Exhibit 99.1

Analyst Day March 2022

Welcome

© 2022 TeleSign 4 Disclaimer This presentation (“Presentation”) has been prepared by Proximus SA/NV (“Proximus”) and North Atlantic Acquisition Corporatio n ( “NAAC”) in connection with the proposed business combination (the “Business Combination”) of NAAC with Torino Holding Corp., a wholly - owned indirect subsidiary of Proximus and the indirect parent company of TeleSign Corp., (“TeleSign”). On December 16, 2021, BICS SA, Torino Holding Corp., NAAC, North Atlantic Acquisition, LLC and NAAC Holdco, Inc. (“Holdco”) entered into a Business Combination Agreement in conne cti on with the Business Combination. On March 21, 2022, Holdco publicly filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S - 4 relating to the Business Combination. No Representations and Warranties. This presentation is for informational purposes only and does not purport to contain all of the information that may be requi red to evaluate a possible investment decision with respect to the proposed Business Combination. The recipient agrees and acknowledges that this presentation is not intended to form the basis of any investment de cision by the recipient. This Presentation is not intended to constitute and should not be construed as investment advice and does not constitute investment, tax, or legal advice. No representation or warranty, expre ss or implied, is or will be given by NAAC, Proximus, Holdco or TeleSign or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of t he information in this Presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of a possible Business Combination, and no responsib ili ty or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions, misstatements, negligent or otherwise, relating thereto. The recipient also acknowledges and agrees that the infor mat ion contained in this Presentation is preliminary in nature and is subject to change, and any such changes may be material. Use of Projections [This Presentation contains financial forecasts with respect to certain financial metrics of TeleSign, including, but not lim ite d to, revenues, gross profit, gross margin, adjusted gross margin, operating expenses, EBITDA, and capital expenditures. Neither Proximus’ nor NAAC’s independent auditors, nor the independent registered public accounting fi rm of TeleSign, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinio n o r provided any other form of assurance with respect thereto for the purpose of this Presentation. The financial forecasts and projections in this Presentation should not be relied upon as being necessarily ind ica tive of future results. Neither Proximus nor NAAC nor TeleSign undertakes any commitment to update or revise the projections, whether as a result of new information, future events, or otherwise. Furthermore, the finan cia l forecasts and historical numbers included throughout this Presentation have been prepared using generally accepted accounting principles in the United States (“US GAAP”). Because the US GAAP audit was not complete a t t he time the projections contained herein were prepared, such projections do not take into account certain adjustments that may be made during the audit process, as further discussed below.] In this Presentation, certain of the above - mentioned projected information has been repeated (in each case, with an indication t hat the information is an estimate) and is subject to the qualifications presented herein, for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial in for mation are inherently uncertain and are subject to a wide variety of significant business, economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained i n t he prospective financial information. Accordingly, there can be no assurance that the prospective forecasts are indicative of the future performance of TeleSign or the combined company after completion of the pr opo sed Business Combination or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation s hou ld not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved.

Disclaimer © 2022 TeleSign 2 Cautionary Language Regarding Forward - Looking Statements The Presentation and oral statements made in connection herewith include “forward - looking statements” within the meaning of Sect ion 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included herein, regarding the proposed Business Combination, NAAC’s and Proximus’ ability to consummate the transaction, the benefits of the transaction an d T eleSign future financial performance following the transaction, as well as TeleSign’s strategy, future operations, financial position, estimated revenues, and losses, projected co sts, prospects, plans and objectives of management are forward looking statements. When used herein, including any oral statements made in connection herewith, the words “outlook,” “b elieves,” “expects,” “potential,” “continues,” “may,” “might,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” the ne gative of such terms and other similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words. These forward - l ooking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timin g o f future events. Except as otherwise required by applicable law, NAAC, Proximus, Holdco and TeleSign disclaim any duty to update any forward - looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. NAAC and Proximus caution you that these forward - looking statements are s ubject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of NAAC and Proximus. These risks include, but are not limited to, (1) the inability to complete the transactions contemplated by the proposed Business Combination; (2) the inability to recognize the anticipated benefits of the proposed Business Combinati on, which may be affected by, among other things, competition, and the ability of the combined business to grow and manage growth profitably; (3) risks related to the rollout of TeleSign’s business and expansion strategy; (4) overall demand for the products offered by TeleSign; (5) the possibility that TeleSign’s technology and products could have undetecte d d efects or errors; (6) the effects of competition on TeleSign’s future business; (7) the inability to successfully retain or recruit officers, key employees, or directors followi ng the proposed Business Combination; (8) the market’s reaction to the proposed Business Combination; (9) TeleSign’s financial performance following the proposed Business Combination; (10) cos ts related to the proposed Business Combination; (11) changes in applicable laws or regulations; (12) the possibility that the novel coronavirus (“COVID - 19”) may hinder Proximus’ abi lity to consummate the Business Combination; (13) the possibility that COVID - 19 may adversely affect the results of operations, financial position and cash flows of TeleSign; (14) th e possibility that Proximus or TeleSign may be adversely affected by other economic, business, and/or competitive factors; and (15) other risks and uncertainties indicated from time to time in documents filed or to be filed with the SEC by the companies. Should one or more of the risks or uncertainties described herein and in any oral statements made in connection th ere with occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward - looking statements. [UNAUDITED FINANCIAL STATEMENTS THE FINANCIAL INFORMATION AND DATA CONTAINED IN THIS PRESENTATION IS UNAUDITED AND DOES NOT CONFORM TO REGULATION S - X. ACCORDING LY, SUCH INFORMATION AND DATA MAY NOT BE INCLUDED IN, MAY BE ADJUSTED IN, OR MAY BE PRESENTED DIFFERENTLY IN, ANY PROXY STATEMENT/PROS PEC TUS OR REGISTRATION STATEMENT TO BE FILED BY NAAC WITH THE SEC. IN ADDITION, ALL TELESIGN HISTORICAL FINANCIAL INFORMATION INCLUDED HER EIN IS PRELIMINARY AND SUBJECT TO CHANGE PENDING FINALIZATION OF THE AUDITS OF THE TARGET AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2020 AND DE CEM BER 31, 2019 IN ACCORDANCE WITH PCAOB AUDITING STANDARDS.] [

Disclaimer © 2022 TeleSign 5 Use of Non - GAAP Financial Measures This Presentation includes non - GAAP financial measures, including EBITDA and adjusted gross margin. EBITDA is calculated as reve nue less cost of goods sold, and operating expenses. Adjusted gross margin is calculated as gross profit plus inventory write downs divided by revenue. Management believes that these non - GAAP measures of financial results provide useful information to management and investors reg arding certain financial and business trends relating to TeleSign’s financial condition and results of operations. NAAC and Proximus believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management does not consider these non - GAAP measures in isolation or as an alte rnative to financial measures determined in accordance with GAAP. Other companies may calculate non - GAAP measures differently, and therefore the non - GAAP measures of TeleSi gn included in this Presentation may not be directly comparable to similarly titled measures of other companies.] Industry and Market Data; Trademarks and Trade Names Information and opinions in this Presentation rely on and refer to information and statistics regarding the sectors in which Tel eSign competes and other industry data. Proximus obtained this information and statistics from third - party sources, including reports by market research firms. NAAC, Proximus and TeleSig n have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness. NAAC, Proximus and TeleSign have suppl eme nted this information where necessary with information from TeleSign’s own internal estimates, taking into account publicly available information about other industry participants and TeleSign’s management’s best view as to information that is not publicly available. The industry and market data included herein presents information only as of and for the periods indi cat ed, is subject to change at any time, and is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regardi ng your engagement with NAAC, Proximus or TeleSign. NAAC, Proximus and TeleSign also own or have rights to various trademarks, service marks and trade names that they use in con nec tion with the operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their r esp ective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply a relationship wi th NAAC, Proximus or TeleSign, or an endorsement or sponsorship by or of NAAC, Proximus or TeleSign. Solely for convenience, the trademarks, service marks and trade names referr ed to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that NAAC, Proximus or TeleSign will not assert, to th e fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. Notice to Prospective Investors in the United Kingdom The communication of this presentation and any other document or materials relating to the transaction have not been approved , b y an authorized person for the purposes of section 21 of the Financial Services and Markets Act 2000. Accordingly, this presentation and any such documents and/or materials are not b ein g distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of this presentation and other documentation or materials relating to th e transaction as a financial promotion is only being made to those persons in the United Kingdom (i) who have professional experience in matters relating to investments and who fall w ith in the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "Financial Pro mot ion Order")), (ii) who fall within Article 49(2)(a) to (d) of the Financial Promotion Order, or (iii) who are any other persons to whom it may otherwise lawfully be made under the Financi al Promotion Order (all such persons together being referred to as "FPO Persons"). In the United Kingdom, any investment or investment activity to which this presentation relates will be en gaged in only with FPO Persons. Any person in the United Kingdom that is not an FPO Person should not act or rely on this presentation or any of its contents.

Disclaimer © 2022 TeleSign 6 Notice to Prospective Investors in the European Economic Area and the United Kingdom The information in this presentation is not intended to be, and should not be, provided, distributed or otherwise made availa ble to: (a) any person in the European Economic Area who (i) is a retail investor, as defined in Regulation (EU) No 1286/2014 or (ii) is not a qualified investor, as defined in Regulation ( EU 2017/1129 (all, “EEA Relevant Persons”); or (b) any person in the United Kingdom (“UK”) who (i) is a retail investor, as defined in Regulation (EU) No 1286/2014 as it forms part of UK dom est ic law or (ii) is not a qualified investor, as defined in Regulation (EU) 2017/1129 as it forms part of domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Ac t 2018, as amended by the European Union (Withdrawal Agreement) Act 2020 (all, “UK Relevant Persons”). None of TeleSign or NAAC have authorized and nor do they authorize the prov isi on, distribution or making available of the information herein to any EEA Relevant Person or any UK Relevant Person. No Offer or Solicitation This Presentation is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offe r t o buy any securities pursuant to the proposed Business Combination or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or s ale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting th e r equirements of Section 10 of the Securities Act. Additional Information and Where to Find It In connection with the proposed business combination, Holdco has filed the Registration Statement with the SEC, which include s a preliminary prospectus and preliminary proxy statement. NAAC will mail a definitive proxy statement/final prospectus and other relevant documents to its shareholders. This communica tio n is not a substitute for the Registration Statement, the definitive proxy statement/final prospectus or any other document that NAAC will send to its shareholders in connection with the proposed business combination. Investors and security holders of NAAC are advised to read, when available, the proxy statement/prospectus in connection with NAAC's solicitation of pr oxies for its special meeting of shareholders to be held to approve the proposed business combination (and related matters) because the proxy statement/prospectus will contain important in formation about the proposed business combination and the parties to the proposed business combination. The definitive proxy statement/final prospectus will be mailed to sharehold ers of NAAC as of a record date to be established for voting on the proposed business combination. Shareholders will also be able to obtain copies of the proxy statement/prospectus, without ch arge, once available, at the SEC's website http://www.sec.gov or by directing a request to North Atlantic Acquisition Corporation, c/o McDermott Will & Emery LLP, One V and erbilt Avenue, New York, New York 10017. Confidentiality All recipients agree that they will keep confidential all information contained herein and not already in the public domain a nd will use this Presentation solely for evaluation purposes. Recipient will maintain all such information in strict confidence, including in strict accordance with any underlying contrac tua l obligations and all applicable laws, including United States federal and state securities laws. Participants in the Solicitation NAAC, Proximus, Holdco, TeleSign and their respective directors and executive officers may be deemed to be participants in th e s olicitation of proxies from shareholders of NAAC in connection with the proposed transaction. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when the y b ecome available.

Today’s Presenters © 2022 TeleSign 7 Joe Burton CEO Thomas Dhondt CFO Tom Wesselman CTO Aaron Seyler SVP, Sales Guillaume Bourcy VP, Digital Identity

Joe Burton, CEO

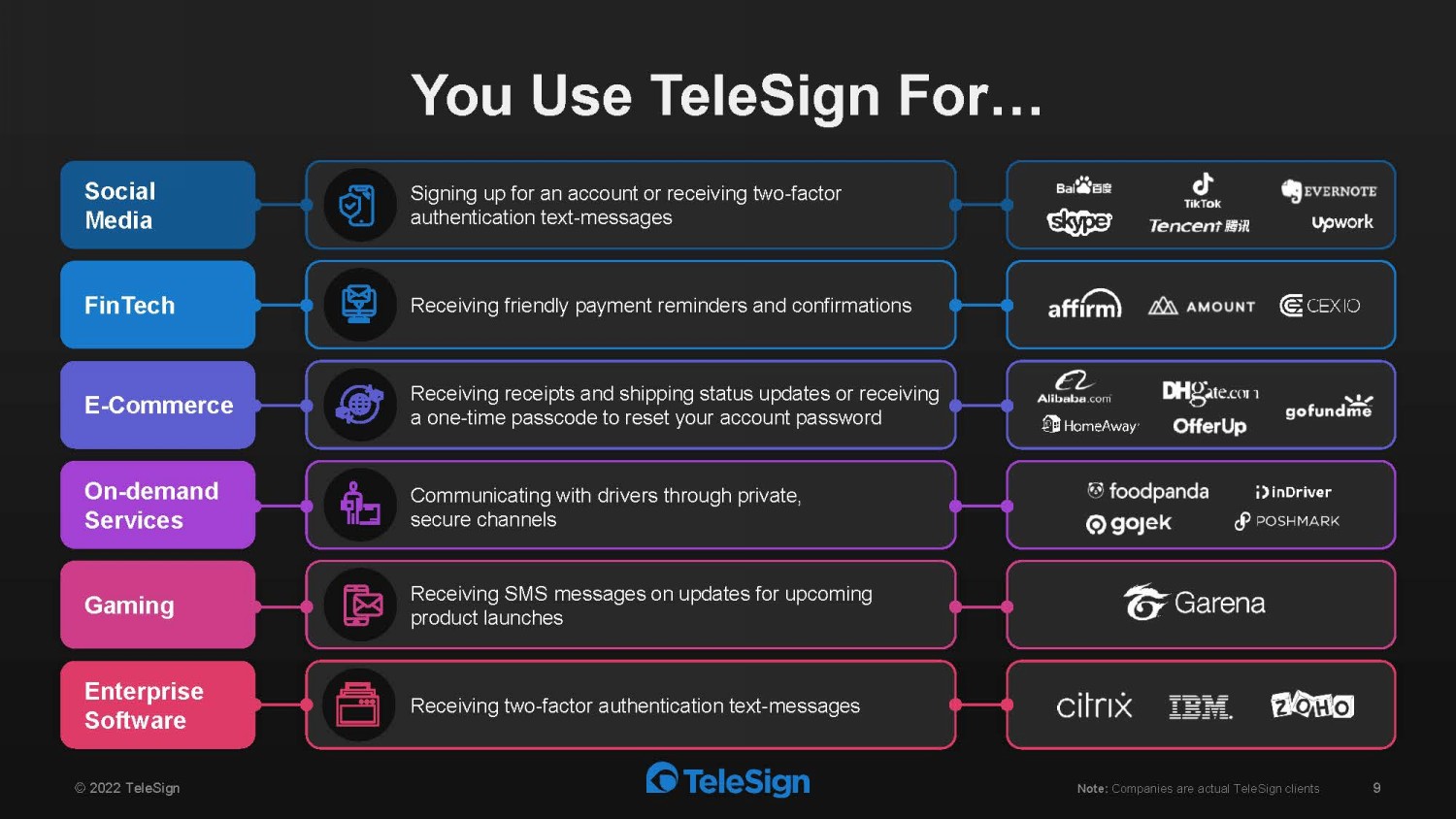

You Use TeleSign For… © 2022 TeleSign 9 Social Media FinTech E - Commerce On - demand Services Gaming Signing up for an account or receiving two - factor authentication text - messages Receiving friendly payment reminders and confirmations Receiving receipts and shipping status updates or receiving a one - time passcode to reset your account password Communicating with drivers through private, secure channels Receiving SMS messages on updates for upcoming product launches Enterprise Software Receiving two - factor authentication text - messages Note: Companies are actual TeleSign clients

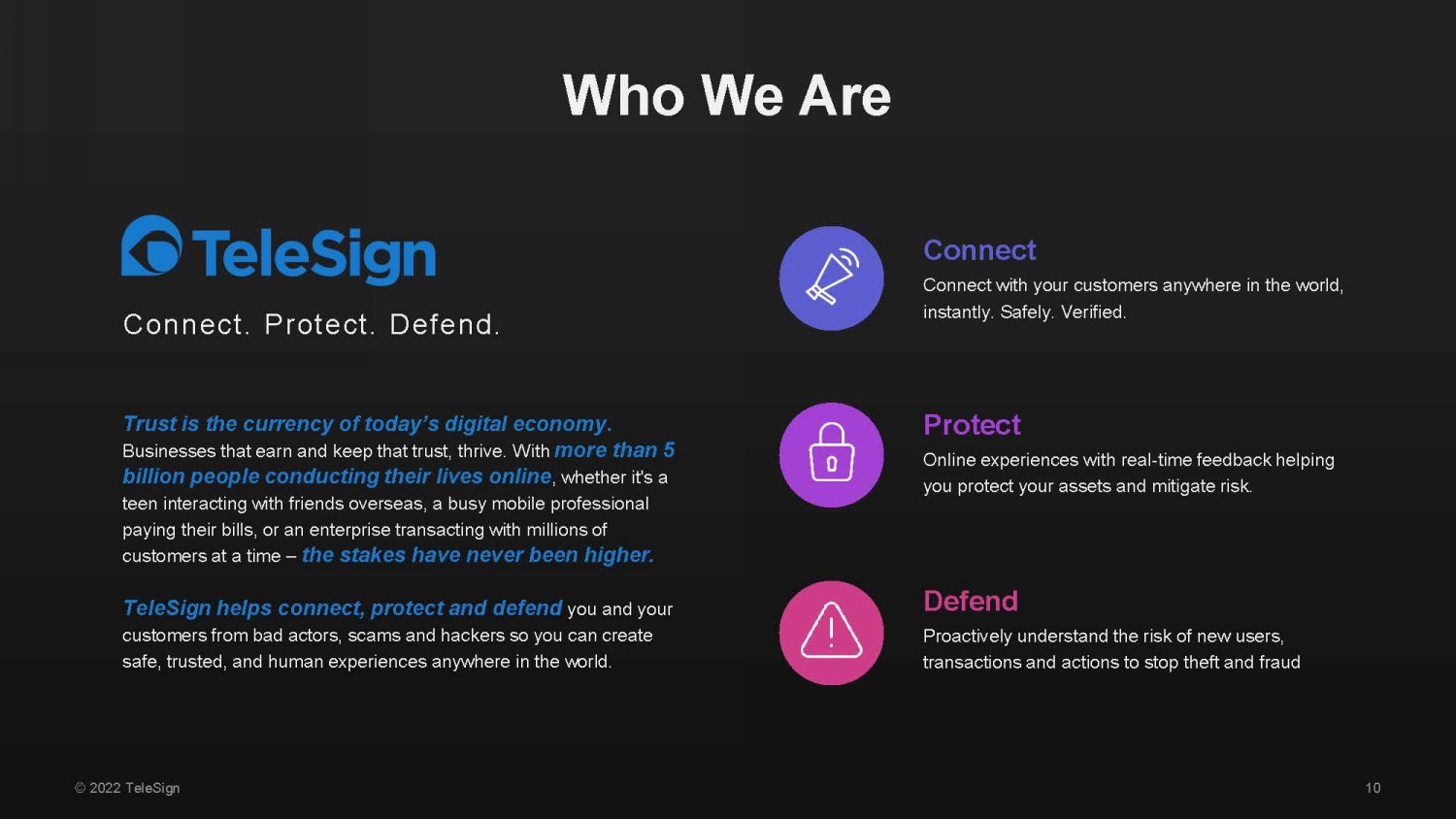

Who We Are Connect with your customers anywhere in the world, instantly. Safely. Verified. Connect Online experiences with real - time feedback helping you protect your assets and mitigate risk. Protect Proactively understand the risk of new users, transactions and actions to stop theft and fraud Defend Trust is the currency of today’s digital economy . Businesses that earn and keep that trust, thrive. With more than 5 billion people conducting their lives online , whether it's a teen interacting with friends overseas, a busy mobile professional paying their bills, or an enterprise transacting with millions of customers at a time – the stakes have never been higher. TeleSign helps connect, protect and defend you and your customers from bad actors, scams and hackers so you can create safe, trusted, and human experiences anywhere in the world. Connect. Protect. Defend. 10 © 2022 TeleSign

