UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

| ☒ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

2024

Proxy Statement

And Notice of Annual Meeting

of Stockholders

| 2024 Coupang Proxy Statement |

PROXY STATEMENT

For the 2024 Annual Meeting of Stockholders

To Be Held on Thursday, June 13, 2024 at 5:00 p.m., Pacific Time

|

|

|

|

TIME

5:00 p.m. Pacific Time

|

DATE

June 13, 2024

|

LOCATION

Virtual www.virtualshareholdermeeting.com/CPNG2024 |

720 Olive Way, Suite 600

Seattle, Washington 98101

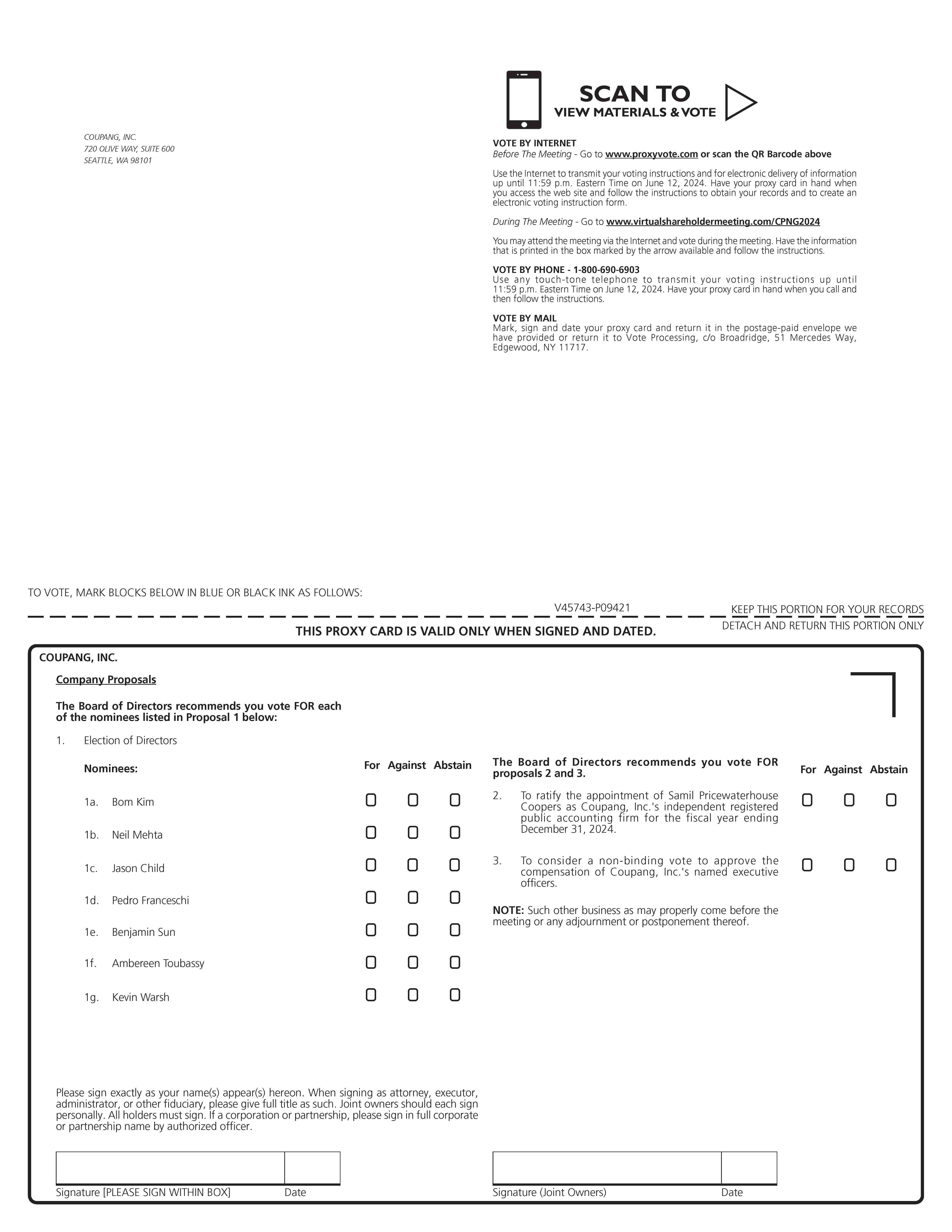

| Proposals |

Coupang, Inc. (the “Company”, “Coupang”, “we,” or “us”) is holding our 2024 Annual Meeting of Stockholders (including any adjournment or postponement thereof, the “Annual Meeting”) for the following purposes, as more fully described in this Proxy Statement (this “Proxy Statement”):

1. to elect the seven director nominees named herein (Proposal No. 1);

2. to ratify the appointment of Samil PricewaterhouseCoopers as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal No. 2);

3. to consider a non-binding vote to approve the compensation of our named executive officers (Proposal No. 3); and

4. to consider such other business as may properly come before the Annual Meeting.

|

| Record Date | Stockholders of record as of the close of business on April 19, 2024 (the “Record Date”) are entitled to this notice and to vote at the Annual Meeting. |

| Proxy Voting |

On or about April 26, 2024, we will mail to stockholders of record as of the Record Date (other than those who previously requested electronic or paper delivery on an ongoing basis) a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) with instructions for accessing our proxy materials and voting instructions.

As described in this Proxy Statement, you may vote online or by phone, or, if you received paper copies of the proxy materials by mail, you may also vote by mail by following the instructions on the proxy card or voting instruction card.

|

| Attending the Meeting | To attend the Annual Meeting, vote, or view the list of registered stockholders during the Annual Meeting, stockholders of record will be required to visit the meeting website listed above and log in using their 16-digit control number included on their proxy card or Internet Notice. Beneficial owners should review the proxy materials and their voting instruction form or Internet Notice for how to vote in advance of, and how to participate in, the Annual Meeting. |

|

|

By Order of the Board of Directors, |

|

|

|

|

|

|

|

|

|

Harold Rogers |

|

|

|

|

|

|

|

|

|

General Counsel and |

|

|

|

|

Chief Administrative Officer |

|

|

| 1 | 2024 Coupang Proxy Statement |

TABLE OF CONTENTS

| 2 | 2024 Coupang Proxy Statement |

PROXY STATEMENT

For the 2024 Annual Meeting of Stockholders

To Be Held on Thursday, June 13, 2024, at 5:00 p.m., Pacific Time

GENERAL INFORMATION ABOUT VOTING AND THE ANNUAL MEETING

This Proxy Statement (this “Proxy Statement”) is being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Coupang, Inc. (the “Company”, “Coupang”, “we,” or “us”) for use at our 2024 Annual Meeting of Stockholders (including any adjournment or postponement thereof, the “Annual Meeting”). The Annual Meeting will be held virtually via live webcast. To attend and vote at the Annual Meeting and view the list of registered stockholders as of the close of business on April 19, 2024 (the “Record Date”) during the meeting, stockholders of record must access the meeting website at www.virtualshareholdermeeting.com/CPNG2024 and enter the 16-digit control number found on the Internet Notice or on the proxy card provided to you with this Proxy Statement. If your shares are held in street name through a broker, bank, trustee, or other nominee and your Internet Notice or voting instruction form indicates that you may vote those shares through the www.proxyvote.com website, then you may access and vote at the Annual Meeting with the 16-digit control number indicated on that Internet Notice or voting instruction form. Otherwise, stockholders who hold their shares in street name should contact their broker bank, trustee, or other nominee that holds their shares (preferably at least five days before the Annual Meeting) to obtain a legal proxy in order to be able to attend, participate in, or vote at the Annual Meeting.

See “Attending the Virtual Meeting Online” below for more information.

