As filed with the Securities and Exchange Commission on May 14, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

Commission file number

(Exact Name of Registrant as Specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of Incorporation or Organization)

(Address of principal executive offices)

Tel: +

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class: |

Trading Symbol |

Name of each exchange on which registered: |

|

|

|

|

____________________

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

The number of outstanding shares as of December 31, 2023 was

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes

Note- Checking the box above will not relieve any registrant required to file reports pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-

accelerated filer or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

|

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial

Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b) ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements

included in this filing:

|

☐ U.S. GAAP |

☒ |

☐ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial

statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act).

Yes

Certain Definitions

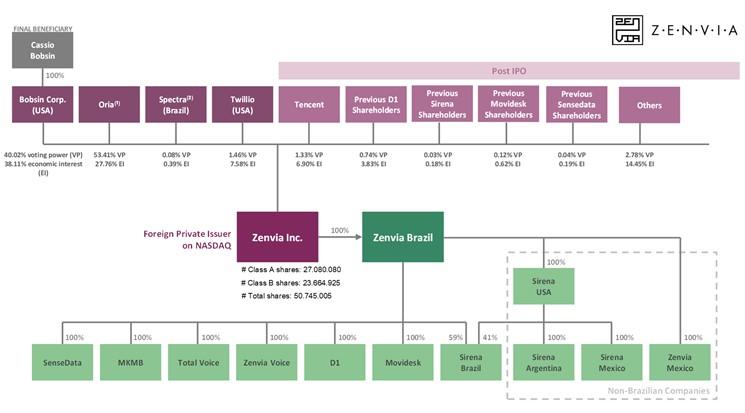

Unless otherwise indicated or the context otherwise requires, all references in this annual report to “Zenvia” or the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to Zenvia Inc., together with its consolidated subsidiaries; references to “Zenvia Brazil” refers to Zenvia Mobile Serviços Digitais S.A.

The term “Brazil” refers to the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil. All references to “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “U.S. dollar,” “U.S. dollars” or “US$” are to U.S. dollars, the official currency of the United States of America. All references to “Brazilian Central Bank” are to the Brazilian Central Bank (Banco Central do Brasil).

Financial Information

Zenvia Inc. was incorporated on November 3, 2020, as a Cayman Islands exempted company with limited liability duly registered with the Cayman Islands Registrar of Companies. Zenvia Inc. became the holding company of Zenvia Brazil, through the completion of a corporate reorganization on May 7, 2021 whereby Zenvia Brazil shares were contributed to Zenvia Inc. Until the contribution of Zenvia Brazil to us, Zenvia Inc. had not commenced operations and had only nominal assets and liabilities and no material contingent liabilities or commitments. Subsequent to the completion of the above referred corporate reorganization, our consolidated financial information include the operations of Zenvia Brazil.

We maintain our books and records in Brazilian reais, the functional currency of our operations in Brazil and the presentation currency for our consolidated financial statements. Unless otherwise noted, the consolidated financial information of Zenvia contained in this annual report is derived from our audited consolidated financial statements as of December 31, 2023 and 2022 and for each of the three years in the period ended December 31, 2023, together with the notes thereto. All references herein to “our financial statements” and “our audited consolidated financial statements” are to Zenvia’s consolidated financial statements included elsewhere in this annual report, which were, prepared in accordance with the International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB.

We have translated some of the real amounts contained in this annual report into U.S. dollars. The rate used to translate such amounts in respect of the year ended December 31, 2023 was R$4.8413 to US$1.00, which was the U.S. dollar selling rate as of December 31, 2023, as reported by the Brazilian Central Bank. The U.S. dollar equivalent information presented in this annual report is provided solely for the convenience of the reader and should not be construed as implying that the real amounts represent, or could have been or could be converted into, U.S. dollars at the above rate.

Special Note Regarding Non-GAAP Financial Measures

This annual report presents certain non-GAAP financial measures, which are not recognized under IFRS, specifically Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP Operating Profit (Loss) and Adjusted EBITDA. A non-GAAP financial measure is generally defined as one that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable GAAP measure. Non-GAAP financial measures do not have standardized meanings and may not be directly comparable to similarly-titled measures adopted by other companies. These non-GAAP financial measures are used by our management for decision-making purposes and to assess our financial and operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. We also believe that the disclosure of our Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP Operating Profit (Loss) and Adjusted EBITDA provides useful supplemental information to investors and financial analysts and other interested parties in their review of our operating performance. Potential investors should not rely on information not recognized under IFRS as a substitute for the IFRS measures of earnings, cash flows or profit (loss) in making an investment decision.

We use Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP Operating Profit (Loss) and Adjusted EBITDA, collectively, to evaluate our ongoing operations and for internal financial planning and forecasting purposes. We believe that non-GAAP financial measures, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance and facilitates period-to-period comparisons of results of operations.

Non-GAAP Gross Profit and Non-GAAP Operating Profit (Loss) are measures that exclude amortization of intangible assets acquired from business combinations. Our acquisition activities have resulted in the recognition of intangible assets, which consist primarily of client portfolio and digital platform. Finite-lived intangible assets are amortized over their estimated useful lives and are tested for impairment when events indicate that the carrying value may not be recoverable. The amortization of intangible assets acquired from business combinations is reflected in our consolidated statements of profit or loss and intangible asset amortization is an expense that typically fluctuates based on the size and timing of our acquisition activity. Accordingly, we believe that excluding the amortization of intangible assets acquired from business combinations enhances our and our investors’ ability to compare our past financial performance with our current performance and to analyze underlying business performance and trends. While amortization of intangible assets acquired from business combinations was excluded from Non-GAAP Gross Profit and Non-GAAP Operating Profit (Loss), the revenue generated by such intangible assets acquired from business combinations has not been excluded from such non-GAAP financial measures.

Non-GAAP Gross Profit, Non-GAAP Gross Margin and Non-GAAP Operating Profit (Loss)

We calculate Non-GAAP Gross Profit as gross profit plus amortization of intangible assets acquired from business combinations.

We calculate Non-GAAP Gross Margin as Non-GAAP Gross Profit divided by revenue.

We calculate Non-GAAP Operating Profit (Loss) as profit (loss) for the year adjusted by income tax and social contribution (current and deferred) and financial expenses, net plus amortization of intangible assets acquired from business combinations and expenses related to IPO grants.

