UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number:

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate market value of voting shares held by non-affiliates of the Registrant was $

As of February 23, 2023, the registrant had

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the Annual Meeting of Shareholders to be held in 2023, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Annual Report relates.

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

4 |

|

Item 1A. |

27 |

|

Item 1B. |

65 |

|

Item 2. |

65 |

|

Item 3. |

65 |

|

Item 4. |

65 |

|

|

|

|

PART II |

|

|

Item 5. |

66 |

|

Item 6. |

67 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

68 |

Item 7A. |

81 |

|

Item 8. |

82 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

110 |

Item 9A. |

110 |

|

Item 9B. |

112 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

112 |

|

|

|

PART III |

|

|

Item 10. |

113 |

|

Item 11. |

113 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

113 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

113 |

Item 14. |

113 |

|

|

|

|

PART IV |

|

|

Item 15. |

114 |

|

Item 16. |

116 |

|

|

117 |

i

FORWARD-LOOKING STATEMENTS

Throughout this annual report on Form 10-K (this “Annual Report”), we make “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this Annual Report are forward-looking statements. Forward-looking statements give our current expectations relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and other words and terms of similar meaning. The forward-looking statements contained in this Annual Report are generally located in the material set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” but may be found in other locations as well. These statements are based upon management’s current expectations, assumptions and estimates and are not guarantees of timing, future results or performance. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

1

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report.

All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements as well as other cautionary statements that are made from time to time in our other SEC filings and public communications. You should evaluate all forward-looking statements made in this Annual Report in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information in this Annual Report concerning economic conditions, our industry, our markets and our competitive position is based on a variety of sources, including information from independent industry analysts and publications, as well as our own estimates and research. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the information presented in this Annual Report is generally reliable, forecasts, assumptions, expectations, beliefs, estimates and projects involve risk and uncertainties and are subject to change based on various factors, including those described under “Forward-Looking Statements” and “Risk Factors.”

Throughout this Annual Report, all references to “Net Promoter Score” or “NPS” are to a measure of satisfaction widely used in the healthcare industry. We calculate NPS based on responses to member surveys, conducted by a third-party administrator (either telephonically or online) that selects a random sample of members to participate. The surveys ask the consumer to rank, on a scale of one to 10, how likely the member would be to recommend Alignment to a friend or relative. We assign the designation of “Promoter” to respondents who provide a score of 9 or 10, the designation of “Neutral” to respondents who provide a score of 7 or 8, and the designation of “Detractor” to respondents who provide a score of 0 to 6. We then subtract the percentage of Detractors from Promoters to determine our overall Net Promoter Score. We believe that this method of calculation aligns with industry standards and that this metric is meaningful for investors because of the correlation between Net Promoter Score and consumer satisfaction.

2

Throughout this Annual Report, all references to the “Five-Star Rating System” or “Star rating” are to a measure used by the CMS to rate the performance of Medicare Advantage and Part D plans. Although subject to change, Medicare Advantage Plans are currently rated on how well they perform in five different categories: (1) staying healthy: screenings, tests, and vaccines, (2) managing chronic (long-term) conditions, (3) member experience with health plan, (4) member complaints and changes in the health plan’s performance, and (5) health plan customer service. Similarly, Part D plans are currently rated on how well they perform in four different categories: (1) drug plan customer service, (2) member complaints and changes in the drug plan’s performance, (3) member experience with the drug plan, and (4) drug safety and accuracy of drug pricing. Ratings range from one to five stars, with five being the highest and one being the lowest. Plans are rated in each individual measure within the categories noted above and also at the category level. Medicare also assigns Medicare Advantage plans one summary star rating to summarize the plan’s performance on the Medicare Advantage measures, and assigns Part D plans a similar summary star rating. Medicare Advantage-Part D combined plans are also given an overall rating, which combines performance all measures. All ratings are reported at the contract level.

BASIS OF PRESENTATION

We historically operated as a Delaware limited liability company under the name Alignment Healthcare Holdings, LLC. On March 17, 2021, Alignment Healthcare Holdings, LLC converted into a Delaware corporation pursuant to a statutory conversion and changed its name to Alignment Healthcare, Inc. As a result of this conversion, Alignment Healthcare Partners, LP, a Delaware limited partnership (“Alignment Partners”) and the sole unitholder of Alignment Healthcare Holdings, LLC, became the sole holder of shares of common stock of Alignment Healthcare, Inc. (the “Corporate Conversion”).

Prior to the closing of our initial public offering (“IPO”), (i) Alignment Healthcare, Inc. effected an approximately 1 for 260 split of its common stock (the “Stock Split”) and (ii) Alignment Partners merged with and into Alignment Healthcare, Inc., with Alignment Healthcare, Inc. surviving the merger (the “Company Merger”). Pursuant to the Company Merger, the partners of Alignment Partners received all of the then-outstanding shares of common stock of Alignment Healthcare, Inc. in exchange for their units in Alignment Partners. The Stock Split and Company Merger are collectively referred to herein as the “Corporate Reorganization.” Except as disclosed in this Annual Report, the consolidated financial statements and selected historical consolidated financial data and other financial information included in this Annual Report are those of Alignment Healthcare, Inc. and its subsidiaries and give effect to the Corporate Conversion and the Corporate Reorganization.

Unless the context otherwise requires, the terms “Alignment,” the “Company,” “our company,” “we,” “us” and “our” in this annual report refer to Alignment Healthcare Holdings, LLC, its consolidated subsidiaries and its affiliated medical groups, for all periods prior to the Corporate Conversion and to Alignment Healthcare, Inc., its consolidated subsidiaries and its affiliated medical groups, for all periods following the Corporate Conversion.

We are a holding company and our sole asset is the capital stock of our wholly owned subsidiaries, including Alignment Healthcare USA, LLC. Alignment Healthcare Holdings, LLC is the predecessor of the issuer for financial reporting purposes.

3

PART I

Item 1. Business.

Our Mission

Alignment Healthcare was founded in 2013 with one mission in mind: improving healthcare one senior at a time. We pursue this mission by relentlessly focusing on our core values:

We created Alignment based on the frustrating experiences we had when our parents and other loved ones needed healthcare. We saw firsthand the complexity they faced as seniors attempting to navigate care delivery and insurance without an advocate to create an integrated consumer experience that provides holistic and quality care at an affordable price. Our parents and seniors across the country are systemically and disproportionately impacted by the absence of care coordination, poor information transparency and misaligned incentives that characterize the healthcare system.

Our team of highly experienced healthcare leaders created the Alignment model to incorporate the lessons our management team has learned over decades collectively spent serving senior consumers. We believe that by combining our experienced, mission-driven team with purpose-built technology we have found a way to address the unmet needs of senior consumers and to “do well by doing good.” Our ultimate goal is to bring this differentiated, advocacy-driven healthcare experience to millions of senior consumers in the United States and to become the most trusted senior healthcare brand in the country.

How We are Revolutionizing Healthcare for Seniors

Alignment is a next generation, consumer-centric platform designed to revolutionize the healthcare experience for seniors. We deliver this experience through our Medicare Advantage plans, which are designed to meet the needs of a diverse array of seniors. Our platform was developed to align with the six core principles that we believe will be required to successfully deliver healthcare in the 21st century and that we believe represent our key competitive strengths. Our platform enables us to:

Leverage Data, Technology and Analytics to Power All Aspects of Our Model

Healthcare organizations have long struggled to effectively harness data and technology to enhance business operations, improve clinical outcomes and drive consumer satisfaction. The industry produces an extraordinary amount of digitized data that is often unusable and siloed within organizations. This has created an opportunity for integrated end-to-end data management to be a significant competitive advantage.