Our fiscal year is consistent with the calendar year and ends on December 31. Unless stated otherwise, all references to years herein shall relate to our fiscal years. For example, references to year 2023 relate to our fiscal year ended December 31, 2023.

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on June 13, 2024.

Copies of this Proxy Statement and our Annual Report on Form 10-K for 2023 (the “2023 Annual Report”) are available at www.proxyvote.com.

|

Voting Rights

Only holders of record of our Class A common stock and Class B common stock as of the Record Date will be entitled to vote at the Annual Meeting. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

In deciding all matters at the Annual Meeting, as of the Record Date, each share of Class A common stock represents one vote, and each share of Class B common stock represents 29 votes. We do not have cumulative voting rights for the election of directors. As of the Record Date, we had 1,612,466,408 shares of Class A common stock and 174,802,990 shares of Class B common stock outstanding and entitled to vote, according to the records maintained by our transfer agent.

For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be made available for examination by any stockholder for any purpose relating to the Annual Meeting during ordinary business hours at our headquarters, at 720 Olive Way, Suite 600, Seattle, Washington 98101, and will be available in electronic form on the day of the Annual Meeting at www.virtualshareholdermeeting.com/CPNG2024. If, due to adverse weather conditions or other unforeseen circumstances, our headquarters are closed or visitation is limited during the ten days prior to the Annual Meeting, a stockholder may send a written request to corporatesecretary@coupang.com, and we will arrange a way for the stockholder to inspect the list.

| 3 | 2024 Coupang Proxy Statement |

Notice of Internet Availability of Proxy Materials

As permitted by the U.S. Securities and Exchange Commission (the “SEC”) rules, for the Annual Meeting, we have elected to furnish our proxy materials, including this Proxy Statement and our 2023 Annual Report, to our stockholders electronically via the Internet. On or about April 26, 2024, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing notice of the Annual Meeting and instructions on how to access our proxy materials, including this Proxy Statement and our 2023 Annual Report, to vote at the Annual Meeting, and to request printed copies of the proxy materials. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in this Proxy Statement and 2023 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice. Stockholders may request to receive all future materials in printed form by mail or electronically by e-mail by following the instructions contained in the Internet Notice. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote your shares are contained in the proxy card included in those materials.

Voting Your Shares

If you are the record holder of your shares as of the close of business on the Record Date, you may vote in one of four ways. You may vote by submitting your proxy over the Internet, by telephone, or by mail, or you may vote electronically during the Annual Meeting.

| By Internet | You may vote your shares from any location in the world at www.proxyvote.com (you will need the control number printed on your Internet Notice or proxy registration confirmation email). |

| By Telephone | You may vote your shares by calling 1-800-690-6903 and following the instructions on your proxy card. |

| By Mail | If you received a proxy card by mail, you may vote by completing, dating, and signing the proxy card and promptly mailing it in the postage-paid envelope provided. |

| During the Meeting | To vote at the meeting, visit www.virtualshareholdermeeting.com/CPNG2024 (you will need the control number printed on your Internet Notice or proxy registration confirmation email). |

| 4 | 2024 Coupang Proxy Statement |

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 8:59 p.m., Pacific Time, on June 12, 2024. Note that, in light of possible disruptions in mail service related to any unforeseen circumstances, we encourage stockholders to submit their proxy via telephone or online.

If the shares you own are held by a broker, bank, trustee, or other nominee in a fiduciary capacity (typically referred to as being held in “street name”), you may instruct that institution on how to vote your shares. You will receive instructions from the broker, bank, trustee, or other nominee that holds your shares, which you must follow in order for your shares to be voted.

Attending the Annual Meeting Online

We have decided to hold the Annual Meeting virtually in the form of a live webcast. At this time, we believe that this is the right choice for the Company and our stockholders as it provides expanded stockholder access regardless of the resources available to stockholders, improves communications, and reduces the carbon footprint of our activities. The Annual Meeting will convene promptly at 5:00 p.m., Pacific Time, on June 13, 2024. In order to attend and vote at the Annual Meeting, and view the list of registered stockholders as of the Record Date during the meeting, stockholders of record must access the meeting website at www.virtualshareholdermeeting.com/CPNG2024 and input the 16-digit control number found on the Internet Notice or on the proxy card provided to you with this proxy statement. If your shares are held in street name through a broker, bank, trustee, or other nominee and your Internet Notice or voting instruction form indicates that you may vote those shares through the www.proxyvote.com website, then you may access, participate in, and vote at the Annual Meeting with the 16-digit control number indicated on that Internet Notice or voting instruction form. Otherwise, stockholders who hold their shares in street name should contact their broker, bank, trustee, or other nominee that holds their shares (preferably at least five days before the Annual Meeting) to obtain a “legal proxy” in order to be able to attend, participate in, or vote at the Annual Meeting.

Even if you plan to attend the live webcast of the Annual Meeting, we encourage you to vote in advance by Internet, telephone, or mail so that your vote will be counted even if you later decide not to attend the Annual Meeting.

Technical Difficulties

We encourage you to access the Annual Meeting before it begins. Online check-in will be available at www.virtualshareholdermeeting.com/CPNG2024 approximately 15 minutes before the meeting starts on June 13, 2024. If you have difficulty accessing the meeting, please email ir@coupang.com. We will have technicians available to assist you.

Recommendations of the Board

At the Annual Meeting, our stockholders will be asked to vote on the proposals set forth below. The Board recommends that you vote your shares as indicated below. If you return a properly completed proxy card or vote your shares by telephone or over the Internet, your shares of common stock will be voted on your behalf as you direct. If not otherwise specified, the shares of common stock represented by the proxies will be voted in accordance with the Board’s recommendations as follows:

|

“FOR” the election of the seven director nominees named herein; |

|

“FOR” the ratification of the appointment of Samil PricewaterhouseCoopers as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

|

“FOR” the approval of the compensation of our named executive officers. |

| 5 | 2024 Coupang Proxy Statement |

We are not aware of any matters to be voted on by stockholders at the Annual Meeting other than those referenced above. If any matter is properly presented at the Annual Meeting, your executed proxy gives your proxy holder discretionary authority to vote your shares in accordance with their best judgment with respect to the matter.

Broker Non-Votes

If the shares you own are held in street name through a broker, bank, trustee, or other nominee, such broker, bank, trustee, or other nominee is required to vote your shares in accordance with your instructions. You should direct any such organization on how to vote the shares held in your account. Under applicable stock exchange rules, if you do not instruct the broker, bank, trustee, or other nominee that holds your shares on how to vote your shares, such organization will be able to vote your shares with respect to certain “routine” matters but will not be allowed to vote your shares with respect to certain “non-routine” matters. The ratification of the appointment of Samil PricewaterhouseCoopers as our independent registered public accounting firm is expected to be a routine matter. Each other proposal to be voted on at the Annual Meeting is expected to be a non-routine matter. Generally, broker non-votes occur when shares held by a broker, bank, trustee, or other nominee in street name for a beneficial owner are not voted with respect to a particular proposal because the organization has not received voting instructions from the beneficial owner and lacks discretionary voting power to vote those shares. Note that whether a proposal is considered routine or non-routine is subject to stock exchange rules and final determination by the stock exchange. Even with respect to routine matters, some brokers are choosing not to exercise discretionary voting authority. As a result, we urge you to direct your broker, bank, trustee, or other nominee how to vote your shares on all proposals to ensure that your vote is counted.

