UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SmartRent, Inc.

8665 E. Hartford Drive, Suite 200

Scottsdale, Arizona 85255

Notice of Annual Meeting of Stockholders

To Be Held On May 14, 2024, at 8:00 a.m. Arizona Time

To the Stockholders of SmartRent, Inc.:

On behalf of our board of directors, it is our pleasure to invite you to attend the 2024 annual meeting of stockholders of SmartRent, Inc., a Delaware corporation. The annual meeting will be held virtually, via live webcast at www.virtualshareholdermeeting.com/SMRT2024, originating from Scottsdale, Arizona, on Tuesday, May 14, 2024, at 8:00 a.m. Arizona Time, for the following purposes, as more fully described in the accompanying proxy statement:

You will be able to attend the annual meeting as well as vote and submit your questions during the live webcast of the annual meeting by visiting www.virtualshareholdermeeting.com/SMRT2024 and entering the 16-digit control number included in your Notice of Internet Availability of Proxy Materials (the “Notice”), on your proxy card or in the instructions that accompanied your proxy materials. We expect to mail the Notice on or about April 3, 2024. The accompanying proxy statement and our annual report can be accessed directly at the following Internet address: www.proxyvote.com. You will be asked to enter the 16-digit control number located in your Notice, on your proxy card or in the instructions that accompanied your proxy materials.

The record date for the annual meeting is March 18, 2024. Only stockholders of record of our Class A common stock at the close of business on that date may vote at the annual meeting or any adjournment thereof.

A list of stockholders entitled to vote will be available for 10 days prior to the annual meeting at our headquarters, 8665 E. Hartford Drive, Suite 200, Scottsdale, Arizona 85255. If you would like to view the stockholder list, please contact our Investor Relations Department via email at investors@smartrent.com to schedule an appointment. In addition, a list of stockholders of record will be available during the annual meeting for inspection by stockholders of record for any legally valid purpose related to the annual meeting at www.virtualshareholdermeeting.com/SMRT2024.

By Order of the Board of Directors

/s/ Lucas Haldeman

Lucas Haldeman

Chairman, Chief Executive Officer, and Founder

Scottsdale, Arizona

April 3, 2024

YOUR VOTE IS IMPORTANT. Whether or not you expect to attend the annual meeting, we urge you to vote and submit your proxy by following the voting procedures described in the proxy card. Even if you have voted by proxy, you may still vote during the annual meeting. Please note, however, that if your shares are held of record by a broker, bank, or other agent and you wish to vote during the annual meeting, you must follow the instructions from your broker, bank, or other agent.

TABLE OF CONTENTS

SMARTRENT, INC.

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 14, 2024, at 8:00 a.m. Arizona Time

In this proxy statement (this “Proxy Statement”), “SmartRent,” “we,” “us,” “our,” or the “Company,” as applicable, refers to SmartRent, Inc., a Delaware corporation, and, where appropriate, its subsidiaries. SmartRent’s 2024 annual meeting of stockholders (the “Annual Meeting”), will be held virtually, via live webcast, at www.virtualshareholdermeeting.com/SMRT2024, originating from Scottsdale, Arizona, on Tuesday, May 14, 2024 at 8:00 a.m. Arizona Time. You are invited to attend the Annual Meeting if you are a stockholder as of the close of business on March 18, 2024, the record date for the Annual Meeting (the “Record Date”) or hold a valid proxy for the Annual Meeting. If you are a holder of our Class A common stock (our “Class A Common Stock”) as of the Record Date, we request that you vote on the proposals described in this Proxy Statement.

QUESTIONS AND ANSWERS

ABOUT THESE PROXY MATERIALS, VOTING, AND THE ANNUAL MEETING

The information provided below is for your convenience only and is merely a summary of the information contained in this Proxy Statement. You should read this entire Proxy Statement carefully before casting your vote. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this Proxy Statement, and references to our website addressed in this Proxy Statement are inactive textual references only.

Why am I receiving these materials?

Our board of directors (our “Board”) is soliciting your proxy to vote at the Annual Meeting. This Proxy Statement, along with the accompanying notice, summarizes the purposes of the Annual Meeting and the information you need to know to vote on the proposals described in this Proxy Statement.

What is a proxy?

A proxy means that you authorize persons selected by us to vote your shares at our Annual Meeting in the way that you instruct. All shares represented by valid proxies that are received and not revoked before our Annual Meeting will be voted at our Annual Meeting in accordance with the stockholders’ specific voting instructions.

Why did I receive a notice regarding the availability of proxy materials on the Internet?

We have elected to provide access to our proxy materials over the Internet. Accordingly, we will send you a Notice of Internet Availability of Proxy Materials (the “Notice”) because our Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements thereof. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice. We expect to mail the Notice on or about April 3, 2024, to all stockholders of record entitled to vote at the meeting.

How can I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to:

1

Our proxy materials are also available on the internet at www.proxyvote.com and on our investor relations website at investors.smartrent.com (information at or connected to our website is not and should not be considered part of this Proxy Statement). Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to you and will lessen the impact of our annual meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

What information is contained in this Proxy Statement?

This Proxy Statement includes information about the nominees for directors and other matters to be voted on at our Annual Meeting. It also explains the voting process and requirements; describes the compensation of our principal executive officer and the next two most highly compensated executive officers, as well as one additional individual for whom disclosure would have been provided as one of such next two most highly compensated executive officers but for such individual not serving as an executive officer as of December 31, 2023; describes the compensation of our directors; and provides certain other information that the Securities and Exchange Commission (“SEC”) rules require.

What should I do with these materials?

Please carefully read and consider the information contained in this Proxy Statement and then vote your shares as soon as possible to ensure that your shares will be represented at our Annual Meeting. You may vote your shares prior to our Annual Meeting even if you plan to attend our Annual Meeting.

How do I attend and participate in the Annual Meeting online?

We will be hosting the meeting via live webcast only. Any stockholder can attend the meeting live online at www.virtualshareholdermeeting.com/SMRT2024. The webcast will start at 8:00 a.m. Arizona Time. Stockholders may vote and submit questions while attending the meeting online. We encourage you to access the meeting prior to the start time. The webcast will open 15 minutes before the start of the meeting. In order to enter the meeting, you will need the control number. The control number will be included in the Notice, on your proxy card if you are a stockholder of record of shares of Class A Common Stock, or with your voting instructions received from your broker, bank, or other agent if you hold your shares of common stock in a “street name.” Instructions on how to attend and participate online are available at www.virtualshareholdermeeting.com/SMRT2024. The webcast will be recorded and available for replay for at least 30 days following the Annual Meeting on our investor relations website at investors.smartrent.com.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. As of the close of business on the Record Date, there were 204,036,865 shares of our Class A Common Stock outstanding and entitled to vote. A list of stockholders entitled to vote will be available for 10 days prior to the Annual Meeting at our headquarters, 8665 E. Hartford Drive, Suite 200, Scottsdale, Arizona 85255.

If you would like to view the stockholder list, please contact our Investor Relations Department via email at investors@smartrent.com to schedule an appointment. In addition, a list of stockholders of record will be available during the Annual Meeting for inspection by stockholders of record for any legally valid purpose related to the Annual Meeting at www.virtualshareholdermeeting.com/SMRT2024.

