As filed with the Securities and Exchange Commission on June 11, 2024

Registration No. 333-275062

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 8731 | ||||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Tel:

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Chief Executive Officer

Tel:

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Darrin M. Ocasio, Esq. | Raymond Ressy, Esq. |

| Sichenzia Ross Ference Carmel LLP | Lucosky Brookman LLP |

| 1185 Avenue of the Americas, 31 Fl. | 101 Wood Avenue South, 5th Floor |

| New York, NY 10036 | Woodbridge, NJ 08830 |

| Tel: (212) 930-9700 | Tel: (732) 395-4400 |

| Fax: (212) 930-9725 | Fax: (732) 395-4401 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large Accelerated Filer ☐ | Accelerated Filer ☐ |

| Smaller

Reporting Company | |

| Emerging

Growth Company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B)

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PROSPECTUS | SUBJECT TO COMPLETION | DATED JUNE 11, 2024 |

1,500,000 Shares

Common Stock

This is a firm commitment initial public offering of 1,500,000 shares of common stock of Impact BioMedical, Inc. (the “Company”, “we”, “us”, “our”). We anticipate that the initial public offering price of our common stock will be between $3.00 and $5.00 per share.

No public market currently exists for our common stock. We intend to apply to list our shares of common stock on the NYSE American, subject to official notice of issuance, under the symbol “IBO”. No assurance can be given that our applications will be approved. If our application is not approved, we will not continue with this offering.

We are an emerging growth company and a smaller reporting company under the federal securities laws, and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. Investing in our common stock involves a high degree of risk.

Unless otherwise stated, the information in this prospectus assumes or gives effect to the (1) a 1:55 reverse stock split of our outstanding common stock and (2) an exchange by a shareholder of common stock for Series A Convertible Preferred Stock, both of which became effective on October 31, 2023. See “Description of Our Capital Stock.”

The final public offering price per share will be determined through negotiation between us and the underwriter in this offering and will take into account the recent market price of our Common Stock, the general condition of the securities market at the time of this offering, the history of, and the prospects for, the industry in which we compete, and our past and present operations and our prospects for future revenues. The recent market price per share of Common Stock used throughout this prospectus may not be indicative of the final public offering price per share.

Investing in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds to us (before expenses) | $ | $ | ||||||

| (1) | See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted the underwriters an option, exercisable within 45 days after the closing of this offering, to purchase an additional 225,000 shares of our common stock at the initial public offering price less underwriting discounts and commissions.

The underwriters expect to deliver our shares to purchasers in the offering on or about [*], 2024.

Revere Securities, LLC

The date of this prospectus is [*], 2024

TABLE OF CONTENTS

You should rely only on information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

For investors outside the United States: Neither we nor the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside of the United States.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve substantial risks and uncertainties. The forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” but are also contained in this prospectus. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “aim,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “target,” “seek” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward-looking statements contained in this prospectus include, but are not limited to, statements about:

| ● | our future financial performance, including our revenue, costs of revenue, operating expenses and profitability; | |

| ● | the sufficiency of our cash and cash equivalents to meet our liquidity needs; |

| i |

| ● | the availability of financing for smaller publicly traded companies like us; | |

| ● | our ability to effectively manage our growth and future expenses; | |

| ● | changes adversely affecting the industry in which we operate; | |

| ● | our ability to achieve our business strategies or to manage our growth; | |

| ● | general economic condition; | |

| ● | changes in assumptions used to make industry forecasts; | |

| ● | our ability to retain our key employees and executives; | |

| ● | our future operating results and financial condition; | |

| ● | our business operations; | |

| ● | changes in our business and investment strategy; | |

| ● | availability, terms, and deployment of capital; | |

| ● | changes in, or the failure or inability to comply with, governmental laws and regulations; | |

| ● | the degree and nature of our competition; | |

| ● | our leverage and debt service obligations; and | |

| ● | additional factors discussed under the sections captioned “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Our Business.” |

These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this prospectus and are subject to risks and uncertainties. We discuss many of these risks in greater detail under “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement of which this prospectus forms a part with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements made in this prospectus relate only to events as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements after the date of this prospectus or to conform such statements to actual results or revised expectations, except as required by law.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this prospectus.

These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain.

You should refer to the “Risk Factors” section of this prospectus for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by federal securities law.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

| ii |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. Before investing in our securities, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes thereto and the information set forth under the sections “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto, in each case included in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.” Except as otherwise indicated, references to “we”, “us”, “our”, and the “Company” refer to Impact BioMedical Inc., a Nevada corporation, and its wholly-owned subsidiaries.

Unless otherwise noted the share and per share information in this prospectus reflects a 1-for-55 reverse stock split of our outstanding common stock effective as of October 31, 2023.

