As filed with the U.S. Securities and Exchange Commission on July 1, 2024.

Registration No. 333-279908

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

to

FORM

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 7372 | 85-3961600 | |||||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

6701 Democracy Blvd., Suite 300

Bethesda,

Maryland 20817

(650) 248-9874

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Harish

Chidambaran

Chief Executive Officer

6701 Democracy Blvd., Suite 300

Bethesda, Maryland 20817

(650) 248-9874

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Josh

Holleman

Eric Blanchard

Paul Alexander

Cooley LLP

1299 Pennsylvania Avenue NW, Suite 700

Washington,

D.C. 20004

(202) 842-7800

Approximate

date of commencement of proposed sale to the public:

From time to time on or after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling security holders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated July 1, 2024

PRELIMINARY PROSPECTUS

Up to 22,624,975 Shares of Common Stock Issuable Upon Exercise of Warrants

Up to 100,774,669 Shares of Common Stock

and

Up to 8,250,000 Warrants to Purchase Common Stock

This prospectus relates to the issuance by us of an aggregate of up to 22,624,975 shares of our common stock, $0.0001 par value per share (the “Common Stock”), issuable upon the exercise of warrants, which consists of (a) up to 8,250,000 shares of Common Stock that are issuable upon the exercise of 8,250,000 warrants (the “Private Placement Warrants”) originally issued to Arrowroot Acquisition LLC, a Delaware limited liability company (the “Sponsor”), in a private placement at a price of $1.00 per Private Placement Warrant in connection with the initial public offering of Arrowroot Acquisition Corp. (“ARRW”) and (b) up to 14,374,975 shares of Common Stock that are issuable upon the exercise of 14,374,975 warrants (the “Public Warrants” and, together with the Private Placement Warrants, the “Warrants”) originally issued as part of the units offered in the ARRW initial public offering at a price of $10.00 per unit, with each unit consisting of one common stock and one-half of one Public Warrant by the holders thereof. We will receive the proceeds from any exercise of any Warrants for cash.

This prospectus also relates to the offer and sale, from time to time, by the Selling Securityholders named in this prospectus or their permitted transferees (the “Selling Securityholders”) of (i) up to 100,774,669 shares of Common Stock (the “Resale Securities”) consisting of up to (a) 8,089,532 shares of Common Stock that were issued for a total price of $29,414,500 (equivalent to a per share price of $3.64) upon the conversion of the convertible notes originally issued to investors in a private placement pursuant to the 2024 Convertible Note Purchase Agreement (as defined below) (the “2024 Convertible Note Shares”) in satisfaction of the convertible notes payable to such investors, (b) 6,787,500 shares of Common Stock (the “Founder Shares”) (160,000 of which were subsequently transferred by the Sponsor to current and former directors of ARRW) originally issued at a price of approximately $0.004 per share in a private placement to the Sponsor prior to ARRW’s initial public offering, (c) 82,091 shares of Common Stock (the “Meteora Shares”) issued at a fair value price of $10.00 per share to certain investors pursuant to a non-redemption agreement with certain investors as consideration for the non-exercise of redemption rights by such investors in connection with the shareholder meetings preceding the Business Combination (as defined below), (d) 3,763,378 shares of Common Stock (the “Lender Shares”) issued at a fair value price of $10.00 per share to Venture Lending & Leasing IX, Inc. (“Venture Lending”) and WTI Fund X, Inc. (“WTI Fund X” and together with Venture Lending, the “Lenders”) pursuant to the Second Omnibus Amendment to Loan Documents with In2vate, L.L.C., iLearningEngines, Inc. (solely with respect to the issuance of shares of Common Stock) and the Lenders, as consideration, in part, for the revision of amortization schedules under the WTI Loan Agreements (as defined below) prior to the Business Combination and, after the Business Combination, the repayment in full of all outstanding obligations under (1) the Loan and Security Agreement, dated as of December 30, 2020, between iLearningEngines Inc. and Venture Lending & Leasing IX, Inc. (the “2020 Loan Agreement”), (2) the Loan and Security Agreement, dated as of October 21, 2021, between iLearningEngines Inc., and Venture Lending & Leasing IX, Inc. and WTI Fund X, Inc. (the “2021 Loan Agreement”), and (3) the Loan and Security Agreement, dated as of October 31, 2023, between iLearningEngines Inc., and WTI Fund X, Inc. (the “2023 Loan Agreement” and, together with the 2020 Loan Agreement and the 2021 Loan Agreement, the “WTI Loan Agreements”), (e) 460,384 shares of Common Stock (“Working Capital Shares”) issued to the Sponsor as consideration for the repayment of $4,510,000 (equivalent to a per share price of $9.80), which represented part of the then-outstanding obligations under unsecured promissory notes issued to ARRW, (f) 78,730 shares of Common Stock (“Unvested Shares”) issuable upon the vesting and settlement of restricted stock units that were initially granted at no cash cost by iLearningEngines Inc. (”Legacy iLearningEngines”) and assumed by the Company and converted into restricted stock units with respect to the Common Stock pursuant to the Merger Agreement, which were granted at no cost to the recipients thereof (the “Assumed RSUs”), (g) 8,250,000 shares of Common Stock (“Warrant Shares”) acquired by the Sponsor at a purchase price of $8,250,000 (equivalent to a per share price of $1.00) issuable upon exercise of the Private Placement Warrants at an exercise price of $11.50 per share of Common Stock, (h) 71,508,370 shares of Common Stock (including 4,727,199 shares issuable upon settlement of vested RSUs) (“Control Shares”) issued to certain directors and officers at a fair value price of $10.00 per share as merger consideration for such shares originally issued by Legacy iLearningEngines to such directors and officers as consideration for employment and services provided to Legacy iLearningEngines prior to the Business Combination, (i) 511,073 shares of Common Stock ("BTIG Shares”) that were issued at a price of $5.87 per share pursuant to that amendment to the BTIG Engagement Letter (the “BTIG Amendment”), dated as of March 27, 2024, by and between ARRW and BTIG, LLC (“BTIG”), in connection with the payment of certain Business Combination transaction expenses, (j) 1,022,146 shares of Common Stock (“Cantor Shares”) that were issued in lieu of payment of deferred underwriting commissions in an aggregate amount of $6,000,000 at a price of $5.87 per share, pursuant to that certain fee modification agreement (the “Fee Modification Agreement”), dated as of March 27, 2024, by and among iLearningEngines Inc., ARRW, Cantor Fitzgerald & Co. (“Cantor”), in connection with the Closing (as defined herein), and (k) 221,465 shares of Common Stock (“Cooley Shares”) that were issued at a price of $5.87 per share pursuant to that amendment to the Letter Agreement (the “Cooley Fee Agreement”), dated as of March 27, 2024, by and among, iLearningEngines Inc., Cooley LLP (“Cooley”) and ARRW, in connection with the payment of Business Combination transaction expenses; and (ii) up to 8,250,000 Private Placement Warrants. We will not receive any proceeds from the sale of shares of Common Stock or Warrants by the Selling Securityholders pursuant to this prospectus.

