Table of Contents

As filed with the Securities and Exchange Commission on June 8, 2021.

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Genius Sports Limited

(Exact name of registrant as specified in its charter)

| Island of Guernsey | 7990 | 98-1583958 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Genius Sports Group

9th Floor, 10 Bloomsbury Way

London, WC1A 2SL

Telephone: +44 (0) 20 7851 4060

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Donald J. Puglisi, Esq.

Puglisi & Associates

850 Library Avenue #204

Newark, Delaware 19711

Telephone: (302) 738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Joshua N. Korff, P.C. Ross M. Leff, P.C. Aaron M. Schleicher Kirkland & Ellis LLP 601 Lexington Avenue New York, NY 10022 Telephone: (212) 446-4800 |

Joel L. Rubinstein Jonathan P. Rochwarger Elliott M. Smith White & Case LLP 1221 Avenue of the Americas New York, NY 10020 Telephone: (212) 819-8200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to registered additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Number of Shares to be Registered(1) |

Proposed Maximum Offering Price Per Unit(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Ordinary Shares, par value $0.01 per share |

23,000,000 | $20.65 | $474,950,000 | $51,817 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 3,000,000 Ordinary Shares that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low sales price of the Registrant’s Ordinary Shares as reported on the New York Stock Exchange on June 7, 2021. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information contained in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it’s not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED JUNE 8, 2021

20,000,000 Ordinary Shares

Genius Sports Limited

(a non-cellular company limited by shares incorporated and registered under the laws of the Island of Guernsey)

We are offering 12,000,000 ordinary shares. The selling shareholders identified in this prospectus are offering 8,000,000 ordinary shares. We will not receive any of the proceeds from the sale of ordinary shares by the selling shareholders pursuant to this prospectus. However, we will pay the expenses, other than underwriting discounts and commissions incurred by the selling shareholders. We intend to use the net proceeds from our offering for general corporate purposes.

Our ordinary shares and public warrants are currently listed on the New York Stock Exchange (the “NYSE”) under the symbol “GENI” and “GENI WS,” respectively. The last reported sale price of our ordinary shares on June 7, 2021 was $19.82 per share.

We are an “emerging growth company” and a “foreign private issuer” as defined under applicable federal securities laws and are subject to reduced public company reporting requirements for this prospectus and future filings. See, “Prospectus Summary—Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

Our business and an investment in our ordinary shares involves a high degree of risk. See “Risk Factors” beginning on page 25 of this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Ordinary Share |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| Proceeds to the selling shareholders, before expenses |

$ | $ | ||||||

| (1) | See the section titled “Underwriting” on page 178 for additional information regarding underwriting compensation. |

We have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to an additional 3,000,000 ordinary shares.

The underwriters expect to deliver the ordinary shares to purchasers on or about , 2021.

Book-Running Manager

Goldman Sachs & Co. LLC

Prospectus dated , 2021

Table of Contents

| 1 | ||||

| SUMMARY CONSOLIDATED HISTORICAL AND OTHER FINANCIAL INFORMATION |

22 | |||

| 24 | ||||

| 25 | ||||

| 56 | ||||

| UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

57 | |||

| 70 | ||||

| 71 | ||||

| 72 | ||||

| 73 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

75 | |||

| 100 | ||||

| 121 | ||||

| 131 | ||||

| 135 | ||||

| 138 | ||||

| 156 | ||||

| 159 | ||||

| 175 | ||||

| 178 | ||||

| 184 | ||||

| 185 | ||||

| 185 | ||||

| 185 | ||||

| F-1 |

i

Table of Contents

ABOUT THIS PROSPECTUS

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “Genius,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to (i) Genius Sports Limited and its consolidated subsidiaries after the Closing, (ii) Maven Topco Limited and its consolidated subsidiaries prior to the Closing and after the Apax Funds Investment and (iii) Genius Sports Group Limited and its consolidated subsidiaries prior to the Apax Funds Investment. Genius Sports Limited, previously known as Galileo NewCo Limited, is the new combined company in connection with the Business Combination, in which shareholders of Genius and dMY exchanged their shares for shares in Genius Sports Limited.

Neither we nor the underwriters or selling shareholders have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. Neither we nor the underwriters or selling shareholders take any responsibility for, or provide any assurance as to the reliability of, any other information that others may give you. Neither we nor the underwriters or selling shareholders are making an offer to sell the ordinary shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of the ordinary shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

For investors outside the United States: neither we nor the underwriters or selling shareholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus outside the United States.

ii

Table of Contents

FREQUENTLY USED TERMS

Unless otherwise stated in this prospectus or the context otherwise requires, references to:

“Apax Funds” means certain funds the ultimate general partners of which are advised by Apax Partners LLP.

“Apax Funds Investment” means Topco’s acquisition of all of the issued and outstanding equity interests of Genius Sports Group Limited on September 7, 2018, following of which Genius Sports Group Limited, inclusive of its wholly-owned subsidiaries, became wholly-owned subsidiaries of Topco.

“B shares” means B shares of Genius, par value $0.0001.

“Business Combination” means the transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated as of October 27, 2020, by and among dMY, TopCo, MidCo, Genius, Merger Sub and Sponsor, a copy of which is filed as Exhibit 2.1 to the registration statement of which this prospectus forms a part, and as may be amended from time to time.

“Class A Shares” means dMY’s Class A common stock, par value $0.0001.

“Class B Shares” means dMY’s Class B common stock, par value $0.0001.

“Closing” means the closing of the Business Combination.

“Continental” means Continental Stock Transfer & Trust Company.

“DGCL” means the Delaware General Corporation Law as the same may be amended from time to time.

“dMY” means dMY Technology Group, Inc. II, a Delaware corporation.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Genius” means Genius Sports Limited.

“Genius Board” means the board of directors of Genius.

“Genius Governing Documents” means the Genius Amended and Restated Memorandum of Incorporation and the Genius Amended and Restated Articles of Incorporation.

“Genius ordinary shares” means the ordinary shares of Genius, par value $0.01.

“Genius Sports Group” means Genius Sports Group Limited, a private limited company incorporated under the laws of England and Wales.

“Guernsey Companies Law” means the Companies (Guernsey) Law, 2008 (as amended).

“IPO” means dMY’s August 18, 2020 initial public offering of units, with each unit consisting of one Class A Share and one-third of one warrant, raising total gross proceeds of approximately $276,000,000.

“Merger Sub” means Genius Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Genius.

“MidCo” means Maven Midco Limited, a private limited company incorporated under the laws of England and Wales.

“NewCo” means Galileo NewCo Limited, a company incorporated under the laws of Guernsey, and its subsidiaries when the context requires, that changed its name to Genius Sports Limited in connection with the Business Combination.

iii

Table of Contents

“NFL Warrants” means the warrants issued to NFL Enterprises LLC, with each such warrant entitling the holder thereof to purchase one Genius ordinary share at a price of $0.01 per Genius ordinary share.

“NYSE” means the New York Stock Exchange.

“private placement warrants” means the warrants issued to the Sponsor in a private placement simultaneously with the closing of the IPO, with each such warrant entitling the holder thereof to purchase one Class A Share at a price of $11.50 per share.

“public warrants” means the 9,200,000 redeemable warrants sold as part of the units in the IPO.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Sponsor” means dMY Sponsor II, LLC, a Delaware limited liability company.