Business Overview

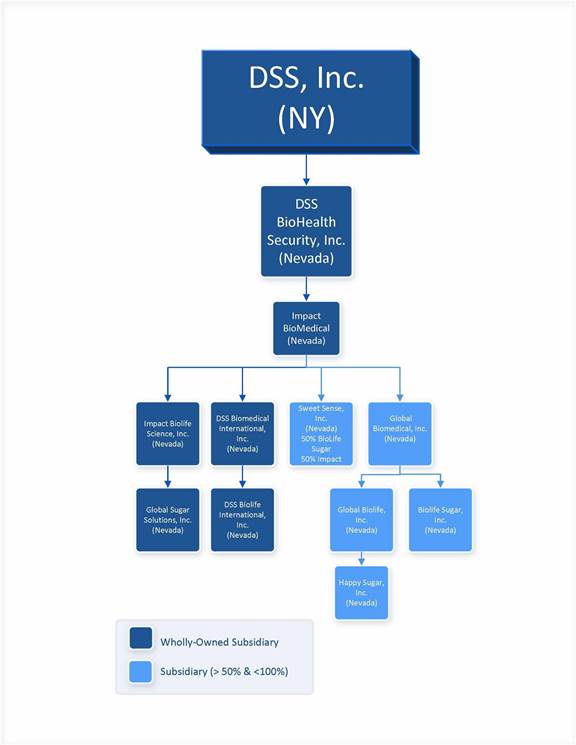

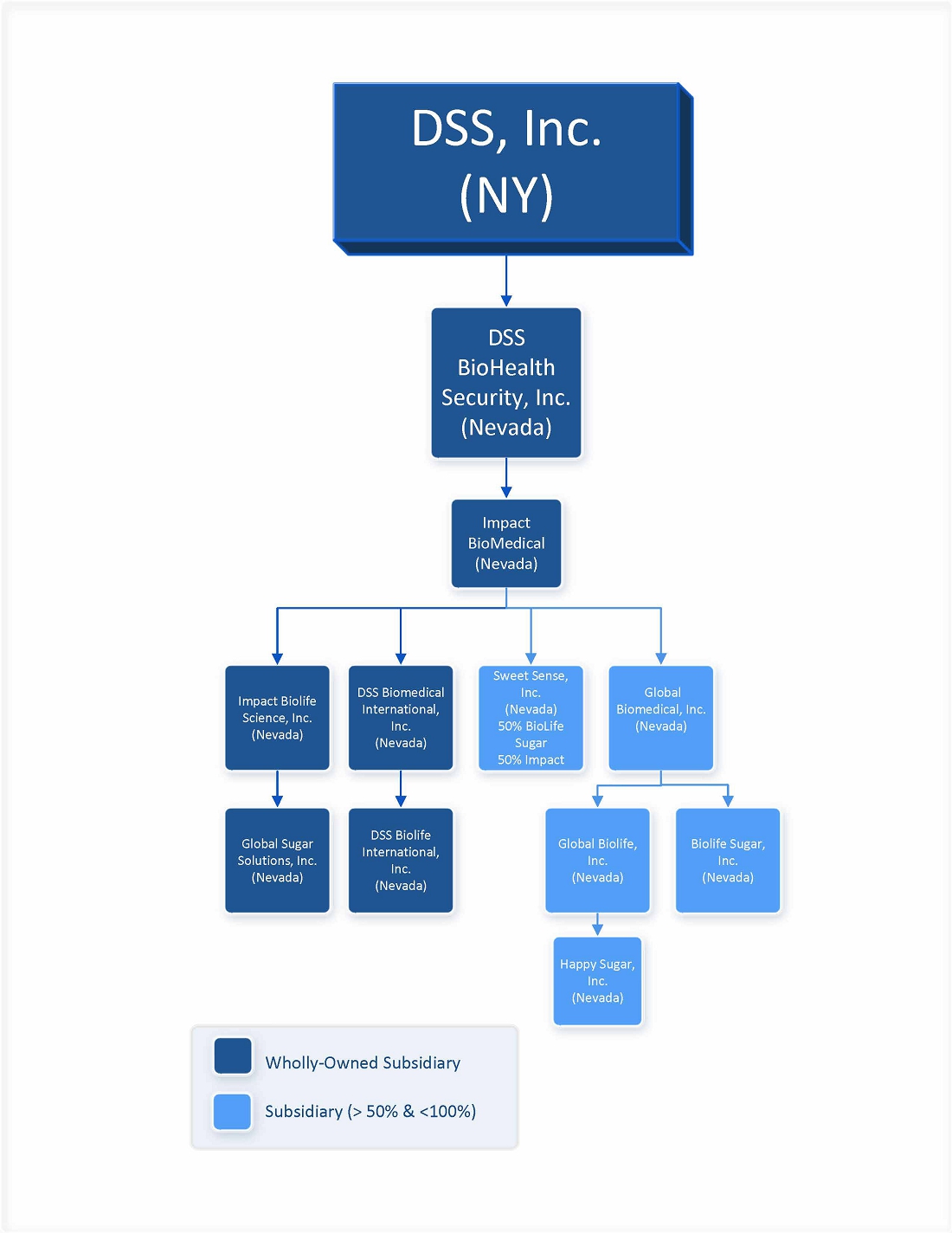

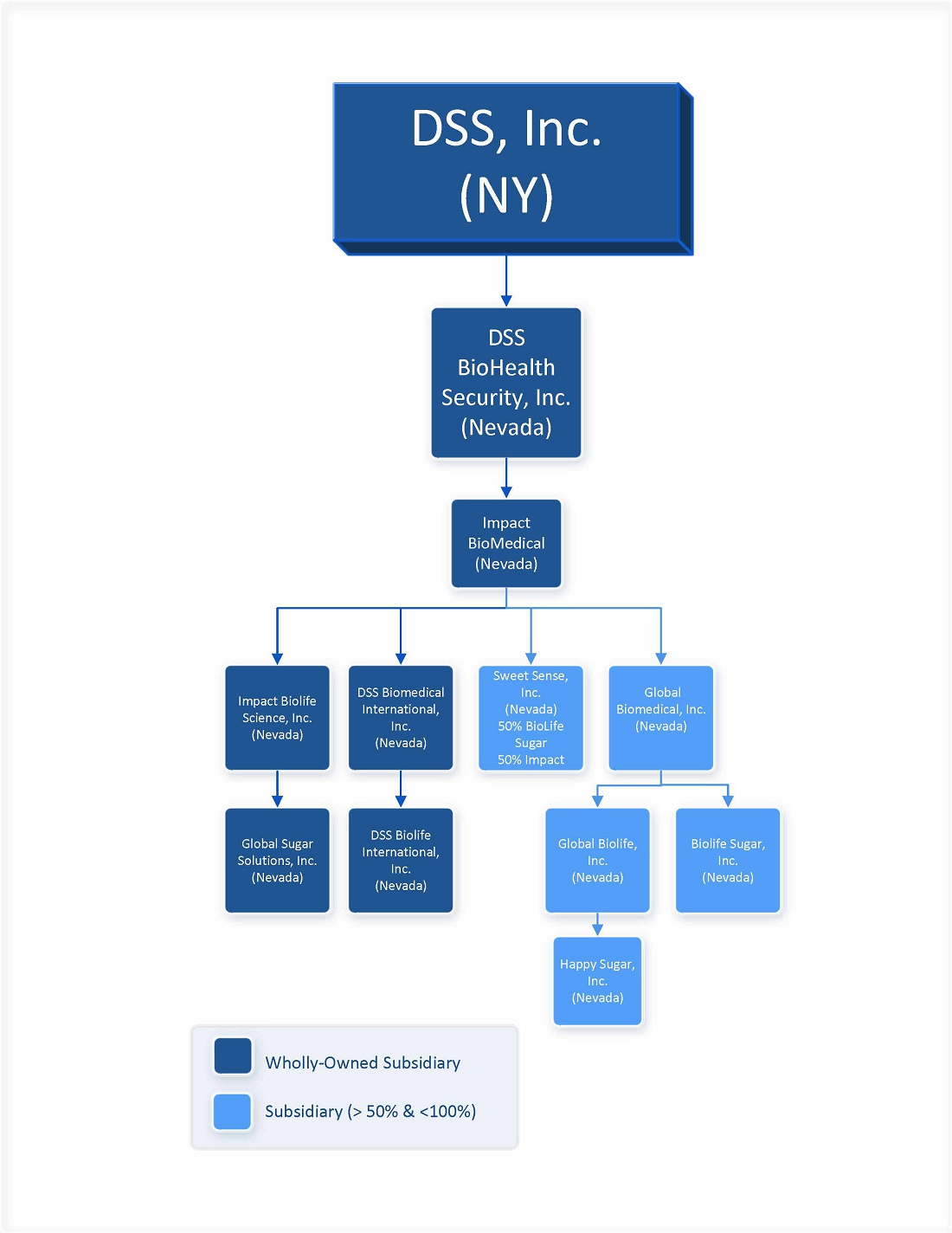

Impact Biomedical Inc. (“IBIO”) is a subsidiary of DSS, Inc (“DSS”; NYSE: DSS). IBIO discovers, confirms, and patents unique science and technologies which can be developed into new offerings in human healthcare and wellness in collaboration with external partners through licensing, co-development, joint ventures, and other relationships. Currently, our operations are conducted, and our assets are owned through our principal subsidiaries: (i) Global BioLife, Inc. (“Global BioLife”), which was incorporated on April 14, 2017, (ii) Impact BioLife Science (“Impact BioLife”), which was incorporated on August 28, 2020, (iii) Global BioMedical, Inc. (“Global BioMedical”), which was incorporated on April 18, 2017, and (iv) Sweet Sense, Inc. (“Sweet Sense”), which was incorporated on April 30, 2018.

