UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

Terran Orbital Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

1 | Page

|

|

|

|

|

TERRAN ORBITAL CORPORATION 6800 BROKEN SOUND PARKWAY NW SUITE 200 BOCA RATON, FL 33487 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held at 11:00 am Eastern Time on May 1, 2023

Dear Stockholders of Terran Orbital Corporation:

We cordially invite you to attend the 2023 annual meeting of stockholders (the “2023 Annual Meeting”) of Terran Orbital Corporation, a Delaware corporation, to be held on May 1, 2023 at 11:00 am Eastern Time. The 2023 Annual Meeting will be conducted exclusively online through a live audio webcast to facilitate stockholder attendance and to enable stockholders to participate fully and equally, regardless of size of holdings, resources or physical location. You will be able to attend the 2023 Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/LLAP2023, where you will be able to listen to the meeting live, submit questions and vote online.

Whether or not you attend the 2023 Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, we urge you to promptly vote and submit your proxy via the Internet, by telephone or by mail.

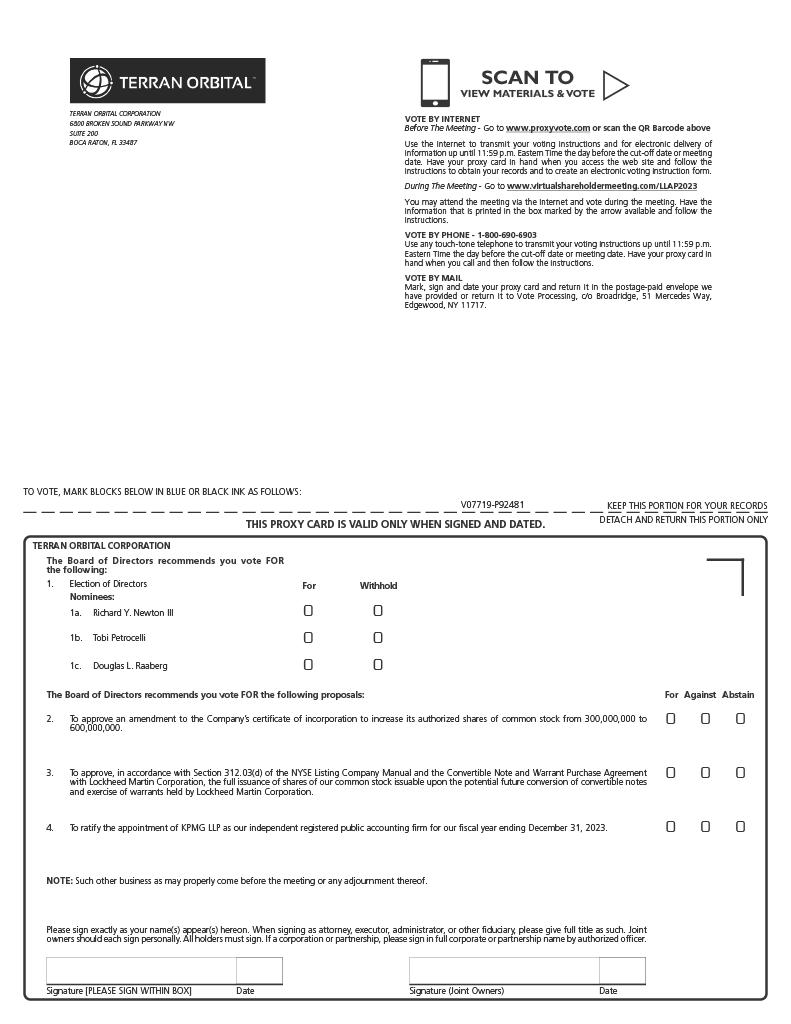

We are holding the 2023 Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement:

|

1. |

To elect three nominees identified in the accompanying proxy statement to serve as Class I directors until the 2026 annual meeting of stockholders and until their successors are duly elected and qualified; |

|

2. |

To approve an amendment to our certificate of incorporation to increase the authorized shares of our common stock, par value $0.0001 per share (our “Common Stock”) from 300,000,000 to 600,000,000; |

|

3. |

To approve, in accordance with Section 312.03(d) of the NYSE’s Listed Company Manual and the Convertible Note and Warrant Purchase Agreement with Lockheed Martin Corporation (“Lockheed Martin”), the full issuance of shares of our Common Stock issuable upon the potential future conversion of the convertible notes and exercise of the warrants held by Lockheed Martin; |

|

4. |

To ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023; and |

|

5. |

To transact such other business as may properly come before the 2023 Annual Meeting or any adjournments or postponements thereof. |

Our Board of Directors has fixed the close of business on March 31, 2023 as the record date for the 2023 Annual Meeting. Stockholders of record on March 31, 2023 are entitled to receive this notice (the “Notice”) and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement. These proxy materials include this Notice, the proxy statement and the proxy card.

The accompanying proxy materials and our annual report can be accessed by visiting: www.virtualshareholdermeeting.com/LLAP2023. You will be asked to enter the 12-digit control number located on your proxy card.

2 | Page

YOUR VOTE IS IMPORTANT. Whether or not you plan to virtually attend the 2023 Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail as soon as possible to ensure your shares are represented. For additional instructions on voting by Internet, telephone or mail, please refer to your proxy card. Returning the proxy does not deprive you of your right to virtually attend the 2023 Annual Meeting and to vote your shares at the 2023 Annual Meeting.

By order of the Board of Directors,

Marc Bell

Chairman and CEO

Boca Raton, Florida

The date of this proxy statement is April 13, 2023 and is being mailed to stockholders on or about April 13, 2023.

3 | Page

TERRAN ORBITAL CORPORATION

PROXY STATEMENT

FOR 2023 ANNUAL MEETING OF STOCKHOLDERS

to be held at 11:00 am Eastern Time on May 1, 2023

Table of Contents

|

6 |

|

|

7 |

|

|

13 |

|

|

14 |

|

|

15 |

|

|

17 |

|

|

17 |

|

|

21 |

|

Board Leadership Structure and Role of the Lead Independent Director |

|

21 |

|

22 |

|

|

22 |

|

|

23 |

|

|

23 |

|

Corporate Governance Guidelines and Code of Business Conduct and Ethics |

|

25 |

|

25 |

|

|

26 |

|

|

27 |

|

|

29 |

|

|

31 |

|

|

31 |

|

Fees Paid to the Independent Registered Public Accounting Firm |

|

32 |

|

32 |

|

|

34 |

|

|

35 |

|

|

38 |

|

|

38 |

|

|

38 |

|

|

40 |

|

|

41 |

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

46 |

4 | Page

|

48 |

|

Certain Relationships and Related Person Transactions — the Company and Legacy Terran Orbital |

|

49 |

|

52 |

|

Certain Relationships and Related Person Transactions — Tailwind Two |

|

53 |

|

54 |

|

|

54 |

|

|

55 |

|

|

55 |

|

|

55 |

|

|

55 |

|

|

55 |

5 | Page

GENERAL INFORMATION

This proxy statement and the enclosed proxy card are furnished in connection with the solicitation of proxies by our board of directors (the “Board”) for use at the 2023 annual meeting of stockholders of Terran Orbital Corporation (“Terran Orbital,” the “Company,” “we,” “us” or similar terms), a Delaware corporation, and any postponements, adjournments, or continuations thereof (the “2023 Annual Meeting”).