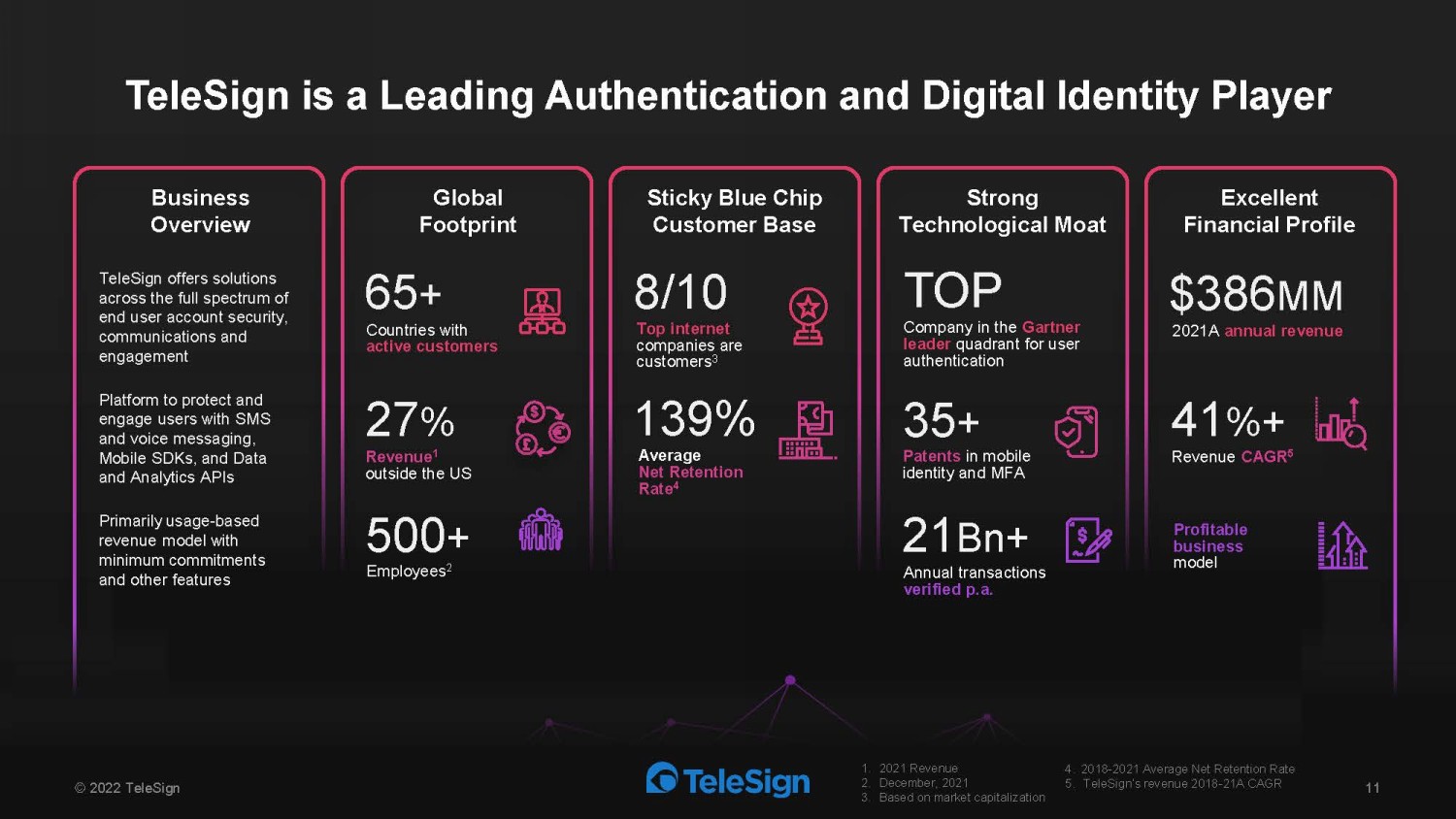

TeleSign is a Leading Authentication and Digital Identity Player 500 + Employees 2 Sticky Blue Chip Customer Base Excellent Financial Profile Global Footprint Strong Technological Moat 65 + Countries with active customers 27 % Revenue 1 outside the US TOP Company in the Gartner leader quadrant for user authentication 35 + Patents in mobile identity and MFA 21 Bn+ Annual transactions verified p.a. $386 MM 2021A annual revenue 41 %+ Revenue CAGR 5 © 2022 TeleSign 11 8/10 Top internet companies are customers 3 139% Average Net Retention Rate 4 TeleSign offers solutions across the full spectrum of end user account security, communications and engagement Platform to protect and engage users with SMS and voice messaging, Mobile SDKs, and Data and Analytics APIs Primarily usage - based revenue model with minimum commitments and other features Business Overview 1. 2021 Revenue 2. December, 2021 3. Based on market capitalization Profitable business model 4. 2018 - 2021 Average Net Retention Rate 5. TeleSign’s revenue 2018 - 21A CAGR

We exist to make the digital world a more trustworthy place. © 2022 TeleSign 12

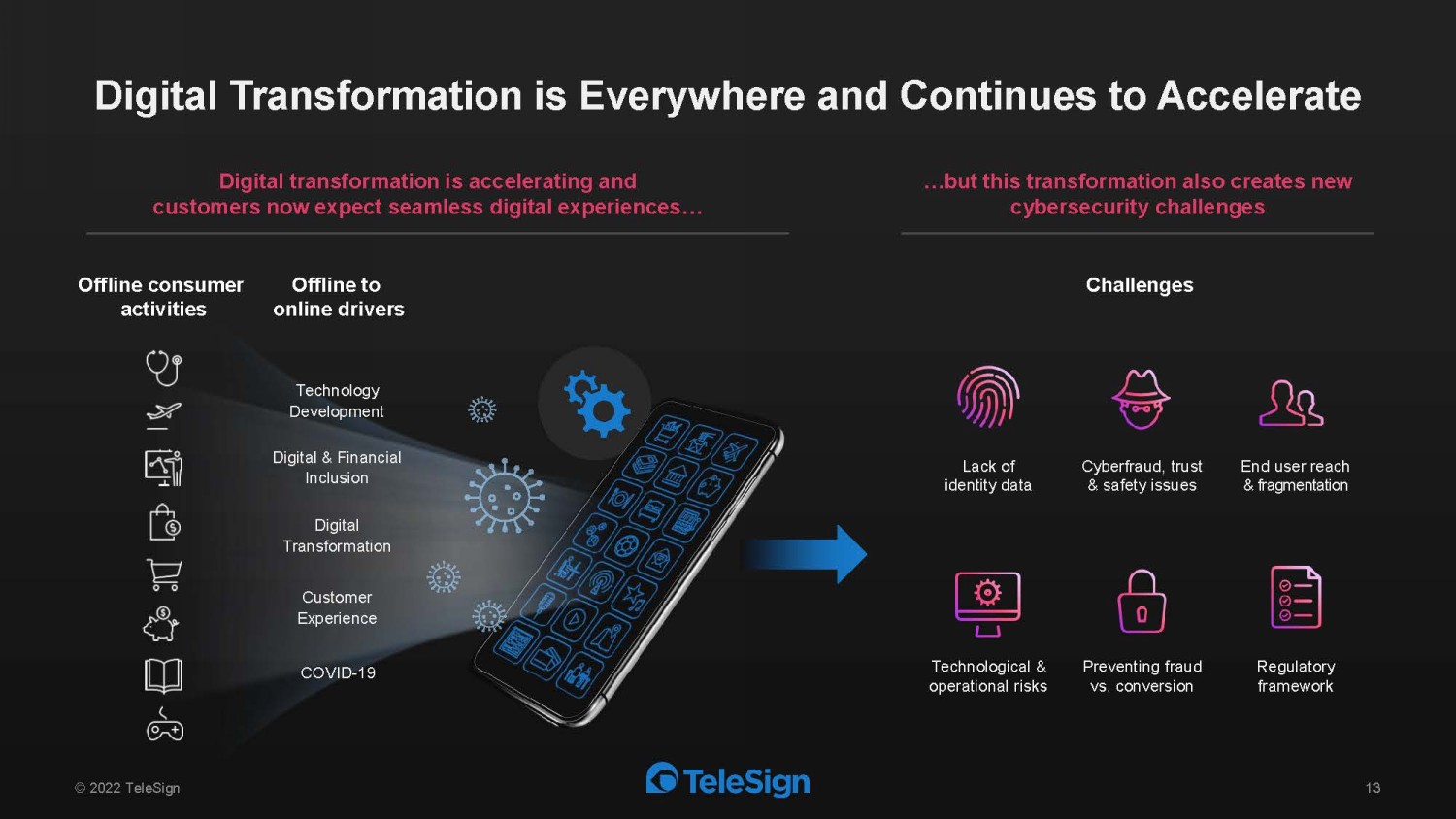

Digital & Financial Inclusion Digital Transformation is Everywhere and Continues to Accelerate …but this transformation also creates new cybersecurity challenges Digital transformation is accelerating and customers now expect seamless digital experiences… Challenges Offline to online drivers Technology Development Digital Transformation Customer Experience Offline consumer activities COVID - 19 Lack of identity data Cyberfraud, trust & safety issues End user reach & fragmentation Technological & operational risks Preventing fraud vs. conversion Regulatory framework 13 © 2022 TeleSign

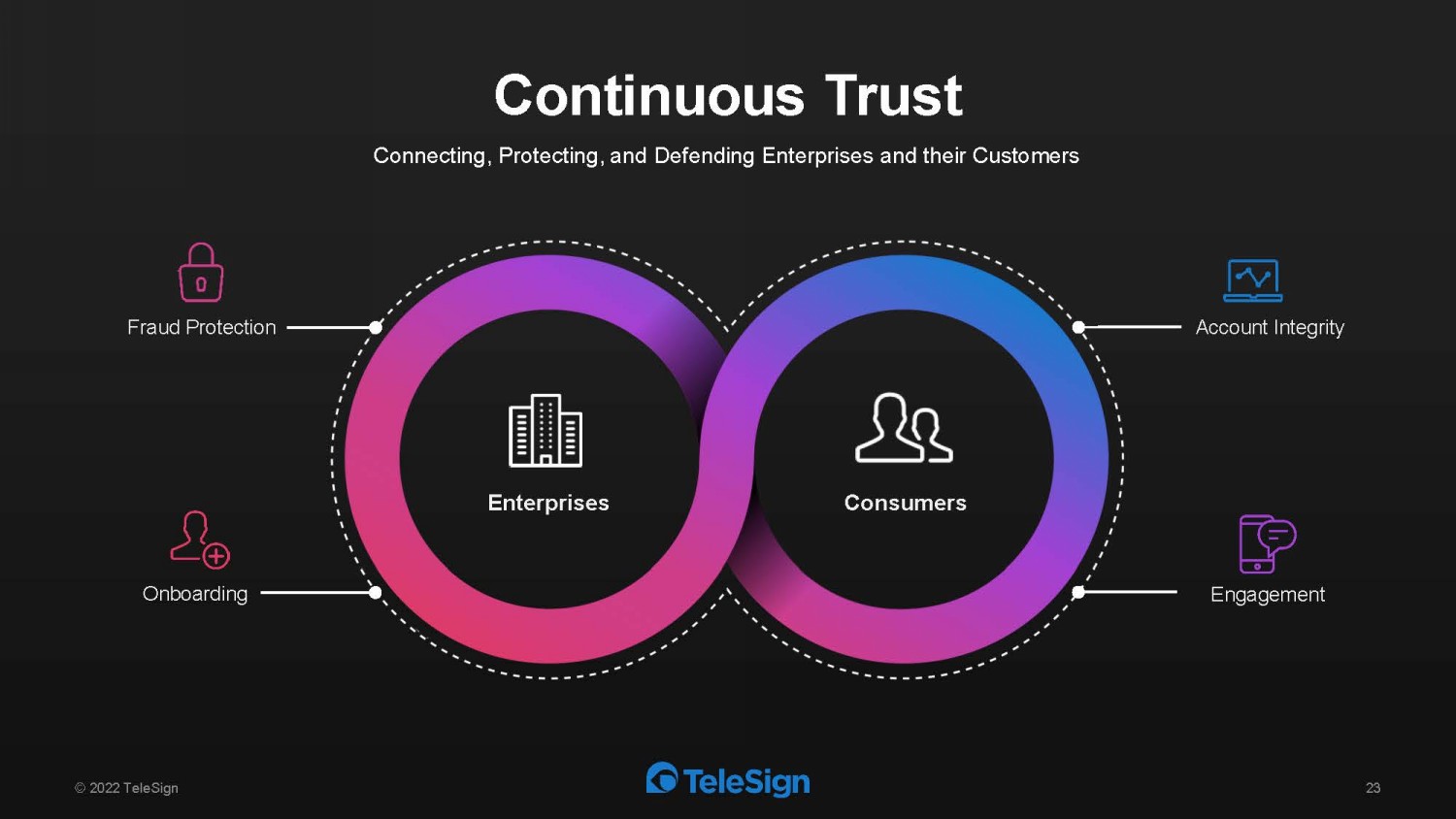

Connecting, Protecting, and Defending Enterprises and their Customers Cybersecurity Threats Create Requirement For Continuous Trust © 2022 TeleSign 14 Fraud Protection Onboarding Engagement Account Integrity Enterprises Consumers

Tom Wesselman, CTO Guillaume Bourcy, VP, Digital Identity

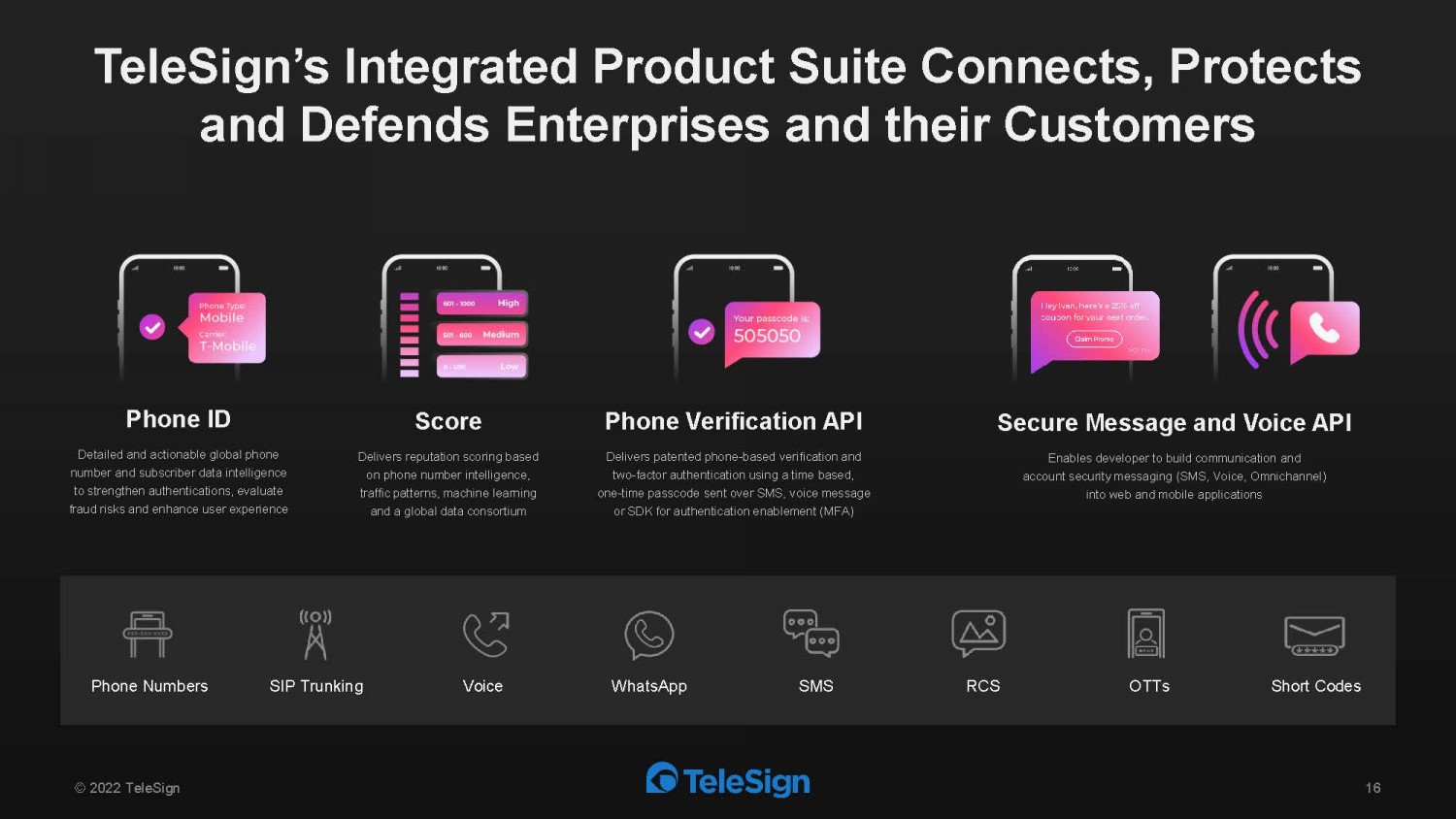

TeleSign’s Integrated Product Suite Connects, Protects and Defends Enterprises and their Customers © 2022 TeleSign 16 Phone ID Detailed and actionable global phone number and subscriber data intelligence to strengthen authentications, evaluate fraud risks and enhance user experience Score Delivers reputation scoring based on phone number intelligence, traffic patterns, machine learning and a global data consortium Phone Verification API Delivers patented phone - based verification and two - factor authentication using a time based, one - time passcode sent over SMS, voice message or SDK for authentication enablement (MFA) Secure Message and Voice API Enables developer to build communication and account security messaging (SMS, Voice, Omnichannel) into web and mobile applications Phone Numbers SIP Trunking Voice WhatsApp SMS RCS OTTs Short Codes

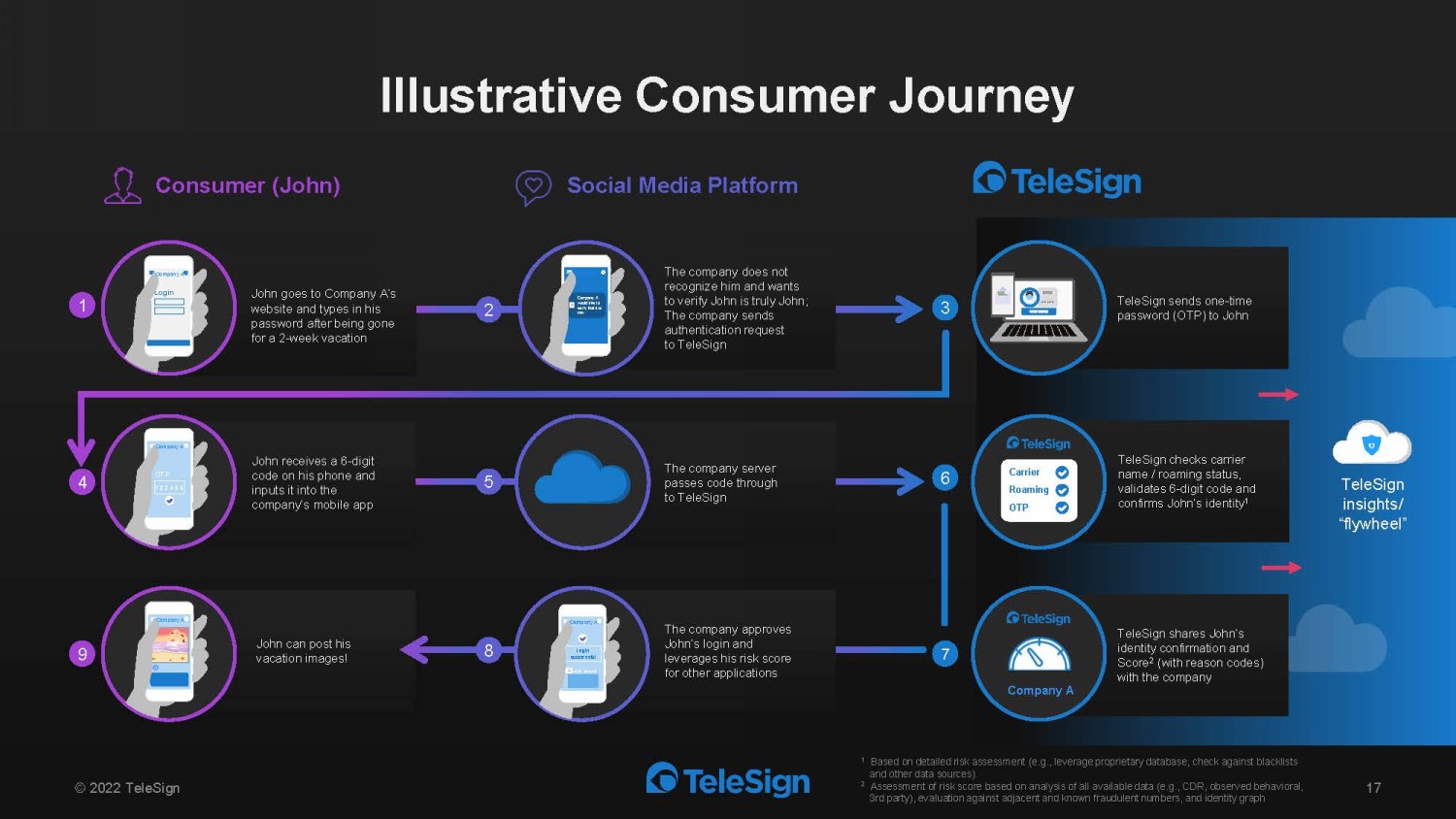

TeleSign checks carrier name / roaming status, validates 6 - digit code and confirms John’s identity 1 TeleSign shares John’s identity confirmation and Score 2 (with reason codes) with the company TeleSign sends one - time password (OTP) to John John can post his vacation images! John goes to Company A’s website and types in his password after being gone for a 2 - week vacation John receives a 6 - digit code on his phone and inputs it into the company’s mobile app The company does not recognize him and wants to verify John is truly John; The company sends authentication request to TeleSign The company server passes code through to TeleSign The company approves John’s login and leverages his risk score for other applications Illustrative Consumer Journey © 2022 TeleSign Consumer (John) 9 4 Company A would like to verify that it is you No Image 2 5 1 TeleSign insights/ “flywheel” 8 3 6 Roaming Carrier OTP 7 Social Media Platform Login Company A 1 2 3 4 5 6 OTP Company A Company A Login successful Risk score No Image Company A Company A 1 Based on detailed risk assessment (e.g., leverage proprietary database, check against blacklists and other data sources) 2 Assessment of risk score based on analysis of all available data (e.g., CDR, observed behavioral, 3rd party), evaluation against adjacent and known fraudulent numbers, and identity graph 17