“Target Companies” means, collectively, TopCo, MidCo, Genius, Merger Sub and all direct and indirect subsidiaries of TopCo.

“TopCo” means Maven Topco Limited, a company incorporated under the laws of Guernsey.

“Transfer Agent” means Continental Stock Transfer & Trust Company.

“warrants” means the private placement warrants, public warrants and NFL Warrants.

iv

Table of Contents

EXPLANATORY NOTE

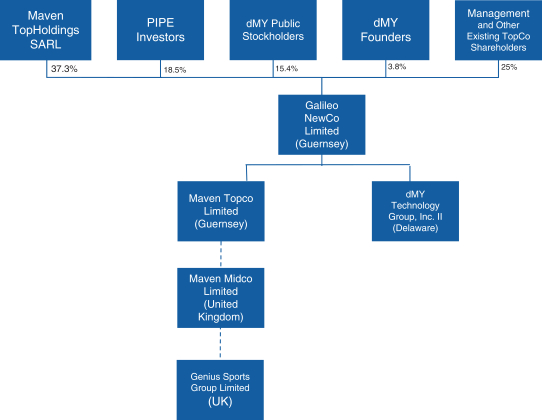

On October 27, 2020, dMY Technology Group, Inc. II, a Delaware corporation (“dMY”), entered into a Business Combination Agreement (the “Business Combination Agreement”) with Maven Topco Limited, a company incorporated under the laws of Guernsey (the “TopCo”), Maven Midco Limited, a private limited company incorporated under the laws of England and Wales (“MidCo”), Genius Sports Limited, a company incorporated under the laws of Guernsey (f/k/a Galileo NewCo Limited) (“Genius”), Genius Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Genius (“Merger Sub” and, together with TopCo, MidCo and Genius, the “Target Companies”), and dMY Sponsor II, LLC, a Delaware limited liability company (the “Sponsor”). The transactions contemplated by the Business Combination are referred to herein as the “Business Combination.”

Pursuant to the Business Combination Agreement, at the closing of the Business Combination (the “Closing”), Genius underwent a pre-closing reorganization (the “Reorganization”) wherein all existing classes of shares of TopCo (except for certain preference shares of TopCo which were redeemed and cancelled as part of the Reorganization (the “Redemption”)) were exchanged for newly issued ordinary shares of Genius (“Genius ordinary shares”). As described in the Business Combination Agreement, solely with respect to the shares of TopCo that were unvested prior to such reorganization and because the holders of such shares executed and delivered support agreements agreeing to the vesting and restrictions provisions therein, such shares were exchanged for Genius ordinary shares but are still subject to the vesting and restrictions as set forth therein (“Restricted Shares”).

Pursuant to the Business Combination Agreement, subject to the satisfaction or waiver of certain conditions set forth therein, the following has occurred: (a) dMY’s issued and outstanding shares of Class B Shares, subject to the terms of the Founder Holder Consent Letter (as defined and described below), have converted automatically on a one-for-one basis into Class A Shares; and (b) Merger Sub has merged with and into dMY, with dMY continuing as the surviving company, as a result of which (i) dMY has become a wholly-owned subsidiary of Genius; (ii) each issued and outstanding unit of dMY, consisting of one Class A Share and one-third of one warrant (the “dMY warrants”), were automatically detached, (iii) each issued and outstanding Class A Share was converted into the right to receive one Genius ordinary share; (iv) each issued and outstanding dMY warrant to purchase a share of dMY Class A common stock have become exercisable for one Genius ordinary share (the “Genius warrants”); and (v) NewCo changed its name to Genius Sports Limited.

Concurrently with the execution of the Business Combination Agreement, Genius and dMY entered into certain subscription agreements, each dated October 27, 2020 (the “Subscription Agreements”), with a number of accredited and institutional investors (the “PIPE Investors”), including the Caledonia US Funds, pursuant to which such PIPE Investors subscribed to purchase an aggregate of 33,000,000 Genius ordinary shares (together, the “Subscriptions”), for a purchase price of $10.00 per share, for an aggregate purchase price of $330,000,000, to be issued immediately prior to or substantially concurrently with the Closing (the “PIPE Investment”).

The Business Combination and the PIPE Investment were consummated on April 20, 2021.

Certain amounts that appear in this prospectus may not sum due to rounding.

v

Table of Contents

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

NewCo was incorporated on October 21, 2020 for the purpose of effectuating the Business Combination described herein. Prior to the Business Combination, NewCo had no material assets and did not operate any businesses. Accordingly, no financial statements of NewCo have been included in this prospectus. The Business Combination was first accounted for as a capital reorganization whereby NewCo is the successor to its predecessor TopCo. In connection with the Reorganization described above, the existing shareholders of TopCo continued to retain control through ownership of NewCo. The capital reorganization was immediately followed by the acquisition of dMY, which was accounted for within the scope of ASC 805, Business Combinations (“ASC 805”). Under this method of accounting, dMY was treated as the “acquired” company for financial reporting purposes. Accordingly, for accounting purposes, the Business Combination was treated as the equivalent of NewCo issuing NewCo ordinary shares for the net assets of dMY, accompanied by a recapitalization.

CONVENTIONS WHICH APPLY TO THIS PROSPECTUS AND EXCHANGE RATE PRESENTATION

In this prospectus, unless otherwise specified or the context otherwise requires:

| • | “$,” “USD” and “U.S. dollar” each refer to the United States dollar; |

| • | “£,” “GBP” and “pounds” each refer to the British pound sterling; and |

| • | “€,” “EUR” and “Euro” each refer to the Euro. |

Certain amounts described herein have been expressed in U.S. dollars for convenience, and when expressed in U.S. dollars in the future, such amounts may be different from those set forth herein due to intervening exchange rate fluctuations. The exchange rate used for conversion between U.S. dollars and pounds is based on the historical exchange rate of the pound released by the Federal Reserve, the central bank of the United States.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

TopCo, MidCo, NewCo, Merger Sub, dMY and their respective subsidiaries own or have rights to trademarks, trade names and service marks that they use in connection with the operation of their businesses. In addition, their names, logos and website names and addresses are their trademarks or service marks. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable ®, ™ and SM symbols, but such references are not intended to indicate, in any way, that we or the owners thereof will not assert, to the fullest extent under applicable law, our or their rights to these trademarks, trade names and service marks.

MARKET AND INDUSTRY DATA

In this prospectus, we present industry data, information and statistics regarding the markets in which Genius competes, as well as Genius’ statistics, data and other information provided by third parties relating to markets, market sizes, market shares, market positions and other industry data pertaining to Genius’ business and markets, including information obtained from Ellers & Krejcik Gaming (collectively, “Industry Analysis”). Such information is supplemented where necessary with Genius’ own internal estimates and information obtained from H2 Gambling Capital, taking into account publicly available information about other industry participants and the judgment of Genius’ management where information is not publicly available. This information appears in “Business” and other sections of this prospectus.

vi

Table of Contents

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

vii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and the notes thereto, included elsewhere in this prospectus, before deciding to invest in our ordinary shares. For purposes of this section, unless otherwise indicated or the context otherwise requires, all references to “Genius,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to (i) Genius Sports Limited and its consolidated subsidiaries after the Closing, (ii) Maven Topco Limited and its consolidated subsidiaries prior to the Closing and after the Apax Funds Investment and (iii) Genius Sports Group Limited and its consolidated subsidiaries prior to the Apax Funds Investment. Genius Sports Limited, previously known as Galileo NewCo Limited, is the newly combined company in connection with the Business Combination, in which shareholders of Genius and dMY exchanged their shares for shares in Genius Sports Limited.

