Table of Contents

As filed with the Securities and Exchange Commission on March 16, 2021

Registration No. 333-253682

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

VIZIO HOLDING CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 3651 | 85-4185335 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

VIZIO Holding Corp.

39 Tesla

Irvine, California 92618

(949) 428-2525

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William W. Wang

Chairman and Chief Executive Officer

VIZIO Holding Corp.

39 Tesla

Irvine, California 92618

(949) 428-2525

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Katharine A. Martin | Jerry C. Huang | Alan F. Denenberg | ||

| Rezwan D. Pavri | Scott V. Becker | Emily Roberts | ||

| Lisa L. Stimmell | VIZIO Holding Corp. | Davis Polk & Wardwell LLP | ||

| Mark G.C. Bass | 39 Tesla | 1600 El Camino Real | ||

| Wilson Sonsini Goodrich & Rosati, P.C. | Irvine, California 92618 | Menlo Park, California 94025 | ||

| 650 Page Mill Road | (949) 428-2525 | (650) 752-2000 | ||

| Palo Alto, California 94304 | ||||

| (650) 493-9300 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

| Non-accelerated filer |

☒ |

Smaller reporting company |

☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Shares to be |

Proposed Maximum |

Maximum Aggregate Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Class A common stock, par value $0.0001 per share |

17,388,000 | $23.00 | $399,924,000 | $43,632 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes an additional 2,268,000 shares of our Class A common stock that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | The registrant previously paid $10,910 of this amount in connection with a prior filing of this registration statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a) may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated March 16, 2021

|

|

15,120,000 Shares

Class A Common Stock

$21.00 to $23.00 per share |

| |

|

VIZIO Holding Corp. |

This is the initial public offering of shares of Class A common stock of VIZIO Holding Corp. We are selling 7,560,000 shares of Class A common stock and the selling stockholders are selling an additional 7,560,000 shares of Class A common stock. We will not receive any proceeds from the sale of shares of our Class A common stock by any of the selling stockholders.

We anticipate the initial public offering price of our Class A common stock will be between $21.00 and $23.00 per share. Currently, no public market exists for our Class A common stock. We have applied to list our Class A common stock on the New York Stock Exchange under the symbol “VZIO.”

We have three classes of authorized common stock, Class A common stock, Class B common stock, and Class C common stock. The rights of the holders of Class A common stock, Class B common stock and Class C common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to 10 votes per share and is convertible at any time into one share of Class A common stock. Shares of Class C common stock have no voting rights, except as otherwise required by law, and will convert into Class A common stock, on a share-for-share basis, following the conversion or exchange of all outstanding shares of Class B common stock into shares of Class A common stock and upon the date or time specified by the holders of a majority of the outstanding shares of Class A common stock voting as a separate class. Upon the completion of this offering, no shares of Class C common stock will be issued and outstanding.

Upon the completion of this offering, all shares of Class B common stock will be held by William Wang, our Founder, Chairman and Chief Executive Officer, and his affiliates. Accordingly, upon completion of this offering, assuming an offering size as set forth above, the shares beneficially owned by Mr. Wang (including shares over which he has voting control) will represent 91.7% of the total voting power of our outstanding capital stock. Mr. Wang will be able to determine or significantly influence any action requiring the approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws, and the approval of any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transaction. As a result, we will be a “controlled company” within the meaning of the rules of the New York Stock Exchange.

Investing in our Class A common stock involves a high degree of risk. See “Risk Factors” beginning on page 17 of this prospectus.

| Per share | Total | |||

| Initial public offering price |

$ | $ | ||

| Underwriting discount(1) |

$ | $ | ||

| Proceeds to VIZIO Holding Corp., before expenses |

$ | $ | ||

| Proceeds to selling stockholders, before expenses |

$ | $ | ||

| (1) | We refer you to “Underwriting” beginning on page 176 for additional information regarding underwriter compensation. |

At our request, the underwriters have reserved up to 5% of the shares offered by this prospectus for sale at the initial public offering price through a directed share program. See the section titled “Underwriting—Directed Share Program” for additional information.

The underwriters may also exercise their option to purchase up to an additional 2,268,000 shares of Class A common stock from the selling stockholders, at the initial public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The shares of Class A common stock will be ready for delivery on or about , 2021.

| J.P. Morgan | BofA Securities | |

| Wells Fargo Securities | Guggenheim Securities | |

| Needham & Company | Piper Sandler | |

| Roth Capital Partners | ||

The date of this prospectus is , 2021.

Table of Contents

VIZIO

Table of Contents

Incredible TVs.

Innovative sound bars.

Entertainment on demand.

Table of Contents

We take you there.

Table of Contents

Our Mission

Create amazing

experiences for all.

VIZIO

Table of Contents

$2B+

Revenue

12M+

(+61% YOY)

SmartCast Active Accounts

23B+

(+95% YOY)

Total VIZIO Hours

Endless

ENTERTAINMENT

Possibilities

USA

Designed in the United States

VIZIO

Founded in 2002

Figures as of 12/31/2020 or for fiscal year 2020, as applicable. See

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a discussion of how we calculate Total VIZIO Hours and SmartCast Active Accounts.

Table of Contents

| Page | ||||

| LETTER FROM WILLIAM WANG, FOUNDER, CHAIRMAN AND CHIEF EXECUTIVE OFFICER |

ii | |||

| iv | ||||

| 1 | ||||

| 17 | ||||

| 67 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 72 | ||||

| 75 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

78 | |||

| 109 | ||||

| 127 | ||||

| 136 | ||||

| 163 | ||||

| 166 | ||||

| 169 | ||||

| 176 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

180 | |||

| 184 | ||||

| 199 | ||||

| 199 | ||||

| 199 | ||||

| F-1 | ||||

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in the Class A common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we, nor the selling stockholders, nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or any related free writing prospectus. Neither we, nor the underwriters nor the selling stockholders take responsibility for, nor can provide any assurance as to the reliability of, any other information that others may give you. We and the selling stockholders are offering to sell, and seeking offers to buy, our Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus and any applicable free writing prospectus is accurate only as of its date, regardless of the time of delivery or of any sale of our Class A common stock. The information may have changed since that date.

For investors outside the United States: No action is being taken in any jurisdiction outside the United States to permit a public offering of our Class A common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

i

Table of Contents

FOUNDER, CHAIRMAN AND CHIEF EXECUTIVE OFFICER

The Start of a Vision

Twenty years ago, I boarded a plane in Taiwan, heading back home to Los Angeles. I had been working on a computer monitor company at the time, and had a series of long, exhausting meetings with many business partners. All I could think about was how much I wanted to go home and be with the people I love.

A little after takeoff, the plane crashed into a construction site.

The entire time, all I could think about was how I had to survive. How I would do anything to get home. I ran to the front of the plane, forced open the emergency door and jumped out. I’ll save you the messy details, but let’s just say that I am beyond thankful to be here today, writing you this letter.

Finally getting home after the accident was one of the best moments of my life. I remember thinking how much I loved being home, and from this thought, VIZIO was born.

Great Technology Should Be Accessible to Everyone

My dream was to make the home everyone’s favorite place. I kicked off this dream by creating VIZIO to make home entertainment accessible to everyone.

