Exhibit 99.1

For Immediate Release

| Contact: |

Patrick A. Reynolds | |

| Director of Investor Relations | ||

| (706) 649-4973 |

Synovus Reports 16.1% Increase in Net Income for Second Quarter of 2012

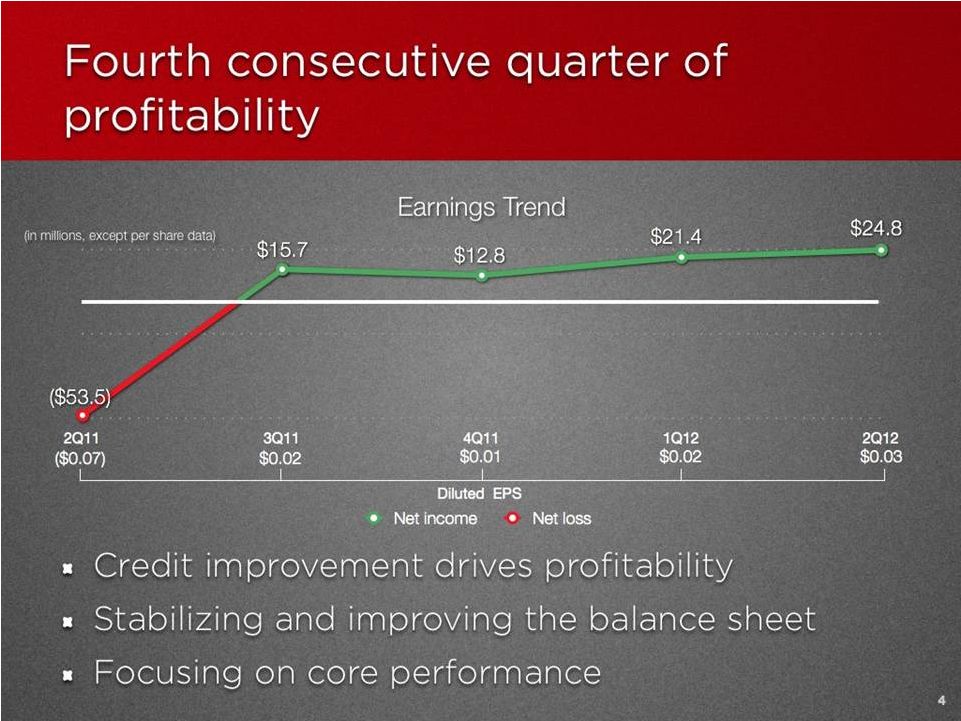

Continued Credit Improvement Drives Fourth Consecutive Quarter of Profitability

Columbus, Ga., July 24, 2012 – Synovus Financial Corp. (NYSE: SNV) today reported financial results for the quarter ended June 30, 2012.

Second Quarter Results

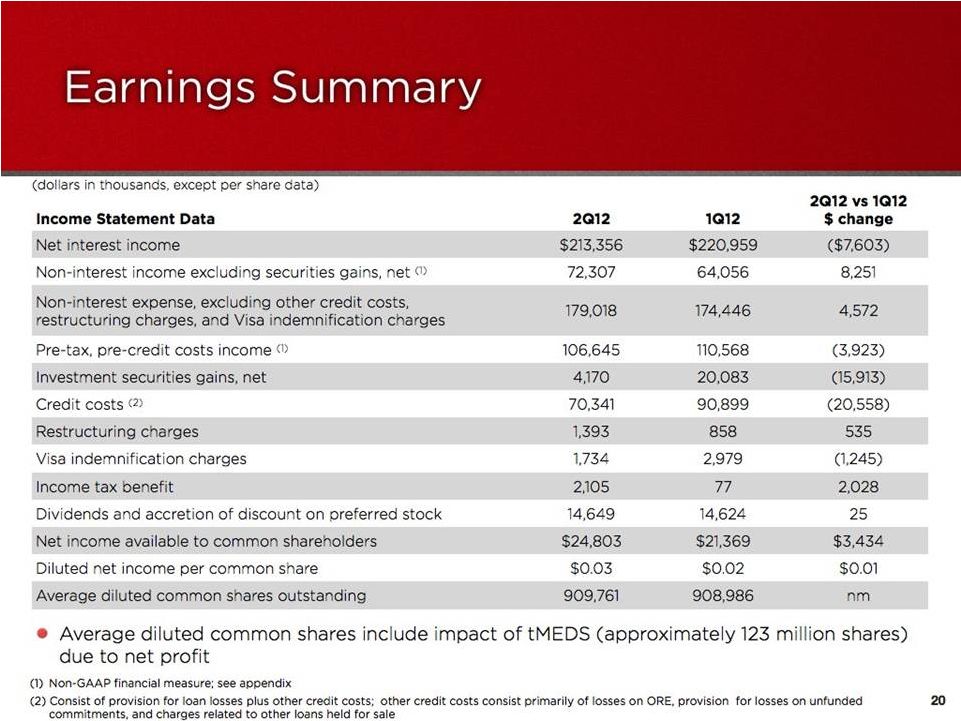

| • | Net income available to common shareholders was $24.8 million for the second quarter of 2012, a 16.1% increase compared to net income available to common shareholders of $21.4 million for the first quarter of 2012 and a net loss attributable to common shareholders of $53.5 million in the second quarter of 2011. Net income available to common shareholders was $46.2 million for the first six months of 2012, compared to a net loss attributable to common shareholders of $147.2 million for the first six months of 2011. |

| • | Diluted net income per common share for the second quarter of 2012 was $0.03, compared to diluted net income per common share of $0.02 for the first quarter of 2012, and a net loss per common share of $0.07 for the second quarter of 2011. Diluted net income per common share for the first six months of 2012 was $0.05, compared to a net loss per common share of $0.19 for the first six months of 2011. |

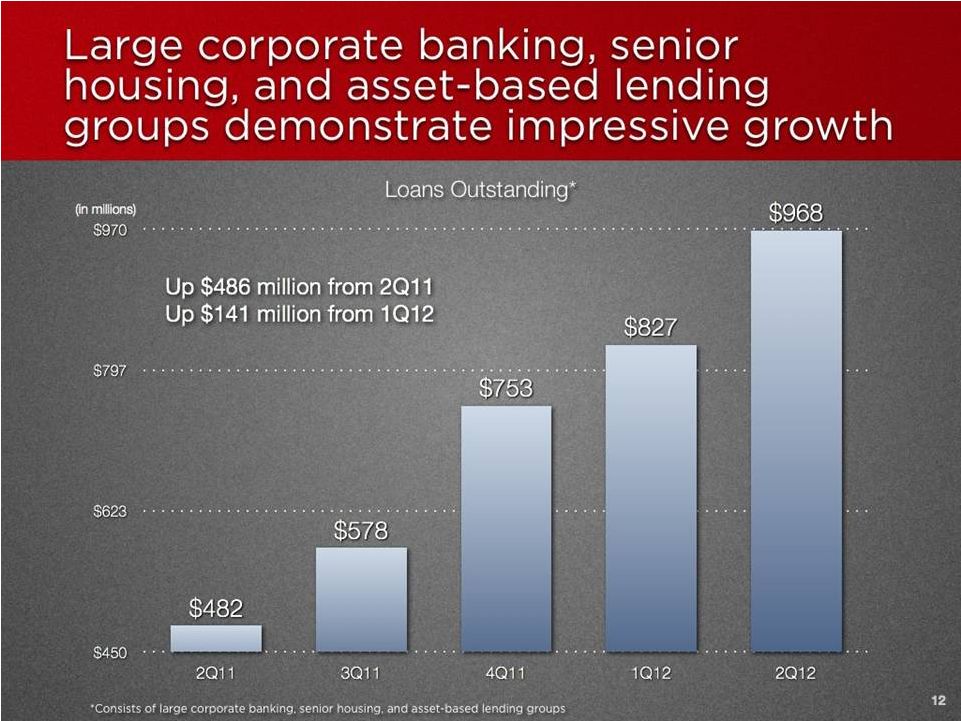

“Continued credit improvement drove our fourth consecutive quarter of profitability,” said Kessel D. Stelling, Chairman and CEO of Synovus. “Declines in total credit costs, non-performing loan inflows, non-performing assets, and total delinquencies contributed significantly to the overall credit improvement. We were pleased to again see increases in loans outstanding from our Large Corporate Banking, Senior Housing, and Asset-Based Lending groups and continued pipeline growth throughout our footprint, reflecting the ongoing success of our commercial banking strategy.”