The Company’s predecessor corporation was Tailwind Two Acquisition Corp. (“Tailwind Two”), a special purpose acquisition company. On March 25, 2022 (the “Closing Date)”, we consummated the business combination contemplated by that certain Agreement and Plan of Merger, dated as of October 28, 2021, as amended by Amendment No. 1 thereto dated February 8, 2022 and Amendment No. 2 thereto dated March 9, 2022, by and among Tailwind Two, Titan Merger Sub, Inc. (“Merger Sub”) and Terran Orbital Corporation (“Legacy Terran Orbital”), whereby Merger Sub merged with and into Legacy Terran Orbital, with Legacy Terran Orbital surviving the merger as a wholly-owned subsidiary of the Company on the Closing Date (the “Merger”). In addition, in connection with the Business Combination, Tailwind Two effected a deregistration and a transfer by way of continuation from the Cayman Islands to the State of Delaware, pursuant to which Tailwind Two’s jurisdiction of incorporation was changed from the Cayman Islands to the State of Delaware (the “Domestication” and together with the Merger, the “Business Combination”). At the effective time in connection with the Merger, Tailwind Two changed its name to “Terran Orbital Corporation” and Legacy Terran Orbital changed its name to “Terran Orbital Operating Corporation”. References to “Tailwind Two” refer to Tailwind Two Acquisition Corp. prior to the consummation of the Business Combination and references to “Legacy Terran Orbital” refer to Terran Orbital Corporation prior to the consummation of the Business Combination.

The 2023 Annual Meeting will be held on May 1, 2023 at 11:00 am Eastern Time. The 2023 Annual Meeting will be conducted virtually via live audio webcast. You will be able to attend the 2023 Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/LLAP2023 , where you will be able to listen to the meeting live, submit questions and vote online. We have opted to provide our materials pursuant to the full set delivery option in connection with the 2023 Annual Meeting. Under the full set delivery option, a company delivers all proxy materials to its stockholders. The approximate date on which the proxy statement and proxy card are intended to be first sent or given to the Company’s stockholders is April 13, 2023. This delivery can be by mail or, if a stockholder has previously agreed, by e-mail. In addition to delivering proxy materials to stockholders, the Company must also post all proxy materials on a publicly accessible website and provide information to stockholders about how to access that website. Accordingly, you should have received our proxy materials by mail or, if you previously agreed, by e-mail. These materials are available free of charge on our website at investors.terranorbital.com and at www.proxyvote.com.

6 | Page

Questions and Answers about the Meeting and Voting

Why do we conduct a virtual annual meeting?

We will conduct our Annual Meeting exclusively online through a live audio webcast. We adopted this format to facilitate attendance and to enable stockholders to attend fully and equally, regardless of size of holdings, resources or physical location.

How do I attend and participate at the virtual 2023 Annual Meeting?

Broadridge Financial Solutions, Inc. (“Broadridge”) will host the virtual 2023 Annual Meeting. In order to attend the virtual 2023 Annual Meeting, vote during the 2023 Annual Meeting and submit questions, please log into the meeting platform at: www.virtualshareholdermeeting.com/LLAP2023. You will be prompted to enter the unique control number received with your proxy materials to join and participate in the meeting.

When should I log into the virtual 2023 Annual Meeting?

The 2023 Annual Meeting will begin promptly at 11:00 ET on May 1, 2023. You may login into the meeting platform beginning approximately 30 minutes before the meeting start time. We encourage attendees to log into the meeting at least 15 minutes before the start time to test your audio system.

Can I attend the virtual 2023 Annual Meeting from a mobile device?

Yes, you should be able to access the 2023 Annual Meeting using any device capable of running the most common internet browsers.

Who can assist me if I have technical difficulties prior to or during the meeting?

Broadridge will have technicians ready to assist you with any individual technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual 2023 Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual 2023 Annual Meeting log-in page.

Who can submit a question during the 2023 Annual Meeting?

Stockholders attending the meeting using their control number will be able to submit questions via the virtual meeting platform in accordance with the 2023 Annual Meeting rules and procedures, which will be available on the meeting website. If you do not have a control number, you may attend the 2023 Annual Meeting as a guest, but you will not have the functionality to ask a question.

When will my question be answered?

A live question and answer session will take place after the formal business is completed, during which our representatives will respond to questions submitted via the virtual meeting platform during the meeting.

7 | Page

What am I voting on?

You are being asked to vote on:

Who is entitled to vote?

Holders of record of our Common Stock at the close of business on March 31, 2023 (the “Record Date”), are entitled to vote at the 2023 Annual Meeting. Each share of our Common Stock is entitled to one vote on each matter to be voted on. As of March 23, 2023 (the last practicable date prior to the Record Date and the mailing of the proxy statement), there were 144,298,727 shares of our Common Stock issued and outstanding and entitled to vote.

Are a certain number of shares required to be present at the 2023 Annual Meeting?

A quorum is the minimum number of shares required to be present at the 2023 Annual Meeting to properly hold an annual meeting of stockholders and conduct business. The presence, virtually or by proxy, of a majority of the voting power of all issued and outstanding shares of our Common Stock entitled to vote at the 2023 Annual Meeting will constitute a quorum at the 2023 Annual Meeting. Abstentions, withhold votes, and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum.

How can I vote my shares without virtually attending the 2023 Annual Meeting?

Whether you hold shares as a stockholder of record or a beneficial owner, you may direct how your shares are voted without virtually attending the 2023 Annual Meeting, by the following means:

8 | Page

You will need the 12-digit control number included on your proxy card if you vote by Internet or telephone.

How does the Board recommend I vote on these proposals?

Our Board recommends a vote:

How do I participate and vote at the 2023 Annual Meeting?

Even if you plan to virtually attend the 2023 Annual Meeting, we recommend that you also submit your proxy or voting instructions as described above so that your vote will be counted if you later decide not to attend the meeting.

If you are a stockholder of record, you may vote virtually at the 2023 Annual Meeting. If you hold shares beneficially in street name, you may vote virtually at the 2023 Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee or nominee that holds your shares, giving you the right to vote the shares.

Can I change my vote?

You can change your vote before the vote is taken virtually at the 2023 Annual Meeting. If you are a stockholder of record, you can change your vote by:

9 | Page

If you are a beneficial owner of shares held in street name, you may generally change your vote by (1) submitting new voting instructions to your broker, bank or other intermediary or (2) if you have obtained a legal proxy from the organization that holds your shares giving you the right to vote your shares, by virtually attending the 2023 Annual Meeting and voting at the meeting. However, please consult that organization for any specific rules it may have regarding your ability to change your voting instructions.

How are votes counted and what happens if I fail to vote or vote to abstain from voting?

Your shares will be voted as you instruct, assuming that you have properly voted over the Internet or by telephone or that your properly signed proxy card is received in time to be voted at the 2023 Annual Meeting. A “broker non-vote” occurs when your broker submits a proxy card for your shares, but does not vote on a particular proposal because the broker has not received voting instructions from you and does not have the authority to vote on that matter without instructions. Under the rules that govern brokers who are voting shares held in street name, brokers have the discretion to vote those shares on routine matters but not on non-routine matters. For purposes of these rules, the only routine matters in this proxy statement are the Share Authorization Proposal and the Auditor Ratification Proposal. Therefore, if you hold your shares in street name and do not provide voting instructions to your broker, your broker does not have discretion to vote your shares on any proposal at the 2023 Annual Meeting, and broker non-votes will not have any effect on such proposal, other than the Share Authorization Proposal and the Auditor Ratification Proposal. However, your shares will be considered present at the 2023 Annual Meeting for purposes of determining the existence of a quorum.

If you vote to abstain from voting, or are the stockholder of record and you fail to vote, it will not have any effect on the voting proposals, assuming a quorum is present. However, abstentions are counted for the purpose of determining whether a quorum is present.

If you submit your proxy and do not indicate your voting preference, the appointed proxies will vote your shares FOR each of the nominees listed in the Director Election Proposal, FOR the Share Authorization Proposal, FOR the Share Issuance Proposal and FOR the Auditor Ratification Proposal.

