Exhibit (a)(1)(ii)

PLEASE CONTACT YOUR MERRILL FINANCIAL ADVISER TO ENSURE THE

PROPER

COMPLETION AND SUBMISSION OF THE NECESSARY DOCUMENTATION

LETTER OF TRANSMITTAL

REGARDING

SHARES OF BENEFICIAL INTEREST

IN

BLACKROCK HEDGE FUND GUIDED PORTFOLIO SOLUTION

TENDERED PURSUANT TO THE OFFER TO PURCHASE

DATED SEPTEMBER 26, 2022

The Offer will expire

at, and this Letter of Transmittal must be

received by, 11:59 p.m., Eastern Time,

on Wednesday, October 26, 2022, unless the Offer is extended.

| Letter of Transmittal – BlackRock Hedge Fund Guided Portfolio Solution | Page 1 |

Ladies and Gentlemen:

The undersigned hereby tenders to BlackRock Hedge Fund Guided Portfolio Solution, a closed-end, non-diversified, management investment company organized under the laws of the State of Delaware (the “Fund”), the shares of beneficial interest (“Shares”) in the Fund or portion thereof held by the undersigned, described and specified below, on the terms and conditions set forth in the offer to purchase dated September 26, 2022 (“Offer to Purchase”), receipt of which is hereby acknowledged, and in this Letter of Transmittal (which together constitute the “Offer”). All capitalized terms used herein have the meaning as defined in the Fund’s Agreement and Declaration of Trust. The tender and this Letter of Transmittal are subject to all the terms and conditions set forth in the Offer to Purchase, including, but not limited to, the absolute right of the Fund to reject any and all tenders determined by it, in its sole discretion, not to be received timely and in the appropriate form.

The undersigned hereby sells to the Fund the Shares of the Fund tendered hereby pursuant to the Offer. The undersigned hereby represents and warrants that the undersigned has full power and authority to tender, sell, assign and transfer Shares tendered hereby and all dividends, distributions (including, without limitation, distributions of additional Shares) and rights declared, paid or distributed in respect of such Shares that are declared, paid or distributed in respect of a record date on or after the Expiration Date (as defined in the Offer to Purchase) (collectively, “Distributions”), that when such Shares are accepted for payment by the Fund, the Fund will acquire good, marketable and unencumbered title thereto and to all Distributions, free and clear of all liens, restrictions, charges and encumbrances, and that none of such Shares and Distributions will be subject to any adverse claim. The undersigned, upon request, shall execute and deliver all additional documents deemed by the Transfer Agent or the Fund to be necessary or desirable to complete the sale, assignment and transfer of Shares tendered hereby and all Distributions. In addition, the undersigned shall remit and transfer promptly to the Transfer Agent for the account of the Fund all Distributions in respect of Shares tendered hereby, accompanied by appropriate documentation of transfer, and pending such remittance and transfer or appropriate assurance thereof, the Fund shall be entitled to all rights and privileges as owner of each such Distribution and may withhold the entire purchase price of Shares tendered hereby, or deduct from such purchase price, the amount or value of such Distribution as determined by the Fund in its sole discretion.

The undersigned recognizes that under certain circumstances set forth in the Offer, the Fund may not be required to purchase any of the Shares of the Fund or portion thereof tendered hereby. The undersigned recognizes that, if the Offer is oversubscribed, not all the undersigned’s Shares of the Fund may be purchased.

A non-transferable, non-interest bearing promissory note for the purchase price will be paid to the undersigned if the Fund accepts for purchase the Shares tendered hereby. The undersigned acknowledges that the promissory note will be held for the undersigned by BNY Mellon Investment Servicing (U.S.) Inc., the Fund’s administrator. The cash payment(s) of the purchase price for the Shares tendered by the undersigned and accepted for purchase by the Fund will be made by wire transfer of the proceeds to the undersigned’s account at Merrill. The undersigned hereby represents and warrants that the undersigned understands that upon a withdrawal of such cash payment from the account, the institution at which the account is held may subject such withdrawal to any fees that it would customarily assess upon the withdrawal of cash from such account. The undersigned hereby represents and warrants that the undersigned understands that any payment in the form of marketable securities would be made by means of special arrangement with the tendering shareholder in the sole discretion of the Fund’s Board of Trustees.

