Table of Contents

As filed with the Securities and Exchange Commission on December 3, 2021

Registration No. 333-253626

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 7

to the

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Intermedia Cloud Communications, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7372 | 37-1837321 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

100 Mathilda Place, Suite 600

Sunnyvale, CA 94086

Telephone: (650) 641-4000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael J. Gold

President and Chief Executive Officer

100 Mathilda Place, Suite 600

Sunnyvale, CA 94086

Telephone: (650) 641-4000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies of all communications, including communications sent to agent for service, should be sent to: | ||

| Robert M. Hayward, P.C. Alexander M. Schwartz Kirkland & Ellis LLP 300 North LaSalle Chicago, IL 60654 (312) 862-2000 |

Rezwan Pavri Jeana S. Kim | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

| ||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Amount of Registration Fee | ||

| Common Stock, par value $0.001 per share |

100,000,000 |

$10,910(2) | ||

|

| ||||

|

| ||||

| (1) | Includes the aggregate offering price of shares of common stock subject to the underwriters’ option to purchase additional shares from the selling shareholder. |

| (2) | $10,910 was previously paid in connection with the previous filing of this Registration Statement on February 26, 2021. Additionally, on March 23, 2021, $29,034 was paid in connection with the previous filing of this Registration Statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the Selling Shareholder may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and neither we, nor the Selling Shareholder, are soliciting offers to buy these securities in any jurisdiction where the offer and sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued December 3, 2021

Shares

COMMON STOCK

Intermedia Cloud Communications, Inc. is offering shares of our common stock, and Ivy Parent Holdings, LLC (the “Selling Shareholder”) is offering shares of our common stock. We will not receive any proceeds from the sale of shares by the Selling Shareholder. This is our initial public offering, and no public market currently exists for shares of our common stock. We anticipate that the initial public offering price will be between $ and $ per share.

Immediately after this offering, assuming an offering size as set forth above, funds controlled by our equity sponsor, Madison Dearborn Partners, LLC, will beneficially own approximately % of our outstanding common stock (or % of our outstanding common stock if the underwriters’ option to purchase additional shares from the Selling Shareholder is exercised in full). As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the NASDAQ Global Select Market (“Nasdaq”). See “Management—Corporate Governance—Controlled Company Status.”

We have applied to list our common stock on Nasdaq under the symbol “INTM.”

We are an “emerging growth company” as defined under the federal securities laws, and as such, we have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings. Investing in our common stock involves risks. See “Risk Factors” beginning on page 21.

PRICE $ A SHARE

| Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds to Intermedia |

Proceeds to the Selling Shareholder |

|||||||||||||

| Per Share |

$ | $ | $ | $ | ||||||||||||

| Total |

$ | $ | $ | $ | ||||||||||||

| (1) | See the section titled “Underwriters” for a description of compensation payable to the underwriters. |

At our request, the underwriters have reserved up to 5% of the shares of common stock offered by this prospectus for sale, at the initial public offering price, for sale to certain individuals through a directed share program. See “Underwriters—Directed Share Program.”

In addition, NEC Corporation has agreed to purchase $40.0 million in shares of our common stock at the initial public offering price per share in a private placement that is expected to close concurrently with, and is conditioned upon consummation of, this offering. The shares to be sold in the concurrent private placement will constitute restricted securities under the Securities Act of 1933, as amended. Morgan Stanley & Co. LLC is serving as placement agent for the concurrent private placement and will receive a placement agent fee that is based upon a percentage of the total purchase price of the private placement shares. The closing of this offering is not conditioned upon the closing of the concurrent private placement.

We have granted the underwriters the right to purchase up to an additional shares of our common stock from the Selling Shareholder at the initial public offering price less the underwriting discount.

The Securities and Exchange Commission and state regulators have not approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2021.

| MORGAN STANLEY | J.P. MORGAN |

| CREDIT SUISSE | EVERCORE ISI | JEFFERIES |

| WILLIAM BLAIR | KEYBANC CAPITAL MARKETS | TD SECURITIES | LOOP CAPITAL MARKETS |

, 2021

Table of Contents

Table of Contents

Table of Contents

Table of Contents

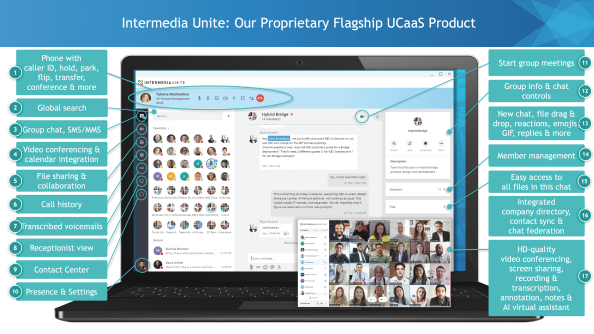

Fully Integrated Experience PC and Mac Platforms, iPhone, and Android Devices 1 Phone with caller ID, hold, park, flip, transfer, conference & more 2 Group chat 3 Video conferencing 4 File sharing & Collaboration 5 Call history 6 Transcribed voicemails 7 Contact Center 8 Receptionist view 9 Presence 10 Start meetings, place calls, search in chat, add participants to any chat 11 HD-quality video conferencing, screen sharing, recording & transcription, annotation, notes & AI virtual assistant 12 Integrated company directory

Table of Contents

| 1 | ||||

| 15 | ||||

| 18 | ||||

| 21 | ||||

| 69 | ||||

| 72 | ||||

| 74 | ||||

| 75 | ||||

| 76 | ||||

| 78 | ||||

| 81 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

89 | |||

| 118 | ||||

| 145 |

| 151 | ||||

| 161 | ||||

| 163 | ||||

| 166 | ||||

| 168 | ||||

| 175 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

178 | |||

| 183 | ||||

| 194 | ||||

| 194 | ||||

| 194 | ||||

| 194 |

Neither we nor the Selling Shareholder nor any of the underwriters have authorized anyone to provide any information or make any representations other than those contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission, or the SEC. Neither we, the Selling Shareholder, nor any of the underwriters take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Shareholder are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, financial condition, results of operations, and prospects may have changed since such date.

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside of the United States, neither we nor the Selling Shareholder nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. For a more complete understanding of us and this offering, you should read and carefully consider the entire prospectus, including the more detailed information set forth under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes. Some of the statements in this prospectus are forward-looking statements. See “Forward-Looking Statements.”

Unless the context otherwise requires, the terms “Intermedia,” the “Company,” “our company,” “we,” “us” and “our” in this prospectus refer to Intermedia Cloud Communications, Inc. and, where appropriate, its consolidated subsidiaries. The terms “MDP” and “our Sponsor” refer to Madison Dearborn Partners, LLC, our equity sponsor, and the term “MDP Funds” refers to Madison Dearborn Capital Partners VII-A, L.P., Madison Dearborn Capital Partners VII-C, L.P. and Madison Dearborn Capital Partners VII Executive-A, L.P.