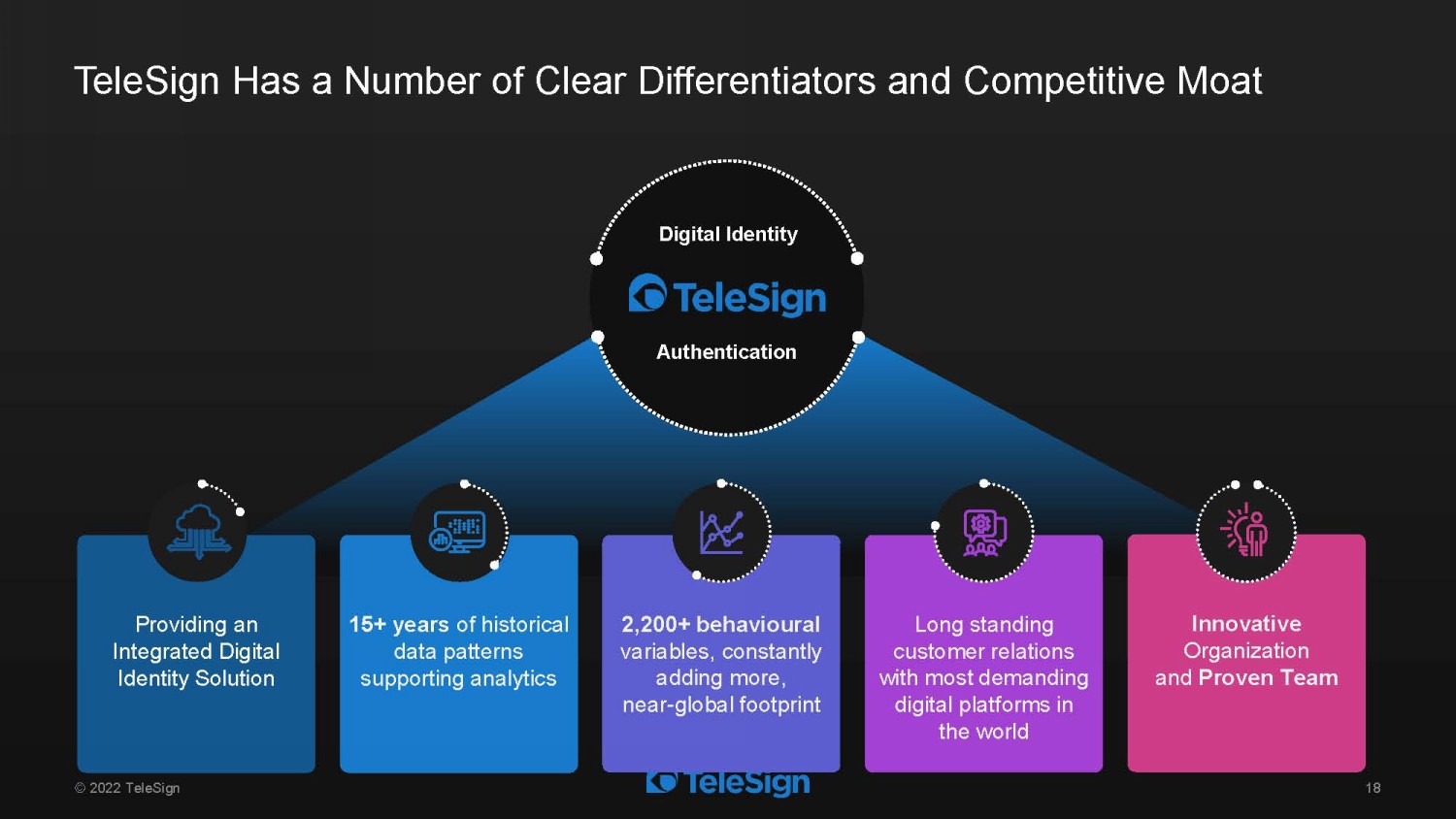

Providing an Integrated Digital Identity Solution 2,200+ behavioural variables, constantly adding more, near - global footprint Long standing customer relations with most demanding digital platforms in the world Innovative Organization and Proven Team © 2022 TeleSign 18 TeleSign Has a Number of Clear Differentiators and Competitive Moat Digital Identity Authentication 18 15+ years of historical data patterns supporting analytics

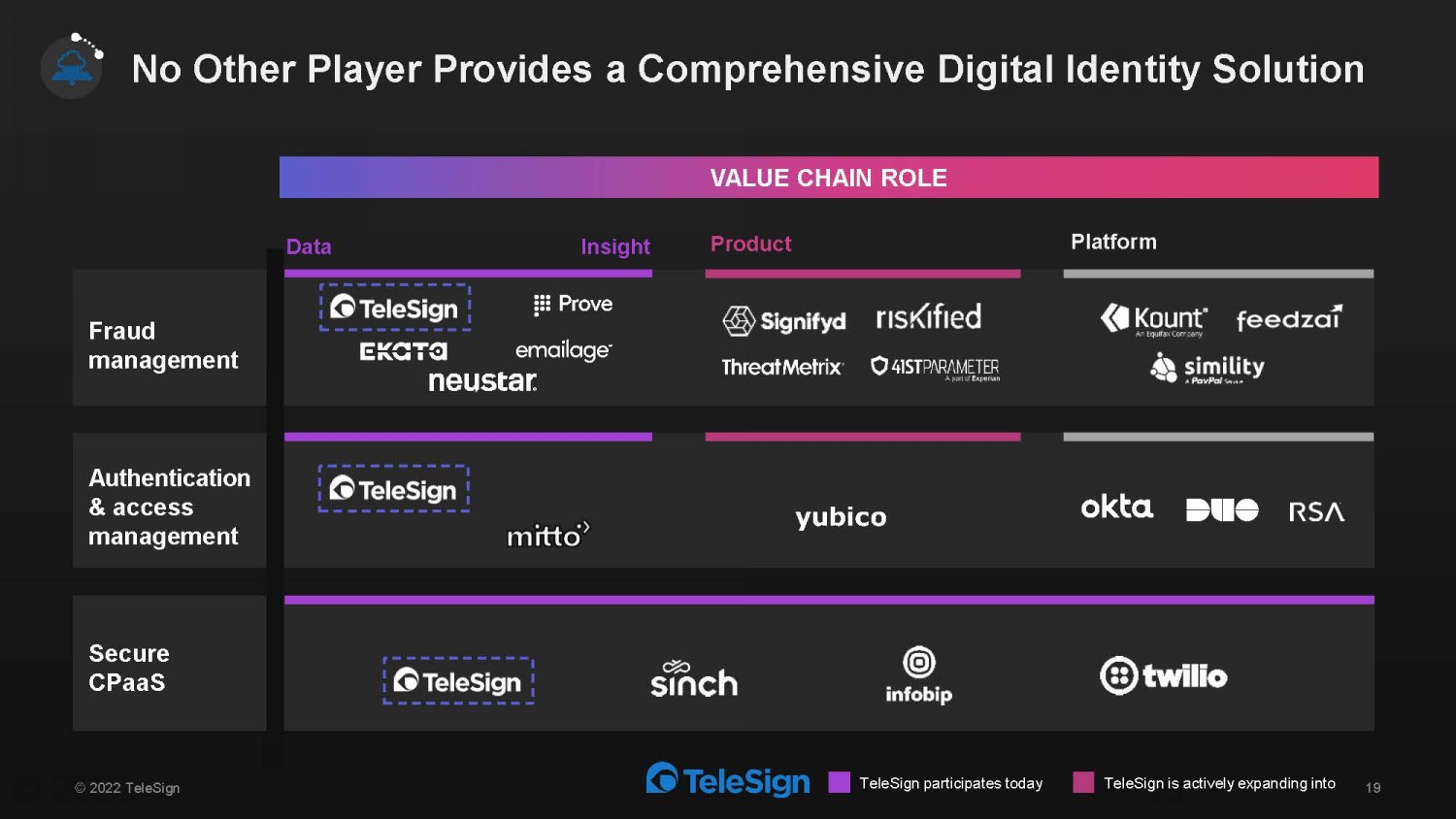

© 2021 19 Authentication & access management Fraud management Secure CPaaS Product Platform VALUE CHAIN ROLE Data Insight TeleSign participates today TeleSign is actively expanding into No Other Player Provides a Comprehensive Digital Identity Solution © 2022 TeleSign 19

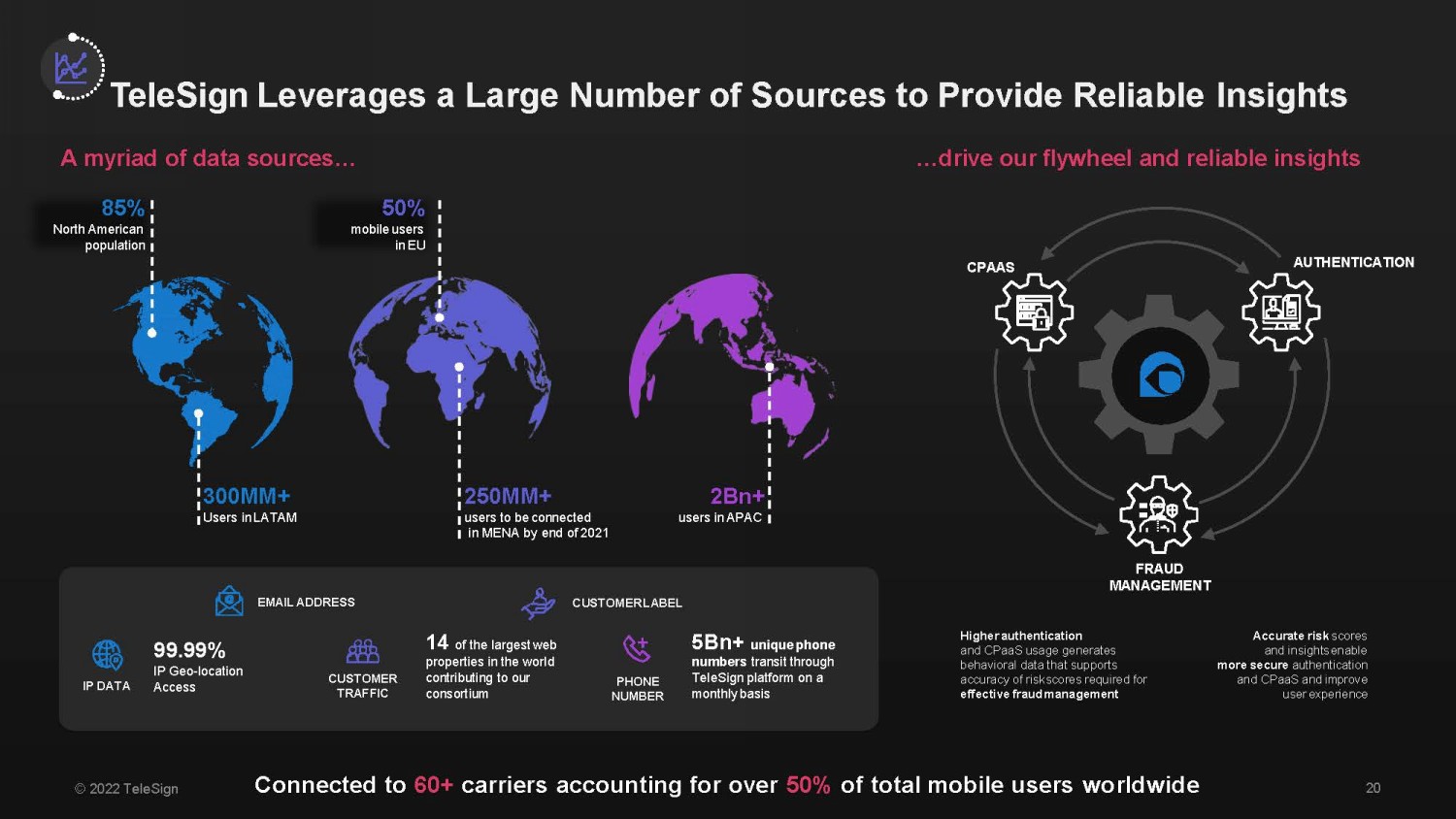

CP AA S FRAUD M A N A GE M ENT AUTHENTICATION TeleSign Leverages a Large Number of Sources to Provide Reliable Insights © 2022 TeleSign 20 Accurate risk scores and insights enable more secure authentication and CPaaS and improve user experience Higher authentication and CPaaS usage generates behavioral data that supports accuracy of risk scores required for effective fraud management …drive our flywheel and reliable insights Connected to 60+ carriers accounting for over 50% of total mobile users worldwide 8 5 % North American population 300MM+ Users in LATAM 5Bn+ unique phone numbers transit through TeleSign platform on a monthly basis 14 of the largest web properties in the world contributing to our consortium A myriad of data sources… 99.99% IP Geo - location IP DATA Access CUSTOMER LABEL PHONE N UM B E R C U S T O M E R TRAFFIC 5 0 % mobile users in EU 250MM+ users to be connected in MENA by end of 2021 2 B n+ users in APAC EMAIL ADDRESS

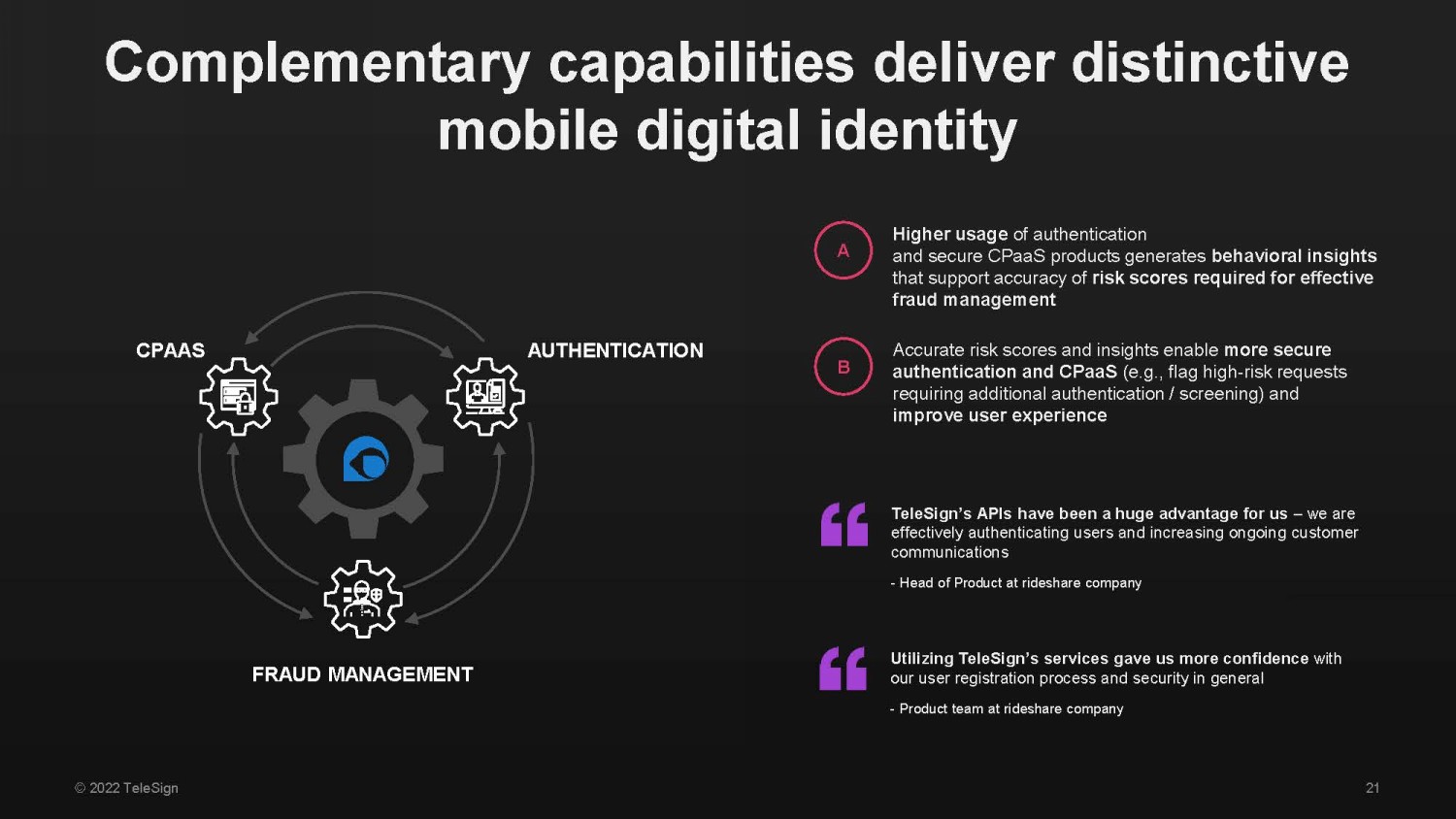

Complementary capabilities deliver distinctive mobile digital identity CP AA S FRAU D M A N A GE M ENT AUTHENTICATION TeleSign’s APIs have been a huge advantage for us – we are effectively authenticating users and increasing ongoing customer communications - Head of Product at rideshare company Higher usage of authentication and secure CPaaS products generates behavioral insights that support accuracy of risk scores required for effective fraud management A Accurate risk scores and insights enable more secure authentication and CPaaS (e.g., flag high - risk requests requiring additional authentication / screening) and improve user experience B Utilizing TeleSign’s services gave us more confidence with our user registration process and security in general - Product team at rideshare company 21 © 2022 TeleSign

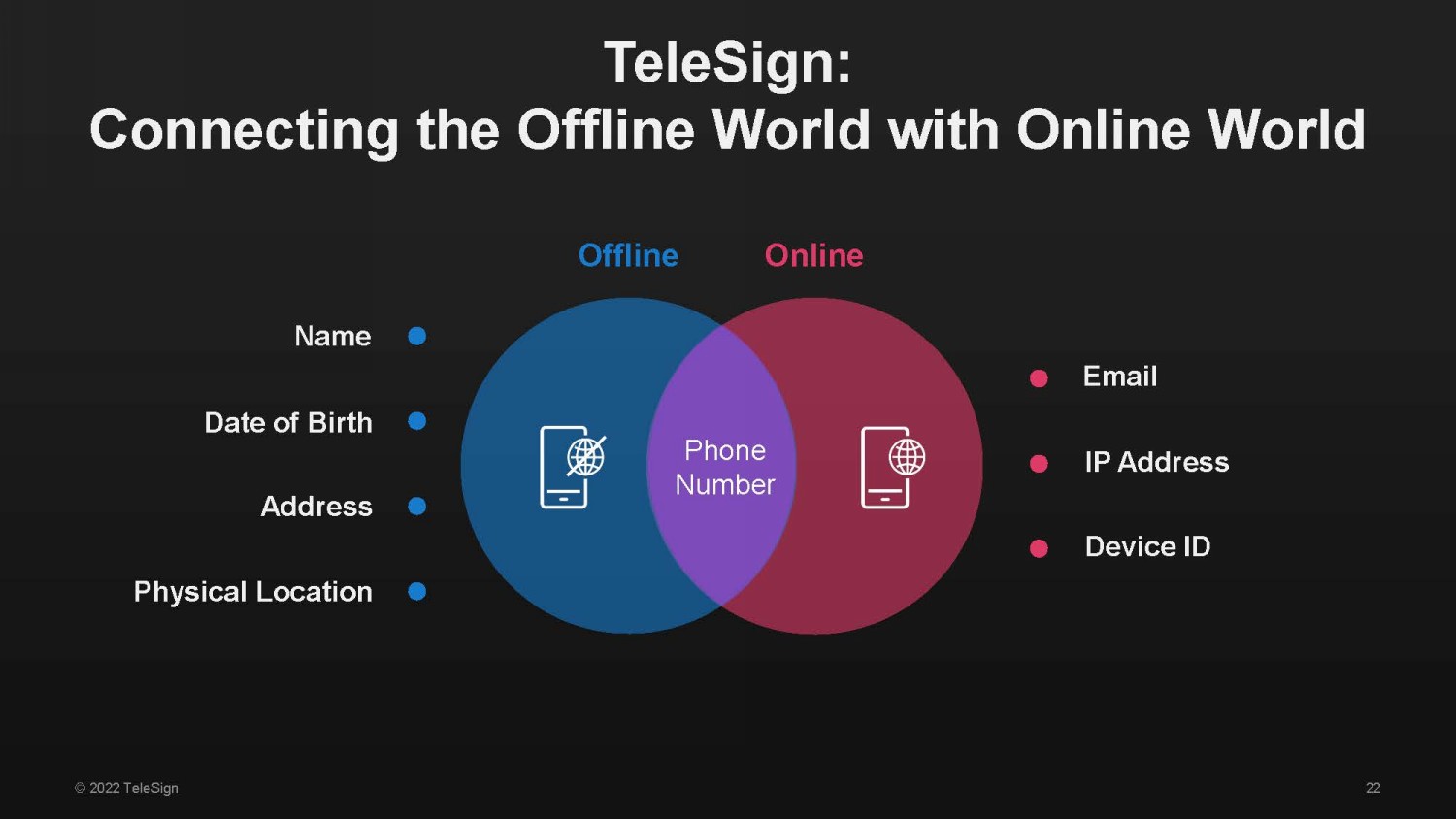

TeleSign: Connecting the Offline World with Online World Phone Number Offline Online Name Date of Birth Address Physical Location Email IP Address Device ID 22 © 2022 TeleSign

Connecting, Protecting, and Defending Enterprises and their Customers Continuous Trust Fraud Protection Onboarding Account Integrity Engagement Enterprises Consumers 23 © 2022 TeleSign