Our proprietary technology platform, Alignment's Virtual Application ("AVA"), was designed specifically for senior care and provides end-to-end coordination of the healthcare ecosystem. AVA’s full suite of tools and services is built within a unified data architecture. Our technology capabilities and position in the healthcare ecosystem enables us to ingest and transform broad, longitudinal datasets into insights, analytics and custom-built applications designed to ensure consistent, high-quality care and service for Alignment’s members. We believe that AVA generates more timely, accurate and actionable insights than existing solutions, driving targeted member interventions and enabling internal care team workflows that result in superior clinical outcomes and consumer experiences.

4

The AVA platform is purpose-built to be used in all aspects of providing superior healthcare for Alignment’s senior members. AVA supports our own internally employed care teams, operations teams, marketing teams and concierge personnel, as well as local community-based healthcare providers and brokers. In addition, AVA’s scalability enables us to reliably produce replicable outcomes and experiences for our members as we scale in existing markets and expand to new ones.

Engage Consumers Directly and Develop Products to Address Their Needs

Traditional healthcare coverage and care delivery is complex and fails to consistently engage and satisfy consumers. Today, consumers have more purchasing power and exercise more control over their own healthcare decision-making than ever before. Medicare Advantage is marketed and sold direct-to-consumer, allowing seniors to select on an annual basis the manner in which they receive healthcare coverage and services.

At Alignment, we have designed our platform to be consumer-centric, to listen to and understand our members’ needs, and to delight our senior consumers. We believe that our primary role is to act as a trusted advocate on behalf of seniors and to design and offer healthcare plans that meet their unique healthcare and lifestyle needs. We believe that our approach delivers outstanding service to our members and results in high-quality, convenient and accessible care that is affordable and represents superior value compared to existing solutions.

We recognize that seniors’ needs extend beyond traditional healthcare, which is why we provide additional services such as transportation, pet care, grocery benefits, companion care, fitness memberships, a 24/7 concierge and a clinical service hotline. Our member satisfaction is evidenced by our overall NPS score of greater than 60 which, based on data collected and made publicly available by Customer Guru, is significantly higher than the industry average NPS ranging from 30-40 and is comparable to celebrated consumer brands. See “Market and Industry Data” above for additional information regarding the calculation of NPS.

Proactively Manage and Coordinate Care for our Most Vulnerable Members

Seniors with complex, chronic conditions represent a small portion of the population, but account for a disproportionate amount of total healthcare spending. The complexity of the U.S. healthcare system results in uncoordinated care for this category of seniors, leading to poor outcomes, unnecessary spend and an unsatisfactory consumer experience.

Alignment identifies high-risk, chronically ill individuals and designs personalized care plans for those members. Our AVA platform stratifies our members based on their health status and social needs, allowing us to identify our most vulnerable members and deploy our Care Anywhere team to deliver timely, effective and coordinated care at the senior’s home, in a healthcare facility, or through a virtual channel. Our Care Anywhere program utilizes our own dedicated clinical teams to provide a combination of high-tech and high-touch care. These cross-disciplinary care teams, which include physicians, advanced practice clinicians, case managers, social workers and behavioral health coaches, work together to establish customized care plans and engage our high-risk seniors with ongoing care interventions that address their health and social needs.

Our high-risk, chronic, and complex care management capabilities, supported by the AVA platform, allow us to effectively manage risk, provide better clinical outcomes and improve our seniors’ experience.

Empower Providers and Employ Flexible Care Delivery Models

Despite being well-situated to influence outcomes for the seniors that they treat, providers often do not have the information and support required to optimize their patients’ outcomes. Many organizations have struggled to build a cohesive and flexible platform that can support and empower providers to delight senior consumers.

We engage with physicians and healthcare provider organizations by tailoring our care delivery tools, product designs and contract types to local market needs in a way that accommodates providers’ preferences and risk tolerance. Our provider engagement and training processes help generate consistent clinical outcomes across various markets with a diverse array of providers and varying degrees of value-based care sophistication. We currently have successful partnerships across a range of provider types, from health system-employed physicians to independent, community-based providers. We provide our partners with care performance metrics and actionable insights that enable them to continuously enhance quality of care, access relevant data to drive informed decision-making and improve the experience of members. This customized level of provider engagement, curated based on their particular needs and circumstances, helps them deliver the best possible clinical care.

Our flexible approach to local market care delivery enables us to attract key provider relationships in various markets and to scale more rapidly and with greater capital efficiency than we could if we were to rely entirely on our own clinical staff.

5

Design and Deploy Innovative Value–Based Payment Models

The legacy healthcare system relies on payment models that compensate healthcare providers based on the volume of services delivered rather than the quality of the care they provide. Despite the increasing focus of CMS on tying payments to health outcomes, we have yet to see widespread improvement in outcomes relative to overall healthcare spending.

Our company name, Alignment Healthcare, reflects one of our founding principles: to align all stakeholders in the healthcare ecosystem around doing what is best for the senior consumer. Our business model is value-based and our ultimate profitability is aligned with the healthcare outcomes of our seniors. We also enter into downstream contracts that are tailored to each providers’ capabilities and local market structure. These contracts employ various value-based payment models, such as shared risk or gainshare arrangements, which are designed to ensure that our provider partners are incentivized to improve the health outcomes of our seniors. In order to successfully manage the financial risk of delivering healthcare for our seniors, we utilize advanced tools, enable access to unified data, and maintain broad coverage and management over an ecosystem of healthcare professionals who are aligned to provide the best possible care.

Cultivate a Culture of Innovation

Traditional healthcare companies are burdened by their scale, administrative complexity and reliance on legacy technology solutions, resulting in their inability to adapt quickly and provide integrated services tailored to the dynamic needs of evolving healthcare consumers.

Given Alignment’s entrepreneurial heritage, a focus on continuous improvement and innovation is at the heart of our culture and DNA. We constantly solicit feedback from our members and seek opportunities to provide new solutions to meet their healthcare and lifestyle needs. We further believe our focus on innovation is a critical competitive advantage that enables our superior member experience, cost and health outcomes. Examples of our continued innovation include:

Built upon these six core principles, we believe Alignment is revolutionizing healthcare for seniors.

Industry Overview

The U.S. healthcare system has grown too complex and costly to meet the evolving needs of senior consumers who are increasingly exercising control over how they manage their overall health and wellness

We are exclusively focused on serving the senior population, a significant and rapidly growing segment within the United States. As used in this annual report, “seniors” refer to Medicare-eligible persons, which are primarily people over the age of 65. Seniors are living longer than previous generations, with approximately 10,000 adults becoming eligible for Medicare each day, according to the U.S. Census Bureau. The population of U.S. seniors is expected to grow to 73.1 million by 2030, up from 56.1 million in 2020, and to increase as a percentage of the population from 17% to 21% over the same period. As our targeted population grows, so do their needs and demands.

6

Rising healthcare costs, particularly among the growing senior population, are uncoupled from outcomes

The growing senior population is putting additional pressure on an already-strained healthcare system. According to the Kaiser Family Foundation, from 2010 to 2021, net Medicare spending increased from approximately $450 billion to more than $680 billion at an annual growth rate of 4%. The Congressional Budget Office projected net Medicare spending at $768 billion in 2022 and expects that figure to exceed $1.3 trillion by 2030, representing an 8% compound annual growth rate. Despite increasing healthcare spending, U.S. seniors have poor health outcomes relative to other developed nations, exemplified through lower life expectancy, higher levels of hospital utilization and greater prevalence of chronic conditions. A significant portion of our nation’s unsustainably high healthcare costs are a direct result of the underserved senior population, especially high-risk and high-acuity seniors.