Adjusted EBITDA

We calculate Adjusted EBITDA as profit (loss) adjusted by income tax and social contribution (current and deferred), financial expenses, net and depreciation and amortization, plus expenses related to IPO grants and goodwill impairment. In particular, the exclusions in calculating Adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis and such exclusions remove items that we do not consider to be indicative of our core operating performance.

Market Information

This annual report contains data related to economic conditions in the market in which we operate. The information contained in this annual report concerning economic conditions is based on publicly available information from third-party sources that we believe to be reliable. Market data and certain industry forecast data used in this annual report were derived from our management’s knowledge and our experience in the industry, internal reports and studies, where appropriate, as well as estimates, market research, publicly available information and industry publications. We obtained the information included in this annual report relating to the Brazilian communication platforms market, and more broadly, the industry in which we operate, as well as the estimates concerning market shares, through internal research, public information and publications on the industry prepared by official public sources and specialized industry sources, such as the Brazilian Central Bank, Fundação Getúlio Vargas, or FGV, Brazilian Institute for Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or IBGE, International Data Corporation, or IDC, Research Nester, Statista, Brazilian Association of Software Companies (Associação Brasileira das Empresas de Software), or ABES, and Mobile Time, amongst others.

Industry publications, governmental publications and other market sources, including those referred to above, generally state that the information they include has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have no reason to believe any of this information or these reports are inaccurate in any material respect and believe and act as if they are reliable. We have not independently verified it and they are subject to change based on various factors, including those discussed in “Item 3. Key Information—D. Risk Factors.” Governmental publications and other market sources, including those referred to above, generally state that their information was obtained from recognized and reliable sources, but the accuracy and completeness of that information is not guaranteed. Estimates of market and industry data are based on statistical models, key assumptions and limited data sampling, and actual market and industry data may differ significantly from estimated industry data. In addition, the data that we compile internally and our estimates have not been verified by an independent source. Information derived from management’s knowledge and our experience is presented on a reasonable, good faith basis. Except as disclosed in this annual report, none of the publications, reports or other published industry sources referred to in this annual report were commissioned by us or prepared at our request. Except as disclosed in this annual report, we have not sought or obtained the consent of any of these sources to include such market data in this annual report.

Rounding

We have made rounding adjustments to some of the figures included in this annual report for ease of presentation. Accordingly, certain of the numerical figures shown as totals in the tables may not be the exact sum total of the figures that precede them.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering, (b) in which we have total annual revenues of at least US$1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our shares that is held by non-affiliates exceeds US$700.0 million, as of the prior June 30, and (2) the date on which we have issued more than US$1.00 billion in non-convertible debt during the prior three-year period. As an emerging growth company, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies in the United States that are not emerging growth companies including, but not limited to, exemptions from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and any Public Company Accounting Oversight Board, or PCAOB, rules, including any future audit rule promulgated by the PCAOB (unless the SEC determines otherwise). Accordingly, the information about us available to investors will not be the same as, and may be more limited than, the information available to shareholders of a non-emerging growth company.

Forward-Looking Statements

This annual report contains certain information that constitutes forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act, that are not based on historical facts and are not assurances of future results and as such, are subject to risks and uncertainties. Many of the forward-looking statements in this annual report can be identified based on forward-looking words such as “aim,” “anticipate,” “believe,” “can,” “confident,” “continue,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “probable,” “project,” “seek,” “should,” “target,” “would,” or the opposite of these terms or other similar expressions.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur and we undertake no obligation to update publicly or revise any forward-looking statements and estimates whether as a result of new information, future events or otherwise.

Forward-looking statements include, but are not limited to, statements regarding our current belief or expectations as of the date of this annual report and estimates on future events and trends that affect or may affect our business, financial condition, results of operations, liquidity, prospects and the trading price of our Class A common shares. Although such forward-looking statements are based on assumptions and information currently available to us, which we believe to be reasonable, none of the forward-looking statements, whether expressed or implied, are indicative of or guarantee future results. Given such limitations, investors should not make any investment decision on the basis of the forward-looking statements contained herein.

Our forward-looking statements may be affected by the following factors, among others:

| ● | our ability to increase cash generation and/or obtain funding through issuance of new equity or debt to comply with short and long term liabilities; | |

| ● | our ability to achieve or maintain profitability; | |

| ● | our ability to face challenges in the expansion of our operations into new market segments and/or new geographic regions within and outside of Brazil; | |

| ● |

our ability to successfully develop, acquire and integrate new businesses as customers in new industry verticals and appropriately manage our international expansion; | |

| ● | our failure to enhance our brand recognition or maintain a positive public image; | |

| ● | our failure to implement adequate internal controls, including in the acquired companies; | |

| ● | the inherent risks related to the SaaS and CPaaS market, such as the interruption, failure or breach of our computer or information technology systems, resulting in the degradation of the quality or a decline in the use of the products and services we offer; | |

| ● | general macro- and micro-economic, political and business conditions in Brazil and other countries where we operate and the impact on our business, notably with respect to inflation and interest rates and their impact on the discretionary spending of businesses, as well as the impact of these conditions into our growth expectations and overall performance of our operations; | |

| ● |

the impact of substantial and increasing competition in our market, innovation by our competitors, and our ability to compete effectively; | |

| ● |

our compliance with applicable regulatory and legislative developments and regulations and legislation that currently apply or become applicable to our business as we continue to grow; | |

| ● |

our ability to attract and retain qualified personnel while controlling our personnel related expenses, as well as the lack of a qualified labor force (particularly developers); | |

| ● | the dependence of our business on our relationship with service providers as well with certain cloud infrastructure providers, and volatility of the costs related therewith; | |

| ● | our ability to maintain, protect and enhance our brand and intellectual property; | |

| ● | our ability to maintain our classification as an emerging growth company under the JOBS Act; | |

| ● | other factors that may affect our financial condition, liquidity and results of operations; and | |

| ● | other risk factors discussed under “Item 3. Key Information—D. Risk Factors.” |

Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those in the forward-looking statements. The accompanying information contained in this annual report on Form 20-F, including without limitation the information set forth under “Item 5. Operating and Financial Review and Prospects,” identifies important factors that could cause such differences. In light of the risks, uncertainties and assumptions associated with forward-looking statements, investors should not place undue reliance on any forward-looking statements. Additional risks that we may currently deem immaterial or that are not presently known to us could also cause the forward-looking events discussed in this annual report on Form 20-F not to occur.

Our forward-looking statements speak only as of the date of this annual report on Form 20-F, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

Not applicable.

Not applicable.

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Certain Risks Relating to Our Business and Industry

We have substantial liabilities and may be exposed to liquidity constraints, which could adversely affect our financial condition and results of operations.

