Filed by ECARX Holdings, Inc.

Pursuant to Rule 425 under the Securities Act of 1933,

as

amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: COVA Acquisition

Corp.

Commission File No.: 001-40012

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com Investor Presentation May 2022

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 2 Disclaimer THIS PRESENTATION AND ITS CONTENTS ARE CONFIDENTIAL AND ARE NOT FOR RELEASE, REPRODUCTION, PUBLICATION OR DISTRIBUTION, IN WH OLE OR IN PART, DIRECTLY OR INDIRECTLY, TO ANY OTHER PERSON OR IN OR INTO OR FROM ANY JURISDICTION WHERE SUCH RELEASE, REPRODUCTION, PUBLICATION OR DISTRIBUTION IS UNLAWFUL. PERSONS INTO WHOSE POSSESSION THIS PR ESE NTATION COMES SHOULD INFORM THEMSELVES ABOUT, AND OBSERVE, ANY SUCH RESTRICTIONS. THIS PRESENTATION IS NOT AN OFFER OR AN INVITATION TO BUY, SELL OR SUBSCRIBE FOR SECURITIES. About this Presentation This Presentation has been prepared by COVA Acquisition Corp ("SPAC") and ECARX Holdings Inc. (the "Company") in connection w ith a potential business combination involving SPAC and the Company (the "Transaction"). This Presentation is preliminary in nature and solely for information and discussion purposes and must not be relied upon for any other purpose. For the purpose of this notice, "Presentation" shall mean and include the slides that follow, the oral presentation of the sl ide s by members of SPAC or the Company or any person on their behalf, the question - and - answer session that follows that oral presentation, copies of this document and any materials distributed at, or in connection with, that presentation. By acceptin g t his Presentation, participating in the meeting, or by reading the Presentation slides, you will be deemed to have ( i ) acknowledged and agreed to the following conditions, limitations and notifications and made the following undertakings, and ( ii) acknowledged that you understand the legal and regulatory sanctions attached to the misuse, disclosure or improper circulation of this Presentation. This Presentation does not constitute ( i ) an offer or invitation for the sale or purchase of the securities, assets or business described herein or a commitment of t he Company or SPAC with respect to any of the foregoing, or (ii) a solicitation of proxy, consent or authorization with respect to any securities or in respect of the Transaction, and this Presentation shall not for m t he basis of any contract, commitment or investment decision and does not constitute either advice or recommendation regarding any securities. The Company and SPAC expressly reserve the right, at any time and in any respect, to amend or terminate this pro cess, to terminate discussions with any or all potential investors, to accept or reject any proposals and to negotiate with, or cease negotiations with, any party regarding a transaction involving the Company and SPAC. Any offer to sell securities will be made only pursuant to a definitive subscription agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (collectively, the "Securi tie s Act"), for offers and sales of securities that do not involve a public offering. Except where otherwise indicated, this Presentation speaks as of the date hereof. The information contained in this Presentat ion replaces and supersedes, in its entirety, information of all prior versions of similar presentations. This Presentation does no t purport to contain all information that may be required for or relevant to an evaluation of the Transaction. Further, this Pr ese ntation should not be construed as legal, tax, investment or other advice, and should not be relied upon to form the basis of , o r be relied on in connection with, any contract or commitment or investment decision whatsoever. You will be responsible for co ndu cting any investigations and analysis that is deemed appropriate and should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and must make your own investment decision and per form your own independent investigation and analysis with respect to the Transaction or any of an investment in SPAC and the transactions contemplated in this Presentation. SPAC and the Company reserve the right to amend or replace this Presentation at any time but none of SPAC and the Company, th eir respective subsidiaries, affiliates, legal advisors, financial advisors or agents shall have any obligation to update or supplement any content set forth in this Presentation or otherwise provide any additional information to you in connection wi th the Transaction should circumstances, management's estimates or opinions change or any information provided in this Presentation become inaccurate. Confidential Information The information contained in this Presentation is confidential and being provided to you solely for the purpose of assisting you in familiarizing yourself with SPAC and the Company in connection with the Transaction. This Presentation shall remain the property of the Company and the Company reserves the right to require the return of this Presentation (together with any copi es or extracts thereof) at any time. Neither this Presentation nor any of its contents may be disclosed or used for any purposes other than information and discussion purposes without the prior written consent of SPAC and the Company. You agree that you wil l not copy, reproduce or distribute this Presentation, in whole or in part, to other persons or entities at any time without the prior written consent of SPAC and the Company. Any unauthorized distribution or reproduction of any part of this Presenta tio n may result in a violation of the Securities Act.

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 3 Disclaimer Forward - Looking Statements This Presentation contains certain forward - looking statements within the meaning of Section 27A of the Securities Act, and Secti on 21E of the Securities Exchange Act of 1934, as amended, and also contains certain financial forecasts and projections. All statements other than statements of historical fact contained in this Presentation, including statements as to future results of operations and financial position, planned products and services, business strategy and plans, objectives of management for future operations of the Company, market size and growth opportunities, competitive position and technological and market tre nds , are forward - looking statements. Some of these forward - looking statements can be identified by the use of forward - looking words, including "anticipate," "expect," "suggests," "plan," "believe," "intend," "estimates," "targets," "projects," "s hould," "could," "would," "may," "will," "forecast" or other similar expressions. All forward - looking statements are based upon current estimates and forecasts and reflect the views, assumptions, expectations, and opinions of SPAC and the Company as of the date of this Presentation, and are therefore subject to a number of factors, risks and uncertainties, some of which are not currently known to us. Some of these factors include, but are not limited to: the success of new product or service offerings of the Co mpa ny and its subsidiaries (collectively the "Group"), the Group's ability to attract new and retain existing customers, competi tiv e pressures in the industry in which the Group operates, the Group's ability to achieve profitability despite a history of loss es, the Group's ability to implement its growth strategies and manage its growth, the Group's ability to meet consumer expectatio ns , the Group's ability to produce accurate forecasts of its operating and financial results, the Group's internal controls, fluc tua tions in foreign currency exchange rates, the Group's ability to raise additional capital, media coverage of the Group, chang es in the regulatory environments of the countries in which the Group operates or to which the Group is subject, general economic condi tio ns in the countries in which the Group operates, the Group's ability to attract and retain senior management and skilled employees, the success of the Group's strategic alliances and acquisitions, changes in the Group's relationship with its curr ent customers, suppliers and service providers, disruptions to information technology systems and networks, the Group's ability t o protect its brand and the Group's reputation, the Group's ability to protect its intellectual property, potential and future lit igation that the Group may be involved in, taxes or other liabilities that may be incurred or required subsequent to, or in c onn ection with, the consummation of the Transaction. The foregoing list of factors is not exhaustive. We undertake no obligation to pub lic ly update or review any forward - looking statement, whether as a result of new information, future developments or otherwise, except as required by law. In light of these factors, risks and uncertainties, the forward - looking events and circumstances discussed in this Presentation may not occur, and any estimates, assumptions, expectations, forecasts, views or opinions set forth in this Presentation shou ld be regarded as preliminary and for illustrative purposes only and should not be relied upon as being necessarily indicative of f utu re results. You should carefully consider the risks and uncertainties described in the "Risk Factors" section of this Present ati on and the "Risk Factors" section of the proxy statement/prospectus on Form F - 4 relating to the Transaction, which is expected to b e filed with the U.S. Securities and Exchange Commission ("SEC"), and other documents filed from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to diff er materially from those contained in the forward - looking statements. SPAC and the Company assume no obligation and do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise . Moreover, the Company operates in a very competitive and rapidly changing environment, and new risks may emerge from time to tim e. It is not possible to predict all risks, nor assess the impact of all factors on the Company's business or the extent to which any factor, or combination of factors, may cause the Company's actual results, performance or financial condition to be ma terially different from the expected future results, performance of financial condition. In addition, the analyses of SPAC an d the Company contained herein are not, and do not purport to be, appraisals of the securities, assets or business of the Compa ny, SPAC or any other entity. There may be additional risks that neither SPAC nor the Company presently knows or that SPAC and the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forwa rd - looking statements. These forward - looking statements should not be relied upon as representing the Company's or SPAC's assessment as of any date subsequent to the date of this Presentation. More generally, we caution you against relying on thes e f orward - looking statements, and we qualify all of our forward - looking statements by these cautionary statements. Industry and Market Data This Presentation also contains information, estimates and other statistical data derived from third party sources (including Fr ost & Sullivan). Such information involves a number of assumptions and limitations, and due to the nature of the techniques a nd methodologies used in market research, Frost & Sullivan cannot guarantee the accuracy of such information. You are cautioned not to give undue weight to such estimates. Neither SPAC nor the Company has independently verified such third party information, and makes no representation, express or implied, as to the accuracy, completeness, timeliness, reliability or av ail ability of, such third party information. SPAC and the Company may have supplemented such information where necessary, taking into account publicly available information about other industry participants. Use of Projections and Historical Financial Information The 2021 historical financial data included in this Presentation have been derived based on the Company's 2021 management accounts prepared in accordance with United States generally accepted accounting principles ("GAAP") and are subject to changes following PCAOB audit/review that will be conducted prior to filing any registration statement or proxy with the SEC.

