Filed by Calculator New Pubco, Inc. and Quantum FinTech Acquisition Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934

Subject Company:

Quantum FinTech Acquisition Corporation

(Commission File No. 001-40009)

Date: May 17, 2023

AtlasClear May 2023

FinTech Investment Opportunity May 2023 1

This information package (this “Package”) is provided for informational purposes only and has been prepared to assist interes ted parties in making their own evaluation with respect to a potential business combination among Calculator New Pubco , Inc. (“New Pubco ”), AtlasClear , Inc. (“ AtlasClear ”), Quantum FinTech Acquisition Corporation (“Quantum”) and related transactions (the “Proposed Transaction”) and for no othe r p urpose. By reviewing or reading this Package, you will be deemed to have agreed to the obligations and restrictions set out below. Without the exp res s prior written consent of AtlasClear and Quantum, this Package and any information contained within it may not be (i) reproduced (in whole or in part), (ii) copied at any time, (iii) used for any purpose other than you r e valuation of AtlasClear and the Proposed Transaction or (iv) provided to any other person, except your employees and advisors with a need to know who are advised of the confidentiality of the information. This Package supersedes an d replaces all previous oral or written communications between the parties hereto relating to the subject matter hereof. This Package and any oral statements made in connection with this Package do not constitute an offer to sell or the solicitat ion of an offer to purchase, or a recommendation to purchase any securities in any jurisdiction, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the Proposed Transaction or any r ela ted transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This P ack age does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities will be made only pursuant to a definitive Subscription Agreement and will be made in reliance on an exemption fro m r egistration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. Quantum and AtlasClear reserve the right to withdraw or amend for any reason any offering and to reject any Subscription Agreement for any reason. T he communication of this Package is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use woul d b e contrary to local law or regulation. The information contained in this Package, including, but not limited to, estimated financial information, is based on certai n a ssumptions and AtlasClear’s analysis of information available at the time the Package was prepared. While the information contained in the Package is believed to be accurate and reliable, none of AtlasClear , Quantum, their respective members, owners, partners, principals, managers, employees, agents or representatives makes any warranty or representation, whether express or implied, or assumes any legal liability for the accuracy, or complet ene ss of any information contained in this Package. Certain information contained herein is based on data provided by third - party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed and should not be relied upon as such. The financial information contained herein has not been audited and is not necessarily indicative of future results. Prospective investors or purchasers should conduct and rely on their own inquiries, investigation and analysis of the business, data and property described herein. This Package is as of the date indicated and is subject to revision at any time without not ice. Neither AtlasClear nor Quantum undertakes any obligation to provide the recipient with access to any additional information. The Package is provided on the basis that it is kept CONFIDENTIAL and its circulation and use are re stricted. Neither this package nor any part hereof may be copied, duplicated or redistributed, or used for any purpose other than evaluation of the combined company by the person to whom this Package has been delivered. ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the Proposed Transaction, New Pubco has publicly filed with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S - 4 (the “Form S - 4”) containing a preliminary proxy statement of Quantum and prospectus of New Pubco , and after the registration statement is declared effective, Quantum will mail a definitive proxy statement/prospectus relat ing to the Proposed Transaction to its stockholders. This Package does not contain any information that should be considered by Quantum’s stockholders concerning the Proposed Tra nsa ction and is not intended to constitute the basis of any voting or investment decision in respect of the Proposed Transaction or the securities of New Pubco . Quantum’s stockholders and other interested persons are advised to read the preliminary proxy statement/prospectus and the ame ndments thereto and, when available, the definitive proxy statement/prospectus and other documents filed in connection with the Proposed Transacti on, as these materials will contain important information about New Pubco , Quantum, AtlasClear , Wilson - Davis & Co., Inc. (“Wilson - Davis”), Commercial Bancorp of Wyoming (“Commercial Bancorp”) and its subsidiary bank, Farmers State Bank (“FSB”), and the Proposed Transaction. When available, the definitive proxy statement/prospectus will be mailed to stockholders of Quantum as of a record date to be established for voting on the Propos ed Transaction. Stockholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/ prospectus and other documents filed with the SEC, without charge, once av ailable, at the SEC’s website at www.sec.gov, or by directing a request to: Quantum FinTech Acquisition Corporation, 4221 W Boy Scout Blvd., Suite 300, Tampa, FL 33607, Attention: Investor Relations or by email at atlasclearir@icrinc.com . DISCLAIMER 2