Our Business

Overview

Genius is a B2B provider of scalable, technology-led products and services to the sports, sports betting and sports media industries. Genius is a fast-growing business with significant scale, distribution and an expanding addressable market and opportunity.

Genius’ mission is to be the official data, technology and commercial partner that powers the global ecosystem connecting sports, betting and media. In doing so, the Company creates engaging and immersive fan experiences while simultaneously providing sports leagues with reliable and sustainable revenue streams.

Genius sits at the heart of the global sports betting ecosystem where the Company has deep, critical relationships with over 400 sports leagues and federations, over 300 sportsbook brands and over 100 marketing customers (which includes some of the aforementioned sportsbook brands). The following are examples of services Genius provides its partners globally:

| • | Sports Leagues: Genius provides the technology infrastructure for the collection, integration and distribution of live data that is essential both to running a league’s operations and to growing their profile and revenue streams. Genius also works alongside leagues to protect the integrity of their competitions from the threat of match-fixing through global bet monitoring technology, online and offline education services, and consultancy services including integrity audits and investigations. |

| • | Sportsbooks: Genius’ technology, content and services allow sportsbook operators to outsource selected core, but resource-heavy, functions necessary to run their business. This includes the collection of live sports data, oddsmaking, risk management and player marketing. |

| • | Sports Media (brands and digital publishers): Genius engages with sports media customers both from the gaming and non-gaming sectors to provide a range of online marketing and fan engagement tools that drive customer acquisition and retention. |

What Genius Does

Genius is a data and technology company that enables consumer-facing businesses such as sports leagues, sportsbook operators and media companies to engage with their customers. The

1

Table of Contents

scope of Genius’ software bridges the entire sports data journey, from intuitive applications that enable accurate real-time data capture, to the creation and provision of in-game betting odds and digital content that help Genius’ customers create engaging experiences for the ultimate end-user, who are primarily sports fans.

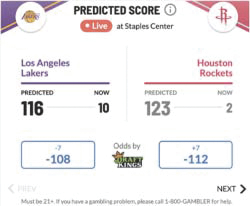

The collection of high quality, live sports data has become indispensable for sportsbooks as in-game betting has continued to grow rapidly across the world. In mature markets such as the United Kingdom, in-game betting currently represents the majority of total bets by Gross Gaming Revenue (“GGR”), which represents the difference between the amount of money players wager and the amount that they win, making it a critical offering for all major sportsbooks. In-game betting typically increases in popularity as markets mature, and it is expected that the United States will follow suit.

Genius’ live data services, alongside other value-add solutions, are deeply integrated into nearly all regulated sportsbook operators, comprising over 300 sportsbook brands worldwide. None of these sportsbooks currently take Genius’ entire product offering and so these integrations provide a clear runway for future growth. Genius provides customized solutions depending on its customers’ requirements, ranging from supplying live data feeds, in-game oddsmaking and risk management, to managing a sportsbook’s entire back-end operation. Genius customers include global sportsbook brands such as bet365, DraftKings, FanDuel, and Entain (formerly GVC), as well as leading B2B gaming technology platform providers such as Scientific Games, IGT, Kambi and DraftKings B2B (formerly SBTech).

In order to supply sportsbooks with a sufficient volume of sports data, Genius has built a broad portfolio that covers over 240,000 events, and over 160,000 events under official data and/or streaming rights agreements (of which approximately 100,000 are exclusive). This includes official data and trading for leagues such as the English Premier League (“EPL”) and National Basketball Association (“NBA”), as well as several events that are popular with bettors. Due to the need for sportsbooks to provide their customers with deep betting markets and content at all times of the day, Genius believes that its critical mass of events is vital to the operation of these companies.

Genius has established long-term, mutually beneficial relationships with sports leagues and federations and has acquired the rights to collect and monetize their data. Genius utilizes a network of more than 7,000 highly trained statisticians across over 150 countries who work on the ground, pitch-side and court-side, to capture data in real-time using Genius software.

In exchange for these sports data rights, for the majority of Genius’ league partners, the Company provides vital technology infrastructure solutions, including competition management software, scoreboard technology, athlete registration, data collection and distribution, fan-facing websites, officiating, and coaching analysis tools. The integration of sports leagues and robust human infrastructure gives Genius a highly diversified rights portfolio and deep competitive position.

Genius’ technology and services extend beyond the symbiotic sports data—sports betting relationship. The Company provides data-driven performance marketing technology and services to a range of advertisers, primarily sportsbooks and iGaming brands, which effectively optimize player acquisition, retention and engagement costs. Genius’ multiple data sets, including real-time statistics, betting odds, behavioral data and engagement data, enhance its digital marketing solutions and further deepen its relationships with its customer base.

2

Table of Contents

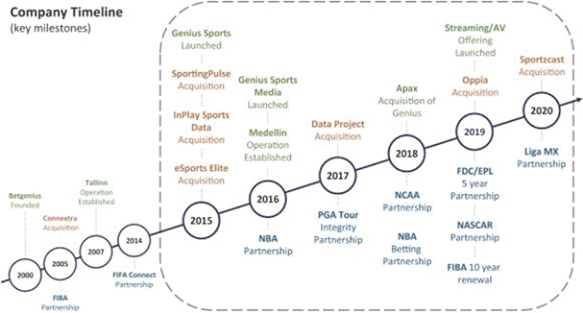

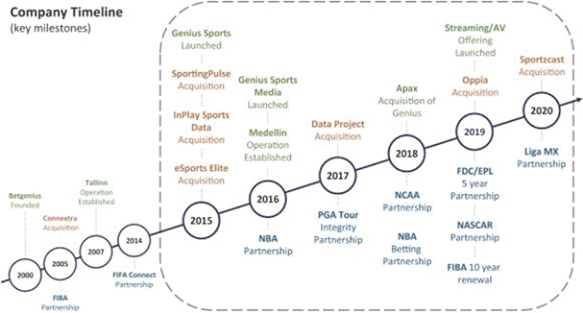

Company Background

The Company was co-founded by the current Chief Executive Officer, Mark Locke, as a software company which specialized in aggregating sports betting data. It then evolved into providing outsourced oddsmaking solutions to sportsbooks. The Company then expanded into a software provider to sports and media technology companies and, in 2015, Genius Sports Group was formed.

With a growing portfolio of betting customers that were driving increasingly large volumes of in-game bets, the Company and its leadership team realized the importance of live sports data and began to develop the technology that would enable Genius to own and control the entire value chain, from live data collection to pre-game and in-game oddsmaking. As of the date of this prospectus, Genius has invested more than $110 million in building out its full suite of proprietary technology and software solutions.

A portion of this amount was provided by private equity firm Three Hills Capital Partners (“THCP”), who have been an investment partner of Genius’ since 2015. THCP’s investment also bolstered Genius’ growth strategy into new territories and financed strategic acquisitions.

