Our Approach

The acute inflammatory response occurs in a well-defined coordinated sequential response. Neutrophils are the first responders followed by monocytes. The monocytes, as they egress into tissue also follow another sequence of differentiation into tissue macrophages. The first are proinflammatory macrophages, followed by patrolling, reparative macrophages.

This complex, tightly coordinated process is critical for host defense and tissue repair but needs to be tightly regulated by the body’s inflammatory signaling and cellular apoptosis. If not, further tissue destruction may occur when uncontrolled hyperinflammation leads to degradative reparative processes with worsening tissue or organ function. If this excessive systemic inflammation is severe and prolonged, multi-organ failure, including cardiovascular, respiratory, kidney, liver and neurologic dysfunction may occur, resulting in poor clinical outcomes. Prior therapeutic approaches to block soluble mediator targets, such as a cytokines or free radicals have not proven successful. We believe that our SCD approach, which targets activated cells, is a potentially transformative, if not disruptive, therapeutic approach to a range of acute and chronic inflammatory disorders.

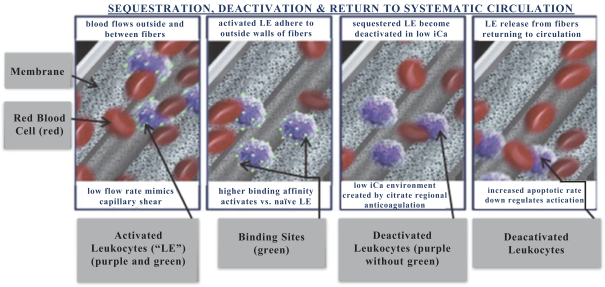

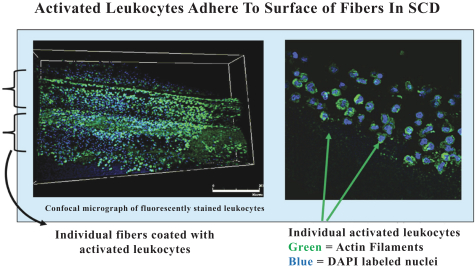

Our SCD is an extracorporeal synthetic membrane device designed to bind activated leukocytes (neutrophils and monocytes) as part of a CRRT extracorporeal circuit. When added to the circuit of a standard CRRT system (using regional citrate anticoagulation) immediately following a standard hemofilter cartridge, blood within the standard hemofilter cartridge enters our SCD and disperses among the fibers of the device. Upon exiting our SCD, the blood is returned to the patient’s body.

Our SCD delivers its therapeutic benefit by attenuating the excessive inflammatory response of activated neutrophils and monocytes. Uninterrupted, the excessive inflammatory response progresses to multi-organ failure (“MOF”), with documented increases in both morbidity and mortality in critically ill patients. Our initial lead product is focused on

critically-ill

AKI pediatric and adult patients on CRRT. Our SCD leverages the existing footprint of CRRT pump systems in ICUs today, as well as the growing use and adoption of regional citrate as an anticoagulant. A recent study in the Journal of the American Medical Association in 2020 demonstrated that while the use of regional citrate anticoagulation has the same mortality profile as heparin, regional citrate anticoagulation showed longer filter life compared to heparin. 161