REGISTRATION STATEMENT

As filed with the Securities and Exchange Commission on September 8, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

(State or Other Jurisdiction of |

(Primary Standard |

(I.R.S. Employer |

Incorporation or Organization) |

Industrial Classification Code Number) |

Identification No. |

(

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Chief Executive Officer

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Albert Lung, Esq. Morgan, Lewis & Bockius LLP 1400 Page Mill Road Palo Alto, California 94304 Tel: (650) 843-4000 |

Barry I. Grossman, Esq. |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 under the Securities Exchange Act of 1934:

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

☒ |

Smaller reporting company |

||

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter

become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION — DATED SEPTEMBER 8, 2023

PRELIMINARY PROSPECTUS

Up to ____ Units, Each Unit Consisting of One Share of Common Stock and One Common Warrant to Purchase One Share of Common Stock

Up to ____ Pre-Funded Units, Each Pre-Funded Unit Consisting of One Pre-Funded Warrant to Purchase One Share of Common Stock and One Common Warrant to Purchase One Share of Common Stock

Up to ____ Placement Agent Warrants to Purchase an Aggregate of Up To ____ Shares of Common Stock

Common Stock Underlying the Pre-Funded Warrants

Common Stock Underlying the Common Warrants

Common Stock Underlying the Placement Agent Warrants

We are offering on a best-efforts basis up to _________ units, each unit consisting of one share of our common stock, $0.0001 par value per share (the “Common Stock”), and one common warrant to purchase one share of the Common Stock (the "Common Warrant") pursuant to this prospectus. The assumed offering price is $_________ per unit, which is equal to the closing price of our Common Stock on the Nasdaq Capital Market, or Nasdaq, on _________, 2023. The Common Warrants included in the units will have an exercise price of $_________ per share, will be exercisable immediately upon issuance and will expire five (5) years from the date of issuance. We are also offering the shares of our Common Stock that are issuable from time to time upon the exercise of the Common Warrants included in the units.

We are also offering to certain purchasers whose purchase of units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded units, each pre-funded unit consisting of one pre-funded warrant (a "Pre-Funded Warrant") to purchase one share of Common Stock and one common warrant to purchase one share of Common Stock, in lieu of units that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock. The purchase price of each pre-funded unit will be equal to the price per unit being sold to the public in this offering, minus $0.0001, and the exercise price of each Pre-Funded Warrant included in the pre-funded units will be $0.0001 per share. The Pre-Funded Warrants will be exercisable immediately upon issuance and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. Each common warrant included in the pre-funded units has an exercise price of $_________ per share, will be exercisable immediately upon issuance and will expire five (5) years from the date of issuance. For each pre-funded unit we sell, the number of shares of Common Stock we are offering will be decreased on a one-for-one basis. This offering also relates to the shares of Common Stock issuable upon the exercise of the Pre-Funded Warrants and the Common Warrants included in the pre-funded units.

The units and the pre-funded units will not be certificated. The shares of Common Stock or Pre-Funded Warrants, as the case may be, and the Common Warrants included in the units or the pre-funded units, can only be purchased together in this offering, but the securities contained in the units or pre-funded units will be issued separately and will be immediately separable upon issuance.

The units will be offered at a fixed price and are expected to be issued in a single closing. There is no minimum number of units to be sold or minimum aggregate offering proceeds for this offering to close. We expect that this offering will end two trading days after we

first enter into a securities purchase agreement and we will deliver all securities issued in connection with this offering delivery versus payment/receipt versus payment upon our receipt of investor funds. Accordingly, neither we nor the Placement Agent (as defined below) have made any arrangements to place investor funds in an escrow account or trust account since the Placement Agent will not receive investor funds in connection with the sale of securities offered hereunder.

We have engaged Maxim Group LLC, or the placement agent or Maxim, to act as our exclusive Placement Agent in connection with this offering. The Placement Agent has agreed to use its best efforts to arrange for the sale of the securities offered by this prospectus. The Placement Agent is not purchasing or selling any of the securities we are offering and the Placement Agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. We have agreed to pay to the Placement Agent the Placement Agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. There is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum offering requirement as a condition of closing of this offering. We may sell fewer than all of the units and pre-funded units offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund if we do not sell all of the units and pre-funded units offered hereby. Because there is no escrow account and no minimum number of securities or amount of proceeds, investors could be in a position where they have invested in us, but we have not raised sufficient proceeds in this offering to adequately fund the intended uses of the proceeds as described in this prospectus. See “Risk Factors” on page ____ of this prospectus. We will bear all costs associated with the offering. See “Plan of Distribution” on page ____ of this prospectus for more information regarding these arrangements.

Our Common Stock and warrants exercisable for one share of Common Stock (the “Listed Warrants”) for $11.50 per share (which warrants are not being offered for sale pursuant to this prospectus) are listed on The Nasdaq Capital Market, or Nasdaq, under the symbols, “ICU” and “ICUCW,” respectively. On August 31, 2023, the last reported sale price of our shares of Common Stock, as reported on the Nasdaq Capital Market, was $0.26 per share. The public offering price per unit or pre-funded unit, as the case may be, will be determined through negotiation among us, the Placement Agent and the investors in the offering based on market conditions at the time of pricing, and may be at a discount to the current market price of our Common Stock. Therefore, the recent market price used throughout this prospectus may not be indicative of the final offering price. There is no established trading market for the Pre-Funded Warrants or the Common Warrants, and we do not expect a market to develop. We do not intend to apply for a listing of the Pre-Funded Warrants or the Common Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants and the Common Warrants will be limited.

We are an “emerging growth company” under federal securities laws and are subject to reduced public company reporting requirements. Investing in our Common Stock or Listed Warrants involves a high degree of risk. See the section titled “Risk Factors” beginning on page ____ of this prospectus to read about factors you should consider before buying our securities.

|

|

Per Unit(1) |

|

|

Total |

|

Public offering price |

|

$ |

— |

|

|

|

Placement agent fees ( %) |

|

$ |

— |

|

|

|

Proceeds to us (before expenses) |

|

$ |

— |

|

|

|

Delivery of the securities offered hereby is expected to be made on or about , 2023, subject to satisfaction of customary closing conditions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

MAXIM GROUP LLC

The date of this prospectus is , 2023.