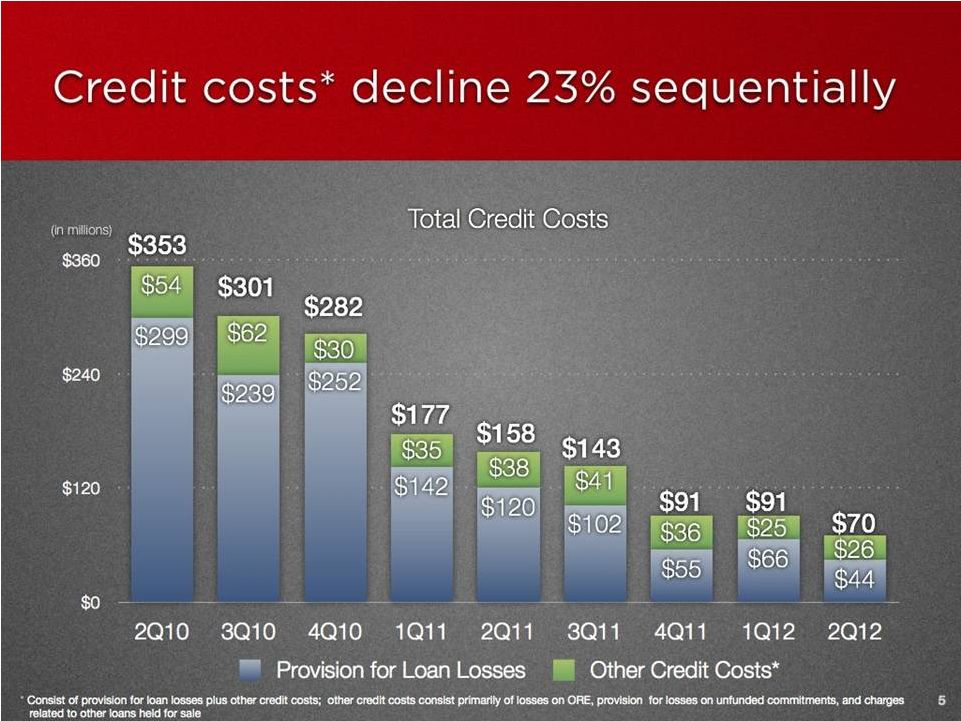

Credit Trends

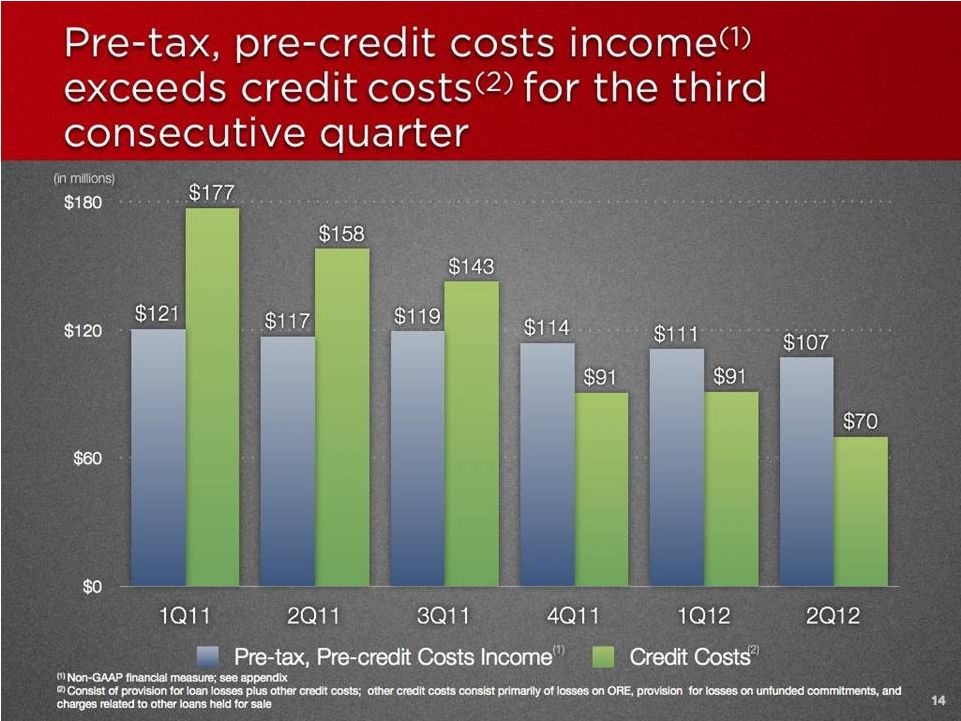

| • | Total credit costs were $70.3 million in the second quarter of 2012, down 22.6% from $90.9 million in the first quarter of 2012 and down 55.5% from $157.9 million in the second quarter of 2011. |

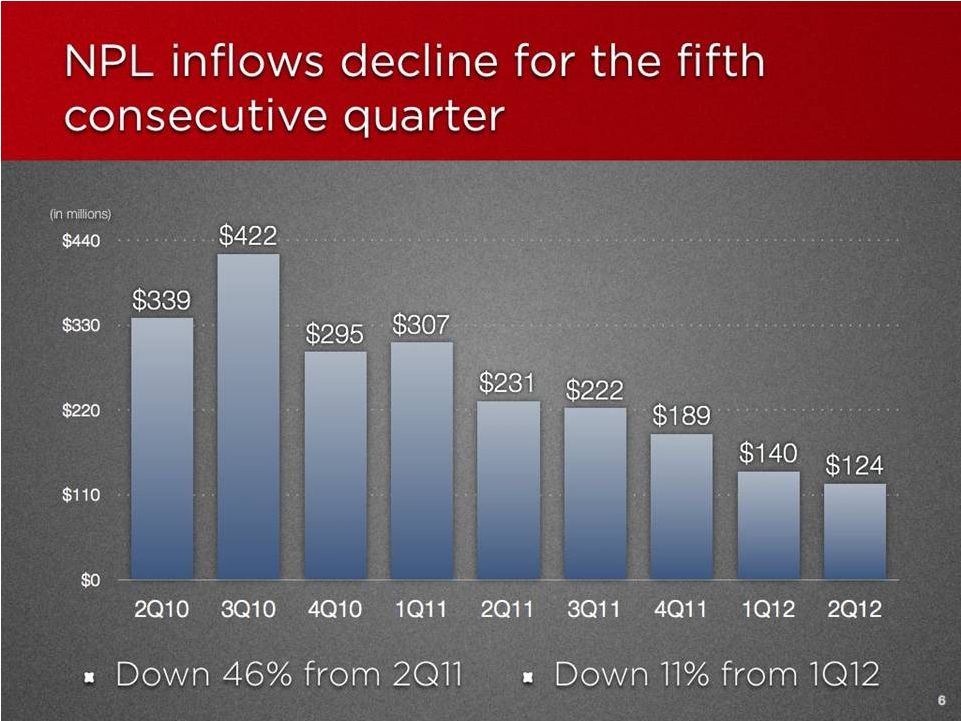

| • | Non-performing loan inflows were $124.3 million in the second quarter of 2012, down 10.9% from $139.6 million in the first quarter of 2012 and down 46.2% from $231.1 million in the second quarter of 2011. |

| • | Distressed asset sales were approximately $128 million during the second quarter, compared to approximately $135 million in the first quarter of 2012, and approximately $195 million in the second quarter of 2011. |

