Table of Contents

Delaware |

2836 |

87-2652913 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

| Marko Zatylny Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199-3600 (617) 951-7000 |

Karen Tepichin General Counsel Ginkgo Bioworks Holdings, Inc. 27 Drydock Avenue 8th Floor Boston, MA 02210 (877) 422-5362 |

Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

☒ |

Smaller reporting company |

|||||

Emerging growth company |

||||||

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be issued until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and does not constitute the solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 1, 2022

PRELIMINARY PROSPECTUS

GINKGO BIOWORKS HOLDINGS, INC.

Prospectus for 292,051,107 Shares of

Class A Common Stock of Ginkgo Bioworks Holdings, Inc.

This prospectus relates to the resale from time to time by the selling securityholders named in this prospectus (which term as used in this prospectus includes their respective transferees, pledgees, distributees, donees, and successors-in-interest, each a “Selling Securityholder” and, collectively, the “Selling Securityholders”) of 292,051,107 shares of Class A common stock, par value of $0.0001 per share (“Class A common stock”), of Ginkgo Bioworks Holdings, Inc.

This prospectus provides a general description of such securities and the general manner in which the Selling Securityholders may offer or sell the securities. More specific terms of any securities that the Selling Securityholders may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

We are registering certain of the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. The Selling Securityholders may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. We will pay certain offering fees and expenses and fees in connection with the registration of our Class A common stock. We will not receive any of the proceeds from the resale of the shares of Common Stock by the Selling Securityholders. Class A common stock is currently listed on the NYSE and trades under the symbol “DNA.” The last reported sale price of Class A common stock on the NYSE on August 8, 2022 was $4.20 per share.

We are an “emerging growth company” under applicable federal securities laws and will be subject to reduced public company reporting requirements.

INVESTING IN OUR SECURITIES INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 6 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

Table of Contents

TABLE OF CONTENTS

| iv | ||||

| vi | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 16 | ||||

| 17 | ||||

| 20 | ||||

| 22 | ||||

| 30 | ||||

| 32 | ||||

| 34 | ||||

| Risks Related to our Common Stock, Organizational Structure and Governance |

46 | |||

| 53 | ||||

| 53 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

54 | |||

| 54 | ||||

| 56 | ||||

| 59 | ||||

| 60 | ||||

| 60 | ||||

| 60 | ||||

| Modification of Equity Awards in Connection with Business Combination |

61 | |||

| 61 | ||||

| 65 | ||||

| 74 | ||||

| 77 | ||||

| 84 | ||||

| 84 | ||||

| 85 | ||||

| 85 | ||||

| 85 | ||||

| 87 | ||||

| 89 | ||||

| 90 | ||||

| 94 | ||||

| 96 | ||||

| 97 | ||||

| 99 | ||||

| 110 | ||||

| 111 | ||||

| 113 | ||||

| 113 |

i

Table of Contents

| 115 | ||||

| 117 | ||||

| 118 | ||||

| 120 | ||||

| 134 | ||||

| 134 | ||||

| 135 | ||||

| 135 | ||||

| 136 | ||||

| 141 | ||||

| 141 | ||||

| 142 | ||||

| 142 | ||||

| 142 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| 147 | ||||

| Action by the Ginkgo Board of Directors to Terminate a Founder |

147 | |||

| 147 | ||||

| 150 | ||||

| 150 | ||||

| 154 | ||||

| Limitations on Liability and Indemnification of Officers and Directors |

155 | |||

| 155 | ||||

| 155 | ||||

| 155 | ||||

| 156 | ||||

| 156 | ||||

| 157 | ||||

| 157 | ||||

| Restrictions on the Use of Rule 144 by Shell Companies or Former Shell Companies |

157 | |||

| 158 | ||||

| 162 | ||||

| 163 | ||||

| 165 | ||||

| 165 | ||||

| 168 | ||||

| 168 | ||||

| 168 | ||||

| 168 | ||||

| 169 | ||||

| 170 | ||||

| 170 | ||||

| 170 | ||||

| 170 | ||||

| 170 | ||||

| 173 | ||||

| 174 | ||||

| 174 | ||||

| 177 | ||||

| 177 |

ii

Table of Contents

| 177 | ||||

| 181 | ||||

| 182 | ||||

| 183 | ||||

| 184 | ||||

| 187 | ||||

| 190 | ||||

| 190 | ||||

| 190 | ||||

| 191 | ||||

| F-1 |

You should rely only on the information contained in this prospectus. We have not and the Selling Securityholders have not authorized anyone to provide you with information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

For investors outside the United States, neither we, nor the Selling Securityholders, have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

iii

Table of Contents

SELECTED DEFINITIONS

Unless otherwise stated or unless the context otherwise requires, the terms “combined company,” “Company,” “Ginkgo,” “New Ginkgo,” “we,” “us,” “our” and similar terms refer to Ginkgo Bioworks Holdings, Inc. and its subsidiaries.

In this document:

“Business Combination” means the Domestication together with the Merger.

“Business Combination Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement, dated as of September 16, 2021, by and among Ginkgo, the Sponsor and Viking Global Opportunities Illiquid Investments Sub-Master LP.

“Bylaws” means our amended and restated bylaws.

“Charter” means our amended and restated certificate of incorporation. “Code” means the Internal Revenue Code of 1986, as amended. “DGCL” means the General Corporation Law of the State of Delaware.

“Class A common stock” means the shares of Class A common stock, par value $0.0001 per share, of Ginkgo, which shares have the same economic terms as the shares of Class B common stock, however they are only entitled to one (1) vote per share.

“Class B common stock” means the shares of Class B common stock, par value $0.0001 per share, of Ginkgo, which shares have the same economic terms as the shares of Class A common stock, however they are entitled to ten (10) votes per share and the holders of Class B common stock, as a class, will have the right, for so long as the outstanding shares of Class B common stock continue to represent at least 2% of all of the outstanding shares of Common Stock, to elect 25% of the directors constituting the Ginkgo Board.

“Class C common stock” means the shares of Class C common stock, par value $0.0001 per share, of Ginkgo, which shares have the same economic terms as the shares of Class A common stock, but which carry no voting rights (except as otherwise expressly provided in the Charter or required by applicable law).

“Closing” means the closing of the Business Combination on the Closing Date.

“Closing Date” means September 16, 2021.

“Common Stock” means, collectively, the Class A common stock, the Class B common stock and the Class C common stock.

“Earn-out Consideration” means the 188.7 million Earn-Out Shares of Common Stock issued in connection with the Business Combination, which are subject to forfeiture to the extent that certain vesting conditions are not satisfied on or before the fifth anniversary of Closing Date.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Founder” means any of Jason Kelly, Reshma Shetty, Austin Che, Bartholomew Canton and Thomas F. Knight, Jr. “founder shares” means the SRNG Class B ordinary shares sold prior to SRNG’s initial public offering.

“Ginkgo Board” means the board of directors of Ginkgo.

iv

Table of Contents

“Ginkgo Management” means the management of Ginkgo. “Governing Documents” means the Charter and the Bylaws.

