Filed by Global Partner Acquisition Corp II pursuant

to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under

the Securities Exchange Act

of 1934, as amended.

Subject Company: Global Partner Acquisition Corp II

Commission File No. 001-39875

Date: May 17, 2024

INVESTOR PRESENTATION Q2 2024 Li 3 6.94 Leading the Charge on America’s Energy Future: Manufacturing Battery - Grade Lithium

20 24 Investor Presentation TODAY’S PRESENTERS 2 Roshan Pujari CEO Uday Devasper CFO Jarett Goldman CFO Chandra Patel CEO

202 4 Investor Presentation The information included herein and in any oral statements made in connection herewith include “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended (the “Securities Act” and Section 21 E of the Securities Exchange Act of 1934 , as amended (the “Exchange Act”) . All statements, other than statements of present or historical fact included herein, regarding the proposed business combination, Global Partner Acquisition Corp II’s (GPAC II) and Stardust Power Inc . ’s ( “Stardust Power”) ability to consummate the transaction, the benefits of the transaction, GPAC II’s and Stardust Power’s future financial performance following the transaction, as well as GPAC II’s and Stardust Power’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward - looking statements . When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words . These forward - looking statements are based on GPAC II’s and Stardust Power’s management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events . GPAC II and Stardust Power caution you that these forward - looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of GPAC II and Stardust Power . These risks include, but are not limited to, ( i ) the risk that the proposed business combination may not be completed in a timely manner or at all, which may adversely affect the price of GPAC II’s securities ; (ii) the risk that the proposed business combination may not be completed by GPAC II’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by GPAC II ; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval of the proposed business combination by GPAC II’s shareholders and Stardust Power’s stockholders, the satisfaction of the minimum trust account amount following redemptions by GPAC II’s public shareholders and the receipt of certain governmental and regulatory approvals ; (iv) the effect of the announcement or pendency of the proposed business combination on Stardust Power’s business relationships, performance, and business generally ; (v) risks that the proposed business combination disrupts current plans of Stardust Power and potential difficulties in Stardust Power’s employee retention as a result of the proposed business combination ; (vi) the outcome of any legal proceedings that may be instituted against GPAC II or Stardust Power related to the agreement and the proposed business combination ; (vii) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination ; (viii) the ability to maintain the listing of GPAC II’s securities on the Nasdaq ; (ix) the price of GPAC II’s securities, including volatility resulting from changes in the competitive and highly regulated industries in which Stardust Power plans to operate, variations in performance across competitors, changes in laws and regulations affecting Stardust Power’s business and changes in the combined capital structure ; (x) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities ; (xi) the impact of the global COVID - 19 pandemic ; (xii) risks that GPAC II and/or Stardust will be unable to raise additional funds through a private placement or equity or debt raise by prior to or in connection with Closing ; (xiii) risks that Stardust Power may not be able to secure government benefits described herein ; (xiv) risks that the anticipated growth of the Lithium industry may not be achieved ; (xv) the risk factors included in the Appendix to this presentation and (xvi) other risks and uncertainties related to the transaction set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in GPAC II’s prospectus relating to its initial public offering (File No . 333 - 351558 ) declared effective by the U . S . Securities and Exchange Commission (the “SEC”) on January 11 , 2021 and other documents filed, or to be filed with the SEC by GPAC II, including GPAC II’s periodic filings with the SEC, including GPAC II’s Annual Report on Form 10 - K filed with the SEC on March 19 , 2024 , Annual Report on Form 10 - K/A filed with the SEC on April 22 , 2024 and any other Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K, GPAC II’s SEC filings are available publicly on the SEC’s website at http : //www . sec . gov . The foregoing list of factors is not exhaustive . There may be additional risks that neither GPAC II nor Stardust Power presently know or that GPAC II or Stardust Power currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . You should carefully consider the foregoing factors and the other risks and uncertainties described in GPAC II’s proxy statement contained in the registration statement on Form S - 4 (File No . 333 - 276510 ) filed with the SEC on January 12 , 2024 (the “Registration Statement”, as amended or supplemented), including those under “Risk Factors” therein, and other documents filed by GPAC II from time to time with the SEC . The Registration Statement is now effective, having been declared effective by the SEC on May 10 , 2024 . These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements . Forward - looking statements speak only as of the date they are made . Readers are cautioned not to put undue reliance on forward - looking statements, and GPAC II and Stardust Power assume no obligation and, except as required by law, do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise . Neither GPAC II nor Stardust Power gives any assurance that either GPAC II or Stardust Power will achieve its expectations . INDUSTRY AND MARKET DATA Although all information and opinions expressed herein, including market data and other statistical information, were obtained from sources believed to be reliable and are included in good faith, Stardust Power and GPAC II have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness . Some data is also based on the good faith estimates of Stardust Power and GPAC II, which are derived from their respective reviews of internal sources as well as the independent sources described above . This communication contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with Stardust Power and GPAC II . RISK FACTORS For a description of the risks relating to an investment in Stardust Power, including in business and operations, we refer you to “Risk Factors” in the Appendix to this presentation . Forward - Looking Statements and Disclaimers (1/2) © 2024 Stardust Power Inc. All Rights Reserved. "Stardust Power" and the log o are trademarks of Stardust Power, Inc. All other trademarks used herein are the property of their respective owners. 3

202 4 Investor Presentation Important Information About the Business Combination and Where to Find It In connection with the proposed business combination, GPAC II has filed a Registration Statement with the SEC that includes a preliminary prospectus with respect to GPAC II’s securities to be issued in connection with the proposed transactions and a preliminary proxy statement with respect to the shareholder meeting of GPAC II to vote on the proposed transactions (the “proxy statement/prospectus”) . GPAC II may also file other documents regarding the proposed business combination with the SEC . The proxy statement/ prospectus contains important information about the proposed business combination and the other matters to be voted upon at an extraordinary general meeting of GPAC II’s shareholders to be held to approve the proposed business combination and other matters and may contain information that an investor may consider important in making a decision regarding an investment in GPAC II’s securities . BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF GPAC II AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND ALL RELEVANT DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION FILED OR THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN, OR WILL CONTAIN, IMPORTANT INFORMATION ABOUT GPAC II, STARDUST POWER AND THE PROPOSED BUSINESS COMBINATION . The Registration Statement has been declared effective . The definitive proxy statement/prospectus will be mailed to GPAC II shareholders as of the record date to be established for voting on the proposed transactions . Shareholders of GPAC II are able to obtain free copies of the Registration Statement and, once available, will also be able to obtain free copies of the definitive proxy statement/ prospectus and all other relevant documents containing important information about GPAC II and Stardust Power filed or that will be filed with the SEC by GPAC II through the website maintained by the SEC at http : //www . sec . gov, or by directing a request to Global Partner Acquisition Corp II, 200 Park Avenue 32 nd Floor, New York, New York 10166 , attention : Global Partner Sponsor II LLC or by contacting Morrow Sodali LLC, GPAC II’s proxy solicitor, for help, toll - free at ( 800 ) 662 - 5200 (banks and brokers can call collect at ( 203 ) 658 - 9400 ) . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Participants in the Solicitation GPAC II, Stardust Power and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from GPAC II’s shareholders with respect to the proposed business combination . A list of the names of those directors and executive officers of GPAC II and a description of their interests in GPAC II is set forth in GPAC II’s filings with the SEC (including GPAC II’s prospectus relating to its initial public offering (File No . 333 - 251558 ) declared effective by the SEC on January 11 , 2021 , GPAC II’s Annual Report on Form 10 - K filed with the SEC on March 19 , 2024 , Annual Report on Form 10 - K/A filed with the SEC on April 22 , 2024 and subsequent filings on Form 10 - Q and Form 4 ) . Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration Statement . The documents described in this paragraph are available free of charge at the SEC’s website at www . sec . gov, or by directing a request to Global Partner Acquisition Corp II, 200 Park Avenue 32 nd Floor, New York, New York 10166 , attention : Global Partner Sponsor II LLC . Additional information regarding the names and interests of such participants will be contained in the Registration Statement for the proposed business combination when available . No Offer or Solicitation This communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and is not intended to and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of GPAC II, Stardust Power or the combined company or a solicitation of any vote or approval, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act . Forward - Looking Statements and Disclaimers (2/2) © 2024 Stardust Power Inc. All Rights Reserved. "Stardust Power" and the log o are trademarks of Stardust Power, Inc. All other trademarks used herein are the property of their respective owners. 4