Table of Contents

|

ii |

|

|

iii |

|

|

1 |

|

|

3 |

|

|

6 |

|

|

34 |

|

|

35 |

|

|

36 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

38 |

|

47 |

|

|

51 |

|

|

74 |

|

|

80 |

|

|

87 |

|

|

92 |

|

|

94 |

|

|

99 |

|

|

103 |

|

|

108 |

|

|

108 |

|

|

108 |

|

|

F-1 |

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any prospectuses supplement prepared by or on behalf of us or to which we have referred you. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the units, the pre-funded units and the shares of Common Stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any prospectus supplement is current only as of its date, regardless of its time of delivery or any sale of our units, the pre-funded units and the shares of Common Stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States: we have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our units, the pre-funded units and the shares of Common Stock and the distribution of this prospectus outside of the United States.

ABOUT THIS PROSPECTUS

We have not, and the Placement Agent has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains statistical data and estimates, including those relating to market size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions have been verified by any independent source.

For investors outside the United States: We have not, and the Placement Agent has not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United States.

This prospectus contain references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

Unless the context indicates otherwise, references to the “Company,” “we,” “us” and “our” refer to the business of SeaStar Medical Holding Corporation, a Delaware corporation, and its consolidated subsidiaries following the Business Combination. “LMAO” refers to LMF Acquisition Opportunities, Inc. prior to the Business Combination.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and any accompanying prospectus supplement may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management. Although the Company believes that its plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning the Company’s possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements. In some instances, these statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or the negatives of these terms or variations of them or similar terminology.

Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should understand that the following important factors, among others, could affect the Company’s future results and could cause those results or other outcomes to differ materially from those expressed or implied in the Company’s forward-looking statements:

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this prospectus are more fully described in the “Risk Factors” section. The risks described in “Risk Factors” are not exhaustive. New risk factors emerge from time to time and it is not possible for us to predict all such risk factors, nor can the Company assess the impact of all such risk factors on its business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. The Company undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

iii

SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus and, the registration statement of which this prospectus is a part carefully, including the information set forth under the heading “Risk Factors” and our financial statements.

Business Summary

Company Overview

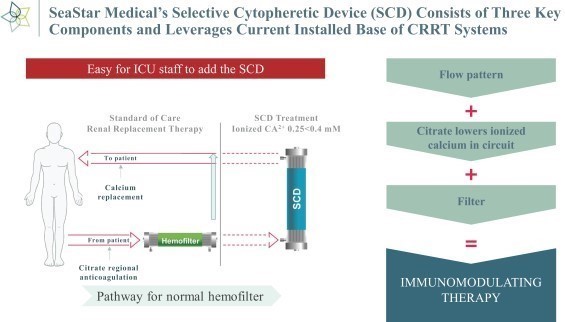

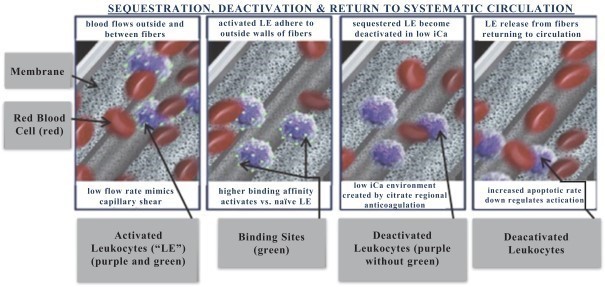

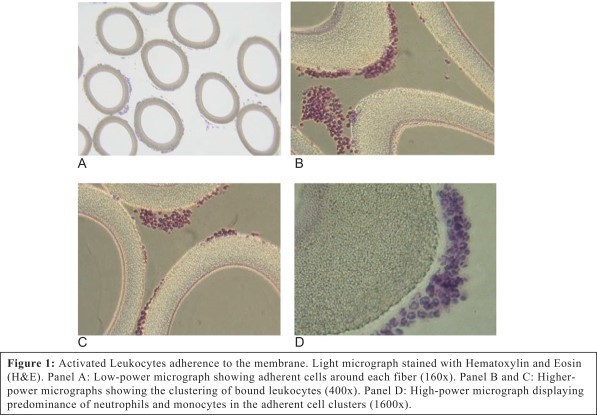

We are a medical technology company focused primarily on developing and commercializing our lead product candidate, the Selective Cytopheretic Device (“SCD”), for pediatric and adult acute kidney injury (“AKI”) indications. We submitted an application for a Humanitarian Device Exemption (“HDE”) for SCD in June 2022 for the treatment of pediatric patients with AKI on continuous renal replacement therapy (“CRRT”). In a letter from the FDA, the FDA indicated that the application is not approvable in its current form but outlined specific guidance as to how the application may be amended and resubmitted successfully. We are currently working with the FDA to address these issues. Assuming we are able to address all of the FDA’s concerns, we are targeting approval of the HDE by the end of 2023. While the Company believes that each of the current deficiencies cited by CBER in their letter are readily addressable, there is no guarantee that the Company will be able to fully address these deficiencies to obtain approval in a timely or at all. In addition, we have enrolled the first patient in the pivotal trial of SCD for adult patients with AKI on CRRT based on a previously approved investigative device exemption (“IDE”) protocol. The SCD received a Breakthrough Device Designation from the U.S. Food and Drug Administration (“FDA”) on April 29, 2022 for the proposed use in the treatment of immunomodulatory dysregulation in adult patients who are 18 years and older with AKI. We began enrollment of adult patients in June 2023 and expect to generate interim study results by mid-2024 and topline study results and submission of a Pre-market Approval (“PMA”) application by the end of 2024, and we are targeting FDA approval by the end of 2025. There is no guarantee that we will complete the AKI adult trial in a timely manner, or at all, nor will there be any assurance that positive data will be generated from such trial. Even if we are able to generate positive results from this trial, the FDA and other regulatory agencies may require us to conduct additional trials to support the study or disagree with the design of the trial and request changes or improvements to such design. To date, we have not obtained regulatory approval to commercialize or sell any of our products candidates.

On October 18, 2022, we completed a business combination with LMAO, pursuant to that certain Agreement and Plan of Merger, dated as of April 21, 2022 (the “Merger Agreement”), by and among LMAO, LMF Merger Sub, Inc., a Delaware corporation and direct wholly-owned subsidiary of LMAO (“Merger Sub”), and SeaStar Medical, Inc., a Delaware corporation (“SeaStar Medical, Inc.”). As contemplated by the Merger Agreement, SeaStar Medical, Inc. merged with and into Merger Sub, with SeaStar Medical, Inc. continuing as the surviving entity in the merger as a wholly-owned subsidiary of LMAO (the “Business Combination”). In connection with the closing of the Business Combination (the “Closing”), LMAO changed its name to “SeaStar Medical Holding Corporation” (the “Company” or “SeaStar Medical”).

Corporate Information

Our principal executive offices are located at 3513 Brighton Boulevard, Suite #410, Denver, Colorado 80216, and our phone number is 844-427-8100.

