Issuing Entity or Trust

|

Verizon ABS II LLC

Depositor

(CIK Number: 0001836995)

|

Cellco Partnership d/b/a

Verizon Wireless

Sponsor and Servicer

(CIK Number: 0001175215)

|

|

Notes(1) |

Initial Note Balance

|

Interest Rate

|

Accrual Method

|

Anticipated Redemption Date

|

Final

Maturity Date |

||||

|

Class A notes

|

$850,000,000

|

%(2)

|

30/360

|

October 21, 2024

|

April 20, 2028

|

||||

|

Class B notes

|

$52,000,000

|

%(2)

|

30/360

|

October 21, 2024

|

April 20, 2028

|

||||

|

Class C notes

|

$52,500,000

|

%(2)

|

30/360

|

October 21, 2024

|

April 20, 2028

|

||||

|

Total

|

$954,500,000

|

|

Initial Public Offering Price

|

Underwriting Discounts and Commissions

|

Net Proceeds(3)

|

|||

|

Class A notes

|

$

|

%

|

$

|

||

|

Class B notes

|

$

|

%

|

$

|

||

|

Class C notes

|

$

|

%

|

$

|

||

|

Total

|

$

|

$

|

| • |

The issuing entity will pay interest on the notes on the 20th day of each month (or if not a business day, the next business day). The first payment date will be December 20, 2021. It is not

expected that any payments of principal will be made on the notes prior to the payment date in October 2024, unless the amortization period begins or the notes are redeemed prior to such date.

|

| • |

The notes may be subject to optional redemption on any date on or after the payment date in November 2022. If the issuing entity effects an optional redemption on any date prior to the payment

date occurring in July 2024, the issuing entity will be required to pay a make-whole payment in connection with such redemption.

|

| • |

The notes are expected, but not required, to be redeemed by the issuing entity on or before the payment date in October 2024. If the notes have not been redeemed as of the payment date in

October 2024, an amortization event will occur on such payment date and, beginning on such payment date, in addition to interest at the stated interest rate, each class of notes will accrue additional interest at the additional interest rate

applicable to that class of notes, which accrued additional interest amounts will be distributed to noteholders as set forth under “Description of the Notes—Priority of Payments”. See “Description of the Notes—Optional Redemption.”

|

| • |

On the closing date, the credit and payment enhancement for the notes will consist of a reserve account, overcollateralization, excess spread and, in the case of the Class A notes, subordination

of the Class B notes and Class C notes, and in the case of the Class B notes, subordination of the Class C notes.

|

|

RBC Capital Markets

(sole structurer)

|

BofA Securities

|

MUFG

|

TD Securities

|

|

CastleOak Securities, L.P.

|

Great Pacific Securities

|

Mischler Financial

|

|

Title of Each Class of

Securities to be Registered

|

Amount to

be Registered

|

Proposed Maximum Offering Price Per Unit (1)

|

Proposed Maximum Aggregate Offering Price (1)

|

Amount of Registration Fee (2)