Stardust Power is on a Mission to Contribute to U.S. Energy Leadership Through the Production of Battery - Grade Lithium 5 202 4 Investor Presentation Li 3 6.94

20 24 Investor Presentation Stardust Power Inc. At a Glance • Development stage American manufacturer of battery - grade lithium products designed for advanced energy storage systems and other critical technologies • Contributing to U.S. energy leadership • Strategic location for future lithium refinery in Muskogee, Oklahoma, capable of producing up to 50,000 tons annually of battery - grade lithium • Entered definitive agreement with GPAC II on November 21, 2023, for a business combination that would result in Stardust Power becoming a publicly listed company on Nasdaq under the new ticker symbol "SDST" 6 Artistic Rendering Concept

20 24 Investor Presentation Company Attributes Sustainable Process • Access to renewable wind and solar power sources • Water recycling capability during the refining process • Extracting lithium from oil & gas brine Significant Scale • Planned development of one of the largest lithium refineries in the US – 50,000 tpa battery - grade lithium • Well - developed feed stock p lan • Phase approach to scale up Aligned Incentives • Illustrative incentives package for up to $257M incentives from the State of Oklahoma 1 • Intent to seek federal grant and loan program incentives Prudent Build - Out • Proven refining technology • Experienced engineering partners • Experienced technical leadership 7 Centralized Logistics • Centrally located near multiple US battery manufacturers • Access to multiple U.S. brine resources • Proximity to railroads, waterways, and major highways 1. Subject to meeting milestones, to offset the refinery’s costs, and other conditions

20 24 Investor Presentation Key Investment Summary 8 Unprecedented Lithium Demand • Lithium demand driven by more than 20 - fold increase from use in EVs essential to the global electrification transition 1 Lack of Battery Grade Lithium Product Supply • While forecasted demand and supply indicates a balanced industry for the short term, there is a potential need to galvanize new capacity by 2030 2 National Security and Sustainability Priority for the United States • National security is a key focus for the United States as evidenced by the creation of the Office of Strategic Capital in 2022 by the DOD to identify and fund technology areas that are deemed as critical for national security 3 • More than $500 billion new spending and tax incentives related to Inflation Reduction Act 4 1. BloombergNEF . “Electric Vehicle Outlook 2023” dated 2023 2. McKinsey & Co., Lithium mining: How new production technologies could fuel the global EV revolution , April 12th, 2022 3. US Dept of Defense, Office of Strategic Capital, Secretary of Defense Establishes Office of Strategic Capital, December 1st, 202 2 4. McKinsey & Co., Inflation Reduction Act; Here’s what is in it , October 24th, 2022UD0

20 24 Investor Presentation Uses $450 Equity to Stardust Power 40 Cash to balance sheet 10 Transaction expense $500 Total TRANSACTION OVERVIEW 9 % Own. Shares 84.5% 45.0 Stardust Rollover Equity 5.6% 3.0 SPAC Sponsor 9.9% 5.3 PIPE Deal Structure • The Stardust Power existing shareholders will roll 100% of their equity and will own a pro forma equity ownership of 84.5 % at close • The GPAC sponsor will retain 3.0M promote shares at close Valuation • Transaction implies $ 493 M pro forma enterprise value • Additional 5M share price based earnout available for Stardust Power shareholders • Implied pre - money market capitalization of $450M Financing • Transaction expected to provide up to ~$ 50M of gross proceeds to Stardust Power through a PIPE or similar financing transaction • While supplemental financing is not a condition of closing, the parties intend to work collaboratively to establish a PIPE or similar supplemental financing instrument 1. Assumptions: • No cash and $0.1M of debt on balance sheet prior to transaction • 53.3M pro forma shares outstanding at $10.00 per common share • The GPAC sponsor will forfeit 3.5M promote shares, and place 1.0M sponsor shares subject to forfeiture • Assumes 100% redemptions of current number of outstanding shares by closing of the transaction and no cash in trust. Shares t hat are not redeemed will result in cash in trust and additional pro forma shares • All charts and tables exclude warrants held by shareholders. All warrants have a strike price of $11.50 per common share • PIPE illustratively raised at $9.50 per share. Anticipated PIPE may be less than $50M, may be in the form of debt or converti ble debt and may not be struck at $10/share. There have been no commitments for a PIPE at this time and the Company may be unable t o raise any proceeds in a PIPE or similar supplemental financing instrument. See Forward - Looking Statements and Disclaimers for more information • All charts and tables exclude 5M earnout shares for Stardust triggered at a $12.00 per share VWAP Pro Forma Ownership 1 2 53.3 PF Shares Outstanding (M) $10.00 Share Price ($) $533 PF Equity Value ($M) $0.1 (+) PF Debt ($M) ($40.0) ( - ) PF Cash ($M) $493 PF Enterprise Value ($M) 1 2 3 Transaction Highlights 1 ($M) Sources and Uses 1 ($M, except per share value) Pro Forma Valuation 1 (Shares M) Pro Forma Ownership 1 Sources $450 Stardust Power Rollover - Cash in Trust 50 PIPE $500 Total 3