In the context of our inorganic growth through acquisitions, we have recorded in our consolidated financial statements as of December 31, 2023 an amount of R$294,703 thousand as liabilities from acquisitions (being R$134,466 thousand recorded as current liabilities and R$160,237 thousand recorded as non-current liabilities), representing 35.8% of total liabilities (current and non-current liabilities) as of December 31, 2023. Also, as of December 31, 2023, our loans, borrowings and debentures amounted to R$87,796 thousand, of which R$36,191 thousand was current and R$51,605 thousand was non-current, while our existing cash and cash equivalents, as of December 31, 2023, amounted to R$63,742 thousand.

If, for any reason, we face difficulties in increasing our cash generation and/or accessing financing, we may be unable to timely meet our principal and interest payment obligations in general. See “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Liquidity.”

We have a history of net losses, which might continue in the near future, and our expenses might surpass our Adjusted EBITDA, which could prevent us from achieving or maintaining profitability.

We have incurred net losses in the past three years, including a net loss of R$60,771 thousand for the year ended December 31, 2023, R$243,025 thousand for the year ended December 31, 2022 and R$44,646 thousand for the year ended December 31, 2021. We may not succeed in increasing our Adjusted EBITDA to be profitable, as we seek to continue to expend significant funds to expand our marketing efforts to attract new customers, to develop and enhance our products and for general corporate purposes, including operations, upgrading our infrastructure and expanding into new geographical markets. To the extent we successfully increase our user base for our SaaS segment, we may also incur increased losses because costs associated with acquiring customers are generally incurred up front and may not be recovered from our customers, while the nature of the SaaS services refers to license subscriptions for the use of Zenvia platforms, where it is recognized proportionally to the time used. Our efforts to grow our business may be costlier than we expect, and we may not be able to increase revenue from our customers in a sufficient manner to offset our higher operating expenses. We may incur significant losses in the future for a number of reasons, including as a result of the other risks described herein, and unforeseen expenses, difficulties, complications, delays and other unknown events. If we are unable to achieve and sustain profitability, the value of our business and Class A common shares may significantly decrease. Furthermore, it is difficult to predict the size and growth rate of our market, customer demand for our platform, user adoption and renewal of our platform, the entry of competitive products and services, or the success of existing competitive products and services. As a result, we may not achieve or maintain profitability in future periods. If we fail to grow our revenues sufficiently to keep pace with our related investments and other expenses, our business would be harmed.

The market for our products and platform is relatively new and unproven, may decline or experience limited growth and is dependent on businesses continuing to adopt our platform and use our products.

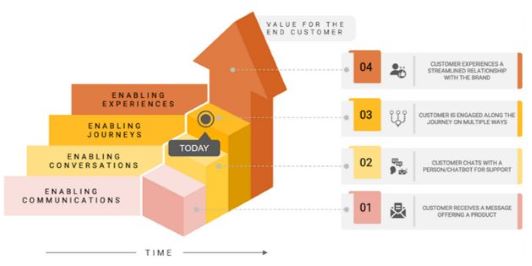

We develop and provide a cloud-based communications platform that enables businesses to integrate several communication capabilities (including SMS, WhatsApp, Voice, WebChat and Facebook Messenger) into their software applications, empowering them to simplify communications along their end-consumers journey. This market is relatively new, unproven and subject to a number of risks and uncertainties, including changes to end-consumer behavior, technologies, products and industry standards. The utilization of tools such as APIs and Bots by businesses to build, foster and simplify communications with their end-consumer is still relatively new, and businesses may not recognize the need for, or benefits of, our products and platform. Moreover, if they do not recognize the need for and benefits of our products and platform, they may decide to adopt alternative products and services to satisfy some portion of their business needs. In order to grow our business and extend our market position, we intend to focus on educating current and potential customers about the benefits of our products and platform, expanding the functionality of our products and bringing new technologies to market to increase market acceptance and use of our platform. Our ability to expand the market that our products and platform address depends upon a number of factors, including the cost, performance and perceived value associated with such products and platform. The market for our products and platform could fail to grow significantly or there could be a reduction in demand for our products as a result of a lack of acceptance by businesses, technological challenges, competing products and services, decreases in spending by current and prospective customers, and weakening macroeconomic conditions, among other causes. If our market does not experience significant growth or demand for our products decreases, our business, results of operations and financial condition could be materially adversely affected.

63.5% of our revenue for the year ended December 31, 2023 was derived from our CPaaS segment and a substantial part of such revenue is generated from our SMS text messaging service. A reduction in our revenue from this service could materially adversely affect our operation results, cash flows and liquidity.

A substantial portion of our revenue is currently dependent on our SMS text messaging service. As a result, a reduction in revenue from this source of income, whether due to increased competition, cost increase from network service providers, adverse market conditions or a general reduction in demand for SMS text messaging services or other factors (including our inability to generate revenue from the other products we offer to our customers), could materially adversely affect our operational results, cash flows and liquidity. See also “—If we cannot keep pace with rapid developments and changes in our industry and fail to continue to acquire new customers, the use of our products and services could cease to grow or decline and, thereby, adversely affect our revenues, business and prospects.”

A significant portion of our revenue is currently concentrated on our outlier customers and an economic slowdown affecting these customers could lead to decreased demand for our products and services, which could adversely affect us.

A significant portion of our revenue is currently concentrated in our outlier customers, which are our top 10 largest customers in terms of revenue. For the years ended December 31, 2023, 2022 and 2021, 33.4%, 37.0% and 34.5%, respectively, of our revenue was derived from such customers. Of our outlier customers, our single top customer alone accounts for more than 10% of our revenues. For the years ended December 31, 2023, 2022 and 2021, 10.2%, 12.5% and 13.0%, respectively, of our revenue was derived from such single top customer. Therefore, a slowdown in the industries in which such customers are concentrated due to market forces, macroeconomic conditions or regulatory changes could result in decreased demand for our products and services. In particular, such customers are particularly vulnerable to the effects of adverse macroeconomic conditions due to the corresponding impacts that macroeconomic factors typically have on end-consumer spending. Such effects may affect our revenue volumes, results of operations and profit margins. For example, certain of our outlier customers reduced the usage of our SMS text messaging services in April 2020 as a cost-saving initiative designed to mitigate the impacts of COVID-19 pandemic on their businesses (the usage of such SMS services was restored to comparable levels in the succeeding six-month period). In addition, any adverse market forces affecting the industry in which our customers are currently concentrated also increases our counterparty risk as it may heightens their risk of default.

