As filed with the Securities and Exchange Commission on May 2, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

OR

OF THE SECURITIES EXCHANGE ACT OF 1934

OR

OF THE SECURITIES EXCHANGE ACT OF 1934

Commission

file number:

Sendas Distribuidora S.A.

(Exact Name of Registrant as Specified in Its Charter)

| The Federative Republic of | |

| (Translation of Registrant’s Name into English) | (Jurisdiction of Incorporation or Organization) |

(Address of Principal Executive Offices)

Telephone: +

Email:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on which Registered |

| New York Stock Exchange1 | ||

| American Depositary Share, each representing one common share |

| (1) | Not for trading, but only in connection with the listing of the American Depositary Shares on the New York Stock Exchange. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2021:

common shares, without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities.

Act.

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934. Yes ¨

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

x Accelerated filer ¨ Non-accelerated filer ¨

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ |

| Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨

TABLE OF CONTENTS

| i |

INTRODUCTION

Except where the context otherwise requires, in this annual report, “Sendas” refers to Sendas Distribuidora S.A., and “we,” “our,” “us,” “our company” or like terms refer to Sendas and its consolidated subsidiaries.

In addition, unless otherwise indicated or the context otherwise requires, all references to:

| · | “ADSs” are to American Depositary Shares; |

| · | “B3” or “São Paulo Stock Exchange” are to B3 S.A. – Brasil, Bolsa, Balcão; |

| · | “Brazil” are to the Federative Republic of Brazil; |

| · | “Brazilian Corporate Law” are to Brazilian Law No. 6,404/76, as amended; |

| · | “Brazilian government” are to the federal government of Brazil; |

| · | “Casino” are to Casino, Guichard-Perrachon S.A., a French corporation (société anonyme). Casino is our indirect controlling shareholder. It is ultimately controlled by Mr. Jean-Charles Naouri, the chairman of our board of directors. For more information about Mr. Naouri, see “Item 6. Directors, Senior Management and Employees.” For more information about our direct and indirect shareholders, see “Item 7. Major Shareholders and Related Party Transactions—A. Major Shareholders”; |

| · | “Casino Group” are to Casino and its subsidiaries; |

| · | “CBD” are to Companhia Brasileira de Distribuição, a corporation (sociedade anônima) incorporated under the laws of Brazil; |

| · | “CBD ADSs” are to ADSs, each representing one common share of CBD; |

| · | “CBD ADS Custodian” are to Banco Itaú Corretora de Valores S.A., the Brazilian custodian of the CBD common shares underlying the CBD ADSs; |

| · | “Central Bank” are to the Central Bank of Brazil (Banco Central do Brasil); |

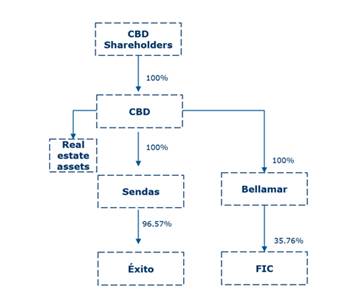

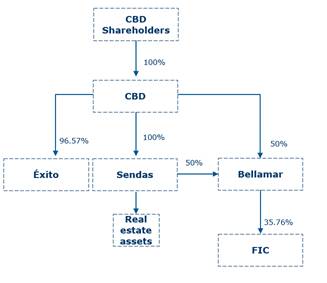

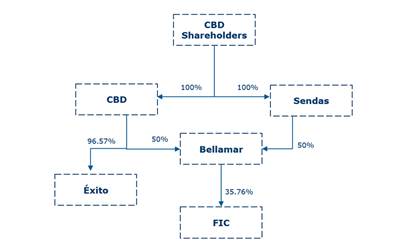

| · | “Corporate Reorganization” are to, collectively, the series of internal corporate transactions completed by CBD and Sendas on December 31, 2020. For more information about the Corporate Reorganization, see “Item 4. Information on the Company—A. History and Development of the Company—History—The Spin-Off”; |

| · | “CVM” are to the Brazilian Securities Commission (Comissão de Valores Mobiliários); |

| · | “Éxito” are to Almacenes Éxito S.A., a Colombian corporation; |

| · | “Éxito Acquisition” are to our acquisition of 96.57% of the shares of Éxito through a cash tender offer on the Colombian Securities Exchange. The Éxito Acquisition was completed on November 27, 2019. For more information, see “Item 4. Information on the Company—A. History and Development of the Company—History—Éxito Acquisition”; |

| · | “Éxito Group” are to Éxito and its consolidated subsidiaries; |

| · | “Exchange Act” are to the U.S. Exchange Act of 1934, as amended; |

| ii |

| · | “Extra Transaction” are to the transaction involving the assignment and conversion of up to 70 commercial points/stores operated by CBD under the Extra Hiper banner in several Brazilian states into cash and carry stores under the Assaí banner, among other transactions. For more information about the Extra Transaction, see “Item 4. Information on the Company—A. History and Development of the Company—History—Extra Transaction”; |

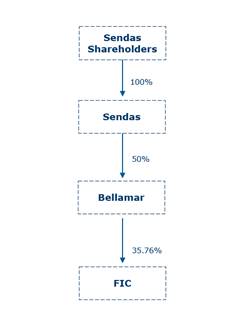

| · | “FIC” are to Financeira Itaú CBD S.A. Crédito, Financiamento e Investimento, a Brazilian financial services company; |

| · | “NYSE” are to the New York Stock Exchange; |

| · | “SEC” or the “Commission” are to the U.S. Securities and Exchange Commission; |

| · | “Securities Act” are the U.S. Securities Act of 1933, as amended: |

| · | “Sendas ADSs” are to ADS, each representing five Sendas common shares; |

| · | “Sendas ADS Custodian” are to Banco Itaú Corretora de Valores S.A., the Brazilian custodian of the Sendas common shares underlying the Sendas ADSs; |

| · | “Sendas common shares” are to common shares of Sendas; |

| · | “Sendas Deposit Agreement” are to the deposit agreement dated February 19, 2021, as amended on August 16, 2021, entered into between Sendas and the Sendas Depositary and the owners and holders from time to time of Sendas ADSs issued thereunder; |

| · | “Sendas Depositary” means JPMorgan Chase Bank N.A., the depositary for the Sendas ADSs; |

| · | “Separation” refers to our separation from CBD. On December 14, 2020, we entered into a Separation Agreement with CBD to provide a framework for our relationship with CBD following the Separation and the Spin-Off. For more information about the Separation Agreement, see “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Agreements Related to the Spin-Off”; and |

| · | “Spin-Off” are to the distribution of substantially all of the issued and outstanding Sendas common shares to holders of CBD common shares, including the CBD ADS Custodian, on a pro rata basis for no consideration. The Sendas common shares were distributed on March 3, 2020, and the Sendas ADSs were distributed on March 5, 2021. For more information about the Spin-Off, see “Item 4. Information on the Company—A. History and Development of the Company—History—The Spin-Off.” |

| iii |

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

All references herein to “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “U.S. dollars,” “dollars” or “US$” are to U.S. dollars.