“IPO” means SRNG’s initial public offering, consummated on February 26, 2021, through the sale of 22,500,000 units at $10.00 per unit.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

“Merger Agreement” means that certain Agreement and Plan of Merger, dated as of May 11, 2021, as amended on May 14, 2021, by and among SRNG, Merger Sub and Old Ginkgo.

“Merger Sub” means SEAC Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of SRNG. “NYSE” means the New York Stock Exchange.

“Old Ginkgo” means Ginkgo Bioworks, Inc., a Delaware corporation.

“Old Ginkgo capital stock” means, collectively, the Old Class A common stock, the Old Class B common stock and each other class or series of capital stock of Old Ginkgo (including preferred stock).

“Old Class A common stock” means the Class A common stock, par value $0.0001 per share, of Old Ginkgo.

“Old Class B common stock” means the Class B common stock, par value $0.0001 per share, of Old Ginkgo.

“Old Ginkgo warrant” means each warrant to purchase shares of Old Ginkgo capital stock.

“Private Placement Warrants” means the 17,325,000 warrants held by the Sponsor, which were issued concurrently with the IPO, each of which is exercisable for one share of Class A common stock.

“Public Warrants” means the warrants included in the units issued in the IPO, each of which is exercisable for one share of Class A common stock, in accordance with its terms.

“SEC” means the U.S. Securities & Exchange Commission.

“Sponsor” means Eagle Equity Partners III, LLC, a Delaware limited liability company.

“SRNG” means Soaring Eagle Acquisition Corp., a Cayman Islands exempted company, prior to the Domestication.

“SRNG Class A ordinary shares” means the Class A ordinary shares, par value $0.0001 per share, of SRNG.

“SRNG Class B ordinary shares” means the Class B ordinary shares, par value $0.0001 per share, of SRNG.

“SRNG ordinary shares” means, collectively, the SRNG Class A ordinary shares and SRNG Class B ordinary shares.

“SRNG warrants” means, collectively, the SRNG Public Warrants and the SRNG Private Placement Warrants.

“Transfer Agent” means Computershare Trust Company, N.A.

“Warrants” means the Private Placement Warrants and the Public Warrants.

v

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements regarding, among other things, the plans, strategies and prospects, both business and financial, of Ginkgo Bioworks Holdings, Inc. (“Ginkgo”). These statements are based on the beliefs and assumptions of the management of Ginkgo. Although Ginkgo believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, Ginkgo cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “estimates”, “expects”, “projects”, “forecasts”, “may”, “will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates” or “intends” or similar expressions. Forward-looking statements contained in this prospectus include, but are not limited to, statements about:

| • | Ginkgo’s ability to raise financing in the future and to comply with restrictive covenants related to long-term indebtedness; |

| • | Ginkgo’s ability to retain or recruit, or adapt to changes required in, its founders, senior executives, key personnel or directors; |

| • | factors relating to the business, operations and financial performance of Ginkgo, including: |

| • | Ginkgo’s ability to effectively manage its growth; |

| • | Ginkgo’s exposure to the volatility and liquidity risks inherent in holding equity interests in certain of its customers; |

| • | rapidly changing technology and extensive competition in the synthetic biology industry that could make the products and processes Ginkgo is developing obsolete or non-competitive unless it continues to collaborate on the development of new and improved products and processes and pursue new market opportunities; |

| • | Ginkgo’s reliance on its customers to develop, produce and manufacture products using the engineered cells and/or biomanufacturing processes that Ginkgo develops; |

| • | Ginkgo’s ability to comply with laws and regulations applicable to its business; and |

| • | market conditions and global and economic factors beyond Ginkgo’s control; |

| • | intense competition and competitive pressures from other companies worldwide in the industries in which Ginkgo operates; |

| • | litigation and the ability to adequately protect Ginkgo’s intellectual property rights; |

| • | the success of Ginkgo’s programs and their potential to contribute revenue; |

| • | Ginkgo’s ability to close and realize the benefits of pending merger and acquisition transactions; and |

| • | other factors detailed under the section entitled “Risk Factors.” |

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this prospectus are more fully described under the heading “Risk Factors” and elsewhere in this report. The risks described under the heading “Risk Factors” are not exhaustive. Other sections of this prospectus describe additional factors that could adversely affect the business, financial condition or results of Ginkgo. New risk factors emerge from time to time and it is not possible to predict all such risk factors, nor can Ginkgo assess the impact of all such risk factors on the business of Ginkgo, or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements, which speak only as of the date hereof. All forward-looking statements attributable to Ginkgo or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. Ginkgo undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

vi

Table of Contents

SUMMARY OF THE PROSPECTUS

This summary highlights selected information included in this prospectus and does not contain all of the information that may be important to you in making an investment decision. This summary is qualified in its entirety by the more detailed information included in this prospectus. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including the information under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements included elsewhere in this prospectus.

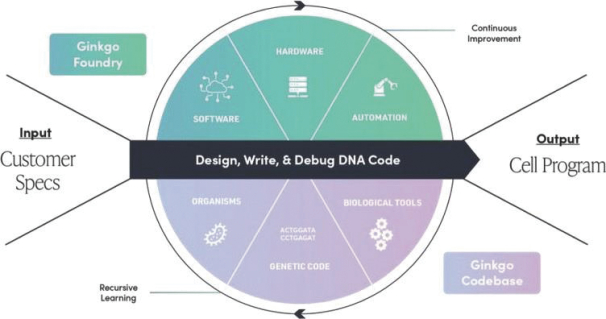

The Company

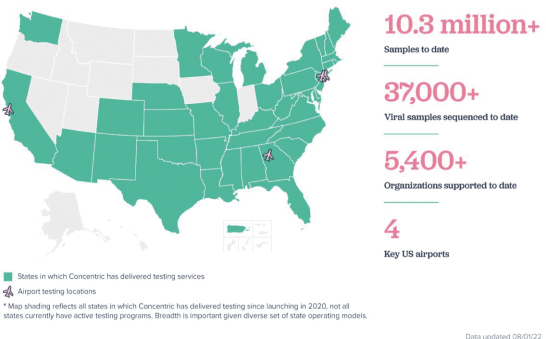

Ginkgo Bioworks Holdings, Inc. is building a platform to enable customers to program cells as easily as we can program computers. Ginkgo’s platform is market agnostic and enables biotechnology applications across diverse markets, from food and agriculture to industrial chemicals to pharmaceuticals. Ginkgo is also actively supporting a number of biosecurity efforts to respond to COVID-19, including vaccine manufacturing optimization, therapeutics discovery, and K-12 pooled testing. Ginkgo has incurred net losses since its inception. Ginkgo’s net loss attributable to its stockholders was approximately $668.8 million and $1,259.3 million for the three and six months ended June 30, 2022, respectively, and $1,830.0 million, $126.6 million and $119.3 million for the fiscal years ended December 31, 2021, 2020 and 2019, respectively. As of June 30, 2022, Ginkgo had an accumulated deficit of approximately $3,557.3 million, and as of December 31, 2021, Ginkgo had an accumulated deficit of approximately $2,297.9 million. For more information, see “Risk Factors—Risks Related to Ginkgo’s Business—We have a history of net losses. We expect to continue to incur losses for the foreseeable future, and we may never achieve or maintain profitability.”

