Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|||

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO

As of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by our non-affiliates was approximately $

As of March 2, 2023, there were

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report is incorporated by reference from the registrant’s definitive proxy statement relating to its annual meeting of stockholders to be held in 2023, which definitive proxy statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Table of Contents

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

1 |

|

Item 1A. |

41 |

|

Item 1B. |

83 |

|

Item 2. |

83 |

|

Item 3. |

83 |

|

Item 4. |

84 |

|

|

|

|

|

|

|

Item 5. |

85 |

|

Item 6. |

86 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

87 |

Item 7A. |

107 |

|

Item 8. |

107 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

107 |

Item 9A. |

107 |

|

Item 9B. |

112 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

112 |

|

|

|

|

|

|

Item 10. |

113 |

|

Item 11. |

113 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

113 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

113 |

Item 14. |

113 |

|

|

|

|

|

|

|

Item 15. |

114 |

|

Item 16. |

118 |

Table of Contents

Cautionary Note Regarding Forward Looking Statements

This report includes forward-looking statements regarding, among other things, the plans, strategies and prospects, both business and financial, of Ginkgo Bioworks Holdings, Inc. ("Ginkgo"). These statements are based on the beliefs and assumptions of the management of Ginkgo. Although Ginkgo believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, Ginkgo cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “estimates”, “expects”, “projects”, “forecasts”, “may”, “will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates” or “intends” or similar expressions. Forward-looking statements contained in this annual report on Form 10-K (“Annual Report”) include, but are not limited to, statements about:

i

Table of Contents

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this Annual Report are more fully described under the heading “Risk Factors” and elsewhere in this report. The risks described under the heading “Risk Factors” are not exhaustive. Other sections of this Annual Report describe additional factors that could adversely affect the business, financial condition or results of Ginkgo. New risk factors emerge from time to time and it is not possible to predict all such risk factors, nor can Ginkgo assess the impact of all such risk factors on the business of Ginkgo, or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements, which speak only as of the date hereof. All forward-looking statements attributable to Ginkgo or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. Ginkgo undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Risk Factors Summary

Investing in our securities involves risks. You should carefully consider the risks described in “Risk Factors” beginning on page 41 before making a decision to invest in our Class A common stock. If any of these risks actually occur, our business, financial condition and results of operations would likely be materially adversely affected. Some of the risks related to Ginkgo’s business and industry are summarized below. References in the summary below to “we,” “us,” “our” and “the Company” generally refer to Ginkgo.

ii

Table of Contents

iii

Table of Contents

iv

Table of Contents

PART I

Item 1. Business.

Unless the context otherwise requires, all references in this section to the “Company,” “Ginkgo,” “we,” “us,” or “our” refer to the business of Ginkgo Bioworks Holdings, Inc. and our subsidiaries.

Mission

Our mission is to make biology easier to engineer. That has never changed. Every choice we’ve made with respect to our business model, our platform, our people and our culture is grounded in whether it will advance our mission. Biology inherently offers incredible capabilities that we can only imagine in human-made technologies—self-assembly, self-repair, self-replication—capabilities that can enable more renewable and innovative approaches for nearly every industry. To realize this potential, we are building a platform for cell programming by bringing together unparalleled scale, software, automation, data science and reusable biological knowledge, enabling responsible solutions for the next generation of foods, pharmaceuticals, materials and more.

Overview

Ginkgo is the leading platform for cell programming, providing flexible, end-to-end services that solve challenges for organizations across diverse markets, from food and agriculture to pharmaceuticals to industrial and specialty chemicals. Ginkgo’s biosecurity and public health unit, Concentric by Ginkgo, is building global infrastructure for biosecurity to empower governments, communities, and public health leaders to prevent, detect and respond to a wide variety of biological threats.

Our founders are engineers from diverse fields who, more than 20 years ago, were inspired by an astonishing feature of biology: it runs on digital code. It’s just A, T, C, and G rather than 0 and 1. But where computer bits are used to communicate information, genetic code is inherently physical and as it is read, physical structures are made. We program computers to manipulate bits, but we program cells to manipulate atoms. Cells are the building blocks of our food, our environment and even ourselves.

We use our platform to program cells on behalf of our customers. These “cell programs” are designed to enable biological production of products as diverse as novel therapeutics, key food ingredients, and chemicals currently derived from petroleum. Biology did not evolve by end market. All of these applications run on cells which have a common code—DNA—and a common programming platform can enable all of them. Because of this shared platform, we are able to drive scale and learning efficiencies while maintaining flexibility and diversity in our program areas. Ultimately, customers come to us because they believe we maximize the probability of successfully developing their products.

Customers may work with Ginkgo to discover new molecules or biological systems, to accelerate the development of a system, or to overhaul their manufacturing processes. They might, for example, be looking to produce a particular chemical via fermentation, at a lower cost, with enhanced supply chain reliability or sustainability. Or perhaps the customer needs a microbe that will live and grow on the roots of corn and convert nitrogen in the air into usable fertilizer for a plant, resulting in improved plant growth. Or a customer might need a viral capsid engineered to target certain tissue types and deliver a gene therapy where it’s needed while not causing a problematic immune response. All of these programs and more run on a common platform at Ginkgo.

We care deeply how our platform is used and recognize biosecurity as a necessary complement to our cell programming work. Biology has the potential to transform health, agriculture, energy, materials, and beyond—but we also know that advances in biotechnology, alongside an increasingly interconnected biological world, contribute to enhanced biological risk. The first, critical step in addressing this risk is to build a robust early warning system to act as a radar for biological threats. This is the focus of our biosecurity and public health unit, Concentric by Ginkgo. Through this initiative, we are building a biosecurity "operating system" that manages the underlying capabilities, networks, and data infrastructure needed for a flexible combination of biomonitoring solutions.

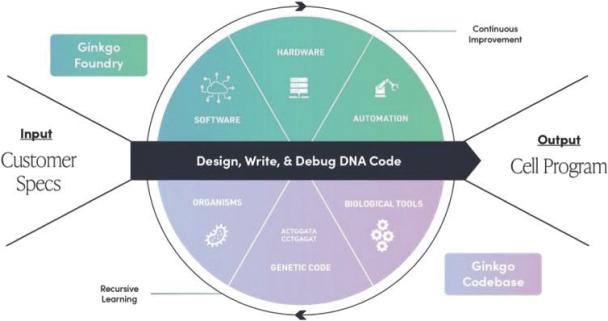

The foundation of our cell programming platform includes two core assets that execute a wide variety of cell programs for customers according to their specifications: our Foundry and our Codebase.

1

Table of Contents

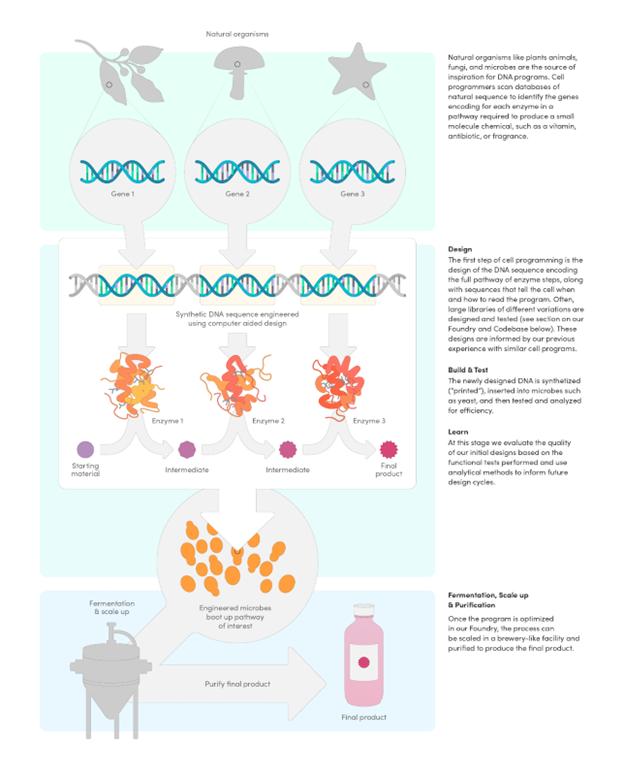

Figure 1: Our platform is used to design, write, and debug DNA code in engineered organisms to execute programs for our customers. Our Foundry leverages proprietary software, automation, and data analytics to reduce the cost of cell programming. Our Codebase consists of reusable biological assets that help accelerate the engineering process.

As the platform scales, we have observed a virtuous cycle between our Foundry, our Codebase, and the value we deliver to customers. Sketched below, we believe this virtuous cycle sustains Ginkgo’s growth and differentiated value proposition.

