Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

This management discussion and analysis (“MD&A”) of the financial condition and results of operations of Cresco Labs Inc. (the “Company,” “Cresco Labs,” “we,” or “our”) is dated August 16, 2023 and has been prepared for the three and six months ended June 30, 2023 and 2022. It is supplemental to, and should be read in conjunction with, the Company’s audited Consolidated Financial Statements and accompanying notes as of and for the years ended December 31, 2022 and 2021, which were previously filed on SEDAR+, and the Company’s unaudited condensed interim consolidated financial statements and accompanying notes as of and for the three and six months ended June 30, 2023 and 2022. The Company’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Financial information presented in this MD&A is presented in United States (“U.S.”) dollars (“USD” or “$”) unless otherwise indicated. The three and six months ended data presented below is unaudited.

The Company has provided certain supplemental non-GAAP financial measures in this MD&A. Where the Company has provided such non-GAAP financial measures, we have also provided a reconciliation to the most comparable GAAP financial measure. Please see the information under the heading “Non-GAAP Financial Measures” for additional information on the Company’s use of non-GAAP financial measures.

This MD&A contains certain “forward-looking statements” and certain “forward-looking information” as defined under applicable U.S. securities laws and Canadian securities laws. Please refer to the discussion of forward-looking statements and information set out under the heading “Cautionary Note Regarding Forward-Looking Information,” located at the beginning of the Company’s Annual Information Form for the year ended December 31, 2022, filed on SEDAR+. As a result of many factors, the Company’s actual results may differ materially from those anticipated in these forward-looking statements and information. Please refer to the discussion of risks and uncertainties set out under the heading “Risk Factors,” located within the Company’s Annual Information Form for the year ended December 31, 2022, filed on SEDAR+.

OVERVIEW OF THE COMPANY

Cresco Labs was incorporated in the Province of British Columbia and is licensed to cultivate, manufacture and sell cannabis and cannabis-based products. The Company operates in and/or has ownership interests in Arizona, California, Florida, Illinois, Massachusetts, Michigan, New York, Ohio and Pennsylvania.

Cresco Labs is primarily engaged in the business of cultivating medical-grade cannabis, manufacturing medical- grade products derived from cannabis cultivation and distributing such products to medical or adult-use consumers in legalized cannabis markets. Cresco Labs exists to provide high-quality and consistent cannabis-based products to consumers. Cresco Labs’ business focuses on regulatory compliance while working to develop condition-specific strains of cannabis and non-invasive delivery methods (alternatives to smoke inhalation) to provide controlled-dosage medicinal cannabis relief to qualified patients and consumers in legalized cannabis markets. As of June 30, 2023, the Company was operating one (1) adult-use and medical cannabis cultivation center, two (2) adult-use and medical cannabis manufacturing centers, five (5) adult-use and medical dispensary locations and five (5) adult-use dispensary locations in Illinois; one (1) medical cannabis cultivation and manufacturing center and thirteen (13) medical dispensary locations in Pennsylvania; one (1) medical cannabis cultivation and processing center and five (5) medical dispensary locations in Ohio; two (2) adult-use and medical cannabis cultivation and distribution facilities in California; one (1) adult-use and medical cannabis cultivation and manufacturing center and one (1) adult-use and

1

medical dispensary location in Arizona; three (3) adult-use and medical cannabis cultivation and manufacturing centers, one (1) medical dispensary location, one (1) adult-use dispensary location and two (2) adult-use and medical dispensary locations in Massachusetts; one (1) medical cannabis manufacturing center and four (4) medical dispensary locations in New York; one (1) adult-use and medical cannabis cultivation and processing center in Michigan; and one (1) medical cannabis cultivation and manufacturing center and thirty-one (31) medical dispensary locations in Florida.

For additional information on wholly-owned or effectively controlled subsidiaries and affiliates of Cresco Labs, refer to Note 2 under the heading “Basis of Consolidation” of the Company’s unaudited condensed interim consolidated financial statements for the three and six months ended June 30, 2023 and 2022.

During 2019, the Company announced a new dispensary brand, Sunnyside*®1. Sunnyside* was created to accelerate industry growth by shifting consumer expectations and perceptions around shopping for cannabis from intimidation and doubt to curiosity and acceptance through a new trial and marketing approach. During the second quarter of 2023, the Company opened three (3) Sunnyside* dispensaries in Florida and two (2) dispensaries in Pennsylvania. As of June 30, 2023, the Company operated ten (10) Sunnyside* dispensaries in Illinois, thirteen (13) dispensaries in Pennsylvania, five (5) dispensaries in Ohio, one (1) dispensary in Arizona, four (4) dispensaries in Massachusetts, four (4) dispensaries in New York and thirty-one (31) dispensaries in Florida. In August of 2023, the Company opened one (1) additional Sunnyside* location in Palm Bay, Florida, bringing the total number of dispensaries in the state to thirty-two (32). Cresco Labs’ portfolio of owned cannabis consumer-packaged goods includes Cresco®1, High Supply®2, Mindy’sTM, Good News®2, RemediTM, Wonder Wellness Co.®2 and FloraCal® Farms2. The Company distributes and markets these products both to third-party licensed retail cannabis stores across the U.S. and to Cresco Labs’ owned retail stores.

Cresco Labs’ corporate headquarters is located at Suite 110, 400 W. Erie St, Chicago, IL 60654 and the registered office is located at Suite 2500, 666 Burrard Street, Vancouver, BC V6C 2X8. The Company employs approximately 3,000 people across the organization as of June 30, 2023.

Issuing IPO, Reverse Takeover & Corporate Structure

The Company (then Randsburg Gold Corporation) was incorporated in the Province of British Columbia under the Company Act (British Columbia) on July 6, 1990. On December 30, 1997, the Company changed its name from Randsburg Gold Corporation to Randsburg International Gold Corp. (“Randsburg”) and consolidated its common shares on a five (5) old for one (1) new basis. On November 30, 2018, in connection with a reverse takeover (the “Transaction”), the Company, (i) consolidated its outstanding Randsburg common shares on an 812.63 old for one (1) new basis and (ii) filed an alteration to its Notice of Articles with the British Columbia Registrar of Companies to (a) change its name from Randsburg International Gold Corp to Cresco Labs Inc., (b) amend the rights and restrictions of its existing class of common shares and redesignate such class as the class of Subordinate Voting Shares (“SVS”) and (c) create the Proportionate Voting Shares (“PVS”) and the Super Voting Shares (“MVS”).

Pursuant to the Transaction, the Company (then Randsburg) and Cresco Labs, LLC, completed a series of transactions on November 30, 2018, resulting in a reorganization of Cresco Labs, LLC and Randsburg in which Randsburg became the indirect parent and sole voting unitholder of Cresco Labs, LLC. The Transaction constituted a reverse takeover of Randsburg by Cresco Labs, LLC under applicable securities laws. Cresco Labs, LLC was formed as a limited liability company under the laws of the State of Illinois on October 8, 2013 and is governed by an amended and restated limited liability company agreement.

| 1 | The Sunnyside*® (inclusive of the stand-alone asterisk mark) and Cresco® brands maintain federal trademark registrations for websites pertaining to medical cannabis and cannabis educational services, as well as multiple state trademark registrations. |

| 2 | The High Supply®, Good News®, Wonder Wellness Co.® and FloraCal® Farms brands maintain federal trademark registrations for apparel and multiple state trademark registrations. |

2

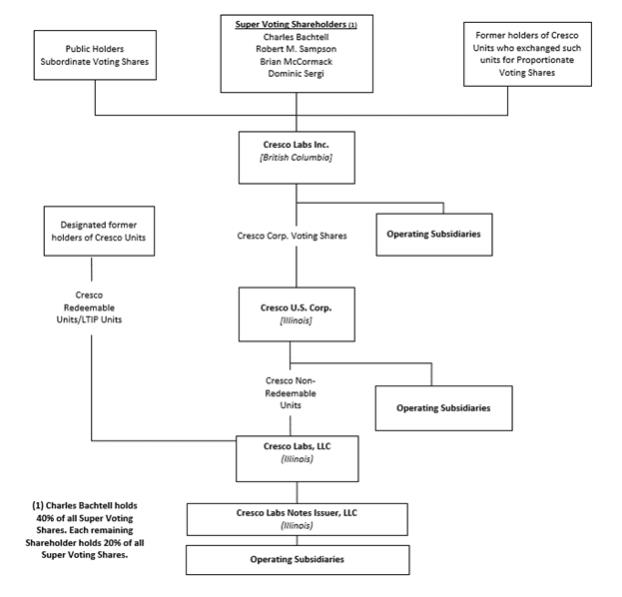

Set forth below is the condensed organization chart of the Company.