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 4 Disclaimer This Presentation contains fi nancial forecasts for the Company with respect to certain of its fi nancial results for the fi scal years 202 2 through 2024 for illustrative purposes. Neither SPAC's nor the Company's independent auditors have audited, studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Pre sen tation, and accordingly, they did not express any opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections are forward - looking statements and should not be relied upon as being necessaril y indicative of future results. In this Presentation, certain of the above - mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective fi nancial information are inherently uncertain and are subject to a wide variety of signi fi cant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective fi nancial information. While such information and projections are necessarily speculative, SPAC and the Company believe that th e p reparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends f rom the date of preparation. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the prospective fi nancial information. The inclusion of prospective fi nancial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective fi nancial information will be achieved. All subsequent written and oral forward - looking statements concerning the Company or SPAC, the Transaction or other matters and attributable to the Company or SPAC or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements a bov e. Non - GAAP Financial Measures This Presentation also includes references to non - GAAP financial measures such as adjusted EBITDA. Such non - GAAP measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. SPAC and the Company believe these non - GAAP measures of fi nancial results provide useful information to management and investors regarding certain fi nancial and business trends relating to the Company's fi nancial condition and results of operations. SPAC and the Company believe that the use of these non - GAAP fi nancial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and i n c omparing the Company's fi nancial measures with other similar companies, many of which present similar non - GAAP fi nancial measures to investors. Management does not consider these non - GAAP measures in isolation or as an alternative to financi al measures determined in accordance with GAAP. These non - GAAP fi nancial measures are subject to inherent limitations as they re fl ect the exercise of judgments by management about which expense and income are excluded or included in determining these non - GAA P fi nancial measures. Additionally, to the extent that forward - looking non - GAAP financial measures are provided, they are presented on a non - GAAP basi s without reconciliations of such forward - looking non - GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Additional Information If the Transaction is pursued, SPAC will be required to file a preliminary and definitive proxy statement, which may include a r egistration statement, and other relevant documents with the SEC. You are urged to read the proxy statement/prospectus and an y other relevant documents filed with the SEC when they become available because, among other things, they will contain updates to the financial, industry and other information herein as well as important information about SPAC, the Company and the Transaction. Shareholders of SPAC will be able to obtain a free copy of the proxy statement (when filed), as well as other fi lin gs containing information about SPAC, the Company and the Transaction, without charge, at the SEC's website located at www.sec.gov. Participants in the Solicitation SPAC and the Company, and their respective directors and executive officers may be deemed to be participants in the solicitat ion of proxies from SPAC's shareholders in connection with the Transaction. A list of the names of such directors and executive officers and information regarding their interests in the Transaction will be contained in the proxy statement when available . Y ou may obtain free copies of these documents as described in the preceding paragraph. The definitive proxy statement will be mailed to shareholders of SPAC as of a record date to be established for voting on the Transaction when it becomes available. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred t o in this Presentation may be listed without the TM, SM © or ® symbols, but such references are not intended to indicate, in an y w ay, that SPAC, the Company or the third - parties will not assert, to the fullest extent under applicable law, their rights or the right of the applicable owners or licensors to these trademarks, service marks, trade names and copyrights. Neither SPAC, the Company, nor any of their respective directors, officers, employees, affiliates, advisors, representatives or agents, makes any representation or warranty of any kind, express or implied, as to the value that may be realized in connect ion with the Transaction, the legal, regulatory, tax, financial, accounting or other effects of the Transaction or the accuracy o r c ompleteness of the information contained in this Presentation, and none of them shall have any liability based on or arising fro m, in whole or in part, any information contained in, or omitted from, this Presentation or for any other written or oral communica tio n transmitted to any person or entity in the course of its evaluation of the Transaction, and they expressly disclaim any responsibility or liability for direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential da mag es, costs, expenses, legal fees, or losses (including lost income or profits and opportunity costs) in connection with the us e o f the information herein.

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 5 Today ' s Presenters Chairman and CEO ZIYU SHEN CFO TONY CHEN COVA Chairman , CEO JUN HONG HENG VP, Strategy & Partnerships MARK BURTON

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 6 Transaction Overview • Enterprise Value of $3.4bn 1 and Equity Value of $3.4bn 1 • Implied EV multiple of 4.1x 2023E Revenue and 2.5x 2024E Revenue 1 • $303mm raised goes to balance sheet after expenses, including $300mm from COVA cash - in - trust 2 and $45mm in additional capital committed through strategic investments and other financings 3 • Existing ECARX shareholders will retain 89 % of pro forma equity in the combined company 3 FX rate (USD/RMB) = 6.3726 as of December 30, 2021 1. Pre - money valuation, Enterprise Value calculated based on Equity Value of $3.4bn, total debt of $146mm and existing cash balance of $141mm (as of December 31, 2021) 2. Assumes no redemptions by COVA shareholders, and e xcludes ( i ) the impact of any equity awards issued at or after the closing of the transaction, (ii) the dilutive impact of 15.0mm publi c w arrants and 8.9mm sponsor warrants with a strike price of $11.50 per share, and (iii) the impact of shares with super - voting rights 3. As of May 26, 2022, the Company has received a committed amount of $35mm in the form of strategic investments, the proceeds o f w hich are dependent upon the closing of the proposed business combination. The Company has also received $10mm financing in th e f orm of a note convertible into shares of ECARX upon consummation of the proposed business combination, the proceeds of which have been rece ive d by the Company

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 7 COVA Acquisition Corp . Jun Hong Heng Chairman, CEO K.V. Dhillon President, Secretary and Director Alvin Widarta Sariaatmadja Director Austin Russell Senior Advisor Jack Smith Director Pandu Sjahrir Director

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 8 TECHNOLOGY 02 FINANCIALS 03 TRANSACTION 04 01 COMPANY

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 9

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 10 Powering a better, more sustainable life through smart mobility

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 11 Co - founded in 201 7 by renowned Chinese entrepreneurs Mr. Eric Li (Li Shufu ) and Mr. Ziyu Shen to develop the full - stack automotive computing platform 5 years since founding Over 2,000 FTEs 2 80%+ of team are engineers $436mm 2021 revenue 1 3.2 mm+ vehicles equipped with ECARX technologies 3 serving 12 brands in Asia Pacific and Europe 3 All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 1. FX rate (USD/RMB) = 6.3726 as of December 30, 2021 2. Full - time employees 3. Operational data as of December 31, 2021 11 Established business