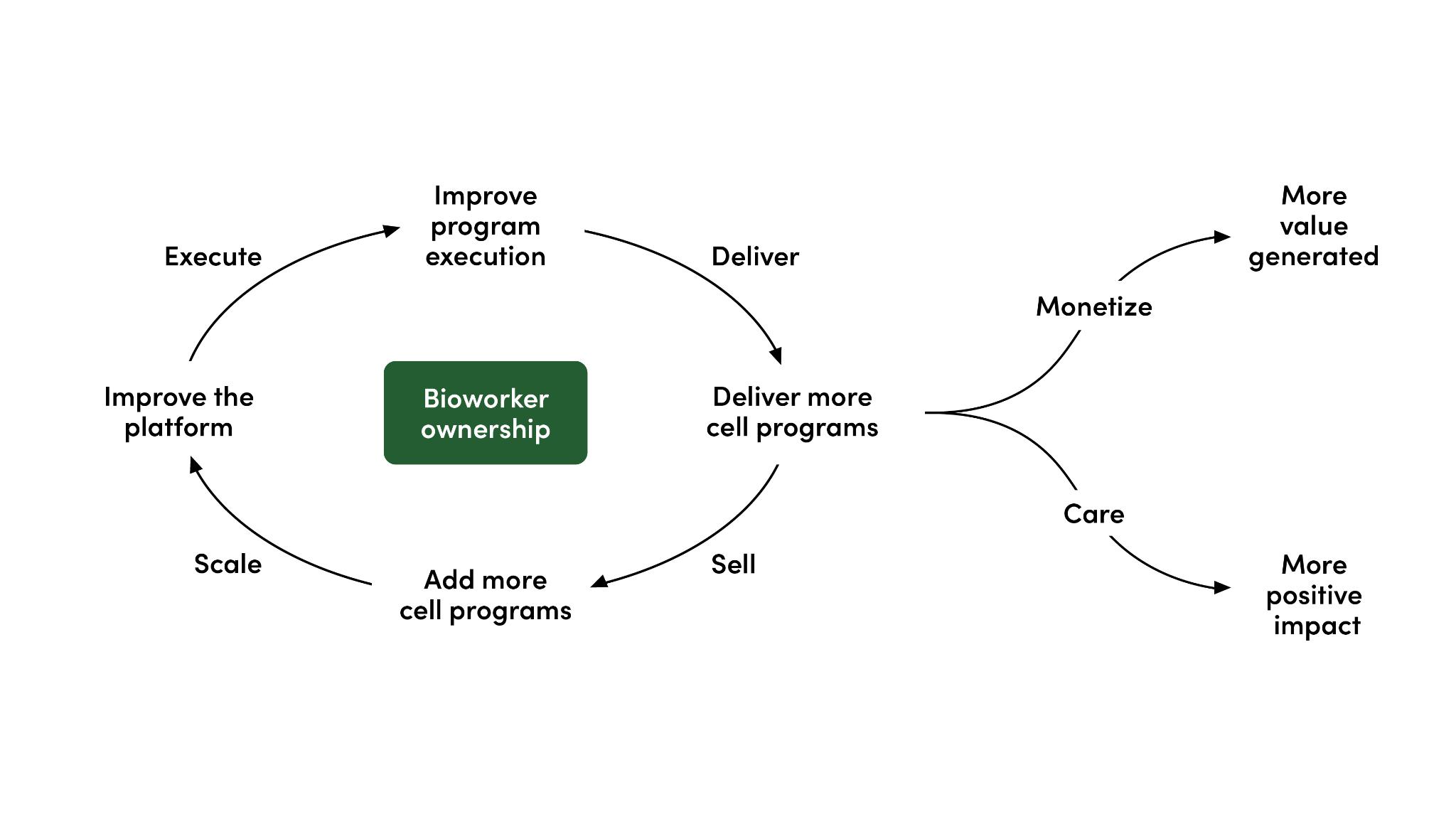

Put simply: we believe that as we scale, the platform improves. We believe that this in turn yields better program execution and customer outcomes, ultimately driving more demand, which drives further investments in scale and platform improvements, and so on. We believe this positive feedback loop has the potential to drive compounding value creation in the future, as every new program we add contributes to both near-term revenues and has the potential to add significant downstream economics and more positive impact.

2

Table of Contents

Figure 2: Ginkgo’s virtuous cycle: as we scale, we see greater efficiency and higher odds of technical success, which helps drive further scaling as our value proposition improves.

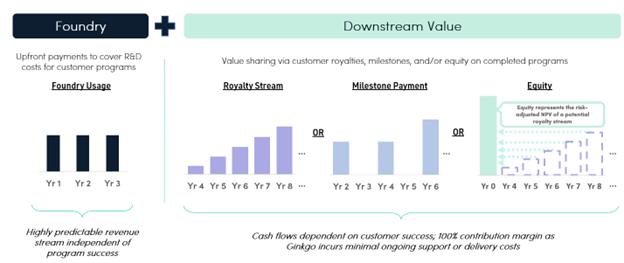

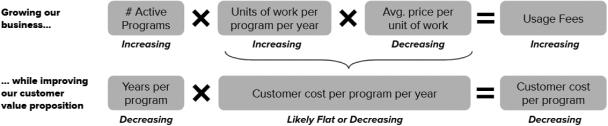

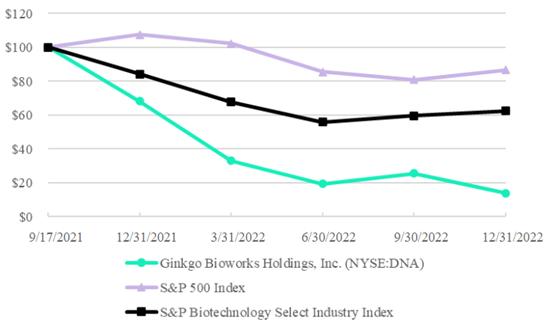

Our cell programming business model mirrors the structure of our platform and we are compensated in two primary ways. First, we charge usage fees for services, in much the same way that cloud computing companies charge usage fees for utilization of computing capacity or contract research organizations (“CROs”) charge for services. The total addressable market for biological R&D services, including labor and tools, is in the tens of billions of dollars—performed mainly by companies in-house—and Ginkgo has a significant penetration opportunity. Additionally, we negotiate a value share with our customers (typically in the form of royalties, milestones, and/or equity interests) in order to align our economics with the success of the programs enabled by our platform. As we add new programs, our portfolio of programs with this “downstream” value potential grows.

We believe that cell programming has the potential to be as ubiquitous in the physical world as computer programming has become in the digital world and that products in the future will be grown rather than made. To enable that vision, we are building a horizontal platform to make biology easier to engineer. Our business model is aligned with this strategy and with the success of our customers, setting us on what we believe is a path towards sustainable innovation for years to come.

An Introduction to Synthetic Biology

To fully tell the story of cell programming, we have to start four billion years ago. All living things evolved from a single cell, a tiny bubble containing the code that enabled it to assemble and reproduce itself. But, importantly, that process of reproduction wasn’t perfect; each copy introduced new mutations in the code. These changes are responsible for one of the most powerful and defining features of biology: evolution. Over eons, that first cell and all its progeny copied themselves, and their DNA evolved to create new functions: to eat new kinds of foods and to produce new kinds of chemicals, structures, and behaviors. As reproduction became more, well, interactive, organisms developed tools to borrow DNA from each other, accelerating the pace of evolution. These functions, and thus the genetic code programming the functions, stuck around when they helped the organisms survive and create more descendants. This went on and on for four billion years, leaving us the wild codebase of DNA that enables the diversity of life forms we see on the planet today.

Synthetic biology’s story begins mere decades ago, as biologists began to decode the molecular secrets of DNA. The billions-year-old tools of cells—enzymes that cut, copy, and paste sequences of DNA code—are now being leveraged by humans to read, write, and edit DNA in the lab. Polymerases that copy DNA are used to enable polymerase chain reaction (“PCR”) tests

3

Table of Contents

for COVID-19 and the CRISPR/Cas system from bacteria now enables editing of human genomes to potentially cure genetic diseases.

Today we are using these tools to learn from the full breadth of evolution and biodiversity to write new biological code. Simple soil bacteria produce everything from vital antibiotics to the smell of fresh rain. We can reuse elements of these DNA programs to make new products. Biochemistry is extraordinarily versatile; we’ve reused the same genetic code libraries across applications as diverse as fine fragrances, baking, and consumer electronics. We may be able to develop programs that can digest human-made “forever chemicals” that biology never encountered before.

As cell programmers, we operate with humility and respect for biology. Our tools are simply borrowed, and the history of biotechnology is a mere blink of an eye compared to the history of living things. Today, we write rudimentary code. We believe that someday our children will write poetry in DNA.

Programming life

Figure 3: DNA strands are sequences composed of four chemical bases, or nucleotides, represented by the letters A, T, C and G.

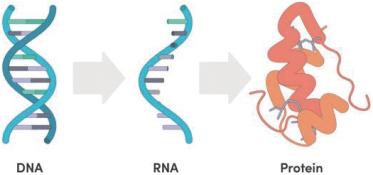

Like computers, cells run on digital code. DNA strands are sequences composed of four chemical bases, or nucleotides, represented by the letters A, T, C and G. The letters along the strand encode the proteins that make up the cell and perform biochemical functions. The translation of DNA to RNA to protein is known as the “central dogma” of molecular biology.

Figure 4: The translation of DNA to RNA to Protein is known as the “central dogma” of molecular biology.

