Table of Contents

As filed with the Securities and Exchange Commission on April 8, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NORTHERN STAR INVESTMENT CORP. II

(Exact name of Registrant as specified in its charter)

| Delaware | 6770 | 85-3909728 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary standard industrial classification code number) |

(I.R.S. Employer Identification Number) |

c/o Graubard Miller

The Chrysler Building

405 Lexington Avenue

New York, New York 10174

(212) 818-8800

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Joanna Coles, Chief Executive Officer

Northern Star Investment Corp. II

c/o Graubard Miller

The Chrysler Building

405 Lexington Avenue

New York, New York 10174

(212) 818-8800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| David Alan Miller, Esq. Jeffrey M. Gallant, Esq. Graubard Miller The Chrysler Building 405 Lexington Avenue New York, New York 10174 Telephone: (212) 818-8800 Fax: (212) 818-8881 |

William Capuzzi Chief Executive Officer Apex Fintech Solutions LLC 350 N St. Paul Street Dallas, Texas 75201 Telephone: (214) 765-1100 |

Jeffrey N. Smith, Esq. Michael P. Heinz, Esq. Ryan Scofield, Esq. Sidley Austin LLP One South Dearborn Street Chicago, Illinois 60603 Telephone: (212) 730-8133 Fax: (877) 881-3007 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and all other conditions to the transactions contemplated by the Agreement and Plan of Reorganization described in the included proxy statement/prospectus have been satisfied or waived.

If the securities being registered on this form are to be offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Security to Be Registered |

Amount to Be Registered |

Proposed Maximum Offering Price Per Security |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Class A Common Stock |

470,000,000(1)(2) | $9.99(3) | $4,695,300,000 | $512,258(4) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Represents a good faith estimate of the maximum number of shares of the registrant’s Class A common stock to be issued or reserved for issuance by Northern Star Investment Corp. II to the security holders of Apex Fintech Solutions LLC, a Delaware limited liability company, upon consummation of the business combination described herein. |

| (2) | Pursuant to Rule 416(a) of the Securities Act, there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

| (3) | Estimated solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the registrant’s Class A common stock (which will be the registrant’s sole class of common stock after the business combination described herein) on April 1, 2021 (a date within five business days prior to the date of this Registration Statement). This calculation is in accordance with Rule 457(f)(1) of the Securities Act of 1933, as amended. |

| (4) | Calculated pursuant to Rule 457 of the Securities Act by multiplying the proposed maximum aggregate offering price of securities to be registered by 0.0001091. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 8, 2021

PROXY STATEMENT FOR SPECIAL MEETING OF

NORTHERN STAR INVESTMENT CORP. II

PROSPECTUS FOR UP TO 470,000,000 SHARES OF CLASS A COMMON STOCK

The board of directors of Northern Star Investment Corp. II, a Delaware corporation (“Northern Star”), has unanimously approved the Agreement and Plan of Reorganization, dated as of February 21, 2021 (the “Merger Agreement”), by and among Northern Star, NISC II-A Merger LLC, a Delaware limited liability company and wholly-owned subsidiary of Northern Star (“Merger Sub I”), NISC II-B Merger LLC, a Delaware limited liability company and wholly-owned subsidiary of Northern Star (“Merger Sub II” and, together with Merger Sub I, the “Merger Subs”), Apex Fintech Solutions LLC (f/k/a Apex Clearing Holdings LLC), a Delaware limited liability company (“Apex Fintech” or “AFS”) and, solely for the purposes of Section 5.21 therein, PEAK6 Investments LLC, a Delaware limited liability company (“PEAK6”), whereby (i) Merger Sub I will merge with and into Apex Fintech (the “Initial Merger”), with Apex Fintech being the surviving entity (the “Initial Surviving Company”) of the Initial Merger and Apex Fintech’s members receiving shares of Class A common stock, par value $0.0001 per share, of Northern Star (“Class A Common Stock”) in exchange for their membership interests in Apex Fintech, and (ii) immediately following the Initial Merger and as part of the same overall transaction as the Initial Merger, the Initial Surviving Company will merge with and into Merger Sub II (the “Final Merger” and, together with the Initial Merger, the “Mergers”), with Merger Sub II being the surviving entity of the Final Merger (the “Final Surviving Company”). As a result of the Mergers, Apex Fintech will become a wholly owned subsidiary of Northern Star, with the members of Apex Fintech becoming stockholders of Northern Star. We sometimes refer to the Mergers and the other transactions contemplated by the Merger Agreement as the “Business Combination” and to Northern Star after the Business Combination as “New Apex.”

Pursuant to the Merger Agreement, at the time of the Initial Merger, each issued and outstanding membership interest of Apex Fintech will be automatically converted into the right to receive a number of shares of Northern Star (“Merger Shares”) equal to the Exchange Ratio (the “Per Share Merger Consideration”). The “Exchange Ratio” is the quotient obtained by dividing 470,000,000 by the number of membership interests of Apex Fintech outstanding immediately prior to the closing of the Business Combination (other than any such membership interests issued or issuable upon the conversion of the convertible senior notes due 2023 issued by Apex Fintech on February 19, 2021). We presently estimate that the Exchange Ratio will be .

The Apex Convertible Notes shall, in accordance with their terms, become convertible into shares of New Apex common stock at an initial conversion price of $10.00 per share. See the section entitled “The Business Combination Proposal—Structure of the Merger—Consideration to Apex Securityholders.”

Accordingly, this proxy statement/prospectus covers up to an aggregate of 470,000,000 shares of Class A Common Stock, representing the estimated maximum number of shares to be issued or reserved for issuance to the securityholders of Apex Fintech at the closing of the Business Combination.

In connection with the Merger, Northern Star has entered into subscription agreements with certain investors (the “PIPE Investors”), pursuant to which such PIPE Investors have agreed to purchase an aggregate of 45,000,000 shares of Class A Common Stock in a private placement at a price of $10.00 per share for an aggregate commitment of $450,000,000. The closing of the private placement is expected to take place concurrently with the closing of the Business Combination. The subscription agreements are subject to certain conditions, including, among other things, the closing of the Business Combination.

Proposals to approve the Merger Agreement and the other matters discussed in this proxy statement/prospectus will be presented at the special meeting of stockholders of Northern Star scheduled to be held on , 2021.

Northern Star’s units, Class A Common Stock and warrants are currently listed on the New York Stock Exchange (the “NYSE”) under the symbols NSTB.U, NSTB and NSTB.WS, respectively. Northern Star intends to apply for listing on the NYSE of the New Apex common stock and warrants, under the proposed symbols APX and APX.WS, respectively, to be effective at the consummation of the Business Combination. Northern Star’s units will not be listed on the NYSE following consummation of the Business Combination and such units will automatically be separated into their component securities without any action needed to be taken on the part of the holders. Furthermore, each outstanding share of Northern Star’s Class B common stock, par value $0.0001 per share (the “Class B Common Stock”), will convert into one share of Class A Common Stock at the closing of the Business Combination, the Class B Common Stock will cease to exist and Northern Star will thereafter have a single class of common stock. It is a condition to the consummation of the Business Combination that the shares of New Apex common stock to be issued in the Mergers be approved for listing on the NYSE (subject only to official notice of issuance thereof and public holder requirements), but there can be no assurance such listing condition will be met. If such listing condition is not met, the Business Combination will not be consummated unless the listing condition is waived by the parties to the Merger Agreement.

Northern Star is an “emerging growth company” and “smaller reporting company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”), and has elected to comply with certain reduced public company reporting requirements. See “Summary of the Proxy Statement/Prospectus—Emerging Growth Company.”