Our Mission

Our mission is to empower our partners to provide businesses a unified and seamless communications and collaboration platform that enables employees to work better from anywhere.

Overview

We provide a leading, proprietary cloud-based communications and collaboration platform, purpose-built for our extensive and expanding network of more than 7,100 channel partners and used by a growing base of over 125,000 business customers as of September 30, 2021. Through our platform, our partners provide their customers our comprehensive portfolio of enterprise-grade, seamlessly integrated Unified Communications-as-a-Service (UCaaS) solutions, including our flagship product Intermedia Unite®, as well as a suite of Business Cloud Applications (BCA) that includes cloud-based email, security and productivity applications. Our UCaaS solutions benefit from strong growth, with UCaaS annualized recurring revenue (ARR) growing at 31.5% over the 12-month period ended September 30, 2021, as our partners enable businesses to modernize their legacy communications architectures. Our broad solution portfolio is popular among our partners, with partners selling both UCaaS and BCA solutions (Combo Partners) generating 79% of our Partner UCaaS ARR as of July 31, 2021. Our BCA solutions are synergistic to the growth of our UCaaS solutions, especially in light of our partner-focused go-to-market model, as we continue to migrate our large base of BCA partners to start selling UCaaS solutions and as our partners cross-sell UCaaS solutions to their BCA customers. To incentivize and empower our partners to grow their businesses on our platform, we offer them a highly differentiated Customer Ownership Reseller model, branded CORE™. This model enables them to resell, package and manage our solutions as if they were their own, at highly attractive economic terms while maintaining ownership of their customer relationships. We further differentiate from our competition by providing our partners world-class customer support, J.D. Power-certified six years in a row and with an average monthly Net Promoter Score (NPS) of 83 for the ten months ended October 31, 2021, and HostPilot®, a comprehensive and intuitive management interface, which allows our partners and end customers to manage our full suite of solutions across users and devices from a single control panel. Our recently expanded ten-year exclusive strategic partnership with NEC Platforms, Ltd. (the subsidiary of NEC Corporation that is responsible for NEC’s unified communications business) and its consolidated organizations (NEC), which began in April 2020, provides a foundation to significantly accelerate our partner-led growth strategy. Pursuant to the partnership, NEC and its partner network offer our UCaaS solutions for resale on a private label basis to an estimated installed base of approximately 80 million on-premise NEC business phone users, which makes NEC the global market share leader within the small and medium-sized businesses (SMBs) market. In October 2021, we and NEC agreed (i) to extend the initial term of our partnership from five to ten years and (ii) to designate NEC as our exclusive reseller in Japan for the duration of that initial term. Additionally, we entered into a common stock

1

Table of Contents

purchase agreement whereby NEC Corporation agreed to purchase $40 million of our common stock concurrently with, and conditioned upon, the closing of this offering, as further described below. The purchase of such shares in this private placement will be at the initial public offering price per share. We believe this signifies the strength of our NEC partnership and the positive momentum we have built together.

We employ a channel-first strategy whereby we distribute our solutions predominantly through our Managed Service Provider (MSP) and Value Added Reseller (VAR) partners as well as through our co-marketing program with Costco Business Services targeted at their membership base of millions of businesses. This broadens our sales reach considerably to customers of all sizes, especially in our target market of SMBs, which rely heavily on channel partners to address their IT needs and are not the primary focus of many of our competitors. We establish long-term, strategic and mutually beneficial relationships with our partners, providing them with the tools, capabilities and support to effectively sell our solutions, serve their customers and achieve sustainable growth. We believe our approach is significantly more partner-friendly than our competitors’ primary go-to-market approach, which is centered on our competitors owning the end customer relationship themselves, either through direct sales or by limiting their partners to commission-based sales agent roles.

The most popular model among our partners is our CORE model, which enables our partners to sell our solutions using their own brand or on a co-branded basis, with their own pricing structure, and potentially as part of a broader solutions package they have assembled. This model allows our partners to retain direct sales, support and billing relationships with their customers. While we believe the commissions we pay our sales agents are competitive, CORE partners can earn up to five times higher revenue and up to two times higher profit than our sales agents. In addition, we benefit from significant financial and operational leverage as our partners are responsible for the majority of the customer-facing activities including sales, marketing, onboarding, support, billing and collections. Based on a 2019 market study that we commissioned (the 2019 Market Study), 95% of MSPs and VARs prefer a reseller model over a sales agent model. We believe our differentiated CORE reseller model results in high loyalty among our partners, incentivizes them to grow their businesses on our platform and helps us recruit new partners to our platform.

We are party to a recently expanded, exclusive strategic partnership with NEC with an initial term of ten years through April 2030, whereby NEC offers our UCaaS solutions for resale on a private label basis, directly and through its own partner network, to its global customer base. NEC’s on-premise business phone installed base, estimated at approximately 80 million global users, is the largest installed base within the SMB segment and third largest across all customer segments, globally. The NEC partnership provides us with a significant long-term growth opportunity and a platform to expand internationally while also underscoring the strong appeal of our differentiated partnership strategy. As of September 30, 2021, 724 NEC partners across 8 countries including the United States, Canada and Japan had accepted NEC’s partner agreement to sell our UCaaS solutions under the NEC brand. We expect the number of NEC partners to grow significantly as we continue to strengthen our relationship with NEC and expand our presence globally.

We estimate the total addressable market for our UCaaS and BCA solutions to be $68 billion. The fast growth of our UCaaS solutions, with a total addressable market of $48 billion, is primarily driven by our partners using our solutions to upgrade their customers’ legacy communications systems, which are not designed to address the evolving work environment and need for connected, seamless and modern architectures. Gartner Inc. (Gartner) has estimated that there are 445.4 million business telephony users globally. Synergy Research Group estimates that the number of UCaaS subscribers globally was over 17 million as of June 9, 2021, implying a strong demand backdrop for our UCaaS solutions.

Substantially all of our revenue is recurring from the sale of subscriptions for our solutions predominantly by our partners, who contributed 75.1% of our ARR as of September 30, 2021. We own the underlying core technology of our proprietary platform, allowing us to achieve compelling unit economics and strong profit

2

Table of Contents

margins. To date we have primarily targeted end-customers in the United States, but are actively expanding our presence internationally by leveraging our partner network, including our recent exclusive partnership with NEC.