PARTICIPANTS IN SOLICITATION Quantum, AtlasClear and their respective directors and executive officers may be deemed participants in the solicitation of proxies from Quantum st ockholders with respect to the Proposed Transaction. Quantum stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of Qu ant um in its Annual Report on Form 10 - K, filed with the SEC on March 31, 2023 (the “2022 Form 10 - K”), which is available free of charge at the SEC’s website at www.sec.gov. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Quantum stockholders in connection with the Proposed Transaction and other matters to be voted upon at Quantum’s special meeting of stockholders will be set forth in the proxy statement/prospectus for the Proposed Transaction when available. Additional information regarding the interests of the participants in the solicitation of proxies from Quantum’s stockholders wi th respect to the Proposed Transaction will be contained in the proxy statement/prospectus for the Proposed Transaction when available. Such interests may, in some cases, be different from those of AtlasClear’s or Quantum’s equity holders generally. FORWARD - LOOKING STATEMENTS This Package contains certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1 995, as amended, that reflect AtlasClear’s and Quantum’s current views with respect to, among other things, the future operations and financial performance of AtlasClear , Quantum and the combined company. Forward - looking statements in this communication may be identified by the use of words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “foreseeable,” “future,” “intend,” “may,” “outlook,” “plan,” “po tential,” “proposed” “predict,” “project,” “seek,” “should,” “target,” “trends,” “will,” “would” and similar terms and phrases. Forward - looking statements contained in this communication include, but are not limited to, statements as to ( i ) expectations regarding the Proposed Transaction, (ii) anticipated use of proceeds from the transaction, (iii) AtlasClear and Quantum’s expectations as to various operational results and market conditions, (iv) AtlasClear’s anticipated growth strategy, including the proposed acquisitions, (v) anticipated benefits of the Proposed Transaction and proposed acquisitions, and (vi) the financial technology of the combined entity. The forward - looking statements contained in this communication are based on the current expectations of AtlasClear , Quantum and their respective management and are subject to risks and uncertainties. No assurance can be given that future developments affecting AtlasClear , Quantum or the combined company will be those that are anticipated. Actual results may differ materially from current expec tat ions due to changes in global, regional or local economic, business, competitive, market, regulatory and other factors, many of which are beyond the control of AtlasClear and Quantum. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward - looking statemen ts. Factors that could cause actual results to differ may emerge from time to time, and it is not possible to predict all of them. Such factors include, but are not limited to: the risk that the transaction may not be completed in a timely manner or at all ; t he risk that the transaction closes but AtlasClear’s acquisition of Commercial Bancorp and its subsidiary bank, FSB, does not close as a result of the failure to satisfy the conditions to closing such acquisition (including, withou t l imitation, the receipt of approval of Commercial Bancorp’s stockholders and receipt of required regulatory approvals); the failure to obtain requisite approval for the transaction or meet other closing conditions; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement in respect of the transaction; failure to achieve sufficient cash available (taking into account all available fina nci ng sources) following any redemptions of Quantum’s public stockholders; failure to obtain the requisite approval of Quantum’s stockholders; failure to meet relevant listing standards in connection with the consummation of the tra nsa ction; failure to recognize the anticipated benefits of the transaction, which may be affected by, among other things, competition, the ability of the combined entity to maintain relationships with customers and suppliers an d s trategic alliance third parties, and to retain its management and key employees; potential litigation DISCLAIMER 3

relating to the proposed transaction; changes to the proposed structure of the transaction that may be required or appropriat e a s a result of the announcement and execution of the transaction; unexpected costs and expenses related to the transaction; estimates of AtlasClear and the combined company’s financial performance being materially incorrect predictions; AtlasClear’s failure to complete the proposed acquisitions on favorable terms to AtlasClear or at all; AtlasClear’s inability to integrate, and to realize the benefits of, the proposed acquisitions; changes in general economic or political c on ditions; changes in the markets that AtlasClear targets or the combined company will target; slowdowns in securities or cryptocurrency trading or shifting demand for trading, clearing and settling fin ancial products; the impact of the ongoing COVID - 19 pandemic; any change in laws applicable to Quantum or AtlasClear or any regulatory or judicial interpretation thereof; and other factors, risks and uncertainties, including those to be inclu de d under the heading “Risk Factors” in the proxy statement/prospectus filed or to be later filed with the SEC, and those included under the heading “Risk Factors” in Quantum’s 2022 Form 10 - K and its subsequent filings with the SEC. AtlasClear and Quantum caution that the foregoing list of factors is not exhaustive. Any forward - looking statement made in this communication speaks only as of the date hereof. Plans, intentions or exp ectations disclosed in forward - looking statements may not be achieved and no one should place undue reliance on such forward - looking statements. Neither AtlasClear nor Quantum undertake any obligation to update, revise or review any forward - looking statement, whether as a result of new info rmation, future developments or otherwise, except as may be required by any applicable securities laws. TRADEMARKS This Package contains trademarks, service marks, trade names, and copyrights of AtlasClear , Quantum and third parties, which are the property of their respective owners. The use or display of third parties’ tradema rks , service marks, trade names or copyrights in this Package is not intended to and does not imply a relationship with AtlasClear or Quantum, or an endorsement or sponsorship by or of AtlasClear or Quantum. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Presentation may appear without the TM, SM, * or © sym bols, but such references are not intended to indicate, in any way, that AtlasClear or Quantum will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these tr ade marks, service marks, trade names and copyrights. DISCLAIMER 4