By leveraging technology and new science with strategic partnerships, we provide advances in biopharmaceuticals and over the counter direct to consumer wellness offerings, and drug discovery for the prevention, inhibition, and treatment of neurological, oncology and immuno-related diseases.

In addition to our existing efforts, we continually search for and evaluate other potential new offerings to add to our portfolio.

Our business model includes partnering and potentially direct sales for commercialization and distribution. Potential licensors and development partners include pharmaceutical, consumer packaged goods companies and others, who would commercialize IBIO technologies in exchange for milestone, and royalty licensing payments.

Below is a list of our principal subsidiaries:

| ● | Impact BioLife Science, Inc.; | |

| ● | Global Biomedical, Inc.; | |

| ● | Global BioLife, Inc.; and | |

| ● | Sweet Sense, Inc. |

Impact BioLife Science, Inc. We are the sole owner of the outstanding equity of Impact BioLife Science, Inc.

Global Biomedical, Inc. We own 90.9% of Global Biomedical, Inc.’s outstanding equity.

Global BioLife, Inc. Through our majority owned subsidiary Global Biomedical, Inc., we own 81.8% of the outstanding equity of Global BioLife, Inc.

Sweet Sense, Inc. We are the owner of 95.5% of the outstanding equity of Sweet Sense.

| 1 |

Below is an organization chart showing our ownership structure and ownership interests.

Through our majority-owned subsidiary Global BioLife, we own the rights to a portfolio of intellectual property, including property assigned to Global BioLife by GRDG Sciences, LLC (“GRDG”). Global BioLife leverages its scientific know-how and intellectual property rights to develop various emerging technologies, including biopharmaceuticals, antivirals, antimicrobials, sugar alternatives, health supplements, insect repellents, fragrances, bioplastics, natural preservatives, and others.

Impact BioMedical has several unique and proprietary technologies that are in continuing development.

Linebacker

Linebacker is a platform of small molecule electrophilically enhanced polyphenol compounds with potential application in oncology (solid tumors), inflammatory disorders, and neurology. Polyphenols are substances found in many nuts, vegetables, and berries. Linebacker compounds are modified Myricetin, which is a common plant-derived flavonoid. Myricetin exhibits a wide range of activities that include strong antioxidant and anti-inflammatory activities (source: NIH).

Linebacker can potentially be developed as monotherapy or co-therapy to down-regulate PIM (proviral integration site for Moloney murine leukemia virus) kinase which plays a key role as an oncogene in various cancers (e.g. colon, lung, prostate, breast). Additional potential applications include inflammatory disorders and neurology.

Linebacker-1 and Linebacker-2 compounds have been licensed to ProPhase Laboratories (NASDAQ: PRPH) for development and commercialization worldwide, from which Impact Biomedical could receive future milestone and royalty payments.

Composition and method patents are issued to the Company for Linebacker in the U.S. and other countries.

Laetose

Laetose™ technology demonstrates compelling potential in reducing caloric intake and glycemic index in foods, while also inhibiting tumor necrosis factor alpha (TNF-α), a cytokine associated with inflammatory chronic diseases (data on file with IBIO).

The patented formulation has potential to inhibit the inflammatory and metabolic response of sugar alone and has potential applications in therapeutic administration to reduce or limit inflammatory or metabolic diseases (e.g., diabetes). Use of Laetose in a daily diet, compared to sugar, could result in 30% lower sugar consumption and lower caloric and glycemic index/load.

Laetose has a unique composition patent allowed in the United States and patents are pending in other countries worldwide.

IBIO is actively seeking potential partners for further development and commercialization of Laetose as a consumer-packaged or biopharmaceutical offering worldwide.

| 2 |

Functional Fragrance Formulation (“3F”)

3F is a suite of “functional fragrances” containing specialized botanical ingredients (e.g., terpenes) with potential application as an antimicrobial, or as an additive in insect repellents, detergents, lotions, shampoo, fabrics and other substances to increase effectiveness.

IBIO has partnered with the Chemia Corporation (St. Louis, MO) to pursue development of the 3F technology. Chemia is a leading developer and manufacturer of fragrances and flavors.

In addition to Chemia, IBIO is actively seeking potential partners for further development and commercialization of 3F worldwide, given the broad application of this technology.

Composition patents have issued in the U.S. and are pending in other countries.

Equivir

Equivir/Equivir G technology is a novel blend of FDA Generally Recognized as Safe (GRAS) eligible polyphenols (e.g. Myricetin, Hesperetin, Piperine) which have demonstrated antiviral effects with additional potential application as health supplements or medication. Polyphenols are substances found in many nuts, vegetables, and berries. Myricetin is a member of the flavonoid class of polyphenolic compounds with antioxidant properties. Hesperitin is a flavanone and Piperine is an alkaloid, commonly found in black pepper.

Equivir/Equivir G is licensed to ProPhase Laboratories for development and commercialization worldwide. ProPhase Lab’s initial focus is for use as an over-the-counter offering for upper respiratory wellness. Additional applications could be pursued in the future.

Method and composition patents are issued in the U.S. and other countries.

Emerging Technology

Impact BioMedical continually evaluates additional proprietary technologies that are in various phases of development. These include, and are not limited to biopharmaceuticals, indoor air quality products, preservatives, bioplastics, personalized medicine (e.g. genomics, diagnostics), nanotechnology, cannabis products and technology, pain management, and others.

These activities include discussions with potential companies/technologies which, subject to completion of diligence, and approval of the respective management boards, could potentially expand the offerings of Impact Biomedical Inc. There is no assurance that any one, or all, of these will result in a material transaction and this is exemplary of consistent and ongoing search and discovery efforts within Impact Biomedical Inc.

Corporate History and Information

The Company was incorporated in the State of Nevada as a for-profit company on October 16, 2018, and established a fiscal year end of December 31st. The Company issued 9,000 shares to Global BioMedical Pte. Ltd., which was wholly owned by Alset International Limited (formally Singapore eDevelopment Limited), a multinational public company, listed on the Singapore Exchange Securities Trading Limited (“SGXST”). On March 31, 2020, the Company issued 125,064,621 shares of common stock to its sole shareholder Global BioMedical Pte. Ltd. On July 24, 2020, the Board approved the Stock Split, pursuant to which each share of the Company’s common stock issued and outstanding was split into nine shares of the Company’s common stock. The numbers of authorized common stock and issued and outstanding common stock in the reporting periods were retrospectively adjusted for the stock split.