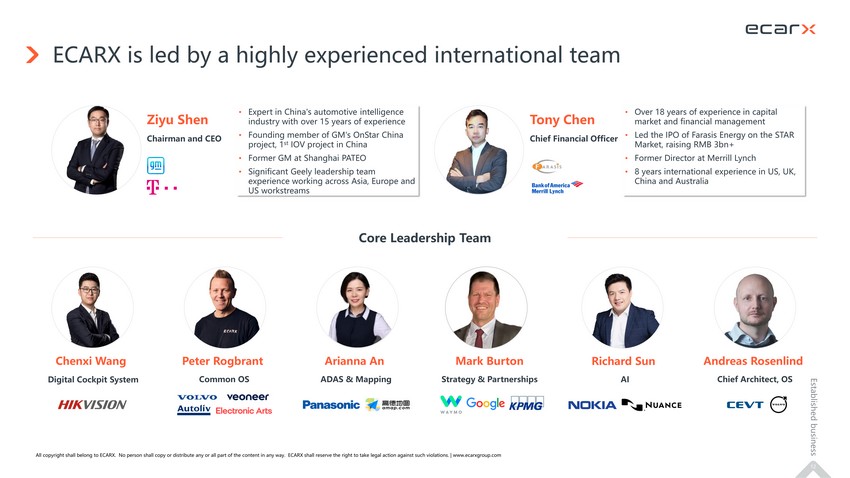

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 12 ECARX is led by a highly experienced international team Established business • Expert in China's automotive intelligence industry with over 15 years of experience • Founding member of GM's OnStar China project, 1 st IOV project in China • Former GM at Shanghai PATEO • Significant Geely leadership team experience working across Asia, Europe and US workstreams • Over 18 years of experience in capital market and financial management • Led the IPO of Farasis Energy on the STAR Market, raising RMB 3 bn+ • Former Director at Merrill Lynch • 8 years international experience in US, UK, China and Australia Chenxi Wang Peter Rogbrant Common OS ADAS & Mapping Arianna An Richard Sun AI Andreas Rosenlind Chief Architect, OS Tony Chen Chief Financial Officer Chairman and CEO Ziyu Shen Core Leadership Team Strategy & Partnerships Mark Burton Digital Cockpit System

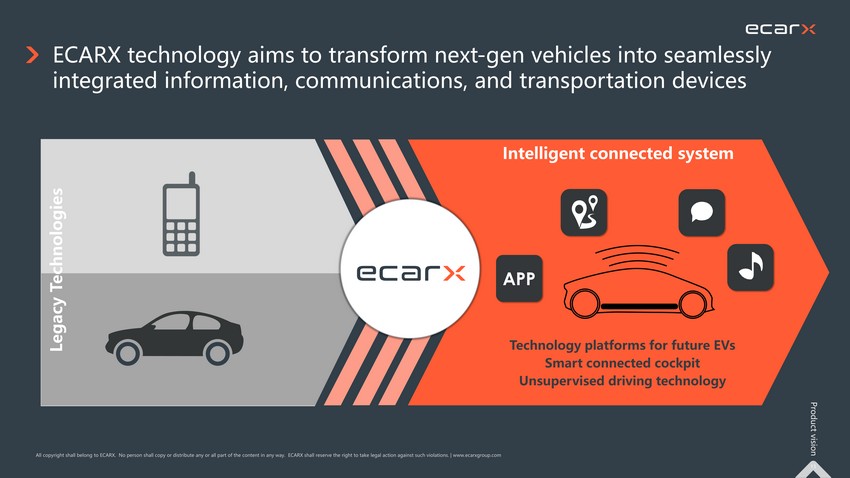

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 13 ECARX technology aims to transform next - gen vehicles into seamlessly integrated information, communications, and transportation devices APP Technology platforms for future EVs Smart connected cockpit Unsupervised driving technology Legacy Technologies Intelligent connected system Product vision

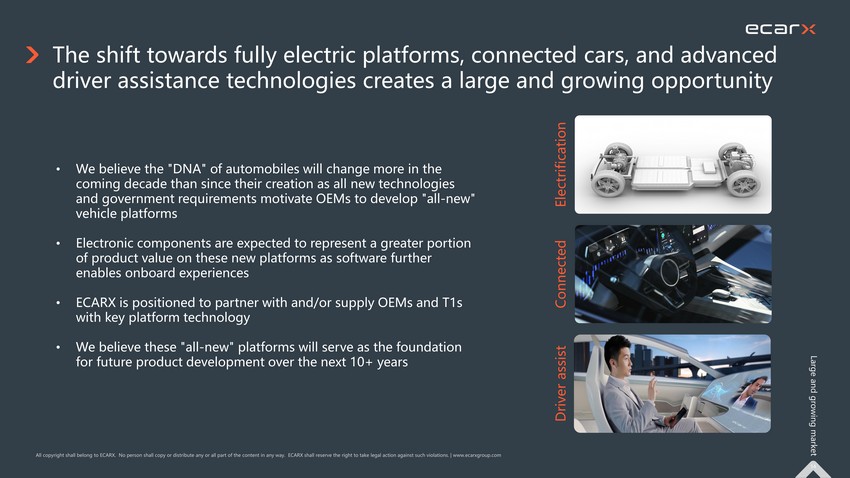

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 14 The shift towards fully electric platforms, connected cars, and advanced driver assistance technologies creates a large and growing opportunity • We believe the "DNA" of automobiles will change more in the coming decade than since their creation as all new technologies and government requirements motivate OEMs to develop "all - new" vehicle platforms • Electronic components are expected to represent a greater portion of product value on these new platforms as software further enables onboard experiences • ECARX is positioned to partner with and/or supply OEMs and T1s with key platform technology • We believe these "all - new" platforms will serve as the foundation for future product development over the next 10+ years Electrification Driver assist Large and growing market Connected

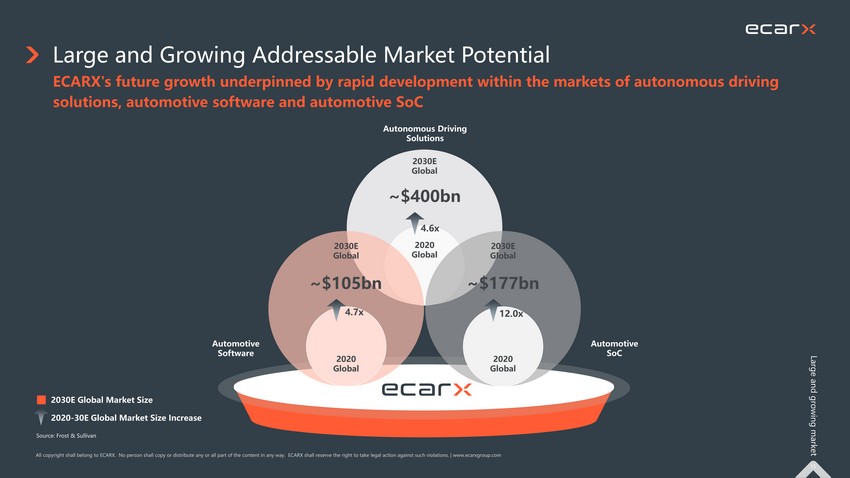

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 15 Large and Growing Addressable Market Potential 2030E Global Market Size 2020 - 30E Global Market Size Increase ECARX's future growth underpinned by rapid development within the markets of autonomous driving solutions, automotive software and automotive SoC Automotive SoC Autonomous Driving Solutions Automotive Software 2020 Global 2020 Global 2020 Global 2030E Global 2030 E Global 2030E Global ~$ 105 bn ~$400bn ~$ 177 b n 4.7x 12.0x 4.6x Source: Frost & Sullivan Large and growing market