What vote is required to approve each of the proposals?

If a quorum is present at the 2023 Annual Meeting, the Share Issuance Proposal and the Auditor Ratification Proposal require the affirmative vote of a majority of the shares present or by proxy and entitled to vote on the proposal at the 2023 Annual Meeting. The Share Authorization Proposal requires the affirmative vote of a majority of the total voting power of our outstanding Common Stock entitled to vote as of the Record Date. The Director Election Proposal requires a plurality vote of the shares present or represented by proxy at the 2023 Annual Meeting and entitled to vote in the election of directors. The three director nominees receiving the highest number of “FOR” votes cast by the stockholders entitled to vote at the 2023 Annual Meeting will be elected. As described above, abstentions will have no effect on the outcome of any of the proposals.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board. Marc Bell and James Black have been designated as proxy holders by our Board. When proxies are properly dated, executed, and returned, the shares represented by such proxies will be voted at the 2023 Annual Meeting in accordance with the instructions of the stockholder. If the proxy is dated and signed, but no specific instructions are given, the shares will be voted in accordance with the recommendations of our Board as described above. If any matters not described in this proxy statement are properly presented at the 2023 Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the 2023 Annual Meeting is adjourned, the proxy holders can vote the shares on the new 2023 Annual Meeting date as well, unless you have properly revoked your proxy, as described above.

10 | Page

How are proxies solicited for the 2023 Annual Meeting?

Our Board is soliciting proxies for use at the 2023 Annual Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank, or other nominee holds shares of our Common Stock on your behalf. In addition, our directors and employees may also solicit proxies by telephone, by electronic communication, or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies.

Where can I find the voting results of the 2023 Annual Meeting?

We will announce preliminary voting results at the 2023 Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the 2023 Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the 2023 Annual Meeting, we will file a Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

How are proxy materials delivered to stockholders who share the same household?

SEC rules allow us to deliver a single copy of an annual report and proxy statement to any household at which two or more stockholders reside. We believe this rule benefits everyone. It eliminates duplicate mailings that stockholders living at the same address receive, and it reduces our printing and mailing costs. This rule applies to any annual reports, proxy statements, proxy statements combined with a prospectus and information statements.

If your household would like to receive single rather than duplicate mailings in the future, please write to Broadridge Investor Communications Solutions, Householding Department, 51 Mercedes Way, Edgewood, New York 11717, or call 1-866-540-7095. Each stockholder will continue to receive a separate proxy card or Notice of Internet Availability of Proxy Materials. If a broker or other nominee holds your shares, you may continue to receive some duplicate mailings. Certain brokers will eliminate duplicate account mailings by allowing stockholders to consent to such elimination, or through implied consent if a stockholder does not request continuation of duplicate mailings. Since not all brokers and nominees offer stockholders the opportunity to eliminate duplicate mailings, you may need to contact your broker or nominee directly to discontinue duplicate mailings from your broker to your household.

Your household may have received a single set of proxy materials this year. If you would like to receive another copy of this year's proxy materials, please write to Broadridge Investor Communications Solutions, Householding Department, 51 Mercedes Way, Edgewood, New York 11717, or call 1-866-540-7095.

What other business may be brought up at the 2023 Annual Meeting?

Our Board does not intend to present any other matters for a vote at the 2023 Annual Meeting. No stockholder has given the timely notice required by our bylaws in order to present a proposal at the 2023 Annual Meeting. Similarly, no additional candidates for election as a director can be nominated at the 2023 Annual Meeting because no stockholder has given the timely notice required by our bylaws in order to nominate a candidate for election as a director at the 2023 Annual Meeting. If any other business is properly brought before the meeting, the persons named as proxy on the proxy card will vote on the matter using their best judgment.

Information regarding the requirements for submitting a stockholder proposal for consideration at next year's annual meeting, or nominating a candidate for election as a director at next year's annual meeting, can be found near the end of this proxy statement under the heading “Stockholder Proposals for 2024 Annual Meeting”.

11 | Page

Is it possible that the 2023 Annual Meeting may be postponed?

The meeting may be adjourned or postponed, if needed, as provided by our bylaws (the “Bylaws”) and pursuant to Delaware law. Unless a new record date is fixed, your proxy will still be valid and may be voted at any adjourned or postponed meeting. You will still be able to change or revoke your proxy until it is voted at the reconvened or rescheduled meeting.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at next year’s annual meeting of stockholders by submitting their proposals in writing to our Secretary in a timely manner. Since we do not expect that the Company’s 2024 annual meeting of stockholders (the “2024 Annual Meeting”) will be held more than 30 days earlier, or more than 60 days later, than in 2023, if you would like to submit a proposal for us to include in the proxy statement for our 2024 Annual Meeting pursuant to Rule 14a-8 (“Rule 14a-8”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), our Secretary must receive the written proposal at our principal executive offices not later than December 15, 2023. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to:

Terran Orbital Corporation

Attention: Jim Black, Secretary

6800 Broken Sound Parkway NW, Suite 200

Boca Raton, FL 33487

(949) 591-7749

Email: James.Black@terranorbital.com

Our Bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our Bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our proxy materials with respect to such annual meeting, (ii) otherwise properly brought before such annual meeting by or at the direction of our Board, or (iii) properly brought before such meeting by a stockholder of record entitled to vote at such annual meeting who has delivered timely written notice to our Secretary, which notice must contain the information specified in our Bylaws. To be timely for the 2024 Annual Meeting, our Secretary must receive the written notice at our principal executive offices:

|

• |

|

not earlier than January 2, 2024; and |

|

• |

|

not later than February 1, 2024. |

In the event that we hold the 2024 Annual Meeting more than 30 days before or more than 60 days after the one-year anniversary of the 2023 Annual Meeting, a notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before the 2024 Annual Meeting and no later than the close of business on the later of the following two dates:

|

• |

|

the 90th day prior to the 2024 annual meeting of stockholders; or |

|

• |

|

the 10th day following the day on which public announcement of the date of the 2024 annual meeting of stockholders is first made. |

In addition to the timely notice requirements, a stockholder’s proposal for nominees for directors must comply with Article I, Section 2 of the Bylaws and other applicable procedures described therein or established by our

12 | Page

Nominating and Corporate Governance Committee (the “Governance Committee”). Stockholder proposals related to other business must also comply with Article 1, Section 2 of our Bylaws. Furthermore, any stockholder proposal must comply with all applicable requirements of the Exchange Act and the rules and regulations thereunder. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these or other applicable requirements. If a stockholder who has notified us of his, her, or its intention to present a proposal at an annual meeting of stockholders does not appear to present his, her, or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

To comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees, other than nominees we nominate for election, must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 2, 2024.

Availability of Bylaws

A copy of our Bylaws is available via the SEC’s website at http://www.sec.gov. You may also contact our Secretary at the address set forth above for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our Board. As of March 23, 2023, our Board consisted of eight (8) directors, six of whom qualified as “independent” under the listing standards of the NYSE. There is currently one vacancy on the Board. We have a classified board of directors consisting of three classes, each serving staggered three-year terms. Only one class of directors is elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year terms. Each director’s term will continue until the end of such director’s three-year term and the election and qualification of their successor, or their earlier death, resignation, or removal.