This proxy statement/prospectus provides you with detailed information about the Mergers and other matters to be considered at the special meeting of Northern Star’s stockholders. We encourage you to carefully read this entire document. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 41 of this proxy statement/prospectus. These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus incorporates by reference important business and financial information about Northern Star from documents Northern Star has filed with the Securities and Exchange Commission that are not included in or delivered with this proxy statement/prospectus. You can obtain documents incorporated by reference in this proxy statement/prospectus and other filings of Northern Star with the Securities and Exchange Commission by visiting its website at www.sec.gov or requesting them in writing or by telephone from Northern Star at the following address:

Ms. Joanna Coles

Northern Star Investment Corp. II

c/o Graubard Miller

The Chrysler Building

405 Lexington Avenue, 11th Floor

New York, NY 10174

Tel: (212) 818-8800

You will not be charged for any of these documents that you request. Stockholders requesting documents should do so by , 2021 in order to receive them before the special meeting.

This proxy statement/prospectus is dated , 2021, and is first being mailed to Northern Star security holders on or about such date.

Table of Contents

NORTHERN STAR INVESTMENT CORP. II

c/o Graubard Miller

The Chrysler Building

405 Lexington Avenue, 11th Floor

New York, NY 10174

NOTICE OF

SPECIAL MEETING

TO BE HELD ON , 2021

TO THE STOCKHOLDERS OF NORTHERN STAR INVESTMENT CORP II:

NOTICE IS HEREBY GIVEN that a special meeting of stockholders of Northern Star Investment Corp. II (“Northern Star” or, after the completion of the transactions described herein, “New Apex”), a Delaware corporation, will be held at eastern time, on , 2021. Due to health concerns stemming from the COVID-19 pandemic, and to support the health and well-being of our stockholders, the special meeting will be a virtual meeting, held solely over the Internet by means of a live audio webcast. You are cordially invited to attend and participate in the special meeting accessing the meeting web portal located at https://www. .com/ . The special meeting will be held for the following purposes:

| (1) | Proposal No. 1—The Business Combination Proposal—to consider and vote upon a proposal to approve and adopt the Agreement and Plan of Reorganization, dated as of February 21, 2021 (the “Merger Agreement”), by and among Northern Star, NSIC II-A Merger LLC, a Delaware limited liability company and wholly owned subsidiary of Northern Star (“Merger Sub I”), NSIC II-B Merger LLC, a Delaware limited liability company and wholly-owned subsidiary of Northern Star (“Merger Sub II” and, together with Merger Sub I, the “Merger Subs”), Apex Fintech Solutions LLC (f/k/a Apex Clearing Holdings LLC), a Delaware limited liability company (“Apex Fintech” or “AFS”) and, solely for the purposes of Section 5.21 therein, PEAK6 Investments LLC, a Delaware limited liability company (“PEAK6”), a copy of which is attached to this proxy statement/prospectus as Annex A, and the transactions contemplated thereby (the “Business Combination”), including (i) the merger of Merger Sub I with and into Apex Fintech (the “Initial Merger”), with Apex Fintech surviving as a wholly owned subsidiary of Northern Star (the “Initial Surviving Company”); (ii) immediately following the Initial Merger and as part of a single integrated transaction as the Initial Merger, the merger of the Initial Surviving Company with and into Merger Sub II (the “Final Merger” and, together with the Initial Merger, the “Mergers”), with Merger Sub II surviving as a wholly owned subsidiary of Northern Star; and (iii) the issuance of shares of Class A Common Stock of Northern Star to Apex Fintech’s members in the Initial Merger—we refer to this proposal as the “business combination proposal”; |

| (2) | Proposal No. 2—The PIPE Proposal—to consider and vote upon a proposal to approve the issuance of an aggregate of 45,000,000 shares of New Apex common stock in a private placement at a price of $10.00 per share, for an aggregate purchase price of $450,000,000 (the “PIPE Transaction”), the closing of which is subject to certain conditions, including, among other things, the substantially concurrent closing of the Mergers—we refer to this proposal as the “PIPE proposal”; |

| (3) | The Charter Proposals—to consider and vote upon separate proposals to approve the amendment and restatement of Northern Star’s current amended and restated certificate of incorporation to: |

| (i) | change the name of Northern Star to “Apex Fintech Solutions, Inc.”, as opposed to the current name of “Northern Star Investment Corp. II” (Proposal No. 3); |

| (ii) | increase the number of shares of common stock Northern Star is authorized to issue to 1,300,000,000 shares, as opposed to the current number of 150,000,000 shares, and to remove the provisions for Northern Star’s current Class B Common Stock (the shares of which will all convert into shares of Class A Common Stock in connection with the Business |

Table of Contents

| Combination) so that the Class B Common Stock will cease to exist and Northern Star will have a single class of common stock (Proposal No. 4); |

| (iii) | remove the right of stockholders of Northern Star to act without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of the outstanding common stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares of common stock were present and voted (Proposal No. 5); |

| (iv) | add supermajority voting provisions applicable after such time as PEAK6 Investments LLC (“PEAK6”), PEAK6 Group LLC (“PEAK6 Group”) and their respective affiliates no longer beneficially own more than 50% of the then outstanding shares of the capital stock of New Apex, requiring the affirmative vote of the holders of 75% of the voting power of all of the then outstanding shares of the capital stock of New Apex to amend certain provisions of the certificate of incorporation and to adopt, amend or repeal any provision of the bylaws (Proposal No. 6); and |

| (v) | remove the various provisions applicable only to special purpose acquisition companies (such as the obligation to dissolve and liquidate if a business combination is not consummated within a certain period of time) and make certain other immaterial changes that the Northern Star board deems appropriate (Proposal No. 7)—we refer to Proposals 3, 4, 5, 6 and 7, collectively, as the “charter proposals”; |

| (4) | Proposal No. 8—The Director Election Proposal—to elect seven directors who, upon the closing of the Business Combination, will be the directors of New Apex—we refer to this proposal as the “director election proposal”; |

| (5) | Proposal No. 9—The Incentive Equity Plan Proposal—to consider and vote upon a proposal to approve the 2021 Incentive Equity Plan (the “2021 Plan”), which is an incentive compensation plan for employees and other service providers of Northern Star and its subsidiaries, including, after the Mergers, Apex Fintech and its subsidiaries—we refer to this proposal as the “incentive plan proposal”; and |

| (6) | Proposal No. 10—The Adjournment Proposal—to consider and vote upon a proposal to adjourn the special meeting to a later date or dates if it is determined by the officer presiding over the special meeting that more time is necessary for Northern Star to consummate the Mergers and the other transactions contemplated by the Merger Agreement—we refer to this proposal as the “adjournment proposal.” |

We also will transact any other business as may properly come before the special meeting or any adjournment or postponement thereof.

The items of business listed above are more fully described elsewhere in the proxy statement/prospectus. Whether or not you intend to attend the special meeting, we urge you to read the attached proxy statement/prospectus in its entirety, including the annexes and accompanying financial statements, before voting. IN PARTICULAR, WE URGE YOU TO CAREFULLY READ THE SECTION IN THE PROXY STATEMENT/PROSPECTUS ENTITLED “RISK FACTORS.”

Only holders of record of Northern Star’s Class A and Class B common stock (collectively, “Northern Star common stock”) at the close of business on , 2021 (the “record date”) are entitled to notice of the special meeting and to vote and have their votes counted at the special meeting and any adjournments or postponements of the special meeting.

