UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number:

(Exact name of Registrant as specified in its charter)

The

(Jurisdiction of incorporation)

(Address of principal executive offices)

Legal Counsel

(Name, E-mail and Address of Company Contact Person)

Securities registered or to be registered, pursuant to Section 12(b) of the Act

Title of Each Class |

| Trading |

| Name of Each Exchange |

The |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | ☐ |

| Other | ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

TABLE OF CONTENTS

3

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We report under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (the “IASB”), which differ in certain significant respects from U.S. generally accepted accounting principles (“U.S. GAAP”). None of our financial statements were prepared in accordance with U.S. GAAP. The consolidated financial statements and financial information included in this Annual Report on Form 20-F were prepared for MYT Netherlands B.V., its accounting predecessor Mariposa I S.à r.l., and its subsidiaries, including Mytheresa Group GmbH (“MGG”). Except where the context otherwise requires or where otherwise indicated, references to the financial information of MYT Netherlands includes the predecessor information of Mariposa I S.à r.l. and its consolidated subsidiaries.

Our financial information is presented in Euros. For the convenience of the reader, we have translated some of our financial information into U.S. Dollars. Unless otherwise indicated, these translations were made at the rate of €1.00 to $1.185 and €1.00 to $1.047, the noon buying rate of the Federal Reserve Bank of New York on June 30, 2021 and June 30, 2022, respectively. Such U.S. Dollar amounts are not necessarily indicative of the amounts of U.S. Dollars that could actually have been purchased upon exchange of Euros at the dates indicated. All references in this Annual Report to “dollar,” “USD” or “$” mean U.S. Dollars and all references to “€” or “euro” mean Euros.

Our fiscal year begins on July 1 and ends on June 30 of the following year. All references to (i) fiscal 2018 relate to the year ended June 30, 2018, (ii) fiscal 2019 relate to the year ended June 30, 2019, (iii) fiscal 2020 relate to the year ended June 30, 2020, (iv) fiscal 2021 relate to the year ended June 30, 2021, (v) fiscal 2022 relate to the year ended June 30, 2022, and (vi) fiscal 2023 relate to the year ended June 30, 2023.

We have made rounding adjustments to some of the figures contained in this Annual Report. Accordingly, numerical figures shown as totals in some tables may not be exact arithmetic aggregations of the figures that preceded them.

Defined Terms and key Performance Indicators in this Annual Report

Throughout this Annual Report, we use a number of key terms and provide a number of key performance indicators used by management. These key performance indicators are discussed in more detail in the sections entitled “Item 5: Operating and financial review and prospects -A. Operating Results”. We define these terms as follows:

| ● | “active customer” means a unique customer account from which an online purchase was made across our sites at least once in the preceding twelve-month period. |

| ● | “Adjusted EBITDA” means net income before finance expense (net), income taxes, and depreciation and amortization, adjusted to exclude U.S. sales tax expenditures temporarily borne by us, strategic investor sale preparation costs, IPO preparation and transaction costs, Other transaction-related, certain legal and other expenses and IPO related share-based compensation expenses. Adjusted EBITDA is not calculated in accordance with IFRS. For an explanation of why we use Adjusted EBITDA and a reconciliation to the most directly comparable measure calculated in accordance with IFRS, please see “Item 5: Operating and financial review and prospects -A. Operating Results”. |

| ● | “Adjusted Net Income” means net income, adjusted for the impact of U.S. sales tax expenditures temporarily borne by us, strategic investor sale preparation costs, IPO preparation and transaction costs, Other transaction-related, certain legal and other expenses and IPO related share-based compensation expenses, finance expenses on our Shareholder Loans and Retired Shareholder Loans and related income tax effects connected to the finance expenses on our Shareholder Loans. Adjusted Net Income is not calculated in accordance with IFRS. For an explanation of why we use Adjusted Net Income and a reconciliation to the most directly comparable measure calculated in accordance with IFRS, please see “Item 5: Operating and financial review and prospects -A. Operating Results”. |

4

| ● | “Adjusted Operating Income” means operating income, adjusted for the impact of U.S. sales tax expenditures temporarily borne by us, strategic investor sale preparation costs, IPO preparation and transaction costs, Other transaction-related, certain legal and other expenses and IPO related share-based compensation expenses. Adjusted Operating Income is not calculated in accordance with IFRS. For an explanation of why we use Adjusted Operating Income and a reconciliation to the most directly comparable measure calculated in accordance with IFRS, please see “Item 5: Operating and financial review and prospects -A. Operating Results”. |

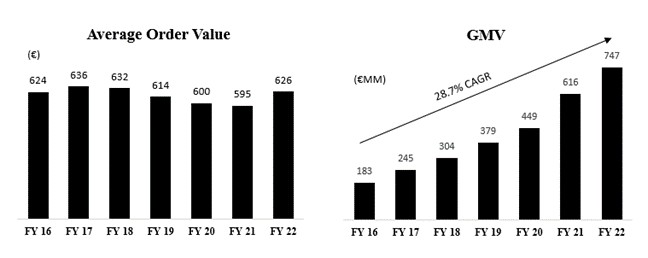

| ● | “average order value” is an operating metric used by management calculated as the total GMV from online orders shipped from our sites during the fiscal year ended on the last day of the period presented divided by the total online orders shipped during the same twelve-month period. |

| ● | “contribution profit” means gross profit less shipping, packaging, fulfillment (including personnel), payment expenses and the portion of marketing expenses attributable to retaining existing customers. |

| ● | “Gross Merchandise Value” (GMV) is an operative measure and means the total Euro value of orders processed, including the value of orders processed on behalf of others for which we earn a commission. GMV is inclusive of product value, shipping and duty. It is net of returns, value added taxes and cancellations. GMV does not represent revenue earned by us. We use GMV as an indicator for the usage of our platform that is not influenced by the mix of direct sales and commission sales. The indicators we use to monitor usage of our platform include, among others, active customers, total orders shipped and GMV. |

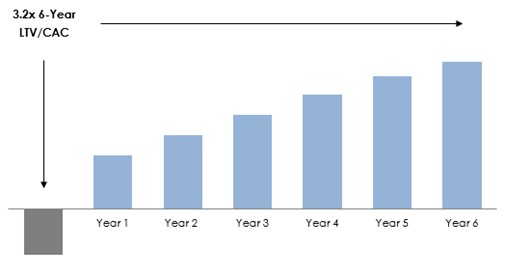

| ● | “customer acquisition cost” or “CAC” means our online marketing expenses, excluding software costs, which we attribute to acquiring new customers, divided by the number of customers who placed their first order in the relevant period. |

| ● | “full-time equivalents” or “FTEs” is presented to quantify the number of employees assuming each employee worked 40 hours per week. Full time employees, who are not conscripted to hours are assumed to work 40 hours per week. |