The following table sets forth the names, ages as of March 23, 2023, and certain other information for each of the directors with terms expiring at the 2023 Annual Meeting (all of whom are also nominees for election as a director at the 2023 Annual Meeting) and for each of the continuing members of our Board:

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Class |

|

Age |

|

Position |

|

Current |

|

Expiration of |

Directors with Term expiring at the 2023 Annual Meeting |

|

|

|

|

|

|

|

|

|

|

Richard Y. Newton III(2) |

|

I |

|

67 |

|

Director |

|

2023 |

|

2026 |

Douglas L. Raaberg(1)(3) |

|

I |

|

67 |

|

Director |

|

2023 |

|

2026 |

Tobi Petrocelli(1)(2) |

|

I |

|

39 |

|

Director |

|

2023 |

|

2026 |

Continuing Directors |

|

|

|

|

|

|

|

|

|

|

James LaChance(3) |

|

II |

|

58 |

|

Director |

|

2024 |

|

- |

Daniel C. Staton |

|

II |

|

70 |

|

Vice Chairman |

|

2024 |

|

- |

Stratton Sclavos(1)(3) |

|

II |

|

61 |

|

Director |

|

2024 |

|

- |

Marc H. Bell |

|

III |

|

55 |

|

Chief Executive Officer and Chairman |

|

2025 |

|

- |

Thomas E. Manion(2) |

|

III |

|

69 |

|

Director |

|

2025 |

|

- |

(1) Member of our compensation committee.

(2) Member of our nominating and corporate governance committee.

(3) Member of our audit committee.

13 | Page

Nominees for the Board of Directors (Class I)

Lieutenant General Richard Y. Newton III, USAF (ret.) has served as a member of the Board and Chairman of our Governance Committee since March 25, 2022. Mr. Newton has been an independent director to USAA Mutual Funds Trust at Victory Capital Management, Inc. since 2017. From 2019 until 2021, Mr. Newton also served as Vice Chairman of the Board of Directors of PredaSAR Corporation, when PredaSAR Corporation was a non-wholly owned subsidiary of Terran Orbital. From 2018 until 2019, Mr. Newton also served on the Board of Directors of ELTA North America. Mr. Newton served as Executive Director of The Union League Club of the City of New York from 2014 until 2015 and as Executive Vice President of the Air Force Association from 2012 until 2014. Mr. Newton served 34 years in the U.S. Military, including serving in the position of the United States Air Force Assistant Vice Chief of Staff, until he retired in 2012. He also served as the Deputy Chief of Staff for Manpower and Personnel. Additionally, he oversaw the Global Operations directorate for the Joint Chiefs of Staff, responsible for overseeing worldwide cyber security, reconnaissance, space and missile defense, the National Military Command Center and US military special technical operations, among others. Mr. Newton earned a B.S. degree from the United States Air Force Academy, a M.A. degree in Industrial Psychology and Human Relations from Webster University and a M.S. degree in National Security Strategy from The National War College.

We believe that Mr. Newton’s extensive experience and leadership in the U.S. military, and his experience in national security and in serving on the boards of directors of public and private companies qualifies him to serve on our Board.

Major General Douglas L. Raaberg, USAF (ret.) has served as a member of our Board since March 25, 2022. Mr. Raaberg has been Executive Vice President of the Air Force Association since 2019, where he serves as a staff leader and provides strategic direction for the association. Mr. Raaberg has also served as a member of the Board of Advisors of Atomic-6 since 2020. From 2019 until 2021, Mr. Raaberg served as a member on the Board of Directors of PredaSAR Corporation, when PredaSAR Corporation was a non-wholly owned subsidiary of Terran Orbital. From 2013 until 2017, Mr. Raaberg was Chief Executive, United Arab Emirates of Northrop Grumman Aerospace and Defense, where he led global business development in the UAE. From 2010 until 2013, Mr. Raaberg was Business Development Director of the Aerospace Sector at Northrop Grumman, where he was responsible for $10 billion in U.S. Air Force business development efforts. Mr. Raaberg served 31 years in the United States Air Force, until he retired as a Major General in 2009, where he directed a staff of 1,200 people from nine nations executing combat operations with over 29,000 aviators in the Middle East, Central Asia and Horn of Africa. Mr. Raaberg holds a B.S. degree in Aeronautical Engineering from the United States Air Force Academy, a M.S. degree in Systems Management from the University of Southern California and a M.S. degree in National Security Strategy from the National War College. Mr. Raaberg is a graduate of the Lead Virginia program for experienced leaders, and has participated in several executive leadership programs including, National Association of Corporate Directors’ Battlefield to Boardroom, Thunderbird University’s Global Business Executive Program and Federal Executive Institute’s Aspen Institute Executive Leadership Seminar. Mr. Raaberg also serves as a senior advisor to the Council for a Strong America on Mission: Readiness in Washington, D.C. and as a Falcon Foundation Trustee to the Air Force Academy.

We believe that Mr. Raaberg’s extensive experience and leadership in air, space and cyber operations and defense, and his experience in international business management and development as well as service on the boards of directors of private and public companies qualifies him to serve on our Board.

14 | Page

Dr. Tobi Petrocelli has served as a member of the Board since March 25, 2022. Dr. Petrocelli has been Director, Environmental and Sustainability Management of Mitsubishi UFJ Financial Group, MUFG Americas N.A., (“MUFGA”) since June 2020. In this role, Dr. Petrocelli leads MUFGA’s Environmental, Social and Governance program and its $330 billion sustainable finance goal. In May 2008, Dr. Petrocelli founded Verde Enterprises LLC, a sustainability consulting service, where she served as President from its inception until June 2020. Dr. Petrocelli earned a B.A. degree in Communications from Fordham University, a M.S. degree in Sustainability Management from Columbia University and a Doctorate of Business Administration in International Business from Walden University.

We believe that Dr. Petrocelli’s extensive experience and leadership in project management, sustainability management and corporate communications qualifies her to serve on our Board.

Continuing Directors

James LaChance has served as a member of the Board and Chairman of our audit committee (the “Audit Committee”) since March 25, 2022. Prior to the Business Combination, Mr. LaChance served as a member of Legacy Terran Orbital’s board of directors (the “Legacy Board”) from 2018 until March 2022 and served as chairman of its compensation committee from 2018 until January 2020. Mr. LaChance also founded BreakPoint Asset Management (“BreakPoint”), a full service merchant bank, where he has served as Chairman since its inception in 2007. At BreakPoint, Mr. LaChance engaged in, strategized and led multiple multi-billion dollar projects. Mr. LaChance is currently the founder and owner, serving as Chairman and Chief Executive Officer, of The Compound LLC, an adventure marketing business in Las Vegas, Nevada, which he formed in 2011. Mr. LaChance currently serves as the Chairman of Paratus Energy Service LTD (f/k/a Seadrill New Finance Ltd.) since his appointment in January 2022. Previously, Mr. LaChance served as Chairman and lead independent director of Fieldwood Energy from July 2020 until August 2021. Prior to that, Mr. LaChance served as Chairman, lead independent director and interim Chief Strategic Officer of Energy XXI from December 2013 to January 2016, Chairman and interim Chief Executive Officer of Northern Offshore from 2007 to 2014 and Chairman and Interim Chief Executive Officer of Global Aviation from 2010 to 2013. In addition, Mr. LaChance has served on the board of directors of various private and public companies, including Eletson Shipping as Co-Lead Chairman from 2017 to 2020, Horizon Lines as director from 2010 until 2014 and Aspire LLC as Executive Chairman from 2015 until 2019. Prior to these appointments, for over 20 years, Mr. LaChance was an investment manager specializing in highly leveraged companies and distressed investment situations across the capital structure, serving as Portfolio Manager and Chief Investment Officer for several multi-billion dollar investment funds. Mr. LaChance earned a B.S. degree in Business from Northeastern University and a M.B.A. degree from New York University Stern School of Business.

We believe that Mr. LaChance’s extensive entrepreneurial experience and leadership in managing and growing hedge funds and in operations management in the technology and science industries, as well as his experience serving on private and public boards of directors qualifies him to serve on our Board.