20 24 Investor Presentation EXPERIENCED TEAM 10 Randal Harris – Director of Construction • Director of Construction at Stardust Power • Extensive construction executive level experience in addition to engineering director level leadership, merge and form a unique ability to lead teams executing major industrial business lines. • Prior to Stardust, Harris held positions at Primero Group, Clough Group, and Worley Parsons. Uday Devasper - CFO • CFO of Stardust with over 20 years of experience in successfully leading finance and accounting teams in accounting advisory and public accounting firms, and publicly traded organizations. • Part of the founding team at Effectus Group, leading 15+ de - SPAC/ IPO transactions as a leader of the Technology Industry vertical, and managing remote work transitions. • Prior to Stardust, Devasper held positions at KPMG, Synopsys, and Echelon. Michael Circelli – Senior Project Director • Senior Project Director at Stardust Power with 23 years of experience in the EPCM (engineering, procurement construction management) and EPC (engineering and procurement construction) environments. • Experience gained across various industries such as minerals and metallurgy, rail infrastructure, water/ wastewater treatment, power/transmission and hydrocarbons. • Prior to Stardust held senior and corporate positions at Worley, Lycopodium, Bantrel /Bechtel and SNC Lavalin primarily in the Minerals and Metallurgy sector. • Co - Founder and CTO of Stardust. • Over 13 years of experience in civil and mining projects, specializing in lithium, he has a strong background in hydrogeological field programs and expertise in lithium brine deposits. • Prior to Stardust, Cortegoso held positions at Aurora Lithium and SRK Consulting, among others. Pablo Cortegoso – Co - Founder, CTO Roshan Pujari – Founder, CEO • CEO and founder of Stardust. • Over 20 years of experience in investments and transactions and demonstrated expertise and deep domain knowledge in new company formation and fund raising. • Prior to Stardust, he founded VIKASA Capital LLC, a diversified investment firm. • Pujari is also a philanthropist, having established the Pujari Foundation to support education, arts, and communities globally. Adam Johnson – Acting Chief Commercial Officer • Critical minerals expert with 20+ years leading teams across private equity, critical minerals, and frontier technologies. • At Ara Partners, a $5.6B industrial decarbonization PE firm, he developed their investment strategy into rare earths. • As SVP, Corporate Development & Strategy at MP Materials (NYSE: MP), he led their $700M vertical integration into metals and magnets.

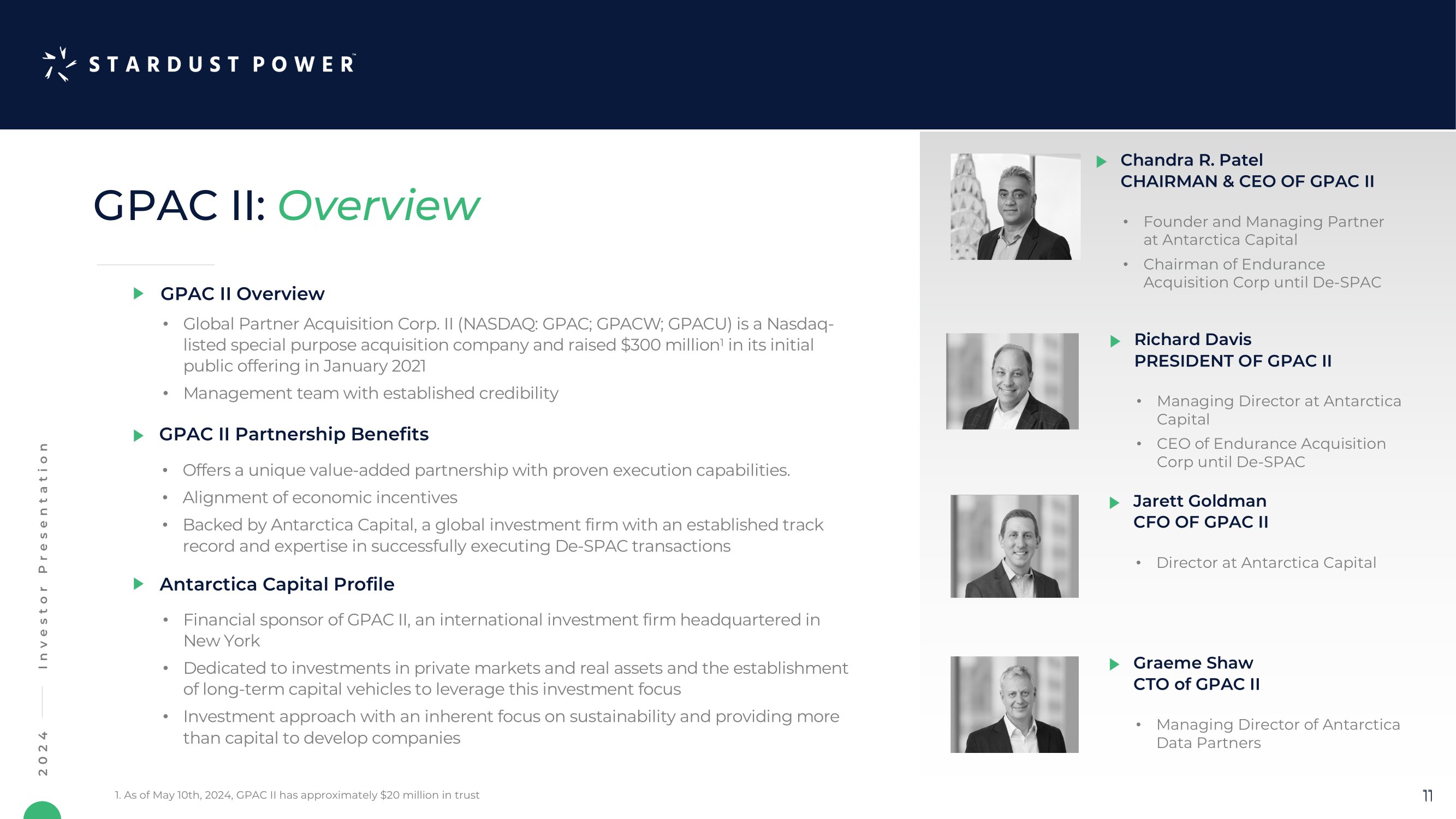

202 4 Investor Presentation GPAC II: Overview GPAC II Partnership Benefits • Offers a unique value - added partnership with proven execution capabilities. • Alignment of economic incentives • Backed by Antarctica Capital, a global investment firm with an established track record and expertise in successfully executing De - SPAC transactions GPAC II Overview • Global Partner Acquisition Corp. II (NASDAQ: GPAC; GPACW; GPACU) is a Nasdaq - listed special purpose acquisition company and raised $300 million 1 in its initial public offering in January 2021 • Management team with established credibility Antarctica Capital Profile • Financial sponsor of GPAC II, an international investment firm headquartered in New York • Dedicated to investments in private markets and real assets and the establishment of long - term capital vehicles to leverage this investment focus • Investment approach with an inherent focus on sustainability and providing more than capital to develop companies 11 11 Chandra R. Patel CHAIRMAN & CEO OF GPAC II • Founder and Managing Partner at Antarctica Capital • Chairman of Endurance Acquisition Corp until De - SPAC Richard Davis PRESIDENT OF GPAC II • Managing Director at Antarctica Capital • CEO of Endurance Acquisition Corp until De - SPAC Graeme Shaw CTO of GPAC II • Managing Director of Antarctica Data Partners Jarett Goldman CFO OF GPAC II • Director at Antarctica Capital 1. As of May 10th , 2024, GPAC II has approximately $ 20 million in trust