The fragmented U.S. healthcare system is complex and burdensome for seniors, particularly those with chronic, complex conditions driving a significant amount of the total spend

Navigating the U.S. healthcare system is particularly complex and burdensome for seniors, who often have more significant care needs and complex medical conditions. Seniors today experience a healthcare landscape that is fragmented across disparate point solutions and uncoordinated healthcare providers. According to the National Council on Aging, approximately 80% of the U.S. senior population suffers from at least one chronic illness, while nearly 70% of the senior population has been diagnosed with at least two chronic illnesses. Anyone who has cared for a senior understands the tremendous challenge this can represent. This dynamic results in a small percentage of the population representing a disproportionately high level of healthcare expenditures. According to a study by the American Hospital Association, the 36% percent of the Medicare population with four or more chronic conditions represents 75% of total Medicare spending. Many of these individuals have complex co-morbidities and would benefit from highly coordinated clinical care along with integrated social, psychological, pharmaceutical and functional support. Existing care models have failed to provide the level of coordination that these seniors need and deserve.

Traditional Medicare has struggled to incentivize high-quality, low-cost care, but Medicare Advantage is designed to employ value-based care to achieve better outcomes

Under the Medicare system, seniors have two primary choices for health insurance once they reach the age of 65. They can enroll in (i) traditional Medicare fee-for-service ("FFS") administered by CMS, or (ii) a Medicare Advantage plan administered by a managed care company. Traditional Medicare FFS offers members few network restrictions, but often leaves them exposed to catastrophic events with substantial out-of-pocket costs for care and drug coverage, and does not provide supplemental benefits. The Medicare Advantage system offers a greater value proposition to the senior in that it often provides enhanced pharmaceutical coverage, greater certainty of expected annual costs, out of pocket limits, holistic supplemental benefits and better catastrophic coverage relative to traditional Medicare.

The legacy healthcare delivery system of Medicare FFS results in reactive and often costly care for acute events. By linking payments to the number of encounters and pricing to the complexity of the intervention, the fee-for-service model does not reward prevention, but rather incentivizes the treatment of acute care episodes with more costly and complex treatments. The Medicare Advantage system, on the other hand, has a value-based care economic construct whereby CMS shifts the responsibility for the outcomes, medical cost control and the administration of benefits to private health plans. Funding to Medicare Advantage plans is capped based on local Medicare FFS costs, which is designed to ensure that only those Medicare Advantage plans that are able to provide valuable, low-cost options on a consistent and long-term basis will succeed. By aligning profitability with overall patient outcomes and total medical expenditures rather than volume of services, the Medicare Advantage system allows managed care companies to adopt a high-touch, comprehensive and long-term approach to care.

Medicare Advantage incentivizes holistic care through supplemental benefit offerings that address social determinants of health and daily lifestyle needs, driving the consumerism of senior healthcare

The Medicare Advantage program incentivizes plans to develop innovative products that better respond to seniors’ needs beyond traditional medical care. CMS has adopted a broad definition of supplemental benefits that allows Medicare Advantage plans to proactively offer cross-disciplinary services specifically targeting social determinants of health that can have a significant impact on seniors’ health outcomes. This shift in the United States healthcare industry’s regulatory landscape has given rise to new market opportunities for Medicare Advantage plans to provide more holistic healthcare solutions and achieve superior clinical outcomes for their members. By allowing Medicare Advantage plans to provide access to healthcare via typical care delivery services combined with supplemental benefits, such as a monthly allowance for groceries, transportation, vision and dental services and other targeted product features, CMS has enabled Medicare Advantage plans to continue to increase their value proposition to seniors.

The concept of healthcare expanding into the senior’s daily life, combined with the increasing prevalence of, and seniors’ increasing familiarity with, digital solutions, have been cited as key drivers in the trend towards the consumerization of the senior

7

healthcare industry. We believe that seniors’ desire and demand for change is driving the growth of the Medicare Advantage market and we intend to continuously innovate to offer products that address seniors’ unmet needs. The convergence of senior healthcare with senior consumerism has created a high-value market that we are well-positioned to serve.

The enhanced value-proposition of value-based care models, coupled with the aging senior population, are leading to significant growth in Medicare Advantage

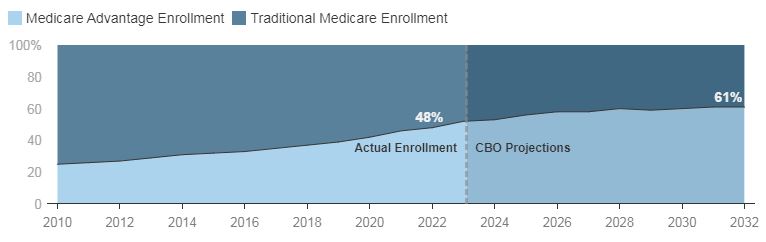

A growing number of seniors are choosing Medicare Advantage plans over traditional Medicare FFS. In 2010, only 24% of the Medicare eligible population, or 11.1 million seniors, were enrolled in a Medicare Advantage plan. In 2022, this number had grown to 48% of the Medicare eligible population, or 28 million seniors. Industry projections have forecasted a continued increase in the Medicare Advantage penetration rate, with the Kaiser Family Foundation estimating that Medicare Advantage penetration will accelerate to approximately 52% in 2023.

Medicare Enrollment Trend

Source: Kaiser Family Foundation ("KFF")

Full potential of the Medicare Advantage health plan model remains unrealized

We believe that Medicare Advantage is unique in that it allows one entity to influence the entirety of a senior’s healthcare through a singular, direct-to-consumer product. Through the ability to drive comprehensive healthcare delivery and leverage robust data and analytics at the helm of the senior’s healthcare ecosystem, the health plan can develop a personalized, adaptive and reproducible approach to care delivery. However, traditional Medicare Advantage plans are not technology driven, lack delivery of care capabilities and often outsource key functions; as such, these traditional plans have been unable to offer a fully integrated healthcare ecosystem. These plans frequently operate disparate and antiquated IT systems assembled from historical acquisitions that do not permit the real time sharing and analysis of medical data and history, which is often key to a senior receiving the right treatment at the right time. As a result, existing Medicare Advantage plans often fall short in their attempts to significantly improve the quality of care and consumer experience for seniors.

We created a consumer-centric and purpose-built Medicare Advantage model that addresses the limitations of Medicare FFS and traditional Medicare Advantage plans by seizing the opportunities provided by evolving senior preferences, the consumerization of healthcare and changes in the regulatory landscape. By leveraging our purpose-built technology platform, we are able to rethink, redesign and deploy solutions specifically tailored to meet the needs and improve the lives of our seniors.

Our Market Opportunity

We address a $768 billion market opportunity today that is expected to grow 8% annually over the next decade.

We built the Alignment Healthcare platform to bring tech-enabled, consumer-centric healthcare to all seniors in the United States. Seniors represent the highest proportion of healthcare spending in the United States on a per capita basis. There are approximately 8.3 million Medicare eligible seniors and approximately 4.4 million Medicare Advantage enrollees in our current markets, which we estimate represents a total addressable market of approximately $103 billion.

We believe there is tremendous opportunity to further scale our business and address the growing need for seniors to experience a better approach to healthcare. The Congressional Budget Office projected net Medicare spending at $768 billion in 2022 and expects that figure to exceed $1.3 trillion by 2030, representing an 8% compound annual growth rate. Furthermore, with seniors increasingly choosing Medicare Advantage over traditional Medicare FFS, federal spending on payments to Medicare Advantage

8

plans is projected to increase from $420 billion in 2022 to $631 billion in 2026, representing a 11% compound annual growth rate. Ultimately, we believe our relentless pursuit of putting the senior first will allow us to capture market share in a sector with significant demographic tailwinds.