Our revenue was $251.6 million in the year ended December 31, 2020 and $203.0 million in the nine months ended September 30, 2021. Our fast-growing UCaaS Solutions product group, which includes video, voice, chat, contact center, and file backup and collaboration solutions delivered 31.5% ARR growth over the 12-month period ended September 30, 2021, and contributed 35.4% and 40.8% of our total ARR as of December 31, 2020 and September 30, 2021, respectively. ARR from our BCA product group, which includes cloud-based email solutions, email protection, archiving and encryption services, file backup and collaboration solutions, productivity services and other services including SIP trunking, declined 3.4% over the 12-month period ended September 30, 2021, and contributed 64.6% and 59.2% of our total ARR as of December 31, 2020 and September 30, 2021, respectively. In the year ended December 31, 2020, our net loss was $21.7 million, representing a net loss margin of 8.6%, and our Adjusted EBITDA was $46.7 million, representing an Adjusted EBITDA margin of 18.6%. In the nine months ended September 30, 2021, our net loss was $18.2 million, representing a net loss margin of 9.0%, and our Adjusted EBITDA was $27.3 million, representing an Adjusted EBITDA margin of 13.5%. See “Selected Consolidated Financial Data—Non-GAAP Financial Measures—Adjusted EBITDA and Adjusted EBITDA margin” for a definition of Adjusted EBITDA and Adjusted EBITDA margin and a reconciliation to the most directly comparable GAAP financial measure.

Industry Trends in Our Favor

Companies are modernizing their legacy communications architectures. According to Gartner, in 2020, an estimated 76% of global business telephony users were still utilizing on premises-based telephony. These legacy PBX telephony systems are operated by companies such as Cisco, Avaya, NEC and others, and are not designed to address the evolving work environment and need for connected, seamless and modern architectures. Rapid technological development over recent years has enabled the rise of cloud-based, device-agnostic communications and collaboration solutions that are rapidly displacing legacy communications infrastructures.

SMBs are reliant on channel partners to address their IT needs. Channel partners provide SMBs with a single reliable and comprehensive source to meet their complex IT needs. In the United States, an estimated 70% of more than $500 billion in IT spending by U.S. companies flows through or is influenced by the approximately 160,000 solution providers in the country’s IT channel ecosystem, according to a 2020 study by CompTIA. Channel partners have become the de facto and trusted technology advisors for the SMB segment that represents a base of 31.7 million companies in the U.S. alone, according to the U.S. Small Business Administration Office of Advocacy. Within this base of channel partners, according to the 2019 Market Study, 95% of MSPs and VARs prefer a reseller model in lieu of a traditional agent-based approach. This highlights the significant opportunity ahead of us to tap the broader channel partner network and offer them our differentiated CORE model.

The IT environment is being consolidated, with fully integrated solutions replacing suboptimal, siloed point solutions. As organizations upgrade their existing legacy communications architectures, they are faced with a range of digital and cloud-based solutions that are often disparate and siloed. The deployment of multiple point solutions has resulted in increasingly complex IT environments that, for the IT administrator and partner, are inefficient and expensive to manage and, for the end user, are difficult to navigate and deliver a suboptimal user experience. Now more than ever, there is a need for unified, fully integrated, feature-rich and simplified IT solutions. This need is particularly strong among SMBs that are served by MSPs or VARs.

Collaboration platforms are fundamental to the effectiveness of increasingly distributed organizations. With the increasing prevalence of distributed and mobile workforces along with the proliferation of the work-from-home environment accelerated by the COVID-19 pandemic, effective, device-agnostic communication and collaboration solutions are becoming increasingly critical to enable companies and their employees, irrespective of their physical location, to disseminate information, stay connected and engage internally and externally.

3

Table of Contents

Our Market Opportunity

We estimate the total addressable global market for our UCaaS and BCA solutions to be $68 billion.

Our UCaaS solutions address the Unified Communications, Collaboration and Public Cloud-Based Contact Center markets, which we estimate to amount to $43 billion based on IDC data, and File Sync and Share market, which MarketsandMarkets has estimated to amount to $5 billion globally. Additionally, we have observed the following trends:

| • | Gartner has estimated that of the 445.4 million business telephony users globally, only 105.0 million had migrated to cloud-based solutions by the end of 2020, representing a penetration rate of 23.6%. Gartner further estimates that in 2025 the number of global business telephony users on cloud-based solutions will be 200.4 million, representing an estimated compound annual growth rate of 13.8%. Gartner estimates that there were 340.4 million on-premise business telephony users in 2020. The migration to the cloud of NEC’s installed base of on-premise business telephony users, estimated to be approximately 80 million globally, represents an attractive opportunity that we are well positioned to address through our exclusive strategic partnership with NEC. |

| • | The North American business telephony market, our primary operating market today, is undergoing a migration to cloud-based solutions similar to the global market. According to Gartner, the number of business telephony users in North America in 2020 was 117.0 million, of which 41.4 million had migrated to cloud-based solutions, representing a penetration rate of 35.4%. In 2025, Gartner expects 70.5 million business telephony users to be on cloud-based solutions, representing an estimated compound annual growth rate of 11.2%. |

| • | Synergy Research Group estimates that the number of UCaaS subscribers globally was over 17 million as of June 9, 2021, with U.S. subscribers representing over 75% of total subscribers. |

| • | Omdia further estimates that by the end of 2020, there were 10.5 million contact center agent positions globally, of which 3.4 million were using cloud hosted solutions, representing a penetration rate of 32.4%. Omdia estimates that by the end of 2024, 5.0 million contact center agent positions will be using cloud hosted solutions, representing an estimated compound annual growth rate of 10.1%. |

Our BCA solutions address markets whose combined global size is estimated to be $20 billion according to various third-party market sources.

Our Differentiated Partnership Strategy

We primarily target small and medium-sized businesses (SMBs) with our solutions. We have built our business around a channel-first strategy whereby we distribute our solutions predominantly through our growing partner network. This model allows us to efficiently expand and accelerate our sales reach and better address our large but fragmented target market of SMBs, which rely heavily on channel partners to address their IT needs. Consequently, competition in the SMB market is less intense than in the enterprise market as most of our competitors lack a channel partner-focused infrastructure and approach similar to ours that would allow them to grow efficiently in the SMB market, and have strategically chosen to primarily target the enterprise market. While we primarily target SMBs, we also serve our enterprise customers through our partner network.

Our philosophy is to empower our partners. We strive to eliminate the challenges that our partners face in addressing their customers’ needs by providing them with the tools, capabilities and support to effectively sell our solutions, serve their customers and achieve sustainable growth. Guided by this approach, we have been able to grow our partner network to more than 7,100 loyal and motivated partners as of September 30, 2021 and establish a position as an integral part of their businesses.