Financial Statements

Historical Financial Statements

We maintain our books and records in reais. This annual report includes financial information derived from our audited historical consolidated financial statements as of December 31, 2021 and 2020 and for the years ended December 31, 2021, 2020 and 2019, and the related notes thereto, which are included in this annual report. We refer to these financial statements and the related notes thereto collectively as our “audited consolidated financial statements.”

We have prepared our audited consolidated financial statements in accordance with the International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB. Our audited consolidated financial statements have been audited in accordance with auditing standards of the Public Company Accounting Oversight Board.

Recast of Financial Statements

On December 31, 2020, we completed the Corporate Reorganization (defined below), pursuant to which we transferred to CBD all the shares of Éxito held by us (corresponding to 96.57% of the total outstanding shares of Éxito). Accordingly, we present the results of the Éxito Group as discontinued operations in our financial statements for the year ended December 31, 2020, and we recast our consolidated statements of operations and comprehensive income for the year ended December 31, 2019 in accordance with IFRS 5 - Non-current Assets Held for Sale and Discontinued Operations.

On August 11, 2021, our shareholders approved a one-to-five stock split of Sendas common shares, or the Stock Split. For more information about the Stock Split, see “Item 4. Information on the Company—A. History and Development of the Company—History—Stock Split.” Accordingly, we have retrospectively adjusted our basic and diluted earnings per share for the years ended December 31, 2020 and 2019 to reflect the effect of the Stock Split. For more information, see note 4 to our audited consolidated financial statements included elsewhere in this annual report.

The Corporate Reorganization and the Spin-Off

On December 31, 2020, we completed a corporate reorganization pursuant to which we transferred all of our equity interest in Éxito to CBD, and CBD transferred certain assets to us. We refer to these internal corporate transactions collectively as the “Corporate Reorganization.” For more information about the Corporate Reorganization, see “Item 4. Information on the Company—A. History and Development of the Company—History—The Spin-Off—Corporate Reorganization.” In addition, on December 14, 2020, we entered into a Separation Agreement with CBD to effect our separation from CBD, which we refer to as the “Separation,” and provide a framework for our relationship with CBD following the Separation and the Spin-Off. For more information about the Separation Agreement, see “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Agreements Related to the Spin-Off.”

| iv |

On December 31, 2020, an extraordinary general shareholders’ meetings of CBD and Sendas approved the distribution of substantially all of the issued and outstanding Sendas common shares to holders of CBD common shares, including the CBD ADS Custodian, on a pro rata basis for no consideration. We refer to this distribution as the “Spin-Off.” As a result of this approval, for purposes of Brazilian law, Sendas was technically no longer a subsidiary of CBD as of December 31, 2020. On February 19, 2021, the SEC declared effective the registration statement on Form 20-F to register the Sendas common shares, each represented by ADSs, under the Exchange Act, in connection with the trading of the Sendas ADSs on the NYSE.

The Sendas common shares were distributed on March 3, 2020, and the Sendas ADSs were distributed on March 5, 2021. The Sendas common shares began to trade on the B3 under the ticker symbol “ASAI3” The Sendas ADSs began to trade on a “regular way” basis on the NYSE under the ticker symbol “ASAI” on March 8, 2021. For more information about the Spin-Off, see “Item 4. Information on the Company—A. History and Development of the Company—History—The Spin-Off.”

Translation of Reais into U.S. Dollars

We have translated certain amounts included in this annual report from reais into U.S. dollars. The exchange rate used to translate such amounts was R$5.5805 to US$1.00, which was the commercial selling rate at closing for the purchase of U.S. dollars on December 31, 2021, as reported by the Central Bank. The U.S. dollar equivalent information included in this annual report is provided solely for convenience of investors and should not be construed as representation that the real amounts represent, or have been or could be converted into, U.S. dollars at such rates or at any other rate.

Market and Industry Data

We obtained the statistical data and information relating to the markets where we operate from reports prepared by government agencies and other publicly-available sources, including the Brazilian Supermarket Association (Associação Brasileira de Supermercados) and the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística). While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under “Cautionary Statement with Respect to Forward-Looking Statements” and “Item 3. Key Information—D. Risk Factors.”

Brands

This annual report includes trademarks, trade names and trade dress of other companies. Use or display by us of other parties’ trademarks, trade names or trade dress or products is not intended to and does not imply a relationship with, or endorsement or sponsorship of us by, the trademark, trade name or trade dress owners. Solely for the convenience of investors, in some cases we refer to our brand in this annual report without the ® symbol, but these references are not intended to indicate in any way that we will not assert our rights to our brand to the fullest extent permitted by law.

Rounding

We have made rounding adjustments to reach some of the figures included in this annual report. As a result, numerical figures shown as totals in some tables may not be arithmetic aggregations of the figures that precede them.

| v |

CAUTIONARY STATEMENT WITH RESPECT TO FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, principally in “Item 3. Key Information—D. Risk Factors,” “Item 4. Information on the Company—B. Business Overview” and “Item 5. Operating and Financial Review and Prospects.” We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting our business. These forward-looking statements are subject to risks, uncertainties and assumptions including, among other things:

· the economic, financial, political and social effects of the ongoing COVID-19 pandemic (or other pandemics, epidemics and similar crises), particularly in Brazil, and to the extent that they continue to cause serious negative macroeconomic effects, thus prompting and exacerbating the risks described under “Item 3. Key Information—D. Risk Factors;”

· global economic, political and social conditions and their impact on consumer spending patterns, particularly in Brazil (including, but not limited to, unemployment rates, interest rates, monetary policies and inflation rates);

· the ongoing impacts of the COVID-19 pandemic on customer demand, as well as on our expected results of operations, financial condition and cash flows our ability to sustain or improve our performance;

· competition in the sectors in which we operate;

· Brazilian government regulation and tax matters;

· adverse legal or regulatory disputes or proceedings;

· our ability to implement our strategy, including our digital transformation initiatives;

· credit and other risks of lending and investment activities;

· the political instability related to the outcome of the 2022 presidential elections in Brazil;

· our ability to expand our operations outside of our existing markets; and

· other risk factors as set forth under “Item 3. Key Information—D. Risk Factors.”

The words “believe”, “may”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect” and similar words are intended to identify forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements because of new information, future events or otherwise. In light of these risks and uncertainties, the forward-looking information, events and circumstances discussed in this annual report might not occur. Our actual results and performance could differ substantially from those anticipated in our forward-looking statements.

| vi |

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should carefully consider the risks described below, together with all of the other information included in this annual report, in evaluating our company, the Sendas common shares and the Sendas ADSs. The following risk factors could adversely affect our business, financial condition, results of operations and the price of the Sendas common shares and the Sendas ADSs.

Risks Relating to our Industry and Us

We face significant competition and pressure to adapt to changing consumer habits, which may adversely affect our market share and net income.

We operate in the cash and carry (atacado de autosserviço) sector of the Brazilian retail industry, which are highly competitive. We compete with other retailers based on price, product mix, store location and layout and services. Consumer habits are constantly changing and we may not be able to anticipate and quickly respond to these changes. We face intense competition from small and regional retailers, especially from those that operate in the informal segment of the Brazilian economy. We also compete with large chains in the cash and carry sector. In addition, in our markets, and particularly in the São Paulo and Rio de Janeiro metropolitan areas, we compete in the food retail sector with a number of large multinational food retailers, general merchandise and cash and carry chains, as well as local supermarkets and independent grocery stores. See “Item 4. Information on the Company—B. Business Overview—Competition.” Acquisitions or consolidations within the industry may also increase competition and adversely affect our market share and net income.