Recent Developments

On March 23, 2022, the Company announced it had entered into a definitive arrangement agreement (the “Arrangement Agreement”) with Columbia Care Inc. (“Columbia Care”) to acquire all of the issued and outstanding shares of Columbia Care pursuant to a statutory plan of arrangement (the “Arrangement”) in an all-share transaction (the “Columbia Care Transaction”). Under the terms of the Arrangement Agreement, holders of common shares of Columbia Care will receive 0.5579 SVS of Cresco Labs for each Columbia Care share, subject to adjustments. On July 8, 2022, the shareholders of Columbia Care voted to approve the Arrangement. On July 15, 2022, Columbia Care obtained the final order from the Supreme Court of British Columbia approving the Arrangement. On June 30, 2023, it was announced that the Company will not be able to complete the divestitures necessary to secure all necessary regulatory approvals to close the pending transaction by the outside date of June 30, 2023 that is specified in the arrangement agreement dated March 23, 2022 and amended on February 27, 2023. On July 30, 2023, the Company and Columbia Care mutually agreed to terminate the previously announced definitive arrangement agreement, including all divestitures associated with this transaction.

3

During the second quarter of 2023, the Company sold a production facility in Maryland. Certain assets related to the sale were disposed of during the quarter.

In the fourth quarter of 2022, Management committed to a plan to restructure certain operations and activities within the California reporting unit. The plan was effective as of May 15, 2023. In conjunction with the termination of manufacturing and distribution activities at these locations, the Company entered into an agreement with a third-party distribution company to purchase and distribute the on-hand inventory as of that date. Related to that plan, during the first quarter of 2023, the Company recognized a $1.1 million gain on lease termination related to the impacted facilities and additional depreciation expense taken on leasehold improvements at those locations in the amount of $1.1 million. Further, $1.0 million of accounts receivable was reserved for and the Company recorded a $0.7 million severance accrual for one-time involuntary termination benefits.

Components of Our Results of Operations

Revenue

For the three and six months ended June 30, 2023 and 2022, approximately 58.5% and 56.4% of our revenue was derived from Company-owned retail dispensary locations. Retail revenue includes medical and adult-use cannabis sales in the U.S. Revenue from the wholesale of cannabis products represents the remaining 41.5% and 43.6% for the same periods.

Gross profit

Gross profit is calculated as revenue less cost of goods sold (“COGS”). COGS includes the direct costs attributable to the cultivation and production of the products sold and is comprised of the following:

| • | Direct labor costs: These expenses include all salaries, benefits and taxes for all employees at the cultivation and manufacturing facilities. |

| • | Direct supplies: The direct material cost for maintenance of the plants, the supplies and nutrients, the production expenses, packaging costs and equipment used to process marijuana. |

| • | Facility expenses: The facility expense for the cultivation operations is the cost for the facility, utilities, property taxes, maintenance and costs associated with monitoring the security systems. |

| • | Other operating expenses: These expenses include all costs associated with the facility itself including insurance, community benefit fees, professional services related to licenses and compliance, uniforms, employee training programs, tracking and inventory management systems, product testing, business development, information technology, license renewal fees and certain excise taxes. |

In addition to market fluctuations, cannabis costs are affected by various state regulations that limit the sourcing and procurement of cannabis products. The changes in regulatory environments may create fluctuations in gross profit over comparative periods. Additionally, gross profit may include the cost of inventory required to be marked to fair value as part of purchase accounting in a business combination.

4

Selling, general and administrative expenses (“SG&A”)

SG&A consist mainly of salary and benefit costs of executive and back-office employees, consulting and professional fees, advertising and marketing, office and retail operation costs, share-based compensation, certain excise taxes, technology, insurance, security, travel and entertainment, rent expense and business expansion costs.

Selling costs generally correlate to revenue. As a percentage of sales, we expect SG&A to generally decrease as our revenue increases due to efficiencies associated with scaling the business, while market conditions and investments in growing the business may contribute to increases as a percentage of sales in some periods.

For the three and six months ended June 30, 2023 and 2022, SG&A was comprised of the following:

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| ($ in thousands) |

2023 | 2022 | 2023 | 2022 | ||||||||||||

| Payroll and employee costs |

$ | 38,613 | $ | 39,708 | $ | 78,847 | $ | 79,195 | ||||||||

| Selling and marketing expenses |

2,265 | 5,256 | 4,757 | 8,281 | ||||||||||||

| Share-based compensation |

1,043 | 6,583 | 7,167 | 13,089 | ||||||||||||

| Depreciation and amortization |

4,345 | 5,652 | 8,618 | 10,204 | ||||||||||||

| Excise taxes |

4,261 | 5,013 | 7,973 | 9,925 | ||||||||||||

| Facility expenses |

5,184 | 6,539 | 10,986 | 14,289 | ||||||||||||

| Consulting and professional fees |

3,856 | 4,443 | 5,868 | 8,855 | ||||||||||||

| Computer and software expense |

2,083 | 2,824 | 4,563 | 5,474 | ||||||||||||

| Business insurance |

1,947 | 1,845 | 4,457 | 4,288 | ||||||||||||

| Rental fees |

3,324 | 2,852 | 6,760 | 4,814 | ||||||||||||

| Accounting |

1,269 | 1,338 | 3,661 | 3,878 | ||||||||||||

| Legal |

3,946 | 2,994 | 6,056 | 6,837 | ||||||||||||

| Travel and employee expenses |

833 | 1,336 | 1,697 | 2,456 | ||||||||||||

| Loss on sale of asset |

— | 1,480 | — | 1,480 | ||||||||||||

| Other expenses |

2,981 | 2,284 | 6,834 | 4,188 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total SG&A |

$ | 75,950 | $ | 90,147 | $ | 158,244 | $ | 177,253 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Other income (expense), net

Other income (expense), net consists mainly of reoccurring gains (losses) on derivative instruments, foreign currency and derivative liabilities related to warrants as well as ad hoc expenses such as gain (loss) on lease termination and gain (loss) on disposition of assets. These gains (losses) do not generally correlate to revenue and do not include interest expense, net, which when added to Other income, net, sum to Total other expense, net discussed in the “Selected Financial Information” section below.

5

For the three and six months ended June 30, 2023 and 2022, Other income (expense), net consisted of the following:

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| ($ in thousands) |

2023 | 2022 | 2023 | 2022 | ||||||||||||

| Unrealized gain on derivative liabilities - warrants |

$ | — | $ | 809 | $ | — | $ | 1,184 | ||||||||

| Loss on derivative instruments |

— | (32 | ) | — | (5,698 | ) | ||||||||||

| (Loss) gain on provision - loan receivable |

(136 | ) | (55 | ) | (195 | ) | 683 | |||||||||

| Unrealized loss on investments held at fair value |

(262 | ) | (2,216 | ) | (299 | ) | (3,885 | ) | ||||||||

| Gain on disposal of assets |

407 | — | 341 | — | ||||||||||||

| Gain on conversion of investment |

— | 22 | — | 22 | ||||||||||||

| Loss on foreign currency |

(241 | ) | (95 | ) | (272 | ) | (29 | ) | ||||||||

| Gain on lease termination |

128 | 5,243 | 1,263 | 5,243 | ||||||||||||

| Other income, net |

506 | 1,005 | 523 | 389 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Other income (expense), net |

$ | 402 | $ | 4,681 | $ | 1,361 | $ | (2,091 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

Income Taxes

The Company is classified for U.S. federal income tax purposes as a U.S. corporation under Section 7874 of the Internal Revenue Code (“IRC”). The Company is subject to income taxes in the jurisdictions in which it operates and, consequently, income tax expense is a function of the allocation of taxable income by jurisdiction and the various activities that impact the timing of taxable events. As the Company operates in the cannabis industry, the Company is subject to the limits of IRC Section 280E for U.S. federal income tax purposes as well as state income tax purposes. Under IRC Section 280E, the Company is only allowed to deduct expenses directly related to sales of product. This results in permanent differences between ordinary and necessary business expenses deemed non-allowable under IRC Section 280E. However, certain states do not conform to IRC Section 280E and, accordingly, the Company deducts all operating expenses on its state income tax returns in these states.