Revoking Your Proxy or Changing Your Vote

Voting over the Internet or by telephone or execution of a proxy will not in any way affect a stockholder’s right to attend the Annual Meeting and vote electronically. A proxy may be revoked before it is used to cast a vote at the Annual Meeting. If you are the record holder of your shares, you can revoke a proxy by doing one of the following:

| ● | filing with our General Counsel and Chief Administrative Officer, at or before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a later date than the proxy; |

| ● | properly submitting a duly executed proxy (via the Internet, telephone, or by returning a proxy card) bearing a later date; or |

| ● | attending the Annual Meeting and voting electronically (please note that your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting). |

Any written notice of revocation should be sent to us at the following address: Coupang, Inc., 720 Olive Way, Suite 600, Seattle, Washington 98101, Attention: Harold Rogers, General Counsel and Chief Administrative Officer.

If the shares you own are held in street name, you will need to follow the directions provided to you by your broker, bank, trustee, or other nominee that holds your shares to change your vote.

Quorum and Votes Required

The holders of a majority of the voting power of the outstanding shares of our Class A common stock and Class B common stock (voting together as a single class) entitled to vote at the Annual Meeting as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present by remote communication at the Annual Meeting or if you have properly submitted a proxy. Abstentions and broker non-votes are included in the shares present or represented at the Annual Meeting for purposes of determining whether a quorum is present. If a quorum is not present, the chair of the Annual Meeting may adjourn the meeting until a quorum is obtained.

| 6 | 2024 Coupang Proxy Statement |

| Proposal | Votes Required | Effect of Votes Withheld, Abstentions and Broker Non-Votes | ||

| Proposal 1 Election of Directors |

Each director is elected by the affirmative vote of the holders of a majority of the voting power of the outstanding shares of common stock voting together as a single class. | Abstentions and broker non-votes will have the effect of a vote “Against.” | ||

| Proposal 2 Ratification of Appointment of Independent Registered Public Accounting Firm |

The affirmative vote of the holders of a majority of the voting power of the shares present by remote communication or represented by proxy and entitled to vote thereon. | Abstentions will have the effect of a vote “Against.” We do not expect any broker non-votes on this proposal. | ||

| Proposal 3 Approval, on an Advisory (Non-Binding) Basis, of the Compensation of Our Named Executive Officers (“Say-on-Pay Vote”) |

The affirmative vote of the holders of a majority of the voting power of the shares present by remote communication or represented by proxy and entitled to vote thereon. | Abstentions will have the effect of a vote “Against” and broker non-votes will have no effect. |

The votes will be counted, tabulated, and certified by a representative of Broadridge, our inspector of election for the Annual Meeting. We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K.

Solicitation of Proxies

We will bear the cost of soliciting proxies in the accompanying form and will reimburse brokerage firms and others for expenses involved in forwarding proxy materials to beneficial owners or soliciting their execution. In addition to solicitations by mail, we, through our directors and officers, may solicit proxies in person, by telephone, or by electronic means. Such directors and officers will not receive any special remuneration for these efforts.

| 7 | 2024 Coupang Proxy Statement |

PROPOSAL 1: ELECTION OF DIRECTORS

The nominating and corporate governance committee of the Board (the “Nominating and Corporate Governance Committee”) identifies, evaluates, and recommends nominees for directors to serve on the Board consistent with the criteria approved by the Board, including consideration of the potential conflicts of interest, director independence, diversity, and other relevant requirements. In doing so, our Nominating and Corporate Governance Committee seeks to assemble a board of directors that, as a group, can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of background and experience in various areas. To that end, the committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment, and other qualities deemed critical to effective functioning of the Board. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board has considered and nominated the seven directors listed below for re-election to the Board at the Annual Meeting.

The directors elected at the Annual Meeting will hold office until our annual meeting of stockholders to be held in 2025 after the end of our fiscal year ending December 31, 2024 (the “2025 Annual Meeting of Stockholders”) and until their successors are duly elected and qualified. We have no reason to believe that any of the nominees will be unavailable or, if elected, will decline to serve. In the event these nominees should become unavailable to serve due to any presently unforeseen reason, proxies will be voted for a substitute as designated by the Board, or alternatively, the Board may leave a vacancy on the Board or reduce the size of the Board.

Nominees for Election to the Board of Directors

The Board of Directors

The biographies of each of our director nominees are included below. Each of the biographies highlights specific experience, qualifications, attributes, and skills that led us to conclude that such person should serve as a member of the Board. We believe that, as a whole, the Board possesses the requisite skills and characteristics, leadership traits, work ethic, and independence to provide effective oversight. No director or executive officer is related by blood, marriage, or adoption to any other director or executive officer. No arrangements or understandings exist between any director and any other person pursuant to which such person was selected as a director or nominee.

| 8 | 2024 Coupang Proxy Statement |

Director Biographies

|

Bom Kim Chief Executive Officer and Chair of the Board

|

|

Age 45

Director Since 2010

Committee Memberships None

|

|

|

Bom Kim founded our company and has served as our Chief Executive Officer and as a Chairman of the Board since May 2010. Mr. Kim attended Harvard University, earning an A.B. degree in Government.

Skills and Qualifications

We believe Mr. Kim is qualified to serve on the Board because of his extensive experience building and leading our business and his insight into our technology as our Founder and Chief Executive Officer.

|

|

|

Neil Mehta Lead Independent Director

|

|

Age 39

Director Since 2010

Committee Memberships Compensation (Chair); Nominating and Corporate Governance

|

|

|

Neil Mehta has served as a member of the Board since December 2010. Mr. Mehta founded Greenoaks Capital Partners LLC (“Greenoaks”), an investment firm, and has served as a Managing Director since April 2014. Prior to Greenoaks, Mr. Mehta was a Senior Investment Professional for special situations investments in India, the Middle East, and Southeast Asia for Orient Property Group Ltd., a Hong Kong-based investment firm financed by a fund managed by D.E. Shaw & Co., L.P., from October 2007 to November 2009. Mr. Mehta also previously worked for Kayne Anderson Capital Advisors, an alternative investment firm, where he invested in private companies in the general business and technology sector. Mr. Mehta earned a BSc in Government from The London School of Economics and Political Science.

Skills and Qualifications

We believe Mr. Mehta is qualified to serve as a member of the Board because of his operational experience in the technology industry and extensive knowledge of high-growth companies.

|

|

| 9 | 2024 Coupang Proxy Statement |

|

Jason Child

|

|

Age 55

Director Since 2022

Committee Memberships Audit

|

|

|

Jason Child has served as a member of the Board since April 2022. Mr. Child has served as Executive Vice President and Chief Financial Officer of Arm Holdings plc, a technology company that provides processor designs and software platforms, since November 2022. Prior to joining Arm, Mr. Child served as Chief Financial Officer at various global companies, including as Senior Vice President and Chief Financial Officer of Splunk Inc., a technology company specializing in security and observability, from 2019 to 2022 and as Chief Financial Officer at Opendoor Technologies Inc., an online real estate company, from 2017 to 2019, as well as AliphCom, Inc. (d/b/a Jawbone), a consumer technology and wearable device company, and Groupon, Inc., a global e-commerce marketplace. He holds a B.A. from the Foster School of Business at the University of Washington, where he currently serves on its Global Advisory Board.

Skills and Qualifications

We believe Mr. Child is qualified to serve as a member of the Board because of his extensive background in global finance and strategy, accounting, capital markets and treasury, and investor relations matters, including his extensive experience in scaling disruptive technologies within enterprise software and software-as-a-service industries, e-commerce, and local commerce.

|

|

|

Pedro Franceschi

|

|

Age 27

Director Since 2022

Committee Memberships Compensation

|

|

|

Pedro Franceschi has served as a member of the Board since March 2022. Mr. Franceschi is Co-Founder & Co-Chief Executive Officer of Brex, a company reimagining financial systems for fast-growing businesses. Launched in 2018 as the corporate card for startups, Brex now serves tens of thousands of companies through its expanded portfolio of financial services and software to help all fast-growing companies reach their full potential. Prior to launching Brex, Mr. Franceschi co-founded the payment company Pagar.me, a payment processor system, which was acquired by StoneCo Ltd., one of the largest payments companies in Brazil. At age 14, Mr. Franceschi built a popular window manager for Apple’s iPad allowing users to manage multiple applications simultaneously-a process previously impossible. At the age of 12, Mr. Franceschi was the first person to build software to make Apple’s Siri virtual assistant speak in Portuguese. Mr. Franceschi has served as a director of StoneCo Ltd. since May 2021.