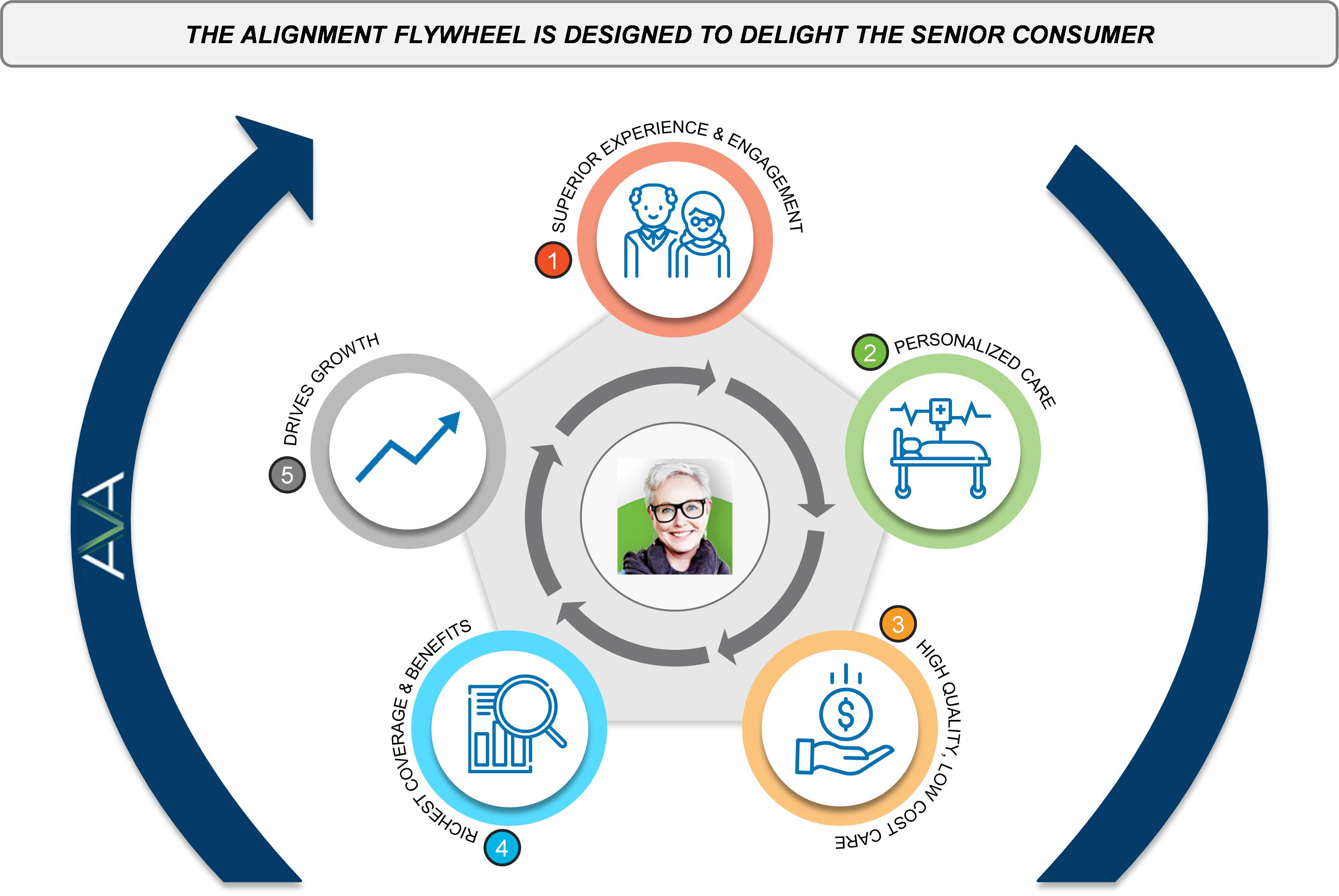

Alignment’s Virtuous Cycle

Our model is based on a flywheel concept, referred to as our “virtuous cycle”, which is designed to delight our senior consumers. We start by listening to and engaging with our seniors in order to provide a superior experience, in both their healthcare and daily living needs. Through our AVA technology platform, we utilize data and predictive algorithms that are specifically designed to ensure personalized care is delivered to each member. When our information-enabled care model is combined with our member engagement, we are able to improve healthcare outcomes by, for example, reducing unnecessary hospital admissions, which in turn lowers overall costs. Our unique ability to manage healthcare expenditures, while maintaining quality and member satisfaction, is a distinct and sustainable competitive advantage. The lower total healthcare expenditures allow us to reinvest our savings into richer coverage and benefits, which propels our growth in revenue and membership due to the enhanced consumer value proposition. As we grow, we continue to listen to and incorporate member feedback, and are able to further enhance benefits and produce strong clinical outcomes. Our virtuous cycle, based on the principle of doing well by doing good, is highly repeatable and a core tenet of our ability to continue to expand in existing and new markets in the future.

1) Superior experience and engagement: Our philosophy for serving seniors starts with our goal of treating each member as if they were our own mother, father or loved one. We have developed a variety of programs that are designed to address seniors’ healthcare and social needs. Our AVA platform provides care teams with actionable insights that help strengthen the quality and efficacy of our touch points with members. Additionally, our comprehensive benefit offerings establish us as fixtures in our members’ daily lives, which uniquely positions us to serve as an advocate when navigating the complexities of the healthcare system. Combined with consumer engagement activities, such as companion care (providing “grandkids on-demand”) and the delivery of meals and masks to members during the COVID-19 pandemic, we are able to build trusting, long-term relationships with our seniors.

2) Personalized care: AVA uses comprehensive data and predictive analytics to identify the needs of our members and create personalized experiences in every aspect of how we care for and serve them. We educate and provide timely information to our broader network of independent physicians to optimize health outcomes for our overall member population, and we deploy our internal clinical resources to care for our highest risk, most complex members. To manage our highest risk members, we rely on AVA to enable seamlessly integrated virtual and at-home healthcare delivery by utilizing direct “smart” interactions through the most effective engagement channels. For those of our members who are less vulnerable, we partner with local providers and support them with Alignment’s insights and resources to deliver high-quality, coordinated care. Members also have 24/7 access to a dedicated concierge team that can assist with medical needs, care navigation, transportation and other services that are important to the health of our members.

3) High-quality, low-cost care: The economic model underlying the Medicare Advantage value-based framework enables us to invest in preventative health and wellness activities, which reduce unnecessary medical events that can have lasting, negative consequences for our seniors. If a single nurse visit to a high-risk senior’s home prevents an avoidable hospitalization, then that visit represents a 30 to 1 return-on-investment, based on our internal calculations of the average cost of a nurse visit and

9

hospitalization. Our ability to provide high- quality and low-cost care is critical to our ability to continue to offer a superior product offering and is a defining characteristic of our company relative to our competition.

4) Richest coverage and benefits: We leverage our improved clinical and operating results to proactively invest in more comprehensive coverage and richer benefits for our members, as well as in additional services that support the full spectrum of seniors’ daily healthcare and social needs. While we tailor our various products to meet the individual needs of our diverse consumers, we strive to consistently deliver the Alignment experience and enhanced value proposition across all offerings. For example, in 2023 we are offering $0 member premium products in 49 out of our 52 markets across California, North Carolina, Nevada, Arizona, Florida and Texas.

5) Drives growth: Our next generation platform is designed to drive superior member experiences, differentiated clinical results and strong financial outcomes, which has led to a compound growth rate since inception through December 31, 2022, of 35% in revenue and 29% in the number of members enrolled in our HMO and PPO contracts ("Health Plan Membership"). See “—Our Results” below. As we continue to grow and increase density within existing markets, Alignment’s brand recognition with senior consumers, relationships with the broker community, and ability to influence provider behavior will continue to power our flywheel and drive sustained growth in our current and new markets.