SELECTED FINANCIAL INFORMATION

The Company reports results of operations of its affiliates from the date that control commences, either through the purchase of the business, through a management agreement or through other arrangements that grant such control. The following selected financial information includes only the results of operations after the Company established control of its affiliates. Accordingly, the information included below may not be representative of the results of operations if such affiliates had included their results of operations for the entire reporting period.

6

Summary of Quarterly Results

| ($ in thousands) |

2023 | 2022 | 2021 | |||||||||||||||||||||||||||||

| Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | |||||||||||||||||||||||||

| Revenues, net |

$ | 197,887 | $ | 194,202 | $ | 199,580 | $ | 210,484 | $ | 218,226 | $ | 214,391 | $ | 217,787 | $ | 215,483 | ||||||||||||||||

| (Loss) income from operations |

(10,752 | ) | 3,586 | (143,479 | ) | 16,240 | 22,677 | 20,267 | 15,557 | (264,018 | ) | |||||||||||||||||||||

| Net loss attributable to Cresco Labs Inc. |

(36,534 | ) | (26,051 | ) | (161,337 | ) | (9,788 | ) | (13,541 | ) | (27,381 | ) | (14,732 | ) | (270,645 | ) | ||||||||||||||||

| Basic and Diluted EPS |

$ | (0.12 | ) | $ | (0.09 | ) | $ | (0.54 | ) | $ | (0.03 | ) | $ | (0.05 | ) | $ | (0.09 | ) | $ | (0.08 | ) | $ | (1.00 | ) | ||||||||

Three Months Ended June 30, 2023 Compared to the Three Months Ended June 30, 2022

The following tables set forth selected consolidated financial information for the periods indicated that are derived from our unaudited condensed interim consolidated financial statements and the respective accompanying notes prepared in accordance with GAAP.

The selected consolidated financial information set out below may not be indicative of the Company’s future performance:

| Three Months Ended June 30, | ||||||||||||||||

| ($ in thousands) |

2023 | 2022 | $ Change | % Change | ||||||||||||

| Revenues, net |

$ | 197,887 | $ | 218,226 | $ | (20,339 | ) | (9.3 | )% | |||||||

| Cost of goods sold |

111,187 | 105,402 | 5,785 | 5.5 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

86,700 | 112,824 | (26,124 | ) | (23.2 | )% | ||||||||||

| Selling, general and administrative |

75,950 | 90,147 | (14,197 | ) | (15.7 | )% | ||||||||||

| Impairment loss |

21,502 | — | 21,502 | — | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

97,452 | 90,147 | 7,305 | 8.1 | % | |||||||||||

| Total other expense, net |

(18,774 | ) | (7,335 | ) | (11,439 | ) | 156.0 | % | ||||||||

| Income tax expense |

(13,937 | ) | (23,638 | ) | 9,701 | (41.0 | )% | |||||||||

|

|

|

|

|

|

|

|||||||||||

| Net loss1 |

$ | (43,463 | ) | $ | (8,296 | ) | $ | (35,167 | ) | nm | ||||||

|

|

|

|

|

|

|

|||||||||||

| 1 | Net loss includes amounts attributable to non-controlling interests. |

Revenues, net

Revenue for the three months ended June 30, 2023 decreased $20.3 million, or 9.3%, compared to the three months ended June 30, 2022. The decrease in revenue was primarily driven by lower sales volumes and price compression in Illinois and the Pennsylvania wholesale market due to increased competition, as well as the Company’s reduced California operations compared to the prior year period. The decrease was partially offset by an increase in revenue generated in Michigan as a result of higher flower prices and total units sold during the second quarter of 2023 compared to the prior year period.

COGS and Gross profit

COGS for the three months ended June 30, 2023, increased $5.8 million, or 5.5%, compared to the three months ended June 30, 2022. The increase was primarily attributable to increased production to accommodate for the increased wholesale activity in Michigan as well as increased closure costs in 2023.

7

Gross profit decreased by $26.1 million, or 23.2%, for the three months ended June 30, 2023, compared to the three months ended June 30, 2022. As a percentage of Revenue, net, Gross profit was 43.8% and 51.7% for the three months ended June 30, 2023 and 2022, respectively. The decline in gross profit as a percentage of revenue, net was driven by the combination of price compression, increased fixed cost absorption on lower revenue in 2023, increased closure costs and a decrease in sales from higher margin states resulting in higher percentage of total sales generated from lower margin states.

SG&A

Selling, general and administrative expenses for the three months ended June 30, 2023 decreased $14.2 million, or 8.1%, compared to the three months ended June 30, 2022. The decrease was primarily attributable to a reduction in incentive compensation, selling and marketing expenses as well as overall cost control initiatives.

Impairment

Total impairment the three months ended June 30, 2023 increased $21.5 million compared to the three months ended June 30, 2022. During the three months ended June 30, 2023, the Company determined it is more likely than not that the Massachusetts reporting unit’s carrying value exceeded its fair value due to updated forecasts and projections for this reporting unit. As a result, a $21.5 million impairment charge reducing the carrying value of goodwill and licenses was recognized in the Unaudited Condensed Interim Consolidated Statements of Operations.

Total other expense, net

Total other expense, net for the three months ended June 30, 2023 increased $11.4 million, or 156.0%, compared to the three months ended June 30, 2022, primarily due to the write off of a $5 million consent fee related to the termination of the Columbia Care acquisition in 2023 and a gain on lease terminations in the second quarter of 2022.

Provision for income taxes

Income tax expense for the three months ended June 30, 2023, decreased $9.7 million, or 41.0%, compared to the three months ended June 30, 2022. The change was primarily due to the impact of lower pre-tax book income, additional states decoupling from IRC Section 280E and various state tax rate changes.

Net loss

Net loss for the three months ended June 30, 2023, increased $35.2 million, compared to the three months ended June 30, 2022. This was primarily driven by lower revenues and the $21.5 million impairment charge recorded in 2023, partially offset by lower total operating expenses and lower income tax expense.

Six Months Ended June 30, 2023 Compared to the Six Months Ended June 30, 2022

The following tables set forth selected consolidated financial information for the periods indicated that are derived from our unaudited condensed interim consolidated financial statements and the respective accompanying notes prepared in accordance with GAAP.

8

The selected consolidated financial information set out below may not be indicative of the Company’s future performance:

| Six Months Ended June 30, | ||||||||||||||||

| ($ in thousands) |

2023 | 2022 | $ Change | % Change | ||||||||||||

| Revenues, net |

$ | 392,089 | $ | 432,617 | $ | (40,528 | ) | (9.4 | )% | |||||||

| Costs of goods sold |

219,509 | 212,420 | 7,089 | 3.3 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

172,580 | 220,197 | (47,617 | ) | (21.6 | )% | ||||||||||

| Selling, general and administrative |

158,244 | 177,253 | (19,009 | ) | (10.7 | )% | ||||||||||

| Impairment loss |

21,502 | — | 21,502 | — | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

179,746 | 177,253 | 2,493 | 1.4 | % | |||||||||||

| Total other expense, net |

(33,363 | ) | (28,470 | ) | (4,893 | ) | 17.2 | % | ||||||||

| Income tax expense |

(30,746 | ) | (46,445 | ) | 15,699 | (33.8 | )% | |||||||||

|

|

|

|

|

|

|

|||||||||||

| Net loss1 |

$ | (71,275 | ) | $ | (31,971 | ) | $ | (39,304 | ) | 122.9 | % | |||||

|

|

|

|

|

|

|

|||||||||||

| 1 | Net loss income includes amounts attributable to non-controlling interests. |

Revenues, net

Revenue for the six months ended June 30, 2023 decreased $40.5 million, or 9.4%, compared to the six months ended June 30, 2022. The decrease in revenue was primarily driven by increased competition and price promotions in Illinois as well as fewer units sold at a lower average selling price in the Pennsylvania wholesale market.

COGS and Gross profit

COGS for the six months ended June 30, 2023 increased $7.1 million, or 3.3%, compared to the six months ended June 30, 2022. The increase was primarily attributable to increased production to accommodate for the increased wholesale activity in Michigan as well as increased closure costs in 2023.

Gross profit decreased by $47.6 million, or 21.6%, for the six months ended June 30, 2023, compared to the six months ended June 30, 2022. As a percentage of Revenue, net, Gross profit was 44.0% and 50.9% for the six months ended June 30, 2023 and June 30, 2022, respectively. The decline in gross profit as a percentage of revenue, net was driven by the combination of price compression, certain inventory adjustments to net realizable value and higher period costs as a percentage of revenue at some of our operating facilities.