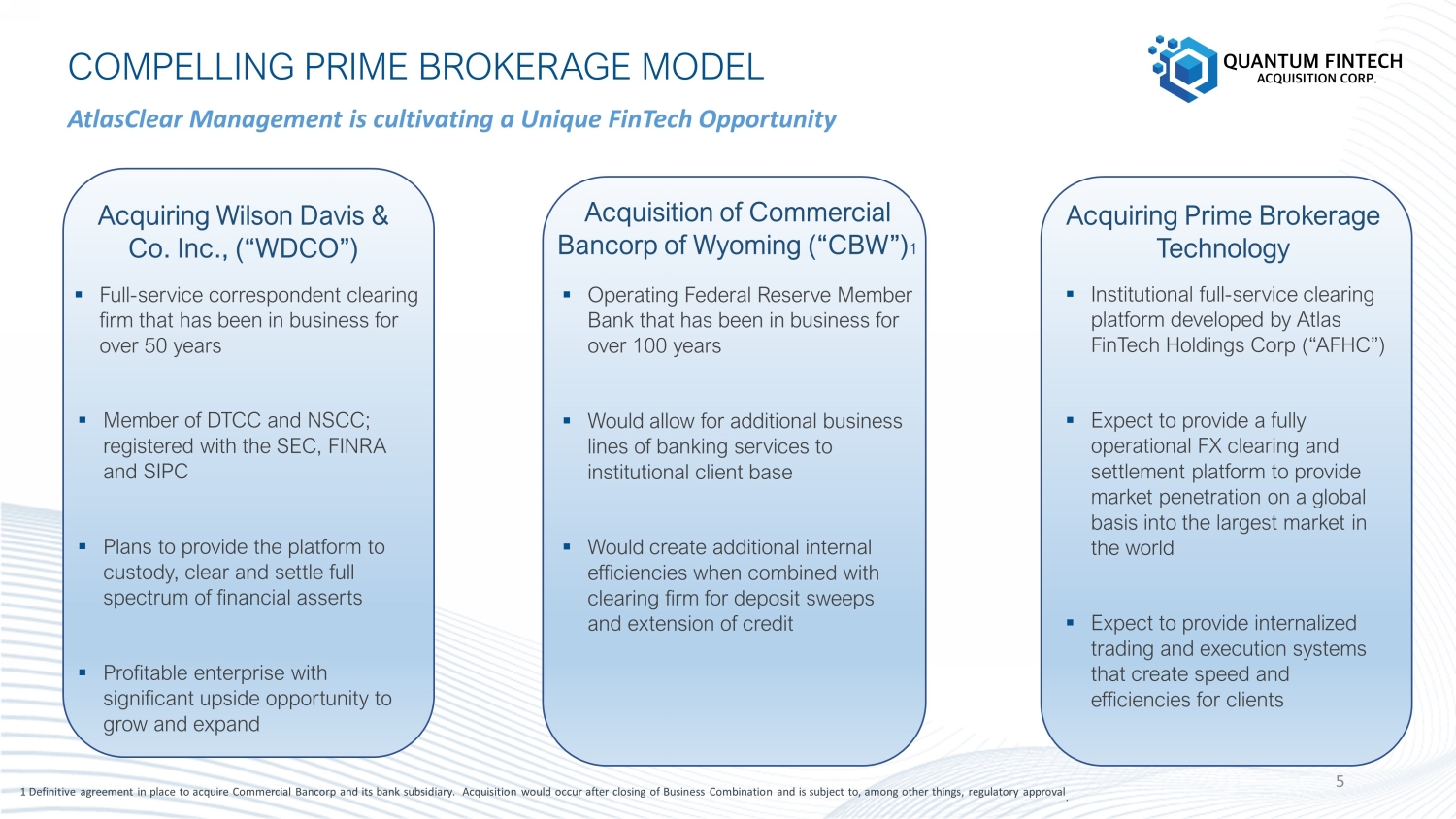

Acquiring Prime Brokerage Technology Acquisition of Commercial Bancorp of Wyoming (“CBW”) 1 ▪ Full - service correspondent clearing firm that has been in business for over 50 years Acquiring Wilson Davis & Co. Inc., (“WDCO”) 1 Definitive agreement in place to acquire Commercial Bancorp and its bank subsidiary. Acquisition would occur after closing of Business Combination and is subject to, among other things, regulatory approval . COMPELLING PRIME BROKERAGE MODEL AtlasClear Management is cultivating a Unique FinTech Opportunity ▪ Operating Federal Reserve Member Bank that has been in business for over 100 years ▪ Would allow for additional business lines of banking services to institutional client base ▪ Would create additional internal efficiencies when combined with clearing firm for deposit sweeps and extension of credit ▪ Institutional full - service clearing platform developed by Atlas FinTech Holdings Corp (“AFHC”) ▪ Expect to provide a fully operational FX clearing and settlement platform to provide market penetration on a global basis into the largest market in the world ▪ Expect to provide internalized trading and execution systems that create speed and efficiencies for clients 5 ▪ Member of DTCC and NSCC; registered with the SEC, FINRA and SIPC ▪ Plans to provide the platform to custody, clear and settle full spectrum of financial asserts ▪ Profitable enterprise with significant upside opportunity to grow and expand