If we cannot keep pace with rapid developments and changes in our industry and fail to continue to acquire new customers, the use of our products and services could cease to grow or decline and, thereby, adversely affect our revenues, business and prospects.

The Customer Experience (CX) SaaS platform market in which we compete is subject to rapid and significant technological changes, new product and service roll outs, evolving industry standards and changing customer needs. New technologies can disrupt SaaS platforms, making them outdated and ineffective to attend to increasing customer demands.

Also, our CPaaS platform is currently substantially dependent on our SMS text messaging services. Although we believe there is still a growing market for SMS text messaging services, there has been an increase in alternative messaging channels that use data connections such as internet protocol based, or IP-based, messaging services, e.g., WhatsApp, Facebook Messenger, WeChat, Telegram and Line, which could impact our growth in CPaaS.

In order to remain competitive and continue to acquire new customers, we are continually involved in a number of projects to develop new products and services, in both CPaaS (communications platform as a service) and SaaS (software as a service) segments. These projects carry risks, such as cost overruns, delays in delivery, performance problems and lack of customer adoption. Any delay in the delivery of new services or the failure to differentiate our services or to accurately predict and address market demand could render our services less desirable, or even obsolete, to our customers. Furthermore, despite the evolving market for CX communications, the market may not continue to develop rapidly enough for us to recover the costs we incur in developing new services targeted at this market.

In addition, we deliver services designed to simplify the way that businesses connect with their end-consumers. Any failure to deliver an effective and secure service or any performance issue that arises with a new service could result in significant processing or reporting errors or other losses. As a result of these factors, our development efforts could result in increased costs and we could also experience a loss in business that could reduce our earnings or could cause a loss of revenue if scheduled new services are not delivered to our customers on a timely basis or do not perform as anticipated. We also, and may in the future, rely in part on third parties, including some of our existing and potential competitors, for the development of, and access to, new technologies. Our future success will depend in part on our ability to develop or adapt to technological changes and evolving industry standards. We cannot predict the effects of technological changes on our business. If we are unable to develop, adapt or access technological changes or evolving industry standards necessary to meet our customers’ needs on a timely and cost-effective basis, our business, financial condition and results of operations could be materially adversely affected.

Furthermore, our competitors may have the ability to devote more financial and operational resources than us to the development of new technologies, products and services. If successful, their development efforts could render our services less desirable to customers, resulting in the loss of customers or a reduction in the fees we could generate from our offerings.

We expect to be increasingly dependent on WhatsApp, since it has become a preferred channel of communication in Brazil and elsewhere in Latin America. Since WhatsApp is notably strict about the manner in which companies are allowed to interact with WhatsApp users, changes in the policies or in the terms and conditions of use of this communication channel might also adversely affect market potential and attractiveness for WhatsApp based solutions in the event such changes result in a decrease of possible use cases or result in increases on message content restrictions. For instance, in 2021, WhatsApp made changes to the conversation-based pricing policy of its business platform. As a result of these changes, certain interactions between businesses and their end-customers, which were previously free of charge, may now be subject to charges under certain conditions. This change had no significant impact in our operations in 2022 and 2023, but we cannot guarantee that a future increase in costs in the usage of WhatsApp will not adversely impact our results of operations or the expected growth derived from the usage of this channel of communication or that we will be able to pass such costs onto our customers.

Failure to set optimal prices for both our SaaS solutions and CPaaS solutions could adversely impact our business, results of operations and financial condition.

We charge our CPaaS customers based on the use of our products. One of our pricing challenges is that our costs related to network service providers, on whose networks we transmit SMS communications, which is our main product within the CPaaS segment, can vary given certain elements that may be difficult for us to predict, such as pricing increases upon renewal of our agreements with such providers and/or annual adjustments on SMS fees as a result of inflation or otherwise, that we cannot pass onto our customers and/or certain minimum take or pay SMS volume purchase obligations imposed on us by network services providers and the volume of which we cannot guarantee will be contracted by our new or existing customers. Additionally, fees paid by us to network service providers can be also affected by the enactment of new rules and regulations (including an increased amount of applicable taxes or governmental fees). This can result in us incurring increased costs that we may be unable or unwilling to pass through to our customers, which could adversely impact our business, results of operations and financial condition. For more information about our relationship with network service providers, see “Item 10. Additional Information—C. Material Contracts.”

Our SaaS solutions are mostly charged based on a subscription-based revenue model. We may fail to set pricing for subscriptions at levels appropriate to maintain our revenue streams or our customers may choose to deploy products from our competitors that they believe are more favorably priced. Similarly, we may fail to accurately predict subscription renewal rates or their impact on our operating results. Given that revenue from subscriptions is recognized for our services over the term of the subscription, downturns or upturns in sales may not be reflected immediately in our results.

Further, as competitors introduce new products or services at prices that are more competitive than ours for similar products and services, we may be unable to attract new customers or retain existing customers based on our historical pricing. As we expand internationally, we also must determine the appropriate price to enable us to compete effectively internationally. In addition, if the mix of products sold changes, including the ongoing shift to IP-based products (such as WhatsApp and Facebook Messenger), then we may need to, or choose to, revise our pricing to remain competitive. As a result, in the future we may be required or choose to reduce our prices or change our pricing model, which could adversely affect our business, results of operations and financial condition.

We may require additional financing to support our future capital requirements and we may not be able to secure such financing on favorable terms or at all. Our current level of indebtedness could make it more difficult or expensive to refinance our maturing debt and/or incur new debt.

We intend to continue to make investments to support our business and may require additional funds to support our capital requirements. In particular, we may seek additional funds to develop new products and enhance our platform and existing products, expand our operations, including our sales and marketing departments and our presence outside of Brazil, improve our infrastructure or acquire complementary businesses, technologies, services, products and other assets. Accordingly, we may need to engage in equity or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our shareholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our Class A common shares. Any debt financing that we may secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth, scale our infrastructure, develop product enhancements and to respond to business challenges could be significantly impaired, and our business, results of operations and financial condition may be adversely affected.

Our current level of indebtedness could affect our credit rating and our ability to obtain any necessary financing in the future and may increase our cost of borrowing. In addition, our level of indebtedness could make it more difficult to refinance our existing indebtedness and could make us more vulnerable in the event of a downturn in our business. In these and other circumstances, servicing our indebtedness may use a substantial portion of our cash flow from operations, which could adversely affect us as well as to fund our operations, working capital and capital expenditures necessary for the maintenance and expansion of our business activities. As of December 31, 2023, our total loans, borrowings and debentures outstanding was R$87,796 thousand, comprised of R$36,191 thousand of current liabilities and R$51,605 thousand of non-current liabilities.