For the next eighteen years, working closely with channel partners and suppliers, my team and I have built VIZIO into one of the leading entertainment brands in America. By producing quality TVs and speakers and offering them at affordable prices, we democratize the home entertainment experience. We work hard in listening to our customers and partners and fine-tuning our products to be of superb quality. Most importantly, we make sure that we offer affordable prices, so that everyone can have access to VIZIO.

The TV Can Be So Much More

At VIZIO, we find value in the home. There is something so universally comforting about being in your own space. Yet something I’ve noticed is that, at home, we still crave ways to connect ourselves to a larger community. The TV industry has not been focused on this connection.

We want VIZIO to be that connection, to be the portal connecting the home to the outside world. We envision the VIZIO Smart TV as the center of the connected home—where families play games together, where friends watch movies together, where work and learning happen and where all things in between take place.

Imagine if your television became a central, interactive part of your home. You could stream real-time exercise classes, with an instructor giving you real-time feedback. You could connect to family thousands of miles away. Imagine if the television was a bridge between you and everything the world has to offer.

This is our vision at VIZIO. We want to create the optimal experience that will fluidly connect people to the world, all within the comfort and convenience of the home.

The Opportunity Is Ours to Build with You

Given our large customer base, we have the perfect opportunity to make the VIZIO vision for the future a reality. Millions of people out there already love their VIZIO products. We need to act fast to bring our full vision to life for them.

ii

Table of Contents

We have a lot to get done, but we are off to a quick start. We have cutting-edge products and powerful software. But we need to continually improve the software, and we must also keep up with the latest hardware technology and maintain quality products. At the same time, we have to stay ahead of the curve in predicting trends and figuring out what our customers desire in a portal-like Smart TV.

At VIZIO, we have a top-notch team to reach this vision. We have a strong culture based on tenacity and trust—we work hard and get things done, even when we encounter obstacles. What drives us is the desire to provide the best experience for our customers. We always think of the customers before everything.

To our shareholders, we promise that we will stay true to our values of tenacity and trust. We will not give up on our vision. I fought to survive in a plane crash, and I bring that tenacious spirit into the VIZIO team every single day. We will continue our successful hardware business, iterating on models as we’ve done before, and at the same time build our name in Smart TV software. Going public is an important milestone for us as we continue to grow and execute our goals.

The TV industry is evolving. When we started, we were simply focused on building the best possible hardware. Now, with a combination of our Smart TVs and our evolving software platform, we have a path to integrate the VIZIO experience into a lifestyle.

The evolution of TVs is calling for a revolution, and VIZIO is here to answer it. We invite you to join us on this journey!

iii

Table of Contents

Unless we otherwise indicate, or unless the context requires otherwise, any references in this prospectus to the following key business terms have the respective meaning set forth below:

Ad-supported Video on Demand (AVOD): Over-the-Top video services supported by serving ads. These include free platforms like YouTube TV, Pluto TV or our WatchFree and VIZIO Free Channel offerings, as well as those, like Hulu, that charge a subscription fee in addition to serving ads.

Automatic Content Recognition (ACR): Technology that tracks viewing data on connected TVs. Advertisers and content providers use this data, among other things, to measure viewership reach and ad effectiveness.

Connected home: Home electronics configuration in which appliances (such as an air conditioner or refrigerator) and devices (such as a home security system) can be controlled remotely using a mobile or other device connected to the internet.

Connected TV: A television that is connected to the internet through built-in capabilities (i.e., a Smart TV) or through another device such as a Blu-ray player, game console, or set-top box (e.g., Apple TV, Google Chromecast or Roku).

Dynamic Ad Insertion (DAI): Technology that seamlessly replaces TV ads with targeted ads from the Smart TV in real time, across multiple inputs.

HDTV: High-definition television.

Internet-of-Things (IoT): A network of devices that are connected and exchange data with other devices over the internet (e.g., connected home appliances, wearables or security systems).

Linear TV: Live, scheduled television programming distributed through cable, satellite or broadcast (antennae).

Multichannel Video Programming Distributor (MVPD): A service provider that delivers multiple television channels over cable, satellite, or wireline or wireless networks (e.g., Comcast’s Xfinity cable TV and DISH satellite TV).

Over-the-Top (OTT): Any app or website that bypasses MVPD distribution and provides streaming video content directly to viewers, over the internet (e.g., Disney+, Hulu, Netflix and YouTube TV).

Pay TV: Traditional bundle of television channels typically provided over cable or satellite by MVPDs for a subscription price.

Premium Video on Demand (PVOD): Similar to TVOD, but lets consumers access premium on-demand content at a higher price point. Examples include feature films made available alongside, or in place of, a traditional movie theater release.

SmartCast: VIZIO’s proprietary Smart TV operating system. The software platform where consumers can access VIZIO’s WatchFree and VIZIO Free Channels as well as a wide array of third-party OTT apps (e.g. Amazon Prime Video, Apple TV+, Disney+, Hulu, Netflix, Paramount+, Peacock and YouTube TV).

Smart TV: A television with built-in internet capability. Often includes an operating system.

System-on-Chip (SOC): Microchip that integrates all of the necessary electronic circuits and processors needed to power devices such as Smart TVs.

iv

Table of Contents

Subscription Video on Demand (SVOD): OTT services that generate revenue through selling subscriptions to consumers (e.g., Disney+ and Netflix).

Transactional Video on Demand (TVOD): Distribution method by which consumers purchase video-on-demand content on a pay-per-view basis (e.g., Amazon Prime Video rentals and Fandango Now).

Virtual Multichannel Video Programming Distributor (vMVPD): An MVPD that is delivered over the internet; interchangeable with “linear OTT” (e.g., Sling TV and YouTube TV).

WatchFree: VIZIO’s free, ad-supported OTT app. Offers access to news, sports, movies and general entertainment TV shows in a format similar to linear TV through programmed channels.

VIZIO Free Channels: VIZIO’s free, ad-supported OTT app with linear channels. Content is sourced from a variety of providers into a curated set of channels across news, sports, movies and general entertainment.

v

Table of Contents

The following summary highlights selected information contained elsewhere in this prospectus and does not contain all the information that you should consider before investing in our Class A common stock. You should read the entire prospectus carefully, including the “Risk Factors,” “Special Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing elsewhere in this prospectus before making an investment decision.

Prior to the consummation of the Reorganization Transaction (as defined below) and in reference to events which took place prior to the consummation of the Reorganization Transaction, unless the context requires otherwise, the words “VIZIO,” “we,” the “Company,” “us” and “our” refer to VIZIO, Inc., a California corporation, and its subsidiaries. Subsequent to the consummation of the Reorganization Transaction and in reference to events which are to take place subsequent to the consummation of the Reorganization Transaction, unless the context requires otherwise, the words “VIZIO,” “we,” the “Company,” “us” and “our” refer to VIZIO Holding Corp., a Delaware corporation, and its subsidiaries. In addition, unless otherwise stated or the context otherwise requires, “Parent” refers to VIZIO Holding Corp., a Delaware corporation, and “California VIZIO” refers to VIZIO, Inc., a California corporation. See “—Corporate Information.” References to our “common stock” include our Class A common stock, Class B common stock and Class C common stock.