900 High - risk Irregular Activity High Activity on Risky Services Seen in the Last 2 Months Irregular Call Duration Low Range Activity Block - listed Number Category Number Type A2P P2P P2P P2P Risky User 300 Regular Activity Low Range Activity Seen in the Last 1 Day Regular Number of Completed Calls Regular Call Duration Continuous Long - term Activity Category P2P A2P P2P P2P P2P Good User Risk Assessment How risky is this user? We evaluate: • Phone number velocity • Traffic Patterns • Fraud Database Lookup • Phone Data Attributes Onboarding Onboarding 24 © 2022 TeleSign

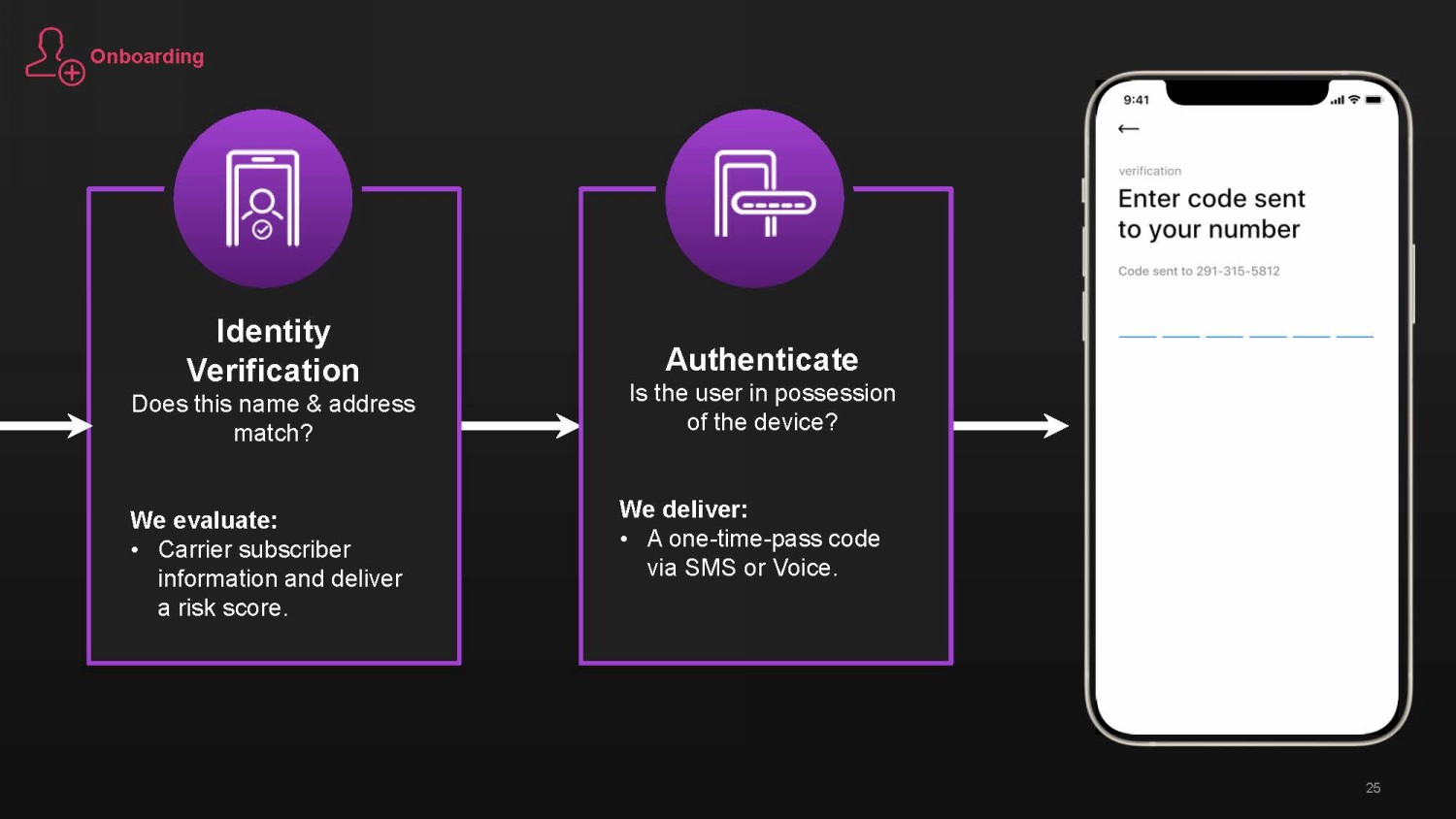

Identity Verification Does this name & address match? We evaluate: • Carrier subscriber information and deliver a risk score. Authenticate Is the user in possession of the device? We deliver: • A one - time - pass code via SMS or Voice. Onboarding 25

LOGIN CONTINUE mchang@gmail.com ************ Risk Assessment Identification Account Integrity Establish Trust in Milliseconds Authentication GET STARTED Welcome, Mikel Account Integrity 26 © 2022 TeleSign

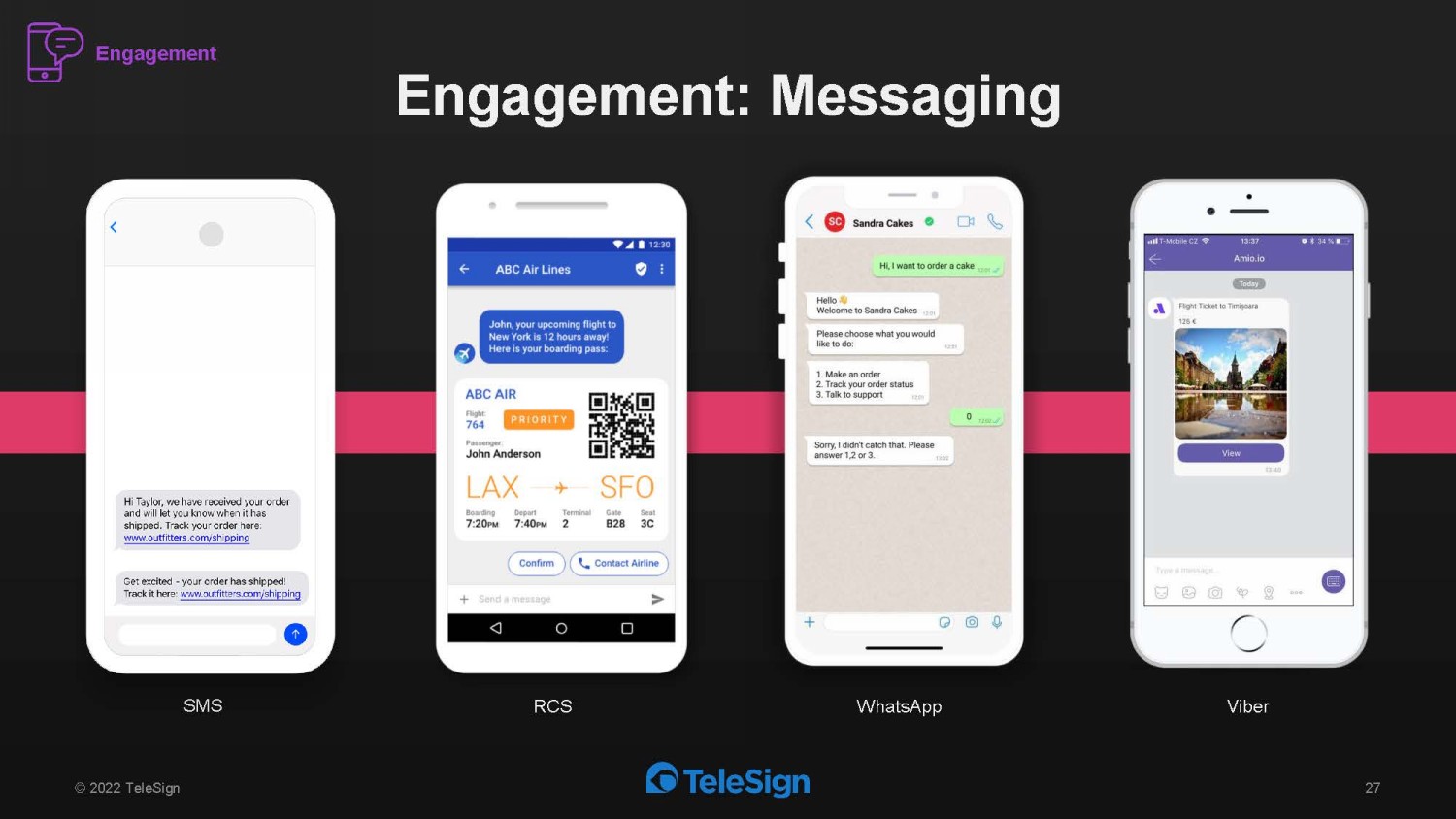

Engagement: Messaging © 2022 TeleSign 27 SMS RCS WhatsApp Viber Engagement

Engagement: Voice © 2022 TeleSign 28 Make, Receive And Control Calls Programmatically control, make, receive, manage and route calls around the world – available in over 230 countries & territories. Build Interactive Voice Response (IVR) Flows Build easy - to - manage IVR flows with DTMF key prompts to send callers through pre - selected call flows – even follow up with automates surveys. Advanced Phone Number Cleansing Properly formats phone number entered by end - user for more reliable and secure call delivery, which improves deliverability by more than 10% in most markets. Lease Phone Numbers & Set CallerID Buy and use phone numbers across many countries (120+) to receive inbound calls and to establish end - user recognizable CallerIDs for outbound calls. Engagement

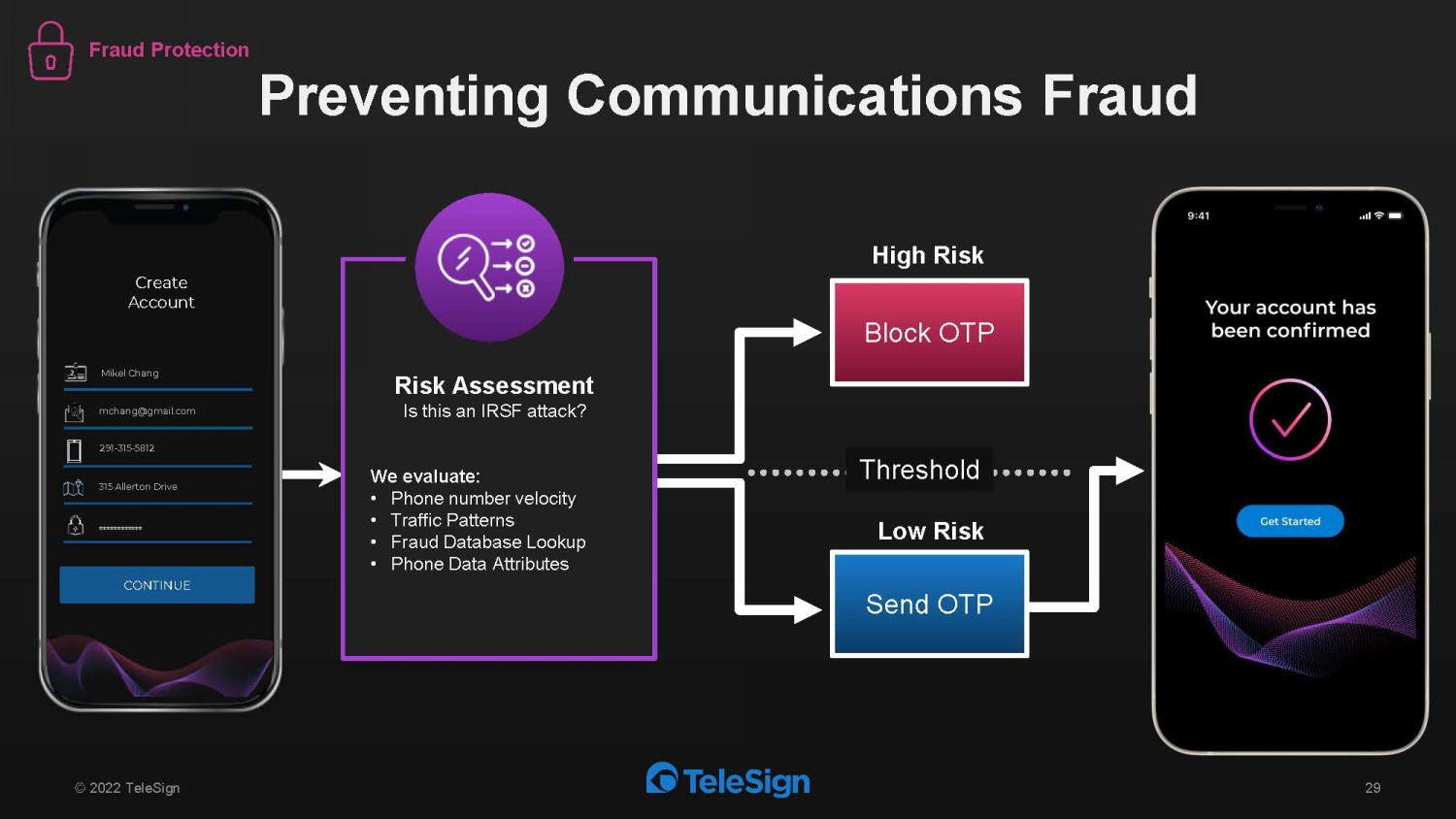

© 2022 TeleSign 29 Risk Assessment Is this an IRSF attack? We evaluate: • Phone number velocity • Traffic Patterns • Fraud Database Lookup • Phone Data Attributes Block OTP Preventing Communications Fraud Threshold Create Account CONTINUE Mikel Chang mchang@gmail.com 291 - 315 - 5812 315 Allerton Drive ************ Send OTP High Risk Low Risk Fraud Protection

Proven Growth Strategy Enabled by Multiple Pillars © 2022 TeleSign 30 Continued Market Growth Value Chain & Use Case Expansion Geographic Expansion New Customer Segments Acceleration Opportunity Through M&A

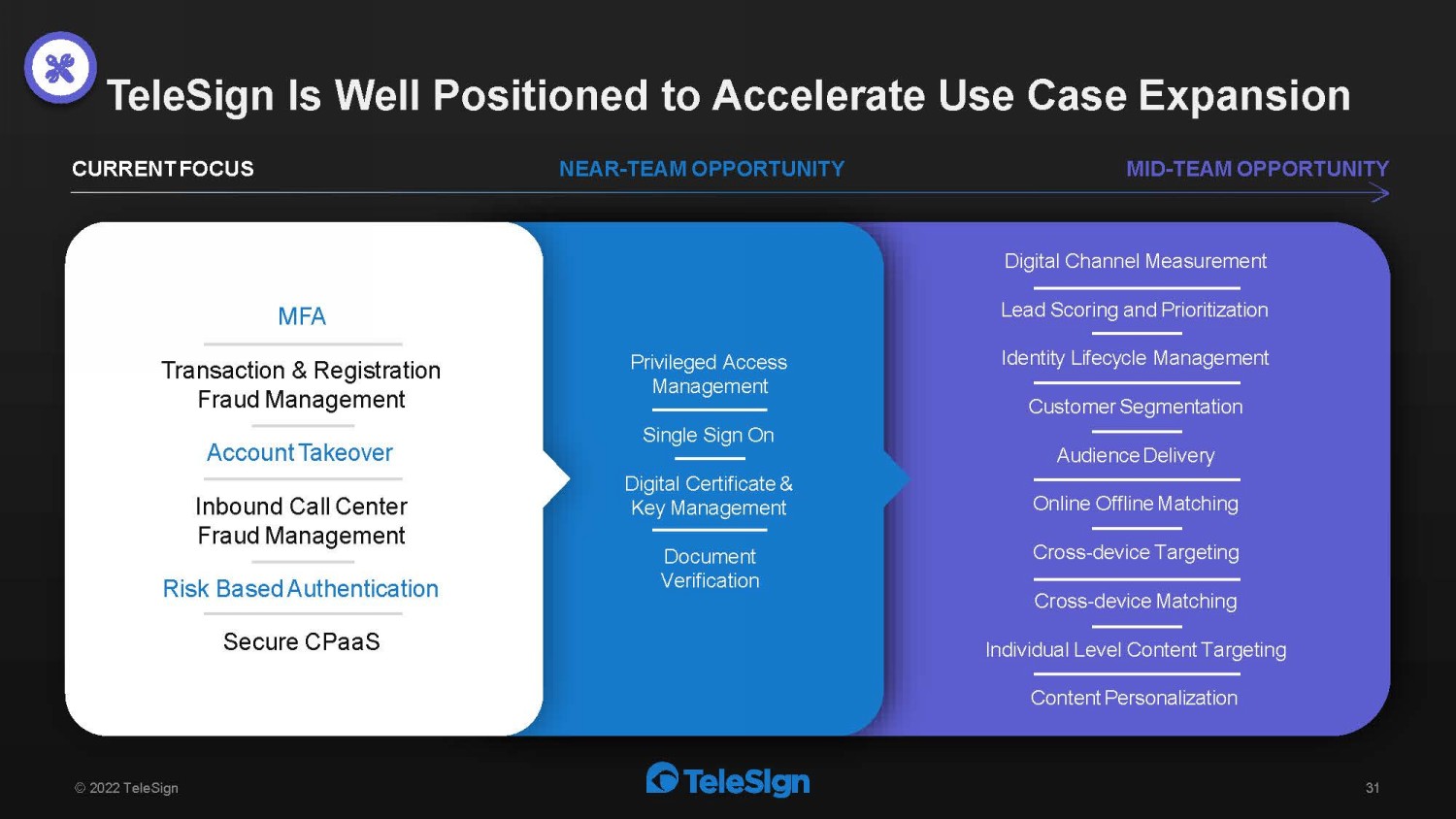

TeleSign Is Well Positioned to Accelerate Use Case Expansion 31 Digital Channel Measurement Lead Scoring and Prioritization Identity Lifecycle Management Customer Segmentation Audience Delivery Online Offline Matching Cross - device Targeting Cross - device Matching Individual Level Content Targeting Content Personalization Privileged Access Management Single Sign On Digital Certificate & Key Management Document Verification © 2022 TeleSign CURRENT FOCUS MID - TEAM OPPORTUNITY M F A Transaction & Registration Fraud Management Account Takeover Inbound Call Center Fraud Management Risk Based Authentication Secure CPaaS NEAR - TEAM OPPORTUNITY

Aaron Seyler, SVP of Sales

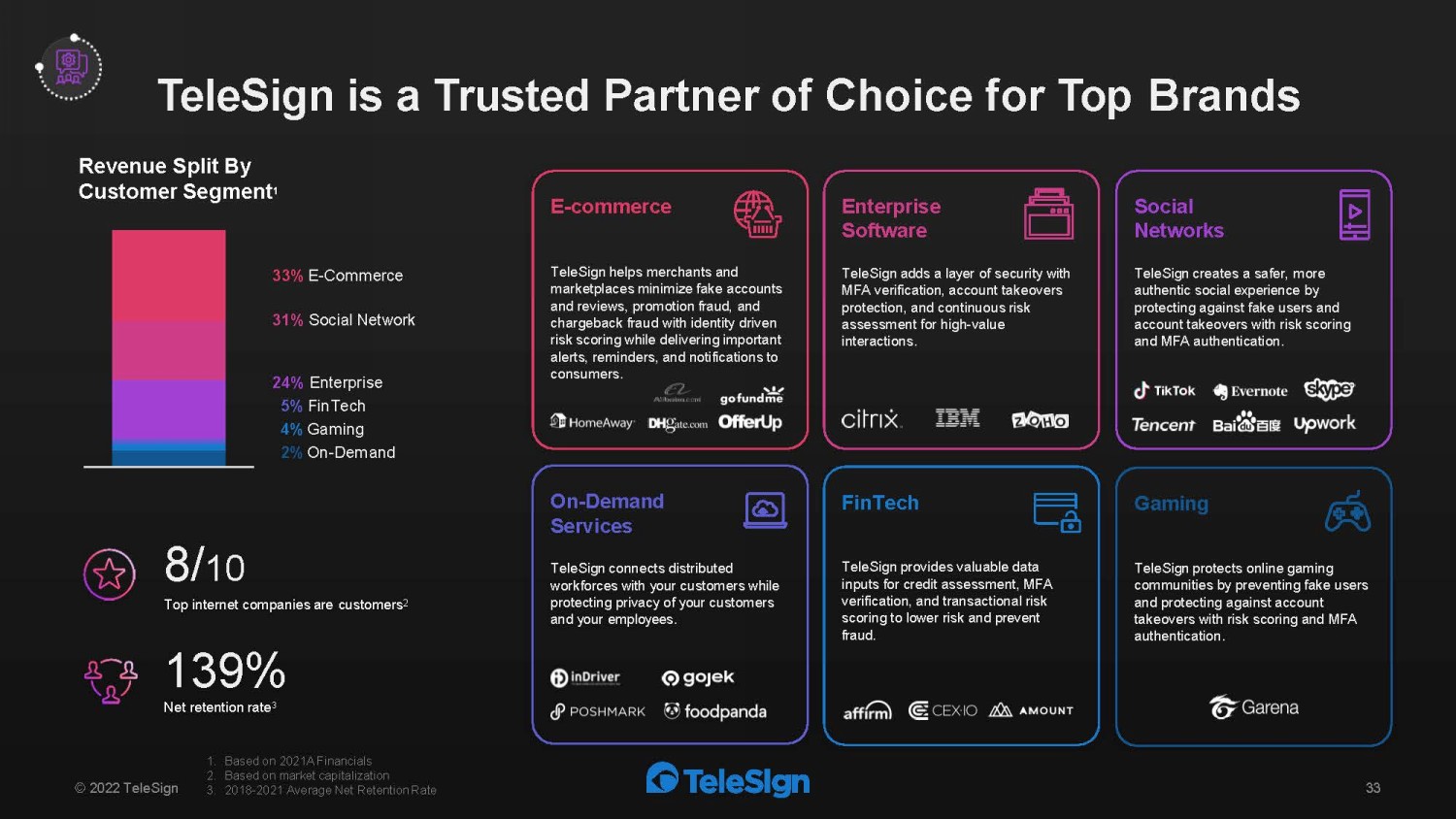

E - commerce TeleSign helps merchants and marketplaces minimize fake accounts and reviews, promotion fraud, and chargeback fraud with identity driven risk scoring while delivering important alerts, reminders, and notifications to consumers. TeleSign is a Trusted Partner of Choice for Top Brands Revenue Split By Cus t omer Segment 1 8/ 10 Top internet companies are customers 2 139 % Net retention rate 3 Social Net w o r ks TeleSign creates a safer, more authentic social experience by protecting against fake users and account takeovers with risk scoring and MFA authentication. G a m ing TeleSign protects online gaming communities by preventing fake users and protecting against account takeovers with risk scoring and MFA authentication. O n - Demand Services TeleSign connects distributed workforces with your customers while protecting privacy of your customers and your employees. E nte r p r ise Software TeleSign adds a layer of security with MFA verification, account takeovers protection, and continuous risk assessment for high - value interactions. FinTech TeleSign provides valuable data inputs for credit assessment, MFA verification, and transactional risk scoring to lower risk and prevent fraud. 33 % E - Commerce 24% Enterprise 5% FinTech 4% Gaming 2% On - Demand 31 % Social Network 1. Based on 2021A Financials 2. Based on market capitalization 3. 2018 - 2021 Average Net Retention Rate 33 © 2022 TeleSign