After careful consideration, Northern Star’s board of directors has determined that each of the business combination proposal, the PIPE proposal, the charter proposals, the election of the seven nominees identified in this proxy statement/prospectus to serve as directors, the incentive plan proposal and the adjournment proposal is fair to and in the best interests of Northern Star and its stockholders and unanimously recommends that you vote

Table of Contents

or give instruction to vote “FOR” the business combination proposal, “FOR” the PIPE proposal, “FOR” each of the charter proposals, “FOR” the election of the seven director nominees identified in this proxy statement/prospectus, “FOR” the incentive plan proposal and “FOR” the adjournment proposal, if presented. When you consider the recommendations of Northern Star’s board of directors, you should keep in mind that Northern Star’s directors and officers may have interests in the Business Combination that conflict with, or are different from, your interests as a stockholder of Northern Star. See the section entitled “The Business Combination Proposal—Interests of the Sponsor and Northern Star’s Directors and Officers in the Business Combination.”

The closing of the Business Combination is conditioned on approval of the business combination proposal, the PIPE proposal, the charter proposals, the incentive plan proposal and the director election proposal. If any of the proposals is not approved and the applicable closing condition in the Merger Agreement is not waived, the remaining proposals will not be presented to stockholders for a vote.

All Northern Star stockholders are cordially invited to attend and participate in the special meeting by accessing the meeting web portal located at https://www. .com/ . To ensure your representation at the special meeting, however, you are urged to complete, sign, date and return the enclosed proxy card as soon as possible. If you are a holder of record of Northern Star common stock on the record date, you may also cast your vote at the special meeting. If your Northern Star common stock is held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your shares or, if you wish to attend the special meeting, obtain a proxy from your broker or bank.

A complete list of Northern Star stockholders of record entitled to vote at the special meeting will be available for ten days before the special meeting at the principal executive offices of Northern Star for inspection by stockholders during business hours for any purpose germane to the special meeting.

Your vote is important regardless of the number of shares you own. Whether you plan to attend the special meeting virtually or not, please complete, sign, date and return the enclosed proxy card as soon as possible in the envelope provided. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly voted and counted.

If you have any questions or need assistance voting your common stock, please contact D.F. King & Co., Inc., our proxy solicitor, by calling , or banks and brokers can call collect at . Questions can also be sent by email to @dfking.com. This notice of special meeting is and the proxy statement/prospectus relating to the Business Combination will be available at https://www. .com/ .

Thank you for your participation. We look forward to your continued support.

| By Order of the Board of Directors |

| Joanna Coles |

| Chief Executive Officer |

, 2021

IF YOU RETURN YOUR SIGNED PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS.

ALL HOLDERS (THE “PUBLIC STOCKHOLDERS”) OF SHARES OF NORTHERN STAR CLASS A COMMON STOCK ISSUED IN NORTHERN STAR’S INITIAL PUBLIC OFFERING (THE “PUBLIC SHARES”) HAVE THE RIGHT TO HAVE THEIR PUBLIC SHARES REDEEMED FOR CASH IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION. PUBLIC STOCKHOLDERS ARE NOT REQUIRED TO AFFIRMATIVELY VOTE FOR OR AGAINST THE BUSINESS COMBINATION PROPOSAL, TO VOTE ON THE BUSINESS COMBINATION PROPOSAL AT ALL,

Table of Contents

OR TO BE HOLDERS OF RECORD ON THE RECORD DATE IN ORDER TO HAVE THEIR SHARES REDEEMED FOR CASH. THIS MEANS THAT ANY PUBLIC STOCKHOLDER HOLDING PUBLIC SHARES MAY EXERCISE REDEMPTION RIGHTS REGARDLESS OF WHETHER THEY ARE EVEN ENTITLED TO VOTE ON THE BUSINESS COMBINATION PROPOSAL.

TO EXERCISE REDEMPTION RIGHTS, HOLDERS MUST TENDER THEIR STOCK TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY, NORTHERN STAR’S TRANSFER AGENT, NO LATER THAN TWO BUSINESS DAYS PRIOR TO THE SPECIAL MEETING. YOU MAY TENDER YOUR STOCK BY EITHER DELIVERING YOUR STOCK CERTIFICATE TO THE TRANSFER AGENT OR BY DELIVERING YOUR SHARES ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DEPOSIT WITHDRAWAL AT CUSTODIAN SYSTEM. IF THE BUSINESS COMBINATION IS NOT COMPLETED, THEN THESE SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS. SEE “SPECIAL MEETING OF NORTHERN STAR STOCKHOLDERS—REDEMPTION RIGHTS” FOR MORE SPECIFIC INSTRUCTIONS.

Table of Contents

| ii | ||||

| v | ||||

| 1 | ||||

| 4 | ||||

| 15 | ||||

| 35 | ||||

| SELECTED COMBINED CONSOLIDATED FINANCIAL DATA OF APEX FINTECH |

36 | |||

| SELECTED UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

37 | |||

| 39 | ||||

| 41 | ||||

| 87 | ||||

| 108 | ||||

| 116 | ||||

| 133 | ||||

| 135 | ||||

| 137 | ||||

| 148 | ||||

| 151 | ||||

| 158 | ||||

| 159 | ||||

| 169 | ||||

| APEX FINTECH’S MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

185 | |||

| 207 | ||||

| 212 | ||||

| 220 | ||||

| INFORMATION ON NORTHERN STAR AND APEX SECURITIES AND DIVIDENDS |

236 | |||

| 236 | ||||

| 237 | ||||

| 237 | ||||

| 237 | ||||

| 237 | ||||

| 238 | ||||

| F-1 |

Annexes

| A-1 | ||||

| Annex B – Second Amended and Restated Certificate of Incorporation |

B-1 | |||

| C-1 |

You should rely only on the information contained or incorporated by reference in this proxy statement/prospectus in determining whether to vote in favor of the Business Combination and the other proposals. No one has been authorized to provide you with information that is different from that contained in this proxy statement/prospectus. This proxy statement/prospectus is dated , 2021. You should not assume that the information contained or incorporated by reference in this proxy statement/prospectus is accurate as of any date other than that date. Neither the mailing of this proxy statement/prospectus to Northern Star securityholders nor the issuance by Northern Star of its common stock in connection with the Business Combination will create any implication to the contrary.

i

Table of Contents

As used in this proxy statement/prospectus:

| • | “2023 Notes” means the convertible senior notes due 2023 issued by Apex Fintech on February 19, 2021 to certain investors with an aggregate initial principal amount of $100 million (plus up to $20 million additional principal amount that may be issuable under the related purchase agreement); |

| • | “Apex” means Apex Clearing Corporation, a Delaware corporation and wholly owned subsidiary of AFS; |

| • | “Apex Crypto” means Apex Crypto LLC, a Delaware limited liability company and wholly owned subsidiary of PEAK6, which is under contract to become a wholly owned subsidiary of AFS; |

| • | “Apex Fintech” or “AFS” means Apex Fintech Solutions LLC, a Delaware limited liability company; |

| • | “Apex Pro” means Electronic Transaction Clearing, Inc., a Delaware corporation and wholly owned subsidiary of AFS; |

| • | “B/Ds” means, Apex and Apex Pro, the registered broker-dealer subsidiaries of AFS; |

| • | “Business Combination” means the Mergers and the other transactions contemplated by the Merger Agreement; |

| • | “Charter” means the second amended and restated certificate of incorporation of New Apex following the Mergers; |

| • | “client” means a firm that is a customer of AFS or one of its subsidiaries; |

| • | “Code” means the Internal Revenue Code of 1986, as amended; |

| • | “combined company” means Northern Star following the closing of the Business Combination (at which time, subject to stockholder approval, Northern Star will be renamed “Apex Fintech Solutions, Inc.” and is referred to by us as “New Apex”); |

| • | “convertible notes” means the convertible promissory notes issued by Apex Fintech and outstanding immediately prior to the consummation of the Business Combination; |