If we are unable to compete successfully in our target markets (including by adapting our store format mix or layout, identifying locations and opening stores in preferred areas, and quickly adjusting our product mix or prices) or otherwise adjust to changing consumer habits and preferences, such as shopping on mobile devices, we may lose market share, which would adversely affect our financial condition and results of operations.

We face increasing competition from internet sales, which may negatively affect sales through traditional channels, and we might not have an effective response to this competition.

In recent years, sales of food, clothing and home appliances over the internet have increased significantly in Brazil, and we expect this trend to continue as more traditional retailers enter into the online retail field or expand

| 1 |

their existing infrastructure related to internet sales. For example, Amazon recently announced that it would focus more resources on its Brazilian business. Internet retailers are able to sell directly to consumers, reducing the importance of traditional distribution channels such as cash and carry stores, supermarkets and retail stores. Certain internet food retailers have significantly lower operating costs than traditional hypermarkets and supermarkets because they do not rely on an expensive network of retail points of sale or a large workforce. As a result, internet food retailers are able to offer their products at lower costs than we do and in certain cases are able to bypass intermediaries in the cash and carry segment and deliver products directly to consumers. We believe that our customers are increasingly using the internet to shop electronically for food and other retail goods, and that this trend is likely to continue, especially as a result of the COVID-19 pandemic.

Additionally, technology employed in retail sales of food and home appliances evolves constantly as part of a modern digital culture. We may not be able to adapt to these changes quickly enough to meet our customers’ demands and preferences, as well as standards of the industry in which we operate.

We cannot provide any assurance that our strategy will be successful in meeting customer demands or maintaining our market share in light of our competitors’ internet businesses. If internet sales in Brazil continue to grow, consumers’ reliance on traditional distribution channels such as our cash and carry stores could be materially diminished, which could have a material adverse effect on our financial condition and results of operations.

The Brazilian cash and carry industry is sensitive to decreases in consumer purchasing power and unfavorable economic cycles.

Historically, the Brazilian cash and carry industry has experienced periods of economic slowdown that led to declines in consumer expenditures. The success of operations in the cash and carry sector depends on various factors related to consumer expenditures and consumer income, including general business conditions, interest rates, inflation, consumer credit availability, taxation, consumer confidence in future economic conditions, employment and salary levels. Reductions in credit availability and more stringent credit policies adopted by us and credit card companies may negatively affect our sales, especially for small home appliances offered in our stores. Unfavorable economic conditions in Brazil, or unfavorable economic conditions worldwide reflected in the Brazilian economy, may significantly reduce consumer expenditure and available income, particularly for lower income classes, who have less access to credit than higher income classes, more limited debt refinancing conditions and more susceptibility to be affected by increases in the unemployment rate. These conditions may have a material adverse effect on our financial condition and results of operation.

Restrictions of credit availability to consumers in Brazil and Brazilian government rules and interventions affecting financial operations may adversely affect our sales volumes and operations, and we are exposed to risks related to customer financing and loans.

Sales in installments are an important component of the result of operations for Brazilian non-food retailers. The increase in the unemployment rate combined with relatively high interest rates have resulted in an increased restriction of credit availability to consumers in Brazil. The unemployment rate reached 13.2% in 2021, compared to 13.8% in 2020 and 11.9% in 2019. These circumstances have not been noticeably improved by gradual reductions in the basic interest rate in Brazil, the SELIC rate, which reached 9.25%, 2.0% and 4.5% in December 2021, 2020 and 2019, respectively.

Our sales volumes, particularly for non-food products, and, consequently, our results of operations may be adversely affected if the credit availability to consumers is reduced, or if Brazilian government policy restricts the granting of credit to consumers.

Additionally, we are involved through FIC in extending credit to customers through our partnership with Itaú Unibanco Holding S.A., or Itaú Unibanco, one of the largest privately-owned financial institutions in Brazil. FIC exclusively offers credit cards, financial services and insurance coverage at our stores. For more information on FIC, see “Item 4. Information on the Company—B. Business Overview—FIC.”

| 2 |

FIC is subject to the risks normally associated with providing financing services, including the risk of default on the payment of principal and interest and any mismatch of cost and maturity of our funding in relation to the cost and maturity of financing to customers, which could have a material adverse effect on us.

Furthermore, FIC is a financial institution regulated by the Central Bank and is therefore subject to extensive regulation. The regulatory structure of the Brazilian financial system is continuously changing. Existing laws and regulations may be amended, and their application or interpretation may also change, and new laws and regulations may be adopted. FIC and, therefore, we, may be adversely affected by regulatory changes, including those related to:

| · | minimum capital requirements; |

| · | requirements for investment in fixed capital; |

| · | credit limits and other credit restrictions; |

| · | accounting requirements; |

| · | intervention, liquidation and/or temporary special management systems; and |

| · | interest rates. |

Brazilian government rules and intervention may adversely affect our operations and profitability more than those of a competitor without financial operations.

We are dependent on credit card sales. Any changes in the policies of merchant acquirers may adversely affect us.

We are dependent on credit card sales. For the years ended December 31, 2021 and 2020, 44% and 47%, respectively, of our net operating revenue was represented by credit sales, principally in the form of credit card sales. In order to offer credit card sales to our customers, we depend on the policies of merchant acquirers, including fees charged by acquirers. Any change in the policies of acquirers, including, for example, their merchant discount rate, may adversely affect us.

Our business depends on our strong brand. We may not be able to maintain and enhance our brand, or we may receive unfavorable customer complaints or negative publicity, which could adversely affect our brand.

We believe that our brand, Assaí, contributes significantly to the success of our business. The Assaí brand was ranked the 20th most valuable brand in Brazil, according to a study entitled “Most Valuable Brazilian Brands 2021” published by global brand consultant Interbrand in 2021. According to this study, the Assaí brand is valued at approximately R$654 million. We were also named the most admired company in Brazil by popular vote in the 2021 and 2020 editions of Exame magazine’s “Melhores e Maiores” ("Best and Biggest”) survey. Exame magazine’s annual survey ranks more than 1,000 Brazilian companies under various categories. “Melhores e Maiores” is considered one of the most prestigious corporate awards in Brazil. We also believe that maintaining and enhancing that brand is critical to expanding our base of customers, which depends largely on our ability to continue to create the best customer experience, based on our competitive pricing and our large assortment of products.

Customer complaints or negative publicity about our product offerings or services could harm our reputation and diminish consumer confidence in us. A diminution in the strength of our brand and reputation could adversely affect our business, financial condition and operating results.

| 3 |

The global outbreak of the novel coronavirus disease (COVID-19) could disrupt our operations and could have an adverse impact on our business, financial condition, results of operations or prospects.