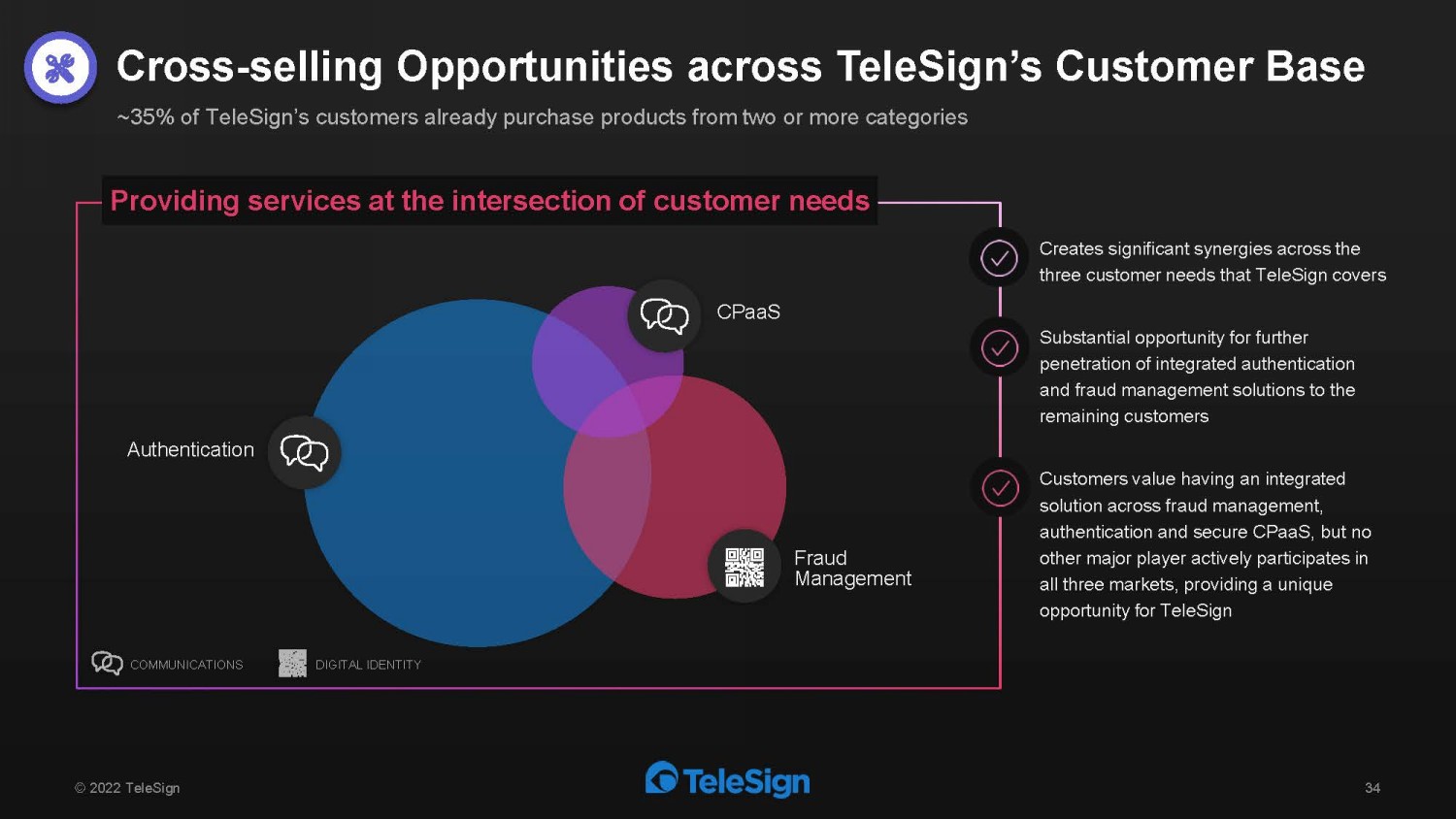

Creates s ignificant synergies across the three customer needs that TeleSign covers Substantial opportunity for further penetration of integrated authentication and fraud management solutions to the remaining customers Customers value having an integrated solution across fraud management, authentication and secure CPaaS , but no other major player actively participates in all three markets, providing a unique opportunity for TeleSign Providing services at the intersection of customer needs COMMUNICATIONS DIGITAL IDENTITY Cross - selling Opportunities across TeleSign’s Customer Base © 2022 TeleSign 34 ~ 35 % of TeleSign ’ s customers already purchase products from two or more categories Authentication Fraud Management CPaaS

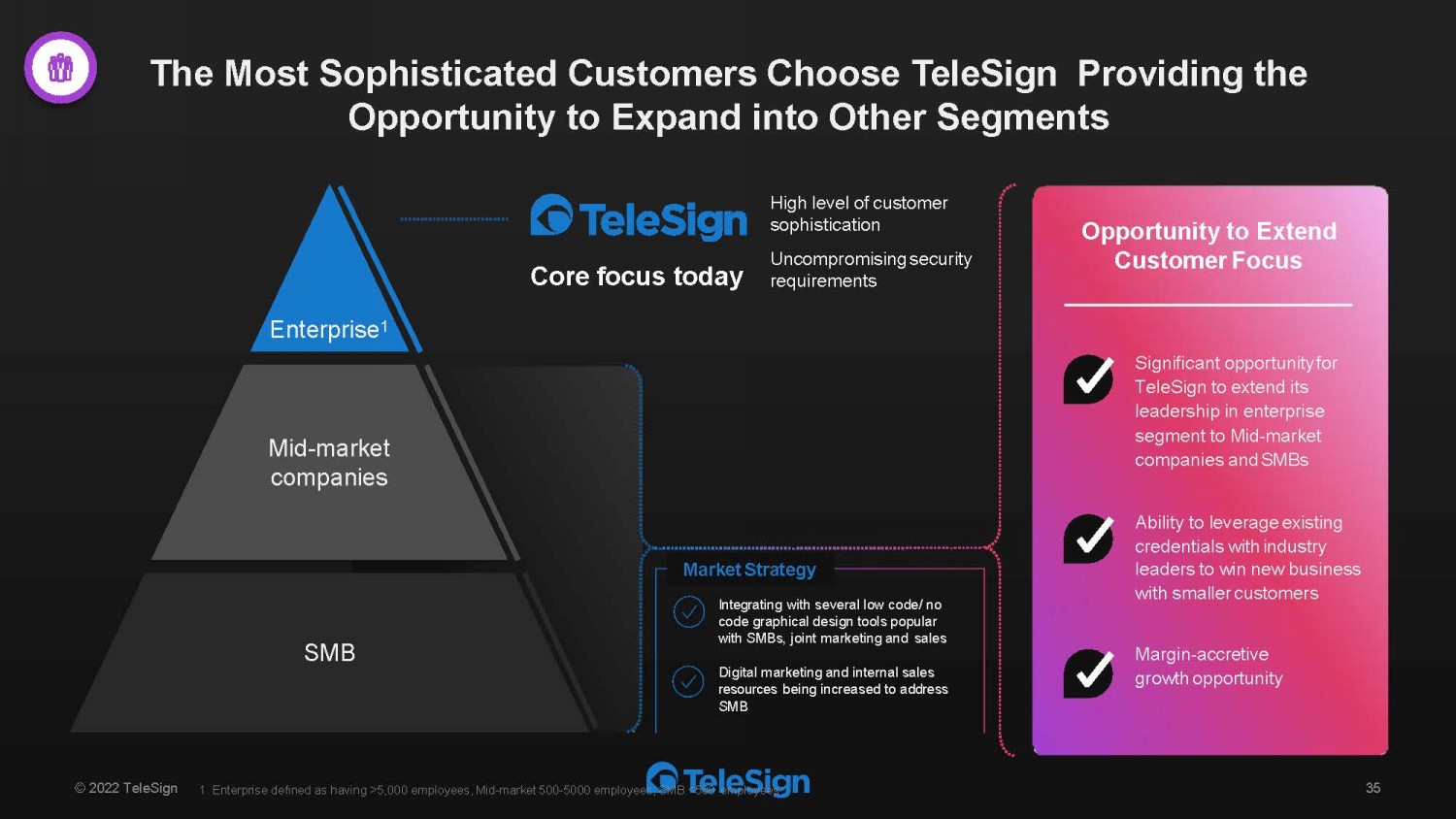

The Most Sophisticated Customers Choose TeleSign Providing the Opportunity to Expand into Other Segments E n t e rpris e 1 Mid - m a rket c om pa n i e s SMB Core focus today High level of customer sophistication Uncompromising security requirements 1. Enterprise defined as having >5,000 employees, Mid - market 500 - 5000 employees; SMB <500 employees Opportunity to Extend Customer Focus Significant opportunity for TeleSign to extend its leadership in enterprise segment to Mid - market companies and SMBs Ability to leverage existing credentials with industry leaders to win new business with smaller customers Margin - accretive growth opportunity 35 © 2022 TeleSign Market Strategy Integrating with several low code/ no code graphical design tools popular with SMBs, joint marketing and sales Digital marketing and internal sales resources being increased to address SMB

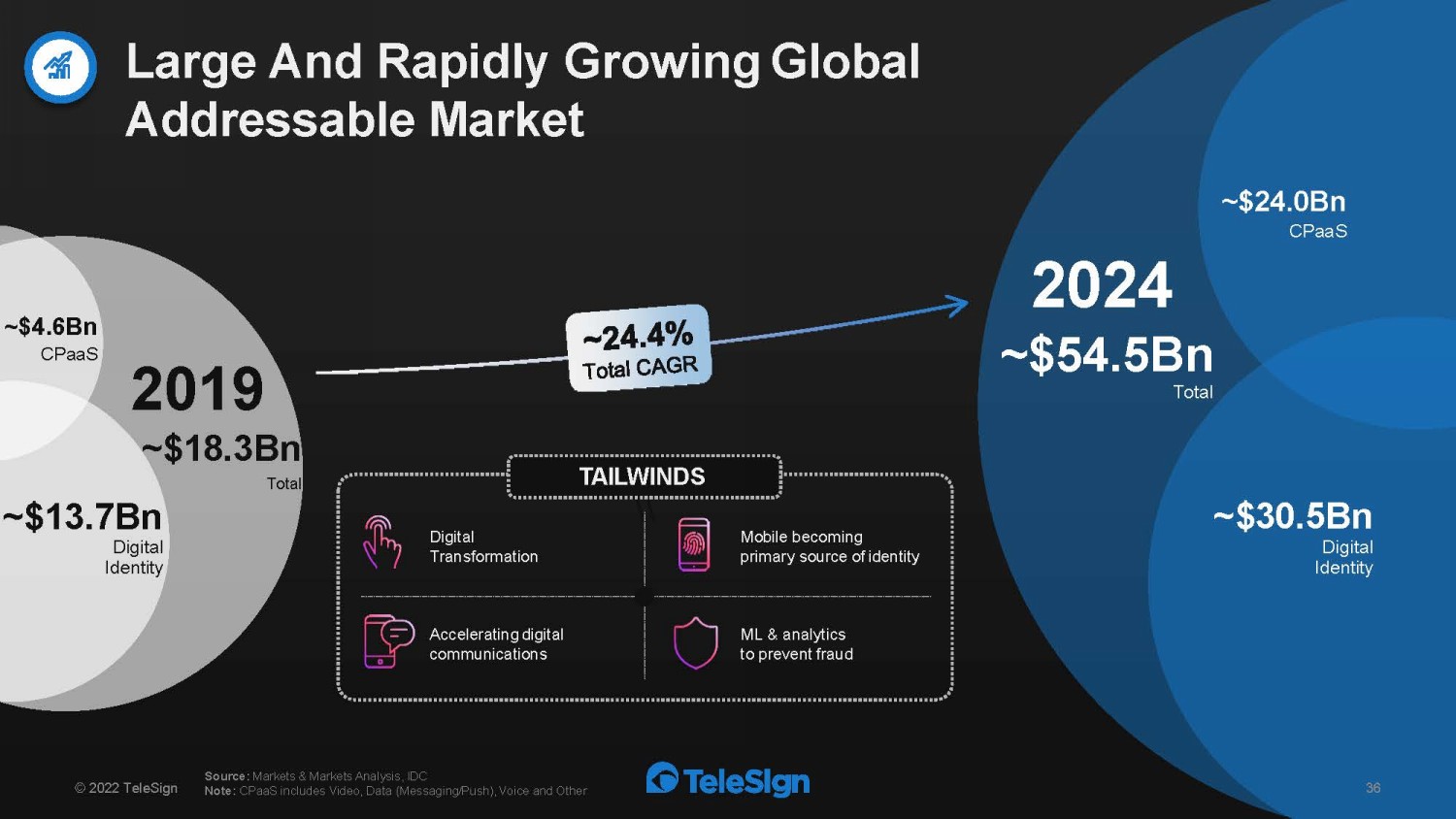

~$ 24.0 Bn CPaa S ~ $ 30 . 5B n Di g i ta l Identity ~$4.6Bn CPaa S ~ $1 3. 7 B n Di g i ta l Id en t i ty T o t a l Large And Rapidly Growing Global Addressable Market Source: Markets & Markets Analysis, IDC Note: CPaaS includes Video, Data (Messaging/Push), Voice and Other 2024 ~ $ 5 4 . 5 B n T o ta l 2019 ~ $ 1 8 . 3 B n \ \ Digital T ran sf or m a tion Mobile becoming primary source of identity Accelerating digital communications ML & analytics to prevent fraud TAILWINDS 36 © 2022 TeleSign

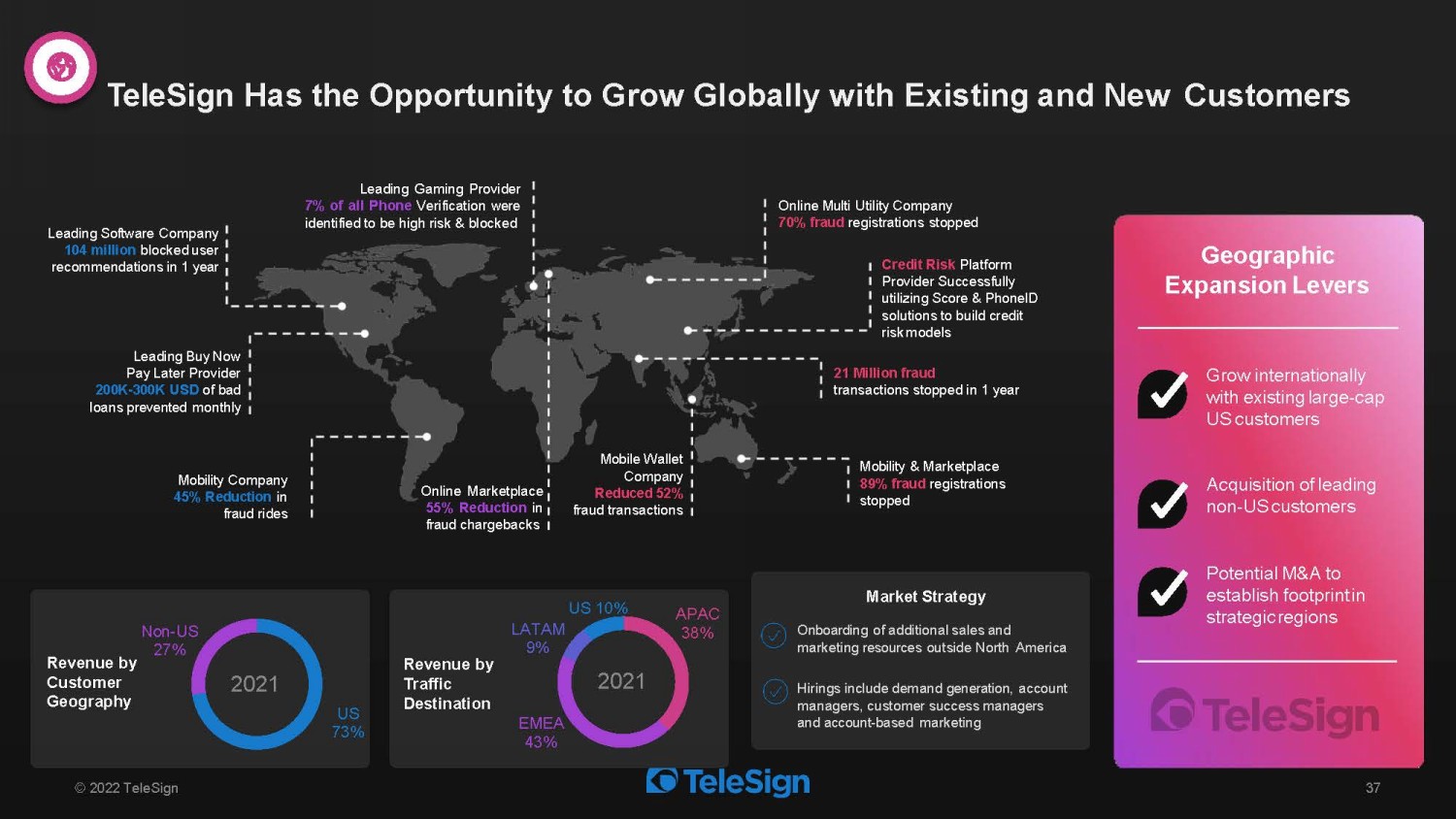

Geographic Expansion Levers Grow internationally with existing large - cap US customers Acquisition of leading non - US customers Potential M&A to establish footprint in strategic regions TeleSign Has the Opportunity to Grow Globally with Existing and New Customers Online Multi Utility Company 70% fraud registrations stopped Online Marketplace 55 % Reduction in fraud chargebacks Mobility Company 45% Reduction in fraud rides Leading Software Company 104 million blocked user recommendations in 1 year Leading Buy Now Pay Later Provider 200K - 300K USD of bad loans prevented monthly Leading Gaming Provider 7 % of all Phone Verification were identified to be high risk & blocked Mobile Wallet Co m pan y Reduced 52% fraud transactions Mobility & Marketplace 89% fraud registrations stopped 21 Million fraud transactions stopped in 1 year Credit Risk Platform Provider Successfully utilizing Score & PhoneID solutions to build credit risk models 37 © 2022 TeleSign Onboarding of additional sales and marketing resources outside North America Hirings include demand generation, account managers, customer success managers and account - based marketing Market Strategy US 73% Non - US 27% 2021 Revenue by Customer Geography Revenue by Traffic Destination APAC 38% EMEA 43% LATAM 9% US 10% 2021

“ At Affirm, we have the best algorithms for evaluating financial risk and TeleSign has the best digital identity solutions to recognize possible fraud.” Jeremy Shu Head of Financial Partnerships Identity Phone ID Suite 38 © 2022 TeleSign