SG&A

Selling, general and administrative expenses for the six months ended June 30, 2023 decreased $19.0 million, or 10.7% compared to the six months ended June 30, 2022. The decrease was primarily attributable to closing costs partially offset by reduced SG&A.

Impairment

Total impairment for the six months ended June 30, 2023 increased $21.5 million compared to the six months ended June 30, 2022. During the six months ended June 30, 2023, the Company determined it is more likely than not that the Massachusetts reporting unit’s carrying value exceeded its fair value due to updated forecasts and projections for this reporting unit. As a result, a $21.5 million impairment charge reducing the carrying value of goodwill and licenses was recognized in the Unaudited Condensed Interim Consolidated Statements of Operations.

9

Total other expense, net

Total other expense, net for the six months ended June 30, 2023 increased $4.9 million, or 17.2%, compared to the six months ended June 30, 2022. The increase in expense was primarily driven by gains on lease terminations and mark-to-market losses on investments offset by a write off of a $5 million consent fee related to the termination of the Columbia Care acquisition in 2023.

Provision for income taxes

Income tax expense for the six months ended June 30, 2023, decreased $15.7 million, or 33.8%, compared to the six months ended June 30, 2022. The decrease was primarily due to the impact of additional states decoupling from IRC Section 280E, partially offset by an increase in expense related to uncertain tax positions (including penalties and interest).

Net loss

Net loss for the six months ended June 30, 2023, increased $39.3 million compared to the six months ended June 30, 2022. The increase in net loss was primarily driven by the impairment charge recorded in 2023, lower revenue in the current period and higher operating expenses, partially offset by lower SG&A.

10

Non-GAAP Financial Measures

Earnings before interest, taxes, depreciation and amortization (“EBITDA”) and Adjusted EBITDA are non-GAAP financial measures and do not have standardized definitions under GAAP. The Company has provided the non-GAAP financial measures, which are not calculated or presented in accordance with GAAP, as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP and may not be comparable to similar measures presented by other issuers. These supplemental non-GAAP financial measures are presented because management has evaluated the financial results both including and excluding the adjusted items and believe that the supplemental non-GAAP financial measures presented provide additional perspectives and insights when analyzing the core operating performance of the business. These supplemental non-GAAP financial measures should not be considered superior to, as a substitute for, or as an alternative to and should only be considered in conjunction with, the GAAP financial measures presented herein. Accordingly, the Company has included below reconciliations of the supplemental non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP.

| Three Months Ended June 30, | ||||||||||||||||

| ($ in thousands) |

2023 | 2022 | $ Change | % Change | ||||||||||||

| Net loss1 |

$ | (43,463 | ) | $ | (8,296 | ) | $ | (35,167 | ) | nm | ||||||

| Depreciation and amortization |

14,002 | 13,113 | 889 | 6.8 | % | |||||||||||

| Interest expense, net |

19,176 | 12,016 | 7,160 | 59.6 | % | |||||||||||

| Income tax expense |

13,937 | 23,638 | (9,701 | ) | (41.0 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| EBITDA (non-GAAP) |

$ | 3,652 | $ | 40,471 | $ | (36,819 | ) | (91.0 | )% | |||||||

|

|

|

|

|

|

|

|||||||||||

| Other income, net |

(402 | ) | (4,681 | ) | 4,279 | (91.4 | )% | |||||||||

| Fair value mark-up for acquired inventory |

— | 123 | (123 | ) | (100.0 | )% | ||||||||||

| Adjustments for acquisition and other non-core costs |

13,522 | 7,231 | 6,291 | 87.0 | % | |||||||||||

| Impairment loss |

21,502 | — | 21,502 | — | % | |||||||||||

| Share-based compensation |

2,204 | 7,449 | (5,245 | ) | (70.4 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA (non-GAAP) |

$ | 40,478 | $ | 50,593 | $ | (10,115 | ) | (20.0 | )% | |||||||

|

|

|

|

|

|

|

|||||||||||

| 1 | Net loss includes amounts attributable to non-controlling interests. |

Adjusted EBITDA (non-GAAP)

Adjusted EBITDA, a non-GAAP financial measure, excludes depreciation and amortization; interest expense, net; income taxes; other income, net; share-based compensation; adjustments for acquisition and other non-core costs and adjustments for the fair value of mark-up for acquired inventory. Non-core costs include non-operating costs such as costs related to restructuring, loss on sale of assets, unique legal expenses and other expenses that are mostly one-time in nature. Adjusted EBITDA was $40.5 million for the three months ended June 30, 2023, compared to $50.6 million for the three months ended June 30, 2022. The decrease in adjusted EBITDA of $10.1 million is due to lower gross profit partially offset by lower SG&A.

11

| Six Months Ended June 30, | ||||||||||||||||

| ($ in thousands) |

2023 | 2022 | $ Change | % Change | ||||||||||||

| Net loss1 |

$ | (71,275 | ) | $ | (31,971 | ) | $ | (39,304 | ) | 122.9 | % | |||||

| Depreciation and amortization |

26,963 | 24,073 | 2,890 | 12.0 | % | |||||||||||

| Interest expense, net |

34,724 | 26,379 | 8,345 | 31.6 | % | |||||||||||

| Income tax expense |

30,746 | 46,445 | (15,699 | ) | (33.8 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| EBITDA (non-GAAP) |

$ | 21,158 | $ | 64,926 | $ | (43,768 | ) | (67.4 | )% | |||||||

|

|

|

|

|

|

|

|||||||||||

| Other (income) expense, net |

(1,361 | ) | 2,091 | (3,452 | ) | (165.1 | )% | |||||||||

| Fair value mark-up for acquired inventory |

— | 5,445 | (5,445 | ) | 100.0 | % | ||||||||||

| Adjustments for acquisition and other non-core costs |

19,193 | 13,925 | 5,268 | 37.8 | % | |||||||||||

| Impairment loss |

21,502 | — | 21,502 | — | % | |||||||||||

| Share-based compensation |

9,267 | 14,955 | (5,688 | ) | (38.0 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA (non-GAAP) |

$ | 69,759 | $ | 101,342 | $ | (31,583 | ) | (31.2 | )% | |||||||

|

|

|

|

|

|

|

|||||||||||

| 1 | Net loss includes amounts attributable to non-controlling interests. |

Adjusted EBITDA (non-GAAP)

Adjusted EBITDA, a non-GAAP financial measure, excludes depreciation and amortization; interest expense, net; income taxes; other income, net; share-based compensation; adjustments for acquisition and other non-core costs; loss on equity method investments and adjustments for the fair value of mark-up for acquired inventory. Non-core costs include non-operating costs such as costs related to restructuring, loss on sale of assets, unique legal expenses and other expenses which are mostly one-time in nature. Adjusted EBITDA was $69.8 million for the six months ended June 30, 2023, compared to $101.3 million for the six months ended June 30, 2022. The decrease in adjusted EBITDA of $31.6 million is primarily driven by lower gross profit partially offset by lower SG&A.

12

LIQUIDITY AND CAPITAL RESOURCES

Overview

Our primary sources of liquidity are cash and cash equivalents from the operations of our business and debt and equity offerings. Our principal uses of cash include working capital related items, capital expenditures, debt and tax related payments. Additionally, we may use cash for acquisitions and other investing or financing activities.

As of June 30, 2023, the Company held $73.2 million in cash and cash equivalents and $1.7 million in restricted cash compared to December 31, 2022, where the Company held $119.3 million in cash and cash equivalents and $2.2 million in restricted cash.

The Company is generally able to access private and/or public financing through, but not limited to, institutional lenders, such as the Senior Secured Term Loan (“the Senior Loan”) of $400.0 million, effective August 12, 2021, private loans through individual investors and private and public equity raises such as the equity distribution agreement that was announced on April 26, 2021 with Canaccord Genuity Corp.

The Company expects cash on hand and cash flows from operations, along with the private and/or public financing options discussed above, will be adequate to meet capital requirements and operational needs for the next twelve months.

We cannot guarantee this will be the case or that our assumptions regarding revenues and expenses underlying this belief will be accurate. If, in the future, we require more liquidity than contemplated, we may need to raise additional funds through debt and/or equity offerings. Adequate funds may not be available when needed or may not be available on terms favorable to us. If additional funds are raised by issuing equity securities, dilution to existing shareholders may result. If we raise additional funds by obtaining loans from third parties, the terms of those financing arrangements may include negative covenants or other restrictions on our business that could impair our operational flexibility and would also require us to fund additional interest expense. If funding is insufficient at any time in the future, we may be unable to develop or enhance our products or services, take advantage of business opportunities, or respond to competitive pressures, any of which could have a material adverse effect on our business, financial condition and results of operations. See the section entitled “Risk Factors” in the Company’s Annual Information Form for the year ended December 31, 2022, which is available on SEDAR+ under the Company’s issuer profile, for further information.