On March 12, 2020, Alset International Limited (“Alset”), a related party, Global BioMedical Pte Ltd., a related party, DSS, Inc (“DSS”), a related party, and DSS BioHealth Security Inc. (“DSS BioHealth”), a related party, signed Term Sheets, and subsequently on April 21, 2020, these four companies entered into Share Exchange Agreement (“Share Exchange”). Pursuant to the Share Exchange, Global BioMedical Pte Ltd., agreed to sell all of the issued and outstanding shares of the Company to DSS BioHealth in exchange for the combination of common and preferred shares of DSS. Under the terms of the Share Exchange, DSS issued 483,334 shares of the DSS Common Stock nominally valued at $6.48 per share, and 46,868 newly issued shares of the DSS Series A Convertible Preferred Stock (“Series A Preferred Stock”), with a stated value of $46,868,000, or $1,000 per share, for a total consideration valued at $50 million. Due to several factors, including a discount for illiquidity, the value of the Series A Preferred Stock was discounted from $46,868,000 to $35,187,000, thus reducing the final consideration given to approximately $38,319,000. The Company’s former Chairman, Heng Fai Ambrose Chan, a related party, who is also the largest shareholder of Alset, at the time of the signing of the Share Exchange Agreement was the beneficial owner of approximately 18.3% of the outstanding shares of DSS and is the Chairman of the Board of Directors of DSS. On August 21, 2020, the transaction was concluded, and the Company became a direct wholly owned subsidiary of DSS BioHealth. In connection with the acquisition, and the related accounting determination, DSS BioHealth has elected to apply push-down accounting and reflect in its financial statements of Impact BioMedical, the fair value of its assets and liabilities. Utilizing an income approach, the Company has completed its valuations of certain developed technology and pending patents assets acquired in the transaction as well the fair value of the non-controlling interests. More specifically, a Multi-Period Excess Earnings Method (“MPEEM”) estimates the value of an intangible asset by quantifying the amount of residual (or excess) estimated cash flows generated by the asset and discounting those cash flows to the present. These have been valued at approximately $22,260,000 and $3,910,000, respectively, and are included on the Consolidated Balance Sheet on December 31, 2020. Estimated useful life of these assets is twenty years, based on the remaining terms of the related patents, with annual amortization approximating $1,113,000. The Company has also completed its valuation of goodwill and deferred tax liabilities of Impact BioMedical, and has recorded goodwill of approximately $25,093,000, driven by other intangible assets that do not qualify for separate recognition, and a deferred tax liability of approximately $5,234,000. The goodwill is not deductible for tax purposes and has been allocated to Impact BioMedical in totality as a single reporting unit. The Company is committed to both funding research and developing intellectual property portfolio.

| 3 |

Recent Developments

The information below does not assume or give effect to (1) a 1:55 reverse split of the Company’s outstanding common stock and (2) an exchange by a shareholder of common stock for Series A Convertible Preferred Stock, both of which became effective October 31, 2023.

Vivacitas Investment

On March 15, 2021, the Company entered into a Stock Purchase Agreement (the “Vivacitas Agreement #1”) with Vivacitas Oncology Inc. (“Vivacitas”), to purchase 500,000 shares of its common stock at the per share price of $1.00, with an option to purchase 1,500,000 additional shares at the per share price of $1.00. This option will terminate upon one of the following events: (i) Vivacitas’ board of directors cancels this option because it is no longer in the best interest of the Company; (ii) December 31, 2022; or (iii) the date on which Vivacitas receives more than $1.00 per share of the Company’s common stock in a private placement with gross proceeds of $500,000. Under the terms of the Vivacitas Agreement #1, the Company will be allocated two seats on the board of Vivacitas. On March 18, 2021, the Company entered into an agreement with Alset EHome International, Inc. (“Seller”) to purchase from the Seller’s its wholly owned subsidiary Impact Oncology PTE Ltd. (“IOPL”) for a purchase price of $2,480,000. The acquisition of IOPL has been treated as an asset acquisition as IOPL does not meet the definition of a business as defined in Topic 805. IOPL owns 2,480,000 shares of common stock of Vivacitas along with the option to purchase an additional 250,000 shares of common stock. The Sellers largest shareholder is Mr. Chan Heng Fai Ambrose, the former Chairman of the Company’s board of directors and its largest shareholder.

On April 1, 2021, the Company entered into an additional stock purchase agreement with Vivacitas (“Vivacitas Agreement #2”), whereas Vivacitas wished to employ the service of the Chief Business Officer of Impact Biomedical, and in return for the services of this individual, Vivacitas shall issue to the Company, the aggregate purchase price for the Class A Common Shares of Vivacitas at the value of $1.00 per share shall be $120,000 to be paid in twelve (12) equal monthly installments for the period between April 1, 2021 and March 31, 2022.

On July 22, 2021, the Company exercised 1,000,000 of the available options under the Vivacitas Agreement #1 for $1,000,000. This, along with the shares received as part Vivacitas Agreement #2 increased the Company’s equity position in Vivacitas to approximately 16% as of December 31, 2022. As of December 31, 2022, the Company determined to impair 100% of its investment in Vivacitas, in the amount of $4,100,000.

Promissory Note 1

On February 19, 2021, Impact entered into a promissory note with an individual. The Company loaned the principal a sum of $206,000, with interest at a rate of 6.5%, and maturity date of August 19, 2022 later amended to February 19, 2024. Monthly payments are due on the twenty-first day of each month and continuing each month thereafter until February 19, 2024, later amended to February 19, 2026. This note is secured by certain real property situated in Collier County, Florida. The outstanding principal and interest as of December 31, 2023, approximately $203,000 and is classified in current notes receivable on the accompanying consolidated balance sheets. The outstanding principal and interest as of March 31, 2024 and December 31, 2023, was approximately $203,000, and is classified in Current notes receivable on the accompanying consolidated balance sheets.

DSS Note

On December 31, 2020, and later amended, the Company executed a Revolving Promissory Note (“Note”) with DSS Inc., a related party, which accrues interest at a rate of 4.25% and is due in full at the maturity date of September 30, 2030. The revolving nature of this Note permits principal amounts borrowed to be repaid and reborrowed. In the case of default, at DSS’s option, (i) eighteen percent (18%) per annum, or (ii) such lesser rate of interest as Lender in its sole discretion may choose to charge; but never more than the maximum lawful rate under applicable laws. On January 18, 2024, the Note was amended to extend the maturity date to September 30, 2030 with interest calculated at the Wall Street Journal prime rate plus 0.50%. The payment of principal and interest is on demand. On May 31, 2024, the note was further amended to have interest only payments paid the last day of the quarter beginning on September 30, 2024 through June 30, 2026. Principal and interest in an amount approximating $126,000 is to be paid monthly thereafter until the Note matures. The Company, at its discretion, may make the scheduled interest and principal payments with cash or via Company equity. As of March 31, 2024 and December 31, 2023 the outstanding balance, inclusive of interest was $12,787,000 and $12,074,000, respectively.

Although there is no formal written agreement to fund the Company, DSS may continue to fund the operations of the Company on an as needed basis to be decided by its board of directors.

| 4 |

GRDG Licensing Proceeds Distribution Agreement

On February 15, 2022, the Company entered into a Licensing Proceeds Distribution Agreement (the “Licensing Agreement”) with GRDG Sciences, LLC (“GRDG”), Global BioLife, Inc., and Impact BioLife Sciences, Inc., pursuant to which GRDG would conditionally receive 20% of the gross licensing or sale proceeds received by the Company from the licensing of improvements with patent and patent applications (the “Improvements”), and all research and technology developed, made, owned, or conceived by GRDG through the life of the agreement in exchange for funding from the Company for research and technology development activities. This Licensing Agreement ended in September 2023 as core technologies achieved significant development milestones. For the three months ended March 31, 2023, the Company incurred approximately $129,000 in expenses, and had approximately $43,000 in prepaid monthly fees. For the three months ended March 31, 2024, the Company had incurred $0 in fees.