Since December 2019, a novel strain of coronavirus known as COVID-19 has spread in China and other countries. In 2020, the COVID-19 outbreak has compelled governments around the world, including in Brazil, to adopt temporary measures to contain the spread of COVID-19, such as lockdowns of cities, restrictions on travel and public transportation, business and store closures, and emergency quarantines, among others, all of which have caused significant disruptions to the global economy and normal business operations across a growing list of sectors and countries. The measures adopted to combat the COVID-19 outbreak have adversely affected and will continue to adversely affect business confidence and consumer sentiment, and have been, and may continue to be, accompanied by significant volatility in financial and commodity markets as well as stock exchanges worldwide.

A detailed discussion of the measures taken by the Brazilian government to combat the health and economic impacts of COVID-19, as well as the impacts of the COVID-19 pandemic on our business and results of operations, can be found in “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Current Conditions and Trends in our Industry—COVID-19,” for a detailed discussion of the impacts of COVID-19 on our business and results of operations.

While we have not experienced significant disruptions thus far from the COVID-19 outbreak, any future impacts that COVID-19 may have on us is subject to numerous uncertainties, including: (1) the severity and duration of the pandemic, including whether there are new waves caused by additional periods of increases or spikes in the number of COVID-19 cases, future mutations or related strains of the virus in areas in which we operate; (2) evolving macroeconomic factors, including general economic uncertainty, unemployment rates, and recessionary pressures; (3) unknown consequences on our business performance and initiatives stemming from the substantial investment of time and other resources to the pandemic response; and (4) the long-term impact of the pandemic on our business, including consumer behaviors. Accordingly, our business may be adversely impacted by the fear of exposure to uncertainties related to or actual effects of COVID-19 or similar disease outbreak.

In addition, the COVID-19 pandemic may negatively impact our business by causing or contributing to, among other things, the following, each of which could adversely affect our business, results of operations, financial condition and cash flows:

| · | We cannot assure you that the emergency health measures we have adopted will continue to be effective or that we will not have to adopt new protective measures, including work from home policies, which may divert our management’s attention and increase our operating costs. |

| · | If individual states and municipalities continue to implement different COVID-19 preventative measures, we may be required to expend additional time to implement them, which may increase our operating costs. In addition, we cannot assure you that we will be able to fully comply with these measures, which may negatively impact the way we operate our stores. |

| · | In case we face a worsening in the pandemic situation in the future, we may require some investments with additional temporary workers or new adaptations in our stores, which may increase our operating costs. Until June 2021, amid escalating COVID-19 cases, hospitalization and deaths, many states and municipalities in Brazil reinstituted strict lockdown measures. If restrictions are re-imposed in the future, our sales may be impacted. |

| · | If new restrictions are imposed that again impact the production capacity of some of our suppliers, we might face new shortages in the future, in which case we may have to seek alternate sources of supply which may be more expensive, may not be available or may result in delays in shipments to us and subsequently to our customers. |

These and other impacts of the COVID-19 pandemic could also have the effect of heightening many of the other risk factors described herein, including but not limited to “—We face significant competition and pressure to adapt to changing consumer habits, which may adversely affect our market share and net income”, “—We face

| 4 |

increasing competition from internet sales, which may negatively affect sales through traditional channels, and we might not have an effective response to this competition”, “The Brazilian cash and carry industry is sensitive to decreases in consumer purchasing power and unfavorable economic cycles”, “Some categories of products that we sell are principally acquired from a few suppliers and changes in this supply chain could adversely affect our business”.

We may not be able to protect our intellectual property rights.

Our future success depends significantly on our ability to protect our current and future brands and to defend our intellectual property rights, including trademarks, patents, domain names, trade secrets and know-how. We have been granted numerous trademark registrations covering our brand and products and have filed, and expect to continue to file, trademark and patent applications seeking to protect newly developed brands and products. We cannot guarantee that trademark and patent registrations will be issued with respect to any of our applications. There is also a risk that we could inadvertently fail to renew a trademark or patent on a timely basis or that our competitors will challenge, invalidate or circumvent any existing or future trademarks and patents issued to, or licensed by, us. Although we have put in place appropriate actions to protect our portfolio of intellectual property rights (including trademark registration and domain names), we cannot be certain that the steps we have taken will be sufficient or that third parties will not infringe upon or misappropriate our proprietary rights. Any failure in our ability to protect our proprietary rights against infringement or misappropriation could adversely affect our business, results of operations, cash flows or financial condition, and in particular, on our ability to develop our business.

We may not be able to renew or maintain our stores’ lease agreements on acceptable terms, or at all, and we may be unable to obtain or renew the operational licenses of our stores or distribution centers in a timely manner.

Most of our stores are leased. The strategic location of our stores is key to the development of our business strategy and, as a result, we may be adversely affected in the event that a significant number of our lease agreements is terminated and we fail to renew these lease agreements on acceptable terms, or at all. In addition, in accordance with applicable law, landlords may increase rent periodically, usually every three years. A significant increase in the rent of our leased properties may adversely affect our financial position and results of operations.

Our stores and distribution centers are also subject to certain operational licenses. Our inability to obtain or renew these operational licenses may result in the imposition of fines and, as the case may be, in the closing of stores or distribution centers. Given that smooth and uninterrupted operations in our stores and distribution centers are a critical factor for the success of our business strategy, we may be negatively affected in the case of their closing as a result of our inability to obtain or renew the necessary operational licenses.

Our product distribution is dependent on a limited number of distribution centers and we depend on the transportation system and infrastructure in Brazil to deliver our products, and any disruption at one of our distribution centers or delay related to transportation and infrastructure could adversely affect our supply needs and our ability to distribute products to our stores and customers.

Approximately 30% of our products are distributed through our 11 distribution centers and warehouses located in the Southeastern, Midwestern and Northeastern regions of Brazil. The transportation system and infrastructure in Brazil are underdeveloped and need significant investment to work efficiently and to meet our business needs.

Any significant interruption or reduction in the use or operation of transportation infrastructure in the cities where our distribution centers are located or in operations at one of our distribution centers, as a result of natural disasters, fire, accidents, systemic failures, strikes (such as the May 2018 Brazilian truckers’ strike) or other unexpected causes, may delay or affect our ability to distribute products to our stores and may decrease our sales, which may have a material adverse effect on us.

Our growth strategy includes the opening of new stores which may require the opening of new distribution centers or the expansion of the existing ones to supply and meet the demand of additional stores. Our operations may be negatively affected if we are not able to open new distribution centers or expand our existing distribution centers in order to meet the supply needs of these new stores. For more information on our distribution and logistics operations, see “Item 4. Information on the Company—B. Business Overview—Distribution and Logistics.”

| 5 |

Our systems are subject to cyberattacks and security and privacy breaches, which could cause a material adverse effect on our business and reputation.

We, like all business organizations in the digital world, have been subject to a broad range of cyber threats, including attacks, with varying levels of sophistication. These cyber threats are related to the confidentiality, availability and integrity of our systems and data, including our customers’ confidential, classified or personal information.

We maintain what we believe to be reasonable and adequate technical security controls, policy enforcement mechanisms, monitoring systems and management oversight to address these threats. While these measures are designed to prevent, detect and respond to unauthorized activity in our systems, certain types of attacks, including cyberattacks, may occur.

Furthermore, some of our suppliers and service providers have significant access to confidential and strategic data collected by our systems, including confidential information regarding our customers.