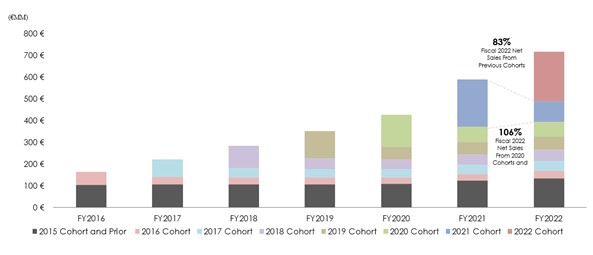

| ● | “lifetime value” or “LTV” means the cumulative contribution profit attributable to a particular customer cohort, which we define as all of our customers who made their initial purchase between July 1 and June 30 in a given cohort year. |

| ● | “net shipped revenue” is an operating metric used by management calculated using total orders shipped, net of returns, applying a fixed foreign exchange rate for each reporting period. |

| ● | “Retired Shareholder Loans” means the convertible preferred equity certificates and variable interest shareholder loans, which were retired in fiscal 2020. For further information regarding our related party financing arrangements, refer to Note 2 of the consolidated financial statements included elsewhere in this Annual Report. |

| ● | “Shareholder Loans” means the approximately $217.0 million aggregate principal amount of 6.0% Notes due October 9, 2025, and accrued but unpaid interest, of MGG held by a wholly owned U.S. subsidiary of MYT Holding LLC (“MYT Holding”), which have been repaid fully in January 2021. |

| ● | “total gross sales” means all sales after cancellations, before returns, and includes associated shipping revenues and delivery duties collected. |

| ● | “total orders shipped” means the total number of online customer orders shipped to our customers during the fiscal year ended on the last day of the period presented. |

| ● | “You” refers to the reader of this report. |

| ● | “Basis points” or “BPs” refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument. The relationship between percentage changes and basis points can be summarized as follows: 1% change = 100 basis points and 0.01% = 1 basis point. |

5

Market and Industry Data

We obtained the industry, market and competitive position data in this Annual Report from our own internal estimates, surveys and research as well as from publicly available information, industry and general publications and research, surveys and studies conducted by third parties, such as reports by Bain & Company and Capgemini. Note Bain & Company and Capgemini are not affiliated with Mytheresa, and the information contained in this report has not been reviewed or endorsed by Bain & Company or Capgemini, as applicable.

Industry publications, research, surveys, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this report. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the forecasts or estimates from independent third parties and us.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains statements that constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are neither historical facts nor assurances of future performance. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties, some of which are beyond our control, and are made in light of the information currently available to us. Our actual results or performance may differ materially from any future results or performance expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words.

These statements involve risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report, we caution you that these statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect, the Company’s actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements. Forward-looking statements in this Annual Report and the factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements include, but are not limited to, statements and factors about:

| ● | the highly competitive nature of our industry and our ability to compete effectively; |

| ● | our ability to respond to consumer demand, spending and tastes; |

| ● | our ability to respond to any current or future health epidemic or other adverse public health development, such as the COVID-19 pandemic, and the resulting business disruption, sustained economic downturn, inflation and margin pressures; |

| ● | our ability to maintain and enhance our brand; |

| ● | our ability to retain our existing customers and acquire new customers; |

| ● | the growth of the market for luxury products, and the online market for luxury products in particular; |

| ● | our ability to obtain and maintain differentiated high-quality products from appropriate brands in sufficient quantities from vendors; |

| ● | our ability to expand our product offerings; |

6

| ● | our ability to effectively manage or sustain our growth, including through new distribution models, such as the curated platform model, and to effectively expand our operations; |

| ● | our ability to manage currency exchange rate fluctuations; |

| ● | our ability to obtain and maintain sufficient inventory at prices that will make our business model profitable, and of a quality that will continue to retain existing customers and attract new customers; |

| ● | seasonal sales fluctuations; |

| ● | our ability to optimize, operate, manage and expand our network infrastructure, and our fulfillment centers and delivery channels; |

| ● | our ability to retain existing vendors and brands and to attract new vendors and brands; and |

| ● | general economic conditions, including economic conditions resulting from Russia’s war in Ukraine, inflation and other geopolitical and macroeconomic conditions or trends that may impact consumer demand. |

You should refer to the “Risk Factors” section of this Annual Report for a discussion of other important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

RISK FACTOR SUMMARY

Our ability to execute our strategy is also subject to certain risks. You should carefully consider all of the information set forth in this Annual Report and, in particular, should evaluate the specific factors set forth under the heading “Risk Factors” in deciding whether to invest in our securities. These risks include, but are not limited to, the following:

| ● | the highly competitive nature of our industry and our ability to compete effectively; |

| ● | consumers of luxury products may not choose to shop online in sufficient numbers; |

| ● | the luxury fashion industry can be volatile and difficult to predict; |

| ● | our ability to maintain strong relationships with our brand partners; |

| ● | any current or future health epidemic or other adverse public health development, such as the outbreak of novel coronavirus (“COVID-19”), could result in business disruption, sustained economic downturn, inflation, margin pressures and have an material adverse effect on our business and operating results; |

| ● | our reliance on consumer discretionary spending, which may be adversely affected by economic downturns, including economic conditions resulting from Russia’s war in Ukraine, inflation and other geopolitical and macroeconomic conditions or trends; |

| ● | our ability to acquire new customers and retain existing customers in a cost-effective manner depends on the success of our advertising efforts; |

| ● | our ability to maintain average order value levels; |

| ● | our ability to accurately forecast net sales and appropriately plan our expenses in the future; |

7

| ● | our recent growth rates may not be sustainable or indicative of our future growth; |

| ● | our ability to manage currency exchange rate fluctuations; |

| ● | our ability to effectively manage our inventory; |

| ● | loss of, or disruption in, our only distribution facility; |

| ● | the imposition or increase of tariffs and the uncertainty regarding international economic relations could adversely affect our business; |

| ● | changes in customs and international trade laws may result in increased costs which could limit our ability to operate our business and limit our ability to grow; |

| ● | if sensitive information about our customers is disclosed, or if we or our third-party providers are subject to real or perceived cyberattacks, our customers may curtail use of our sites; and |

| ● | the loss of senior management or attrition among our buyers or key employees could adversely affect our business. |

8

PART I

Item 1: Identity of directors, senior management and advisers

Not applicable.