2

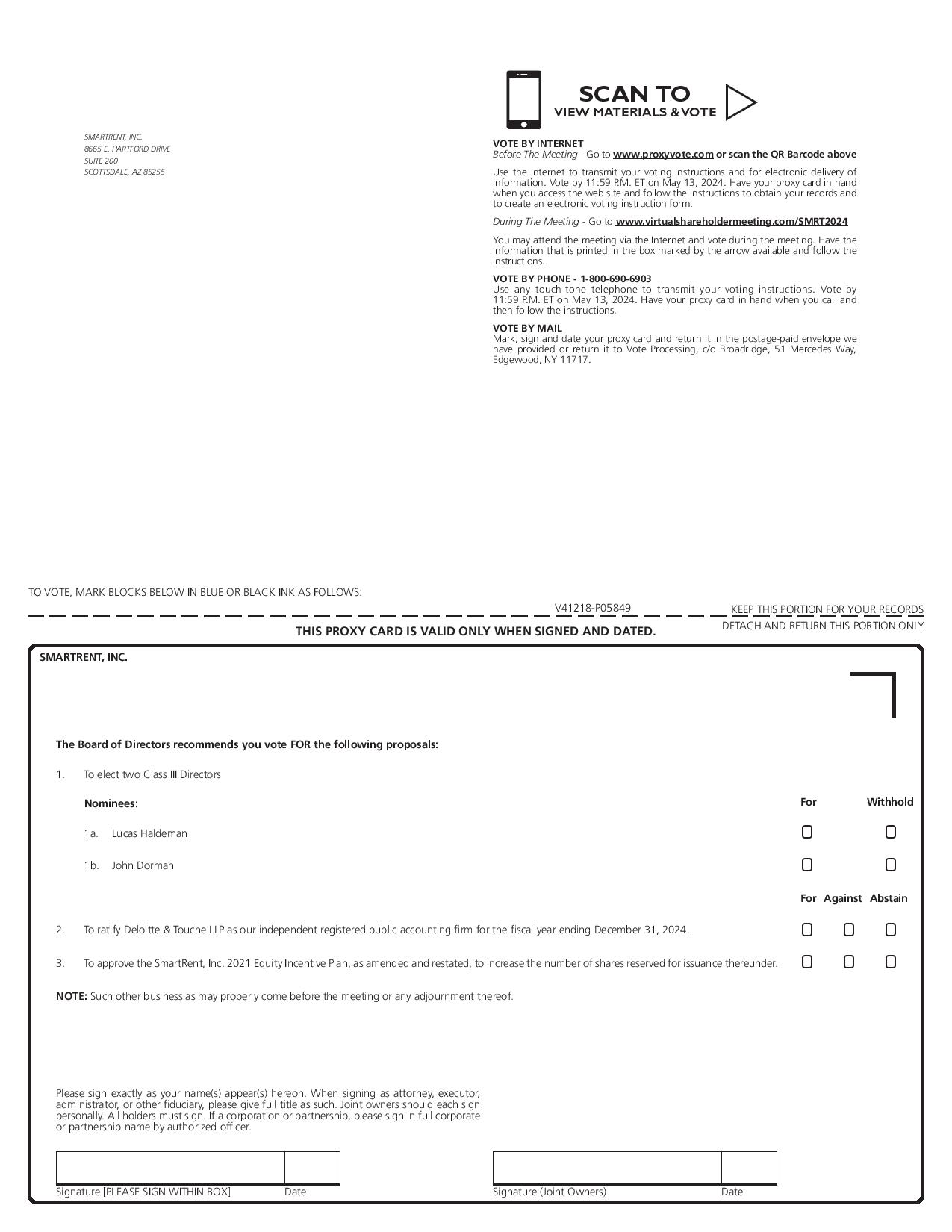

What matters am I voting on?

There are three matters scheduled for a vote. The following table sets forth a description of each of the proposals you are being asked to vote on, how you may vote on each proposal, and how our Board recommends that you vote on each proposal.

Proposal |

|

Description |

|

How May I Vote? |

|

How Does our Board Recommend That I Vote? |

Proposal 1 |

|

Elect two Class III directors, Lucas Haldeman and John Dorman, to hold office until the 2027 annual meeting of stockholders. |

|

You may either vote FOR each nominee to serve as a Class III director or WITHHOLD with respect to each nominee. |

|

Our Board recommends a vote FOR each of the Class III director nominees. |

Proposal 2 |

|

Ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

|

You may vote FOR or AGAINST or you may ABSTAIN from voting. |

|

Our Board recommends a vote FOR the ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

Proposal 3 |

|

Approve the SmartRent, Inc. 2021 Equity Incentive Plan, as amended and restated, to increase the number of shares reserved for issuance thereunder. |

|

You may vote FOR or AGAINST or you may ABSTAIN from voting. |

|

Our Board recommends a vote FOR the approval of the SmartRent, Inc. 2021 Equity Incentive Plan, as amended and restated, to increase the number of shares reserved for issuance thereunder. |

What if another matter is properly brought before the Annual Meeting?

Our Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters not described in the Proxy Statement are properly brought before the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares.

How do I vote?

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares of Class A Common Stock are registered directly in your name with our transfer agent, Continental Stock Transfer and Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person during the Annual Meeting or vote by proxy through the internet, over the telephone or using a proxy card that you may request. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the Annual Meeting, you may still attend and vote during the Annual Meeting. In such case your previously submitted proxy will be disregarded.

3

If we receive your vote by internet or phone or your signed proxy card prior to 11:59 p.m. Arizona Time the day before the Annual Meeting, we will vote your shares as you direct.

To vote, you will need the control number. The control number will be included in the notice, on your proxy card if you are a stockholder of record of shares of Class A Common Stock, or with your voting instructions received from your broker, bank, or other agent if you hold your shares of Class A Common Stock in “street name.”

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If, on the Record Date, your shares of Class A Common Stock are held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name.” The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting.

As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting.

If you are a beneficial owner, you should have received a Notice containing voting instructions from your brokerage firm, bank, dealer, or other similar organization rather than from us. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote online during the Annual Meeting, you must follow the instructions from your broker, bank, or other agent.

Internet proxy voting is provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions.

Can I change my vote?

Yes. Subject to the voting deadlines above, if you are a stockholder of record, you may revoke your proxy at any time before the close of voting using one of the following methods:

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by such party.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote during the Annual Meeting, or through the internet, by telephone or by completing your proxy card before the Annual Meeting, your shares will not be voted.

4

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

Broker non-votes occur when shares held by a broker for a beneficial owner are not voted either because (i) the broker did not receive voting instructions from the beneficial owner or (ii) the broker lacked discretionary authority to vote the shares. Abstentions represent a stockholder’s affirmative choice to decline to vote on a proposal and occur when shares present at the meeting are marked “ABSTAIN.” Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present.

A broker has discretionary authority to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares. Absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters.