Our Results

In order to achieve our mission of improving healthcare one senior at a time, we have developed a business model with a predictable, recurring revenue stream that provides significant visibility into our financial growth trajectory. We generally contract directly with CMS as a licensed Medicare Advantage plan and receive a recurring per member per month (“PMPM”) payment in exchange for bearing the responsibility of our members’ healthcare outcomes and expenditures. These contractual arrangements, combined with the fact that the majority of our net membership growth occurs effective on January 1 of a calendar year after the annual enrollment period (“AEP”), provide a higher degree of visibility to our full year projected revenue early in the calendar year, subject to our ability to model for in-year member growth, as well as revenue PMPM, which in turn depends on member health and mortality trends.

We believe that Medicare Advantage is unique in that it allows one entity to influence the entirety of a senior’s healthcare through a single, direct-to-consumer product. Our platform is designed to maximize the benefits of Medicare Advantage, with all stakeholders being rewarded as we improve the clinical outcomes and experience for our consumers. We believe that the outcomes below clearly demonstrate the success of our unique consumer-centric platform by delivering on the promise of our virtuous cycle.

Our ability to deliver lower healthcare costs while improving the consumer’s experience is a unique competitive advantage. In 2022, we achieved a net promoter score of greater than 60 versus the industry average of 40 and a hospitalization rate of approximately 159 hospitalizations per every 1,000 at-risk members, which is approximately 37% lower than the 2019 Medicare FFS performance in our markets. Our care model resulted in a 52% reduction in 2021 emergency room visits among our members compared to 2019 Medicare fee-for-service ER visits and a 26% reduction in member 30-day readmission rates compared to 2019 Medicare fee-for-service readmission rates. This differentiation has led to our demonstrated ability to rapidly scale, as evidenced by the expansion of our model to 52 markets across six states covering approximately 108,300 Health Plan Members as of January 1, 2023. We believe we have proven that our model is highly predictable and repeatable across different markets and will enable strong growth on a national level as we pursue our vision of becoming the most trusted senior healthcare brand in the country.

We anticipate further investments in our business as we expand into new markets and continue to offer additional innovative product offerings and supplementary benefits in order to attract new members. Accordingly, in the near term we expect that as our business grows our costs related to this growth, such as expanding our operations, hiring additional employees and operating as a public company, also will increase. However, in the longer term we anticipate that these investments will positively impact our business and results.

Our Product Solutions

We leverage our control of the full healthcare dollar and plan design to rethink, redesign and deploy innovative products based on the needs and changing preferences of seniors.

We deliver our healthcare platform through our Medicare Advantage plan offerings. Our plan offerings reflect CMS’s advocacy for improving seniors’ healthcare experience and addressing social determinants of health, and represent the convergence of quality healthcare, enhanced customer experience and lifestyle-focused features in a direct-to-consumer product. We recognize that no two seniors are alike and strive to meet the needs of a diverse array of consumers. We do this by offering various products that are designed with different populations in mind, all while providing personalized, easy to navigate healthcare with a great consumer experience at a superior value.

10

Our current product portfolio consists of Medicare Advantage products tailored to take into account factors such as health condition (ranging from plans for healthy members to chronic special needs plans), socioeconomic status (including Medicare and Medicaid dually-eligible special needs products), and ethnicity (including our Harmony product, featuring benefits associated with Eastern medicine disciplines). Each product is carefully developed to create an offering that will suit the needs of the diverse senior population.

Our product offerings are described in the table below.

|

|

|

|

|

Product |

|

Consumer Target |

|

Product Description |

HMO |

|

Cost Conscious, Value Oriented |

|

Zero or low monthly premium, high value, more limited provider network |

|

|

|

||

Dually-Eligible |

|

Low Income, Complex Medical Conditions |

|

Product designed for |

|

|

|

||

Provider Sponsored Plan |

|

Provider Brand Conscious |

|

Co-branded or provider-aligned to jointly market the access of a specific provider with Alignment’s Medicare Advantage (“MA”) capabilities |

|

|

|

||

Chronic Special Needs |

|

Polychronic Conditions, Extra Care Support |

|

Specialized product design geared towards certain chronic conditions, such as Cardiovascular Disorders, Chronic Heart Failure, and/or Diabetes |

|

|

|

||

PPO |

|

Higher Income, Values More Choice |

|

Greater network flexibility, potentially higher monthly premium /out-of-pocket cost |

|

|

|

||

Virtual Care |

|

Tech-savvy; Telehealth Oriented |

|

Virtual-first primary care offering with rich and expansive supplemental benefits |

|

|

|

||

Ethnic Product Lines |

|

Traditionally Underserved Ethnic Communities |

|

Features products designed with the Asian and Hispanic communities in-mind |

|

|

|

||

Traditional Medicare/ACO REACH |

|

Original Medicare; Strong Primary Care Physician “PCP” Relationship |

|

Value-based arrangement with CMS for beneficiaries who want to remain in traditional Medicare |

Our plans include PPO offerings in select markets, which we believe are attractive to those seniors that prefer a more open network design. We have also continued to innovate by launching a unique virtual care plan, which will allow our members to select a virtual provider as their primary care physician, enjoy a rich array of benefits, and still access local, in-person healthcare resources when needed. These product line expansions will feature the same quality and experience that members have come to expect of other Alignment products, and our clinical team continues to pursue proactive care management to ensure we can deliver innovative plans at an attractive price point to the consumer.

We believe that addressing the social determinants of health has a significant impact on the overall health of our seniors. As such, we have expanded our focus beyond traditional medical benefits to design products that provide seniors with a package of benefits and experiences that cover both healthcare and lifestyle needs. In addition to competitive pricing and coverage for primary care providers, specialists, inpatient and emergency room visits, vision, hearing, lab/x-ray services, pharmaceutical coverage and other similar benefits that many Medicare Advantage plans offer, we offer numerous additional features including:

11

While not every plan feature is available to all of our members and certain plan features entail additional costs, we have designed our existing portfolio of products to provide us with the flexibility to meet the distinctive needs of the communities we serve and our diverse membership. Our product solutions—supported by AVA and our integrated care delivery capabilities—are core to our mission of providing the highest-quality healthcare experience to all seniors.

Our Technology: Alignment’s Virtual Application

AVA empowers senior consumers and all the constituents in their health journey with relevant, timely and complete information as well as actionable insights to improve their health experience and outcomes.

Our position in the healthcare ecosystem as a Medicare Advantage plan and having our proprietary unified data platform provides us with differentiated access to large amounts of member data. With the benefit of this information, we are better able to effect change and positively impact our members’ healthcare experience. Since our founding, we have recognized that harnessing data and information had to be core tenants of our technology solution and care delivery model. As such, we leveraged our management team’s experience across healthcare and technology to build AVA—our proprietary technology platform designed to provide the best health outcomes and experiences for our members. AVA is a core system that was purpose-built from the ground up with the senior population and their ecosystem in mind. The benefits of AVA apply to our members, as well as everyone in their care ecosystem, including doctors, nurses, caregivers, health plan operational teams and health insurance brokers.

Key aspects of the AVA platform include:

12

Personalized Application Ecosystem: AVA offers a digital ecosystem with a personalized and customizable suite of applications for consumers, internal care teams, external provider partners, health plan operations and brokers/sales agents:

13

When paired with our operational expertise, we believe AVA is integral to our ability to drive our operations and business outcomes consistently across markets. AVA provides us with the flexibility to adapt our operating models to meet the needs of local communities and providers, while achieving high-quality, low-cost care in each market. We designed our technology tools and applications to result in a customized, yet consistent, experience for our members. From driving workflows to enabling smarter interventions, we believe AVA is a significant competitive advantage that allows us to deliver information-enabled healthcare at scale.