Thomas Dhondt, CFO

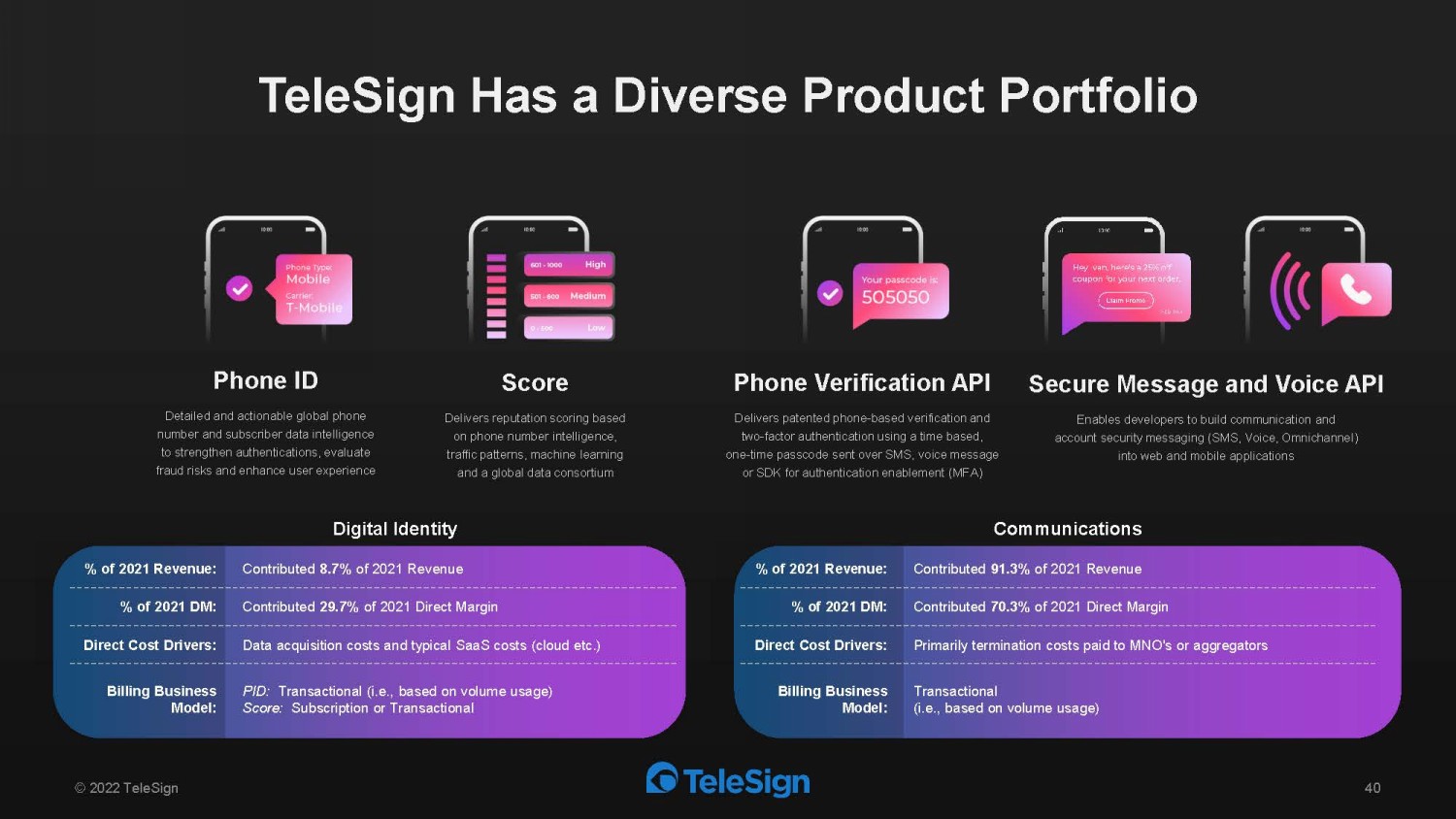

© 2022 TeleSign 40 Phone ID Detailed and actionable global phone number and subscriber data intelligence to strengthen authentications, evaluate fraud risks and enhance user experience Score Delivers reputation scoring based on phone number intelligence, traffic patterns, machine learning and a global data consortium Phone Verification API Delivers patented phone - based verification and two - factor authentication using a time based, one - time passcode sent over SMS, voice message or SDK for authentication enablement (MFA) Secure Message and Voice API Enables developers to build communication and account security messaging (SMS, Voice, Omnichannel) into web and mobile applications TeleSign Has a Diverse Product Portfolio % of 2021 Revenue: Contributed 8.7% of 2021 Revenue % of 2021 DM: Contributed 29.7% of 2021 Direct Margin Direct Cost Drivers: Data acquisition costs and typical SaaS costs (cloud etc.) Billing Business Model: PID: Transactional (i.e., based on volume usage) Score: Subscription or Transactional Digital Identity Communications % of 2021 Revenue: Contributed 91.3% of 2021 Revenue % of 2021 DM: Contributed 70.3% of 2021 Direct Margin Direct Cost Drivers: Primarily termination costs paid to MNO's or aggregators Billing Business Model: Transactional (i.e., based on volume usage)

41 Strong future growth opportunity Attractive margin expansion driven by shift towards Digital Identity Significant investments driving efficient growth and future opportunity Stable business model with loyal customer base Best - in - class organic growth track record © 2022 TeleSign TeleSign’s Financial Highlights

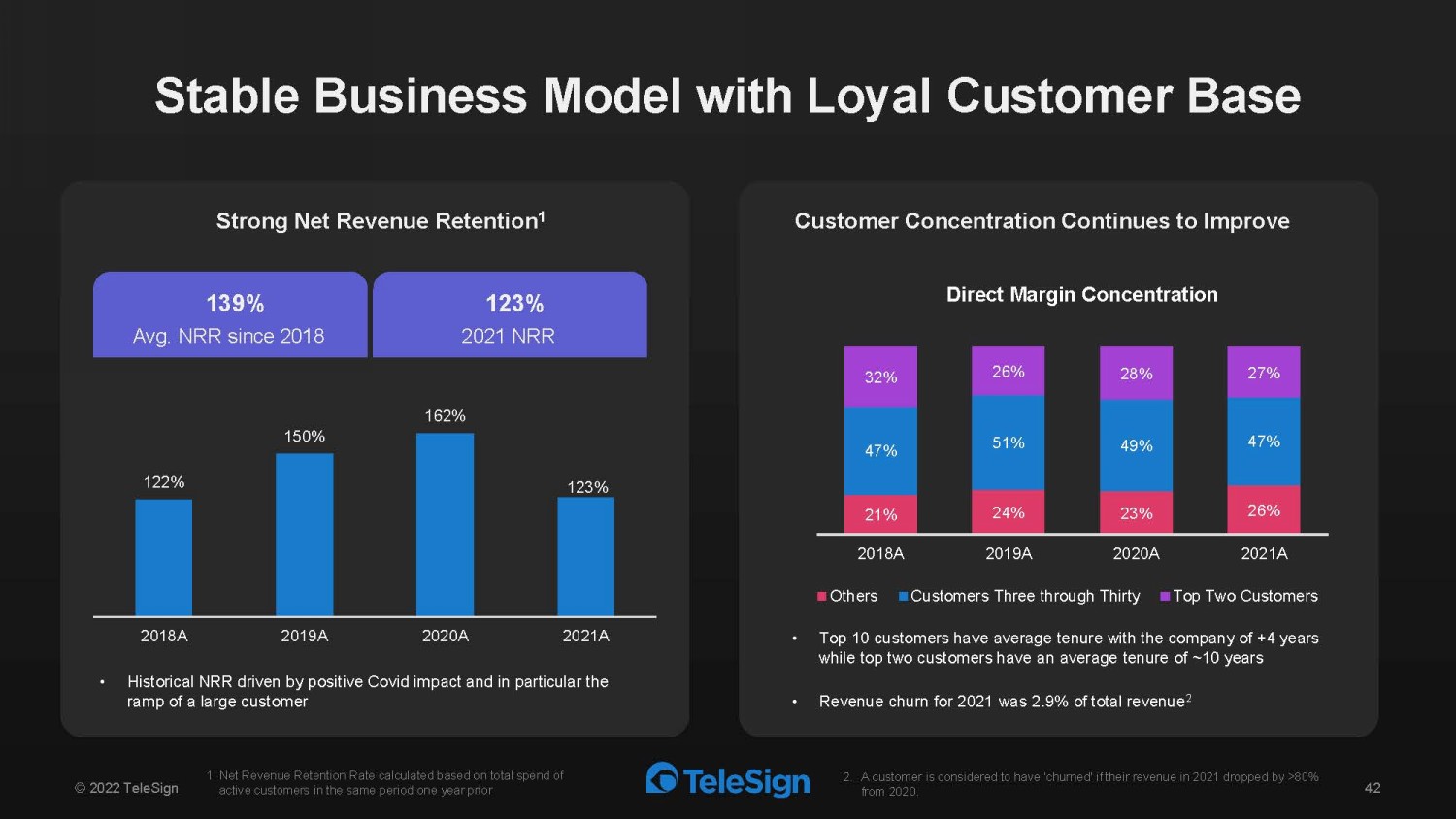

Stable Business Model with Loyal Customer Base 42 122% 150% 162% 123% 2018A 2019A 2020A 2021A 139% Avg. NRR since 2018 Strong Net Revenue Retention 1 123% 2021 NRR • Historical NRR driven by positive Covid impact and in particular the ramp of a large customer Customer Concentration Continues to Improve 21% 24% 23% 26% 47% 51% 49% 47% 32% 26% 28% 27% 2018A 2019A 2020A 2021A Direct Margin Concentration Others Customers Three through Thirty Top Two Customers 1. Net Revenue Retention Rate calculated based on total spend of active customers in the same period one year prior 2. A customer is considered to have 'churned' if their revenue in 2021 dropped by >80% from 2020. • Top 10 customers have average tenure with the company of +4 years while top two customers have an average tenure of ~10 years • Revenue churn for 2021 was 2.9% of total revenue 2 © 2022 TeleSign

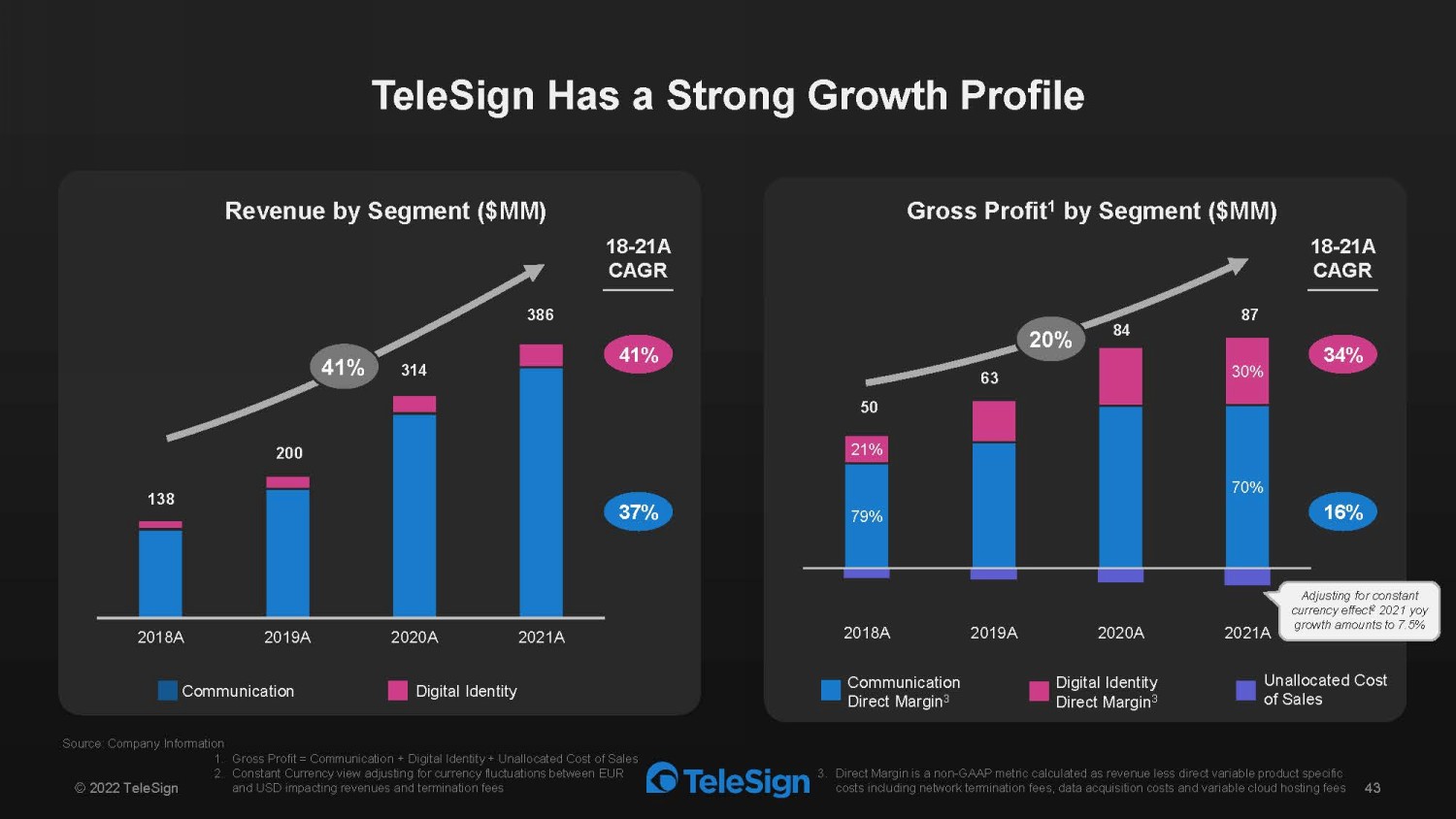

TeleSign Has a Strong Growth Profile 43 2018A 2019A 2020A 2021A 138 200 314 79% 70% 21% 30% 2018A 2019A 2020A 2021A 50 63 84 386 87 Revenue by Segment ($MM) Gross Profit 1 by Segment ($MM) 18 - 2 1 A CAGR 1 8 - 2 1 A CAGR 34 % 16 % 41 % 37% Communication Digital Identity 41 % 20 % Adjusting for constant currency effect 2 2021 yoy growth amounts to 7.5% Source: Company Information 1. Gross Profit = Communication + Digital Identity + Unallocated Cost of Sales 2. Constant Currency view adjusting for currency fluctuations between EUR and USD impacting revenues and termination fees Unallocated Cost of Sales Communication Direct Margin 3 Digital Identity Direct Margin 3 3. Direct Margin is a non - GAAP metric calculated as revenue less direct variable product specific costs including network termination fees, data acquisition costs and variable cloud hosting fees © 202 2 TeleSign

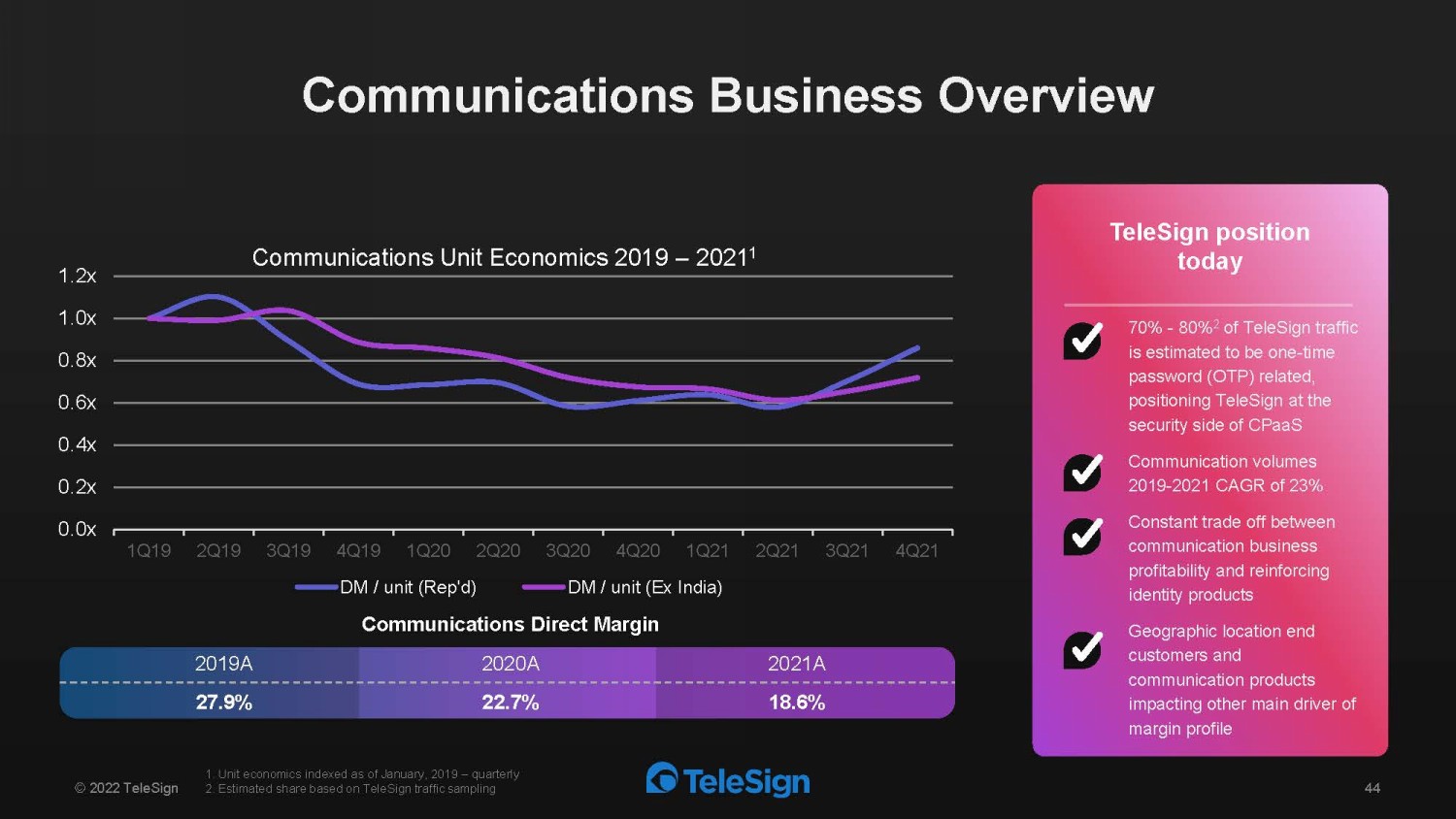

44 © 202 2 TeleSign 1. Unit economics indexed as of January, 2019 – quarterly 2. Estimated share based on TeleSign traffic sampling Communications Business Overview 0.0x 0.2x 0.4x 0.6x 0.8x 1.0x 1.2x 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Communications Unit Economics 2019 – 2021 1 DM / unit (Rep'd) DM / unit (Ex India) TeleSign position today 70% - 80% 2 of TeleSign traffic is estimated to be one - time password (OTP) related, positioning TeleSign at the security side of CPaaS Communication volumes 2019 - 2021 CAGR of 23% Constant trade off between communication business profitability and reinforcing identity products Geographic location end customers and communication products impacting other main driver of margin profile Communications Direct Margin 2019A 2020A 2021A 27.9% 22.7% 18.6%

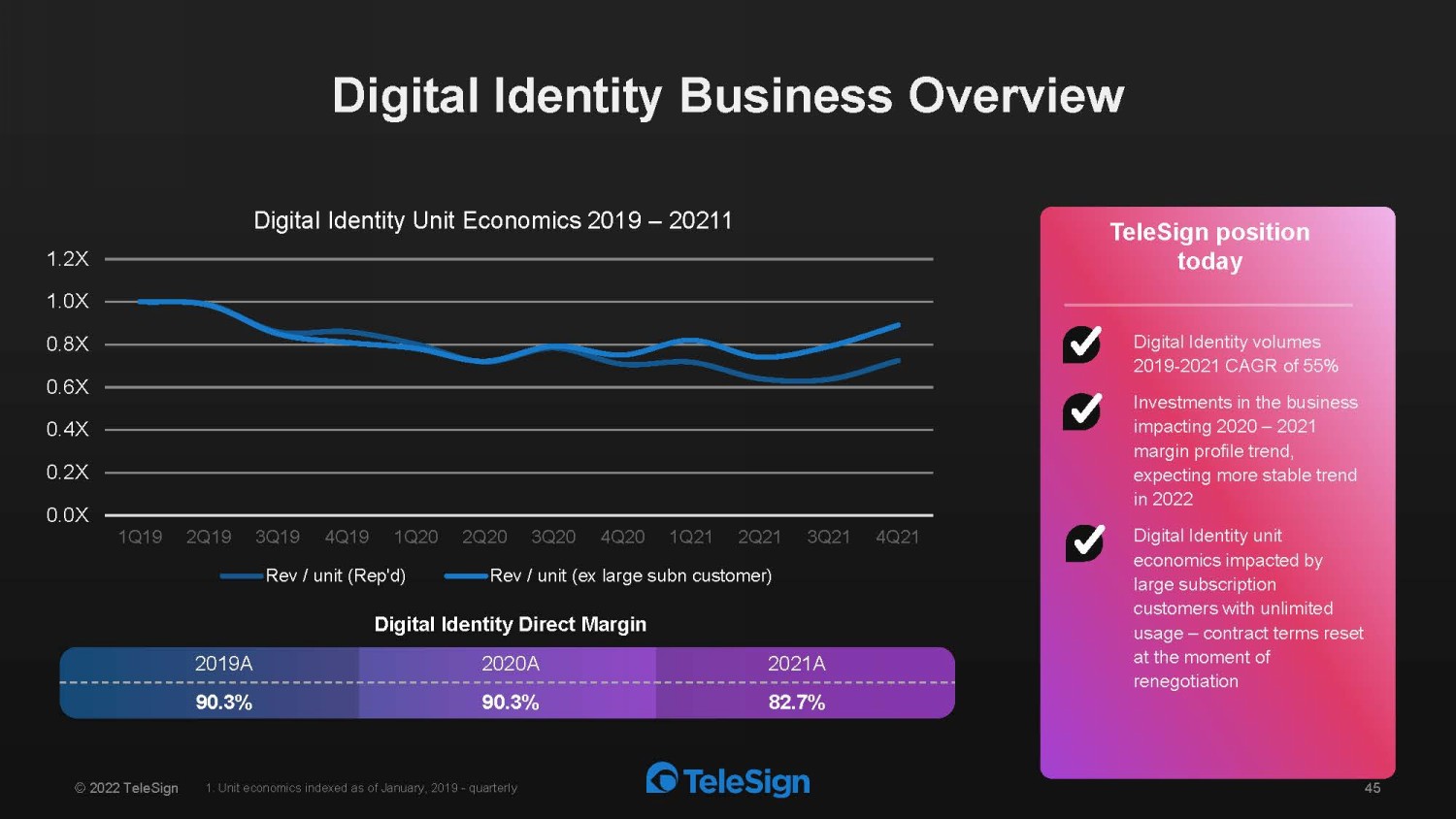

45 1. Unit economics indexed as of January, 2019 - quarterly © 202 2 TeleSign Digital Identity Business Overview TeleSign position today Digital Identity Direct Margin 2019A 2020A 2021A 90.3% 90.3% 82.7% Digital Identity volumes 2019 - 2021 CAGR of 55% Investments in the business impacting 2020 – 2021 margin profile trend, expecting more stable trend in 2022 Digital Identity unit economics impacted by large subscription customers with unlimited usage – contract terms reset at the moment of renegotiation 0.0X 0.2X 0.4X 0.6X 0.8X 1.0X 1.2X 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Digital Identity Unit Economics 2019 – 20211 Rev / unit (Rep'd) Rev / unit (ex large subn customer)