Skills and Qualifications

We believe Mr. Franceschi is qualified to serve as a member of the Board because of his extensive experience creating and leading technology companies.

|

|

| 10 | 2024 Coupang Proxy Statement |

|

Benjamin Sun

|

|

Age 50

Director Since 2010

Committee Memberships Audit, Compensation, Nominating and Corporate Governance

|

|

|

Benjamin Sun has served on the Board since July 2010. Mr. Sun has been General Partner and co-founder of Primary Venture Partners, an early-stage venture capital fund, since 2013. Mr. Sun also co-founded LaunchTime LLC (“LaunchTime”) in January 2010, which invests in early-stage companies, and currently serves as a Partner. Previously, Mr. Sun served as President and Chief Executive Officer of Community Connect Inc., a leading online publisher, from October 1996 to December 2008 (Community Connect Inc. was acquired by Radio Once, Inc. in 2008). Mr. Sun began his financial career in Investment Banking at Merrill Lynch. Mr. Sun earned a B.A. degree in Economics from the University of Michigan in 1995.

Skills and Qualifications

We believe Mr. Sun is qualified to serve as a member of the Board because of his extensive experience working with technology companies.

|

|

|

Ambereen Toubassy

|

|

Age 51

Director Since 2023

Committee Memberships Audit

|

|

|

Ambereen Toubassy has served as a member of the Board since March 2023. Ms. Toubassy has served as Chief Financial Officer of Airtable, a cloud-based software company, since January 2021. Prior to joining Airtable, Ms. Toubassy served as Chief Financial Officer of Quibi, a mobile media startup, from September 2018 to November 2020 and as Chief Financial Officer and Partner of WndrCo, a media and technology holding company, from May 2017 to September 2018. Her career spans multiple investing roles as partner and portfolio manager at JMB Capital, Ivory Capital Management, and Empyrean Capital Partners. Ms. Toubassy began her career at Goldman Sachs and worked in the Risk Arbitrage, M&A, and Software banking groups of Goldman Sachs. Ms. Toubassy holds a B.A. in Economics from Yale University and an MBA from Stanford University Graduate School of Business.

Skills and Qualifications

We believe Ms. Toubassy is qualified to serve as a member of the Board because of her extensive background in finance and accounting matters at technology companies.

|

|

| 11 | 2024 Coupang Proxy Statement |

|

Kevin Warsh

|

|

Age 54

Director Since 2019

Committee Memberships Compensation, Nominating and Corporate Governance (Chair)

|

|

|

Kevin Warsh has served as a member of the Board since October 2019. Since April 2011, he has served as the Shepard Family Distinguished Visiting Fellow in Economics at the Hoover Institution and lecturer at the Stanford Graduate School of Business. He has served on the board of directors of United Parcel Service, a multinational package delivery and supply chain management company, since July 2012. Governor Warsh is a member of the Group of Thirty and the Panel of Economic Advisers of the Congressional Budget Office, and Governor Warsh advises Duquesne Family Office LLC. Governor Warsh served as a member of the Board of Governors of the Federal Reserve System from 2006 until 2011. From 2002 until 2006, Governor Warsh served as Special Assistant to the President for Economic Policy and Executive Secretary of the White House National Economic Council. Previously, Governor Warsh was a member of the Mergers & Acquisitions department at Morgan Stanley & Co. in New York, serving as Vice President and Executive Director. Governor Warsh received his A.B. from Stanford University, and J.D. from Harvard Law School.

Skills and Qualifications

We believe Mr. Warsh is qualified to serve on the Board because of his extensive experience in economics, finance, and corporate governance.

|

|

| 12 | 2024 Coupang Proxy Statement |

The Board of Directors and Certain Governance Matters

Director Independence and Independence Determinations

Our Corporate Governance Guidelines (“Corporate Governance Guidelines”) provide that the Board will consist of a majority of independent directors. Under our Corporate Governance Guidelines and the rules and regulations of the New York Stock Exchange (the “NYSE”), on which our Class A common stock is traded, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with us or any of our subsidiaries. Our Corporate Governance Guidelines provide that, to determine independence, the Board will consider the definition of independence in the applicable listing standards, which includes definition of an “independent” director in accordance with Section 303A.02 of the NYSE’s Listed Company Manual, and other factors that will contribute to effective oversight and decision making. In addition, members of the Audit Committee and Compensation Committee are subject to the additional independence requirements of applicable SEC rules and NYSE listing standards.

The Nominating and Corporate Governance Committee undertook its annual review of director independence and made a recommendation to the Board regarding director independence. As a result of this review, the Board affirmatively determined that Ms. Toubassy and Messrs. Child, Franceschi, Mehta, Sun, and Warsh are independent for purposes of applicable NYSE standards, including with respect to any applicable committee service. In addition, the Board determined that Harry You, who left the Board in June 2023, was independent during the period in 2023 he served on the Board. In addition, the Board has determined that each of Ms. Toubassy and Messrs. Child and Sun is “independent” for purposes of service on the Audit Committee in accordance with Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and that each of Messrs. Mehta, Franceschi, Sun, and Warsh is “independent” for purposes of service on the Compensation Committee in accordance with Section 10C(a)(3) of the Exchange Act. In assessing directors’ independence, the Board considered certain transactions, relationships, and arrangements involving some of the directors, including those described in the subsection titled “Certain Related Person Transactions” of this Proxy Statement, and concluded that such transactions, relationships, and arrangements, did not impair the independence of the director. Additionally, the Board considered that during 2023, Mr. Child was employed by organizations that did business with Coupang. The amount received by Coupang or such other organization in each of the last three fiscal years did not exceed the greater of $1 million or 1% of either Coupang’s or such organization’s consolidated gross revenues.

Board Structure

Our bylaws and Corporate Governance Guidelines provide that the Chair of the Board shall be appointed by the Board and that the positions of Chief Executive Officer and the Chair of the Board may be held by the same person. Our Corporate Governance Guidelines further provide that in the event a non-independent director is serving as the Chair of the Board, the Board may designate a lead independent director, whose responsibilities shall include:

| ● | working with the Chief Executive Officer to develop Board meeting schedules and agendas; |

| ● | providing the Chief Executive Officer with feedback on the quality, quantity, and timeliness of the information provided to the Board; |

| ● | developing the agenda for and moderating executive sessions of the independent members of the Board; |

| ● | presiding over the Board meetings (when the Chair is not present); |

| ● | acting as principal liaison between the independent members of the Board and the Chief Executive Officer; |

| ● | convening meetings of the independent directors as appropriate; |

| ● | if requested and appropriate, being available for consultation with major stockholders; and |

| ● | performing such other duties as the Board may determine from time to time. |

| 13 | 2024 Coupang Proxy Statement |

Currently, Mr. Bom Kim, our founder and Chief Executive Officer, also holds the Chair of the Board position, and Mr. Neil Mehta has served as Lead Independent Director of the Board since our initial public offering (our “IPO”). The Board believes that the combined role of the Chair and Chief Executive Officer positions is appropriate and in the best interests of the Company and our stockholders, given Mr. Kim’s role in founding Coupang, the depth and breadth of his insight into our business, vision, and industry. Further, the Board believes that this Board leadership structure is effective and improves the Board’s ability to focus on key policy and operational issues and helps us operate in the long-term interests of our stockholders.