Any unauthorized access to, or release or violation of our systems and data or those of our customers, suppliers or service providers could disrupt our operations, particularly our digital operations, cause information losses and cause us to incur significant costs, including the cost of retrieving lost information, which could have a material adverse effect on our business and reputation.

Our information systems may suffer interruptions due to factors beyond our control, such as natural disasters, hacking, failures in telecommunication and computer viruses, among other factors. Any of these types of interruption may adversely affect our operations, thereby impacting our cash generation and our financial condition.

Failure to protect our database, which contains the personal data of our clients, suppliers and employees, and developments in data protection and privacy laws, could have an adverse effect on our business, financial condition or results of operations.

We maintain a database of information about our suppliers, employees and customers. If we experience a breach in our security procedures that affect the integrity of our database, including unauthorized access to any personal information of our customers, we may be subject to new legal proceedings that could result in damages, fines and harm to our reputation.

Currently, the processing of personal data in Brazil is regulated by a series of laws, such as the Federal Constitution, the Consumer Protection Code (Law No. 8,708/90) and the Internet Civil Registry (Law No. 12,965/14). Failure to comply with provisions of these laws, especially in connection with: (1) providing clear information on the data processing operations performed by us; (2) respect for the purpose of the original data collection; (3) legal deadlines for the storage of user data; and (4) the adoption of legally required security standards for the preservation and inviolability of the personal data processed, can give rise to penalties, such as fines and even temporary or permanent suspension of our personal data processing activities.

The General Data Protection Act (Law No. 13,709/18), or GDPA, became effective on September 18, 2020, except for the administrative sanctions provided thereunder, which became effective on August 1, 2021. The GDPA establishes a new legal framework to be observed in the processing of personal data, including that of our customers, suppliers and employees. The GDPA establishes, among other things, the rights of personal data owners, the legal basis applicable to the protection of personal data, requirements for obtaining consent, obligations and requirements relating to security incidents, data leaks and data transfers, as well as the creation of the National Data Protection Authority (Autoridade Nacional de Proteção de Dados), or ANPD. In the event of non-compliance with the GDPA, we may be subject to administrative penalties, including blockage or elimination of the personal data to which the infraction relates, the suspension or blockage of activities relating to personal data and fines of up to R$50 million, as well as legal proceedings, which may materially adversely affect us, including damage to our reputation. The ANPD may revise data protection standards and proceedings based on the GDPA in the future, and the public prosecutor’s office, consumer protection agencies and the judiciary will have significant roles in the interpretation and application of the GDPA.

| 6 |

In preparation for our compliance with the GDPA, we have reviewed our internal policies and procedures. However, given its recent effectiveness, the lack of regulation of critical aspects of the GDPA by the ANPD and the uncertainty about the possible interpretations of the GDPA by different agents, we cannot guarantee that we will not be exposed to litigation or subject to sanctions with respect to the GDPA in the future.

The Casino Group has the ability to direct our business and affairs.

As of April 20, 2022, the Casino Group was the beneficial owner of 41.0% of the total capital stock of Sendas. The Casino Group has the power to: (1) appoint the majority of the members of our board of directors, who, in turn, appoint our executive officers; and (2) determine the outcome of the vast majority of actions requiring shareholder approval. Accordingly, the Casino Group is considered to be our controlling shareholder pursuant to Brazilian Corporate Law. The Casino Group’s interests and business decisions may prevail over those preferred by our other shareholders or ADS holders.

Unfavorable decisions in legal or administrative proceedings could have a material adverse effect on us.

We are party to legal and administrative proceedings related to civil, regulatory, tax and labor matters. We cannot assure you that pending legal proceedings will be decided in our favor. We have made provisions for proceedings in which the chance of loss has been classified as probable by our management in consultation with external legal advisors. Our provisions may not be sufficient to cover the total cost arising from unfavorable decisions in legal or administrative proceedings. If all or a significant number of these proceedings have an outcome unfavorable to us, our business, financial condition and results of operations may be materially and adversely affected. In addition to financial provisions and the cost of legal fees associated with the proceedings, we may be required to post bonds in connection with the proceedings, which may adversely affect our financial condition. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal and Administrative Proceedings,” and note 18 to our audited consolidated financial statements included in this annual report for a description of our material litigation contingencies.

We may be unable to attract or retain key personnel.

In order to support and develop our operations, we must attract and retain personnel with specific skills and knowledge. We face various challenges inherent to the administration of a large number of employees over a wide geographical area. Key personnel may leave us for a variety of reasons and the impact of these departures is difficult to predict, which may hinder the implementation of our strategic plans and adversely affect our results of operations.

We could be materially adversely affected by violations of the Brazilian Anti-Corruption Law, the U.S. Foreign Corrupt Practices Act, the Sapin II Law and similar anti-corruption laws.

Law No. 12,846, of August 1, 2013, or the Brazilian Anti-Corruption Law, the U.S. Foreign Corrupt Practices Act of 1977, or the FCPA, and similar anti-corruption laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to government officials or other persons for the purpose of obtaining or retaining business. Recent years have seen a substantial increase in anti-corruption law enforcement activity, with more frequent and aggressive investigations and enforcement proceedings by both the U.S. Department of Justice and the SEC increased enforcement activity by non-U.S. regulators, and increases in criminal and civil proceedings brought against companies and individuals.

The Brazilian Anti-Corruption Law, introduced the concept of strict liability for legal entities involved in harmful acts against the public administration, subjecting the violator to penalties both in administrative and civil law. The Brazilian Anti-Corruption Law considers that an effective implementation of a compliance program may be used to mitigate the administrative penalties to be applied as a consequence of a harmful act against the public administration.

Additionally, French Law No. 1,691, of December 2016, or the Sapin II Law, relates to transparency, preventing corruption and the modernization of economic activity, and stipulates that companies must establish an anti-corruption program to identify and mitigate corruption risks. Under the Sapin II Law, among others, any legal

| 7 |

entity or individual may be held criminally liable for offering a donation, gift or reward with the intent to induce a foreign public official to abuse their position or influence to obtain an undue advantage. The Sapin II Law is applicable to companies belonging to a group whose parent company is headquartered in France and whose workforce includes at least 500 employees worldwide. As such, the Sapin II Law applies to us. The key anti-corruption provisions of the Sapin II Law have been in force since June 1, 2017.

Our policies mandate compliance with these anti-corruption laws. We cannot assure you that our internal control policies and procedures will protect us from reckless or criminal acts committed by our employees or third party intermediaries. In the event that we believe or have reason to believe that our employees or agents have or may have violated applicable anti-corruption laws, including the FCPA, we may be required to investigate or have outside counsel investigate the relevant facts and circumstances, which can be expensive and require significant time and attention from senior management.

Failure to comply with anti-corruption laws to which we are subject or any investigations of misconduct, or enforcement actions may result in criminal or civil sanctions, inability to do business with existing or future business partners (either as a result of express prohibitions or to avoid the appearance of impropriety), injunctions against future conduct, profit disgorgements, disqualifications from directly or indirectly engaging in certain types of businesses, the loss of business permits or other restrictions which could disrupt our business and have a material adverse effect on us and our reputation.