Proposal 1, the election of our Class III directors, is a non-routine matter, so your broker or nominee may not vote your shares on Proposal 1 without your instructions. Proposal 2, the ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2024, is a routine matter, so your broker or nominee may vote your shares on Proposal 2 even in the absence of your instruction. Proposal 3, the approval of the SmartRent, Inc. 2021 Equity Incentive Plan, as amended and restated, to increase the number of shares reserved for issuance thereunder, is a non-routine matter, so your broker or nominee may not vote your shares on Proposal 3 without your instructions. Please instruct your bank, broker, or other agent to ensure that your vote will be counted.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote but do not make specific choices, your shares will be voted FOR the election of each of the nominees for Class III director, FOR the ratification of the appointment of Deloitte as our independent registered public accounting firm, and FOR the approval of the SmartRent, Inc. 2021 Equity Incentive Plan, as amended and restated. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

How many votes do I have?

Each holder of Class A Common Stock will have the right to one vote per share of Class A Common Stock.

5

How many votes are needed to approve each proposal?

The following table sets forth the voting requirements with respect to each of the proposals:

Proposal |

|

Description |

|

Voting Requirement |

Proposal 1 |

|

Elect two Class III directors, Lucas Haldeman and John Dorman, to hold office until the 2027 annual meeting of stockholders. |

|

Each Class III director must be elected by a plurality of the votes cast. A plurality means that the nominees with the largest number of FOR votes are elected as directors up to the maximum number of directors to be elected at the Annual Meeting. A WITHHOLD vote will have no effect on the vote. |

Proposal 2 |

|

Ratify the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

|

To be approved, this proposal must be approved by a majority in voting power of the votes cast by the stockholders present in person or by proxy, meaning that the votes cast by the stockholders FOR the approval of the proposal must exceed the number of votes cast AGAINST the approval of the proposal. If a stockholder votes to ABSTAIN, it is not counted as a vote cast and has no effect as a vote on the outcome of this proposal. If you are a beneficial owner, your broker, bank, or other nominee may vote your shares on this proposal without receiving voting instructions from you. |

Proposal 3 |

|

Approve the SmartRent, Inc. 2021 Equity Incentive Plan, as amended and restated, to increase the number of shares reserved for issuance thereunder. |

|

To be approved, this proposal must be approved by a majority in voting power of the votes cast by the stockholders present in person or by proxy, meaning that the votes cast by the stockholders FOR the approval of the proposal must exceed the number of votes cast AGAINST the approval of the proposal. If a stockholder votes to ABSTAIN, it is not counted as a vote cast and has no effect as a vote on the outcome of this proposal. |

Who counts the votes?

We have engaged Broadridge Financial Solutions, Inc. (“Broadridge”) as our independent agent to tabulate stockholder votes. If you are a stockholder of record, and you choose to vote over the internet or by telephone, Broadridge will access and tabulate your vote electronically, and if you choose to sign and mail your proxy card, your executed proxy card is returned directly to Broadridge for tabulation. As noted above, if you hold your shares through a broker, your broker (or its agent for tabulating votes of shares held in street name, as applicable) returns one proxy card to Broadridge on behalf of all its clients.

Who is paying for this proxy solicitation?

We will pay the cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid additional compensation for soliciting proxies. We may reimburse brokers, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

When are stockholder proposals due for next year’s annual meeting?

Requirements for stockholder proposals to be brought before the 2025 annual meeting.

Our bylaws provide that, for stockholder director nominations or other proposals to be considered at an annual meeting, the stockholder must give timely notice thereof in writing to our Corporate Secretary. This notice may be delivered to us via email at corporatesecretary@smartrent.com or via mail at SmartRent, Inc. Attention: Corporate Secretary, 8665 E. Hartford Drive, Suite 200, Scottsdale, Arizona 85255. To be timely for the 2025 annual meeting of stockholders, a stockholder’s notice must be delivered to or mailed and received by our Corporate Secretary at our principal executive offices between January 14, 2025 and

6

February 13, 2025; provided that if the date of that annual meeting of stockholders is earlier than April 14, 2025 or later than July 13, 2025, you must give the required notice not earlier than the 120th day prior to the meeting date and not later than the 90th day prior to the meeting date or, if later, the 10th day following the day on which public disclosure of that meeting date is first made. A stockholder’s notice to the Corporate Secretary must also set forth the information required by our bylaws.

Requirements for stockholder proposals to be considered for inclusion in our proxy materials.

Stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and intended to be presented at the 2025 annual meeting of stockholders must be received by us not later than December 4, 2024, in order to be considered for inclusion in our proxy materials for that meeting. Such proposals may be delivered to us via email at corporatesecretary@smartrent.com or via mail at SmartRent, Inc., Attention: Corporate Secretary, 8665 E. Hartford Drive, Suite 200, Scottsdale, Arizona 85255.

Stockholder Solicitation of Proxies in Support of Director Nominees Other Than Company Nominees.

In addition, to comply with Rule 14a-19 under the Exchange Act, the SEC’s universal proxy rule, if a stockholder intends to solicit proxies in support of director nominees submitted under the advance notice provisions of our bylaws for next year’s annual meeting of stockholders, then such stockholder must provide proper written notice that sets forth all the information required by Rule 14a-19 under the Exchange Act to our Corporate Secretary at corporatesecretary@smartrent.com or via mail at SmartRent, Inc. Attention: Corporate Secretary, 8665 E. Hartford Drive, Suite 200, Scottsdale, Arizona 85255 by March 17, 2025 (or, if next year’s annual meeting is called for a date that is more than 30 days before or more than 30 days after the first anniversary of this year’s Annual Meeting, then notice must be provided not later than the close of business on the later of the 60th day prior to the date of the 2025 annual meeting of stockholders or the 10th day following the day on which our public announcement of the date of such meeting is first made). The notice requirements under Rule 14a-19 are in addition to the applicable advance notice requirements under our bylaws as therein.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the aggregate voting power of the shares of Class A Common Stock issued, outstanding and entitled to vote at the meeting are present at the meeting or represented by proxy. On the Record Date, there were 204,036,865 shares of Class A Common Stock outstanding and entitled to vote. Our Class A common stock has one vote per share. To have a quorum the holders of shares representing an aggregate of 102,018,433 votes must be present or represented by proxy at the Annual Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank, or other nominee) or if you attend the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairperson of the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

We expect that preliminary voting results will be announced during the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting.

7

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the instructions on each Notice to ensure that all your shares are voted.

What does it mean if multiple members of my household are stockholders, but we only received one Notice or full set of proxy materials in the mail?

The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for notices and proxy materials with respect to two or more stockholders sharing the same address by delivering a single notice or set of proxy materials addressed to those stockholders. In accordance with a prior notice sent to certain brokers, banks, dealers, or other agents, we are sending only one Notice or full set of proxy materials to those addresses with multiple stockholders unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” allows us to satisfy the requirements for delivering notices or proxy materials with respect to two or more stockholders sharing the same address by delivering a single copy of these documents. “Householding” helps to reduce our printing and postage costs, reduces the amount of mail you receive and helps to preserve the environment. If you currently receive multiple copies of the Notice or proxy materials at your address and would like to request “householding” of your communications, or you would like to revoke your consent to future “householding” mailings, please contact your broker, bank, or other agent or contact us at the following address:

SmartRent, Inc.

Attn: Investor Relations

8665 E. Hartford Drive, Suite 200

Scottsdale, Arizona 85255

What are the implications of being an “emerging growth company”?