DNA is transcribed to RNA, which is translated to proteins, which in turn perform myriad functions inside or outside of the cell, as structural supports, antibodies, and enzymes that catalyze reactions of all the chemistry performed by the cell. Synthetic biology, through the programming of DNA, enables the development of products made from all of these biological molecules, including DNA based gene therapies, mRNA vaccines, proteins and enzymes used as therapeutics, food ingredients or processing aids, or organic molecules that can be made by building pathways of enzymes inside a cell, antibiotics and other medicines, vitamins, fragrances, and even the building blocks of polymers that are today produced via petroleum. Programmed cells themselves are also products of synthetic biology, as probiotics for nutrition and wellness, microbiome therapeutics or cell therapies, agricultural biologicals, or industrial tools for remediation.

Once a cell is programmed to produce a new molecule, it can produce the molecule and also replicate itself, creating an exponentially growing number of product-producing cells. Many products of genetic engineering are manufactured in facilities that look like breweries, taking advantage of the centuries old process of industrial fermentation to grow cells at high density, and transforming simple sugars into valuable products that can be extracted and commercialized.

4

Table of Contents

Cell programming services

Ginkgo’s platform is a generalized, horizontal platform that provides end-to-end cell programming services to our customers, enabling them to develop the wide array of biological products listed above (and beyond). From the discovery of novel biological functions through the optimization of production strains, processes, and downstream purification of biological products, Ginkgo’s platform is a full spectrum synthetic biology R&D services provider. We provide more details about our platform and our customers' applications in the sections that follow.

5

Table of Contents

Figure 5: An overview of a simple cell program.

The Impact of Cell Programming & Biosecurity

The power of biology has never been more apparent. When synthetic biology was featured on the cover of The Economist in April of 2019, a much smaller segment of the world considered its implications. Today, the global lexicon has shifted. The

6

Table of Contents

COVID-19 pandemic awakened billions of people to the need for biosecurity infrastructure and showed them the value biological products provide to their lives. The impact biology can have on society and industries is clearer than ever.

Further, in September 2022, Jake Sullivan—President Biden’s national security adviser—announced that the U.S. government expects biotechnology to have “outsized importance over the coming decade” in the context of geopolitical competition, because of the ability to “read, write, and edit genetic code, which has rendered biology programmable.” To this end, President Biden issued an Executive Order on Advancing Biotechnology and Biomanufacturing for a Sustainable, Safe and Secure American Bioeconomy and the U.S. government launched a new National Biotechnology and Biomanufacturing Initiative. Both are meant to unlock synthetic biology innovations for health, climate change, energy, food security, agriculture, supply chain resilience, and national and economic security. The Administration also released a National Biodefense Strategy and Implementation Plan, underscoring that advances in biotechnology must be accompanied by robust capabilities to counter biological threats, whether naturally-occurring, accidental, or deliberate.

We no longer question if biotechnology will transform a given industry, we simply question whether we are creative enough to imagine how, and whether we are ready to utilize biology responsibly.

ESG is in our DNA

Biology affects all of us, and we believe cell programming will change the world. Our customers are developing products with far reaching implications for health and the environment. This potential for extraordinary impact, which reaches to the core of who we are and everything about our natural world, requires extraordinary care in how the tools of cell programming are built and used. Technologies reflect the values of the organizations that build them, so our commitment to Environmental, Social and Governance (“ESG”) priorities and care must underscore everything we do.

We also must recognize that biotechnologies have not always reflected the values necessary for sustainable and equitable impact and, as a result, remain controversial. Indeed, companies that produce GMOs for human consumption are restricted from certain ESG indices, placing genetic engineering as a major ESG risk alongside the production of weapons, tobacco products, and fossil fuels. We hope to chart a new course built on care so that the world can benefit from the power of biological engineering while avoiding potential risks.

In July 2022, we released our inaugural sustainability report, Caring at Ginkgo. Our inaugural report was guided by key ESG frameworks and standards (e.g., the Global Reporting Initiative (“GRI”) and Stakeholder Capitalism Metrics) as well as a third-party led materiality assessment (as defined by GRI).

Environmental

We face an urgent environmental crisis that is forcing us to reconsider how we make everything, from our homes, to our food, to our clothing. For centuries, we’ve treated nature as an infinite resource and infinite trash can, extracting raw materials, shaping them through industrial processes that spew out greenhouse gases, and then throwing them away. But these resources are not infinite and there is no “away.” The results have been disastrous—climate change, loss of biodiversity, and pollution have impacted every corner of our world and continue to threaten our way of life.

Cell programming and biological manufacturing are working to address some of the issues that are most contributing to climate change today, from fossil fuel dependency to agricultural emissions, and land use to plastic pollution. Ultimately, biology offers a fundamental shift in how things are made and disposed of: a world where things grow and decay, creating circular, regenerative processes.

There is significant concern that genetic engineering itself creates a form of genetic “pollution” in the environment, with genes from one context introduced into another. This is a concern we take seriously and consider deeply throughout the lifecycle of our programs to ensure that genes introduced will not cause damage—for example, by spreading antibiotic resistance or toxins. We care because the environmental release of certain genetically engineered microbes can also offer tremendous environmental benefit. For example:

7

Table of Contents

And we are just getting started… we believe biology is our best tool to reverse the damage to our planet and chart us on a path towards sustainability in the future.

Social

Technology isn’t neutral. Our values and biases are embedded in the technologies we make, in the applications we consider, and in the ways we address problems. Inclusion of those who have historically been left out of the development of new technologies is essential to building equitable and positive outcomes. Just as biological ecosystems thrive with more diversity, the inclusion of many different voices is essential to growing our company and to ensuring that the viewpoints of historically marginalized people are included in the development of our platform. We have many active efforts in recruiting and retaining diverse talent and will continue to invest in this work (see “—Our People & Culture”).

Marginalized people who have been left out of the development of technologies are also the groups most likely to bear the greatest harm, whether from climate change, pollution, or health disparities. The COVID-19 pandemic has made this inequality starkly clear—in the United States, it has been communities of color that have been disproportionately impacted by the pandemic and have had the least access to testing, treatment, and vaccination.

These values and initiatives are not just a top-down corporate policy, they are an intrinsic part of our culture. Grassroots fundraising challenges to support local and international aid organizations are a regular feature of our internal messaging channels.

Governance

Our culture is built on care, transparency, diversity, employee ownership and engagement, and a deep, humble respect for biology. Transparency is essential to how we operate, to enable sharing of the insights and tools that enable our platform to grow, as well as to build trust and accountability with all of our stakeholders. We have advocated for more transparency in our industry, including supporting GMO labeling, and seek to educate policymakers and the general public about the benefits and risks of synthetic biology through our advocacy efforts.

The individuals who work at Ginkgo and build our platform care deeply about how that platform is used and the impact our company will have in the world. We believe a workforce with strong equity ownership will make the wise decisions needed to build long-term value for our company, and a company whose long-term impacts make them proud. That is why we have implemented a multi-class stock structure that permits all employees (current and future), not just founders, to hold high-vote (10 votes per share) common stock. We believe that our multi-class stock structure will help maintain the long-term mentality we have benefited from as a founder-led company.

For more information, see “Risk Factors—Risks Related to Ginkgo’s Business—Risks Related to Our Common Stock, Organizational Structure and Governance—Only our employees and directors are entitled to hold shares of Class B common stock (including shares of Class B common stock granted or otherwise issued to our employees and directors in the future), which shares have ten votes per share. This limits or precludes other stockholders’ ability to influence the outcome of matters submitted to stockholders for approval, including the election of directors, the approval of certain employee compensation plans, the adoption of certain amendments to our organizational documents and the approval of any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transaction requiring stockholder approval.”

We have selected directors with decades of experience serving as leaders in the life sciences and technology industries. Ginkgo’s board of directors and management team will leverage that experience and consider the interests of stockholders, customers, employees, suppliers, academic researchers, governments, communities, and other stakeholders to pursue long-term value for our company and drive the sustained health of our global community. For more information, see “Risk Factors—Risks Related to Ginkgo’s Business—Risks Related to Our Common Stock, Organizational Structure and Governance—Our focus on the long-term best interests of our company and our consideration of all of our stakeholders, including our stockholders, workforce, customers, suppliers, academic researchers, governments, communities and other stakeholders that we may identify from time to time, may conflict with short-term or medium-term financial interests and business performance, which may adversely impact the value of our common stock.”

Cell programming is expected to transform all industries

Biology grows. Biology adapts and evolves. Biology heals itself and regenerates. Biology is also, remarkably, programmable, offering us the tools to work with biology to transform how we make stuff. With cell programming, we help our customers

8

Table of Contents

across industries grow better products. What does “better” mean? Better products might be more sustainable, have more stable and resilient supply chains, be more accessible, have higher quality and more consistency, and come with lower economic and environmental costs of manufacturing. They can also be truly transformative, fundamentally changing the field of possibilities for what products can do. We have supported many companies that are leveraging our cell programming platform to address some of the world’s most challenging environmental and social issues.