Our Clinical Model

We engage regularly with members as part of their daily lives and proactively manage their chronic conditions to improve outcomes and reduce cost.

Our clinical model is designed specifically for seniors and is managed across multiple disciplines (medical, social, psychological, pharmaceutical and functional) and sites of care (home, inpatient, outpatient, virtual and others). Our internal care teams and external providers use AVA to coordinate high-quality care for members and manage the complexity of the healthcare system. Given the prevalence of comorbidities within our chronically ill members, coordination across a multi-disciplinary care team is vital to providing a medical and behavioral care plan that drives improved outcomes.

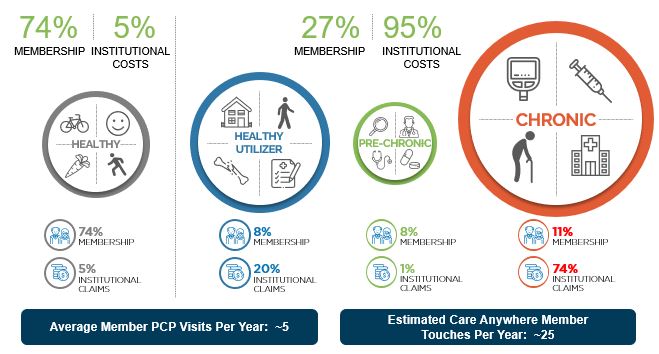

Our care delivery model creates a highly personalized experience that is unique to each member depending on their personal health and circumstances. Our clinical continuum separates seniors into four categories in order to provide optimized care for every stage of a senior’s life: healthy, healthy utilizer, pre-chronic and chronic. We organize members into these care requirement categories using insights derived from AVA, which reflects detailed profiles of each members’ individual risks and gaps in care based on our longitudinal and comprehensive data sets. The data below represents a sample of our population stratification from 2022.

Healthy: The typical member in the “healthy” category requires low levels of medical care. Healthy members comprise approximately 74% of our membership base but account for only 5% of the institutional claims submitted.

Healthy Utilizer: The typical member in the “healthy utilizer” category is an otherwise healthy senior who has had isolated or unexpected health challenges requiring significant medical care. Healthy utilizers comprise approximately 8% of our membership base and account for 20% of the institutional claims submitted.

Pre-Chronic: The typical member in the “pre-chronic category” is identified as high-risk by AVA but has yet to incur significant healthcare expenditures. We also refer to these members as on the “launching pad”, and by deploying our targeted care programs towards this population we work to prevent or slow their increasing acuity levels. Pre-chronic members comprise approximately 8% of our membership but account for only 1% of the institutional claims submitted. Our active approach to monitoring gaps in

14

care and acting before emerging health problems worsen is reflective of the culture of care embedded in our organization, and our focus on being a persistent advocate for our members.

Chronic: The typical member in the “chronic” category is generally a complex patient with multiple chronic conditions in need of significant, coordinated care. Chronic members comprise 11% of our membership but account for 74% of the institutional claims submitted.

Proactive, Coordinated Care Management

The majority of healthy and healthy utilizer members’ care needs are managed by our network of local community providers in conjunction with our support and oversight. We utilize continuous communication with our network of independent primary care providers to ensure that our members have access to preventative and ongoing care. We have also established a variety of tools and applications that provide us with insight into how our various providers are performing on key quality and cost metrics. We use this data to create a routine feedback loop with our external providers for the benefit of our broader senior population.

Our pre-chronic and chronic members are typically targeted for engagement through our Care Anywhere program. Care Anywhere is an advanced clinician-driven model of care that is staffed by Alignment-employed physicians, advanced practice clinicians, case managers, social workers and behavioral health coaches to assure execution of cross-functional care plans. Unlike many managed care plans, we have built these services in-house to provide valuable, high-quality care to members for free, which complements the care provided by our provider partners for their most challenging and resource-intensive patients. On average, a Care Anywhere patient is 77 years old, has five to six chronic conditions and average monthly institutional healthcare expenditures in excess of $1,500 prior to their first Care Anywhere visit.

We structure our Care Anywhere program with a focus on prioritizing compassionate and effective care delivery and proactive health management. Key features of the Care Anywhere program include: proactive outreach; 24/7 access; highly detailed personalized care plans; and enhanced coordination of care and social needs. Standardized care programs are targeted to seniors based on their underlying conditions, such as Chronic Heart Failure or Chronic Obstructive Pulmonary Disorder, which are then personally tailored based on each individual’s underlying circumstances. We engage with this high-risk group of seniors based on their preferences for care delivery, which is typically in their homes or through telephonic and video consultations. During the initial months of the COVID-19 pandemic, we were able to rapidly pivot the modality of our clinical care to a virtual setting. In a period of 30 days, we went from approximately 97% of our care delivered in the home to 100% care delivered telephonically and virtually. Our abrupt shift in modality of care exemplifies our adaptability and willingness to prioritize the safety and convenience of our members most in need of care.

We believe the combined capabilities of customized, coordinated care delivery with our health plan capabilities for this vulnerable population uniquely positions us in the marketplace and differentiates us from other healthcare companies. We believe, based on data gathered and analyzed using AVA, that our Care Anywhere program creates several benefits for our high-risk, complex members: improved quality of life, high patient satisfaction, reductions in unnecessary emergency room visits and inpatient care, and lower re-admission rates. This also allows us to establish a more direct relationship with seniors, building member loyalty and brand recognition. Our Care Anywhere program has an NPS score greater than 70, underscoring the positive impact it has on our most vulnerable members. These improved outcomes translate into financial savings that we can reinvest in our product offerings, which we believe is a significant competitive advantage.

The following real-life case studies demonstrate how we combine our technology with our cross-functional senior care programs in our pursuit of serving our seniors:

Case Study #1—Cross-Disciplinary Care Plans Tailored to the Needs of Our Members

The Issue: Mr. Smith suffers from multiple chronic conditions, including severe depression, schizophrenia, opioid dependence and estrangement from his three adult children. His PCP is not aware that the opioids he takes have rendered his psychiatric medications ineffective due to drug-to-drug interactions.

Typical Outcome: No intervention, which results in the continued use of an ineffective combination of medications, potentially leading to increased psychiatric issues, social isolation and hospitalizations.

AVA Response: AVA identifies Mr. Smith as a high-risk member based on his clinical profile. Additionally, AVA algorithms alert us to his recent history of multiple emergency room visits, hospitalizations (20+ in one year) and inpatient psychiatric admissions. Post-engagement, AVA continues to ingest diverse sources of raw data on his medication, treatments received, provider interactions and use of supplemental benefits (e.g., transportation) in order to support our Care Anywhere team’s high-touch management of Mr. Smith’s care.

15

Alignment Superior Solution: Once AVA identifies Mr. Smith’s issues, the Care Anywhere team devises a holistic, high-touch care plan which includes regular outreach, care coordination across his providers and pharmacy, and a support system for him via family, neighbors and community service providers. Mr. Smith’s care team also identifies the medication regimen that works best for him and coordinates with transportation providers and a local pharmacy to ensure he has reliable access to the care and medications he needs.

Case Study #2—Preventing Unnecessary Hospitalizations by Addressing Social Factors

The Issue: Due to a lack of financial stability and low health literacy, Mr. Jones, a Type 1 diabetic since childhood, frequently visits the emergency room in response to low blood sugar because he cannot afford a balanced diet.