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, including certain executive compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Exchange Act. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year following the fifth anniversary of the completion of Fifth Wall Acquisition Corp. I’s (“FWAA”) initial public offering (the “IPO”), (ii) the last day of the first fiscal year in which our annual gross revenue is $1.235 billion or more, (iii) the date on which we have, during the previous rolling three-year period, issued more than $1 billion in non-convertible debt securities, or (iv) the date on which we are deemed to be a “large accelerated filer” as defined in the Exchange Act.

Other Information

We were originally incorporated in Delaware on November 23, 2020, as FWAA, as a special purpose acquisition company, formed to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or other similar business combination with one or more target businesses. On February 9, 2021, FWAA consummated the IPO, following which its shares began trading on the Nasdaq Capital Market (“Nasdaq”).

On August 24, 2021, we consummated the Business Combination contemplated by a Merger Agreement dated April 21, 2021 (as amended by Amendment No. 1 to Merger Agreement, dated July 23, 2021), among FWAA, Einstein Merger Corp. I, a wholly owned subsidiary of FWAA (“Merger Sub”), and SmartRent.com, Inc. Upon the closing of the Business Combination, Merger Sub merged with and into SmartRent.com, Inc., with SmartRent.com, Inc. continuing as the surviving company. “Business Combination” refers to these mergers, together with the other related transactions.

8

At the closing of the Business Combination, SmartRent.com, Inc. changed its name to “SmartRent Technologies, Inc.” and FWAA changed its name to “SmartRent, Inc.” We additionally changed our trading symbol and listing on a securities exchange from “FWAA” on Nasdaq to “SMRT” on the New York Stock Exchange (“NYSE”).

9

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Corporate Governance

SmartRent is strongly committed to good corporate governance practices. These practices provide an important framework within which our Board and management can pursue our strategic objectives for the benefit of our stockholders. Our Board has adopted written charters for our audit committee, compensation committee, and nominating and corporate governance committee, as well as a code of conduct and business ethics that applies to all of our employees, contingent workers, officers, and directors. The committee charters and the code of conduct and business ethics, and any waivers or amendments to the code of conduct and business ethics, are all available on our investor relations website at investors.smartrent.com in the “Governance Documents” section.

Corporate Governance Highlights

Key highlights of our corporate governance practices include:

● All of our directors, except our Chairman and Chief Executive Officer, are independent. ● Our Board committees are comprised entirely of independent directors. ● Our independent directors regularly meet in executive session. ● We maintain a clawback policy applicable to senior executives. |

● We have an anti-hedging policy applicable to directors and employees. ● We have robust Board and committee risk oversight practices. ● Our Board is continually evaluating itself and the needs of the Company for Board refreshment and succession planning. |

Board Overview

The following table sets forth the names, ages as of the Record Date, and certain other information for each of the nominees for election as a Class III director at the Annual Meeting, each of the continuing members of the Board and the non-continuing member of the Board, Alana Beard, who is not standing for re-election. The Board thanks Ms. Beard for her distinguished service as a director.

Name |

|

Age |

|

Position/Office Held with SmartRent |

||||

Class I directors whose terms expire at the annual meeting of stockholders in 2025 |

||||||||

Ann Sperling(1)(3) |

|

68 |

|

Director |

||||

Frederick Tuomi(2) |

|

69 |

|

Director |

||||

|

|

|

|

|

||||

Class II directors whose terms expire at the annual meeting of stockholders in 2026 |

||||||||

Bruce Strohm(1)(3) |

|

69 |

|

Director |

||||

Alison Dean(1) |

|

59 |

|

Director |

||||

|

|

|

|

|

||||

Class III director nominees for election until the annual meeting of stockholders in 2027 |

||||||||

Lucas Haldeman |

|

46 |

|

|

|

|

Director and Chief Executive Officer |

|

John Dorman(1)(2)(3) |

|

73 |

|

|

|

|

Director |

|

|

|

|

|

|

|

|||

Non-continuing director not standing for re-election at the Annual Meeting |

||||||||

Alana Beard(2) |

|

41 |

|

|

|

|

Non-Continuing Director |

|

10

Director Independence

The Board makes an affirmative determination at least annually as to the independence of each director in accordance with Section 303A.02 of the Listed Company Manual of the NYSE. The Board broadly considers all relevant facts and circumstances, including information provided by the directors and SmartRent with regard to each director’s business and personal activities as they may relate to SmartRent and its management. In addition, each director’s independence is evaluated under our policy and procedures with respect to related person transactions as discussed in the “Related Person Transactions Policy” section.

In March 2024, we reviewed the independence of each then-sitting director (including all our nominees), applying the independence standards set forth in Section 303A.02 of the Listed Company Manual of the NYSE and our corporate governance guidelines. The reviews considered relationships and transactions between each director (and the director’s immediate family and affiliates) and SmartRent, SmartRent’s management, and SmartRent’s independent registered public accounting firm. Based on this review, the Board has affirmatively determined that no director other than Mr. Haldeman has a material relationship with SmartRent and its affiliates (either directly or as a partner, shareholder or officer of an organization that has a relationship within the company) and that each director other than Mr. Haldeman is independent as defined in Section 303A.02 of the Listed Company Manual of the NYSE. Mr. Haldeman is not independent because of his employment relationship with SmartRent.

Board Leadership Structure

Lucas Haldeman currently serves as the Chairman of our Board. The Board believes that the current board leadership structure, together with the Lead Independent Director and a strong emphasis on board independence, provides effective independent oversight of management while allowing the Board and management to benefit from Mr. Haldeman’s extensive operational experience. In addition, the Board’s governance processes preserve Board independence by ensuring discussion among independent directors and independent evaluation of and communication with members of senior management.

Lead Independent Director

Because Mr. Haldeman is our Chairman and is not an “independent” director under the NYSE listing standards, in August 2021, the Board, including a majority of the independent directors, appointed Frederick Tuomi as our Lead Independent Director. The Board believes that Mr. Tuomi provides an effective independent voice in our leadership structure.

The lead independent director position is a critical aspect of our corporate governance framework. The Board believes that having a lead independent director enhances communications and relations among the Board, Mr. Tuomi, and other members of our senior management, and assists the Board in reaching a consensus on strategies and policies. In addition to serving as principal liaison between the independent directors and the Chairman, the Lead Independent Director presides over executive sessions of the independent directors, approves information sent to the Board, collaborates with the Chairman on agendas, schedules, and materials for Board meetings, and performs such other functions as may be prescribed by the Board from time to time. The Board believes the role of the Lead Independent Director exemplifies SmartRent’s continuing commitment to strong corporate governance and Board independence.

11

Board Meetings

The Board is responsible for the oversight of company management and the strategy of our company and for establishing corporate policies. The Board and its committees meet throughout the year on a regular schedule, and also hold special meetings and act by written consent from time to time. In 2023, the Board met 13 times and acted by unanimous written consent two times. All directors attended 75% or more of the meetings of the Board and committees on which they served.

Each regularly scheduled Board meeting normally begins or ends with a session between the Chief Executive Officer and the independent directors. This provides a platform for discussions outside the presence of the non-Board management attendees. The independent directors may meet in executive session, without the Chief Executive Officer, at any time, but such non-management executive sessions are scheduled and typically occur at each regular Board meeting. The Lead Independent Director presides over these executive sessions.