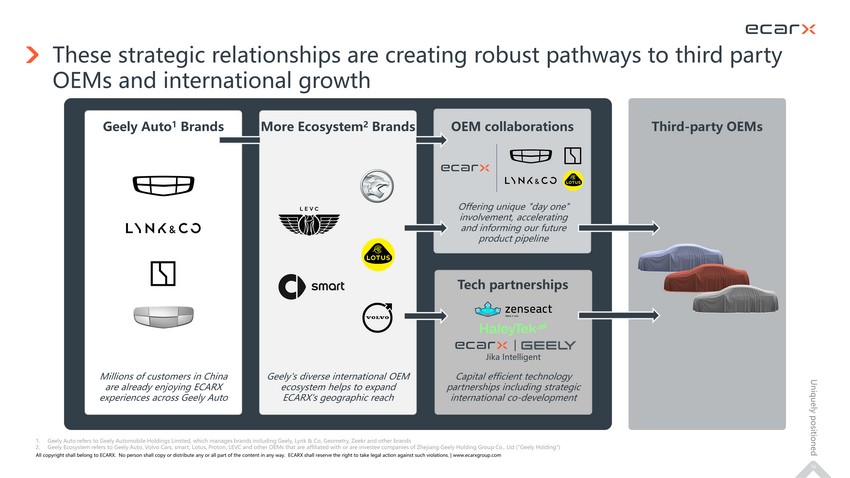

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 16 These strategic relationships are creating robust pathways to third party OEMs and international growth Uniquely positioned Geely Auto 1 Brands Tech partnerships More Ec osystem 2 Brands Third - party OEMs OEM collaborations Millions of customers in China are already enjoying ECARX experiences across Geely Auto Geely's diverse international OEM ecosystem helps to expand ECARX's geographic reach Offering unique "day one" involvement, accelerating and informing our future product pipeline Capital efficient technology partnerships including strategic international co - development 1. Geely Auto refers to Geely Automobile Holdings Limited, which manages brands including Geely , Lynk & Co, Geometry, Zeekr and other brands 2. Geely Ecosystem refers to Geely Auto, Volvo Cars, s mart, Lotus, Proton, LEVC and othe r OEMs that are affiliated with or are investee companies of Zhejiang Geely Holding Group Co., Ltd (" Geely Holding") Jika Intelligent

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 17 ECARX's unique go - to - market strategy creates multiple development and commercialization opportunities Uniquely positioned 1. SoC Core M odule refers to complete computing board which efficiently integrates SoC together with core ICs (integrated circuit) and peripheral 2. Zenseact was founded by Volvo Cars. ECARX holds 13.5% equity interest in Zenseact as of May 10, 2022 3. Jika Intelligent was co - founded by ECARX and a subsidiary of Geely Holding in April 2021. ECARX holds 50% equity interest in Jika Intelligent as of May 10, 2022 4. Haleytek was co - founded by ECARX and Volvo Cars in September 2021. ECARX holds 40% equity interest in Haleytek as of May 10, 2022 5. SiEngine was co - founded by ECARX and ARM China in September 2018. ECARX holds 29.1% equity interest in SiEngine as of May 10, 2022 Sales of ECARX products to automotive Tier 1 suppliers Example: Sale of SoC Core M odule 1 to Tier 1 for infotainment & cockpit product Tier 1 suppliers Geely Auto Collaborations Early vehicle program involvement Third party OEMs Sales & collaborations More Geely Ecosystem OEMs Sales & collaborations Automotive OEMs Partnerships Development and / or sales through Joint Ventures or Partnerships System on a Chip Operating system Driver assist / unsupervised highway 4 2 5 Jika Intelligent 3

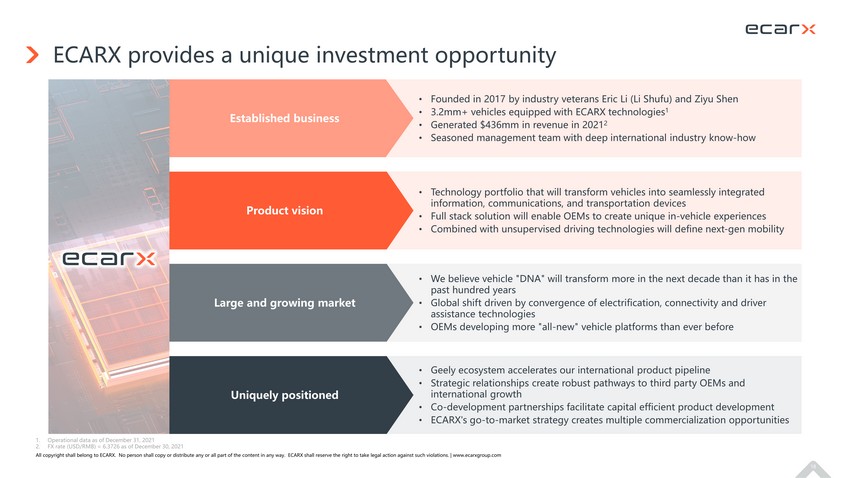

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 18 ECARX provides a unique investment opportunity 1. Operational data as of December 31, 2021 2. FX rate (USD/RMB) = 6.3726 as of December 30, 2021 • Founded in 2017 by industry veterans Eric Li (Li Shufu ) and Ziyu Shen • 3.2 mm+ vehicles equipped with ECARX technologies 1 • Generated $ 436 mm in revenue in 2021 2 • Seasoned management team with deep international industry know - how • Technology portfolio that will transform vehicles into seamlessly integrated information, communications, and transportation devices • Full stack solution will enable OEMs to create unique in - vehicle experiences • Combined with unsupervised driving technologies will define next - gen mobility • We believe vehicle "DNA" will transform more in the next decade than it has in the past hundred years • Global shift driven by convergence of electrification, connectivity and driver assistance technologies • OEMs developing more "all - new" vehicle platforms than ever before • Geely ecosystem accelerates our international product pipeline • Strategic relationships create robust pathways to third party OEMs and international growth • Co - development partnerships facilitate capital efficient product development • ECARX's go - to - market strategy creates multiple commercialization opportunities Established business Product vision Large and growing market Uniquely positioned

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 1

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 2 ECARX is developing an automotive technology platform uniquely informed by our strategic OEM collaborations Clear platform roadmap consisting of one SoC family and versatile OS Customized Android Linux and RTOS Digital Cockpit Initial SOP: 2021 SoC : Snapdragon 8155 ( 2021 ); SE 1000 ( 2022 ) 1 Cluster + Infotainment + ADAS Infotainment S o C: E 01 ( 2018 ) , E 02 ( 2020 ) Initial SOP: 201 7 Customized Android Infotainment Oriented Next Generation Products Seamlessly integrated information, communications, and transportation devices Automotive Central Computing Platform Initial SOP: 2024 1 SoC Family (Multiple) One OS Platform Cockpit + Body + ADAS + Unsupervised highway driving 1. Estimated All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 2 Technology

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 3 ECARX combines SoC and OS technology with a unique software stack System on a Chip Operating System Software Stack Powerful SoC targeting automotive applications Operating system and tool chain intended to maximize the power of ECARX SoC Software to address major domains of automotive applications Technology Technology platform simplifies and speeds up product development