4

Table of Contents

The Key Benefits of Our Differentiated Partnership Strategy for Our Partners:

| • | Platform built for partners. We have built our platform to both serve the needs of our end customers and to empower our partners. Our HostPilot cloud management platform provides our partners with an effective platform to market and sell our solutions to new customers and manage their existing customers. In addition, our integrations with leading third-party applications enable our partners to offer more comprehensive solutions to their customers and transfer data efficiently from our platform into the systems they use to manage their own businesses. |

| • | Highly attractive customer ownership reseller model. Our CORE model allows our partners to retain the direct sales, support and billing relationships with their customers and to integrate our solutions into their broader portfolio of solutions on their own terms, including pricing, packaging, billing and solution-bundling. This structure gives our partners greater control over the growth and profitability of their businesses. Because in this model the contract to deliver our solutions is between our partner and our end customer, it allows our partners to recognize the entirety of the amounts paid by the customers as revenue. While we believe the commissions we pay our sales agents are competitive, CORE partners can earn up to five times higher revenue and up to two times higher profit than our sales agents. This contrasts with the traditional approach adopted by most of our competitors in which our competitors own the end customer relationship themselves, either through direct sales or by limiting their partners to commission-based sales agent roles, while their partners’ customer relationships are gradually disintermediated by our competitors. Based on the 2019 Market Study, 95% of MSPs and VARs prefer a reseller model over a sales agent model. |

| • | Flexibility. We offer our partners the flexibility to choose, on a customer by customer basis, whether they wish to sell under our CORE model or act as our commissioned agent to sell Intermedia-branded bundled solutions, where we are responsible for support and billing. |

| • | Business support. We provide rebrandable marketing materials, marketing automation (including pre-built campaigns) and dedicated co-marketing assistance to our partners. Through Intermedia University, our digital training portal, we educate our partners on the underlying capabilities and technology of our solutions as well as how to sell, market and provide support for our solutions. We also provide technical and onboarding support to our partners to allow them to deliver a seamless experience to their customers and have developed a set of proprietary management tools that allow our partners to operate their businesses and serve their customers more efficiently. |

The Key Benefits of Our Differentiated Partnership Strategy for Us:

| • | Expansion of our partner network. Our partnership strategy is built on the alignment of interests between us and our partners, which we believe increases our partners’ loyalty and helps us to establish long-term, mutually beneficial relationships with them. This contributes to our ability to retain our existing partner relationships as well as actively recruit new partners to our platform, and therefore expand our partner network. |

| • | Partner network that is incentivized to sell our solutions. Due to the potential for higher revenue and more control over the customer relationship under our CORE model, compared to our competitors’ sales agent model and its associated risk of customer relationship disintermediation, our partners are highly incentivized to sell our solutions to their customers and to deepen their relationship with us. |

| • | Ability to scale our business in a capital efficient manner. In our CORE model, which represented 56% of our partner ARR as of September 30, 2021, our partners are responsible for the majority of the customer-facing activities, providing us with significant financial and operational leverage. In particular, our partners leverage our tools and support to handle sales, marketing, customer onboarding, billing and collections and incur the costs associated with those activities. In addition, while we provide 24/7 technical support to our partners, they are responsible for providing the higher touch implementation and |

5

Table of Contents

| ongoing support services to their customers, which allows us to avoid the significant costs associated with providing support and service activities to our entire end customer base. |

Our Platform

We provide a leading, proprietary cloud-based communications and collaboration platform for our end customers and our partners that serve them. The seamlessly integrated solutions on our platform are delivered and centrally managed through our proprietary HostPilot cloud management platform, which is the primary interface through which our partners market and sell our solutions to new customers and manage their existing customers and their solutions, and through which our direct customers manage their services with us. In addition, our HostPilot platform offers integrations with leading third-party applications to deliver more comprehensive solutions to our end customers and enable our partners to transfer data efficiently from our platform into the systems they use to manage their own businesses. Our platform is recognized as a leading, proprietary cloud-based communications and collaboration platform based on third-party industry reports and industry awards.

The Key Benefits of Our Platform for Our Partners:

| • | Flexible pricing models and product configurations. Our platform allows our CORE partners to configure and set pricing for customized solutions assembled from our broad product portfolio. |

| • | Capabilities for rebranding. Through our platform, our partners are able to deliver rebranded or unbranded solutions to their customers, as if the solutions were end-to-end delivered by our partners, including using their own brand for customer control panel appearance, system-generated email communications, sales and marketing materials, quotes, invoices, educational and support materials and technical documentation. |

| • | Sales and marketing support. We provide our partners with rebrandable marketing materials and sales tools, enabling them to effectively communicate with their customers and sell our solutions. We also support our partners by providing them with sales leads. |

| • | Education and training. Our digital self-paced training portal, Intermedia University, is accessible through HostPilot and allows our partners to access courses on sales training, marketing, product features and product support to improve our partners’ ability to sell our solutions and to support their customers. In addition, we provide our partners with a rebrandable Knowledge Base that they can offer to their customers and use for their own needs. |

| • | Quality assurance tools. Our platform offers various tools to ensure the quality of service before, during and after the sale, including Intermedia’s proprietary pre-qualification and network assessment tool, referred to as VoIP Scout™, as well as an AI-based carrier downtime monitoring and alerting tool. |

| • | Central cloud management platform. HostPilot enables our partners to manage their customers’ use of our solutions from an easy-to-use central control panel, as well as provision new accounts and add solutions to existing accounts. We also provide advanced migration and provisioning tools and wizards to facilitate frictionless transition to our platform. |

| • | Automation of billing and taxation. Our platform automates billing and calculates taxes payable by customers at federal, state and county levels. This allows our partners in the United States to avoid the complex tax analysis and administration required as a result of the intricacy of the U.S. telecom taxation rules, which given its complexity and associated costs has historically prevented many channel partners from selling voice solutions to their customers. |

| • | Platform integration with leading partner support solutions. HostPilot integrates with leading third-party partner support solutions such as ConnectWise, Autotask and Salesforce for easy billing, ticketing and quality of service issue reporting, and includes an open application programming interface (API) for custom integrations. |

6

Table of Contents

The Key Benefits of Our Platform for Our End Customers:

| • | Comprehensive portfolio of solutions. Our platform includes a comprehensive portfolio of enterprise-grade communications and collaboration solutions including video, voice, chat, contact center, email, productivity, file sharing, backup, archiving and security. |

| • | Integrated platform. Our platform seamlessly integrates our products into a one-stop solution with a common, intuitive user interface which allows our end customers to manage an integrated set of communications and collaboration solutions and to avoid the cost, IT management complexity and interoperability issues that commonly arise with multiple, disparate point solution vendors. |

| • | Omni-channel communications on any device. Our platform enables end users to connect with other users flexibly and fluidly through any relevant communications channel using a device of their choice, including business phone, desktop, tablet or smartphone. Furthermore, end users can interact through multiple channels and devices, in parallel during the same engagement. |

| • | Empowering a distributed workforce. Our platform enables employees to work virtually anywhere. Whether in the actual office, at home, or anywhere else, our customers’ workforce is armed with an entire office communications and collaboration suite for seamless business operations at all times. |