Stock Exchange Listing

Ginkgo’s Class A common stock and public warrants are listed on the NYSE under the symbols “DNA” and

“DNA.WS”, respectively.

Summary of Risk Factors

Investing in our securities involves risks. You should carefully consider the risks described in “Risk Factors” beginning on page 8 before making a decision to invest in our Class A common stock. If any of these risks actually occur, our business, financial condition and results of operations would likely be materially adversely affected. Some of the risks related to Ginkgo’s business and industry are summarized below. References in the summary below to “we,” “us,” “our” and “the Company” generally refer to Ginkgo.

| • | We have a history of net losses. We expect to continue to incur losses for the foreseeable future, and we may never achieve or maintain profitability. |

| • | We are not, and do not intend to become, regulated as an “investment company” under the Investment Company Act of 1940, as amended (“Investment Company Act”), and if we were deemed an “investment company” under the Investment Company Act, applicable restrictions could make it impractical for us to continue our business as contemplated and could have a material adverse effect on our business. |

| • | Only our employees and directors are entitled to hold shares of Class B common stock (including shares of Class B common stock granted or otherwise issued to our employees and directors in the future), which have ten votes per share. This limits or precludes other stockholders’ ability to influence the outcome of matters submitted to stockholders for approval, including the election of directors, the approval of certain employee compensation plans, the adoption of certain amendments to our organizational documents and the approval of any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transaction requiring stockholder approval. |

1

Table of Contents

| • | Outstanding Class C common stock may have the effect of extending voting power in Class B common stock, and may discourage potential acquisitions of our business and could have an adverse effect on the trading price of Class A common stock. |

| • | We may need substantial additional capital in the future in order to fund our business. |

| • | We have experienced rapid growth and expect our growth to continue, and if we fail to effectively manage our growth, then our business, results of operations, and financial condition could be adversely affected. |

| • | Our limited operating history makes it difficult to evaluate our current business and future prospects. |

| • | We currently own and may in the future own equity interests in other operating companies, including certain of our customers; consequently, we have exposure to the volatility and liquidity risks inherent in holding their equity and overall operational and financial performance of these businesses. |

| • | We may pursue strategic acquisitions and investments that are dilutive to our stockholders and that could have an adverse impact on our business if they are unsuccessful. |

| • | We must continue to secure and maintain sufficient and stable supplies of laboratory reagents, consumables, equipment, and laboratory services. We depend on a limited number of suppliers, some of which are single-source suppliers, and contract manufacturers for critical supplies, equipment, and services for research, development, and manufacturing of our products and processes. Our reliance on these third parties exposes us to risks relating to costs, contractual terms, supply, and logistics, and the loss of any one or more of these suppliers or contract manufacturers or their failure to supply us with the necessary supplies, equipment, or services on a timely basis, could cause delays in our research, development, or production capacity and adversely affect our business. |

| • | We use biological, hazardous, flammable and/or regulated materials that require considerable training, expertise and expense for handling, storage and disposal and may result in claims against us. |

| • | Third parties may use our engineered cells, materials, and organisms and accompanying production processes in ways that could damage our reputation. |

| • | If our customers discontinue their development, production and manufacturing efforts using our engineered cells and/or biomanufacturing processes, our future financial position may be adversely impacted. |

| • | Our revenue is concentrated in a limited number of customers, some of which are related parties, and our revenue, results of operations, cash flows and reputation in the marketplace may suffer upon the loss of a significant customer. |

| • | In certain cases, our business partners may have discretion in determining when and whether to make announcements about the status of our collaborations, including about developments and timelines for advancing programs, and the price of our common stock may decline as a result of announcements of unexpected results or developments. |

| • | Uncertainty regarding the ongoing demand and/or capacity (including capacity at third party clinical testing laboratories) of our COVID-19 individual and pooled sample tests could materially adversely affect our business. |

| • | Uncertainty regarding the sales and delivery of our COVID-19 individual and pooled sample tests could materially adversely affect our business. |

| • | We may be subject to tort liability if the COVID-19 tests we utilize in our testing programs provide inaccurate results. |

2

Table of Contents

| • | Rapidly changing technology and emerging competition in the synthetic biology industry could make the platform, programs, and products we and our customers are developing obsolete or non-competitive unless we continue to develop our platform and pursue new market opportunities. |

| • | Ethical, legal and social concerns about GMOs and Genetically Modified Materials and their resulting products could limit or prevent the use of products or processes using our technologies, limit public acceptance of such products or processes and limit our revenues. |

| • | If we are unable to obtain, maintain and defend patents protecting our intellectual property, our competitive position will be harmed. |

| • | Under certain circumstances, we may share or lose rights to intellectual property developed under U.S. federally funded research grants and contracts. |

| • | The use of digital genetic sequence information may be subject to the Nagoya Protocol, which could increase our costs and adversely affect our business. |

| • | We rely on our customers, joint venturers, equity investees and other third parties to deliver timely and accurate information in order to accurately report our financial results in the time frame and manner required by law. |

| • | Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited. |

| • | Failure to comply with federal, state, local and international laws and regulations could adversely affect our business and our financial condition. |

| • | We may incur significant costs complying with environmental, health and safety laws and regulations, and failure to comply with these laws and regulations could expose us to significant liabilities. |

| • | We may become subject to the comprehensive laws and rules governing billing and payment, noncompliance with which could result in non-payment or recoupment of overpayments for our services or other sanctions. |

| • | We and our laboratory partners are subject to a variety of laboratory testing standards, compliance with which is an expensive and time-consuming process, and any failure to comply could result in substantial penalties and disruptions to our business. |

| • | If we fail to comply with healthcare and other governmental regulations, we could face substantial penalties and our business, financial condition and results of operations could be adversely affected. |

| • | We are engaged in certain research activities involving controlled substances, including cannabinoids and other chemical intermediates, the making, use, sale, importation, exportation, and distribution of which may be subject to significant regulation by the DEA and other regulatory agencies. |

| • | Significant disruptions to our and our service providers’ information technology systems or data security incidents could result in significant financial, legal, regulatory, business and reputational harm to us. |

| • | Our business could be adversely affected by legal challenges to our telehealth partner’s business model. |

Corporate Information

We were originally incorporated as a Cayman Islands exempted company in October 2020 as a special purpose acquisition company, formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, recapitalization, reorganization or similar business combination with one or more businesses. SRNG completed its IPO in February 2021. In September 2021, our wholly owned subsidiary merged with and into Old Ginkgo, with Old Ginkgo surviving the merger as a wholly owned subsidiary of SRNG. In connection with the Business Combination, we changed our name to “Ginkgo Bioworks Holdings, Inc.” Our principal executive offices are located at 27 Drydock Avenue, 8th Floor, Boston MA 02210.

3

Table of Contents

Our telephone number is (877) 422-5362. Our website address is www.ginkgobioworks.com. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part.