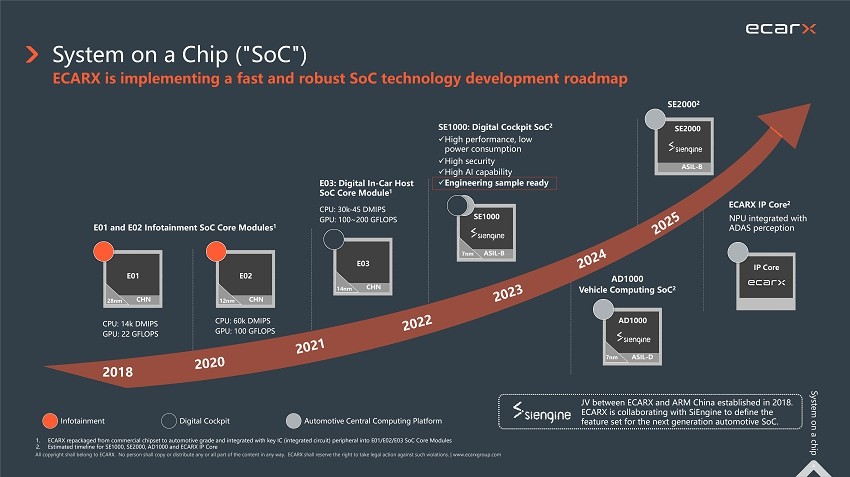

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 4 System on a Chip ("SoC") System on a chip ECARX is implementing a fast and robust SoC technology development roadmap JV between ECARX and ARM China established in 2018 . ECARX is collaborating with SiEngine to define the feature set for the next generation automotive SoC. 1. ECARX repackaged from commercial chipset to automotive grade and integrated with key IC (integrated circuit) peripheral into E 01 /E 02 /E 03 SoC Core Modules 2. Estimated timeline for SE 1000 , SE 2000 , AD 1000 and ECARX IP Core Infotainment Digital Cockpit Automotive Central Computing Platform AD1000 Vehicle Computing SoC 2 Coc kp it i n ASIL - D AD 1000 2018 Coc kp it i n 7 nm ASIL - B SE1000 SE 1000 : Digital Cockpit SoC 2 x High performance, low power consumption x High security x High AI capability x Engineering sample ready E01 and E02 Infotainment SoC Core Modules 1 CPU: 14k DMIPS GPU: 22 GFLOPS Coc kp it i n CHN 28 nm E01 CPU: 60k DMIPS GPU: 100 GFLOPS Coc kp it i n CHN 12nm E 02 E 03 : Digital In - Car Host SoC Core Module 1 CPU: 30 k - 45 DMIPS GPU: 100 ~ 200 GFLOPS Coc kp it i n CHN 14 nm E03 IP Core 7 nm SE 2000 2 Coc kp it i n ASIL - B SE2000 NPU integrated with ADAS perception ECARX IP Core 2

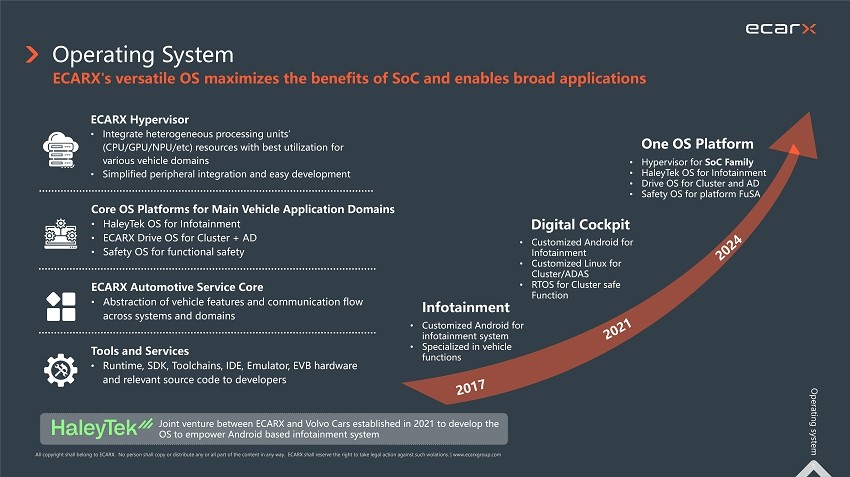

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 5 Joint venture between ECARX and Volvo Cars established in 2021 to develop the OS to empower Android based infotainment system Operating System Operating system ECARX's versatile OS maximizes the benefits of SoC and enables broad applications ECARX Hypervisor • Integrate heterogeneous processing units’ (CPU/GPU/NPU/ etc ) resources with best utilization for various vehicle domains • Simplified peripheral integration and easy development Core OS Platforms for Main Vehicle Application Domains • HaleyTek OS for Infotainment • ECARX Drive OS for Cluster + AD • Safety OS for functional safety ECARX Automotive Service Core • Abstraction of vehicle features and communication flow across systems and domains Tools and Services • Runtime, SDK, Toolchains, IDE, Emulator, EVB hardware and relevant source code to developers • Hypervisor for SoC Family • HaleyTek OS for Infotainment • Drive OS for Cluster and AD • Safety OS for platform FuSA One OS Platform • Customized Android for infotainment system • Specialized in vehicle functions Infotainment • Customized Android for Infotainment • Customized Linux for Cluster/ADAS • RTOS for Cluster safe Function Digital Cockpit

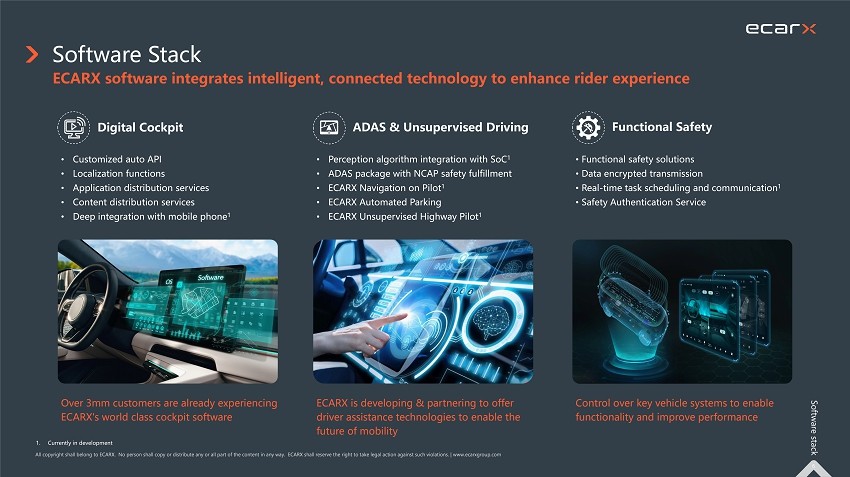

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 6 Software Stack Software stack ECARX software integrates intelligent, connected technology to enhance rider experience • Customized auto API • Localization functions • Application distribution services • Content distribution services • Deep integration with mobile phone 1 Digital Cockpit Over 3mm customers are already experiencing ECARX's world class cockpit software • Perception algorithm integration with SoC 1 • ADAS package with NCAP safety fulfillment • ECARX Navigation on Pilot 1 • ECARX Automated Parking • ECARX Unsupervised Highway Pilot 1 ADAS & Unsupervised Driving ECARX is developing & partnering to offer driver assistance technologies to enable the future of mobility • Functional safety solutions • Data encrypted transmission • Real - time task scheduling and communication 1 • Safety Authentication Service Functional S afety Control over key vehicle systems to enable functionality and improve performance 1. Currently in development

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 7

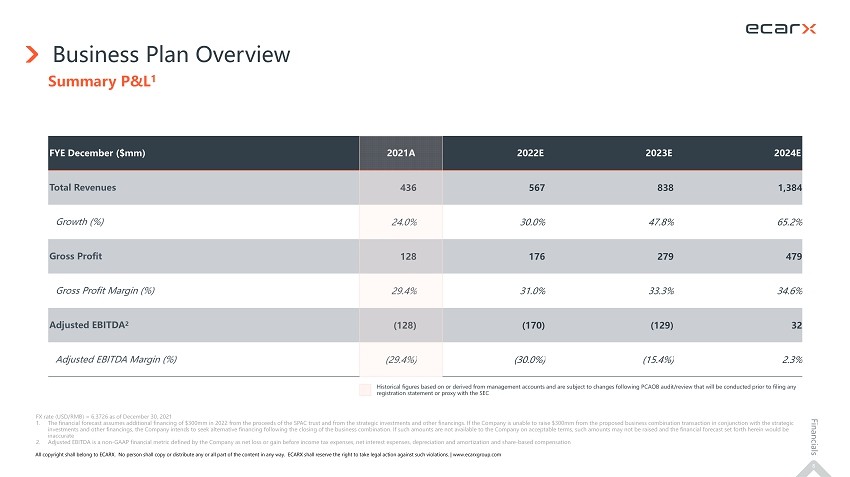

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 8 FYE December ($mm) 2021 A 2022 E 2023 E 2024E Total Revenues 436 567 838 1,384 Growth (%) 24.0% 30.0% 47.8% 65.2% Gross Profit 128 176 279 479 Gross Profit Margin (%) 29.4% 31.0% 33.3% 34.6% Adjusted EBITDA 2 (128) (170) (129) 32 Adjusted EBITDA Margin (%) (29.4%) (30.0%) (15.4%) 2.3% Business Plan Overview Summary P&L 1 Historical figures based on or derived from management accounts and are subject to changes following PCAOB audit/review that will be conducted prior to filing any registration statement or proxy with the SEC FX rate (USD/RMB) = 6.3726 as of December 30, 2021 1. The financial forecast assumes additional financing of $300mm in 2022 from the proceeds of the SPAC trust and from the strate gic investments and other financings. If the Company is unable to raise $300mm from the proposed business combination transaction i n conjunction with the strategic investments and other financings, the Company intends to seek alternative financing following the closing of the business com bin ation. If such amounts are not available to the Company on acceptable terms, such amounts may not be raised and the financial fo recast set forth herein would be inaccurate 2. Adjusted EBITDA is a non - GAAP financial metric defined by the Company as net loss or gain before income tax expenses, net intere st expenses, depreciation and amortization and share - based compensation Financials