If we fail to anticipate and adequately respond to rapidly changing technology, evolving industry standards, changing regulations, and changing consumer trends, requirements or preferences, our products from both the SaaS and CPaaS segments may become less competitive, which may adversely affect our sales.

We need to understand our consumers’ behavior and needs in order to prepare for the next shift in the relationship between businesses and their end-consumers so that we are well positioned to propose and develop new products to support this change in consumer trends and behavior. Additionally, we need to understand the communication channel of choice between businesses and their end-consumers throughout all phases of a customer journey so that we are in a position to quickly develop and deploy the communication channel that businesses need to most effectively communicate with their end-consumers.

We cannot guarantee that we will always be able to offer the products and services sought by our customers. We are subject to potential changes to consumer habits as well as to demand for products and services by our customers (and the end-consumers of our customers). This requires us to adapt to their preferences on an ongoing basis. Accordingly, we may not be able to anticipate or respond adequately to changes in the habits of our consumers (and the habits of the end-consumers of our customers), which may adversely affect our sales. In addition, we cannot guarantee that the habits of our customers (and the habits of the end-consumers of our customers) will not change due to factors such as limitations or restrictions on the movement of people, including due to the impacts of an actual or possible pandemic or epidemic. In addition, if there are changes in customer habits, we cannot guarantee that we will be efficient and effective in adapting to meet those habits.

The market for communications in general, and cloud communications in particular, is subject to rapid technological change, (such as the adoption of artificial intelligence in our product offerings), evolving industry standards, changing regulations, as well as changing customer needs, requirements and preferences. We may not be able to adapt quickly enough to meet our customers’ requirements, preferences and industry standards. We may face obstacles in our search for a digital transformation related to corporate culture, business complexity and the lack of processes that make employee collaboration and integration feasible. These challenges may limit the growth of our platform and adversely affect our business and results of operations. The success of our business will depend, in part, on our ability to adapt and respond effectively to these changes on a timely basis. If we are unable to develop new products that satisfy our customers and provide enhancements and new features for our existing products that keep pace with rapid technological and industry change and applicable industry standards, our business, results of operations and financial condition could be adversely affected. If new technologies emerge that are able to deliver competitive products and services at lower prices than ours and more efficiently, more conveniently or more securely, such technologies could adversely impact our ability to compete effectively. If we do not respond to the urgency in meeting new standards and practices, our platform and our own technology may become obsolete and materially adversely affect our results.

In this context, as a result of our use of artificial intelligence technologies into our business, the risks and unintended consequences in social, ethical and regulatory issues related to the use of artificial intelligence / generative artificial intelligence in our product offerings may result in reputational harm and adversely impact our results of operations. Most artificial intelligence solutions are evolving and are not infallible, and issues with data sourcing, technology integration, decision-making bias of artificial intelligence algorithms, security challenges, protection of privacy for personal identifiable information, content labeling and an effective use governance has not yet been perfected. While efforts are being made to deploy artificial intelligence responsibly with appropriate controls, our ability to do so effectively cannot be guaranteed. If our solutions incorporating artificial intelligence are flawed, they may cause harm to our clients or their customers and could impact our reputation and results of operations. The regulatory landscape surrounding artificial intelligence technologies is rapidly evolving, and how these technologies will be regulated remains uncertain. Such regulations may result in significant risks and operational costs which would impact our profitability and results of operations

Degradation of the quality of the products and services we offer could diminish demand for our products and services, adversely affecting our ability to attract and retain customers, harming our business and results of operations and subjecting us to liability.

Our customers expect a consistent level of quality in the provision of our products and services. Our customers use our products for important aspects of their businesses, and any errors, defects or disruptions to our products and any other performance problems with our products could damage our customers’ businesses and, in turn, harm our brand and reputation and erode customer trust. Although we regularly update our products, they may contain undetected errors, failures, vulnerabilities and bugs when first introduced or released. Real or perceived errors, failures or bugs in our products could result in negative publicity, loss of, or delay in, market acceptance of our platform, loss of competitive position, lower customer retention or claims by customers for losses sustained by them. In such events, we may be required, or may choose, for customer relations or other reasons, to expend additional resources in order to help correct the problem, which may result in increased costs to us. Any failure to maintain the high quality of our products and services, or a market perception that we do not maintain a high quality service, could erode customer trust and adversely affect our reputation, business, results of operations and financial condition.

If we are not able to maintain and enhance our brand and increase market awareness of our company and products, our business, results of operations and financial condition may be adversely affected.

We believe that maintaining and enhancing the “Zenvia” brand identity and increasing market awareness of our company and products, is critical to achieving widespread acceptance of our platform, to strengthen our relationships with our existing customers and to our ability to attract new customers. The successful promotion of our brand will depend largely on our continued marketing efforts, our ability to continue to offer high quality products, and our ability to successfully differentiate our products and platform from competing products and services. Our brand promotion activities may not be successful or yield increased revenue.

Negative publicity about us, our products or our platform could materially and adversely impact our ability to attract and retain customers, our business, results of operations and financial condition.

The promotion of our brand also requires us to make substantial expenditures, and we anticipate that these expenditures will increase as our market becomes more competitive and as we expand into new markets. To the extent that these activities increase revenue, this revenue may not be enough to offset the increased expenses we incurred. If we do not successfully maintain and enhance our brand, our business may not grow, our pricing power may be reduced relative to our competitors and we may lose customers, all of which would adversely affect our business, results of operations and financial condition.

Our segments (CPaaS and SaaS) depend on customers increasing their use of our products, and any loss of customers or decline in their use of our products could materially and adversely affect our business, results of operations and financial condition. In addition, our customers generally do not have long-term contractual arrangements with us and may cease to use our products at any time without penalties or termination charges.

Our ability to grow and generate incremental revenue from both our segments (CPaaS and SaaS) depend, in part, on our ability to maintain and grow our relationships with existing customers (including any customers acquired through our acquisitions) and to have them increase their usage of our platform. Customers are charged based on the actual usage volume of our products, and if they do not increase their use of our products, our revenue may decline and our results of operations may be adversely affected. For more information as to our product offerings, see “Item 4. Information on the Company—B. Business Overview—Our Customers.”