Typical Outcome: Mr. Jones continues visiting the emergency room and has a high likelihood of hospital readmission. The root cause of his frequent utilization goes unaddressed.

AVA Response: AVA’s AI algorithms leverage the social determinant and chronic illness diagnosis data to stratify the member as high-risk. Mr. Jones’ telehealth call for low blood sugar is automatically routed to the after-hours on-call physician at Alignment due to his status in AVA as a vulnerable member. AVA’s Patient 360 platform notifies the on-call physician of the member’s food needs, leading to an after-hours call and targeted intervention.

Alignment Superior Solution: Alignment’s on-call physician queries the member regarding his food instability, and after gaining an understanding of the significant barriers he faces has food delivered to Mr. Jones within 30 minutes to elevate his blood sugar. Mr. Jones is enrolled in the Care Anywhere program and seen by a nurse the next morning, who then enrolls him into Mom’s Meals food delivery program. Mr. Jones has regular check ins with the Alignment social worker and Care Anywhere provider which prevents further emergency room utilization for low blood sugar. Mr. Jones is a highly satisfied member given Alignment’s initial intervention and ongoing support.

Case Study #3—Clinical Interventions Leveraging Longitudinal Member Data

The Issue: Mrs. Johnson enters an emergency room at an out-of-network facility with shortness of breath and an undiagnosed pulmonary embolism (blood clot in her lung).

Typical Outcome: After a brief evaluation, the emergency room doctor sends Mrs. Johnson home without any communication with the patient’s health plan. The health plan may not know Mrs. Johnson was in the emergency room until a claim arrives 30 days later. Meanwhile, Mrs. Johnson’s pulmonary embolism remains undiagnosed and untreated, leaving Mrs. Johnson vulnerable to a catastrophic outcome.

AVA Response: AVA generates a notification of Mrs. Johnson’s emergency room visit through a centralized data feed. AVA, which contains Mrs. Johnson’s entire medical history, including information from unrelated specialists, indicates a high risk of blood clots based on a pharmacy alert triggered by a prescription for an anticoagulant medication in her medical records. The AVA Patient 360 platform shares the alert with Alignment’s on-call physician.

Alignment Superior Solution: Alignment is ready and equipped to provide consultation with emergency room doctors 24 hours a day. The Alignment on-call physician engages with the emergency room physician to discuss the AVA alert, causing the emergency room doctor to conduct a further assessment of Mrs. Johnson’s condition. Upon further evaluation, the emergency room doctor recognizes the significant risk at-hand and immediately has Mrs. Johnson admitted to the hospital instead of sending her home as previously planned. Mrs. Johnson then has her blood clot appropriately treated, potentially avoiding a catastrophic outcome.

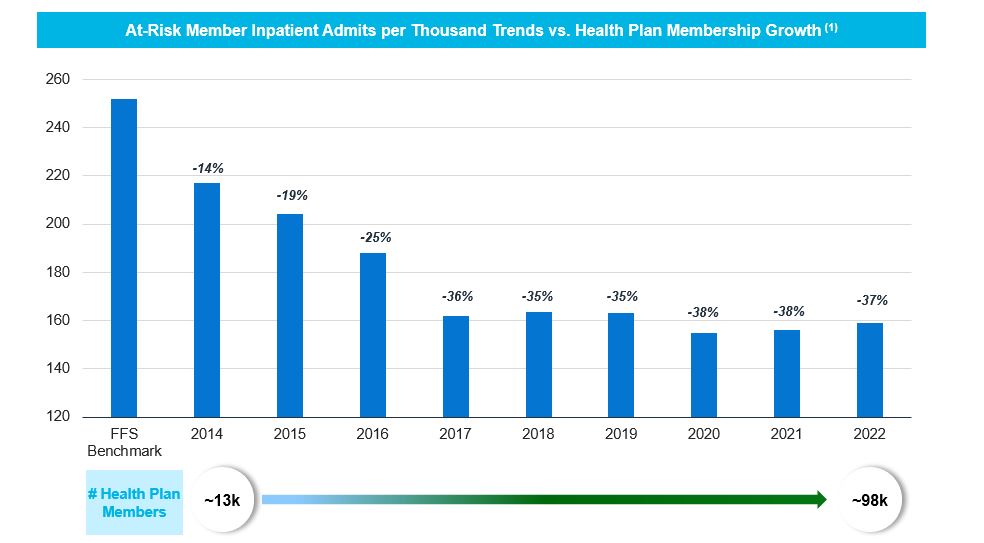

Our collective investment in our care model and technology platform has produced strong clinical outcomes for our seniors. In 2022, we achieved a hospitalization rate of approximately 159 hospitalizations per every 1,000 at-risk members, which is approximately 37% lower than the 2019 Medicare FFS performance in our markets. Further, we have achieved approximately 155-165 inpatient admissions per thousand on our at-risk membership for the last five years in a row, in spite of our significant membership growth over that period of time.

16

(1) FFS benchmark based on 2022 enrollment mix by market using 2020 Medicare FFS data. 2022 inpatient admits/k metric represents estimated full year 2022. Historical periods include estimated utilization where appropriate to account for billing settlements.

Our Growth Strategy

Accelerate our “virtuous cycle” flywheel to drive growth across markets while continuing to innovate and expand our product offerings.

The key elements of our growth strategy include:

Capitalize on the significant opportunity within our current markets

We currently operate in 52 markets, or counties, across California, North Carolina, Nevada, Arizona, Florida and Texas. We had approximately 108,300 Health Plan Members across these markets, as of January 1, 2023, representing approximately 3% of the overall market share among seniors that are in a Medicare Advantage plan in these counties; as such, we believe there is tremendous opportunity for growth in our existing geographical footprint. Meanwhile, we believe we have demonstrated an ability to compete with much larger competitors due to the significant value proposition of our product offerings:

We selected our initial markets due to their highly concentrated senior populations and favorable statewide demographic trends. For example, California has over 6.6 million Medicare eligible seniors, the highest of any state. According to CMS data, Los Angeles County alone has more seniors than 38 individual states. There are approximately 8.3 million Medicare eligible seniors and approximately 4.4 million Medicare Advantage enrollees in our current markets, which we estimate represents a total addressable market of approximately $103 billion. Additionally, Medicare Advantage penetration is rapidly increasing in our

17

existing markets, reaching 53% across California, North Carolina, Nevada, Arizona, Florida and Texas according to CMS as of January 2023.

We attract new members through both our internal and external sales channels. Our internal sales channel consists of Alignment representatives, both in the field and telephonically, who market and sell Alignment’s portfolio of products to prospective members. This channel also includes our new sales to members who sign up using Alignment’s direct online enrollment tools. Our external sales channel consists of partnerships with third-party broker channels who sell Alignment products alongside competing products. These third-party organizations also employ in person, telephonic and online sales distribution channels. Our growth will depend on our continued success in marketing our products through these channels. We believe that we will continue to gain share in our current markets due to our strong track record of providing exceptional care, expanding our network with new contracts and innovative partnerships with a wide array of providers and offering a best-in-class member experience.

Expand into new markets

Given our track record of delivering exceptional results and delighting consumers in our existing markets, we recently launched our national expansion strategy guided by our disciplined approach to identifying new markets. In geographically adjacent markets, we have the benefit of leveraging our existing provider relationships and infrastructure to expand more rapidly in a less capital-intensive manner. In entirely new markets, we can reach scale quickly given our highly portable and adaptable AVA technology platform and our wealth of transferable care management expertise.