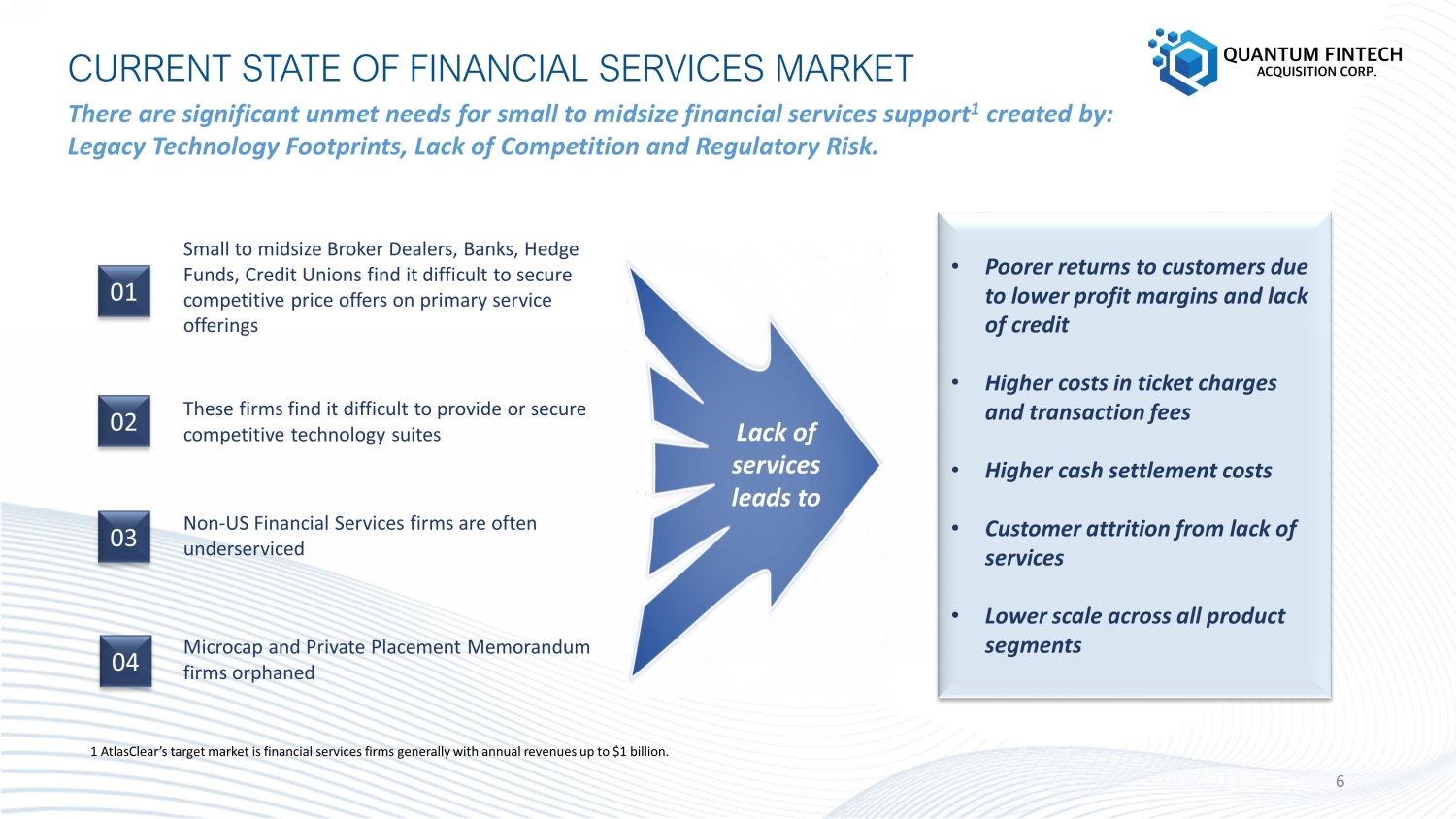

CURRENT STATE OF FINANCIAL SERVICES MARKET 01 02 03 Small to midsize Broker Dealers, Banks, Hedge Funds, Credit Unions find it difficult to secure competitive price offers on primary service offerings These firms find it difficult to provide or secure competitive technology suites Non - US Financial Services firms are often underserviced 04 Microcap and Private Placement Memorandum firms orphaned There are significant unmet needs for small to midsize financial services support 1 created by: Legacy Technology Footprints, Lack of Competition and Regulatory Risk. • Poorer returns to customers due to lower profit margins and lack of credit • Higher costs in ticket charges and transaction fees • Higher cash settlement costs • Customer attrition from lack of services • Lower scale across all product segments Lack of services leads to 6 1 AtlasClear’s target market is financial services firms generally with annual revenues up to $1 billion.

Offering Core to Overall Business Universal Margin and NPL Full - Service, One - Stop Shop FX Full Suite Innovative SaaS Technology Complete Regulatory Structure* DTC Eligibility Sponsor *Defined as affiliated correspondent clearing firm and FDIC bank for active sweeps, lending, and FX custody AtlasClear Capabilities Would Answer Unmet Needs Compared to Competitors ATLASCLEAR SOLUTION 7