Although we do not have a formal policy regarding attendance by members of our Board at our annual meeting of stockholders, we encourage our directors and director nominees to attend our annual meeting of stockholders. Our 2023 annual meeting was held virtually on May 16, 2023, and all of our directors attended.

Board Committees

The Board has delegated some of its authority to three committees: the audit committee; the compensation committee; and the nominating and corporate governance committee. Each of our Board committees has adopted a charter that complies with current NYSE rules relating to corporate governance matters. Copies of the committee charters are available at https://investors.smartrent.com. Each committee is composed solely of independent directors and regularly reports on its activities to the full Board.

12

The committee structure and memberships are described in the table below.

AUDIT COMMITTEE Fiscal 2023

Members: John Dorman (Chair) Ann Sperling Bruce Strohm Alison Dean (appointed to the Committee on March 21, 2024)

|

|

● Oversees the independent registered public accounting firm’s qualifications, independence, and performance ● Assists the Board in overseeing the integrity of our financial statements, compliance with legal requirements, and the performance of our internal auditors ● Pre-approves all audit and allowable non-audit services by the independent registered public accounting firm ● With the assistance of management, approves the appointment of the independent registered public accounting firm’s lead engagement partner ● All members have been determined to be independent and financially literate under current NYSE listing standards, including those standards applicable specifically to audit committee members ● The Board has determined that Mr. Dorman, Mr. Strohm, and Ms. Dean are “audit committee financial experts” as defined by the SEC and that each has accounting or related financial management expertise as required by NYSE listing standards |

COMPENSATION COMMITTEE Fiscal 2023

Members: Frederick Tuomi (Chair) Alana Beard (until the Annual Meeting) John Dorman (appointed to the Committee on November 14, 2023).

|

|

● Makes recommendations to the Board regarding incentive and equity-based compensation plans ● Evaluates and approves the compensation of our executive officers (except for the compensation of our Chief Executive Officer, which is approved by the full Board), including reviewing and approving the performance goals and objectives that will affect that compensation ● Evaluates and approves compensation granted pursuant to SmartRent’s equity-based and incentive compensation plans, policies, and programs ● Retains, oversees, and assesses the independence of compensation consultants and other advisors ● Reviews and discusses with management SmartRent’s compensation discussion and analysis to be included (when and as necessary) in SmartRent’s annual proxy statement or annual report on Form 10-K ● All members have been determined to be independent under current NYSE listing standards, including those standards applicable specifically to compensation committee members |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE Fiscal 2023

Members: Bruce Strohm (Chair) Ann Sperling John Dorman |

|

● Identifies individuals qualified to become Board members and selects, or recommends that the Board select, director nominees ● Develops and recommends to the Board the corporate governance guidelines, policies, and codes applicable to SmartRent ● Leads the Board in its annual review of the Board’s performance ● Oversees the evaluation of Board members ● Recommends to the Board directors for each committee ● Monitors and oversees aspirations and activities related to environmental, social, and governance matters ● All members have been determined to be independent under current NYSE listing standards |

13

Compensation Committee Interlocks and Insider Participation

Our compensation committee is comprised of Frederick Tuomi, Alana Beard, and John Dorman, none of whom is or has been an officer or employee of the Company. Robert Best resigned from the compensation committee effective January 15, 2024. None of our executive officers currently serve, or during the fiscal year ended December 31, 2023, have served, as a member of the compensation committee or director (or other board committee performing equivalent functions or, in the absence of any such committee, the entire Board) of any entity that has one or more executive officers serving on our compensation committee or our Board.

Communications with our Board of Directors

Stockholders or interested parties who wish to communicate with our Board or with an individual director may do so by mail to our Board or the individual director, care of our General Counsel and Corporate Secretary at 8665 E. Hartford Drive, Suite 200, Scottsdale, Arizona 85255. The communication should indicate that it contains a stockholder or interested party communication. In accordance with our corporate governance guidelines, all such communication will be reviewed by the General Counsel, in consultation with appropriate directors as necessary, and, if appropriate, will be forwarded to the director or directors to whom the communications are addressed or, if none are specified, to the Chairman of our Board.

Anti-Hedging and Pledging Policy

We have adopted an insider trading policy that includes restrictions and limitations on the ability of our directors, officers, and certain other employees to engage in transactions involving the hedging and pledging of our Class A Common Stock. Under the policy, hedging or monetization transactions, such as zero-cost collars and forward-sale contracts, which allow an individual to lock in much of the value of his or her stock holdings, often in exchange for all or part of the potential for upside appreciation in the stock, and thus to continue to own our Class A Common Stock without the full risks and rewards of ownership, are prohibited. In addition, the policy prohibits our directors, officers, and employees from holding our securities in a margin account or pledging our securities as collateral for a loan unless (i) they represent that they have the financial capacity to repay the loan without resorting to the sale of the pledged securities, (ii) the securities pledged, or subject to the margin account, do not represent more than 50% of the total securities beneficially owned by such person, (iii) the loan, pledge, or margin account arrangement does not contain provisions requiring automatic or forced sales prior to notice and a cure period of not less than three business days, (iv) they obtain prior written approval from our General Counsel prior to the proposed execution of the arrangement, and (v) any shares subject to such arrangement will not count for purposes of any minimum stock ownership guidelines. No shares of our Class A Common Stock beneficially owned by any director or named executive officer are currently pledged or held in a margin account.

Stock Ownership Guidelines

In September 2022, our Board adopted stock ownership guidelines for our executive leadership team and non-employee directors. These stock ownership guidelines are intended to align executive officer and director interests and motivations with those of long-term stakeholders. Our Board also believes that the policy will reduce the likelihood of excessive risk taking.

Pursuant to the Stock Ownership Guidelines, our Chief Executive Officer, Section 16 officers, and non-employee directors (the “Participants”) are expected to hold a number of shares of the Company’s Class A Common Stock with a fair market value equivalent to at least the following:

• Chief Executive Officer – 5x annual base salary

• Executive Leaders – 2x annual base salary

• Non-Employee Directors – 5x base annual retainer

14

Participants must satisfy the required level of stock ownership under the guidelines within five years of the later of (a) the date the guidelines were initially adopted and (b) the date a Participant first becomes subject to the guidelines. The guidelines are applicable for so long as each Participant continues to serve in their respective role. Shares underlying unexercised stock options (whether vested or unvested) and shares underlying unvested performance-based restricted stock units are not counted for purposes of meeting the ownership requirements of the guidelines.

Our Compensation Committee has the authority to amend, modify, or waive the stock ownership guidelines or any portion thereof, and to designate other officers and employees to be subject to the provisions of the guidelines, or to remove individuals or classes of officers. As of December 31, 2023, all of our executive officers and directors are in compliance with our Stock Ownership Policy or are within the five-year phase in period.

Clawback Policy for Executive Compensation

In November 2023, our Compensation Committee approved, and our Board adopted, a compensation recovery policy in compliance with New York Stock Exchange and SEC rules requiring public companies to recover excess incentive-based compensation from current and former executive officers in the event of an accounting restatement. Consistent with the rules, this policy requires that if the company is required to prepare an accounting restatement due to the company’s material noncompliance with financial reporting requirements under the securities laws, we must claw back from certain officers any incentive-based compensation received by them after October 2, 2023 and during the applicable covered period (which generally includes the three completed fiscal years prior to the restatement date) that was in excess of what they would have received had their incentive compensation been determined based on the restated amounts.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics applicable to all of our directors, officers (including our principal executive officer, principal financial officer, and principal accounting officer) and employees. Our code of business conduct and ethics is available on our investor relations website (https://investors.smartrent.com) in the “Governance Documents” section. In the event that we amend or waive certain provisions of our code of business conduct and ethics applicable to our principal executive officer, principal financial officer or principal accounting officer that require disclosure under applicable SEC rules, we will disclose the same on our website.