Item 2: Offer statistics and expected timetable

Not applicable.

Item 3: Key Information

A. Selected financial data

Not applicable.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks and uncertainties described below, which we believe are material risks of our business. Our business, financial condition, results of operations or growth prospects could be harmed by any of these risks. In such an event, the value of our securities could decline, and you may lose all or part of your investment. In assessing these risks, you should also refer to all of the other information contained in this report, including our consolidated financial statements and related notes. Please also see “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

The online luxury sector is highly competitive and if we do not compete effectively, our results of operations could be adversely affected.

The online luxury sector is highly competitive and fragmented. We compete for customers primarily with other global multi-brand online luxury retailers and online marketplaces, luxury mono-brand retailers and luxury multi-brand retailers, and to a lesser extent specialty retailers, department stores, apparel chains, stand-alone boutiques, traffic aggregators, luxury pre-owned and consignment stores, off-price retailers and flash sale websites. We believe our ability to compete depends on many factors within and beyond our control, including:

| ● | attracting new customers and retaining existing customers; |

| ● | enhancing our relationships with existing customers; |

| ● | attracting customers from our brand partners’ increasing online offerings and capabilities; |

| ● | converting online viewing to online purchases; |

| ● | further developing our data analytics capabilities; |

9

| ● | maintaining favorable brand recognition and effectively marketing our services to customers; |

| ● | the amount, diversity and quality of brands and merchandise that we or our competitors offer; |

| ● | the price at which we are able to offer our merchandise; |

| ● | maintaining and growing our market share; |

| ● | price fluctuations or demand disruptions of our brand partners or other third-party vendors; |

| ● | inventory management; |

| ● | the speed and cost at which we can deliver merchandise to our customers and the ease with which they can use our services to return merchandise; and |

| ● | anticipating and quickly responding to changing fashion trends and customer shopping preferences. |

Competition may increase as other established and emerging companies, including Amazon.com Inc., enter the markets in which we compete, as customer requirements evolve and as new products and technologies are introduced.

Many of our current competitors have, and potential competitors may have, longer operating histories, larger fulfillment infrastructures, greater technical capabilities, faster shipping times, lower-cost shipping, larger databases, greater financial, marketing, institutional and other resources and larger customer bases than we do. These factors may allow our competitors to derive greater net sales and profits from their existing customer bases, acquire customers at lower costs or respond more quickly than we can to new or emerging technologies and changes in fashion trends and customer shopping behavior. These competitors may engage in extensive research and development efforts, enter or expand their presence in the online luxury market, undertake more far-reaching marketing campaigns, build stronger relationships with our brand partners, more effectively address our customers’ needs or adopt more aggressive pricing policies. In addition, as a result of the COVID-19 pandemic, retailers and brands that have not typically participated in e-commerce may establish an online presence on their own or with our existing competitors, which may create new or strengthen existing competitors. In September 2020, Amazon.com, Inc. launched “Amazon Luxury Stores,” an invitation-only marketplace that offers high-end ready-to-wear clothing from luxury brand partners to eligible customers. Any of the foregoing may allow our competitors to acquire a larger and more lucrative customer base or generate net sales from their existing customer bases more effectively than we do and, as a result, may have an adverse impact on our results of operations.

Competition, along with other factors such as consolidation within the luxury retail industry and changes in customer spending patterns, could also result in significant pricing pressure. Such factors may result in the loss of brand partners or customers. If we lose customers, our brand partners could reduce or terminate their relationships with us and our results of operations and profitability could decline.

If we are unable to anticipate and respond to changing customer preferences and shifts in fashion and industry trends in a timely manner, our business, financial condition and results of operations could be harmed.

The online personal goods luxury sector is driven in part by fashion and beauty trends, which may shift quickly. Our continued success depends on our ability to anticipate, gauge and react in a timely and cost-effective manner to the latest fashion trends, changes in customer preferences for products, customer attitudes toward our industry and brands and where and how customers shop for those products. We must continually work to develop, produce and market new and highly curated content to our sites, provide customers with products from coveted luxury brands, offer unique products, maintain and enhance the recognition of our brand and develop our approach as to how and where we market and sell products. We typically enter into agreements to purchase our merchandise in advance of the applicable selling season and our failure to anticipate, identify or react appropriately, or in a timely manner to changes in customer preferences, tastes and trends or economic conditions could lead to, among other things, missed opportunities, excess inventory or inventory shortages or delays, markdowns and write-offs, any of which could negatively impact our profitability and have a material adverse effect on our business, financial condition and results of operations. Failure to respond to changing customer preferences and to gauge and anticipate upcoming fashion trends could also negatively impact our brand image with our customers and result in diminished customer loyalty.

10

There is no assurance that customers will continue to purchase goods from us in the future. Customers may purchase fewer or lower-priced products if their discretionary income decreases. During periods of economic uncertainty, we may need to reduce prices in response to competitive pressures or otherwise to maintain sales, which could adversely affect relationships with our brand partners and consequently our business, financial condition, results of operations and prospects.

Any current or future health epidemic or other adverse public health development, such as the COVID-19 pandemic, could result in business disruption, supply chain disruption, sustained economic downturn, inflation, margin pressures and have a material adverse effect on our business and operating results.

Our business could be adversely affected by infectious disease outbreaks, such as the COVID-19 pandemic, which has spread rapidly across the globe, including in all major countries in which we operate, resulting in adverse economic conditions and business disruptions. Governments worldwide have imposed, and in some cases continue to impose, varying degrees of preventative and protective actions, such as temporary travel bans, forced business closures, and stay-at-home orders, all in an effort to reduce the spread of the virus, which has resulted in supply shortages and other business disruptions in many regions, in particular China, but with knock-on effect in other countries as well, and has also adversely affected demand. It is impossible to predict the effect and ultimate impact of the COVID-19 pandemic as the situation is rapidly evolving. Accordingly, we cannot predict for how long and to what extent this crisis will impact our business operations or the global economy as a whole.

A substantial majority of our brand partners, offices and employees are located in Europe, and we ship all our products from our distribution center in Heimstetten, outside Munich, Germany. As a result, the effects of this virus has disrupted somewhat our supply chain and distribution and fulfillment capabilities, including the delivery of merchandise from our brand partners and shipments of our merchandise to impacted regions or from our distribution center in Heimstetten. Furthermore, many of our brand partners temporarily closed their retail stores, warehouses and/or distribution centers and may do so again in the future in response to the COVID-19 pandemic, which could further interrupt our supply chain in the future. Our offices, logistics and operations centers and employees more generally have also been affected. We have instituted many health and safety protective measures for our employees and customers, and as a consequence, our capacity for processing orders was somewhat reduced.