Certain of the Selling Securityholders acquired securities at prices that are significantly less than the current trading price of our Common Stock. The original holder of the Founder Shares paid approximately $0.004 per share for each share of Common Stock and $1.00 per private placement warrant for each private placement warrant being offered pursuant to this prospectus.

The Common Stock being offered for resale pursuant to this prospectus by the Selling Securityholders would represent approximately 61.7% of our outstanding Common Stock as of April 16, 2024 (after giving effect to the issuance of the shares issuable upon exercise of the Warrants, the acquisition of certain shares acquirable upon the settlement of assumed restricted stock units, and the issuance of the Resale Securities). Given the substantial number of shares of Common Stock being registered for potential resale by Selling Securityholders pursuant to this prospectus, the sale of shares by the Selling Securityholders of a large number of shares, or the perception in the market that the Selling Securityholders of a large number of shares intend to sell shares, could increase the volatility of the market price of our Common Stock or result in a significant decline in the public trading price of our Common Stock. Even if our trading price is significantly below $10.00, the offering price for the units offered in the initial public offering of ARRW, the purchasers of which exchanged their ARRW shares for our Common Stock in the business combination described in this prospectus, the Selling Securityholders may still have an incentive to sell our shares of our Common Stock because they purchased the shares at prices that are significantly lower than the purchase prices paid by our public investors or the current trading price of our Common Stock.

Due to the significant number of redemptions of ARRW Class A common stock in connection with the Business Combination, there was a significantly lower number of shares of ARRW Class A common stock that converted into shares of our Common Stock in connection with the Business Combination. As a result, the shares of our Common Stock being registered for resale (a substantial portion of which may not be resold until the expiration of the applicable lock-up period) are anticipated to constitute a considerable percentage of our public float. The registration of these shares for resale creates the possibility of a significant increase in the supply of our Common Stock in the market. The increased supply, coupled with the potential disparity in purchase prices, may lead to heightened selling pressure, which could negatively affect the public trading price of our Common Stock.

While the Selling Securityholders may, on average, experience a positive rate of return based on the current market price, public stockholders may not experience a similar rate of return on the Common Stock they purchased if there is such a decline in price and due to differences in the purchase prices and the current market price. For example, based on the closing price of our Common Stock of $9.13 per share on June 24, 2024 (the “June 24, 2024 Closing Price”): (i) the holders of the 2024 Convertible Note Shares would experience a potential profit of up to approximately $5.49 per share, or up to approximately $44.4 million in the aggregate; (ii) the holders of the Founder Shares would experience a potential profit of up to approximately $9.13 per share that they purchased prior to the initial public offering of ARRW, or up to approximately $70.0 million in the aggregate (not giving effect to the issuance of Common Stock issuable upon exercise of the Warrants held by them); (iii) the holders of the Unvested Shares would experience a potential profit of up to approximately $9.13 per share, or up to approximately $0.7 million in the aggregate; (iv) the holders of the BTIG Shares would experience a potential profit of up to approximately $3.26 per share, or up to approximately $1.7 million in the aggregate; (v) the holders of the Cantor Shares would experience a potential profit of up to approximately $3.26 per share, or up to approximately $3.3 million in the aggregate; (vi) the holders of the Cooley Shares would experience a potential profit of up to approximately $3.26 per share, or up to approximately $0.7 million in the aggregate; and (vii) the holders of the Warrant Shares would experience a potential profit of up to approximately $8.13 per share, or up to approximately $67.1 million in the aggregate. None of the other Selling Securityholders would have any potential profit, as each of their effective purchase prices per share are greater than the June 24, 2024 Closing Price.

The Selling Securityholders may sell the securities being offered for resale through various methods, as described in the section titled “Plan of Distribution.” These sales may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. In connection with any sales of securities offered hereunder, the Selling Securityholders and any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended.

We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of shares of Common Stock or Warrants. See the section titled “Plan of Distribution.” We will not receive any of the proceeds from such sales of the shares of Common Stock or Warrants, except with respect to amounts received by us upon exercise, if any, of the Warrants. We believe the likelihood that holders of the Warrants will exercise their warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the trading price of our Common Stock. The exercise price of our outstanding Warrants is $11.50 per share, which exceeds the trading price of our Common Stock as of the date of this prospectus.

So long as the trading price for our Common Stock is less than $11.50 per share, meaning the Warrants are “out of the money”, we believe holders of our Warrants will be unlikely to exercise their warrants. In addition, to the extent the Warrants are exercised on a “cashless basis,” the amount of cash we would receive from the exercise of the Warrants will decrease. The Private Placement Warrants may be exercised for cash or on a “cashless basis.” The Public Warrants may only be exercised for cash provided there is then an effective registration statement registering the shares of common stock issuable upon the exercise of such warrants. If there is not a then-effective registration statement, then such warrants may be exercised on a “cashless basis,” pursuant to an available exemption from registration under the Securities Act of 1933, as amended.

The Common Stock and Public Warrants are listed on the Nasdaq Global Market under the ticker symbols “AILE” and “AILEW,” respectively. On May 31, 2024, the last reported sales price of our Common Stock was $5.95 per share and the last reported sales price of our Warrants was $0.465 per warrant.

Our Chief Executive Officer and Chairman of our Board of Directors, Harish Chidambaran, and his wife, Preeta Chidambaran, beneficially own 96,764,327 shares of our Common Stock, representing approximately 71.7% of the voting power of iLearningEngines, Inc. as of June 24, 2024. Under the rules of the Nasdaq Stock Market (“Nasdaq”), a company of which more than 50% of the voting power is held by an individual, a group or another company is a “controlled company.” Accordingly, we are a “controlled company” within the meaning of Nasdaq rules and, as a result, qualify for exemptions from certain corporate governance requirements. Although we do not intend to rely on the controlled company exemptions under Nasdaq rules, we could elect to rely on these exemptions in the future, and if so, you would not have the same protection afforded to stockholders of companies that are subject to all of the corporate governance requirements of Nasdaq. See “Risk Factors—Risks Related the Ownership of Our Securities—As long as our principal stockholders hold a majority of the voting power of our capital stock, we may rely on certain exemptions from the corporate governance requirements of Nasdaq available for “controlled companies.”