If the undersigned’s Shares are tendered and accepted for purchase, the promissory note will provide for payment of the purchase price in two or more installments as described in Section 7 of the Offer to Purchase. The undersigned recognizes that the amount of the purchase price for Shares will be based on the unaudited net asset value of the Fund as of December 30, 2022 (the “Valuation Date”), subject to an extension of the Offer as described in Section 15 of the Offer to Purchase.

All authority herein conferred or agreed to be conferred shall survive the death or incapacity of the undersigned and the obligation of the undersigned hereunder shall be binding on the heirs, personal representatives, successors and assigns of the undersigned. Except as stated in Section 6 of the Offer to Purchase, this tender is irrevocable.

Investors wishing to tender Shares pursuant to the Offer should contact their Merrill Financial Adviser (“Merrill FA”) who will enter the order and provide the Investor with a customized Tender Offer Form for its account. Included with this Offer material is a sample Tender Offer Form which is for reference only. The Tender Offer Form

| Letter of Transmittal – BlackRock Hedge Fund Guided Portfolio Solution | Page 2 |

generated for an Investor’s account will need to be signed and returned to the Investor’s Merrill FA. Upon receiving signed documentation, the Investor’s Merrill FA will submit the form for processing. An Investor’s Merrill FA must submit the form by the Expiration Date.

If you do not want to sell your Shares at this time, please disregard this notice. This is simply notification of the Fund’s tender offer. If you decide to tender, you are responsible for confirming that your Merrill Financial Adviser has received your documents in good order.

| Letter of Transmittal – BlackRock Hedge Fund Guided Portfolio Solution | Page 3 |

Tender Offer Signature Pages - U.S. Investors Document No.: Client Account No.: These Tender Offer Request Signature Pages (or "Signature Pages") relate to the client's (the "Client") redemption from one or more Investment funds (each, a "Fund"). The term "Fund" or Funds as used herein refers to each investment fund from which the Client is redeeming as set forth in the Signature Pages. The term "Interest" refers to any unit of participation, share, or other form of interest issued by a Fund. Registration / Client Account Details Account classification Taxpayer identification number Account registration and address Exempt payee code Account to debit Exemption from FATCA reporting code FATCA classifications Document No.: Client Account No.: TENDER_v.0 1 of 4

| Letter of Transmittal – BlackRock Hedge Fund Guided Portfolio Solution | Page 4 |

