☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under §240.14a-12 |

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

Proxy Statement 2024

Our Mission

To create a world where all relationships are healthy and equitable, through Kind Connections.

|

Letter to Stockholders |

April 19, 2024

| |

Dear Stockholders,

On behalf of the Board of Directors, our executive leadership team, and our employees around the world, I would like to thank you for your investment in Bumble Inc.

We are pleased to invite you to our 2024 Annual Meeting of Stockholders on Wednesday, June 5, 2024 at 12 p.m. Eastern Time. The meeting will be held virtually and we encourage you to join us at www.virtualshareholdermeeting.com/BMBL2024.

In my first months as CEO of Bumble Inc., I have had the chance to witness firsthand the impact that the Bumble Inc. team has had on building connections for people around the world. I’ve been moved by the countless stories I’ve heard and letters I’ve received from our customers who have found relationships of all kinds through our family of apps. It’s been inspiring to see the team’s unwavering pursuit of our mission to create a world where all relationships are healthy and equitable. We are known throughout the world for our great products and powerful, trusted brand. Every Bumble Inc. stockholder can feel proud that our work helps millions of people every day make meaningful connections.

I am truly honored to lead the Company through its next chapter of growth and look forward to our first Annual Meeting together.

Delivering for Stockholders

2023 marked an important year in Bumble Inc.’s history as we achieved record annual revenue exceeding $1 billion.

Throughout the year, we continued to expand our global reach and introduced new products, features, and safety solutions, which enabled us to deliver another year of solid growth. We grew total revenue by 16% to $1.05 billion and exercised strong financial discipline to improve our profit margins and generate free cash flow. We also returned capital to our stockholders under the Share Repurchase Program authorized by our Board of Directors.

Vision for the Future

We are deeply committed to delivering authentic and engaging new user experiences and I am excited by the tremendous opportunity ahead. 2024 marks 10 years since the founding of Bumble App and we are commemorating this exciting milestone by re-envisioning how we support women throughout connection experiences.

My vision is for Bumble Inc. to lead the online dating industry with even more positive experiences for users across the globe by marrying emerging technologies – such as generative AI – with the proprietary data and unique insights we have amassed over the last decade to deliver compelling experiences.

Our Next Phase of Growth

Our focus on innovation and delivering what our customers need to find love, partnership and friendship is the key to unlocking our next phase of growth. We are taking bold and decisive actions to position the company for long-term success and we are bringing together the right vision, priorities and leadership team to execute this mission.

In the year ahead, we are planning a significant update of Bumble App, which is designed to deliver a compelling modern and intuitive user experience. This update will provide a stronger platform upon which we can build new and exciting innovative features that advance our mission and better serve the needs of our customers.

We are also accelerating the pace of product innovation across our company by transforming our organization to operate with greater efficiency and agility. We plan to use cost savings from this initiative to help fund investments in innovation and our brand, as well as to improve the structural economics of our business.

Your continued support is important to us. To that end, we encourage you to vote by telephone or online, or by completing, signing, dating, and returning the enclosed proxy card or voting instruction form if you requested to receive printed proxy materials.

Thank you for your continued confidence in Bumble Inc.

|

||||

|

Sincerely,

Lidiane Jones Chief Executive Officer

|

|

2024 Proxy Statement |

Notice of Annual Meeting of Stockholders

| Date and Time

Wednesday, June 5, 2024 at 12:00 p.m. Eastern Time |

|

Virtual Location

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Bumble Inc., which will be held virtually at www.virtualshareholdermeeting.com/BMBL2024. You will need to have your 16-Digit Control Number included on your proxy card or the instructions that accompanied your proxy materials in order to join the Annual Meeting. |