|

|

Series 2021-2 Asset-Backed Notes

|

$1,700,000,000

|

100%

|

$1,700,000,000

|

$157,590.00

|

|

Important Notice About Information in this Prospectus

|

5

|

|

Reading this Prospectus

|

5

|

|

Forward-Looking Statements

|

6

|

|

Copies of the Documents

|

6

|

|

Note Legend

|

6

|

|

Notice to Residents of the United Kingdom

|

7

|

|

Notice to Residents of the European Economic Area

|

8

|

|

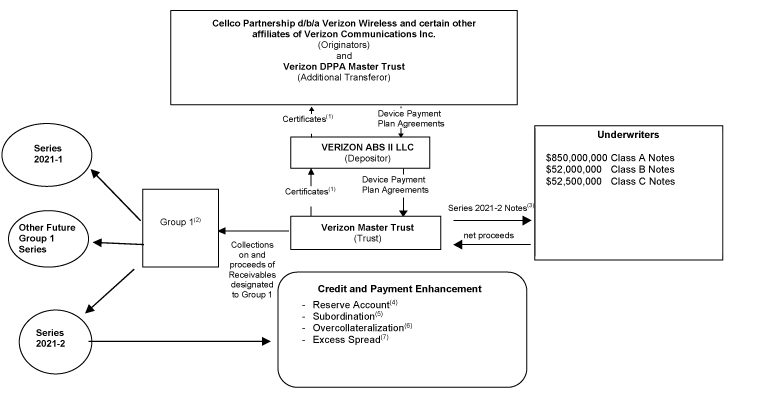

Trust and Transaction Structure Diagram

|

9

|

|

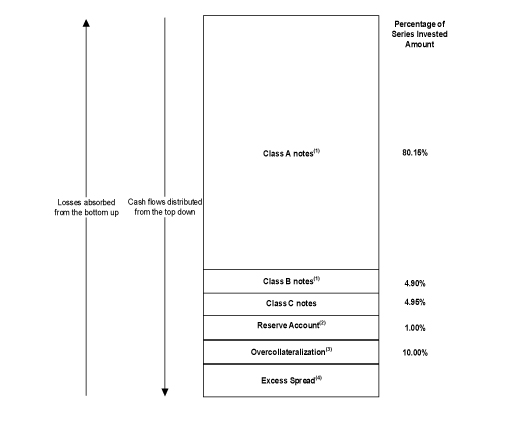

Transaction Credit and Payment Enhancement Diagram

|

10

|

|

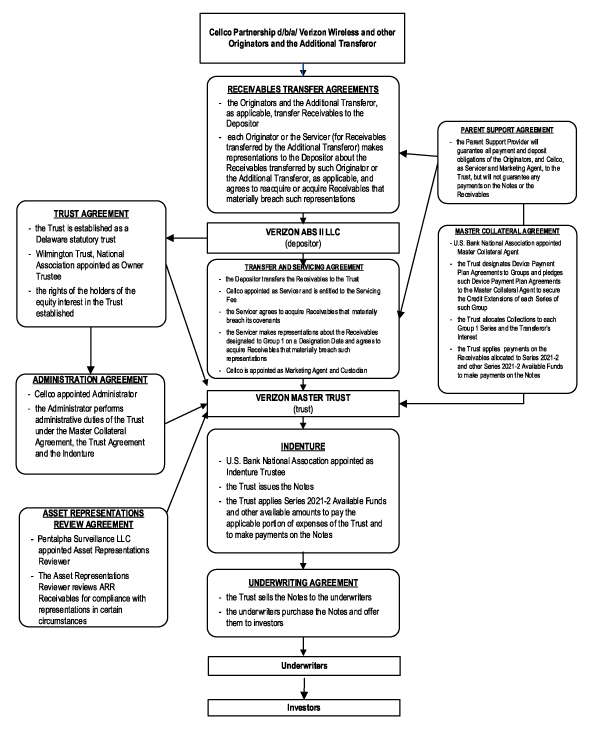

Transaction Parties and Documents Diagram

|

11

|

|

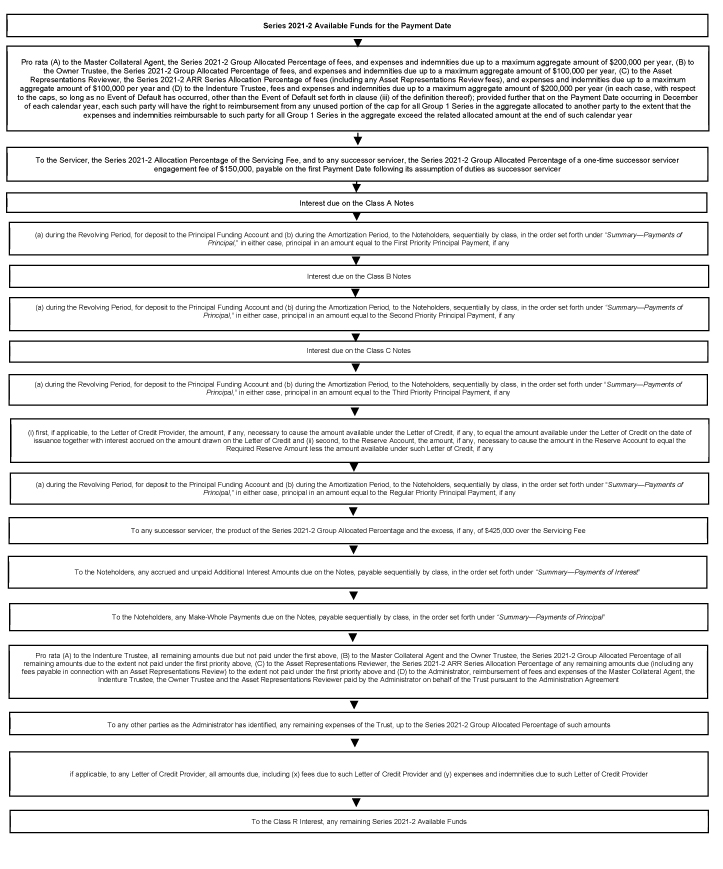

Transaction Payments Diagram

|

12

|

|

Summary

|

13

|

|

Glossary

|

35

|

|

Risk Factors

|

35

|

|

Summary of Principal Risk Factors

|

35

|

|

Descriptions of the Transaction Documents

|

68

|

|

The Trust

|

68

|

|

Addition of Receivables

|

70

|

|

Release of Receivables

|

71

|

|

Issuance of Additional Group 1 Series

|

72

|

|

Depositor

|

73

|

|

Owner Trustee

|

73

|

|

Master Collateral Agent and Indenture Trustee

|

75

|

|

Master Collateral Agent

|

76

|

|

Indenture Trustee

|

78

|

|

Asset Representations Reviewer

|

80

|

|

Sponsor, Servicer, Custodian, Marketing Agent and Administrator

|

82

|

|

General

|

82

|

|

Sponsor

|

82

|

|

Servicer, Custodian, Marketing Agent and Administrator

|

84

|

|

Parent Support Provider

|

85

|

|

The Originators

|

86

|

|

Additional Transferor

|

87

|

|

Origination and Description of Device Payment Plan Agreement Receivables

|

88

|

|

Wireless Equipment and Distribution

|

88

|

|

Wireless Device Payment Plan Agreements

|

88

|

|

Insurance on Wireless Devices

|

90

|

|

Underwriting Criteria

|

90

|

|

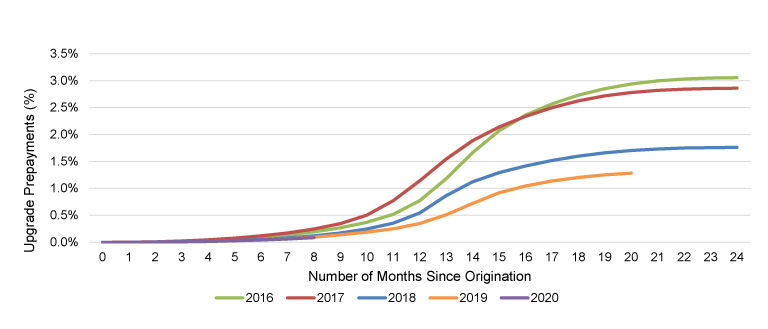

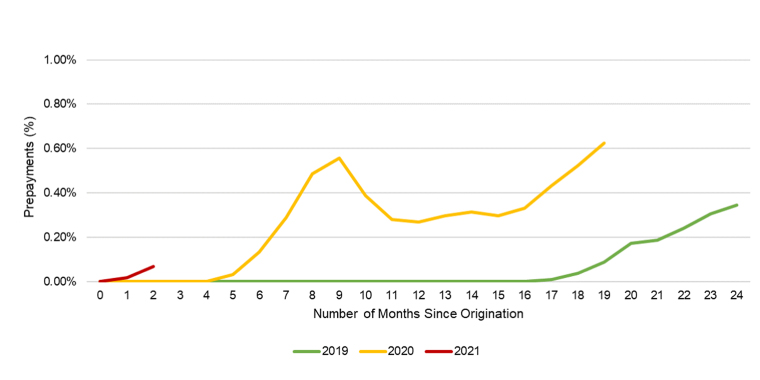

Upgrade Offers

|

92

|

|

Account Credits

|

92

|

|

Transfer of Service

|

93

|

|

Bankruptcy Surrendered Devices

|

93

|

|

Origination Characteristics

|

93

|

|

Servicing the Receivables and the Securitization Transaction

|

94

|

|

General

|

94

|

|

Servicing Duties

|

94

|

|

Collections and Other Servicing Procedures

|

95

|

|

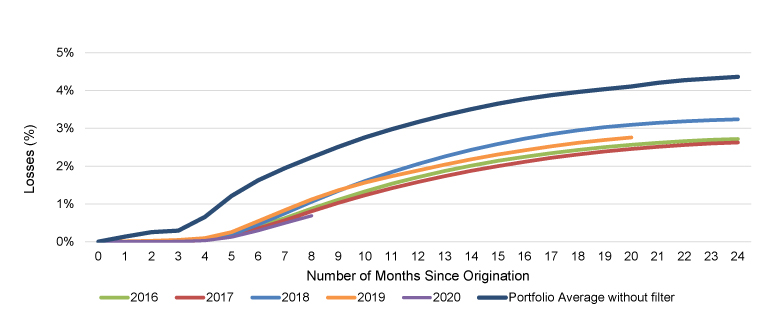

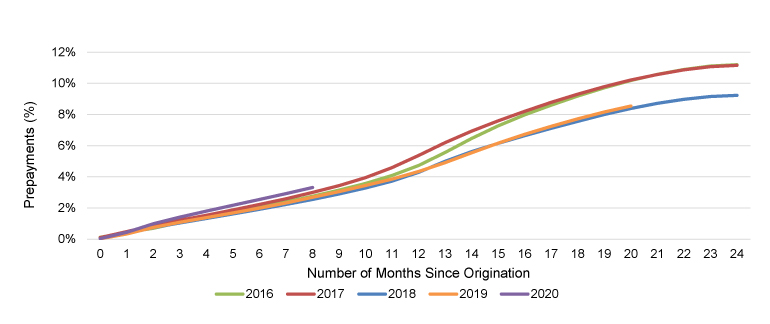

Delinquency and Write-Off Experience

|

97

|

|

Servicing Fees

|

99

|

|

Servicer Modifications and Obligation to Acquire Receivables

|

99

|

|

Bank Accounts

|

100

|

|

Deposit of Collections

|

100

|

|

Custodial Obligations of Cellco

|

101

|

|

Servicing Obligations of Cellco

|

101

|

|

Limitations on Liability

|

102

|

|

Amendments to Transfer and Servicing Agreement

|

102

|

|

Resignation and Termination of Servicer

|

102

|

|

Notice Obligations of Cellco

|

104

|

|

Receivables

|

105

|

|

Receivables, Group 1 Assets and Series 2021-2 Assets

|

105

|

|

Description of the Receivables

|

106

|

|

Criteria for Selecting the Receivables

|

106

|

|

Composition of the Receivables

|

107

|

|

Additional Receivables

|

112

|

|

Series 2021-2 Concentration Limits

|

112

|

|

Representations About the Receivables

|

114

|

|

Asset Representations Review

|

115

|

|

Obligation to Acquire or Reacquire Receivables; Obligation to Make Credit Payments and Upgrade Prepayments

