Letter from Ron Johnson, Enjoy Founder and Chief Executive Officer

Dear Prospective Investors and Enjoyers,

When I led the Apple Stores one of the best compliments we frequently received from customers was, “I wish I could take you home with me!”

Years later, that request became the idea for starting Enjoy: “What if the best of the store could come to you?”

Today, seven years since our inception, we bring an entire retail experience through the door of Consumers’ homes and operate mobile stores for several of the world’s leading companies.

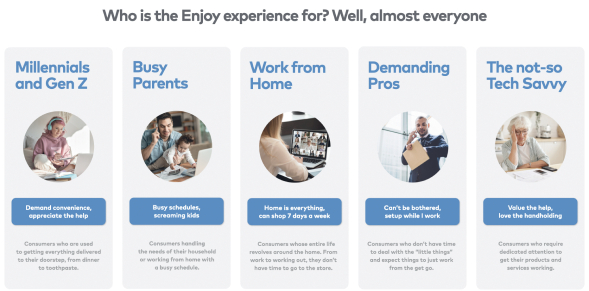

Over the past 25 years, Commerce has been moving to the home as customers choose to shop at home versus go to stores. Unfortunately, all we have had is digital convenience. Now, with Enjoy, customers get more. Our Mobile Stores pair the convenience of online shopping with the experience of a store all in the comfort of the home.

Retail has always been about the next disruption - and we believe Enjoy is the next disruption.

Our Commerce-at-Home experience starts when you make a purchase online from AT&T in the United States, BT or EE in the United Kingdom and Rogers in Canada, and Apple in select US cities. You simply book a time and place – often as soon as today or tomorrow – and a trained Enjoy Expert delivers and sets up your new products in the comfort of your home, for free. But that’s just the start. We provide an entire shopping experience, which includes the chance to purchase additional hardware and accessories, sign up for subscriptions and services, and trade in old devices.

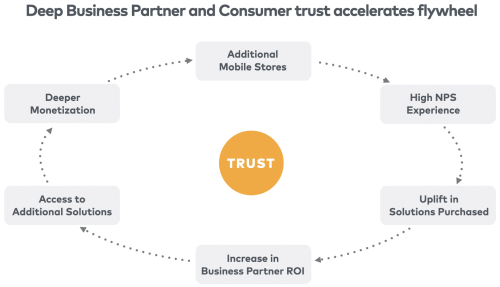

For our Business Partners, we elevate the online buying experience while providing substantial new revenue opportunities. We are proud of the tremendous value we deliver to both our Business Partners and Consumers and are especially gratified by our industry leading Net Promoter Score.

Our ability to create a retail experience in the comfort of your home rests on a complex technology platform. Our first engineering hires came right out of top-tier tech companies. They in turn attracted an incredible team that has created the proprietary technology platform which fuels our Mobile Stores.

We see our technology platform as being the key ingredient to our “secret sauce,” and it’s hard to replicate. There’s a reason we can say that no one else has done this before. Our Mobile Stores are managed efficiently, delivering experiences in two-hour timeframes. Every store is like a warehouse on wheels serving consumers as it moves around the market daily. Our Experts deliver experiences with a point of sale device that brings the store to the home. Our proprietary technology platform is powered by our Live Apps and Smart Systems to track inventory and improve efficiency in real-time, making an exceptional Consumer experience.

We estimate that we are on track to deliver more than $1 billion in revenue with 30% EBITDA margin by 2025. We are currently in 84 locations globally, and in North America we experienced 28% year-over-year revenue growth in 2020, even amid an incredibly challenging environment. We acknowledge that financial projections reflect numerous estimates and assumptions with respect to general business, economic, regulatory, market and financial conditions and other future events, as well as matters specific to Enjoy’s business, all of which are difficult to predict and many of which are beyond Enjoy’s and MRAC’s control. We have devoted substantial capital resources to our development and incurred a history of substantial losses. During the years ended December 31, 2020 and 2019, we incurred net losses of $157.8 million and $89.7 million, respectively. While we currently expect to incur losses as we continue to expand into new markets and geographies, we nevertheless believe that our platform is strong, with the potential for ample growth.

With our focus on the leading communications and consumer electronics companies, and our first mover advantage, we have the opportunity to expand worldwide and become the primary way people buy technology from the industry’s leading brands. Our lifetime Net Promoter Score (NPS) or customer satisfaction score is 88, far surpassing other telecommunications and technology groups.

We also see a day when Consumers will experience Enjoy for fashion, beauty, fitness and other consumer product categories that demand a premium experience in the place that matters to them most – their home.

When I was 25 and had just completed business school, I’ll never forget telling my family and friends that I’d found my dream job unloading trucks at a Mervyn’s store. My goal was to impact a single industry for a lifetime. I knew that to do this, I had to start on the ground floor.

Years later, while I was working at Target, we partnered with world-class designer Michael Graves and created beautiful new products, proving that good design didn’t have to be expensive. With the Apple stores, we proved that an experience is the best way to serve a customer. Now I get to move the store to the home.

I have been passionate about retail my entire career. I have learned from many but the most powerful lessons I learned came from working at Apple with Steve Jobs. He taught me that when you deliver the highest quality you can imagine, you will have a great business forever. We are building Enjoy with the same mindset.

Like the disruptions I have admired for so many years, we believe the massive and rapid movement to Commerce-at-Home gives us a multi-decade opportunity to build something great.

I want to thank everyone at Enjoy who has helped create our wonderful company, and I want to thank our Business Partners for trusting us with their customers. I also am grateful to the millions of Consumers who have invited us into their homes.

We would be honored to be invited into your home someday as well.

Sincerely,

Ron Johnson

Founder and CEO

206