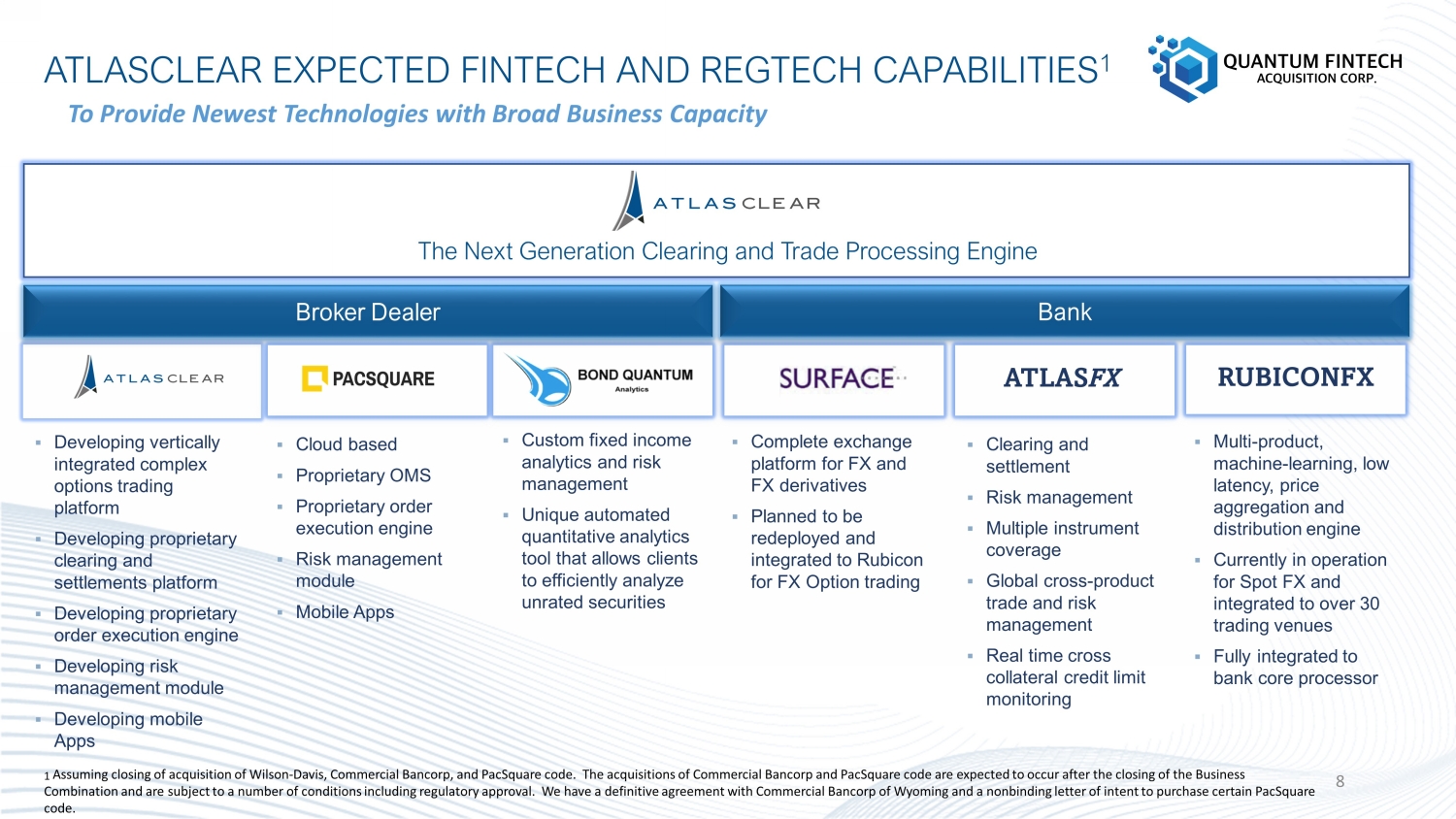

ATLASCLEAR EXPECTED FINTECH AND REGTECH CAPABILITIES 1 Bank The Next Generation Clearing and Trade Processing Engine ▪ Custom fixed income analytics and risk management ▪ Unique automated quantitative analytics tool that allows clients to efficiently analyze unrated securities ▪ Complete exchange platform for FX and FX derivatives ▪ Planned to be redeployed and integrated to Rubicon for FX Option trading ▪ Clearing and settlement ▪ Risk management ▪ Multiple instrument coverage ▪ Global cross - product trade and risk management ▪ Real time cross collateral credit limit monitoring ▪ Multi - product, machine - learning, low latency, price aggregation and distribution engine ▪ Currently in operation for Spot FX and integrated to over 30 trading venues ▪ Fully integrated to bank core processor ▪ Developing vertically integrated complex options trading platform ▪ Developing proprietary clearing and settlements platform ▪ Developing proprietary order execution engine ▪ Developing risk management module ▪ Developing mobile Apps Broker Dealer To Provide Newest Technologies with Broad Business Capacity RUBICONFX ATLAS FX 8 ▪ Cloud based ▪ Proprietary OMS ▪ Proprietary order execution engine ▪ Risk management module ▪ Mobile Apps 1 Assuming closing of acquisition of Wilson - Davis, Commercial Bancorp, and PacSquare code. The acquisitions of Commercial Bancorp and PacSquare code are expected to occur after the closing of the Business Combination and are subject to a number of conditions including regulatory approval. We have a definitive agreement with Com mer cial Bancorp of Wyoming and a nonbinding letter of intent to purchase certain PacSquare code.