Emerging Growth Company

Section 102(b)(1) of the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a registration statement under the Securities Act declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. We have elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company (“EGC”), can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of Ginkgo’s financial statements with those of another public company that is neither an EGC nor an EGC that has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.

We will remain an EGC until the earlier of: (1) the last day of the fiscal year (a) following the fifth anniversary of the Closing of SRNG’s initial public offering, (b) in which we have total annual gross revenue of at least $1.07 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date on which we have issued more than $1.00 billion in non- convertible debt securities during the prior three-year period. References herein to “EGC” have the meaning associated with it in the JOBS Act.

4

Table of Contents

THE OFFERING

| Issuer |

Ginkgo Bioworks Holdings, Inc. |

| Class A common stock offered by the Selling Securityholders |

Up to 292,051,107 shares of Class A common stock |

| Shares of our Class A common stock outstanding prior to exercise of all Warrants (as of August 8, 2022) |

1,099,693,341 |

| Use of proceeds |

The Selling Securityholders will receive all of the proceeds from this offering. We will not receive any of the proceeds from the sale of the shares of common stock by the Selling Securityholders. |

| Ticker symbols |

“DNA” and “DNA.WS” for the Class A common stock and Public Warrants, respectively. |

| Risk factors |

Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” and elsewhere in this prospectus. |

5

Table of Contents

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors, together with all of the other information included in this prospectus, before making an investment decision. Our business, prospects, financial condition or operating results could decline due to any of these risks and, as a result, you may lose all or part of your investment.

Unless the context otherwise requires, all references in this section to the “Company,” “we,” “us” or “our” refer to the business of Ginkgo and its subsidiaries.

Risks Related to Ginkgo’s Business

We have a history of net losses. We expect to continue to incur losses for the foreseeable future, and we may never achieve or maintain profitability.

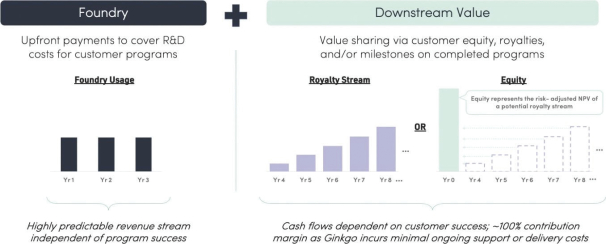

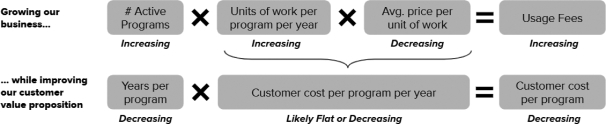

We have incurred significant operating losses since our inception. Our net loss attributable to our stockholders was approximately $668.8 million and $1,259.3 million for the three and six months ended June 30, 2022, respectively. As of June 30, 2022, we had an accumulated deficit of approximately $3,557.3 million. We may incur losses and negative cash flow from operating activities for the foreseeable future as we continue to invest significant additional funds toward further developing our platform, the cell programs we perform on behalf of our customers and otherwise growing our business, including our biosecurity offering. Our operating expenses have increased as a result of becoming a public company, and we expect that our operating expenses will continue to increase as we grow our business. We have derived a significant portion of our revenues from fees and milestone payments from technical development services provided to customers to advance programs, as well as a significant portion of our revenues from our biosecurity offering. Historically, these fees have not been sufficient to cover the full cost of our operations. Additionally, if our customers terminate their agreements or development plans with us, our near-term revenues could be adversely affected. In addition, certain of our customer agreements provide for milestone payments, future royalties and other forms of contingent consideration, the payment of which are uncertain, as they are dependent on our ability to successfully develop engineered cells, bioprocesses, or other deliverables and our customers’ ability and willingness to successfully develop and commercialize products and processes.

Our expenses may exceed revenues for the foreseeable future and we may not achieve profitability. If we fail to achieve profitability, or if the time required to achieve profitability is longer than we anticipate, we may not be able to expand or continue our business, and the value of our common stock could be negatively impacted. Our ability to achieve or sustain profitability is based on numerous factors, many of which are beyond our control, including the development of our platform, the initiation of new programs with new and existing customers, the commercial terms of our programs, our ability to advance cell engineering programs in a timely and cost-effective manner, our ability to extend new offerings to customers, our customers’ ability to scale up bioprocesses, the ability of our customers to produce and sell products, the impact of market acceptance of our customers’ products, and our customers’ market penetration and margins. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

We may need substantial additional capital in the future in order to fund our business.

We have consumed considerable amounts of capital to date, and we expect to incur continued net losses over the next several years as we continue to develop our business, advance our programs, expand and enhance our platform, and make the capital investments necessary to scale up our Foundry operations and Codebase assets. We may also use additional capital for our biosecurity offering, strategic investments and acquisitions. We believe that our cash and cash equivalents, short-term investments, and interest earned on investments will be sufficient to meet our projected operating requirements for several years and until we reach profitability. However, these assumptions may prove to be incorrect and we could exhaust our available capital resources

6

Table of Contents

sooner than we currently expect. Because of the numerous risks and uncertainties associated with our programs, including risks and uncertainties that could impact the rate of progress of our programs, we are unable to estimate with certainty the amounts of capital outlays and operating expenditures associated with these activities.

We do not currently have any commitments for future funding. We may receive fees, milestones, and royalty payments under our customer agreements, but these are not guaranteed. Additionally, we may be able to sell our equity interests in certain subsidiaries or collaborations but most of these equity stakes are illiquid (e.g., in private companies) and we may not be able to find a buyer or may incur significant impairment if forced to sell these positions for liquidity. We may not receive any further funds under those agreements, the funds we receive may be lower than projected, or our program costs may be higher than projected. In addition, we may not be able to sign new customer agreements or enter into new development plans with existing customers with adequate funds to cover program development expenses. As a result of these and other factors, we do not know whether additional financing will be available when needed, or, if available, whether such financing would be on terms favorable to our stockholders or us.

If future financings involve the issuance of equity securities, our existing stockholders would suffer dilution. If we raise debt financing in the future, we may be subject to restrictive covenants that limit our ability to conduct our business. Our ability to raise funds may be adversely impacted by current or future economic conditions. If we fail to raise sufficient funds and continue to incur losses, our ability to fund our operations, take advantage of strategic opportunities, or otherwise respond to competitive pressures could be significantly limited. If adequate funds are not available, we may not be able to successfully execute our business plan or continue our business.

We have experienced rapid growth and expect our growth to continue, and if we fail to effectively manage our growth, then our business, results of operations, and financial condition could be adversely affected.

We have experienced substantial growth in our business since inception, which has placed and may continue to place significant demands on our company culture, operational infrastructure, and management. We believe that our culture has been a critical component of our success. We have invested substantial time and resources in building our team and nurturing a culture of empowerment of, and active engagement by, our employees. As we expand our business and mature as a public company, we may find it difficult to maintain our culture while managing this growth. Any failure to manage our anticipated growth and organizational changes in a manner that preserves the key aspects of our culture could be detrimental to future success, including our ability to recruit and retain personnel, and effectively focus on and pursue our objectives. This, in turn, could adversely affect our business, results of operations, and financial condition.