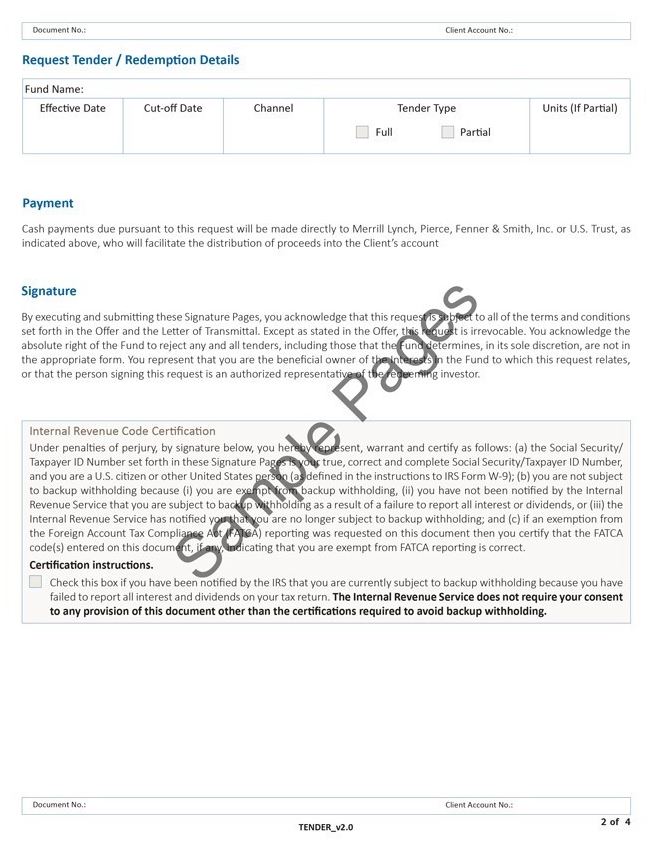

Document No.: Client Account No.: Request Tender / Redemption Details Fund Name: Effective Date Cut-off Date ChannelTender Type FullPartial Units (If Partial) Payment Cash payments due pursuant to this request will be made directly to Merrill Lynch, Pierce, Fenner & Smith, Inc. or U.S. Trust, as indicated above, who will facilitate the distribution of proceeds into the Client's account Signature By executing and submitting these Signature Pages, you acknowledge that this request is subject to all of the terms and conditions set forth in the Offer and the Letter of Transmittal. Except as stated in the offer, this request is irrevocable. You acknowledge the absolute right of the Fund to reject any and all tenders, including those that the Fund determines, in its sole discretion, are not in the appropriate form. You represent that you are the beneficial owner of the interests in the Fund to which this request relates, or that the person signing this request is an authorized representative of the redeeming investor. Internal Revenue Code Certification Under penalties of perjury, by signature below, you hereby represent, warrant and certify as follows: (a) the Social Security/Taxpayer ID Number set forth in these Signature pages is your true, correct and complete Social Security/Taxpayer ID Number, and you are a U.S. citizen or other United States person (as defined in the instructions to IRS Form W-9); (b) you are not subject to backup withholding because (i) you are exempt from backup withholding, (ii) you have not been notified by the Internal Revenue Service that you are subject to backup withholding as a result of a failure to report all interest or dividends, or (iii) the Internal Revenue Service has notified you that you are no longer subject to backup withholding; and (c) if an exemption from the Foreign Account Tax Compliance Act (FATCA) reporting was requested on this document then you certify that the FATCA code(s) entered on this document, if any, indicating that you are exempt from FATCA reporting is correct. Certification instructions. Check this box if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding. Document No.: Client Account No.: TENDER_v2.0 2 of 4

| Letter of Transmittal – BlackRock Hedge Fund Guided Portfolio Solution | Page 5 |

