% of the fully diluted equity interests of Warehouse or, after the closing of the Business Combination (the “Closing”), the Company and (b) the date that is six months after Walmart no longer has the board observer rights described above.

Products

Our system is typically sold in three parts: the initial system sale, software maintenance and support services, and operation services. The Symbotic system is a modular, highly configurable capital asset purchase that we sell to our customer in the year of deployment. Then over the remaining system life, which is typically 25-30 years, we charge a software maintenance fee. Finally, we provide training and system operation until the customer assumes operational duties. Our typical deployment model is to install the system over a period of six to twelve months, operate the system for a limited time, and then transfer daily operation to the customer.

Omni-Channel Application

We are currently prototyping, in one of our customer’s operating distribution centers, an application that integrates an additional function for the Symbotic platform, called Omni-Channel. This application atomizes cases to the item level and handles totes filled with multiple items just like we handle native cases. This novel application creates an environment in which both cases and toted items can be handled and shipped from a single platform. We believe this provides a significant step forward in our ability to provide an integrated omni-channel platform.

System deployments

Symbotic is an end-to-end automated system for product distribution at the heart of the supply chain. We have spent 15 years working at the confluence of product manufacturing and retail distribution to produce a fully automated system that allows more efficient handling, storage, selection, and transportation of goods once they are placed into the supply chain by manufacturers. We have accomplished this by combining “smart” software with “smart” hardware such as our autonomous mobile robots. The power of our system is that the components of the platform and applications work together in one system-of-systems to provide the results our customers experience.

Technologies

Our technologies fall into two categories: (1) platform and applications software; and (2) hardware, which includes firmware related to the operation of that hardware.

Software

•A.I.–Enabled Software: Our systems utilize artificial intelligence technologies in a variety of ways to dynamically achieve optimal performance and improve over time. For example, our platform can independently determine the best locations to buffer inventory in the structure to improve outbound efficiency. In addition, the software enables our autonomous robots to independently place and retrieve various sizes of packages with different package material, make corrections to account for product movement, and efficiently navigate through our platform to complete the system’s objectives in the shortest amount of time and at the lowest cost. Our software also dynamically responds to changes in inventory availability to fulfill customer orders on time.

By using machine learning and A.I. tools to process all the data our system is generating, our system is improved by the tasks it performs. This helps us to develop algorithmic innovations that further improve system performance over time.

•System Manager: The System Manager module of our software stack balances work across the inbound and outbound cells of our platform. It does this by managing inbound inventory and inventory levels in the buffering

13

structure against fulfillment orders, optimized to fulfillment gate times. The System Manager module also creates the pallet build plan based on a variety of factors including the aforementioned inventory levels, but also store and aisle specific plan-o-grams, pallet structure, and even more granular criteria such as isolating hazardous products that require special handling.

•Storage & Retrieval Engine: Our Storage and Retrieval Engine coordinates the mechanical components (or assets) within our platform such as our autonomous robots, buffer shelves, and lifts. It also determines, orders, and assigns all the tasks to be performed by the system. Finally, the engine manages the safety systems within the platform by monitoring physical access and related zonal lockouts.

The engine builds a put-away task list as goods are received that is based on a put-away optimization which determines the best placement of goods within the buffering structure. Simultaneously, the engine builds a retrieval task list based on fulfillment requests.

Next, the location and status of every platform asset and every case of goods is evaluated, and mobile robot routes are assigned to optimally perform all the put-away and retrieval tasks.

Since the flow of goods through our platform is highly dynamic and related parameters are constantly changing, the engine reoptimizes every task that needs to be completed multiple times per second. The re-optimization is based on the supply of goods on hand, the location of those goods, and the assets available within the buffering structure. Tasks may then be reassigned, and the routes of the mobile robot recomputed.

•Real-Time Data Analytics Software: Our proprietary software aggregates and synthesizes system data to provide real-time analytics and actionable insights regarding inventory levels, system throughput, accuracy, and performance. We also collect and analyze real-time data on various systems throughout the platform to evaluate system health, predict maintenance needs, and as a result maintain a high level of system performance.

Hardware

•Intelligent Autonomous Mobile Robots: Our intelligent, autonomous mobile robots utilize a suite of sensors to handle cases and locate, retrieve, and transport approximately 80% of the SKUs in our customers’ facilities at speeds of up to 25 mph (10 times faster than the average human) with 99.9999% accuracy. Our newest version of these robots uses vision technology in addition to our autonomous routing algorithms (described above) to achieve optimal speed, safety, and routing.

•A.I.-Powered De-Palletizing Robotic Systems: Our proprietary de-palletizing robotic end of arm tools, coupled with our A.I. and state-of-the-art vision enhanced robotic arms de-palletize up to 1,800 cases and 200 SKU layers per hour. In the de-palletization process, we scan each case to create a digital model of every case, including, among other things, its size, stability, and density that enables our A.I. software to optimize storage, retrieval and palletizing for distribution to stores based upon an individual case’s characteristics. Our software also analyzes the structural integrity of a case during the de-palletization process to understand whether it needs to be rejected or repaired rather than inducted into the system to improve system performance and optimize inventory in the system.