We are an “emerging growth company” as defined under U.S. federal securities laws and, as such, have elected to comply with reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company. We are incorporated in Delaware.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled “Risk Factors” beginning on page 7 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2024

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus, any supplement to this prospectus or in any free writing prospectus, filed with the Securities and Exchange Commission (the “SEC”). Neither we, nor the Selling Securityholders have authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the SEC. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. The Selling Securityholders are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States: Neither we, nor the Selling Securityholders, have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside the United States.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the SEC before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using the “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of Common Stock issuable upon the exercise of any Warrants. We will not receive any proceeds from the sale of shares of Common Stock underlying the Warrants pursuant to this prospectus, except with respect to amounts received by us upon the exercise of the Warrants for cash.

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Securityholders take responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the section titled “Where You Can Find More Information.”

iLearningEngines, Inc. (formerly known as Arrowroot Acquisition Corp. (“ARRW”), a Delaware corporation (“New iLearningEngines” or the “Company”), previously entered into that certain Agreement and Plan of Merger and Reorganization, dated as of April 27, 2023 (as amended, the “Merger Agreement”), with ARAC Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Arrowroot Acquisition Corp. (“Merger Sub”), and iLearningEngines Inc., a Delaware corporation (“Legacy iLearningEngines”). On April 16, 2024, the Company consummated the merger transactions contemplated by the Merger Agreement (the “Business Combination”) whereby Merger Sub merged with and into Legacy iLearningEngines with the separate corporate existence of Merger Sub ceasing and Legacy iLearningEngines surviving the merger as a wholly owned subsidiary of the Company. In connection with the consummation of the Business Combination, ARRW changed its name from Arrowroot Acquisition Corp. to iLearningEngines, Inc. and Legacy iLearningEngines changed its name from iLearningEngines Inc. to iLearningEngines Holdings, Inc.

Unless the context indicates otherwise, references in this prospectus to the “Company,” “iLearningEngines,” “we,” “us,” “our” and similar terms refer to iLearningEngines, Inc. (f/k/a Arrowroot Acquisition Corp.) and its consolidated subsidiaries (including Legacy iLearningEngines). References to “ARRW” refer to the predecessor company prior to the consummation of the Business Combination.

ii

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this prospectus constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. These forward-looking statements include statements regarding our intentions, beliefs and current expectations and projections concerning, among other things our results of operations, financial condition, liquidity, prospects, growth, strategies and the markets in which we operate. In some cases, you can identify these forward-looking statements by the use of terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words or phrases.

The forward-looking statements contained in this prospectus reflect our current views about the Business Combination and future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause its actual results to differ significantly from those expressed in any forward-looking statement. There are no guarantees that the transactions and events described will happen as described (or that they will happen at all). As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| ● | our ability to recognize the anticipated benefits of the Business Combination which may be affected by, among other things, competition and our ability to grow and manage growth profitably; |

| ● | our ability to maintain the listing of our Common Stock and warrants on the Nasdaq Capital Market, and the potential liquidity and trading of such securities; |

| ● | changes in applicable laws or regulations; |

| ● | our ability to execute our business model; |

| ● | our ability to attract and retain customers and expand customers’ use of our products and services |

| ● | our ability to raise capital; |

| ● | the possibility that we may be adversely affected by other economic, business and/or competitive factors |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| ● | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| ● | our business, operations and financial performance including: |

| ● | our history of operating losses and expectations of significant expenses and continuing losses for the foreseeable future; |

| ● | our ability to execute our business strategy, including the growth potential of the markets for our products and our ability to serve those markets; |

| ● | our ability to grow market share in our existing markets or any new markets we may enter; |

| ● | our ability to develop and maintain our brand and reputation; |

| ● | our ability to partner with other companies; |

iii

| ● | our expectations regarding our ability to obtain and maintain intellectual property protection and not infringe on the rights of others; |

| ● | our ability to manage our growth effectively; |

| ● | the outcome of any legal proceedings that may be instituted against us; and |

| ● | unfavorable conditions in our industry, the global economy or global supply chain, including financial and credit market fluctuations, international trade relations, pandemics, political turmoil, natural catastrophes, warfare, and terrorist attacks. |

In addition, statements that “iLearningEngines believes,” “the Company believes” or “we believe” and similar statements reflect our beliefs and opinions on the relevant subjects. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. Except to the extent required by applicable law, we are under no obligation (and expressly disclaim any such obligation) to update or revise our forward-looking statements whether as a result of new information, future events, or otherwise. For a further discussion of these and other factors that could cause our future results, performance or transactions to differ significantly from those expressed in any forward-looking statement, please see the section titled “Risk Factors.” You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements).

iv

FREQUENTLY USED TERMS

“A&R Registration Rights Agreement” means that certain Amended and Restated Registration Rights Agreement entered into at Closing by and among iLearningEngines, the members of Sponsor, certain former stockholders of Legacy iLearningEngines.

“ARRW” or “Arrowroot” means Arrowroot Acquisition Corp. (which was renamed “iLearningEngines, Inc” in connection with the consummation of the Business Combination).

“ARRW IPO” means ARRW’s initial public offering, consummated on March 4, 2021.

“ARRW Units” means equity securities of us, each consisting of one share of Class A Common Stock and one-half of one redeemable Warrant.

“Business Combination” means the transactions contemplated by the Merger Agreement, including, among other things, the Merger.

“Closing” means the closing of the Business Combination.

“Closing Date” means April 16, 2024, the date on which the Closing occurred.

“Common Stock” means the shares of our common stock, $0.0001 par value per share.

“DGCL” means the General Corporation Law of the State of Delaware.

“Fourth Promissory Note” means the unsecured promissory note in the principal amount of $2,000,000 in favor of the Sponsor Arrowroot issued on June 13, 2023.

“IPO” means Arrowroot’s initial public offering of Arrowroot Units, consummated on March 4, 2021.

“IPO Promissory Note” means an unsecured promissory note the Sponsor issued to the Company on December 21, 2020, pursuant to which the Company may borrow up to an aggregate principal amount of $300,000.

“Legacy iLearningEngines” means iLearningEngines Holdings, Inc., a Delaware corporation which, pursuant to the Business Combination, became a direct, wholly owned subsidiary of iLearningEngines, Inc., and, unless the context otherwise requires, its consolidated subsidiaries.

“Merger” means the merger of Merger Sub, a direct, wholly owned subsidiary of ARRW, with and into Legacy iLearningEngines, with Legacy iLearningEngines continuing as the surviving entity.

“Merger Agreement” means that certain Agreement and Plan of Merger and Reorganization, dated as of April 27, 2023, with Merger Sub and Legacy iLearningEngines.