202 4 Investor Presentation Bridging the Gap is Critical Refining capacity is the critical gap in the American supply chain 1. Upstream • Network of upstream partners • Offtake agreements under negotiation 2 . Raw Material Extraction • Brine assets are more environmentally friendly and cost efficient than open pit and large evaporation pools 1 3 . Material Purification • Planned ability to concentrate at or near site assets • Leveraging existing third - party technologies • Barge, rail, and road connectivity to centrally - located refinery 12 1. International Battery Metals, Why Direct Lithium Extraction is Better than Traditional Methods, July 19th, 2021. *Artistic Rendering Concepts 4. Material Refinement • Scaled up approach to production • Proven chemical conversion process • Creating battery - grade lithium products 5. Industry Usage • EV and battery manufacturers • U.S. Military and OEMs

20 24 Investor Presentation Lithium Refinery in Heartland of the United States 13 • Stardust Power has secured approximately 66 acres at Southside Industrial Park in Muskogee, Oklahoma to build the plant. • The strategic location is advantageous from a supply and offtake perspective. • The site has access to the largest inland waterway system in America, a strong interstate highway network and rail lines. • Once operational, the refinery will draw on Oklahoma's highly skilled workforce in the oil and gas engineering sector and can be trained for lithium refinery operations. • Once at capacity, the plant is anticipated to be capable of producing up to 50,000 tons of battery - grade lithium annually. STARDUST POWER’S SOLUTION Artistic Rendering Concept

20 24 Investor Presentation Phased Approach Maximum Total Annual Lithium Capacity (in tons) 1 Resource Ownership Lithium Refining (Battery Grade) Greenfield Exploration Strategic Partnerships Vertical Integration 1 Phase 1 25,000 Phase 2 50,000 PATHWAY TO VERTICAL INTEGRATION 1. Phase 2 Maximum Total Annual Capacity includes Phase 1, up to 25,000 tons, and Phase 2, up to 50,000 tons expansion 14

Up to $257 Million in State Incentives May Be Available Strong state support to strengthen Oklahoma’s industrial base. There are numerous incentives to take advantage of. 202 4 CONFIDENTIAL Investor Presentation 15 1. U.S. Department of Energy. “Biden - Harris Administration Announces $3.5 Billion to Strengthen Domestic Battery Manufacturing.” Av ailable at: https://www.energy.gov/articles/biden - harris - administration - announces - 35 - billion - strengthen - domestic - battery - manufacturing. 2. Oklahoma Commerce, Quality Jobs Incentive Program 2023 Guidelines , 2023 3. Oklahoma Commerce, Investment/New Jobs Tax Credit Package The Oklahoma Department of Commerce provides a robust incentive package including 5% cash rebates on payroll for all new jobs created for 10 years through the Quality Jobs (“QJ”) program, and an Investment Tax Credit (“ITC”) 1 Cash Incentives Program provides quarterly cash payments up to 5% of payrolls for up to 10 years. Companies must achieve an average wage threshold and create at least ten new jobs within three years to qualify. Companies must offer basic health insurance to employees. 10 - year Cash Rebate 2 Investments in qualified depreciable property earn a tax credit of 1% each year for five years. The credit doubles if the investment is made in an enterprise zone equaling a total of 10% of the qualifying investment. 5 - Year Investment Tax Credit 3 On February 6, 2023, the Company has received an illustrative incentive analysis for up to $257 million in performance - based inc entives from the State of Oklahoma (covering Phase 1 and 2) and potential federal incentives, and may be further eligible for federal grants. The state incentives are bas ed on initial job creation, equipment procurement, training and recruitment incentives, property tax exemptions, sales tax exemptions, and capital expenditure projections submi tte d to the Oklahoma Department of Commerce in Q1 of 2023, and are subject to changes as the Company progresses in terms of setting up the Facility and commercial productio n o f battery - grade lithium. These incentives may change based on the actuals of the Company in the future and they may be lower or higher.

20 24 Investor Presentation OUTSTANDING PARTNERSHIPS Best in Class, Established, Proven Technology Partners A global leader in lithium engineering, procurement and construction management 16 A global leader of Direct Lithium Extraction (DLE) F ocused on exploration and development of battery minerals, with lithium brine projects in the U.S Site Due Diligence Partner Strategic Partners A leading global provider of services to the lithium brine industry Engaged for assessment and feasibility

Lithium Market Overview Li 3 6.94

Macro Backdrop 321k Size of the U.S. lithium market in tons LCE by 2030 2 Generational Shift 1 • Consumer demand and policy initiatives are transforming energy and transportation • Lithium is expected to play a large role in these multi - decade electrification trends • The United States lithium supply currently relies almost entirely on imports 14% 30% EV adoption in global passenger vehicle sales from 2022 to 2026 3 Significant Demand Opportunity 1 • Growth in lithium - ion battery usage has fueled increased demand for battery grade lithium • Auto OEMs and battery manufacturers are proactively seeking domestic supply options 50,000 Stardust Power Plans Production of up to 50,000 Tons of Battery - Grade Lithium Products per Annum Stardust Power Solution • Aims to develop a fully integrated domestic lithium supply • Seeks to ensure high - purity lithium is available to meet demand • Strives to contribute to U.S. energy leadership 202 4 Investor Presentation 18 1. US Dept. Of Energy, National Blueprint for Lithium Batteries 2021 - 2030, June 2021 2. Benchmark Market Intelligence data, S&P Global, Project Blue, Goldman Sachs, Companies websites, lithium expert interviews 3. BloombergNEF . “Electric Vehicle Outlook 2023” dated 2023.