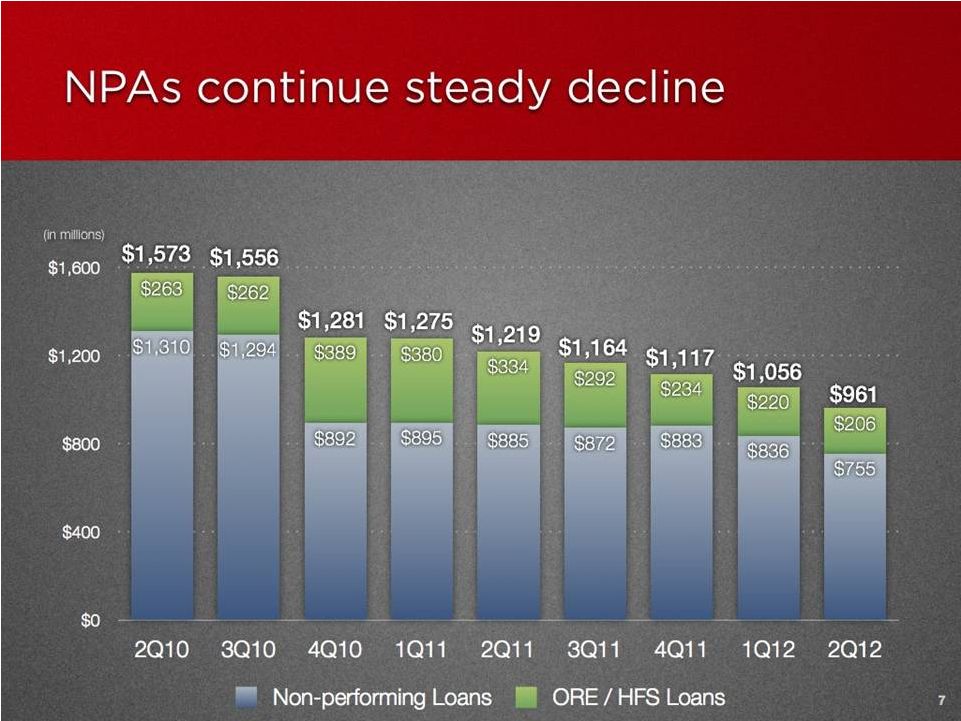

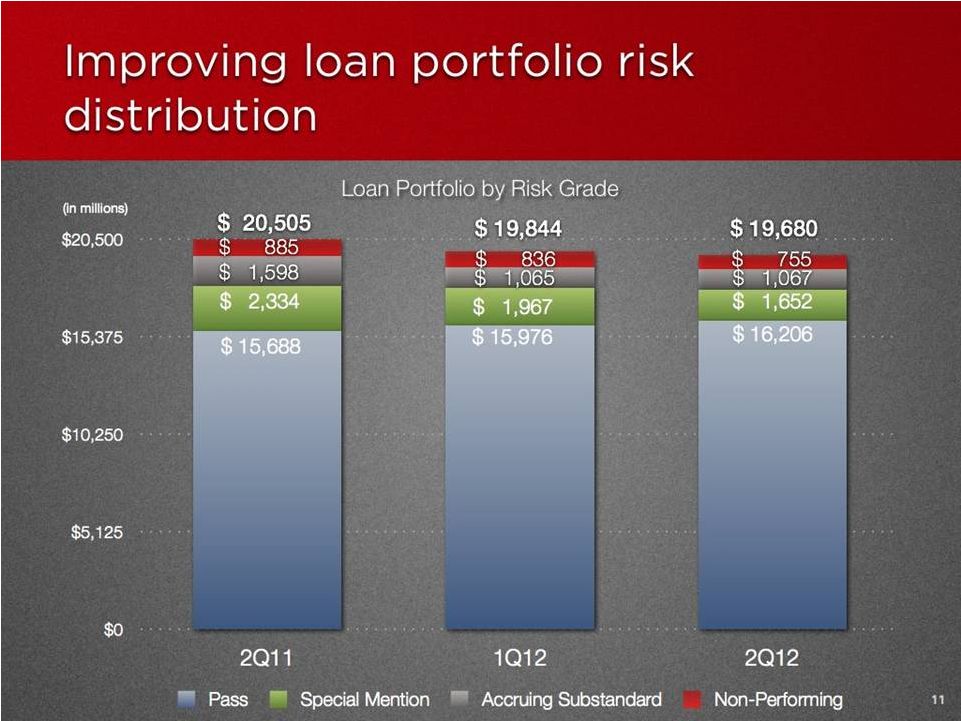

| • | Non-performing loans, excluding loans held for sale, were $755.2 million at June 30, 2012, down $80.9 from the previous quarter, and down $130.1 million from the second quarter of 2011. The non-performing loan ratio was 3.84% at June 30, 2012, down from 4.21% at the end of the previous quarter and 4.32% at June 30, 2011. |

| • | Total non-performing assets were $961.4 million at June 30, 2012, down $94.4 million from the previous quarter, and down $257.3 million or 21.1% from the second quarter of 2011. The non-performing asset ratio was 4.83% at June 30, 2012, compared to 5.26% at the end of the previous quarter and 5.85% at June 30, 2011. |