In addition, in order to successfully manage our rapid growth, our organizational structure has become more complex and is likely to continue to become more complex. In order to manage these increasing complexities, we will need to continue to scale and adapt our operational, financial, and management controls, as well as our reporting systems and procedures. The expansion of our systems and infrastructure will require us to commit substantial financial, operational, and management resources before our revenue increases and without any assurances that our revenue will increase.

Finally, continued growth could strain our ability to maintain reliable service levels and offerings for our customers. If we fail to achieve the necessary level of capacity, quality and efficiency in performing services and other development activities, or the necessary level of efficiency in our organizational structure as we grow, then our business, results of operations, and financial condition could be adversely affected.

Our limited operating history makes it difficult to evaluate our current business and future prospects.

We have a portfolio of cell engineering programs which vary in start date, duration, complexity, and revenue potential. Additionally, our downstream economics in the form of equity interests, milestone payments, or royalty streams add an additional level of uncertainty to our possible future performance. Consequently,

7

Table of Contents

predictions about our future success or viability are highly uncertain and may not be as accurate as they could be if we had a longer company history of successfully developing, commercializing and generating revenue from our programs and/or downstream economic participation. With respect to our biosecurity offering, prior to 2020, we had no experience developing or commercializing testing services. Moreover, as described above, given the limited operating history of our biosecurity offering, our reliance on government funding for testing, potential disruptions from vaccine rollout generally, the availability of COVID-19 therapeutics, the impact of summer vacation and other school breaks, and the increased availability of over-the-counter testing options, the future performance of our COVID-19 testing program is unpredictable. Moreover, we cannot predict how long the COVID-19 pandemic will continue and, therefore, we cannot predict the duration of the revenue stream, which could diminish significantly, from our COVID-19 testing services.

Our long-term objective is to generate free cash flow from the commercialization of programs by customers across a variety of industries, as well as from our biosecurity-focused offerings. Our estimated costs and timelines for the completion of programs are based on our experiences to date and our expectations for each stage of the program in development. Given the variety of types of programs we support and the continued growth of our platform, there is variability in timelines and costs for launching and executing programs, and completion dates can change over the course of a customer engagement. In addition, our costs and timelines may be greater or subject to variability where regulatory requirements lead to longer timelines, such as in agriculture, food, and therapeutics. In addition, we have equity interests in certain companies and there is and will continue to be variability in the financial performance of these other companies or future companies in which we may have equity interests.

As a business with a limited operating history, we may encounter unforeseen expenses, difficulties, complications, delays, and other known and unknown obstacles. We have encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies with limited operating histories in emerging and rapidly changing industries. If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our results of operations could differ materially from our expectations, and our business, financial condition, and results of operations could be adversely affected.

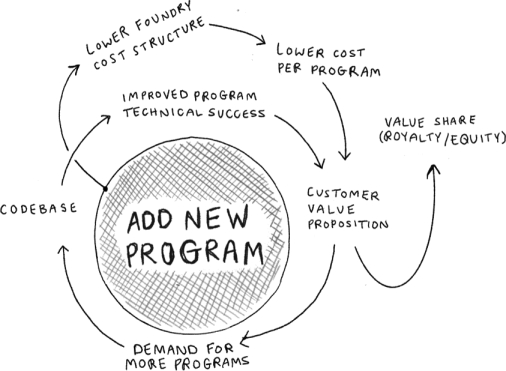

If we cannot maintain and expand current customer partnerships and enter into new customer partnerships, our business could be adversely affected.

We do not generate substantial revenue from our own products, and instead generate revenue from customer collaborations in which we provide services, and also receive downstream value in the form of royalties, equity, or milestone payments. As a result, our success depends on our ability to expand the number, size and scope of our customer collaborations. Our ability to win new business depends on many factors, including our reputation in the market, the quality of our service offerings relative to alternatives, the pricing and efficiency of our services relative to alternatives, and our technical capabilities. If we fail to maintain a position of strength in any of these factors, our ability to either sign new customer collaborations or launch new programs with existing customers may suffer and this could adversely affect our prospects. Additionally, in the process of developing programs, we generate Foundry know-how and accumulate meaningful biological and data assets, including optimized proteins and organisms, characterized genetic parts, enhanced understanding of metabolic pathways, biological, chemical, and genetic libraries, and other elements of biological data. Data and know-how generated from our programs provide the basis for expanded capabilities that we believe further supports our customer collaborations. As a result, in addition to reducing our revenue or delaying the development of our programs, the loss of one or more of our customer relationships or the failure to add new customers or programs may hinder our accumulation of such information, thus hindering our efforts to advance our technological differentiation and improve our platform.

We engage in conversations with companies regarding potential customer collaborations on an ongoing basis. We may spend considerable time and money engaging in these conversations and feasibility assessments,

8

Table of Contents

including understanding the technical approach to a program, customer concerns and limitations, and legal or regulatory landscape of a potential program or offering, which may not result in a commercial agreement. Even if an agreement is reached, the resulting relationship may not be successful for many reasons, including our inability to complete a program to our customers’ specifications or within our customers’ time frames, or unsuccessful development or commercialization of products or processes by our customers. In such circumstances, our revenues and downstream value potential from such a collaboration might be meaningfully reduced.

We currently own and may in the future own equity interests in other operating companies, including certain of our customers; consequently, we have exposure to the volatility and liquidity risks inherent in holding their equity and overall operational and financial performance of these businesses.

We currently own equity interests in several of our customers. In the future, we may also own equity interests in other companies. The process by which we receive equity interests and the factors we consider in deciding whether to accept, hold or dispose of these equity positions may differ significantly from those that an independent investor would evaluate when considering equity interests in a company. Owning equity increases our exposure to the risks of the other company and, in the case of customers, beyond the products of our collaborations. Our equity ownership positions expose us to market volatility and the potential for negative returns. We may have restrictions on resale or limited markets to sell our equity ownership. In many cases, our equity position is a minority position which exposes us to further risk, as we are not able to exert control over the companies in which we hold securities.

In connection with future collaborations or joint ventures, we may, from time to time, receive warrants or options, all of which involve special risks. To the extent we receive warrants or options in connection with future collaborations or joint ventures, we would be exposed to risks involving pricing differences between the market value of underlying securities and our exercise price for the warrants or options, a possible lack of liquidity, and the related inability to close a warrant or option position, all of which could ultimately have an adverse effect on our financial position.

We leverage our own resources and partner with strategic and financial investors in order to help early stage companies and innovators secure funding and benefit from our platform, which exposes us to a number of risks.

Since our founding, we have helped to launch new companies (such as BiomEdit, LLC, Motif FoodWorks, Inc., Allonnia, LLC, Arcaea, LLC (formerly known as Kalo Ingredients, LLC), Ayana Bio, LLC, Joyn Bio LLC and Verb Biotics, LLC) by bringing together strategic and financial investors to secure funding for these early stage and small companies. Going forward, we intend to continue to leverage our own balance sheet and partner with investors to enable companies at all stages to benefit from our platform.