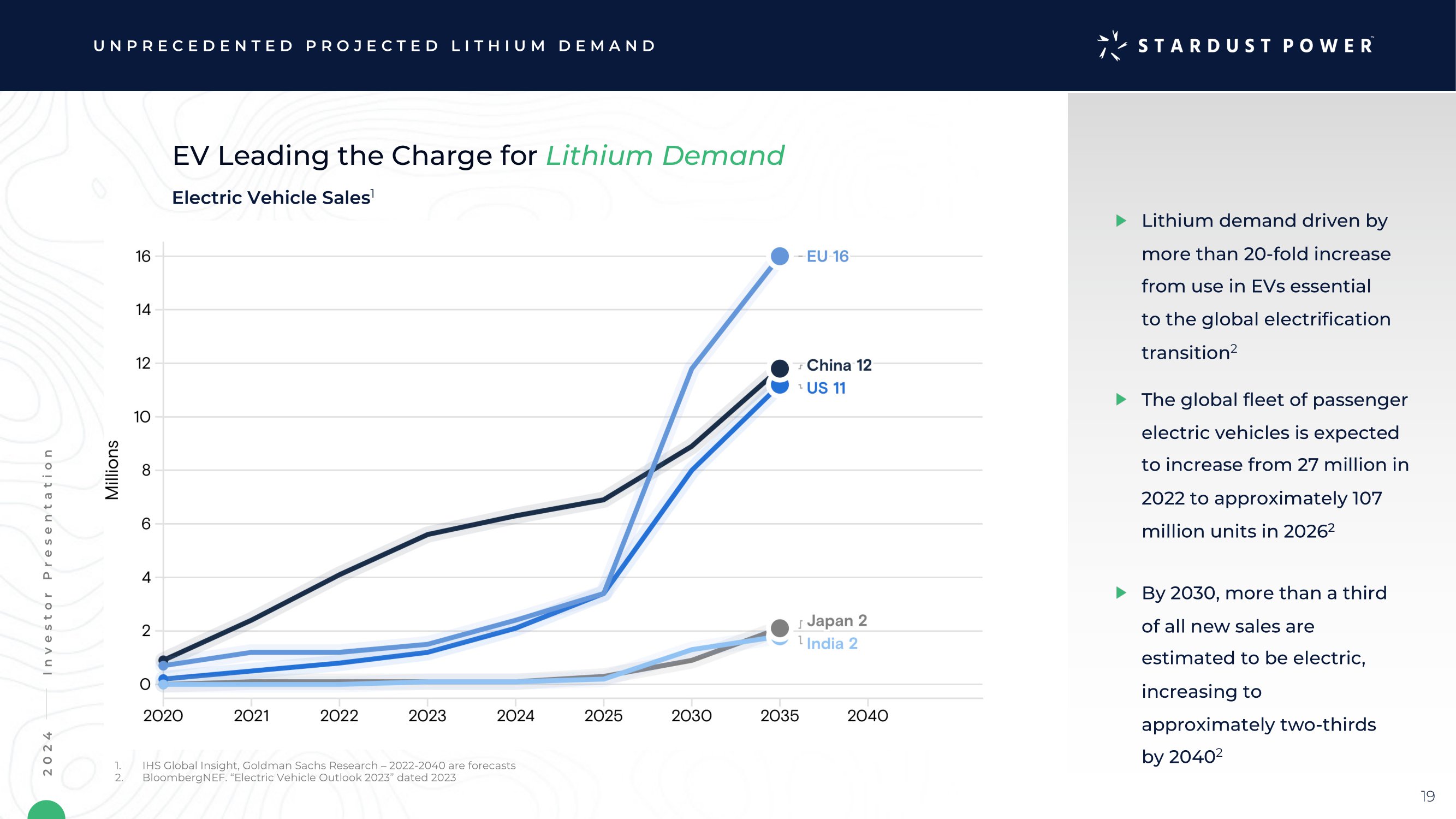

20 24 Investor Presentation Lithium demand driven by more than 20 - fold increase from use in EVs essential to the global electrification transition 2 The global fleet of passenger electric vehicles is expected to increase from 27 million in 2022 to approximately 107 million units in 2026 2 By 2030, more than a third of all new sales are estimated to be electric, increasing to approximately two - thirds by 2040 2 Electric Vehicle Sales 1 EV Leading the Charge for Lithium Demand 1. IHS Global Insight, Goldman Sachs Research – 2022 - 2040 are forecasts 2. BloombergNEF . “Electric Vehicle Outlook 2023” dated 2023 19 UNPRECEDENTED PROJECTED LITHIUM DEMANDUD0UD1

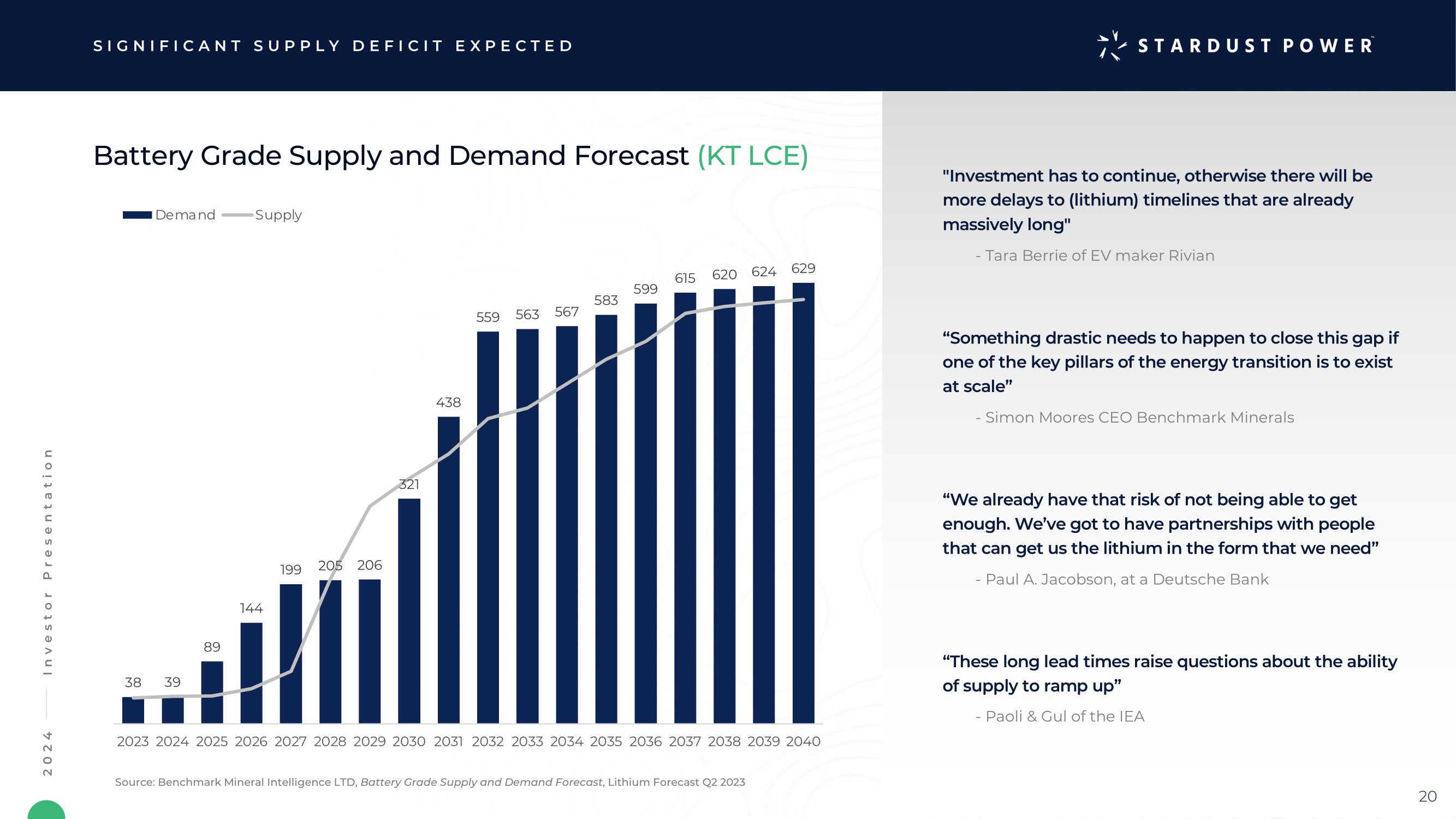

20 24 Investor Presentation Battery Grade Supply and Demand Forecast (KT LCE) 38 39 89 144 199 205 206 321 438 559 563 567 583 599 615 620 624 629 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 Demand Supply Source: Benchmark Mineral Intelligence LTD, Battery Grade Supply and Demand Forecast , Lithium Forecast Q2 2023 SIGNIFICANT SUPPLY DEFICIT EXPECTED - Paoli & Gul of the IEA “These long lead times raise questions about the ability of supply to ramp up” - Simon Moores CEO Benchmark Minerals “Something drastic needs to happen to close this gap if one of the key pillars of the energy transition is to exist at scale” - Tara Berrie of EV maker Rivian "Investment has to continue, otherwise there will be more delays to (lithium) timelines that are already massively long" - Paul A. Jacobson, at a Deutsche Bank “We already have that risk of not being able to get enough. We’ve got to have partnerships with people that can get us the lithium in the form that we need” 20