ProPhase License Agreement

On March 17, 2022, the Company entered into a License Agreement (the “License Agreement”) with ProPhase Labs, Inc. (“ProPhase”) and Global BioLife, Inc., pursuant to which ProPhase obtained a license to Equivir/Equivir G intellectual property rights of Global BioLife, Inc. in exchange for a royalty fee of five- and one-half percent (5.5%) of net sales. Pursuant to the License Agreement, Global BioLife, Inc. shall reimburse ProPhase for fifty percent (50%) of the development costs up to one million two hundred fifty dollars ($1,250,000). The term (the “Term”) of the License Agreement is the later of (a) the expiration date of the last to expire a valid claim comprising the licensed patents, or (b) twelve (12) years from the date of first commercial sale. ProPhase may terminate this Agreement for any or no reason upon thirty (30) days prior written notice to Global BioLife, Inc. In addition, at any time prior to expiration of the Term, either party may terminate the License Agreement for cause by providing written notice. As of March 31, 2024 and December 31, 2023, a liability of $152,000 and $200,000, respectively, has been recorded in relation to the License Agreement.

On July 18, 2022, the Company entered into a Linebacker License Agreement (“Linebacker License Agreement”) by and between ProPhase, and Global BioLife, Inc., pursuant to which Global BioLife, Inc. licensed compounds to ProPhase for research purposes for a one-time upfront license fee of fifty thousand dollars ($50,000). The Linebacker License Agreement contains milestones that may result in payment to Global BioLife, Inc. of (a) nine hundred thousand dollars ($900,000) upon successful completion of a first Phase 3 study, which may be required by the FDA, and (b) one million dollars ($1,000,000) for regulatory approval of an NDA for the first licensed product. In addition, ProPhase will pay Global BioLife, Inc. 3% royalties on net revenue of each licensed product from the date of first commercial sale and for the term of the agreement. The term of the Linebacker License Agreement is automatically upon the last to occur of the expiration of the last-to-expire licensed patent. ProPhase has the right to terminate the Linebacker License Agreement for any reason or for convenience in its sole discretion. Global BioLife, Inc. has the right to terminate the Linebacker License Agreement only for uncured material breaches by ProPhase.

Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. This basis of accounting contemplates the recovery of our assets and the satisfaction of liabilities in the normal course of business. As reflected in the accompanying financial statements the Company has incurred operating losses as well as negative cash flows from operating and investing activities over the past two years. These factors raise substantial doubt about the Company’s ability to continue as a going concern within one year of the date that the financial statements are issued. These consolidated financial statements do not include any adjustments to the specific amounts and classifications of assets and liabilities, which might be necessary should we be unable to continue as a going concern.

To continue as a going concern, the Company has entered into an updated revolving promissory note which extended the maturity through September 30, 2030, and DSS, Inc. (“DSS”), the majority shareholder of the Company, intends to continue to fund the operations of the Company through a year from the date these financial statements were available to be issued. The Company’s management intends to take actions necessary to continue as a going concern. Management’s plans concerning these matters include, among other things, monetization of its intellectual properties, and tightly controlling operating costs. The Company has increased its efforts to raise additional capital through an initial public offering. The Company has engaged an underwriter and has been approved by the NYSE American for listing on its exchange. However, the Company cannot be certain that such capital (from its stockholders or third parties) will be available to the Company or whether such capital will be available on terms that are acceptable to the Company.

| 5 |

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in revenue during our last completed fiscal year, we qualify as an “emerging growth company” as defined in the federal securities laws. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These reduced reporting requirements include:

| ● | an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting; | |

| ● | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; | |

| ● | an exemption from the requirements to obtain a non-binding advisory vote on executive compensation or a stockholder approval of any golden parachute arrangements; | |

| ● | extended transition periods for complying with new or revised accounting standards; | |

| ● | being permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, in addition to any required unaudited interim financial statements in this prospectus; and | |

| ● | reduced disclosures regarding executive compensation in our periodic reports, proxy statements and registration statements, including in this prospectus. |

We will remain an emerging growth company until the earliest to occur of: (i) the end of the first fiscal year in which our annual gross revenue is $1.235 billion or more; (ii) the end of the first fiscal year in which we are deemed to be a “large accelerated filer,” as defined in the Securities Exchange Act of 1934, as amended, (the “Exchange Act”); (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; and (iv) the end of the fiscal year during which the fifth anniversary of this offering occurs. We may choose to take advantage of some, but not all, exemptions afforded to emerging growth companies. We currently intend to take advantage of the exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. The Company will take advantage of the extended transition period for complying with any new or revised financial account standards provided pursuant to Section 7(a)(2)(B).

Implications of Being a Smaller Reporting Company

We are also a “smaller reporting company” as defined under SEC Regulation S-K. As such, we also are exempt from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and also are subject to less extensive disclosure requirements regarding executive compensation in our periodic reports and proxy statements. We will continue to be deemed a smaller reporting company until our public float exceeds $75 million on the last day of our second fiscal quarter in the preceding fiscal year.

Corporate Information

Impact BioMedical Inc. is a Nevada corporation and was incorporated in October 2018. Our principal executive offices are located at 1400 Broadfield Blvd., Suite 130, Houston, Texas 77084. Our telephone number is (585) 325-3610. Our website address is www.impbio.com. The information on our website is neither incorporated by reference into this prospectus nor intended to be used in connection with this offering.

| 6 |

The Offering

The following summary of the offering contains basic information about the offering and the common stock and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the common stock, please refer to the section of this prospectus entitled “Description of our Capital Stock.”

| Securities offered by us: | 1,500,000 shares of common stock. | |

| Common Stock outstanding before this offering: | 10,000,000 shares | |

| Common Stock to be outstanding immediately after this offering: | 11,500,000 shares(1) | |

| Underwriter Warrants: | We have agreed to issue to the underwriter warrants to purchase up to a total of 75,000 shares of our common stock (or 86,250 shares assuming the over-allotment option is exercised in full), representing five percent (5%) of the number of shares of our common stock sold in each offering. The warrants will be exercisable at a price per share equal to 125% of the initial public offering price per share at any time and from time to time, in whole or in part, from (9) months after the commencement of sales in this offering to the third anniversary thereof. | |

| Option to purchase additional shares: | We have granted the underwriter an option, exercisable at any time and from time to time, in whole or in part, within 45 days after the closing of this offering to purchase up to an additional 225,000 shares of our common stock at the initial public offering price less underwriting discounts and commissions, solely to cover over-allotments, if any. | |

| Use of proceeds: | We expect to receive approximately $5,108,000 in net proceeds from the sale of our common stock offered by us in this offering (approximately $5,927,000 if the underwriters exercise their over-allotment option in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We currently intend to use the net proceeds received from this offering for general and working capital purposes, including but not limited to investing in research and development, including in our technology, the repayment of debt and for other working capital and general corporate purposes. See “Use of Proceeds”. | |

| Dividend Policy: | Holders of common stock are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of funds legally available. We have not paid any dividends since our inception, and we presently anticipate that all earnings, if any, will be retained for the development of our business. Any future disposition of dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors. | |

| Risk Factors: | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 9 of this prospectus before deciding whether or not to invest in our securities. | |