Partnering with and investing in early stage and small companies may expose us to a number of risks, including that early stage and small companies may have:

| • | shorter operating histories, narrower product lines and smaller market shares than larger businesses, which tend to render small companies more vulnerable to competitors’ actions and market conditions, as well as general economic downturns; |

| • | more limited access to capital and higher funding costs, may be in a weaker financial position and may need more capital than originally anticipated to expand, compete and operate their business; |

| • | the inability to obtain financing from the public capital markets or other traditional sources, such as commercial banks, in part because loans made to these types of companies entail higher risks than loans made to companies that have larger businesses, greater financial resources or are otherwise able to access traditional credit sources on more attractive terms; |

9

Table of Contents

| • | a higher likelihood of depending on the management talents and efforts of a small group of persons; therefore, the death, disability, resignation or termination of one or more of these persons could have a material adverse impact on such company and, in turn, on us; |

| • | less predictable operating results, may be engaged in rapidly changing businesses with products subject to a substantial risk of obsolescence, and may require substantial additional capital to support their operations, finance expansion or maintain their competitive position; |

| • | particular vulnerabilities to changes in customer preferences and market conditions, depend on a limited number of customers, and face intense competition, including from companies with greater financial, technical, managerial and marketing resources; and |

| • | fewer administrative resources, which can lead to greater uncertainty in their ability to generate accurate and reliable financial data, including their ability to deliver audited financial statements. |

Any of these factors or changes thereto could impair an early stage or small company’s financial condition, results of operation, cash flow or result in other adverse events, such as bankruptcy. This, in turn, could result in losses in our investments and a change in our income (loss) on investments.

We may be unable to complete pending strategic acquisitions or successfully integrate strategic acquisitions which could adversely affect our business and financial condition.

Our inability to complete any pending strategic acquisitions or to successfully integrate any new or previous strategic acquisitions could have a material adverse effect on our business. Our business strategy includes the acquisition of technologies and businesses that complement or augment our existing products and services. We may continue to seek attractive opportunities to acquire businesses, enter into joint ventures and make other investments that are complementary to our existing strengths. There are no assurances, however, that any strategic acquisition opportunities will arise or, if they do, that they will be consummated. Certain acquisitions may be difficult to complete for a number of reasons, including the need to satisfy customary closing conditions, the need for antitrust and/or other regulatory approvals, as well as disputes or litigation. For example, our announced and pending Zymergen merger and Bayer acquisition are subject to a number of closing conditions, as described in Note 15 to our consolidated financial statements. Any strategic acquisition we may complete may be made at a substantial premium over the fair value of the net identifiable assets of the acquired company and thus our realization of this value relies on successful integration and continued operations. We may not be able to integrate acquired businesses successfully into our existing businesses, make such businesses profitable, retain key employees or realize anticipated cost savings or synergies, if any, from these acquisitions, which could adversely affect our business and financial condition. Further, our ongoing business may be disrupted, and our management’s attention may be diverted by acquisitions, investments, transition and/or integration activities.

We may pursue strategic acquisitions and investments that are dilutive to our stockholders and that could have an adverse impact on our business if they are unsuccessful.

We have made acquisitions in the past and, as appropriate opportunities become available, we may acquire additional businesses, assets, technologies, or products to enhance our business in the future, but our ability to do so successfully cannot be ensured. We have also made investments in companies that we view as synergistic with our business. Although we conduct due diligence on these acquisitions and investments, such processes may underestimate or fail to reveal significant liabilities and we could incur losses resulting from liabilities of the acquired business that are not covered by indemnification we may obtain from the seller. Even if we identify suitable opportunities, including pending transactions, we may not be able to complete such acquisitions on favorable terms or at all, which could damage our business. Additionally, pursuing acquisitions, whether successful or unsuccessful, could result in civil litigation and regulatory penalties. Any acquisitions we make may not strengthen our competitive position, and these transactions may be viewed negatively by customers or investors. We may decide to incur debt or spend cash in connection with a strategic acquisition, which may cause

10

Table of Contents

us to face liquidity concerns or be subject to restrictive covenants in the future. We have, and in the future may, also issue common stock or other equity securities to the stockholders of the acquired company, which could constitute a material portion of our then-outstanding shares of common stock and may reduce the percentage ownership of our existing stockholders.

In addition, we may not be able to successfully integrate the acquired personnel, assets, technologies, products and/or operations into our existing business in an effective, timely, and non-disruptive manner or retain acquired personnel following an acquisition. Acquisitions may also divert management’s attention from day-to-day responsibilities, increase our expenses and reduce our cash available for operations and other uses. In addition, we may not be able to fully recover the costs of such acquisitions or be successful in leveraging any such strategic transactions into increased business, revenue, or profitability. We also cannot predict the number, timing, or size of any future acquisitions or the effect that any such transactions might have on our operating results.

Accordingly, although there can be no assurance that we will undertake or successfully complete any future acquisitions, any transactions that we do complete may not yield the anticipated benefits and may be subject to the foregoing or other risks and have a material and adverse effect on our business, financial condition, results of operations, and prospects. Conversely, any failure to pursue or delay in completing any acquisition or other strategic transaction that would be beneficial to us, including those caused by competing parties, could delay the development of our platform or advancement of our programs and, thus, potential commercialization of our customer’s products.

Our programs may not achieve milestones and other anticipated key events on the expected timelines or at all, which could have an adverse impact on our business and could cause the price of our common stock to decline.

We may adopt various technical, manufacturing, regulatory, commercial, and other objectives for our programs. These milestones may include our or our customers’ expectations regarding the commencement or completion of technical development, the achievement of manufacturing targets, the submission of regulatory filings, or the realization of other development, regulatory, or commercialization objectives by us or our customers. The achievement of many of these milestones may be outside of our control. All of these milestones are based on a variety of assumptions, including assumptions regarding capital resources, constraints, and priorities, progress of and results from research and development (“R&D”) activities, and other factors, including impacts resulting from the COVID-19 pandemic, any of which may cause the timing of achievement of the milestones to vary considerably. If we, our collaborators, or our customers fail to achieve milestones in the expected timeframes, the commercialization of our programs may be delayed, our credibility may be undermined, our business and results of operations may be harmed, and the trading price of our common stock may decline.

We must continue to secure and maintain sufficient and stable supplies of laboratory reagents, consumables, equipment, and laboratory services. We depend on a limited number of suppliers, some of which are single-source suppliers, and contract manufacturers for critical supplies, equipment, and services for research, development, and manufacturing of our products and processes. Our reliance on these third parties exposes us to risks relating to costs, contractual terms, supply, and logistics, and the loss of any one or more of these suppliers or contract manufacturers or their failure to supply us with the necessary supplies, equipment, or services on a timely basis, could cause delays in our research, development, or production capacity and adversely affect our business.

The COVID-19 pandemic has caused substantial disruption in global supply chains and the ability of third parties to provide us services on a timely basis or at all. As a result, we have experienced shortages in some of our key equipment and supplies, including those required in our labs, as well as disruptions in services provided by third parties, and may continue to do so in the future as a result of the pandemic, or otherwise. We may also experience price increases, quality issues and longer lead times due to unexpected material shortages, service

11

Table of Contents

disruptions, and other unanticipated events, which may adversely affect our supply of lab equipment, lab supplies, chemicals, reagents, supplies, and lab services. For some suppliers, we do not enter into long-term agreements and instead secure our materials and services on a purchase order basis. Our suppliers may reduce or cease their supply of materials or services to us at any time in the future. If the supply of materials or services is interrupted, our programs may be delayed.