“Merger Sub” means ARAC Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of ARRW.

v

“Private Placement Warrants” means the 8,250,000 warrants purchased by the Sponsor in connection with the ARRW IPO in a private placement transaction occurring simultaneously with the closing of the ARRW IPO.

“Promissory Notes” means, collectively, the IPO Promissory Note, First Promissory Note, Second Promissory Note, Third Promissory Note and Fourth Promissory Note.

“Public Warrants” means the 14,374,975 warrants included as a component of the ARRW Units sold in the ARRW IPO, each of which is exercisable, at an exercise price of $11.50, for one share of Common Stock, in accordance with its terms.

“SEC” means the U.S. Securities and Exchange Commission.

“Second Promissory Note” means an unsecured promissory note in the principal amount of $500,000 in favor of the Sponsor Arrowroot issued on February 23, 2023.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Sponsor” means Arrowroot Acquisition LLC, a Delaware limited liability company.

“Warrants” means the Private Placement Warrants and the Public Warrants.

“2024 Convertible Note Purchase Agreement” means the convertible note purchase agreement that Legacy iLearningEngines entered into with an investor (the “March Investor“) on March 21, 2024, pursuant to which, among other things, Legacy iLearningEngines issued and sold a 2024 Convertible Note (as defined below) to the March Investor with an aggregate principal amount of $700,000. On April 16, 2024, Legacy iLearningEngines entered into the 2024 Convertible Note Purchase Agreement with certain investors (collectively, the “April Investors” and, together with the March Investor, the “2024 Convertible Note Investors”), pursuant to which, among other things, Legacy iLearningEngines issued and sold to the April Investors convertible notes due in October 2026 (“2024 Convertible Notes”) with an aggregate principal amount of $28,714,500. Each 2024 Convertible Note accrued interest at a rate of (i) 15% per annum until the aggregate accrued interest thereunder equals 25% of the principal amount of such note, and (ii) 8% per annum thereafter. Immediately prior to the consummation of the Business Combination, each 2024 Convertible Note automatically converted into shares of Legacy iLearningEngines thereby entitling the holder thereof to receive, in connection with the consummation of the Business Combination, a number of shares New iLearningEngines Common Stock (rounded down to the nearest whole share) equal to (i) 2.75, multiplied by the outstanding principal under such Convertible Note, plus all accrued and unpaid interest thereon, divided by (ii) $10.00.

vi

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes thereto and the information set forth in the sections titled “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes thereto included elsewhere in this prospectus, before deciding to invest in our shares of common stock. For purposes of this section, unless otherwise indicated or the context otherwise requires, all references to “iLearningEngines,” “the Company,” “we,” “our,” “ours,” “us” or similar terms refer to iLearningEngines, Inc. and its consolidated subsidiaries after the Closing.

Overview

iLearningEngines is an out-of-the-box AI platform that empowers customers to “productize” their institutional knowledge and generate and infuse insights in the flow-of-work to drive mission critical business outcomes. iLearningEngines’ customers “productize” their institutional knowledge by transforming it into actionable intellectual property that enhances outcomes for employees, customers and other stakeholders. Since its commercial deployment in 2018, our platform has enabled enterprises to build intelligent “Knowledge Clouds” that incorporate large volumes of structured and unstructured information across disparate internal and external systems, and automate organizational processes that leverage these Knowledge Clouds to improve performance. Our Learning Automation offering addresses the corporate learning market and our Information Intelligence offering addresses the information management, analytics and automation markets. We combine our offerings with vertically focused capabilities and data models to operationalize AI and automation to effectively and efficiently address critical challenges facing our customers. Our customers utilize our platform to analyze and address employee knowledge gaps, provide personalized cognitive assistants or chatbots, and make predictive decisions based on real-time insights.

Legacy iLearningEngines was incorporated in 2010 as iHealthEngines Inc. and changed its name to iLearningEngines Inc. in 2018. On April 16, 2024, we completed the Business Combination, and Legacy iLearningEngines changed its name to iLearningEngines Holdings, Inc.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012, as amended, and therefore we intend to take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in this prospectus, our periodic reports and our proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments not previously approved. We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year in which the market value of our Common Stock that is held by non-affiliates equals or exceeds $700 million as of the end of that year’s second fiscal quarter, (ii) the last day of the fiscal year in which we have total annual gross revenue of $1.235 billion or more during such fiscal year (as indexed for inflation), (iii) the date on which we have issued more than $1.00 billion in non-convertible debt in the prior three-year period or (iv) December 31, 2026.

Additionally, we are a “smaller reporting company” as defined in Item 10 (f) (1) of Regulation S-K, which allows us to take advantage of certain exemptions from disclosure requirements including exemption from compliance with the auditor attestation requirements of Section 404. We will remain a smaller reporting company until the last day of the fiscal year in which (i) the market value of the shares of our Common Stock held by non-affiliates exceeds $250 million as of the prior June 30, and (ii) our annual revenue exceeded $100 million during such completed fiscal year or the market value of the shares of our Common Stock held by non-affiliates exceeds $700 million as of the prior June 30. To the extent we take advantage of such reduced disclosure obligations, it may also make comparison of our financial statements with other public companies difficult or impossible.

Implications of Being a Controlled Company

Our Chief Executive Officer and Chairman of the Board, Harish Chidambaran, and his wife, Preeta Chidambaran, beneficially own 96,764,327 shares of our Common Stock, representing approximately 71.7% of the voting power of iLearningEngines, Inc. as of June 24, 2024. Under Nasdaq rules, a company of which more than 50% of the voting power is held by an individual, a group or another company is a “controlled company.” Accordingly, we are a “controlled company” within the meaning of Nasdaq rules and, as a result, qualify for exemptions from certain corporate governance requirements. Although we do not intend to rely on the controlled company exemptions under Nasdaq rules, we could elect to rely on these exemptions in the future, and if so, you would not have the same protection afforded to stockholders of companies that are subject to all of the corporate governance requirements of Nasdaq. See “Risk Factors—Risks Related the Ownership of Our Securities—As long as our principal stockholders hold a majority of the voting power of our capital stock, we may rely on certain exemptions from the corporate governance requirements of Nasdaq available for “controlled companies.”