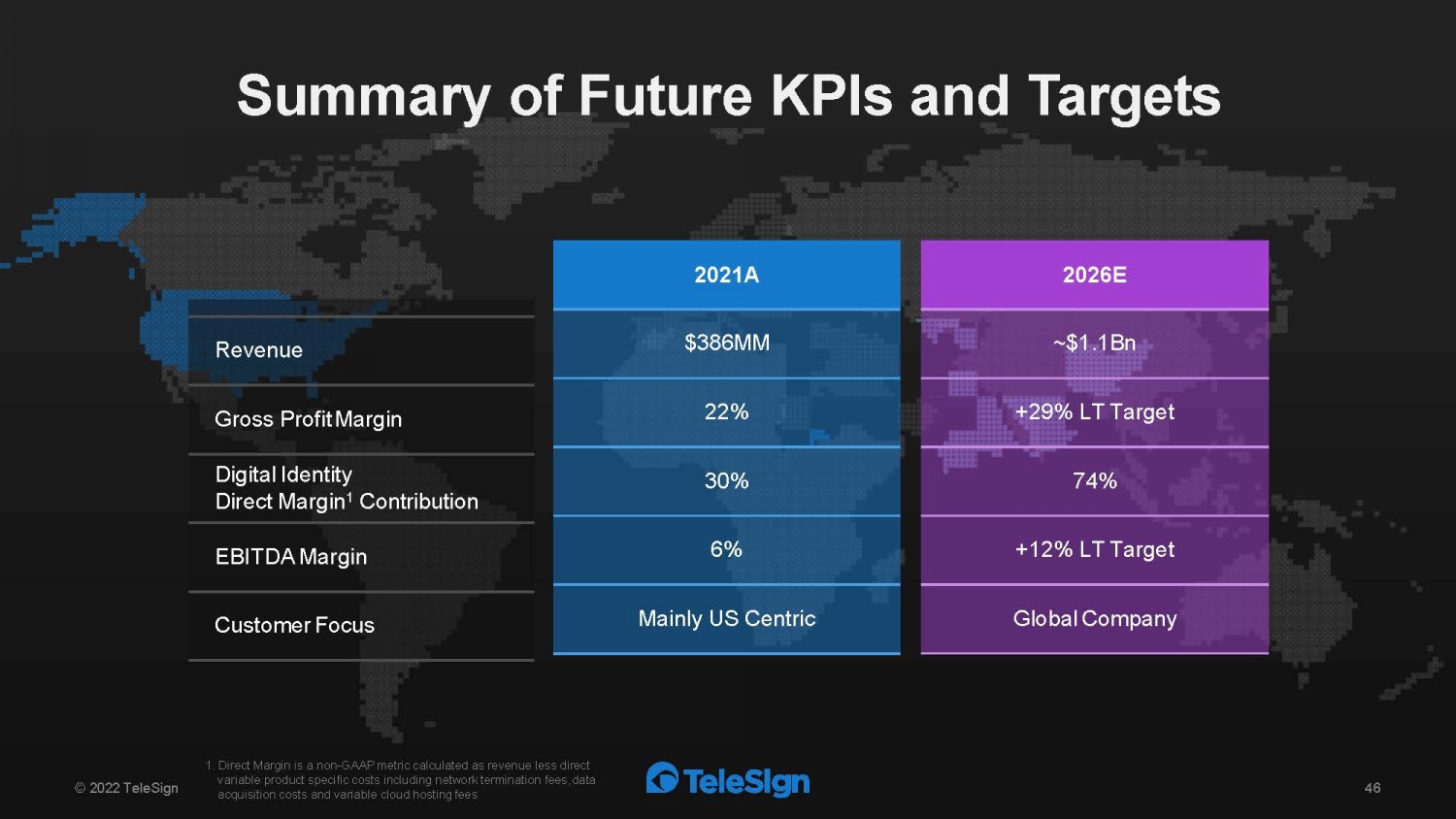

Summary of Future KPIs and Targets © 202 2 TeleSign Revenue Gross Profit Margin Digital Identity Direct Margin 1 Contribution EBITDA Margin Customer Focus 2026E ~$1.1Bn +2 9 % LT Target 74% +12% LT Target Global Company 2021 A $3 86 MM 22% 3 0 % 6 % Mainly US Centric 1. Direct Margin is a non - GAAP metric calculated as revenue less direct variable product specific costs including network termination fees, data acquisition costs and variable cloud hosting fees 46

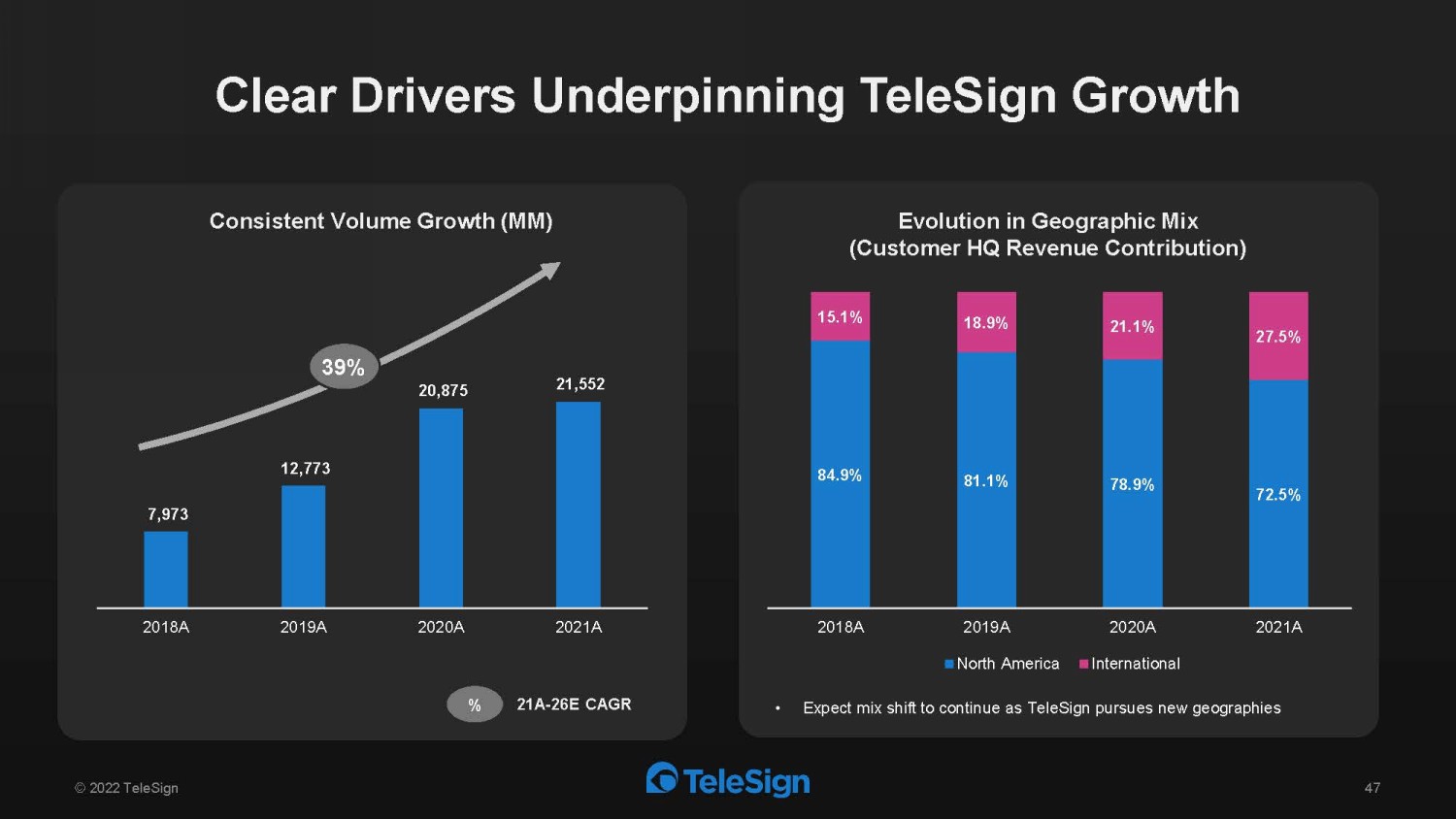

Clear Drivers Underpinning TeleSign Growth Evolution in Geographic Mix (Customer HQ Revenue Contribution) Consistent Volume Growth (MM) 84.9% 81.1% 78.9% 72.5% 15.1% 18.9% 21.1% 27.5% 2018A 2019A 2020A 2021A North America International • Expect mix shift to continue as TeleSign pursues new geographies 7,973 12,773 20,875 21,552 2018A 2019A 2020A 2021A © 202 2 TeleSign 47 21A - 26E CAGR % 39 %

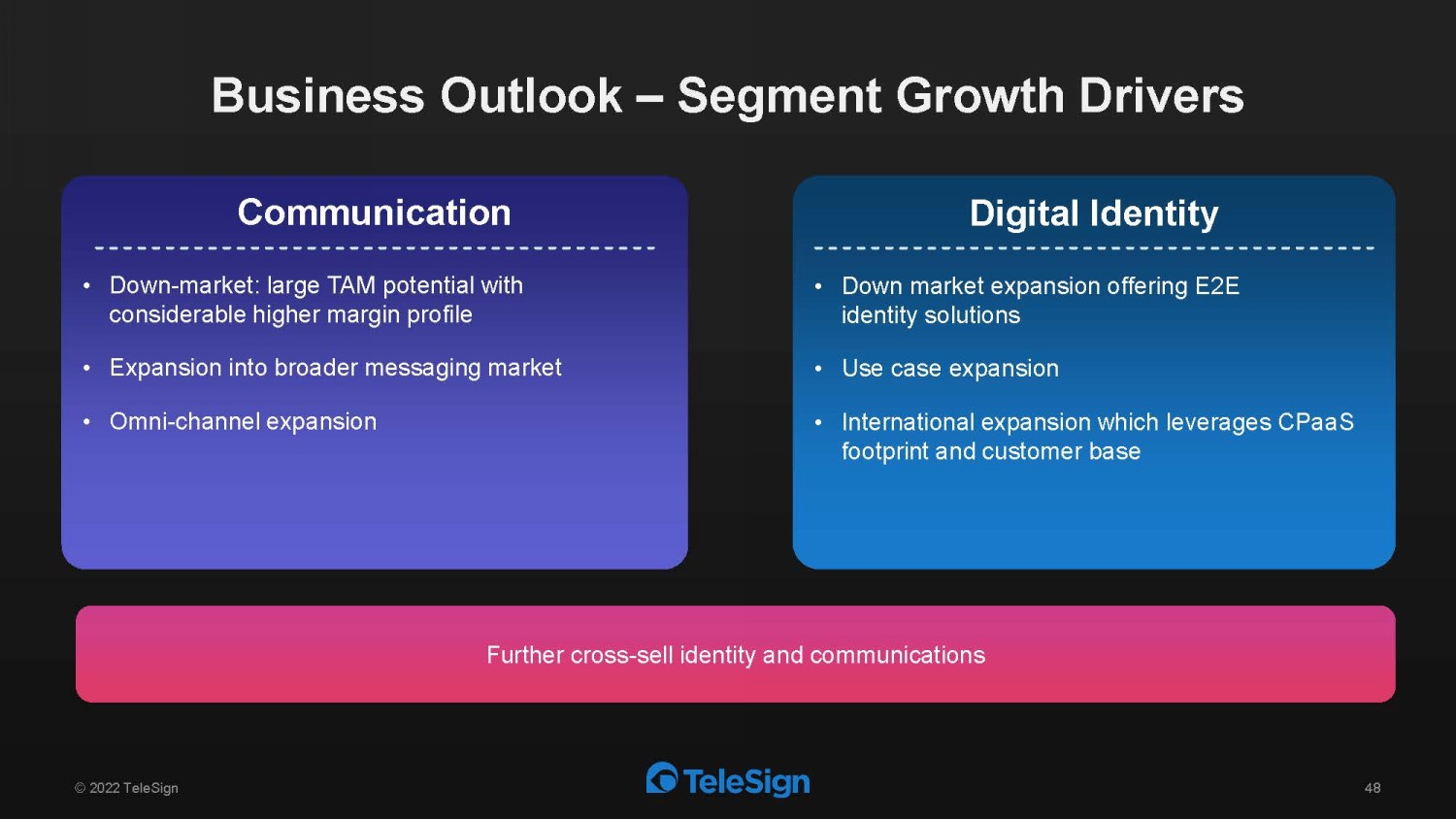

Further cross - sell identity and communications 48 © 202 2 TeleSign Business Outlook – Segment Growth Drivers Communication • Down - market: large TAM potential with considerable higher margin profile • Expansion into broader messaging market • Omni - channel expansion Digital Identity • Down market expansion offering E2E identity solutions • Use case expansion • International expansion which leverages CPaaS footprint and customer base

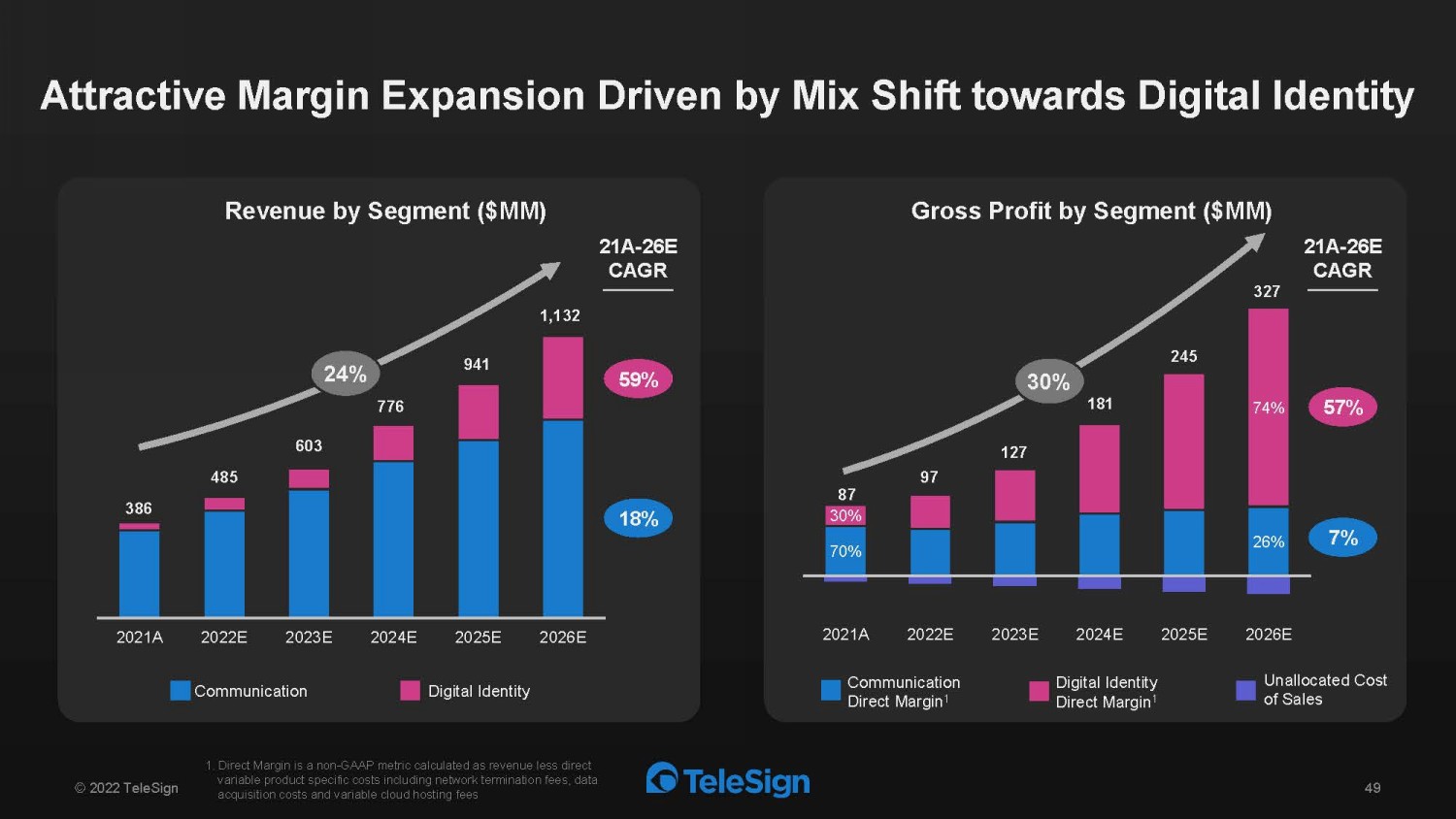

Attractive Margin Expansion Driven by Mix Shift towards Digital Identity 49 Revenue by Segment ($MM) Communication Digital Identity 2021A 2022E 2023E 2024E 2025E 2026E 386 485 603 776 941 1,132 Gross Profit by Segment ($MM) Communication Direct Margin 1 Digital Identity Direct Margin 1 70% 26% 30% 74% 2021A 2022E 2023E 2024E 2025E 2026E 21A - 26E CAGR 87 97 127 181 245 327 21A - 26E CAGR 57% 7% 59% 18% 24% 30 % Unallocated Cost of Sales 1. Direct Margin is a non - GAAP metric calculated as revenue less direct variable product specific costs including network termination fees, data acquisition costs and variable cloud hosting fees © 202 2 TeleSign

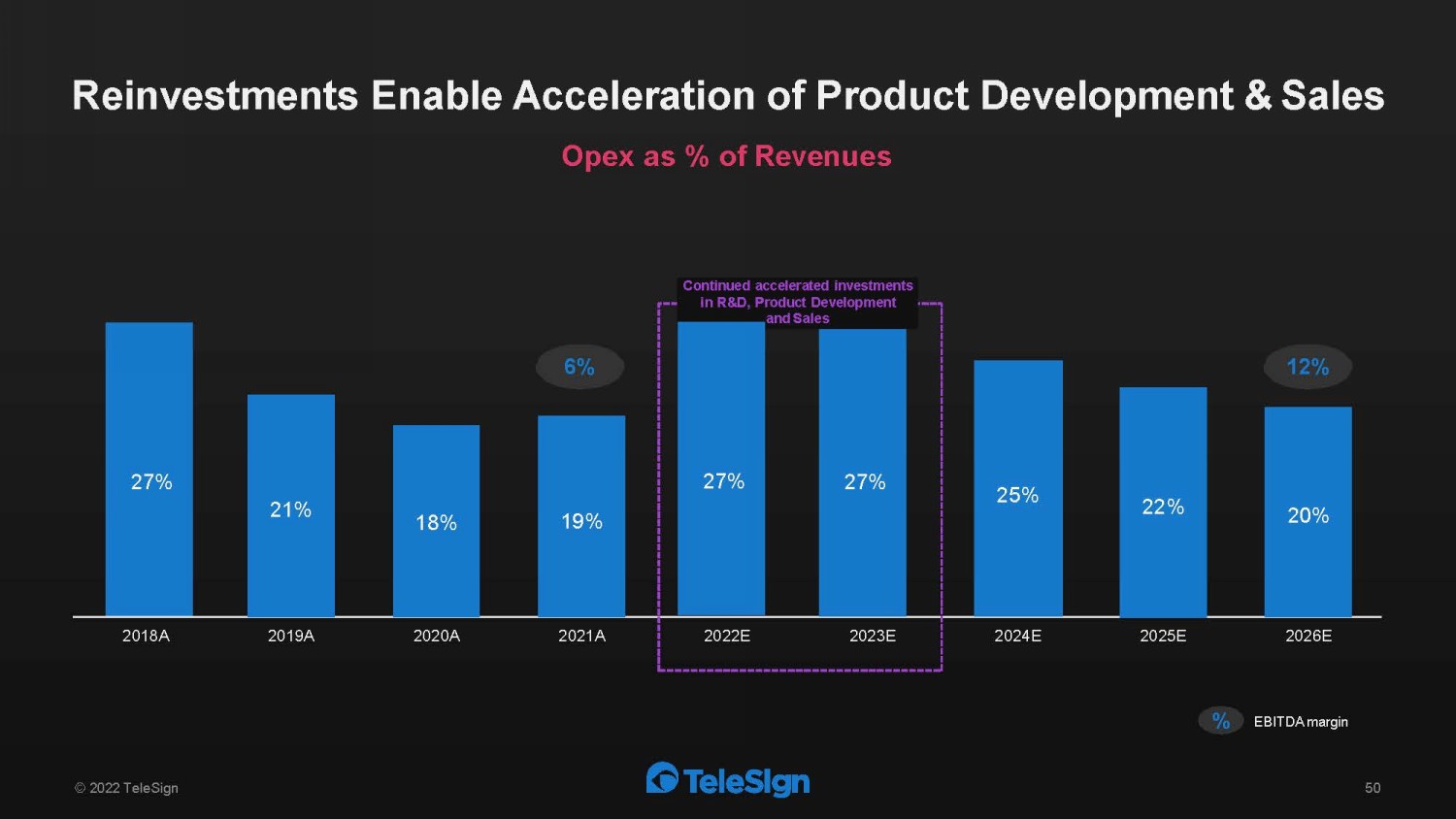

Reinvestments Enable Acceleration of Product Development & Sales © 202 2 TeleSign Opex as % of Revenues 27% 21% 18% 19% 25 % 22 % 20% 2018A 2019A 2020A 2021 A 2022 E 2023E 2024E 2025E 2026E Continued accelerated investments in R&D, Product Development and Sales 12% 6 % EB I T DA m arg in % 27% 27% 50