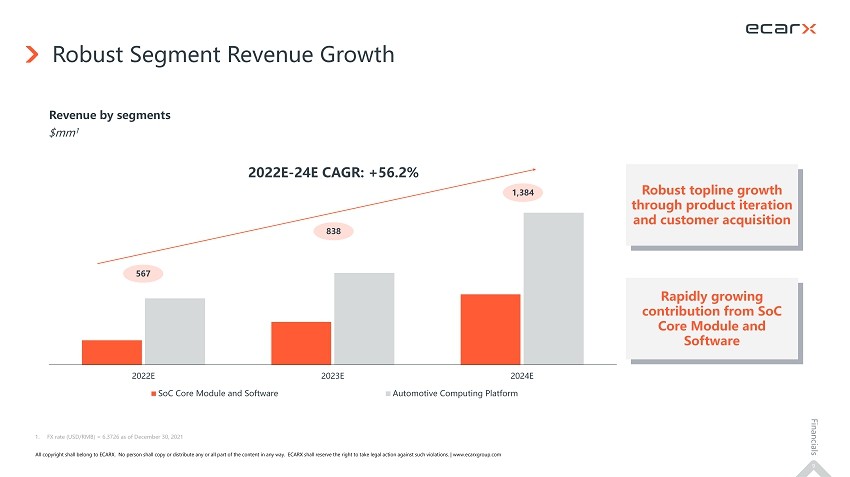

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 9 2022E 2023E 2024E SoC Core Module and Software Automotive Computing Platform Robust Segment Revenue Growth Revenue by segments $mm 1 Rapidly growing contribution from SoC Core Module and Software Robust topline growth through product iteration and customer acquisition 567 838 1,384 2022E - 24E CAGR: +56.2% 1. FX rate (USD/RMB) = 6.3726 as of December 30, 2021 Financials

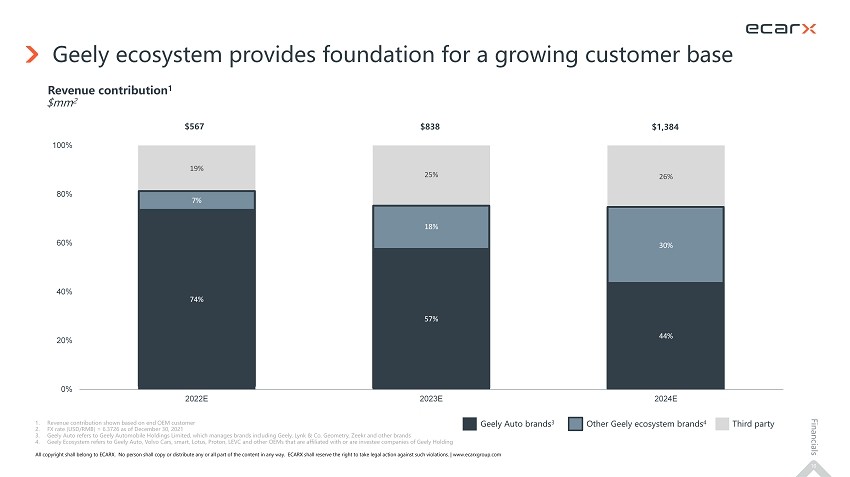

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 10 74 % 57 % 44% 7% 18% 30% 19% 25% 26 % 0% 20% 40% 60% 80% 100% 2022E 2023E 2024E Geely ecosystem provides foundation for a growing customer base Revenue contribution 1 1. Revenue contribution shown based on end OEM customer 2. FX rate (USD/RMB) = 6.3726 as of December 30, 2021 3. Geely Auto refers to Geely Automobile Holdings Limited, which manages brands including Geely , Lynk & Co, Geometry, Zeekr and other brands 4. Geely Ecosystem refers to Geely Auto, Volvo Cars, s mart, Lotus, Proton, LEVC and othe r OEMs that are affiliated with or are investee companies of Geely Holding Geely Auto brands 3 Other Geely ecosystem brands 4 Third party Financials $mm 2 $567 $838 $1,384

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 11

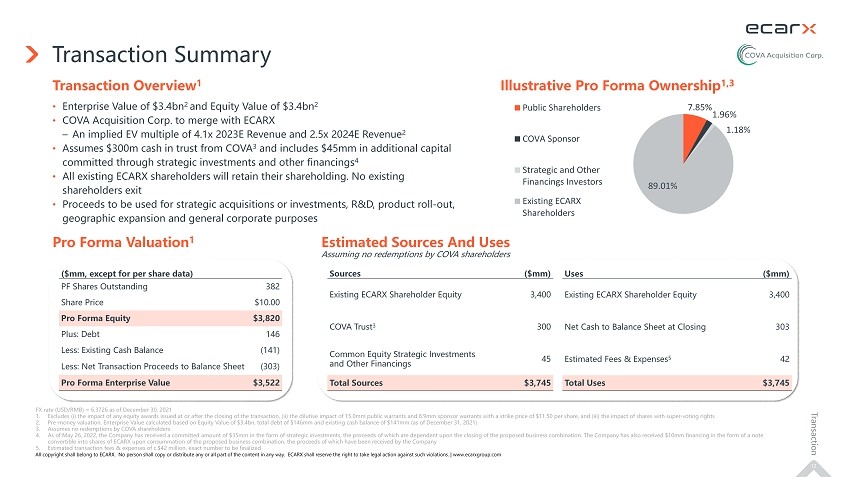

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 12 Transaction Overview 1 Illustrative Pro Forma Ownership 1,3 Transaction S ummary Estimated Sources And Uses Pro Forma Valuation 1 • Enterprise Value of $3.4bn 2 and Equity Value of $3.4bn 2 • COVA Acquisition Corp. to merge with ECARX – An implied EV multiple of 4.1x 2023E Revenue and 2.5x 2024E Revenue 2 • Assumes $300m cash in trust from COVA 3 and includes $45mm in additional capital committed through strategic investments and other financings 4 • All existing ECARX shareholders will retain their shareholding. No existing shareholders exit • Proceeds to be used for strategic acquisitions or investments, R&D, product roll - out, geographic expansion and general corporate purposes Sources ($mm) Existing ECARX Shareholder Equity 3,400 COVA Trust 3 300 Common Equity Strategic Investments and Other Financings 45 Total Sources $3,745 ($mm, except for per share data) PF Shares Outstanding 382 Share Price $10.00 Pro Forma Equity $3,820 Plus: Debt 146 Less: Existing Cash Balance (141) Less: Net Transaction Proceeds to Balance Sheet (303) Pro Forma Enterprise Value $3,522 Uses ($mm) Existing ECARX Shareholder Equity 3,400 Net Cash to Balance Sheet at Closing 303 Estimated Fees & Expenses 5 42 Total Uses $3,745 FX rate (USD/RMB) = 6.3726 as of December 30, 2021 1. Excludes ( i ) the impact of any equity awards issued at or after the closing of the transaction, (ii) the dilutive impact of 15.0mm publi c w arrants and 8.9mm sponsor warrants with a strike price of $11.50 per share, and (iii) the impact of shares with super - voting rig hts 2. Pre - money valuation, Enterprise Value calculated based on Equity Value of $3.4bn, total debt of $146mm and existing cash balance of $141mm (as of December 31, 2021) 3. Assumes no redemptions by COVA shareholders 4. As of May 26, 2022, the Company has received a committed amount of $35mm in the form of strategic investments, the proceeds o f w hich are dependent upon the closing of the proposed business combination. The Company has also received $10mm financing in th e f orm of a note convertible into shares of ECARX upon consummation of the proposed business combination, the proceeds of which have been rece ive d by the Company 5. Estimated transaction fees & expenses of c.$42 million, exact number to be finalized Transaction Assuming no redemptions by COVA shareholders 7.85% 1.96% 1.18% 89.01% Public Shareholders COVA Sponsor Strategic and Other Financings Investors Existing ECARX Shareholders