Our model enables us to deliver high-quality care and exceptional experience for our members across a diverse array of markets. We intend to focus on markets with significant senior populations where we expect to be able to replicate our model most effectively. An important component of our model is our ability to be flexible in our approach to contracting with provider partners and to tailor our applications and services. Since our founding in 2013, we have been successful in rural, urban and suburban markets, as well as markets with varying degrees of provider and health system competition and control. Additionally, our markets feature a diverse array of membership profiles across ethnicities, income levels and acuity. As a result, our model and platform are designed to scale and allow us to provide a predictable and replicable set of outcomes, regardless of the local market considerations.

Through our thoughtful and disciplined national expansion strategy, we believe we will be able to sustainably scale and reliably replicate our competitive advantages in new markets.

Partner with providers to accelerate growth and improve operational performance

We intend to grow in new and existing markets by leveraging the flexibility and adaptability of our model to contract with provider partners across a spectrum of risk sharing arrangements. Across our 52 existing markets, we have a wide variety of successful operating and financial arrangements with medical groups, shared risk providers, affiliate providers, providers employed by health systems and community-based, independent primary care physicians. These arrangements typically have multi-year terms across a number of contractual and financial frameworks. Our approach to contracting includes forms of capitation, including global, partial, or primary care risk, and fee-for-service payments. In addition to the basic form of the contract, and to further align ourselves with our provider partners, we often use upside-only incentive programs in an effort to engage our delivery network towards coordinating and supporting our members’ care delivery plans, including the provision of high-quality, cost-effective care. Within these relationships we can deploy different aspects of the existing Alignment toolkit depending on the level of risk and provider infrastructure. Our value-based approach to patient care and provider contracts, including profit and risk share programs, ensures that economic incentives are well-aligned so that providers can focus on delivering the best care. By enabling successful outcomes and offering an appealing value proposition to new provider partners, we are able to grow in new markets and rapidly build out robust provider networks that drive further growth for our platform.

We have also developed a track record of enabling mid-sized independent physician associations ("IPAs") and provider groups to thrive by providing them with access to a scaled platform that includes provider tools and support structures that enable them to effectively manage Medicare Advantage patients. As we grow and continue to partner with the physician community, we believe there will be increased opportunities to vertically integrate with providers. These opportunities could come in the form of minority investments, affiliate-relationships, joint ventures or acquisitions, and could generate growth and longer-term margin expansion opportunities by capturing additional channels of revenue outside of the Medicare Advantage business model. Vertical integration provides a true win-win scenario in which the member, physician and health plan benefit from better care coordination, enhanced product design and delivery, and superior data sharing and operational integration. These integrated benefits lead to an improved consumer experience and increased ability to invest in growth.

Expand services and product offerings

18

We see substantial opportunity to continue to build on our existing Medicare Advantage health plan offerings by providing an expanding portfolio of direct-to-consumer products. With the launch of our Medicare Advantage PPO products in 2020, we began to offer senior members additional choices while still relying on our sophisticated technology platform and member support model to provide proactive care to our members. Furthermore, the COVID-19 pandemic has accelerated a shift towards and increased preference for virtual care. As a result, we launched a virtual care plan in 2021, which allows our members to select a virtual provider as their primary care physician, enjoy a rich array of benefits, and still access local, in-person healthcare resources when needed. We will continue to tailor new Medicare Advantage product offerings to meet the distinct needs of our members in the future, such as potentially offering special needs plans tailored for niche populations.

We believe we can continue to drive our longer-term growth by insourcing certain product lines over time, such as vision, dental, specialty pharmacy, and others. We believe this “horizontal integration” of various product features can be further coupled with other forms of more “vertical integration,” such as hospice, home health or behavioral health, to directly serve a broader range of our members’ needs. Expanded offerings will continue to provide our healthcare consumers with more integrated services, which enhances their Alignment experience and contributes to improved quality of life and health.

Extending the Alignment model to broader senior populations

We will continue to innovate as regulatory changes expand our opportunities to deliver the Alignment experience to seniors in traditional Medicare and we are evaluating other opportunities to leverage our historical investments in our technology platform and our comprehensive clinical model across our existing and potentially new geographies. For example, we participate in the CMS Center for Medicare and Medicaid Innovation’s (“CMMI”) direct contracting arrangement, now known as “ACO REACH,” which allows us to partner directly with physicians to help manage their Medicare FFS patient populations and participate in the upside and downside risk for caring for traditional Medicare members associated with managing the health of such patients. This program opens additional opportunities for us to deploy our technology platform and care management capabilities across a broader set of members and potentially new markets. As of January 1, 2023, we had approximately 7,900 members in the ACO REACH program arrangement with our physician partners in North Carolina, California and Nevada. While still in its early stages, we believe this effort is indicative of the value Alignment can potentially deliver to a broader set of seniors in traditional Medicare over time.

Grow through strategic acquisitions

We continually evaluate potential acquisition targets that would accelerate growth, enhance our care delivery model, and/or allow us to apply the Alignment model across broader populations. We will primarily focus on acquiring healthcare delivery groups in key geographies, standalone and provider-sponsored Medicare Advantage plans and other complementary risk bearing assets. We will also selectively explore additional opportunities that serve to enhance our technology platform and product offerings for our members and partners.

Regulation

Our operations and those of our affiliated entities are subject to extensive federal, state and local governmental laws and regulations. These laws and regulations require us to meet various standards relating to, among other things, reports to CMS, personnel qualifications, maintenance of proper records and quality assurance programs and patient care. The majority of our regulation and oversight comes from CMS, which regulates almost every aspect of our business, including our provider network, benefits, member enrollment, risk adjustment program, plan offerings, claims payments, quality improvement programs, and appeals and grievances. We have entered into standard form agreements with CMS pursuant to Sections 1851 through 1859 and Sections 1860D-1 through 1860D-43 of the Social Security Act ("SSA"), pursuant to which we have agreed to operate our plans in accordance with applicable laws and regulations and CMS has agreed to make payments to us under the SSA. Each CMS contract has a one-year term expiring on December 31 of the applicable calendar year and is subject to annual one-year renewal terms. Under the contracts we are obligated to provide our members basic benefits and services covered by Part A and Part B of the original Medicare Program, any applicable supplemental benefits we elect to provide in our final benefit and price bid proposals approved by CMS, and prescription drugs. The CMS contracts further require us to develop our annual benefit and price bid proposals and submit to CMS all related information on premiums, benefits and cost sharing by no later than the first Monday in June prior to the commencement of the subsequent calendar year to which they apply, in accordance with the CMS regulations. Each CMS contract may be terminated by mutual consent or by CMS or by us for cause. We are required to accept new enrollments, make enrollments effective, process voluntary disenrollments and limit involuntary disenrollments in accordance with the CMS regulations. Generally, to enroll or remain enrolled in one of our Medicare Advantage plans, an individual must be a U.S. citizen or lawfully present in the United States, be entitled to Medicare under Part A and enrolled in Part B, reside in the service area covered by the plan, complete and sign the required election forms to enroll and agree to abide by the rules of the Medicare Advantage plan into which he or she is enrolled or intends to enroll. Such agreements also provide for member and provider protections and marketing requirements, as well as recordkeeping and reporting requirements, all with reference to applicable laws and regulations. If any of our operations or those of our affiliated professional medical corporations are found to violate applicable laws or regulations, or if we otherwise failed to adhere to our contracts with CMS, we could suffer

19

severe consequences that would have a material adverse effect on our business, results of operations, financial condition, cash flows, reputation and stock price, including:

We expect that our industry will continue to be subject to substantial regulation, the scope and effect of which are difficult to predict. See “Risk Factors—Risks Related to Regulation.”

In addition to the SSA, CMS regulations, and our contractual obligations, we must also comply with a variety of other laws:

HIPAA, HITECH Act and Other Laws, Rules and Regulations Related to Data Privacy