In September 2018, Apax Funds acquired a majority interest in Genius. Approximately $35 million of additional capital was invested into the business, which enabled Genius to invest in people and key sports relationships which has accelerated the Company’s growth. As a key partner, Apax Funds helped realign the Company’s global operations, strengthen the management team, support the Company to execute its acquisition strategy, and grow the organization that is now scaled and poised for growth.

Genius is the Global Leader in Official Data Rights

Official data as it pertains to sports betting is the feed of live statistics that is sanctioned by sports rights holders, typically sports leagues and federations, and used to create betting markets, update odds in real-time, and settle bets accurately and timely. The Company believes that as the global

3

Table of Contents

sports betting industry, especially in-game betting, is expected to grow, the reliance on high quality data is similarly expected to increase over time. Further, the Company believes that the adoption of official data is inevitable as the sports betting market matures, and Genius’ technology and relationships are critical to capturing this trend.

The Company believes that:

| • | official data is critical to sports, as it serves as a means for rights holders to monetize their data; |

| • | official data is critical to sportsbooks, as only official data provides guaranteed access to the fast and reliable data necessary for in-game betting; and |

| • | official data is critical to regulators, as it is legally compliant and an independent source of truth that protects consumers. |

Genius’ existing portfolio of official data includes some of the most valuable sports rights, including the NFL, EPL, NBA, National Association for Stock Car Auto Racing (“NASCAR”), and the International Basketball Federation (“FIBA”). Genius continues to identify and strategically acquire additional sports rights that are expected to generate a positive return and create value for Genius’ shareholders.

Genius classifies sports and the associated rights as Tiers 1 through 4. Sports rights classified as Tier 1 are those from leagues with global name recognition, which are typically acquired by rights fees alone. Sports rights that are not classified as Tier 1 are typically from regional leagues. These non-Tier1 rights are typically acquired by Genius through a contra model in which Genius secures long-term agreements with the respective leagues in exchange for Genius’ technology and software solutions (and occasionally de minimis cash fees). This allows the Company to develop mutually beneficial partnerships with leagues globally and integrate Genius’ technology and services deeply within each league’s operations. It is notable that while non-Tier 1 sports are typically smaller leagues that are less popular at a global level, they are very popular in their local countries or regions and often have large, dedicated fan bases.

Taking this dual approach to Tier 1 and non-Tier 1 rights respectively is unique and beneficial for several reasons. The low cost “contra” strategy in the non-Tier 1 sports helps mitigate the risk of rights inflation for this content while also helping to lock in sports with strong future potential value into long-term deals. The Company believes that these tiers facilitate the vital content a sportsbook needs to be competitive at all times. Furthermore, this approach gives Genius the fiscal flexibility to be competitive for Tier 1 rights when it believes they will be strategically accretive to its portfolio.

The Company started its expansion into the provision of audio visual (“A/V”) services in the second half of 2019. This includes providing sports leagues with proprietary AI-powered A/V production services to capture live game streams with minimal human intervention. These streams are a valuable addition to Genius’ portfolio of sports betting services as a complimentary offering to in-game data and oddsmaking. By the end of 2021, the Company anticipates having official A/V rights for a large number of events which will be captured and distributed from courtside and pitchside using Genius’ proprietary technology.

The Sports Betting Industry and Genius’ Opportunity

The Growing Global Sports Betting Market

Genius operates in the global sports betting industry. H2 Gambling Capital projects the Global Sports Betting industry GGR to grow from $31 billion in 2020 to $59 billion by 2025. The Company

4

Table of Contents

believes it is well positioned to grow alongside this rapidly expanding industry. Most of the GGR currently generated by the entire industry is estimated to come from Asia and the Middle East, with Europe being the second largest region.

H2 Gambling Capital expects the sports betting industry to grow across all regions globally, led by rapid expansion in newly regulating markets such as the United States. In May 2018, the US Supreme Court repealed the Professional and Amateur Sports Protection Act of 1992 (“PASPA”), which lifted federal restrictions on sports betting and gave individual states the power to legalize sports betting. As of year-end 2020, 26 states, including Washington, DC for these purposes, have passed measures to legalize sports betting, of which 20 states have already launched active sports betting industries with 14 states allowing mobile sports betting. The Company expects additional states to legalize sports betting in the coming years, which will further grow the U.S. sports betting market. Per H2 Gambling Capital, the US sports betting market is projected to generate an estimated $8 billion in GGR in 2025, increased from just an estimated $2 billion in 2020.

Regions such as Europe also have several countries, such as Germany, that remain in the early stages of liberalization and proliferation of sports betting. H2 Gambling Capital expects Europe to generate an estimated $20 billion in GGR in 2025, increased from an estimated $12 billion in 2020. Europe remains a key market for Genius due to its large scale and relevance within the global sports betting industry.

Genius’ wide-ranging, well-embedded role across the sports betting industry means that the Company generates revenue regardless of which operators take market share within any given jurisdiction. Genius’ revenue share model also gives it upside exposure as its customers grow and expand.

Sports betting helps leagues create exciting and memorable moments for their fans. Naturally, in-game sports betting is an engaging type of sports betting experience and adds another layer of connection for fans as they watch the action unfold in real time. As sports betting markets mature, in-game betting typically increases in popularity and eventually represents the majority of bets placed, both by GGR and by number of bets. For example, figures published by the European Gaming and Betting Association (“EGBA”) in 2019 stated that in-game accounted for 63% of sports betting activity among its membership, which includes bet365, Entain (formerly GVC) and William Hill. Bet365 reported that in-game accounted for 79% of its total sports betting revenue in the twelve months ending March 31, 2019.

Given the nature of the sports betting data market, where sportsbook operator expenditure on data is mainly driven by in-game data consumption, this is a tailwind that Genius is well-positioned to capitalize on given its strong focus on expanding its portfolio of rights and the focus on official live data.

Furthermore, Genius believes its position in the sports data value chain and ability to continually and effectively upsell on betting content, services and product innovations will allow the Company to increase its share of customers over time. This includes several end-user engagement solutions, including live streaming and ad-tech products, which Genius expects to become a larger part of its business in the future.

Advantages of Scale

Genius believes that its scale creates meaningful competitive advantages. The human infrastructure the Company has built, with more than 1,500 employees and access to a network of more than 7,000 trained statisticians and agents worldwide, provides scale enabling Genius to better serve its customers.

5

Table of Contents

The broad portfolio of events Genius offers is enabled by its technological expertise and deep relationships and integrations with sports leagues. Building this portfolio has taken many years and requires a deep understanding of each sport league’s technical and strategic requirements, along with developing bespoke technology to meet those requirements. For example, Genius developed technology for basketball leagues that is used by more than 180 leagues in 120 countries around the world, equating to more than 80% of all organized basketball competitions.

To gain access to Genius’ sports betting services, such as live sports data feeds or outsourced oddsmaking, sportsbooks must integrate their back office systems with Genius’ proprietary technology. This technology and the managed services provided by Genius drives the sportsbook’s consumer facing offering – from the events they offer on their site to the odds on those events. This makes Genius’ technology a core and critical part of every customers’ operations on a day-to-day basis.