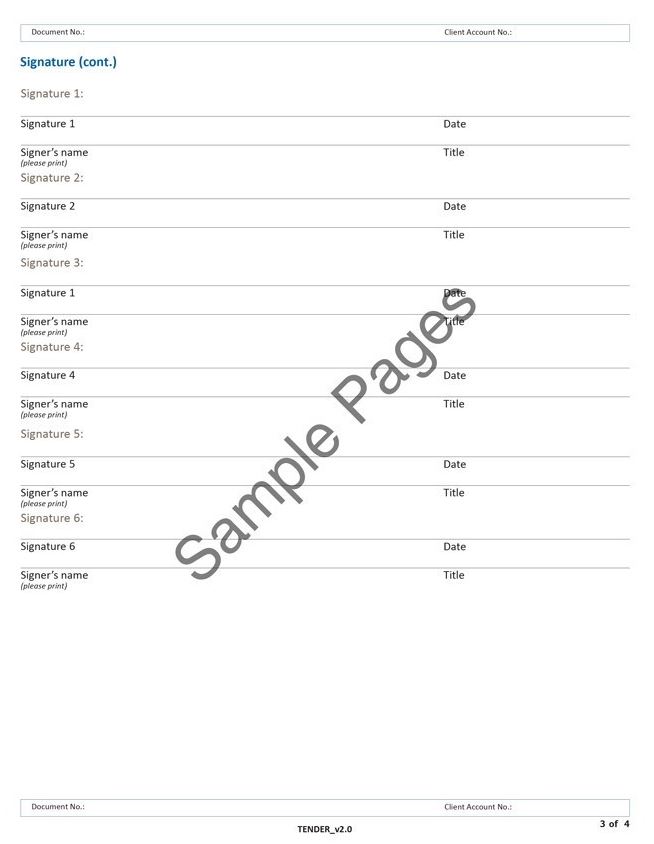

Document No.: Client Account No.: Signature (cont.) Signature 1: Signature 1 Date Signer's nameTitle (please print) Signature 2: Signature 2 Date Signer's name Title (please print) Signature 3: Signature 1 Date Signer's name Title (please print) Signature 4: Signature 4 Date Signer's name Title (please print) Signature 5: Signature 5 Date Signer's name Title (please print) Signature 6: Signature 6 Date Signer's name Title (please print) Document No.: Client Account No.: TENDER_v2.0 3 of 4

| Letter of Transmittal – BlackRock Hedge Fund Guided Portfolio Solution | Page 6 |

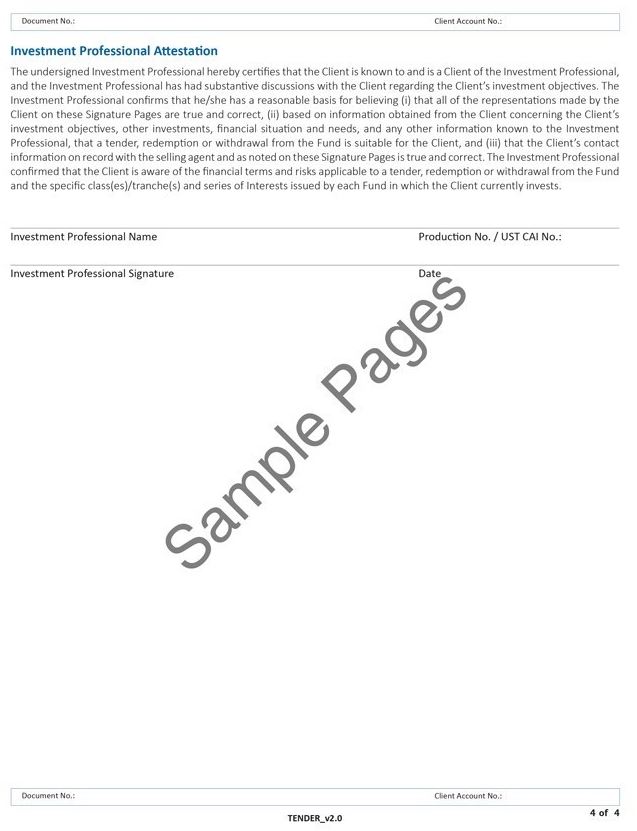

Document No.: Client Account No.: Investment Professional Attestation The undersigned Investment Professional hereby certifies that the Client is known to and is a Client of the Investment Professional, and the Investment Professional has had substantive discussions with the Client regarding the Client's investment objectives. The Investment Professional Professional confirms that he/she has a reasonable basis for believing (i) that all of the representations made by the Client on these Signature Pages are true and correct, (ii) based on information obtained from the Client concerning the Client's investment objectives, other investments, financial situation and needs, and any other information known to the Investment Professional, that a tender, redemption or withdrawal from the Fund is suitable for the Client, and (iii) that the Client's contact information on record with the selling agent and as noted on these Signature Pages is true and correct. The Investment Professional confirmed that the Client is aware of the financial terms and risks applicable to a tender, redemption or withdrawal from the Fund and the specific class(es)/tranche(s) and series of Interests issued by each Fund in which the Client currently invests. Investment Professional Name Production No. / UST CAI No.: Investment Professional Signature Date Document No.: Client Account No.: TENDER_v2.0 4 of 4

| Letter of Transmittal – BlackRock Hedge Fund Guided Portfolio Solution | Page 7 |