Restrictions on travel, quarantines and other measures imposed in response to the outbreak, as well as ongoing concern regarding its potential impact, have had and will likely continue to have a negative effect on the economies, financial markets and business activities of global market, resulting in inflationary pressure and worker shortages. Global financial markets have experienced significant losses and volatility as a result of these conditions. A continued economic downturn and increased inflation resulting from these measures could negatively impact customer demand and spending in the impacted regions, and cause an oversupply of inventory that could lead to markdowns or promotional sales to dispose of excess inventory, which could force us to follow suit and have an adverse effect on our gross margins and results of operations. Should any of these factors worsen, customer demand and our results of operations could be negatively affected in the current or future fiscal periods.

The luxury fashion industry can be volatile and difficult to predict.

In the luxury fashion industry, customer demand can quickly change depending on many factors, including the behavior of both online and brick and mortar competitors, promotional activities of competitors, rapidly changing tastes and preferences, frequent introductions of new products and services, advances in technology and the internet and macroeconomic factors, many of which are beyond our control, especially in light of the COVID-19 pandemic. With this constantly changing environment, our future business strategies, practices and results may not meet expectations or respond quickly enough to customer demand, and we may face operational difficulties in adjusting to any changes. Any of these developments could harm our business, financial condition, results of operations and prospects.

Our continued success is substantially dependent on positive perceptions of our brand which, if eroded, could adversely affect our customer, employee and brand partner relationships.

We offer products from over 200 established brands through our sites. Our ability to identify new brands and maintain and enhance our relationships with our existing brands is critical to maintaining and expanding our base of customers. A significant portion of our customers’ experience depends on third parties outside of our control, including brand partners, third-party vendors, logistics providers such as DHL, FedEx and UPS and social media providers, distributors and influencers. If these third parties do not meet our or our customers’ expectations or if they increase their prices or materially reduce or terminate their relationship with us, our brand may suffer irreparable damage and/or our costs may increase.

11

Customer complaints or negative publicity about our sites, products, product delivery times, customer support, customer data handling or security practices, especially on blogs and social media platforms, could rapidly and severely diminish use of our sites and current and potential customers’ and brand partners’ confidence in us, which could result in harm to our brand and our business. We believe that some of the growth in our customer base to date has originated from social media, influencer marketing and affiliate marketing. If we are not able to develop and maintain positive relationships with our influencer and affiliate marketing partners, or if we or such partners are targets of negative publicity, including in connection with reactions to social or political events, such as the war in Ukraine, the Black Lives Matter movement or protests against the use of fur, on social media, our ability to promote and maintain awareness of our sites and brands and leverage social media platforms to drive customers to our sites may be adversely affected, which could have an adverse effect on our business, financial condition, results of operations and prospects.

We depend on the success of our advertising efforts. If we fail to acquire new customers through our marketing effort in a cost-effective manner or at all we may not be able to increase net sales or maintain profitability.

Our success depends on the success of our marketing efforts in acquiring customers in a cost-effective manner. Our advertising efforts primarily comprise brand and performance-based advertising, public relations and events. In order to expand our customer base, we must appeal to and acquire customers who have historically used other means of shopping for luxury goods and may prefer alternatives to our offerings, such as traditional brick-and-mortar retailers and the websites of our competitors. We make significant investments related to customer acquisition and expect to continue to spend significant amounts to acquire additional customers. For example, our performance-based advertising includes paid search/product listing ads, affiliate networks, display prospecting and retargeting and other digital channels.

In addition to our performance-based advertising, we may use third-party social media platforms as, among other things, marketing tools. For example, we currently maintain Instagram, Facebook, Twitter, Pinterest, YouTube, Weibo, WeChat, and Naver accounts. As existing e-commerce and social media platforms continue to rapidly evolve and new platforms develop, we must continue to maintain a presence on these platforms and establish a presence on new or emerging popular social media platforms. If we are unable to cost-effectively use some of our social media platforms as marketing tools or if the social media platforms we use do not evolve quickly enough for us to optimize our use of such platforms, our ability to attract new customers and our financial condition may suffer. Furthermore, as laws and regulations rapidly evolve to govern the use of these platforms, the failure by us or our employees to abide by applicable laws and regulations in the use of these platforms or otherwise could subject us to regulatory investigations, class action lawsuits, liability, fines or other penalties and have a material adverse effect on our business, financial condition and results of operations.

We are also subject to certain risks due to our reliance on digital channels in our advertising efforts. Digital channels change their algorithms and policies periodically, and our rankings in organic searches and visibility in social media feeds could be adversely affected by those changes. This has occurred in the past and required us to increase our spending on paid marketing to offset the loss in traffic. Further, digital platforms such as Apple and Google have announced changes to their privacy policies that, as implemented, could adversely affect our ability to provide more relevant online advertisements to the most relevant potential customers. Search engine companies may also determine that we are not in compliance with their guidelines and penalize us in their algorithms. Even with an increase in marketing spend to offset any loss in search engine optimization traffic as a result of algorithm changes, the recovery period in organic traffic may span multiple quarters or years. If digital platforms change their policies or penalize us with their algorithms, terms of service, display and featuring of search results, or if competition increases for advertisements, we may be unable to cost-effectively attract customers. Our relationships with digital platforms are not covered by long-term contractual agreements and do not require any specific performance commitments. In addition, many of the platforms and agencies with whom we have advertising arrangements provide advertising services to other companies, including retailers with whom we compete. As competition for online advertising has increased, the cost for some of these services has also increased.

In addition, we partner with influential figures and social media and celebrity influencers within the fashion and entertainment industry in order to promote our sites. Such campaigns are expensive and may not result in the cost-effective acquisition of new customers. Further, the competition for relationships with influencers is increasing, and the cost of maintaining such relationships will likely increase. In addition, we do not prescribe what our influencers post, and if we were held responsible for the content of their posts or their actions, we could be forced to alter our practices, which could have an adverse impact on our business. Influencers, designers and celebrities with whom we maintain relationships could engage in behavior or use their platforms to communicate directly with our customers in a manner that reflects poorly on our brand and may be attributed to us or otherwise adversely affect us. The harm may be immediate, without affording us an opportunity for redress or correction.