Most of our customers, both from CPaaS and SaaS, do not have long-term contractual arrangements with us and may reduce or cease their use of our products at any time without penalty or termination charges provided they give us thirty days prior written notice. Customers may terminate or reduce their use of our products for a number of reasons, including if they are not satisfied with our products, the value proposition of our products or our ability to meet their needs and expectations. We cannot accurately predict customers’ usage levels and the loss of customers or reductions in their usage levels of our products may each have a negative impact on our business, results of operations and financial condition. If a significant number of customers cease using, or reduce their usage of our products, we may be required to spend significantly more on sales and marketing initiatives than we currently plan to spend in order to maintain or increase revenue from customers. Such additional sales and marketing expenditures could adversely affect our business, results of operations and financial condition. See “—A significant portion of our revenue is currently concentrated on our outlier customers and an economic slowdown affecting these customers could lead to decreased demand for our products and services, which could adversely affect us.”

If we are unable to increase adoption of our products by customers and attract new customers, our business, results of operations and financial condition may be adversely affected.

Our ability to increase our customer base and achieve broader market acceptance of our products will depend, in part, on our ability to effectively organize, focus and train our sales and marketing personnel. Also, the decision by our customers to adopt our products may require the approval of multiple technical and business decision makers, including legal, security, compliance, procurement, operations and IT. In addition, sales cycles for businesses (particularly for large businesses) are inherently more complex and these complex and resource intensive sales efforts could place additional strain on our product and engineering resources. Furthermore, businesses, including some of our current customers, may choose to develop their own solutions that do not include our products. They may also demand price reductions as their usage of our products increases, which could have an adverse impact on our gross margin.

In addition, in order to grow our business, we must continue to attract new customers in a cost-effective manner. We use a variety of marketing channels to promote our products and platform, such as events and webinars, as well as search engine marketing and optimization initiatives. We periodically adjust the mix of our other marketing programs such as regional customer events, email campaigns and public relations initiatives. If the costs of the marketing channels we use increase significantly, we may choose to use alternative and less expensive channels, which may not be as effective as the channels we currently use. As we add to or change the mix of our marketing strategies, we may need to expand into more expensive channels than those we are currently in, which could adversely affect our business, results of operations and financial condition. We will incur marketing expenses before we are able to recognize any revenue that the marketing initiatives may generate, and these expenses may not result in increased revenue or brand awareness. If we are unable to attract new customers in a cost-effective manner, our business, results of operations and financial condition would be adversely affected.

Our number of active customers for the years ended December 31, 2023, 2022 and 2021 was 12,929, 13,336 and 11,827, respectively. We cannot guarantee that we will be able to increase the number of our customers and revenues generated within the active customer base. Our Net Revenue Expansion (NRE) rate was 92.4%, 107.7% and 122.4% for the years ended December 31, 2023, 2022 and 2021, respectively. Net Revenue Expansion (NRE) rate is a metric that indicates how much revenue has grown with the same customers, which can come from organic growth of one product (i.e., an increase in the volume purchased of the same product) and also cross-selling (i.e., customer base using more than one product). For more information about our Net Revenue Expansion (NRE) rate, see “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Principal Factors Affecting Our Results of Operations— Expansion Strategy and Net Revenue Expansion (NRE) Rate.”

There can be no assurance that we will be able to sustain or grow our customer base or sustain or improve overtime our Net Revenue Expansion (NRE) rate.

Potential customers of our CPaaS and SaaS segments may be reluctant to switch to a new vendor, which may adversely affect our growth.

As we expand our offerings into new products (such as IP-based products), our potential customers may be concerned about disadvantages associated with switching platform providers, such as a loss of accustomed functionality, increased costs and business disruption. For prospective customers, switching from one vendor of products similar to those provided by us (or from an internally developed system) to a new vendor may be a significant undertaking. As a result, certain potential customers may resist changing vendors.

We strive to attract new customers by constantly refining and evolving our products to enhance customer experiences. We are expanding features to educate users on the functionality and operation of our products, and we are directing our efforts toward a consulting approach focused on enterprise clients. This involves gaining a better understanding of customer needs and more effectively customizing our products to align with customers’ specific businesses. However, there can be no assurance that our approach to overcome potential customer reluctance to change vendors will be successful, which may adversely affect our growth.

If we do not develop enhancements to our products and introduce new products that achieve market acceptance, our business, results of operations and financial condition could be adversely affected.

Our ability to attract new customers and increase revenue from existing customers depends in part on our ability to enhance and improve our existing products, increase adoption and usage of our products and introduce new products. The success of any product enhancements or new products depends on several factors, including timely completion, adequacy to customer needs, adequate quality testing, actual performance quality, market-accepted pricing levels and overall market acceptance. We cannot guarantee that product enhancements and new products will perform as well as or better than our existing offerings. Product enhancements and new products that we develop may not be introduced in a timely or cost-effective manner, may contain errors or defects, may have interoperability difficulties with our platform or other products or may not achieve the broad market acceptance necessary to generate significant revenue. We also have invested, and may continue to invest, in the acquisition of complementary businesses, technologies, services, products and other assets that expand the products that we can offer our customers. For instance, since the completion of our initial public offering, we completed the acquisition of Sensedata Tecnologia Ltda, or SenseData, One To One Engine Desenvolvimento e Licenciamento de Sistemas de Informática S.A. - Direct One, or D1, and Movidesk Ltda., or Movidesk, in order to create the basis for the solutions provided by our SaaS business segment. We also intend to continue developing new SaaS services, which may require us to maintain and/or increase a developers team and, therefore, may lead to higher expenses in research and development. For instance, in February 2023, we integrated ChatGPT technology into our mass texting solution, Zenvia Attraction, to provide increasingly personalized and efficient suggestions in the composition of messages and in May 2023, we also integrated ChatGPT technology with our chatbot tool, which improves certain solutions in our SaaS segment with enterprise customers. There can be no assurance that these investments and any future investments will result in products or enhancements that will be accepted by existing or prospective customers. Our ability to generate additional usage of products by our customers may also require increasingly sophisticated and more costly sales efforts and result in a longer sales cycle. If we are unable to successfully enhance our existing products to meet evolving customer requirements, increase adoption and usage of our products, develop new products, or if our efforts to increase the usage of our products are more expensive than we expect, our business, results of operations and financial condition would be adversely affected.

The market in which we participate is intensely competitive, and if we do not compete effectively, our business, results of operations and financial condition could be adversely affected.