| • | Easy onboarding, set-up and use. The solutions on our platform are designed for quick and smooth onboarding, set-up and ease of use, for both our end customers’ IT administrators and end users. In particular, our pre-integrated solutions provide intuitive, easy-to-use functionality and common user interface for end users across all levels of the organization. With comprehensive tools and J.D. Power-certified support, set-up and management require minimal resources, which administrators without extensive IT expertise are able to carry out. Specifically, our Cloud Concierge™ team is committed to transitioning customers to our solutions seamlessly and at no extra cost, with no data loss, no downtime and no disruption to their business. |

| • | All solutions managed from a single control panel. Our proprietary HostPilot cloud management platform integrates solutions, users and devices by enabling IT administrators to simultaneously manage more than 25 business solutions for their entire employee base from a single control panel. HostPilot provides a command post with a common set of intuitive controls with unified control protocols, avoiding the inefficiency and friction associated with multiple disparate solutions. |

| • | Flexible integration with other business solutions. The ability to integrate our solutions into our clients’ broader IT stack is an important consideration for our end customers. Consequently, we have designed our platform to integrate with cloud solutions in other business categories such as Google Workspace, ServiceNow, Zendesk, Oracle NetSuite, Salesforce, SugarCRM, Zoho, Slack, and the Microsoft 365 ecosystem of applications. In addition, our platform supports integration with on-premise applications. |

| • | Security, privacy protection and compliance. We protect the users of our end customers and their data with powerful, up-to-date security protocols with a layered security model. Our monitored, secure data centers are geographically dispersed. We use redundant, enterprise-class firewall systems to help prevent unwarranted intrusions and operate multiple intrusion protection systems to help detect and deter malicious traffic. In addition, our solutions comply with major legal and regulatory frameworks. |

| • | Uptime and reliability. We offer a financially backed 99.999% uptime service level agreement (SLA) for our primary solutions, which translates to less than 26 seconds of downtime a month, representing superior reliability in our industry. We believe our reliability is one of the key drivers of our growth and customer retention. |

7

Table of Contents

Our Key Competitive Strengths

| • | Differentiated value proposition for our partners. Unlike most of our competitors, we allow our partners to operate as customer ownership resellers whereby they retain direct sales, support and billing relationships with their customers. While we believe the commissions we pay our sales agents are competitive, CORE partners can earn up to five times higher revenue and up to two times higher profit than our sales agents. This approach combined with the sales and marketing materials and support, 24/7 technical support, and training that we provide to our partners has resulted in us establishing long-term, strategic and mutually beneficial relationships with them, further incentivizing our partners to sell our solutions to their customers. |

| • | Distribution power of our more than 7,100 active partners, including NEC, as of September 30, 2021. Our vast and growing partner network gives us tremendous leverage to grow our end customer base, increase revenue from our existing end customers and expand our footprint to new geographies without commensurate investment in our sales, marketing or support functions. In particular, NEC’s business phone installed base is estimated at approximately 80 million on-premise business phone users globally, whose migration to cloud-based solutions represents a significant long-term growth opportunity for us. |

| • | Comprehensive portfolio of integrated and proprietary cloud communications and collaboration solutions. Due to the breadth of our application portfolio, we are able to offer comprehensive, integrated, and easy-to-use solutions to meet our end customers’ and partners’ communication and collaboration needs, which saves them from the complexity of sourcing, integrating and managing multiple disparate solutions from different vendors. We own the underlying core technology of our proprietary platform and continue to develop it in-house, which allows us to rapidly adapt to evolving customer and partner requirements as well as achieve compelling unit economics and strong profit margins. |

| • | Our BCA solutions product group and the related partner ecosystem is synergistic to the growth of our UCaaS solutions product group. Our partners value our broad solution portfolio due to the opportunity to achieve greater revenues and stronger customer retention with limited incremental operating costs given the ability to manage all solutions from the HostPilot management platform. This is illustrated by the fact that our partners that are selling both UCaaS and BCA solutions (Combo Partners) generated 79% of our Partner UCaaS ARR as of July 31, 2021. Furthermore, the penetration of UCaaS solutions among the BCA customer base of our Combo Partners has nearly doubled from 8.6% as of December 31, 2018 to 17.1% as of August 31, 2021, which is a testament to our partners’ success in cross-selling. In addition, the approximately 3,800 partners that are currently only selling our BCA solutions provide us with a low-cost opportunity to source new partners to sell our UCaaS solutions and drive growth of our UCaaS solutions product group. Our success in migrating BCA partners to start selling UCaaS solutions is underscored by the fact that 70% of our current Combo Partners started the partnership with us by selling BCA solutions. |

| • | Award-winning customer support. We were the first cloud provider to be recognized by J.D. Power for the quality of its customer support, and we are the only cloud provider to have earned the prestigious recognition for six years in a row. Our teams consistently achieve very high NPS, a testament to our excellent customer support. For the ten months ended October 31, 2021, the average monthly NPS for our onboarding and technical support was 83, which is an outstanding score in our industry. For further discussion on our NPS, see “Market and Industry Data.” |

| • | Track record and focus on innovative solutions. Our long track record of innovation includes our HostPilot control panel, our CORE partner model, and our pioneering role in converging UCaaS, video and web conferencing, Contact Center as a Service (CCaaS) and business email solutions. In addition, as of September 30, 2021, almost 40% of our employees were dedicated to intellectual property development, a metric that is far above industry standard. |

8

Table of Contents

| • | Employee-friendly culture that allows us to attract and retain talent. We have sought to create a workplace and culture that is positive, employee-friendly and encourages our employees to work towards our shared goals of delivering innovative solutions to our end customers and supporting our partners. The strength of our culture and employee satisfaction are underpinned by our Glassdoor ratings, which as of November 2021 include a 4.7 overall rating, 97% friend recommendation rating, and 96% CEO approval rating, which are among the highest ratings across all companies for which Glassdoor ratings are available. |