Executive Sessions

Mr. Kim, as Chief Executive Officer and Chair of the Board, is currently the only employee member of the Board. To promote open discussion among the non-management directors, and as required under applicable NYSE rules and our Corporate Governance Guidelines, non-management directors of the Board meet at regularly scheduled executive sessions (without members of management present), and Mr. Mehta, our lead independent director, presides over all such executive sessions.

Meetings of the Board of Directors and Attendance

Our Corporate Governance Guidelines provide that all members of the Board are expected to prepare for, attend, and participate in all meetings of the Board and committees on which they serve. During 2023, the Board met five times. No member of the Board attended fewer than 75% of the aggregate of the total number of meetings of the Board (held during the period for which he or she was a director) and the total number of meetings held by all committees of the Board on which such director served (held during the period that such director served).

Members of the Board are encouraged to attend annual meetings of stockholders; however, we do not have a formal policy regarding board members’ attendance at annual meetings of stockholders. Six of our directors then serving on the Board attended the 2023 Annual Meeting of Stockholders.

Committees of the Board of Directors

The Board has established three standing committees thereof—the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee—each of which operates under a charter that has been approved by the Board. Current copies of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee charters are posted on the “Governance” section of the Investor Relations page of our website at ir.aboutcoupang.com. In 2023, the Audit Committee held eight meetings, the Compensation Committee held four meetings, and the Nominating and Corporate Governance Committee held four meetings.

| 14 | 2024 Coupang Proxy Statement |

Audit Committee

|

Primary Responsibilities

We have adopted a committee charter that details the primary responsibilities of the Audit Committee, including:

● overseeing our accounting and financial reporting processes, systems of internal control, financial statement audits, and the integrity of our financial statements;

● evaluating and determining whether to retain the independent registered public accounting firm to audit our consolidated financial statements;

● assessing the qualifications, performance, and independence of the independent registered public accounting firm;

● reviewing the results of the audit with management and the independent registered public accounting firm, as well as our annual audited and quarterly financial statements, including management’s discussion and analysis of financial condition and results of operations and risk factors;

● overseeing procedures for receiving, retaining, and investigating complaints received by us regarding accounting, internal accounting controls, or auditing matters, and confidential and anonymous submissions by employees concerning questionable accounting or auditing matters;

● conferring with management and the independent registered public accounting firm concerning the scope, design, adequacy, and effectiveness of internal control over financial reporting and our disclosure controls and procedures;

● reviewing and approving related party transactions, in accordance with our policies;

● approving or, as permitted, pre-approving all audit and permissible non-audit related services and fees that the independent registered public accounting firm provide to us; and

● overseeing the activities of our internal audit function.

Financial Expertise and Independence

All members of the Audit Committee are “independent” in accordance with the NYSE listing standards and SEC rules applicable to boards of directors in general and audit committee members in particular. The Board has determined that Ms. Toubassy and Mr. Child each qualify as an “audit committee financial expert” as defined by the applicable SEC rules and that each member of the Audit Committee is “financially literate” within the meaning of the NYSE listing standards.

Report

The Report of the Audit Committee is set forth beginning on page 24 of this Proxy Statement. |

Current Committee Members

Jason Child (Chair)

|

| 15 | 2024 Coupang Proxy Statement |

Compensation Committee

|

Primary Responsibilities

We have adopted a committee charter that details the primary responsibilities of the Compensation Committee, including:

● reviewing, overseeing, and approving (or making recommendations to the Board for approval of) our overall executive compensation strategy and policies;

● reviewing and approving the compensation, individual and corporate performance goals and objectives, and other terms of employment of our executive officers;

● reviewing and approving (or making recommendations to the Board for approval of) the type and amount of compensation to be paid or awarded to Board members;

● reviewing our practices and policies of employee compensation as they relate to risk management and risk-taking incentives;

● administering our equity awards, pension, and profit sharing plans, bonus plans, benefit plans, and other similar programs; and

● periodically discussing with management and overseeing as it deems appropriate the development, implementation, and effectiveness of our policies and strategies relating to our human capital management function, including but not limited to those policies and strategies regarding recruiting, retention, career development and progression, diversity and inclusion, and employment practices.

Independence

All members of the Compensation Committee are “independent” in accordance with NYSE listing standards and SEC rules applicable to boards of directors in general and compensation committees in particular. In addition, each of Messrs. Franceschi and Sun qualify as “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act.

Delegation Authority

Under the charter of the Compensation Committee, the Compensation Committee may form and delegate authority to one or more subcommittees, consisting of one or more members of the Board (whether or not he, she, or they are on the Compensation Committee) for any purpose that the Committee deems appropriate, including (a) a subcommittee consisting of a single member, and (b) a subcommittee consisting of at least two members, each of whom qualifies as a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act. Pursuant to this delegation authority, the Compensation Committee has formed a subcommittee thereof, named “Section 16 Equity Committee,” for the purpose of granting equity awards under our compensation plans in accordance with Rule 16b-3 under the Exchange Act, consisting of Messrs. Franceschi and Sun, each of whom qualifies as a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act.

Compensation Committee Interlocks and Insider Participation

None of the directors who are currently or who were members of our Compensation Committee during 2023 are either currently, or have been at any time, one of our officers or employees. None of our executive officers currently serves, or served during 2023, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee. See the section titled "Certain Relationships and Related Person Transactions" for information about related party transactions involving members of our Compensation Committee or their affiliates.

Role of Executive Officers and Compensation Consultant

See page 34 of this Proxy Statement for a discussion of the role of our executive officers and compensation consultant in determining executive compensation.

Report

The Report of the Compensation Committee is set forth beginning on page 41 of this Proxy Statement. |

Current Committee Members

Neil Mehta (Chair) |

|

| 16 | 2024 Coupang Proxy Statement |

Nominating and Corporate Governance Committee

|

Primary Responsibilities

We have adopted a committee charter that details the primary responsibilities of the Nominating and Corporate Governance Committee, including:

● helping the Board oversee our corporate governance functions;

● advising the Board on corporate governance matters;

● identifying and evaluating candidates, including the nomination of incumbent directors for reelection and nominees recommended by stockholders, to serve on the Board;

● considering and making recommendations to the Board regarding the composition and Chair position of the committees of the Board;

● reviewing and making recommendations to the Board regarding our corporate governance guidelines and related policies and procedures;

● periodically reviewing the performance of the Board, including Board committees; and

● periodically reviewing the processes and procedures used by us to provide information to the Board and its committees.

Independence

All members of the Nominating and Corporate Governance Committee are “independent” in accordance with NYSE listing standards. |

Current Committee Members

Kevin Warsh (Chair)

|

| 17 | 2024 Coupang Proxy Statement |

Director Nomination Process and Qualifications

We believe that an effective board should be made up of individuals who collectively provide an appropriate balance of diverse professional and personal backgrounds and perspectives and who have a range of skills and expertise sufficient to provide guidance and oversight with respect to our strategy and operations. The Board and the Nominating and Corporate Governance Committee seek individuals with backgrounds and qualities that, when combined with those of our other directors, enhance the Board’s effectiveness and result in the Board having a balance of knowledge, experience, and capability.