Core Strengths

| • | The largest portfolio of official betting data: The combination of greater numbers of sports leagues taking control over their data assets and rapid growth of in-game betting makes official data both increasingly valuable and harder to acquire. The scale of Genius’ portfolio, built up over more than a decade, puts it at the very forefront of this trend and is a key differentiator from its main competitor. |

| • | Market-leading data and technology: Genius’ currency is real-time data. Its value is derived from the Company’s ability to capture, process and distribute vast volumes of data points in milliseconds, which requires highly robust technology alongside machine learning and complex analytics capabilities. Genius’ core systems are highly scalable to support ongoing growth in customers, sports event coverage, and volume of bet types. The Company’s technology framework is standardized, allowing it to support multiple sports leagues at a low incremental cost to the business. |

| • | Good earnings visibility due to long-term contracts with a large share of recurring revenues and low customer churn: Genius holds long-term contracts with sportsbooks and sports rights holders, and has historically experienced low churn. Sportsbook contracts are structured with guaranteed minimum payments throughout the life of the term (typically 3-5 years), which allow for good earnings visibility. Approximately 60% of Genius’ revenue is from recurring revenue related to contractual minimum guarantees. Genius’ contracts are also structured with upside levers that allow the Company to benefit as its partners grow through increased GGR, expansion into new markets, and utilization of more events. |

| • | Improved operating margins from scaled cost structure with high operating leverage: Genius benefits from significant economies of scale driven by its highly scalable technology and software architecture. Approximately 70% of the Company’s operating expenses, such as data production, trading and hosting costs, are expected to grow slower than revenues. |

| • | World-class management team with depth of experience and track record of success: Genius is led by a highly experienced management team with a strong track record of success. The executive team has extensive experience in the global sports, betting and iGaming sectors. Management has successfully led the business to capture meaningful growth as the regulatory landscape matured in Europe over the past decade, and is well positioned to capitalize on developing markets around the globe including the United States and Latin America. Genius co-Founder and CEO Mark Locke is recognized as a global expert on sports technology, integrity and sports betting. |

6

Table of Contents

The Genius Company Culture

Genius’ culture is fair, ethical and performance-oriented. The Company operates a clear ‘Game Plan,’ setting out the company vision and values that all staff are expected to uphold. It also sets out the Company’s ‘team goals,’ in the form of a simple set of targets for which staff can aim. These encapsulate Genius’ values as an organization, encouraging staff to think big, get stuck in, do the right thing, go fast/aim high, express themselves—and win as a team.

The Company believes this is key to fostering a culture that values performance with integrity, with everyone having the chance to make their mark, and where every contribution counts.

The Company’s success is highly dependent on human capital and a strong leadership team. Genius aims to attract, retain and develop staff with the skills, experience and potential necessary to implement its growth strategy. As part of this, emphasis is placed on the development of a ready pipeline of ‘home-grown’ management talent, supplemented as necessary by external hires with appropriate experience and expertise.

Genius regularly engages with staff on issues relating to its values and/or affecting the business generally, through a combination of group-wide and location-specific ‘town hall’ sessions and other engagement platforms. Regular surveys indicate healthy staff engagement and identification with the business, and highlight opportunities for further growth and development.

The Genius Growth Strategy

Genius has multiple levers for growth with existing customers, as well as ongoing customer and partner acquisition strategies.

Capitalizing on the growth of global sports betting

| • | Share in existing customer growth. Typically betting customer contracts include some form of minimum commitment to Genius, whether that be revenue and/or number or quality of events utilized. However, none of these contracts provide customers with Genius’ entire product offering. As a result, Genius’ betting customer contracts may be further expanded as its customers expand and grow. This is especially true as customers move into newly regulated markets, such as the United States, which is expected to continue approving legislation to legalize sports betting across multiple states. |

| • | Expand Genius’ presence and acquire new customers in growth markets. Genius’ strong partnerships with sports leagues, data-driven marketing products and existing relationships with B2B sports betting platform providers give the Company a major competitive advantage in high growth jurisdictions. Genius is a preferred data supplier to a majority of significant sportsbooks in the U.K. and anticipates this will translate well in new markets. |

Additionally, the Company has a forward-looking licensing strategy. Genius is already permitted to supply in 11 U.S. states and plans to be licensed in all states that legalize sports betting. Genius expects to employ a similar licensing strategy in countries, such as Germany, that can potentially liberalize sports betting in the near future. Genius also has permission to supply in three tribal jurisdictions in the United States.

Increase in sports rights and event utilization

| • | Continue to develop strong partnerships with sports leagues worldwide. Genius strategically acquires rights in both high profile and non-Tier 1 sports worldwide in a way that |

7

Table of Contents

| enhances the Company’s rights portfolio and offering to sportsbooks. In non-Tier 1 sports, Genius will continue to aggressively deploy its “contra” model and acquire long-term agreements in exchange for technology and software solutions. |

| • | Ability to capitalize on the expansion of adjacent total addressable market opportunities. As other nascent industries such as iGaming grow, Genius will have the opportunity to leverage its technology and existing distribution to expand its offerings into new verticals. |

| • | Continue to grow event utilization. Genius has historically seen strong growth in its sport events utilization as the demand for its services and its number of customers has grown. The Company expects this growth to continue, which should create stronger operating leverage. |

Price escalators and wallet share

| • | Price escalators. Many of Genius’ customer contracts for Betting Technology, Content and Services have already built in price escalators whereby customer revenue and product commitments grow through the term of the contract. |

| • | Expand value-add services and increase share of wallet. Genius is constantly expanding its services to sportsbooks. For example, the Company developed and has started to commercialize streaming and risk services capabilities. As these and other verticals grow and develop, the Company believes this will allow it to increase its share of the customer’s wallet. |

Media and Advertising

| • | Expand its dynamic and tailored digital marketing capabilities beyond sports betting and iGaming. Genius’ ad-tech solutions are deployed by dozens of sportsbooks to reach sports fans with relevant marketing messages that include game statistics and real-time betting odds. The Company expects that non-betting brands may recognize the value in the Company’s ability to align online advertising campaigns to live sporting action, enabling Genius to diversify its client base for digital marketing services. |

Sports Technology

| • | Additional Development of Sports Facing Technology and Services. Continued development in the breadth of Genius’ sports facing technology and services means that the Company expects to expand the number of sports leagues it works with, as well as the number of products it offers to existing and new customers. This is an enabler to further build long-term, sticky relationships with sports leagues. |

Strategic acquisitions

| • | Selectively pursue strategic acquisitions. Genius seeks acquisition opportunities that it believes will provide long-term value to its shareholders. While a primary area of focus is expected to be on smaller, complimentary technology companies that improve its product and technology offerings, the Company also maintains an active pipeline of larger, more transformational opportunities. |

In December 2020, Genius acquired Sportzcast, a U.S. based company, which builds and supplies proprietary devices that automate collection of low latency, official data feeds direct from in-venue scoreboards.

8

Table of Contents

Products and Business Model

Genius provides critical technology and services required to power the global ecosystem connecting sports, betting and media. The Company’s services are organized into three key products areas—Sports Technology and Services; Betting Technology, Content and Services; and Media Technology, Content and Services. All of Genius’ products are powered by proprietary technology and robust data infrastructure.