We cannot guarantee that our service providers or suppliers do not engage in irregular practices.

Given the decentralization and outsourcing of our service providers’ operations and our suppliers’ production chains, we cannot guarantee that they will not have issues regarding working conditions, sustainability, outsourcing the provision or production chain and improper safety conditions, or that they will not engage in these irregular practices to lower service or product costs. If a significant number of our service providers or suppliers engage in these practices, our reputation may be harmed and, as a consequence, our customers’ perception of our products may be adversely affected, causing a reduction in net revenue and results of operations as well as in the trading price of the Sendas common shares and the Sendas ADSs.

Some categories of products that we sell are principally acquired from a few suppliers and changes in this supply chain could adversely affect our business.

Some categories of products that we sell are principally acquired from a few suppliers. Notably, we procure our beverage and meat products mainly from five suppliers. The products provided by these suppliers represented approximately 8.3% of our total sales for the year ended December 31, 2021. If any of these suppliers is not able to supply the products in the quantity and at the frequency that we normally acquire them, and we are not able to replace the supplier on acceptable terms or at all, we may be unable to maintain our usual level of sales in the affected category of product, which may have a material adverse effect on our business and operations and, consequently, on our results of operations.

In addition, some of our principal suppliers are currently involved in Lava Jato investigation and developments in the related investigations or possible convictions of such suppliers may adversely affect their ability to supply products to us and, consequently, our sales levels for such products. For more information, see “—Risks Relating to Brazil— Political instability has adversely affected and may continue to adversely affect our business, results of operations and the trading price of the Sendas common shares and the Sendas ADSs” below.

We may be held responsible for consumer incidents involving adverse reactions after consumption of products sold by us.

Products sold in our stores may cause consumers to suffer adverse reactions. Incidents involving these products may have a material adverse effect on our operations, financial condition, results of operations and reputation. Legal or administrative proceedings related to these incidents may be initiated against us, with allegations, among others, that our products were defective, damaged, adulterated, contaminated, do not contain the properties advertised or do not contain adequate information about possible side effects or interactions with other chemical substances. Any

| 8 |

actual or possible health risk associated with these products, including negative publicity related to these risks, may lead to a loss of confidence among our customers regarding the safety, efficacy and quality of the products sold in our stores. Any allegation of this nature made against our brand or products sold in our stores may have a material adverse effect on our operations, financial condition, results of operations and reputation.

We are subject to environmental laws and regulations and any non-compliance may adversely affect our reputation and financial position.

We are subject to a number of federal, state and municipal laws and regulations relating to the preservation and protection of the environment. Among other obligations, these laws and regulations establish environmental licensing requirements and standards for the release of effluents, gaseous emissions, management of solid waste and protected areas. We incur expenses for the disposal and handling of wastes at our stores, distribution centers and headquarters. Any failure to comply with those laws and regulations may subject us to administrative and criminal sanctions, in addition to the obligation to remediate or indemnify others for the damages caused. We cannot ensure that these laws and regulations will not become stricter. If they do, we may be required to increase, perhaps significantly, our capital expenditures and costs to comply with these environmental laws and regulations. Unforeseen environmental investments may reduce available funds for other investments and could materially and adversely affect us.

Our indebtedness could adversely affect our business.

As of December 31, 2021, we had total borrowings and financing and debentures of R$8,033 million, of which R$613 million was classified as current borrowings and financing and debentures and R$7,420 million was classified as non-current borrowings and financing and debentures. If we are unable to repay or refinance our current or non-current borrowings and financing and debentures as they mature, this would have a material adverse effect on our financial condition. Our combined indebtedness may:

| · | make it difficult for us to satisfy our obligations, including making interest payments on our debt obligations; |

| · | limit our ability to obtain additional financing to operate our business; |

| · | require us to dedicate a substantial portion of our cash flow to serve our debt, reducing our ability to use our cash flow to fund working capital, capital expenditures and other general corporate requirements; |

| · | limit our flexibility to plan for, and react to, changes in our business and the industry in which we operate; |

| · | place us at a competitive disadvantage relative to some of our competitors that have less debt than us; |

| · | make us more vulnerable to increases in interest rates, resulting in higher interest costs in respect of our floating rate debt; and |

| · | increase our vulnerability to general adverse economic and industry conditions, including changes in interest rates, lower cattle and hog prices or a downturn in our business or the economy. |

In addition, any business that we acquire by borrowing additional funds may increase our leverage and make it more difficult for us to satisfy our obligations, limit our ability to obtain additional financing to operate our business, require us to dedicate a substantial portion of our cash flow to payments on our debt, reducing our ability to use our cash flow to fund working capital, capital expenditures and other general corporate requirements, and place us at a competitive disadvantage relative to some of our competitors that have less debt than us.

| 9 |

Certain of our debt instruments contain covenants that could limit our ability to operate our business and have other adverse consequences.

Certain of our debt instruments contain financial covenants that require us to maintain specified financial ratios, measured on a quarterly basis. See “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Indebtedness—Long-Term Indebtedness” for more information. Complying with these financial covenants may require that we take action to reduce debt or to act in a manner contrary to our business objectives. Events beyond our control, including changes in general business and economic conditions, may affect our ability to meet these financial ratios. We may not meet these ratios, and our creditors may not waive any failure to meet them. In addition, the instruments governing our debentures, promissory notes and commercial notes contain restrictive covenants that limit our ability to distribute dividends in excess of the statutorily required minimum dividend should we not be able to fulfill our obligations under those instruments.

Our failure to comply with any of these covenants could result in an event of default under the relevant credit facility, and any such event of default or resulting acceleration under such credit facilities could result in an event of default under other debt agreements. Our assets or cash flow may not be sufficient to fully repay borrowings under our outstanding debt agreements if accelerated upon an event of default, and there is no guarantee that we would be able to repay, refinance or restructure the payments on those debt agreements.

Risks Relating to Brazil

The outbreak of communicable diseases around the world, including COVID-19, may lead to higher volatility in the global capital markets and recessionary pressure on the Brazilian economy. Any outbreak in Brazil could directly affect our operations, each of which may materially and adversely affect our business, financial condition and results of operations.

The outbreak of communicable diseases on a global scale may affect investment sentiment and result in higher volatility in global capital markets and may have a recessionary effect on the Brazilian economy. Since December 2019, a novel strain of coronavirus that causes the disease known as COVID-19 has spread in China and other countries. In 2020 and 2021, and even into 2022, the COVID-19 outbreak compelled governments around the world, including in Brazil, to adopt temporary measures to contain the spread of COVID-19, such as lockdowns of cities, restrictions on travel and public transportation, business and store closures, and emergency quarantines, among others, all of which have caused significant disruptions to the global economy and ordinary course of business operations across a growing list of sectors and countries. These disruptions have continued in many cases into 2022. The measures adopted to combat the COVID-19 outbreak have adversely affected and will continue to adversely affect business confidence and consumer sentiment, and they have been, and may continue to be, accompanied by significant volatility in financial and commodity markets as well as stock exchanges worldwide.