|

118

|

|

Dispute Resolution

|

121

|

|

Review of Receivables

|

123

|

|

Static Pool Information

|

124

|

|

Description of the Notes

|

124

|

|

Pool Balance and Required Pool Balance

|

124

|

|

Allocation of Group 1 Available Funds

|

125

|

|

Series 2021-2 Available Funds

|

125

|

|

Payments of Interest

|

125

|

|

Payments of Principal

|

126

|

|

Revolving Period

|

127

|

|

Amortization Period

|

127

|

|

Earliest Redemption Date; Optional Redemption of the Notes

|

128

|

|

Anticipated Redemption Date

|

129

|

|

Make-Whole Payments

|

129

|

|

Priority of Payments

|

129

|

|

Post-Acceleration Priority of Payments

|

132

|

|

Controlling Class; Voting Rights

|

133

|

|

Events of Default

|

133

|

|

Notes Owned by Transaction Parties

|

136

|

|

List of Noteholders

|

136

|

|

Noteholder Communications

|

136

|

|

Satisfaction and Discharge of Indenture

|

137

|

|

Amendments to Master Collateral Agreement

|

137

|

|

Amendments to Indenture

|

139

|

|

Equity Interest

|

140

|

|

Book-Entry Registration

|

140

|

|

Definitive Securities

|

142

|

|

Computing the Outstanding Note Balance of the Notes

|

143

|

|

Credit and Payment Enhancement

|

143

|

|

Reserve Account

|

143

|

|

Letter of Credit

|

144

|

|

Subordination

|

145

|

|

Overcollateralization

|

145

|

|

Excess Spread

|

146

|

|

Credit Risk Retention

|

146

|

|

EU Securitization Regulation and the UK Securitization Regulation

|

151

|

|

Some Important Legal Considerations

|

153

|

|

Matters Relating to Bankruptcy

|

153

|

|

Security Interests in Receivables

|

158

|

|

Realization on the Receivables

|

158

|

|

Use of Proceeds

|

160

|

|

Transaction Fees and Expenses

|

160

|

|

Fees and Expenses for the Notes

|

160

|

|

Monthly Investor Reports

|

162

|

|

Annual Compliance Reports

|

164

|

|

U.S. Federal Income Tax Consequences

|

164

|

|

Tax Characterization of the Trust

|

165

|

|

Tax Consequences to Owners of the Notes

|

165

|

|

Material State Tax Consequences

|

170

|

|

Certain Considerations for ERISA and Other Benefit Plans

|

170

|

|

General Investment Considerations for Fiduciaries Investing Plan Assets

|

170

|

|

Prohibited Transactions

|

171

|

|

Benefit Plans Not Subject to ERISA or the Code

|

172

|

|

Additional Considerations

|

172

|

|

Affiliations and Relationships and Related Transactions

|

172

|

|

Where You Can Find More Information About Your Notes

|

173

|

|

The Trust

|

173

|

|

The Depositor

|

173

|

|

Static Pool Data

|

174

|

|

Legal Proceedings

|

174

|

|

Underwriting

|

174

|

|

Legal Opinions

|

177

|

|

Available Information

|

177

|

|

Schedule I: Glossary of Defined Terms

|

S‑I-1

|

|

Annex A: Static Pool Data: Vintage Pools

|

A‑1

|

|

Annex B: Static Pool Data: Receivables

|

B‑1

|

|

Annex C: Static Pool Data: Prior Securitized Pools

|

C‑1

|

|

Annex D: Other Group 1 Series of Credit Extensions Outstanding

|

D‑1

|

| • |

Trust and Transaction Structure Diagram – illustrates the structure of the trust, this securitization transaction and the credit and payment enhancement

available for the notes,

|

| • |

Transaction Credit and Payment Enhancement Diagram – illustrates the credit and payment enhancement available for the notes on the closing date and how

credit and payment enhancement is used to absorb losses on the receivables,

|

| • |

Transaction Parties and Documents Diagram – illustrates the role of each transaction party and the obligations that are governed by each transaction

document relating to the notes,

|

| • |

Transaction Payments Diagram – illustrates how series 2021-2 available funds will be paid on each payment date,

|

| • |

Summary – describes the transaction parties, the main terms of the issuance of and payments on the notes, the

assets of the issuing entity, the cash flows in this securitization transaction and the credit and payment enhancement available for the notes, and

|

| • |

Risk Factors – describes the most significant risks of investing in the notes.

|

Attention: Investor Relations

| (1) |

The Certificates are held by the Depositor and Verizon DPPA True-up Trust, as nominee of the Originators and equityholder of the Additional Transferor, which is another Delaware statutory trust

similar to the Trust, which is beneficially owned by the Originators. The Certificates represent the ownership interest in the Trust and are entitled to (i) distributions of the Transferor’s Allocation on each Payment Date, (ii) any

collections on or proceeds of any Trust DPPAs allocated to any other Series not needed to make payments on the related Credit Extensions, or to make any other required payments or deposits according to the priority of payments for such Series

and (iii) investment earnings on amounts held in the Collection Account or any Series Bank Accounts. Series 2021-2 also includes the Class R Interest, which represents an “eligible horizontal residual interest” pursuant to the U.S. Risk

Retention Rules representing the right to any Series 2021-2 Available Funds not needed on any Payment Date to make payments on the Notes, or to make any other required payments or deposits according to the priority of payments described under

“Description of the Notes—Priority of Payments.” For more details about the Class R Interest, see “Credit Risk Retention.”

|

| (2) |

The Trust has issued one other Series of notes, and expects to issue or enter into in the future other Series of notes and loans. The notes and loans of any Series are secured by all of the

Trust’s assets but are only entitled to the portion of collections on and proceeds of the Trust DPPAs designated to the related Group that are allocated to it under the transaction documents, except to the extent Trust DPPAs designated to any

other Group are sold upon the occurrence of an Event of Default and an acceleration of the Notes in the limited circumstances described under “Description of the Notes—Events of Default—Remedies Following

Event of Default.”

|

| (3) |

The Depositor or one or more of its affiliates may initially retain all or a portion of one or more classes of Notes.

|

| (4) |

On the Closing Date, the Reserve Account will be fully funded with an amount equal to $ , which is the Required Reserve Amount as of the Closing Date. For more details about the Reserve Account, you should read “Credit and Payment Enhancement—Reserve Account.”

|

| (5) |

All Notes other than the Class C Notes benefit from subordination of more junior classes to more senior classes. The order of subordination varies depending on whether interest or principal is

being paid and whether an Event of Default that results in acceleration has occurred. For more details about subordination, you should read “Description of the Notes—Priority of Payments,” “—Post-Acceleration Priority of Payments” and “Credit and Payment

Enhancement—Subordination.”

|

| (6) |

Overcollateralization is the amount by which, on any date of determination, (x) the Series 2021-2 Allocated Pool Balance exceeds (y) the aggregate Note Balance of the Notes. The Series 2021-2

Required Overcollateralization Percentage is 10.00% and the Series 2021-2 Required Overcollateralization Amount is initially equal to $ . For more details about overcollateralization, you

should read “Credit and Payment Enhancement—Overcollateralization.”

|

| (7) |

Excess spread for Series 2021-2 on any Payment Date will be equal to the excess of (i) the product of (a) the Series 2021-2 Discount Rate and (b) the Series 2021-2 Available Funds for such

Payment Date over (ii) the sum of (a) the aggregate amount of interest payments required to be made on the Notes on such Payment Date and (b) the aggregate amount of senior fees and expenses of the Trust that are allocated to Series 2021-2 on

such Payment Date.

|

| (1) |

All Notes other than the Class C Notes benefit from subordination of more junior classes to more senior classes. The order of the subordination varies depending on whether interest or principal

is being paid and whether an Event of Default that results in acceleration has occurred. For more details about subordination, you should read “Description of the Notes—Priority of Payments,” “—Post-Acceleration Priority of Payments” and “Credit and Payment Enhancement—Subordination.”

|

| (2) |

On the Closing Date, the Reserve Account will be fully funded with an amount equal to $ , which is the Required Reserve Amount as of the Closing Date. For

more details about the Reserve Account, you should read “Credit and Payment Enhancement—Reserve Account.”

|

| (3) |

Overcollateralization is the amount by which, on any date of determination, (x) the Series 2021-2 Allocated Pool Balance exceeds (y) the aggregate Note Balance of the Notes. The Series 2021-2

Required Overcollateralization Percentage is 10.00% and the Series 2021-2 Required Overcollateralization Amount is initially equal to $ . For more details about overcollateralization, you should

read “Credit and Payment Enhancement—Overcollateralization.”

|

| (4) |

Excess spread for Series 2021-2 on any Payment Date will be equal to the excess of (i) the product of (a) the Series 2021-2 Discount Rate and (b) the Series 2021-2 Available Funds for such

Payment Date over (ii) the sum of (a) the aggregate amount of interest payments required to be made on the Notes on such Payment Date and (b) the aggregate amount of senior fees and expenses of the Trust that are allocated to Series 2021-2 on

such Payment Date.

|

|

Initial Note Balance(1)

|

Interest Rate

|

||

|

Class A Notes

|

$850,000,000

|

%(2)

|

|

|

Class B Notes

|

$52,000,000

|

%(2)

|

|

|

Class C Notes

|

$52,500,000

|

%(2)

|

| • |

Series 2021-2;

|

| • |

other Group 1 Series; and

|

| • |

the Certificates.

|

| • |

the amount by which the aggregate Principal Balance of Receivables with Obligors that have less than twelve (12) months of Customer Tenure with Verizon Wireless exceeds 22.00% of the Pool

Balance,

|

| • |

the amount by which the aggregate Principal Balance of Receivables with Obligors that have less than sixty (60) months of Customer Tenure with Verizon Wireless exceeds 45.00% of the Pool

Balance, and

|

| • |

with respect to all Receivables for which the origination date was less than thirty-one (31) days prior to the related Cutoff Date, or in the case of any determination made on a Payment Date,

the last day of the related Collection Period, the product of (i) the aggregate Principal Balance of all such Receivables and (ii) 10.00%,

|

| • |

the aggregate Principal Balance of all Consumer Receivables with the lowest FICO® Scores that would need to be

excluded from the calculation of the Pool Balance of all Consumer Receivables in order to cause the weighted average FICO® Score of the Consumer Obligors with

respect to all Consumer Receivables (weighted based on Principal Balances) included in such calculation of the Pool Balance

|

|

of all Consumer Receivables to be at least 700 (excluding any Consumer Receivables with Consumer Obligors for whom FICO®

Scores are not available), and

|

| • |

the amount by which the aggregate Principal Balance of Consumer Receivables with Consumer Obligors for whom FICO®

Scores are not available exceeds 4.50% of the Pool Balance of all Consumer Receivables,

|

| • |

the amount by which the aggregate Principal Balance of Business Receivables exceeds 10.00% of the Pool Balance.