Sports Technology and Services

Genius builds and supplies technology and services that allow sports leagues to collect, analyze and monetize their data. The Company has trained statisticians that are highly skilled in collecting accurate, real-time data during events and matches. The data can then be repackaged and analyzed almost instantaneously, where it can then be used to help leagues and teams analyze real time statistics, develop coaching tools, and support broadcast partners. It is this same data that Genius also uses to power its Betting Content and Services.

|

|

9

Table of Contents

Using the data collected, Genius can also develop additional tools that help sports leagues deepen fan engagement. These include automated creation of fan-facing websites, social media content, and statistical content such as team and player standings that are updated in real time.

The Company’s streaming solution provides the technology, automatic production and distribution needed by sports to commercialize video footage of their games. This is particularly useful for non-Tier 1 sports leagues that lack the capabilities or resources to develop their own live streaming solutions.

Genius’ also provides its end-to-end integrity services to sports leagues, and is the trusted integrity partner for over 100 sports leagues worldwide. Integrity services range from full-time active monitoring technology, which uses mathematical algorithms to identify and flag suspicious betting activity in global betting markets, to a full suite of online and offline educational and consultancy services. The technology and services provided to sports leagues are typically provided on a contra basis in return for access to live sports data for commercialization in betting and media. In some cases, sports leagues also pay fees for licensing the technology.

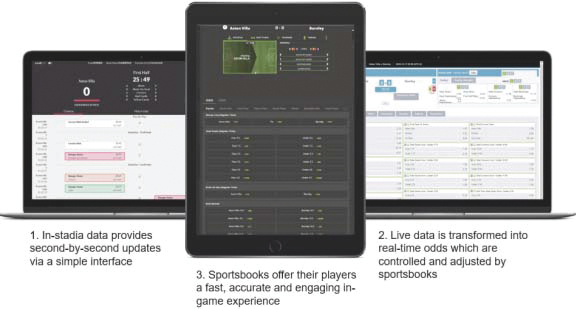

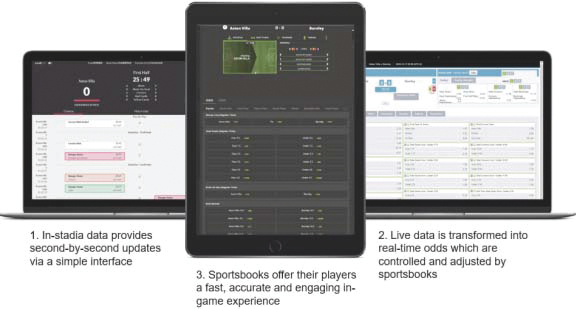

Betting Technology, Content and Services

Genius supplies the technology, content and services that powers global sportsbooks. Sportsbooks can outsource as much or as little of these capabilities as necessary depending on their requirements. Genius’ offering includes:

| • | Live sports data: Fast and reliable feeds of live match data, the majority of which are delivered direct from stadiums around the world in under a second using Genius technology. These real-time data points allow sportsbooks to create odds for in-game betting markets on over 240,000 events a year. |

| • |

Pre-game and in-game odds feeds: A combination of automated oddsmaking powered unique mathematic algorithms, a specialist trading team of over 400 people and robust technology, enables Genius to manage the full sports betting lifecycle on behalf of its sportsbook customers. This includes creating the events, setting the odds and managing them in real-time as the game unfolds, and settling betting markets so that sportsbooks can update their users’ accounts. Configuration by the customer within Genius’ backend system enables sportsbooks to create a bespoke experience for their userbase. |

| • | Risk management services: Genius offers real-time management of all sportsbook liabilities, including customer profiling, monitoring of incoming bets, automated acceptance and rejection |

10

Table of Contents

| of bets, and limit setting. Risk management is a vital part of a sportsbook’s operation because it protects its profitability. |

| • | Live streaming: Thousands of official live streams, most of which are derived from Genius’ official partnerships with Tier 2 through 4 sports leagues, captured at courtside and pitchside around the world using Genius technology. This service is designed to boost betting appeal and drive sportsbook handle at off-peak times, in a cost-efficient manner when compared to Tier 1 streaming content. |

These services are provided to sportsbooks under long term contracts. In each of these contracts the sportsbook makes a commitment to Genius regarding what services and/or what sports events they will use Genius’ products and services for. The business model is either revenue share, where Genius receives a share of customer net gaming revenue (“NGR”)/ GGR, or a usage-based license fee model.

Media Technology, Content and Services

Genius builds and supplies technology, services and data to enable its partners to efficiently acquire, retain and engage with their customers in a highly cost-effective manner. These partners include sportsbooks, online and brick and mortar gaming operators, sports leagues and other non-gaming brands that target sports fans. Genius provides services such as the creation, delivery and measurement of personalized online marketing campaigns, all run through Genius’

11

Table of Contents

proprietary technology. These campaigns have been proven to help brands significantly reduce acquisition costs.

Genius also develops fan engagement widgets for digital publishers, featuring live game statistics and betting-related content that drive traffic to sportsbooks. This helps unlock alternative revenue streams for digital content developers and sports betting affiliate programs.

In all cases, Genius is compensated through a performance-based model which fully aligns the Company’s interests with its partners, ultimately resulting in increased partner retention and satisfaction.

Awards

Over the past decade, Genius has consistently been recognized as a leader in its field with a host of industry awards. Most recently, Genius’ in-game betting services were awarded In-play Betting Software of the Year and Sports Data Supplier of the Year at the 2020 EGR B2B Awards, and the Sports Data Product of the Year and Live Betting Product of the Year at the 2020 SBC Gaming

12

Table of Contents

Awards. Additionally, in 2020, the Genius Live streaming product was given the Innovation of the Year prize at the 2020 Sports Technology Awards, ahead of other entries from BT Sport, Nielsen Sports, Intel and Manchester City.

Representative Customers and Partnerships

Whether they are sports organizations or sportsbooks, Genius enjoys deep and long-term relationships with its customers rooted in the provision of mission critical technology, live data, or services that are fundamental to its partners’ success. The nature of these partnerships creates a deep technological connection and dependence, leading to very low customer churn rates.

Genius has relationships with over 300 sportsbook brand customers, including:

| • | Global sportsbooks such as Fanduel, Betfair, PaddyPower and Sky Bet (all Flutter), BetMGM, Ladbrokes and Coral (all GVC/Entain), DraftKings, bet365, William Hill, 888 Wynn Bet, Caliente, Pari Match, SNAI and Microgame; and |

| • | Leading B2B platform providers such as Scientific Games, IGT, Kambi, and SBTech (now DraftKings B2B); |

Genius has over 400 sports league partners, including:

| • | Globally recognized leagues such as the NFL, EPL, NBA, NCAA, PGA, FIBA, FIFA, and Serie A; and |

| • | Numerous other regional and lower tier league divisions across various sports such as basketball, soccer, ice hockey and volleyball. |

Genius has over 100 media and advertising customers, including:

| • | Recognized U.S. gaming brands such as BetMGM, Caesars, BetAmerica, Golden Nugget, DraftKings, FanDuel, William Hill, Delaware North and Unibet; |

| • | A wide range of sports betting and iGaming brands in Europe and Africa, including bet365, PlayOjo, and Unibet; |

| • | Major global media publishers, such as CBS and MSN, to which Genius helps drive valuable new audiences with data-driven sports and betting content; and |

| • | Sports properties including the National Football League (“NFL”) and more than 20 teams from Major League Baseball (“MLB”), including the LA Dodgers, the Houston Astros and the San Diego Padres, that Genius helps target fans with contextual marketing campaigns that drives ticket and merchandise sales. |

Genius Technology

Innovation is fundamental to the culture at Genius. The Company’s technical teams have a deep understanding of sports, how they interact with fans online, and the data that is critical to driving value through the ecosystem. Sports are fast-paced, and dynamic; the action does not stop to wait for technology—teams develop products with the speed, accuracy, scalability, reliability, and flexibility to meet the expectations of passionate and demanding fans.