VIZIO Holding Corp.

Our Mission

VIZIO’s mission is to deliver immersive entertainment and compelling lifestyle enhancements that make our products the center of the connected home.

Overview

VIZIO is driving the future of televisions through our integrated platform of cutting-edge Smart TVs and powerful SmartCast operating system. Every VIZIO Smart TV enables consumers to search, discover and access a broad array of content. In addition to watching cable TV, viewers can use our platform to stream a movie or show from their favorite over-the-top (OTT) service, watch hundreds of free channels through our platform, including on our WatchFree and VIZIO Free Channel offerings, enjoy an enhanced immersive experience catered to gaming or access a variety of other content options. Our platform gives content providers more ways to distribute their content and advertisers more tools to target and dynamically serve ads to a growing audience that is increasingly transitioning away from linear TV.

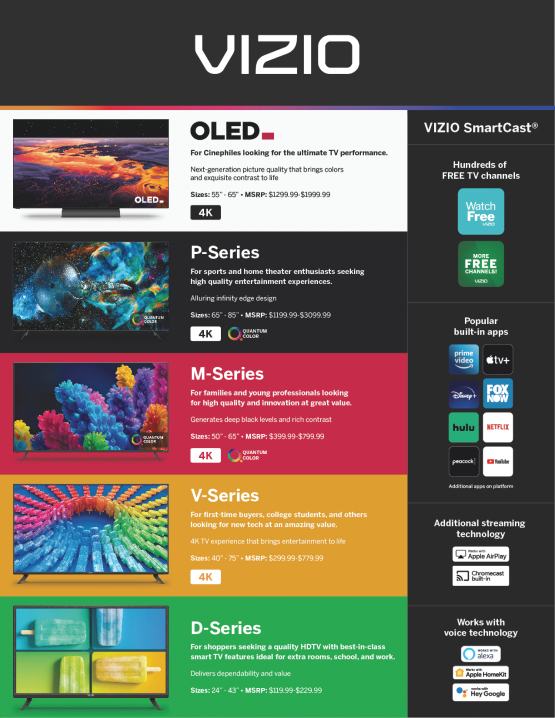

We currently offer:

| • | a broad range of high-performance Smart TVs that encompass a variety of price points, technologies, features and screen sizes, each designed to address specific consumer preferences; |

| • | a portfolio of innovative sound bars that deliver immersive audio experiences; and |

| • | a proprietary Smart TV operating system, SmartCast, which enhances the functionality and monetization opportunities of our devices. |

And this is just the beginning. Today, a television is primarily viewed as an entertainment device – but our Smart TVs are capable of so much more. Our seamless integration of devices and software allows us to create new interactive use cases, such as personal communications, fitness and wellness, commerce, social interaction and dynamic entertainment experiences. We believe we can reshape the way consumers use the largest screen in their home.

1

Table of Contents

Throughout our history, we have been an innovator and a market disruptor. Founded in Orange County, California in 2002, we saw an opportunity to bring U.S. consumers quality televisions and sound bars with a significantly greater value proposition. We are based in the United States. We believe this gives us a better understanding of U.S. consumer preferences. As of December 1, 2020, we have sold approximately 82.2 million televisions and 11.8 million sound bars over the lifetime of our company. According to OMDIA, VIZIO was #2 in television market share in North America on a unit shipment basis for the January 2018 to December 2020 combined period. In addition, according to The NPD Group Retail Tracking Service, VIZIO was the #1 sound bar brand in America on a unit sales basis for the January 2018 to December 2020 combined period.

We have both driven and benefitted from powerful secular trends that are transforming the way consumers, content providers and advertisers interact in the entertainment industry. Due to the proliferation of high-speed internet access and a growing array of content options, we foresaw that consumers would shift increasing amounts of their entertainment into the home. In 2009, we embedded the Netflix application directly on a TV, bypassing the need for additional, externally connected hardware to stream OTT content. Building on this success, we launched our upgraded operating system in 2016, known today as SmartCast, driving consumers to change the way they access and consume content. Through our acquisition of Inscape in 2015, which enhanced our data capabilities including our proprietary Automatic Content Recognition (ACR) technology, we offer valuable data-driven insights and targeting opportunities for our advertisers. Our easy-to-use and integrated platform gives content providers an additional distribution channel and offers advertisers incremental reach to a growing audience that is transitioning away from linear TV.

We have accomplished all of this by staying faithful to our founding principle that VIZIO is “Where Vision Meets Value,” and that same principle will continue to guide us as we move forward.

The success of our Device business has created a massive growth opportunity for us. Our Smart TVs provide us with the opportunity to add consumers that are actively engaged with our SmartCast operating system, which in turn, expands our Platform+ monetization opportunities. While we generate the significant majority of our total net revenue from sales of our Smart TVs and sound bars, our Platform+ net revenue has grown 304.4% from $36.4 million in 2018 to $147.2 million in 2020. We believe that Platform+ will be the key driver of our future margin growth and financial performance.

Our key financial metrics for 2018, 2019 and 2020 included:

| 2018 | 2019 | 2020 | ||||||||||

| (in thousands) | ||||||||||||

| Total net revenue |

$ | 1,780,730 | $ | 1,836,799 | $ | 2,042,473 | ||||||

| Total gross profit |

$ | 110,261 | $ | 165,165 | $ | 296,358 | ||||||

| Net income (loss) |

$ | (156 | ) | $ | 23,086 | $ | 102,475 | |||||

| Adjusted EBITDA(1) |

$ | 584 | $ | 37,604 | $ | 138,971 | ||||||

| (1) | We define Adjusted EBITDA, a non-GAAP financial metric, as total net income before interest income (expense), net, other income, net, provision for (benefit from) income taxes, depreciation and amortization and stock-based compensation. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics—Non-GAAP financial measure” for a reconciliation between Adjusted EBITDA and net income, the most directly comparable generally accepted accounting principle (GAAP) financial measure and a discussion about the limitations of Adjusted EBITDA. |

Our key business metrics for 2018, 2019 and 2020 included:

| 2018 | 2019 | 2020 | ||||||||||

| (in millions, except dollars) | ||||||||||||

| Smart TV Shipments(1) |

4.4 | 5.9 | 7.1 | |||||||||

| SmartCast Active Accounts(1) (as of December 31) |

3.6 | 7.6 | 12.2 | |||||||||

| SmartCast Average Revenue Per User (ARPU)(1)(2) |

N/A | $ | 7.31 | $ | 12.99 | |||||||

2

Table of Contents

| (1) | For a discussion of how we calculate our key business metrics, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics.” |

| (2) | Prior to 2019, we did not track SmartCast ARPU and as such we do not present this metric for 2018. |

Our Businesses

We operate two distinct but fully integrated businesses: Device and Platform+.

Device

We offer a portfolio of cutting-edge Smart TVs and a versatile series of sound bars that provide an immersive consumer entertainment experience and cater to a range of different consumer price segments. Our devices are sold both in stores and online, including at major national retailers, such as Amazon, Best Buy, Costco, Sam’s Club, Target and Walmart. We also sell our devices through our online channel at VIZIO.com. Through our strong and long-standing relationships with our retailers, our product lines are well distributed across the country, which attracts consumers across a broad range of demographics. By working closely with our suppliers, we have been able to focus our resources on design, marketing and distribution.