|

| • |

the Receivables and Collections on the Receivables received after the end of the calendar day on the applicable Cutoff Date (other than net recoveries on Written-Off Receivables, including any

proceeds from the sale of a wireless device securing a Receivable, which will be retained by the Servicer as a supplemental servicing fee),

|

| • |

funds in the Collection Account in respect of the Receivables,

|

| • |

rights of the Trust under the Transfer and Servicing Agreement, the Receivables Transfer Agreements and the other transaction documents in respect of the Receivables,

|

| • |

rights to funds from (i) the reacquisition by Originators or the acquisition by the Servicer (in the case of Receivables transferred by the Additional Transferor or designated to Group 1 on a

Designation Date), as applicable, of Receivables that, as of the applicable Cutoff Date, were not Eligible Receivables, (ii) the acquisition by the Servicer of Receivables that breach certain covenants, (iii) the reacquisition by

Originators or the acquisition by the Servicer (in the case of Receivables transferred by the Additional Transferor), as applicable, of secured Receivables (that are not Written-Off Receivables) if the related Obligor becomes the subject of

a bankruptcy proceeding and Verizon Wireless accepts the surrender of the related wireless device in satisfaction of the Receivable, (iv) the acquisition by the Marketing Agent or the reacquisition by an Originator of Receivables that are

subject to certain transfers, (v) Credit Payments and Upgrade Prepayments made by the Marketing Agent or an Originator in respect of the Receivables, and (vi) any amounts remitted by the Parent Support Provider under the Parent Support

Agreement in respect of the Receivables, and

|

| • |

all proceeds of the above.

|

| • |

funds in the Series Bank Accounts, and

|

| • |

if applicable, any amounts drawn under any Letter of Credit.

|

|

Number of Receivables

|

6,986,137

|

|

Aggregate Principal Balance

|

$4,379,849,542.00

|

|

Average Principal Balance

|

$626.93

|

|

Average monthly payment

|

$32.29

|

|

Weighted average remaining installments (in months)(1)

|

21

|

|

Weighted average FICO® Score of Consumer Obligors under Consumer Receivables(1)(2)(3)

|

705

|

|

Percentage of Consumer Receivables with Consumer Obligors

without a FICO® Score(3)

|

3.72%

|

|

Geographic concentration (Top 3 States)(4)

|

|

|

California

|

10.80%

|

|

Texas

|

6.46%

|

|

Florida

|

6.25%

|

|

Weighted average Customer Tenure (in months)(1)(5)

|

100

|

|

Percentage of Receivables with Obligors with smartphones

|

94.36%

|

|

Percentage of Receivables with other wireless devices

|

5.64%

|

|

Percentage of Consumer Receivables

|

90.22%

|

|

Percentage of Business Receivables

|

9.78%

|

| (1) |

Weighted averages are weighted by the aggregate Principal Balance of the applicable Receivables as of the Statistical Calculation Date.

|

| (2) |

Excludes Consumer Receivables that have Consumer Obligors who did not have FICO® Scores because they are

individuals with minimal or no recent credit history.

|

| (3) |

This FICO® Score reflects the FICO®

Score 8 of the related Consumer Obligor under a Consumer Receivable. The FICO® Score is calculated with respect to each Consumer Obligor on or about the date

on which such Consumer Receivable was originated.

|

| (4) |

Based on the billing addresses of the Obligors under the Receivables.

|

| (5) |

For a complete description of the calculation of Customer Tenure included in this summary, see “Origination and Description of Device Payment Plan Agreement

Receivables—Origination Characteristics.”

|

| • |

on any Payment Date, interest due is not paid on any class of Notes,

|

| • |

on the fifth Business Day after any Payment Date during the Revolving Period, after giving effect to distributions on such Payment Date, the sum of the amount on deposit in the Reserve Account

plus, if a Letter of Credit has been issued for the benefit of the Notes, the amount available under the Letter of Credit, is less than the Required Reserve Amount,

|

| • |

as of the Anticipated Redemption Date, the Trust has not redeemed the Notes,

|

| • |

as of any Payment Date, a Pool Balance Deficit exists after giving effect to distributions on such Payment Date (including deposits to the Principal Funding Account on such Payment Date),

|

| • |

for any Payment Date, the sum of the fractions, expressed as percentages, for

|

|

each of the three (3) Collection Periods immediately preceding that Payment Date, calculated by dividing the aggregate Principal Balance of all Receivables which became Written-Off Receivables

during each of the three (3) prior Collection Periods by the Pool Balance as of the first day of each of those Collection Periods, multiplied by four (4), exceeds 10.00%,

|

| • |

for any Payment Date, the sum of the fractions, expressed as percentages, for each of the three (3) Collection Periods immediately preceding that Payment Date, calculated by dividing the

aggregate Principal Balance of all Receivables that are ninety-one (91) days or more delinquent at the end of each of the three (3) prior Collection Periods by the Pool Balance as of the last day of each of those Collection Periods, divided

by three (3), exceeds 2.00%,

|

| • |

with respect to any Payment Date, the Series 2021-2 Allocated Pool Balance is less than 50.00% of (x) the aggregate Note Balance minus (y) the amount on deposit in the Principal Funding

Account, in each case as of such Payment Date,

|

| • |

as of any date of determination, the Discounted Series Invested Amount for Series 2021-2 is greater than the excess of (i) the Pool Balance over (ii) the sum of (x) the Ineligible Amount for

Series 2021-2 and (y) the Series 2021-2 Excess Concentration Amount,

|

| • |

a Servicer Termination Event has occurred and is continuing, or

|

| • |

an Event of Default has occurred and is continuing.

|

| • |

failure to pay interest (other than any additional interest amounts, if applicable) due on any Group 1 Credit Extension of the controlling class of any Group 1 Series within thirty-five (35)

days after any Payment Date,

|

| • |

failure to pay the Outstanding principal amount or make-whole payments (as applicable) on any Group 1 Credit Extension on the related final maturity date,

|

| • |

failure by the Trust to observe or perform any material covenant or agreement in any Primary Series Document, or any representation or warranty of the Trust made in any Primary Series Document

or in any officer’s certificate delivered in connection with any Primary Series Document is incorrect in any material respect when made, and, in either case, (x) has a material adverse effect on the Group 1 Creditors, and (y) is not cured

for a period of ninety (90) days after written notice was given to the Trust by the Master Collateral Agent or to the Trust and the Master Collateral Agent by Creditor Representatives representing Group 1 Series with Credit Extensions

comprising at least 25% of the aggregate Outstanding principal amount of all Group 1 Credit Extensions, or

|

| • |

a bankruptcy or dissolution of the Trust.

|

| • |

(x) the Servicer fails to deposit, or deliver to the Master Collateral Agent for deposit, any collections or payments in respect of the Trust DPPAs required to be delivered under the Transfer

and Servicing Agreement; (y) so long as Cellco is the Servicer, the Marketing Agent fails to deposit, or to cause the related Originators to deposit, into the Collection Account any prepayments in respect of the Trust DPPAs required by

Upgrade Contracts under an Upgrade Program required to be delivered under the Transfer and Servicing Agreement, or (z) so long as Cellco is the Servicer, the Parent Support Provider fails to make any payments with respect to the items set

forth in clause (x) or clause (y) above, to the extent the Servicer, or the Marketing Agent or any related Originator, respectively, fails to do so, and, in each case, which failure continues for five (5) Business Days after the Servicer,

the Marketing Agent or the Parent Support Provider, as applicable, receives written notice of the failure from the Master Collateral Agent or a responsible person of the Servicer, the Marketing Agent or the Parent Support Provider, as

applicable, obtains actual knowledge of the failure; or

|

| • |

the Servicer (including in its capacity as Custodian) fails to fulfill its duties under the Transfer and Servicing Agreement (other than pursuant to the immediately preceding bullet point or

the immediately following bullet point), which failure has a material adverse effect on the Creditors and continues for ninety (90) days after the Servicer receives written notice of the failure from the Master Collateral Agent

|

|

or the Majority Trust Creditor Representatives, or

|

| • |

so long as Cellco is the Servicer, failure by (i) the Marketing Agent to make, or to cause the related Originator to make, any payments required to be paid by the Marketing Agent in respect of

the Trust DPPAs, including without limitation Credit Payments or payments relating to the acquisition by the Marketing Agent or the related Originator of Trust DPPAs that are subject to certain transfers, but not including prepayments

required by Upgrade Contracts under an Upgrade Program, or (ii) the Parent Support Provider to make any payments set forth in clause (i) above, to the extent that the Marketing Agent or the related Originator fails to do so, in either case,

that continues for ten (10) Business Days after the Marketing Agent or Parent Support Provider, as applicable, receives written notice of the failure from the Master Collateral Agent, or a responsible person of the Marketing Agent or the

Parent Support Provider, as applicable, obtains actual knowledge of the failure, or

|

| • |

certain insolvency events of the Servicer;

|

| (1) |

Transaction Fees and Expenses — pro rata (A) to the Master Collateral Agent, the Series 2021-2 Group Allocated Percentage of all amounts due, including (x) fees due to the Master Collateral