Summary of Risks

You should consider all the information contained in this prospectus before investing in our securities. These risks are discussed more fully in the section titled “Risk Factors”. If any of these risks actually occur, our business, financial condition or results of operations would likely be materially adversely affected. These risks include, but are not limited to, the following:

Risks Related to the Company’s Financial Condition

1

Risks Related to the Company’s Business Operations

Risks Related to the Company’s Intellectual Property

2

Risks Related to this Offering

available to purchasers that purchase without the benefit of a securities purchase agreement.

have no rights as common stockholders with respect to the shares of our Common Stock underlying the warrants until

such holders exercise their warrants and acquire our Common Stock, except as otherwise provided in the Pre-Funded

Warrants, Placement Agent Warrants, and the Common Warrants.

Risks Related to Being a Public Company

THE OFFERING

Units to be Offered |

Up to _________ units, each unit consisting of one share of Common Stock and one Common Warrant to purchase one share of Common Stock. |

|

|

Description of Warrants |

Each Common Warrant will have an exercise price of $_________ per share, will be immediately exercisable upon issuance and will expire on the five (5) year anniversary of the original issuance date. This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Common Warrants. |

|

|

Pre-funded Units to be Offered |

We are also offering to certain purchasers whose purchase of units in this offering would otherwise result in the purchaser, together with its affiliates, beneficially owning more than 4.99% of our outstanding Common Stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, pre-funded units, each pre-funded unit consisting of one Pre-Funded Warrant to purchase one share of Common Stock and one common warrant to purchase one share of Common Stock, in lieu of units that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock. The purchase price of each pre-funded unit will equal the price per unit being sold to the public in this offering, minus $0.0001, and the exercise price of each Pre-Funded Warrant will be $0.0001 per share of Common Stock. The Pre-Funded Warrants will be exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each pre-funded unit we sell, the number of units we are offering will be decreased on a one-for-one basis. This offering also relates to the shares of Common Stock issuable upon the exercise of any Pre-Funded Warrants or Common Warrants comprising the pre-funded unit sold in this offering. |

3

Placement Agent Warrants |

We have agreed to issue to the Placement Agent warrants to purchase a number of shares of Common Stock equal to _________% of the total number of securities being sold in this offering (the "Placement Agent Warrants"). The Placement Agent’s Warrants will be exercisable immediately, and from time to time, in whole or in part, from the date of closing. The Placement Agent Warrants will be exercisable at a price per share equal to _________% of the exercise price of the Common Warrants. We are also registering the shares of Common Stock issuable upon the exercise of the Placement Agent Warrants. The shares underlying the Placement Agent Warrants cannot be sold during the 180 day period commencing on the date of closing. |

Common Stock Outstanding before this Offering |

19,445,971 shares |

|

|

Common Stock Outstanding after this Offering |

Up to _________ shares (assuming the sale of the maximum number of units covered by this prospectus, no sale of pre-funded units and no exercise of the Common Warrants or Placement Agent Warrants issued in this offering). |

|

|

Offering Price |

The assumed offering price is $_________ per unit and $_________ per pre-funded unit. |

|

|

Use of Proceeds |

Assuming the maximum number of units are sold in this offering at an assumed public offering price of $_________ per unit, the net proceeds from our sale of units in this offering will be approximately $_________, after deducting the Placement Agent fees and estimated offering expenses payable by us and assuming no sale of any pre-funded units offered in this offering. We plan to use the net proceeds of this offering for working capital and general corporate purposes. See “Use of Proceeds.” |

|

|

Risk Factors |

Investing in our securities involves a high degree of risk. See the section titled “Risk Factors” of this prospectus for a discussion of factors you should carefully consider before investing in our securities. |

|

|

Nasdaq Ticker-Symbol |

Our Common Stock and Listed Warrants (which warrants are not being offered for sale pursuant to this prospectus) are listed on The Nasdaq Capital Market, or Nasdaq, under the symbols, “ICU” and “ICUCW,” respectively. There is no established trading market for the Common Warrants or the Pre-Funded Warrants, and we do not expect a trading market to develop. We do not intend to list the Common Warrants or the Pre-Funded Warrants on any securities exchange or other trading market. Without a trading market, the liquidity of the Common Warrants and the Pre-Funded Warrants will be extremely limited. |

|

|

Best Efforts Offering |

We have agreed to offer and sell the securities offered hereby to the purchasers through the Placement Agent. The Placement Agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page __ of this prospectus. |

The above discussion is based on 19,445,971 shares of our Common Stock outstanding as of August 15, 2023, and excludes, as of that date, the following:

4

5

RISK FACTORS

Investing in our securities involves risks. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the specific risks set forth herein. If any of these risks actually occur, it may materially harm our business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and you could lose all or part of your investment. Additionally, the risks and uncertainties described in this prospectus and any prospectus supplement are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business.

Risks Related to the Company’s Financial Condition

The Company has incurred significant losses since its inception and anticipates that it will continue to incur significant losses for the foreseeable future.

The Company is a medical technology company focused primarily on developing and commercializing its lead product candidate, the SCD, for pediatric and adult AKI indications. The Company has submitted an HDE application with the FDA for pediatric patients with AKI on CRRT. In addition, on February 9, 2023, the Company received approval from the FDA of its IDE application to conduct a pivotal study evaluating the effectiveness of its SCD in reducing hyperinflammation in adults with AKI requiring CRRT. The Company began enrollment in June 2023 and expects to generate interim study results by mid-2024 and topline study results and submission of a PMA application by the end of 2024, and the Company is targeting FDA approval by the end of 2025. However, there is no guarantee that the Company will complete any planned clinical trial in a timely manner, or at all, nor will there be any assurance that positive data will be generated from such trial. Even if the Company is able to generate positive results from this trial, the FDA and other regulatory agencies may require the Company to conduct additional trials to support the study or disagree with the design of the trial and request changes or improvements to such design.

The Company recently announced that it has received a letter from the Center for Biologics Evaluation and Research of the FDA (“CBER”) regarding the Company’s HDE application for its pediatric SCD program. In the letter, the FDA indicated that the

application is not approvable in its current form but outlined specific guidance as to how the application may be amended and

resubmitted successfully. We are currently working with the FDA and our partners to address the issues raised by the FDA. Assuming we are able to address all of the FDA's concerns, we are targeting approval of the HDE by the end of 2023. While the Company believes that each of the current deficiencies cited by CBER in their letter are readily addressable, there is no guarantee that the Company will be able to fully address these deficiencies to obtain approval in a timely manner, or at all. In addition, even if the Company is able to comply with the guidance provided by the FDA and address the deficiencies, the Company may be required to make significant or material changes to the device structure and process of implement of SCD, and such changes may render the device less effective or require additional testing or trial to confirm effectiveness, which will increase the cost of our operations significantly. Our failure to address the FDA’s concerns will adversely affect the Company’s business operations and financial conditions.

