DocumentExhibit 10.1

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE IT IS NOT MATERIAL AND WOULD LIKELY CAUSE COMPETITIVE HARM TO THE COMPANY IF PUBLICLY DISCLOSED

SUPPLEMENTAL AGREEMENT FOR NHCM

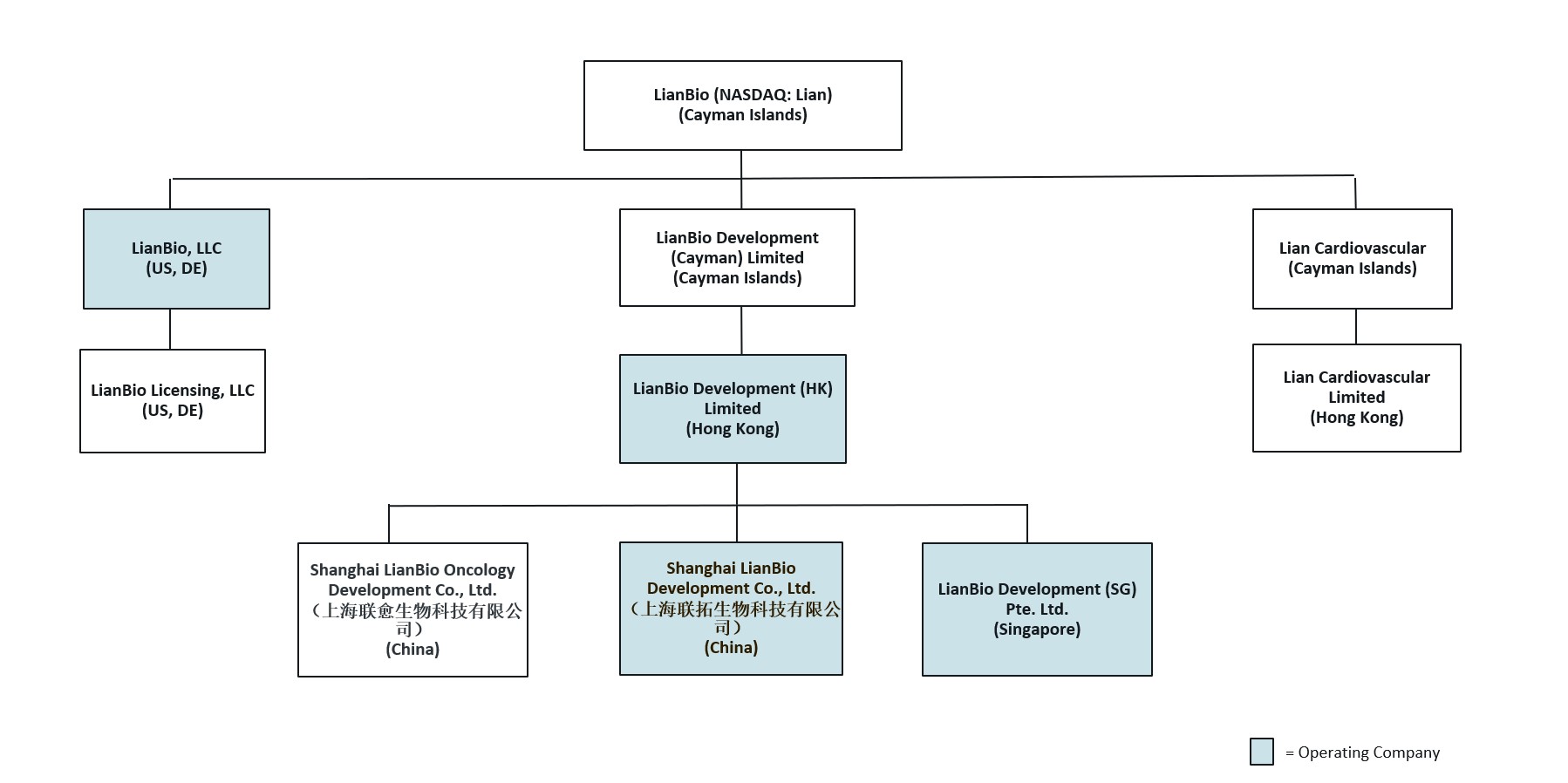

THIS SUPPLEMENTAL AGREEMENT FOR NHCM (this “nHCM Supplemental Agreement”), dated as of August 11, 2023 (the “nHCM Supplemental Agreement Effective Date”), is made by and between MyoKardia, Inc., a corporation organized and existing under the laws of the State of Delaware, having its place of business at 1000 Sierra Point Parkway, Brisbane, California 94005 United States (“Company”), on the one hand, and LianBio, an exempted company organized under the laws of the Cayman Islands (“LianBio”), LianBio Licensing, LLC, a limited liability company organized and existing under the laws of the State of Delaware, having its place of business at 103 Carnegie Center Drive Suite 215, Princeton, NJ 08540 (“LianBio Licensing”), and Lian Cardiovascular Limited, a private company limited by shares organized under the laws of Hong Kong (“Lian Cardiovascular HK”), and Shanghai LianBio Development Co., Ltd., a limited liability company organized and existing under the laws of the PRC (“Local Regulatory Agent”, and collectively with LianBio, LianBio Licensing and Lian Cardiovascular HK, “Licensee,” and each, individually, a “Licensee Party”), on the other hand. Company and Licensee are sometimes referred to herein individually as a “Party” and collectively as the “Parties.”

RECITALS

WHEREAS, Company, LianBio and LianBio Licensing are parties to that certain Exclusive License Agreement dated as of August 10, 2020, as amended October 8, 2020 and January 4, 2021 (the “License Agreement”) pursuant to which Company granted to Licensee certain rights and licenses under intellectual property owned or controlled by Company to Develop, have Manufactured and Commercialize the Compound and Licensed Products in the Field in the Territory (each, as defined in the License Agreement);

WHEREAS, [***]

WHEREAS, LianBio Licensing assigned its rights and obligations under the License Agreement to Lian CV under the Contribution, Assignment and Assumption Agreement dated as of September 28, 2021, and Lian CV assigned its rights and obligations under the License Agreement to Lian Cardiovascular HK under the Contribution, Assignment and Assumption Agreement dated as of September 28, 2021;

WHEREAS, Company wishes to allow Licensee to conduct, and Licensee wishes to conduct, a portion of the Global Clinical Study (as defined below) in the PRC (as defined in the License Agreement); and

WHEREAS, the Parties wish to enter into a supplemental agreement to provide for additional terms and conditions that govern each Party’s rights and responsibilities with respect to activities to be conducted in the PRC with respect to such portion of the Global Clinical Study.

NOW, THEREFORE, in consideration of the foregoing premises, the mutual promises and covenants of the Parties contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, do hereby agree as follows:

Article I

DEFINITIONS

As used herein, the following terms shall have the following meanings. Capitalized terms used herein but not otherwise defined shall have the meanings ascribed to them in the License Agreement.

Section 1.1“Acquirer” means, with respect to a Change of Control of a Licensee Party, the applicable third party as referred to in the definition of “Change of Control” under the License Agreement and under this nHCM Supplemental Agreement.

Section 1.2“[***]” has the meaning set forth in Section 2.4(c).

Section 1.3“[***]” has the meaning set forth in Section 2.4(c).

Section 1.4“Adverse Event” or “AE” means any untoward medical occurrence associated with the use of a product in human subjects, whether or not considered related to such product, including those required to be reported under applicable Laws in the PRC. An AE does not necessarily have a causal relationship with a product, that is, an AE can be any unfavorable and unintended sign (including an abnormal laboratory finding), symptom, or disease temporally associated with the use of such product.

Section 1.5“Allocable Global Study Costs” has the meaning set forth in Section 2.4(b).

Section 1.6“Ancillary Agreement” means each of the Development Supply Agreement, the Clinical Quality Agreement and the PV Agreement.

Section 1.7“Anti-Corruption Laws” has the meaning set forth in Section 5.4(a).

Section 1.8“Breaching Party” has the meaning set forth in Section 9.2.

Section 1.9“Change of Control” has the meaning ascribed to such term in the License Agreement; provided that, with respect to a Licensee Party, a “Change of Control” shall also include the sale, transfer, exclusive license or other disposition to a third party that is not an Affiliate of such Licensee Party, in a transaction or a series of related transactions, of all or substantially all of such Licensee Party’s and its controlled Affiliates’ assets related to the Compound.

Section 1.10“China Study” means, with respect to the Global Clinical Study, the portion of such Global Clinical Study to be conducted in the PRC.

Section 1.11“China Study Development Plan” has the meaning set forth in Section 2.2(a).

Section 1.12“China Study Key Milestones” mean [***].

Section 1.13“[***]” has the meaning set forth in Section 2.2(b).

Section 1.14“[***]” has the meaning set forth in Section 2.2(b).

Section 1.15“China Study Regulatory Filings” means any documentation comprising any filing or application with, and any documents submitted to, any Regulatory Authority in the PRC with respect to the China Study, including CTA(s), ethics committee approval(s), HGR Approval(s) and all correspondence with any Regulatory Authority with respect to the China Study (including minutes of any meetings, telephone conferences or discussions with any Regulatory Authority with respect to the China Study). For clarity, China Study Regulatory Filings shall exclude Regulatory Approval Applications, Regulatory Approvals, and Marketing Authorizations.

Section 1.16“Clinical Quality Agreement” means that certain Quality Agreement between Company, on the one hand, and Lian Cardiovascular HK and Local Regulatory Agent, on the other hand, effective as of August 13, 2021, as may be amended from time to time.

Section 1.17“Company” has the meaning set forth in the preamble hereto.

Section 1.18“Company Territory” means (a) the world other than the Territory, and (b) any and all Region(s) with respect to which the License Agreement is terminated pursuant to the terms thereof.

Section 1.19“Company Trainers” has the meaning set forth in Section 5.3.

Section 1.20[***]

Section 1.21“Compliance Failure” has the meaning set forth in Section 9.2.

Section 1.22“Compliance Program” has the meaning set forth in Section 5.1(b).

Section 1.23“Compliance Program Confirmation” has the meaning set forth in Section 5.1(b).

Section 1.24“Compliance Standards” has the meaning set forth in Section 5.1(b).

Section 1.25“Confidentiality Exceptions” has the meaning set forth in Section 2.2(a).

Section 1.26“Connected Dispute” has the meaning set forth in Section 10.2(c).

Section 1.27“CRO” means a Third Party contract research organization.

Section 1.28“CTA” means a Clinical Trial Application filed with the NMPA for authorization to commence clinical studies in the PRC and all supplements and amendments (including annual reports) that may be filed with respect to the foregoing. With respect to the China Study, the terms “IND” and “CTA” are used interchangeably to mean a Clinical Trial Application filed with the NMPA for authorization to commence the China Study and all supplements and amendments (including annual reports) that may be filed with respect to the foregoing.

Section 1.29“Curable Compliance Failure” has the meaning set forth in Section 9.2.

Section 1.30“Data Governance System” has the meaning set forth in Section 2.9.

Section 1.31“Development Supply Agreement” means that certain Development Supply Agreement among LianBio, LianBio Licensing, Lian Cardiovascular HK, Local Regulatory Agent, on the one hand, and Company, on the other hand, effective as of August 12, 2021, as may be amended from time to time.

Section 1.32“Diligent Efforts” means, with respect to any task or activity, applying the necessary resources and personnel to complete such task or activity in a timely manner, including (a) assigning responsibility for such task or activity to specific employee(s) with appropriate experience and expertise and monitoring such progress; (b) setting and seeking to achieve specific and meaningful objectives for carrying out such task or activity; and (c) making and implementing decisions and allocating resources designed to advance progress with respect to such task or activity. For clarity, the foregoing standard is not intended to guarantee a particular result with respect to a task or activity.

Section 1.33“Enrollment Completion Date” has the meaning set forth in Section 2.2(b).

Section 1.34“FFDCA” means the United States Federal Food, Drug, and Cosmetic Act, 21 U.S.C. 301, et. seq., as it may be amended, and the rules, regulations, guidance, guidelines, and requirements promulgated or issued thereunder.

Section 1.35“GCP” or “Good Clinical Practice” means all applicable then-current standards for the design, conduct, performance, monitoring, auditing, recording, analyses and reporting of Clinical Studies, including, as applicable, (a) as set forth in the ICH Harmonised Tripartite Guideline for Good Clinical Practice (CPMP/ICH/135/95) and any other guidelines for good clinical practice for trials on medicinal products, (b) the Declaration of Helsinki (2013) as last amended at the 64th World Medical Association in October 2013 and any further amendments or clarifications thereto, (c) as set forth in the PRC Good Clinical Practice for Pharmaceuticals, as released by the NMPA in 2020, and its subsequent amendments and related rules and guidelines, including the Drug Good Pharmacovigilance Practice Rule effective as of December 1, 2021, (d) U.S. Code of Federal Regulations Title 21, Parts 50 (Protection of Human Subjects), 56 (Institutional Review Boards) and 312 (Investigational New Drug Application), and (e) the equivalent applicable Laws in any relevant Region, each as may be amended and applicable from time to time and in each case, that provide for, among other things, assurance that the clinical data and reported results are credible and accurate and protect the rights, integrity, and confidentiality of trial subjects.

Section 1.36“Global Clinical Study” means the multi-regional Clinical Study with respect to a Licensed Product that is intended to support regulatory approval of such Licensed Product both within and outside of the Territory for nHCM and is conducted in multiple countries, regions, territories and medical institutions.

Section 1.37“[***]” has the meaning set forth in Section 2.2(b).

Section 1.38“Global Study Data and Filings” has the meaning set forth in Section 2.8.

Section 1.39“GLP” or “Good Laboratory Practice” means all applicable then-current standards for laboratory activities for pharmaceuticals, as set forth in the FDA’s Good Laboratory Practice regulations as defined in 21 C.F.R. Part 58, the PRC Good Laboratory

Practice effective as of September 1, 2017, or the Good Laboratory Practice principles of the Organization for Economic Co-Operation and Development (OECD), and such standards of good laboratory practice as are required by the equivalent applicable Laws in the relevant Region and other organizations and governmental agencies in countries in which the Licensed Product is intended to be sold by the Party that is subject to such standards.

Section 1.40“HGR Approval” means all filings to, or approvals, certificates or other clearances from the OHGRA that are necessary for commencing research in the form of an international collaboration and disclosing to, transferring to or sharing with a “foreign party” any “Chinese human genetic resource information” or “Chinese human genetic resource materials”, each of the foregoing terms as defined in the PRC Regulation on the Administration of Human Genetic Resources (人类遗传资源管理条例). For the avoidance of doubt, HGR Approval includes any amendments to approvals for international collaborations granted by OHGRA and record filings with OHGRA for data transfer.

Section 1.41[***]

Section 1.42“Investigator” means an investigator who participates in the China Study.

Section 1.43“JDC” has the meaning set forth in Section 4.2.

Section 1.44“Joint Compliance Committee” has the meaning set forth in Section 4.3.

Section 1.45“Law” or “Laws” means all laws, statutes, rules, codes, regulations, standards, orders, decrees, judgments or ordinances of any Governmental Authority, or any license, permit or similar right granted under any of the foregoing, or any similar provision having the force or effect of law.

Section 1.46“Lian Cardiovascular HK” has the meaning set forth in the preamble hereto.

Section 1.47“Lian CV” has the meaning set forth in the recitals.

Section 1.48“LianBio Licensing” has the meaning set forth in the preamble hereto.

Section 1.49“License Agreement” has the meaning set forth in the recitals.

Section 1.50“Licensee” has the meaning set forth in the preamble hereto.

Section 1.51“Licensee China Study Development Activities” has the meaning set forth in Section 2.2(a).

Section 1.52“[***]” has the meaning set forth in Section 2.2(c).

Section 1.53“Licensee Party” has the meaning set forth in the preamble hereto.

Section 1.54“[***]” has the meaning set forth in Section 2.2(c).

Section 1.55“Licensee Trainers” has the meaning set forth in Section 5.3.

Section 1.56“Local Regulatory Agent” has the meaning set forth in the preamble hereto.

Section 1.57“Mava Agreements” means each of (a) the License Agreement, (b) this nHCM Supplemental Agreement, (c) [***], and (d) any Ancillary Agreement.

Section 1.58“nHCM Supplemental Agreement” has the meaning set forth in the preamble hereto.

Section 1.59“nHCM Supplemental Agreement Effective Date” has the meaning set forth in the preamble hereto.

Section 1.60“NMPA” means the National Medical Product Administrations of the PRC, or its successor, including any functional subdivisions or centers thereof (e.g., Center for Drug Evaluation).

Section 1.61“Non-Breaching Party” has the meaning set forth in Section 9.2.

Section 1.62[***]

Section 1.63“OHGRA” means the Office of Human Genetic Resource Administration within the Ministry of Science and Technology in the PRC.

Section 1.64“Party” and “Parties” has the meaning set forth in the preamble hereto.

Section 1.65“Patient-Level Study Payments” means [***].

Section 1.66[***]

Section 1.67“Permitted Subcontractor” has the meaning set forth in Section 2.3.

Section 1.68[***]

Section 1.69[***]

Section 1.70“Publication” means any abstract, manuscript or presentation (including, for clarity, any oral or poster presentation).

Section 1.71“PV Agreement” means that certain Pharmacovigilance Agreement between Bristol Myers Squibb Company and Lian Cardiovascular HK regarding Mavacamten (MYK-461) in the Territory, effective as of June 4, 2021, as may be amended from time to time.

Section 1.72“Regulatory Meeting” has the meaning set forth in Section 3.2(a).

Section 1.73“Representatives” means, with respect to Licensee, its Affiliates, Permitted Subcontractors and Study Sites, and its and their respective officers, directors, employees (including, with respect to Study Sites, Investigators), agents, representatives and other personnel.

Section 1.74[***].

Section 1.75“Senior Officers” means (a) with respect to Company, the [***], or his/her delegates and (b) with respect to Licensee, the Chief Executive Officer. If the position of any of the Senior Officers identified in this definition no longer exists due to a corporate reorganization, corporate restructuring or the like that results in the elimination of the identified position, the applicable title of the Senior Officer set forth herein will be replaced with the title of another executive officer with responsibilities and seniority comparable to the eliminated Senior Officer, and the relevant Party will promptly provide notice of such replacement title to the other Party.

Section 1.76“SMO” means a Third Party site management organization.

Section 1.77“Sponsor” means, with respect to a Clinical Study, the Person who applies for and holds in its name the IND or CTA for such Clinical Study.

Section 1.78“Study Data” means, collectively, all data and information collected, received or otherwise generated in connection with the China Study, including all raw data collected or analyzed and all study reports and documents summarizing or analyzing such data.

Section 1.79“Study Guidelines” mean the guidelines for the China Study, including: (a) the design of the China Study; (b) the full protocol for the China Study (and, to the extent required by applicable Laws, a PRC-specific protocol for the China Study developed by the Parties and approved by Company in writing at its sole discretion); (c) plans with respect to data collection, storage, transfer, cleaning, review, and analysis; (d) scientific integrity and statistical analysis plans, data review plans, informed consent forms, and any investigator’s brochure(s); (e) plans with respect to the study subject safety and appropriate compensation in the event of an injury arising from the China Study; and (f) the selection process and criteria for Study Sites, subcontractors (including CROs and SMOs) and recruitment of consultants, in each case ((a) through (f)), provided to Licensee by Company, as may be amended from time to time. For clarity, Study Guidelines constitutes an integral part of, and are hereby incorporated into this nHCM Supplemental Agreement.

Section 1.80“Study Site” has the meaning set forth in Section 2.2(e).

Section 1.81“Term” has the meaning set forth in Section 9.1.

Article II

COMPANY-SPONSORED STUDIES

Section 1.1Overview.

(a)The Parties acknowledge that, as of the nHCM Supplemental Agreement Effective Date, Company is the Sponsor for the Global Clinical Study.

(b)For the China Study, Company will be the Sponsor of the China Study and will appoint the Local Regulatory Agent as Company’s regulatory agent in the PRC to prepare, submit and maintain any China Study Regulatory Filing to a Regulatory Authority in the PRC in connection with the China Study, and to conduct other development or regulatory activities to be performed by the Local Regulatory Agent with respect to the China Study as provided herein, in each case, subject to Company’s oversight provided herein.

(c)Prior to or together with submitting the CTA for the China Study, the Local Regulatory Agent shall submit to the applicable Regulatory Authority a delegation of authority form approved and signed by Company (or its applicable Affiliate) delegating to the Local Regulatory Agent specified activities to be conducted by the Local Regulatory Agent in connection with the China Study. For clarity, the Local Regulatory Agent shall perform all applicable activities under this nHCM Supplemental Agreement and the License Agreement applicable to the Local Regulatory Agent with respect to the China Study; provided that [***].

(d)The terms and conditions of this nHCM Supplemental Agreement shall apply solely with respect to the China Study. The License Agreement, together with this nHCM Supplemental Agreement, shall, with effect on and from the nHCM Supplemental Agreement Effective Date, be read and construed as one document and (a) references in the License Agreement to “this Agreement” and (b) references in any Ancillary Agreement to the License Agreement shall, in each case ((a) and (b)), incorporate references to this nHCM Supplemental Agreement during the Term and thereafter with respect to any surviving provisions. In the event of a conflict between the terms of this nHCM Supplemental Agreement and the terms of the License Agreement with respect to the Global Clinical Study, the terms of this nHCM Supplemental Agreement shall govern with respect to the Global Clinical Study, including the China Study. [***] In the event of any conflict between this nHCM Supplemental Agreement and the Exhibits hereto, this nHCM Supplemental Agreement shall prevail. In the event of any conflict between this nHCM Supplemental Agreement and any Ancillary Agreement, this nHCM Supplemental Agreement shall prevail.

Section 1.2Conduct of the China Study.

(a)Licensee shall carry out the China Study in accordance with a written development plan for the China Study (as amended from time to time in accordance with this Section 2.2(a) and Section 4.6), which development plan shall be reviewed and approved by the JSC promptly (and in any event within [***]) following the nHCM Supplemental Agreement Effective Date and shall be incorporated into this nHCM Supplemental Agreement by reference (the “China Study Development Plan”), and in accordance with the Study Guidelines, under the oversight and subject to the authority of the JSC, subject to the final decision-making authority of Company as provided hereunder. The China Study Development Plan shall include the descriptions and timelines (including the Enrollment Completion Date) of the China Study activities assigned to Licensee (the “Licensee China Study Development Activities”), including the number of patients to be enrolled in the PRC by Licensee for the China Study. As between the Parties, Company shall have the sole right to prepare and provide to Licensee any Study Guidelines; provided that with respect to any PRC-specific protocol for the China Study as may be required by applicable Laws in the PRC, [***]. From time to time, Company may amend the Study Guidelines and the China Study Development Plan by proposing an amendment (including an amendment as required by the applicable Regulatory Authority) to the JSC for review and approval, which amendment shall become effective upon approval by the JSC; provided that if the JSC cannot reach consensus on the proposed amendment at a duly called meeting of the JSC, Company shall have final decision-making authority with respect to any such proposed amendment. For clarity, to the extent any activities with respect to the Global Clinical Study planned by Company to be conducted by or on behalf of Company or for any Region, country or jurisdiction outside the PRC is included in the China Study Development Plan, such activities shall be for informational purposes only, shall be non-binding, and, subject to clauses (i) through (iv) in the definition of Confidential Information in the License Agreement (“Confidentiality Exceptions”), shall be deemed to be Company’s Confidential Information.

(b)The Parties acknowledge and agree that, as of the nHCM Supplemental Agreement Effective Date, their intent is that [***]. Any amendment (to the extent permitted by applicable Laws) to the [***] or the [***] shall be reviewed and approved by the JSC, subject to the final decision-making authority of Company as provided in Section 4.6. Licensee shall use Commercially Reasonable Efforts to achieve the China Study Key Milestones; provided that if [***] then, [***]. In the event Licensee fails to achieve the China Study Key Milestone set forth in clause (a) of Section 1.12, (A) for clarity, Licensee shall continue to carry out the China Study in accordance with this Agreement (including, for clarity, the China Study Development Plan), (B) Company shall have the right to continue the conduct of the Global Clinical Study outside of the PRC in its sole discretion, including to close patient enrollment, and to start data read-out, for the Global Clinical Study, (C) without limitation to the foregoing clause (B) and notwithstanding anything to the contrary herein, in no event shall Company be required to delay any timeline, deadline or commencement of any activity conducted in connection with the Global Clinical Study, (D) the Parties shall discuss in good faith the regulatory strategy with respect to applying for and obtaining Regulatory Approval of the Licensed Product for nHCM in the PRC, and (E) without limitation to the foregoing clauses (B) and (C), Company will have the final decision-making authority, without further resort to any other dispute resolution mechanism, on all matters that relate to the China Study. In the event of a change to the [***] or the [***], the Parties shall discuss in good faith possible revision(s) to [***] and the Parties may agree (but will not be obligated to agree) through the JSC or in writing to [***], subject to Company’s final decision-making authority. Notwithstanding the foregoing or anything else herein, (1) [***] will [***] once the [***] is reached, subject to Company’s final decision-making authority in Section 4.6(c) (including, for clarity, Company’s final decision-making authority with respect to any amendment to the [***] or [***]) and (2) [***].

(c)The Parties acknowledge that, [***] to the extent permitted by applicable Laws and subject to this Section 2.2(c), Licensee shall be permitted to [***]; provided that, Licensee shall not, and shall cause its Affiliates not to, [***] unless and until the Parties have discussed and [***]. Notwithstanding the foregoing or anything else herein, [***], Licensee shall be permitted to [***], and Licensee shall provide Company with an opportunity to [***]. Subject to the foregoing, Company will provide such requisite materials or documents as mutually agreed by the Parties to be provided by Company [***]. After the foregoing [***] and prior to [***], Licensee shall not, and shall cause its Affiliates not to, directly or indirectly through any Third Party, conduct any activities [***], (iii) conducting any other activities relating to or in furtherance of [***], or (iv) [***]. Prior to [***], the Parties shall discuss in good faith the regulatory strategy with respect to [***], including whether Licensee (or its designated Affiliate) shall be permitted to [***]. At any time following [***] Licensee shall have the right to [***], provided that (1) for clarity, Licensee shall [***] in accordance with a JSC-approved [***] for the Licensed Product in the PRC for nHCM as set forth in the License Agreement (including Section [***] of the License Agreement), which [***], once approved by the JSC, shall be [***], (2) Licensee shall [***] in compliance with [***], and the terms and conditions set forth in Section 2.2(d), Section 5.1(b) (the last sentence only), Section 5.2, Section 5.3, and Section 5.4 [***], and (3) in the event Licensee’s conduct [***], Company may provide written notice to Licensee of such breach and require Licensee to [***] until such time as such breach is remedied (if such breach is capable of being remedied) [***], and Licensee will [***] as permitted by and in accordance with Applicable Laws. For the avoidance of doubt, in no event shall Company be required to [***].

(d)Licensee shall, and shall cause its applicable Affiliates, Permitted Subcontractors, Study Sites and Investigators to conduct the China Study [***] and perform

other applicable activities with respect thereto in accordance with applicable Laws (including applicable GLP and GCP), the terms and conditions of this nHCM Supplemental Agreement and the License Agreement, and the Study Guidelines.

(e)The Local Regulatory Agent shall enter into a clinical trial agreement with each clinical site that will conduct the China Study (each, a “Study Site”), in each case substantially in the form of Exhibit 2.2(e) attached hereto; provided that Licensee shall obtain Company’s written consent to each such Study Site prior to entering into such agreement. Company shall provide its approval or disapproval [***] of a Study Site proposed by Licensee within [***] of [***], which notice shall be accompanied by sufficient information for Company to assess the qualifications of such proposed Study Site as set forth in Section 2.3 and all information for such proposed Study Site and applicable Investigator(s) as requested by Company pursuant to Section 2.2(f). Without limitation to the foregoing, Licensee shall not enter into any clinical trial agreement with a Study Site that contains any material deviation from Exhibit 2.2(e) without the prior written approval from Company. Company shall provide its approval or disapproval of a clinical trial agreement containing any such material deviation within [***] of its receipt of a copy of such clinical trial agreement provided by Licensee. For the purpose of this Section 2.2(e), any change to the provisions with respect to [***] in Exhibit 2.2(e) or the addition of any new term or requirement to Exhibit 2.2(e) shall be deemed to be a material deviation. Licensee shall cause each Study Site to comply strictly with, and not to deviate from, the Study Guidelines in the conduct of the China Study, and shall promptly notify Company in writing of any deviation from the Study Guidelines by any Study Site. Without limitation to the foregoing, Licensee shall cooperate with Company in the enforcement of any such clinical trial agreement at Company’s direction and shall terminate, or cause to be terminated, any such clinical trial agreement upon Company’s request. The Parties acknowledge that Licensee may lead the negotiation of a clinical trial agreement with a Study Site to the extent such clinical trial agreement does not contain any material deviation from Exhibit 2.2(e). Notwithstanding the foregoing, Company reserves the right to lead or participate in the negotiation of a clinical trial agreement with any Study Site and/or to be a party to the clinical trial agreement with any Study Site as Company deems necessary or appropriate. For clarity, neither the attachment of the form clinical trial agreement in Exhibit 2.2(e) hereto, nor Company’s approval of or being a party to any clinical trial agreement with a Study Site or Company’s approval of any subcontract agreement between Licensee and the applicable Permitted Subcontractor, is intended, or shall be construed, to relieve Licensee of any of its obligations under this Agreement or any Ancillary Agreement (including any such obligations with respect to any Permitted Subcontractor, Study Site or Investigator).

(f)Upon Company’s request, Licensee shall promptly provide the following to Company for each Study Site and Investigator: (i) any documentation required under applicable Law to demonstrate the Investigator’s suitability to participate in the China Study and such Investigator’s curriculum vitae, each signed by such Investigator, or any other similar documentation or information as Company may reasonably request, (ii) any documents required under applicable Law relating to the financial interests of such Study Site and the applicable Investigator and any sub-investigators in the China Study, including financial disclosure statements in FDA form 1572 or any applicable foreign equivalent thereof, (iii) documentation showing that the applicable ethics committee has reviewed and approved the applicable protocol, the applicable informed consent forms and any other information to be provided to potential subjects of the China Study to secure their informed consent, which informed consent forms and other information have been provided or approved by Company and comply with applicable Law, (iv) documentation showing that the applicable ethics committee has reviewed and

approved any materials with respect to the conduct of the China Study, including any materials with respect to safety reporting, (v) the fully executed clinical trial agreement with such Study Site, and (vi) such other statements, information or documents as Company may reasonably require pursuant to applicable Law.

(g)Unless otherwise instructed by Company, (i) Licensee shall be responsible for all communications with the Study Sites and Investigators with respect to the China Study in accordance with the China Study Development Plan and, to the extent not specifically set forth in the China Study Development Plan, as directed by Company, and (ii) prior to the commencement of any portion of the China Study at a Study Site, Licensee shall provide each applicable Investigator with the protocol and such other materials required to conduct the China Study, as directed by Company. Except as otherwise agreed by Company in writing, no changes, whether [***] or otherwise, shall be made to the protocol or any other Study Guidelines provided by Company with respect to the China Study. Licensee shall (A) keep Company reasonably informed by providing Company with a reasonably detailed written summary in English of any material communication with a Study Site or Investigator within [***] following such communication, and a reasonably detailed written summary in English of all non-material communications with all Study Sites and all Investigators on a [***] basis, except to the extent provided in the following clause (D), (B) provide Company notice of any scheduled meetings (including telephone conferences) with a Study Site or Investigator at least [***] prior thereto, (C) use best efforts to provide Company notice of any unscheduled meeting (including telephone conference) with a Study Site or Investigator as soon as practicable, and (D) provide Company with a reasonably detailed written summary in English of (1) any unscheduled meeting (including telephone conference) with any Study Site or Investigator and (2) any scheduled meeting (including telephone conference) with any Study Site or Investigator that Company elects not to participate in, in each case (1) and (2), promptly (and in any event within [***]) thereafter. Company shall have the right, at its sole discretion and at any time, to lead or participate in any meeting, telephone conference, discussion or other communication with any Study Sites or Investigators [***].

(h)Licensee shall promptly (and, if requested by Company, within [***] after Company’s request) furnish to Company any information or materials necessary or useful for Company to comply with its legal obligations as the Sponsor of the China Study under applicable Laws. In addition, Licensee shall assist Company to comply with its legal obligations as the Sponsor for the China Study, including obtaining and maintaining all applicable approvals from NMPA for the China Study (including applicable ethics committee approval, HGR Approval, and approval of the CTA).

(i)Each Party shall as soon as practicable (and in any event within [***]) notify the other Party of any event, notification or information that such Party becomes aware of that could reasonably be expected to: (i) result in legal or regulatory action against the Sponsor or Local Regulatory Agent for the China Study or (ii) affect the quality or the integrity of the China Study. If either Party learns of any enforcement action by the Regulatory Authorities in the PRC against Company (or its applicable Affiliates), Licensee (or its applicable Affiliates) or any Permitted Subcontractor, Study Site or Investigator, such Party shall as soon as practicable (and in any event within [***]) notify the other Party thereof. With respect to any such action that is related to the China Study, Licensee shall (A) in the event of any such action against Company or its applicable Affiliates, provide all assistance as Company may reasonably request to resolve or, to the extent not resolvable, alleviate such action, and (B) in the event of any such

action against Licensee or its applicable Affiliates, use Diligent Efforts to resolve [***] such action in consultation with Company.

(j)Notwithstanding anything to the contrary in this nHCM Supplemental Agreement, the License Agreement or any Ancillary Agreement, Licensee shall, and, as applicable, shall cause its Affiliates, Permitted Subcontractors, Study Sites and Investigators to, (i) promptly terminate or suspend the China Study upon written notice from Company of Company’s determination (in its sole discretion) that such termination or suspension is warranted because of [***], or (ii) terminate or suspend any portion of the China Study conducted at any Study Site upon written notice from Company and in accordance with Company’s instructions including with respect to timing of such termination or suspension; provided that, in the case of this clause (ii), [***] such proposed termination or suspension shall be finally determined by Company.

Section 1.3Subcontracting. Except with respect to Study Sites, which are addressed in Section 2.2(e) through Section 2.2(g), Licensee shall not subcontract or delegate any of its obligations under this nHCM Supplemental Agreement to an Affiliate or a Third Party (including any CRO or SMO) without Company’s prior written consent (each such approved subcontractor, “Permitted Subcontractor”). Licensee certifies that each potential Permitted Subcontractor or Study Site proposed by Licensee for Company’s consent has never been, and as of the time of such proposal is not, debarred, excluded, convicted or otherwise ineligible as set forth in clauses (a) through (d) of Section 9.4 of the License Agreement or the last sentence of Section 7.2, and shall provide to Company sufficient information for Company to assess the qualifications of any proposed Permitted Subcontractor or Study Site. Without limitation to the remainder of this Section 2.3, Licensee shall [***]. Any subcontract agreement between Licensee or its applicable Affiliate and a Permitted Subcontractor relating to activities conducted under this nHCM Supplemental Agreement shall require Company’s prior written approval. Without limitation to the foregoing, each subcontract agreement shall include provisions requiring the applicable Permitted Subcontractor to comply with all the applicable terms and conditions of this nHCM Supplemental Agreement, the License Agreement and any Ancillary Agreements. Licensee shall be responsible and liable for the compliance of any Permitted Subcontractor or Study Site with the applicable terms and conditions of this nHCM Supplemental Agreement, the License Agreement and any Ancillary Agreements. Any act or omission of such Permitted Subcontractor or Study Site that would be a breach of this nHCM Supplemental Agreement, the License Agreement or any Ancillary Agreements if performed by Licensee will be deemed to be a breach by Licensee under this nHCM Supplemental Agreement, the License Agreement or any Ancillary Agreements, as the case may be. Licensee hereby waives any requirement that Company exhaust any right, power or remedy, or proceed against any Permitted Subcontractor or Study Site, for any obligation or performance under this nHCM Supplemental Agreement, the License Agreement or any Ancillary Agreements prior to proceeding directly against Licensee. A list of Permitted Subcontractors as of the nHCM Supplemental Agreement Effective Date is set forth in Exhibit 2.3, which list shall be updated promptly upon Company’s written consent to any new Permitted Subcontractor.

Section 1.4Costs and Expenses.

(a)Licensee shall be responsible for all Patient-Level Study Payments and other internal and external costs and expenses incurred by or on behalf of Licensee or its Affiliates to carry out activities in connection with the China Study under this nHCM Supplemental Agreement.

(b)Except to the extent provided otherwise in the third sentence of Section 2.2(b), Licensee will reimburse Company for all internal and external costs and expenses reasonably incurred by or on behalf of Company or its applicable Affiliates for the Global Clinical Study that are generally applicable to both the China Study and the portion of the Global Clinical Study conducted outside of the PRC, to the extent such costs and expenses are reasonably allocable to the China Study based on the actual number of patients that are enrolled in the PRC for the China Study by Licensee (such costs and expenses reasonably allocable to the China Study, the “Allocable Global Study Costs”). The Parties acknowledge and agree that the Allocable Global Study Costs for each patient enrolled in the China Study shall be [***]. Company will provide to Licensee an invoice, together with reasonable documentation of the incurrence or accrual of the costs and expenses to be reimbursed, for amounts to be reimbursed to Company under this nHCM Supplemental Agreement on a [***] basis and Licensee will pay such amounts within [***] after receipt of such invoice. Such payments shall be subject to the payment terms of the License Agreement, including Section 6.8 through Section 6.10 and Section 14.2 thereof. The Licensee shall have no right to offset, set off or deduct any amounts paid or reimbursed to Company pursuant to this nHCM Supplemental Agreement from or against the amounts due to Company under the License Agreement. Without limitation to the foregoing, (A) in the event that Company or any of its Affiliates incur any internal or external costs or expenses at the written request of Licensee or any of its Affiliates, and (B) with respect to any amounts owed to Company hereunder, in each case ((A) and (B)), Company will invoice Licensee for such amounts, and Licensee will pay the invoiced amounts within [***] after the date of any such invoice.

(c)In the event the [***] is increased to more than [***] and the [***] is increased to more than [***], and solely to the extent such increase to the [***] directly results from [***] pursuant to [***], [***] shall be responsible for (i) [***], and (ii) [***] incurred by or on behalf of Licensee or its Affiliates to carry out activities in connection with the China Study under this nHCM Supplemental Agreement, in each case ((i) and (ii)), for the [***] as a result of such increase to the [***] (each such [***] and such [***] in clause (ii), collectively, [***]) and solely to the extent such [***] are reasonable and would not have been incurred by Licensee or its Affiliates but for such increase to the [***]; provided that (A) all [***] are documented, verifiable and reasonably allocable to the [***], and (B) with respect to [***] will not be responsible for [***] in excess of [***] for [***].

Section 1.5Pharmacovigilance. As soon as reasonably practicable following the nHCM Supplemental Agreement Effective Date, and in any event no later than the first dosing of the first patient in the China Study, the Parties shall amend the PV Agreement to provide that: (a) Licensee will be responsible for collecting all Adverse Events and safety data relating to the Licensed Product in the PRC or the China Study as required by applicable Laws, (b) Licensee will report to Company all Adverse Events and safety data relating to the Licensed Product in the PRC or the China Study and, subject to Section 3.1, will be responsible for reporting (and if instructed by Company, will report) Adverse Events and safety data relating to the Licensed Product or the China Study to applicable Regulatory Authorities in the PRC, as well as responding (and if instructed by Company, will respond) to safety issues and to all requests of Regulatory Authorities in the PRC relating to the Licensed Product or the China Study, in each case within appropriate timeframes and in an appropriate format to ensure Company’s compliance with all applicable Laws and fulfillment of all local and international regulatory reporting obligations, and (c) subject to Section 3.1, Licensee shall immediately forward to Company any such inquiry from a Regulatory Authority in the PRC relating to the Licensed Product or the China Study, and shall send any draft responses to Company to review, comment

and approve (in Company’s sole discretion) before responding to the applicable Regulatory Authority in the PRC. For clarity, as between the Parties, Company shall have the final decision-making authority with respect to all safety and pharmacovigilance issues (including safety reports) in connection with the China Study.

Section 1.6Clinical Quality Agreement. As soon as reasonably practicable following the nHCM Supplemental Agreement Effective Date, and in any event no later than the initiation of any activities related to any quantity of the Licensed Product for the conduct of the China Study (excluding, for clarity, selection of Study Sites), the Parties shall amend the Clinical Quality Agreement to provide for each Party’s rights and responsibilities with respect to quality matters with respect to the Licensed Product supplied for use in the China Study, including (a) Licensee will be responsible for collecting all quality complaints relating to the Licensed Product in the PRC or the China Study as required by applicable Laws, (b) Licensee will report to Company all quality complaints relating to the Licensed Product in the PRC or the China Study, and, subject to Section 3.1, will be responsible for reporting (and if instructed by Company, will report) quality complaints relating to the Licensed Product or the China Study to applicable Regulatory Authorities in the PRC, as well as responding (and if instructed by Company, will respond) to all requests of Regulatory Authorities in the PRC relating to any quality complaints, (c) subject to Section 3.1, Licensee shall immediately forward to Company any such inquiry from a Regulatory Authority in the PRC relating to any quality complaints, and shall send any draft responses to Company to review, comment and approve (in Company’s sole discretion) before responding to the applicable Regulatory Authority in the PRC, and (d) if any recall of Licensed Product in the PRC is required under applicable Laws, including any such recall that Company determines must be conducted or that is ordered by the Regulatory Authority in the PRC with respect to the Licensed Product, Licensee shall, under the instruction of Company and at Licensee’s own cost and expense, conduct such recall in accordance with applicable Laws and requirements by any Regulatory Authority in the PRC. For clarity, as between the Parties, Company shall have the final decision-making authority with respect to all quality issues (including recalls) in connection with the China Study.

Section 1.7Development Supply Agreement. As soon as reasonably practicable following the nHCM Supplemental Agreement Effective Date, and in any event no later than [***] prior to the planned first shipment of any quantity of the Licensed Product for the conduct of the China Study, the Parties shall amend the Development Supply Agreement to provide for each Party’s rights and responsibilities with respect to Company’s supply, and Licensee’s, its Affiliates’ and Permitted Subcontractors’ exclusive purchase from Company, of Licensed Product for the conduct of the China Study.

Section 1.8Study Data. Licensee shall, and shall cause its Affiliates, Permitted Subcontractors, Study Sites and Investigators to, comply with its and their obligations (if any) under applicable Laws to provide any notice to and obtain any approval from any Governmental Authority and perform any other government process with respect to its and their collection and processing of Study Data and further agrees to provide such notices to and obtain such approvals from any Governmental Authority, perform such other government processes and take all such other steps as may be required by applicable Laws or as Company may reasonably request from time to time in order to permit Company and its Affiliates to comply with any such notification, approval or other process obligation applicable to Company or its Affiliates in connection with this nHCM Supplemental Agreement or as otherwise necessary for Company or its Affiliates to export and use such Study Data outside the PRC. Licensee shall promptly (unless a more immediate response is required under another section of this nHCM Supplemental Agreement),

upon Company’s request, provide Company with copies (in such electronic form as may be reasonably requested by Company) of the results of all activities under the China Study Development Plan and any and all other Inventions or other results generated by or on behalf of Licensee, its Affiliates, Permitted Subcontractors or Study Sites with respect to the China Study, including any Study Data, and completed informed consent forms; provided that Licensee shall provide the foregoing results once available and upon Licensee obtaining all requisite approvals required under applicable Law (including PRC data regulations), and Licensee shall obtain all requisite approvals and make all filings required under applicable Law (including PRC data regulations) to provide the foregoing results generated in connection with the China Study no later than [***]. All key results memoranda, and Study Data captured or processed in Company’s Global Clinical Study database and any other Study Data that Company requests to be provided in English shall be promptly provided in English. [***]. As between the Parties, any and all Study Data and other Inventions collected, generated or developed hereunder shall be solely owned by Company. Licensee hereby assigns and shall assign, and shall cause its Affiliates, Permitted Subcontractors, Study Sites and Investigators to assign, to Company (or its designee) all of its and their right, title and interest in any Study Data and other Inventions and Patent Rights related thereto. Without limitation to the foregoing, the provisions set forth in Section 7.1(c) of the License Agreement shall apply, mutatis mutandis, with respect to any Study Data and Inventions generated hereunder and any Patent Rights related to any of the foregoing (including any portion thereof). Company and its Affiliates shall have the right to use Study Data for any purpose (including, for clarity, providing Study Data to Third Parties) but subject to the second to last sentence in this Section 2.8). Licensee shall take all such steps as may be required by applicable Laws or as Company may reasonably request to obtain any approval or provide any notification required by a Governmental Authority in the PRC to fully effect the ownership of Study Data, Inventions, Patent Rights and China Study Regulatory Filings as provided in this Section 2.8 and Section 3.1(a). For clarity and without limiting the License Agreement (including Section 2.1 therein), subject to the terms and conditions of this nHCM Supplemental Agreement (including, for clarity, Section 6.2), Company hereby grants Licensee access to, and a right of reference with respect to, (a) the data from the Global Clinical Study, including Study Data, and (b) any regulatory filings and applications with, and documents submitted to, any regulatory authority with respect to the Global Clinical Study, including China Study Regulatory Filings ((a) and (b), collectively, “Global Study Data and Filings”), in each case ((a) and (b)), to the extent Controlled by Company that are reasonably necessary for Developing and seeking and securing INDs, CTAs, Regulatory Approvals, Marketing Authorizations and Pricing and Reimbursement Approvals of Licensed Products in the Field in the Territory, to Develop and seek and secure INDs, CTAs, Regulatory Approvals, Marketing Authorizations and Pricing and Reimbursement Approvals for Licensed Products in the Field in the Territory. For clarity, as between the Parties, subject to the access right and right of reference granted by Company to Licensee pursuant to the foregoing sentence, Company solely owns all right, title and interest in and to Global Study Data and Filings.

Section 1.9Good Data Practice. Licensee shall, and shall cause its applicable Affiliates, Permitted Subcontractors and Study Sites to, establish and maintain an effective data governance system that will ensure that any Study Data, irrespective of the format in which it is collected, received or otherwise generated, is recorded, processed, transmitted, retained and used to ensure a complete, consistent and accurate record throughout the lifecycle of such Study Data, including meeting the principals of ALCOA+ to ensure the integrity of such Study Data as required by applicable Laws (the “Data Governance System”). Except to the extent otherwise provided in any standard operating procedure(s) provided by Company to Licensee, the Data Governance System shall have a process in place for reviewing Study Data (including metadata,

such as audit trail) as per the frequency set forth in Licensee’s standard operating procedures. Licensee shall (a) promptly notify Company in writing of any incident that has, or potentially has, any impact on the integrity (e.g., security, accuracy and availability) of Study Data throughout its lifecycle, (b) timely investigate each such incident and take necessary remedial actions promptly, and (c) keep Company reasonably informed of such investigation, any remedial actions taken and the status thereof.

Article III

REGULATORY MATTERS

Section 1.1Regulatory Filings, Communications and Approvals Related to the China Study.

(a)Company or its applicable Affiliates shall own all right, title and interest in and to, and have the sole and exclusive right to hold in its (or its designee’s) name, the CTA for the China Study and all other China Study Regulatory Filings. Without limitation to Section 2.8, Company or its applicable Affiliates shall file and hold in its (or its designee’s) name the CTA for the China Study and all other China Study Regulatory Filings. For clarity, as between the Parties, (i) Company shall [***], and (ii) Licensee shall [***].

(b)Prior to the submission of the CTA for the China Study, Licensee shall provide Company a list of required documents for such submission and the related submission procedure(s) to, as applicable, obtain all approvals necessary to conduct the China Study as set forth herein, including ethics committee approval, HGR Approval, and approval of the CTA from NMPA; provided that if Company considers such list of required documents as overly broad, Licensee shall use Diligent Efforts to communicate with any applicable Regulatory Authority to narrow the list of required document(s).

(c)Subject to Section 3.1(d), Licensee shall be responsible for preparing, submitting and maintaining any China Study Regulatory Filings on Company’s behalf and in Company’s name in accordance with this Section 3.1(c).

(i)Except as provided in Section 3.2, Licensee shall consult with Company with respect to any China Study Regulatory Filing and shall provide a draft thereof to Company (including, with respect to draft China Study Regulatory Filings that are not in English, a full English translation thereof) at least [***] (or, with respect to correspondence with respect to the China Study with the applicable Regulatory Authority that does not involve any filing, application or document submission, such shorter period of time as may be mutually agreed by the Parties), or where Regulatory Authority timelines require a shorter review period, such shorter period of time as may be required for Company to comply with any applicable regulatory deadline, prior to the date such China Study Regulatory Filing is required to be made to the applicable Regulatory Authority for Company’s review, comment and approval, and Licensee shall implement all comments received from Company in connection therewith. Licensee shall not submit to a Regulatory Authority any China Study Regulatory Filing (or any portion thereof) that has not been approved by Company. Licensee shall provide Company with an as-filed copy of any China Study Regulatory Filing and an English translation thereof (to the extent not already in English) as soon as

practicable (and in any event within [***]) after submission to the relevant Regulatory Authority.

(ii)Except as provided in Section 3.2 and Section 2.2(i), Licensee shall notify Company in writing of all communications from a Regulatory Authority with respect to the China Study or any China Study Regulatory Filings no later than [***] after Licensee’s receipt thereof and earlier if needed to permit Company’s response to a question or deadline, and shall provide Company with a copy of the original communication, a written record of a phone call or oral communication or other documentation. As soon as practicable (and in any event within [***]) after Licensee’s receipt of any such communication, Licensee shall provide Company with an English translation of any written communication or other documentation (to the extent not already in English) and a detailed written summary in English of any oral communication.

(iii)Without limitation to the rights and licenses granted by Company to Licensee under Section 2.1 of the License Agreement, to the extent Company provides to Licensee any Confidential Information of Company specifically for use with respect to any China Study Regulatory Filing, Licensee shall only use such Confidential Information for the purpose of the applicable China Study Regulatory Filing.

(iv)Except as provided in Section 3.2, unless otherwise agreed by the Parties, Licensee shall make and respond to all communications with respect to China Study Regulatory Filings to and from the applicable Regulatory Authorities via written or electronic mail or, only if written or electronic mail is not reasonably practical, online inquiry systems of the applicable Regulatory Authority; provided that (A) any written communication via written or electronic mail shall include Company as a carbon copied party and (B) Licensee shall provide to Company a copy of any written communication via online inquiry systems of the applicable Regulatory Authority promptly (and in any event within [***]) and an English translation thereof (to the extent not already in English) as soon as practicable (and in any event within [***]).

(v)Licensee shall [***] ensure that the confidentiality of any proprietary portion of any China Study Regulatory Filing and other Confidential Information of Company is protected when submitted to a Regulatory Authority, via such methods as may be directed by Company, and that it is handled and stored in a secure manner by qualified personnel and according to proper procedures and safeguards, including encryption and password protection to prevent unauthorized disclosure. Without limitation to the foregoing, the Local Regulatory Agent shall not include in any communication via WeChat or other social media platforms any Confidential Information of Company or any of its Affiliates.

(d)Company shall have the right to prepare, submit directly to and conduct directly with any applicable Regulatory Authority one or more China Study Regulatory Filings (including Regulatory Meetings), or any portion thereof, at its sole discretion. Subject to Section 3.2, Licensee shall cooperate with and support Company with respect to any applicable China Study Regulatory Filing and Regulatory Meeting, at Company’s reasonable request, including by

coordinating and facilitating any discussions between Company and any applicable Regulatory Authority.

Section 1.2Regulatory Meetings and Discussions.

(a)Licensee shall provide written notice to Company of any meetings, telephone conferences or discussions with Regulatory Authorities in the PRC relating to the China Study or any China Study Regulatory Filing (each, a “Regulatory Meeting”) sufficiently in advance so as to allow for a reasonable opportunity for the Parties to cooperate on the preparation for such Regulatory Meeting and for Company to provide comments or instructions thereon and, in any event, within [***] (or, if Licensee receives any such notice less than [***] prior to the scheduled Regulatory Meeting, within [***]) of Licensee’s receipt from the applicable Regulatory Authority of notice of any Regulatory Meeting, [***]; provided that Licensee shall provide to Company a detailed written summary in English of [***] as soon as practical (and in any event within [***] after [***]).

(b)Except to the extent Company instructs Licensee otherwise, Company shall have the right to lead, and Licensee shall have the right to attend and participate, in any Regulatory Meeting; provided that (i) upon Company’s request, Licensee shall recuse itself from any portion of such Regulatory Meeting that relates to proprietary Know-How with respect to the Manufacturing of the Licensed Product and (ii) without limitation to the rights and licenses granted by Company to Licensee under Section 2.1 of the License Agreement, if Licensee obtains or is exposed to any information, whether written or oral, about Company’s business or products unrelated to the Licensed Product, such information shall be deemed to be Company’s Confidential Information (subject to Confidentiality Exceptions), which Licensee shall not use or disclose for any purpose. To the extent Licensee has access to or is provided with any copy of such Confidential Information, Licensee shall not retain any copy thereof, shall promptly destroy all copies of such Confidential Information in its possession or control and, upon Company’s request, shall confirm such destruction in writing to Company.

(c)Unless otherwise agreed by the Parties, for any Regulatory Meeting in which Licensee is participating or leading on behalf of Company (in each case as instructed by Company), (i) the Parties shall cooperate and, to the extent instructed by Company, prepare written messaging and goals in advance of any such Regulatory Meeting, (ii) Licensee shall implement comments and instructions made by Company and comply with any applicable written messaging and goals in the conduct of such Regulatory Meeting, and (iii) Licensee shall prepare and provide for Company’s review and approval draft written minutes (and English translations thereof) promptly (and in any event within [***]) after each such Regulatory Meeting and shall implement any reasonable comments of Company on such draft minutes. With respect to any such Regulatory Meeting that Company elects, in its sole discretion, not to participate in, Licensee shall provide Company with (A) [***] in English of such Regulatory Meeting within [***] after such Regulatory Meeting and (B) [***] in English of such Regulatory Meeting within [***] after such Regulatory Meeting. For clarity, any submission of China Study Regulatory Filing to a Regulatory Authority in connection with a Regulatory Meeting shall be subject to Section 3.1.

Section 1.3Inspections and Audits.

(a)If a Regulatory Authority plans to conduct an inspection or audit of Licensee, its relevant Affiliates, Permitted Subcontractors or Study Sites with respect to the

China Study or Licensed Product, Licensee shall, within [***] of the receipt of notice of such inspection or audit (or [***] of the receipt of notice of such inspection or audit if the inspection or audit is scheduled to occur within [***] of the receipt of such notice), notify Company thereof and provide a copy of all written correspondence from such Regulatory Authority regarding the planned inspection or audit. Licensee shall, and shall cause its relevant Affiliates, Permitted Subcontractors and Study Sites to cooperate with Company and the applicable Regulatory Authority with respect to such inspection or audit in accordance with such standard operating procedure(s) to the extent such standard operating standards and the relevant trainings are provided by Company to Licensee in advance and provide all assistance requested by Company with respect thereto, including, upon Company’s request, [***] to schedule such inspection or audit to allow representatives of Company to be present during any such inspection or audit (including accommodating Company’s attendance, rescheduling or use available extensions). Except to the extent otherwise provided in any standard operating procedure(s) provided by Company to Licensee with respect to an inspection or audit by a Regulatory Authority, following receipt of the inspection or audit observations of the Regulatory Authority, Licensee shall promptly (and, in any event, within [***] of Licensee’s receipt thereof) provide a copy to Company (including a copy of the original communication or documentation) and shall provide an English translation thereof (to the extent not already in English) to Company as soon as practicable (and in any event within [***] following Licensee’s receipt of such original communication or documentation), and Licensee will prepare, in consultation with Company, any appropriate responses or filings (including filing any remediation plan or responses to findings) with respect thereto in accordance with Section 3.1. For clarity, in accordance with Section 3.1, prior to responding to any applicable Regulatory Authority with respect to such inspection or audit, Licensee shall provide draft responses to Company for review, comment and approval, and Licensee shall not submit any response or filing to any applicable Regulatory Authority in connection with such inspection or audit that has not been approved by Company. Licensee shall maintain complete and accurate records of all such inspections and audits (including the Regulatory Authority’s findings and responses thereto) and all remediation or corrective actions planned or taken with respect to any such inspection or audit. If a Regulatory Authority desires to conduct an inspection or audit of Company, its relevant Affiliates or subcontractors, with respect to the China Study, then, upon Company’s reasonable request, Licensee shall, and shall cause its applicable Affiliates, Permitted Subcontractors and Study Sites to, cooperate with and assist Company and the Regulatory Authority with respect to such inspection or audit.

(b)Company, by itself or through its Affiliate(s) or designee(s), shall have the right, at Licensee’s reasonable cost and expense (no more than [***]), no more than [***] per [***] (other than any for-cause audit), upon reasonable advance notice, and during regular business hours, to (i) inspect the facilities where any quantities of the Licensed Product are stored or handled by Licensee, its Affiliates, Permitted Subcontractors or Study Sites, including any associated books and records, for purposes of verifying Licensee’s compliance with this nHCM Supplemental Agreement, (ii) inspect Licensee’s, its Affiliates’ or Permitted Subcontractors’ conduct of the China Study and any Study Sites or laboratories or other testing facilities used by Licensee, its Affiliates or Permitted Subcontractors to conduct any portion of the China Study or testing activities with respect thereto, including any associated books and records (including copies of agreements with Study Sites and Permitted Subcontractors), to observe and verify Licensee’s compliance with this nHCM Supplemental Agreement, (iii) review, copy and audit all Study Data generated, maintained or used in connection with Licensee’s, its Affiliates’, Permitted Subcontractors’ or Study Sites’ conduct of the China Study or any other activities hereunder, (iv) interview any of Licensee’s (or its Affiliates’, Permitted

Subcontractors’ or Study Sites’) personnel involved in the conduct of the China Study or any other activities hereunder, and (v) audit any recordkeeping, data collection and processing, information and other systems and business processes used by or on behalf of Licensee in the conduct of the China Study or any other activities hereunder. Promptly upon Licensee’s request, Company shall provide Licensee with reasonable documentation of the cost of any such audit, which documentation shall include an itemized list of costs and expenses for such audit in reasonable detail. Licensee shall, and shall cause its Affiliates, Permitted Subcontractors and Study Sites to, cooperate with any and all activities contemplated by this Section 3.3(b) and shall ensure timely access to requested facilities and documentation. If any such inspection, review or audit identifies an issue with respect to Licensee’s, its Affiliates’, Permitted Subcontractors’ or Study Sites’ conduct of the China Study or any other activities hereunder, then, without limitation to any rights or remedies that may be available to Company under this nHCM Supplemental Agreement or the License Agreement, the Parties shall promptly confer and Licensee shall, and shall cause its applicable Affiliates, Permitted Subcontractors or Study Sites to, [***] implement mitigation or remediation measures required by Company at Licensee’s cost and expense as soon as reasonably practicable but in any event not more than [***] after the Parties reach such agreement, unless otherwise agreed in writing by the Parties.

Section 1.4HGR Filings and Approvals.

(a)Unless otherwise instructed by Company, Licensee shall file all necessary applications for HGR Approvals for the China Study with the OHGRA to enable Licensee and Company to commence the China Study. In connection with the foregoing, Licensee (i) shall prepare and provide for Company’s review and comment sufficiently in advance of (and in any event at least [***] prior to) filing any draft applications for any such HGR Approval in English, including any applications for transferring and sharing of data or information in connection with the China Study, (ii) shall not file any such application that has not been approved by Company, and (iii) shall provide Company with an as-filed copy of any application for HGR Approvals and an English translation thereof (to the extent not already in English) promptly (and in any event within [***]) after submission to the OHGRA. The foregoing sentence shall apply to any amendment applications to any issued HGR Approvals, mutatis mutandis. For the avoidance of doubt, Company shall have the right to make all decisions regarding the content of any applications (including amendment applications) for any HGR Approvals with respect to the China Study and Licensee may not delegate preparation of any materials with respect to any such HGR Approvals to any Third Party without prior written approval from Company. Any such Third Party as may be approved by Company shall be deemed a Permitted Subcontractor and subject to the applicable terms and conditions hereunder (including Section 2.3) and under the License Agreement.

(b)Subject to Section 3.4(a), Licensee shall ensure, and shall cause its applicable Affiliates, Permitted Subcontractors and Study Sites, to take all necessary actions to ensure that (i) the collection, use and processing of Study Data in connection with the China Study, (ii) all transferring and sharing of Study Data and any other data and information in connection with the China Study among Licensee, its Affiliates, Permitted Subcontractors, Study Sites, Company, and its Affiliates or designee, and (iii) the Publication of Study Data or other results generated in the course of the conduct of the China Study under this Agreement, in each case ((i) through (iii)), are conducted in accordance with applicable Laws and after having received all requisite approvals from Governmental Authorities in the PRC, including applicable HGR Approval(s), and, upon Licensee’s specific reasonable request and at Licensee’s sole costs (with respect to internal and external costs and expenses reasonably incurred by Company or its

Affiliates), Company shall, and shall cause its applicable Affiliates, to provide reasonable assistance in furtherance of the foregoing.

Article IV

GOVERNANCE

Section 1.1Authority of the JSC. In addition to its responsibilities set forth in the License Agreement, the JSC shall have the authority to oversee the Development and regulatory activities with respect to the China Study conducted by each Party under this nHCM Supplemental Agreement, and shall be the forum to facilitate information exchange between the Parties with respect to the China Study, including the following responsibilities:

(a)provide a forum for the discussion of the Parties’ activities under this nHCM Supplemental Agreement;

(b)oversee activities with respect to the China Study conducted by Licensee, its applicable Affiliates, Permitted Subcontractors and Study Sites under this nHCM Supplemental Agreement, including the review of compliance and quality procedures (including GLP and GCP compliance);

(c)subject to Section 2.2(j), oversee safety and pharmacovigilance issues with respect to the China Study, including any expedited safety reports and recalls with respect thereto;

(d)oversee the participation, to the extent permitted by applicable Laws and as applicable, of any representative or designee of either Party in any open session meeting of the data monitoring committee with respect to the China Study;

(e)review and approve the China Study Development Plan (if the full China Study Development Plan has not been finalized as of the nHCM Supplemental Agreement Effective Date) and any amendments to the Study Guidelines or China Study Development Plan;

(f)review and approve any amendment to the [***] or [***];

(g)if applicable, serve as a forum for the Parties to discuss [***] in the event of a change to the [***] or the [***] as set forth in Section 2.2(b);

(h)resolve any matter with respect to which mutual agreement by the Parties is expressly required hereunder and the Parties are unable to reach such agreement within a reasonable amount of time (or such time as may be expressly specified for such agreement by the Parties);

(i)[***];

(j)review and discuss any dispute over whether Licensee (or its designated Affiliate) may [***]; and

(k)perform such other functions as are assigned to it pursuant to this nHCM Supplemental Agreement or as appropriate to further the purposes of this nHCM Supplemental Agreement to the extent agreed to in writing by Company and Licensee.

Section 1.2Development Subcommittee. Pursuant to Section 5.6(a) of the License Agreement, the Parties will form a joint development committee (the “JDC”) as soon as practicable, but no later than [***] after the nHCM Supplemental Agreement Effective Date. Notwithstanding anything to the contrary in the last sentence of Section 5.6(a) of the License Agreement, the JSC may delegate specifically-defined responsibilities of the JSC out of those set forth in Section 4.1 to the JDC, for which the JDC will be able to make decisions by unanimous vote by the Parties pursuant to the following sentence. Company’s representatives on the JDC will collectively have one vote, Licensee’s representatives on the JDC will collectively have one vote, and no decision will be made by the JDC without a unanimous vote by the Parties. Should the JDC not be able to reach agreement with respect to a matter at a duly called meeting of the JDC, at the written request of either Company or Licensee, such matter shall promptly, and in any event within [***] (or [***] in the event of an urgent matter) after such request, be referred to the JSC for resolution as set forth in Section 4.6.

Section 1.3Establishment of the Joint Compliance Committee. Within [***] after the nHCM Supplemental Agreement Effective Date, the JSC will establish a joint compliance committee (the “Joint Compliance Committee”) under the License Agreement, which will consist of [***] representatives from each of Company and Licensee (or such other equal number of representatives from each of Company and Licensee as the JSC determines is appropriate from time to time), each with the requisite expertise relevant to issues falling within the authority of the Joint Compliance Committee. From time to time, each of Company and the Licensee may substitute one or more of its representatives to the Joint Compliance Committee on written notice to the other. The Joint Compliance Committee will be co-chaired by one designated representative of each of Company and Licensee.

Section 1.4Authority of the Joint Compliance Committee. The Joint Compliance Committee will operate under the supervision and control of the JSC. All compliance activities with respect to Licensee’s conduct of the China Study during the Term shall be conducted under the oversight of the Joint Compliance Committee. In addition to its overall responsibility to oversee and address compliance matters for the China Study during the Term, the Joint Compliance Committee will:

(a)oversee and address operational issues associated with the implementation of the Compliance Standards with respect to the Compliance Program as set forth in Section 5.1(b);

(b)oversee and provide input on the implementation of any necessary corrective actions as set forth in Section 5.1(b); and

(c)perform such other functions as appropriate to further the purposes of this nHCM Supplemental Agreement to the extent agreed to in writing by Company and Licensee.

Section 1.5Meetings; Minutes. The Joint Compliance Committee shall hold meetings at such times as Company and Licensee shall determine, but in no event less frequently than each [***] during the Term, commencing from and after the time the Joint Compliance Committee is established as provided herein unless the co-chairpersons agree otherwise. All Joint Compliance Committee meetings may be conducted by telephone, video-conference or in person as determined by mutual agreement of the co-chairpersons. Unless otherwise agreed by the Parties, all in-person meetings of the Joint Compliance Committee shall be held at Company’s or its Affiliates’ facilities. Further, in addition to the regularly scheduled meetings,