The market for cloud communications is rapidly evolving, significantly fragmented and highly competitive, with relatively low barriers to entry in some segments. The principal competitive factors in our market includes our ability to offer solutions embedded in the main channels of communications, the ease of integration and programmability of our solutions, product features, cost-benefit, platform scalability, reliability, deliverability, security and performance, brand awareness, reputation, the strength of sales and marketing efforts, customer support and customer service experience, as well as the cost of deploying and using our products.

Our competitors fall into four primary categories:

| ● | communication channels providers such as Infobip, Sinch and Twilio; | |

| ● | regional network service providers that offer limited customer functionality together with their own physical infrastructure; | |

| ● | smaller software companies that compete with certain of our products; and | |

| ● | software-as-a-service, or SaaS, companies and cloud platform vendors that offer applications and platforms, mainly offerings of integrated communication channels. |

Some of our competitors and potential competitors are larger than us and have greater name recognition, longer operating histories, more established customer relationships, larger budgets and significantly greater resources than we do. In addition, they have the operating flexibility to bundle competing products and services at little or no perceived incremental cost, including offering them at a lower price as part of a larger sales transaction. As a result, our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. In addition, some competitors may offer products or services that address one or a limited number of functions at lower prices, with greater depth than our products or in different geographies. Our current and potential competitors may develop and market new products and services with comparable functionality to our products, and this could lead to us having to decrease prices in order to remain competitive. Customers utilize our products in many ways and use varying levels of functionality that our products offer or are capable of supporting or enabling within their applications. Customers that use many of the features of our products or use our products to support or enable core functionality for their applications may have difficulty or find it impractical to replace our products with a competitor’s products or services, while customers that use only limited functionality may be able to more easily replace our products with competitive offerings. Our current or prospective customers (as well as some of our sales channel partners) may also choose to replicate some of the functionality our products provide, which may limit or eliminate their demand for our products.

With the introduction of new products and services and new market entrants, we expect competition to intensify in the future. In addition, some of our customers may choose to use our products and our competitors’ products simultaneously. Furthermore, our customers and their end-consumers may choose to adopt other forms of electronic communications or alternative communication platforms, which could harm our business, results of operations and financial condition.

With the completion of the acquisitions of Rodati Motors Corporation, or Sirena, D1, SenseData and Movidesk, we expanded the scope of our offerings and now also offer to our customers multichannel communications, generation of variable documents, authenticated message delivery and contextualized conversational experiences, including customer service solutions to define workflows, by integrating communication channels and monitoring tickets (through dashboards and reports), as well as communication actions and specific 360º customer journeys, from our acquired companies. As we expand the scope of our products, we may face additional competition. If one or more of our competitors were to merge or partner with other competitors, the change in the competitive landscape could also adversely affect our ability to compete effectively. In addition, some of our competitors have lower listed prices than us, which may be attractive to certain customers even if those products have different or lesser functionality. If we are unable to maintain our current pricing due to competitive pressures, our margins will be reduced and our business, results of operations and financial condition would be adversely affected. In addition, pricing pressures and increased competition generally could result in reduced revenue, reduced margins, increased losses or the failure of our products to achieve or maintain widespread market acceptance, any of which could harm our business, results of operations and financial condition.

We have experienced rapid growth and if we fail to manage effectively our business growth with the available workforce our business, results of operations and financial condition could be adversely affected.

We have experienced growth in our business in terms of employees and customers. For example, our consolidated headcount was 1,076, 1,191, 1,085 and 470 as of December 31, 2023, 2022 2021 and 2020, respectively, a decrease of 9.7% to December 31, 2023 from December 31, 2022, an increase of 9.8% to December 31, 2022 from December 31, 2021 and an increase of 131% from December 31, 2020.

Despite the reduction in our international headcount, we are working towards expanding our brand presence outside of Brazil. We currently have offices in Argentina, the United States and Mexico and are in the process of reaching/acquiring customers in other countries in Latin America and internationally.

We may fail to effectively execute, or achieve the stated goals of, the reduction in workforce or our key strategic priorities. Our plans may also change as we continue to refocus on our key priorities. These actions may take more time than we currently estimate and we may not be able to achieve the cost-efficiencies sought. In addition, the reduction in workforce may negatively impact employee morale for those that are not directly impacted, which may increase employee attrition and hinder our ability to achieve our key priorities. Any failure to achieve the expected benefits from the reduction in workforce or from other recent management and personnel related changes could adversely affect our stock price, financial condition and ability to achieve our key priorities.

We believe that our corporate culture has been a critical component of our success. We have invested substantial time and resources in building our team and nurturing our culture. As we expand our business outside Brazil, namely Argentina, Mexico and the United States, and mature as a public company, we may find it difficult to maintain our corporate culture while managing this growth. Any failure to manage growth and organizational changes in our business in a manner that preserves the key aspects of our culture could harm our future prospects, including our ability to recruit and retain personnel, and effectively focus on and pursue our corporate objectives. This, in turn, could adversely affect our business, results of operations and financial condition.

In addition, as we have rapidly grown, our organizational structure has become more complex. In order to manage these increasing complexities, we will need to continue to expand and adapt our operational, financial and management controls, as well as our reporting systems and procedures. The expansion of our systems and infrastructure will require us to commit substantial financial, operational and management resources before our revenue increases and we cannot guarantee that our revenue will increase.

Furthermore, if we continue to grow, our ability to maintain reliable service levels for our customers could be affected. If we fail to achieve the necessary level of efficiency as we grow, our business, results of operations and financial condition could be adversely affected.

Finally, as we continue to grow, we expect to continue to spend substantial financial and other resources on, among other things:

| ● | investments in our engineering team, improvements in security and data protection, the development of new products, features and functionality and enhancements to our platform; | |

| ● | sales and marketing, including the continued expansion of our direct sales and marketing programs, especially for businesses outside of Brazil; | |

| ● | expansion of our operations and infrastructure, both domestically and internationally; and | |

| ● | general administration, including legal, accounting and other expenses related to being a public company. |

These investments may not result in increased revenue or the growth of our business. Accordingly, we may not be able to generate sufficient revenue to offset our expected cost increases and achieve and sustain profitability. If we fail to achieve and sustain profitability, our business, results of operations and financial condition would be adversely affected.

Our results may fluctuate, and if we fail to meet securities analysts’ and investors’ expectations, then the trading price of our Class A common shares and the value of an investor’s investment could decline substantially.