To date, the Company has not obtained regulatory approval to commercialize or sell any of its SCD product candidates, and it does not expect to generate any significant revenue for the foreseeable future. SeaStar Medical has incurred significant net losses since its inception and had an accumulated deficit of $99.3 million and, $76.3 million as of December 31, 2022 and 2021, respectively.

The Company has devoted most of its financial resources to research and development, including clinical trials and non-clinical development activities, and to obtain regulatory approval of its SCD product candidates. Since the completion of the Business Combination, the Company relied primarily on the sales of securities to fund its operations and are limited as the Company needs to meet certain conditions before such funding becomes available. The size of its future net losses will depend, in part, on the rate of future expenditures and its ability to generate revenues. To date, none of its product candidates have generated significant revenue, and if its product candidates are not successfully developed or commercialized, or if revenues are insufficient following marketing approval, it will not achieve profitability and its business may fail. Even if the Company successfully obtains regulatory approval to market its product candidates in the United States, its revenues are also dependent upon the size of the markets outside of the United States, regulatory approval outside of the United States, and its ability to obtain market approval and achieve commercial success.

The Company expects to continue to incur substantial and increased expenses as it expands research and development activities and advances clinical programs through the regulatory approval process. The Company also expects an increase in its expenses associated with preparing for the potential commercialization of its products and creating additional infrastructure to support operations as a public company. As a result of the foregoing, it expects to continue to incur significant and increasing losses and negative cash flows for the foreseeable future.

The Company has not generated any significant revenue and may never be profitable.

6

The Company’s ability to generate revenue and achieve profitability depends on its ability, alone or with collaborators, to successfully complete the development, obtain the necessary regulatory approvals of and commercialize its lead product candidate, the SCD. It does not anticipate generating revenues from its product candidates’ sales for the foreseeable future. Its ability to generate future revenues from product sales depends heavily on its success with the following items:

Because of the numerous risks and uncertainties associated with medical device product development, the Company is unable to predict the timing or amount of increased expenses, when, or if, it will be able to achieve or maintain profitability. In addition, its expenses could increase beyond expectations if it is required by the FDA to perform additional, unanticipated studies.

Even if its product candidates are approved for commercial sale, the Company anticipates incurring significant costs associated with commercializing any approved product candidate. In the case of its SCD product candidate for the treatment of pediatric AKI, even if the Company receives approval from the FDA for its HDE application, the Company will be limited in its ability to sell and distribute its SCD units due to certain restrictions under the HDE requirements that limit the number of units that can be sold on an annual basis, which will further limit the amount of revenue that could be generated by the Company. Even if it is able to generate revenues from the sale of its products, the Company may not become profitable and may need to obtain additional funding to continue operations.

The Company has a limited operating history, which makes it difficult to forecast its future results of operations.

The Company has not received approval from the FDA and other regulatory authorities to sell its SCD product candidates and therefore it has a limited commercial operating history. Accordingly, the Company’s ability to accurately forecast future results of its operations is limited and subject to a number of uncertainties and risks, including its ability to plan for and model future growth. If the Company receives regulatory approval to market and sell its SCD product candidates, its revenue growth could slow in the future, or its revenue could decline or fluctuate for a number of reasons, including slowing demand for its products, increasing competition, changing demand in the markets, new scientific or technological developments, a decrease in the growth of its overall market, its failure to attract more customers, the inability to obtain reimbursement for its products by government agencies and insurers, or its failure, for any reason, to continue to take advantage of growth opportunities. If its assumptions regarding these risks and uncertainties and its future revenue growth are incorrect or change, or if it does not address these risks successfully or forecast its results accurately, the Company’s operating and financial results could differ materially from its expectations, and its business could suffer.

If the Company fails to obtain additional financing, it would be forced to delay, reduce or eliminate its product development program, which may result in the cessation of its operations.

Developing medical device products, including conducting preclinical studies and clinical trials, is expensive. The Company expects its research and development expenses to substantially increase in connection with its ongoing activities, particularly as it advances its clinical programs. As of June 30, 2023 and December 31, 2022, the Company had negative working capital of $(11.4) million and $2.3 million, respectively. The Company currently does not have sufficient capital to support its operations and complete its planned regulatory approval process. The Company will need to secure additional capital to continue its operation, and such funding may not be available on acceptable terms, or at all. In addition, the Company incurred a significant amount of debt, including the issuance of unsecured and secured promissory notes to LM Funding America, Inc. (“LMFA”), LMFAO Sponsor (the "Sponsor"), Maxim ("Maxim”), and convertible notes to 3i LP, an affiliate of Tumim Stone Capital ("Tumim"), and the Company may not have sufficient funds to repay these loans. Even if the Company obtains additional funding, the Company will be required to make certain mandatory payments under such promissory notes, which will reduce the amount of proceeds available for the Company to operate its business.

On August 23, 2022, LMAO and SeaStar Medical, Inc. entered into a Common Stock Purchase Agreement (the “Purchase Agreement”) with Tumim for the purchase of up to $100.0 million in shares of the Common Stock after the consummation of the Business Combination. There are certain conditions and limitations on the Company’s ability to utilize the $100.0 million equity line with Tumim. The Company will be required to satisfy various conditions, which include, among others: (1) delivery of a compliance certificate; (2) filing of an initial registration statement; and (3) customary bring-down opinions and negative assurances, in order to commence the

7

selling of Common Stock to Tumim under the Purchase Agreement. Once such conditions are satisfied, Tumim’s purchases are subject to various restrictions and other limitations, including a cap on the number of shares of Common Stock that we can sell based on the trading volume of our Common Stock, as well as certain beneficial ownership restrictions of Tumim. If any of these conditions are not satisfied or limitations are in effect, the Company may not be able to utilize all or part of the Tumim equity line, which would have an adverse impact on the Company’s ability to satisfy its capital needs and could have a material adverse impact on its business. The Company has received a total of $1.9 million from the Purchase Agreement through June 30, 2023. However, this source of capital may be limited since it depends substantially on the trading volume and price of our Common Stock.