In assessing potential candidates, the Board and the Nominating and Corporate Governance Committee will consider, among other factors, whether the candidate:

| ● | possesses relevant expertise to offer advice and guidance to management; |

| ● | has sufficient time to devote to the affairs of the Company; |

| ● | demonstrates excellence in his or her field; |

| ● | has the ability to exercise sound business judgment; and |

| ● | is committed to represent the long-term interests of our stockholders. |

Moreover, the Board and the Nominating and Corporate Governance Committee will carefully consider diversity, broadly defined, in the board composition and, when assessing potential candidates, will take into account a candidate’s diversity and status as a member of an underrepresented community. The Board will assess its effectiveness in this regard as part of the annual board evaluation process.

In addition, our Corporate Governance Guidelines also require that to be qualified to serve as a director, a candidate must possess the highest personal integrity and ethics, possess the ability to read and understand basic financial statements, and be older than 21 years of age.

The Nominating and Corporate Governance Committee considers the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, or the Nominating and Corporate Governance Committee and the Board determine to increase the size of the Board, the Nominating and Corporate Governance Committee considers potential director candidates using the criteria set forth above. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, members of management, professional search firms, stockholders, or other persons. The Nominating and Corporate Governance Committee is responsible for conducting appropriate inquiries into the backgrounds and qualifications of potential director candidates and evaluating their suitability for service on the Board.

The Nominating and Corporate Governance Committee will evaluate director candidates recommended by stockholders in the same manner in which the Nominating and Corporate Governance Committee evaluates any other director candidate.

Any recommendation submitted to the General Counsel and Chief Administrative Officer should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation but must include information that would be required under the “advance notice” provisions of our bylaws and rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the General Counsel and Chief Administrative Officer of the Company at c/o Coupang, Inc., 720 Olive Way, Suite 600, Seattle, Washington 98101, U.S.A. All recommendations for nomination received by the General Counsel and Chief Administrative Officer that satisfy our “advance notice” bylaw requirements relating to such director nominations will be presented to the Board for its consideration. Stockholders must also satisfy the notification, timeliness, consent, and information requirements set forth in our bylaws. These requirements are also described under the section entitled “Stockholder Proposals for the 2025 Annual Meeting of Stockholders.”

| 18 | 2024 Coupang Proxy Statement |

Corporate Governance Documents

Complete copies of our Corporate Governance Guidelines and Committee charters are available on the Investor Relations page of our website at ir.aboutcoupang.com.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics is available on the Investor Relations page of our website at ir.aboutcoupang.com. If we ever were to amend or waive any provision of our Code of Business Conduct and Ethics that applies to our executive officers or directors, we intend to satisfy our disclosure obligations, if any, with respect to any such waiver or amendment by posting such information on our website set forth above rather than by filing a Current Report on Form 8-K.

Communications with the Board

Stockholders and other interested parties may communicate with a member or members of the Board, including the Chair of the Board, Chair of the Audit, Compensation, or Nominating and Corporate Governance Committees, or to the non-management or independent directors. We maintain a “Stockholders Communications Policy” that outlines the applicable procedures and is available on the Investor Relations page of our website at ir.aboutcoupang.com.

Board’s Role in Risk Oversight

The Board’s role in risk oversight at the Company is consistent with our leadership structure, with the Chief Executive Officer and other members of senior management having responsibility for assessing and managing risks we face in executing our business plans, and the Board and its committees providing oversight in connection with those efforts. These risks include, but are not limited to, financial, legal and regulatory, technological, competitive, and operational risks and exposures.

In addition to the full Board, the Audit Committee plays an important role in the oversight of our enterprise risk assessment and management activities, which identify key risks to our business, including risks related to financial reporting, information security, data privacy, and other regulations, and assesses any steps taken to monitor and control such risk. The Audit Committee periodically reviews key enterprise risks with senior management and the Chief Audit Executive.

The Compensation Committee is charged with overseeing risks relating to human capital and assessing whether our compensation policies and procedures encourage risk-taking in a manner that would have a material adverse impact on us.

The Nominating and Corporate Governance Committee is charged with overseeing risk related to our governance processes. Each Committee reports its findings to the full Board for consideration.

| 19 | 2024 Coupang Proxy Statement |

Director Compensation

In December 2021, the Board adopted a director compensation policy for our non-employee directors and subsequently amended the policy in June 2023 (as so amended, the “Non-Employee Director Compensation Policy”). The Board has formed the Compensation Committee to oversee, with consultation with the Board and compensation consultants, the Non-Employee Director Compensation Policy.

Initial Equity Awards

In connection with joining the Board, a new non-employee director may be granted an equity award in the form of restricted stock units, with each such unit representing a contingent right to receive one share of the Company’s Class A Common Stock upon settlement (“RSUs”), with a maximum aggregate value of up to $1,000,000 (as determined by the Board), based on the closing price of our Class A common stock on the date of grant. Each initial award will vest on a schedule determined by the Board at the time of grant. If a non-employee director resigns from the Board prior to the vesting date, the unvested portion of any initial award will be forfeited as of the date of resignation. In the event of a “change of control” (as defined in our 2021 Equity Incentive Plan), the unvested portion of any initial award will vest in full.

Annual Equity Awards

On the date of each annual meeting of stockholders, each non-employee director who is serving on the Board, who has no outstanding and unvested stock grant, and will continue to serve on the Board as a non-employee director immediately following the date of such annual meeting, will automatically be granted an equity award in the form of RSUs covering the number of shares of our Class A common stock having a value of $300,000, based on the closing price of our Class A common stock on the date of grant.

Additionally, each non-employee director will be eligible to earn additional annual retainers for their additional services as follows, in each case in the form of RSUs covering the number of shares of our Class A common stock having the value set forth below (based on the closing price of our Class A common stock on the date of grant):

| ● | $25,000 for service as Lead Independent Director; |

| ● | $25,000 for service as chair, or $12,500 for service as a member (other than as chair), of our Audit Committee; |

| ● | $20,000 for service as chair, or $10,000 for service as a member (other than as chair), of our Compensation Committee; and |

| ● | $15,000 for service as chair, or $7,500 for service as a member (other than as chair), of our Nominating and Corporate Governance Committee. |

Each annual equity award granted, including awards granted for additional services described above, will be scheduled to vest in full on the earlier of the first anniversary of the date of grant or the date of the next annual meeting of stockholders following the date of grant.

If a non-employee director terminates service in any Board leadership or Committee role prior to the vesting date of their annual award but otherwise remains as a member of the Board, any applicable lead independent director retainer or Committee retainer will vest, unless a different vest date is provided for by the Board, on a pro-rata basis to reflect the applicable non-employee director’s length of Board leadership or Committee service, as applicable, during the vesting period. If an incumbent non-employee director is appointed to any new Board leadership or Committee position during his or her tenure on the Board, such non-employee director will be granted an award of RSUs for such new Board leadership or Committee service. The grant date for such partial year committee award will be the date that the non-employee director’s appointment to the applicable Board leadership or Committee position is effective, unless otherwise provided by the Board. The aggregate dollar value of the partial year committee award will be based on the annual retainers set forth above but prorated to reflect the length of service in such new role. Each partial year committee award granted will vest in full on the first annual award vest date to occur after the applicable grant date, subject to the non-employee director’s continued service to the Company through the applicable annual award vest date. Except as otherwise provided by the Board or in any related award agreement or other written agreement between a non-employee director and the Company, all equity awards granted under the Non-Employee Director Compensation Policy are subject to the non-employee director’s continued service to the Company through the applicable vest date. In the event of a “Change in Control” (as defined in our 2021 Equity Incentive Plan), all equity awards under the Non-Employee Director Compensation Policy, including awards granted for additional services described above, that remain unvested at the time of such Change in Control will vest in full.

| 20 | 2024 Coupang Proxy Statement |

Limitation on Non-Employee Director Compensation

The Non-Employee Director Compensation Policy includes a maximum annual limit of $750,000 of cash compensation and equity awards that may be paid, issued, or granted to a non-employee director in any calendar year other than in the non-employee director’s first calendar year of service, in which case the maximum is $1,000,000.