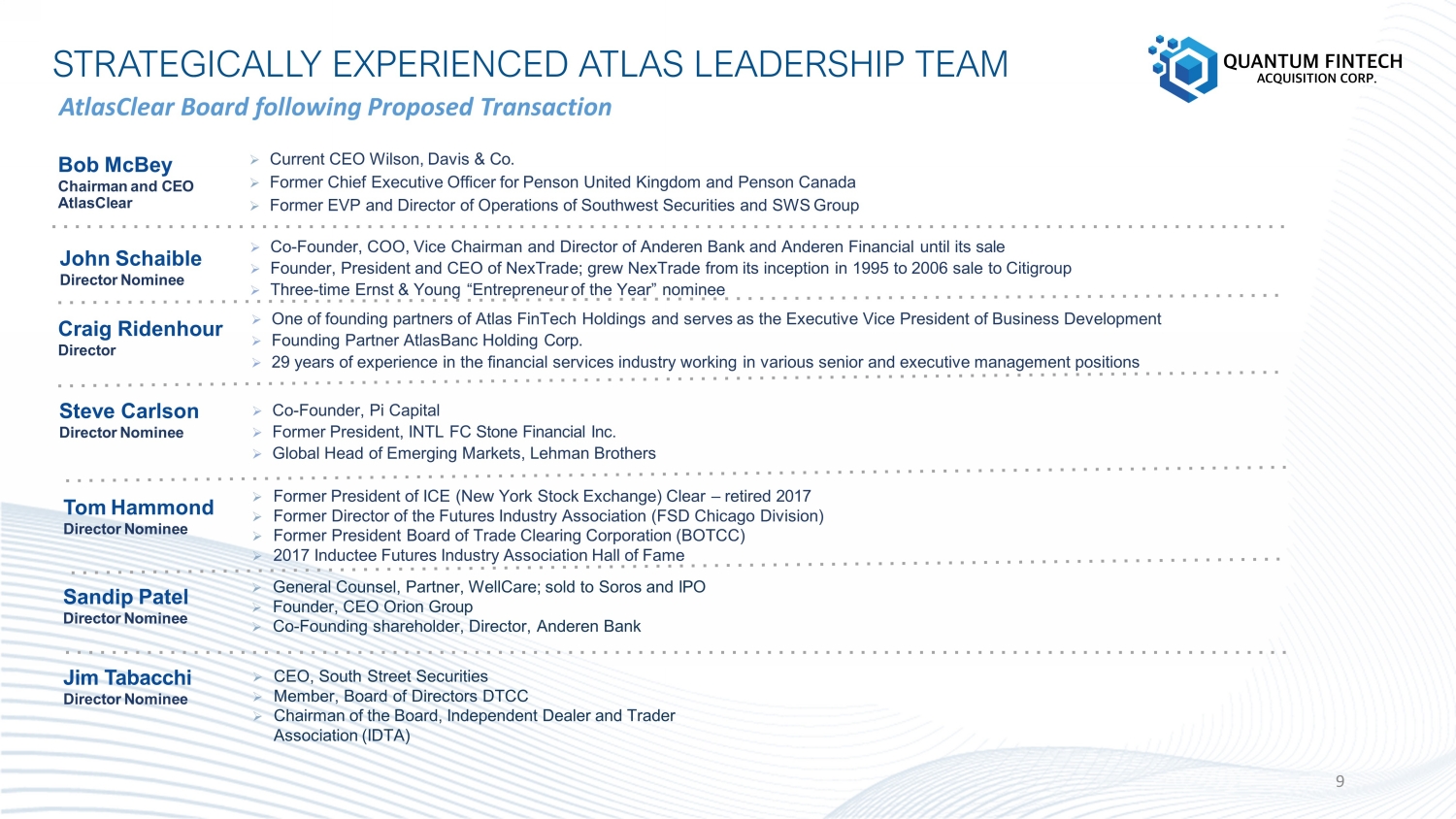

STRATEGICALLY EXPERIENCED ATLAS LEADERSHIP TEAM AtlasClear Board following Proposed Transaction 9 » Co - Founder, Pi Capital » Former President, INTL FC Stone Financial Inc. » Global Head of Emerging Markets, Lehman Brothers » Former President of ICE (New York Stock Exchange) Clear – retired 2017 » Former Director of the Futures Industry Association (FSD Chicago Division) » Former President Board of Trade Clearing Corporation (BOTCC) » 2017 Inductee Futures Industry Association Hall of Fame Steve Carlson Director Nominee Tom Hammond Director Nominee Sandip Patel Director Nominee » General Counsel, Partner, WellCare; sold to Soros and IPO » Founder, CEO Orion Group » Co - Founding shareholder, Director, Anderen Bank Jim Tabacchi Director Nominee Bob McBey Chairman and CEO AtlasClear » Current CEO Wilson, Davis & Co. » Former Chief Executive Officer for Penson United Kingdom and Penson Canada » Former EVP and Director of Operations of Southwest Securities and SWS Group John Schaible Director Nominee Craig Ridenhour Director » Co - Founder, COO, Vice Chairman and Director of Anderen Bank and Anderen Financial until its sale » Founder, President and CEO of NexTrade; grew NexTrade from its inception in 1995 to 2006 sale to Citigroup » Three - time Ernst & Young “Entrepreneur of the Year” nominee » One of founding partners of Atlas FinTech Holdings and serves as the Executive Vice President of Business Development » Founding Partner AtlasBanc Holding Corp. » 2 9 years of experience in the financial services industry working in various senior and executive management positions » CEO, South Street Securities » Member, Board of Directors DTCC » C hairman of the Board, Independent Dealer and Trader Association (IDTA)