Pharma & Biotech

Biopharma has been a nexus of tremendous innovation in cell programming and synthetic biology. The COVID-19 pandemic brought emerging novel technologies, such as mRNA vaccines, to the mainstream. These vaccines contain genetic code that our bodies read to produce viral proteins and stimulate an immune response and antibody production. New nucleic acid vaccines can be programmed quickly, such as the booster vaccines being developed against emerging SARS-CoV-2 variants, offering the potential for rapid response to other future pathogens. They can also be programmed to target a number of other diseases. In the wake of the success of nucleic acid vaccines during the COVID-19 pandemic, new programs for HIV and cancer vaccines, among others, are accelerating.

Biologic medicines like insulin and other protein drugs and antibodies are also produced via cell programming, making a difference in the treatment of countless diseases. Over 40% of the therapies approved by the U.S. Food and Drug Administration (“FDA”) in 2022 were biologics. In addition, new modalities enabled by cell programming, such as cell and gene therapies, microbiome therapies, and regenerative medicines, are beginning to come online. We believe human health and the ways we treat disease will be transformed by improvements in cell programming technology.

Ginkgo has been active in this field in recent years and we expect to significantly expand our support of therapeutic applications over coming years. From supporting companies like Biogen, Inc. (“Biogen”) to develop gene therapies to creating biocatalysts for the production of active pharmaceutical ingredients (“APIs”) with Merck & Co. (“Merck”) to building novel expression hosts for biologic medicines with Novo Nordisk A/S (“Novo Nordisk”), we are using our platform to deliver transformational innovations across a range of disease areas.

Industrials & Environment

Since the industrial revolution, manufacturing techniques have been extractive, wasteful, and unsustainable. Not only must we innovate new manufacturing methods in order to keep up with growing demand, we must also work to remediate issues we have caused historically, by cleaning up our environment and addressing climate change.

Ginkgo is not only working with customers to create cell programs that enable cost-efficient, renewable, and sustainable production of chemicals and materials, such as our work with Genomatica, Inc. (“Genomatica”), but we have also participated in the formation of Allonnia, a company focused on environmental remediation. Plastic waste and many of the pollutants that plague industrial manufacturing and extraction sites are novel in the course of evolutionary history, so biology has not yet evolved to degrade them efficiently. Cell programming can enable the discovery and development of new enzymes capable of degrading recalcitrant pollutants and recycling waste while entirely reimagining manufacturing for the future.

Food & Agriculture

Food is inherently biological: it comes from life and sustains life. Cell programming can be leveraged to improve the availability of essential food and nutrition to a growing population, decrease the environmental impact and cost of food production, and provide consumers with increased choice.

We are working with some of the largest multinational agriculture companies, including Bayer and Corteva, to develop cell programs that would make crop production more efficient and sustainable, reducing synthetic nitrogen fertilizer and pesticide usage. In food, we have been active in flavors and sweeteners with leading global companies such as Robertet, Inc. (“Robertet”) and Givaudan S.A. (“Givaudan”), and helped Motif FoodWorks, Inc. (“Motif”) produce animal proteins without the need for industrial farming of animals, resulting in the launch of its first product, HEMAMI™, in 2021.

Consumer & Technology

Most physical goods have biological origins—from the petrochemicals in our fabrics to fine chemicals extracted from plants—but industry does not necessarily leverage biology, or leverage biology efficiently, to produce these items. Petrochemicals, for example, are used in everything from our fabrics to our cosmetics to our paints. These chemicals and

9

Table of Contents

polymers are generally created in complex chemical and physical reactions from crude oil, but crude oil is just the result of millions of years of decomposition of previously living matter (they are fossil fuels after all). These biological building blocks can instead be programmed in a living organism to produce these items sustainably, without extracting natural resources. Even in areas where industry does leverage biology, such as extracting raw materials or fine chemicals from plants, we believe the current approaches are woefully inefficient or rife with social consequences.

We have supported Cronos in their effort to biosynthesize multiple cannabinoid molecules, with the goal of reducing cost, improving purity and predictability, and enabling production of rare molecules. In 2022, we partnered with Sumitomo Chemical Co., Ltd. (“Sumitomo”) to help produce ingredients for beauty and personal care through fermentation. We also helped launch a new company in 2021, Arcaea LLC ("Arcaea"), which is focusing on leveraging biology, from proteins to the microbiome, to build a suite of innovative and efficacious personal care products.

Market Opportunity

For several decades in the computing industry, software ran entirely in local environments: companies built and ran their own servers and customized their applications. The dominance of software-as-a-service (“SaaS”) and cloud computing over the past decade has demonstrated the value in having common architectures and enabling horizontal platforms. What users may have sacrificed in customizability, they more than gained in innovation, efficiency, and scalability. We believe Ginkgo is ushering in a similar transition in cell programming, a programming discipline with the power to shape living things and grow applications across the physical world.

The value of these applications will be significant

Given the breadth of application areas and the potential of biology (see “—The Impact of Cell Programming”), we believe that the end markets for bioengineered products will be enormous. But these applications reflect only what we can already imagine. As we develop a greater ability to program biology and direct it towards novel and more challenging applications, the spectrum of possibilities will undoubtedly grow. Computers were used for little more than counting for decades; we firmly believe the most valuable applications of cell programming are not yet apparent.

Large existing market for “on prem” cell programming research and development

Cell programming today is done in a highly inefficient, distributed manner reminiscent of the early days of computing. Essentially every organization looking to innovate in biology builds its own biology labs in the same way that individual tech companies used to set up their own servers instead of using cloud computing. Scientists spend hours moving liquids around rather than designing novel experiments just as computer programmers once spent most of their time physically writing and debugging code (by punching cards, for example) rather than designing new applications.

Because of the way cell programming is done today, intellectual property that could be useful for multiple applications is tied up by exclusivities that delay the progress of the field overall. Ginkgo’s platform breaks down these silos and democratizes access to the most advanced technologies in the field, enabling customers of all sizes to more efficiently drive innovation.

While R&D budgets may rise and fall based on the macroeconomic climate, the market is estimated to be in the tens of billions of dollars. This work is being done in a distributed manner, sacrificing benefits from scale and learning economies. The spend comprises both labor—scientists designing and executing experiments—and “tools”—things like DNA synthesis, reagents, and equipment. Ginkgo brings efficiencies to both elements of this existing market.

10

Table of Contents

As the cost of computing power declined exponentially in computer programming, the demand for computing power increased exponentially as developers dreamed up more and more sophisticated applications. We expect the same to be true in cell programming: as our platform scales in capability and capacity, we hope that the range of applications accessible to cell programming will likewise expand in breadth and sophistication.

Given the current and potential future size of the market for this work, Ginkgo’s ability to penetrate the market and convert customers from “on prem” R&D to outsourced services is a key driver. In the current macroeconomic climate, where potential customers’ R&D budgets may be cut, Ginkgo may be somewhat insulated because our growth has much more to do with the willingness of customers to outsource R&D than the growth rate of the industry overall. In fact, we believe that challenging economic climates may actually encourage potential customers to re-evaluate the way they perform R&D, potentially favoring variable cost service providers like us over “on prem” facilities and employee populations that are harder to ramp up and down quickly.

Industry Overview

We believe that Ginkgo is changing the structure of the biotechnology industry. In much the same way that cloud computing centralized hosting services and ushered in a wave of SaaS companies, Ginkgo is scaling the capabilities needed to program cells. By making these tools more accessible, we hope to usher in a wave of innovation in both “hardware” (life science tools) and “software” (cell programs).

At Ginkgo, we have always admired the symbiotic and regenerative nature of biology, which sits in stark contrast to the often extractive nature of existing technologies. We are often asked who we think the “winners” and “losers” in the industry will be as Ginkgo scales, as if it is a given that our growth must come at the expense of others in the ecosystem. We reject that notion. As our platform scales, we seek to drive benefits for all existing players in this ecosystem:

Program Layer: Ginkgo enables and accelerates product companies, which historically have had to vertically integrate

Ginkgo is not a product company; we are an enabling platform for product companies in a range of end markets. We do not seek to “pick winners” and focus instead on building our platform rather than investing in product-specific risk. Platforms require scale and a relentless focus on innovation while taking a product to market requires many specialized functions that vary depending on the product:

Once the product is developed, major investments are also needed to manufacture, distribute, and market the product. These are the jobs of our customers, the product companies.

Historically, product companies have had to invest in their own R&D capabilities, building their own labs and hiring their own scientists. This investment is inefficient due to lack of scale and drains resources away from application testing and product development. Ginkgo’s platform is not application-specific. The same engineering tools can be used for programs in completely different application areas: cells all run on the same genetic code. As product companies develop their products on Ginkgo’s platform, they gain efficiencies and increase their probability of success. New companies that build on our

11

Table of Contents

platform never need to make the fixed capital investments to start a lab from scratch; they are able to leapfrog and compete effectively against established companies.

Technology Layer: Ginkgo collaborates with life science tools companies to drive technology advancements

Because we’re constantly thinking about how to enable the next several years of scaling of our platform, we have good insights into future bottlenecks and welcome the opportunity to collaborate to build and invest in technologies that will break through those barriers. We are the largest customer for many of our strategic suppliers and, as such, play an important role in advancing new technologies. As a result, we are often able to secure preferred access, often including custom development and leading economic terms, to next-generation technologies and pass those benefits along to customers.