| • | “customer” means a client’s end-consumer; |

| • | “DGCL” means the Delaware General Corporation Law, as amended; |

| • | “Exchange Act” means the Securities Exchange Act of 1934, as amended; |

| • | “Exchange Ratio” means the quotient equal to 470,000,000 divided by the number of membership interests of Apex Fintech outstanding immediately prior to the closing of the Business Combination (other than any such membership interests issued or issuable upon conversion of the 2023 Notes); |

| • | “FINRA” means the Financial Industry Regulatory Authority, Inc. |

| • | “founder shares” means the 10,062,500 shares of Northern Star’s Class B common stock that were issued prior to Northern Star’s initial public offering, 10,000,000 of which remain outstanding and will convert on a one-for-one basis into shares of Northern Star’s Class A common stock in connection with the closing of the Business Combination; |

| • | “HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended; |

| • | “initial stockholders” means the holders of the founder shares prior to Northern Star’s initial public offering; |

ii

Table of Contents

| • | “JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended; |

| • | “Marcum” means Marcum LLP, an independent registered public accounting firm serving as auditor for Northern Star; |

| • | “Mergers” means (i) the merger of Merger Sub I with and into Apex Fintech, with Apex Fintech surviving as a wholly owned subsidiary of Northern Star (the “Initial Merger”), followed immediately by (ii) the merger of Apex Fintech with and into Merger Sub II, with Merger Sub II surviving as a wholly owned subsidiary of Northern Star; |

| • | “Merger Agreement” means the Agreement and Plan of Reorganization, dated as of February 21, 2021, by and among Northern Star, Merger Sub I, Merger Sub II, Apex Fintech, and, solely for purposes of Section 5.21 of the Merger Agreement, PEAK6; |

| • | “Merger Consideration” means the aggregate number of shares of Northern Star’s common stock that the securityholders of Apex as of immediately prior to the consummation of the Initial Merger have the right to receive upon consummation of the Initial Merger; |

| • | “Merger Sub I” means NSIC II-A Merger LLC, a Delaware limited liability company and wholly owned subsidiary of Northern Star; |

| • | “Merger Sub II” means NSIC II-B Merger LLC, a Delaware limited liability company and wholly owned subsidiary of Northern Star; |

| • | “New Apex” means Northern Star (or following its name change, Apex Fintech Solutions, Inc.) after the consummation of the Business Combination, including, unless the context otherwise requires, its operating subsidiaries; |

| • | “New Apex common stock” means, after the Mergers and the effectiveness of the Charter, New Apex’s common stock; |

| • | “Northern Star” means Northern Star Investment Corp. II, a Delaware corporation, which is expected to be renamed “Apex Fintech Solutions, Inc.” upon the closing of the Business Combination (unless the context otherwise requires, references to “Northern Star” and “New Apex” after the closing of the Business Combination refer to the combined company, including its operating subsidiaries); |

| • | “Northern Star common stock” means, prior to the Mergers, Northern Star’s Class A Common Stock and Class B Common Stock, collectively; |

| • | “NYSE” means the New York Stock Exchange; |

| • | “PEAK6” means PEAK6 Investments LLC, a Delaware limited liability company; |

| • | “PEAK6 Group” means PEAK6 Group LLC, a Delaware limited liability company; |

| • | “PEAK6 Parties” means PEAK6 and PEAK6 Group; |

| • | “private warrants” means the 9,750,000 warrants of Northern Star sold to the Sponsor in a private placement that took place simultaneously with Northern Star’s initial public offering; |

| • | “public shares” means the shares of Northern Star’s Class A Common Stock included in the units issued in Northern Star’s initial public offering; |

| • | “public stockholders” means holders of public shares, including the Sponsor and Northern Star’s officers and directors to the extent they hold public shares; provided, that the holders of founder shares will be considered a “public stockholder” only with respect to any public shares held by them; |

| • | “public warrants” means the redeemable warrants exercisable for shares of Northern Star’s Class A Common Stock included in the units issued in Northern Star’s initial public offering; |

iii

Table of Contents

| • | “record date” means , 2021; |

| • | “SEC” means the United States Securities and Exchange Commission; |

| • | “Securities Act” means the Securities Act of 1933, as amended; |

| • | “special meeting” means the special meeting of the stockholders of Northern Star that is the subject of this proxy statement/prospectus; |

| • | “Sponsor” means Northern Star II Sponsor LLC, a Delaware limited liability company and an affiliate of certain of Northern Star’s officers and directors; and |

| • | “U.S. GAAP” means generally accepted accounting principles in the United States. |

iv

Table of Contents

Certain information in this proxy statement/prospectus constitutes forward-looking statements within the definition of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”). However, because Northern Star is a “blank check” company, the safe-harbor provisions of the PSLRA do not apply to statements made in this proxy statement/prospectus. You can identify these statements by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,” “estimate,” “intend,” “project,” “budget,” “forecast,” “anticipate,” “plan,” “may,” “will,” “could,” “should,” “predict,” “potential,” and “continue” or similar words. You should read statements that contain these words carefully because they:

| • | discuss future expectations; |

| • | contain projections of future results of operations or financial condition; or |

| • | state other “forward-looking” information. |

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement/prospectus.

All forward-looking statements included herein attributable to any of Northern Star, Apex Fintech or any person acting on either party’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, Northern Star and Apex Fintech undertake no obligations to update these forward-looking statements to reflect events or circumstances after the date of this proxy statement/prospectus or to reflect the occurrence of unanticipated events.

Northern Star believes it is important to communicate its expectations to its security-holders. However, there may be events in the future that Northern Star is not able to predict accurately or over which it has no control. The section in this proxy statement/prospectus entitled “Risk Factors”, “Apex’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the other cautionary language discussed in this proxy statement/prospectus provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by Northern Star in such forward-looking statements.

Before you grant your proxy or instruct your bank or broker how to vote, or vote on the business combination proposal, the PIPE proposal, the charter proposals, the director election proposal, the incentive plan proposal or the adjournment proposal, you should be aware that the occurrence of the events described in the “Risk Factors” section and elsewhere in this proxy statement/prospectus may adversely affect New Apex and/or Apex Fintech.

v

Table of Contents

SUMMARY OF THE MATERIAL TERMS OF THE MERGERS

| • | The parties to the Merger Agreement are Northern Star, Merger Sub I, Merger Sub II, Apex Fintech and, solely for the purposes of Section 5.21 therein, PEAK6. On the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub I will merge with and into Apex Fintech, with Apex Fintech surviving as a wholly owned subsidiary of Northern Star (the “Initial Merger”). In connection with the Initial Merger, the members of Apex Fintech will become stockholders of Northern Star. Immediately following the Initial Merger and as part of a single integrated transaction, Apex Fintech will merge with and into Merger Sub II, with Merger Sub II surviving as a wholly owned subsidiary of Northern Star. See the sections entitled “The Business Combination Proposal” and “The Merger Agreement.” |