Our Growth Strategy

| • | Drive deeper relationships with our existing partners. Our growth accelerates as our existing partners add new customers, upgrade solution packages or sell additional solutions to our existing end customers. Our partnership strategy, including the flexibility of go-to-market alternatives we offer to our partners, our highly attractive CORE model, and the extensive support we provide to our partners, creates strong incentives for our partners to grow their businesses on our platform. Additionally, as of July 31, 2021, approximately 2,000 of our more than 7,000 partners had customers who subscribed to offerings from both UCaaS and BCA product groups while contributing approximately 68% of partner ARR, implying a significant upside opportunity from continued cross-selling. |

| • | Focus on growing in our SMB target market. Our channel-first strategy and partner relationships position us optimally to grow within our SMB target market, which is fragmented and where end customers rely heavily on channel partners to address their IT needs. Consequently, competition in the SMB market is less intense than in the enterprise market as most of our competitors lack a channel partner-focused infrastructure and approach similar to ours that would allow them to grow efficiently in the SMB market, and have strategically chosen to primarily target the enterprise market. While our primary focus is on the SMB market, we also serve enterprise customers through our various channels and our enterprise-grade products. |

| • | Leverage our exclusive, strategic partnership with NEC. Through our exclusive arrangement with NEC, NEC and its partner network offer NEC-branded versions of our cloud-based communications and collaboration solutions for resale to NEC’s global customer base estimated at approximately 80 million on-premise business phone users. |

| • | Continue to drive growth of our UCaaS business through innovative solutions. We will continue to pursue growth of our UCaaS business by introducing new features and integrating new technologies and solutions that our innovation pipeline delivers to meet the needs of our end customers. Our architecture is designed to allow for frictionless integration of new solutions, which enables us to react quickly to changing market conditions. For the twelve-month period ended December 31, 2020, our team completed over 865 product features. In addition, our speed of delivery increased by 36% and productivity improved by 14% when comparing the quarter ended December 31, 2020 to the quarter ended December 31, 2019. |

| • | Expand internationally. We have historically primarily focused on the North American market with 95% of our revenue in the nine months ended September 30, 2021 derived from customers based in the United States. More recently, we started expanding and localizing our solutions portfolio for the European and Asia-Pacific (APAC) markets and have started hiring to establish presence in these markets. Our international expansion will be primarily pursued through our exclusive strategic partnership with NEC, whose customer base is global with particularly strong presence in the Asia-Pacific (APAC) region. |

| • | Grow our partner network. We have developed a highly efficient partner recruitment, onboarding and enablement engine, which allows us to grow our partner network efficiently. As our partner network grows, we gain access to a larger base of potential end customers, which provides an expanding pipeline that drives the growth of our business. |

9

Table of Contents

| • | Selectively pursue acquisitions and strategic investments. We may continue to selectively pursue acquisitions and strategic investments in order to strengthen our platform with new capabilities and solutions as well as to expand our position in our existing markets or to establish a presence in new markets. |

Summary of Risks Associated with Our Business, Our Indebtedness, this Offering and Our Common Stock

There are a number of risks related to our business, our indebtedness, this offering and our common stock that you should consider before you decide to participate in this offering. You should carefully consider all the information presented in the section entitled “Risk Factors” in this prospectus. Some of the principal risks include the following:

| • | We face intense competition in our market, especially from larger, well-established companies, and we may lack sufficient financial or other resources to maintain or improve our competitive position. The markets for communications, collaboration, security and productivity solutions are fragmented, intensely competitive and rapidly changing. We offer a diverse range of integrated communications solutions, including our Unified Communications-as-a-Service (UCaaS) solutions and business cloud applications solutions. Across our portfolio of solutions, we compete with a broad range of UCaaS point solution providers, legacy communications providers and email and productivity suite providers, as well as other traditional providers of Internet, IT and telephony services. If our solutions fail to meet the needs of our end customers and partners, or if our competitors create comparable solutions or go-to-market models that limit or eliminate our competitive differentiators, our competitive position may be harmed. |

| • | If we are unable to increase our sales to existing partners and end customers or attract new partners and end customers to purchase our solutions on a cost-effective basis, our business will be materially and adversely affected. Our future success depends, in part, on our ability to expand the deployment of our solutions with existing partners, which are both the primary source of revenue for our solutions and our primary channel to effectively reaching their end customers with our solutions, as well as with our existing end customers. This includes our ability to successfully convince our partners to migrate their existing end customers to our solutions, to sell our solutions to new end customers and to expand their existing end customers’ use of our portfolio of solutions. If our efforts to attract new partners are not successful, our revenue and rate of revenue growth may decline, we may not achieve profitability and our future results of operations could be materially harmed. Additionally, if our and our partners’ efforts to convince end customers to expand their use of our solutions and purchase additional functionalities are not successful, our business may suffer. |

| • | We rely heavily on partners for a significant portion of sales of our solutions, and if these partners fail to perform, or if they fail to comply with legal requirements when selling our solutions, our ability to sell and distribute our solutions will be significantly impaired, we could incur legal liability and our operating results may be harmed. Our success is significantly dependent upon establishing and maintaining relationships with a variety of partners, and we anticipate that we will continue to depend on these partners in order to grow our business. Our partners include MSPs, VARs, telecommunications companies and other third-party firms. It may take several months or more for a new partner to achieve productivity. In addition, our partners may be unsuccessful in marketing, selling and supporting our solutions and can cease marketing or reselling our solutions at any time with limited or no notice. We may not be able to incentivize these partners to sell our solutions to their end customers. Our agreements with our partners (other than NEC) are generally non-exclusive, such that those partners may offer customers the products and services of several different companies, including those that compete with ours. We also cannot be certain that we will retain these partners or that we will be able to secure additional or replacement partners, or that our partners will retain their customers to which they resell our products. |

10

Table of Contents

| • | The COVID-19 pandemic could materially adversely affect our business, operating results, financial condition and prospects. The severity, magnitude and duration of the current COVID-19 pandemic is uncertain and rapidly changing. The COVID-19 pandemic has resulted in governmental authorities implementing numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter in place orders and shutdowns. These measures have impacted and may further impact all or portions of our facilities, workforce and operations, the operations and behavior of our end customers and end users and the operations of our respective vendors and suppliers. While these measures have not had a material adverse impact on our results of operations to date, our results of operations could be materially adversely affected in the future if such measures were to continue or new measures were imposed. |

| • | Our existing indebtedness could adversely affect our business and growth prospects. As of September 30, 2021, we had a total term loan balance of $266.8 million outstanding under our Term Loan Facility and $6.0 million outstanding under our revolving loan facility (our Revolving Credit Facility, and together with the Term Loan Facility, our Credit Facilities). In addition, as of December 31, 2020 and as of September 30, 2021, we had $52.0 million and $45.9 million, respectively, of additional borrowing capacity under our Revolving Credit Facility. Our indebtedness, or any additional indebtedness we may incur, could require us to divert funds identified for other purposes for debt service and impair our liquidity position. If we cannot generate sufficient cash flow from operations to service our debt, we may need to refinance our debt, dispose of assets or issue equity to obtain necessary funds. |

| • | MDP controls us, and its interests may conflict with ours or yours in the future. Immediately following this offering and the concurrent private placement, the MDP Funds will beneficially own, through their control of Ivy Parent Holdings, LLC, approximately % of our common stock, or % if the underwriters exercise in full their option to purchase additional shares from the Selling Shareholder, which means that, based on its percentage voting power held after the offering, the MDP Funds (as defined below) will control the vote of all matters submitted to a vote of our Board or shareholders, which will enable it to control the election of the members of the Board, among other things, and all other corporate decisions. Accordingly, for such period of time as it has control, the MDP Funds will have significant influence with respect to our management, business plans and policies, including the appointment and removal of our officers, decisions on whether to raise future capital and amending our charter and bylaws, which govern the rights attached to our common stock, and their interest in such matters may conflict with yours or ours. |

| • | An active, liquid trading market for our common stock may not develop, which may limit your ability to sell your shares. The initial public offering price will be determined by negotiations between us and the underwriters and may not be indicative of market prices of our common stock that will prevail in the open market after the offering. The failure of an active and liquid trading market to develop and continue would likely have a material adverse effect on the value of our common stock, which may impair our ability to raise capital to pursue our growth strategies, to continue to fund operations and to pursue acquisitions using our shares as consideration. |

These and other risks are more fully described in the section entitled “Risk Factors” in this prospectus. If any of these risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. As a result, you could lose all or part of your investment in our common stock.