Cash Flows

Operating Activities

Net cash provided by operating activities was $21.2 million for the six months ended June 30, 2023, an increase of $31.7 million compared to $10.5 million of cash used in operating activities during the six months ended June 30, 2022. The $31.7 million increase was primarily attributable to favorable changes in inventory, accounts payable and accrued expenses.

As of June 30, 2023, the Company had working capital (defined as current assets less current liabilities) of $27.6 million compared to $86.1 million as of June 30, 2022. The $58.5 million decrease in working capital was primarily attributable to decreases in inventory, partially offset by decreases in deferred consideration, accounts payable and other accrued expenses.

13

Investing Activities

Net cash used in investing activities was $34.7 million for the six months ended June 30, 2023, a decrease of $12.9 million compared to $47.6 million used in the six months ended June 30, 2022. The decrease in net cash used in investing activities was primarily driven by a reduction from prior year of $11.2 million in purchases of property and equipment due to significant investments in the first quarter of 2022 related to our New York operations.

Financing Activities

Net cash used in financing activities was $33.2 million for the six months ended June 30, 2023, a decrease in cash used of $42.3 million compared to cash used in financing activities of $75.5 million for the six months ended June 30, 2022. The decrease was primarily driven by a $42.8 million decrease in distributions to non-controlling interest redeemable unit holders and other members, including related parties, in the current period.

OFF-BALANCE SHEET ARRANGEMENTS AND PROPOSED TRANSACTIONS

| (a) | Off-Balance Sheet Arrangements |

The Company has no material undisclosed off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on its results of operations, financial condition, revenues or expenses, liquidity, capital expenditures or capital resources that is material to investors.

| (b) | Proposed Transactions |

On July 30, 2023, the Company and Columbia Care mutually agreed to terminate the previously announced definitive arrangement agreement dated March 23, 2022 and amended on February 27, 2023, including all divestitures associated with this transaction.

14

CONTRACTUAL OBLIGATIONS

The Company has the following contractual obligations as of June 30, 2023:

| ($ in thousands) |

< 1 Year | 1 to 3 Years | 3 to 5 Years | > 5 Years | Total | |||||||||||||||

| Accounts payable & Accrued liabilities |

$ | 98,425 | $ | — | $ | — | $ | — | $ | 98,425 | ||||||||||

| Deferred consideration, contingent consideration and other payables, short-term |

2,108 | — | — | — | 2,108 | |||||||||||||||

| Operating leases liabilities |

14,073 | 56,902 | 58,095 | 189,030 | 318,100 | |||||||||||||||

| Finance lease liabilities |

2,861 | 10,501 | 10,980 | 24,062 | 48,404 | |||||||||||||||

| Deferred consideration, long-term |

— | 6,453 | — | — | 6,453 | |||||||||||||||

| Long-term notes payable and loans payable and Short-term borrowings |

18,293 | 27,407 | 429,432 | 111,838 | 586,970 | |||||||||||||||

| Other long-term liabilities |

205 | 3,870 | 10,574 | 8,761 | 23,410 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total obligations as of June 30, 2023 |

$ | 135,965 | $ | 105,133 | $ | 509,081 | $ | 333,691 | $ | 1,083,870 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

15

RELATED PARTY TRANSACTIONS

| (a) | Transactions with Key Management Personnel |

Related parties, including key management personnel, hold 87.4 million Redeemable Units of Cresco Labs, LLC, which accounts for a deficit of $64.7 million in Non-controlling interests as of June 30, 2023. During the three and six months ended June 30, 2023, 54.4% and 67.5% respectively, of required tax distribution payments to holders of Cresco Labs, LLC were made to related parties including to key management personnel. During the three and six months ended June 30, 2022, 72.5% and 73.8%, respectively, of required tax distribution payments to holders of Cresco Labs, LLC were made to related parties including to key management personnel.

| (b) | Related Parties - Leases |

For the three and six months ended June 30, 2023 and 2022, the Company had lease liabilities for real estate lease agreements in which the lessors have a minority interest in SLO Cultivation, Inc. (“SLO”) and MedMar, Inc (“MedMar”). The lease liabilities were incurred in January 2019 and May 2020 and were to expire in 2027 through 2030, except for the leases associated with SLO minority interest holders (“SLO Leases”). During the second quarter of 2022, the Company exercised its early termination right to reduce the SLO Leases term to 180 days. This early termination resulted in a reduction in lease liability and right-of-use (“ROU”) assets. The remaining liability for the SLO Leases expired in the fourth quarter of 2022.

The Company has liabilities for real estate leases and other financing agreements in which the lessor is Clear Heights Properties where Dominic Sergi, MVS shareholder, is Chief Executive Officer. The liabilities were incurred by entering into operating leases, finance leases and other financing transactions with terms that will expire in 2030. During both the three months ended June 30, 2023 and 2022, the Company received tenant improvement allowance reimbursements of $nil. During the six months ended June 30, 2023 and 2022, the Company received tenant improvement allowance reimbursements of $nil and $1.4 million, respectively. The Company expects to receive further reimbursements of $0.8 million within the next twelve months.

16

Below is a summary of the expense resulting from the related party lease liabilities for the three and six months ended June 30, 2023 and 2022:

| Three Months Ended | Six Months Ended | |||||||||||||||||

| June 30, | June 30, | |||||||||||||||||

| ($ in thousands) |

Classification |

2023 | 2022 | 2023 | 2022 | |||||||||||||

| Operating Leases |

||||||||||||||||||

| Lessor has minority interest in SLO |

Rent expense | $ | — | $ | 133 | $ | — | $ | 512 | |||||||||

| Lessor has minority interest in MedMar |

Rent expense | 71 | 73 | 144 | 144 | |||||||||||||

| Lessor is an MVS shareholder |

Rent expense | 259 | 296 | 555 | 594 | |||||||||||||

| Finance Leases |

||||||||||||||||||

| Lessor has minority interest in MedMar |

Depreciation expense | $ | 77 | $ | 76 | $ | 153 | $ | 153 | |||||||||

| Lessor has minority interest in MedMar |

Interest expense | 62 | 68 | 125 | 137 | |||||||||||||

| Lessor is an MVS shareholder |

Depreciation expense | 23 | 20 | 45 | 39 | |||||||||||||

| Lessor is an MVS shareholder |

Interest expense | 17 | 19 | 36 | 39 | |||||||||||||

Additionally, below is a summary of the ROU assets and lease liabilities attributable to related party lease liabilities as of June 30, 2023 and December 31, 2022:

| As of June 30, 2023 | As of December 31, 2022 | |||||||||||||||

| ($ in thousands) |

ROU Asset | Lease Liability |

ROU Asset | Lease Liability |

||||||||||||

| Operating Leases |

||||||||||||||||

| Lessor has minority interest in MedMar |

$ | 1,356 | $ | 1,403 | $ | 1,415 | $ | 1,456 | ||||||||

| Lessor is an MVS shareholder |

5,604 | 5,694 | 5,849 | 5,907 | ||||||||||||

| Finance Leases |

||||||||||||||||

| Lessor has minority interest in MedMar |

$ | 1,881 | $ | 2,334 | $ | 2,034 | $ | 2,452 | ||||||||

| Lessor is an MVS shareholder |

596 | 538 | 596 | 555 | ||||||||||||

The Company also has other financing liabilities with related parties associated with certain properties. During both the three and six months ended June 30, 2023 and 2022, the Company recorded interest expense on those finance liabilities of $0.1 million, respectively. As of June 30, 2023 and December 31, 2022, the Company had finance liabilities totaling $1.5 million, respectively. All of these finance liabilities are due to an entity controlled by an MVS shareholder.

17

FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT

The Company’s financial instruments are held at amortized cost (adjusted for impairments or expected credit losses, as applicable) or fair value. The carrying values of financial instruments held at amortized cost approximate their fair values as of June 30, 2023 and December 31, 2022, due to their nature and relatively short maturity date. Financial assets and liabilities with embedded derivative features are carried at fair value.

Financial instruments recorded at fair value are classified using a fair value hierarchy that reflects the significance of the inputs to fair value measurements. The three levels of hierarchy are:

| • | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities; |

| • | Level 2 – Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly; and |

| • | Level 3 – Inputs for the asset or liability that are not based on observable market data. |

There have been no transfers into or out of level 3 during the periods ended June 30, 2023 and December 31, 2022.