Risk Oversight

Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and to enhance stockholder value. A fundamental part of risk management is not only understanding the most significant risks a company faces and what steps management is taking to manage those risks but also understanding what level of risk is appropriate for a given company. Our Board, as a whole, determines the appropriate level of risk for us, assesses the specific risks that we face and reviews management’s strategies for adequately mitigating and managing the identified risks. Although our Board administers this risk management oversight function, the committees of our Board support our Board in discharging its oversight duties and addressing risks inherent in their respective areas.

Our audit committee has the responsibility to consider and discuss our major strategic, operational, legal and compliance, cybersecurity, and financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our audit committee monitors compliance with legal and regulatory requirements. Our audit committee also monitors management’s preparedness for and responses to data security incidents, and further oversees our initiatives related to cybersecurity, including prevention and monitoring. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines. Our compensation committee assesses and monitors whether our compensation philosophy and practices have the potential to encourage excessive risk taking and evaluates compensation policies and practices that could mitigate such risks. Each of our

15

committees continually assess the risk environment and consult with outside advisors and experts to anticipate future threats and trends as necessary.

At periodic meetings of our Board and its committees, management reports to and seeks guidance from our Board and its committees with respect to the most significant risks that could affect our business, such as legal risks and financial, tax and audit related risks. In addition, among other matters, management provides our audit committee periodic reports on our compliance programs and practices.

Nominations Process and Director Qualifications

Nomination to our Board of Directors

The Board is continually evaluating the skills and talent of the current Board members and strives to add value to the Board by attracting and recruiting qualified Board candidates for our pipeline. Our Board actively recruits members with a pipeline of talented and engaged candidates. Candidates for nomination to our Board are selected by our Board based on the recommendation of our nominating and corporate governance committee in accordance with the committee’s charter, our policies, our certificate of incorporation and bylaws, our corporate governance guidelines, and the criteria adopted by our Board regarding director candidate qualifications. In recommending candidates for nomination, our nominating and corporate governance committee considers candidates recommended by directors, officers, and employees, as well as candidates that are properly submitted by stockholders in accordance with our policies and bylaws, using the same criteria to evaluate all such candidates. We also engage consultants or third-party search firms to assist in identifying and evaluating potential nominees. Evaluations of candidates generally involve a review of background materials, internal discussions, and interviews with selected candidates as appropriate.

Additional information regarding the process for properly submitting stockholder nominations for candidates for membership on our Board is set forth above under “Questions and Answers About these Proxy Materials and Voting.”

Director Qualifications

With the goal of developing an experienced and highly qualified board of directors, our nominating and corporate governance committee is responsible for developing and recommending to our Board the desired qualifications, expertise and characteristics of members of our Board, including qualifications that the committee believes must be met by a committee-recommended nominee for membership on our Board and specific qualities or skills that the committee believes are necessary for one or more of the members of our Board to possess.

In addition to the qualifications, qualities, and skills that are necessary to meet U.S. legal, regulatory, and NYSE listing requirements and the provisions of our certificate of incorporation, bylaws, corporate governance guidelines and charters of the board committees, our nominating and corporate governance committee considers the following qualifications for any nominee for a position on our Board: (i) experience in corporate governance, such as an officer or former officer of a publicly held company; (ii) experience in, and familiarity with, SmartRent’s business and industry; (iii) experience as a board member of another publicly held company; (iv) personal and professional character, integrity, ethics and values; (v) practical and mature business judgment, including the ability to make independent analytical inquiries; (vi) academic expertise in an area of SmartRent’s operations; (vii) background in financial and accounting matters; and (viii) all other factors it considers appropriate, which may include age, diversity of background, existing commitments to other businesses, potential conflicts of interest, legal considerations, corporate governance background, financial and accounting background, executive compensation background, and the size, composition, and combined expertise of the existing Board. Our Board and nominating and corporate governance committee believe that an experienced and highly qualified board of directors fosters a robust, comprehensive, and balanced decision-making process for the continued effective functioning of our Board and our success. Accordingly, through the nomination process, our nominating and corporate governance committee seeks to promote board membership that reflects diversity, factoring in gender, race, ethnicity, differences in professional background, education, skill and experience, and other individual qualities and attributes that contribute to the total mix of viewpoints and experience. Our nominating and

16

corporate governance committee evaluates the foregoing factors, among others, and does not assign any particular weighting or priority to any of the factors.

17

MATTERS TO COME BEFORE THE ANNUAL MEETING

PROPOSAL 1:

Election of Directors

Our Board currently consists of seven members, but the size of the Board will decrease to six members upon the completion of the Annual Meeting. The Board is divided into three staggered classes of directors. At the Annual Meeting, two Class III directors will be elected for a three-year term to succeed the Class III directors whose terms are then expiring. Each director’s term continues until the election and qualification of their successor, or such director’s earlier death, resignation, or removal.

Our nominating and corporate governance committee has recommended, and the Board has approved, John Dorman and Lucas Haldeman as nominees for election as Class III directors at the Annual Meeting. Ms. Beard will continue to serve as a director until her term expires at the Annual Meeting, but she is not standing for re-election. If elected, Messrs. Dorman and Haldeman will serve as Class III directors for a three-year term expiring at the annual meeting of stockholders to be held in 2027 and until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, or removal. John Dorman and Lucas Haldeman have agreed to stand for election as Class III directors, and we have no reason to believe that any nominee will be unable to serve if elected. Should any director nominee become unavailable for election as a result of an unexpected occurrence, your proxy authorizes the persons named as proxies to vote for a substitute nominee if our Board so chooses, or our Board may reduce its size. The terms of office of the directors in Class I and Class II will not expire until the annual meeting of stockholders to be held in 2025 and 2026, respectively.

The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control.

Vote Required

Directors are elected by a plurality of the votes cast by the stockholders present in person or represented by proxy and entitled to vote on the election of directors. Accordingly, the two nominees receiving the highest number of affirmative votes will be elected. Any shares not voted “For” a particular nominee (whether as a result of a withhold vote or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominee named above. If such nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by our Board.

Nominees

Our nominating and corporate governance committee seeks to assemble a board of directors that, as a group, can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its qualifications and experience in various areas. To that end, the committee has identified and evaluated nominees in the broader context of our Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities deemed critical to effective functioning of our Board.

18

The following table sets forth the names, ages as of the date of this Proxy Statement, and certain other information for each of the nominees for election as a Class III director at the Annual Meeting, each of the continuing members of the Board and the non-continuing member of the Board who is not standing for re-election. The Board thanks Ms. Beard for her distinguished service as a director.