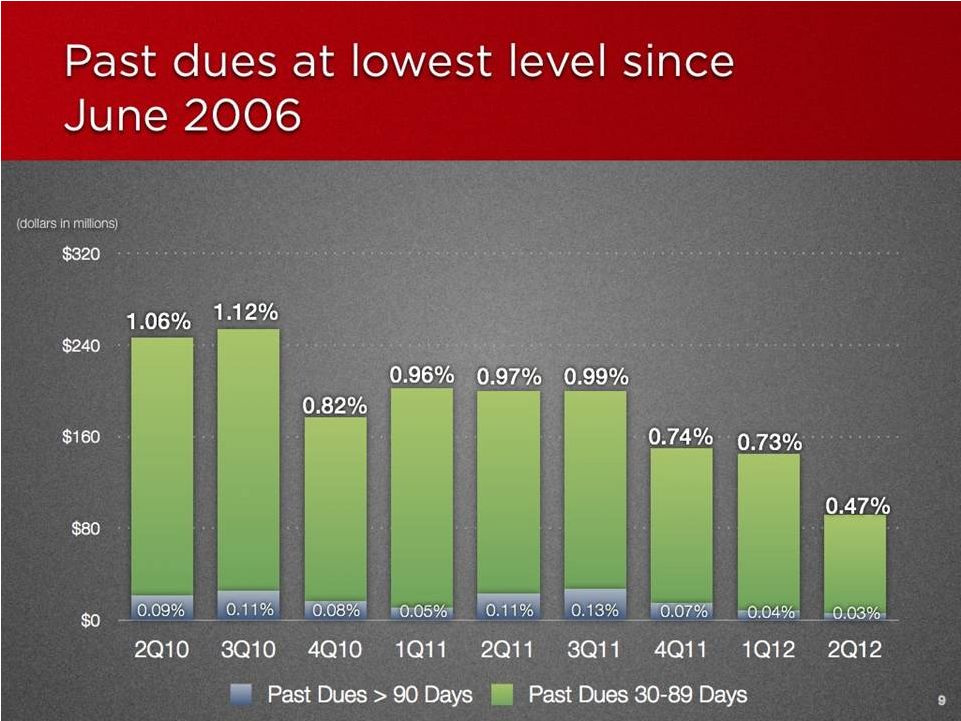

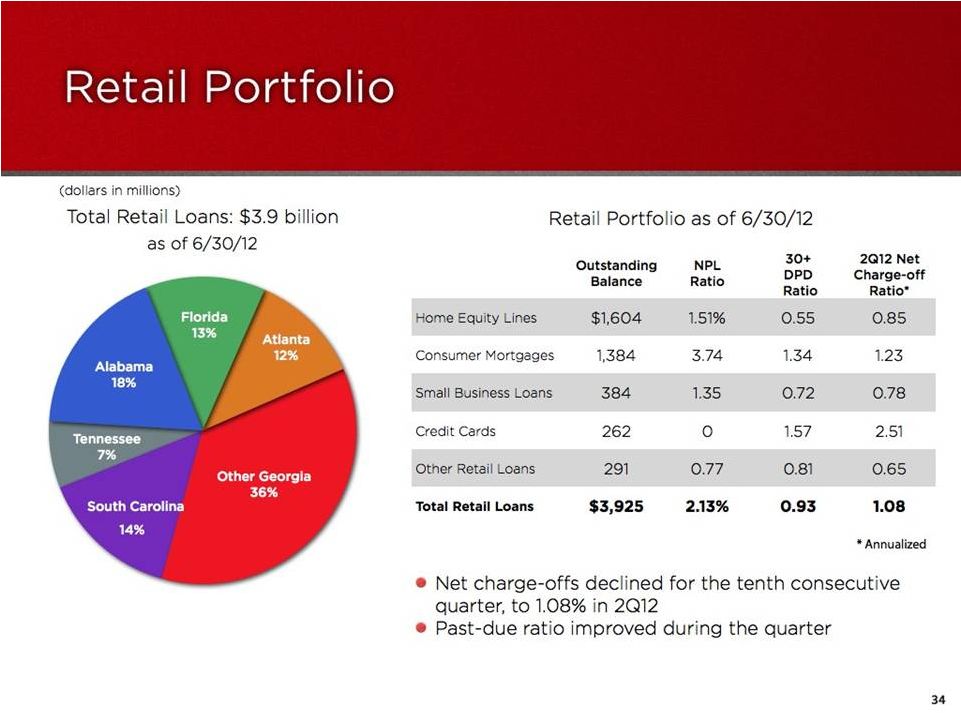

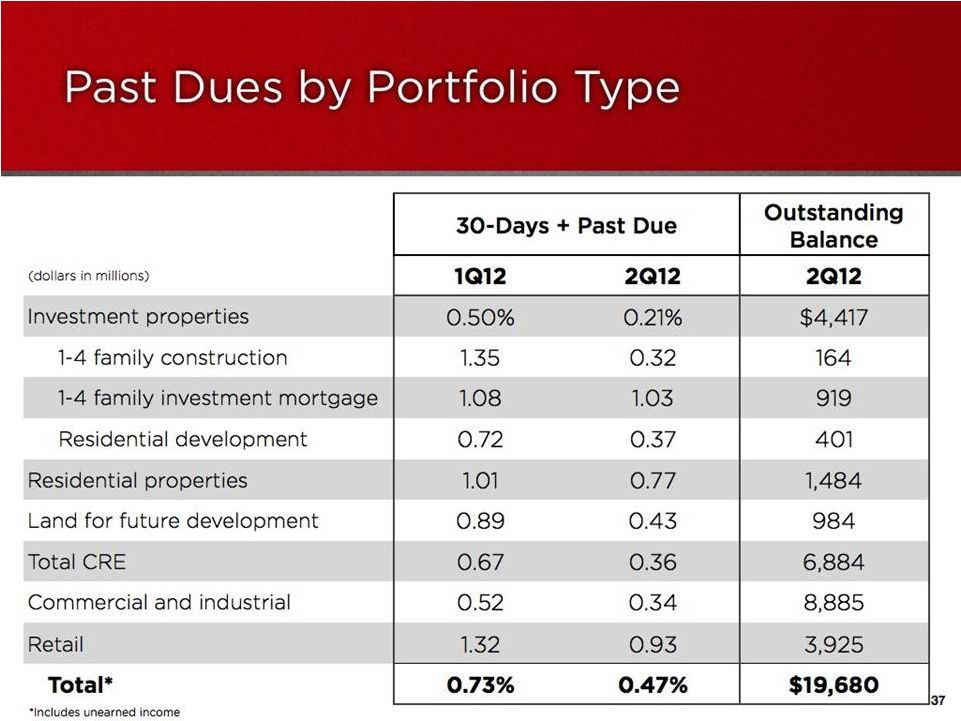

| • | Total delinquencies (consisting of loans 30 or more days past due and still accruing) were 0.47% of total loans at June 30, 2012, down from 0.73% at March 31, 2012, and 0.97% at June 30, 2011. Total loans past due 90 days or more and still accruing were 0.03% at June 30, 2012, down from 0.04% at March 31, 2012, and 0.11% at June 30, 2011. |

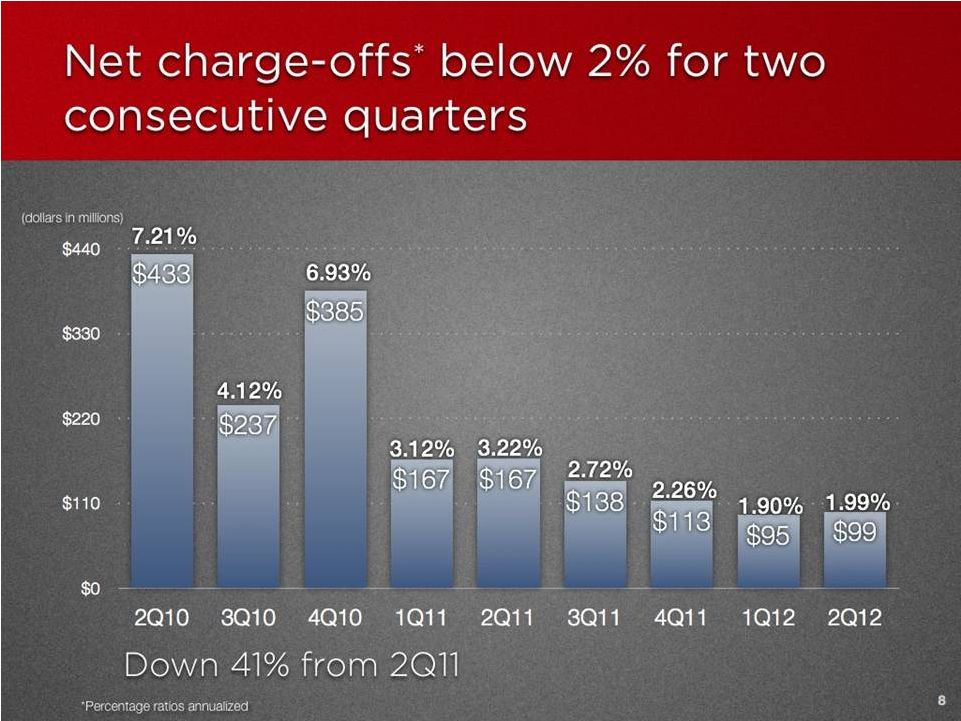

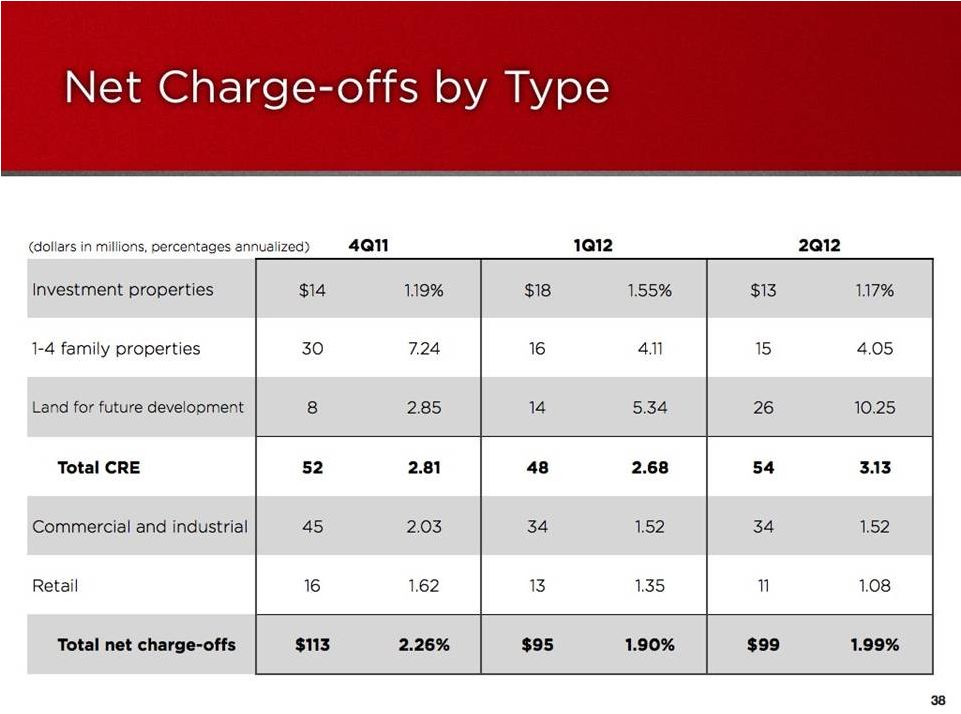

| • | Net charge-offs were $98.7 million in the quarter, up slightly from $94.7 million in the first quarter of 2012, and down 41.0% from $167.2 million in the second quarter of 2011. The annualized net charge-off ratio was 1.99% in the second quarter, up from 1.90% in the previous quarter, and down from 3.22% in the second quarter of 2011. |