20 24 Investor Presentation of global lithium refining capacity is currently based in China. Office of Strategic Capital The Department of Defense established the Office of Strategic Capital in 2022 to identify and fund technology areas that are deemed as critical for national security. The technology areas include advanced materials, next - generation biotechnology, quantum science, renewable energy generation and storage, and supply chain technologies. 5 Defense Production Act Lithium is a National Security Priority In 2022 President Biden ordered the Department of Defense to consider at least five minerals including lithium -- as essential to national security under the Defense Production Act. Under the order, the Pentagon will be authorized to use Defense Production Act funds to provide capital to several mining business activities. 3 Loan Program Office DOE The Advanced Technology Vehicles Manufacturing Loan Program (ATVM) provides loans to support the manufacture of eligible advanced technology vehicles and qualifying components. IRA removed the $25 billion cap on ATVM loan authority and appropriated $3 billion in credit subsidy to support these loans. 4 Of Federal Grants $3 Billion The Department of Energy (“DOE”) funding opportunities for critical materials and battery technologies which include: $3 billion for Battery Manufacturing and Recycling Grants, and $3 billion for Battery Processing and Materials Grants. 2 Estimated total spending and tax incentives from the Inflation Reduction Act (“IRA”) according to McKinsey & Co. 1 $500 Billion Domestic Content Requirements 50% The Inflation Reduction Act included specific requirements to qualify for the Section 30D tax credits: - 50% of the value of battery components must be produced or manufactured in North America in fiscal year 2023, with the minimum percentage increasing annually. - 40% of the value of critical minerals used for the vehicle must be extracted, processed, and/or recycled domestically or in a country with which the U.S. has a free trade agreement, with the minimum percentage increasing annually. 1 U.S. LITHIUM INDEPENDENCE IS A PRIORITY 21 1. McKinsey & Co., Inflation Reduction Act; Here’s what is in it, October 24th, 2022 2. US Dept. Of Energy, Manufacturing and Energy Supply Chains, Battery Manufacturing and Recycling Grants, November 15, 2023 3. Holzman, Joel, Biden's Defense Production Act Order Promises Money to Miners, E&E News, April 4th, 2022 4. US Dept. Of Energy, Loan Programs Office, Advanced Technology Vehicles Manufacturing Loan Program 5. US Dept of Defense, Office of Strategic Capital, Secretary of Defense Establishes Office of Strategic Capital, December 1st, 2022 Incentives May Be Available to Stardust Power Under Certain Federal Programs

investor.relations@stardust - power.com +1 800 742 3095 Stardust Power, Inc. 15 E Putnam Ave #378 Greenwich, CT 06830 United States CONTACT INFORMATION 202 4 Investor Presentation info@gpac2.com +1 646 585 8975 GPAC II 200 Park Ave, Fl 32 New York, NY 10166 United States CONTACT INFORMATION