Teams are allocated responsibility for specific systems and use Agile development methodologies to deliver through an iterative, continuous software delivery life cycle. Teams are also responsible for technically operating the systems that they develop, which involves monitoring and supporting production systems, on boarding new customers, and scaling systems to meet commercial demand.

13

Table of Contents

Fail-safe data and video capture

Genius’ in-venue data collection systems are designed to continue to function when disconnected from supporting systems, ensuring statisticians can continue to collect rich sports data unimpeded. When disconnected from the internet, these systems will continue to support officials, teams, scoreboards, and broadcasters in the venue. While connected, data is synchronized with Genius’ data distribution network, ensuring low latency, accurate, reliable delivery of play-by-play data. The unique sport-specific user interface workflows ensure the most time critical data is delivered at the earliest opportunity while still allowing the collection of a rich dataset.

Supplementing the data solutions, automated cameras allow sports leagues to produce live streaming content for delivery through the distribution network.

Automated monitoring, remote management, and AI-driven production mean minimal interaction is required from sports leagues once the solution has been installed which, alongside Genius’ innovative hardware solution, reduces production costs.

Highly scalable real-time sportsbook content

To support the vast volume of sports events and live data provided to sportsbooks, Genius hosts in-memory controllers that allow independent management of every in-game fixture for each customer. This architecture provides a very low latency service, is horizontally scalable, and implements a failover software design over redundant hardware to ensure uninterrupted service.

Proprietary high-speed algorithmic models driven by live sports data calculates the probability of key actions (i.e., a turnover, foul, or player substitution) within each event. These probabilities are used to generate and continuously update betting markets, lines, margins, and odds that are specific to each event and customer. Sportsbook customers can take control of their own event at any time and adjust their margins, offering, or position within the market through the online portal; however, Genius’ proprietary back-office trading systems ensure that skilled operators can cost-effectively manage all fixtures for Genius’ customers with significant economies of scale.

Robust and Reliable distribution

Genius’ data distribution platforms are integrated directly into B2B customers’ servers through both standard application programming interfaces and services that can be easily customized to integrate with the back office systems commonly used by sportsbooks. These integration pathways ensure reliable, low latency delivery of data that customers are licensed to access with additional features including heart-beats, receipt confirmation, and conflation, ensuring customers are protected from any network disruption or slow consumption under load. The design of the data integrations ensures seamless delivery of additional fixtures to the network with minimal customization required by customers as they on-board new sports.

The streaming network supports B2B and B2C delivery of both in-play and on-demand streams at scale. The Genius Drop and Play media player enables rapid B2C integration allowing customers to deliver Genius Live content alongside other content for a fixture by simply inserting an HTML tag in their websites. Streaming integrations are not sport specific, meaning that all new streaming content can be immediately delivered to all integrated partners in the network.

14

Table of Contents

Targeted fan engagement

With visual components that are embedded directly in league, sportsbook, and media websites and mobile applications, Genius is able to uniquely understand the interests of sports fans and deliver relevant, engaging content. This content is served from the Company’s B2C data and visualization systems achieving high availability and low latency at significant scale.

The components offer fans visualizations of real-time sports and betting data, analysis, and streaming, which offer significant value in their own right and are critical to driving engagement in complementary products. Components are modular and can be styled and composed to support the branding and requirements of each partner allowing investment in new functionality to be leveraged across the ecosystem.

Through big data analytics of data generated from this unique understanding of fans, live sports events, and the sportsbook market Genius is able to offer large scale targeted advertising campaigns which are delivered through cost effective, data driven, real-time bidding for publishing space. The advertising content selected for each fan by the Genius proprietary advertising technology further leverages the Company’s data and visualization capabilities.

Recent Developments

Business Combination

On October 27, 2020, dMY, TopCo, Midco, NewCo, Merger Sub, and Sponsor entered into the Business Combination Agreement. Pursuant to the Business Combination Agreement, Topco undertook a series of transactions pursuant to which it sold, exchanged and contributed its shares for a mix of cash consideration and Genius ordinary shares (the “Reorganization”). The Reorganization was immediately followed by the acquisition of dMY by Merger Sub with dMY being the surviving corporation and a wholly-owned subsidiary of Genius. Additionally, NewCo and dMY entered into subscription agreements for the purchase an aggregate of 33,000,000 Genius ordinary shares, for a purchase price of $10.00 per share, for an aggregate purchase price of $330.0 million (the “PIPE Investment”). The Business Combination and the PIPE Investment closed on April 20, 2021.

NFL License Agreement

On April 26, 2021, Genius and NFL Enterprises LLC (“NFL Enterprises”) entered into a multi-year License Agreement (the “License Agreement”), pursuant to which Genius obtains the right to serve as (a) the worldwide exclusive distributor of NFL official data to the global regulated sports betting market; (b) the worldwide exclusive distributor of NFL official data to the global media market; (c) the NFL’s exclusive international distributor of live digital video to the regulated sports betting market (outside of the United States where permitted); and (d) the NFL’s exclusive sports betting and i-gaming advertising partner. The License Agreement contemplates a six-year period (the “Term”), with an initial four-year period commencing April 1, 2021 and years five and six renewable by NFL Enterprises in one year increments. Pursuant to the License Agreement, Genius will issue to NFL Enterprises an aggregate of up to 22,500,000 warrants (each, a “NFL Warrant” and, collectively, the “NFL Warrants”), with each NFL Warrant entitling NFL Enterprises to purchase one Genius ordinary share (each, a “NFL Warrant Share”) for an exercise price of $0.01 per NFL Warrant Share. The NFL Warrants will be subject to vesting over the six-year Term. The first 11,250,000 of such NFL Warrants were issued on April 26, 2021 and are vested immediately upon issuance. The balance of the NFL Warrants will vest over the remaining Term or upon certain limited specified events and on customary terms. Each NFL Warrant will be issued along with, and be stapled to, one share of a new class of shares of Genius, $0.0001 par value (each, a “B share”), with each B share representing an economic value equal to the $0.0001 par

15

Table of Contents

value per share, and entitling the holder thereof to vote with the holders of the ordinary shares of Genius on the basis of 1/10 of a vote per B share. Upon each purchase of an NFL Warrant Share pursuant to the exercise of an NFL Warrant, each B share attached to such NFL Warrant shall automatically be repurchased or, in the Company’s discretion, redeemed by the Company and cancelled at par value, in each case, in accordance with the Genius governing documents.