Balance Sheet Fundamentals

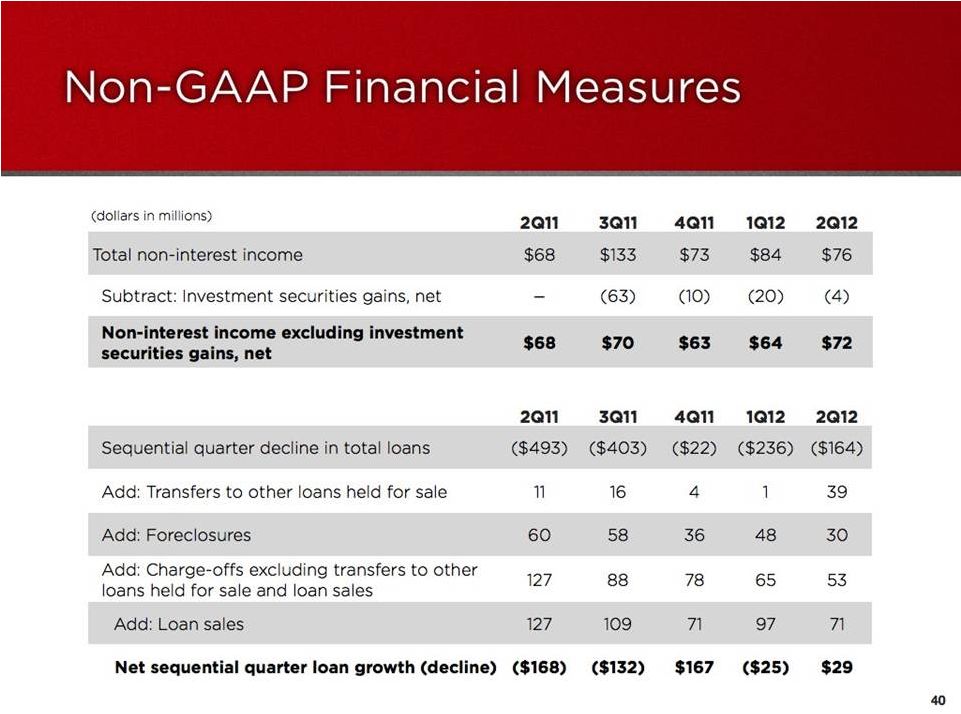

| • | Net sequential quarter loan growth was approximately $29 million for the second quarter, compared to a decrease of approximately $25 million during the first quarter of 2012 and a decline of approximately $168 million during the second quarter of 2011. Net loan growth excludes the impact of loan sales, transfers to loans held-for-sale, charge-offs, and foreclosures. |

| • | Reported loans declined $163.6 million, compared to a $236.1 million decrease in the previous quarter, and a $492.6 million decrease in the second quarter of 2011. |

| • | Loans outstanding from the Large Corporate Banking, Senior Housing, and Asset Based Lending groups were up approximately $486 million over the previous year and up approximately $141 million compared to the previous quarter. |

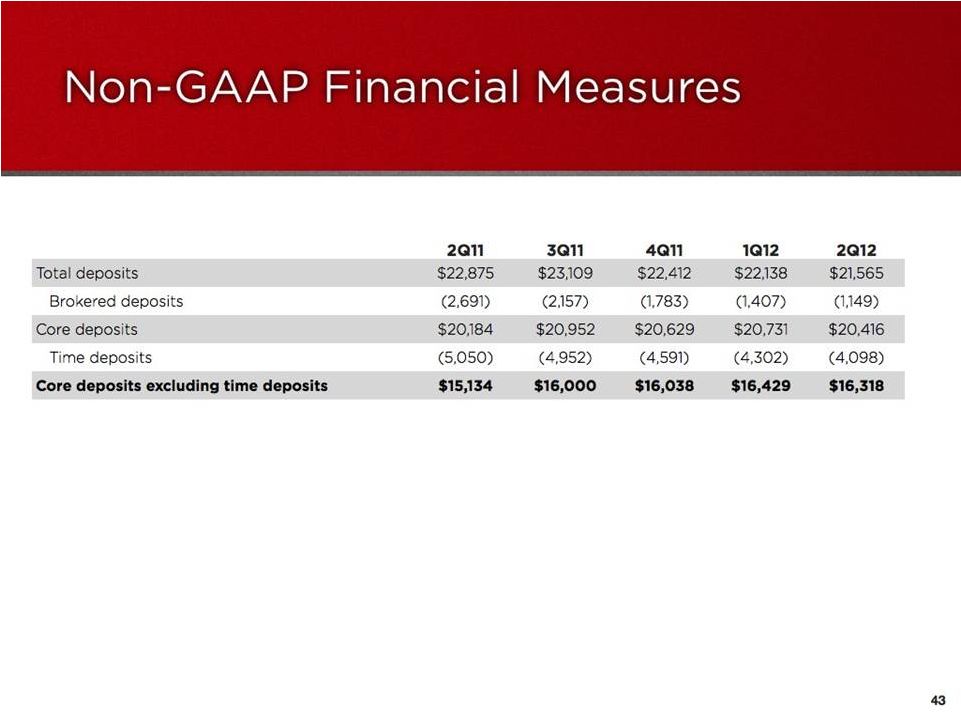

| • | Total deposits ended the quarter at $21.6 billion, down $572.6 million from the previous quarter due primarily to the planned reductions in higher-cost brokered deposits and time deposits of $462.3 million. |

| • | Core deposits ended the quarter at $20.4 billion, down $314.8 million compared to the first quarter of 2012. Core deposits, excluding time deposits, declined $110.4 million compared to the previous quarter due to an expected seasonal decrease in state, county and municipal deposits. Core deposits increased $231.8 million compared to a year ago. Core deposits, excluding time deposits, increased $1.18 billion compared to June 30, 2011. |

| • | The effective cost of core deposits (includes non-interest bearing deposits) continued to decline, with an effective cost of 41 basis points for the second quarter of 2012, down from 47 basis points for the previous quarter and 67 basis points in the second quarter of 2011. |

Core Performance

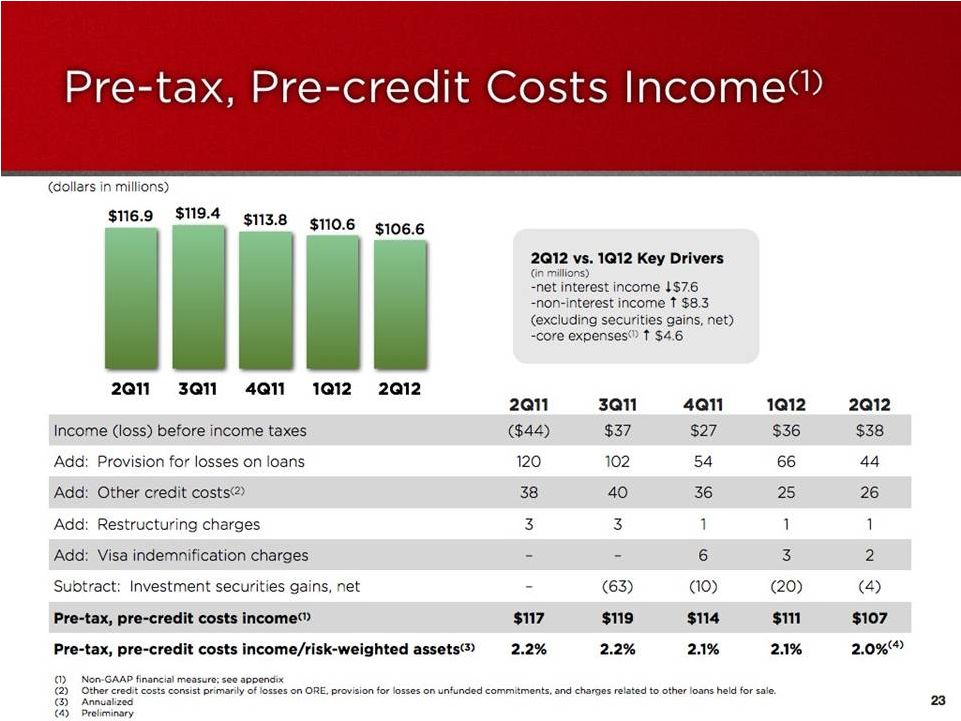

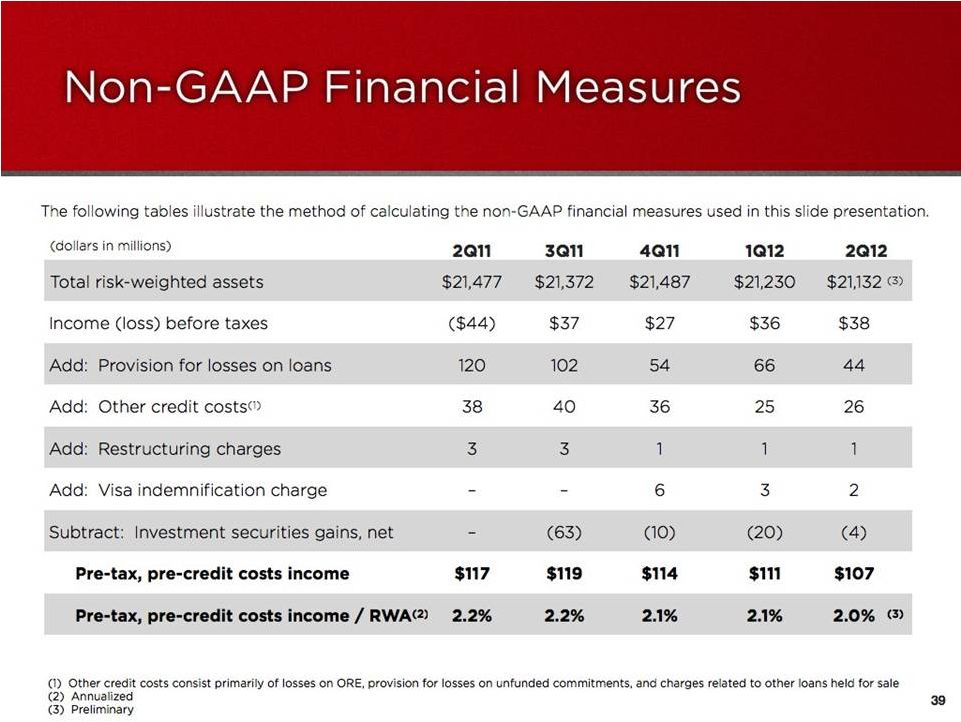

Pre-tax, pre-credit costs income was $106.6 million for the second quarter of 2012, down $3.9 million from $110.6 million in the first quarter of 2012.