12

The net profit from new customers we acquire may not ultimately exceed the cost of acquiring those customers. If we fail to deliver an exclusive shopping experience, or if customers do not perceive the products we offer as unique luxury pieces reflecting the latest fashion trends, we may not be able to acquire new customers. If we are unable to acquire new customers who purchase an amount of merchandise sufficient to grow our business, we may not be able to generate the necessary growth to drive beneficial network effects with our brand partners, our net sales may decrease, and our business, financial condition and results of operations may be adversely affected. Additionally, if our marketing efforts are not successful in promoting awareness of our brand, driving customer engagement or attracting new customers, or if we are not able to cost-effectively manage our marketing expenses, our results of operations could be adversely affected.

Our failure to retain existing customers or to maintain average order value or customer spending levels may impair our net sales growth, which could have a material adverse effect on our business and results of operations.

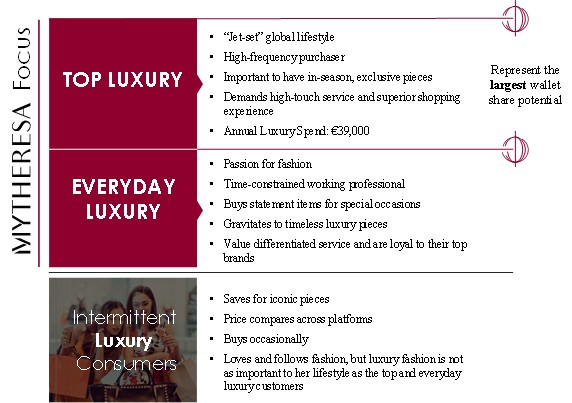

A significant portion of our net sales are generated from sales to existing customers, particularly those existing customers who are highly engaged and make frequent and/or large purchases of the merchandise we offer. In fiscal 2022, the top 3.1% of our customers accounted for approximately 35% of our gross sales. If existing customers no longer find our offerings appealing or shift their shopping and purchasing preferences back to brick-and-mortar stores as COVID-19 pandemic measures ease, or if we are unable to timely update our offerings to meet current trends and customer demands, our existing customers may make fewer or smaller purchases in the future. A decrease in the number of our existing customers who make repeat purchases or a decrease in their spending on the merchandise we offer could negatively impact our results of operations. Further, we believe that our future success will depend in part on our ability to increase sales to our existing customers over time, and if we are unable to do so, our business may suffer. If we fail to generate repeat purchases or maintain high levels of customer engagement and average spend, our financial condition, results of operations and growth prospects could be adversely affected.

In addition, for our most valued customers, we invest in hosting exclusive events, personal shoppers and in-person styling sessions in various international locations, which has continued to be challenging during the COVID-19 pandemic. If our investments in such personal events do not generate sufficient net sales growth from our top customers, if we are unable to retain our most valued customers or if they do not purchase an amount of merchandise sufficient to grow our business, we may not be able to generate the necessary growth to drive beneficial network effects with our brand partners, our net sales may decrease and our business, financial condition and results of operations may be adversely affected.

Our failure to maintain strong relationships with our brand partners could limit our ability to provide differentiated luxury merchandise and harm our business and prospects.

Our relationships with established brand partners are a key factor in our success. Many of our brand partners limit the number of retail and wholesale channels that they use to sell their merchandise, and we have no guaranteed supply arrangements with our brand partners. Nearly all of our luxury brands are sold by competing retailers and have their own proprietary retail stores and/or websites that compete with us. Accordingly, there can be no assurance that any of our brand partners will continue to sell to us or to meet our quality, style and volume requirements. Some of our brand partners also impose geographical restrictions where we are allowed to sell their products. Other brand partners may, in the future, also restrict our ability to sell their products in certain regions. Our failure to offer our brand partners the ability to present their products in a manner that preserves brand integrity could have an adverse impact on our relationships with such brand partners.

Our distribution model has evolved and will likely also evolve over time and includes, among other distribution models, arrangements where a brand partner retains inventory ownership and in some cases directly ships to the customer while we are paid a commission by the brand partner. Any such distribution model could result in changes to our future revenue composition, inventory levels and margins, with a possible negative effect on our future net sales growth rate and gross margin, which could result in an adverse market reaction. In addition, our brand and reputation could be adversely affected if we are not able to continue controlling the full customer experience associated with shopping on our site. In addition, under the curated platform model, we may be required by the brand partner to share customer data, subject to the customer’s active consent in compliance with GDPR and other privacy laws, which could result in a dilution of the customer relationship over time.

13

Brand partner relationships could also be adversely impacted if we are not able to sell our brand partners’ products at full price and instead offer such products at discounted prices. Where we do consider it commercially sensible to discount our brand partners’ products to manage inventory or for other reasons (which we carefully evaluate in each case), this action could undermine the pricing and customer acquisition strategies of our brand partners and in turn indirectly reduce their net sales.

Our partnership with the Vestiaire Collective, which offers a resale service dedicated to our high-end luxury customers, could also adversely affect our brand partner relationships. Engaging in partnerships with resale service providers could be perceived by our brand partners as competitive with their own luxury goods, which could result in reduced sales for the brand partners’ goods. Accordingly, brand partners may be less willing to provide us with differentiated luxury merchandise for upcoming seasons, which could have an adverse effect on our relationships with high-end customers.

During periods of adverse change in general economic, industry or competitive conditions, some of our brand partners may experience cash flow issues, reductions in available credit from banks, factors or other financial institutions, or increases in the cost of capital. In response to those conditions or to concerns about the financial condition of us or our affiliates, such brand partners may attempt to increase their prices, alter historical credit and payment terms available to us or take other actions. Certain of our brand partners use third party trade credits on the basis of orders placed by us to subsidize a portion of their production costs. In certain cases, this has prompted brand partners to alter historical credit and payment terms available to us. They may also experience problems in their supply chains which could delay deliveries of their products to us. If this were to recur in the future, it could disrupt our merchandise sourcing and order fulfilment and adversely affect our liquidity.

Any of these actions could have an adverse impact on our relationships with our brand partners, constrain the amounts or timing of our purchases from such brand partners or cause us to lose customers and hinder our ability to acquire new customers, each of which could ultimately have an adverse effect on our business and prospects.

Our failure to maintain a relevant, enjoyable and reliable experience for our customers and to meet our customers’ evolving shopping preferences could adversely affect our customer relationships.

We seek to provide a relevant, enjoyable and reliable experience for our customers and to meet our customers’ evolving shopping preferences. To do so, we must continuously offer differentiated merchandise and brands, anticipate evolving fashion trends and offer access to exclusive merchandise. We must also provide our customers with superior service throughout their shopping experience and keep up-to-date with current technology trends, including the proliferation of mobile usage, evolving creative user interfaces and other e-commerce marketing trends related to customer acquisition and engagement, among others, which may increase our costs and may not yield higher sales or more customers. We must also keep up with evolving shopping preferences, including convenient and low-cost or free shipping options. Although we continually analyze trends in the way our customers shop, in an effort to maximize incremental sales, we may not gather accurate and relevant data or effectively utilize that data to accurately predict our customers’ shopping preferences, which may impact our strategic planning and decision making. If for any reason we are not successful at developing and providing a convenient, consistent and enjoyable shopping experience for our customers or providing our customers the products they want, when and where they want them, our business, financial condition, results of operation and prospects could be adversely affected.