We depend on a limited number of suppliers for critical items, including lab consumables and equipment, for the development of our programs. Some of these suppliers are single-source suppliers. We do not currently have the infrastructure or capability internally to manufacture these items at the necessary scale or at all. Although we have a reserve of supplies and although alternative suppliers exist for some of these critical products, services, and equipment, our existing processes used in our Foundries have been designed based on the functions, limitations, features, and specifications of the products, services, and equipment that we currently utilize. While we work with a variety of domestic and international suppliers, our suppliers may not be obligated to supply products or services or our arrangements may be terminated with relatively short notice periods. Additionally, we do not have any control over the process or timing of the acquisition or manufacture of materials by our manufacturers and cannot ensure that they will deliver to us the items we order on time, or at all.

In particular, we rely on Twist Bioscience Corporation for custom DNA synthesis and Thermo Fisher Scientific Inc. and others for certain instruments and consumables. The price and availability of DNA, chemicals, reagents, equipment, consumables, and instruments have a material impact on our ability to provide Foundry services. We may rely on contract manufacturers like Fermic, s.a. de.c.v for scale-up fermentation development, fermentation, and manufacturing of products for some customers.

The loss of the products, services, and equipment provided by one or more of our suppliers could require us to change the design of our research, development, and manufacturing processes based on the functions, limitations, features, and specifications of the replacement items or seek out a new supplier to provide these items. Additionally, as we grow, our existing suppliers may not be able to meet our increasing demand, and we may need to find additional suppliers. We may not be able to secure suppliers who provide lab supplies at, or equipment and services to, the specification, quantity, and quality levels that we demand (or at all) or be able to negotiate acceptable fees and terms of services with any such suppliers.

As described above, some lab equipment, lab consumables, and other services and materials that we purchase are purchased from single-source or preferred suppliers, which limits our negotiating leverage and our ability to rely on additional or alternative suppliers for these items. Our dependence on these single-source and preferred suppliers exposes us to certain risks, including the following:

| • | our suppliers may cease or reduce production or deliveries, raise prices, or renegotiate terms; |

| • | we may be unable to locate a suitable replacement on acceptable terms or on a timely basis, if at all; |

| • | if there is a disruption to our single-source or preferred suppliers’ operations, and if we are unable to enter into arrangements with alternative suppliers, we will have no other means of continuing the relevant research, development, or manufacturing operations until they restore the affected facilities or we or they procure alternative sources of supply; |

| • | delays caused by supply issues may harm our reputation, frustrate our customers, and cause them to turn to our competitors for future programs; and |

| • | our ability to progress the development of existing programs and the expansion of our capacity to begin future programs could be materially and adversely impacted if the single-source or preferred suppliers upon which we rely were to experience a significant business challenge, disruption, or failure due to issues such as financial difficulties or bankruptcy, issues relating to other customers such as regulatory or quality compliance issues, or other financial, legal, regulatory, or reputational issues. |

Moreover, to meet anticipated market demand, our suppliers may need to increase manufacturing capacity, which could involve significant challenges. This may require us and our suppliers to invest substantial additional funds

12

Table of Contents

and hire and retain the technical personnel who have the necessary experience. Neither we nor our suppliers may successfully complete any required increase to existing research, development, or manufacturing capacity in a timely manner, or at all.

For the quarter ended June 30, 2022, our cost of lab equipment, lab supplies, and lab services accounted for a significant portion of our total R&D expenses. In the event of price increases by suppliers, whether as a result of inflationary pressures or otherwise, we may attempt to pass the increased costs to our customers. However, we may not be able to raise the prices of our Foundry services sufficiently to cover increased costs resulting from increases in the cost of our materials and services, or the interruption of a sufficient supply of materials or services. As a result, materials and services costs, including any price increase for our materials and services, may negatively impact our business, financial condition, and results of operations.

Some of our suppliers and contract manufacturers are foreign entities. We may face disruptions due to the inability to obtain customs clearances in a timely manner or restrictions on shipping or international travel due to the COVID-19 pandemic. As a result of ongoing global supply chain challenges resulting in very long lead times for certain products and equipment, we may order in larger volumes in order to secure the supplies we require for our future operations, which may negatively impact our financial conditions, especially if we are unable to use the supplies ordered.

We use biological, hazardous, flammable and/or regulated materials that require considerable training, expertise and expense for handling, storage and disposal and may result in claims against us.

We work with biological and chemical materials that could be hazardous to human, animal, or plant health and safety or the environment. Our operations produce hazardous and biological waste products, and we largely contract with third parties for the disposal of these products. Federal, state, and local laws and regulations govern the use, generation, manufacture, storage, handling, and disposal of these materials and wastes. Compliance with applicable laws and regulations is expensive, and current or future laws and regulations may restrict our operations. If we do not comply with applicable laws and regulations, we may be subject to fines and penalties.

In addition, we cannot eliminate the risk of (a) accidental or intentional injury or (b) release, or contamination from these materials or wastes, which could expose us to liability. Furthermore, laws and regulations are complex, change frequently, and have tended to become more stringent. We cannot predict the impact of such changes and cannot be certain of our future compliance. Accordingly, in the event of release, contamination, or injury, we could be liable for the resulting harm or penalized with fines in an amount exceeding our resources and our operations could be suspended or otherwise adversely affected. These liabilities could also include regulatory actions, litigation, investigations, remediation obligations, damage to our reputation and brand, supplemental disclosure obligations, loss of customer, consumer, and partner confidence in the safety of our laboratory operations, impairment to our business, and corresponding fees, costs, expenses, loss of revenues, and other potential liabilities, as well as increased costs or loss of revenue or other harm to our business.

The release of GMOs or Genetically Modified Materials, whether inadvertent or purposeful, into uncontrolled environments could have unintended consequences, which may result in increased regulatory scrutiny and otherwise harm our business and financial condition.

The genetically engineered organisms and materials that we develop may have significantly altered characteristics compared to those found in the wild, and the full effects of deployment or release of our genetically engineered organisms and materials into uncontrolled environments may be unknown. In particular, such deployment or release, including an unauthorized release, could impact the environment or community generally or the health and safety of our employees, our customers’ employees, and the consumers of our customers’ products.