On March 15, 2023, the Company entered into a Securities Purchase Agreement, dated as of March 15, 2023 (the "Securities Purchase Agreement") with an institutional investor, 3i, LP (the “Lender” or "3i"), whereby the Company agreed to issue a series of four senior unsecured convertible notes, with principal amounts totaling up to $9.8 million, and warrants to purchase shares of the Company’s Common Stock. On March 15, 2023, the Company issued the first senior unsecured convertible note in the amount of $3.3 million and warrants to purchase 328,352 shares of Common Stock. On May 12, 2023, the Company issued the second senior unsecured convertible note in the amount of $2.2 million and warrants to purchase 218,901 shares of Common Stock. At each of the third and fourth closings, the Company may, at its option, issue and sell to the Lender (i) additional convertible notes (the “Notes”), each in a principal amount of $2.2 million and (ii) additional warrants to purchase shares of Common Stock equal to 25% of the shares issuable upon conversion of the Notes on the applicable closing date. On August 7, 2023, the Company entered into an amendment to the Securities Purchase Agreement, whereby the provisions of the third closing are amended. The institutional investor shall have the discretion to purchase additional shares of the Company Common Stock in an aggregate principal amount of $2.0 million, provided that institutional investor will purchase additional shares of the Company Common Stock in an aggregate principal amount of $1.0 million in two tranches no later than September 5, 2023. On August 7, 2023, the Company issued a note, convertible into shares of Common Stock at an initial conversion price of $0.20, in a principal amount of $0.5 million, and a warrant to purchase up to 738,791 shares of Common Stock. However, there is no guarantee that the Company will be able to satisfy the conditions required to issue additional notes under the remaining tranches, including the requirement to obtain stockholder approval of such financing at the next annual meeting of stockholders. In addition, because some of the outstanding notes of the Company with Maxim, LMFA, and Sponsor include mandatory prepayment provisions, the Company may be required to use a portion of the proceeds from the Convertible Note Financing to repay such notes, unless the Company can obtain a waiver from holders of such notes, and there is no guarantee that such waivers will be obtained. Even if the Company receives sufficient capital in the future, the Company will be required to raise additional funds to support its own operations and complete its planned regulatory approval process, and such funding may not be available in sufficient amounts or on acceptable terms to the Company, or at all. If it is unable to raise additional capital when required or on acceptable terms, the Company may be required to:

If it is unable to raise additional capital in sufficient amounts or on acceptable terms, the Company will be prevented from pursuing development and commercialization efforts, including completing the clinical trials and regulatory approval process for its SCD product candidates, which would have a material adverse impact on its business, results of operations, and financial condition.

The Company’s ability to use its net operating losses to offset future taxable income may be subject to certain limitations.

As of December 31, 2022, the Company had net operating loss (“NOL”) carryforwards for federal and state (Colorado, California, and Florida) income tax purposes of $82.3 million and $28.9 million, respectively, which may be available to offset taxable income in the future. Under the Tax Cuts and Jobs Act of 2017, as modified by the Coronavirus Aid, Relief, and Economic Security Act, federal NOLs incurred in tax years beginning after December 31, 2017 may be carried forward indefinitely, but the deductibility of such federal net operating losses in tax years beginning after December 31, 2020, is limited to 80 percent of taxable income. Federal NOLs incurred before 2018 may be carried forward 20 years but are not subject to the taxable income limitation. Under current law, California NOLs generally may be carried forward 20 years (with a limited extension for California NOLs incurred in 2020-2021) without a taxable income limitation. The Company’s federal NOLs include $29.4 million that can also be carried forward indefinitely, and the remaining $52.8 million of federal NOLs expire in various years beginning in 2027 for federal purposes. The California NOLs expire beginning in 2039 if not utilized. A lack of future taxable income would adversely affect the Company’s ability to utilize these NOLs before they expire.

In general, under Section 382 of the Internal Revenue Code of 1986, as amended, or the Code, a corporation that undergoes an “ownership change” (as defined in Section 382 of the Code and applicable Treasury Regulations) is subject to limitations on its ability to utilize its pre-change NOLs to offset future taxable income. The Company may experience a future ownership change under Section

8

382 of the Code that could affect its ability to utilize the NOLs to offset its income. The Company has not completed an ownership change analysis pursuant to IRC Section 382. If ownership changes within the meaning of IRC Section 382 are identified as having occurred, the amount of NOL and research tax credit carryforwards available to offset future taxable income and income tax liabilities in future years may be significantly restricted or eliminated. Further, deferred tax assets associated with such NOLs, and research tax credits could be significantly reduced upon realization of an ownership change within the meaning of IRC Section 382. Furthermore, the Company’s ability to utilize NOLs of companies that it may acquire in the future may be subject to limitations. There is also a risk that due to legislative or regulatory changes, such as suspensions on the use of NOLs or other unforeseen reasons, the Company’s existing NOLs could expire or otherwise be unavailable to reduce future income tax liabilities, including for state tax purposes. For these reasons, the Company may not be able to utilize a material portion of the NOLs reflected on its balance sheet, even if it attains profitability, which could potentially result in increased future tax liability to the Company and could adversely affect its business, results of operations and financial condition.

Risks Related to the Company’s Business Operations

The Company has not received, and may never receive, approval from the FDA to market its product in the United States or abroad.

The Company may encounter various challenges and difficulties in its application to seek approval from the FDA to sell and market its SCD product candidates, including the application for HDE for pediatric AKI indication and the pivotal trial for adult AKI indication.

The Company is required to submit a substantial amount of supporting documentation for its HDE application to demonstrate the eligibility of the SCD to treat pediatric patients. The Company recently announced that it has received a letter from CBER regarding the Company’s HDE application for its pediatric SCD program. In the letter, the FDA indicated that the application is not approvable in its current form but outlined specific guidance as to how the application may be amended and resubmitted successfully. While the Company believes that each of the current deficiencies cited by CBER in their letter are readily addressable, there is no guarantee that the Company will be able to fully address these deficiencies to obtain approval in a timely manner, or at all. In addition, even if the Company is able to comply with the guidance provided by the FDA and address the deficiencies, the Company may be required to make significant or material changes to the device structure and process of implement of SCD, and such changes may render the device less effective or require additional testing or trial to confirm effectiveness, which will increase the cost of our operations significantly. Our failure to address the FDA’s concerns will adversely affect the Company’s business operations and financial conditions.