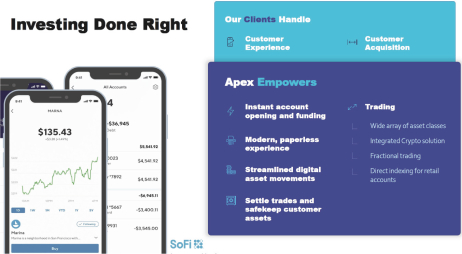

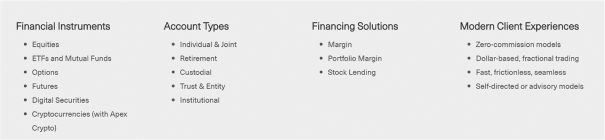

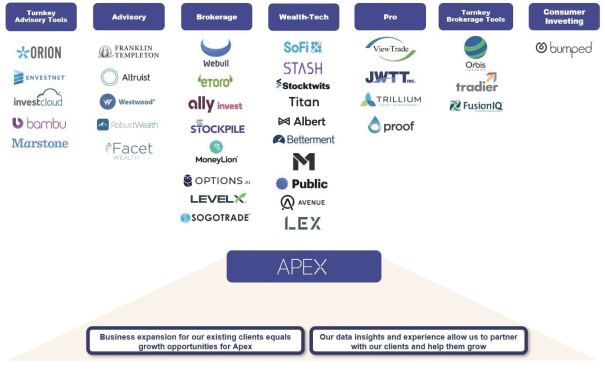

| • | Apex Fintech is the parent company of Apex, a custody and clearing engine that’s powering the future of digital wealth management, and Apex Pro, a trusted clearing partner to broker-dealers, alternative trading systems (“ATS”), routing firms, professional trading firms, hedge funds, institutions and emerging managers. Apex Fintech is the “fintech for fintechs,” — the business-to-business (“B2B”) platform that powers innovation in fintech, investing, and wealth management. Apex Fintech provides a modern, mission-critical suite of solutions to its clients, in turn enabling them to revolutionize digital finance and democratize investing. |

| • | Pursuant to the Merger Agreement, at the time of the Initial Merger, each issued and outstanding membership interest of Apex Fintech (excluding the membership interests issuable upon conversion of the 2023 Notes, as more fully described in this proxy statement/prospectus) will be automatically converted into the right to receive a number of shares of New Apex common stock equal to the Exchange Ratio. We presently estimate that the Exchange Ratio will be . See the section entitled “The Business Combination Proposal—Structure of the Merger.” |

| • | The 2023 Notes shall, in accordance with their terms, become convertible into shares of New Apex common stock at an initial conversion price of $10.00 per share. See the section entitled “The Business Combination Proposal—Structure of the Merger—Consideration to Apex Fintech Securityholders.” |

| • | In connection with the execution of the Merger Agreement, Northern Star entered into subscription agreements with certain investors (the “PIPE Investors”), pursuant to which such PIPE Investors have agreed to purchase an aggregate of 45,000,000 shares of New Apex common stock in a private placement at a price of $10.00 per share for an aggregate commitment of $450,000,000 (the “PIPE Transaction”). The closing of the PIPE Transaction is expected to take place substantially concurrently with the closing of the Mergers. The closing of the subscription agreements is subject to certain conditions, including, among other things, the substantially concurrent closing of the Mergers. For more information about the subscription agreements and the PIPE Transaction, please see the sections entitled “The Business Combination Proposal—Related Agreements—Subscription Agreements for PIPE Transaction”, “The PIPE Proposal” and “Certain Relationships and Related Person Transactions—Northern Star Related Person Transactions—Subscription Agreements.” |

| • | Assuming that the 2023 Notes are not converted prior to the closing and no holder of Northern Star’s public shares exercises redemption rights as described in this proxy statement/prospectus, immediately after the closing of the Business Combination, the former owners of Apex Fintech’s membership interests will hold approximately 83% of the issued and outstanding New Apex common stock, the PIPE Investors will hold approximately 8% of the issued and outstanding New Apex common stock, and the current stockholders of Northern Star will hold approximately 9% of the issued and outstanding New Apex common stock. See the section entitled “The Business Combination Proposal—Structure of the Merger.” |

| • | Certain of Apex Fintech’s members have entered or will enter into a lock-up agreement (“Lock-Up Agreement”), which provides that shares of New Apex common stock to be issued to |

1

Table of Contents

| them in the Mergers will be subject to a 12-month lock-up period, during which, subject to certain exceptions, they will not, directly or indirectly, sell, transfer or otherwise dispose of their shares to be issued in the Initial Merger, which period may be earlier terminated if the reported closing sale price of the New Apex common stock equals or exceeds $15.00 per share (subject to adjustment for stock splits, stock dividends, reorganizations, recapitalizations or other similar transactions) for a period of 20 trading days during any 30-trading-day period commencing at least 150 days following the consummation of the Mergers. In addition, Northern Star has agreed to cause its initial stockholders to amend the existing lock-up restrictions applicable to them and enter into agreements substantially identical to the Lock-Up Agreement, so that the lock-up restrictions with respect to the initial stockholders’ New Apex common stock will be identical to the lock-up restrictions applicable to Apex Fintech’s members who have entered, or will enter, into the Lock-Up Agreement. Furthermore, pursuant to a letter agreement executed in connection with Northern Star’s initial public offering, the private warrants will not be transferable, assignable or salable by the Sponsor until 30 days after the completion of Northern Star’s initial business combination. See the section entitled “The Business Combination Proposal—Structure of the Merger.” |

| • | The Merger Agreement provides that either Northern Star or Apex Fintech may terminate the Merger Agreement if the Mergers have not been consummated on or before November 30, 2021, provided that the right to terminate the Merger Agreement will not be available to any party whose action or failure to act has been a principal cause of or primarily resulted in the failure of the Mergers to occur on or before such date and such action or failure to act constitutes a breach of the Merger Agreement. See the section entitled “The Merger Agreement—Termination.” |

| • | In addition to voting on proposals to approve the Merger Agreement and the Mergers and the issuance of more than 20% of the issued and outstanding shares of the Class A Common Stock in connection with the Mergers and the PIPE Transaction, the stockholders of Northern Star will vote on proposals to: (i) approve amendments to Northern Star’s current amended and restated certificate of incorporation (a) to change the name of Northern Star to “Apex Fintech Solutions, Inc.”, (b) to increase the number of shares of common stock Northern Star is authorized to issue to 1,300,000,000 shares and to remove the provisions for Northern Star’s current Class B Common Stock (the shares of which will all convert into shares of Class A Common Stock in connection with the Business Combination) so that the Class B Common Stock will cease to exist and Northern Star will have a single class of common stock, (c) to remove the right of stockholders of Northern Star to act without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of the outstanding common stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares of common stock were present and voted, (d) to add supermajority voting provisions applicable after such time as the PEAK6 Parties and their affiliates no longer beneficially own more than 50% of the then outstanding shares of the capital stock of New Apex, requiring the affirmative vote of the holders of 75% of the voting power of all of the then outstanding shares of the capital stock of New Apex to amend certain provisions of the second amended and restated certificate of incorporation and to adopt, amend or repeal any provision of the bylaws, and (d) to remove the various provisions applicable only to special purpose acquisition companies (such as the obligation to dissolve and liquidate if a business combination is not consummated within a certain period of time) and make certain other immaterial changes that the Northern Star board deems appropriate; (ii) elect seven directors who, upon the closing of the Business Combination, will be the directors of New Apex; (iii) approve the 2021 Plan; and (iv) adjourn the special meeting to a later date or dates, if it is determined by the officer presiding over the special meeting that more time is necessary for Northern Star to consummate the Mergers and the other transactions contemplated by the Merger Agreement. The approval of these proposals (other than the adjournment proposal) by the stockholders of Northern Star is a condition to the consummation of the Business Combination. |