1

Summary of Risk Factors

Below is a summary of material factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all of the risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and uncertainties that we face, can be found under the section titled “Risk Factors” in this prospectus. The below summary is qualified in its entirety by that more complete discussion of such risks and uncertainties. You should carefully consider the risks and uncertainties described under the section titled “Risk Factors” as part of your evaluation of an investment in our securities:

Risks Related to Our Business

| ● | We have a history of net losses and could continue to incur substantial net losses in the future. |

| ● | Our recent rapid growth may not be indicative of our future growth. our rapid growth also makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful. |

| ● | We may not be able to successfully manage its growth and, if we are not able to grow efficiently, we may not be able to reach or maintain profitability, and its business, financial condition, and results of operations could be harmed. |

| ● | Because we derive substantially all of our revenue from its learning automation and information intelligence offerings, failure of this platform to satisfy customer demands could adversely affect our business, results of operations, financial condition, and growth prospects. |

| ● | If we are unable to attract new customers, its business, financial condition, and results of operations will be adversely affected. |

| ● | A limited number of contracted customers represent a substantial portion of our revenue and ARR. If we fail to retain these contracted customers, our revenue and ARR could decline significantly. |

| ● | We rely on a channel partner for key business development, administrative, operational and other functions that are important to its business. The loss of this service provider could materially and adversely affect our business, results of operations and financial condition. |

| ● | The markets in which we participate are competitive and, if we do not compete effectively, our business, financial condition, and results of operations could be harmed. |

| ● | The success of our platform relies on the ability of our AI-enabled ecosystem to create broad solutions across corporate functions, and a failure to do so would adversely affect our business, financial condition, and results of operations. |

| ● | If we fail to retain and motivate members of our management team or other key employees or to integrate new team members, fail to execute management transitions, or fail to attract additional qualified personnel to support our operations, our business and future growth prospects could be harmed. |

| ● | Market adoption of automated learning solutions is relatively new and may not grow as we expect, which may harm our business and results of operations. |

| ● | We rely on our channel partners to generate a substantial amount of our revenue, and if we fail to expand and manage our distribution channels, our revenue could decline and our growth prospects could suffer. |

| ● | If we are not able to introduce new features or services successfully and to make enhancements to our platform or products, our business and results of operations could be adversely affected. |

2

| ● | We target enterprise customers, and sales to these customers involve risks that may not be present or that are present to a lesser extent with sales to smaller entities. |

| ● | Real or perceived errors, failures, or bugs in our platform and products could adversely affect our business, results of operations, financial condition, and growth prospects. |

| ● | Incorrect or improper implementation or use of our platform and products could result in customer dissatisfaction and harm our business, results of operations, financial condition, and growth prospects. |

| ● | If we are unable to ensure that our platform integrates with a variety of software applications that are developed by others, including our integration partners, we may become less competitive and our results of operations may be harmed. |

| ● | Our outstanding indebtedness could adversely affect our financial condition and our ability to operate our business and pursue our business strategies and we may not be able to generate sufficient cash flows to meet our debt service obligations. |

| ● | We rely on data sets from our customers. If we are not able to acquire or utilize such data sets, or regulations limit it from doing so, our business, financial condition, and results of operations could be adversely affected. |

| ● | We are subject to stringent and changing obligations related to data privacy and security. Our actual or perceived failure to comply with such obligations could lead to regulatory investigations or actions; litigation; fines and penalties; disruptions of our business operations; reputational harm; loss of revenue or profits; loss of customers or sales; and other adverse business consequences. |

| ● | Any failure to obtain, maintain, protect, or enforce our intellectual property and proprietary rights could impair our ability to protect our proprietary technology and our brand. |

| ● | Our management has identified material weaknesses in our internal control over financial reporting and they may identify additional material weaknesses in the future. If we fail to remediate the material weaknesses or if we otherwise fail to establish and maintain effective control over financial reporting, it may adversely affect our ability to accurately and timely report our financial results, and may adversely affect investor confidence and business operations. |

| ● | The common stock being offered in this prospectus represents a substantial percentage of our outstanding common stock, and the sales of such shares, or the perception that these sales could occur, could cause the market price of our common stock to decline significantly. |

Please see the section titled “Risk Factors” beginning on page 7 of this prospectus for a discussion of these and other factors you should consider in evaluating our business.

Corporate Information

Our principal executive office is located at 6701 Democracy Blvd, Suite 300, Bethesda, Maryland 20817 and our telephone number is (650) 248-9874. Our corporate website address is www.ilearningengines.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

We and our subsidiaries own or have rights to trademarks, trade names and service marks that they use in connection with the operation of their business. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable ®, ™ and SM symbols.

3

THE OFFERING

Issuance of Common Stock

| Shares of Common Stock offered by us | Up to 22,624,975 shares of Common Stock, including shares of Common Stock issuable upon exercise of the Private Placement Warrants and Public Warrants, consisting of (i) up to 8,250,000 shares of Common Stock that are issuable upon the exercise of up to 8,250,000 Private Placement Warrants, and (ii) up to 14,374,975 shares of Common Stock that are issuable upon the exercise of up to 14,374,975 Public Warrants. | |

| Shares of Common Stock outstanding prior to the exercise of all Warrants | 134,970,114 shares (as of April 16, 2024). | |

| Shares of Common Stock outstanding assuming exercise of all Warrants | 157,595,089 shares (based on total shares outstanding as of April 16, 2024). | |

| Exercise price of Warrants | $11.50 per share, subject to adjustment as described herein. | |

| Use of proceeds | We will receive up to an aggregate of approximately $260.2 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants, if any, for general corporate purposes. Due to the uncertainty regarding the exercise of the Warrants, none of our projected liquidity requirements discussed in this prospectus assume the receipt of any proceeds from the exercise of the Warrants. The exercise price of our Public Warrants and Private Placement Warrants is $11.50 per warrant, which exceeds the trading price of our Common Stock as of the date of this prospectus. We believe the likelihood that warrant holders will exercise their warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the trading price of our Common Stock. For so long as the trading price for our Common Stock is less than $11.50 per share, meaning the Warrants are “out of the money,” we believe holders of our Warrants will be unlikely to exercise their warrants. In addition, to the extent that our Warrants are exercised on a “cashless basis,” the amount of cash we would receive from the exercise of such Warrants will decrease. The Private Placement Warrants may be exercised for cash or on a “cashless basis.” The Public Warrants may only be exercised for cash provided there is then an effective statement registering the shares of common stock issuable upon the exercise of such warrants. If there is not a then-effective registration statement, then such warrants may be exercised on a “cashless basis,” pursuant to an available exemption from registration under the Securities Act. See the section titled “Use of Proceeds.” | |

| Resale of Common Stock and Warrants | ||

| Shares of Common Stock offered by the Selling Securityholders |

We are registering the resale by the Selling Securityholders named in this prospectus, or their permitted transferees, an aggregate of 100,774,669 shares of Common Stock, consisting of:

● 8,089,532 2024 Convertible Note Shares issued for a total purchase price of $29,414,500 (equivalent to a per share price of $3.64) in satisfaction of the convertible notes payable to such investors;

● 6,787,500 Founder Shares (160,000 of which were subsequently transferred by the Sponsor to current and former directors of ARRW) originally issued at a price of approximately $0.004 per share in a private placement to the Sponsor prior to ARRW’s IPO;

● 82,091 Meteora Shares issued at a fair value price of $10.00 per share to certain investors as consideration for the non-exercise of redemption rights by such investors in connection with the shareholder meetings preceding the Business Combination;

● 3,763,378 Lender Shares issued at a fair value price of $10.00 per share as consideration, in part, for the revision of amortization schedules under the WTI Loan Agreements prior to the Business Combination and, after the Business Combination, the repayment in full of all outstanding obligations under the WTI Loan Agreements; |

4

|

● 460,384 Working Capital Shares issued as consideration for the repayment of $4,510,000 (equivalent to a per share price of $9.80), which represented part of the then-outstanding obligations under unsecured promissory notes issued to ARRW;

● 78,730 shares of Common Stock issuable upon the vesting and settlement of restricted stock units that were initially granted at no cash cost to the recipients thereof by Legacy iLearningEngines;

● 71,508,370 Control Shares issued to certain directors and officers at a fair value price of $10.00 per share as merger consideration for such shares originally issued by Legacy iLearningEngines to such directors and officers as consideration for employment and services provided to Legacy iLearningEngines prior to the Business Combination;

● 511,073 shares of Common Stock that were issued at a price of $5.87 per share pursuant to the BTIG Amendment in connection with the payment of certain Business Combination transaction expenses;

● 1,022,146 shares of Common Stock that were issued in lieu of payment of deferred underwriting commissions in an aggregate amount of $6,000,000 at a price of $5.87 per share, pursuant to the Fee Modification Agreement, in connection with the Closing;

● 221,465 shares of Common Stock that were issued at a price of $5.87 per share pursuant to the Cooley Fee Agreement, in connection with the payment of Business Combination transaction expenses; and

● 8,250,000 shares of Common Stock acquired by the Sponsor at a purchase price of $8,250,000 (equivalent to a per share price of $1.00) issuable upon the exercise of the Private Placement Warrants at a price of $11.50 per share.

Given the substantial number of shares of Common Stock being registered for potential resale by Selling Securityholders pursuant to this prospectus, the sale of shares by the Selling Securityholders of a large number of shares, or the perception in the market that the Selling Securityholders of a large number of shares intend to sell shares, could increase the volatility of the market price of our Common Stock or result in a significant decline in the public trading price of our Common Stock. Even if our trading price is significantly below $10.00 per share, the offering price for the units offered in the initial public offering of ARRW, the purchasers of which exchanged their ARRW shares for our Common Stock in the business combination described in this prospectus, the Selling Securityholders may still have an incentive to sell our shares of our Common Stock because they purchased the shares at prices that are significantly lower than the purchase prices paid by our public investors or the current trading price of our Common Stock. While certain of the Selling Securityholders may experience a positive rate of return on their investment in our Common Stock as a result, the public securityholders may not experience a similar rate of return on the securities they purchased due to differences in their purchase prices and the trading price. For example, based on the closing price of our Common Stock of $9.13 per share on June 24, 2024 (the “June 24, 2024 Closing Price”): (i) the holders of the 2024 Convertible Note Shares would experience a potential profit of up to approximately $5.49 per share, or up to approximately $44.4 million in the aggregate; (ii) the holders of the Founder Shares would experience a potential profit of up to approximately $9.13 per share that they purchased prior to the initial public offering of ARRW, or up to approximately $70.0 million in the aggregate (not giving effect to the issuance of Common Stock issuable upon exercise of the Warrants held by them); (iii) the holders of the Unvested Shares would experience a potential profit of up to approximately $9.13 per share, or up to approximately $0.7 million in the aggregate; (iv) the holders of the BTIG Shares would experience a potential profit of up to approximately $3.26 per share, or up to approximately $1.7 million in the aggregate; (v) the holders of the Cantor Shares would experience a potential profit of up to approximately $3.26 per share, or up to approximately $3.3 million in the aggregate; (vi) the holders of the Cooley Shares would experience a potential profit of up to approximately $3.26 per share, or up to approximately $0.7 million in the aggregate; and (vii) the holders of the Warrant Shares would experience a potential profit of up to approximately $8.13 per share, or up to approximately $67.1 million in the aggregate. None of the other Selling Securityholders would have any potential profit, as each of their effective purchase prices per share are greater than the June 24, 2024 Closing Price. | ||

| Warrants offered by the Selling Securityholders | Up to 8,250,000 Private Placement Warrants. |

5

| Redemption | The Public Warrants are redeemable in certain circumstances. See the section titled “Description of Our Securities — Warrants.” | |

| Lock-up Provisions | Certain of our securityholders are subject to certain restrictions on transfer until the termination of applicable lock-up periods contained in the Amended and Restated Bylaws of the Company. | |

| Terms of the offering | The Selling Securityholders will determine when and how they will dispose of the securities registered for resale under this prospectus. | |

| Use of proceeds | We will not receive any proceeds from the sale of shares of Common Stock or Warrants by the Selling Securityholders, except with respect to amounts received by us due to the exercise of the Warrants. | |

| Risk factors | Before investing in our securities, you should carefully read and consider the information set forth in the section titled “Risk Factors” beginning on page 7. | |

| Nasdaq ticker symbols | “AILE” and “AILEW” |

For additional information concerning the offering, see the section titled “Plan of Distribution” beginning on page 152.

6

RISK FACTORS

Investing in our securities involves a high degree of risk. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Special Note Regarding Forward-Looking Statements,” you should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our financial statements and related notes appearing at the end of this prospectus and in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding to invest in our securities. If any of the events or developments described below were to occur, our business, prospects, operating results, and financial condition could suffer materially, the trading price of our securities could decline, and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks Related to Our Business, Products, Operations, and Industry

We have a history of net losses and could continue to incur substantial net losses in the future.

We have incurred net losses in certain years since our incorporation in 2010. We incurred a net loss of $25.9 million for the three months ended March 31, 2024 and of $4.4 million for the year ended December 31, 2023, and we recorded net income of $11.5 million and $2.5 million for the years ended December 31, 2022 and 2021, respectively. As a result, as of March 31, 2024, we had an accumulated deficit of $83.5 million. We expect to continue to invest in the growth of our business, including by increasing our sales and marketing efforts, hiring additional personnel and introducing new products and technologies. We have incurred and will continue to incur significant legal, accounting and other expenses related to operating as a public company. In addition, we may encounter unforeseen or unpredictable factors, including unforeseen operating expenses, complications or delays, which may also result in increased costs. If our revenue declines or fails to grow at a rate sufficient to offset increases in our operating expenses, we will not be able to achieve profitability in future periods or, if we do become profitable, sustain profitability. As a result, we may continue to generate net losses. There can be no assurances that we will achieve profitability in the future or that we will be able to sustain profitability if we do become profitable.