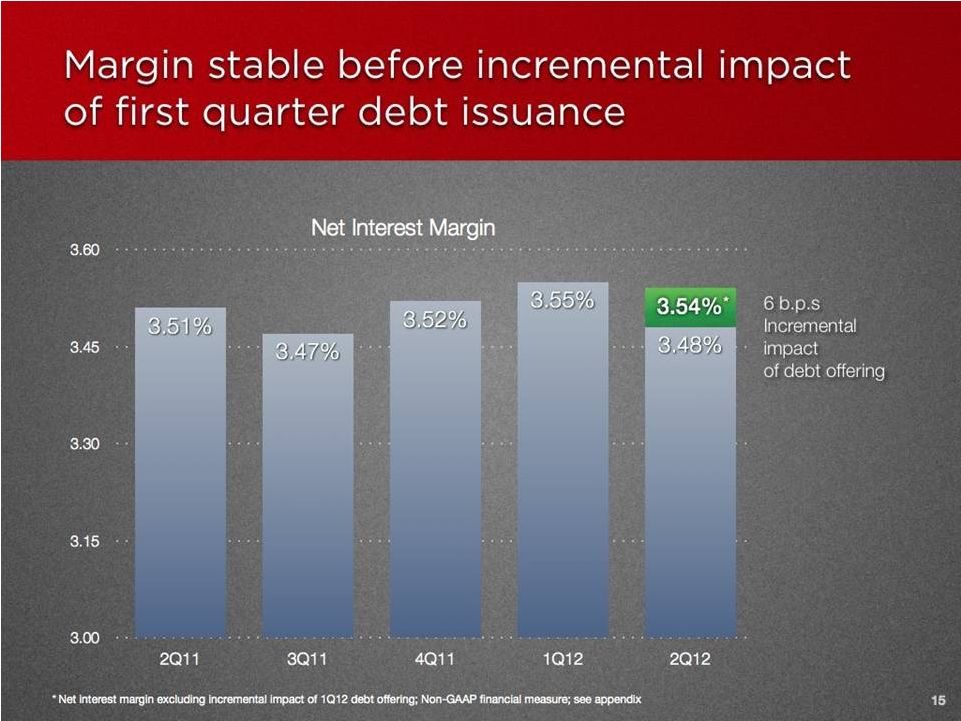

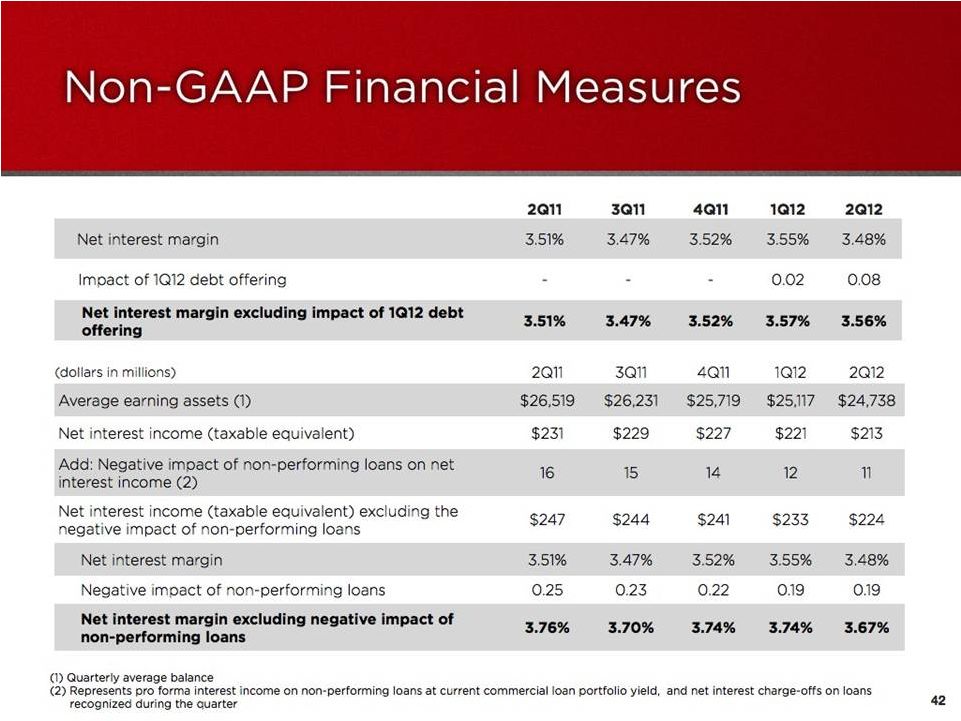

| • | The net interest margin was 3.48%, down seven basis points from the first quarter of 2012, primarily due to the expected six basis point incremental impact from the debt issued in the first quarter of 2012. |

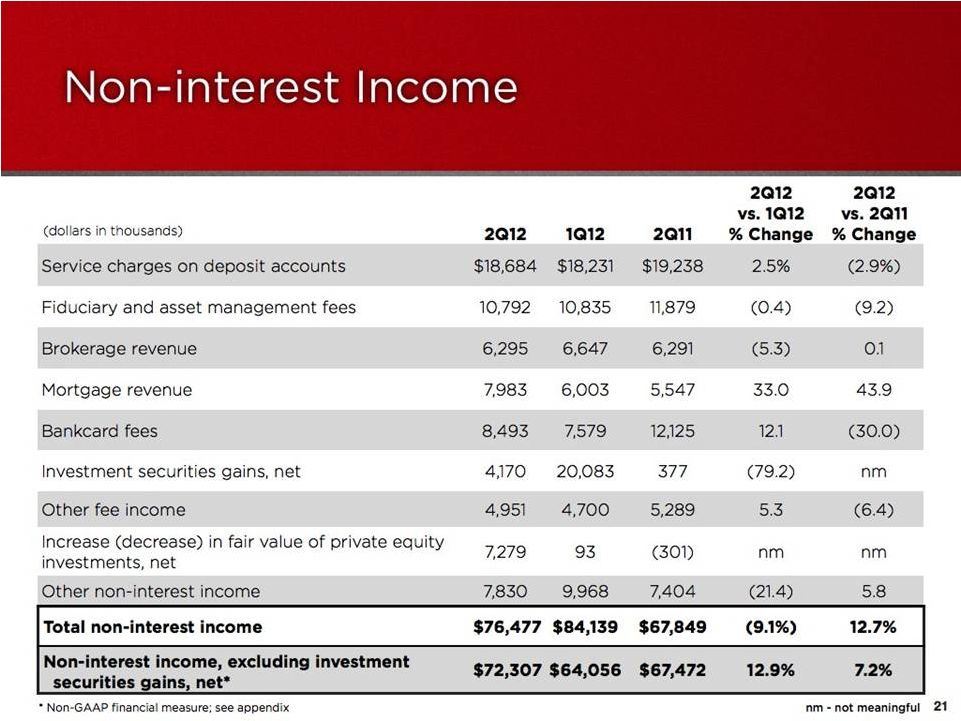

| • | Total non-interest income was $76.5 million for the second quarter of 2012, compared to $84.1 million in the first quarter of 2012. |

| • | Non-interest income, excluding net investment securities gains, was up $8.3 million from the previous quarter. |

| • | Mortgage revenue was up $2.0 million from the previous quarter |

| • | Bankcard fees were up $914 thousand compared to the previous quarter. |

| • | Service charges were up $454 thousand from the previous quarter. |

| • | Increase in fair value of private equity investments was $7.3 million for the quarter. |