Name |

|

Age |

|

Position/Office Held with SmartRent |

||||

Class I directors whose terms expire at the annual meeting of stockholders in 2025 |

||||||||

Ann Sperling(1)(3) |

|

68 |

|

Director |

||||

Frederick Tuomi(2) |

|

69 |

|

Director |

||||

|

|

|

|

|

||||

Class II directors whose terms expire at the annual meeting of stockholders in 2026 |

||||||||

Bruce Strohm(1)(3) |

|

69 |

|

Director |

||||

Alison Dean(1) |

|

59 |

|

Director |

||||

|

|

|

|

|

||||

Class III director nominees for election until the annual meeting of stockholders in 2027 |

||||||||

Lucas Haldeman |

|

46 |

|

|

|

|

Director and Chief Executive Officer |

|

John Dorman(1)(2)(3) |

|

73 |

|

|

|

|

Director |

|

|

|

|

|

|

|

|||

Non-continuing director not standing for re-election at the Annual Meeting |

||||||||

Alana Beard(2) |

|

41 |

|

|

|

|

Non-Continuing Director |

|

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the meeting. This includes information regarding each director’s experience, qualifications, attributes, or skills that led our Board to recommend them for board service.

Nominees for Election Until the Annual Meeting of Stockholders to be Held in 2027

Our Board recommends a vote FOR each of the Class III director nominees to elect them to our Board.

John Dorman, age 73, has served as a member of our Board since August 2021. Mr. Dorman has served as the Chairman of the board of directors of DeepDyve, Inc., a privately held technology platform for scientific and scholarly research since 2007, and also serves on the board of directors for Target Hospitality (Nasdaq: TH), a provider of full-service modular housing solutions for corporate workforce and government-funded humanitarian applications. Mr. Dorman also serves on the board of directors of Landgate, Inc., a privately held information platform and marketplace connecting property owners with renewable energy developers. Mr. Dorman will serve as a board director of LoanDepot, Inc. (NYSE: LDI), a national non-bank lender serving consumers, until the end of his term in June 2024. Additionally, from 2012 to 2021, Mr. Dorman served on the board of directors of CoreLogic, Inc. (NYSE: CLGX). Prior to this appointment, from 2010 to 2013, he was Chairman of the board of directors of Online Resources Corporation (Nasdaq: ORCC) when it was acquired by ACI Worldwide. Previously, Mr. Dorman served as a director and, from 1998 to 2003, as Chairman and Chief Executive Officer of Digital Insight Corporation (Nasdaq: DGIN), a provider of software as a service for online banking and bill payment for financial institutions. Prior to that, he was Senior Vice President and General Manager of the Global Financial

19

Services Division of Oracle Corporation. Earlier in his career, Mr. Dorman was Chairman and Chief Executive Officer of Treasury Services Corporation, a provider of enterprise modeling and financial analysis software for global financial institutions that was acquired by Oracle in 1997. Mr. Dorman holds a Bachelor of Arts degree in Business Administration and Philosophy from Occidental College and a Master of Business Administration in Finance from the USC Marshall School of Business. We believe his strategic perspective in the financial innovation space, financial expertise, and board experience makes Mr. Dorman well qualified to serve as a member of our Board.

Lucas Haldeman, age 46, the Chief Executive Officer and founder of SmartRent, has served as a member of our Board since August 2021. Mr. Haldeman has spent the last two decades innovating and developing property management technology for the real estate industry. Prior to founding SmartRent in 2017, he served as the Chief Technology and Marketing Officer of Colony Starwood Homes (formerly NYSE: SFR and now part of Invitation Homes Inc. (NYSE: INVH)) from 2013 through 2016. Previously, he served as the Chief Information and Marketing Officer for Beazer Pre-Owned Rental Homes from 2012 through 2013 and was the founder and managing partner of Nexus Property Management, Inc. from 2006 through 2012. Mr. Haldeman received a Bachelor of Special Studies degree in economics and business, English, and computer science from Cornell College. We believe that Mr. Haldeman’s in-depth multifamily knowledge and significant experience innovating and developing property management technology for the real estate industry makes him well qualified to serve as a member of our Board.

Directors Continuing in Office Until the 2025 Annual Meeting of Stockholders

Ann Sperling, age 68, has served as a member of our Board since August 2021. Ms. Sperling has over four decades of real estate and management experience, including roles in commercial real estate investment and development, and leadership roles in public real estate companies. Prior to her recent retirement, from 2013 to 2023, Ms. Sperling was Senior Director at Trammell Crow Company, the development and investment firm which is a subsidiary of CBRE. Earlier in her career Ms. Sperling spent twenty-five years at Trammell Crow Company prior to its merger with CBRE, culminating as Senior Managing Director and Area Director in the Rocky Mountain Region. Prior to her last role at Trammell Crow, she was at Jones Lang LaSalle, the public real estate investment and services firm, first as Chief Operating Officer, Americas, and then as President, Markets West. Prior to that, Ms. Sperling was Managing Director of Catellus, then a mixed-use development and investment subsidiary of the public REIT, ProLogis. Ms. Sperling serves on the Advisory Board of the nonprofit Gates Institute for Regenerative Medicine and is a Board Advisor to Anderson Holdings, a privately held company with diversified holdings including substantial commercial real estate. Ms. Sperling also serves on the board of directors for Apartment Income REIT (NYSE: AIRC). Previously, she served on the board of directors of the Apartment Investment and Management Company (NYSE: AIV), prior to its spinout of Apartment Income REIT. She holds a Bachelor of Science degree in biology and psychology from Tufts University and a Master of Business Administration from Harvard Business School. We believe that Ms. Sperling’s extensive real estate investment and development operations, marketing, and finance experience makes her well qualified to serve as a member of our Board.

Frederick Tuomi, age 69, a private real estate investor, has served as a member of our Board since August 2021. Mr. Tuomi served as President, Chief Executive Officer, and director of Invitation Homes Inc. (NYSE: INVH), a national single-family rental company, from 2017 until his retirement in 2019. Prior to its merger with Invitation Homes, Mr. Tuomi served as Chief Executive Officer and director of Starwood Waypoint Homes from 2016 until 2017. Prior to its merger with Starwood Waypoint Homes, he served as Co-President and Chief Operating Officer of Colony American Homes, Inc. from 2013 until 2016. Mr. Tuomi was Executive Vice President and President-Property Management for Equity Residential (NYSE: EQR), a multifamily REIT, from 1994 to 2013. He currently serves as a Venture Partner Consultant with Real Estate Technology Ventures and is a member of the boards of directors of the privately held companies Lessen, Inc., a tech-enabled property services provider; VBC, a modular building company; UltraClean Express, a car wash aggregator; and AvantStay, a vacation rental management firm. Mr. Tuomi is an Affiliate Partner with Lindsay Goldberg LLC, a private equity firm. Throughout his career, he has served on numerous multifamily and single-family rental industry boards and executive committees, including the National Rental Home Council, National Multi-Housing Council, California Housing Council, California Apartment

20

Association, Atlanta Apartment Association, and the USC Lusk Center for Real Estate. Mr. Tuomi also previously served as a member of the board of directors of Tejon Ranch Co. (NYSE: TRC), a diversified real estate development and agribusiness company. He received his Bachelor of Arts degree in Information Systems and Master of Business Administration from Georgia State University. We believe that Mr. Tuomi’s extensive real estate and technology background, and understanding of both the multi-family housing and rental market, make him well qualified to serve as a member of our Board.