Amended and Restated Investor Rights Agreement

On April 26, 2021, the Investor Rights Agreement (as defined below) was amended and restated by the Amended and Restated Investor Rights Agreement (the “Amended and Restated Investor Rights Agreement”), pursuant to which, among other things, (i) Genius agreed to file a shelf registration statement for registration of the resale of the NFL Warrant Shares, (ii) Genius will provide NFL Enterprises customary piggyback registration rights with respect to the NFL Warrant Shares and (iii) NFL Enterprises will be subject to a customary lock-up period and certain transfer restrictions. In contemplation of this offering, the Company waived the applicable lock-up restrictions under the Amended and Restated Investor Rights Agreement for those selling shareholders who are party thereto, solely with respect to the portion of their ordinary shares offered for sale in this offering to the extent required to permit them to sell in this offering. Further, we have recently filed a registration statement on Form F-1 (the “Resale F-1”) to satisfy our obligations to register the offer and sale of ordinary shares by certain of our shareholders pursuant to the Investor Rights Agreement and Subscription Agreements. The Resale F-1 was declared effective on June 1, 2021, upon which their ordinary shares have become freely tradable, subject to any applicable lock-up provisions in the Amended and Restated Investor Rights Agreement. See “Related Party Transactions— Amended and Restated Investor Rights Agreement.”

Acquisition of FanHub

On May 3, 2021, the Company announced it had entered into a definitive agreement to acquire FanHub Media Holdings Pty Ltd (“FanHub”), a leading provider of free-to-play games and fan engagement solutions. The sellers of FanHub will receive a combination of cash and Genius ordinary shares in the transaction. This transaction is expected to close in the second quarter of 2021.

Acquisition of Second Spectrum

On May 6, 2021, the Company announced that it had entered into a definitive agreement to acquire Second Spectrum, Inc. (“Second Spectrum”), a leading provider of cutting-edge data tracking and visualization solutions for $200 million, subject to customary adjustments. The purchase price will be paid at closing in cash and shares of Genius’s common stock. Second Spectrum is a world-leading and fully integrated sports AI provider, offering tracking, analytics and data visualization services, with a strong blue-chip client list including the NBA, EPL and MLS. The transaction is expected to close in the second quarter of 2021.

Summary of Risk Factors

Our business faces significant risks and uncertainties. You should carefully consider all of the information set forth in this prospectus and in other documents we file with or furnish to the SEC, including the following risk factors, before deciding to invest in or to maintain an investment in our securities. Our business, as well as our reputation, financial condition, results of operations and share price, could be materially adversely affected by any of these risks, as well as other risks and uncertainties not currently known to us or not currently considered material. These risks include, among others, the following:

| • | COVID-19 has adversely affected our business, financial condition, results of operations and prospects, including as a result of the reduction in the quantity of global sporting events, |

16

Table of Contents

| closures or restrictions on business operations of our customers and sports organizations and a decrease in consumer spending, and it may continue to do so in the future. |

| • | We rely on relationships with sports organizations from which we acquire sports data, including, among other things, via arrangements for exclusive rights for such data. Loss of existing relationships or failure to renew or expand existing relationships may cause loss of competitive advantage or require us to modify, limit or discontinue certain offerings, which could materially affect our business, financial condition and results of operations. |

| • | Fraud, corruption or negligence related to sports events, or by our employees or contracted statisticians collecting data on behalf of the Company, may adversely affect our business, financial condition and results of operations and negatively impact our reputation. |

| • | We and our customers and suppliers are subject to a variety of domestic and foreign laws and regulations, which are subject to change and interpretation and which could subject us to claims or otherwise harm our and our customers’ and suppliers’ respective businesses. Any change in existing regulations or their interpretation, or the regulatory climate and requirements applicable to our or our customers’ and suppliers’ products and services, or changes in tax rules and regulations or interpretation thereof related to our or our customers’ and suppliers’ products and services, could adversely impact our or our customers’ and suppliers’ ability to operate our or their respective businesses as currently conducted or as we seek to operate in the future, which could have a material adverse effect on our financial condition and results of operations. |

| • | Our collection, storage and use of personal data are subject to applicable data protection and privacy laws, and any failure to comply with such laws may harm our reputation and business or expose us to fines and other enforcement action. |

| • | We are party to pending litigation and investigations in various jurisdictions and with various plaintiffs and we may be subject to future litigation or investigations in the operation of our business. An adverse outcome in one or more proceedings could adversely affect our business. |

| • | Failure to protect or enforce our proprietary and intellectual property rights, including our unregistered intellectual property, and the costs involved in such protection and enforcement could harm our business, financial condition, results of operations and prospects. |

| • | We may face claims for intellectual property infringement, which could subject us to monetary damages or limit us in using some of our technologies or providing certain solutions. |

| • | We rely on information technology and other systems and platforms, including our data center and Amazon Web Services and certain other third-party platforms, and failures, errors, defects or disruptions therein could diminish our brand and reputation, subject us to liability, disrupt our business, affect our ability to scale our technical infrastructure and adversely affect our operating results and growth prospects. Our product offerings and other software applications and systems, and certain third-party platforms that we use could contain undetected errors or errors that we fail to identify as material. |

| • | We have a history of losses and may not be able to achieve or sustain profitability in the future. |

| • | If we are unable to increase our revenues or our operating costs are higher than expected, our profitability may decline and our operating results may fluctuate significantly. |

| • | The international scope of our operations may expose us to increased risk, and our international operations and corporate and financing structure may expose us to potentially adverse tax consequences. |

17

Table of Contents

| • | Risks related to the U.K.’s exit from the European Union (“Brexit”) may have a negative effect on global economic conditions, financial markets and our business. |

| • | Founders and Sellers, whose interests may differ from those of other holders of Genius ordinary shares following the Business Combination, have the ability to significantly influence Genius’s business and management. |

| • | Genius may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on its financial condition, results of operations and share price, which could cause you to lose some or all of your investment. |

| • | Because Genius is incorporated under the laws of the Island of Guernsey, you may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. Federal courts may be limited. |

| • | It may be difficult to enforce a U.S. judgment against Genius or its directors and officers outside the United States, or to assert U.S. securities law claims outside of the United States. |

| • | As a company incorporated in the Island of Guernsey, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from NYSE corporate governance listing standards; these practices may afford less protection to shareholders than they would enjoy if we complied fully with NYSE corporate governance listing standards. |

Corporate Information

The legal name of the Company is Genius Sports Limited. The Company was incorporated under the laws of Guernsey as a non-cellular company limited by shares on October 21, 2020. The Company’s registered office in Guernsey is PO Box 656, East Wing, Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 3PP. The address of the principal executive office of the Company is Genius Sports Group, 9th Floor, 10 Bloomsbury Way, London, WC1A 2SL, and the telephone number of the Company is +44 (0) 20 7851 4060.

Investors should contact us for any inquiries through the address and telephone number of our principal executive office. Our principal website is https://geniussports.com. The information contained on, or accessible from, or hyperlinked to, our website is not a part of this prospectus and you should not consider information on our website to be part of this prospectus.

Implications of Being an “Emerging Growth Company” and a Foreign Private Issuer

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved (to the extent applicable to a foreign private issuer). If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

We will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (i) following the fifth anniversary of the closing of dMY’s IPO, (ii) in which we have total annual gross

18

Table of Contents

revenues of at least $1.07 billion or (iii) in which we are deemed to be a large accelerated filer, which means the market value of our ordinary shares that are held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date on which we have issued more than $1.00 billion in non-convertible debt during the prior three-year period. References herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.