Expense Reimbursement

Under the Non-Employee Director Compensation Policy, each non-employee director is entitled to reimbursement from us for reasonable travel, lodging, and meal expenses incident to meetings of the Board or committees thereof or in connection with other Board-related business, in accordance with and subject to our expense reimbursement policy as presented to the Audit Committee of the Board.

| 21 | 2024 Coupang Proxy Statement |

Director Compensation Table

The following table provides information regarding compensation of our non-employee directors for their service as a director for 2023. Employee directors received no additional compensation for their service as a director.

| Name | Stock Awards(1) | Total | ||

| Jason Child | $324,992 | $324,992 | ||

| Pedro Franceschi | $309,991 | $309,991 | ||

| Neil Mehta | $352,484 | $352,484 | ||

| Benjamin Sun | $319,986 | $319,986 | ||

| Ambereen Toubassy(2) | $398,090 | $398,090 | ||

| Kevin Warsh | $324,992 | $324,992 | ||

| Harry You(3) | — | — |

| 1. | Amounts in this column represent the aggregate grant date fair value of RSUs granted during 2023, calculated in accordance with FASB ASC Topic 718. For additional information regarding the assumptions underlying this calculation, please read Note 4 in the Notes to Consolidated Financial Statements of our 2023 Annual Report. As of December 31, 2023, each of our then-current non-executive directors held the following unvested RSUs: Mr. Child: 19,151; Mr. Franceschi: 18,267; Mr. Mehta: 20,771; Mr. Sun: 18,856; Ms. Toubassy: 24,434; and Mr. Warsh: 19,151. |

| 2. | Ms. Toubassy was appointed to the Board on March 8, 2023 and received an initial equity award upon such appointment with a grant date fair value of $85,604, in addition to her annual equity award for 2023 with a grant date fair value of $312,486. |

| 3. | Mr. You retired from the Board, effective at our 2023 Annual Meeting of Stockholders on June 15, 2023, and therefore in accordance with our Non-Employee Director Compensation Policy, Mr. You did not receive an annual equity award in 2023. |

| 22 | 2024 Coupang Proxy Statement |

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Appointment of Independent Registered Public Accounting Firm

The Audit Committee is solely responsible for the appointment, evaluation, compensation, retention, and, if appropriate, replacement of the independent registered public accounting firm retained to audit our financial statements. The Audit Committee has selected Samil PricewaterhouseCoopers to serve as our independent registered public accounting firm for our fiscal year ending December 31, 2024. Samil PricewaterhouseCoopers has served as our auditor since 2014.

Stockholder approval is not required to appoint Samil PricewaterhouseCoopers as the independent registered public accounting firm for our fiscal year ending December 31, 2024. The Board believes, however, that submitting the appointment of Samil PricewaterhouseCoopers to the stockholders for ratification is a matter of good corporate governance. Even if the appointment is ratified, our Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines such a change would be in the best interests of the Company or our stockholders. The ratification of the appointment of Samil PricewaterhouseCoopers as our independent registered public accounting firm requires the affirmative vote of a majority of the shares cast in person or by proxy and entitled to vote at the Annual Meeting.

One or more representatives of Samil PricewaterhouseCoopers are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they wish and be available to respond to appropriate questions.

Principal Accountant Fees and Services

The following tables set forth Samil PricewaterhouseCoopers’ aggregate fees for 2023 and 2022:

| December 31, 2023 | December 31, 2022 | |

| Audit Fees(1) | $7,103,000 | $6,881,000 |

| Audit-Related Fees | — | — |

| Tax Fees | — | — |

| All Other Fees(2) | 26,000 | 5,000 |

| Total Fees | $7,129,000 | $6,886,000 |

| 1. | Audit fees include the audit of our annual financial statements, the review of our annual report on Form 10-K for the applicable fiscal year, and the review of our quarterly reports on Form 10-Q for the applicable fiscal quarters, statutory audits required internationally, and consents for and review of registration statements filed with the SEC or other documents issued in connection with securities offerings. Our 2023 and 2022 audit fees include fees for attestation services related to Section 404 of the Sarbanes-Oxley Act of 2002. |

| 2. | All other fees consist primarily of subscription fees to access accounting, tax, and financial reporting content. |

| 23 | 2024 Coupang Proxy Statement |

Pre-Approval Policies and Procedures

Our Audit Committee charter requires our Audit Committee to pre-approve all audit and permitted non-audit and tax services that may be provided by our independent registered public accounting firm or other registered public accounting firms. The Audit Committee charter also provides that the Audit Committee may establish policies and procedures for its pre-approval of permitted services in compliance with applicable law or stock exchange listing rules. Our Audit Committee has established procedures relating to the approval of all audit and non-audit services that are to be performed by our independent registered public accounting firm and pre-approves all audit and permitted non-audit services provided by our independent registered public accounting firm prior to each engagement. Since our IPO, our Audit Committee pre-approved all services provided by Samil PricewaterhouseCoopers.

Audit Committee Report

The Audit Committee consists solely of independent directors, as required by and in compliance with SEC rules and regulations and the NYSE listing standards. The Audit Committee operates pursuant to a written charter adopted by the Board.

The Audit Committee is responsible for assisting the Board in its oversight responsibilities related to accounting policies, internal controls, financial reporting, and legal and regulatory compliance. Our management has the primary responsibility for our financial reporting processes, proper application of accounting principles, and internal controls as well as the preparation of its financial statements. Our independent registered public accounting firm is responsible for performing an audit of our financial statements and expressing an opinion as to the conformity of such financial statements with accounting principles generally accepted in the United States and the effectiveness of our internal control over financial reporting.

In performing its functions, the Audit Committee has:

| ● | Reviewed and discussed the audited financial statements, management’s assessment of the effectiveness of our internal control over financial reporting, and the independent auditors’ evaluation of our system of internal control over financial reporting, included in our 2023 Annual Report with management and Samil PricewaterhouseCoopers; |

| ● | Discussed with Samil PricewaterhouseCoopers the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC; and |

| ● | Received from Samil PricewaterhouseCoopers the written disclosures and representations required by PCAOB standards regarding Samil PricewaterhouseCoopers independence, and discussed with them matters relating to independence. |

Based on the review and discussions described above, the Audit Committee recommended to the Board that our audited financial statements be included in our 2023 Annual Report for filing with the SEC.

|

The Audit Committee

Jason Child (Chair), Benjamin Sun, Ambereen Toubassy

The foregoing Report of the Audit Committee of the Board of Directors shall not be deemed to be soliciting material or be incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or under the Exchange Act, except to the extent we specifically incorporate this information by reference, and shall not otherwise be deemed to be filed with the SEC under the Securities Act or the Exchange Act. |

| 24 | 2024 Coupang Proxy Statement |

Executive Officers

Below is a list of our current executive officers and their respective ages and a brief account of the business experience of each of them.

| Name | Age | Position |

| Bom Kim(1) | 45 | Chief Executive Officer and Chair of the Board |

| Gaurav Anand | 48 | Chief Financial Officer |

| Hanseung Kang | 55 | Representative Director, Business Management |

| Harold Rogers | 47 | General Counsel and Chief Administrative Officer |

| Pranam Kolari | 44 | Vice President, Search and Recommendations |

1. Please see “Nominees for Election to the Board of Directors” for information regarding Mr. Kim.

Executive Officers

Gaurav Anand. Gaurav Anand has served as our Chief Financial Officer since December 2020 and previously served as our Chief Operating Officer from January 2019 to December 2020. Mr. Anand previously served as the Chief of Staff to our Chief Executive Officer from January 2017 to December 2018 and our Chief Financial Officer of Global eCommerce from January 2017 to December 2017. Prior to joining Coupang, Mr. Anand served as Vice President of Finance at Myntra, a fashion subsidiary of Flipkart, from November 2014 to December 2016. Mr. Anand also previously worked at Amazon from 2007 to 2014, holding various Finance positions across its North America retail, international retail, AWS business, and payments business.