Daniel C. Staton has served as a member of the Board since March 25, 2022. Prior to the Business Combination, Mr. Staton served as a member of the Legacy Board from July 2014 until March 2022. Since November 2009, Mr. Staton has been Non-Executive Co-Chairman of the Board of ARMOUR Residential REIT, Inc., a residential investment firm. Mr. Staton also served as President, Chief Executive Officer and Director of Enterprise Acquisition Corp., a blank check company formed for the purpose of acquiring an operating business, from its inception in 2007 until its merger with ARMOUR in 2009. Mr. Staton is the founder of Staton Capital LLC, a private investment firm, and has served as the firm’s Chairman and Managing Director since February 2003. Mr. Staton has also served as Director of Staton Techiya LLC since July 2017. Mr. Staton has served on the Board of Directors of Shurgard Self Storage SA since its initial public offering in 2018. From 1999 until 2020, Mr. Staton also served as Director of Public Storage, a self-storage company. Mr. Staton also served as Non-Executive Chairman of JAVELIN Mortgage Investment Corp., a real estate investment firm, from June 2012 until April 2016. Between 1997 and 2007, Mr. Staton was President of The Walnut Group, a private investment firm, where he served as initial investor and Director of Build-A-Bear Workshop, the initial investor in Deal$: Nothing Over a Dollar (until its sale to Supervalu Inc.) and

15 | Page

Director of Skylight Financial. Prior to The Walnut Group, Mr. Staton was General Manager and Partner of Duke Associates from 1981 until its initial public offering in 1993, and then served as Chief Operating Officer and Director of Duke Realty Investments, Inc. until 1997. Mr. Staton supplements his professional network by co-producing and investing in numerous Broadway musicals as well as with relationships with not-for-profit organizations. Mr. Staton holds a B.S. degree in Specialized Business from Ohio University and a B.S. degree in Business (Management) from California Coast University.

We believe that Mr. Staton’s extensive experience serving on the boards of directors of private and public companies and sourcing private equity and venture capital investments qualifies him to serve on our Board.

Stratton Sclavos has served as a member of the Board and Chairman of our compensation committee (the “Compensation Committee”) since March 25, 2022. Prior to the Business Combination, Mr. Sclavos served as a member of the Legacy Board from January 2016 until March 2022 and served as chairman of its compensation committee from January 2020 until March 2022. Since April 2018, Mr. Sclavos has also been a self-employed principal providing strategic advisory services to high technology start-ups. From October 2008 until March 2018, Mr. Sclavos was a General Partner at Radar Partners. In July 1995, Mr. Sclavos joined VeriSign Inc. where he served as Chairman and Chief Executive Officer until May 2008. Additionally, Mr. Sclavos currently serves on the board of directors of BitGo Inc. Mr. Sclavos formerly served on the board of directors for over ten years for each of Salesforce.com, Inc., Juniper Networks, Inc. and Intuit Inc. Mr. Sclavos earned a B.S. degree in Electrical and Computer Engineering from University of California, Davis.

We believe that Mr. Sclavos’ extensive experience and leadership as a principal investor and as an advisor in the technology industry and his experience serving on the boards of directors of public and private companies qualifies him to serve on our Board.

Marc H. Bell has been our Chief Executive Officer and Chairman of the Board since March 2021. Mr. Bell co-founded Legacy Terran Orbital in 2013, joining the board of directors upon the Company’s inception. Mr. Bell previously chaired PredaSAR Corporation from October 2019 until its merger with Terran Orbital.

As Chief Executive Officer and Chairman of the Board, Mr. Bell provides Terran Orbital with top-level leadership and helps guide the overall organization to meet its strategic goals. Mr. Bell is an accomplished entrepreneur whose distinguished career spans over three decades. Mr. Bell has served as Director of ARMOUR Residential REIT, Inc. since November 2009. From November 2009 through August 2013, Mr. Bell served as ARMOUR’s Co-Founder, Co-Chairman of Board of Directors and Chief Strategy Officer. ARMOUR today holds over $8 billion worth of mortgage-backed and other securities in its portfolio. From June 2012 to April 2016, Mr. Bell served as Director of Javelin Mortgage Investment Corp. until its merger into ARMOUR in 2016. From August 2007 to September 2009 Mr. Bell served as Chairman of the Board of Enterprise Acquisition Corp. a $250 million Special Purpose Acquisition Corp. which merged with ARMOUR Residential REIT, Inc. Previously, Mr. Bell was the founder, Chairman and Chief Executive Officer of Globix Corporation, a full-service commercial Internet Service Provider with data centers and a private network with over 20,000 miles of fiber spanning the globe. Mr. Bell served as Chairman of the Board of Globix Corporation from 1998 to 2002 and Chief Executive Officer from 1998 to 2001. Mr. Bell was also a member of the Board of Directors of EDGAR Online, Inc., an Internet-based provider of filings made by public companies with the SEC, from 1998 to 2000. Mr. Bell has also been a co-producer of successful Broadway shows, including Jersey Boys, which won the Tony Award for “Best Musical” and August: Osage County which won a Tony Award for “Best Play”. Since September 2000, Mr. Bell has been Managing Partner at Marc Bell Capital.

In addition, Mr. Bell is a member of the New York University (NYU) Board of Trustees, NYU Langone Health Board of Overseers, NYU Stern Center for Real Estate Finance Research Advisory Board, NYU Schack Institute of Real Estate, and the NYU College of Arts and Science Dean’s Advisory Council. He is also Chairman and Founder of the Boca Raton Police Foundation and serves on the board of directors of SOS Children’s Villages Florida. Mr. Bell earned a B.S. degree from Babson College and a M.S. in Real Estate Development and Investment from New York University.

16 | Page

We believe that Mr. Bell’s experience and operational insight as Terran Orbital’s Chief Executive Officer, his executive leadership at other private and public companies and his extensive background and experience qualifies him to serve on our Board.

Colonel Thomas E. Manion, US Marine Corps (ret.) has served as a member of the Board since March 25, 2022. Mr. Manion held various senior leadership roles in Johnson & Johnson (“J&J”) over a 24-year career prior to his retirement in 2014. From 2010 to 2014, Mr. Manion held various corporate roles at J&J, including supporting the corporate compliance team and the HR transformation team. Prior to that, from 2005 to 2010, Mr. Manion ran the North American Pharmaceutical Group’s financial shared services center. From 2003 to 2005, Mr. Manion was program lead for a 2-year project to implement a new enterprise-wide financial reporting system. Prior to that, from 2000 to 2003, Mr. Manion served as Vice President, CIO and Management Board Member of the Pharmaceutical Research Institute. Prior to that, from 1998 to 2000, Mr. Manion served as the CIO and Management Board Member of the Janssen Research Foundation. Mr. Manion held various roles, including manager, director, and executive director at J&J from 1990 to 1998. Prior to that, Mr. Manion served in the US Marine Corps from 1978 until his retirement as Colonel in 2008 (30 years). Mr. Manion served in various roles in the Marine Corps Reserves from 1989 to 2008, retiring as the G-6 for the Fourth Marine Aircraft Wing. Prior to joining the Marine Corps Reserves, Mr. Manion served on active duty in the Marine Corps from 1978 to 1989. Mr. Manion is the father of 1st Lt. Travis Manion USMC, who made the ultimate sacrifice for our country in April 2007. After the loss of Travis, Mr. Manion and his late wife Janet Manion established the Travis Manion Foundation (“TMF”) to support the U.S. military, the families of the fallen and to help create the next generation of leaders. Mr. Manion has served as the Chairman (from 2007 to 2011), and as Chairman Emeritus (since 2011) of TMF since its founding in 2007. As TMF’s Chairman Emeritus, Mr. Manion works within the community and around the country to inspire people around him to convey a sense of sacrifice and public service in all they do. Mr. Manion is also the co-author of the book, “Brothers Forever,” the story about the friendship, service and sacrifice between Travis and his Naval Academy roommate Lt. (SEAL) Brendan Looney. Mr. Manion earned a B.S. in Political Science from Widener University and an M.S. in Systems Analysis from the Naval Postgraduate School.