14

We rely on customer discretionary spending, which may be adversely affected by economic downturns, inflation and other macroeconomic conditions or trends.

We sell luxury fashion merchandise. Although the market for luxury goods is less sensitive to economic downturns than markets for ordinary goods, purchases of merchandise by our customers are nonetheless discretionary, and therefore dependent upon the level of customer spending, particularly among affluent customers. As a result, our business and results of operations are subject to global economic conditions and their impact on customer discretionary spending. Some factors that may negatively influence customer spending include high levels of unemployment, increased inflation, higher customer debt levels, reductions in net worth, decreased demand resulting from significantly reduced opportunity to wear luxury fashion merchandise in public or social situations due to stay-at-home orders or preferences as a result of the COVID-19 pandemic, declines in asset values and related market uncertainty, home foreclosures and reductions in home values, fluctuating interest rates and credit availability, fluctuating fuel and other energy costs, fluctuating commodity prices and national and global geo-political and economic uncertainty, including in connection with tariffs or trade laws. Economic conditions in certain regions may also be affected by natural disasters, such as earthquakes, hurricanes, tropical storms and wildfires, public health crises, political crises, such as the war in Ukraine, terrorist attacks, war and other political instability or other unexpected events, and such events could also disrupt our operations, internet or mobile networks or the operations of one or more of our third-party service providers. For example, if any such disaster were to impact our flagship store or distribution center in Heimstetten or our planned distribution center under construction in Leipzig, Germany, our results of operations could be adversely affected. Customer purchases of discretionary items, including the merchandise that we offer, may decline during periods of economic uncertainty, when disposable income is reduced or when there is a reduction in customer confidence.

Adverse economic changes could reduce customer confidence, and thereby could negatively affect our results of operations. A reduction in customer spending or disposable income may affect us more significantly than companies in other industries and companies with a more diversified product offering. In addition, negative national or global economic conditions may adversely affect our brand partners’ financial performance, liquidity and access to capital, which may affect their production levels and/or product quality and could cause them to raise prices, lower production levels or cease their operations. In challenging and uncertain economic environments, we cannot predict when macroeconomic uncertainty may arise, whether or when such circumstances may improve or worsen or what impact such circumstances could have on our business.

Any adverse impact on our relationship with the limited number of brand partners from whom we generate a significant portion of our net sales could have a material adverse effect on our business and results of operations.

If one or more of these brand partners were to (i) limit the supply of merchandise made available to us, (ii) increase the supply of merchandise made available to our competitors, (iii) increase the supply of merchandise made available to their own proprietary retail stores and websites or significantly increase the number of their proprietary retail stores, or (iv) cease the distribution of their merchandise to us, our business, net sales, earnings and profitability could be adversely affected. Any decline in the quality or popularity of our top designer brands could also adversely affect our business.

The failure of one or more of these brand partners to supply their products to us on a timely basis, or at all, or at the prices we expect, may have a material adverse effect on our business, financial condition and results of operations. Further, our brand partners may:

| ● | have economic or business interests or goals that are inconsistent with ours; |

| ● | take actions contrary to our requests, policies or objectives; |

| ● | be unable or unwilling to fulfill their obligations under relevant purchase orders, including obligations to meet certain production deadlines, quality standards, pricing guidelines and product specifications, and to comply with applicable regulations, including those regarding the safety and quality of products; |

| ● | have financial difficulties; |

| ● | encounter raw material or labor shortages; |

| ● | encounter increases in raw material or labor costs which may affect their procurement costs, potentially resulting in an increase in their prices; |

| ● | engage in activities or employ practices that may harm our reputation; or |

15

| ● | work with, be acquired by, or come under the control of, our competitors. |

Any of these factors could have an adverse impact on our relationships with such brand partners and the volume or timing of our purchases from such brand partners and could adversely affect our business, financial condition, results of operations and prospects.

If our brand partners or service providers do not continue to produce products or provide services that are consistent with our standards or applicable regulatory requirements, this could adversely affect the quality of our collections, cause customer dissatisfaction and harm our reputation.

We do not own or operate any manufacturing facilities or design the merchandise we sell. The ability of our brand partners to design, manufacture and supply us with their products may be affected by competing orders placed by other retailers and the demands of those retailers. If we experience significant increases in demand, or need to replace a significant amount of merchandise, there can be no assurance that additional supply will be available when required on terms that are acceptable to us, or at all, or that any brand supplier will allocate sufficient capacity to us in order to meet our requirements.

In addition, quality control problems, such as the use of materials and delivery of products that do not meet our quality control standards and specifications or comply with applicable laws or regulations, could harm our business. All products presented on our website have followed a rigorous selection process and quality is an integral part of this selection process. Upon reception of all goods within our warehouse, the quality of the product is controlled and quality control problems could result in regulatory action, such as restrictions on importation, products of inferior quality or product stock outages or shortages, which could harm our sales and create inventory write-downs for unusable products. We have also outsourced portions of our distribution process, as well as certain technology-related functions, to third-party service providers. Specifically, we rely on third parties in a number of foreign countries and territories, and we rely on third parties for credit card processing, hosting and networking for our sites. The failure of one or more of these entities to provide the expected services on a timely basis, or at all, or at the prices we expect, or the costs and disruption incurred in moving these outsourced functions under our management and direct control or that of another third party, may have a material adverse effect on our business, financial condition and results of operations.

Our failure to successfully introduce new product categories could harm our business, financial condition, results of operations and prospects.

As part of our ongoing business strategy we expect to introduce new products in our traditional product categories of clothing, shoes, bags and accessories, while also expanding our product launches into adjacent categories in which we may have little to no operating experience. We launched Mytheresa Kids in 2019, Mytheresa Men in January 2020 and Mytheresa Life in May 2022 to expand our curated offering to these large and underserved categories. If we are unable to effectively market these categories to new and existing customers, the launch of these product lines may not be as successful as we anticipate. Our inability to successfully introduce new products in our traditional categories or in adjacent categories could limit our future growth and have a material adverse effect on our business, financial condition, results of operations and prospects.

Any disruptions at our flagship stores could negatively affect our business, results of operations, financial condition and prospects.