11

Table of Contents

Key Business Metrics

In addition to our GAAP financial information, we review several operating and financial metrics, including the following key business metrics, to evaluate our business, measure our performance, identify trends affecting our business, formulate business plans and make strategic decisions. For more information regarding these metrics, please see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics.”

| Year Ended December 31 | Nine Months Ended September 30 | |||||||||||||||

| 2019 | 2020 | 2020 | 2021 | |||||||||||||

| (in thousands except percentages) | ||||||||||||||||

| Annual Recurring Revenue |

||||||||||||||||

| Total ARR |

$ | 246,317 | $ | 262,185 | $ | 256,678 | $ | 278,080 | ||||||||

| UCaaS ARR |

$ | 72,362 | $ | 92,847 | $ | 86,353 | $ | 113,523 | ||||||||

| UCaaS ARR YoY Growth |

33 | % | 28 | % | 25 | % | 31 | % | ||||||||

| Partner Metrics |

||||||||||||||||

| Partner ARR |

$ | 173,565 | $ | 192,935 | $ | 187,247 | $ | 208,841 | ||||||||

| Partner Gross Sales ARR |

$ | 25,807 | $ | 42,698 | $ | 33,756 | $ | 31,820 | ||||||||

| Number of Partners |

6,691 | 7,017 | 6,930 | 7,169 | ||||||||||||

Our Sponsor

We have a valuable relationship with our equity sponsor, Madison Dearborn Partners, LLC (MDP). MDP manages several private equity funds that own an interest in us (the “MDP Funds”). In 2016, MDP formed our company for the purpose of acquiring all of the capital stock of Intermedia Holdings, Inc. We refer to this transaction as the “MDP Acquisition.” In connection with this offering, we will enter into a Director Nomination Agreement with the MDP Funds that provides such MDP Funds the right to designate all nominees to our board of directors (our Board) so long as the MDP Funds own 40% or more of the total shares of our common stock beneficially owned by the MDP Funds immediately prior to completion of this offering, as adjusted for any reorganization, recapitalization, stock dividend, stock split, reverse stock split or similar changes in the Company’s capitalization (Original Amount); and a number of directors related to the MDP Funds’ percentage of ownership of common stock when such funds own less than 40% of the Original Amount, subject to certain other conditions. See “Certain Relationships and Related Party Transactions—Related Party Transactions—Director Nomination Agreement” for more details with respect to the Director Nomination Agreement. In addition, our bylaws will provide that the directors nominated by the MDP Funds will have the right to designate the Chairman of the Board for so long as the MDP Funds beneficially own at least 15% or more of the voting power of the then outstanding shares of our capital stock then entitled to vote generally in the election of directors.

Madison Dearborn Partners, LLC is a leading private equity investment firm based in Chicago. Since MDP’s formation in 1992, the firm has raised aggregate capital of over $28 billion and has completed over 150 investments. MDP invests across five dedicated industry verticals, including Basic Industries; Business and Government Software and Services; Financial and Transaction Services; Health Care; and Telecom, Media and Technology Services. MDP’s objective is to invest in companies in partnership with outstanding management teams to achieve significant long-term appreciation in equity value.

Concurrent Private Placement

NEC Corporation has agreed to purchase $40.0 million in shares of our common stock at the initial public offering price per share in a private placement that is expected to close concurrently with, and is conditioned upon consummation of, this offering. The shares to be sold in the concurrent private placement will constitute

12

Table of Contents

restricted securities under the Securities Act of 1933, as amended. Morgan Stanley & Co. LLC is serving as placement agent for the concurrent private placement and will receive a placement agent fee that is based upon a percentage of the total purchase price of the private placement shares. The closing of this offering is not conditioned upon the closing of the concurrent private placement. The closing of the concurrent private placement is subject to customary closing conditions and neither party to the private placement agreement having terminated the agreement in accordance with its terms.

NEC Corporation has also agreed to a lock-up agreement with the underwriters pursuant to which the shares purchased in the concurrent private placement will be locked up for a period of 180 days from the date of this prospectus, subject to certain exceptions. See “Underwriters” for additional information.

General Corporate Information

Intermedia was founded in 1993. We were incorporated in 2016 as Ivy Holding Corp., a Delaware corporation, in connection with the MDP Acquisition. In January 2021, we changed the name of our company to Intermedia Cloud Communications, Inc. Our principal executive offices are located at 100 Mathilda Place, Suite 600, Sunnyvale, California 94086. Our telephone number is (650) 641-4000. Our website address is www.intermedia.com. The information contained in, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock. We are a holding company and all of our business operations are conducted through our subsidiaries.

This prospectus includes our trademarks and service marks, such as “Intermedia,” “Intermedia Unite,” “HostPilot,” “AnyMeeting” and “SecuriSync,” which are protected under applicable intellectual property laws and are our property. This prospectus also contains trademarks, service marks, trade names and copyrights of other companies, such as “Microsoft,” “Costco” and “NEC,” which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earliest of (1) the last day of the fiscal year following the fifth anniversary of the completion of this offering, (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion, (3) the date on which we are deemed to be a large accelerated filer (this means the market value of common that is held by non-affiliates exceeds $700.0 million as of the end of the second quarter of that fiscal year) or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

13

Table of Contents

We have elected to take advantage of certain of the reduced disclosure obligations regarding financial statements (such as not being required to provide audited financial statements for the year ended December 31, 2018 or five years of Selected Consolidated Financial Data) in this prospectus and executive compensation in this prospectus and expect to elect to take advantage of other reduced burdens in future filings. As a result, the information that we provide to our shareholders may be different than you might receive from other public reporting companies in which you hold equity interests.

The JOBS Act also permits an emerging growth company like us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to “opt-in” to this extended transition period for complying with new or revised accounting standards and, therefore, we will not be subject to the same new or revised accounting standards as other public companies that comply with such new or revised accounting standards on a non-delayed basis.