|

Items of Business

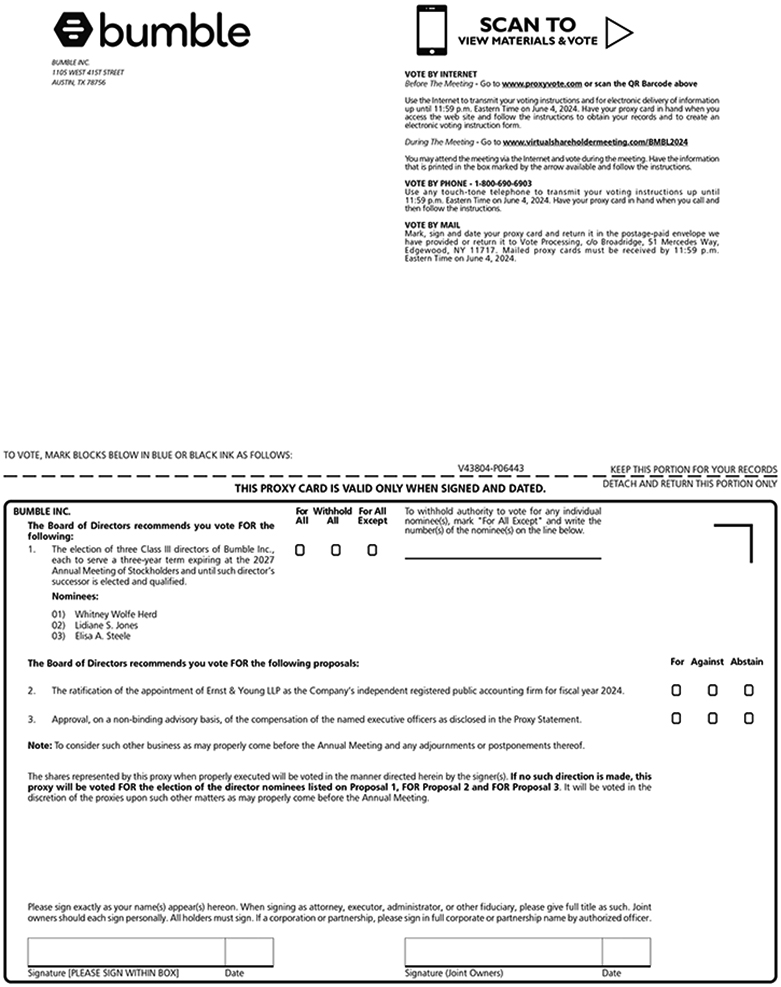

1. To elect the three Class III director nominees listed in this Proxy Statement.

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024.

3. To approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement.

4. To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

|

Record Date

You may vote at the Annual Meeting if you were a stockholder of Bumble Inc. Class A or Class B common stock as of the close of business on April 8, 2024. |

|

Voting

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible, so that the shares may be represented at the Annual Meeting. |

| How to Vote

VOTE IN ADVANCE OF THE MEETING | ||

|

By Internet

| |

| ● Go to the website www.proxyvote.com and follow the instructions, 24 hours a day, seven days a week.

● You will need the 16-digit number included on your Notice of Internet Availability of Proxy Materials or on your proxy card. | ||

|

By Telephone

| |

| ● From a touch-tone telephone, dial 1-800-690-6903 and follow the recorded instructions, 24 hours a day, seven days a week.

● You will need the 16-digit number included on your Notice of Internet Availability of Proxy Materials or on your proxy card in order to vote by telephone. | ||

|

By Mail

| |

| ● If you have not already received a proxy card, you may request a proxy card from us by following the instructions on your Notice of Internet Availability of Proxy Materials.

● Mark your selections on the proxy card.

● Date and sign your name exactly as it appears on your proxy card.

● Mail the proxy card in the enclosed postage-paid envelope provided to you. | ||

|

VOTE ONLINE DURING THE MEETING | ||

|

By Internet

| |

| ● See page 10 of this Proxy Statement for details on voting your shares online during the Annual Meeting at www.virtualshareholdermeeting.com/BMBL2024. | ||

|

|

2024 Proxy Statement |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

This notice of the Annual Meeting, Proxy Statement, and form of proxy are being distributed and made available on or about April 19, 2024.