Appendix

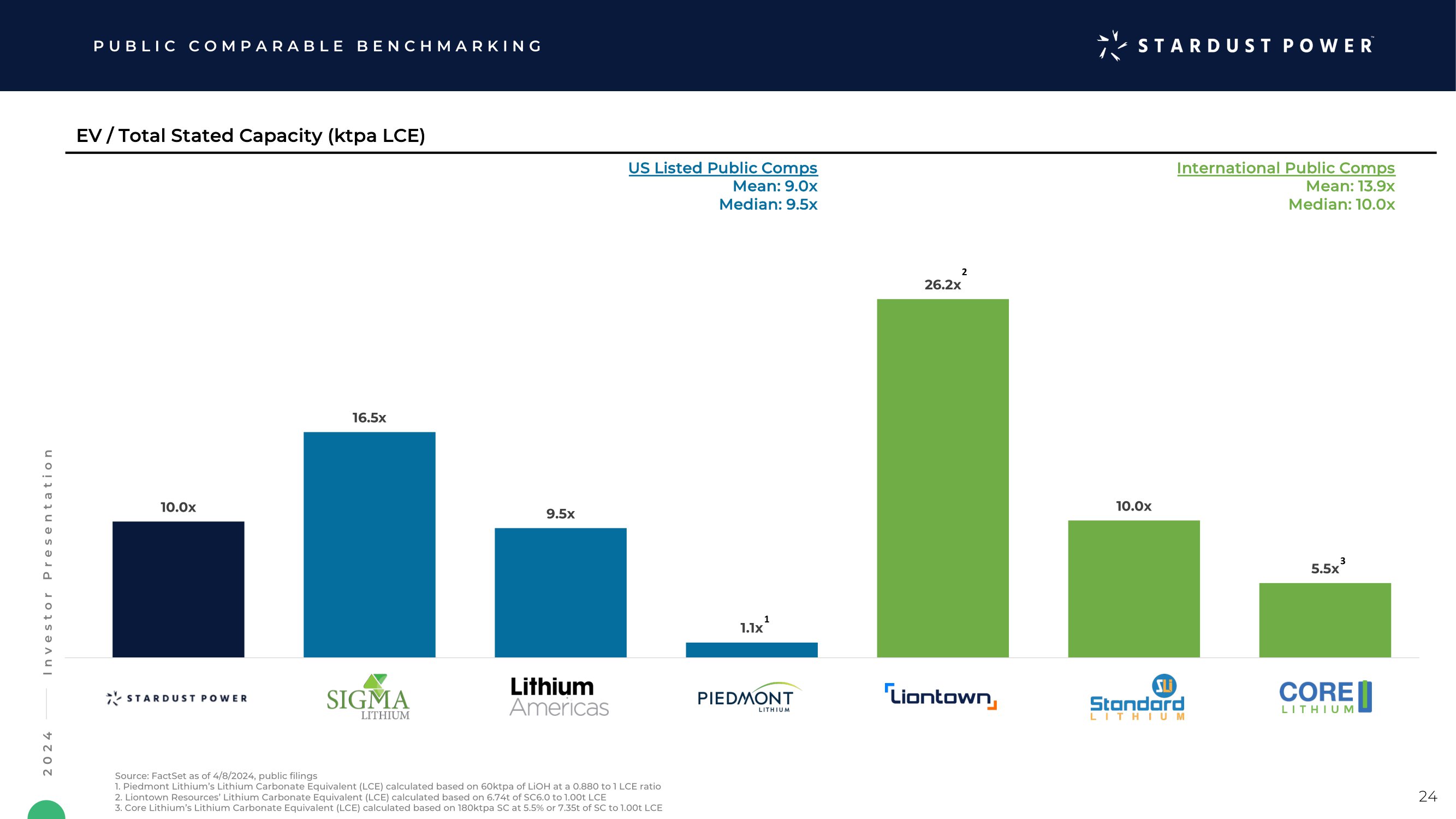

20 24 Investor Presentation 5.5x 10.0x 26.2x 1.1x 9.5x 16.5x 10.0x PUBLIC COMPARABLE BENCHMARKING 24 2 3 EV / Total Stated Capacity ( ktpa LCE) US Listed Public Comps Mean: 9.0x Median: 9.5x International Public Comps Mean: 13.9x Median: 10.0x Source: FactSet as of 4/8/2024, public filings 1. Piedmont Lithium’s Lithium Carbonate Equivalent (LCE) calculated based on 60ktpa of LiOH at a 0.880 to 1 LCE ratio 2. Liontown Resources’ Lithium Carbonate Equivalent (LCE) calculated based on 6.74t of SC6.0 to 1.00t LCE 3. Core Lithium’s Lithium Carbonate Equivalent (LCE) calculated based on 180ktpa SC at 5.5% or 7.35t of SC to 1.00t LCE 1

20 24 Investor Presentation LITHIUM MARKET | U.S. DEMAND *Stardust Power Estimate Map may not capture all announced capacity ~1.2M Electric Vehicles Supplied by Stardust Power* Up to 50,000 tpa of BGLC can supply approximately 10% - 11% of the U.S. EV market by 2035 2 Significant Battery Manufacturing Capacity (Gigafactories) Coming 1 ~321k Tons LCE Estimated U.S. Lithium market size by 2030 3 25 Stardust Power Central Refinery In Oklahoma 1. CIC energiGUNE . North American Battery Initiatives. EV Markets Insights Platform, September 2023. 2. Goldman Sachs. “Electric Vehicles Are Forecast to Be Half of Global Car Sales by 2035”, dated February 10, 2023. Available at : https://www.goldmansachs.com/intelligence/pages/electric - vehicles - are - forecast - to - be - half - of - global - car - sales - by - 2035.html 3. Benchmark Market Intelligence data, S&P Global, Project Blue, Goldman Sachs, Companies websites, lithium expert interviews.

20 24 Investor Presentation “Direct sourcing critical EV raw materials and components from suppliers in North America and free - trade - agreement countries helps make our supply chain more secure, helps us manage cell costs, and creates jobs,” GM Chair and CEO Mary Barra said in a statement announcing the investment. January 2023 Lithium is abundant, Elon Musk noted. The challenging part, he said, is processing it to the point that it can be used in EV battery cells. "You have to refine the lithium into battery - grade lithium carbonate and lithium hydroxide, which has to be extremely high purity," Musk said. July 2022 SUPPORT FOR LITHIUM MINING FROM GOVERNMENT AND INDUSTRY 26 "First of all, batteries are the constraint here," Ford CEO Jim Farley told Yahoo Finance Live (video above). "Both lithium and nickel are really the key constraining commodities. We normally get those from all over the world — South America, Africa, Indonesia.” March 2023 “By 2030, the United States and its partners will establish a secure battery materials and technology supply chain that supports long - term U.S. economic competitiveness and equitable job creation, enables decarbonization, advances social justice, and meets national security requirements.“ – National Blueprint for Lithium Batteries 2021 - 2030 “I hereby determine that sustainable and responsible domestic mining, beneficiation, and value - added processing of strategic and critical materials for the production of large - capacity batteries for the automotive, e - mobility, and stationary storage sectors are essential to the national defense.“ President Joe Biden, Memorandum for Secretary of Defense, March 2022 “As we see more energy manufacturers moving to our state, due in part to our competitive, performance - based incentives, Stardust Power’s new lithium refinery will create hundreds of new jobs while cementing Oklahoma’s place as the best state in the nation for critical mineral manufacturing. I’m proud to welcome Stardust Power to Oklahoma, and I applaud their commitment to American energy dominance.” - Oklahoma Governor Kevin Stitt

20 24 Investor Presentation Local Workforce Development Existing Workforce Pool • Existing pool of oil and gas professionals with transferrable skill set Workforce Training & Job Placement Services 2 • Customized labor market analysis • Talent Acquisition Services • Nationally acclaimed Training for Industry Program (TIP) • Sponsored job fairs and hiring events Quality Jobs Program 1 • 5% of quarterly payroll reimbursed as cash incentive • 10+ new jobs in first three years • Up to $50M total incentive package based on ~$100M in annual payroll over ten years Employer Resources 3 • Free employer portal • Job posting and Employee search portals with job matching features • Education profiles by region – Oklahoma’s institutions partner with industry to provide customized curriculums and workforce incentives SUCCESS THROUGH PEOPLE, PARTNERSHIPS AND PROCESS 27 1,2,3. Oklahoma Commerce, Incentive Program , 2023

20 24 Investor Presentation CENTRAL REFINERY SUPPLY MODEL 28 Impurity Removal Battery - Grade Lithium Carbonate A Central Refinery Has the Ability to Accept Multiple Inputs Multiple sources of supply provides diversification of Stardust’s supply chain Carbonation Process Central Refinery Ship by Rail, Truck, Barge Ensures uniform brine characteristics and concentration up to 5% DLE Processing Crystallization of Concentrated Brine Lithium Chloride Solution Produced Water from Oil & Gas Wells Lithium Resources or Assets

20 24 Investor Presentation STANDARD PROCESS FLOWSHEET Largest inland waterway network in the United States 29 Flowsheet and Engineering in Phases is Based on Proven Technology Source: Hatch LTD, Project Readiness Assessment, Unpublished confidential document, Weekly Meeting #3, September 29, 2023

20 24 Investor Presentation THE REFINERY Largest inland waterway network in the United States 30 *Architect plans for site