| Proposed Ticker Symbol: | We intend to apply to list shares of our common stock on the NYSE American, subject to official notice of issuance, under the symbol “IBO”. No assurance can be given that our applications will be approved, or that a trading market will develop for our shares. If our application is not approved, we will not continue with this offering. | |

| Lock-ups: | We and our directors, officers and certain stockholders who are holders of 5% or more of the outstanding shares of common stock as of the effective date of the registration statement, have agreed with the underwriters that we will not, without the prior written consent of the representatives, for a period of 180 days after the date of this offering: (i) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any classes of our stocks or any securities convertible into or exercisable or exchangeable for any classes of our stocks; (ii) file or caused to be filed any registration statement with the SEC, relating to the offering of any classes of our stocks or any securities convertible into or exercisable or exchangeable for any classes of our stocks; (iii) complete any offering of debt securities, other than entering into a line of credit with a traditional bank; or (iv) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any classes of our stocks, whether any such transaction described in clause (i), (ii), (iii) or (iv) above is to be settled by delivery of any classes of our stocks or such other securities, in cash or otherwise. |

| (1) | Based on 10,000,000 shares of common stock issued and outstanding as of May 21, 2024 and assuming the following: |

| ☐ | No exercise by the underwriter of its option to purchase 225,000 additional shares of common stock; | |

| ☐ | No exercise of the underwriter’s warrants; and | |

| ☐ | 1,500,000 shares of common stock sold in this offering. |

| 7 |

Summary Consolidated Financial Data

The summary consolidated financial data set forth below should be read together with our consolidated financial statements and the related notes to those statements, as well as the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus. The consolidated statement of operations data for the three months ended March 31, 2024 and 2023 have been derived from our reviewed consolidated financial statements included elsewhere in this prospectus. The consolidated balance sheet data as of March 31, 2024 and December 31, 2023 have been derived from our reviewed and/or audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

The tables below do not give effect to the exchange of common stock for Series A Convertible Preferred Stock. Please see “Description of Our Capital Stock” for a discussion regarding the exchange.

Consolidated Statement of Operations Data:

| For the three months ended March 31, 2024 | For the three months ended March 31, 2023 | |||||||

| Unaudited | Unaudited | |||||||

| Revenues | $ | - | $ | - | ||||

| Net loss | $ | (998,000 | ) | $ | (849,000 | ) | ||

| Net loss per share | $ | (0.10 | ) | $ | (0.01 | ) | ||

| Weighted average number of shares | 10,000,000 | 70,496,041 | ||||||

Consolidated Balance Sheet Data:

As of March 31, 2024 | As of December 31, 2023 | |||||||

| Cash | $ | 2,000 | $ | 1,000 | ||||

| Total assets | $ | 44,356,000 | $ | 44,633,000 | ||||

| Total liabilities | $ | 17,092,000 | $ | 16,371,000 | ||||

| Total stockholder’s equity | $ | 27,264,000 | $ | 28,262,000 | ||||

| 8 |

RISK FACTORS

An investment in our securities is highly speculative and involves a high degree of risk. In determining whether to purchase the Company’s securities, an investor should carefully consider all of the material risks described below, together with the other information contained in this Prospectus. We cannot assure you that any of the events discussed below will not occur. These events could have a material and adverse impact on our business, financial condition, results of operations and prospects. If that were to happen, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Liquidity, the Company’s Business and Industry

If we do not adequately protect our intellectual property rights, our operations may be materially harmed.

We rely on and expect to continue to rely on agreements with parties with whom we have relationships, as well as patent, trademark and trade secret protection laws, to protect our intellectual property and proprietary rights. We cannot assure you that we can adequately protect our intellectual property or successfully prosecute potential infringement of its intellectual property rights. Also, we cannot assure you that others will not assert rights in, or ownership of, trademarks and other proprietary rights of ours or that we will be able to successfully resolve these types of conflicts to our satisfaction. Our failure to protect our intellectual property rights may result in a loss in potential revenue and could materially harm our operations and financial condition.

New legislation, regulations or rules related to obtaining patents or enforcing patents could significantly increase our operating costs and decrease any potential revenue we might otherwise make.

We spend a significant amount of resources on our patent assets. If new legislation, regulations or rules are implemented either by Congress, the U.S. Patent and Trademark Office (the “USPTO”) or the courts that impact the patent application process, the patent enforcement process or the rights of patent holders, these changes could negatively affect its expenses, potential revenue and could negatively impact the value of our assets.

Safety and effectiveness concerns can have significant negative impacts on sales and results of operations, lead to litigation and cause reputational damage.

Concerns about product safety, whether raised internally or by litigants, regulators or consumer advocates, and whether or not based on scientific evidence, can result in safety alerts, product recalls, governmental investigations, regulatory action on the part of the FDA (or its counterpart in other countries), private claims and lawsuits, payment of fines and settlements, declining sales and reputational damage. These circumstances can also result in damage to brand image, brand equity and consumer trust in products. Product recalls could in the future prompt government investigations and inspections, the shutdown of manufacturing facilities, continued product shortages and related sales declines, significant remediation costs, reputational damage, possible civil penalties and criminal prosecution.

| 9 |

Significant challenges or delays in our innovation and development of new products, technologies and indications could have an adverse impact on our long-term success.

Our continued growth and success depend on our ability to innovate and develop new and differentiated products and services that address the evolving health care needs of patients, providers and consumers. The development of successful products and technologies may also be necessary to offset revenue losses should our products lose market share due to various factors such as competition and loss of patent exclusivity. We cannot be certain when or whether we will be able to develop, license or otherwise acquire companies, products and technologies, whether particular product candidates will be granted regulatory approval, and, if approved, whether the products will be commercially successful. We pursue product development through internal research and development as well as through collaborations, acquisitions, joint ventures and licensing or other arrangements with third parties. In all of these contexts, developing new products, particularly biotechnology products, requires a significant commitment of resources over many years. Only a very few biopharmaceutical research and development programs result in commercially viable products. The process depends on many factors, including the ability to discern patients’ and healthcare providers’ future needs; develop new compounds, strategies and technologies; achieve successful clinical trial results; secure effective intellectual property protection; obtain regulatory approvals on a timely basis; and, if and when they reach the market, successfully differentiate its products from competing products and approaches to treatment. New products or enhancements to existing products may not be accepted quickly or significantly in the marketplace for healthcare providers, and there may be uncertainty over third-party reimbursement. Even following initial regulatory approval, the success of a product can be adversely impacted by safety and efficacy findings in larger patient populations, as well as market entry of competitive products.

We are subject to risks related to corporate social responsibility and reputational matters.

Our reputation and the reputation of our brands, including the perception held by our customers, end-users, business partners, investors, other key stakeholders and the communities in which we do business are influenced by various factors. There is an increased focus from our stakeholders on ESG practices and disclosure - and if we fail, or are perceived to have failed, in any number of ESG matters, such as environmental stewardship, inclusion and diversity, workplace conduct and support for local communities, or to effectively respond to changes in, or new, legal or regulatory requirements concerning climate change or other sustainability concerns, our reputation or the reputation of our brands may suffer. Such damage to our reputation and the reputation of our brands may negatively impact our business, financial condition and results of operations. In addition, negative or inaccurate postings or comments on social media or networking websites about the Company or our brands could generate adverse publicity that could damage our reputation or the reputation of our brands. If we are unable to effectively manage real or perceived issues, including concerns about product quality, safety, corporate social responsibility or other matters, sentiments toward the Company or our products could be negatively impacted, and our financial results could suffer.