By Order of the Board of Directors,

ELIZABETH MONTELEONE

Secretary

April 19, 2024

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on June 5, 2024: This Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2023 are available free of charge at proxyvote.com or our investor relations website at https://ir.bumble.com. A list of stockholders of record at the close of business on April 8, 2024 will be open for examination by any stockholder for any purpose germane to the Annual Meeting for a period of 10 days prior to the Annual Meeting at our principal executive offices at 1105 West 41st Street, Austin, TX 78756, and electronically during the Annual Meeting at www.virtualshareholdermeeting.com/BMBL2024.

YOUR VOTE IS IMPORTANT TO US. THANK YOU FOR VOTING.

|

|

Table of Contents

|

|

2024 Proxy Statement |

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

References in this Proxy Statement to (i) “we,” “us,” “our,” “ours,” “Bumble,” and the “Company” refer to Bumble Inc. and its consolidated subsidiaries and (ii) “stockholders” refers to holders of our Class A common stock and Class B common stock unless the context requires otherwise.

Voting Agenda/Voting Matters

| Proposal | Board Recommendation |

Page Reference | ||||

| To elect the three Class III director nominees listed in the Proxy Statement |

For All Nominees |

28 | ||||

| Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024. |

For | 39 | ||||

| Advisory (non-binding) vote to approve named executive officer compensation |

For | 43 | ||||

|

1 |

PROXY SUMMARY

Bumble’s mission is to create a world where all relationships are healthy and equitable, through Kind Connections.

We focus on building authenticity and safety in the online space, which is marked at times by isolation and toxicity. We also have extended our platform beyond online dating into healthy relationships in other areas of life, such as friendships.

Who We Are

Our company culture is built upon the advancement of women. As a mission-driven company that cares deeply about the world we live in, we continue to support organizations that help make a positive impact. Our commitment to women’s safety and empowerment extends beyond our products. We believe that everyone should feel safe on all corners of the internet, not just on our services. Because of this, we lobby governments to enact solutions that protect women and underserved communities online. We also engage in global conversations regarding the mitigation of online harms and share our lessons learned with industry peers, civil society and governments to help devise ways to curb online abuse and harassment. Our people, practices and policies reflect a deep understanding of, and commitment to, work-life balance, mental health and wellbeing, and family.

In 2023, we operated five apps, Bumble app, Bumble For Friends app, Badoo app, Fruitz app and Official app, where during 2023, on average, over 42 million users came on a monthly basis to discover new people and connect with each other in a safe, secure and empowering environment. Our apps monetize via a freemium model, where the use of the service is free

and a subset of the users pay for subscriptions or in-app purchases to access premium features. We are a leader in the online dating space, which has become increasingly popular over the last decade and has been cited as the most common way for new couples to meet in the United States.

Bumble is more than our apps—we are powering a movement. Our mission-first strategy ensures that our values guide our business decisions and our business performance enables us to drive impact. Our strategy is anchored by our powerful brand, product leadership, operational excellence and public policy and social impact initiatives.