Our recent rapid growth may not be indicative of our future growth. Our rapid growth also makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

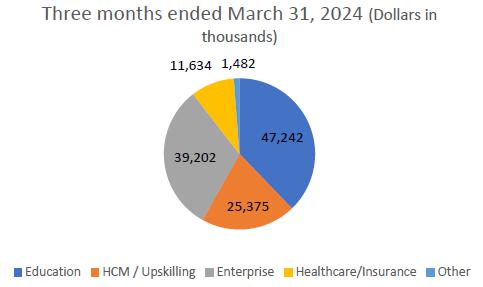

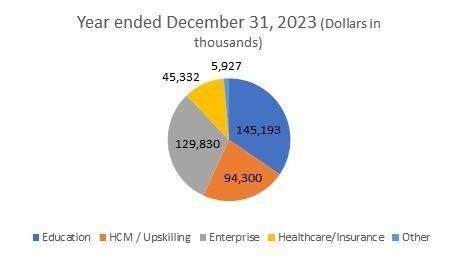

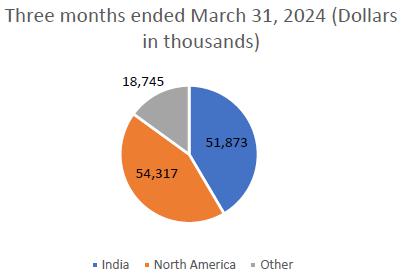

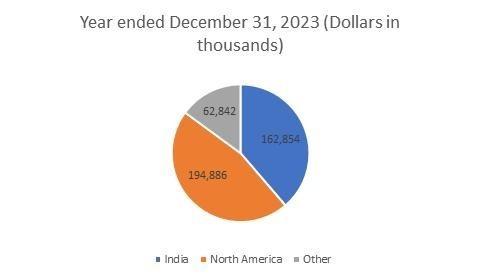

We generated revenue of $420.6 million, $309.2 million and $217.9 million for fiscal years 2023, 2022 and 2021, respectively. Our annual recurring revenue (“ARR”) was $447.3 million, $313.7 million and $224.3 million at December 31, 2023, 2022 and 2021, respectively. You should not rely on our ARR, revenue or key operational and business metrics from any prior quarterly or annual fiscal period as an indication of our future performance. Even if our revenue or key operational and business metrics continue to improve, our revenue or key operational and business metrics may worsen in the future as a result of a variety of factors, including changes in the demand for our products, the maturation of our business, or our failure to capitalize on growth opportunities. Overall growth of our business depends on a number of additional factors, including our ability to:

| ● | price our products effectively so that we are able to attract new customers and expand sales to our existing customers; |

| ● | expand the functionality and use cases for the products we offer on our platform; |

| ● | maintain and grow our customer base; |

| ● | maintain and expand the rates at which contracted customers purchase and renew maintenance and support of our platform; |

| ● | provide our customers with support that meets their needs; |

7

| ● | continue to introduce and sell our products to new industries and markets; |

| ● | continue to develop new products and new functionality for our platform and successfully further optimize our existing products and infrastructure; |

| ● | successfully identify and acquire or invest in businesses, products, or technologies that we believe could complement or expand our platform; and |

| ● | increase awareness of our brand on a global basis and successfully compete with other companies. |

We may not successfully accomplish any of these objectives, and as a result, it is difficult for us to forecast our future results of operations. If the assumptions that we use to plan our business are incorrect or change in reaction to changes in our market, or if we are unable to maintain consistent ARR or key operational and business metrics improvement, our stock price could be volatile, and it may be difficult to achieve and maintain profitability.

In addition, we expect to continue to expend substantial financial and other resources on:

| ● | our specialized data sets and technology infrastructure, including systems architecture, scalability, availability, performance, and security; |

| ● | our sales and marketing organization to engage our existing and prospective customers, increase brand awareness, and drive adoption of our products; |

| ● | product development, including investments in our product development team and the development of new products and new functionality for our platform as well as investments in further optimizing our existing products and infrastructure; |

| ● | acquisitions or strategic investments; |

| ● | our global operations and continued expansion; and |

| ● | general administration, including increased legal and accounting expenses associated with being a public company. |

These investments may not be successful on the timeline we anticipate or at all, and may not result in improvements of our ARR or key operational and business metrics. For instance, we anticipate that our customers will continue to increase adoption of our products in future periods. We have offered our products for only a short period of time, and we cannot predict how increased adoption of our products will change the buying patterns of our customers or impact our future ARR or key operational and business metrics. If we are unable to maintain or improve our ARR or key operational and business metrics at a rate sufficient to offset the expected increase in our costs, our business, financial condition, and results of operations will be harmed, and we may not be able to achieve or maintain profitability over the long term. Additionally, we have encountered, and may in the future encounter, risks and uncertainties frequently experienced by growing companies in rapidly changing industries, such as unforeseen operating expenses, difficulties, complications, delays, and other known or unknown factors that may result in losses in future periods. If the growth of our ARR or key operational and business metrics does not meet our expectations in future periods, our business, financial condition, and results of operations may be harmed, and we may not achieve or maintain profitability in the future.

We may not be able to successfully manage our growth and, if we are not able to grow efficiently, we may not be able to reach or maintain profitability, and our business, financial condition, and results of operations could be harmed.

We have experienced and may continue to experience rapid growth and organizational change, which has placed and may continue to place significant demands on our management and our operational and financial resources. Actions we may decide to take in the future in our attempt to achieve profitability may not be successful in yielding our intended results and may not appropriately address either or both of the short-term and long-term strategy of our business. Implementation of a go forward plan and any other cost-saving initiatives, including possible future restructuring efforts, may be costly and disruptive to our business, the expected costs and charges may be greater than forecasted, and the estimated cost savings may be lower than forecasted. Finally, our organizational structure is becoming more complex as we improve our operational, financial and management controls as well as our reporting systems and procedures. If we fail to manage our anticipated growth, company personnel transitions, and change in a manner that preserves the key aspects of our corporate culture, our employee retention may suffer, which could negatively affect our products, brand, and reputation and harm our ability to retain and attract customers and employees.