We believe that Mr. Manion’s extensive experience and leadership in the U.S. Marine Corps, his experience in management at J&J, and his vision and character as founder of the TMF qualifies him to serve on our Board of Directors.

Director Independence

Under applicable rules of the NYSE, a majority of the members of our Board must be independent. In order to qualify as independent, a director must meet each of the NYSE's five objective independence standards and our Board must also affirmatively determine, in its business judgment and in consideration of all relevant facts and circumstances, that the director has no material relationship with the Company. The Board has reviewed the transactions and relationships between the Company and our directors, their immediate family members, and entities with which they are affiliated and has determined that each of Stratton Sclavos, Richard Y. Newton III, Douglas L. Raaberg, Tobi Petrocelli, James LaChance and Thomas E. Manion satisfy the five NYSE independence standards and does not have a material relationship with the Company that would impair his or her independence from management. Our independent directors have regularly scheduled meetings at which only independent directors are present.

Board Meetings and Committees

During our fiscal year ended December 31, 2022, our Board held nine meetings (including regularly scheduled and special meetings). Each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our Board on which he or she served during the periods that he or she served.

17 | Page

Although we do not have a formal policy regarding attendance by members of our Board at annual meetings of stockholders, we strongly encourage, but do not require, our directors to attend. This 2023 Annual Meeting will be our first annual meeting of stockholders since becoming a public company.

The composition and responsibilities of each of the committees of our Board is described below. Members will serve on these committees until their resignation or until as otherwise determined by our Board.

Audit Committee

Our Audit Committee consists of Messrs. LaChance, Raaberg and Sclavos, with Mr. LaChance serving as chairperson. Each member of the audit committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations and the financial literacy and sophistication requirements of the listing standards of the NYSE. In addition, our Board has determined that Mr. LaChance is an audit committee financial expert within the meaning of Item 407(d)(5) of Regulation S-K under Securities Act of 1933, as amended (the “Securities Act”). Our Audit Committee’s responsibilities include, among other things, to:

18 | Page

19 | Page

No member of the Audit Committee may serve on the audit committee of more than two other public companies, unless our Board determines that such simultaneous service would not impair the ability of such member to effectively serve on our audit committee and we disclose such determination in accordance with the listing standards of the NYSE.

Our audit committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter for our audit committee is available on our website at www.terranorbital.com. During 2022, our audit committee held four meetings.

Compensation Committee

Our Compensation Committee consists of Messrs. Sclavos and Raaberg and Ms. Petrocelli, with Mr. Sclavos serving as chairperson. Each member of our compensation committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations and is a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, or Rule 16b-3. Our Compensation Committee’s responsibilities include, among other things, to:

20 | Page

Our Compensation Committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter for our compensation committee is available on our website at www.terranorbital.com. During 2022, our compensation committee held four meetings.

Nominating and Corporate Governance Committee

Our Governance Committee consists of Messrs. Newton and Manion and Ms. Petrocelli, with Mr. Newton serving as chairperson. Each member of the Governance Committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations. Our Governance Committee’s responsibilities include, among other things, to:

Our Governance Committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter for our Governance Committee is available on our website at www.terranorbital.com. During 2022, our Governance Committee held three meetings.

Lead Independent Director and Executive Sessions

We have a lead independent director (the “Lead Independent Director”) who is nominated by the Governance Committee and approved by the Board. On March 29, 2022, Stratton Sclavos was appointed as the Lead Independent Director.

Consistent with the NYSE rules, our independent directors held executive sessions without management at each of our five regularly scheduled in-person Board meetings in 2022. The Lead Independent Director presides over all executive sessions of independent directors. See also “Board Leadership Structure and Role of the Lead Independent Director” below regarding the Lead Independent Director's role with respect to our overall Board leadership structure.

Board Leadership Structure and Role of the Lead Independent Director

We believe that the structure of our Board and its committees provides strong overall management of our company. Mr. Bell currently serves as both the chairperson of our Board and as our Chief Executive Officer. Our Board has

21 | Page

determined that it is in our best interest to not to have a policy regarding the separation of these roles, allowing the Board greater flexibility to establish a leadership structure that fits our needs at any particular point in time. As our Chief Executive Officer, Mr. Bell is best positioned to identify strategic priorities, lead critical discussions on important matters affecting our business, create a firm link between our Board and management to foster effective communication, and execute our business plans. Additionally, Mr. Sclavos, in his capacity as Lead Independent Director, is charged with leading the Board’s independent directors to engagement and consensus, making sure that independent consensus is heard and implemented regarding substantive business matters or governance issues. In this capacity, Mr. Sclavos is able to serve as a liaison between the independent directors and the full Board in discussing issues from the executive sessions of independent directors, ensuring the flow of information and working in unison with Mr. Bell.

Only independent directors serve on the Audit Committee, Compensation Committee, and the Governance Committee of our Board. As a result of the Board’s committee system and the existence of a majority of independent directors, the Board believes it maintains effective oversight of our business operations, including independent oversight of our financial statements, executive compensation, selection of director candidates, and corporate governance programs. We believe that the leadership structure of our Board, including Mr. Sclavos’ role as lead independent director, as well as the strong independent committees of our Board is appropriate and enhances our Board’s ability to effectively carry out its roles and responsibilities on behalf of our stockholders, while Mr. Bell’s combined role enables strong leadership, creates clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to stockholders.

The Board’s Role in Risk Oversight

Management will regularly report on any potential material risks to our Board at its meetings. Management reports regularly to the full Board, which also considers our material risks, with input from our various Board committees. Our Audit Committee also has certain statutory, regulatory, and other responsibilities with respect to oversight of risk assessment and risk management. Specifically, the Audit Committee is responsible for reviewing and discussing the policies and guidelines with respect to risk assessment and risk management, as well as discussing with management any major financial and other risk exposures and the steps management has taken to monitor and control such exposures. To the extent the Board has delegated to another Board committee responsibility for the review of risk assessment and risk management policies relating to a particular area or item, the Audit Committee shall discuss and review such processes in a general manner.

Considerations in Evaluating Director Nominees

Our Governance Committee is responsible for reviewing with the Board the appropriate characteristics, skills, and experience required for the Board as a whole and its individual members. Our Governance Committee uses a variety of methods to identify and evaluate director nominees. Our Board has adopted corporate governance guidelines (the “Governance Guidelines”), which set forth the qualification standards and criteria considered by the Governance Committee and Board when evaluating director nominees. We do not have any specific minimum qualifications that our Board requires to be met by a director nominee recommended for a position on our Board, nor are there any specific qualities or skills that are necessary for one or more members of our Board to possess, other than as are necessary to meet the requirements of the rules and regulations applicable to us. However, some of the qualifications that our Governance Committee considers pursuant to our Governance Guidelines include, without limitation, the candidate’s personal and professional integrity, judgment, corporate and board experience, technology-proficiency, diversity and other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the Board, potential conflicts of interest, and ability to represent the best interests of all stockholders. Members of our Board are expected to prepare for, attend, and participate in all Board and applicable committee meetings. Our Governance Committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests.

22 | Page

Our Governance Committee also considers the above factors and other factors as it oversees the annual board of director and committee evaluations. After completing its review and evaluation of director candidates, including incumbent directors, our Governance Committee recommends to our full Board the director nominees for selection.