|

2 |

2024 Proxy Statement |

|

PROXY SUMMARY

Board Directors and Nominees

|

|

Whitney Wolfe Herd Nominee for Re-election Founder and Executive Chair

Age: 34

Director Since: January 2020

Committee Membership: – None |

|

Ann Mather Lead Director

Age: 64

Director Since: March 2020

Committee Membership: – Nominating and Corporate |

|||||||||

|

Lidiane S. Jones Nominee for Re-election Chief Executive Officer

Age: 44

Director Since: January 2024

Committee Membership: – None |

|

R. Lynn Atchison

Age: 64

Director Since: October 2020

Committee Membership: – Audit and Risk (Chair) | |||||||

|

Matthew S. Bromberg

Age: 57

Director Since: July 2020

Committee Membership: – None |

|

Amy M. Griffin

Age: 48

Director Since: February 2021

Committee Membership: – Nominating and Corporate | |||||||

|

Sissie L. Hsiao

Age: 45

Director Since: October 2023 Committee Membership: – None |

|

Jonathan C. Korngold

Age: 50

Director Since: January 2020

Committee Membership: – Compensation | |||||||

|

Jennifer B. Morgan

Age: 53

Director Since: February 2021

Committee Membership: – Nominating and Corporate Governance |

|

Elisa A. Steele Nominee for Re-election

Age: 57

Director Since: July 2020

Committee Membership: – Audit and Risk – Compensation (Chair) | |||||||

|

Pamela A. Thomas-Graham

Age: 60

Director Since: August 2020

Committee Membership: – Audit and Risk – Compensation |

|||||||||

|

3 |

PROXY SUMMARY

Board and Leadership Highlights

BOARD DIVERSITY AND INDEPENDENCE

| BOARD PRACTICES

● Classified board, with yearly election of each of three classes of directors

● Annual Board and Committee evaluations

● Independent directors meet in executive sessions without management present

● Directors limited to no more than five public

● Strong corporate governance guidelines |

OVERSIGHT OF RISK, ETHICS & CORPORATE RESPONSIBILITY

● Full Board responsible for risk oversight,

● Code of Conduct applicable to all directors,

● Full Board oversight of corporate responsibility strategy and approval of Company’s long-term goals and commitments |

|

4 |

2024 Proxy Statement |

PROXY SUMMARY

NEOs and Compensation Highlights

EXECUTIVE COMPENSATION HIGHLIGHTS

Last year, we offered our stockholders their first opportunity to cast advisory votes on the approval of the compensation of our named executive officers, and we were pleased that approximately 94% of the votes cast on the advisory “Say on Pay” proposal at last year’s meeting were voted in favor of our executive compensation program. The following discussion summarizes the significant elements of our executive pay program for fiscal year 2023. For additional information on 2023 executive compensation, please refer to the Compensation Discussion and Analysis, beginning on page 45.

Compensation Elements

The compensation of our named executive officers includes three main components: (i) base salary; (ii) short-term incentives (“STI”), consisting of an annual cash bonus based on four performance metrics (revenue, adjusted EBITDA margin, total paying users and individual performance); and (iii) long-term equity incentives, consisting of stock options and restricted stock units (“RSUs”).

Compensation Philosophy, Policies and Practices

It is Bumble’s philosophy that compensation should be performance-focused, market-competitive, simple, transparent and aligned to our values. In setting executive compensation, the Compensation Committee considers the pay programs of a peer group of 18 similarly-sized companies in the consumer technology and software industries. Our pay policies and practices reflect Bumble’s compensation philosophy.

| What We Do | What We Don’t Do | |

| ● Link executive pay to company performance

● Balance short- and long-term incentives, cash and equity, and fixed and variable pay

● Compare executive compensation and company performance to relevant peer group companies

● Have thresholds and maximums in our short-term incentive plan

● Provide only limited perquisites

● All long-term awards are denominated and settled in equity

● Robust stockholder engagement

● An annual assessment by the Compensation Committee of potential risks in our executive compensation programs

● Maintain incentive compensation recoupment (i.e., clawback) policy compliant with the Sarbanes-Oxley Act of 2002

● Retention of an independent compensation consultant, whose performance is assessed by the Compensation Committee annually

● Appoint a Compensation Committee comprised solely of independent directors

|

● No single-trigger change-in-control provisions (except for a legacy provision for Ms. Wolfe Herd)

● No guaranteed annual increases or incentive payouts

● No repricing of underwater stock options without shareholder approval

● No tax gross-ups

● No dividends paid on unvested awards

● No aspect of the pay policies or practices pose a material adverse risk to the Company

● No compensation or incentives that encourage unnecessary or excessive risk taking

● Hedging or pledging of any of our securities by directors, executive officers or other employees is prohibited | |

|

5 |

|

PROXY SUMMARY

Environmental, Social and Governance Highlights

We are proud to be a company committed to responsible environmental, social and governance (“ESG”) practices. We believe our efforts to build sustainable business practices naturally aligns with our values, business strategy and risk management efforts, and serves our stakeholders, including our team members, users, business partners, investors and our communities throughout the world. For additional information on our ESG practices, please see page 20 below.