Platform+

Platform+ is comprised of SmartCast, our award-winning Smart TV operating system, which enables our fully integrated entertainment solution, and Inscape, which powers our data intelligence and services.

SmartCast delivers a compelling array of content and applications through an elegant and easy-to-use interface. It supports many of the leading streaming apps, such as Amazon Prime Video, Apple TV+, Disney+, Hulu, Netflix, Paramount+, Peacock and YouTube TV, and hosts our own free, ad-supported apps, WatchFree and VIZIO Free Channels. SmartCast also supports Apple AirPlay 2 and Chromecast functionalities to allow users to stream additional content from their other devices to our Smart TVs. It provides broad support for third-party voice platforms, including Amazon Alexa, Apple HomeKit and Google Voice Assistant, as well as second screen viewing to offer additional interactive features and experiences.

Our proprietary Inscape technology enables ACR, which identifies most content displayed on the Smart TV screen regardless of the input. We aggregate this viewing data to increase transparency and enhance targeting abilities for our advertisers. Additionally, we are a leader in driving the innovation and development of Dynamic Ad Insertion (DAI). We launched Project OAR (Open, Accessible, Ready), an industry consortium working directly with many of the largest television networks to establish a technology standard to advance the adoption of DAI and addressable advertising. The adoption of our DAI technology is in its early stages and is an example of our innovation in the marketplace.

We monetize Platform+ through several avenues:

Advertising

| • | Ad-supported Video on Demand (AVOD): Ad inventory on services such as WatchFree, VIZIO Free Channels and certain third-party AVOD services |

| • | Home screen: Ad placements on the SmartCast home screen |

| • | Partner marketing: Images of content and available apps on our television cartons |

3

Table of Contents

Data licensing

| • | Inscape: Data licensing fees from ad technology companies, ad agencies and networks to aid ad buying decisions or to enable DAI capabilities |

Content distribution, transactions and promotion

| • | Subscription Video on Demand (SVOD) and Virtual Multichannel Video Programming Distributor (vMVPD): Revenue shared by SVOD and vMVPD services on new user subscriptions activated or reactivated through our platform |

| • | Premium Video on Demand (PVOD) and Transaction Video on Demand (TVOD): Revenue shared by PVOD and TVOD services for purchases made on our platform |

| • | Branded buttons on remote controls: Dedicated shortcuts for content providers |

Industry Trends

We have both driven and benefitted from powerful secular trends that are transforming the way consumers, content providers and advertisers interact in the entertainment industry, including:

| • | Proliferation of Smart TVs and shifting consumer viewing preferences |

| • | Increasingly connected home ecosystem |

| • | Linear TV ad spend shifting to OTT |

Future Role of the TV in the Home

We believe we are well positioned to capitalize on these trends and drive the next big shift in the television landscape. Consider everything in a home that can currently be controlled from a smart phone—things like setting a thermostat, adjusting the lights, controlling the refrigerator or setting the alarm. Our vision is for VIZIO Smart TVs to become the center of the connected home and empower these and many other functions.

We have invested in this future, including through the introduction of our SmartCast platform, and we intend to continue to improve our innovative features, such as mobile app control, IoT voice support and our dynamic operating system to augment such connectivity. Over time, we envision consumers using their VIZIO Smart TVs for:

| • | Communication: Engaging with social networks, using messaging services and accessing telecommuting features such as video conferencing. |

| • | Fitness and wellness: Connecting to interactive fitness and wellness services, such as personal training sessions and exercise tracking, from the comfort of their own living room. |

| • | Commerce: Browsing online shopping services, purchasing products featured on TV as part of dynamic ads and placing food orders on delivery services through voice control. |

| • | Community: Hosting virtual, integrated watch parties for the latest movie or the big game; watching live sports on TV will become an interactive experience through play-along gaming. |

| • | Dynamic entertainment experiences: Attending virtual concerts or sporting events offering viewer-controlled, multi-cam experiences. |

These services create opportunities for in-app transactions and we believe that by enabling these transactions we will increase monetization on our platform.

4

Table of Contents

Our Market Opportunity

We believe we have a sizable market opportunity in Smart TVs. Beyond this opportunity, we have large market opportunities spanning the television advertising and SVOD markets, as well as the developing connected home market.

| • | According to eMarketer, U.S. linear TV advertising spend was $70.6 billion in 2019. As viewership grows, connected TV advertising creates a more valuable audience through its targeting abilities. eMarketer forecasted that connected TV advertising will increase from $6.4 billion in 2019 to $18.3 billion in 2024. |

| • | According to PwC, U.S. consumers spent $18.2 billion in 2019 on SVOD and TVOD services and these markets are expected to grow to $30.9 billion in 2024. |

As we expand the functionalities of our Smart TVs and SmartCast operating system, we expect to generate recurring revenue by facilitating additional services.

Our Products

While our Smart TVs and sound bars continue to generate the majority of our total net revenue, we believe our advertising products offer the largest opportunity to profitably grow our business. We intend to significantly invest in expanding our advertising capabilities further accelerating the secular shift to connected TV advertising.

Advertising

Our advertising products benefit advertisers and content providers by offering a range of options to connect with our audience. Our primary advertising products include:

| • | Ad inventory: Through WatchFree and VIZIO Free Channels, we offer a broad range of advertising inventory across a variety of programming genres. We sell 15-, 30- and 60-second video ads for this programming and enable product sponsorships and promotional channels to drive shopping. We also negotiate inventory shares with certain AVOD apps. |

| • | Promotional ads: Our home screen is a powerful tool that helps consumers discover new content and easily find their favorite apps and shows. We sell advertising space in our Hero Banner and Discover Banner, allowing content providers options to showcase a movie or show. We also offer content providers the opportunity to purchase buttons on our remote controls to facilitate easy access to their apps. |

| • | Viewing data: We utilize our ACR technology to help advertisers and AVOD apps deliver more relevant ads to consumers. |

Smart TVs

Our broad Smart TV portfolio consists of five series, each designed to target a specific consumer segment and their preferences for high picture quality, powerful processing and video performance, smart capabilities, a wide variety of content, streamlined connectivity and convenience features, and a stylish, modern industrial design.

Sound bars

Our broad collection of high-performance sound bars delivers the home theater experience with immersive sound, powerful performance and modern designs optimized to fit the user’s room and television size.

5

Table of Contents

Our Key Differentiators

Founder-led team with clear vision

William Wang founded VIZIO in 2002, with a dream for making home entertainment accessible to everyone. As our Chairman and CEO, he leads our vision to position the Smart TV as the center of the connected home. We strive to live by his founding principle of “Where Vision Meets Value” by providing high-quality, feature-rich products at affordable pricing. Our commitment to value while delivering high performance enables us to attract consumers and deliver on our vision.

Trusted brand with history of innovation

We have built a strong and trusted brand that symbolizes premium technology, quality and value. The VIZIO platform provides consumers with cutting-edge picture and audio performance that enhances the entertainment experience, while being easy to use and connecting viewers to a broad array of content. We have developed a reputation as a visionary company and market disruptor.