Communications with the Board

Interested parties wishing to communicate with non-management members of our Board may do so by writing and mailing the correspondence to our General Counsel or legal department at 6800 Broken Sound Parkway NW, Suite 200, Boca Raton, Florida 33487. Each communication should set forth (i) the name and address of the stockholder, as it appears on our books, and if the shares of our Common Stock are held by a broker, bank or nominee, the name and address of the beneficial owner of such shares, and (ii) the number of shares of our Common Stock that are owned of record by the record holder and beneficially by the beneficial owner.

Our General Counsel or legal department, in consultation with appropriate members of our Board as necessary, will review all incoming stockholder communications (except for mass mailings, product complaints or inquiries, job inquiries, business solicitations and patently offensive or otherwise inappropriate material) and, if appropriate, will route such communications to the appropriate member or members of our Board, or if none is specified, to the chairperson of our Board or the lead independent director if there is not an independent chairperson of our Board.

Our General Counsel or legal department may decide in the exercise of their or its judgment whether a response to any stockholder communication is necessary and shall provide a report to our Governance Committee on a quarterly basis of any stockholder communications received for which the General Counsel or legal department has responded.

This procedure does not apply to (i) communications to non-management directors from our officers or directors who are stockholders or (ii) stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act, which are discussed further in the answer to the question titled “What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors? described above in the Questions and Answers section of this proxy statement.

Director Compensation

Non-Employee Director Compensation

Upon consummation of the Business Combination, the Board approved the compensation of non-employee directors on March 29, 2022. Each non-employee director is eligible to receive compensation for his or her service consisting of annual cash retainers and equity awards. Our Board has the discretion to revise non-employee director compensation as it deems necessary.

Cash Compensation. On March 29, 2022, the Board approved the following cash compensation to the non-employee directors for their services to the Board:

23 | Page

All cash payments to non-employee directors, or the retainer cash payments, are paid quarterly in arrears immediately following the quarter in which the services of the respective non-employee directors were performed.

Equity Compensation. On March 29, 2022, the Board approved the following equity compensation to the non-employee directors for their services to the Board:

Director Compensation Table for Fiscal Year 2022

The following table provides information regarding compensation of our non-employee directors for service as directors, for the year ended December 31, 2022. Directors who are also our employees receive no additional compensation for their service as directors. During 2022, our sole employee director, Mr. Bell, did not receive any compensation for his service as a director. See “Executive Compensation” for additional information regarding Mr. Bell’s compensation.

|

|

|

|

|

|

|

|

|

Name |

|

Fees Earned or |

|

Stock Awards (2) |

|

Option |

|

Total |

Richard Y. Newton III (3) |

|

$77,261 |

|

$176,800 |

|

N/A |

|

$254,061 |

Tobi Petrocelli (4) |

|

$79,192 |

|

$176,800 |

|

N/A |

|

$255,992 |

Douglas L. Raaberg (3) |

|

$83,055 |

|

$176,800 |

|

N/A |

|

$259,855 |

James LaChance (5) |

|

$84,987 |

|

$176,800 |

|

N/A |

|

$261,787 |

Daniel C. Staton (6) |

|

$69,535 |

|

$176,800 |

|

N/A |

|

$246,335 |

Stratton Sclavos (7) |

|

$108,165 |

|

$176,800 |

|

N/A |

|

$284,965 |

Thomas E. Manion (4) |

|

$73,398 |

|

$176,800 |

|

N/A |

|

$250,198 |

(1) The amounts in this column represent the aggregate dollar amount of fees earned for services as a director, including any annual board retainer, committee retainer, committee chairperson retainer and Lead Independent Director retainer for the 2022 fiscal year following the Business Combination.

(2) The amounts in this column represent the aggregate grant date fair value of RSUs granted in the 2022 fiscal year for financial reporting purposes pursuant to the provisions of Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, Compensation—Stock Compensation (“ASC 718”) and include each director’s initial RSU award of 25,000 RSUs for election to the Board (the “Initial RSU Award”) and each director’s annual RSU award of 17,500 RSUs for annual service on the Board (the “Annual RSU Award”). The Initial RSU Award and the Annual RSU Award vest on three-year and one-year anniversaries of April 1, 2022, respectively.

(3) As of December 31, 2022, the non-employee director held 57,065 RSUs.

(4) As of December 31, 2022, the non-employee director held 42,500 RSUs.

(5) As of December 31, 2022, Mr. LaChance held 214,911 RSUs.

(6) As of December 31, 2022, Mr. Staton held 525,241 RSUs.

(7) As of December 31, 2022, Mr. Sclavos held 249,389 RSUs.

24 | Page

Corporate Governance Guidelines and Code of Business Conduct and Ethics

The Board has adopted the Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates, succession planning, risk management and corporate governance policies and standards applicable to us in general. In addition, our Board has adopted a code of business conduct and ethics (the “Code of Conduct”) that applies to all of our employees, officers and directors, including our CEO, CFO, General Counsel, Principal Accounting Officer, Controller and other executive and senior financial officers. The full text of the Governance Guidelines and Code of Conduct are available on our website at investors.terranorbital.com.

Insider Trading Policy

Our insider trading policy prohibits all of our officers, directors and employees from trading in our securities (or securities of any other company with which we do business) while in possession of material nonpublic information, other than in connection with a Rule 10b5-1 plan adopted in compliance with the policy.

Under our insider trading policy, our officers, directors, and employees may not (i) trade in publicly-traded options, such as puts and calls, and other derivative securities with respect to our securities (other than stock options and other compensatory equity awards issued to such persons by us), including any hedging or similar transaction designed to decrease the risks associated with holding our Common Stock, (ii) pledge, without prior approval, our securities as collateral for loans, or (iii) hold our securities in margin accounts.

In addition, our directors, executive officers, and other individuals designated from time to time by the compliance officer are subject to heightened trading restrictions and must obtain pre-clearance and approval from our compliance officer before engaging in certain transactions involving our securities, except for transactions made under a Rule 10b5-1 plan to the extent the establishment and operation of such plan otherwise complies with Rule 10b-5 and is precleared by our compliance officer.

25 | Page

PROPOSAL NO. 1—DIRECTOR ELECTION PROPOSAL

Our Board is currently composed of eight members. We have a classified Board consisting of three classes of approximately equal size, each serving staggered three-year terms.

At each annual meeting of stockholders, directors of a specific class of our Board will be elected to hold office until the expiration of the term for which they are elected and until their successors have been duly elected and qualified or until their earlier death, resignation, or removal, except that if any such election shall not be so held, such election shall take place at a stockholders’ meeting called and held in accordance with the Delaware General Corporation Law.

Nominees for the Board

Our Governance Committee has recommended, and our Board has approved, Richard Y. Newton III, Tobi Petrocelli and Douglas L. Raaberg as nominees for election as Class I directors at the 2023 Annual Meeting. If elected, Messrs. Newton and Raaberg and Ms. Petrocelli will serve as directors until the 2026 Annual Meeting and until his or her successor is duly elected and qualified. Messrs. Newton and Raaberg and Ms. Petrocelli are currently directors of the Company. For information concerning the relevant experiences, qualifications, attributes, and skills of the nominee that led our board of directors to recommend these persons as nominees for director, please see the section titled “Board of Directors and Corporate Governance.” Each of Messrs. Newton and Raaberg and Ms. Petrocelli has consented to being named as a nominee in the proxy statement and to continue to serve as a director, if elected; however, in the event that a director nominee is unable or declines to serve as a director at the time of the 2023 Annual Meeting, the proxies will be voted for any nominee designated by our board of directors to fill such vacancy.