|

ENVIRONMENTAL INITIATIVE HIGHLIGHTS

| ● | We continue our work on our net zero pledge, which is focused on achieving a net zero carbon footprint for scope 1 and scope 2 emissions, as well as scope 3 emissions related to our cloud computing facilities and data centers, by 2025. |

| ● | We continue our engagements with carbon accounting experts to track our activities across the business and manage our emissions. |

| ● | We prioritize working with companies that rely on renewable energy sources like wind and solar to power their data centers. Many of our hosting and cloud services providers already employ a renewable energy footprint and have reported achievement of carbon neutrality. |

SOCIAL INITIATIVE HIGHLIGHTS

| ● | We work to deepen our employees’ approach to diversity, equity, inclusion and belonging, providing company-wide training on topics such as implicit bias. |

| ● | We use our programs and policies to ensure our Company values are reflected in our employees’ experiences at Bumble, supporting their physical, emotional, financial and social health. |

| ● | In 2023, we refreshed and strengthened our safety policies, published safety handbooks for the Bumble and Badoo apps, and launched Deception Detector™, which harnesses AI to help identify spam, scam or fake profiles before our community sees them. |

| ● | Since 2019, our public policy efforts in the United States have focused on developing and advocating for state-level legislation that would establish a deterrent to, and penalties for, sending unsolicited lewd photos. |

| ● | In 2023, we reiterated our focus on developing and innovating responsible AI through the Partnership on AI to help create a first-of-its-kind framework for the ethical and responsible development, creation, and sharing of synthetic media. |

GOVERNANCE HIGHLIGHTS

We have a strong commitment to ESG that is built into the structure of our governance processes. Our commitment to ESG starts at the top, beginning with our Board of Directors and management.

| ● | Our Nominating and Corporate Governance Committee is responsible for reviewing and advising on material environmental, social and governance topics and assisting the Board of Directors with respect to its oversight of the Company’s programs related to such matters. |

| ● | Our ESG steering committee of cross-functional senior leaders is focused on the development and execution of our ESG objectives, and oversight of our ESG disclosures. In 2023, this team used the findings of Bumble’s materiality assessment to further develop ESG strategy. |

| ● | As part of our ESG journey, we are working to increase disclosures on the Bumble investor relations website, align to the Sustainability Accounting Standard Board (“SASB”) framework and build a path to a public impact report. |

|

6 |

2024 Proxy Statement |

|

Questions and Answers about the Proxy Materials and the Annual Meeting |

|

|

Why am I being provided with these materials?

We are providing this proxy statement (the “Proxy Statement”) to you in connection with the solicitation by the Board of Directors (the “Board” or “Board of Directors”) of Bumble Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on June 5, 2024 (the “Annual Meeting”) and at any postponements or adjournments of the Annual Meeting. We either (1) mailed you a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) notifying each stockholder entitled to vote at the Annual Meeting how to vote and how to electronically access a copy of this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (referred to as the “Proxy Materials”) or (2) mailed you a paper copy of the Proxy Materials and a proxy card in paper format. If you have not received, but would like to receive, a paper copy of the Proxy Materials and a proxy card in paper format, you should follow the instructions for requesting such materials contained in the Notice of Internet Availability.

What am I voting on?

There are three proposals scheduled to be voted on at the Annual Meeting:

| ● | Proposal No. 1: Election of the three Class III director nominees listed in this Proxy Statement. |

| ● | Proposal No. 2: Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024. |

| ● | Proposal No. 3: Approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement. |

Who is entitled to vote?

Stockholders as of the close of business on April 8, 2024 (the “Record Date”) may vote at the Annual Meeting or any postponement or adjournment thereof. As of that date, there were 126,115,281 shares of our Class A common stock and 20 shares of our Class B common stock outstanding.

In general, holders of shares of our Class A common stock are entitled to one vote for each share of Class A common stock held as of the Record Date and holders of our Class B common stock are entitled, without regard to the number of shares of Class B common stock held by such holder, to one vote for each Common Unit (as defined below) of Buzz Holdings L.P., a Delaware limited partnership (“Bumble Holdings”), held as of the Record Date.