While the Company recently obtained approval from the FDA to conduct the AKI adult pivotal trial for SCE, there is no guarantee that the Company will be able to complete such trial in a timely manner, or at all, nor will there be any assurance that positive data will be generated from such trials. Even if the Company is able to generate positive results from this trial, the FDA and other regulatory agencies may require the Company to conduct additional trials to support the study or disagree with the design of the trial and request changes or improvements to such design. The Company is also subject to numerous other risks relating to the regulatory approval process, which include but are not limited to:

Even if the Company obtains approval, the FDA or other regulatory authorities may require expensive or burdensome post-market testing or controls. Any delay in, or failure to receive or maintain, clearance or approval for its future products could prevent the Company from generating revenue from these products or achieving profitability. Additionally, the FDA and other regulatory authorities have broad enforcement powers. Regulatory enforcement or inquiries, or other increased scrutiny on the Company, could dissuade some physicians from using its products and adversely affect its reputation and the perceived safety and efficacy of its products.

Delays or rejections may occur based on changes in governmental policies for medical devices during the period of product development. The FDA can delay, limit or deny approval of a PMA application for many reasons, including:

9

If the Company is not able to obtain regulatory approval of its SCD in a timely manner or at all, it may not be able to continue to operate its business and may be forced to shut down its operations.

The Company is subject to certain risks relating to pursuing an FDA approval via the HDE pathway, including limitations on the ability to profit from sales of the product.

Except in certain circumstances, products approved under an HDE cannot be sold for an amount that exceeds the costs of the research and development, fabrication, and distribution of the device (i.e., for profit). Currently, under section 520(m)(6)(A)(i) of the Food, Drug, and Cosmetic Act, as amended (the “FD&C Act”) by the Food and Drug Administration Safety and Innovation Act, a Humanitarian Use Device (“HUD”) is only eligible to be sold for profit after receiving HDE approval if the device (1) is intended for the treatment or diagnosis of a disease or condition that occurs in pediatric patients or in a pediatric subpopulation, and such device is labeled for use in pediatric patients or in a pediatric subpopulation in which the disease or condition occurs; or (2) is intended for the treatment or diagnosis of a disease or condition that does not occur in pediatric patients or that occurs in pediatric patients in such numbers that the development of the device for such patients is impossible, highly impracticable, or unsafe. If an HDE-approved device does not meet this eligibility criteria, the device cannot be sold for profit. With enactment of the FDA Reauthorization Act of 2017, Congress provided that the exemption for the HUD/HDE profitability is available as long as the request for an exemption is submitted on or before October 1, 2022. Not receiving an exemption for the HUD/HDE profitability would have a material adverse effect on the Company’s business, results of operations and financial condition.

In addition, if the FDA subsequently approves a PMA or clears a 510(k) for the HUD or another comparable device with the same indication, the FDA may withdraw the HDE. Once a comparable device becomes legally marketed through PMA approval or 510(k) clearance to treat or diagnose the disease or condition in question, there may no longer be a need for the HUD and so the HUD may no longer meet the requirements of section 520(m)(2)(B) of the FD&C Act.

The Company plans to expand its operations and it may not be able to manage its growth effectively, which could strain its resources and delay or derail implementation of its business objectives.

The Company will need to significantly expand its operations to implement its longer-term business plan and growth strategies, including building and expanding its internal organizational infrastructure to complete the regulatory approval process with the FDA. The Company will also be required to manage and form new relationships with various strategic partners, technology licensors, customers, manufacturers and suppliers, consultants and other third parties. This expansion and these new relationships will require the Company to significantly improve or replace its existing managerial, operational, and financial systems, and procedures and controls; to improve the coordination between its various corporate functions; and to manage, train, motivate and maintain a growing employee base. The time and costs to effectuate these steps may place a significant strain on its management personnel, systems and resources, particularly if there are limited financial resources and skilled employees available at the time. The Company cannot assure that it will institute, in a timely manner or at all, the improvements to its managerial, operational, and financial systems, procedures and controls necessary to support its anticipated increased levels of operations and to coordinate its various corporate functions, or that it will be able to properly manage, train, motivate and retain its anticipated increased employee base. If it cannot manage its growth initiatives, the Company will be unable to commercialize its products on a large-scale in a timely manner, if at all, and its business could fail.

The Company will initially depend on revenue generated from a single product and in the foreseeable future will be significantly dependent on a limited number of products.

If the Company receives approval from the FDA and other regulatory authorities, the Company will initially depend on revenue generated from its SCD product candidate for pediatric and adult patients with AKI and in the foreseeable future will be significantly dependent on a single or limited number of products. Given that, for the foreseeable future, the Company’s business will depend on a single or limited number of products, to the extent a particular product is not well-received by the market, the Company’s sales volume, prospects, business, results of operations and financial condition could be materially and adversely affected.

10

If the Company fails to comply with extensive regulations of United States and foreign regulatory agencies, the commercialization of its products could be delayed or prevented entirely.

The Company’s SCD product candidate and research and development activities are subject to extensive government regulations related to its development, testing, manufacturing and commercialization in the United States and other countries. The determination of when and whether a product is ready for large-scale purchase and potential use in the United States will be made by the United States government through consultation with a number of governmental agencies, including the FDA, the National Institutes of Health and the Centers for Disease Control and Prevention. The Company’s SCD has not received regulatory approval from the FDA, or any foreign regulatory agencies, to be commercially marketed and sold. The process of obtaining and complying with FDA and other governmental regulatory approvals and regulations in the United States and in foreign countries is costly, time consuming, uncertain and subject to unanticipated delays. Obtaining such regulatory approvals, if any, can take several years. Despite the time and expense exerted, regulatory approval is never guaranteed. The Company is also subject to the following risks and obligations, among others:

Failure to comply with these or other regulatory requirements of the FDA may subject the Company to administrative or judicially imposed sanctions, including:

Delays in successfully completing the Company’s planned clinical trials could jeopardize its ability to obtain regulatory approval.

The Company’s business prospects will depend on its ability to complete studies, clinical trials, including its planned pivotal trials of its SCD for adult AKI indication, obtain satisfactory results, obtain required regulatory approvals, and successfully commercialize its SCD product candidate. The completion of the Company’s clinical trials, the announcement of results of the trials and its ability to obtain regulatory approvals could be delayed for a variety of reasons, including:

The Company’s development costs will increase if it has material delays in any clinical trial or if it needs to perform more or larger clinical trials than planned. If the delays are significant, or if any of its product candidates do not prove to be safe or effective or do not receive regulatory approvals, the Company’s financial results and the commercial prospects for its product candidates would be harmed. Furthermore, the Company’s inability to complete its clinical trials in a timely manner could jeopardize its ability to obtain regulatory approval.

11

Delays, interruptions, or the cessation of production by its third-party suppliers of important materials or delays in qualifying new materials, may prevent or delay the Company’s ability to manufacture or process its SCD device.

The Company currently relies on a single supplier for the filters used in the SCD device for the pediatric AKI indications pursuant to a supply agreement. In the event the current supplier is unable to provide filters for the SCD device or otherwise fails to meet its obligations under the agreement, the Company may not be able to obtain a sufficient number of filters to conduct its trials and commercialize its products. In addition, the supplier may decide to discontinue or terminate the specific type of filters that are required for its SCD for reasons beyond the Company’s control, in which case the Company will be forced to identify and secure an alternative source that may not be available immediately or at all. FDA review and approval of a new supplier may be required if these materials become unavailable from the Company’s current suppliers. Although there may be other suppliers that have equivalent materials that would be available to the Company, FDA review of any alternate suppliers, if required, could take several months or more to obtain, if it is able to be obtained at all. Any delay, interruption, or cessation of production by the Company’s third-party suppliers of important materials, or any delay in qualifying new materials, if necessary, would prevent or delay the Company’s ability to manufacture its SCD.

The Company believes that it has sufficient access to the SCD inventory to conduct its current and near future clinical trials, but it is possible that the need for its SCD could increase that may require the Company to acquire more filters than it is currently able to purchase under its agreement with its supplier, and the Company may not be able to negotiate a new supply agreement successfully. If the Company is unable to find alternative sources of supply in a timely manner, any such delay could limit the Company’s ability to meet demand for the SCD and delay its ongoing clinical trials, which would have a material adverse impact on its business, results of operations and financial condition.

The Company has limited experience in identifying and working with large-scale contracts with medical device manufacturers.

To achieve the levels of production necessary to commercialize its SCD and any other future products, the Company will need to secure large-scale manufacturing agreements with contract manufacturers that comply with the manufacturing standards prescribed by various federal, state, and local regulatory agencies in the United States and any other country of use. The Company has limited experience coordinating and overseeing the manufacturing of medical device products on a large-scale. Manufacturing and control problems could arise as the Company attempts to commercialize its products and manufacturing may not be completed in a timely manner or at a commercially reasonable cost. In addition, the Company may not be able to adequately finance the manufacturing and distribution of its products on terms acceptable to the Company, if at all. If the Company cannot successfully oversee and finance the manufacturing of its products after receiving regulatory approval, it may not generate sufficient revenue to become profitable.

Difficulties in manufacturing the Company’s SCD could have an adverse effect upon its revenue and expenses.

The Company currently outsources all of the manufacturing of its SCD. The manufacturing of its SCD is difficult and complex. To support its current clinical trial needs, the Company complies with and intends to continue to comply with current Good Manufacturing Practice (“cGMP”) in the manufacturing of its products. The Company’s ability to adequately manufacture and supply its SCD in a timely matter is dependent on the uninterrupted and efficient operation of its third-party manufacturers, and those of the third parties producing raw materials and supplies upon which it relies on for the manufacturing of its products. The manufacturing of the Company’s products may be impacted by:

If efficient manufacture and supply of its SCD is interrupted, the Company may experience delayed shipments or supply constraints. If it is at any time unable to provide an uninterrupted supply of its products, the Company’s ongoing clinical trials may be delayed, which could materially and adversely affect its business, results of operations and financial condition.

12

The Company’s SCD technology may become obsolete.

The Company’s SCD product candidates may become obsolete prior to commercialization by new scientific or technological developments, or by others with new treatment modalities that are more efficacious and/or more economical than the Company’s products. Any one of the Company’s competitors could develop a more effective product which would render the Company’s technology obsolete. In addition, it is possible that competitors may use similar technologies, equipment or devices, including using certain “off-the-shelf” filters unauthorized by the FDA, to attempt to create a similar treatment mechanism as the SCD. Further, new technological and scientific developments within the hospital setting could cause the Company’s SCD product candidates to become obsolete. For example, the SCD relies on the existing footprint of CRRT pump systems in ICUs, as well as the growing use and adoption of regional citrate as an anticoagulant. Further developments in these areas could require the Company to reconfigure its SCD product candidates, which may not be commercially feasible, or cause them to become obsolete. Lastly, the Company’s ability to achieve significant and sustained growth in its key target markets will depend upon its success in hospital penetration, utilization, publication, its SCD’s reimbursement status and medical education. The Company’s products may not remain competitive with products based on new technologies. If it fails to sell products that satisfy its customers’ demands or respond effectively to new product announcements by its competitors, then market acceptance of the Company’s products could be reduced and its business, results of operations and financial condition could be adversely affected.

The Company faces intense competition in the medical device industry.

The Company competes with numerous United States and foreign companies in the medical device industry, and many of its competitors have greater financial, personnel, operational and research and development resources than the Company. The Company believes that multiple competitors are or will be developing competing technologies to address cytokine storms. Progress is constant in the treatment of the immune system, which may reduce opportunities for the SCD. The Company’s commercial opportunities will be reduced or eliminated if its competitors develop and market products for any of the diseases it targets that:

Even if the Company is successful in developing the SCD and any other future products and obtains FDA and other regulatory approvals necessary for commercializing them, its products may not compete effectively with other products. Researchers are continually learning more about diseases, which may lead to new technologies for treatment. The Company’s competitors may succeed in developing and marketing products that are either more effective than those that it may develop or that are marketed before any SeaStar Medical products. The Company’s competitors include fully integrated pharmaceutical & medical device companies and biotechnology companies, universities, and public and private research institutions. Many of the organizations competing with the Company have substantially greater capital resources, larger research and development staffs and facilities, greater experience in product development and in obtaining regulatory approvals, and greater marketing capabilities. If the Company’s competitors develop more effective treatments for infectious disease or hyperinflammation or bring those treatments to market before the Company can commercialize the SCD for such uses, it may be unable to obtain any market traction for its products, or the diseases it seeks to treat may be substantially addressed by competing treatments. If the Company is unable to successfully compete against larger companies in the pharmaceutical industry, it may never generate significant revenue or be profitable.

If the Company’s products, or the malfunction of its products, cause or contribute to a death or a serious injury, the Company will be subject to medical device reporting regulations, which can result in voluntary corrective actions or agency enforcement actions.

Under the FDA medical device reporting regulations, medical device manufacturers are required to report to the FDA that a device has or may have caused or contributed to a death or serious injury or has malfunctioned in a way that would likely cause or contribute to a death or serious injury. If the Company fails to report these events to the FDA within the required timeframes, or at all, the FDA could take enforcement action against the Company. Any such adverse event involving the Company’s products could also result in future voluntary corrective actions, such as recalls or customer notifications, or agency action, such as inspection or enforcement action. Any corrective action, whether voluntary or involuntary, as well as defending against potential lawsuits, will require the dedication of the Company’s time and capital, distract management from operating its business, and may harm the Company’s reputation and financial results.

The Company outsources many of its operational and development activities for which it may not have full control.

13

The Company relies on third-party consultants or other vendors to manage and implement much of the day-to-day responsibilities of conducting clinical trials and manufacturing its current product candidates. Accordingly, the Company is and will continue to be dependent on the timeliness and effectiveness of the efforts of these third parties. The Company’s dependence on third parties includes key suppliers and third-party service providers supporting the development, manufacturing, and regulatory approval of its SCD, as well as support for its information technology systems and other infrastructure. While its management team oversees these vendors, the failure of any of these third parties to meet their contractual, regulatory, and other obligations, or the development of factors that materially disrupt the performance of these third parties, could have a material adverse effect on the Company’s business, results of operations and financial condition. It is possible that the current COVID-19 pandemic might constrain the ability of third-party vendors to provide services that the Company requires.

If a clinical research organization that the Company utilizes is unable to allocate sufficient qualified personnel to its studies in a timely manner or if the work performed by it does not fully satisfy the requirements of the FDA or other regulatory agencies, the Company may encounter substantial delays and increased costs in completing its development efforts. Any manufacturer of the Company’s products may encounter difficulties in the manufacturing of enough new product to meet demand, including problems with product yields, product stability or shelf life, quality control, adequacy of control procedures and policies, compliance with FDA regulations and the need for FDA approval of new manufacturing processes and facilities. If any of these occur, the development and commercialization of the Company’s product candidates could be delayed, curtailed, or terminated because the Company may not have sufficient financial resources or capabilities to continue such development and commercialization on its own.

If the Company or its contractors or service providers fail to comply with laws and regulations, it or they could be subject to regulatory actions, which could affect its ability to develop, market and sell its product candidates and any other future product candidates and may harm its reputation.

If the Company or its manufacturers or other third-party contractors fail to comply with applicable federal, state or foreign laws or regulations, the Company could be subject to regulatory actions, which could affect its ability to successfully develop, market and sell its SCD product candidate or any future product candidates under development and could harm its reputation and lead to reduced or non-acceptance of its proposed product candidates by the market. Even technical recommendations or evidence by the FDA through letters, site visits, and overall recommendations to academia or biotechnology companies may make the manufacturing of a clinical product extremely labor intensive or expensive, making the product candidate no longer viable to manufacture in a cost-efficient manner. The mode of administration or the required testing of the product candidate may make that candidate no longer commercially viable. The conduct of clinical trials may be critiqued by the FDA, or a clinical trial site’s Institutional Review Board or Institutional Biosafety Committee, which may delay or make impossible the clinical testing of a product candidate. For example, the Institutional Review Board for a clinical trial may stop a trial or deem a product candidate unsafe to continue testing. This would have a material adverse effect on the value of the product candidate and the Company’s business, results of operations and financial condition.

If the Company obtains approval for its products, SeaStar Medical may still be subject to enforcement action if it engages in improper marketing or promotion of its products.

The Company is not permitted to promote or market its product candidates until FDA approval is obtained. After approval, its promotional materials and training methods must comply with the FDA and other applicable laws and regulations, including the prohibition of the promotion of unapproved or off-label use. Practitioners may use the Company’s products off-label, as the FDA does not restrict or regulate a practitioner’s choice of treatment within the practice of medicine. However, if the FDA determines that the Company’s promotional materials or training constitutes promotion of an off-label use, it could request that the Company modify its training or promotional materials or subject the Company to regulatory or enforcement actions, including the issuance of an untitled letter, a warning letter, injunction, seizure, civil fine, or criminal penalties. Other federal, state, or foreign enforcement authorities might also take action if they consider the Company’s promotional or training materials to constitute promotion of an off-label use, which could result in significant fines or penalties under other statutory authorities, such as laws prohibiting false claims for reimbursement. In that event, the Company’s reputation could be damaged, which may lead to reduced or non-acceptance of its proposed product candidates by the market. In addition, the off-label use of the Company’s products may increase the risk of product liability claims. Product liability claims are expensive to defend and could divert the attention of the Company’s management, result in substantial damage awards against the Company, and harm its reputation.

The Company intends to outsource and rely on third parties for the clinical development and manufacture, sales and marketing of its SCD or any future product candidates that it may develop, and its future success will be dependent on the timeliness and effectiveness of the efforts of these third parties.

The Company does not have the required financial and human resources to carry out on its own all the pre-clinical and clinical development for its SCD product candidate or any other or future product candidates that it may develop, and do not have the capability and resources to manufacture, market or sell its SCD product candidate or any future product candidates that it may develop. The

14

Company’s business model calls for the partial or full outsourcing of the clinical, development, manufacturing, sales, and marketing of its product candidates in order to reduce its capital and infrastructure costs as a means of potentially improving its financial position. The Company’s success will depend on the performance of these outsourced providers. If these providers fail to perform adequately, the Company’s development of product candidates may be delayed and any delay in the development of the Company’s product candidates may have a material and adverse effect on its business, results of operations and financial condition.

The Company is and will be exposed to product liability risks, and clinical and preclinical liability risks, which could place a substantial financial burden upon it should it be sued.

The Company’s business exposes it to potential product liability and other liability risks that are inherent in the testing, manufacturing, and marketing of medical devices. Claims may be asserted against it. A successful liability claim or series of claims brought against it could have a material adverse effect on the Company’s business, results of operations and financial condition. The Company may not be able to continue to obtain or maintain adequate product liability insurance on acceptable terms, if at all, and such insurance may not provide adequate coverage against potential liabilities. Claims or losses in excess of any product liability insurance coverage that the Company may obtain could have a material adverse effect on its business, results of operations and financial condition.

The Company’s SCD product candidate may be used in connection with medical procedures where those products must function with precision and accuracy. If medical personnel or their patients suffer injury as a result of any failure of the Company’s products to function as designed, or its products are designed inappropriately, the Company may be subject to lawsuits seeking significant compensatory and punitive damages. The risk of product liability claims, product recalls and associated adverse publicity is inherent in the testing, manufacturing, marketing, and sale of medical products. The Company intends to obtain general clinical trial liability insurance coverage; however, its insurance coverage may not be adequate or available. In addition, the Company may not be able to obtain or maintain adequate product liability insurance on acceptable terms, if at all, and such insurance may not provide adequate coverage against potential liabilities. Any product recall or lawsuit in excess of any product liability insurance coverage that the Company may obtain could have a material adverse effect on its business, results of operations and financial condition. Moreover, a product recall could generate substantial negative publicity about the Company’s products and business and inhibit or prevent commercialization of other future product candidates.