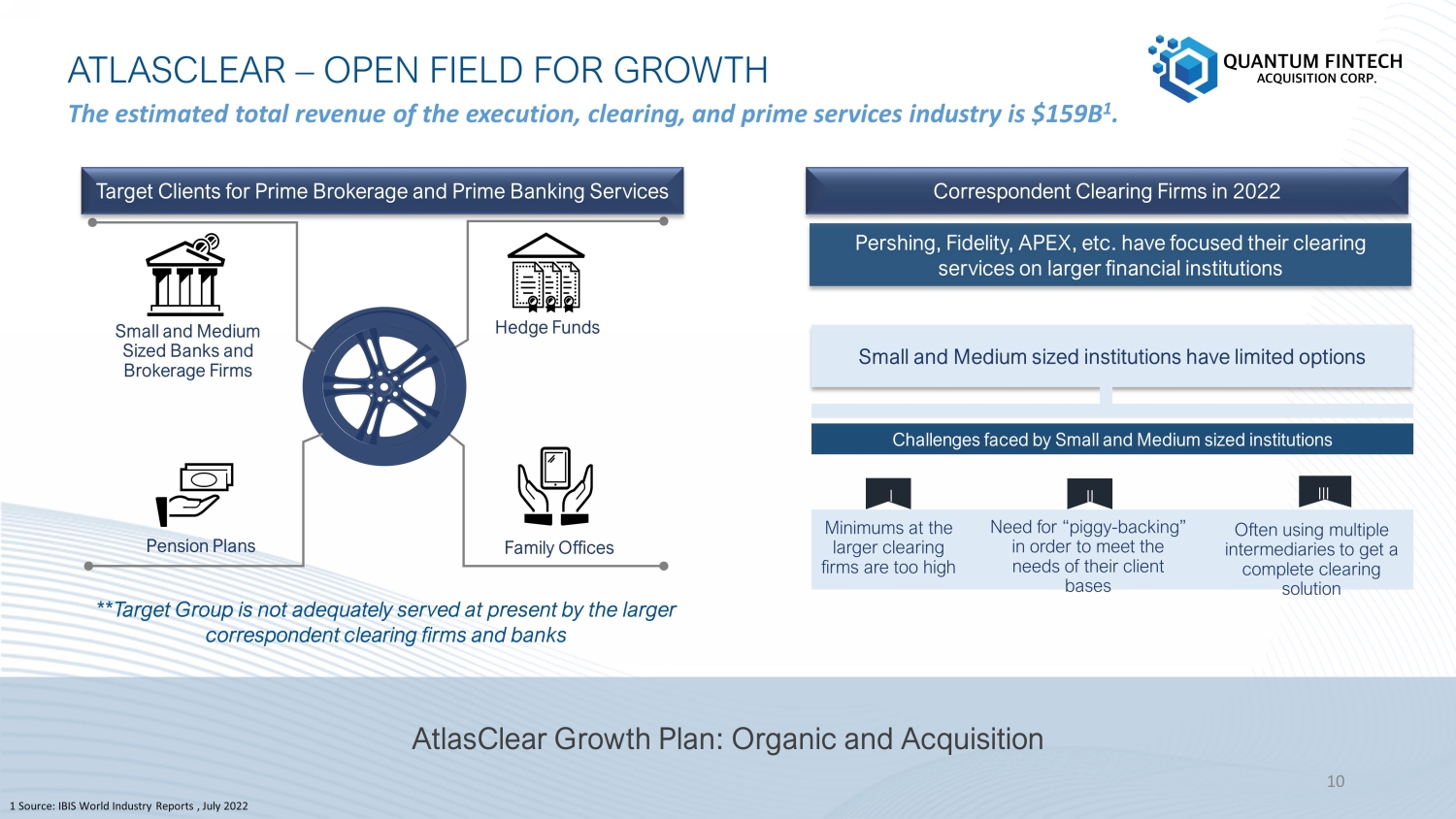

ATLASCLEAR – OPEN FIELD FOR GROWTH AtlasClear Growth Plan: Organic and Acquisition 1 Source: IBIS World Industry Reports , July 2022 The estimated total revenue of the execution, clearing, and prime services industry is $159B 1 . Correspondent Clearing Firms in 2022 Pershing, Fidelity, APEX, etc. have focused their clearing services on larger financial institutions Small and Medium sized institutions have limited options Hedge Funds Pension Plans Family Offices Minimums at the larger clearing firms are too high Need for “piggy - backing” in order to meet the needs of their client bases Often using multiple intermediaries to get a complete clearing solution II I III Small and Medium Sized Banks and Brokerage Firms **Target Group is not adequately served at present by the larger correspondent clearing firms and banks Challenges faced by Small and Medium sized institutions Target Clients for Prime Brokerage and Prime Banking Services 10