We expect to continue to invest in and support the development of emerging technologies in this space. In certain areas where Ginkgo has unique needs, we may acquire technologies directly, as we did with Gen9, Inc.’s ("Gen9") DNA assembly platform, which was particularly valuable for more complex DNA synthesis needs. In many other areas, we will support new and existing technology companies by placing anchor orders and partnering to develop technology roadmaps that break new ground. In 2022, we made several acquisitions that brought technologies that can be broadly deployed across our programs, including Zymergen Inc. ("Zymergen"), FGen AG ("FGen"), and Altar SAS ("Altar"). We also acquired specialized assets that opened up new market opportunities for us such as Bayer’s West Sacramento Agricultural Biologicals team and facility, and Circularis Biotechnologies, Inc. ("Circularis"), an emerging circular RNA company.

By acting as a horizontal platform, Ginkgo can focus on what we do best (cell programming), our customers can focus on what they do best (bringing products to market in their industry), and our suppliers can focus on what they do best (building great hardware and tools). Biology did not evolve by industry and so cell programming is able to benefit from the scale and efficiency of a horizontal platform. Vertical integration is no longer required, allowing each layer of the ecosystem to flourish as we collectively enable more rapid growth across the industry.

Enabling Customer Success

Ginkgo serves diverse customers across a variety of end markets. Some of these customers may have in-house biological R&D teams and others may have never thought biotechnology applied to their business. In either case, they come to us with a challenge—whether it is supply chain volatility, a race to develop an innovative new product, or an existential threat facing an industry on the wrong side of history—and we partner to enable a biological solution. We begin our relationship by working collaboratively to design the set of specifications for the end product(s) our customer desires. Our cell programmers then take that set of specifications and design an engineering plan to create a cell program that meets or exceeds that set of specifications. When we finish, our customers receive the final engineered organism (which either produces or is their product of interest) and a full “tech transfer” package for manufacturing and downstream processing (which they can implement themselves or pass to a contract manufacturer with our support). Our customers then take these organisms and/or purified products through the final stages of product development (e.g., formulations, clinical trials, field trials, etc.).

Our commercial team is organized to both establish new relationships with potential customers (traditional business development) as well as maintain and expand relationships with our existing customers (which we call “alliance management”; this team often works jointly with our business development team on sales efforts).

Our business development team has both expertise in relevant industries (Consumer & Technology, Industrial & Environment, Agriculture, Food & Nutrition, Pharma & Biotech, and Government & Defense) as well as expertise in our Foundry capabilities and synthetic biology. With this background we are able to identify industry or consumer challenges where biology can serve as a solution. Our categories of customers, independent of industry, include potential customers who have R&D teams with some synthetic biology capabilities where choosing Ginkgo can bring automation, scale, and codebase beyond their own; potential customers who are considering but have not yet built lab-scale capabilities where a partnership with Ginkgo allows them to spend their capital on commercialization efforts; and potential customers who are not yet working in synthetic biology whose industries or products stand to be disrupted by biological solutions. Our business development team, with support from our Codebase and Foundry team members, crafts solutions for each of these types of customers through a strategic discussion of customer needs and fit with Ginkgo capabilities.

To grow existing customers, our alliance management and business development teams work closely with customers to identify technical and business opportunities that serve as the basis for consideration of future programs. Through these discussions, our existing customers often bring upcoming strategic R&D needs to our attention.

12

Table of Contents

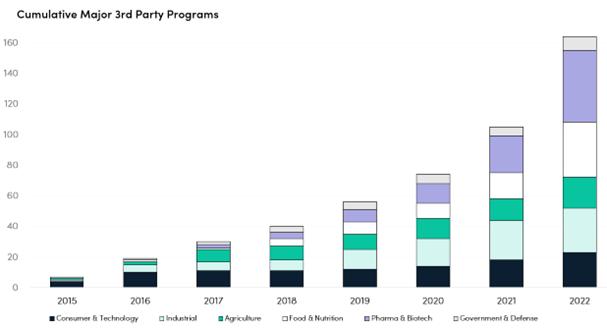

Over 160 Cumulative Programs across diverse industries have run on our platform

While most biotechnology companies focus on building products within a fairly narrow scope, Ginkgo has uniquely pursued a partnered strategy across all end markets. This was not easy. For many years, our platform was less efficient than the status quo of an expert scientist working by-hand at a lab bench. In the early days, the only end markets willing to take a chance on our platform were those without in-house biotechnology capabilities. But as Ginkgo’s platform improved over time and with scale, we were able to win contracts in increasingly sophisticated end markets with more in-house biotechnology expertise. Today, our platform is diversified across all major end markets with marquee customers and a range of focus areas within each.

Figure 6: Cumulative Programs run by third-party customers on Ginkgo’s platform (excluding proof of concept projects and other exploratory work). Today, Ginkgo has a diverse set of programs across all major end markets.

Our customers include large multinational organizations with multibillion dollar R&D budgets as well as startups who are depending on us for essentially all of their bioengineering needs. While these customers and their focus areas may look very different, they are all important and valuable to Ginkgo. All of these programs leverage a common infrastructure, and as we demonstrate the value of this platform, we have the ability to grow significantly with our customers.

Ability to grow with our customers and increasingly complement existing R&D budgets

Ginkgo has grown substantially through inside sales with our existing customers. Some of our customers forego building their own lab space in favor of outsourcing all of their cell engineering needs and so when they grow and expand their product pipeline, we expect their demand for our platform to increase. We believe the relative value of our platform compared to the next best option (building a lab, bioengineering team, and intellectual property from scratch) is immense, which helps us retain customers in this category.

Other customers may already have in-house cell programming capabilities. As Ginkgo demonstrates the value-add of our platform by successfully delivering on programs, we have the opportunity to grow our collaborations with them, complementing their core R&D capabilities. We don’t view this as a “replacement” of customer scientists with Ginkgo’s platform. Rather, we hope to expand our customers’ capacity and need for innovation—giving them more “shots on goal” and enabling them to invest more heavily in R&D as the return on investment of each dollar spent increases.

We have demonstrated our ability to “land and expand” with several customers. With one customer, an initial proof of concept program has turned into a broader strategic relationship with 11 programs today. With another, we launched a relationship with two programs, quickly expanding it to five by the end of the following year. While this initially drove some customer concentration, that has naturally decreased as we’ve scaled and added new customers to the platform. During 2022,

13

Table of Contents

two of our customers each contributed greater than 10% of revenue and collectively they accounted for 22% of total revenue, down from 28% in 2021. With the addition of new customers, we believe customer concentration will decline over time even as we expect to continue to grow our relationships with existing large customers. However, our ability to grow with our customers requires us to maintain satisfied customers, and program or other operational setbacks could impede our ability to meet customer expectations and grow our business.

Powerful proof points across categories

Our platform has now been validated by sophisticated customers across a range of industries. As we launch programs in new areas, those provide a toehold for future sales in that space. As an example, our pro bono project for Moderna, Inc. ("Moderna") at the start of the COVID-19 pandemic to enhance production of a key raw ingredient through process engineering provided a proof point and initiated us into this emerging segment, leading to a commercial relationship with another nucleic acid vaccine company, as well as a program to produce a key processing enzyme for mRNA vaccines. Biopharma discovery programs remain the hardest area to break into as our customers have strong in-house capabilities and many specialized competitors exist in this area. In the last 12-18 months, however, we have been able to demonstrate powerful data and capabilities that have enabled us to sign programs with leading biopharma companies such as Biogen, Merck, and Novo Nordisk.

Our Platform

Ginkgo’s platform combines a strong technical foundation with an ecosystem of supporting resources to maximize our partners’ odds of technical and commercial success. In the nucleus of our platform are our Foundry and Codebase, which our scientists leverage to complete customer programs. The Foundry is, in its simplest form, a very large, highly efficient biology lab, enabled by over a decade of investment in proprietary workflows, custom software, robotic automation, and data science and analytics. It is paired with our Codebase, a collection of biological “parts” and a database of biological data, which helps our scientists program cells. But great technology alone is not enough, and we are building a community and ecosystem around our technical platform that provides our partners with end-to-end support.

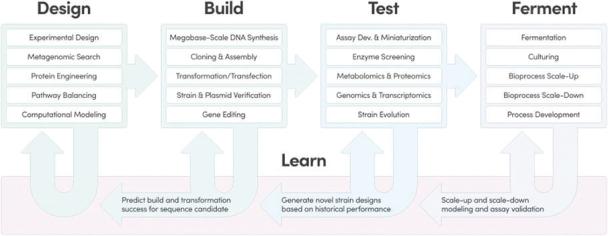

Our Foundry brings economies of scale to cell programming

Cell programming projects involve a conceptually similar process regardless of the specific product or market. Based on customer specifications, Ginkgo’s program team develops designs of proteins, pathways and gene networks (see Figure 5) that might meet the specification, leveraging public and proprietary biological knowledge bases (see “—Our Codebase—organizing the world’s biological code”). Those conceptual designs are refined and specified into particular DNA sequences using computer-aided design tools. Those DNA sequences are then chemically synthesized and inserted into a cell to execute the new DNA code. These prototype cells are then studied and the output or performance of each is measured and compared to the customer’s desired specification. Learnings using data analytics and data science tools can inform a new round of prototypes, if needed. We refer to this engineering cycle from design to learning as a campaign and we perform campaigns both in parallel and serially until either the specification has been met or the customer decides to end the program.