The following tables summarize the Company’s financial instruments as of June 30, 2023 and December 31, 2022:

| June 30, 2023 | ||||||||||||||||||||

| ($ in thousands) |

Amortized Cost |

Level 1 | Level 2 | Level 3 | Total | |||||||||||||||

| Financial Assets: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 73,158 | $ | — | $ | — | $ | — | $ | 73,158 | ||||||||||

| Restricted cash1 |

1,653 | — | — | — | 1,653 | |||||||||||||||

| Security deposits2 |

4,458 | — | — | — | 4,458 | |||||||||||||||

| Accounts receivable, net |

57,705 | — | — | — | 57,705 | |||||||||||||||

| Loans receivable, short-term |

1,394 | — | — | — | 1,394 | |||||||||||||||

| Loans receivable, long-term |

823 | — | — | — | 823 | |||||||||||||||

| Investments |

— | 126 | 190 | 615 | 931 | |||||||||||||||

| Financial Liabilities: |

||||||||||||||||||||

| Accounts payable |

$ | 20,393 | $ | — | $ | — | $ | — | $ | 20,393 | ||||||||||

| Accrued liabilities |

78,032 | — | — | — | 78,032 | |||||||||||||||

| Short-term borrowings |

18,293 | — | — | — | 18,293 | |||||||||||||||

| Current portion of lease liabilities |

26,446 | — | — | — | 26,446 | |||||||||||||||

| Deferred consideration and other payables, short-term |

6 | 6 | — | 2,096 | 2,108 | |||||||||||||||

| Lease liabilities |

149,999 | — | — | — | 149,999 | |||||||||||||||

| Deferred consideration, long-term |

— | — | — | 6,453 | 6,453 | |||||||||||||||

| Long-term notes payable and loans payable |

471,553 | — | — | — | 471,553 | |||||||||||||||

| Other long-term liabilities |

23,410 | — | — | — | 23,410 | |||||||||||||||

| 1 | Restricted cash balances include various escrow accounts related to investments, acquisition, and facility licensing requirements. |

| 2 | Security deposits are included in “Other non-current assets” on the Unaudited Condensed Interim Consolidated Balance Sheets. |

18

| December 31, 2022 | ||||||||||||||||||||

| ($ in thousands) |

Amortized Cost |

Level 1 | Level 2 | Level 3 | Total | |||||||||||||||

| Financial Assets: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 119,341 | $ | — | $ | — | $ | — | $ | 119,341 | ||||||||||

| Restricted cash1 |

2,169 | — | — | — | 2,169 | |||||||||||||||

| Security deposits2 |

4,367 | — | — | — | 4,367 | |||||||||||||||

| Accounts receivable, net |

56,492 | — | — | — | 56,492 | |||||||||||||||

| Loans receivable, short-term |

447 | — | — | — | 447 | |||||||||||||||

| Loans receivable, long-term |

823 | — | — | — | 823 | |||||||||||||||

| Investments |

— | 136 | 432 | 660 | 1,228 | |||||||||||||||

| Financial Liabilities: |

||||||||||||||||||||

| Accounts payable |

$ | 28,093 | $ | — | $ | — | $ | — | $ | 28,093 | ||||||||||

| Accrued liabilities |

65,161 | — | — | — | 65,161 | |||||||||||||||

| Short-term borrowings |

18,812 | — | — | — | 18,812 | |||||||||||||||

| Current portion of lease liabilities |

26,124 | — | — | — | 26,124 | |||||||||||||||

| Deferred consideration and other payables, short-term |

6 | 7 | — | 47,821 | 47,834 | |||||||||||||||

| Lease liabilities |

156,180 | — | — | — | 156,180 | |||||||||||||||

| Deferred consideration, long-term |

— | — | — | 7,770 | 7,770 | |||||||||||||||

| Long-term notes payable and loans payable |

469,055 | — | — | — | 469,055 | |||||||||||||||

| Other long-term liabilities |

7,000 | — | — | — | 7,000 | |||||||||||||||

| 1 | Restricted cash balances include various escrow accounts related to investments, acquisitions and facility licensing requirements. |

| 2 | Security deposits are included in “Other non-current assets” on the Unaudited Condensed Interim Consolidated Balance Sheets. |

19

Financial Risk Management

The Company is exposed in varying degrees to a variety of financial instrument related risks. The Board of Directors and Company management mitigate these risks by assessing, monitoring and approving the Company’s risk management processes:

| (a) | Credit and Banking Risk |

Credit risk is the risk of a potential loss to the Company if a customer or a third-party to a financial instrument fails to meet its contractual obligations. The maximum credit exposure as of June 30, 2023 and December 31, 2022 is the carrying amount of cash, accounts receivable and loans receivable. The Company does not have significant credit risk with respect to its growth in its key retail markets, as payment is typically due upon transferring the goods to the customer at our dispensaries, which currently accept only cash and debit cards. Additionally, the Company does not have significant credit risk with respect to its loan counterparties as the interest rate on our Senior Loan is not variable and therefore, is not materially impacted by interest rate increases enacted by the Federal Reserve. Although all deposited cash is placed with U.S. financial institutions in good standing with regulatory authorities, changes in U.S. federal banking laws related to the deposit and holding of funds derived from activities related to the cannabis industry have passed the U.S. House of Representatives but were not voted on within the U.S. Senate, and would need to be reintroduced by Congress. Given that current U.S. federal law provides that the production and possession of cannabis is illegal, there is a strong argument that banks cannot accept or deposit funds from businesses involved with the cannabis industry, leading to an increased risk of legal actions against the Company and forfeitures of the Company’s assets.

| (b) | Asset Forfeiture Risk |

Because the cannabis industry remains illegal under U.S. federal law, any property owned by participants in the cannabis industry which are either used in the course of conducting such business, or are the proceeds of such business, could be subject to seizure by law enforcement and subsequent civil asset forfeiture. Even if the owner of the property was never charged with a crime, the property in question could still be seized and subject to an administrative proceeding by which, with minimal due process, it could be subject to forfeiture.

| (c) | Liquidity Risk |

The Company prepares its financial statements assuming that the Company will continue as a going concern. The Company has generated positive cash flows from operations and implemented certain cost cutting measures, which are expected to improve cash from operations.

Liquidity risk is the risk that the Company will not be able to meet its financial obligations associated with financial liabilities. The Company primarily manages liquidity risk through the management of its capital structure by ensuring that it will have sufficient liquidity to settle obligations and liabilities when due. The Company also expects to continue to raise debt or equity based capital or sell certain assets, if needed, to fund operations and the expansion of its business.

20

| (d) | Market Risk |

| (i) | Currency Risk |

The operating results and balance sheet of the Company are reported in USD. As of June 30, 2023 and December 31, 2022, the Company’s financial assets and liabilities are primarily in USD. However, from time to time some of the Company’s financial transactions are denominated in currencies other than USD. The results of the Company’s operations are subject to currency transaction and translation risks. For both the three months ended and six months ended June 30, 2023, the Company recorded foreign currency exchange losses of $nil, respectively. For both the three months ended and six months ended June 30, 2022, the Company recorded foreign currency exchange losses of $0.1 million, respectively.

As of June 30, 2023 and December 31, 2022, the Company had no hedging agreements in place with respect to foreign exchange rates. The Company has not entered into any agreements or purchased any instruments to hedge possible currency risks at this time.

| (ii) | Interest Rate Risk |

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. An increase or decrease in the Company’s incremental borrowing rate would result in an associated increase or decrease in Deferred consideration, contingent consideration and other payables and Interest expense, net. The Company’s Senior Loan accrues at a rate of 9.5% per annum and has an effective interest rate of 11.0%.

| (iii) | Price Risk |

Price risk is the risk of variability in fair value due to movements in equity or market prices. The Company is subject to price risk related to derivative liabilities and contingent consideration that are valued based on the Company’s own stock price. An increase or decrease in stock price would result in an associated increase or decrease to Deferred consideration, contingent consideration and other payables, short-term and Derivative liabilities, short-term with a corresponding change to Other income (expense), net.

| (iv) | Tax Risk |

Tax risk is the risk of changes in the tax environment that would have a material adverse effect on the Company’s business, results of operations and financial condition. Currently, state-licensed marijuana businesses are assessed a comparatively high effective federal tax rate due to IRC Section 280E, which bars businesses from deducting all expenses except their cost of goods sold when calculating federal tax liability. Any increase in tax levies resulting from additional tax measures may have a further adverse effect on the operations of the Company, while any decrease in such tax levies will be beneficial to future operations.