Hanseung Kang. Hanseung Kang has served as our Representative Director of Business Management since November 2020. Prior to joining Coupang, Mr. Kang worked as an attorney at Kim & Chang from February 2013 to November 2020, where his practice focused on crisis management, communication strategy, and government affairs. From August 2011 to February 2013, Mr. Kang served as the Secretary to the President of the Republic of Korea for Legal Affairs. During the prior eighteen years, he served in the Korean judiciary, first as a judge at district courts and later as a presiding judge in the appellate court. Mr. Kang has also served as a Special Counselor to the Legislation and Judiciary Committee of the National Assembly of the Republic of Korea, and as the Counselor for the Judicial Affairs at the Embassy of the Republic of Korea in the U.S. Mr. Kang received his LL.B. from Korea University and attended the Judicial Research and Training Institute of the Supreme Court of Korea.

Harold Rogers. Harold Rogers has served as our General Counsel since December 2021 and as our Chief Administrative Officer since January 2020. Prior to joining Coupang, Mr. Rogers served as Executive Vice President, Chief Ethics and Compliance Officer at Millicom, a global telecommunications company, from August 2016 to December 2019. He was also previously a Partner at Sidley Austin LLP from January 2013 to July 2016 and an associate attorney from September 2006 to December 2012. He clerked for the Honorable Thomas B. Griffith on the United States Court of Appeals for the District of Columbia Circuit from 2005 to 2006. Mr. Rogers holds a B.A. in English from Brigham Young University and earned his J.D. from Harvard Law School.

| 25 | 2024 Coupang Proxy Statement |

Pranam Kolari. Pranam Kolari has served as our Vice President of Search and Recommendations since January 2024. Previously Dr. Kolari served as our Vice President, Search Engineering, leading all search and discovery teams for Coupang from April 2022 to January 2024. Prior to joining Coupang, Dr. Kolari held various leadership roles at Walmart Labs, the technology division responsible for Walmart’s global e-Commerce initiatives, from August 2021 to March 2022, including most recently as its Vice President of Engineering for Search Technology. Prior to Walmart, Dr. Kolari held various roles at Yahoo, Inc. focusing on personalization and search ranking from October 2007 to August 2012. Dr. Kolari holds a Ph.D. in Computer Science from the University of Maryland and a Bachelor of Engineering, Computer Science and Engineering, UVCE, from Bangalore University.

| 26 | 2024 Coupang Proxy Statement |

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Policies and Procedures for Related Person Transactions

The Board has adopted a written related person transaction policy setting forth the policies and procedures for the identification, review, and approval or ratification of related person transactions. This policy covers, with certain exceptions set forth in Item 404 of Regulation S-K under the Securities Act of 1933, as amended, any transaction, arrangement, or relationship, or any series of similar transactions, arrangements, or relationships, in which we and a related person were or will be participants and the amount involved exceeds, or is expected to exceed, $120,000, and a related person has a direct or indirect interest deemed to be material by the Audit Committee. In reviewing and approving any such transactions, our Audit Committee will consider all relevant facts and circumstances as appropriate, including, but not limited to, (a) the risks, costs, and benefits to Coupang, (b) the impact on a director’s independence in the event the related person is a director, immediate family member of a director, or an entity with which a director is affiliated, (c) the terms of the transaction, (d) the availability of other sources for comparable services or products, and (e) the terms available to or from, as the case may be, unrelated third parties or to or from employees generally.

Certain Related Person Transactions

Employment Arrangements

The brother of Bom Kim, our Chief Executive Officer and Chair of the Board, is currently employed by the Company. He does not share a household with Mr. Kim and is not one of our executive officers. In 2023, he earned approximately $440,000 in salary, bonus, and expat related benefits. He was also granted 43,052 RSUs in 2023, which will vest over 2 years, subject to his continuous service to the Company through each vesting date. He participates in compensation and incentive plans or arrangements on the same basis as similarly situated employees.

The sister-in-law of Bom Kim, our Chief Executive Officer and Chair of the Board, is currently employed by the Company. She does not share a household with Mr. Kim and is not one of our executive officers. In 2023, she earned approximately $256,000 in salary, bonus, and expat related benefits. She was also granted 5,097 RSUs in 2023, which will vest over 2 years, subject to her continuous service to the Company through each vesting date. She participates in compensation and incentive plans or arrangements on the same basis as similarly situated employees.

Other Related Person Transactions

Jane Lauder, the spouse of Kevin Warsh, a member of the Company’s Board, is a director and executive officer of The Estée Lauder Companies Inc. (“Estée Lauder”) and beneficially owns approximately 6% of Estée Lauder’s outstanding common stock. During fiscal 2023, the Company paid Estée Lauder and its subsidiaries approximately $18 million in connection with the Company’s purchases of skin care, makeup, fragrance, hair care, and other related products in the ordinary course of business.

| 27 | 2024 Coupang Proxy Statement |

In January 2024, we completed the acquisition of all of the business and assets of Farfetch Holdings plc (“Farfetch”; our acquisition of all business and assets of Farfetch, the “Farfetch Acquisition”) through our majority owned subsidiary, Surpique LP (“Surpique”), a Delaware limited partnership. Upon the closing of the Farfetch Acquisition, approximately $150 million previously funded by Surpique under a $500 million delayed-draw bridge loan facility was exchanged for equity interests in Surpique and certain of its direct and/or indirect subsidiaries (the “Farfetch Group”), and Surpique made an additional approximately $150 million capital contribution to the Farfetch Group as an equity contribution. Surpique is obligated to fund up to a further $200 million to the Farfetch Group to the extent called by the Farfetch Group on or prior to January 31, 2025. Surpique is owned 80.1% by the Company and 19.9% by certain funds advised or managed by Greenoaks. In connection with the Farfetch Acquisition, each of the Company and Greenoaks contributed, and remains obligated to contribute, capital to Surpique in accordance with their respective ownership interest percentages in Surpique. As part of the acquisition, a subsidiary of Surpique assumed Farfetch’s then outstanding syndicated term loans of $633 million under Farfetch’s existing credit agreement. Neil Mehta, a member of the Company’s Board and the Lead Independent Director, founded and has served as a Managing Partner of Greenoaks since April 2012. In addition, Greenoaks and certain funds and accounts to which Greenoaks serves as the investment adviser and related persons or entities, including Mr. Mehta, collectively beneficially own approximately 3.0% of the Company’s Class A common stock.

Registration Rights Agreement

We have entered into the Sixth Amended and Restated Registration Rights Agreement containing registration rights and information rights, among other things, with certain holders of common stock. The parties to this agreement include the following holders of more than 5% of our capital stock: SVF Investments (UK) Ltd. and Bom Kim, our Chief Executive Officer and Chair of the Board.

| 28 | 2024 Coupang Proxy Statement |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our capital stock as of March 31, 2024 for:

| ● | each of our named executive officers; |

| ● | each of our directors; |

| ● | all of our executive officers and directors as a group; and |

| ● | each person or group of affiliated persons known by us to beneficially own more than 5% of our Class A common stock or Class B common stock. |

We have determined beneficial ownership in accordance with the rules and regulations of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as indicated by the footnotes below, we believe, based on information furnished to us, that the persons and entities named in the table below have sole voting and sole dispositive power with respect to all shares that they beneficially own, subject to applicable community property laws.