The likelihood of technical success increases with each iterative campaign and with the number of prototypes that are explored per campaign. However, with traditional tools for genetic engineering, each campaign can be slow, expensive and error prone. Many projects across the industry run out of budget or time. Conventional R&D teams often look to stay within budget by running rapid campaigns using largely manual tools and small numbers of prototypes per campaign. However, the inability to broadly explore the potential design space (there are more possible sequences of a 200 amino acid protein encoded in 600 DNA letters than there are stars in the observable universe) and the reliance on manual tools is a difficult handicap to overcome. Since people can only work so hard and since campaigns can’t be shortened beyond the duration of the physical steps, this approach has limited potential to improve in the future.

At Ginkgo, we invest in improving the tools and technology for programming cells in order to maximize program success within the constraints of customer timelines and budgets. We do so by scaling the number of prototypes that can be evaluated in each campaign in an effort to reduce the number of campaigns required to meet the customer’s specification and ultimately shorten project timelines. A typical campaign for one enzyme step in a program might evaluate 1,000 to 2,000 prototypes to optimize function, of which the top 10 to 100 might be short-listed for further study. A relatively basic program might have three to five enzymes working in concert, and so in the process of optimizing the entire pathway, thousands or tens of thousands of enzymes and pathway combinations might be designed, built, and tested in the Foundry. The methods we use to increase scale also tend to reduce the average cost per prototype, which means that more prototypes can be evaluated for a given program budget.

14

Table of Contents

Because diverse cell programs share similarities in process and code, many programs can be run simultaneously in a carefully designed centralized facility. This facility, where we use our investments in advanced cell programming technologies to manage diverse programs, is what we call our Foundry.

We make it possible to centralize many cell programming projects in our Foundry by deconstructing programs into a set of common steps and then standardizing those steps. For each step, we have built a specialized functional team that performs that step for all programs. Those teams define a set of standardized services that can be used in concert to execute an end-to-end cell programming process. Each team has access to scientific, software, and robotic engineering resources to replace manual ad hoc operations with standardized, automated, and optimized services. In addition to enabling scale, this approach ensures standard operating procedures, know-how, and human skill become encoded in software that can be more effectively debugged, monitored, controlled, and optimized.

Figure 7: A non-exhaustive summary of the functions performed throughout the lifecycle of a program in the Foundry. At each stage, learnings are generated, driving improved designs and functional optimizations.

While the engineering strategies described above have historically been relatively uncommon in the life sciences, they are obviously not our invention. Rather, we are inspired by the lessons from other engineering disciplines and seek to apply those to biology. Automotive manufacturing, semiconductor fabrication, and data centers, among many other industries, demonstrate how automation, data, economies of scale, and continuous improvement can produce compounding gains in scale, costs, and quality. Critically, routine performance of these strategies across dozens of projects gives us the data and experience needed to drive continuous improvement.

As described above, a key strategy in our Foundry is to increase the scale of our operations so that we can run larger campaigns, a greater number of campaigns, and hence run more programs. This approach benefits from operational efficiencies and economies of scale across many dimensions:

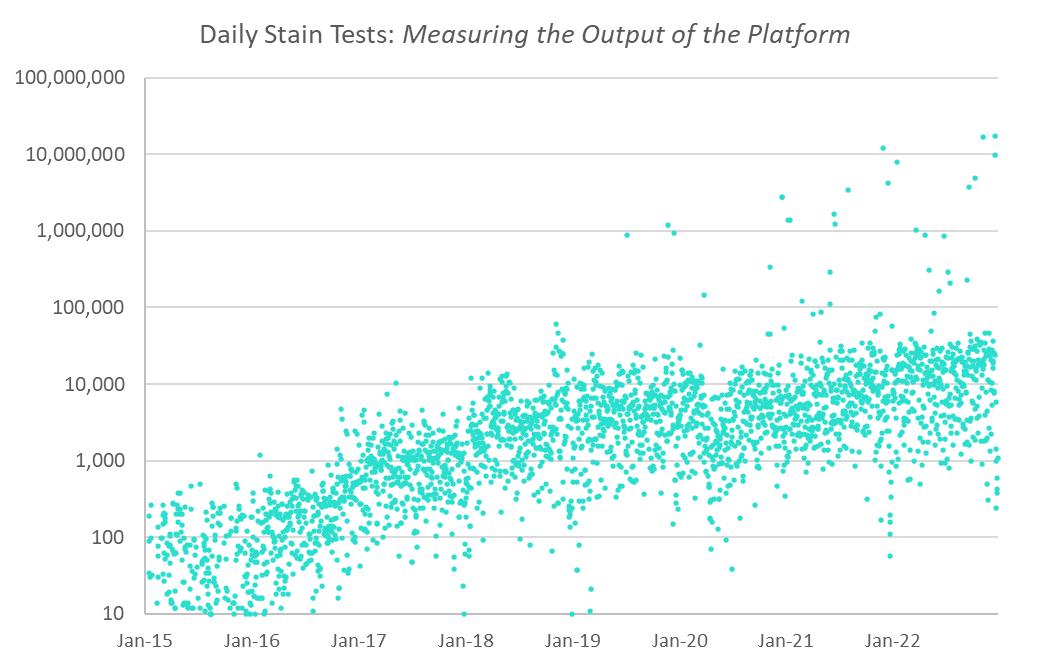

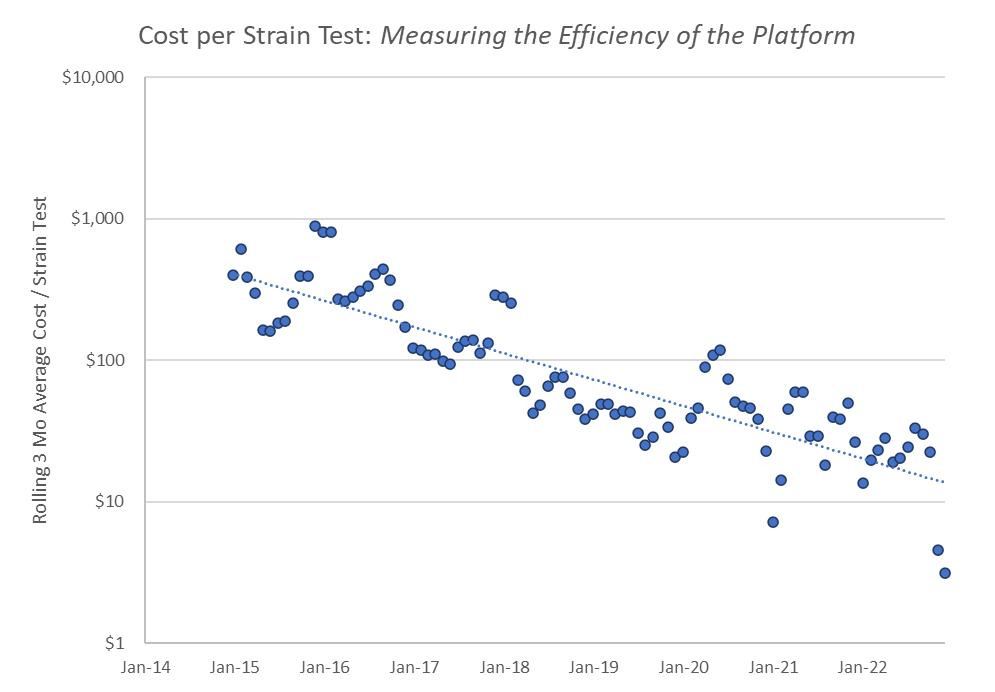

These efficiencies and economies of scale can be observed empirically from a relationship we refer to as “Knight’s Law,” named after Tom Knight, one of our co-founders, and loosely inspired by Moore’s Law for semiconductors. As shown below, we have seen a significant increase in the output of the Foundry over time alongside a significant decline in the average cost per unit of output except during temporary lab shutdowns during the COVID-19 pandemic and reduced capacity due to social

15

Table of Contents

distancing. In 2022, we continued to see significant year-over-year improvements in Foundry output and cost per unit as measured by strain tests, a metric related to the number of prototypes evaluated across all active programs. While strain tests offer one useful measure of Foundry output, we intend to evolve our metrics relating to Knight’s Law to provide what we believe to be a more dispositive snapshot of the true output of our Foundry as it evolves. For example, campaigns using the FGen and Altar technologies we acquired in 2022 are useful to advance certain programs but they do not generate strain tests due to the stringent definition we use for strain tests. Thus, campaigns are a higher level and more generic unit of Foundry output than strain tests. We plan to monitor and assess whether a metric such as number of campaigns serves as a useful metric for Foundry output that may complement our current low-level metric (strain tests) and high-level metric (New Programs).