We generate a portion of our net sales (approximately 2% in fiscal 2022) from our Munich flagship store and, our men’s store, which is also located in Munich. As a result, we are more vulnerable to economic and other conditions affecting the metropolitan region surrounding Munich than our more geographically diversified competitors. Factors that may affect our results of operations include, among other things, the COVID-19 pandemic and resulting lock-downs or shelter-at-home orders, changes in demographics, population and employee bases, wage increases, future changes in economic conditions, severe weather conditions and winter storms. Any events or circumstances that negatively affect the region could adversely affect our net sales and profitability. Such conditions may result in reduced customer traffic and spending in our store, physical damage to our store, loss of inventory or closure of our store. Any of these factors may disrupt our business and adversely affect our business, financial condition and results of operations.

16

We may be unable to accurately forecast net sales and appropriately plan our expenses in the future.

We base our current and future expense levels on our operating forecasts and estimates of future net sales, gross margins and bottom-up estimates of functional cost increases. Net sales and results of operations are difficult to forecast because the purchasing behavior of our existing customers as well as our success in acquiring new customers may vary and is subject to global economic and health conditions. In addition, our historical growth rates, trends and other key performance metrics may not be meaningful predictors of future growth. Our business is affected by general economic and business conditions in the European Union and in the other international markets in which we operate. In addition, we experience shifts in overall sale seasons in our business, and our mix of product offerings is variable from day-to-day and quarter-to-quarter. This variability makes it difficult to predict sales and could result in significant fluctuations in our net sales, margins and profitability. Some of our expenses are fixed, and as a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected shortfall in net sales. Any failure to accurately predict net sales could cause our results of operations to be lower than expected, which could adversely affect our financial condition and the value of our securities.

Our recent growth rates may not be sustainable or indicative of our future growth.

Our historical net sales and profitability may not be indicative of our future performance. We may not be successful in executing our growth strategy, and even if we achieve our strategic plan, we may not be able to sustain profitability. In future periods, our net sales and profitability could decline or grow more slowly than we expect.

We believe that our continued growth will depend upon, among other factors, our ability to:

| ● | identify new and emerging brands and maintain relationships with our established brand partners; |

| ● | acquire new customers and retain existing customers; |

| ● | develop new features to enhance the customer experience on our sites; |

| ● | increase the frequency with which new and existing customers purchase products on our sites through merchandising, data analytics and technology; |

| ● | invest in our online infrastructure to enhance and scale the systems our customers use to interact with our site; |

| ● | access new complementary customer categories; and |

| ● | expand internationally. |

We cannot assure you we will be able to achieve any of the foregoing. Our customer base may not continue to grow or may decline as a result of increased competition and the maturation of our business. Failure to sustain our growth could have an adverse effect on our business, financial condition and results of operations and on the value of our securities.

Additionally, we expect our costs to continue to increase in future periods due to, among other items, inflation, regulatory requirements, competitive pressures, commodity price increases and increased labor costs, which could negatively affect our future results of operations and ability to sustain profitability. We expect to continue to expend substantial financial and other resources on acquiring and retaining customers, our technology infrastructure and the development of new features, sales and marketing, international expansion, including expansion into the United States, and expenses related to being a public company. These investments may not result in increased net sales or growth in our business. If we cannot successfully earn net sales at a rate that exceeds the costs associated with our business, we will not be able to sustain profitability or generate positive cash flow on a sustained basis and our net sales growth rate may decline. If we fail to continue to increase our net sales and grow our overall business, our business, financial condition, results of operations and prospects could be adversely affected.

We are also required to manage numerous relationships with various brand partners and other third parties. Further growth of our operations, fulfillment infrastructure, information technology systems or internal controls and procedures may not be adequate to support our operations. If we are unable to manage the growth of our organization effectively, our business, financial condition and results of operations may be adversely affected.

17

Our quarterly results of operations may fluctuate, which could cause the value of our securities price to decline.

Our quarterly results of operations may fluctuate for a variety of reasons, many of which are beyond our control. These reasons include those described in these risk factors as well as the following:

| ● | fluctuations in net sales generated from the brands on our sites, including as a result of shifts in overall sale seasons, changes in regional mix and changes in brand delivery patterns and timing; |

| ● | fluctuations in sales margin due to shifts in seasonal sales calendars or competitive behaviors; |

| ● | fluctuations in product mix; |

| ● | our ability to effectively manage our sites and new and existing brands; |

| ● | fluctuations in the levels of inventory; |

| ● | fluctuations in capacity as we expand our operations; |

| ● | our success in engaging existing customers and attracting new customers; |

| ● | the amount and timing of our operating expenses; |

| ● | the timing and success of new products and brands we introduce; |

| ● | the impact of competitive developments and our response to those developments; |

| ● | our ability to manage our existing business and future growth; |

| ● | disruptions or defects in our sites, such as privacy or data security breaches; and |

| ● | economic and market conditions, particularly those affecting our industry. |

Fluctuations in our quarterly results of operations may cause those results to fall below the expectations of analysts or investors, which could cause the value of our securities to decline. Fluctuations in our results could also cause a number of other difficulties. For example, analysts or investors might change their models for valuing our securities, we could experience short-term liquidity issues, our ability to retain or attract key personnel may diminish and other unanticipated issues may arise.

In addition, we believe that our quarterly results of operations may vary in the future and that period-to-period comparisons of our results of operations may not be meaningful. For example, our historical growth may have overshadowed the shifts in the overall effect of sale seasons on our historical results of operations. These shifts in the overall effect of sale seasons may become more pronounced over time, which could also cause our results of operations to fluctuate. You should not rely on the results of one quarter as an indication of future performance.

If we are unable to manage fluctuations in exchange rates effectively, our results of operations may be adversely affected.

We are exposed to market risk from fluctuations in foreign currencies. Material portions of our net sales and expenses have been generated by our operations outside the European Union, and we expect that these operations will account for a material portion of our net sales and expenses in the future. We use foreign service vendors whose costs are affected by the fluctuation of their local currency against the Euro or who price their services in currencies other than the Euro, including the British Pound, U.S. Dollar and Swiss Franc. We have also generated significant sales in foreign locations, principally the United Kingdom, the United States, China, South Korea, and the Middle East. Our brand partners may also be impacted by currency exchange rate fluctuations with respect to the purchase of fabric and other raw materials and could pass any such increased costs on to us. We may not be able to pass increased prices on to customers, which could adversely affect our business and financial condition.

18

Certain of our key operating metrics are subject to inherent challenges in measurement, and real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business.