In Brazil, reflecting the scale of investor’s risk aversion, the stock market triggered several automatic suspensions, known as circuit breakers, and the benchmark index of about 70 stocks traded on the B3, or the Ibovespa index, fell 36.9% from January 1, 2020 to March 31, 2020, following the trend of international stock markets mainly related to the beginning of the pandemic. After a decrease of 17.8% in the first half of 2020, the Ibovespa index recovered strongly and increased 2.9% by the end of the year.

| 10 |

The spread of COVID-19, especially if the measures to curb the spread of the virus lingers, may have broader macroeconomic implications, including reduced levels of economic growth and possibly a global recession, the effects of which could be felt well beyond the time the spread of infection is contained. Many countries are implementing relief plans to reduce the effects of COVID-19 in the local and world economy. Due to the uncertainties related to the length of this novel virus, we cannot estimate the additional impacts that COVID-19 may cause on the price and performance of our securities. Any material change in the Brazilian and international financial markets or the Brazilian economy as a result of these events or any developments may materially and adversely affect our business, financial condition and results of operations.

The Brazilian government has exercised, and continues to exercise, significant influence over the Brazilian economy. Brazilian political and economic conditions may adversely affect us and the trading price of the Sendas common shares and the Sendas ADSs.

The Brazilian government has frequently intervened in the Brazilian economy and has occasionally made significant changes to monetary, credit, tariff, tax and other policies and regulations. The Brazilian government’s actions to control inflation have often involved, among other measures, increases and decreases in interest rates, changes in tax and social security policies, price controls, currency exchange and remittance controls, devaluations, capital controls and limits on imports. Our business, financial condition, results of operations and the trading price of the Sendas common shares and the Sendas ADSs may be adversely affected by changes in Brazilian policy or regulations at the federal, state or municipal level involving or affecting various factors, such as:

| · | economic, political and social instability; |

| · | increases in the unemployment rate; |

| · | interest rates and monetary policies (such as restrictive consumption measures that could affect the income of the population and government measures that may affect the levels of investment and employment in Brazil); |

| · | significant increases in inflation or strong deflation in prices; |

| · | currency fluctuations; |

| · | import and export controls; |

| · | exchange controls and restrictions on remittances abroad (such as those that were imposed in 1989 and early 1990s); |

| · | modifications to laws and regulations according to political, social and economic interests; |

| · | efforts to reform labor, tax and social security policies and regulation (including the increase of taxes, both generally and on dividends); |

| · | energy and water shortages and rationing; |

| · | liquidity of domestic capital and lending markets; |

| · | public health, including as a result of epidemics and pandemics, such as the COVID-19 pandemic; and |

| · | other political, diplomatic, social and economic developments in or affecting Brazil. |

Uncertainty over whether the Brazilian government will implement changes in policy or regulation affecting these or other factors in the future may contribute to economic uncertainty in Brazil and to heightened volatility in the Brazilian securities markets and securities issued abroad by Brazilian companies. These uncertainties and other

| 11 |

future developments in the Brazilian economy may adversely affect our business activities, and consequently our results of operations, and may also adversely affect the trading price of the Sendas common shares and the Sendas ADSs.

Such factors are compounded by the overall health and growth of the Brazilian economy. Brazil’s gross domestic product, or GDP, increased by 4.6% in 2021 and decreased by 4.1% in 2020. Prior to 2020, Brazil was emerging from a prolonged recession after a period of a slow recovery, with only meager GDP growth in 2019 and 2018. Brazil’s GDP growth rates were 1.1% in each of 2019 and 2018. Our results of operations and financial condition have been, and will continue to be, affected by the weakness of Brazil’s GDP. Developments in the Brazilian economy may affect Brazil’s growth rates and, consequently, the demand for our products and services, which may adversely affect the trading price of the Sendas common shares and the Sendas ADSs.

Political instability has adversely affected and may continue to adversely affect our business, results of operations and the trading price of the Sendas common shares and the Sendas ADSs.

The Brazilian economy has been and continues to be affected by political events in Brazil, which have also affected the confidence of investors and the public in general, adversely affecting the performance of the Brazilian economy and increasing the volatility of securities issued by Brazilian companies.

Brazilian markets have experienced heightened volatility due to uncertainties from ongoing investigations into money laundering and corruption conducted by the Brazilian Federal Police and the Office of the Brazilian Federal Prosecutor, including the Lava Jato investigation. These investigations adversely affected the Brazilian economy and political scenario. The effects of the Lava Jato investigation and other investigations of corruption had and continue to have an adverse impact on the image and reputation of the implicated companies, and on the general market perception of the Brazilian economy, political environment and capital markets. We have no control over and cannot predict whether the ongoing investigations or allegations will result in further political and economic instability, or if new allegations against government officials and/or companies will arise in the future.

In addition, any difficulty by the Brazilian government in obtaining a majority in the national congress could result in congressional deadlock, political unrest and demonstrations or strikes, which could adversely affect us. Uncertainties relating to the implementation by the government of changes related to monetary, fiscal and social security policies, as well as to related laws may contribute to economic instability. These uncertainties and additional measures may heighten the volatility of the Brazilian securities market, including in relation to the Sendas common shares and the Sendas ADSs.

Furthermore, 2022 is a presidential election year in Brazil and historically, in election years, foreign investments in Brazil decrease and political uncertainty generates greater instability and volatility in the domestic market, which may adversely affect our business and results of operations.

Brazilian government efforts to combat inflation may hinder the growth of the Brazilian economy and could harm us and the trading price of the Sendas common shares and the Sendas ADSs.

Historically, Brazil has experienced high inflation rates. Inflation and certain actions taken by the Brazilian government to curb it, including the increase of the SELIC rate established by the Central Bank, together with the speculation about governmental measures to be adopted, have materially and adversely affected the Brazilian economy and contributed to economic uncertainty in Brazil, heightening volatility in the Brazilian capital markets and adversely affecting us. Brazil’s annual inflation, as measured by the general price index (Índice Geral de Preços – Mercado), was 17.8% in 2021, 23.1% in 2020 and 7.30% in 2019. Brazil’s Broad Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo) recorded inflation of 10.06% in 2021, 4.52% in 2020 and 4.31% in 2019, according to the Brazilian Institute of Geography and Statistics, or IBGE.

Tight monetary policies with high interest rates have restricted and may restrict Brazil’s growth and the availability of credit. Conversely, more lenient government and Central Bank policies and interest rate decreases have triggered and may trigger increases in inflation, and, consequently, growth volatility and the need for sudden and significant interest rate increases, which could negatively affect our business and increase the payments on our

| 12 |

indebtedness. In addition, we may not be able to adjust the prices we charge our customers to offset the effects of inflation on our cost structure.

On February 2, 2022, the Brazilian Monetary Policy Committee (Comitê de Política Monetária) increased official interest rates from 9.25% to 10.75% and on March 16, 2022 from 10.75% to 11.75%, having previously reached historic lows. Any future measures adopted by the Brazilian government, including reductions in interest rates, intervention in the exchange market and the implementation of mechanisms to adjust or determine the value of the Brazilian real may trigger inflation, adversely affecting the overall performance of the Brazilian economy.