Knight’s Law does not provide the full story on our development, but it is a useful tool that allows us to continue to build efficiencies of scale. We believe we can continue to drive significant capacity growth in the foreseeable future, though it is dependent on the development of new technologies, which inherently carries risk, and, like Moore’s Law, we will likely hit a limit over time. This feature compares to a conventional facility, where scaling is driven predominantly by the addition of employees, an exponential increase in work would be infeasible and the cost per unit of work would decline little, if at all.

Figure 8: The output of the platform as measured by daily strain tests increased by well over 2X in 2022 following growth of over 3X per year during the preceding several years (with the exception of 2020). While we expect significant scaling to continue, there is no guarantee that we will be able to do so.

16

Table of Contents

Figure 9: As the output of the platform has increased, our total R&D / operational costs per unit of output has decreased by approximately 30% in 2022 and approximately 50% per year during the preceding several years (with the exception of 2020).

We are frequently asked, and spend much time thinking about, whether it will be possible for compounding gains in output and productivity to continue for many years in the future. It is important to note that given significantly advanced tools, most steps in cell programming could be miniaturized to a point where single molecules of DNA and single cells are being manipulated and monitored. At that ultimate degree of miniaturization, the costs and timelines of cell programming could be reduced orders of magnitude from where they are today. Microfluidic and encapsulation technologies point to the reality of this future of cell programming at the single-cell level. Additionally, because many of the enabling tools of cell programming are biological in nature (e.g., polymerases and CRISPR), we are able to point the platform at itself, developing new biological tools to reduce the number of steps or the complexity of a certain operation. For example, we could develop better gene editing enzymes or novel ways to screen cells in a multiplexed format using biological sensors. It is easy to theorize about these types of developments, however they are hard to execute, we will undoubtedly run into roadblocks along the way and we will have to invest significantly in developing new technologies in order to enable the types of improvements we seek to achieve.

Recent advances in machine learning, molecular simulation, and other computational techniques also hold great promise to improve our ability to program cells. We believe our Foundry is well-positioned to build the kind of large, well-structured datasets that such computational approaches need to succeed. In time, we believe computational approaches will reduce the need for certain kinds of experiments (for example, we already use machine learning to make protein and enzyme design projects more efficient). If computational approaches can replace certain sets of experiments, we expect to use the recovered Foundry capacity to work on ever-more complex cell programming challenges. The reality is that the cells that we program today accomplish relatively simple functions, such as: “produce as much of molecule X as possible.” Programming cells for complex functions, such as live-cell therapeutics, responsive building materials, multicellular organisms, etc., will require sophisticated sub-systems for environmental sensing, intracellular information processing and feedback, and a multidimensional program that responds to such environmental stimuli. Only when we can deliver such sophisticated

17

Table of Contents

programmed cells will we have truly unlocked the potential of biology, and we see the Foundry as being an integral part of the platform for doing so.

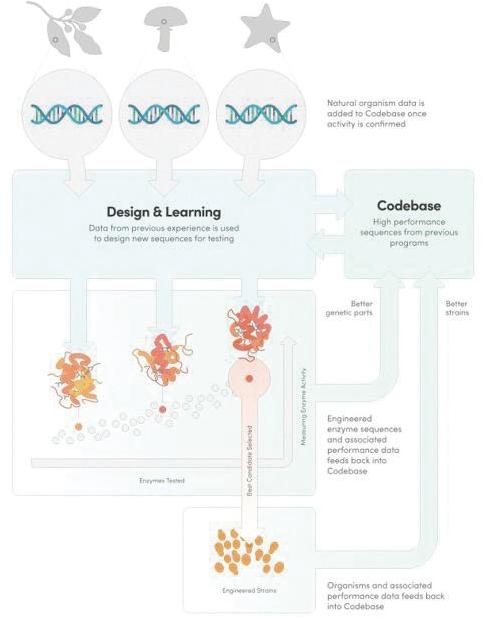

Our Codebase—organizing the world’s biological code

Codebase is a familiar term to software developers but is a new concept in biology. Modern software firms develop their own (typically proprietary) codebase of source code and code libraries that can be leveraged by their software developers to more easily create new applications than they could starting from scratch. Additionally, vast repositories of debugged code are shared publicly so that programmers across application areas can leverage prior art in order to innovate faster. This allows software developers to focus their time and effort on developing new features rather than recreating existing logic. Ginkgo’s Codebase consists of reusable genetic parts and strains that can be repurposed in new cell programs as well as vast datasets mapping genotype to phenotype. We are continually investing in better ways to characterize functional biological code to drive increased reusability. In addition to the raw performance data we generate through our Foundry experiments (approximately 70 million strain tests run in 2022), we have also incorporated many public databases for protein sequences and, together with proprietary databases, have amassed a data set of approximately 5.7 billion unique protein sequences that we leverage in our designs.

Engineering biology is complex—one of the reasons that Foundry scale is important is that it remains highly difficult to predict the performance of a biological “part” in a given context from a DNA sequence alone. The genomics revolution has outpaced biologists’ ability to test the functionality of each DNA sequence as it was discovered, particularly because most of the community is still performing biological experiments by hand without the benefit of automation. Each program performed at Ginkgo involves testing thousands or millions of DNA sequences; with a small fraction of those ending up in our final engineered cells. For that reason, high-performance biological sequences—the handful of designs from thousands of candidate designs that meet our performance goals for an experiment—are hard-won assets and form a key component of Ginkgo’s Codebase. Not to be discounted, the “losing” designs are still valuable, helping inform more effective campaigns in the future that avoid known failure modes.

18

Table of Contents

Figure 10: Our Codebase incorporates both biological assets from nature as well as engineered assets and data from our Foundry experiments. Because the Foundry enables us to test many thousands of prototype enzymes, pathways, and strains in individual engineering cycles, we are able to quickly expand the range of characterized biological assets in our Codebase.

In some ways Codebase is a “parts catalog” that we can draw from when developing a new organism. As Ginkgo performs more projects, we contribute new parts to our Codebase that can be reused in new contexts. For example, we developed novel synthetic promoters (DNA sequences that can turn on the expression of a gene of interest) that allowed us to increase production of proteins in yeast. Initially, we tested thousands of designs to arrive at a select number of promoters with high performance. Now those high-performing promoters can be reused in any program that involves producing a protein in yeast; they are a modular piece of genetic code. Over the past 20 years, our team has supported efforts to build these kinds of parts libraries—the International Genetically Engineered Machine (“iGEM”) Parts Registry and AddGene are two notable examples of initiatives to make reusable parts available to researchers in the community. But despite these efforts, we continue to see intellectual property siloed within organizations across the biotechnology industry, leaving many without the additional intellectual property they need to develop their programs. Ginkgo’s Codebase allows our customers to draw from a broader set of biological assets than any single company would develop for a given application. The scale and diversity of our programs have allowed us to develop a large Codebase that grows with the addition of each new program and can be opened to the broad swath of partners and cell programmers using our platform.

19

Table of Contents

Cell programmers must consider not only the genes in the programs that they design, but also the ways that they interact with the cell that “runs” the program. Therefore, Codebase is more than just the individual modular parts we use to design biological programs. The organisms that have been optimized to run the programs, whether because they have been engineered for robust growth or because they are particularly adept at producing certain classes of products, are known as “chassis” strains. These strains can be reused across multiple programs, significantly reducing the amount of work needed to optimize a program and engineer a commercially viable organism. The breadth of Ginkgo’s customer base allows us to use these chassis strains in many more contexts than traditional industrial biotech players.

For example:

Our Foundry and Codebase are inextricably linked. Our Foundry scale allows us to generate unparalleled Codebase assets. These Codebase assets help us improve our designs and provide reusable parts and chassis strains that improve the efficiency and probability of success of our cell programming efforts in the Foundry. As the capabilities of the platform improve, it drives further demand, which increases the rate of learning in our Codebase. The continuous learning and improvements inherent in this relationship is one of the key features of our platform.

20

Table of Contents

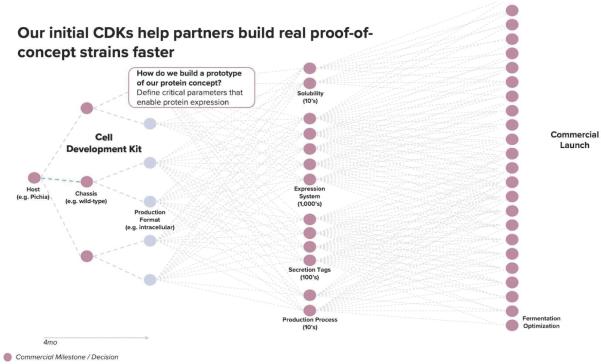

Figure 11: We believe our initial CDKs can help cell programmers build proof-of-concept strains faster.

An ecosystem to support cell programmers

Ginkgo has long recognized that it is critical to build a true ecosystem around our technical platform. We have been inspired by the leading horizontal platforms in information technology, such as Microsoft Windows and Amazon Web Services (“AWS”), which built real developer communities and provided a range of value-added services on top of their core technology. Like these pathbreakers, who set the stage for a generation of computer developers, we too are trying to ensure that the cell programmers who build applications on our platform have the tools they need to succeed beyond the lab.