2

Table of Contents

| See the sections entitled “The Charter Proposals,” “The Director Election Proposal,” “The Incentive Plan Proposal” and “The Adjournment Proposal.” |

| • | Pursuant to the terms of the Merger Agreement, the parties thereto have agreed to nominate the following persons to serve as the initial directors of New Apex upon the closing of the Business Combination: as Class A directors serving until Northern Star’s 2022 special meeting of stockholders, Joanna Coles and ; as Class B directors serving until Northern Star’s 2023 special meeting of stockholders, and ; and as Class C directors serving until Northern Star’s 2024 special meeting of stockholders, William Capuzzi, Matthew Hulsizer and Jennifer Just. See the section entitled “The Director Election Proposal.” |

| • | Upon completion of the Mergers, the executive officers of New Apex will include William Capuzzi, as Chief Executive Officer, Tricia Rothschild, as President, Christopher Springer, as Chief Financial Officer, and the other persons described under “The Director Election Proposal—Information about Executive Officers, Directors and Nominees.” |

| • | Certain members of Apex Fintech, holders of the 2023 Notes and stockholders of Northern Star will enter into a registration rights agreement (the “Registration Rights Agreement”), pursuant to which they will be granted certain rights to have registered, in certain circumstances, the resale under the Securities Act of certain shares of New Apex common stock held by them, subject to certain conditions set forth therein. Northern Star will terminate its existing registration rights agreement with the Northern Star initial stockholders. See the section entitled “The Business Combination Proposal—Related Agreements.” |

| • | In connection with the execution of the Merger Agreement, certain members of Apex Fintech (the “Supporting Holders”) holding more than 50% of the issued and outstanding membership interests of Apex Fintech, have entered into agreements with Northern Star (the “Support Agreements”) pursuant to which the Supporting Holders have agreed, among other things, to vote all of the membership interests in Apex Fintech beneficially owned by them in favor of the Mergers at a meeting called to approve the Mergers by the members of Apex Fintech (or in an action by written consent approving the Mergers). In connection with the execution of the Merger Agreement, the Sponsor and each officer and director of Northern Star who, in the aggregate (together with the Sponsor) hold approximately 20% of the issued and outstanding Northern Star common stock, entered into agreements with Apex Fintech (the “Sponsor Support Agreements”) pursuant to which the Sponsor and such other parties have agreed, among other things, to vote all Northern Star common stock beneficially owned by them to adopt and approve the Merger Agreement, the Mergers, and the other documents and transactions contemplated by the Merger Agreement. See the section entitled “The Business Combination Proposal—Related Agreements.” |

3

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE PROPOSALS

The questions and answers below highlight only selected information set forth elsewhere in this proxy statement/prospectus and only briefly address some commonly asked questions about the special meeting and the proposals to be presented at the special meeting, including with respect to the proposed Business Combination. The following questions and answers do not include all the information that may be important to Northern Star stockholders. Stockholders are urged to carefully read this entire proxy statement/prospectus, including the annexes and the other documents referred to or incorporated by reference herein, to fully understand the proposed Business Combination and the voting procedures for the special meeting.

| Q. | Why am I receiving this proxy statement/prospectus? |

| A. | Northern Star and Apex Fintech have agreed to a business combination under the terms of the Merger Agreement that is described in this proxy statement/prospectus. A copy of the Merger Agreement is attached to this proxy statement/prospectus as Annex A and Northern Star encourages its stockholders to read it in its entirety. Northern Star’s stockholders are being asked to consider and vote upon a proposal to approve and adopt the Merger Agreement and the Mergers, including (1) the merger of Merger Sub I with and into Apex Fintech, with Apex Fintech surviving as a wholly owned subsidiary of Northern Star (the “Initial Merger”), (2) immediately following the Initial Merger and as part of a single integrated transaction as the Mergers, the merger of Apex Fintech with and into Merger Sub II , with Merger Sub II surviving as a wholly owned subsidiary of Northern Star, and (3) the issuance of shares of New Apex common stock to members of Apex Fintech in the Initial Merger. We refer to this proposal as the “business combination proposal.” See the section entitled “The Business Combination Proposal.” |

| Q. | Are there any other matters being presented to stockholders at the meeting? |

| A. | In addition to voting on the business combination proposal, the stockholders of Northern Star will vote on the following: |

| 1. | A proposal to approve the issuance of an aggregate of 45,000,000 shares of New Apex common stock in the PIPE Transaction, the closing of which is subject to certain conditions, including, among other things, the substantially concurrent closing of the Mergers. We refer to this proposal as the “PIPE proposal.” See the section entitled “The PIPE Proposal.” |

| 2. | Separate proposals to approve amendments to Northern Star’s current amended and restated certificate of incorporation to: (i) change the name of Northern Star to “Apex Fintech Solutions, Inc.”, as opposed to the current name of “Northern Star Investment Corp. II”; (ii) increase the number of shares of common stock Northern Star is authorized to issue to 1,300,000,000 shares, as opposed to the current number of 150,000,000 shares, and remove the provisions for Northern Star’s current Class B Common Stock (the shares of which will all convert into shares of Class A Common Stock in connection with the Business Combination) so that the Class B Common Stock will cease to exist and Northern Star will have a single class of common stock; (iii) remove the right of stockholders of Northern Star to act without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of the outstanding common stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares of common stock were present and voted; (iv) add supermajority voting provisions applicable after such time as the PEAK6 Parties and their affiliates no longer beneficially own more than 50% of the then outstanding shares of the capital stock of New Apex, requiring the affirmative vote of the holders of 75% of the voting power of all of the then outstanding shares of the capital stock of New Apex to amend certain provisions of the second amended and restated certificate of incorporation and to adopt, amend or repeal any provision of the bylaws; and (v) remove the various provisions applicable only to special purpose acquisition corporations (such as the obligation to dissolve and liquidate if a business combination is not consummated within a certain period of time) and make certain other immaterial changes that the Northern Star board deems appropriate. We refer to these proposals collectively as |

4

Table of Contents

| the “charter proposals.” A copy of Northern Star’s proposed second amended and restated certificate of incorporation effectuating the foregoing amendments is attached to this proxy statement/prospectus as Annex B. See the section entitled “The Charter Proposals.” |

| 3. | A proposal to elect seven directors who, upon the closing of the Business Combination, will be the directors of New Apex. We refer to this proposal as the “director election proposal.” See the section entitled “The Director Election Proposal.” |

| 4. | A proposal to approve the 2021 Plan. We refer to this proposal as the “incentive plan proposal.” A copy of the 2021 Plan is attached to this proxy statement/prospectus as Annex C. See the section entitled “The Incentive Plan Proposal.” |

| 5. | A proposal to adjourn the special meeting to a later date or dates if it is determined by the officer presiding over the special meeting that more time is necessary for Northern Star to consummate the Mergers and the other transactions contemplated by the Merger Agreement. We refer to this proposal as the “adjournment proposal.” See the section entitled “The Adjournment Proposal.” |

Northern Star will hold the special meeting of its stockholders to consider and vote upon these proposals. This proxy statement/prospectus contains important information about the proposals, the proposed Business Combination and the other matters to be acted upon at the special meeting. Stockholders should read it carefully.

The closing of the Business Combination is conditioned on approval of the business combination proposal, the PIPE proposal, the charter proposals and the incentive plan proposal and on the election of the seven nominees identified in this proxy statement/prospectus to serve as directors of New Apex. If any of the proposals is not approved or the director nominees are not elected, and the applicable closing condition in the Merger Agreement is not waived, the remaining proposals will not be presented to stockholders for a vote.