•A.I.-Powered Palletizing Robotic Systems: Using proprietary A.I.-powered software, state-of-the-art vision enhanced palletizing robotic arms and our patented end of arm tools we combine multiple SKUs into aisle-ready pallets that significantly reduce in-store labor costs for our brick-and-mortar customers while maximizing pallet capacity and throughput. Our palletizing robotic application uses two robots simultaneously to palletize product rapidly and efficiently.

Research and Development

Our technology is underpinned by over $700 million invested in developing the Symbotic platform, and is protected in part by over 490 issued and/or pending patents. Our engineers have extensive robotics and software experience and have been working on our product portfolio for over 15 years. We conduct our research and development in our headquarters, based in Wilmington, Massachusetts as well as at our Canadian headquarters in Montreal, Quebec.

Our research and development activities currently include programs in the following areas:

•Expand the capabilities and improve our technology: We aim to continuously advance our hardware and software development to offer better solutions to our customers that benefit their needs. Specifically, we intend to continue innovating our robust A.I.-enabled robots alongside our proprietary software to continue to help our customers optimize operational efficiency.

14

•Expand system offerings: As our existing customers’ needs shift and expand, we will innovate, evolve and be flexible. We will continue to innovate our existing systems as well as introduce new offerings in specific areas for which we do not have a solution, such as tailoring our platform to handle non-ambient foods. This will not only allow us to deepen our penetration within existing customers, but also grow our customer base in adjacent applications.

Sales and Marketing

We go to market via a direct sales model. Given the size, complexity and value of our technology system, our sales to date have come from long-term discussions between our management team and senior-level executives with our current customers. We intend to accelerate our sales cycle as we begin to expand our marketing efforts and transition from a small number of very large transactions to more widespread adoption of our technology systems.

Manufacturing and Suppliers

We operate two manufacturing centers with co-located engineering support in Wilmington, Massachusetts, and Montreal, Quebec. Our Wilmington facility assembles our fully autonomous mobile robots while our facility in Montreal assembles de-palletizing and palletizing robotic cells. Both facilities use Oracle NetSuite for procurement, and to track & control production. Each factory is roughly 40,000 square feet in size and is staffed with a mix of permanent and temporary employees to manage peak production and can operate on two shifts. To increase production, we intend to increase utilization of our installed manufacturing capacity, as well as continue partnering with subcontractors to take on an increasing amount of production.

We purchase a variety of components from a variety of vendors to assemble our autonomous robots. We also purchase lifts, fixed place robots, conveyors, and steel racking equipment from a wide range of vendors to complete our systems.

Intellectual Property

Our ability to drive innovation in the robotics and A.I. automation markets depends in part upon our ability to protect our core technology and the intellectual property therein and thereto. We seek to protect our intellectual property rights in our core technology through a combination of patents, trademarks, copyrights, and trade secrets. This includes the use of non-disclosure and invention assignment agreements with our contractors and employees and the use of non-disclosure agreements with our customers, vendors, and business partners.

Unpatented research, development, know-how and engineering skills make an important contribution to our business and core technology, but we pursue patent protection when we believe it is possible and consistent with our overall strategy for safeguarding our intellectual property. As of September 24, 2022, we had 315 issued patents in 10 countries and an additional 179 patents pending worldwide. Our issued patents are scheduled to expire between August 2024 and May 2041.

Employees and Human Capital Resources

Our employees are critical to our success. As of September 24, 2022, we had approximately 1,120 full-time employees, including approximately 945 based in the United States. Approximately 53% of our employees work in our offices in Wilmington, Massachusetts and Montreal, Quebec. However, due to the nature of the COVID-19 pandemic, many in our workforce have been and continue to work remotely. The remainder of our employees install, commission, operate or maintain our systems at customers’ facilities. We also engage consultants and contractors to supplement our permanent workforce on an as needed basis.

A significant proportion of our employees are engaged in engineering, research and development, and related functions. We have been investing in our people for over a decade and our team possesses decades of combined technical and engineering experience, with a majority of our full-time employees holding technical degrees and a substantial portion of our total employee base holding advanced degrees, including numerous PhDs in engineering.

We consider our relationship with our employees to be in good standing and have yet to experience any work stoppages. None of our employees are subject to a collective bargaining agreement or represented by a labor union.

Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing, and integrating our existing and additional employees. The principal purposes of our incentive plans are to attract, retain and motivate selected employees and consultants through cash and stock performance rewards and other benefits.

15

Government Regulations

Compliance with various governmental regulations has an impact on our business, including our capital expenditures, earnings and competitive position, which can be material. We incur costs to monitor and take actions to comply with governmental regulations that are applicable to our business, which include, among others, laws, regulations and permitting requirements of federal, state and local authorities, including related to environmental, health and safety, anti-corruption and export controls.