In addition, if a high profile biosecurity breach or unauthorized release of a biological agent occurs within our industry, our customers and potential customers may lose trust in the security of the laboratory environments in

13

Table of Contents

which we produce genetically modified organisms (“GMOs”) and genetically modified plant or animal cells and genetically modified proteins and biomaterials (collectively, “Genetically Modified Materials”), even if we are not directly affected. Any adverse effect resulting from such a release, by us or others, could have a material adverse effect on the public acceptance of products from engineered cells and our business and financial condition. Such a release could result in increased regulatory scrutiny of our facilities, platform, and programs, and could require us to implement additional costly measures to maintain our regulatory permits, licenses, authorizations and approvals. To the extent such regulatory scrutiny or changes impact our ability to execute on existing or new programs for our customers, or make doing so more costly or difficult, our business, financial condition, or results of operations may be adversely affected. In addition, we could have exposure to liability for any resulting harm, as well as to regulatory actions, litigation, investigations, remediation obligations, damage to our reputation and brand, supplemental disclosure obligations, loss of customer, consumer, and partner confidence in the safety of engineered cells materials and organisms, impairment to our business, and corresponding fees, costs, expenses, loss of revenues, and other potential liabilities, as well as increased costs or loss of revenue or other harm to our business.

We could synthesize DNA sequences or engage in other activity that inadvertently contravenes biosecurity requirements, or regulatory authorities could promulgate more far-reaching biosecurity requirements that our standard business practices cannot accommodate, which could give rise to substantial legal liability, impede our business, and damage our reputation.

The Federal Select Agent Program (“FSAP”) involves rules administered by the Centers for Disease Control and Prevention and the Animal and Plant Health Inspection Service that regulate possession, use, and transfer of biological select agents and toxins that have the potential to pose a severe threat to public, animal, or plant health or to animal or plant products. In accordance with the International Gene Synthesis Consortium’s (“IGSC”) Harmonized Screening Protocol for screening of synthetic DNA sequence orders, we follow biosafety and biosecurity industry practices and avoid DNA synthesis activities that implicate FSAP rules by screening synthetic DNA sequence orders against the IGSC’s Regulated Pathogen Database; however, we could err in our observance of compliance program requirements in a manner that leaves us in noncompliance with FSAP or other biosecurity rules. In addition, authorities could promulgate new biosecurity requirements that restrict our operations. One or more resulting legal penalties, restraints on our business or reputational damage could have material adverse effects on our business, financial condition, or results of operations.

Third parties may use our engineered cells, materials, and organisms and accompanying production processes in ways that could damage our reputation.

After our customers have received our engineered cells, materials, and organisms and accompanying production processes, we do not have any control over their use and our customers may use them in ways that are harmful to our reputation. In addition, while we have established a biosecurity program designed to comply with biosafety and biosecurity requirements and export control requirements in an effort to ensure that third parties do not obtain our engineered cells or other biomaterials for malevolent purposes, we cannot guarantee that these preventative measures will eliminate or reduce the risk of the domestic and global opportunities for the misuse or negligent use of our engineered cells materials, and organisms and production processes. Accordingly, in the event of such misuse or negligent use, our reputation, future revenue, and operating results may suffer.

International expansion of our business exposes us to business, regulatory, political, operational, financial, and economic risks associated with doing business outside of the United States.

We currently market our services and deliver our programs, materials, and processes outside of the United States and may market future offerings outside of the United States. We, and our suppliers, collaborators, and customers, currently conduct business outside of the United States. From time to time, our services may include the hiring or secondment of our employees outside the United States at third party facilities or require the hiring or secondment of foreign persons within our facilities, including as a result of foreign acquisitions. Accordingly,

14

Table of Contents

we are subject to a variety of risks inherent in doing business internationally, and our exposure to these risks will increase as we continue to expand our operations and customer base. These risks include:

| • | political, social and economic instability; |

| • | fluctuations in currency exchange rates; |

| • | higher levels of credit risk, corruption, and payment fraud; |

| • | enhanced difficulties of integrating any foreign acquisitions; |

| • | increased expenses and diversion of our management’s attention from advancing programs; |

| • | regulations that might add difficulties in repatriating cash earned outside the United States and otherwise prevent us from freely moving cash; |

| • | import and export controls and restrictions and changes in trade regulations; |

| • | compliance with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act, and similar laws in other jurisdictions; |

| • | multiple, conflicting and changing laws and regulations such as privacy, security and data use regulations, tax laws, tariffs, trade regulations, economic sanctions and embargoes, employment laws, anti-corruption laws, regulatory requirements, reimbursement or payor regimes and other governmental approvals, permits and licenses; |

| • | failure by us, our collaborators or our customers to obtain regulatory clearance, authorization or approval for the use of our services in various countries; |

| • | additional potentially relevant third-party patent rights; |

| • | complexities and difficulties in obtaining intellectual property protection and enforcing our intellectual property; |

| • | difficulties in staffing and managing foreign operations, including difficulties related to the increased operations, travel, infrastructure and legal compliance costs associated with international locations; |

| • | logistics and regulations associated with shipping chemicals, biomaterials and product samples, including infrastructure conditions and transportation delays; |

| • | financial risks, such as longer payment cycles, difficulty collecting accounts receivable, the impact of local and regional financial crises, on demand and payment for our products and exposure to foreign currency exchange rate fluctuations; |

| • | natural disasters, political and economic instability, including wars (including the Russian invasion of Ukraine), terrorism and political unrest, the outbreak of disease, or public health epidemics, such as COVID-19, which could have an adverse impact on our employees, contractors, customers, partners, travel and the global economy; |

| • | breakdowns in infrastructure, utilities and other services; |

| • | boycotts, curtailment of trade and other business restrictions; and |

| • | the other risks and uncertainties described in this prospectus. |

Additionally, as part of our growth strategy, we will continue to evaluate potential opportunities for international expansion. Operating in international markets requires significant resources and management attention and will subject us to regulatory, economic and political risks in addition to those we face in the United States. However, our international expansion efforts may not be successful, which could limit the size of our market or the ability to provide services or programs internationally.

15

Table of Contents

In addition, due to potential costs from any international expansion efforts and potentially higher supplier costs outside of the United States, our international operations may operate with a lower margin profile. As a result, our margins may fluctuate as we expand our operations and customer base internationally.

Any of these factors could significantly harm our future international expansion and operations and, consequently, our revenue and results of operations.

Risks Related to Our Customers

We rely on our customers to develop, produce and manufacture products using the engineered cells and/or biomanufacturing processes that we develop. If these initiatives by our customers are not successful or do not achieve commercial success, or if our customers discontinue their development, production and manufacturing efforts using our engineered cells and/or biomanufacturing processes, our future financial position may be adversely impacted.

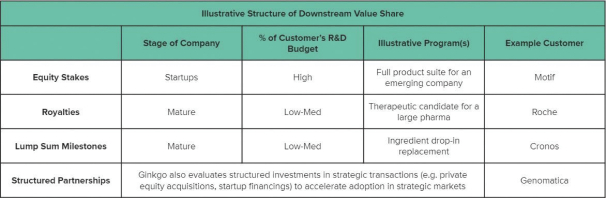

We operate as a platform company. As such, we rely on our customers to commercialize products that may be enabled by our engineered cells and/or biomanufacturing processes. A portion of the value in our customer collaborations is earned through downstream value sharing in the form of equity, royalty streams, or milestone payments. If our customers are not successful in bringing these products to market, the downstream portion of our value will be adversely impacted. Because we do not directly control manufacturing, product or downstream process development or commercialization, we have limited ability to impact the quality of our partners’ production processes and ultimate commercial success.