We track certain key operating metrics using internal data analytics tools, which have certain limitations. In addition, we rely on data received from third parties, including third-party platforms, to track certain performance indicators. Data from such sources may include information relating to fraudulent accounts and interactions with our sites (including as a result of the use of bots, or other automated or manual mechanisms to generate false impressions that are delivered through our sites or their accounts). We have only a limited ability to verify data from our sites or third parties, and perpetrators of fraudulent impressions may change their tactics and may become more sophisticated, which would make it more difficult to detect such activity.

Our methodologies for tracking metrics may also change over time, which could result in changes to the metrics we report. If we under or over count performance due to the internal data analytics tools we use or issues with the operating data received from third parties, or if our internal data analytics tools contain algorithmic or other technical errors, the operating data we report may not be accurate or comparable with prior periods. In addition, limitations, changes or errors with respect to how we measure operating data may affect our understanding of certain details of our business, which could affect our longer-term strategies.

If our operating metrics are not accurate representations of the reach or monetization of our offerings and network, if we discover material inaccuracies in our metrics or the operating data on which such metrics are based, or if we can no longer calculate any of our key operating metrics with a sufficient degree of accuracy and cannot find an adequate replacement for such metrics, our business, financial condition and results of operations could be adversely affected.

If we are unable to manage our inventory effectively, our results of operations could be adversely affected.

Our business requires us to manage a large volume of inventory effectively. We add a total of approximately 800 new apparel, footwear, accessories and fine jewelry to our sites in a typical week, and we depend on our forecasts of demand for and popularity of various products to make purchase decisions and to manage our inventory of SKUs. Demand for products, however, can change significantly between the time inventory is ordered and the date of sale. Demand may be affected by shifts in overall sale seasons, new product launches, rapid changes in product cycles and pricing, product defects, promotions, changes in customer spending patterns, changes in customer tastes with respect to the products we offer and other factors, and our customers may not purchase products in the quantities that we expect.

Seasonality in our business does not follow that of traditional retailers, such as typical concentration of net sales in the holiday quarter since our business is worldwide. Given shifts in overall sale seasons, it may be difficult to accurately forecast demand and determine appropriate levels of product. We generally do not have the right to return unsold products to our brand partners, and in the cases where we do have a right to return to vendor in exchange for a credit note, we remain subject to credit risk of our brand partners. If we fail to manage our inventory effectively or negotiate favorable credit and return to vendor terms with third-party suppliers, we may be subject to a heightened risk of inventory obsolescence, a decline in inventory values, and inventory write-downs or write-offs. In addition, if we are required to lower sale prices in order to reduce inventory levels, our profit margins might be negatively affected, and such price reductions may harm our relationships with our brand partners. Any of the above, including as a result of the COVID-19 pandemic or the economic uncertainty resulting from the war in Ukraine, may materially and adversely affect our business, financial condition and results of operations.

Increased merchandise returns above current levels could harm our business.

We allow our customers to return products, subject to our return policy. If the rate of merchandise returns increases significantly or if merchandise return economics become less efficient, our business, financial condition and results of operations could be harmed. Further, we modify our policies relating to returns from time to time, which may result in customer dissatisfaction or an increase in the number of product returns. From time to time, our products are damaged in transit, and any increase in the occurrence of such damages can increase return rates and harm our business.

19

Our ability to timely deliver merchandise to customers is currently dependent on a single distribution facility. If we suffer a loss of, or disruption in, our only distribution facility, our business and operations could be adversely affected.

Our ability to timely deliver merchandise to customers is dependent on a single distribution facility in Heimstetten and certain brand partners. Although we are building a new distribution facility and warehouse in Leipzig, we could be subject to disruptions in our fulfillment capacity as we begin to operate the Leipzig facility until we are able to optimize our procedures and processes and train the workforce. If we do not have sufficient fulfillment capacity, experience disruptions to order fulfillment or deliveries by our brand partners are not timely, our customers may experience delivery delays, which could harm our reputation and our relationship with our customers.

If we are unable to adequately staff our fulfillment center to meet demand or if the cost of such staffing is higher than historical or projected costs due to mandated wage increases, regulatory changes, international expansion or other factors, our results of operations could be harmed. In addition, operating and optimizing our fulfillment network comes with potential risks, such as workplace safety issues and employment claims for the failure or alleged failure to comply with labor laws or laws respecting union organizing activities. Any such issues may result in delays in shipping times or packing quality, and our reputation and results of operations may be harmed.

We have designed and built our own fulfillment infrastructure, which is tailored to meet the specific needs of our business. If we continue to add or change our fulfillment and warehouse capabilities, add new businesses or categories with different fulfillment requirements or change the mix of products that we sell, our fulfillment network will become increasingly complex, could be subject to workforce disruption risks and increase the challenges to sustain cost-effective operations. Failure to successfully address such challenges in a cost-effective and timely manner could impair our ability to timely deliver our customers’ purchases and could harm our reputation and ultimately, our business, financial condition and results of operations.

We expect that our current and projected capacity will support our near-term growth plans. Over the long term, we may be unable to locate suitable facilities on commercially acceptable terms in accordance with our expansion plans and to recruit qualified managerial and operational personnel to support our expansion plans. If we grow faster than we anticipate, we may exceed our fulfillment center capacity sooner than we anticipate, we may experience problems fulfilling orders in a timely manner or our customers may experience delays in receiving their purchases, and we would need to increase our capital expenditures more than anticipated. Many of the expenses and investments with respect to our fulfillment center are fixed, and any expansion of our fulfillment center infrastructure will require additional investment of capital. We expect to incur higher capital expenditures in the future for our fulfillment center operations in the future. We may incur such expenses or make such investments in advance of expected sales, and such expected sales may not occur. If we are unable to secure new facilities for the expansion of our fulfillment operations or to effectively control expansion-related expenses, our business, financial condition, results of operations and prospects could be adversely affected.

Our results of operations could be adversely affected by natural disasters, public health crises, political crises or other catastrophic events.

Natural disasters, unforeseen public health crises, political crises or other catastrophic events, whether occurring in the European Union or internationally, could disrupt our operations in any of our offices and logistics centers or the operations of one or more of our brand partners or other third parties we do business with. In particular, these types of events could impact our merchandise supply chain, including our ability to ship merchandise to customers from or to the impacted region, and could impact our ability or the ability of third parties to operate our sites and ship merchandise. In addition, these types of events could negatively impact customer spending in the impacted regions. To the extent any of these events occur, our business and results of operations could be adversely affected.

20

Any changes in our shipping arrangements or any interruptions in shipping could adversely affect our results of operations.