8

In addition, as we expand our business, it is important that we continue to maintain a high level of customer service and satisfaction. If we are not able to continue to provide high levels of customer service, our reputation, as well as our business, results of operations, and financial condition, could be harmed. As usage of our platform capabilities grow, we will need to continue to devote additional resources to improving and maintaining our infrastructure and integrating with third-party applications. In addition, we have needed and will continue to need to appropriately scale our internal business systems and our services organization, including customer support and professional services, to serve our growing customer base. Failure of or delay in these continuing efforts could result in impaired system performance and reduced customer satisfaction, resulting in decreased sales to new customers, lower dollar-based net retention rates, the issuance of service credits, or requested refunds, which would hurt our revenue growth and our reputation. Even if we are successful in our expansion efforts, they will be expensive and complex, and require the dedication of significant management time and attention. We have faced and could continue to face inefficiencies or service disruptions as a result of our efforts to scale our internal infrastructure. We cannot be sure that the expansion of and improvements to our internal infrastructure will be effectively implemented on a timely basis, if at all, and such failures could harm our business, financial condition, and results of operations.

Because we derive substantially all of our revenue from our learning automation and information intelligence offerings, failure of this platform to satisfy customer demands could adversely affect our business, results of operations, financial condition, and growth prospects.

We derive and expect to continue to derive substantially all of our revenue from our learning automation and information intelligence offerings. As such, market adoption of our learning automation and information intelligence offerings is critical to our continued success. Demand for our learning automation and information intelligence offerings may be affected by a number of factors, many of which are beyond our control, including continued market acceptance and integration of our platform into our end customers’ operations; the continued volume, variety, and velocity of automations that are generated through use of our platform; timing of development, and release of new offerings by our competitors; technological change, including in the areas of artificial intelligence (“AI”) and machine learning systems, and the rate of growth in our market. Additionally, the utility of our learning automation and information intelligence offerings and products relies in part on the ability of our customers to use our products in connection with other third-party software products that are important to our customers’ businesses. If these third-party software providers were to modify the terms of their licensing arrangements with our customers in a manner that would reduce the utility of our products, or increase the cost to use our products in connection with these third-party software products, then our customers may no longer choose to adopt our learning automation and information intelligence offerings or continue to use our products. If we are unable to continue to meet the demands of our customers and the developer community, our business operations, financial results, and growth prospects will be materially and adversely affected.

If we are unable to attract new customers, our business, financial condition, and results of operations will be adversely affected.

To increase our revenue, we must continue to attract new customers. Our success will depend to a substantial extent on the widespread adoption of our platform and products as an alternative to existing solutions, including as an alternative to traditional systems lacking AI-driven customization and content-augmentation capabilities. Many enterprises have invested substantial personnel and financial resources to integrate traditional human-driven processes into their business architecture and, therefore, may be reluctant or unwilling to migrate to a learning automation platform that is integrated and augmented by AI and machine learning. Accordingly, the adoption of our learning automation and information intelligence offerings may be slower than we anticipate. A large proportion of our target market still uses traditional systems for a major part of their operations. This market may need further education on the value of a learning automation platform that is integrated and augmented by AI and machine learning generally and our platform and products in particular, and on how to integrate them into current operations. A lack of education as to how our learning automation and information intelligence offerings and solutions operate may cause potential customers to prefer more traditional methodologies or to be cautious about investing in our platform and products, or result in difficulty integrating our platform and products into their business architecture. If we are unable to educate potential customers and change the market’s readiness to accept our technology, we may experience slower than projected growth and our business, results of operations, and financial condition may be harmed.

9

In addition, as our market matures, our products evolve, and competitors introduce lower cost or differentiated products that are perceived to be alternatives to our platform and products, our ability to sell maintenance and support for our products could be impaired. Further, as various forms of AI, become more widely adopted and accepted, if customers were to feel that our technology was not developing apace, our business and growth prospects could be harmed. The rapid evolution of AI may require the application of resources to develop, test, and maintain our products and services so that they are ethically designed to minimize unintended, harmful impacts. Similarly, our sales could be adversely affected if customers or users within these organizations perceive that features incorporated into competitive products reduce the need for our products or if they prefer to purchase other products that are bundled with solutions offered by other companies that operate in adjacent markets and compete with our products. As a result of these and other factors, we may be unable to attract new customers, which may have an adverse effect on our business, financial condition, and results of operations.

If we are not able to expand our usage by existing customers, or our existing customers do not renew their maintenance and support agreements, our business, financial condition, and results of operations will be adversely affected.

Our success depends significantly on retaining existing customers and attracting them to different types of service offerings on our platform. Our customers have a range of options to meet their training and education needs, and our ability to retain customers could be materially adversely affected by a number of factors, such as: failing to provide a dynamic, high-quality learning automation and information intelligence offerings at competitive prices; the fees we charge to use our platform; taxes; our failure to facilitate new or enhanced offerings or features that our users value; the performance of our algorithms; our users not receiving timely and adequate support from us; negative perceptions of the trust and safety of our platform; negative associations with, or reduced awareness of, our brand; declines and inefficiencies in our marketing efforts; our efforts or failure or perceived failure to comply with regulatory requirements; or other factors we deem detrimental to our community. Events beyond our control, such as macroeconomic conditions and pandemics or other global health concerns, also may materially adversely impact our ability to attract and retain users.

In addition, if our platform is not easy to integrate into our customer’s various corporate systems, users have an unsatisfactory experience using our platform, the content provided by our platform is not displayed effectively, we are not effective in engaging users or we fail to provide a user experience in a manner that meets rapidly changing demand, we could fail to retain existing users, which could materially adversely affect our business, results of operations and financial condition.

A limited number of contracted customers represent a substantial portion of our revenue and ARR. If we fail to retain these contracted customers, our revenue and ARR could decline significantly.

We derive a substantial portion of our revenue and ARR from sales to our top five contracted customers, all of which are value added resellers (“VARs”). VARs develop solutions which integrate iLearningEngines and sell their solutions directly to their customers. As a result, our revenue and ARR could fluctuate materially and could be materially and disproportionately impacted by the purchasing decisions of these customers or any other significant future customer. Sales to our top four contracted customers accounted for approximately 59% of our revenue for the year ended December 31, 2023. Any of our significant contracted customers may decide to purchase less than they have in the past, may alter their purchasing patterns at any time with limited notice, or may decide not to continue to license our platform and products at all, any of which could cause our revenue and ARR to decline and adversely affect our financial condition and results of operations. If we do not further diversify our customer base, we will continue to be susceptible to risks associated with customer concentration.

10

Third parties with whom we do business may be unable to honor their obligations to us or their actions may put us at risk.