Furthermore, Brazilian government measures to combat inflation that result in an increase in interest rates may have an adverse effect on us, as our indebtedness is indexed to the interbank deposit certificate (Certificados de Depósito Interbancário), or CDI, rate. Inflationary pressures may also hinder our ability to access foreign financial markets or lead to government policies to combat inflation that could harm us or adversely affect the trading price of the Sendas common shares and the Sendas ADSs.

Any further downgrading of Brazil’s credit rating may adversely affect the trading price of the Sendas common shares and the Sendas ADSs.

Credit ratings affect investors’ perceptions of risk and, as a result, the yields required on debt issuances in the financial markets. Rating agencies regularly evaluate Brazil and its sovereign ratings, taking into account a number of factors including macroeconomic trends, fiscal and budgetary conditions, indebtedness and the prospect of change in these factors.

Standard & Poor’s initially downgraded Brazil’s sovereign debt credit rating from BBB-minus to BB-plus in September 2015 and subsequently downgraded it to BB in February 2016, maintaining its negative outlook, citing Brazil’s fiscal difficulties and economic contraction as signs of a worsening credit situation. On January 11, 2018, Standard & Poor’s further downgraded Brazil’s credit rating from BB to BB-minus. In February 2019, Standard & Poor’s affirmed Brazil’s sovereign credit rating at BB-minus with a stable outlook. In December 2019, Standard & Poor’s affirmed Brazil’s sovereign credit rating at BB-minus with a positive outlook, further maintaining the sovereign credit rating at BB-minus, but revising the outlook on this rating from positive to stable in April 2020.

Moody’s placed Brazil’s Baa3 sovereign debt credit rating under review in December 2015 and downgraded it to Ba2 with a negative outlook in February 2016, citing the prospect for further deterioration in Brazil’s debt indicators, taking into account the low growth environment and the challenging political scenario. In April 2018, Moody’s maintained Brazil’s sovereign debt credit rating at Ba2, but changed its prospect from negative to stable, maintaining it in September 2018, citing the expected new government spending cuts. In May 2019, Moody’s affirmed Brazil’s sovereign credit rating at Ba2 and changed the outlook to stable, which rating and outlook were further reaffirmed by Moody’s in May 2020.

Fitch initially downgraded Brazil’s sovereign credit rating to BB-plus with a negative outlook in December 2015, citing the country’s rapidly expanding budget deficit and worse-than-expected recession and subsequently downgraded it to BB with a negative outlook in May 2016. In February 2018, Fitch downgraded Brazil’s sovereign credit rating again to BB-minus, citing, among other reasons, fiscal deficits, the increasing burden of public debt and an inability to implement reforms that would structurally improve Brazil’s public finances. In November 2019, Fitch maintained Brazil’s sovereign credit rating at BB-minus, citing the risk of tax and economic reforms and political instability. In May 2020, Fitch reaffirmed Brazil’s sovereign credit rating at BB-minus and revised the outlook on this rating to negative as a result of the impact of the COVID-19 pandemic.

Any further downgrade of Brazil’s credit rating could heighten investors’ perception of risk and, as a result, increase the cost of debt issuances and adversely affect the trading price of our securities.

| 13 |

Exchange rate volatility may adversely affect the Brazilian economy and us.

The real has historically experienced frequent and substantial variations in relation to the U.S. dollar and other foreign currencies. In 2019, the real depreciated against the U.S. dollar in comparison to 2018, reaching R$4.0301 per US$1.00 as of December 31, 2019. In May 2020, prompted by the COVID-19 crisis, the Brazilian real depreciated significantly in relation to the U.S. dollar, reaching to R$5.9372 to US$1.00 on May 14, 2020. In 2020, the real depreciated against the U.S. dollar in comparison to 2019, reaching R$5.1967 per US$1.00 as of December 31, 2020. In 2021, the real further depreciated against the U.S. dollar in comparison to 2020, reaching R$5.5805 per US$1.00 as of December 31, 2021.On April 20, 2022, the real/U.S. dollar exchange rate was R$4.6397 per US$1.00. There can be no assurance that the real will not depreciate further against the U.S. dollar. Depreciation of the real against the U.S. dollar could create inflationary pressures in Brazil and cause increases in interest rates, which negatively affects the growth of the Brazilian economy as a whole, curtails access to foreign financial markets and may prompt government intervention, including recessionary governmental policies. Depreciation of the real against the U.S. dollar has also, including in the context of an economic slowdown, led to decreased consumer spending, deflationary pressures and reduced growth of the economy as a whole. Depreciation would also reduce the U.S. dollar value of distributions and dividends and the U.S. dollar equivalent of the trading price of the Sendas common shares and the Sendas ADSs. As a result, we may be materially and adversely affected by real/U.S. dollar exchange rate variations.

Developments and the perception of risk in other countries may adversely affect the price of securities of Brazilian issuers, including the Sendas common shares and the Sendas ADSs.

The market value of securities of Brazilian issuers is affected to varying degrees by economic and market conditions in other countries, including developed countries such as the United States and certain European and emerging market countries. Investors’ reactions to developments in these countries may adversely affect the market value of securities of Brazilian issuers, including the Sendas common shares and the Sendas ADSs. Trading prices on B3, for example, have been historically affected by fluctuation in interest rates applicable in the United States and variation in the main U.S. stock indices. Any increase in interest rates in other countries, especially the United States, may decrease global liquidity and the interest of investors in the Brazilian capital markets, adversely affecting the ADSs and our common shares.

Moreover, crises or significant developments in other countries, such as the conflict between Russia and Ukraine, may diminish investors’ interest in securities of Brazilian issuers, including the Sendas common shares and the Sendas ADSs, and their trading price, limiting or preventing our access to capital markets and to funds to finance our future operations at acceptable terms.

Global economic and political instability and conflicts, such as the conflict between Russia and Ukraine, could adversely affect our business, financial condition or results of operations.

Our business could be adversely affected by unstable economic and political conditions and geopolitical conflicts, such as the conflict between Russia and Ukraine. While we do not have any customer or direct supplier relationships in either country at this time, the current military conflict, and related sanctions, as well as export/import controls or actions that may be initiated by nations including Brazil and other potential uncertainties could adversely affect our business and/or our supply chain, business partners or customers, and could cause changes in our customers buying patterns and interrupt our ability to supply products.

Inflation, energy and commodities costs may fluctuate as a result the conflict between Russia and Ukraine and related economic sanctions. These fluctuations may result in an increase in our transportation costs for distribution, utility costs for our stores and costs to purchase products from our suppliers. A continual rise in energy and commodities costs could adversely affect consumer spending and demand for our products and increase our operating costs, both of which could have a material adverse effect on our results of operations, financial condition and cash flows.

While the precise effect of the ongoing military conflict and global economies remains uncertain, they have already resulted in significant volatility in financial markets, as well as in an increase in energy and commodity prices globally. In the event geopolitical tensions fail to abate or deteriorate further, additional governmental sanctions may be enacted adversely impacting the global economy, its banking and monetary systems, markets or customers for our products.

| 14 |

Risks Relating to the Sendas Common Shares and the Sendas ADSs

The volatility and illiquidity of the Brazilian securities markets and of the Sendas common shares may substantially limit your ability to sell the Sendas common shares underlying the Sendas ADSs at the price and time you desire.