21

| (v) | Regulatory Risk |

Regulatory risk pertains to the risk that the Company’s business objectives are contingent, in part, upon the compliance of regulatory requirements. Due to the nature of the industry, the Company recognizes that regulatory requirements are more stringent and punitive in nature. Any delays in obtaining, or failure to obtain regulatory approvals can significantly delay operational and product development and can have a material adverse effect on the Company’s business, results of operation and financial condition. The Company is cognizant of the advent of regulatory changes occurring in the cannabis industry on the city, state and national levels. Although the regulatory outlook on the cannabis industry has been moving in a positive trend, any unforeseen regulatory changes could have a material adverse impact on the goals and operations of the Company’s business.

| (vi) | Economic Risk |

The Company’s business, financial condition and operating results may be negatively impacted by challenging global economic conditions. A global economic slowdown would cause disruptions and extreme volatility in global financial markets, increased rates of default and bankruptcy and declining consumer and business confidence, which can lead to decreased levels of consumer spending. These macroeconomic developments could negatively impact the Company’s business, which depends on the general economic environment and levels of consumer spending. As a result, the Company may not be able to maintain its existing customers or attract new customers, or the Company may be forced to reduce the price of its products. The Company is unable to predict the likelihood of the occurrence, duration or severity of such disruptions in the credit and financial markets or adverse global economic conditions. Any general or market-specific economic downturn could have a material adverse effect on our business, financial condition and operating results.

| (vii) | Inflation Risk |

The Company has experienced increased inflationary pressures, including increased cultivation costs, distribution costs and operating expenses, which adversely has impacted our operating results. The Company expects these inflationary pressures to continue throughout 2023. The Company maintains strategies to mitigate the impact of higher raw material, energy and commodity costs, which include cost reduction, sourcing and other actions, which may help to offset a portion of the adverse impact.

22

SUMMARY OF OUTSTANDING SHARE AND SHARE-BASED DATA

Cresco has the following securities issued and outstanding, as of June 30, 2023:

| Securities |

Number of Shares (in thousands) |

|||

| Issued and Outstanding |

||||

| Super Voting Shares |

500 | |||

| Subordinate Voting Shares1 |

317,250 | |||

| Proportionate Voting Shares2 |

19,512 | |||

| Special Subordinate Voting Shares3 |

2 | |||

| Redeemable Shares |

99,249 | |||

| Stock Options |

25,640 | |||

| Restricted Stock Units |

8,156 | |||

| 1 | SVS includes shares pending issuance or cancellation |

| 2 | PVS presented on an “as-converted” basis to SVS (1-to-200) |

| 3 | SSVS presented on an “as-converted” basis to SVS (1-to-0.00001) |

23

Federal Regulatory Environment

Canadian-Securities Administrators Staff Notice 51-352 (Revised) – Issuers with U.S. Marijuana-Related Activities (“Staff Notice 51-352”) provides specific disclosure expectations for issuers that currently have, or are in the process of developing, cannabis-related activities in the U.S. as permitted within a particular state’s regulatory framework. All issuers with U.S. cannabis-related activities are expected to clearly and prominently disclose certain prescribed information in prospectus filings and other required disclosure documents.

In accordance with Staff Notice 51-352, Cresco Labs will evaluate, monitor and reassess the disclosures contained herein and any related risks, on an ongoing basis and the same will be supplemented, amended and communicated to investors in public filings, including in the event of government policy changes or the introduction of new or amended guidance, laws or regulations regarding marijuana regulation. As a result of the Company’s operations, it is subject to Staff Notice 51-352 and accordingly provides the following disclosure:

Cresco Labs currently directly derives a substantial portion of its revenues from the cannabis industry in certain U.S. states, which industry is illegal under U.S. Federal Law. As of June 30, 2023, the Company is directly involved (through licensed subsidiaries) in both the medical and adult-use cannabis industry in the states of Arizona, California, Florida, Illinois, Maryland, Massachusetts, Michigan, New York, Ohio and Pennsylvania as permitted within such states under applicable state law which states have regulated such industries.

The cultivation, sale and use of cannabis is illegal under federal law pursuant to the U.S. Controlled Substance Act of 1970 (“CSA”). Under the CSA, the policies and regulations of the U.S. Federal Government and its agencies are that cannabis has no medical benefit and a range of activities including cultivation and the personal use of cannabis is prohibited. The Supremacy Clause of the U.S. Constitution establishes that the U.S. Constitution and federal laws made pursuant to it are paramount and in case of conflict between federal and state law, the federal law shall apply.

On January 4, 2018, former U.S. Attorney General Jeff Sessions issued a memorandum to U.S. district attorneys which rescinded previous guidance from the U.S. Department of Justice specific to cannabis enforcement in the U.S., including the Cole Memo (the “Memo”). The Memo previously provided guidance to prioritize a limited scope of federal enforcement including the prevention of the distribution of marijuana to minors, revenue from the sale of marijuana from going to criminal enterprises, diversion of marijuana from states where it is legal under state law in some form to other states, state-authorized marijuana activity from being used as a cover or pretext for the trafficking of other illegal drugs or other illegal activity, violence and the use of firearms in the cultivation and distribution of marijuana, drugged driving and the exacerbation of other adverse public health consequences associated with marijuana use, the growing of marijuana on public lands and marijuana possession or use on federal property. With the Memo rescinded, U.S. federal prosecutors have been given discretion in determining whether to prosecute cannabis-related violations of U.S. Federal Law. If the Department of Justice policy was to aggressively pursue financiers or equity owners of cannabis-related business and U.S. Attorneys followed such Department of Justice policies through pursuing prosecutions, then the Company could face, (i) seizure of its cash and other assets used to support or derived from its cannabis subsidiaries and (ii) the arrest of its employees, directors, officers, managers and investors, who could face charges of ancillary criminal violations of the CSA for aiding and abetting and conspiring to violate the CSA by virtue of providing financial support to state-licensed or permitted cultivators, processors, distributors and/or retailers of cannabis. Additionally, as has been affirmed by U.S. Customs and Border Protection, employees, directors, officers, managers and investors of the Company who are not U.S. citizens face the risk of being barred from entry into the U.S. for life. The Rohrabacher–Farr amendment (also known as the Rohrabacher–

24

Blumenauer amendment) prohibits the Department of Justice from spending funds to interfere with the implementation of state medical cannabis laws. It first passed the U.S. House of Representatives in May 2014 and became law in December 2014 as part of an omnibus spending bill. The passage of the amendment was the first time either chamber of Congress had voted to protect medical cannabis patients and is viewed as a historic victory for cannabis reform advocates at the federal level. The amendment does not change the legal status of cannabis and must be renewed each fiscal year in order to remain in effect. Since 2015, Congress has used a rider provision in the Consolidated Appropriations Acts (currently the Joyce Amendment, but previously called the Rohrabacher-Blumenauer Amendment and before that the Rohrabacher-Farr Amendment) to prevent the federal government from using congressional appropriated funds to enforce federal cannabis laws against state-compliant actors in jurisdictions that have legalized medical cannabis and cannabis-related activities. The Joyce Amendment was again included in the most recent annual appropriations bill. Additionally, the Blumenauer-McClintock-Norton-Lee amendment had been under consideration. This amendment would have extended the protections of the Joyce Amendment to adult-use businesses. However, the Blumenauer-McClintock-Norton-Lee amendment was not included in the appropriations bill that was passed by Congress on March 10, 2022 and signed by President Biden on March 15, 2022.

Unless and until the U.S. Congress amends the CSA with respect to medical and/or adult-use cannabis (and as to the timing or scope of any such potential amendments there can be no assurance), there is a significant risk that federal authorities may enforce current U.S. federal law. If the U.S. Federal Government begins to enforce U.S. federal laws relating to cannabis in states where the sale and use of cannabis is currently legal, or if existing applicable state laws are repealed or curtailed, the Company’s business, results of operations, financial condition and prospects would be materially adversely affected.

Despite the current state of the federal law and the CSA, the states of Alaska, Arizona, California, Colorado, Connecticut, Delaware, Illinois, Maryland, Massachusetts, Maine, Michigan, Minnesota, Missouri, Montana, Nevada, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Virginia, Washington, and the District of Columbia, have legalized adult-use of cannabis. Adult-use sales have not yet begun in Minnesota, Delaware or Virginia. Additionally, although the District of Columbia voters passed a ballot initiative in November 2014, no adult-use operations exist yet because of a prohibition on using funds for regulation within a federal appropriations amendment to local District spending powers.