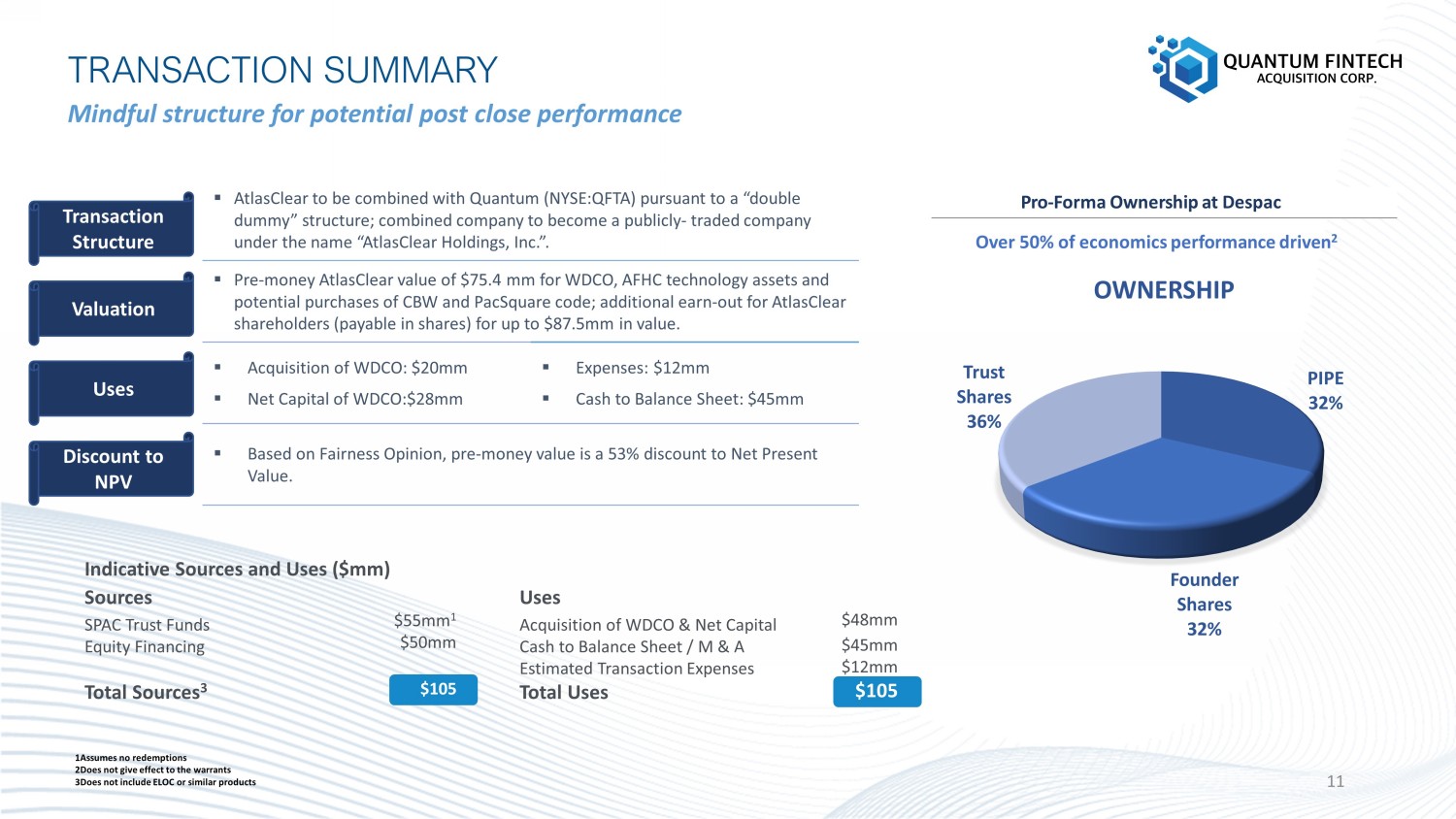

PIPE 32% Founder Shares 32% Trust Shares 36% OWNERSHIP TRANSACTION SUMMARY Sources SPAC Trust Funds Equity Financing Total Sources 3 Indicative Sources and Uses ($mm) Uses Acquisition of WDCO & Net Capital Cash to Balance Sheet / M & A Estimated Transaction Expenses Total Uses ▪ AtlasClear to be combined with Quantum (NYSE:QFTA) pursuant to a “double dummy” structure; combined company to become a publicly - traded company under the name “ AtlasClear Holdings, Inc.”. ▪ Pre - money AtlasClear value of $75.4 mm for WDCO, AFHC technology assets and potential purchases of CBW and PacSquare code; additional earn - out for AtlasClear shareholders (payable in shares) for up to $87.5mm in value. ▪ Acquisition of WDCO: $20mm ▪ Net Capital of WDCO:$28mm ▪ Expenses: $12mm ▪ Cash to Balance Sheet: $45mm ▪ Based on Fairness Opinion, pre - money value is a 53% discount to Net Present Value. $55 mm 1 $50mm $ 105 1Assumes no redemptions 2Does not give effect to the warrants 3Does not include ELOC or similar products Mindful structure for potential post close performance $48mm $ 45 mm $12mm $ 105 1 Transaction Structure Valuation Uses Discount to NPV Pro - Forma Ownership at Despac Over 50% of economics performance driven 2

PIPE 32% Founder Shares 32% Trust Shares 36% OWNERSHIP TRANSACTION SUMMARY Sources SPAC Trust Funds Third - Party PIPE Total Sources 3 Indicative Sources and Uses ($mm) Uses Acquisition of WDCO & Net Capital Cash to Balance Sheet / M & A Estimated Transaction Expenses Total Uses ▪ AtlasClear to be combined with Quantum (NYSE:QFTA) pursuant to a “double dummy” structure; combined company to become a publicly - traded company under the name “ AtlasClear Holdings, Inc.”. ▪ Pre - money AtlasClear value of $75.4 mm for WDCO, AFHC technology assets and potential purchases of CBW and PacSquare code; additional earn - out for AtlasClear shareholders (payable in shares) for up to $87.5mm in value. ▪ Acquisition of WDCO: $20mm ▪ Net Capital of WDCO:$28mm ▪ Expenses: $12mm ▪ Cash to Balance Sheet: $45mm ▪ Based on Fairness Opinion, pre - money value is a 53% discount to Net Present Value. $55 mm 1 $50mm $ 105 1Assumes no redemptions 2Does not give effect to the warrants 3Does not include ELOC or similar products Mindful structure for potential post close performance $48mm $ 45 mm $12mm $ 105 11 Transaction Structure Valuation Uses Discount to NPV Pro - Forma Ownership at Despac Over 50% of economics performance driven 2

1 Accretive Acquisition Opportunities Experienced Leadership Team 3 4 5 Underserved Market to Capture Successful Industry Track Record Robust Outlook 12