The vote of stockholders is important. Regardless of how many shares you own, you are encouraged to vote as soon as possible after carefully reviewing this proxy statement/prospectus.

| Q: | Why is Northern Star providing stockholders with the opportunity to vote on the Business Combination? |

| A: | In connection with the Business Combination, we may issue up to an estimated maximum of 470,000,000 shares of New Apex common stock, representing up to approximately 1,175% of the shares of Northern Star common stock outstanding on the date of this proxy statement/prospectus. NYSE Listing Rules require stockholder approval of certain transactions that result in the issuance of 20% or more of a company’s outstanding voting power or shares of common stock outstanding before the issuance of stock or securities and for any issuance that results in a change in control. Because we may issue 20% or more of our outstanding voting power and outstanding common stock in connection with the Business Combination and such issuance will result in a change in control, we are required to obtain stockholder approval of such issuances pursuant to NYSE Listing Rules. Similarly, in connection with the PIPE Transaction, we may issue 45,000,000 shares of New Apex common stock, representing up to an estimated 112.5% of the shares of Northern Star common stock outstanding on the date of this proxy statement/prospectus. Approval of Northern Star’s stockholders is also required for the adoption of Northern Star’s second amended and restated certificate of incorporation, for adoption of the 2021 Plan under the NYSE Listing Rules, and to enable Northern Star to issue incentive stock options under the 2021 Plan. The closing of the Business Combination is conditioned on the approval of the business combination proposal, the PIPE proposal, the charter proposals, the incentive plan proposal and on the election of the seven nominees identified in this proxy statement/prospectus to serve as directors of New Apex at the special meeting. |

| Q. | I am a Northern Star warrant holder. Why am I receiving this proxy statement/prospectus? |

| A. | The holders of Northern Star warrants are entitled to purchase Northern Star common stock or New Apex common stock, as applicable, at a purchase price of $11.50 per share beginning on the later of January 28, 2022 and 30 days after the closing of the Business Combination. This proxy statement/prospectus includes |

5

Table of Contents

| important information about Northern Star and the business of Northern Star and its subsidiaries following the closing of the Business Combination. Because holders of Northern Star warrants will be entitled to purchase Northern Star common stock or New Apex common stock, as applicable, beginning on the later of January 28, 2022 and 30 days after the closing of the Business Combination, we urge you to read the information contained in this proxy statement/prospectus carefully. |

| Q. | What will happen to Northern Star’s securities upon consummation of the Business Combination? |

| A. | Northern Star’s units, Class A Common Stock and warrants are currently listed on the NYSE under the symbols NSTB.U, NSTB and NSTB WS, respectively. Northern Star intends to apply for listing on the NYSE of the New Apex common stock and warrants, under the proposed symbols APX and APX WS, respectively, to be effective at the consummation of the Business Combination. Northern Star’s units will not be listed on the NYSE following consummation of the Business Combination and such units will automatically be separated into their component securities without any action needed to be taken on the part of the holders of such units. Furthermore, each outstanding share of Northern Star’s Class B Common Stock will convert into one share of Class A Common Stock at the closing of the Business Combination, the Class B Common Stock will cease to exist and Northern Star will have a single class of common stock. |

It is a condition to the consummation of the Business Combination that the shares of New Apex common stock to be issued in the Initial Merger are approved for listing on the NYSE (subject only to official notice of issuance thereof and public holder requirements), but there can be no assurance such listing condition will be met. If such listing condition is not met, the Business Combination will not be consummated unless the listing condition is waived by the parties to the Merger Agreement.

Northern Star warrant holders and those stockholders who do not elect to have their Northern Star shares redeemed for a pro rata share of the trust account need not submit their common stock or warrant certificates, and such shares and warrants will remain outstanding.

| Q. | Why is Northern Star proposing the Business Combination? |

| A. | Northern Star was organized to effect a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities. |

On January 28, 2021, Northern Star completed its initial public offering of units, with each unit consisting of one share of Class A Common Stock and one-fifth of one redeemable warrant, with each whole warrant entitling the holder to purchase one share of Class A Common Stock at a price of $11.50, raising total gross proceeds of approximately $400,000,000. Simultaneously with closing of the initial public offering, Northern Star consummated the sale of 9,750,000 private warrants at a price of $1.00 per warrant. A total of $400,000,000 of the net proceeds was deposited into the trust account. Since its initial public offering, Northern Star’s activity has been limited to the evaluation of business combination candidates.

Apex Fintech is the parent company of Apex, a custody and clearing engine that’s powering the future of digital wealth management, and Apex Pro, a trusted clearing partner to broker-dealers, ATS’s, routing firms, professional trading firms, hedge funds, institutions and emerging managers. Apex Fintech’s proprietary enterprise-grade technology delivers speed, efficiency, and flexibility to firms ranging from innovative start-ups to blue-chip brands focused on transformation to capture a new generation of investors. Apex Fintech helps its clients provide the seamless digital experiences today’s consumers expect with the throughput and scalability needed by fast-growing, high-volume financial services businesses.

Based on Northern Star’s due diligence investigations of Apex Fintech and the industry in which Apex Fintech operates, including the financial and other information provided by Apex Fintech to Northern Star in the course of evaluating a business combination with Apex Fintech and negotiating the Merger Agreement, Northern Star believes that Apex Fintech has a very appealing market opportunity and growth profile, strong position in its industry and a compelling valuation. As a result, Northern Star believes that a business combination with Apex Fintech will provide Northern Star stockholders with an opportunity to participate in the ownership of a company with significant growth potential. See the section entitled “The Business Combination Proposal—Northern Star’s Board of Directors’ Reasons for Approval of the Business Combination.”

6

Table of Contents

| Q. | Did Northern Star’s board of directors obtain a third-party valuation or fairness opinion in determining whether or not to proceed with the Business Combination? |

| A. | No. Northern Star’s board of directors did not obtain a third-party valuation or fairness opinion in connection with its determination to approve the Business Combination. Accordingly, investors will be relying solely on the judgment of Northern Star’s board of directors in valuing Apex Fintech and assuming the risk that the Northern Star board may not have properly valued the business. However, Northern Star’s officers and directors have substantial experience in evaluating the operating and financial merits of companies from a wide range of industries and have substantial experience with mergers and acquisitions. Furthermore, in analyzing the Business Combination, Northern Star’s board of directors conducted significant due diligence on Apex Fintech. Based on the foregoing, Northern Star’s board of directors concluded that its members’ experience and backgrounds enabled it to make the necessary analyses and determinations regarding the Business Combination, including that the Business Combination was fair from a financial perspective to its stockholders and that Apex Fintech’s fair market value was at least 80% of the assets held in Northern Star’s trust account (net of amounts previously disbursed to management for tax obligations and excluding the amount of deferred underwriting discounts held in trust) at the time of the agreement to enter into the Business Combination. There can be no assurance, however, that Northern Star’s board of directors was correct in its assessment of the Business Combination. For a complete discussion of the factors utilized by Northern Star’s board of directors in approving the Business Combination, see the section entitled “The Business Combination Proposal.” |

| Q. | Do I have redemption rights? |

| A. | If you are a holder of public shares, you have the right to demand that Northern Star redeem such shares for a pro rata portion of the cash held in Northern Star’s trust account, calculated as of two business days prior to the consummation of the Business Combination. We sometimes refer to these rights to demand redemption of the public shares as “redemption rights.” |

Notwithstanding the foregoing, a holder of public shares, together with any affiliate of his or any other person with whom such holder is acting in concert or as a “group” (as defined in Section 13(d)(3) of the Exchange Act), will be restricted from seeking redemption rights with respect to 20% or more of the public shares. Accordingly, all public shares in excess of 20% held by a public stockholder, together with any affiliate of such holder or any other person with whom such holder is acting in concert or as a “group,” will not be redeemed.