14

Table of Contents

| Common stock offered by us |

shares. |

| Common stock offered by the Selling Shareholder |

shares. |

| Common stock offered in the concurrent private placement |

shares. |

| Option to purchase additional shares from the Selling Shareholder |

shares. |

| Common stock to be outstanding after this offering and the concurrent private placement |

shares. |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $ million, assuming an initial public offering price of $ per share, which is the midpoint of the estimated public offering price range set forth on the cover page of this prospectus, and after deducting the underwriting discount and estimated offering expenses payable by us. In addition, we expect to receive net proceeds of $ million from the sale of shares of our common stock to NEC Corporation in the concurrent private placement, after deducting estimated placement agent fees payable by us. We will not receive any of the proceeds from the sale of the shares being offered by the Selling Shareholder. |

| The principal purposes of this offering and the concurrent private placement are to increase our capitalization and financial flexibility, create a public market for our common stock and enable access to the public equity markets for us and our shareholders. We expect to use approximately $ million of the net proceeds of this offering and the net proceeds from the concurrent private placement to repay outstanding borrowings under our term loan facility, or our Term Loan Facility, and the remainder of such net proceeds will be used for general corporate purposes or, potentially, for future additional repayment of our outstanding borrowings. At this time, other than the repayment of indebtedness under our Term Loan Facility, we have not specifically identified a large single use for which we intend to use the net proceeds and, accordingly, we are not able to allocate the net proceeds among any of these potential uses in light of the variety of factors that will impact how such net proceeds are ultimately utilized by us. We may also use a portion of our net proceeds to acquire or invest in complementary businesses, products, services or technologies. However, we do not have binding commitments for any acquisitions or investments at this time. See “Use of Proceeds” for additional information. |

| Controlled company |

After this offering, assuming an offering size as set forth in this section, and the concurrent private placement, the MDP Funds will |

15

Table of Contents

| beneficially own approximately % of our common stock (or % of our common stock if the underwriters’ option to purchase additional shares from the Selling Shareholder is exercised in full). As a result, we expect to be a controlled company within the meaning of the corporate governance standards of Nasdaq. See “Management—Corporate Governance—Controlled Company Status.” |

| Directed share program |

At our request, the underwriters have reserved up to shares of our common stock, or 5% of the shares of our common stock to be offered by this prospectus for sale, at the initial public offering price, for sale to certain individuals through a directed share program. Shares purchased through the directed share program will not be subject to a lock-up restriction, except in the case of shares purchased by any of our directors or officers and certain of our employees and existing equityholders. The number of shares of our common stock available for sale to the general public will be reduced to the extent these individuals or entities purchase such reserved shares. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same basis as the other shares offered by this prospectus. |

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed trading symbol |

“INTM.” |

The number of shares of common stock to be outstanding following this offering and the concurrent private placement is based on 47,799,251 shares of common stock outstanding as of September 30, 2021, and excludes:

| • | up to 868,883 shares of common stock issuable upon the exercise of options outstanding under the 2017 Stock Option Plan as of September 30, 2021 with a weighted-average exercise price of $4.73 per share; |

| • | up to 1,988,233 shares of common stock issuable upon the vesting and settlement of restricted stock units outstanding under our 2021 Long-Term Incentive Plan (2021 Plan) as of September 30, 2021, subject to a service-based vesting condition as well as a performance-based vesting condition that will be satisfied in connection with this offering; |

| • | up to 283,000 shares of common stock issuable upon the exercise of options outstanding under the 2021 Plan as of September 30, 2021, with a weighted-average exercise price of $13.42 per share; |

| • | up to 200,000 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2021, with a weighted-average exercise price of $5.76 per share; |

| • | 146,131 shares of common stock reserved for future issuance under the 2017 Stock Option Plan; |

| • | shares of common stock reserved for future issuance under the 2021 Employee Stock Purchase Plan (“ESPP”), which will be adopted in connection with this offering; |

| • | shares of common stock (assuming an initial public offering price of $ per share, which is the midpoint of the estimated public offering price range set forth on the cover of this prospectus) underlying the grants of restricted stock units to be issued upon the closing of this offering to certain of our employees and members of our board of directors under the 2021 Plan; |

16

Table of Contents

| • | shares of common stock (assuming an initial public offering price of $ per share, which is the midpoint of the estimated public offering price range set forth on the cover of this prospectus) underlying the grants of stock options to be issued upon the closing of this offering to certain of our employees under the 2021 Plan, with an exercise price equal to the initial public offering price; |

| • | 285,470 shares of common stock reserved for future issuance under the 2021 Plan; and |

| • | any shares of common stock that may become issuable under the warrant issued to NEC, as further described in “Certain Relationships and Related Party Transactions—Related Party Transactions—Warrants Issued by Ivy Parent.” |

Unless otherwise indicated, all information in this prospectus assumes:

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, each in connection with the closing of this offering; |

| • | no exercise of outstanding options or warrants after September 30, 2021; and |

| • | no exercise by the underwriters of their option to purchase up to additional shares of common stock from the Selling Shareholder. |

17

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our consolidated financial data. The summary consolidated statement of income data and summary consolidated statement of cash flow data for the years ended December 31, 2019 and 2020 and the summary condensed consolidated balance sheet data as of December 31, 2019 and 2020 are derived from our audited consolidated financial statements that are included elsewhere in this prospectus. The condensed consolidated statement of income data and summary consolidated statement of cash flow data for the nine months ended September 30, 2020 and 2021 and the consolidated balance sheet data as of September 30, 2021 are derived from our unaudited condensed consolidated financial statements and related notes included elsewhere in this prospectus.

Our historical results are not necessarily indicative of the results that may be expected in the future. You should read the summary historical financial data below in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31 | Nine Months Ended September 30, | |||||||||||||||

| 2019 | 2020 | 2020 | 2021 | |||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Consolidated Statement of Income Data: |

||||||||||||||||

| Revenue: |

||||||||||||||||

| Subscription |

$ | 236,905 | $ | 244,626 | $ | 180,995 | $ | 197,012 | ||||||||

| Product |

3,554 | 6,969 | 5,168 | 5,987 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

240,459 | 251,595 | 186,163 | 202,999 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cost of revenue: |

||||||||||||||||

| Cost of subscription revenue(1) |

117,234 | 127,075 | 93,294 | 104,309 | ||||||||||||

| Cost of product revenue |

7,619 | 10,659 | 7,361 | 11,627 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenue |

124,853 | 137,734 | 100,655 | 115,936 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

115,606 | 113,861 | 85,508 | 87,063 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Sales and marketing(1) |

37,566 | 46,754 | 32,853 | 40,512 | ||||||||||||

| Research and development(1) |

14,052 | 18,651 | 13,706 | 15,581 | ||||||||||||

| General and administrative(1) |

28,112 | 29,761 | 20,832 | 28,327 | ||||||||||||

| Depreciation and amortization |

18,001 | 15,576 | 11,651 | 10,803 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

97,731 | 110,742 | 79,042 | 95,223 | ||||||||||||

|

|

|

|