Agent and (y) expenses and indemnities due to the Master Collateral Agent, up to a maximum aggregate amount, in the case of clause (y), of $200,000 per year for all Group 1 Series in the aggregate; (B) to the Owner Trustee, the Series

2021-2 Group Allocated Percentage of all amounts due, including (x) fees due to the Owner Trustee and (y) expenses and indemnities due to the Owner Trustee, up to a maximum aggregate amount, in the case of clause (y), of $100,000 per year

for all Group 1 Series in the aggregate; (C) to the Asset Representations Reviewer, the Series 2021-2 ARR Series Allocation Percentage of all amounts due, including (x) fees due to the Asset Representations Reviewer (including fees due in

connection with any Asset Representations Review) and (y) expenses and indemnities due to the Asset Representations Reviewer, up to a maximum aggregate amount, in the case of clause (y), of $100,000 per year for all Group 1 Series in the

aggregate and (D) to the Indenture Trustee all amounts due, including (x) fees due to the Indenture Trustee and (y) expenses and indemnities due to the Indenture Trustee up to a maximum aggregate amount, in the case of clause (y), of

$200,000 per year; provided¸ that after the occurrence of an Event of Default (other than an Event of Default set forth in clause (iii) of the definition thereof), the caps on expenses and indemnities in this clause (1) will not apply;

provided further that on the Payment Date occurring in December of each calendar year, each such party will have the right to reimbursement from any unused portion of the cap allocated to another party to the extent that the expenses and

indemnities reimbursable to such party exceed the related allocated amount at the end of such calendar year,

|

| (2) |

Servicing Fee — to the Servicer, the Series 2021-2 Allocation Percentage of the

|

|

Servicing Fee, and to any successor servicer, the Series 2021-2 Group Allocated Percentage of a one-time successor servicer engagement fee of $150,000, payable on the first Payment Date

following its assumption of duties as successor servicer,

|

| (3) |

Class A Note Interest — to the Noteholders of the Class A Notes, interest due on the Class A Notes,

|

| (4) |

First Priority Principal Payment — (a) during the Revolving Period, for deposit to the Principal Funding Account and (b) during the Amortization Period, to the Noteholders, sequentially by

class, in the order set forth under “—Payments of Principal” above, in either case, an amount equal to the excess, if any, of (x) the aggregate Note Balance of the Class A Notes as of the immediately

preceding Payment Date (or, for the initial Payment Date, as of the Closing Date) over (y) the Series 2021-2 Allocated Pool Balance, if any,

|

| (5) |

Class B Note Interest — to the Noteholders of the Class B Notes, interest due on the Class B Notes,

|

| (6) |

Second Priority Principal Payment — (a) during the Revolving Period, for deposit to the Principal Funding Account and (b) during the Amortization Period, to the Noteholders, sequentially by

class, in the order set forth under “—Payments of Principal” above, in either case, an amount equal to the excess, if any, of (x) the aggregate Note Balance of the Class A Notes and Class B Notes as

of the immediately preceding Payment Date (or, for the initial Payment Date, as of the Closing Date) over (y) the sum of the Series 2021-2 Allocated Pool Balance and any First Priority Principal Payment, if any,

|

| (7) |

Class C Note Interest — to the Noteholders of the Class C Notes, interest due on the Class C Notes,

|

| (8) |

Third Priority Principal Payment — (a) during the Revolving Period, for deposit to the Principal Funding Account and (b) during the Amortization Period, to the Noteholders, sequentially by

class, in the order set forth under “—Payments of Principal” above, in either case, an amount

|

|

equal to the excess, if any, of (x) the aggregate Note Balance of the Class A Notes, Class B Notes and Class C Notes as of the immediately preceding Payment Date (or, for the initial Payment

Date, as of the Closing Date) over (y) the sum of the Series 2021-2 Allocated Pool Balance and any First Priority Principal Payment and any Second Priority Principal Payment, if any,

|

| (9) |

Reserve Account — (1) first, if applicable, to the Letter of Credit Provider, the amount, if any, necessary to cause the amount available under the Letter of Credit to equal the amount

available under the Letter of Credit on the date of issuance together with interest accrued on the amount drawn on the Letter of Credit and (2) second, to the Reserve Account, the amount, if any, necessary to cause the amount in the Reserve

Account to equal the Required Reserve Amount less the amount available under such Letter of Credit, if any,

|

| (10) |

Regular Priority Principal Payment — (a) during the Revolving Period, for deposit to the Principal Funding Account, an amount (not less than zero) equal to the excess, if any, of (x) the

product of the Series 2021-2 Allocation Percentage and any Pool Balance Deficit for such Payment Date over (y) the sum of any First Priority Principal Payment, Second Priority Principal Payment and Third Priority Principal Payment for the

current Payment Date and (b) during the Amortization Period, to the Noteholders, sequentially by class, in the order set forth under “—Payments of Principal” above, an amount (not less than zero)

equal to the excess, if any, of the aggregate Note Balance of the Class A Notes, Class B Notes and Class C Notes as of the immediately preceding Payment Date (or for the initial Payment Date, as of the Closing Date) over the sum of any

First Priority Principal Payment, Second Priority Principal Payment and Third Priority Principal Payment for the current Payment Date, if any,

|

| (11) |

Supplemental Successor Servicing Fee – to any successor servicer, the product of the Series 2021-2 Group Allocated Percentage and the excess, if any, of $425,000 over the Servicing Fee,

|

| (12) |

Additional Interest Amounts — to the Noteholders, any accrued and unpaid Additional Interest Amounts due on the Notes, payable sequentially by class, in the order set forth under “—Payments of Interest” above,

|

| (13) |

Make-Whole — to the Noteholders, any Make-Whole Payments due on the Notes, payable sequentially by class, in the order set forth under “—Payments of Principal”

above,

|

| (14) |

Additional Fees and Expenses — pro rata, (A) to the Indenture Trustee, all remaining amounts due but not paid under priority (1) above, (B) to the

Master Collateral Agent and the Owner Trustee, the Series 2021-2 Group Allocated Percentage of all remaining amounts due to the extent not paid under priority (1) above, (C) to the Asset Representations Reviewer, the Series 2021-2 ARR

Series Allocation Percentage of all remaining amounts due to the extent not paid under priority (1) above and (D) to the Administrator, reimbursement of fees and expenses of the Master Collateral Agent, the Indenture Trustee, the Owner

Trustee and the Asset Representations Reviewer paid by the Administrator on behalf of the Trust pursuant to the Administration Agreement,

|

| (15) |

Additional Trust Expenses — to any other parties as the Administrator has identified, any remaining expenses of the Trust, up to the Series 2021-2 Group Allocated Percentage of such amounts,

|

| (16) |

Letter of Credit Provider Fees — if applicable, to any Letter of Credit Provider, all amounts due, including (x) fees due to such Letter of Credit Provider and (y) expenses and indemnities due

to such Letter of Credit Provider, and

|

| (17) |

Class R Interest — to the Class R Interest, all remaining Series 2021-2 Available Funds.

|

| • |

in the event that, immediately following distributions on any Payment Date (a) the Revolving Period is in effect and (b) the Series 2021-2 Allocated Pool Balance exceeds the Adjusted Series

Invested Amount for Series 2021-2, the amount of such excess (to the extent on deposit in the Principal Funding Account) will be withdrawn from the Principal Funding Account and remitted to the Distribution Account on the immediately

succeeding Payment Date to be included as Series 2021-2 Available Funds on such immediately succeeding Payment Date,

|

| • |

in connection with any Optional Redemption, all amounts on deposit in the Principal Funding Account will be withdrawn and applied to pay any amounts due in connection therewith, or

|

| • |

in the event that the Amortization Period is in effect immediately following distributions made on any Payment Date, amounts on deposit in the Principal Funding Account will be paid to the

Noteholders on such Payment Date, sequentially by class, in the order set forth under “—Payments of Principal” above, until the aggregate Note Balance of the Class A Notes, Class B Notes and Class C

Notes is reduced to zero.

|

| • |

a Delinquency Trigger for the Receivables occurs, and

|

| • |

the requisite amount of Public Group 1 Noteholders vote to direct an Asset Representations Review.

|

| • |

the Notes held by parties unaffiliated with the Trust will be classified as debt for U.S. federal income tax purposes; and

|

| • |

the Trust will not be classified as an association (or a publicly traded partnership) taxable as a corporation for U.S. federal income tax purposes.

|

Attention: Investor Relations

Attention: Investor Relations

|

CUSIP

|

|||

|

Class A Notes

|

92348K AD5

|

||

|

Class B Notes

|

92348K AF0

|

||

|

Class C Notes

|

92348K AG8

|

| • |

The Notes may not be redeemed by the Anticipated Redemption Date, which may result in interest rate risk.