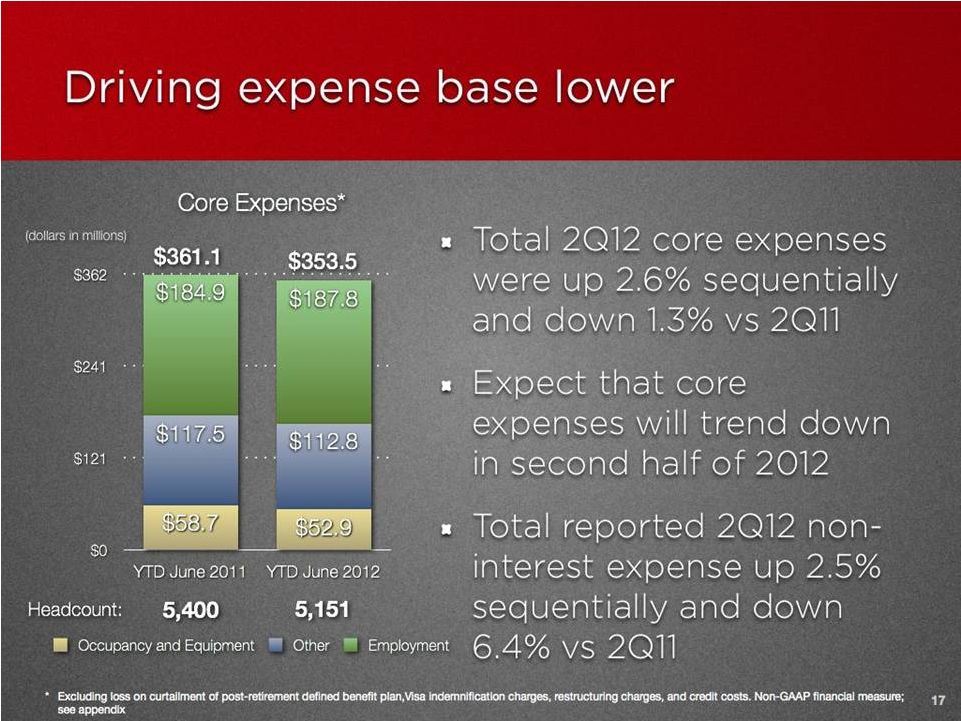

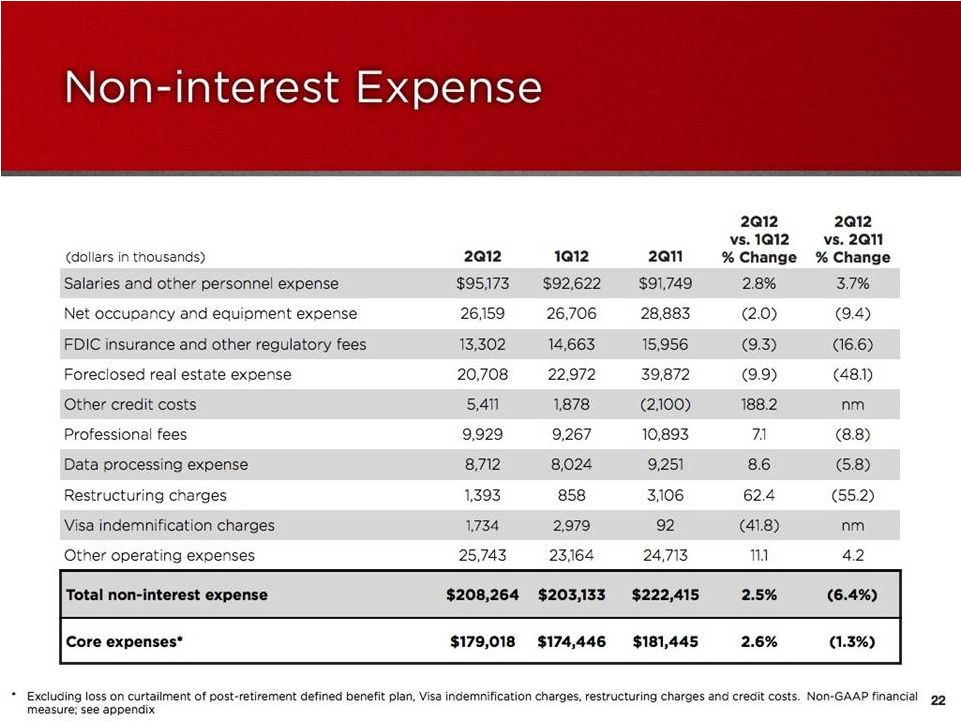

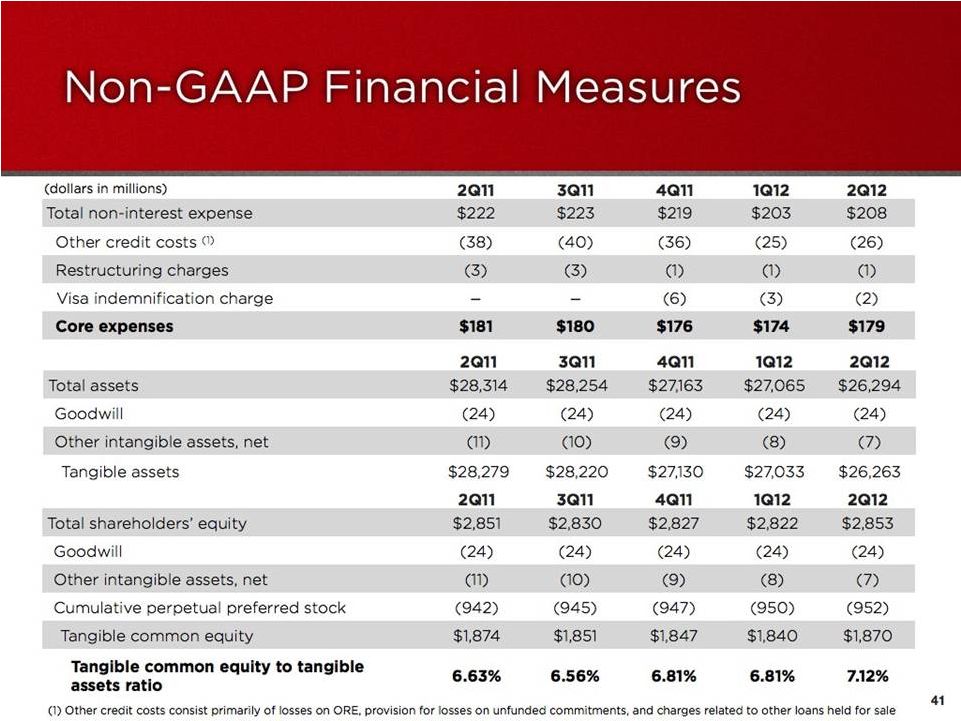

| • | Total reported non-interest expense was $208.3 million for the second quarter of 2012 compared to $203.1 million for the previous quarter. |

| • | Core expenses (excludes Visa indemnification charges, restructuring charges and credit costs) were up $4.6 million from the first quarter of 2012. |

| • | Employment expenses increased $2.6 million from the previous quarter, primarily due to annual merit salary increases and employee incentives. |

| • | Other expenses were up $2.6 million compared to the previous quarter, largely due to higher attorney fees related to problem loans and litigation expenses. |

Capital Ratios

| • | Tier 1 Common Equity ratio was 8.81% at June 30, 2012 up from 8.67% at March 31, 2012. |

| • | Tier 1 Capital ratio was 13.36% at June 30, 2012 up from 13.19% at March 31, 2012. |

| • | Tier 1 Leverage ratio was 10.66% at June 30, 2012 up from 10.41% at March 31, 2012. |

| • | Total Risk Based Capital ratio was 16.32% at June 30, 2012 down from 16.57% at March 31, 2012. |

| • | Tangible Common Equity/Tangible Assets ratio was 7.12% at June 30, 2012 up from 6.81% at March 31, 2012. |

Stelling concluded, “The second quarter was marked by the continued strengthening of our balance sheet as we disposed of non-performing loans and reduced levels of higher risk credits and asset classes, while generating high-quality commercial loans in all segments of our markets. These efforts, coupled with an intense focus on expense control and our customer-focused, relationship-based brand of banking, further position our company for sustained profitability and long-term success.”

Synovus will host an earnings highlights conference call at 8:30 a.m. EST on July 24, 2012. The earnings call will be accompanied by a slide presentation. Shareholders and other interested parties can access the slide presentation and listen to the conference call via simultaneous Internet broadcast at www.synovus.com by clicking on the “Live Webcast” icon. RealPlayer or Windows Media Player can be downloaded prior to accessing the actual call or the replay. The replay will be archived for 12 months and will be available 30-45 minutes after the call.