Unique asset-light operating model with outsourced manufacturing and supply chain excellence

We have created and continue to leverage an asset-light operating model with outsourced manufacturing that provides scale-driven cost savings and greater flexibility. Our manufacturing partners maintain the full production process for our Smart TVs and sound bars while we focus on designs, product specifications, marketing and distribution. We work very closely with our manufacturing partners in providing exceptional service to consumers throughout the warranty period.

Integrated hardware and software solutions

We have evolved from being a designer of cutting-edge televisions to becoming a pioneer of Smart TVs. Our integrated offering enables us to have full control over the user experience. Equipped with our SmartCast operating system, our Smart TVs offer consumers a unified solution for their entertainment needs, allowing us to generate recurring revenue and deliver significant lifetime value, which further enables us to deploy competitive Smart TVs in the future.

Broad access to OTT services provide multiple revenue streams

Our platform provides consumers with seamless access to many popular OTT services, including Amazon Prime Video, Apple TV+, Disney+, Hulu, Netflix, Paramount+, Peacock and YouTube TV. Our largest monetization opportunity stems from third-party content through WatchFree, VIZIO Free Channels and select AVOD platforms. On these services, we receive ad inventory that we sell directly to brands, ad agencies and programmatic connected TV ad buyers. We facilitate a win-win relationship with our content providers by acting as another distribution channel for their content.

Platform+ is well-positioned to monetize the shift to OTT

The consumer shift away from linear TV has disrupted the traditional TV advertising model, which is undergoing a transition to OTT. Smart TVs offer an attractive value proposition for advertisers to reach cord-cutters who have disconnected their Pay TV subscription or consumers who have never subscribed to Pay TV in a more targeted way. Our large Smart TV footprint in the United States provides us with the scale to reach a growing audience of consumers who are shifting away from linear TV. Through WatchFree and VIZIO Free Channels, we offer ad inventory that is attractive to both programmatic and direct advertising buyers. Additionally, we effectively monetize advertising capabilities by leveraging our data and technologies, including ACR, to offer increased transparency and enhanced targeting abilities to advertisers.

6

Table of Contents

The VIZIO Value Proposition

Consumers

For consumers, we deliver a premium and interactive entertainment experience at an affordable price. We offer a large portfolio of Smart TVs and sound bars, and our SmartCast operating system provides many of the leading streaming apps through an easy-to-use interface.

Retailers

For retailers, we provide quality, affordable and competitive products that attract consumers across a broad range of demographics, driving additional consumers to these retailers and helping grow their revenue.

Content providers

For content providers, our large base of Smart TVs that are in millions of homes across the United States provides an additional avenue to increase viewership and subscriptions. SmartCast enables them to reach a growing audience that is shifting away from linear TV.

Advertisers

For advertisers, we offer truly incremental reach to linear TV advertising as many VIZIO consumers either do not connect a cable or satellite box to their Smart TVs, or supplement their linear TV viewing with streaming content. Additionally, we expect our ACR and DAI capabilities to allow for more targeted advertising, including for those consumers who view linear TV on our Smart TVs.

Our Growth Strategy

Increase the sales of our Smart TVs

Our current market position reflects consumer demand for our cutting-edge technology at affordable prices. We will continue to invest in designing and developing new features, as well as in our sales and marketing, to increase the sales of our Smart TVs.

Grow awareness and adoption of SmartCast

By selling Smart TVs, we have the opportunity to bring additional consumers onto our SmartCast operating system. Through a combination of a vast array of content from leading third-party apps and expanding our platform’s functionalities, we are focused on making SmartCast the primary source for content streaming and driving SmartCast Active Accounts.

Drive user engagement

Our SmartCast operating system is the gateway to a streamlined entertainment experience, and we believe that SmartCast can one day power the connected home. SmartCast provides consumers with access to a broad range of content, and our intuitive user interface can deliver a wide variety of relevant, personalized content recommendations based on user viewing behavior. By growing our content library, delivering a more personalized viewing experience and increasing the functionalities of our Smart TVs, we can enhance the consumer experience and drive user engagement.

Grow SmartCast ARPU

We expect to grow SmartCast ARPU as we increase our monetization capabilities and the hours spent on our platform. Increasing advertising on our platform is currently the largest opportunity to enhance our

7

Table of Contents

SmartCast ARPU. We intend to leverage our significant market share in U.S. homes, our engaged user base on SmartCast, our Inscape data capabilities and investments in our advertising sales force to increase our advertising revenue.

Risk Factors Summary

Our ability to successfully operate our business is subject to numerous risks, including those identified in the section titled “Risk Factors” immediately following this prospectus summary. These risks include, among others:

| • | Decreases in average selling prices of our Smart TVs and other devices may reduce our total net revenue, gross profit and net income, particularly if we are not able to reduce our expenses commensurately. |

| • | We depend on sales of our Smart TVs for a substantial portion of our total net revenue, and if the volume of these sales declines or is otherwise less than our expectations, we could lose market share or our Device net revenue may not grow at the rate we expect and our business, financial condition and results of operations may suffer. |

| • | If we fail to keep pace with technological advances in our industry, or if we pursue technologies that do not become commercially accepted, consumers may not buy our devices, and our revenue and profitability may decline. |

| • | We compete in rapidly evolving and highly competitive markets, and we expect intense competition to continue, which could result in a loss of our market share and a decrease in our revenue and profitability and may harm our growth prospects. |

| • | If we are unable to provide a competitive entertainment offering through SmartCast, our ability to attract and retain consumers would be harmed, as they increasingly look for new ways to access, discover and view digital content. |

| • | Platform+ has experienced recent rapid growth, and our future success depends in part on our ability to continue to grow Platform+. |

| • | A small number of retailers account for a substantial majority of our Device net revenue, and if our relationships with any of these retailers is harmed or terminated, or the level of business with them is significantly reduced, our results of operations may be harmed. |

| • | If we do not effectively maintain and further develop our device sales channels, including developing and supporting our retail sales channels, or if any of our retailers experience financial difficulties or fails to promote our devices, our business may be harmed. |

| • | We depend on a limited number of manufacturers for our devices and their components. If we experience any delay or disruption, or quality control problems with our manufacturers in their operations, we may be unable to keep up with retailer and consumer demand for our devices, we could lose market share and revenue and our reputation, brand and business would be harmed. |

| • | We and our third-party service providers collect, store, use, disclose and otherwise process information collected from or about consumers of our devices. The collection and use of personal information subjects us to legislative and regulatory burdens, and contractual obligations, and may expose us to liability. |

| • | A breach of the confidentiality or security of information we hold or of the security of the computer systems used in and for our business could be detrimental to our business, financial condition and results of operations. |

8

Table of Contents

| • | Third parties may claim we are infringing, misappropriating or otherwise violating their intellectual property rights and we could be prevented from selling our devices, or suffer significant litigation expense, even if these claims have no merit. |

| • | Our net revenue and net income vary significantly from quarter to quarter due to a number of factors, including changes in demand for the devices we sell, including seasonal fluctuations reflecting traditional retailer and consumer purchasing patterns. |

| • | After this offering, you will own single-vote-per-share Class A common stock while shares of our 10-vote-per-share Class B common stock held by our Founder, Chairman and Chief Executive Officer, William Wang, and his affiliates will represent a substantial majority of the voting power of our outstanding capital stock. As a result, Mr. Wang will continue to have control over our company after this offering, which will severely limit your ability to influence or direct the outcome of key corporate actions and transactions, including a change in control. |

| • | We are a “controlled company” within the meaning of the New York Stock Exchange rules. As a result, we qualify for, and intend to rely on, exemptions from certain corporate governance requirements that provide protection to stockholders of other companies. |

Our Capital Structure

Upon the closing of this offering, we will have three classes of common stock. Our Class A common stock, which is the stock we are offering by means of this prospectus, has one vote per share, our Class B common stock has 10 votes per share, and our Class C common stock has no voting rights, except as otherwise required by law.