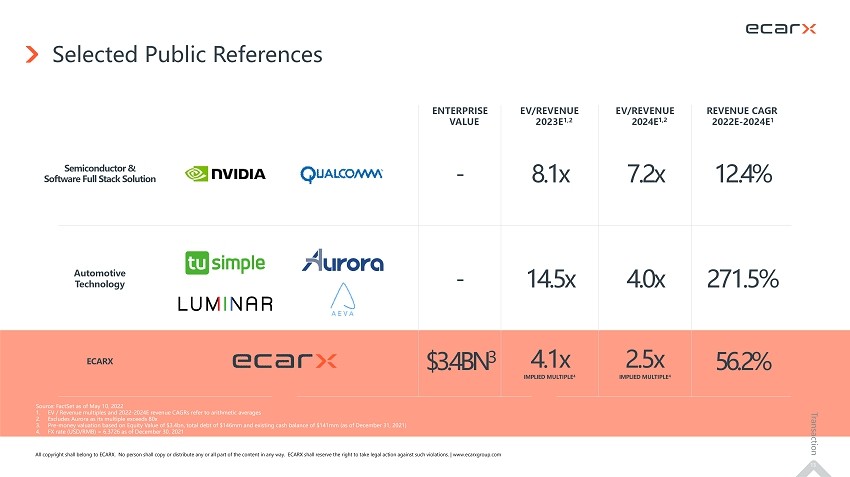

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 13 Selected Public References Semiconductor & Software Full Stack Solution ECARX Automotive Technology ENTERPRISE VALUE - $3.4BN 3 - REVENUE CAGR 202 2 E - 202 4 E 1 12 .4 % 56 . 2 % 271 . 5 % Source: FactSet as of May 10, 2022 1. EV / Revenue multiples and 2022 - 2024E revenue CAGRs refer to arithmetic averages 2. Excludes Aurora as its multiple exceeds 80x 3. Pre - money valuation based on Equity Value of $3.4bn, total debt of $146mm and existing cash balance of $141mm (as of December 31, 2021) 4. FX rate (USD/RMB) = 6.3726 as of December 30, 2021 Transaction 13 E V /R E VENUE 202 3 E 1,2 8.1 x 4.1x IMPLIED MULTIPLE 4 14.5 x E V /R E VENUE 202 4 E 1 ,2 2.5x IMPLIED MULTIPLE 4 7.2 x 4.0 x

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 14

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 15 Risk Factors Risks Relating to ECARX's Business and Industry 1. ECARX has a limited operating history in a new market and faces significant challenges in the fast - developing industry. 2. ECARX is subject to risks associated with automotive intelligence technologies. 3. ECARX ' s automotive intelligence technologies and related hardware and software could have defects, errors, or bugs, undetected or o the rwise, which could create safety issues, reduce market adoption, damage its reputation with current or prospective customers, or expose it to product liability and other claims that could materially and adversely affect its busi nes s, financial condition, and results of operations. 4. Disruptions in the supply of components or the underlying raw materials used in ECARX's products may materially and adversely af fect its business and profitability. 5. The automobile sales and production could be highly cyclical and can adversely affect ECARX's business. 6. A drop in the market share and changes in product mix offered by ECARX's customers could materially and adversely affect ECAR X's business, financial condition, and results of operations. 7. The automotive intelligence industry is highly competitive, and ECARX may not be successful in competing in this industry. 8. ECARX had negative net cash flows from operations in the past and has not been profitable, which may continue in the future. 9. ECARX currently has a concentrated customer base with a limited number of key customers, particularly Geely Holding and its related parties. The loss of one or more of its key customers, or a failure to renew any agreement with one o r more of its key customers, could adversely affect its results of operations and ability to market its products and services. 10. ECARX collects, processes and uses data, some of which contains personal information, and its business is subject to complex and evolving laws and regulations regarding cybersecurity, privacy, data protection and information security in China. Any privacy or data security breach or failure to comply with these laws and regulations could damage its reputation and brand, r esu lt in negative publicity, legal proceedings, increased cost of operations, warnings, fines, service suspension, removal of apps from relevant app stores or otherwise harm its business and results of operations. 11. The evolution of the automotive industry towards autonomous vehicles and mobility on demand services could adversely affect E CAR X's business if it does not respond appropriately. 12. ECARX may not be able to realize the potential financial or strategic benefits of business ventures, acquisitions or strategi c i nvestments or successfully integrate acquisition targets, which could harm its ability to grow its business, develop new products or sell its existing products. 13. ECARX's business depends substantially on the continued efforts of its executive officers, key employees and qualified person nel , and its operations may be severely disrupted if ECARX loses their services. 14. ECARX's management team has limited experience managing a public company. 15. ECARX may incur material losses and costs as a result of warranty claims, product recalls, and product liability that may be bro ught against it. 16. ECARX may not succeed in continuing to establish, maintain, or strengthen its brand, and the brand and reputation of ECARX co uld be harmed by negative publicity with respect to itself, its directors, officers, employees, shareholders, peers, business partners, or the industry in general. 17. ECARX depends on information technology to conduct its business. Any significant disruptions to its information technology sy ste ms or facilities, or to those of third parties with which it does business, such as disruptions caused by cyber - attacks, could adversely impact ECARX's business. 18. ECARX is subject to risks and uncertainties associated with international operations, which may harm its business. 19. ECARX's business plans require a significant amount of capital. In addition, ECARX's future capital needs may require it to s ell additional equity or debt securities that may dilute its shareholders or introduce covenants that may restrict its operations or its ability to pay dividends. 20. ECARX's revenues and financial results may be adversely affected by any economic slowdown in China as well as globally. 21. The COVID - 19 pandemic continues to impact ECARX's business and could materially and adversely affect its financial condition and results of operations. 22. Natural disasters, terrorist activities, political unrest, the ongoing conflict between Russia and Ukraine, rising inflation, an d other global pandemic outbreaks could disrupt ECARX's production, delivery, and operations, which could materially and adversely affect its business, financial condition, and results of operations. 23. ECARX has limited insurance coverage, which could expose it to significant costs and business disruption. 24. Unexpected termination of leases, failure to renew the lease of ECARX's existing premises or to renew such leases at acceptab le terms could materially and adversely affect its business. 25. If ECARX fails to implement and maintain an effective system of internal controls, it may be unable to accurately report its res ults of operations, meet its reporting obligations or prevent fraud, which may have material and adverse effect to investor confidence and the market price of its shares.