21

Table of Contents

Figure 12: Ginkgo strives to create an ecosystem to ensure that cell programmers have the tools they need to succeed.

Access to capital

As in the early days of computer programming, it is still extremely expensive to program biology. For that reason, it can be easier for larger companies to make investments in innovation around this space. But Ginkgo’s platform gives small companies and innovators access to the same horsepower as larger players and obviates the need to invest in fixed laboratory assets, providing an even greater strategic benefit. To help address this discrepancy, Ginkgo has assisted in launching new companies (such as Motif and Arcaea) by bringing together strategic and financial investors to secure funding for these early stage companies. While we maintain a conservative approach to cash management, we are able to leverage our capacity and partner with investors to enable companies at all stages to benefit from our platform. We believe that, as Ginkgo’s customers demonstrate increasing success, there will be an explosion of capital for cell programming applications and a recognition of Ginkgo’s platform as setting the industry standard and providing the backbone for these development efforts. In a challenging capital markets environment, such as the one we have experienced in 2022, access to capital becomes an even bigger challenge for emerging companies. While we remain thoughtful around ensuring a healthy mix of large and small customers, our value proposition to emerging companies has continued to expand significantly.

Manufacturing support

Our job is to ensure that our cell programs can be executed at scale and we support our customers to ensure successful commercial scale manufacturing. We have built relationships with a number of leading contract manufacturing organizations and have demonstrated that we can transfer our lab-developed protocols to commercial scale (e.g., 50,000+ L fermentation tanks) with predictable performance. We have an in-house deployment team dedicated to supporting our customers’ scale-up and downstream processing needs. We have even helped certain customers, such as Cronos acquire and build out their own in-house manufacturing capabilities and certain programs, such as our work with Moderna, focus on manufacturing process optimization.

In 2022, we acquired Bayer’s West Sacramento agricultural biologicals R&D facility, which included robust pilot manufacturing infrastructure for microbial strains, with room to grow. We plan to continue to invest in this capability, helping bridge the gap for our customers between R&D and commercial production.

Intellectual property protection and regulatory support

Ginkgo takes responsibility for the cell engineering intellectual property generated through customer collaborations. Our scientific team collaborates with our customers and with Ginkgo’s intellectual property team to file patent applications and

22

Table of Contents

monitor collaboration deliverables for freedom to operate. We are also active in the evolving regulatory landscape for biological engineering. While our customers are responsible for handling their own regulatory procedures on a product-by-product basis, our broader view can help build understanding of and support for novel product classes.

Building a community of cell programmers

We launched Ferment, our annual conference, in 2018. The conference highlights developments and thought leadership in the field and brings together scientists, entrepreneurs, investors, and suppliers, and we look forward to hosting our next Ferment in April 2023. Even prior to launching Ginkgo, our founders focused on building community within the emerging field of cell programming. Tom Knight, one of our founders, was among the professors who launched the iGEM Competition in 2004, which has now had over 70,000 participants from over 40 countries take part in the competition (including dozens of Ginkgo employees and all five founders!).

Facilitating partnerships within our community

Because Ginkgo serves both large market incumbents and smaller startups, our community also serves to facilitate introductions between innovators and those looking to invest in innovation. We believe that investors and large strategic companies have come to recognize Ginkgo’s platform as a key enabler of innovation and are keen to get to know the companies that are building with us. Those relationships can be the source of funding and go-to-market support for the earlier stage companies building on the platform, increasing the odds that they develop successful products.

We invest in building trust and credibility for the entire industry

The most powerful technologies require the most care. Biology is too powerful for us to not care about how our platform is used. We have and will continue to invest heavily to build and maintain trust in bioengineering as a technology platform across all layers of the industry. At the platform layer, we have focused on building robust biosecurity measures. At the application layer, we are proud to enable a diverse set of programs that drive towards environmental sustainability. We are committed to ESG practices and broad stakeholder engagement at a corporate level. We are also engaged in deep conversations around the implications and ethics of biotechnologies through many public forums, helping shape our platform to promote sustainability in our global community.

Biosecurity: An imperative for our platform and demonstrated source of value

With a mission to make biology easier to engineer, we have always recognized the need to invest in biosecurity as a key component of our platform. We’re building the future bioeconomy with our customers and partners, and we envision the future of biosecurity as a global immune system equipped with the capabilities to prevent, detect, and respond to biological threats. The first, critical step in realizing this future is to build a robust early warning system for biological threats—this is the primary focus of Ginkgo’s biosecurity and public health unit, Concentric by Ginkgo.

The COVID-19 pandemic created a renewed sense of urgency for the need to counter biological risk, deepening our resolve and leading us to accelerate our early warning capabilities. Beginning in 2020, Concentric built a large-scale, end-to-end testing network that has empowered communities and public health leaders at the local, state, and federal levels to make informed decisions as the pandemic has continued to evolve. As part of this work, we launched large-scale efforts in K-12 schools in many U.S. states and partnered with Eurofins’ Clinical Enterprise to support the federal Operation Expanded Testing program in providing free, low-burden testing solutions in underserved and high-risk communities, such as schools and early childhood education centers, long-term care communities, and corrections facilities.

23

Table of Contents

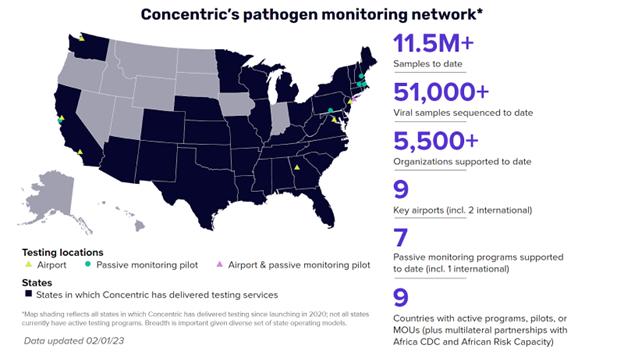

Figure 13: Concentric’s pathogen monitoring network has conducted testing in communities across most of the U.S.

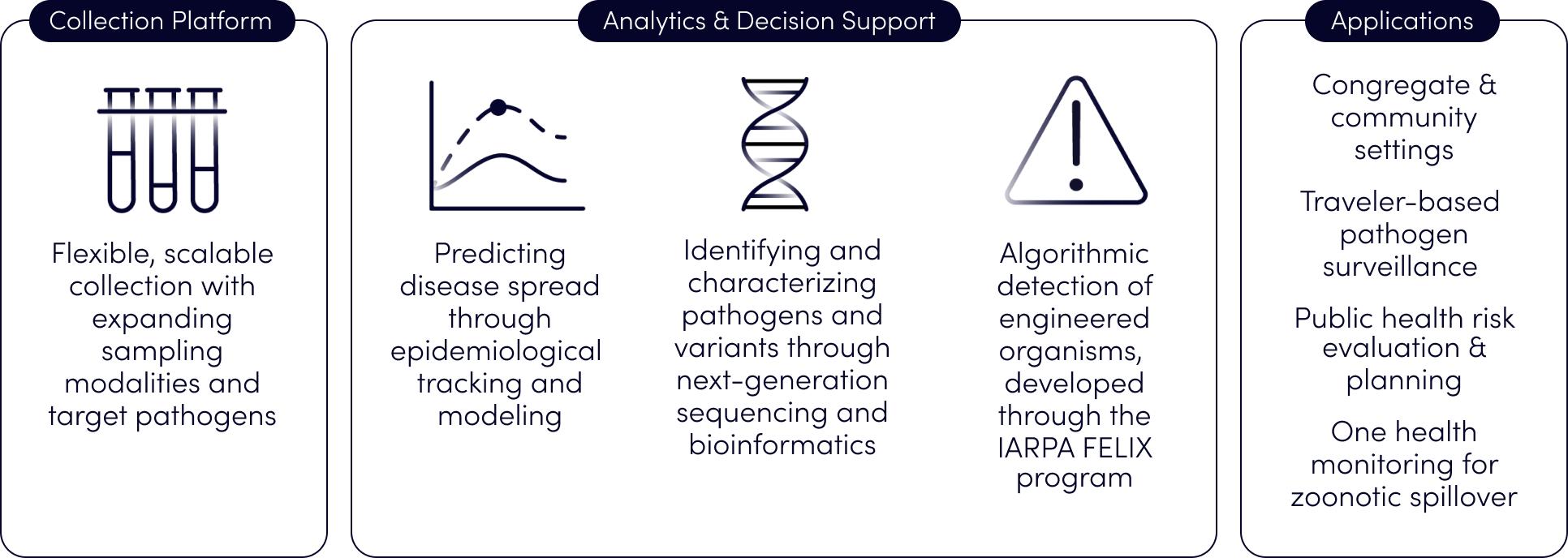

This network is now forming the foundation for a global, real-time biological threat monitoring network. As we grow this network, we are maturing our platform capabilities in several key ways:

24

Table of Contents

Figure 14: Concentric’s growing platform for real-time biological threat monitoring will work like an "operating system" for biosecurity, managing the underlying capabilities, networks, and data infrastructure needed for a flexible combination of biomonitoring solutions.