Under Northern Star’s amended and restated certificate of incorporation, the Business Combination may not be consummated if Northern Star has net tangible assets of less than $5,000,001 either immediately prior to or upon consummation of the Business Combination, after taking into account the redemption for cash of all public shares properly demanded to be redeemed by holders of public shares, the completion of the Business Combination and the completion of the PIPE Transaction. Because the net tangible assets of the combined company will exceed this threshold as a result of the PIPE Transaction, all of the public shares may be redeemed and Northern Star can still consummate the Business Combination. However, the combined company must meet certain distribution criteria, including having a minimum of 1,100,000 publicly held shares (excluding shares held by directors, officers, their immediate family members and other concentrated holdings of 10% or more), in order to be listed on the NYSE, which is a condition to closing the Business Combination.

| Q. | How do I exercise my redemption rights? |

| A. | A holder of public shares may exercise redemption rights regardless of whether it votes for or against the business combination proposal or does not vote on such proposal at all, or if it is a holder of public shares on the record date. If you are a holder of public shares and wish to exercise your redemption rights, you must demand that Northern Star convert your public shares into cash, and deliver your public shares to Northern Star’s transfer agent physically or electronically using The Depository Trust Company’s Deposit/Withdrawal at Custodian (“DWAC”) System no later than two business days prior to the special meeting. |

7

Table of Contents

| Any holder of public shares seeking redemption will be entitled to a full pro rata portion of the amount then in the trust account (which, for illustrative purposes, was $ , or $ per share, as of the record date), less any owed but unpaid taxes on the funds in the trust account. Such amount will be paid promptly upon consummation of the Business Combination. There are currently no owed but unpaid income taxes on the funds in the trust account. |

Any request for redemption, once made by a holder of public shares, may be withdrawn at any time prior to the time the vote is taken with respect to the business combination proposal at the special meeting. If you deliver your shares for redemption to Northern Star’s transfer agent and later decide prior to the special meeting not to elect redemption, you may request that Northern Star’s transfer agent return the shares (physically or electronically). You may make such request by contacting Northern Star’s transfer agent at the address listed at the end of this section.

Any written demand of redemption rights must be received by Northern Star’s transfer agent at least two business days prior to the vote taken on the business combination proposal at the special meeting. No demand for redemption will be honored unless the holder’s stock has been delivered (either physically or electronically) to the transfer agent.

If you are a holder of public shares (including through the ownership of Northern Star units) and you exercise your redemption rights, it will not result in the loss of any Northern Star warrants that you may hold (including those contained in any units you hold). Your warrants will become exercisable to purchase one share of New Apex common stock for a purchase price of $11.50 beginning on the later of January 28, 2022 and 30 days after consummation of the Business Combination.

| Q. | Do I have appraisal rights if I object to the proposed Business Combination? |

| A. | No. Neither Northern Star stockholders nor its unit or warrant holders have appraisal rights in connection with the Business Combination under Delaware law. See the section entitled “Appraisal Rights.” |

| Q. | What happens to the funds deposited in the trust account after consummation of the Business Combination? |

| A. | Of the net proceeds of Northern Star’s initial public offering and simultaneous private placement of warrants, approximately $400,000,000 was placed in the trust account immediately following the initial public offering. After consummation of the Business Combination, the funds in the trust account will be used to pay, on a pro rata basis, holders of the public shares who exercise redemption rights, to pay fees and expenses incurred in connection with the Business Combination, and for general corporate purposes. |

| Q. | What happens if a substantial number of public stockholders vote in favor of the business combination proposal and exercise their redemption rights? |

| A. | Northern Star’s public stockholders may vote in favor of the Business Combination and still exercise their redemption rights, although they are not required to vote either for or against the Business Combination, or vote at all, in order to exercise such redemption rights. Accordingly, the Business Combination may be consummated even though the funds available from the trust account and the number of public stockholders are substantially reduced as a result of redemption by public stockholders. Although the requirement that Northern Star have at least $5,000,001 of net tangible assets will be satisfied as a result of the PIPE Transaction even if all of the public shares are redeemed, with fewer public shares and public stockholders, the trading markets for New Apex common stock and warrants following the closing of the Business Combination may be less liquid than the market for New Apex common stock and warrants were prior to the Merger, and Northern Star may not be able to meet the listing standards of the NYSE or an alternative national securities exchange, which is a condition to closing the Business Combination. For example, the combined company must meet certain distribution criteria, including having a minimum of 1,100,000 publicly held shares (excluding shares held by directors, officers, their immediate family members and other concentrated holdings of 10% or more), in order to be listed on the NYSE. In addition, with fewer funds available from the trust account, the capital infusion from the trust account into Apex’s business will be reduced and Apex may not be able to fully achieve its business plans or goals. |

8

Table of Contents

| Q. | What happens if the Business Combination is not consummated? |

| A. | If Northern Star does not complete the Business Combination with Apex Fintech for whatever reason, Northern Star would search for another target business with which to complete a business combination. If Northern Star does not complete the Business Combination with Apex Fintech or another business combination by January 28, 2023 (or such later date as may be approved by Northern Star stockholders in an amendment to its amended and restated certificate of incorporation), Northern Star must redeem 100% of the outstanding public shares, at a per-share price, payable in cash, equal to an amount then held in the trust account (net of taxes payable and less up to $100,000 of interest to pay dissolution expenses). The Sponsor and Northern Star’s officers and directors have waived their redemption rights with respect to their founder shares in the event a business combination is not effected in the required time period, and, accordingly, the founder shares held by them will be worthless. Additionally, in the event of such liquidation, there will be no distribution with respect to our outstanding warrants. Accordingly, the warrants will expire worthless. |

| Q. | How do the Sponsor and the officers and directors of Northern Star intend to vote on the proposals? |

| A. | The Sponsor, as well as Northern Star’s officers and directors, beneficially own and are entitled to vote an aggregate of 20% of the outstanding Northern Star common stock. These holders have agreed to vote their shares in favor of the business combination proposal and the other proposals being presented at the meeting and in favor of the election of the seven nominees identified in this proxy statement/prospectus to serve as directors of Northern Star. In addition to the shares of Northern Star common stock held by the Sponsor and Northern Star’s officers and directors, Northern Star would need 15,000,001, or just over 37.5%, of the 40,000,000 public shares sold in Northern Star’s initial public offering to be voted in favor of the business combination proposal, the PIPE proposal, the charter proposals, the incentive plan proposal, and the adjournment proposal in order for them to be approved (assuming all outstanding shares are voted on each proposal). |

| Q. | Will Northern Star enter into any financing arrangements in connection with the Business Combination? |

| A. | Yes. On February 21, 2021, in connection with the execution of the Merger Agreement, Northern Star entered into subscription agreements with the PIPE Investors, pursuant to which such PIPE Investors have agreed to purchase an aggregate of 45,000,000 shares of New Apex common stock in a private placement at a price of $10.00 per share for an aggregate commitment of $450,000,000. The closing of the subscription agreements is subject to certain customary conditions, including, among other things, the substantially concurrent closing of the Mergers. The purpose of the PIPE Transaction is to ensure that the combined company has a minimum amount of capital to operate its business following the transaction and for supporting New Apex’s growth, working capital requirements, capital expenditures and general corporate purposes. |

| Q. | What interests do the Sponsor and the current officers and directors of Northern Star have in the Business Combination? |

| A. | In considering the recommendation of Northern Star’s board of directors to vote in favor of the Business Combination, stockholders should be aware that, aside from their interests as stockholders, our Sponsor and certain of our directors and officers have interests in the business combination that are different from, or in addition to, those of other stockholders generally. Our directors were aware of and considered these interests, among other matters, in evaluating the Business Combination, and in recommending to stockholders that they approve the Business Combination and in agreeing to vote their shares in favor of the Business Combination. Stockholders should take these interests into account in deciding whether to approve the Business Combination. These interests include, among other things, the fact that: |

| • | If the Business Combination with Apex Fintech or another business combination is not consummated by January 28, 2023 (or such later date as may be approved by Northern Star’s stockholders), Northern Star will cease all operations except for the purpose of winding up, redeeming 100% of the outstanding public shares for cash and, subject to the approval of its |

9

Table of Contents