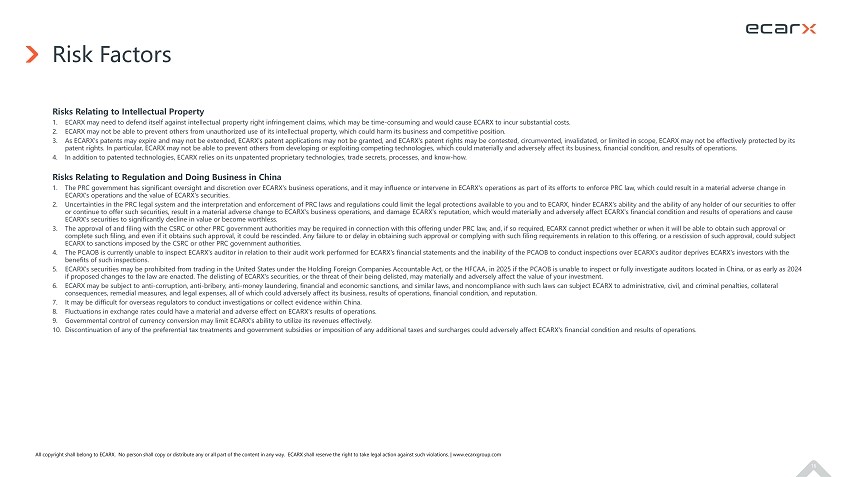

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 16 Risk Factors Risks Relating to Intellectual Property 1. ECARX may need to defend itself against intellectual property right infringement claims, which may be time - consuming and would c ause ECARX to incur substantial costs. 2. ECARX may not be able to prevent others from unauthorized use of its intellectual property, which could harm its business and co mpetitive position. 3. As ECARX's patents may expire and may not be extended, ECARX's patent applications may not be granted, and ECARX's patent rig hts may be contested, circumvented, invalidated, or limited in scope, ECARX may not be effectively protected by its patent rights. In particular, ECARX may not be able to prevent others from developing or exploiting competing technologies, w hic h could materially and adversely affect its business, financial condition, and results of operations. 4. In addition to patented technologies, ECARX relies on its unpatented proprietary technologies, trade secrets, processes, and kno w - how. Risks Relating to Regulation and Doing Business in China 1. The PRC government has significant oversight and discretion over ECARX's business operations, and it may influence or interve ne in ECARX's operations as part of its efforts to enforce PRC law, which could result in a material adverse change in ECARX's operations and the value of ECARX's securities. 2. Uncertainties in the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the lega l p rotections available to you and to ECARX, hinder ECARX's ability and the ability of any holder of our securities to offer or continue to offer such securities, result in a material adverse change to ECARX's business operations, and damage ECARX's rep utation, which would materially and adversely affect ECARX's financial condition and results of operations and cause ECARX's securities to significantly decline in value or become worthless. 3. The approval of and filing with the CSRC or other PRC government authorities may be required in connection with this offering un der PRC law, and, if so required, ECARX cannot predict whether or when it will be able to obtain such approval or complete such filing, and even if it obtains such approval, it could be rescinded. Any failure to or delay in obtaining such app roval or complying with such filing requirements in relation to this offering, or a rescission of such approval, could subjec t ECARX to sanctions imposed by the CSRC or other PRC government authorities. 4. The PCAOB is currently unable to inspect ECARX's auditor in relation to their audit work performed for ECARX's financial stat eme nts and the inability of the PCAOB to conduct inspections over ECARX's auditor deprives ECARX's investors with the benefits of such inspections. 5. ECARX's securities may be prohibited from trading in the United States under the Holding Foreign Companies Accountable Act, o r t he HFCAA, in 2025 if the PCAOB is unable to inspect or fully investigate auditors located in China, or as early as 2024 if proposed changes to the law are enacted. The delisting of ECARX's securities, or the threat of their being delisted, may m ate rially and adversely affect the value of your investment. 6. ECARX may be subject to anti - corruption, anti - bribery, anti - money laundering, financial and economic sanctions, and similar laws , and noncompliance with such laws can subject ECARX to administrative, civil, and criminal penalties, collateral consequences, remedial measures, and legal expenses, all of which could adversely affect its business, results of operations, fi nancial condition, and reputation. 7. It may be difficult for overseas regulators to conduct investigations or collect evidence within China. 8. Fluctuations in exchange rates could have a material and adverse effect on ECARX's results of operations. 9. Governmental control of currency conversion may limit ECARX's ability to utilize its revenues effectively. 10. Discontinuation of any of the preferential tax treatments and government subsidies or imposition of any additional taxes and sur charges could adversely affect ECARX's financial condition and results of operations.

All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX sh all reserve the right to take legal action against such violations. | www.ecarxgroup.com 17

Thanks. All copyright shall belong to ECARX. No person shall copy or distribute any or all part of the content in any way. ECARX shall reserve the right to take legal action against such violations. ECARX Technology Co., Ltd www.ecarxgroup.com

Important Additional Information Regarding the Transaction Will Be Filed With the SEC

In connection with the proposed transaction, ECARX Holdings, Inc. (“ECARX”) will file a registration statement on Form F-4 with the U.S. Securities and Exchange Commission (the “SEC”) that will include a prospectus with respect to ECARX’s securities to be issued in connection with the proposed transaction and a proxy statement with respect to the shareholder meeting of COVA Acquisition Corp. (“COVA”) to vote on the proposed transaction. Shareholders of COVA and other interested persons are encouraged to read, when available, the preliminary proxy statement/prospectus as well as other documents to be filed with the SEC because these documents will contain important information about COVA and ECARX and the proposed transaction. After the registration statement is declared effective, the definitive proxy statement/prospectus to be included in the registration statement will be mailed to shareholders of COVA as of a record date to be established for voting on the proposed transaction. Once available, shareholders of COVA will also be able to obtain a copy of the F-4, including the proxy statement/prospectus, and other documents filed with the SEC without charge, by directing a request to: COVA Acquisition Corp., 530 Bush Street, Suite 703 San Francisco, California 94108. The preliminary and definitive proxy statement/prospectus to be included in the registration statement, once available, can also be obtained, without charge, at the SEC’s website (www.sec.gov).

Participants in the Solicitation

COVA and ECARX and their respective directors and executive officers may be considered participants in the solicitation of proxies with respect to the potential transaction described in this communication under the rules of the SEC. Information about the directors and executive officers of COVA and their ownership is set forth in COVA’s filings with the SEC. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of COVA’s shareholders in connection with the potential transaction will be set forth in the registration statement containing the preliminary proxy statement/prospectus when it is filed with the SEC. These documents are available free of charge at the SEC’s website at www.sec.gov or by directing a request to COVA Acquisition Corp., 530 Bush Street, Suite 703 San Francisco, California 94108.

No Offer or Solicitation

This communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and does not constitute an offer to sell or a solicitation of an offer to buy any securities of COVA or ECARX, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended (the “Securities Act”).

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on beliefs and assumptions and on information currently available to COVA and ECARX.

All statements other than statements of historical fact contained in this communication are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “target,” “seek” or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these words. These statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of COVA and ECARX, which involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by these forward-looking statements. Any such estimates, assumptions, expectations, forecasts, views or opinions, whether or not identified in this communication, should be regarded as preliminary and for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Although each of COVA and ECARX believes that it has a reasonable basis for each forward-looking statement contained in this communication, each of COVA and ECARX caution you that these statements are based on a combination of facts and factors currently known and projections of the future, which are inherently uncertain. In addition, there will be risks and uncertainties described in the proxy statement/prospectus on Form F-4 relating to the proposed transaction, which is expected to be filed by ECARX with the SEC and other documents filed by COVA or ECARX from time to time with the SEC. These filings may identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those expressed or implied in the forward-looking statements. Neither COVA nor ECARX can assure you that the forward-looking statements in this communication will prove to be accurate. These forward-looking statements are subject to a number of risks and uncertainties, including the ability to complete the business combination due to the failure to obtain approval from COVA shareholders or satisfy other closing conditions in the merger agreement, the occurrence of any event that could give rise to the termination of the merger agreement, the ability to recognize the anticipated benefits of the business combination, the amount of redemption requests made by COVA public shareholders, costs related to the transaction, the impact of the global COVID-19 pandemic, the risk that the transaction disrupts current plans and operations as a result of the announcement and consummation of the transaction, the outcome of any potential litigation, government or regulatory proceedings and other risks and uncertainties, including those to be included under the heading “Risk Factors” in the registration statement on Form F-4 to be filed by ECARX with the SEC and those included under the heading “Risk Factors” in the final prospectus of COVA dated February 4, 2021 and in its subsequent filings with the SEC. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by COVA or ECARX, their respective directors, officers or employees or any other person that COVA or ECARX will achieve their objectives and plans in any specified time frame, or at all. The forward-looking statements in this communication represent the views of COVA and ECARX as of the date of this communication. Subsequent events and developments may cause those views to change. However, while COVA and ECARX may update these forward-looking statements in the future, COVA and ECARX specifically disclaim any obligation to do so, except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing the views of COVA and ECARX as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.