We may not have adequate funds to implement our business plan.

Although we have received capital from our parent companies to meet our working capital and financing needs in the past, additional financing may be required in order to meet our current and projected cash requirements for operations. We cannot assure that we will secure all or any of the funding we anticipate. If our entire original capital is fully expended and additional costs cannot be funded from borrowings or capital from other sources, then our financial condition, results of operations and business performance would be materially adversely affected. We cannot assure that we will have adequate capital or financing to conduct our business or to grow.

| 10 |

Our ability to resell and/or license our products will depend upon successful clinical trials.

Only a small number of research and development programs result in the development of a product that obtains FDA approval. Success in preclinical work or early-stage clinical trials does not ensure that later stage or larger scale clinical trials will be successful. Conducting clinical trials is a complex, time-consuming and expensive process. Our ability to complete our clinical trials in a timely fashion depends in large part on a number of key factors including protocol design, regulatory and institutional review board approval, the rate of patient enrollment in clinical trials, and compliance with extensive current Good Clinical Practices. If we fail to adequately manage the design, execution and regulatory aspects of our clinical trials, our studies and ultimately our regulatory approvals may be delayed, or we may fail to gain approval for our product candidates. Clinical trials may indicate that our product candidates have harmful side effects or raise other safety concerns that may significantly reduce the likelihood of regulatory approval, result in significant restrictions on use and safety warnings in any approved label, adversely affect placement within the treatment paradigm, or otherwise significantly diminish the commercial potential of the product candidate. Also, positive results in a registrational trial may not be replicated in any subsequent confirmatory trials. Even if later stage clinical trials are successful, regulatory authorities may disagree with our view of the data or require additional studies, and may fail to approve or delay approval of our product candidates or may grant marketing approval that is more restricted than anticipated, including indications for a narrower patient population than expected and the imposition of safety monitoring or educational requirements or risk evaluation and mitigation strategies. In addition, if another company is the first to file for marketing approval of a competing drug candidate, that company may ultimately receive marketing exclusivity for its drug candidate, thereby reducing the value of our product.

We face significant competition from other biopharmaceutical and consumer product companies.

While we believe that our technology, development experience and scientific knowledge provide competitive advantages, we face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical, and biotechnology companies, academic institutions and governmental agencies, and public and private research institutions. Many of our existing or potential competitors have substantially greater financial, technical and human resources than we do and significantly greater experience in the development of drug candidates as well as in obtaining regulatory approvals of those drug candidates in the United States and in foreign countries.

Mergers and acquisitions in the pharmaceutical and biotechnology industries could result in even more resources being concentrated among a small number of our competitors. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries. Our competitors may succeed in developing, acquiring or licensing, on an exclusive basis, drug candidates that are more effective or less costly than any drug candidate that we may develop.

Our ability to compete successfully will depend largely on our ability to:

| ● | attract qualified scientific, product development and commercial personnel; | |

| ● | obtain patent or other proprietary protection for our drugs and technologies; | |

| ● | obtain required regulatory approvals; successfully collaborate with pharmaceutical companies in the discovery, development and commercialization of new drugs; and | |

| ● | negotiate competitive pricing and reimbursement with third party payors |

The availability of our competitors’ technologies could limit the demand, and the price we are able to charge for our services and for any drug candidate we develop. The inability to compete with existing or subsequently introduced drug development technologies would have a material adverse impact on our business, financial condition and prospects.

Established pharmaceutical companies and research institutions may invest heavily to accelerate discovery and development of novel compounds or to in license novel compounds that could make our products less competitive, which would have a material adverse impact on our business.

| 11 |

We are dependent on our collaborative agreements for the development of products and business development, which exposes us to the risk of reliance on the viability of third parties.

In conducting our research and development activities, we currently rely, and will in the future rely, on collaborative agreements with third parties such as manufacturers, contract research organizations, commercial partners, universities, governmental agencies and not-for-profit organizations for both strategic and financial resources. The loss of, or failure to perform by us or our partners under, any applicable agreements or arrangements, or our failure to secure additional agreements for other products in development, would substantially disrupt or delay our research and development and commercialization activities. Any such loss would likely increase our expenses and materially harm our business, financial condition and results of operation.

We are a human healthcare and consumer wellness company with no significant revenue. We have incurred operating losses since our inception, and we expect to incur losses for the foreseeable future and may never achieve profitability.

We have incurred significant operating losses since our inception. To date, we have not generated any revenue and we may not generate any revenue from sales of our clinical analytics services or drug candidates for the foreseeable future. We expect to continue to incur significant operating losses and we anticipate that our losses may increase substantially as we expand our drug development programs.

To achieve profitability, we must successfully develop, register and commercialize multiple technologies in biopharmaceuticals and over the counter consumer products. Even if we succeed in developing and commercializing one or more technologies, we may not be able to generate sufficient revenue and we may never be able to achieve or sustain profitability.

We are increasingly dependent on information technology systems to operate our business and a cyber-attack or other breach of our systems, or those of third parties on whom we may rely, could subject us to liability or interrupt the operation of our business.

We are increasingly dependent on information technology systems to operate our business. A breakdown, invasion, corruption, destruction or interruption of critical information technology systems by employees, others with authorized access to our systems or unauthorized persons could negatively impact operations. In the ordinary course of business, we collect, store and transmit confidential information and it is critical that we do so in a secure manner to maintain the confidentiality and integrity of such information. Additionally, we outsource certain elements of our information technology systems to third parties. As a result of this outsourcing, our third-party vendors may or could have access to our confidential information, making such systems vulnerable. Data breaches of our information technology systems, or those of our third-party vendors, may pose a risk that sensitive data may be exposed to unauthorized persons or to the public. For example, the loss of clinical trial data from completed or ongoing clinical trials or preclinical studies could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. While we believe that we have taken appropriate security measures to protect our data and information technology systems, and have been informed by our third party vendors that they have as well, there can be no assurance that our efforts will prevent breakdowns or breaches in our systems, or those of our third party vendors, that could materially adversely affect our business and financial condition.

If we are unable to obtain U.S. and/or foreign regulatory approval, we will be unable to resell or license our drug candidates.