Public Market Listing to Enable the Next Phase of TeleSign ’s Growth © 202 2 TeleSign Funding future organic growth opportunity Opportunity for geographic expansion Investment funds for M&A Attract top talent Enhanced visibility / credibility with partners and customers 51

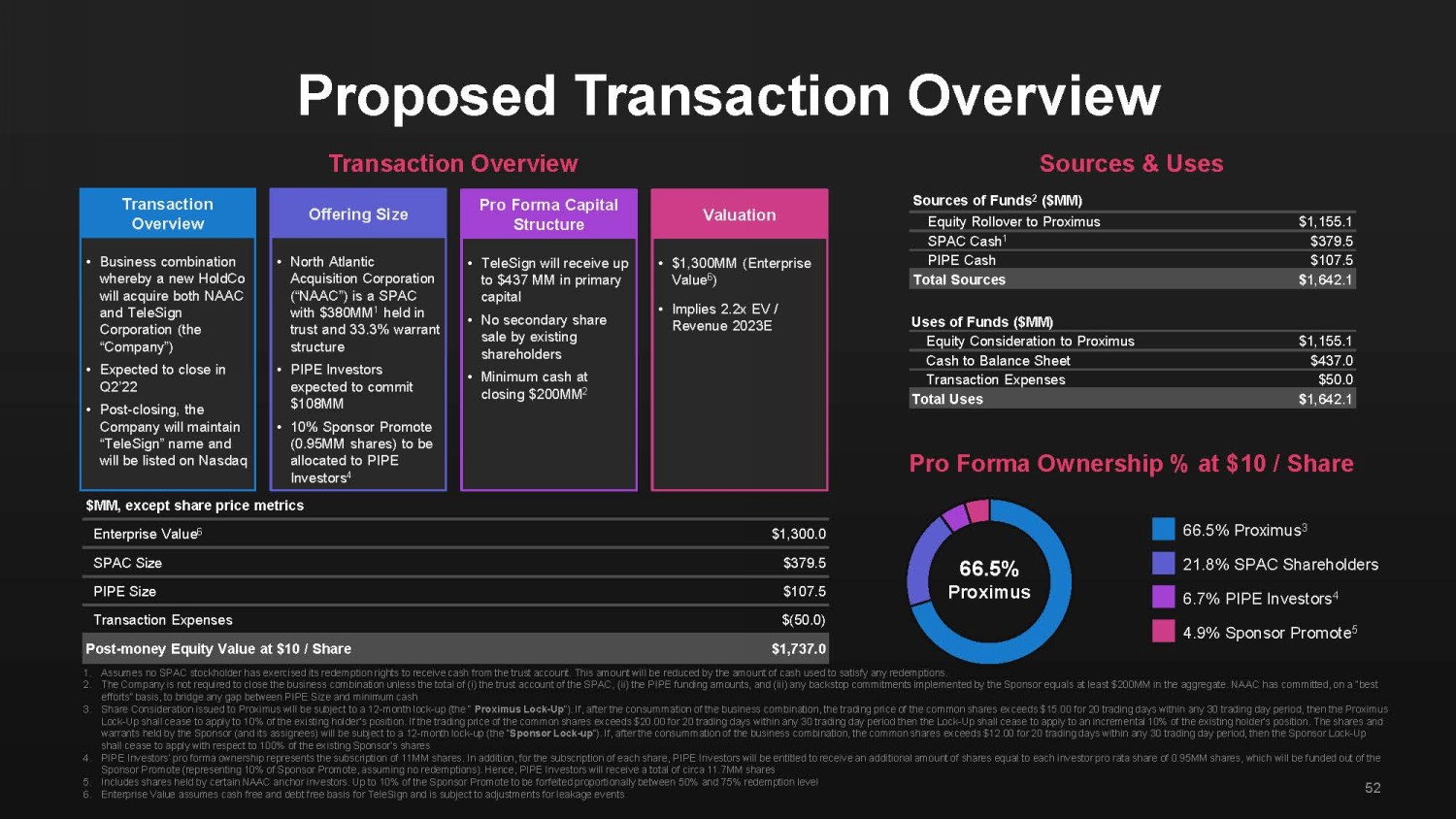

Proposed Transaction Overview 52 Transaction Overview Sources & Uses Pro Forma Ownership % at $10 / Share • Business combination whereby a new HoldCo will acquire both NAAC and TeleSign Corporation (the “Company”) • Expected to close in Q2’22 • Post - closing, the Company will maintain “TeleSign” name and will be listed on Nasdaq • North Atlantic Acquisition Corporation (“NAAC”) is a SPAC with $380MM 1 held in trust and 33.3% warrant structure • PIPE Investors expected to commit $108MM • 10% Sponsor Promote (0.95MM shares) to be allocated to PIPE Investors 4 • TeleSign will receive up to $437 MM in primary capital • No secondary share sale by existing shareholders • Minimum cash at closing $200MM 2 • $1,300MM (Enterprise Value 6 ) • Implies 2.2x EV / Revenue 2023E Transaction Overview Offering Size Pro Forma Capital Structure Valuation Sources of Funds 2 ($MM) Equity Rollover to Proximus $1,155.1 SPAC Cash 1 $379.5 PIPE Cash $107.5 Total Sources $ 1,642.1 Uses of Funds ($MM) Equity Consideration to Proximus $1,155.1 Cash to Balance Sheet $437.0 Transaction Expenses $50.0 Total Uses $ 1,642.1 $MM, except share price metrics Enterprise Value 6 $1,300.0 SPAC Size $379.5 PIPE Size $107.5 Transaction Expenses $(50.0) Post - money Equity Value at $10 / Share $1,737.0 66.5 % Proximus 6.7% PIPE Investors 4 21.8% SPAC Shareholders 66.5% Proximus 3 4.9% Sponsor Promote 5 1. Assumes no SPAC stockholder has exercised its redemption rights to receive cash from the trust account. This amount will be r edu ced by the amount of cash used to satisfy any redemptions. 2. The Company is not required to close the business combination unless the total of (i) the trust account of the SPAC, (ii) the PI PE funding amounts, and (iii) any backstop commitments implemented by the Sponsor equals at least $200MM in the aggregate. NA AC has committed, on a “best efforts” basis, to bridge any gap between PIPE Size and minimum cash 3. Share Consideration issued to Proximus will be subject to a 12 - month lock - up (the “ Proximus Lock - Up ”). If, after the consummation of the business combination, the trading price of the common shares exceeds $15.00 for 20 trad ing days within any 30 trading day period, then the Proximus Lock - Up shall cease to apply to 10% of the existing holder’s position. If the trading price of the common shares exceeds $20.00 for 20 trading days within any 30 trading day period then the Lock - Up shall cease to apply to an incremental 10% of the existing holder’s position. The shares and warrants held by the Sponsor (and its assignees) will be subject to a 12 - month lock - up (the “ Sponsor Lock - up ”). If, after the consummation of the business combination, the common shares exceeds $12.00 for 20 trading days within any 3 0 t rading day period, then the Sponsor Lock - Up shall cease to apply with respect to 100% of the existing Sponsor’s shares 4. PIPE Investors’ pro forma ownership represents the subscription of 11MM shares. In addition, for the subscription of each sha re, PIPE Investors will be entitled to receive an additional amount of shares equal to each investor pro rata share of 0.95MM sha re s, which will be funded out of the Sponsor Promote (representing 10% of Sponsor Promote, assuming no redemptions). Hence, PIPE Investors will receive a total of ci rca 11.7MM shares 5. Includes shares held by certain NAAC anchor investors. Up to 10% of the Sponsor Promote to be forfeited proportionally betwee n 5 0% and 75% redemption level 6. Enterprise Value assumes cash free and debt free basis for TeleSign and is subject to adjustments for leakage events

Thank You Q&A

Appendix © 2021 TeleSign 54

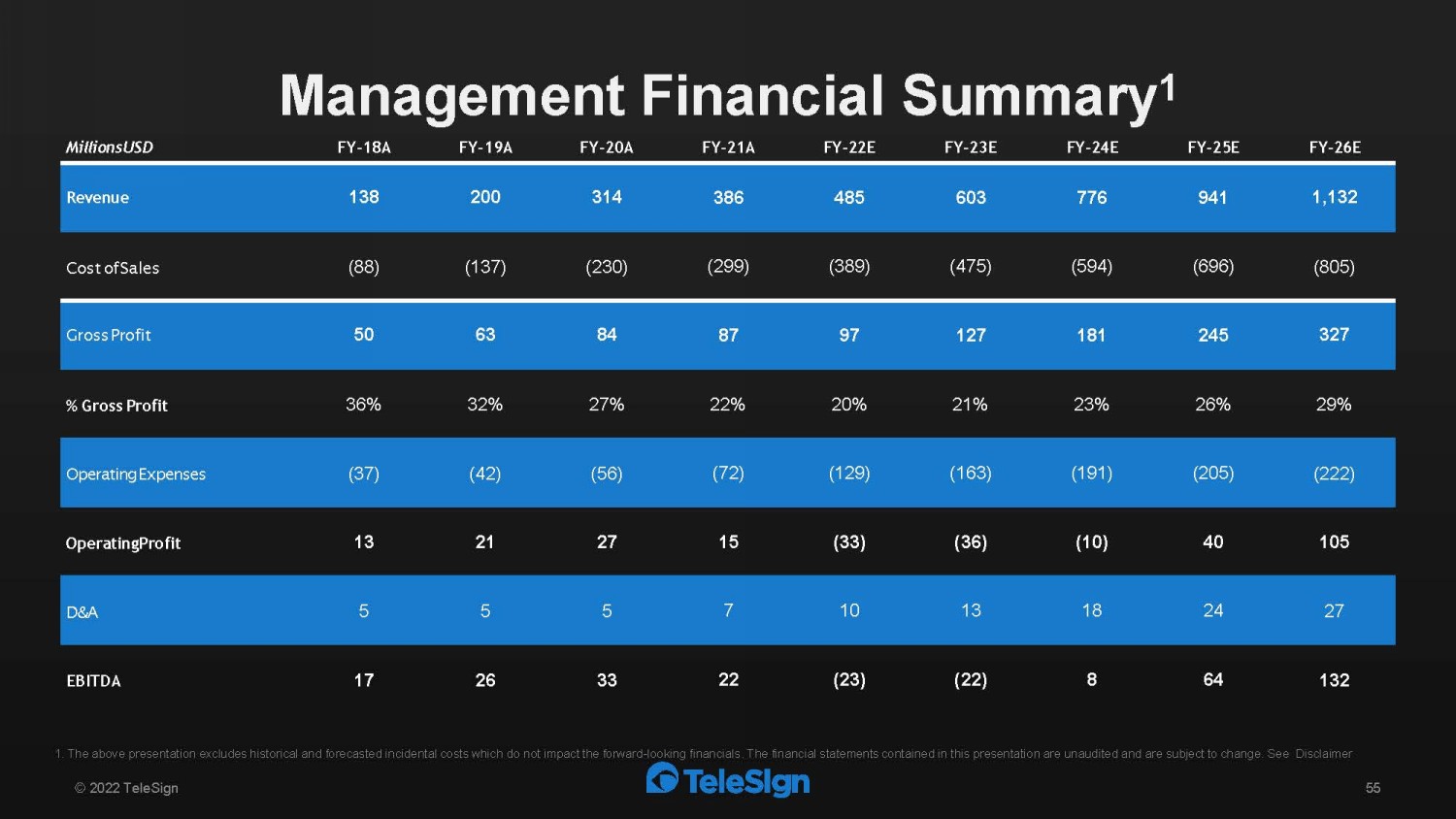

Management Financial Summary 1 Millions USD FY - 18A FY - 19A FY - 20A FY - 21 A FY - 22E FY - 23E FY - 24E FY - 25E FY - 26E Revenue 138 200 314 386 485 603 776 941 1,132 Cost of Sales (88) (137) (230) (299) (389) (475) (594) (696) (805) Gross Profit 50 63 84 87 97 127 181 245 327 % Gross Profit 36% 32% 27% 22% 20% 21% 23% 26% 29% Operating Expenses (37) (42) (56) (72) (129) (163) (191) (205) (222) Operating Profit 13 21 27 15 (33) (36) (10) 40 105 D&A 5 5 5 7 10 13 18 24 27 EBITDA 17 26 33 22 (23) (22) 8 64 132 1. The above presentation excludes historical and forecasted incidental costs which do not impact the forward - looking financials. The financial statements contained in this presentation are unaudited and are subject to change. See Disclaimer 55 © 202 2 TeleSign

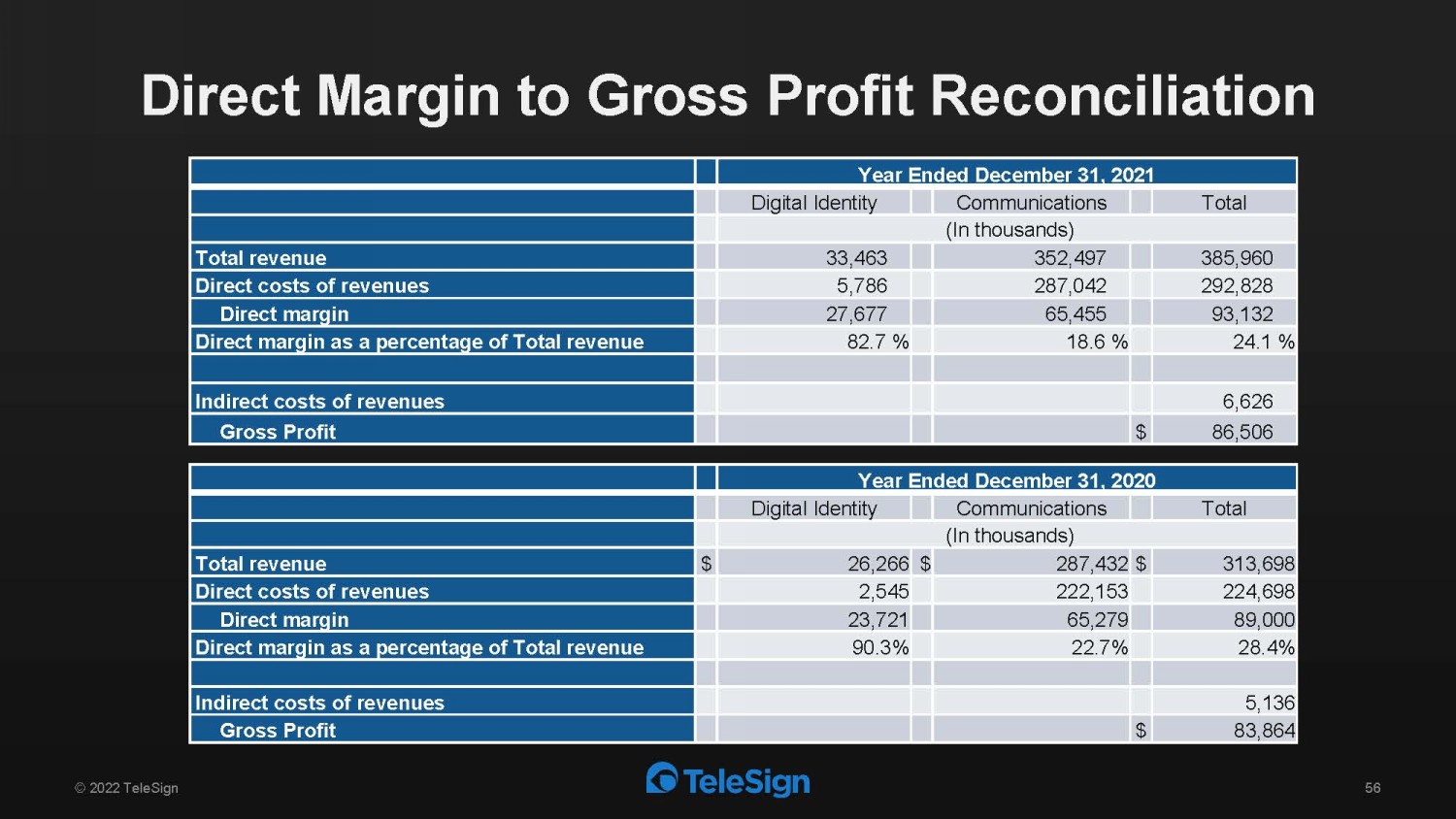

Direct Margin to Gross Profit Reconciliation 56 Year Ended December 31, 2021 Digital Identity Communications Total (In thousands) Total revenue 33,463 352,497 385,960 Direct costs of revenues 5,786 287,042 292,828 Direct margin 27,677 65,455 93,132 Direct margin as a percentage of Total revenue 82.7 % 18.6 % 24.1 % Indirect costs of revenues 6,626 Gross Profit $ 86,506 Year Ended December 31, 2020 Digital Identity Communications Total (In thousands) Total revenue $ 26,266 $ 287,432 $ 313,698 Direct costs of revenues 2,545 222,153 224,698 Direct margin 23,721 65,279 89,000 Direct margin as a percentage of Total revenue 90.3% 22.7% 28.4% Indirect costs of revenues 5,136 Gross Profit $ 83,864 © 2022 TeleSign

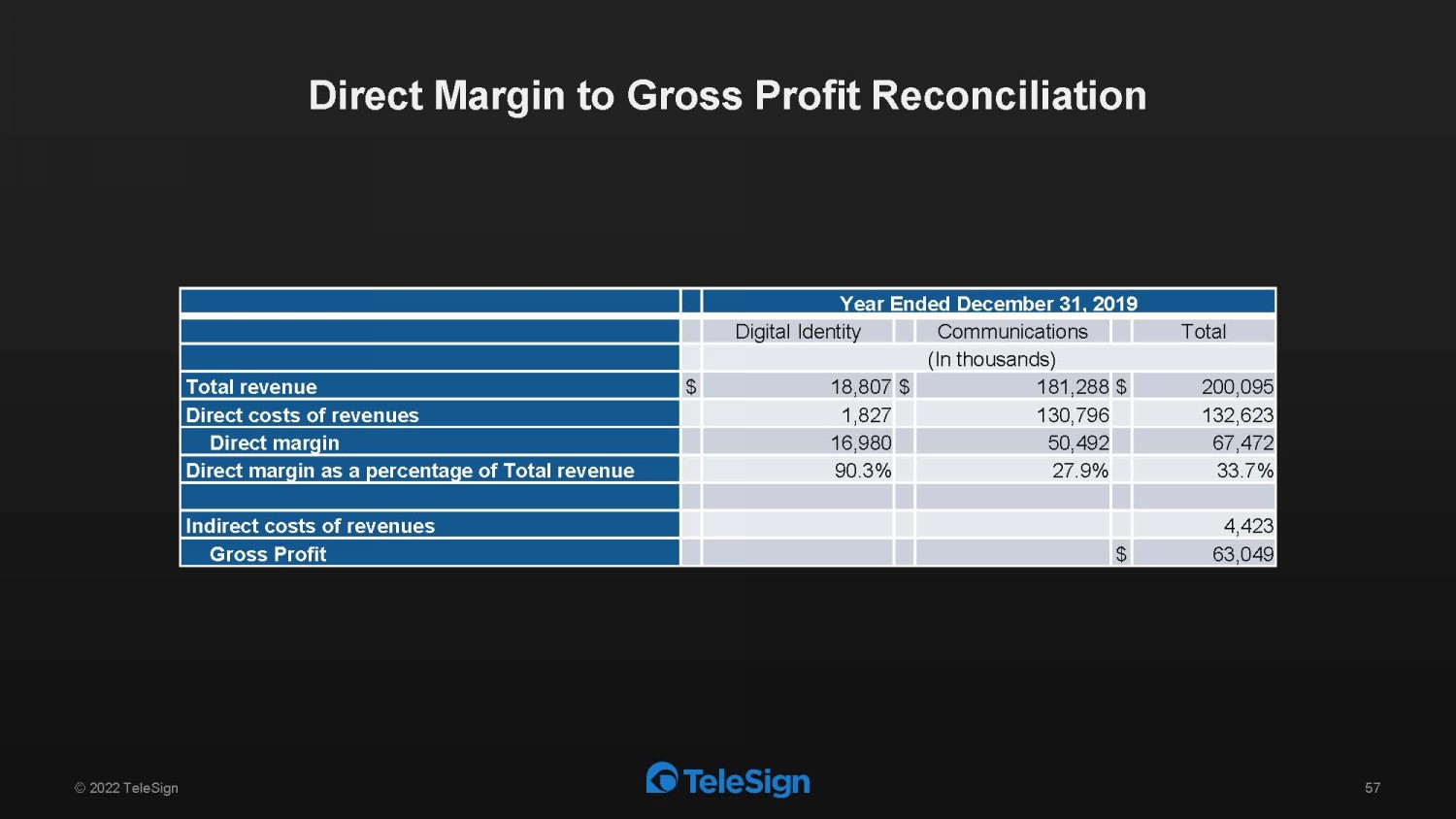

Direct Margin to Gross Profit Reconciliation 57 Year Ended December 31, 2019 Digital Identity Communications Total (In thousands) Total revenue $ 18,807 $ 181,288 $ 200,095 Direct costs of revenues 1,827 130,796 132,623 Direct margin 16,980 50,492 67,472 Direct margin as a percentage of Total revenue 90.3% 27.9% 33.7% Indirect costs of revenues 4,423 Gross Profit $ 63,049 © 2022 TeleSign

Thank You Q&A