About Synovus

Synovus Financial Corp. is a financial services company with over $26 billion in assets based in Columbus, Georgia. Synovus Financial Corp. provides commercial and retail banking, investment and mortgage services to customers in Georgia, Alabama, South Carolina, Florida and Tennessee. See Synovus Financial Corp. on the web at www.synovus.com.

Forward-Looking Statements

This press release and certain of our other filings with the Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements through Synovus’ use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the outlook for Synovus’ future business and financial performance and/or the performance of the commercial banking industry and economy in general. These forward-looking statements include, among others, our expectations on credit trends, deposits, loan growth and our loan portfolio; expectations on growth and future profitability; and the assumptions underlying our expectations. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus’ management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this report. Many of these factors are beyond Synovus’ ability to control or predict.

These forward-looking statements are based upon information presently known to Synovus’ management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in Synovus’ filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2011 under the captions “Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors” and in Synovus’ quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law.

Use of Non-GAAP Financial Measures

The measures entitled core deposits, core deposits excluding time deposits, tangible common equity to tangible assets ratio, pre-tax, pre-credit costs income, core expenses, non-interest income excluding net investment securities gains, and net sequential quarter loan growth (decline) are not measures recognized under U.S. generally accepted accounting principles (GAAP) and therefore are considered non-GAAP financial measures. The most comparable GAAP measures are total deposits, total shareholders’ equity to total assets ratio, income (loss) before income taxes, total non-interest expense, total non-interest income, and sequential quarter total loan growth (decline), respectively.

Synovus believes that these non-GAAP financial measures provide meaningful additional information about Synovus to assist management and investors in evaluating Synovus’ capital strength and the performance of its core business. These non-GAAP financial measures should not be considered as

substitutes for total deposits, total shareholders’ equity to total assets ratio, income (loss) before income taxes, total non-interest expense, total non-interest income, or sequential quarter total loan growth (decline) determined in accordance with GAAP and may not be comparable to other similarly titled measures at other companies.

The computations of core deposits, core deposits excluding time deposits, tangible common equity to tangible assets ratio, pre-tax, pre-credit costs income, core expenses, non-interest income excluding net investment gains, and net sequential quarter loan growth (decline) and the reconciliation of these measures to total deposits, total shareholders’ equity to total assets ratio, income (loss) before income taxes, total non-interest expense, total non-interest income, and sequential quarter total loan growth (decline) are set forth in the tables below.

Reconciliation of Non-GAAP Financial Measures

| (dollars in thousands) | 2Q12 | 1Q12 | 4Q11 | 3Q11 | 2Q11 | |||||||||||||||

| Core Deposits |

||||||||||||||||||||

| Total deposits |

$ | 21,565,065 | 22,137,702 | 22,411,752 | 23,109,427 | 22,875,017 | ||||||||||||||

| Subtract: Brokered deposits |

(1,148,892 | ) | (1,406,709 | ) | (1,783,174 | ) | (2,157,631 | ) | (2,690,598 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core deposits |

20,416,173 | 20,730,993 | 20,628,578 | 20,951,796 | 20,184,419 | |||||||||||||||

| Subtract: Time deposits |

(4,097,834 | ) | (4,302,292 | ) | (4,591,164 | ) | (4,952,144 | ) | (5,049,901 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core deposits excluding time deposits |

$ | 16,318,339 | 16,428,701 | 16,037,414 | 15,999,652 | 15,134,518 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible Common Equity To Tangible Assets Ratio |

||||||||||||||||||||

| Total assets |

$ | 26,294,110 | 27,064,792 | 27,162,845 | 28,253,923 | 28,313,910 | ||||||||||||||

| Subtract: Goodwill |

(24,431 | ) | (24,431 | ) | (24,431 | ) | (24,431 | ) | (24,431 | ) | ||||||||||

| Subtract: Other intangible assets, net |

(6,693 | ) | (7,589 | ) | (8,525 | ) | (9,482 | ) | (10,449 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible assets |

$ | 26,262,986 | 27,032,772 | 27,129,889 | 28,220,010 | 28,279,030 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total shareholders’ equity |

$ | 2,853,389 | 2,821,763 | 2,827,452 | 2,829,447 | 2,850,937 | ||||||||||||||

| Subtract: Goodwill |

(24,431 | ) | (24,431 | ) | (24,431 | ) | (24,431 | ) | (24,431 | ) | ||||||||||

| Subtract: Other intangible assets, net |

(6,693 | ) | (7,589 | ) | (8,525 | ) | (9,482 | ) | (10,449 | ) | ||||||||||

| Subtract: Cumulative perpetual preferred stock |

(952,093 | ) | (949,536 | ) | (947,017 | ) | (944,538 | ) | (942,096 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible common equity |

$ | 1,870,172 | 1,840,207 | 1,847,479 | 1,850,996 | 1,873,961 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total shareholders’ equity to total assets ratio |

10.85 | % | 10.43 | 10.41 | 10.01 | 10.07 | ||||||||||||||

| Tangible common equity to tangible assets ratio |

7.12 | % | 6.81 | 6.81 | 6.56 | 6.63 | ||||||||||||||

| Pre-tax, Pre-credit Costs Income |

||||||||||||||||||||

| Income (loss) before income taxes |

$ | 37,347 | 35,916 | 26,979 | 37,118 | (43,764 | ) | |||||||||||||

| Add: Provision for losses on loans |

44,222 | 66,049 | 54,565 | 102,325 | 120,159 | |||||||||||||||

| Add: Other credit costs(1) |

26,119 | 24,849 | 35,962 | 40,211 | 37,772 | |||||||||||||||

| Add: Restructuring charges |

1,393 | 858 | 639 | 2,587 | 3,106 | |||||||||||||||

| Subtract/Add: Net (gain) loss on investment securities |

(4,170 | ) | (20,083 | ) | (10,337 | ) | (62,873 | ) | (377 | ) | ||||||||||

| Add: Visa indemnification charge |

1,734 | 2,979 | 5,942 | — | 92 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pre-tax, pre-credit costs income |

$ | 106,645 | 110,568 | 113,750 | 119,368 | 116,988 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core Expenses |

||||||||||||||||||||

| Total non-interest expense |

$ | 208,264 | 203,133 | 219,082 | 222,552 | 222,415 | ||||||||||||||

| Subtract: Other credit costs(1) |

(26,119 | ) | (24,849 | ) | (35,962 | ) | (40,211 | ) | (37,772 | ) | ||||||||||

| Subtract: Restructuring charges |

(1,393 | ) | (858 | ) | (639 | ) | (2,587 | ) | (3,106 | ) | ||||||||||

| Subtract: Visa indemnification charge |

(1,734 | ) | (2,979 | ) | (5,942 | ) | — | (92 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core expenses |

$ | 179,018 | 174,447 | 176,539 | 179,754 | 181,445 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Other credit costs consist primarily of losses on ORE, provision for losses on unfunded commitments, and charges related to other loans held for sale. |

Reconciliation of Non-GAAP Financial Measures (continued)

| (dollars in thousands) | 2Q12 | 1Q12 | 4Q11 | 3Q11 | 2Q11 | |||||||||||||||

| Non-interest income excluding investment securities gains (losses), net |

||||||||||||||||||||

| Total non-interest income |

$ | 76,477 | 84,139 | 73,470 | 133,392 | 67,849 | ||||||||||||||

| Subtract/Add: Net investment securities (gains) losses |

(4,170 | ) | (20,083 | ) | (10,337 | ) | (62,873 | ) | (377 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-interest income excluding investment securities gains (losses), net |

$ | 72,307 | 64,056 | 63,133 | 70,519 | 67,472 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Net sequential quarter loan growth (decline)

| Sequential quarter decline in total loans |

$ | (163,571 | ) | (236,115 | ) | (22,273 | ) | (402,724 | ) | (492,612 | ) | |||||||||

| Add: Transfers to other loans held for sale |

38,999 | 578 | 3,457 | 16,004 | 11,275 | |||||||||||||||

| Add: Foreclosures |

30,087 | 48,127 | 36,331 | 57,859 | 60,426 | |||||||||||||||

| Add: Charge-offs excluding transfers to other loans held for sale and loan sales |

53,075 | 65,498 | 78,443 | 87,660 | 126,821 | |||||||||||||||

| Add: Loan sales |

70,590 | 96,621 | 70,808 | 109,140 | 126,462 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net sequential quarter loan growth (decline) |

$ | 29,180 | (25,291 | ) | 166,766 | (132,061 | ) | (167,628 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|