Upon the completion of this offering, all shares of Class B common stock will be held by William Wang, our Founder, Chairman and Chief Executive Officer and his affiliates. In addition, Mr. Wang is expected to enter into voting agreements whereby he will maintain voting control over the shares of Class B common stock held by his affiliates. Accordingly, upon completion of this offering, assuming an offering size as set forth above, the shares beneficially owned by Mr. Wang (including shares over which he has voting control) will represent 91.7% of the total voting power of our outstanding capital stock. Mr. Wang will be able to determine or significantly influence any action requiring the approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws, and the approval of any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transaction.

Shares of our Class C common stock, which entitle the holder to zero votes per share, will not be issued and outstanding at the closing of the offering and we have no current plans to issue shares of Class C common stock. These shares will be available to be used in the future to further strategic initiatives, such as financings or acquisitions, or issue future equity awards to our service providers. Because the shares of Class C common stock have no voting rights (except as otherwise required by law), the issuance of such shares will not result in further dilution to the voting power held by Mr. Wang. Further, one of the events that will result in the final conversion of all of the outstanding shares of Class B common stock is the date fixed by the board of directors that is no less than 61 days and more than 180 days following the first date after the completion of this offering that the number of shares of Class B common stock held by Mr. Wang and his affiliates is less than 25% of the Class B common stock held by Mr. Wang and his affiliates as of the date of the completion of this offering (the 25% Ownership Threshold).

The multi-class structure of our common stock is intended to ensure that, for the foreseeable future, Mr. Wang continues to control or significantly influence our governance which we believe will permit us to continue to prioritize our long-term goals rather than short-term results, to enhance the likelihood of stability in the composition of our board of directors and its policies, and to discourage certain types of transactions that may involve an actual or threatened acquisition of us. This multi-class structure is intended to preserve this control until Mr. Wang departs our company or the 25% Ownership Threshold is no longer met.

9

Table of Contents

Controlled Company Status

Following this offering, because William Wang, our Founder, Chairman and Chief Executive Officer will control more than 50% of the voting power of our Class A and Class B common stock, we will be considered a “controlled company” under the New York Stock Exchange rules. As such, we are permitted to opt out of compliance with certain New York Stock Exchange corporate governance requirements and we intend to rely on certain of such exemptions. Accordingly, stockholders will not have the same protections afforded to stockholders of companies that are subject to all of the New York Stock Exchange corporate governance requirements.” See “Risk Factors—We are a “controlled company” within the meaning of the New York Stock Exchange rules. As a result, we qualify for, and intend to rely on, exemptions from certain corporate governance requirements that provide protection to stockholders of other companies.”

Corporate Information

California VIZIO was formed as a California corporation in October 2002, and we launched our principal operations in 2003. California VIZIO was originally incorporated as V, Inc. and was renamed VIZIO, Inc. in March 2007. In December 2020, we began reorganizing in Delaware by forming Parent as a Delaware corporation. On March 12, 2021, pursuant to an agreement and plan of merger, VIZIO Reorganization Sub, LLC, a wholly owned subsidiary of Parent, merged with and into California VIZIO, with California VIZIO surviving as the wholly owned subsidiary of Parent. As a result of this transaction, referred to throughout this prospectus as the Reorganization Transaction:

| • | Parent became a holding company with no material assets other than 100% of the equity interests of California VIZIO; |

| • | Each share of Class A common stock and Series A convertible preferred stock, respectively, of California VIZIO was cancelled in exchange for the issuance of one share of Class A common stock and Series A convertible preferred stock, respectively, of Parent; |

| • | Parent will consolidate the financial results of California VIZIO and its subsidiaries; |

| • | Parent assumed the 2007 Incentive Award Plan and 2017 Incentive Award Plan of California VIZIO, and the options and other awards granted thereunder, on a one-for-one basis and on the same terms and conditions; and |

| • | All of our business operations will continue to be conducted through California VIZIO and its subsidiaries. |

Between Parent’s incorporation in December 2020 and the completion of the Reorganization Transaction, Parent did not conduct any activities other than those incidental to its formation and the preparation of this prospectus. Accordingly, our consolidated financial statements and other financial information included in this prospectus reflect the results of operations and financial position of California VIZIO and its subsidiaries.

Our principal executive offices are located at 39 Tesla, Irvine, California 92618, and our telephone number is (949) 428-2525. Our website is located at www.VIZIO.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus or in deciding to purchase our Class A common stock.

VIZIO® and our other registered or common law trademarks, service marks, or trade names appearing in this prospectus are the property of VIZIO, Inc. Solely for convenience, our trademarks, tradenames, and service marks referred to in this prospectus appear without the ®, TM, and SM symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, tradenames, and service marks. This prospectus contains additional trademarks, tradenames, and service marks of other companies that are the property of their respective owners.

10

Table of Contents

THE OFFERING

Class A common stock offered:

| By us |

7,560,000 shares |

| By the selling stockholders |

7,560,000 shares |

| Total |

15,120,000 shares |

| Underwriters’ option to purchase additional shares |

The selling stockholders have granted the underwriters an option to purchase an additional 2,268,000 shares of Class A common stock. |

| Class A common stock to be outstanding after the offering |

87,515,505 shares (or 88,246,395 shares if the underwriters exercise in full their option to purchase additional shares from the selling stockholders) |

| Class B common stock to be outstanding after the offering |

96,196,743 shares (or 95,465,853 shares if the underwriters exercise in full their option to purchase additional shares from the selling stockholders) |

| Class C common stock to be outstanding after the offering |

None |

| Class A, Class B and Class C common stock to be outstanding after the offering |

183,712,248 shares |

| Use of proceeds |

We estimate that the net proceeds from our sale of shares of Class A common stock in this offering at an assumed initial public offering price of $22.00 per share, which is the midpoint of the price range set forth on the front cover of this prospectus, will be approximately $151.1 million, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| The principal purposes of this offering are to increase our capitalization and financial flexibility, create a public market for our Class A common stock, and enable access to the public equity markets for us and our stockholders. We intend to use the net proceeds from this offering for general corporate purposes, including working capital, operating expenses, and capital expenditures. We also intend to use $14.0 million of the net proceeds from this offering to satisfy a licensing payment that will become due in connection with this offering. We may use up to $12.5 million of the net proceeds from this offering to satisfy tax withholding obligations for certain restricted stock awards that will vest on the date that this registration statement is declared effective by the SEC. We may also use further net proceeds from this offering to satisfy tax withholding obligations for certain restricted stock awards that will vest after the date that this registration statement is declared effective by the SEC. |