If you are a stockholder of record and you sign your proxy card or vote by telephone or over the Internet but do not give instructions with respect to the voting of directors, your shares will be voted “FOR” the election of Messrs. Richard Y. Newton III and Douglas L. Raaberg and Ms. Tobi Petrocelli. If you are a street name stockholder and you do not give voting instructions to your broker or nominee, your broker will leave your shares unvoted on this matter.

Vote Required

Each director is elected by a plurality of the votes cast by the stockholders present or represented by proxy at the 2023 Annual Meeting and entitled to vote in the election of directors. The three director nominees receiving the highest number of “FOR” votes cast by the stockholders entitled to vote at the 2023 Annual Meeting will be elected. Abstentions and broker non-votes will have no effect on the outcome of the vote. You may vote “For” or “Withhold” for the nominee for election as a director.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES NAMED ABOVE.

26 | Page

Background and Overview

On March 17, 2023, the Board unanimously approved, subject to stockholder approval, an amendment to our Certificate of Incorporation to increase our authorized shares of Common Stock from 300,000,000 to 600,000,000 and to make a corresponding change to the number of authorized shares of capital stock. The form of the proposed Certificate of Amendment effecting the amendment is attached to this proxy statement as Appendix A.

We currently have a total of 350,000,000 shares of capital stock authorized under our Certificate of Incorporation, consisting of 300,000,000 shares of Common Stock and 50,000,000 shares of preferred stock. Our Board is asking our stockholders to approve an amendment that will increase the number of authorized shares of Common Stock from 300,000,000 to 600,000,000 and increase the number of authorized shares of all classes of stock from 350,000,000 to 650,000,000. The number of shares of authorized preferred stock would remain unchanged.

The additional Common Stock to be authorized by adoption of the amendment would have rights identical to our currently outstanding Common Stock. Adoption of the proposed amendment and issuance of the Common Stock would not affect the rights of the holders of our currently outstanding Common Stock, except for effects incidental to increasing the number of shares of our Common Stock outstanding, such as diluting earnings per share, voting power and common shareholdings of stockholders. It could also have the effect of making it more difficult for a third party to acquire control of our company.

As of March 23, 2023, 144,298,727 shares of Common Stock, $0.0001 par value, were outstanding, leaving 155,701,273 shares of Common Stock available for issuance. As of March 23, 2023, we had reserved, pursuant to our 2021 Omnibus Incentive Plan, which became effective upon consummation of the Business Combination (the “2021 Plan”), 27,227,891 shares of Common Stock. Additionally, as of March 23, 2023, 2022, we had warrants outstanding to purchase 47,608,845 shares of Common Stock, convertible notes outstanding convertible into 42,220,000 shares of Common Stock (inclusive of reserve for approximately two years of PIK interest) and 27,077,304 shares of Common Stock reserved but unissued pursuant to our committed equity facility with B. Riley Capital II, LLC. Thus, as of March 23, 2023, we had 11,567,233 shares of Common Stock that were unissued and unreserved for issuance. We have no shares of preferred stock outstanding. As of the date of this proxy statement, we have a sufficient number of authorized shares of Common Stock under our current Certificate of Incorporation to issue shares of Common Stock upon the exercise of outstanding convertible securities, including the conversion of the Convertible Notes and exercise of the Warrants if the stockholders approve the Share Issuance Proposal, below.

From our inception, we have financed our operations primarily through the sale of equity securities and debt financings. Until we can generate sufficient product revenues, if ever, we expect to finance our cash needs in whole or in part through equity offerings. Our Board is continuously evaluating, including at present, various strategic and financial alternatives to finance our cash needs and has determined that it would be in our best interest to increase the number of authorized shares of Common Stock in order to provide our company with the flexibility to pursue all finance and corporate opportunities involving our Common Stock, which may include private or public offerings of our equity securities utilizing the newly authorized shares of Common Stock, without the need to obtain additional stockholder approvals. The shares will be available for issuance by our Board for proper corporate purposes, including but not limited to, acquisitions, financings and equity compensation plans. Our management believes the increase in authorized share capital is in the best interests of our company and our stockholders and recommends that the stockholders approve the increase in authorized share capital.

27 | Page

If the authorization of an increase in the available Common Stock is postponed until the foregoing specific needs arise, the delay and expense incident to obtaining approval of the stockholders at that time could impair our ability to meet our objectives. Further, if this proposal is not approved by our stockholders, our financing alternatives will likely be limited by the lack of sufficient unissued and unreserved authorized shares of Common Stock, and stockholder value may be harmed by this limitation. In short, if our stockholders do not approve this proposal, we may not be able to access the capital markets, complete corporate collaborations, partnerships or other strategic transactions, attract, retain and motivate employees, and pursue other business opportunities integral to our growth and success.

The additional shares of Common Stock that would become available for issuance if the proposal were adopted could also be used by us to oppose a hostile takeover attempt or to delay or prevent changes in control or our management. For example, if the proposal were adopted, then, without further stockholder approval, the Board could strategically sell shares of Common Stock in a private transaction to purchasers who would oppose a takeover or favor the current Board. Although this proposal to increase the authorized Common Stock has been prompted by business and financial considerations and not by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at us), nevertheless, stockholders should be aware that approval of proposal could facilitate future efforts by us to deter or prevent changes in control, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices.

Vote Required

The amendment to our Certificate of Incorporation to increase the authorized shares of our Common Stock from 300,000,000 to 600,000,000 requires a majority of the total voting power of our outstanding Common Stock entitled to vote as of the Record Date. Abstentions will have no effect on the outcome of the vote. Since the NYSE has advised us that the Share Authorization Proposal is a “routine” matter, if you hold your shares in street name and do not provide voting instructions to your broker, your broker has discretion to vote your shares on the Share Authorization Proposal.

If the Share Authorization Proposal is approved by the requisite vote of the stockholders, we will file a certificate of amendment to our Certificate of Incorporation with the Delaware Secretary of State as soon as reasonably practicable after the 2023 Annual Meeting. The amendment will become effective upon filing with the Delaware Secretary of State.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE SHARE AUTHORIZATION PROPOSAL.

28 | Page

Background and Overview

On October 31, 2022, we entered into a Convertible Note and Warrant Purchase Agreement (the “Purchase Agreement”) with U.S. Bank Trust Company, National Association as collateral agent (the “Convertible Notes Agent”) and Lockheed Martin Corporation (“Lockheed Martin”), providing for the issuance and sale to Lockheed Martin of second lien secured notes (the “Convertible Notes”) in an aggregate principal amount of $100 million (the “Debt Transaction”). In connection with the Debt Transaction, immediately following the closing, Lockheed Martin was issued warrants (the “Warrants”) to purchase 17,253,279 shares of Common Stock.

Why We are Seeking Stockholder Approval

Pursuant to Section 312.03(d) of the NYSE's Listed Company Manual, stockholder approval is required prior to the issuance of securities when the issuance or potential issuance will result in a “change of control” of the registrant.

In light of this rule, the terms of the Purchase Agreement require that we will use our reasonable best efforts to obtain stockholder approval for the issuance of shares of Common Stock issuable upon conversion of the Convertible Notes and exercise of the Warrants by Lockheed Martin that would exceed 30% of the Common Stock then outstanding at this 2023 Annual Meeting and that we will include a recommendation by the Board that the stockholders vote in favor of such proposal. If the stockholders do not approve the issuance of all such shares, the terms of the Purchase Agreement require that we use our reasonable best efforts to obtain stockholder approval at the next annual meeting of stockholders and each subsequent annual meeting thereafter, provided that if such approval is not obtained and Lockheed Martin seeks to convert any of its Convertible Notes or exercise any of the Warrants in accordance with the terms of the Purchase Agreement, we may settle the excess above any limit on conversion of the Convertible Notes and exercise of the Warrants set by applicable NYSE rules in cash in accordance with the terms of the Purchase Agreement.