202 4 Investor Presentation Risks Related to Stardust Power’s Business, Industry and Economic Condition Our future performance is difficult to evaluate because we have a limited operating history in the lithium industry . Our limited history makes it difficult to evaluate our business and prospects and may increase the risks associated with your investment . Our management has identified conditions that raise substantial doubt about our ability to continue as a going concern . Lithium can be highly combustible, and if we have incidences, it could adversely impact us . We are a development stage company, and there is no guarantee that our development will result in the commercial production of lithium from brine sources . We face numerous risks related to exploration, construction, and extraction of brine by our suppliers . Our quarterly and annual operating and financial results and our revenue are likely to fluctuate significantly in future periods . Our long - term success will depend ultimately on our ability to generate revenues, achieve and maintain profitability, and develop positive cash flows from our battery - grade lithium production activities . Logistics costs based on a hub and spoke refinery model may increase the price to where it is not economically viable . Pipeline of lithium feedstock may prove to be non - viable, which could have material adverse impact on our business and operations . Even if we are successful in completing all initial phases and the first commercial production at our Facility and consistently produce battery - grade lithium on a commercial scale, we may not be successful in commencing and expanding commercial operations to support the growth of our business . Our products may not qualify for use for our intended customers . We might not be able to sell our products as intended . Our ability to manage growth will have an impact on our business, financial condition, and results of operations . Delays and other obstacles may prevent the successful completion of our Facility . We may not be able to develop, maintain and grow strategic relationships, identify new strategic relationship opportunities, or form strategic relationships, in the future . We depend on our ability to successfully access the capital and financial markets . Any inability to access the capital or financial markets may limit our ability to meet our liquidity needs and long - term commitments, fund our ongoing operations, execute our business plan or pursue investments that we may rely on for future growth . The lithium brine industry includes well capitalized players . Low - cost producers could disrupt the market and be able to provide products cheaper than the Combined Company . We may be unable to qualify for existing federal and state level grants and incentives and the grants and incentives may not be released to us as quickly or efficiently as we anticipate or at all . We may in the future use hedging arrangements to mitigate certain risks, but the use of such derivative instruments could have a material adverse effect on our results of operations . We may acquire or invest in additional companies, which may divert our management’s attention, result in additional dilution to our stockholders, and consume resources that are necessary to sustain our business . We are dependent upon key management employees . Our success as a company producing battery - grade lithium and related products depends to a great extent on the capabilities of our partners for lithium extraction from brine and our ability to secure capital for the implementation of brine processing plants . The development of non - lithium battery technologies could adversely affect us . Lithium prices are subject to unpredictable fluctuations . The development of our lithium refinery is highly dependent upon the currently projected demand for and uses of lithium - based end products . Our future growth and success are dependent upon consumers' demand for electric vehicles in an automotive industry that is generally competitive, cyclical and volatile . We may be unable to successfully negotiate final, binding terms related to our current non - binding memoranda of understanding and letters of intent for the supply and offtake agreements, which could harm our commercial prospects . Our future business prospects could be adversely affected if we are unable to enter into definitive agreements relating to contemplated joint ventures with Usha and IGX and, if such agreements are in fact completed, there can be no assurance that such joint ventures will ultimately be successful . Changes in technology or other developments could adversely affect demand for lithium compounds or result in preferences for substitute products . Our business and operations may be significantly disrupted upon the occurrence of a catastrophic event, information technology system failures or cyberattack . We may be subject to liabilities and losses that may not be covered by insurance . We may be subject to claims that our employees, consultants or independent contractors have wrongfully used or disclosed confidential information or alleged trade secrets of third parties or competitors or are in breach of noncompetition or non - solicitation agreements with our competitors or their former employers . Lawsuits may be filed against us and an adverse ruling in any such lawsuit may adversely affect our business, financial condition, or liquidity or the market price of our common stock . Our operations may be further disrupted, and our financial results may be adversely affected by any global pandemic or a public health crisis, such as from the sustained effect from the novel coronavirus pandemic . An escalation of the current war in Ukraine, generalized conflict in Europe and the Middle East, or the emergence of conflict elsewhere, may adversely affect our business . If we fail to adequately protect our intellectual property or technology (including any later developed or acquired intellectual property or technology), our competitive position could be impaired and we may lose valuable assets, generate reduced revenue and incur costly litigation to protect our rights . Certain Risk Factors (1/2) © 2024 Stardust Power Inc. All Rights Reserved. "Stardust Power" and the log o are trademarks of Stardust Power, Inc. All other trademarks used herein are the property of their respective owners. 31

202 4 Investor Presentation Certain Risk Factors (2/2) © 2024 Stardust Power Inc. All Rights Reserved. "Stardust Power" and the log o are trademarks of Stardust Power, Inc. All other trademarks used herein are the property of their respective owners. 32 If we are unable to protect the confidentiality of our proprietary information or trade secrets, our business and competitive position may be harmed . We may be subject to claims challenging the inventorship or ownership of our future intellectual property, particularly those that may be developed or invented by our employees, consultants or contractors . If our trademarks and trade names are not adequately protected, then we may not be able to build name recognition in our markets and our business may be adversely affected . We may be sued by third parties for alleged infringement of their intellectual property rights, which could be costly, time - consuming and limit our ability to use certain technologies in the future . Compliance with environmental regulations and litigation based on environmental regulations could require significant expenditures . Liabilities and costs associated with hazardous materials, contamination and other environmental conditions may require us to conduct investigations or remediation or expose us to other liabilities, both of which may adversely impact our operations and financial condition . Increased stakeholder focus on sustainability or other ESG matters could adversely impact our business, reputation, and operating results . We will be subject to environmental, health and safety laws and regulations in multiple jurisdictions, which may impose substantial compliance requirements and other obligations on our operations . Our operating costs could be significantly increased in order to comply with new or more stringent regulatory standards in the jurisdictions in which we operate . Climate change, legislation, regulation and policies may result in increased operating costs and otherwise affect our business, our industry and the global economy . The physical impacts of climate change, including adverse weather, may have a negative impact on our business and results of operations . Compliance with health and safety laws and regulations can be complex, and noncompliance with these laws and regulations may result in potentially significant monetary damages and fines . The reduction or elimination of government subsidies and economic incentives for alternative energy technologies, or the failure to renew such subsidies and incentives, could reduce demand for our products, lead to a reduction in our revenues, and adversely impact our operating results and liquidity . Existing, and future changes to, federal, state and local regulations and policies, including permitting requirements applicable to us, and enactment of new regulations and policies, may adversely affect the market for environmental attributes generated by our operations . Compliance with data privacy regulations could require additional expenditures, and may have an adverse impact on the operating cashflows of the Company . We identified material weaknesses in our internal control over financial reporting . If we are unable to remediate these material weaknesses, or if we experience additional material weaknesses or other deficiencies in the future, or otherwise fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately or timely report our financial results, which could result in loss of investor confidence and adversely impact our stock price . Our Proposed Certificate of Incorporation will provide that the Court of Chancery of the State of Delaware and the federal district courts of the United States of America will be the exclusive forums for substantially all disputes between us and our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, or employees . Delaware law and the Proposed Governing Documents contain certain provisions, including anti - takeover provisions, that limit the ability of stockholders to take certain actions and could delay or discourage takeover attempts that stockholders may consider favorable . Investments in us may be subject to U . S . and non - U . S . foreign investment screening regulations, which may impose conditions or limitations on certain investment transactions (including, but not limited to, limits on purchasing our capital stock, limits on our ability to share information with our shareholders, corporate governance modifications, forced divestitures, or other measures) . An active trading market for common stock may never develop or be sustained, which may make it difficult to sell the shares of common stock you receive . The Company's business and operations could be negatively affected if it becomes subject to any securities litigation or shareholder activism, which could cause the Company to incur significant expense, hinder execution of business and growth strategy and impact its stock price . The Fairness Opinion obtained by the GPAC II Board from Enclave will not be updated to reflect changes in circumstances between signing the Business Combination Agreement and the completion of the Business Combination . Nasdaq may delist the Combined Company’s securities from trading on its exchange, which could limit investors’ ability to make transactions in the Combined Company’s securities and subject the Combined Company to additional trading restrictions . The price of the Combined Company’s securities may be volatile . The combined Company does not intend to pay cash dividends for the foreseeable future . Significant inflation could adversely affect our business and financial results . We will incur significantly increased costs and devote substantial management time as a result of operating as a public company .