There were several cannabis ballot initiatives considered by voters during the November 2022 elections. Voters in Maryland and Missouri voted in favor of legalizing adult-use cannabis.

In addition, over three quarters of the U.S. states have enacted legislation to legalize and regulate the sale and use of medical cannabis, provided that there are strict purchasing or possession limits. However, there is no guarantee that state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned, or that local government authorities will not limit the applicability of state laws within their respective jurisdictions.

The Company’s objective is to capitalize on the opportunities presented as a result of the changing regulatory environment governing the cannabis industry in the U.S. Accordingly, there are significant risks associated with the business of the Company. Unless and until the U.S. Congress amends the CSA with respect to medical and/or adult-use cannabis (and as to the timing or scope of any such potential amendments there can be no assurance), there is a significant risk that federal authorities may enforce current federal law and the business of the Company may be deemed to be producing, cultivating, extracting, or dispensing cannabis or aiding or abetting or otherwise engaging in a conspiracy to commit such acts in violation of federal law.

25

For these reasons, the Company’s investments in the U.S. cannabis market may subject the Company to heightened scrutiny by regulators, stock exchanges, clearing agencies and other Canadian authorities. There are risks associated with the business of the Company. See sections “Risk Factors,” “General Development of the Business” and “Description of the Business” in the Annual Information Form for the year ended December 31, 2022, filed on SEDAR+.

On November 20, 2019, the House Judiciary Committee approved the Marijuana Opportunity Reinvestment and Expungement Act of 2019 (the “MORE Act”) by a 24 to 10 vote. The MORE Act would decriminalize and remove Cannabis as a Schedule I controlled substance. In April 2021, days before a floor vote in the U.S. House of Representatives, the MORE Act was stalled due to a late added amendment. While the main thrust of the bill remained intact, including a tax to fund programs to repair the harms of the drug war, a provision was added requiring a federal permit to operate a “cannabis enterprise” along with restrictions that could ban people with prior marijuana convictions from being eligible. Advocates viewed the amendment as problematic as it allows for federal cannabis permits to be suspended or revoked if a person has a past or current legal proceeding related to a felony violation of any state or federal cannabis law. Following the Judiciary Committee approval in November, 2019, the MORE Act was passed by the House by a vote of 228-164 in December 2020. The bill did not advance in the U.S. Senate. The bill was reintroduced by Representative Nadler (D-NY) in May 2021. On September 30, 2021, the MORE Act passed the House Judiciary Committee by a vote of 26-15. Two Republicans joined all of the committee’s Democratic members to move the bill forward. On April 1, 2022, the U.S. House of Representatives passed the MORE Act once again. The bill was received in the Senate and Read twice and referred to the Committee on Finance; however, the bill was not brought to a vote in 2022 and would need to be reintroduced by the new Congress.

On April 19, 2021, the SAFE Banking Act of 2019 (the “SAFE Banking Act” or “SAFE”) again passed the U.S. House of Representatives by a 321 – 101 vote. The U.S. Senate opted to pursue comprehensive federal reform legislation rather than bring the SAFE Banking Act up for a regular order vote due to proposed comprehensive federal reform legislation led by Senate Majority Leader Chuck Schumer (D-NY), Senator Ron Wyden (D-OR) and Senator Cory Booker (D-NJ). On April 26, 2023, SAFE was reintroduced as a bipartisan and bicameral piece of legislation by Sen. Jeff Merkley (D-OR), Sen. Steve Daines (R-MT), Rep. Dave Joyce (R-OH), and Rep. Earl Blumenauer (D-OR). The reintroduced bills included important new changes that could provide opportunities for non-depository Community Development Financial Institutions and Minority Depository Institutions. In May 2023, the Senate Committee on Banking, Financial Services, and Urban Affairs discussed SAFE Banking during their hearing titled, “Examining Cannabis Banking Challenges of Small Businesses and Workers.” However, Senate Banking Chairman Sherrod Brown recently said that the bipartisan cannabis banking bill will not get a committee markup during the summer session, instead looking to September 2023 for a markup and committee vote.

On February 1, 2021, Leader Schumer and Senators Wyden and Booker issued a joint statement announcing the imminent release of comprehensive cannabis reform legislation which stated, “We will release a unified discussion draft on comprehensive reform to ensure restorative justice, protect public health and implement responsible taxes and regulations.” On July 14, 2021, Leader Schumer and Senators Wyden and Booker released the Cannabis Administration and Opportunity Act (the “CAO Act”), a 163-page discussion draft bill, alongside a 30-page summary document, which effectively deschedules cannabis, provides restorative justice for past cannabis-related convictions and establishes a federal regulatory system within the U.S. Food and Drug Administration (“FDA”) for cannabis products. In addition to the aforementioned provisions, the bill also maintains state authority to establish individual cannabis policies and establishes a federal tax on cannabis products. Stakeholder comments were submitted to the Sponsoring Offices on or before the requested deadline of September 1, 2021. The Sponsoring Offices spent significant time considering those comments and amended the discussion draft bill. On July 21, 2022, Leader Schumer and Senators Wyden and Booker formally filed the CAO Act. The bill was not brought to a vote in 2022 and would need to be reintroduced by the new Congress.

26

On November 15, 2021, Rep. Nancy Mace (R-SC) introduced the States Reform Act. The bill, if enacted, would legalize cannabis at the federal level by removing cannabis from the Controlled Substances Act and provide some deference to the states and state programs. The bill defers to the states to prohibit or commercially regulate adult-use cannabis within their borders. In addition to state regulation, cannabis would generally be regulated at the federal level in manner similar to alcohol, including by the U.S. FDA, the U.S. Department of Agriculture and the Alcohol and Tobacco Tax and Trade Bureau, which would be renamed the Bureau of Alcohol, Tobacco and Cannabis Tax and Trade Bureau. The States Reform Act was referred to the House Judiciary Committee and will be reported to several other committees and subcommittees before advancement. The bill was not brought to a vote in 2022 and would need to be reintroduced by the new Congress.

On June 23, 2022, U.S. Congressmen Troy A Carter, Sr. (D-LA) and co-sponsors Guy Reschenthaler (R-PA), David Joyce (R-OH), Dwight Evans (D-PA) and Patrick Ryan (D-NY) introduced bipartisan legislation, The Capital Lending and Investment for Marijuana Businesses Act, to allow state legal American cannabis companies, including small, minority and veteran-owned businesses the ability to access critical lending and investment opportunities currently available to other domestic and regulated industries. The bill was not brought to a vote in 2022 and would need to be reintroduced by the new Congress.

On October 6, 2022, President Joe Biden announced he will take executive action to pardon thousands of people convicted of marijuana possession under federal law. President Biden said he would also encourage state governors to take similar action with state offenses and asked the U.S. Department of Health and Human Services and the U.S. Department of Justice to review how marijuana is scheduled, or classified, under federal law. The head of the U.S. Department of Health and Human Services (“HHS”) is aiming to present President Joe Biden with a federal cannabis scheduling decision “this year” as agencies work “as quickly as we can” to complete an administrative review, according to Secretary Xavier Becerra. The Food and Drug Administration under HHS is carrying out an eight-step scientific review into marijuana to determine whether it should be rescheduled, descheduled or remain in Schedule I, which is reserved for the most strictly controlled drugs under the Controlled Substances Act.

On December 27, 2022, Congresswoman Rep. Nancy Mace (R-SC) filed a bill that would provide federal tax relief for cannabis businesses by amending the Internal Revenue Service’s 280E Code. The bill would allow state-legal cannabis operators to be able to deduct business expenses on their federal taxes, an option applicable to any other legal business. The bill did not receive a vote. On April 17, 2023, Rep. Earl Blumenauer (D-OR), refiled the bill, the Small Business Tax Equity Act, which would amend Internal Revenue Service (“IRS”) code 280E to allow state-legal cannabis businesses to take federal tax deductions. Rep. Mace, together with Rep. Barbara Lee (D-CA) and Rep. Joyce, are cosponsors the refiled bill in addition to Rep. Blumenauer.

On January 16, 2023, Rep. Alex Mooney (R-WV) introduced a bill, the Second Amendment Protection Act, cosponsored by Rep. Brian Mast (R-FL) and Rep. Thomas Massie (R-KY), which would allow medical cannabis patients to purchase and possess firearms.