Directors Continuing in Office Until the 2026 Annual Meeting of Stockholders

Bruce Strohm, age 69, a private real estate investor, has served as a member of our Board since August 2021. From June 2019 to December 2020. Mr. Strohm served as Chief Legal Officer of Equity International, a private equity company focused on investing in real estate outside the United States. He previously served as the Executive Vice President, General Counsel and Corporate Secretary of Equity Residential (NYSE: EQR), a multifamily REIT, from January 1995 until January 2018. Mr. Strohm worked closely with the chief executive officer and chief financial officer on capital markets activities and shareholder relations. Mr. Strohm earned a Bachelor of Science degree in accounting from the University of Illinois and a Juris Doctor degree from Northwestern University Law School. We believe Mr. Strohm’s extensive legal, real estate, public company, and financial experience makes him well qualified to serve as a member of our Board.

Alison Dean, age 59, was appointed as a member of our Board in March 2024. Ms. Dean has over three decades of experience in high tech overseeing corporate finance and financial planning, as well as information technology, supply chain operations, acquisitions, and investor relations. From April 2005 until her retirement in May 2020, Ms. Dean held executive positions at iRobot Corporation (Nasdaq: IRBT), a global consumer robot company, most recently as Executive Vice President, Chief Financial Officer. From 2013 to 2020, she was the Treasurer and Principal Accounting Officer at iRobot. Prior to that, she held several financial positions at 3Com Corporation (Nasdaq: COMS), a digital electronics manufacturer, from 1995 to 2005, including vice president and corporate controller (2004 to 2005) and vice president of finance, worldwide sales (2003 to 2004). Ms. Dean has served on the board of directors of Yeti Holding, Inc. (NYSE: YETI) a global retailer of outdoor products, since October 2020 and Everbridge, Inc. (Nasdaq: EVBG), a global software company that provides critical event management and enterprise safety applications, since July 2018. Ms. Dean has also served as a board member for Salsify, a privately held commerce management software company, since September 2021. Ms. Dean holds a Bachelor of Arts degree in Business Economics from Brown University and a Master of Business Administration from Boston University. We believe Ms. Dean’s extensive background in finance, technology, and operations qualifies her to serve on our Board.

21

Non-Employee Director Compensation

We compensate our non-employee directors with a combination of cash and equity in the form of restricted stock units (“RSUs”). Lucas Haldeman, our Chief Executive Officer, also serves as a director and we compensate Mr. Haldeman solely for serving as our Chief Executive Officer - see “Executive Compensation” below - and do not provide additional compensation for his service as a director. Our Board adopted a non-employee director compensation policy that is designed to enable us to attract and retain highly qualified non-employee directors. Specifically, we provide annual cash payments, payable quarterly in arrears, to each director who is not an employee of ours, with additional amounts for service as Lead Independent Director and chairpersons or members of our audit, compensation, and nominating and corporate governance committees, as set forth below:

Cash(1) |

|

Annual Amount ($) |

|

Board member fee |

|

80,000 |

|

Lead Independent Director fee |

|

20,000 |

|

Committee chair fee(2) |

|

|

|

Audit Committee |

|

20,000 |

|

Compensation Committee |

|

15,000 |

|

Nominating and Corporate Governance Committee |

|

10,000 |

|

Committee member fee(2) |

|

|

|

Audit Committee |

|

10,000 |

|

Compensation Committee |

|

7,500 |

|

Nominating and Corporate Governance Committee |

|

5,000 |

|

(1) Amounts reflected are annual amounts; payments are made on a quarterly basis.

(2) Each committee chair receives only the fee due to him or her for his service as chair on such committee and does not receive an additional fee as a member of such committee.

In addition to cash compensation, our non-employee director compensation policy provides for the grant of annual equity awards in the form of RSUs to our non-employee directors as follows:

Equity(1) |

|

|

Grant Date Fair Value ($) |

|

Annual restricted stock unit grant(2)

|

|

|

150,000 |

|

(1) Each equity award has a grant date fair value as shown in the table (subject to minor variations due to the rounding of any fractional share).

(2) Each annual restricted stock unit award is scheduled to vest as to 100% of such award on the earlier of (a) the date immediately preceding the date of the next annual stockholder meeting following the grant or (b) one year from the grant date, subject to the director’s continued service through such vesting date.

22

The following table provides information for all compensation awarded to, earned by, or paid to each person who served as a non-employee director in the fiscal year ending December 31, 2023. Mr. Haldeman is not included in the table below because he did not receive additional compensation for his service as a director. The compensation received by Mr. Haldeman as an employee for the fiscal year ending December 31, 2023, is shown below in “Executive Compensation-Summary Compensation Table.”

Name |

|

Fees Earned or Paid in Cash(1) |

|

|

Stock Awards(2) ($) |

|

|

Total ($) |

|

|||

Ann Sperling |

|

|

95,000 |

|

|

|

150,000 |

|

|

|

245,000 |

|

Frederick Tuomi |

|

|

111,250 |

|

|

|

150,000 |

|

|

|

261,250 |

|

Robert Best(3) |

|

|

91,250 |

|

|

|

150,000 |

|

|

|

241,250 |

|

Bruce Strohm |

|

|

100,000 |

|

|

|

150,000 |

|

|

|

250,000 |

|

Alana Beard |

|

|

87,500 |

|

|

|

150,000 |

|

|

|

237,500 |

|

John Dorman |

|

|

106,875 |

|

|

|

150,000 |

|

|

|

256,875 |

|

Alison Dean(4) |

|

|

― |

|

|

|

― |

|

|

|

― |

|

(1) Amounts shown in this column reflect the total cash retainer earned by each director for board and committee service during 2023.

(2) Amounts shown in this column do not reflect dollar amounts actually received by our non-employee directors. Instead, these amounts reflect the aggregate grant date fair value of each equity award granted in 2023, computed in accordance with the provisions of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. Assumptions used in the calculation of these amounts are included in the notes to our consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as amended. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions.

(3) Mr. Best resigned from the Board effective January 15, 2024.

(4) Ms. Dean was appointed to the Board on March 21, 2024.

The following table lists all outstanding equity awards held by our non-employee directors as of December 31, 2023:

Name |

|

Number of Shares Subject to Outstanding Stock Options |

|

Number of Shares Subject to Outstanding Restricted Stock Units |

Ann Sperling |

|

|

|

48,553 |

Frederick Tuomi |

|

187,057 |

|

48,553 |

Robert Best(1) |

|

|

|

48,553 |

Bruce Strohm |

|

|

|

48,553 |

Alana Beard |

|

|

|

48,553 |

John Dorman |

|

|

|

48,553 |

(1) Mr. Best resigned from the Board effective January 15, 2024. Upon such resignation, the restricted stock units shown in the table above, all of which were unvested as of such resignation date, were forfeited by him.

We currently reimburse our directors for their reasonable out-of-pocket expenses in connection with attending meetings of our Board and committees.

23

MATTERS TO COME BEFORE THE ANNUAL MEETING

PROPOSAL 2:

Ratification of Appointment of Independent Registered Public Accounting Firm

Our audit committee has appointed Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and has further directed that management submit this appointment for ratification by the stockholders at the Annual Meeting. Deloitte has been our independent registered public accounting firm since the consummation of the Business Combination on August 24, 2021.