Our drug candidates will be subject to extensive governmental regulations relating to, among other things, research, testing, development, manufacturing, safety, efficacy, record keeping, labeling, marketing and distribution of drugs. Rigorous preclinical testing and clinical trials and an extensive regulatory approval process are required in the U.S. and in many foreign jurisdictions prior to the commercial sale of drug candidates. Satisfaction of these and other regulatory requirements is costly, time-consuming, uncertain and subject to unanticipated delays. It is possible that no drug candidate that we present to the FDA will obtain marketing approval which will significantly diminish the value and desirability of our product candidates. In connection with the clinical trials for our drug candidates, we face risks that:

| ● | the drug candidate may not prove to be efficacious; | |

| ● | the drug candidate may not prove to be safe; |

| 12 |

| ● | the drug candidate may not be readily co-administered or combined with other drugs or drug candidates; | |

| ● | the results may not confirm the positive results from earlier preclinical studies or clinical trials; | |

| ● | the results may not meet the level of statistical significance required by the FDA or other | |

| ● | regulatory agencies; and | |

| ● | the FDA or other regulatory agencies may require us to carry out additional studies. |

We have limited experience in conducting and managing later stage clinical trials necessary to obtain regulatory approvals, including approval by the FDA. However, this risk would be mitigated in the event the Company is successful entering into a co-development agreement with a pharma partner for late-stage clinical development. The time required to complete clinical trials and for the FDA and other countries’ regulatory review processes is uncertain and typically takes many years. Our analysis of data obtained from preclinical and clinical trials is subject to confirmation and interpretation by regulatory authorities, which could delay, limit or prevent regulatory approval. We may also encounter unanticipated delays or increased costs due to government regulation from future legislation or administrative action or changes in FDA policy during the period of product development, clinical trials, and FDA regulatory review.

We will rely on third parties for manufacturing our clinical drug supplies; our dependence on these manufacturers may impair the development of our drug candidates.

We have no ability to internally manufacture the drug candidates that we need to conduct our clinical trials for the products that we acquire. For the foreseeable future, we expect to continue to rely on third-party manufacturers and other third parties to produce, package and store sufficient quantities of our drug candidates and any future drug candidates for use in our clinical trials. We may face various risks and uncertainties in connection with our reliance on third-party manufacturers, including:

| ● | reliance on third-party manufactures for regulatory compliance and quality assurance; | |

| ● | the possibility of breach of the manufacturing agreement by the third-party manufacturer because of factors beyond our control; | |

| ● | the possibility of termination or nonrenewal of our manufacturing agreement by the third-party manufacturer at a time that is costly or inconvenient for us; | |

| ● | the potential that third-party manufacturers will develop know-how owned by such third-party | |

| ● | manufacturer in connection with the production of our drug candidates that is necessary for the manufacture of our drug candidates; and | |

| ● | reliance on third-party manufacturers to assist us in preventing inadvertent disclosure or theft of our proprietary knowledge. |

Our drug candidates may be complicated and expensive to manufacture. If our third-party manufacturers fail to deliver our drug candidates for clinical use on a timely basis, with sufficient quality, and at commercially reasonable prices, we may be required to delay or suspend clinical trials or otherwise discontinue development of our drug candidates. While we may be able to identify replacement third-party manufacturers or develop our own manufacturing capabilities for these drug candidates, this process would likely cause a delay in the availability of our drug candidates and an increase in costs. In addition, third-party manufacturers may have a limited number of facilities in which our drug candidates can be manufactured, and any interruption of the operation of those facilities due to events such as equipment malfunction or failure or damage to the facility by natural disasters could result in the cancellation of shipments, loss of product in the manufacturing process or a shortfall in available drug candidates.

Risks Related to Intellectual Property Rights

We rely on various intellectual property rights, including patents and licenses, in order to operate our business.

Our intellectual property rights, may not be sufficiently broad or otherwise may not provide us with a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights.

| 13 |

As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving and, consequently, intellectual property positions in our industry are generally uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

The Company could be negatively impacted if found to have infringed on intellectual property rights.

Technology companies frequently enter into litigation based on allegations of patent infringement or other violations of intellectual property rights. In addition, patent holding companies seek to monetize patents they have purchased or otherwise obtained. As the Company grows, the intellectual property rights claims against it will likely increase. The Company intends to vigorously defend infringement actions in court and before the U.S. International Trade Commission. The plaintiffs in these actions frequently seek injunctions and substantial damages. Regardless of the scope or validity of such patents or other intellectual property rights, or the merits of any claims by potential or actual litigants, the Company may have to engage in protracted litigation. If the Company is found to infringe one or more patents or other intellectual property rights, regardless of whether it can develop non-infringing technology, it may be required to pay substantial damages or royalties to a third-party, or it may be subject to a temporary or permanent injunction prohibiting the Company from marketing or selling certain products. In certain cases, the Company may consider the desirability of entering into licensing agreements, although no assurance can be given that such licenses can be obtained on acceptable terms or that litigation will not occur. These licenses may also significantly increase the Company’s operating expenses. Regardless of the merit of particular claims, litigation may be expensive, time-consuming, disruptive to the Company’s operations and distracting to management. In recognition of these considerations, the Company may enter into arrangements to settle litigation. If one or more legal matters were resolved against the Company’s consolidated financial statements for that reporting period could be materially adversely affected. Further, such an outcome could result in significant compensatory, punitive or trebled monetary damages, disgorgement of revenue or profits, remedial corporate measures or injunctive relief against the Company that could adversely affect its financial condition and results of operations.

We rely heavily on our technology and intellectual property, but we may be unable to adequately or cost-effectively protect or enforce our intellectual property rights, thereby weakening our competitive position and increasing operating costs.

To protect our rights in our services and technology, we rely on a combination of copyright and trademark laws, patents, trade secrets, confidentiality agreements and protective contractual provisions. We also rely on laws pertaining to trademarks and domain names to protect the value of our corporate brands and reputation. Despite our efforts to protect our proprietary rights, unauthorized parties may copy aspects of our services or technology, obtain and use information, marks, or technology that we regard as proprietary, or otherwise violate or infringe our intellectual property rights. In addition, it is possible that others could independently develop substantially equivalent intellectual property. If we do not effectively protect our intellectual property, or if others independently develop substantially equivalent intellectual property, our competitive position could be weakened.

Effectively policing the unauthorized use of our services and technology is time-consuming and costly, and the steps taken by us may not prevent misappropriation of our technology or other proprietary assets. The efforts we have taken to protect our proprietary rights may not be sufficient or effective, and unauthorized parties may copy aspects of our services, use similar marks or domain names, or obtain and use information, marks, or technology that we regard as proprietary. We may have to litigate to enforce our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of others’ proprietary rights, which are sometimes not clear or may change. Litigation can be time consuming and expensive, and the outcome can be difficult to predict.

| 14 |

We rely on agreements with third parties to provide certain services, goods, technology, and intellectual property rights necessary to enable us to implement some of our applications.

Our ability to implement and provide our applications and services to our clients depends, in part, on services, goods, technology, and intellectual property rights owned or controlled by third parties. These third parties may become unable to or refuse to continue to provide these services, goods, technology, or intellectual property rights on commercially reasonable terms consistent with our business practices, or otherwise discontinue a service important for us to continue to operate our applications. If we fail to replace these services, goods, technologies, or intellectual property rights in a timely manner or on commercially reasonable terms, our operating results and financial condition could be harmed. In addition, we exercise limited control over our third-party vendors, which increases our vulnerability to problems with technology and services those vendors provide. If the services, technology, or intellectual property of third parties were to fail to perform as expected, it could subject us to potential liability, adversely affect our renewal rates, and have an adverse effect on our financial condition and results of operations.

If any third-party owners of intellectual property we may license in the future do not properly maintain or enforce the patents underlying such licenses, our competitive position and business prospects will be harmed.

We may enter into licenses for third-party intellectual property in the future. Our success will depend in part on the ability of our licensors to obtain, maintain and enforce patent protection for their intellectual property, in particular, those patents to which we have secured exclusive rights.