|

| • |

The terms of other Group 1 Series may affect the timing and amounts of the payments on your Notes.

|

| • |

Payment priorities increase the risk of losses or payment delays for certain classes of Notes, and Class B Notes and Class C Notes are subject to greater risk of loss because

of subordination.

|

| • |

Principal payments on the Notes may occur earlier than expected, which may result in reinvestment risk.

|

| • |

Principal payments on the Notes may occur later than expected, which may result in interest rate risk.

|

| • |

An increase or decrease in the aggregate initial Note Balance of the Notes may affect the liquidity of your Notes or dilute your voting rights, as applicable.

|

| • |

Your limited control (including over actions of the Trust and over amendments to the transaction documents), and conflicts between classes of Notes and conflicts between

different Group 1 Series, may result in losses on your Notes.

|

| • |

Insufficient Collections on the Receivables allocated to Series 2021-2 will result in losses on your Notes.

|

| • |

Limited recoveries on defaulted Receivables and the unavailability of recoveries on Written-Off Receivables may result in losses on your Notes.

|

| • |

From time to time, Receivables may be added or removed, which may decrease the credit quality of the assets of the Trust designated to Group 1 and may impact payments on the

Notes.

|

| • |

Performance of the Receivables depends on many factors and may worsen in an economic downturn, which may result in payment delays or losses on your Notes.

|

| • |

The characteristics of the Receivables as of the Statistical Calculation Date may differ from the characteristics of the Receivables on the Closing Date.

|

| • |

Geographic concentration of the Receivables may result in payment delays or losses on your Notes.

|

| • |

Interests of other Persons in the Receivables could reduce funds available to pay your Notes.

|

| • |

Payments on the Receivables will be subordinated to certain other payments by the Obligors, which may result in payment delays or losses on your Notes.

|

| • |

Verizon Wireless’ Upgrade Offers may adversely impact Collections on the Receivables and the timing of principal payments, which may result in reinvestment risk, and may

present bankruptcy risks, which may result in losses on your Notes.

|

| • |

The application of credits to Obligor accounts may reduce payments received on the Receivables, which may result in payment delays or losses on your Notes.

|

| • |

Increased delinquencies and defaults may result if an Obligor under a Receivable no longer has a functioning wireless device, which may result in losses on your Notes.

|

| • |

An interruption or degradation of wireless service provided by Verizon Wireless could result in reduced Collections on the Receivables and may result in losses on your Notes.

|

| • |

A wireless device recall or manufacturing defect may result in delayed payments or losses on your Notes.

|

| • |

An Originator’s or the Servicer’s failure to reacquire or acquire Receivables that do not comply with consumer protection laws may result in payment delays or losses on your

Notes.

|

| • |

The Servicer’s inability to perform its obligations, or Cellco’s removal or resignation as Servicer, may result in payment delays or losses on your Notes.

|

| • |

The Servicer’s ability to commingle Collections with its own funds may result in payment delays or losses on your Notes.

|

| • |

Conflicts of interest among certain transaction parties may result in losses on your Notes.

|

| • |

The financial condition or bankruptcy of certain transaction parties may affect their ability to perform their obligations, which may result in payment delays or losses on

your Notes.

|

| • |

Federal financial regulatory reform could have an adverse impact on certain transaction parties, which could adversely impact the servicing of the Receivables or the

securitization of Device Payment Plan Agreements.

|

| • |

The Notes may not be a suitable investment for investors subject to the EU Securitization Regulation or the UK Securitization Regulation.

|

| • |

A reduction, withdrawal or qualification of the ratings on your Notes, or the issuance of unsolicited ratings on your Notes, could adversely affect the market value of your

Notes and/or limit your ability to resell your Notes.

|

| • |

The ratings of any Letter of Credit Provider may affect the ratings of the Notes.

|

| • |

Adverse events arising from the COVID-19 Pandemic may cause you to incur losses on your Notes.

|

|

Risks Relating to the Structure of the Notes and the Trust

|

||

|

The Notes may not be redeemed by the Anticipated Redemption Date, and Noteholders will bear all interest rate risk resulting from principal payments on the Notes occurring

later than expected

|

The Trust is expected, but is not required, to redeem the Notes by the Anticipated Redemption Date. The Trust is a special purpose entity with no material assets other than

the Receivables and other Trust DPPAs. Unlike traditional securitizations, where the source of payments to investors is periodic payments on loans or other receivables, this transaction contemplates that the Trust will make a substantial

balloon payment on or prior to the Anticipated Redemption Date to redeem the Notes. The Trust’s ability to redeem the Notes may depend on its ability to issue another Group 1 Series to refinance the Notes or the Trust’s ability to sell

Receivables at a sufficiently high price, which, in turn, will depend on a number of factors prevailing at the time such refinancing or sale is required, including but not limited to the market for the Receivables, the availability of credit,

prevailing interest rates and general economic conditions. If the Trust is unable to issue another Group 1 Series to refinance the Notes or to sell Receivables at a sufficiently high price, the Trust may not have sufficient cash available to

it (including distributions on the Certificates, proceeds of the issuance of another Series, proceeds of sales of Receivables to another Verizon special purpose entity and/or a third-party purchaser, amounts on deposit in the Principal

Funding Account and the Reserve Account or capital contributions by the Certificateholders) to redeem the Notes. There can be no assurances that the Trust will be able to redeem the Notes by the Anticipated Redemption Date. The failure of

the Trust to redeem the Notes as of the Anticipated Redemption Date will be an Amortization Event, but will not be an Event of Default.

|

|

|

The terms of other Group 1 Series may affect the timing and amounts of the payments on your Notes

|

The Trust may issue or enter into additional Group 1 Series from time to time without your consent. The terms of a new Group 1 Series may be different from Series 2021-2,

which may affect the allocation of Collections on the Receivables to Series 2021-2. For instance, other Group 1 Series may have different discount rates, eligibility criteria, concentration limits, interest rates, required

overcollateralization percentages, revolving periods, amortization events, anticipated redemption dates and/or final maturity dates, which may cause some Group 1 Series to amortize earlier than Series 2021-2.

Other Group 1 Series may have (i) more-stringent concentration limits than the Series 2021-2 Concentration Limits, (ii) more-stringent eligibility criteria than the

eligibility criteria for Series 2021-2 and/or (iii) a higher discount rate than the Series 2021-2 Discount Rate. If a Group 1 Series has more stringent concentration limits than the Series 2021-2

|

|

|

Concentration Limits, more-stringent eligibility criteria than the eligibility criteria for Series 2021-2 or a higher discount rate than the Series 2021-2 Discount Rate, the

positive difference of the Adjusted Series Invested Amount for such Group 1 Series over the Series Invested Amount for such Group 1 Series may be proportionally larger than the positive difference of the Adjusted Series Invested Amount for

Series 2021-2 over the Series Invested Amount for Series 2021-2. The Adjusted Series Invested Amount for each Group 1 Series is used to determine the Series Allocation Percentage for such Group 1 Series. Consequently, in the event that a

Pool Balance Deficit exists, if any Group 1 Series has more stringent concentration limits than the Series 2021-2 Concentration Limits, more-stringent eligibility criteria than the eligibility criteria for Series 2021-2 and/or a higher

discount rate than the Series 2021-2 Discount Rate, such circumstance may result in reduced Group 1 Available Funds allocated to Series 2021-2 on any Payment Date than would be the case if the concentration limits, eligibility criteria and

discount rate for each Group 1 Series were the same.

Because some actions require the consent of Majority Group 1 Creditor Representatives, additional Group 1 Series may dilute the voting rights of your Notes. In addition, the

Trust may also issue Series related to other Groups of Trust DPPAs. Because certain actions of the Trust will require the consent of Majority Trust Creditor Representatives, the addition of Groups may further dilute the voting rights of your

Notes. The interests of the Creditors of a new Group 1 Series or Group may be different from your interests.

|

||

|

Payment priorities increase the risk of loss by, or delay in payment to, holders of certain classes of Notes

|

Based on the priorities described under “Description of the Notes—Priority of Payments,” during the Amortization Period, classes of

Notes that receive principal payments before other classes will be repaid more rapidly than the other classes. Because principal of the Notes will be paid sequentially during the Amortization Period, if an Optional Redemption has not been

effected by the Trust, classes of Notes lower in payment priority will be Outstanding longer, and therefore, will be exposed to the risk of losses on the Receivables during periods after other classes have received most or all amounts payable

on their Notes, and after which a disproportionate amount of credit and payment enhancement may have been applied and not replenished.

If an Optional Redemption has not been effected by the Trust, because of the priority of payment on the Notes, the yields of the classes of Notes lower in payment priority

will be more sensitive to losses on the Receivables and the timing of these losses than the classes of Notes higher in payment priority. Accordingly, the Class B Notes will be relatively more

|

|

sensitive to losses on the Receivables and the timing of these losses than the Class A Notes; and the Class C Notes will be relatively more sensitive to losses on the

Receivables and the timing of these losses than the Class A Notes and Class B Notes. If the actual rate and amount of losses exceed expectations, and if amounts available under any Letter of Credit and in the Reserve Account are insufficient

to cover the resulting shortfalls on any Payment Date, it may adversely affect the yield on your Notes, and you may incur losses on your Notes.

In addition, the Notes are subject to risk because payments of principal and interest on the Notes on each Payment Date are subordinated to the payment of the Servicing Fee,

certain amounts payable to the Master Collateral Agent, the Indenture Trustee, the Owner Trustee and the Asset Representations Reviewer in respect of fees, expenses and indemnification amounts and certain amounts payable to the successor

servicer in respect of a one-time engagement fee. As a result, payments on your Notes may be delayed or you may incur losses on your Notes.

For additional information, you should refer to “—Collections on Receivables allocated to Series 2021-2, and any credit or payment

enhancement, are the only source of payment for your Notes, and if they are not sufficient, you will incur losses on your Notes” below.

|

||

|

Holders of Class B Notes and Class C Notes will be subject to greater risk of loss because of subordination

|

The Class B Notes bear a greater risk of loss than the Class A Notes and the Class C Notes bear a greater risk of loss than the Class A Notes and Class B Notes because of the

subordination features of the transaction. Payment of principal of the Class B Notes is subordinated to payment of interest on and principal of the Class A Notes. Payment of principal of the Class C Notes is subordinated to payment of

interest on and principal of the Class A Notes and Class B Notes.

If a Priority Principal Payment is required on any Payment Date (including for deposit into the Principal Funding Account, as applicable), interest on each class of Notes

will be subordinated to the payment of allocation of any such required Priority Principal Payments ranking higher in payment priority, until such Priority Principal Payments have been paid (or deposited into the Principal Funding Account, as

applicable) in full.

In addition, so long as any Class A Notes are Outstanding, failure to pay interest on the Class B Notes will not be an Event of Default. So long as any Class A Notes or

Class B Notes are Outstanding,

|

|

failure to pay interest on the Class C Notes will not be an Event of Default.

In addition, in the event the Notes are accelerated and declared to be due and payable following the occurrence of an Event of Default, no interest or principal will be paid

to the Class B Notes until the Class A Notes have been paid in full, and no interest or principal will be paid to the Class C Notes until the Class A Notes and Class B Notes have been paid in full. Only the most senior class of Notes

Outstanding, as the Controlling Class, may accelerate the Notes or direct the Indenture Trustee, as Creditor Representative, to vote in respect of Series 2021-2 in the exercise of remedies under the Master Collateral Agreement upon an Event

of Default, including in connection with the sale of the Receivables and other assets of the Trust designated to Group 1 in certain circumstances (and, in the limited circumstances described under “Description

of the Notes—Events of Default—Remedies Following Event of Default,” other Trust DPPAs designated to any other Group). Because of the subordination provisions of the transaction, the Controlling Class may have an incentive to

accelerate the Notes and/or to cause the Indenture Trustee to vote to cause the sale of the Receivables and other assets of the Trust designated to Group 1 (and, in the limited circumstances described under “Description

of the Notes—Events of Default—Remedies Following Event of Default,” other Trust DPPAs designated to any other Group), since the Controlling Class must be paid in full before any of the more junior classes are entitled to any

payments; provided, that the Receivables and other assets of the Trust designated to Group 1 (and, in the limited circumstances described under “Description of the Notes—Events of Default—Remedies Following

Event of Default,” other Trust DPPAs designated to any other Group) will only be sold by the Master Collateral Agent upon the occurrence of an Event of Default and an acceleration of the Notes in the circumstances described under “Description of the Notes—Events of Default—Remedies Following Event of Default”. The Class C Notes, as the most subordinated class of Notes, bear the greatest risk of loss.

|

||

|

Noteholders will bear all reinvestment risk resulting from principal payments on the Notes occurring earlier than expected

|

It is not anticipated that any principal payments will be made on the Notes prior to the Anticipated Redemption Date. However, if an Amortization Event occurs prior to the

Anticipated Redemption Date, the Amortization Period will begin earlier than anticipated and the Trust will pay principal of your Notes earlier than expected. During the Amortization Period, the Notes are required to be paid in full,

sequentially by class. In addition, while the Notes are expected to be redeemed on the Anticipated Redemption Date, an Optional Redemption of the Notes may occur prior to

|

|

the Anticipated Redemption Date on any date on or after the Earliest Redemption Date.

For a full description of the circumstances giving rise to an Amortization Event, see “Description of the Notes—Amortization Period.”

During the Amortization Period, the rate of payment on the Notes will also depend on the rate of payment on the Receivables, including prepayments. Faster than expected

rates of prepayments on the Receivables will cause the Trust to pay principal of your Notes more quickly during the Amortization Period. Prepayments on the Receivables will occur if:

|

|||

|

•

|

Obligors prepay all or a portion of their Receivables, including in connection with entering into an Upgrade Contract,

|

||

|

•

|

the Servicer acquires modified or impaired Receivables, including cancelled Receivables,

|

||

|

•

|

an Originator or the Servicer, as applicable reacquires Receivables that were not Eligible Receivables as of the related Acquisition Date or Designation Date, as applicable,

|

||

|

•

|

the Marketing Agent acquires, or causes the related Originator to acquire, a transferred Receivable, or the Marketing Agent makes certain payments, or requires the related

Originator to make certain payments, with respect to credits granted to an Obligor under a Receivable, or

|

||

|

•

|

the Marketing Agent prepays, or causes the related Originator to prepay, a Receivable under the terms of an Upgrade Contract.

|

||

|

A variety of economic, social and other factors will influence the rate of prepayments on the Receivables, including individual Obligor circumstances, the types of Verizon

Wireless marketing programs and those of its competitors, changes in technology, changes in customer preferences for certain wireless devices, the release of new versions of certain manufacturer’s wireless devices and changes in the demand

for wireless devices in general during celebration seasons that occur during the calendar year, and changes made by the Servicer to the order in which the Servicer applies payments and credits to an Obligor’s account. For a discussion of risks related to certain economic, social and other factors affecting individual Obligors, see “—Performance of the Receivables is uncertain and depends on many factors and may worsen in an economic downturn, which may increase the likelihood that payments on your Notes will be delayed or that you will incur

losses on your Notes” below. Verizon Wireless permits customers to cancel their Device Payment Plan Agreement, including any Receivable, for thirty

|

|||

|

(30) days after origination. In addition, Verizon Wireless has permitted, and may permit in the future, cancellations of Device Payment Plan Agreements for specified periods

of time during holiday periods. No prediction can be made about the actual prepayment rates that will occur for the Receivables. For a discussion of additional risks related to Upgrade Offers, see “—Verizon Wireless’ Upgrade Offers may

adversely impact Collections on the Receivables and the timing of principal payments, which may result in reinvestment risk” below.

You will bear all reinvestment risk resulting from principal payments on your Notes occurring earlier than expected as a result of the circumstances and factors described

above.

|

||

|

Noteholders will bear all interest rate risk resulting from principal payments on the Notes occurring later than expected

|

Other than in connection with an Optional Redemption on or after the Earliest Redemption Date, no principal will be paid on the Notes until the Amortization Period begins.

It is anticipated that the Trust will redeem the Notes by the Anticipated Redemption Date, but the Trust has no obligation to do so. Whether the Trust effects an Optional Redemption depends on the ability of the Trust to obtain cash

sufficient to pay all principal of and accrued and unpaid interest on the Notes, and any applicable Make-Whole Payments and Additional Interest Amounts due and payable on that date, in full in connection therewith. The Trust may redeem the

Notes with any amounts available to it for such purpose, including distributions on the Certificates, proceeds of the issuance of another Series, proceeds of sales of Receivables to another Verizon special purpose entity and/or a third-party

purchaser, amounts on deposit in the Principal Funding Account and the Reserve Account or capital contributions by the Certificateholders. Whether such amounts are available to the Trust will be dependent on a number of factors prevailing at

the time an Optional Redemption may be exercised, including, among other things, the market for and the value of the Receivables, prevailing interest rates, the availability of credit and general economic conditions. There can be no

assurance that the Trust will have sufficient funds to effect an Optional Redemption or that the Trust will effect an Optional Redemption on any date when it is eligible to do so.

In addition, the Trust does not have an obligation to pay a specified amount of principal of any class of Notes on any date other than the remaining Outstanding amount of

that class of Notes on its Final Maturity Date. Failure to pay principal of any class of Notes on any Payment Date will not be an Event of Default until the Final Maturity Date of that class. If the Notes have not been redeemed as of the

Anticipated Redemption Date, an Amortization Event will occur and the Amortization Period will begin.

|

|

During the Amortization Period, the Notes are required to be paid in full, sequentially by class, and no principal will be paid on any class of Notes until all senior classes

of Notes have been paid in full. If principal of your Notes is paid later than expected, it may adversely affect the yield on your Notes. You will bear all interest rate risk resulting from principal payments on your Notes occurring later

than expected.

|

||

|

An increase or decrease in the aggregate initial Note Balance of the Notes may affect the liquidity of your Notes or dilute your voting rights, as applicable

|

The Trust may offer and sell Notes of each class having an initial Note Balance that is greater than or less than the Note Balance shown on the cover page of this prospectus

depending on, among other considerations, market conditions and demand for the Notes. The aggregate initial Note Balance of the Notes is not expected to be known until pricing. The size of a class of Notes may affect liquidity of that class,

with smaller classes being less liquid than larger classes. In addition, if your class of Notes is larger than you expected, then you will hold a smaller percentage of that class of Notes and the voting power of your Notes will be diluted.

|

|

|

Because you have limited control over actions of the Trust and amendments to the transaction documents, and conflicts between classes of Notes may occur, your Notes may be

adversely affected

|

The Trust will pledge the Receivables to the Master Collateral Agent to secure payment of the Group 1 Credit Extensions. In the event that certain votes or directions may

occur or be given under the Master Collateral Agreement by a specified percentage of Group 1 Creditors, the Controlling Class will direct the Indenture Trustee, as Group 1 Creditor Representative for Series 2021-2, as to how it should vote or

direct such matters; provided that if any vote or direction under the Master Collateral Agreement requires the consent or direction of Creditor Representatives representing all Credit Extensions, or Group 1 Creditor Representatives

representing all Group 1 Credit Extensions, the Indenture Trustee, as Creditor Representative for Series 2021-2, will only vote or give such direction in accordance with the direction of 100% of the Noteholders. Any such vote or direction by

the Indenture Trustee, as Creditor Representative for Series 2021-2, at the direction of the Controlling Class, will be made on behalf of all Noteholders, notwithstanding that such action was taken solely at the direction of the Controlling

Class. In particular, the Controlling Class will be entitled to direct the Indenture Trustee to accelerate the Notes after an Event of Default, waive Events of Default (other than failure to pay principal or interest or for a breach of a

covenant or term that can only be waived with the consent of all Noteholders), vote to terminate the Servicer upon a Servicer Termination Event, vote to waive Servicer Termination Events and to direct the Indenture Trustee with respect to

certain other actions or votes in connection with remedies or rights available to Noteholders.

|

|

In addition, as described under “The Trust,” “Servicing the Receivables and the Securitization Transaction—Amendments to Transfer and

Servicing Agreement,” “Description of the Notes—Amendments to Master Collateral Agreement” and “Description of the Notes—Amendments to Indenture,”

upon the satisfaction of certain requirements, certain amendments to the Indenture and other transaction documents can be effected without the consent of any Noteholders, with the consent of only a specified percentage of Noteholders of the

Controlling Class or with the consent of a specified percentage of the Creditor Representatives of all Credit Extensions, including Credit Extensions related to Groups other than Group 1. The Controlling Class will have the right to direct

the Indenture Trustee, as Creditor Representative for Series 2021-2, as to how to vote in connection with any amendments to the transaction documents that require the consent of Creditor Representatives. There can be no assurance as to

whether or not amendments effected without a Noteholder vote will adversely affect the performance of the Notes.

Noteholders that are not part of the Controlling Class will have no right to cause the Indenture Trustee to take any of these actions or vote in favor of any of these

actions. Only the Controlling Class will have these rights. The Controlling Class may have different interests from the Noteholders of other classes and will not be required to consider the effect of its actions on the Noteholders of other

classes, which may adversely affect your rights under your Notes. In addition, Creditors of different Groups may have different interests than the Group 1 Creditors and will not be required to consider the interests of the Group 1 Creditors

(including Noteholders) in connection with the exercise of rights or remedies under the transaction documents that require the consent or direction of Creditor Representatives from all Groups, which may adversely affect the Notes.

Under the Master Collateral Agreement, a percentage of the Group 1 Creditors (through the applicable Creditor Representative, which for Series 2021-2 will be the Indenture

Trustee) may direct the Master Collateral Agent to take actions after an Event of Default, including liquidating the Receivables. These actions may be contrary to the actions that you determine to be in your best interest. The Controlling

Class may, in some circumstances, direct the Indenture Trustee to vote, on behalf of Series 2021-2, to cause the Master Collateral Agent to sell the Receivables and other assets of the Trust designated to Group 1 (and, in the limited

circumstances described under “Description of the Notes—Events of Default—Remedies Following Event of Default,” other Trust DPPAs designated to any other Group) after an Event of Default and an

acceleration of the

|

|

Notes even if the proceeds would not be sufficient to pay all of the Notes in full. In this event, if your Notes cannot be paid in full with the proceeds of a sale of the

Receivables and other assets of the Trust designated to Group 1 (and, in the limited circumstances described under “Description of the Notes—Events of Default—Remedies Following Event of Default,”

other Trust DPPAs designated to any other Group), you will incur a loss on your Notes.

|

||

|

For a more detailed description of the actions that the Controlling Class may direct, you should read “Description of the Notes—Events of

Default—Remedies Following Event of Default” and “Servicing the Receivables and the Securitization Transaction—Resignation and Termination of Servicer.”

|

||

|

Risks Related to the Receivables

|

||

|

Collections on Receivables allocated to Series 2021-2, and any credit or payment enhancement, are the only sources of payment for your Notes, and if they are not sufficient,

you will incur losses on your Notes

|

Other than in the case of an Optional Redemption, no assets or sources of funds other than the Collections on the Receivables (but not including recoveries on Written-Off

Receivables) allocated to Series 2021-2, and other credit or payment enhancement expressly set forth in this prospectus, will be available to make payments on the Notes. The Trust may own Device Payment Plan Agreements that are designated to

Groups other than Group 1, but collections on or proceeds of such Device Payment Plan Agreements will not be available to make payments on the Notes. In addition, the credit or payment enhancement for the Notes is limited. The Notes will

not be insured or guaranteed by the Sponsor, the Originators, the Additional Transferor, the Servicer, the Depositor, the Parent Support Provider, the Marketing Agent, any of their respective affiliates or any other Person. Therefore, in the

event that an Optional Redemption has not been effected by the Trust, if Collections on the Receivables allocated to Series 2021-2, together with the credit and payment enhancement for Series 2021-2, are insufficient to pay amounts due on

your Notes on any Payment Date, you will incur losses on your Notes. See also “—Payment priorities increase the risk of loss by, or delay in payment to, holders of certain classes of Notes” above.

|

|

|

Recoveries on defaulted Receivables may be limited, and recoveries on Written-Off Receivables will be unavailable to make payments on the Notes, and you may incur losses on

your Notes

|

If an Obligor defaults on a Receivable, the Servicer may be unable to collect the remaining amount due under that Receivable. In addition, recoveries on Written-Off

Receivables, including any proceeds from the sale of a wireless device securing a Receivable, will be retained by the Servicer as additional servicing compensation. Therefore, Noteholders should not rely on any recoveries on defaulted or

Written-Off Receivables as a source of funds available to make payments on the Notes. Depending on the amount, rate and timing of defaults

|

|

|

and write-offs on Receivables, you may incur losses on your Notes.

|

||

|

The addition or removal of Receivables may decrease the credit quality of the assets of the Trust designated to Group 1 securing the Notes and may result in accelerated,

reduced or delayed payments on the Notes

|

The pool of Receivables may change every day depending on the number of Device Payment Plan Agreements transferred to the Trust and designated to Group 1, any sales of

Receivables by the Trust, the amortization of the Receivables and, subject to the conditions set forth under “The Trust—Addition of Receivables,” re-designating Trust DPPAs previously designated to a

Group that does not relate to any Outstanding Credit Extensions to another Group. If the addition or removal of Receivables reduces the credit quality of the pool of Receivables, it may impact the ability of the Trust to effect an Optional

Redemption or increase the likelihood of the occurrence of an Amortization Event, and consequently increase the likelihood of accelerated, reduced or delayed payments on your Notes or that you will incur losses on your Notes. Any Receivables

transferred to the Trust and designated to Group 1 after the Closing Date will be originated by the Originators using the origination and underwriting policies and procedures described under “Origination and

Description of Device Payment Plan Agreement Receivables—Underwriting Criteria,” as in effect at the time the additional Receivables are originated, which may be updated in the normal course of Verizon Wireless’ business, as

described under “Receivables—Description of the Receivables.” Moreover, the additional Receivables may have different terms than the Receivables existing on the Closing Date, including, but not

limited to, with respect to the charging of interest, the original term, the amount of the monthly payment and/or the Obligor’s ability to prepay the related Device Payment Plan Agreement.