11

Table of Contents

| We will not receive any proceeds from the sale of shares by the selling stockholders. See “Use of Proceeds.” |

| Voting rights |

On all matters to be voted upon by our common stockholders, holders of our Class A common stock are entitled to one vote per share, holders of our Class B common stock are entitled to 10 votes per share and holders of our Class C common stock have no voting rights, except as otherwise required by law. Shares of our Class A and Class B common stock vote together as a single class on all matters submitted to a vote of stockholders, unless otherwise required by law or our amended and restated certificate of incorporation. See “Description of Capital Stock.” |

| Controlled company |

Immediately following completion of this offering, the shares beneficially owned by Mr. Wang (including shares over which he has voting control) will represent 91.7% of the total voting power of our outstanding capital stock, assuming the offering size set forth on the cover of this prospectus. As a result, Mr. Wang will be able to control the outcome of all matters submitted to a vote of our stockholders, including, for example, the election of directors, amendments to our certificate of incorporation and mergers or other business combinations. See “Description of Capital Stock.” In addition, we are able to avail ourselves of the controlled company exemption under the corporate governance requirements of the New York Stock Exchange, so you will not have the same protections afforded to stockholders of companies that are subject to all of such requirements. |

| Risk factors |

See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider carefully before investing in shares of our Class A common stock. |

| Directed share program |

At our request, the underwriters have reserved up to 5% of shares offered by this prospectus for sale at the initial public offering price through a directed share program available to directors, officers, employees and their friends and family members. The sales will be administered by J.P. Morgan Securities LLC, an underwriter in this offering. We do not know if these parties will choose to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available to the general public. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same terms as the other shares of Class A common stock. Additionally, except in the case of shares purchased by any director or officer, shares purchased through the directed share program will not be subject to a lock-up restriction. See the section titled “Underwriting—Directed Share Program” for additional information. |

| Proposed New York Stock Exchange trading symbol |

“VZIO” |

12

Table of Contents

The number of shares of Class A common stock, Class B common stock and Class C common stock that will be outstanding after this offering is based on 77,519,223 shares of our Class A common stock, 98,633,025 shares of our Class B common stock and no shares of our Class C common stock outstanding, in each case as of December 31, 2020, after giving effect to the Reorganization Transaction, the Forward Stock Split, the Series A Conversion, the RSA Forfeiture and the Class B Stock Exchange described below, as if they had occurred on December 31, 2020, and includes:

| • | 47,203,623 shares of our Class A common stock, which reflects an actual 150,831,648 shares of Class A common stock outstanding (including 1,415,700 shares of restricted stock, certain of which will be forfeited to us to satisfy tax withholding obligations in connection with this offering), reduced by (i) 4,995,000 shares of our Class A common stock forfeited in the RSA Forfeiture (as defined below) and (ii) 98,633,025 shares exchanged in the Class B Stock Exchange (as defined below); |

| • | 30,315,600 additional shares of our Class A common stock following the conversion of our Series A convertible preferred stock in the Series A Conversion (as defined below); and |

| • | 98,633,025 shares of our Class B common stock, which reflects the shares to be issued in the Class B Stock Exchange. |

The number of shares of our Class A common stock and Class B common stock outstanding as of December 31, 2020 excludes the following:

| • | 14,542,173 shares of our Class A common stock issuable upon the exercise of options outstanding under our 2017 Incentive Award Plan (2017 Plan) as of December 31, 2020 at a weighted average exercise price of $4.37 per share; |

| • | 688,068 shares of our Class A common stock issuable upon the exercise of options granted after December 31, 2020 at an exercise price of $8.55 per share; |

| • | 1,874,250 shares of our Class A common stock issuable upon the exercise of options outstanding under our 2007 Incentive Award Plan (2007 Plan) as of December 31, 2020 at a weighted average exercise price of $2.57 per share; |

| • | 2,034,972 shares of our Class A common stock subject to RSUs outstanding as of December 31, 2020; |

| • | 5,085,000 shares of our Class A common stock subject to RSUs granted after December 31, 2020; |

| • | 14,435,442 shares of our Class A common stock reserved for future issuance under our 2017 Plan (reflecting 20,208,510 shares reserved as of December 31, 2020 reduced by the equity awards granted after December 31, 2020 described above); and |

| • | 1,800,000 shares of our Class A common stock to be reserved for future issuance under our 2021 Employee Stock Purchase Plan (our ESPP), which will become effective prior to the completion of this offering. |

Our 2017 Plan and our ESPP will provide for annual automatic increases in the number of shares of our Class A common stock reserved thereunder. See the section titled “Executive Compensation—Employee Benefit and Stock Plans” for additional information.

In addition, unless otherwise indicated, all information in this prospectus assumes and reflects:

| • | the consummation of the Reorganization Transaction, including the issuance to the former holders of all of the outstanding shares of Class A common stock and Series A preferred stock of California |

13

Table of Contents

| VIZIO of an equivalent number of shares of Class A common stock or Series A preferred stock, as applicable, of VIZIO Holding Corp.; |

| • | a nine-for-one split of our Class A common stock effected on March 15, 2021 (the Forward Stock Split), including an increase in the authorized shares of our capital stock, with all share, option, RSU and per share information for all periods presented in this prospectus adjusted to reflect the Forward Stock Split on a retroactive basis; |

| • | the conversion of all of the outstanding shares of our Series A convertible preferred stock into shares of our Class A common stock (the Series A Conversion), with each share of Series A convertible preferred stock converting into 225 shares of Class A common stock due to the Forward Stock Split and a prior 25-for-one split of our Class A common stock; |

| • | the filing of our amended and restated certificate of incorporation, which will occur concurrently with the completion of this offering; |

| • | the forfeiture of 4,995,000 shares of our Class A common stock subject to restricted stock awards subsequent to December 31, 2020 (the RSA Forfeiture); |

| • | no forfeiture of certain shares of our Class A common stock for the purpose of satisfying withholding taxes due upon the vesting of 944,775 shares of Class A common stock subject to restricted stock awards in connection with this offering; |

| • | the exchange of all of the shares of our Class A common stock held by William Wang, our Founder, Chairman and Chief Executive Officer and certain of his affiliated entities into an equivalent number of shares of our Class B common stock, which exchange will occur immediately prior to the completion of this offering pursuant to the terms of an exchange agreement (the Class B Stock Exchange); |

| • | the conversion of shares of Class B common stock held by Mr. Wang and his affiliates following the Class B Stock Exchange into shares of Class A common stock prior to their sale in this offering; |

| • | no exercise of options or vesting of RSUs subsequent to December 31, 2020; and |

| • | no exercise of the underwriters’ option to purchase additional shares from the selling stockholders. |

14

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table summarizes the consolidated financial data of California VIZIO for the periods presented and should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements of California VIZIO and related notes appearing elsewhere in this prospectus. Prior to the completion of the Reorganization Transaction, VIZIO Holding Corp. will not conduct any activities other than those incidental to its formation and the preparation of this prospectus. Accordingly, our consolidated financial statements and other financial information included in this prospectus reflect the results of operations and financial position of California VIZIO and its subsidiaries. See “Prospectus Summary—Corporate Information.” The summary consolidated statements of income data for the years ended December 31, 2018, 2019 and 2020 are derived from our audited consolidated financial statements included elsewhere in this prospectus. The historical results presented below are not necessarily indicative of financial results to be achieved in future periods.