Our results of operations, including the levels of our revenue, cost of services, gross profit and other operating (expenses) income may vary significantly in the future. These fluctuations may result from a variety of factors, many of which are outside of our control and may be difficult to predict and may or may not fully reflect the underlying performance of our business. If our results of operations, forward-looking quarterly and annual financial guidance or expected key metrics fall below the expectations of investors or securities analysts, then the trading price of our Class A common shares could decline substantially. Some of the important factors that may cause our results of operations to fluctuate from quarter to quarter include:

| ● | our ability to retain and increase revenue from existing customers and attract new customers; | |

| ● | fluctuations in the amount of revenue from our customers; | |

| ● | our ability to attract and retain businesses as customers; | |

| ● |

our ability to introduce new products and enhance existing products; | |

| ● | competition and the actions of our competitors, including pricing changes and the introduction of new products, services and geographies; | |

| ● | changes in laws, industry standards, regulations or regulatory enforcement, in Brazil or internationally, including Signature-based Handling of Asserted Information Using to KENs/Secure Telephone Identity Revisited (SHAKEN/STIR), a technology framework intended to combat unwanted robocalls and fraudulent caller ID spoofing, and other robocalling prevention and anti-spam standards as well as enhanced Know-Your-Client processes that impact our ability to market, sell or deliver our products; | |

| ● | the number of new employees; | |

| ● | changes in network service provider fees that we pay in connection with the delivery of communications on our platform; | |

| ● | changes in cloud infrastructure fees that we pay in connection with the operation of our platform; | |

| ● | changes in our pricing as a result of our optimization efforts or otherwise; | |

| ● | reductions in pricing as a result of negotiations with our larger customers; | |

| ● | the rate of expansion and productivity of our sales force; | |

| ● | changes in the size and complexity of our customer relationships; | |

| ● | the length and complexity of the sales cycle for our services, especially for sales to larger businesses, as well as government and regulated businesses; | |

| ● | change in the mix of products that our customers use; | |

| ● | change in the revenue mix of Brazil and international products; | |

| ● | the amount and timing of operating costs and capital expenditures related to the operations and expansion of our business, including investments in our international expansion, additional systems and processes and research and development of new products and services; | |

| ● |

significant security breaches of, technical difficulties with, or interruptions to, the delivery and use of our products on our platform; | |

| ● |

the timing of customer payments and any difficulty in collecting accounts receivable from customers; | |

| ● |

general economic conditions that may adversely affect a prospective customer’s ability or willingness to adopt our products, delay a prospective customer’s adoption decision, reduce the revenue that we generate from the use of our products or affect customer retention; | |

| ● | changes in foreign currency exchange rates and our ability to effectively hedge our foreign currency exposure; | |

| ● | sales tax and other tax determinations by authorities in the jurisdictions in which we conduct business; | |

| ● | the impact of new accounting pronouncements; and | |

| ● | expenses in connection with mergers, acquisitions or other strategic transactions and the follow-on costs of integration, as well as potential goodwill and intangible asset impairment charges and amortization associated with acquired businesses. |

The occurrence of one or more of the foregoing and other factors may cause our results of operations to vary significantly. As such, we believe that quarter-to-quarter comparisons of our results of operations may not be meaningful and should not be relied upon as an indication of future performance. In addition, a significant percentage of our operating expenses is fixed in nature and is based on forecasted revenue trends. Accordingly, in the event of a revenue shortfall, we may not be able to mitigate the negative impact on our income (loss) and margins in the short term. If we fail to meet or exceed the expectations of investors or securities analysts, then the trading price of our Class A common shares could fall substantially, and we could face costly lawsuits, including securities class action suits.

Additionally, global pandemics such as COVID-19 as well as certain large scale events, such as major elections and sporting events, can significantly impact usage levels on our platform, which could cause fluctuations in our results of operations. We expect that significantly increased usage of all communications platforms, including ours, during certain seasonal and one-time events could impact delivery and quality of our products during those events. Such annual and one-time events may cause fluctuations in our results of operations and may impact both our revenue and operating expenses.

If we are unable to develop and maintain successful relationships with sales channel partners, our business, results of operations and financial condition could be adversely affected.

We believe that continued growth of our business depends in part upon identifying, developing and maintaining strategic relationships with sales channel partners that will apply service layers over our products (including consultancy, implementation, integration development, flows development, solutions developed using our platform, among others). Sales channel partners embed our software products in their solutions, such as software applications for contact centers and sales force and marketing automation, and then sell such solutions to other businesses. When potential customers do not have the resources to develop their own applications, we refer them to our partners, who embed our products in the solutions that they sell to other businesses. As part of our growth strategy, we intend to further develop business relationships and specific solutions with sales channel partners. If we fail to establish these relationships in a timely and cost-effective manner, or at all, our business, results of operations and financial condition could be adversely affected. Additionally, even if we are successful at developing these relationships but there are integration problems or issues or businesses are not willing to purchase our products through sales channel partners, our reputation and ability to grow our business may be adversely affected.

We rely upon cloud infrastructure and physical data center providers to operate our platform, and any disruption of or interference with our use of these cloud infrastructure or physical data center providers could adversely affect our business, results of operations and financial condition.

We outsource our cloud infrastructure to various cloud infrastructure providers, which host our products and platform. We also rely on certain third-party providers to provide us with physical data centers to host certain of our products. Our customers need to be able to access our platform and products at any time, without interruption or degradation of performance. These service providers operate the platforms that we access and we are therefore vulnerable to service interruptions in those platforms. We have experienced, and expect that in the future we may experience interruptions, delays and outages in service and availability due to a variety of factors, including infrastructure changes, networking issues due to internet backbone provider outage, human or software errors, website hosting disruptions and capacity constraints. Capacity constraints could be due to a number of potential causes, including technical failures, natural disasters, pandemics, fraud or security attacks. In addition, if our security, or that of such services providers, is compromised, or our products or platform are unavailable or our users are unable to use our products within a reasonable amount of time or at all, our business, results of operations and financial condition could be adversely affected. In some instances, we may not be able to identify the cause or causes of these performance problems within a period of time acceptable to our customers. It may also become increasingly difficult to maintain and improve our platform performance, especially during peak usage times, as our products become more complex and the usage of our products increases. To the extent that we do not effectively address capacity constraints, our business, results of operations and financial condition may be adversely affected. In addition, we access the platform of our cloud infrastructure providers through standard IP connectivity. Any problem with this access can prevent us from responding in a timely manner to any issues with the availability of our products. More generally, any changes in service levels from the cloud infrastructure providers may adversely affect our ability to meet our customers’ requirements.