Environmental Matters

We are subject to domestic and foreign environmental laws and regulations governing our operations, including, but not limited to, emissions into the air and water and the use, handling, disposal and remediation of hazardous substances. A certain risk of environmental liability is inherent in our production activities, operation of our systems and the disposal of our systems. These laws and regulations govern, among other things, the generation, use, storage, registration, handling and disposal of chemicals and waste materials, the presence of specified substances in electrical products, the emission and discharge of hazardous materials into the ground, air or water, the cleanup of contaminated sites, including any contamination that results from spills due to our failure to properly dispose of chemicals and other waste materials and the health and safety of our employees.

Export and Trade Matters

We are subject to anti-corruption laws and regulations imposed by governments around the world with jurisdiction over our operations, including the U.S. Foreign Corrupt Practices Act, as well as the laws of the countries where we do business. We are also subject to various trade restrictions, including trade and economic sanctions and export controls, imposed by governments around the world with jurisdiction over our operations. For example, in accordance with trade sanctions administered by the U.S. Department of Treasury’s Office of Foreign Assets Control and export controls administered by the U.S. Department of Commerce, we are prohibited from engaging in transactions involving certain persons and certain designated countries or territories, including Cuba, Iran, Syria, North Korea and the Crimea Region of Ukraine. In addition, our systems may be subject to export regulations that can involve significant compliance time and may add additional overhead cost to our systems. In recent years the United States government has a renewed focus on export matters. For example, the Export Control Reform Act of 2018 and regulatory guidance thereunder have imposed additional controls and may result in the imposition of further additional controls, on the export of certain “emerging and foundational technologies.” Our current and future systems may be subject to these heightened regulations, which could increase our compliance costs.

See “Risk Factors—Other Risks—We are subject to U.S. and foreign anti-corruption and anti-money laundering laws and regulations and could face criminal liability and other serious consequences for violations, which could adversely affect our business, financial condition and results of operations” for additional information about the anti-corruption and anti-money laundering laws that may affect our business.

Available Information

Our internet address is www.symbotic.com. Our website and the information contained therein or linked thereto are not part of this Annual Report. We make available free of charge through our internet website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, registration statements and amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish them to the SEC. The SEC maintains a website that contains reports, proxy statements and other information regarding issuers that file electronically with the SEC. These materials may be obtained electronically by accessing the SEC’s website at www.sec.gov.

Item 1A. Risk Factors

In evaluating our Company and our business, you should carefully consider the risks and uncertainties described below, together with the other information in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes and in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may have a material adverse effect on our business, reputation, revenue, financial condition, results of operations and future prospects, in which case the market price of our Class A common stock

16

could decline, and you could lose part or all of your investment. The material and other risks and uncertainties described below and elsewhere in this Annual Report on Form 10-K are not intended to be exhaustive and are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations.

Risk Factor Summary

•Risks related to Symbotic’s business, operations and industry, including that:

◦Symbotic is an early-stage company with a limited operating history. Symbotic has not been profitable historically and may not achieve or maintain profitability in the near term or at all, and it is difficult to evaluate Symbotic’s future prospects and the risks and challenges it may encounter.

◦Symbotic depends heavily on principal customers, and therefore, its success is heavily dependent on its principal customers’ ability to grow their businesses and their adoption of Symbotic’s warehouse automation systems.

◦Symbotic’s operating results and financial condition may fluctuate from period to period, which could make its future operating results difficult to predict or cause its operating results to fall below analysts’ and investors’ expectations.

◦C&S Wholesale Grocers, an important customer of Symbotic, is an affiliate of Symbotic. Despite Symbotic’s affiliation with C&S Wholesale Grocers, there is no guarantee that it will continue to be a customer beyond the term of its current contracts with Symbotic.

◦Symbotic depends upon key employees and other highly qualified personnel, and will need to hire and train additional personnel.

◦Symbotic’s new warehouse automation systems, software, services and products may not be successful or meet existing or future requirements in supply agreements with existing or future customers, and may be affected from time to time by design and manufacturing defects that could adversely affect its business, financial condition and results of operations and result in harm to its reputation.

◦Symbotic relies on suppliers to provide equipment, components and services. Any disruption to the suppliers’ operations could adversely affect Symbotic’s business, financial condition and results of operations.

◦The markets in which Symbotic participates could become more competitive and many companies may target the markets in which Symbotic does business. Additionally, Symbotic’s customers and potential customers may develop in-house solutions that compete with its warehouse automation systems. If Symbotic is unable to compete effectively with these potential competitors and developments, its sales and profitability could be adversely affected.

◦If Symbotic is unable to develop new solutions, adapt to technological change, evolving industry standards and changing business needs or preferences, sell its software, services and products into new markets or further penetrate its existing markets, its revenue may not grow as expected.

◦Laws and regulations governing the robotics and warehouse automation industries are still developing and may restrict Symbotic’s business or increase the costs of its solutions, making Symbotic’s solutions less competitive or adversely affecting its revenue growth.

◦Supply chain interruptions may increase Symbotic’s costs or reduce its revenue.

•Risks related to intellectual property, including that: