adr-20230630000183128312-312023Q2False00018312832023-01-012023-06-3000018312832023-08-07xbrli:shares00018312832023-06-30iso4217:USD00018312832022-12-31iso4217:USDxbrli:shares00018312832023-04-012023-06-3000018312832022-04-012022-06-3000018312832022-01-012022-06-300001831283us-gaap:CommonStockMember2022-12-310001831283us-gaap:AdditionalPaidInCapitalMember2022-12-310001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001831283us-gaap:RetainedEarningsMember2022-12-310001831283us-gaap:ParentMember2022-12-310001831283us-gaap:NoncontrollingInterestMember2022-12-310001831283us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001831283us-gaap:ParentMember2023-01-012023-03-3100018312832023-01-012023-03-310001831283us-gaap:CommonStockMember2023-01-012023-03-310001831283us-gaap:RetainedEarningsMember2023-01-012023-03-310001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001831283us-gaap:CommonStockMember2023-03-310001831283us-gaap:AdditionalPaidInCapitalMember2023-03-310001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001831283us-gaap:RetainedEarningsMember2023-03-310001831283us-gaap:ParentMember2023-03-310001831283us-gaap:NoncontrollingInterestMember2023-03-3100018312832023-03-310001831283us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001831283us-gaap:ParentMember2023-04-012023-06-300001831283us-gaap:CommonStockMember2023-04-012023-06-300001831283us-gaap:RetainedEarningsMember2023-04-012023-06-300001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001831283us-gaap:CommonStockMember2023-06-300001831283us-gaap:AdditionalPaidInCapitalMember2023-06-300001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001831283us-gaap:RetainedEarningsMember2023-06-300001831283us-gaap:ParentMember2023-06-300001831283us-gaap:NoncontrollingInterestMember2023-06-300001831283us-gaap:CommonStockMember2021-12-310001831283us-gaap:AdditionalPaidInCapitalMember2021-12-310001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001831283us-gaap:RetainedEarningsMember2021-12-310001831283us-gaap:ParentMember2021-12-310001831283us-gaap:NoncontrollingInterestMember2021-12-3100018312832021-12-310001831283us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001831283us-gaap:ParentMember2022-01-012022-03-3100018312832022-01-012022-03-310001831283us-gaap:RetainedEarningsMember2022-01-012022-03-310001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001831283us-gaap:CommonStockMember2022-03-310001831283us-gaap:AdditionalPaidInCapitalMember2022-03-310001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001831283us-gaap:RetainedEarningsMember2022-03-310001831283us-gaap:ParentMember2022-03-310001831283us-gaap:NoncontrollingInterestMember2022-03-3100018312832022-03-310001831283us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001831283us-gaap:ParentMember2022-04-012022-06-300001831283us-gaap:CommonStockMember2022-04-012022-06-300001831283us-gaap:RetainedEarningsMember2022-04-012022-06-300001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001831283us-gaap:CommonStockMember2022-06-300001831283us-gaap:AdditionalPaidInCapitalMember2022-06-300001831283us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001831283us-gaap:RetainedEarningsMember2022-06-300001831283us-gaap:ParentMember2022-06-300001831283us-gaap:NoncontrollingInterestMember2022-06-3000018312832022-06-300001831283us-gaap:IPOMember2021-11-032021-11-030001831283us-gaap:IPOMemberdei:AdrMember2021-11-032021-11-030001831283us-gaap:IPOMember2021-11-030001831283us-gaap:OverAllotmentOptionMemberdei:AdrMember2021-12-012021-12-010001831283us-gaap:OverAllotmentOptionMemberdei:AdrMember2021-12-010001831283us-gaap:IPOMember2021-12-012021-12-0100018312832021-11-030001831283adr:QedMemberadr:AmendedLicensingAgreementMember2019-10-012019-10-310001831283adr:LianOncologyMemberadr:WarrantsToPurchaseCommonStockMemberadr:QedMemberadr:AmendedLicensingAgreementMember2019-10-310001831283adr:LianOncologyMemberadr:QedMemberadr:AmendedLicensingAgreementMember2019-10-3100018312832019-10-31adr:tranche0001831283adr:LianOncologyMemberadr:QedMemberadr:TrancheTwoMemberadr:AmendedLicensingAgreementMember2019-10-31xbrli:pure0001831283adr:LianOncologyMemberadr:QedMemberadr:AmendedLicensingAgreementMemberadr:TrancheOneMember2019-10-310001831283adr:LianOncologyMemberadr:TrancheThreeMemberadr:QedMemberadr:AmendedLicensingAgreementMember2019-10-310001831283adr:LianOncologyMemberadr:WarrantsToPurchaseCommonStockMemberadr:QedMemberadr:AmendedLicensingAgreementMember2021-10-180001831283adr:SpecifiedDevelopmentRegulatoryMilestoneMemberadr:QedMemberadr:AmendedLicensingAgreementMember2019-10-310001831283adr:QedMemberadr:AmendedLicensingAgreementMemberadr:SalesBasedMilestoneMember2019-10-310001831283adr:QedMember2023-04-012023-06-300001831283adr:QedMember2023-01-012023-06-300001831283adr:QedMemberus-gaap:SubsequentEventMember2023-08-012023-08-310001831283adr:MyokardiaMember2020-08-012020-08-310001831283adr:WarrantsToPurchaseCommonStockMemberadr:MyokardiaMember2020-08-310001831283adr:WarrantsToPurchaseCommonStockMemberadr:MyokardiaMember2021-10-120001831283adr:MyokardiaMemberadr:NonRefundableFinancingMilestonePaymentMember2020-08-310001831283adr:MyokardiaMemberadr:AmendedLicensingAgreementMemberadr:NonRefundableFinancingMilestonePaymentMember2020-10-292020-10-290001831283adr:SpecifiedDevelopmentRegulatoryMilestoneMemberadr:MyokardiaMember2020-08-310001831283adr:MyokardiaMemberadr:SalesBasedMilestoneMember2020-08-310001831283adr:SpecifiedDevelopmentRegulatoryMilestoneMemberadr:MyokardiaMember2022-01-012022-12-310001831283adr:MyokardiaMember2023-01-012023-06-300001831283adr:MyokardiaMember2023-04-012023-06-300001831283adr:NavireMemberadr:AmendedLicensingAgreementMember2020-08-012020-08-310001831283adr:NavireMemberadr:SpecifiedDevelopmentRegulatoryMilestoneMemberadr:AmendedLicensingAgreementMember2020-08-310001831283adr:NavireMemberadr:AmendedLicensingAgreementMemberadr:SalesBasedMilestoneMember2020-08-310001831283adr:NavireMemberadr:AmendedLicensingAgreementMembersrt:MinimumMember2020-08-012020-08-310001831283adr:NavireMembersrt:MaximumMemberadr:AmendedLicensingAgreementMember2020-08-012020-08-310001831283adr:NavireMemberadr:AmendedLicensingAgreementMember2021-01-012021-12-310001831283adr:NavireMember2023-01-012023-06-300001831283adr:NavireMember2023-04-012023-06-300001831283adr:PfizerMember2020-11-300001831283adr:PfizerMember2022-12-310001831283adr:PfizerMember2022-12-012022-12-310001831283adr:TarsusPharmaceuticalsMember2021-03-012021-03-310001831283adr:WarrantsToPurchaseCommonStockMemberadr:TarsusPharmaceuticalsMember2021-03-012021-03-310001831283adr:WarrantsToPurchaseCommonStockMemberadr:TarsusPharmaceuticalsMember2021-03-3100018312832021-03-310001831283adr:WarrantsToPurchaseCommonStockMemberadr:TrancheOneMemberadr:TarsusPharmaceuticalsMember2021-03-310001831283adr:WarrantsToPurchaseCommonStockMemberadr:TrancheTwoMemberadr:TarsusPharmaceuticalsMember2021-03-310001831283adr:TrancheThreeMemberadr:WarrantsToPurchaseCommonStockMemberadr:TarsusPharmaceuticalsMember2021-03-310001831283adr:WarrantsToPurchaseCommonStockMemberadr:TarsusPharmaceuticalsMember2021-10-182021-10-180001831283adr:TarsusWarrantsMember2021-10-180001831283adr:WarrantsToPurchaseCommonStockMemberadr:TarsusPharmaceuticalsMember2021-10-180001831283adr:WarrantsToPurchaseCommonStockMemberadr:TarsusPharmaceuticalsMember2022-06-062022-06-060001831283adr:WarrantsToPurchaseCommonStockMemberadr:TarsusPharmaceuticalsMember2022-06-060001831283adr:MilestoneStageTwoMemberadr:TarsusPharmaceuticalsMember2021-03-310001831283adr:SpecifiedDevelopmentRegulatoryAndSalesBasedMilestoneMemberadr:TarsusPharmaceuticalsMember2021-03-310001831283adr:SpecifiedDevelopmentRegulatoryMilestoneMemberadr:TarsusPharmaceuticalsMember2021-03-310001831283adr:SalesBasedMilestoneMemberadr:TarsusPharmaceuticalsMember2021-03-310001831283adr:TarsusPharmaceuticalsMember2022-01-012022-12-310001831283adr:TarsusPharmaceuticalsMember2023-01-012023-06-300001831283adr:TarsusPharmaceuticalsMember2023-04-012023-06-300001831283adr:TarsusPharmaceuticalsMember2023-01-012023-06-300001831283adr:LandosMember2021-05-012021-05-310001831283adr:SpecifiedDevelopmentRegulatoryAndSalesBasedMilestoneMemberadr:LandosMember2021-05-310001831283adr:SpecifiedDevelopmentRegulatoryMilestoneMemberadr:LandosMember2021-05-310001831283adr:LandosMemberadr:SalesBasedMilestoneMember2021-05-310001831283adr:LandosMember2023-01-012023-06-300001831283adr:LandosMember2023-04-012023-06-300001831283adr:NImmuneMember2023-01-012023-06-300001831283adr:NImmuneMember2023-04-012023-06-300001831283adr:SpecifiedDevelopmentRegulatoryAndSalesBasedMilestoneMemberadr:N1mmuneMember2023-02-280001831283adr:SpecifiedDevelopmentRegulatoryMilestoneMemberadr:N1mmuneMember2023-02-280001831283adr:SalesBasedMilestoneMemberadr:N1mmuneMember2023-02-280001831283adr:N1mmuneMember2023-01-012023-06-300001831283adr:N1mmuneMember2023-04-012023-06-300001831283adr:NanobiotixMember2021-05-012021-05-310001831283adr:SpecifiedDevelopmentRegulatoryAndSalesBasedMilestoneMemberadr:NanobiotixMember2021-05-310001831283adr:SpecifiedDevelopmentRegulatoryMilestoneMemberadr:NanobiotixMember2021-05-310001831283adr:NanobiotixMemberadr:SalesBasedMilestoneMember2021-05-310001831283adr:NanobiotixMembersrt:MinimumMember2021-05-012021-05-310001831283srt:MaximumMemberadr:NanobiotixMember2021-05-012021-05-310001831283adr:NanobiotixMember2023-01-012023-06-300001831283adr:NanobiotixMember2023-04-012023-06-300001831283adr:LyraMember2021-05-012021-05-310001831283adr:LyraMemberadr:SpecifiedDevelopmentRegulatoryAndSalesBasedMilestoneMember2021-05-310001831283adr:LyraMemberadr:SpecifiedDevelopmentRegulatoryMilestoneMember2021-05-310001831283adr:LyraMemberadr:SalesBasedMilestoneMember2021-05-310001831283adr:LyraMember2023-01-012023-06-300001831283adr:LyraMember2023-04-012023-06-300001831283us-gaap:CommercialPaperMember2023-06-300001831283us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-06-300001831283us-gaap:CommercialPaperMember2022-12-310001831283us-gaap:CorporateDebtSecuritiesMember2022-12-310001831283us-gaap:USGovernmentDebtSecuritiesMember2022-12-310001831283us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-06-300001831283us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-06-300001831283us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-06-300001831283us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-06-300001831283us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-06-300001831283us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-06-300001831283us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-06-300001831283us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-06-300001831283us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001831283us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001831283us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001831283us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001831283us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001831283us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001831283us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001831283us-gaap:FairValueMeasurementsRecurringMember2023-06-300001831283us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001831283us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001831283us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001831283us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001831283us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2022-12-310001831283us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2022-12-310001831283us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2022-12-310001831283us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2022-12-310001831283us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001831283us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001831283us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001831283us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001831283us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001831283us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001831283us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001831283us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001831283us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001831283us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001831283us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001831283us-gaap:FairValueMeasurementsRecurringMember2022-12-310001831283us-gaap:LeaseholdImprovementsMember2023-06-300001831283us-gaap:LeaseholdImprovementsMember2022-12-310001831283us-gaap:FurnitureAndFixturesMember2023-06-300001831283us-gaap:FurnitureAndFixturesMember2022-12-310001831283adr:ComputerEquipmentAndSoftwareMember2023-06-300001831283adr:ComputerEquipmentAndSoftwareMember2022-12-310001831283us-gaap:ConstructionInProgressMember2023-06-300001831283us-gaap:ConstructionInProgressMember2022-12-310001831283adr:TwoThousandAndNineteenPlanMember2021-11-030001831283adr:TwoThousandAndTwentyOnePlanMember2021-11-030001831283adr:TwoThousandAndTwentyOnePlanMember2023-01-012023-06-300001831283adr:TwoThousandAndNineteenPlanMember2019-12-012023-06-300001831283adr:TwoThousandAndTwentyOnePlanMember2021-11-032023-06-300001831283us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001831283us-gaap:EmployeeStockOptionMember2023-06-300001831283srt:MinimumMemberus-gaap:EmployeeStockOptionMember2023-01-012023-06-300001831283srt:MaximumMemberus-gaap:EmployeeStockOptionMember2023-01-012023-06-300001831283us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001831283us-gaap:EmployeeStockOptionMember2022-06-300001831283srt:MinimumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-06-300001831283srt:MaximumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-06-300001831283us-gaap:PerformanceSharesMember2023-01-012023-06-300001831283us-gaap:PerformanceSharesMember2022-01-012022-06-300001831283us-gaap:PerformanceSharesMember2023-06-300001831283us-gaap:PerformanceSharesMember2022-06-300001831283us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:PerformanceSharesMember2023-01-012023-06-300001831283us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:PerformanceSharesMember2022-01-012022-06-300001831283us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:PerformanceSharesMember2023-06-300001831283us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:PerformanceSharesMember2022-06-300001831283us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001831283us-gaap:RestrictedStockUnitsRSUMember2023-06-300001831283us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001831283us-gaap:RestrictedStockUnitsRSUMember2022-06-300001831283us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2023-06-300001831283us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2022-06-300001831283us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001831283us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001831283us-gaap:RestrictedStockMember2023-01-012023-06-300001831283us-gaap:RestrictedStockMember2022-01-012022-06-300001831283adr:WarrantsInLianCardiovascularIssuedToMyokardiaMember2023-01-012023-06-300001831283adr:WarrantsInLianCardiovascularIssuedToMyokardiaMember2022-01-012022-06-300001831283us-gaap:WarrantMember2023-01-012023-06-300001831283us-gaap:WarrantMember2022-01-012022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_________________

FORM 10-Q

_________________

(Mark One)

| | | | | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

OR

| | | | | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission File Number: 001-40947

_________________

LianBio

(Exact Name of Registrant as Specified in its Charter)

_________________

| | | | | |

| Cayman Islands | 98-1594670 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification No.) |

| |

103 Carnegie Center Drive, Suite 309 Princeton, NJ | 08540 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (609) 486-2308

_________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

| American Depositary Shares, each representing 1 ordinary share, par value $0.000017100448 per share | | LIAN | | The Nasdaq Global Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | o |

| | | | |

| Non-accelerated filer | x | | Smaller reporting company | x |

| | | | |

| Emerging growth company | x | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 7, 2023, 107,167,609 ordinary shares of the registrant, par value $0.000017100448 per share, were outstanding, of which 42,312,215 ordinary shares were held in the form of American Depositary Shares. This total number of ordinary shares and total number of ordinary shares held in the form of American Depositary Shares excludes 2,051,410 ordinary shares that are held by the depositary on reserve to satisfy obligations of the registrant under the registrant’s equity plans.

Table of Contents

| | | | | | | | |

| | Page |

| PART I. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PART II | | |

| | |

ITEM 1A. | | |

| | |

| ITEM 3. | | |

| | |

ITEM 5. | | |

| | |

| |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, about us and our industry that involve substantial risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q, including statements regarding our strategy, future operations, future financial position, prospects, plans, objectives of management and expected growth, are forward-looking statements. These statements are based on our current beliefs, expectations and assumptions regarding our intentions, beliefs or current expectations concerning, among other things, the future of our business, future plans and strategies, our operational results and other future conditions. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Forward-looking statements can be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “seek,” “target,” “will,” “would,” “could,” “should,” “continue,” “contemplate” and other similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about:

•our ability to successfully develop, gain regulatory approval for and launch commercial products in Greater China and other Asian markets;

•our ability to deliver innovative therapeutic solutions to patients and become a leading biopharmaceutical company in Greater China, including Mainland China, Hong Kong, Taiwan and Macau, and other Asian markets;

•our plans and ability to leverage data generated in our partners’ global registrational trials and clinical development programs to obtain regulatory approval for and bring our current product candidates to market in our licensed territories, and our plans to maximize patient reach for each of our product candidates;

•our partners’ announced plans and expectations with respect to the success, cost and timing of their product development activities, preclinical studies and clinical trials, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work, the timing of expected review from regulatory authorities and the period during which the results of the trials are expected to become available;

•our ability to expand our pipeline through the continued strategic in-licensing of innovative and complementary product candidates with the potential to become the new standard of care in Greater China and other Asian markets;

•our ability to successfully establish an international infrastructure, including by building a focused salesforce in China and leveraging the commercial infrastructure we create to benefit our other assets;

•our ability to establish and maintain relationships and collaborations with investors and our current and any future licensing partners that will contribute to our success in sourcing value and creating partnerships to enable us to build out a broad and clinically validated pipeline;

•our ability to design, initiate and complete any clinical trials to advance our current product candidates, including mavacamten, TP-03, NBTXR3, infigratinib, BBP-398, LYR-210, omilancor, NX-13 and sisunatovir, as well as any future product candidates, towards regulatory approval in China and our other licensed territories;

•our ability to conduct, and the timing of and costs related to, our product development activities, including any preclinical studies and related clinical trials in Greater China and other Asian markets of our current and any future product candidates, and our ability to obtain, and the timing of and costs related to, potential regulatory approval of such product candidates in Greater China and other Asian markets;

•our plans to pursue the development of certain product candidates for additional treatment indications;

•our ability to successfully utilize the data we may generate from any clinical trials we conduct in Greater China or other territories, including in conjunction with data from clinical trials conducted by our partners, to seek regulatory approval in Greater China and other Asian markets;

•our plans and ability to join our current and future partners’ clinical and registrational trials and our plans and ability to initiate and complete our standalone clinical and registrational trials;

•our ability to design and implement the development strategies for our product candidates in each of our licensed territories and, where applicable, our ability to design and implement global development strategies for our product candidates in new indications in connection with our local development strategies;

•the potential for certain of our current and future product candidates to have more benign safety profiles or result in differentiated safety profiles than currently available therapeutic options;

•the size, composition and growth potential of the patient populations and markets we intend to target with our product candidates and our ability to develop and commercialize product candidates to address those patient populations and markets;

•our ability to successfully procure from our partners or other third parties, as applicable, sufficient supply of our product candidates for any preclinical studies, clinical trials or commercial use, if approved;

•our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our product candidates and our general and administrative expenses;

•the rate and degree of market acceptance of our product candidates;

•our ability to attract and retain key scientific or management personnel;

•the impact of laws and regulations and of any legal and regulatory developments in our licensed territories or internationally;

•our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates;

•our ability to license intellectual property relating to our product candidates and to comply with our existing license and collaboration agreements;

•our reliance on third parties to conduct product development, manufacturing and other services, and any agreements we have or into which we may enter with such parties in connection with the commercialization of our product candidates and any other approved product;

•our expectations regarding the time during which we will be an emerging growth company or smaller reporting company;

•the direct and indirect impact of the COVID-19 pandemic on our business, operations (including clinical trials) and the markets and communities in which we and our partners, collaborators and vendors operate;

•our estimates of our expenses, capital requirements and needs for additional financing; and

•other risks and uncertainties, including those listed under the caption “Risk Factors.”

Although we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution investors that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this Quarterly Report on Form 10-Q. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in this Quarterly Report on Form 10-Q, those results or developments may not be indicative of results or developments in subsequent periods.

Given these risks and uncertainties, investors are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statement that we make in this Quarterly Report on Form 10-Q speaks only as of the date of such statement, and we undertake no obligation to update any forward-looking statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data. Investors should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Quarterly Report on Form 10-Q.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report on Form 10-Q, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Unless the context requires otherwise, references in this report to the “Company,” “LianBio,” “we,” “us” and “our” refer to LianBio and its consolidated subsidiaries. We are not a Chinese operating company but are a Cayman Islands holding company with operations conducted by our subsidiaries. For more information on risks relating to our organizational structure, see “Risks Related to Doing Business in China and Our International Operations” and “Risks Related to Ownership of our Ordinary Shares or ADSs and our Status as a Public Company” in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022.

PART I-FINANCIAL INFORMATION

Item 1. Financial Statements

LianBio

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 104,059 | | | $ | 79,221 | |

| Marketable securities | 163,209 | | | 223,142 | |

| | | |

| Prepaid expenses and other current assets | 4,805 | | | 8,640 | |

| Other receivable | 1,025 | | | 1,770 | |

| Total current assets | 273,098 | | | 312,773 | |

| Restricted cash, non-current | 69 | | | 73 | |

| Property and equipment, net | 2,562 | | | 3,116 | |

| Operating lease right-of-use assets | 3,049 | | | 3,978 | |

| Other non-current assets | 20 | | | 20 | |

| Total assets | $ | 278,798 | | | $ | 319,960 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,908 | | | $ | 1,453 | |

| Accrued expenses | 16,879 | | | 19,826 | |

| Current portion of operating lease liabilities | 1,859 | | | 1,851 | |

| | | |

| Other current liabilities | 996 | | | 485 | |

| Total current liabilities | 21,642 | | | 23,615 | |

| Operating lease liabilities | 1,441 | | | 2,488 | |

| Other liabilities | 210 | | | 210 | |

| | | |

| Total liabilities | 23,293 | | | 26,313 | |

| Commitments and contingencies (Note 8) | | | |

| Shareholders’ equity: | | | |

Ordinary shares, $0.000017100448 par value. 2,923,900,005 shares authorized as of June 30, 2023; 107,167,609 shares issued and outstanding as of June 30, 2023; 2,923,900,005 shares authorized as of December 31, 2022; 107,043,924 shares issued and outstanding as of December 31, 2022 | 2 | | | 2 | |

| Additional paid-in capital | 741,246 | | | 732,476 | |

| Accumulated other comprehensive loss | (3,326) | | | (2,080) | |

| Accumulated deficit | (516,191) | | | (470,525) | |

| Total LianBio shareholders’ equity | 221,731 | | | 259,873 | |

| Non-controlling interest | 33,774 | | | 33,774 | |

| Total shareholders’ equity | 255,505 | | | 293,647 | |

| Total liabilities and shareholders’ equity | $ | 278,798 | | | $ | 319,960 | |

See accompanying notes to the consolidated financial statements

LianBio

Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| | | | | | | |

| Research and development | $ | 9,454 | | | $ | 28,591 | | | $ | 20,285 | | | $ | 40,920 | |

| General and administrative | 15,590 | | | 14,551 | | | 30,728 | | | 30,639 | |

| Total operating expenses | 25,044 | | | 43,142 | | | 51,013 | | | 71,559 | |

| Loss from operations | (25,044) | | | (43,142) | | | (51,013) | | | (71,559) | |

| Other income: | | | | | | | |

| Interest income, net | 2,754 | | | 553 | | | 5,160 | | | 833 | |

| Other income, net | 869 | | | 203 | | | 825 | | | 620 | |

| Net loss before income taxes | (21,421) | | | (42,386) | | | (45,028) | | | (70,106) | |

| Income taxes | 200 | | | 5 | | | 638 | | | 11 | |

| Net loss | (21,621) | | | (42,391) | | | (45,666) | | | (70,117) | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation loss, net of tax | (1,641) | | | (421) | | | (1,537) | | | (814) | |

| Unrealized gain (loss) on marketable securities, net of tax | (154) | | | (291) | | | 291 | | | (1,114) | |

| Comprehensive loss | $ | (23,416) | | | $ | (43,103) | | | $ | (46,912) | | | $ | (72,045) | |

| Net loss per share attributable to ordinary shareholders, basic and diluted | $ | (0.20) | | | $ | (0.39) | | | $ | (0.43) | | | $ | (0.65) | |

| Weighted-average shares outstanding used in computing net loss per share attributable to ordinary shareholders, basic and diluted | 107,164,401 | | | 107,922,501 | | | 107,163,220 | | | 107,600,767 | |

See accompanying notes to the consolidated financial statements

LianBio

Consolidated Statements of Shareholders’ Equity

(In thousands, except share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ordinary Shares | | Additional

Paid in

Capital | | Accumulated

Other

Comprehensive (Loss) Income | | Accumulated

Deficit | | Total LianBio

Shareholders’

Equity (Deficit) | | Non-

Controlling

Interest | | Total

Shareholders’

Equity (Deficit) |

| | | | | | | Shares | | Amount | | | | | | |

| Balance, December 31, 2022 | | | | | | 107,043,924 | | | $ | 2 | | | $ | 732,476 | | | $ | (2,080) | | | $ | (470,525) | | | $ | 259,873 | | | $ | 33,774 | | | $ | 293,647 | |

| Share-based compensation expense | | | | | | — | | | — | | | 4,276 | | | — | | | — | | | 4,276 | | | — | | | 4,276 | |

| Issuance of restricted stock units | | | | | | 120,251 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net loss | | | | | | — | | | — | | | — | | | — | | | (24,045) | | | (24,045) | | | — | | | (24,045) | |

| Comprehensive income | | | | | | — | | | — | | | — | | | 549 | | | — | | | 549 | | | — | | | 549 | |

| Balance, March 31, 2023 | | | | | | 107,164,175 | | | $ | 2 | | | $ | 736,752 | | | $ | (1,531) | | | $ | (494,570) | | | $ | 240,653 | | | $ | 33,774 | | | $ | 274,427 | |

| Share-based compensation expense | | | | | | — | | | — | | | 4,494 | | | — | | | — | | | 4,494 | | | — | | | 4,494 | |

| Issuance of restricted stock units | | | | | | 3,434 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net loss | | | | | | — | | | — | | | — | | | — | | | (21,621) | | | (21,621) | | | — | | | (21,621) | |

| Comprehensive loss | | | | | | — | | | — | | | — | | | (1,795) | | | — | | | (1,795) | | | — | | | (1,795) | |

| Balance, June 30, 2023 | | | | | | 107,167,609 | | | $ | 2 | | | $ | 741,246 | | | $ | (3,326) | | | $ | (516,191) | | | $ | 221,731 | | | $ | 33,774 | | | $ | 255,505 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Ordinary Shares | | Additional

Paid in

Capital | | Accumulated

Other

Comprehensive

(Loss) Income | | Accumulated

Deficit | | Total LianBio

Shareholders’

Equity (Deficit) | | Non-

Controlling

Interest | | Total

Shareholders’

Equity (Deficit) |

| | | | | | | Shares | | Amount | | | | | | |

| Balance, December 31, 2021 | | | | | | 107,275,458 | | | $ | 2 | | | $ | 713,269 | | | $ | 526 | | | $ | (360,235) | | | $ | 353,562 | | | $ | 33,774 | | | $ | 387,336 | |

| Share-based compensation expense | | | | | | — | | | — | | | 4,669 | | | — | | | — | | | 4,669 | | | — | | | 4,669 | |

| Receivable from related party | | | | | | — | | | — | | | 1,710 | | | — | | | — | | | 1,710 | | | — | | | 1,710 | |

| Net loss | | | | | | — | | | — | | | — | | | — | | | (27,726) | | | (27,726) | | | — | | | (27,726) | |

| Comprehensive Income | | | | | | — | | | — | | | — | | | (1,216) | | | — | | | (1,216) | | | — | | | (1,216) | |

| Balance, March 31, 2022 | | | | | | 107,275,458 | | | $ | 2 | | | $ | 719,648 | | | $ | (690) | | | $ | (387,961) | | | $ | 330,999 | | | $ | 33,774 | | | $ | 364,773 | |

| Share-based compensation expense | | | | | | — | | | — | | | 4,528 | | | — | | | — | | | 4,528 | | | — | | | 4,528 | |

| Exercise of options | | | | | | 1,000,000 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Exercise of warrants | | | | | | 78,373 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net loss | | | | | | — | | | — | | | — | | | — | | | (42,391) | | | (42,391) | | | — | | | (42,391) | |

| Comprehensive loss | | | | | | — | | | — | | | — | | | (712) | | | — | | | (712) | | | — | | | (712) | |

| Balance, June 30, 2022 | | | | | | 108,353,831 | | | $ | 2 | | | $ | 724,176 | | | $ | (1,402) | | | $ | (430,352) | | | $ | 292,424 | | | $ | 33,774 | | | $ | 326,198 | |

See accompanying notes to the consolidated financial statements

LianBio

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | Six Months Ended

June 30, 2023 | | Six Months Ended

June 30, 2022 |

| Net loss | $ | (45,666) | | | $ | (70,117) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| | | |

| Non-cash operating lease expense (benefit) | — | | | 430 | |

| Depreciation expense | 658 | | | 409 | |

| Share based compensation expense | 8,770 | | | 9,197 | |

| Amortization of discounts on investments, net | (2,360) | | | 1 | |

| Unrealized foreign currency transaction (gain) loss, net | (1,261) | | | 240 | |

| Changes in operating assets and liabilities: | | | |

| | | |

| | | |

| Prepaid expenses and other current assets | 3,710 | | | 3,130 | |

| Other receivable | 745 | | | (1,281) | |

| | | |

| Other non-current assets | — | | | 8 | |

| Accounts payable | 476 | | | (1,957) | |

| Accrued expenses | (2,198) | | | 7,414 | |

| Other current liabilities | 273 | | | 50 | |

| Operating lease assets and liabilities, net | (97) | | | (32) | |

| | | |

| Net cash used in operating activities | (36,950) | | | (52,508) | |

| Cash flows from investing activities: | | | |

| Purchase of property and equipment | (69) | | | (673) | |

| Purchase of marketable securities | (87,806) | | | (126,138) | |

| Sales and redemption of marketable securities | 150,391 | | | 85,125 | |

| Net cash provided by (used for) investing activities | 62,516 | | | (41,686) | |

| Cash flows from financing activities: | | | |

| | | |

| Proceeds from exercise of share options | — | | | 1,710 | |

| | | |

| | | |

| Net cash provided by financing activities | — | | | 1,710 | |

| Effect of exchange rate changes on cash and cash equivalents | (732) | | | (1,289) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | $ | 24,834 | | | $ | (93,773) | |

| Cash and cash equivalents, and restricted cash—beginning of period | 79,294 | | | 248,182 | |

| Cash and cash equivalents, and restricted cash—ending of period | $ | 104,128 | | | $ | 154,409 | |

| Cash and cash equivalents—end of period | $ | 104,059 | | | $ | 134,334 | |

| Restricted cash—end of period | $ | 69 | | | $ | 20,075 | |

| Cash and cash equivalents, and restricted cash—ending of period | $ | 104,128 | | | $ | 154,409 | |

| Supplemental disclosure of cash information | | | |

| Cash paid for income taxes | $ | 3 | | | $ | 343 | |

| Supplemental disclosure of non-cash operating activities: | | | |

| | | |

| | | |

Purchase of property and equipment in accounts payable | $ | 150 | | | $ | 938 | |

See accompanying notes to the consolidated financial statements

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular Dollars in Thousands, Except Share and per Share Data)

(Unaudited)

1. Nature of Business

LianBio (“LianBio” or the “Company”) is a clinical stage biopharmaceutical company dedicated to bringing innovative medicines to patients with unmet medical needs in Asia. The Company’s initial focus is to license assets for development and commercialization in Greater China and other Asian markets.

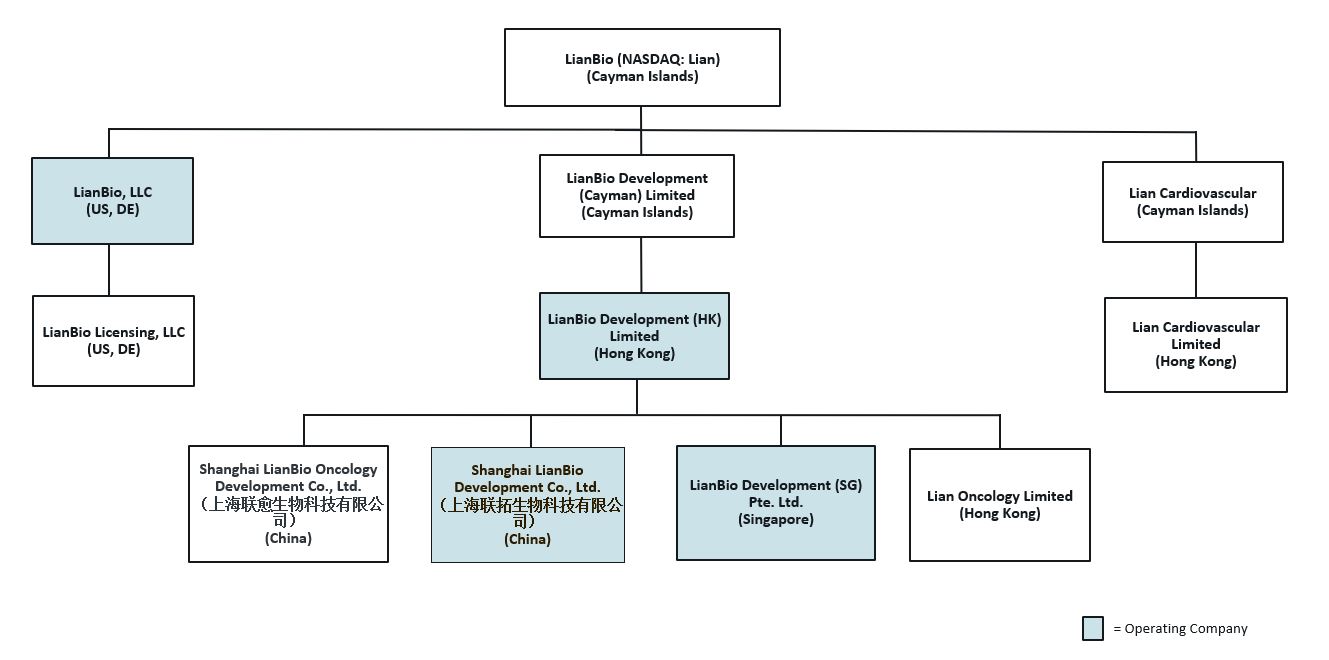

The Company was incorporated in the Cayman Islands in July 2019 and maintains its Chinese headquarters in Shanghai, China. The Company conducts its corporate activities at its United States headquarters located in Princeton, New Jersey.

On November 3, 2021, the Company completed its initial public offering (“IPO”) through an underwritten sale of 20,312,500 American Depositary Shares (“ADSs”) representing 20,312,500 ordinary shares at a price of $16.00 per share. Following the close of the IPO, on December 1, 2021, the underwriters partially exercised their option to purchase additional shares and purchased an additional 593,616 ADSs at the IPO price of $16.00 per ADS. The Company received gross proceeds of $334.5 million in connection with the IPO and subsequent exercise of the underwriters’ option and aggregate net proceeds of $304.8 million after deducting underwriting discounts, commissions and other offering expenses.

Concurrent with the IPO, all of the Company’s convertible preferred shares then-outstanding were automatically converted into an aggregate of 64,467,176 ordinary shares and were reclassified into permanent equity. Following the IPO, there were no preferred shares outstanding.

2. Significant Accounting Policies

(A) Basis of Presentation

The Company’s consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative U.S. GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates of the Financial Accounting Standards Board.

The accompanying consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, which include the People’s Republic of China (“PRC”) registered entities directly owned by the Company. All intercompany accounts and transactions have been eliminated in consolidation.

The interim balance sheet as of June 30, 2023, and the interim consolidated statements of operations and comprehensive loss, changes in shareholders’ equity for the three and six months ended June 30, 2023 and 2022, and the cash flows for the six months ended June 30, 2023 and 2022 are unaudited. These unaudited interim financial statements have been prepared on the same basis as the Company’s annual financial statements and, in the opinion of management, reflect all adjustments, which consist of only normal recurring adjustments, necessary for the fair statement of the Company’s financial information. The financial data and other information disclosed in these notes related to the three and six month periods are also unaudited. The interim results for the three and six months ended June 30, 2023 are not necessarily indicative of results to be expected for the year ending December 31, 2023, any other interim periods or any future year or period. The accompanying financial statements should be read in conjunction with the audited financial statements and the related notes thereto for the year ended December 31, 2022 included in the Company’s Annual Report on Form 10-K filed with the SEC on March 28, 2023.

(B) Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Company’s management to make estimates and assumptions that affect the reported financial position at the date of the financial statements and the reported results of operations during the reporting period. Such estimates and assumptions affect the reported amounts of assets, liabilities, and expenses, and disclosure of contingent assets and liabilities in the consolidated financial statements and accompanying notes. The only material estimates in the accompanying financial statements are the fair value of warrants, share-based compensation, and share options. Actual results could differ from those used in evaluating these accounting estimates.

(i) Concentration of Credit Risk and Other Risks and Uncertainties

The Company’s operations have not been significantly impacted by the global novel coronavirus disease 2019 (“COVID-19”) pandemic. However, the Company cannot at this time predict the specific extent, duration, or full impact that the COVID-19 pandemic will have on its financial condition and operations, including planned clinical trials. The impact of the COVID-19 pandemic on the Company’s financial performance will depend on future developments, including the duration and spread of the pandemic and related governmental advisories and restrictions. These developments and the impact of the COVID-19 pandemic on the financial markets and the overall economy continue to be highly uncertain and cannot be predicted. If the financial markets and/or the overall economy are impacted for an extended period, the Company’s results may be materially adversely affected.

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist primarily of cash and cash equivalents in deposits at financial institutions that exceed federally insured limits. The Company has not experienced any losses in such accounts and management believes that the Company is not exposed to material credit risk due to the financial position of the banking institutions. The Company has no off-balance sheet risks, such as foreign exchange contracts, option contracts, or other foreign hedging arrangements.

The Company’s results of operations involve numerous risks and uncertainties. Factors that could affect the Company’s operating results and cause actual results to vary materially from expectations include, but are not limited to, uncertainty of results of clinical trials, uncertainty of regulatory approval of the Company’s potential product candidates, uncertainty of market acceptance of its product candidates, competition from substitute products and larger companies, securing and protecting proprietary technology, strategic relationships and dependence on key individuals and sole source suppliers.

Each of the Company’s product candidates require approvals from the National Medical Products Administration (“NMPA”) in China and comparable foreign regulatory agencies prior to commercial sales in their respective jurisdictions. There can be no assurance that any product candidates will receive the necessary approvals. If the Company is denied approval, approval is delayed or the Company is unable to maintain approval for any product candidate, such events could have a materially adverse impact on the Company’s business.

(ii) Liquidity

The Company has incurred operating losses since inception and had an accumulated deficit of $516.2 million as of June 30, 2023 and $470.5 million as of December 31, 2022. The Company’s cash and cash equivalents and marketable securities were $267.3 million as of June 30, 2023 and $302.4 as of December 31, 2022. The Company has financed its operations to date primarily through equity capital raises.

The Company believes that existing capital resources, will be sufficient to meet projected operating requirements for at least 12 months from the date of issuance of the accompanying consolidated financial statements, though it expects to continue to incur operating losses and negative operating cash flows. The Company will be required to raise additional capital to fund future operations, however, no assurance can be given as to whether additional needed financing will be available on terms acceptable to the Company, if at all. If sufficient funds on acceptable terms are not available when needed, the Company may be required to curtail planned activities to preserve cash resources. These factors may adversely impact the Company’s ability to achieve its business objectives and would likely have an adverse effect on its future business prospects, or even its ability to remain a going concern.

(C) Significant Accounting Policies Update

The Company’s significant accounting policies are disclosed in Note 2, Significant Accounting Policies in the Annual Report on Form 10-K for the year ended December 31, 2022. There have been no material changes to the Company’s significant accounting policies during the three and six months ended June 30, 2023.

(D) Recently Issued Accounting Pronouncements Not Yet Adopted

The Company is an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. As an emerging growth company, the Company has elected to “opt out” of such extended transition period for the implementation of new or revised accounting standards and, as a result, the Company will comply with new or revised accounting standards on the same timeline as other public companies. The Company has evaluated recent accounting pronouncements and believes that there are none that will have a material impact on its financial position or results of operations upon adoption.

(E) Reclassification

Certain reclassifications of prior year information have been made to conform to the current year’s presentation.

3. Material Agreements

License Agreement with QED Therapeutics, Inc.

In October 2019, the Company entered into a license agreement (the “QED License Agreement”) with QED Therapeutics, Inc. (“QED”), as subsequently amended, under which the Company obtained an exclusive license under certain patents and know-how (including patents and know-how that QED licensed from QED’s upstream licensor) to develop, manufacture, use, sell, import, and commercialize QED’s ATP-competitive, FGFR1-3 tyrosine kinase inhibitor, infigratinib, in pharmaceutical products in the licensed territory of Mainland China, Macau, Hong Kong, Taiwan, Thailand, Singapore and South Korea, in the licensed field of human prophylactic and therapeutic uses in cancer indications. In September 2020, the Company entered into an amendment with QED to reduce the licensed territories to include Mainland China, Macau and Hong Kong. In December 2021, the Company entered into a second amendment with QED to modify the Company’s development obligations with respect to certain clinical trials, and change the development milestone payments the Company owes to QED and the royalty rates for the tiered royalties on net sales of licensed products the Company will pay to QED. Under the QED License Agreement, QED received a nonrefundable upfront payment of $10.0 million and was granted warrants to purchase 100,000 ordinary shares in Lian Oncology, a subsidiary of LianBio, valued at $1.0 million. Pursuant to ASC 505-50, as the fair value of the warrants were more reliably determinable than the fair value of the benefits received from the licensing agreement, the Company valued the warrants using the Black-Scholes Model. The warrants were issued in three tranches with the aggregate number of shares across all tranches equaling 10% of the fully diluted equity of Lian Oncology as of the issue date. Vesting of the warrant shares are linked to regulatory milestones and the warrants expire 10 years from the issue date. The amended and restated option agreement also provided QED with the option to choose to either convert the warrant (“Subsidiary Warrant”) into ordinary shares of the Company (“Parent Company Shares”) or a warrant to purchase a certain number of Parent Company Shares (“Parent Company Warrant”) immediately prior to an IPO of the Company. In the event QED chose to convert the Subsidiary Warrant into Parent Company Shares, the number of Parent Company Shares QED was entitled to receive would have been calculated as the aggregate fair market value of the ordinary shares of Lian Oncology that are under the Subsidiary Warrant, divided by the per share fair market value of the Parent Company Shares, on a fully diluted and as-converted basis and as of the date the Company sent QED the notice of the IPO. In the event QED chose to convert the Subsidiary Warrant into the Parent Company Warrant, the number of Parent Company Shares under the Parent Company Warrant QED was entitled to receive would have been calculated as the aggregate intrinsic value of the Subsidiary Warrant (the number of the ordinary shares of Lian Oncology under the Subsidiary Warrant multiplied by the difference between the strike price of the Subsidiary Warrant and the per share fair market value of Lian Oncology), divided by the per share intrinsic value of the Parent Company Warrant (the difference between the strike price of the Parent Company Warrant and the per share fair market value of Parent Company Shares), on a fully diluted and as-converted basis on the date of the warrant conversion. This conversion feature was not required to be bifurcated as it is clearly and closely related to the equity host instrument, pursuant to ASC 815. On October 18, 2021, based on the conversion feature, LianBio issued to QED a warrant to purchase 347,569 of its ordinary shares at an exercise price of $0.000017100448 per share and, concurrently with such issuance, the Subsidiary Warrant was deemed to be performed and settled in full and was irrevocably terminated. Additionally, QED is entitled to receive from the Company development milestone payments of up to $7.0 million upon achievement of specified development milestones, and sales milestone payments of up to $87.5 million based on cumulative net sales of infigratinib, in addition to tiered royalties on net sales of licensed products at the greater of (a) percentage rates in the mid- to high-teens on the net sales of the licensed products, or (b) the applicable rate payable under QED’s agreement with its upstream licensor (capped in the mid-teens). No payments were made under this agreement during the three and six months ended June 30, 2023. In August 2023, LianBio received a $1.5 million payment under the terms of the QED License Agreement for the reimbursement of research and development costs.

License Agreement with MyoKardia

In August 2020, the Company entered into an exclusive license agreement (the “MyoKardia License Agreement”) with MyoKardia Inc. (“MyoKardia,” now a wholly-owned subsidiary of Bristol-Myers Squibb (“BMS”)), under which the Company obtained an exclusive license under certain patents and know-how of MyoKardia to develop, manufacture, use, sell, import and commercialize MyoKardia’s proprietary compound, mavacamten, in the licensed territory of Mainland China, Hong Kong, Macau, Taiwan, Thailand and Singapore, and in the licensed field of any indication in humans, which includes any prophylactic or therapeutic use in humans. Under the MyoKardia License Agreement, MyoKardia received a nonrefundable upfront payment of $40.0 million and was granted a warrant to purchase 170,000 ordinary shares in Lian Cardiovascular, a subsidiary of LianBio, valued at $33.8 million. Pursuant to ASC 505-50, as the fair value of the warrants were more reliably determinable than the fair value of the benefits received from the licensing agreement, the Company valued the warrants using the Black-Scholes Model and the underlying assumptions are discussed in further detail in Note 10 in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. The warrants, representing 17% of the fully diluted equity of Lian Cardiovascular, are exercisable by MyoKardia at any time after issuance. The amended and restated option agreement also provided MyoKardia with the option to choose to either convert the warrant (“Subsidiary Warrant”) into ordinary shares of the Company (“Parent Company Shares”) or a warrant to purchase a certain number of Parent Company Shares (“Parent Company Warrant”) immediately prior to an IPO of the Company. MyoKardia was entitled to choose to convert the Subsidiary Warrant into Parent Company Shares, and the number of Parent Company Shares MyoKardia was entitled to receive would have been calculated as the aggregate fair market value of the ordinary shares of Lian Cardiovascular that are under the Subsidiary Warrant, divided by the per share fair market value of the Parent Company Shares, on a fully diluted and as-converted basis on the date the Company sent MyoKardia the notice of the IPO. Alternatively, MyoKardia was entitled to choose to convert the Subsidiary Warrant into the Parent Company Warrant, the number of Parent Company Shares under the Parent Company Warrant MyoKardia was entitled to receive would be calculated as the aggregate intrinsic value of the Subsidiary Warrant (the number of the ordinary shares of Lian Cardiovascular under the Subsidiary Warrant multiplied by the difference between the strike price of the Subsidiary Warrant and the per share fair market value of Lian Cardiovascular), divided by the per share intrinsic value of the Parent Company Warrant (the difference between the strike price of the Parent Company Warrant and the per share fair market value of Parent Company Shares), on a fully diluted and as-converted basis on the date of the warrant conversion. This conversion feature was not required to be bifurcated as it was clearly and closely related to the equity host instrument, pursuant to ASC 815. As of October 12, 2021, MyoKardia elected not to exercise this option and, therefore, continues to hold its warrant to purchase 170,000 ordinary shares in Lian Cardiovascular. MyoKardia’s option to convert the warrant irrevocably terminated upon the completion of the Company’s IPO. Additionally, MyoKardia was entitled to receive a nonrefundable financing milestone payment of $35.0 million upon a specified financing event, which occurred on October 29, 2020. The financing milestone was recorded at present value upon execution of the MyoKardia License Agreement, with total imputed interest of $2.3 million accreted under the effective interest method through the date the liability was settled. The financing milestone was paid to MyoKardia in December 2020 as a result of the Series A Preferred financing. Additionally, MyoKardia is entitled to receive from the Company development milestone payments of up to $60.0 million upon achievement of specified development milestones, and sales milestone payments of up to $87.5 million based on cumulative net sales of mavacamten, plus tiered royalties on net sales ranging from the low to upper-teens. The Company paid the first development milestone of $5.0 million during the twelve months ended December 31, 2022. No payments were made under this agreement during the three and six months ended June 30, 2023.

On August 11, 2023, the Company and its wholly-owned subsidiary LianBio Licensing, LLC, Lian Cardiovascular Limited, and Shanghai LianBio Development Co., Ltd. (each, a “Lian Party”, and collectively, “Lian Parties”) entered into a supplemental agreement (the “nHCM Supplemental Agreement”) with MyoKardia in relation to a clinical trial for mavacamten to be conducted in Mainland China for treatment of non-obstructive hypertrophic cardiomyopathy (“nHCM”). Pursuant to the nHCM Supplemental Agreement, MyoKardia will be the sponsor of a global trial with respect to mavacamten for nHCM (the “Global Clinical Study”), and will authorize and permit Shanghai LianBio Development Co., Ltd. to conduct a portion of the Global Clinical Study in Mainland China (the “China Study”) in accordance with a development plan for the China Study. Lian Parties are obligated to use commercially reasonable efforts to achieve certain key milestones including enrolling in Mainland China a certain percentage of the total number of patients planned to be enrolled in the Global Clinical Study, and dosing of the first patient in the China Study within a certain period of time after the first submission of the applicable Clinical Trial Application to the applicable regulatory authority. During the term of the nHCM Supplemental Agreement, any Lian Party may effect, authorize or enter into any agreement to effect, a change of control so long as (i) the acquirer is a permissible third party acquiror that satisfies certain specified standards in the nHCM Supplemental Agreement, and (ii) the acquiror agrees in writing to be bound by the nHCM Supplemental Agreement and the MyoKardia License Agreement.

License Agreement with Navire

In August 2020, pursuant to the BridgeBio exclusivity agreement, the Company entered into an exclusive license agreement with Navire Pharma, Inc. (“Navire”), a BridgeBio affiliate. Pursuant to the license agreement, Navire granted to the Company an exclusive, sublicensable license under certain patents and know-how of Navire to develop, manufacture, use, sell, import and commercialize Navire’s proprietary SHP2 inhibitor, BBP-398 (formerly known as IACS-15509) in the licensed territory of Mainland China, Hong Kong, Macau, Taiwan, Thailand, Singapore, and South Korea. Under the license agreement, Navire received a nonrefundable upfront payment of $8.0 million. Additionally, Navire is entitled to receive from the Company development milestone payments of up to $24.5 million upon achievement of specified development milestones, and sales milestone payments of up to $357.6 million upon achievement of specified commercialization milestones, plus tiered royalties on net sales ranging from approximately 5-15% on the net sales of the licensed products. The Company paid the first development milestone of $8.5 million for IND acceptance in the PRC in 2021. No payments were made under this agreement during the three and six months ended June 30, 2023.

Pfizer Strategic Collaboration

In November 2020, the Company entered into a strategic collaboration agreement (the “Pfizer Collaboration Agreement”) with Pfizer Inc. (“Pfizer”), pursuant to which Pfizer will contribute up to $70.0 million of restricted, non-dilutive capital (the “Funds”), including a $20.0 million upfront payment, toward the Company’s in-licensing and co-development activities in Greater China. The Company has accounted for the Pfizer Collaboration Agreement as a contract to perform research and development services for others under ASC 730-20 and the consideration received for performing these services will be recognized as contra-R&D in the Consolidated Statement of Operations and Comprehensive Loss as the services are performed.

Upon receipt in 2021, the upfront payment was recorded as restricted cash within the consolidated balance sheet and will remain restricted until such time as the upfront payment is utilized for specified in-licensing and co-development activities or until the Pfizer Collaboration Agreement terminates. Under the Pfizer Collaboration Agreement, Pfizer and LianBio will form a joint collaboration committee to discuss potential third party in-license opportunities and development and commercialization of the Company’s products in Greater China. In the event the Company seeks to engage a third-party commercialization partner with respect to the commercialization of the Company’s future products in Greater China, Pfizer will have a right to opt into such product. Upon opting in, a portion of the Funds will be used to pay for development and commercialization costs of such product and Pfizer will thereafter have a right of first negotiation and right of last refusal to obtain the commercialization rights of such product in Greater China, in each instance for additional, separate financial consideration. During the collaboration, Pfizer may provide in-kind support to the Company for marketing, development and regulatory activities.

In December 2022, the Company, Pfizer, and ReViral Ltd. (“ReViral,” now a wholly owned subsidiary of Pfizer) entered into a commercial agreement (the “Pfizer Commercial Agreement”) with respect to sisunatovir (a fusion inhibitor product for the treatment of respiratory syncytial virus (“RSV”)) as the first opted-in product under the Pfizer Collaboration Agreement. Pursuant to the Pfizer Commercial Agreement, LianBio will assign and transfer its development and commercialization rights to sisunatovir in Mainland China, Hong Kong, Macau and Singapore (the “Territory”) to Pfizer.

Under the Pfizer Commercial Agreement, the $20.0 million upfront payment, which was previously received and recorded as restricted cash, paid by Pfizer to LianBio in 2020 pursuant to the Pfizer Collaboration Agreement was released, as there are no further obligations and the associated contingencies were resolved. In addition, LianBio could also receive up to $135.0 million in potential development and sales milestones contingent on sisunatovir achieving a specified regulatory milestone event prior to the end of October 2035 and specified net sales milestone events. LianBio is further entitled to receive tiered payments in the low single digits on a percentage of net sales of sisunatovir in the Territory. Pfizer will lead all development and commercial activities, use commercially reasonable efforts to develop and seek regulatory approval for sisunatovir as a fusion inhibitor product for treatment of RSV as a single active pharmaceutical product in Mainland China, assume all costs in the Territory, and will waive LianBio’s milestone payment and royalty payment obligations previously due to ReViral pursuant to the Co-Development and License Agreement dated March 1, 2021, by and between LianBio Respiratory Limited and ReViral, which was superseded in its entirety by the Pfizer Commercial Agreement.

The Company has accounted for the Pfizer Commercial Agreement under ASC 450-30 and the consideration received under the agreement will be recognized as other income as they become realizable.

License Agreement with Tarsus

In March 2021, the Company entered into an exclusive license agreement (the “Tarsus License Agreement”) with Tarsus Pharmaceuticals, Inc. (“Tarsus”). Pursuant to the license agreement, Tarsus granted to the Company an exclusive, sublicensable license under the licensed patent rights and know-how to develop, manufacture and commercialize TP-03 for the treatment of patients with Demodex blepharitis and Meibomian Gland Disease in Mainland China, Macau, Hong Kong and Taiwan. Under the license agreement, Tarsus received a nonrefundable upfront payment of $15.0 million and was granted three warrants to purchase 125,000 ordinary shares in Lian Ophthalmology, a subsidiary of LianBio, valued at $9.4 million (the “Tarsus Warrants”). Pursuant to ASC 505-50, as the fair value of the warrants were more reliably determinable than the fair value of the benefits received from the licensing agreement, the Company valued the warrants using the Black-Scholes Model and the underlying assumptions are discussed in further detail in Note 10 in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. The warrants were issued in three tranches with the aggregate number of shares across all tranches equaling 12.5% of the fully diluted equity of Lian Ophthalmology as of the issue date. Vesting of the warrant shares are linked to regulatory milestones and the warrants expire 10 years from the issue date. Pursuant to a related option agreement (the “Tarsus Option Agreement”), Tarsus also had the option to convert the warrants into ordinary shares of the Company (“Parent Company Shares”) or warrants to purchase a certain number of the Company’s ordinary shares (“Parent Company Warrants”) based on appreciation of the value in the Lian Ophthalmology since the inception of the Tarsus License Agreement. This conversion feature was not required to be bifurcated as it was clearly and closely related to the equity host instrument, pursuant to ASC 815. On October 18, 2021, Tarsus exercised its options to convert the Tarsus Warrants under the Tarsus Option Agreement and the Company subsequently issued to Tarsus 78,373 of its ordinary shares and two warrants to purchase an aggregate of 156,746 of its ordinary shares at an exercise price of $0.000017100448 per share. Following the issuances, the Tarsus Warrants were irrevocably terminated. On June 6, 2022, Tarsus exercised one warrant and the Company subsequently issued 78,373 of its ordinary shares at an exercise price of $0.000017100448 per share. Additionally, Tarsus is entitled to receive a nonrefundable second milestone payment of $10.0 million due and payable within forty-five days following the effective date. Additionally, Tarsus is entitled to receive payments from the Company totaling an aggregate of up to $175.0 million upon the achievement of specified development and commercial milestones, up to $75.0 million and $100.0 million, respectively, plus tiered royalties at percentage rates ranging from the low- to high-teens on net sales. During the twelve months ended December 31, 2022, the Company paid $25.0 million to Tarsus as a result of the achievement of these milestones. No payments were made under this agreement during the three and six months ended June 30, 2023.

In February 2023, the Company entered into a clinical supply agreement (the “Tarsus Supply Agreement”) with Tarsus. Upon the execution of the Tarsus Supply Agreement, Tarsus was entitled to receive a one-time payment of $2.5 million from the Company which has been paid as of June 30, 2023.

License Agreement with Landos

In May 2021, the Company entered into an exclusive license agreement (the “Landos License Agreement”) with Landos BioPharma, Inc. (“Landos”). Pursuant to the license agreement, Landos granted to the Company an exclusive, sublicensable license under the licensed patent rights and know-how to develop, manufacture and commercialize novel, gut-restricted small molecule omilancor (formerly known as BT-11) and NX-13 for the treatment of inflammatory bowel disease, that targets the NLRX1 pathway in Mainland China, Hong Kong, Macau, Taiwan, Cambodia, Indonesia, Myanmar, Philippines, Singapore, South Korea, Thailand and Vietnam. Under the license agreement, Landos received a nonrefundable upfront payment of $18.0 million. Additionally, Landos is entitled to receive payments from the Company totaling an aggregate of up to $200.0 million upon the achievement of specified development and commercial milestones, up to $95.0 million and $105.0 million, respectively, plus tiered royalties at percentage rates ranging from the low- to the mid-teens on net sales. No payments were made under this agreement during the three and six months ended June 30, 2023.

In February 2023, the Company entered into an amendment to the Landos License Agreement, reflecting that Landos has transferred and assigned substantially all of its rights in omilancor to NImmune Biopharma, Inc (“NImmune”). As a result, the Landos License Agreement will relate only to NX-13, and the Company has entered into a direct license agreement with NImmune setting forth the terms of its continued development and commercialization of omilancor in its licensed territories. No payments were made under this agreement during the three and six months ended June 30, 2023.

License Agreement with NImmune

In February 2023, the Company entered into a license and collaboration agreement with NImmune, under which it obtained an exclusive license with the right to sublicense to affiliates and specified third parties under certain patents and know-how of NImmune to develop, manufacture, commercialize and otherwise, make and have made, use, offer for sale, sell, have sold, and import NImmune’s proprietary compound, omilancor, in the licensed regions of Mainland China, Hong Kong, Macau, Taiwan, Cambodia, Indonesia, Myanmar, Philippines, Singapore, South Korea, Thailand and Vietnam. NImmune is entitled to receive payments from the Company totaling an aggregate of up to $150.0 million upon the achievement of certain development and sales milestone events, up to $45.0 million and $105.0 million, respectively, plus tiered royalties at percentage rates ranging from the low- to the mid-teens on net sales. No payments were made under this agreement during the three and six months ended June 30, 2023.

License Agreement with Nanobiotix

In May 2021, the Company entered into an exclusive license agreement with Nanobiotix S.A. (“Nanobiotix”). Pursuant to the license agreement, Nanobiotix granted to the Company an exclusive, sublicensable license under the licensed patent rights and know-how to develop and commercialize NBTXR3, a potential first-in-class radioenhancer in Mainland China, Hong Kong, Taiwan, Macau, South Korea, Singapore and Thailand. Under the license agreement, Nanobiotix received a nonrefundable upfront payment of $20.0 million. Additionally, Nanobiotix is entitled to receive payments from the Company totaling an aggregate of up to $220.0 million upon the achievement of specified development and commercial milestones, up to $65.0 million and $155.0 million, respectively, plus tiered royalties of 10-13% of net sales. No payments were made under this agreement during the three and six months ended June 30, 2023.

License Agreement with Lyra

In May 2021, the Company entered into an exclusive license agreement (the “Lyra License Agreement”) with Lyra Therapeutics, Inc. (“Lyra”). Pursuant to the license agreement, Lyra granted to the Company an exclusive, sublicensable license under the licensed patent rights and know-how to develop and commercialize LYR-210, an anti-inflammatory, intra-nasal drug matrix in late-stage development that is designed to treat chronic rhinosinusitis in Mainland China, Hong Kong, Taiwan, Macau, South Korea, Singapore and Thailand. Under the license agreement, Lyra received a nonrefundable upfront payment of $12.0 million. Additionally, Lyra is entitled to receive payments from the Company totaling an aggregate of up to $135.0 million upon the achievement of specified development and commercial milestones, up to $40.0 million and $95.0 million, respectively, plus tiered royalties from the low- to high-teens on net sales. During the twelve months ended December 31, 2022, the Company paid $5.0 million to Lyra upon the completion of the first development milestone under the Lyra License Agreement. No payments were made under this agreement during the three and six months ended June 30, 2023.

4. Marketable Securities and Fair Value Measurements

The following is a summary of marketable securities accounted for as available-for-sale securities at June 30, 2023 and December 31, 2022: | | | | | | | | | | | | | | | | | | | | | | | |

As of June 30, 2023 (in thousands) | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Estimated Fair Value |

| Commercial paper | $ | 59,879 | | | $ | 2 | | | $ | (55) | | | $ | 59,826 | |

| | | | | | | |

| Government obligations & agency securities | 103,878 | | | — | | | (495) | | | 103,383 | |

| Total | $ | 163,757 | | | $ | 2 | | | $ | (550) | | | $ | 163,209 | |

| | | | | | | | | | | | | | | | | | | | | | | |

As of December 31, 2022 (in thousands) | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Estimated Fair Value |

| Commercial paper | $ | 120,570 | | | $ | 5 | | | $ | (313) | | | $ | 120,262 | |

| Corporate debt securities | 14,146 | | | — | | | (16) | | | 14,130 | |

| Government obligations | 89,265 | | | 4 | | | (519) | | | 88,750 | |

| Total | $ | 223,981 | | | $ | 9 | | | $ | (848) | | | $ | 223,142 | |