Consolidated Statements of Operations Data

| Year Ended December 31, | ||||||||||||

| 2018 | 2019 | 2020 | ||||||||||

| (in thousands, except per share data) | ||||||||||||

| Net revenue: |

||||||||||||

| Device |

$ | 1,744,353 | $ | 1,773,600 | $ | 1,895,275 | ||||||

| Platform+ |

36,377 | 63,199 | 147,198 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total net revenue |

1,780,730 | 1,836,799 | 2,042,473 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cost of goods sold: |

||||||||||||

| Device |

1,656,082 | 1,648,583 | 1,710,776 | |||||||||

| Platform+ |

14,387 | 23,051 | 35,339 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total cost of goods sold |

1,670,469 | 1,671,634 | 1,746,115 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit: |

||||||||||||

| Device |

88,271 | 125,017 | 184,499 | |||||||||

| Platform+ |

21,990 | 40,148 | 111,859 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total gross profit |

110,261 | 165,165 | 296,358 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating expenses: |

||||||||||||

| Selling, general and administrative |

95,753 | 108,983 | 130,884 | |||||||||

| Marketing |

19,161 | 22,656 | 31,279 | |||||||||

| Depreciation and amortization |

5,030 | 4,134 | 2,296 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

119,944 | 135,773 | 164,459 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) from operations |

(9,683 | ) | 29,392 | 131,899 | ||||||||

| Interest income (expense), net |

(1,633 | ) | 1,178 | 12 | ||||||||

| Other income (expense), net |

10,532 | 235 | 532 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-operating income |

8,899 | 1,413 | 544 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

(784 | ) | 30,805 | 132,443 | ||||||||

| Provision for (benefit from) income taxes |

(628 | ) | 7,719 | 29,968 | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

$ | (156 | ) | $ | 23,086 | $ | 102,475 | |||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive income (loss): |

||||||||||||

| Net income (loss) |

(156 | ) | 23,086 | 102,475 | ||||||||

| Foreign currency translation adjustments |

330 | (125 | ) | 721 | ||||||||

|

|

|

|

|

|

|

|||||||

| Comprehensive income (loss) |

174 | 23,211 | 103,196 | |||||||||

|

|

|

|

|

|

|

|||||||

| Earnings per share: |

||||||||||||

| Basic |

$ | 0.00 | $ | 0.12 | $ | 0.56 | ||||||

| Diluted |

$ | 0.00 | $ | 0.12 | $ | 0.55 | ||||||

| Weighted average shares outstanding: |

||||||||||||

| Basic |

137,961 | 144,127 | 144,381 | |||||||||

| Diluted |

137,961 | 147,063 | 147,012 | |||||||||

15

Table of Contents

Consolidated Balance Sheet Data

| As of December 31, 2020 | ||||||||||||

| Actual | Pro Forma(1) |

Pro Forma As Adjusted(2)(3) |

||||||||||

| (in thousands) | ||||||||||||

| Cash and cash equivalents and investments |

$ | 207,728 | $ | 207,140 | $ | 344,227 | ||||||

| Working capital(4) |

64,094 | 63,507 | 214,600 | |||||||||

| Total assets |

774,982 | 774,395 | 911,482 | |||||||||

| Total liabilities |

625,751 | 625,751 | 611,751 | |||||||||

| Convertible preferred stock |

2,565 | — | — | |||||||||

| Total stockholders’ equity |

149,231 | 148,643 | 299,731 | |||||||||

| (1) | The pro forma column in the consolidated balance sheet data table above reflects (i) the consummation of the Reorganization Transaction prior to the completion of this offering; (ii) the occurrence of the Series A Conversion upon the completion of this offering; (iii) the payment of dividends totaling an aggregate of $0.6 million to holders of our Series A preferred stock accruing through the consummation of this offering, substantially all of which had been accrued as of December 31, 2020; (iv) the filing of our amended and restated certificate of incorporation prior to the completion of this offering; (v) the RSA Forfeiture and (vi) the occurrence of the Class B Stock Exchange immediately prior to the completion of this offering. |

| (2) | The pro forma as adjusted column in the balance sheet data table above gives effect to (i) the pro forma adjustments set forth above, (ii) the sale and issuance by us of shares of our Class A common stock in this offering at an assumed initial public offering price of $22.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us and (iii) the application of $14.0 million of the net proceeds from this offering to satisfy a licensing payment that will become due in connection with this offering. |

| (3) | Each $1.00 increase or decrease in the assumed initial public offering price of $22.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease the amount of our pro forma as adjusted cash and cash equivalents, working capital, total assets, and total stockholders’ equity by $7.0 million, assuming that the number of shares of common stock offered, as set forth on the cover page of this prospectus, remains the same, after deducting estimated underwriting discounts and commissions. An increase or decrease of 1.0 million shares in the number of shares offered by us would increase or decrease, as applicable, the amount of our pro forma as adjusted cash and cash equivalents, working capital, total assets, and total stockholders’ equity by $20.5 million, assuming the assumed initial public offering price remains the same, and after deducting estimated underwriting discounts and commissions. |

| (4) | Working capital is defined as current assets less current liabilities. |

Non-GAAP Financial Measure

In addition to our financial information presented in accordance with GAAP, we believe Adjusted EBITDA is useful to investors in evaluating our operating performance. We define Adjusted EBITDA, a non-GAAP financial metric, as total net income before interest income (expense), net, other income, net, provision for (benefit from) income taxes, depreciation and amortization and stock-based compensation. We use Adjusted EBITDA in conjunction with net income (loss) as part of our overall assessment of our operating performance and the management of our working capital needs. Our definition of Adjusted EBITDA may differ from the definition used by other companies and therefore comparability may be limited. In addition, other companies may not publish Adjusted EBITDA or similar metrics. Furthermore, Adjusted EBITDA has certain limitations in that it does not include the impact of certain expenses that are reflected in our consolidated statement of operations that are necessary to run our business. Thus, Adjusted EBITDA should be considered in addition to, not as a substitute for, or in isolation from, measures prepared in accordance with GAAP, including net income (loss).

| Year Ended December 31, | ||||||||||||

| 2018 | 2019 | 2020 | ||||||||||

| (in thousands) | ||||||||||||

| Net income (loss) |

$ | (156 | ) | $ | 23,086 | $ | 102,475 | |||||

| Adjusted EBITDA(1) |

$ | 584 | $ | 37,604 | $ | 138,971 | ||||||

| (1) | See the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics—Non-GAAP financial measure” for a reconciliation between Adjusted EBITDA and net income, the most directly comparable generally accepted accounting principle (GAAP) financial measure. |

16

Table of Contents

An investment in our Class A common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the financial statements and all the other information in this prospectus, before you decide to purchase any shares of our Class A common stock. Many of the risks and uncertainties described below may be exacerbated by the ongoing COVID-19 pandemic and any worsening of the global business and economic environment as a result. If any of the following risks actually occur, our business, financial condition or results of operations may be harmed and you may lose all or part of your investment.

Risks Relating to Our Industry and Business