This includes shares:

| ● | Held directly in your name as “stockholder of record” (also referred to as “registered stockholder”); and |

| ● | Held for you in an account with a broker, bank or other nominee (shares held in “street name”). |

Notwithstanding the foregoing, unless they elect otherwise, each of certain affiliates of Whitney Wolfe Herd, our Founder and Executive Chair, and affiliates of Blackstone Inc. (“Blackstone” or “our Sponsor”), to whom we refer collectively as our “Principal Stockholders”, have outsized voting rights as follows. Each Principal Stockholder that holds Class A common stock is entitled to ten votes for each share of Class A common stock held as of the Record Date and each Principal Stockholder that holds Class B common stock is entitled, without regard to the number of shares of Class B common stock held by such Principal Stockholder, to a number of votes equal to 10 times the aggregate number of Common Units (as defined below) (including Common Units issued upon conversion of vested Incentive Units (as defined below)) of Bumble Holdings held by such Principal Stockholder as of the Record Date.

|

7 |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

“Class B Units” refers to the interests in Bumble Holdings called “Class B Units” that were outstanding prior to the Reclassification.

“Common Units” refers to the new class of units of Bumble Holdings created by the Reclassification and does not include Incentive Units.

“Incentive Units” refers to the new class of units of Bumble Holdings created by the reclassification of the Class B Units in the Reclassification. The Incentive Units are “profit interests” having economic characteristics similar to stock appreciation rights and having the right to share in any equity value of Bumble Holdings above specified participation thresholds. Vested Incentive Units may be converted to Common Units and be subsequently exchanged for shares of Class A common stock.

“IPO” refers to our initial public offering of Class A common stock, which was completed on February 16, 2021.

“Reclassification” refers to the reclassification of the limited partnership interests of Bumble Holdings in connection with the IPO pursuant to which certain outstanding Class A units were reclassified into a new class of limited partnership interests that we refer to as “Common Units” and certain outstanding Class B Units were reclassified into a new class of limited partnership interests that we refer to as “Incentive Units.”

What constitutes a quorum?

The presence in person or by proxy of stockholders holding a majority in voting power of the issued and outstanding shares of capital stock entitled to vote at the Annual Meeting constitutes a quorum for the Annual Meeting. Abstentions and “broker non-votes” are counted as present for purposes of determining a quorum.

How many votes are required to approve each proposal?

Under our Amended and Restated Bylaws (the “Bylaws”), directors are elected by a plurality vote, which means that the director nominees with the greatest number of votes cast in respect of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors, even if less than a majority, will be elected. There is no cumulative voting.

Under our Bylaws, the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024 (Proposal No. 2) requires the vote of the holders of a majority of the voting power of the shares of capital stock present in person or represented by proxy and entitled to vote on the subject matter at the Annual Meeting. It is important to note that the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024 (Proposal No. 2) is non-binding and advisory. While the ratification of Ernst & Young LLP as our independent registered public accounting firm is not required by our Bylaws or otherwise, if our stockholders fail to ratify the selection, we will consider it notice to the Board and the Audit and Risk Committee to consider the selection of a different firm.

The non-binding advisory approval of the compensation of our named executive officers (Proposal No. 3) requires the vote of the holders of a majority of the voting power of the shares of capital stock present in person or by proxy and entitled to vote on the subject matter at the Annual Meeting. Although, as an advisory vote, this proposal is not binding upon the Company or the Board, the Board will carefully consider the stockholder vote on this matter, along with all other expressions of stockholder views it receives on specific policies and desirable actions.

Ms. Wolfe Herd and Blackstone have informed the Company that they intend to vote in favor of the director nominees named in this Proxy Statement (Proposal No. 1), and in favor of Proposal Nos. 2 and 3. Because of their collective voting power, these nominees are assured election, and Proposal Nos. 2 and 3 are assured passage.

What is a “broker non-vote”?

A broker non-vote occurs when shares held through a broker are not voted with respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the authority to vote the shares at its discretion. Under current Nasdaq listing rules, Proposal No. 1 and

|

8 |

2024 Proxy Statement |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Proposal No. 3 are considered non-routine matters, and a broker will lack the authority to vote uninstructed shares at their discretion on these proposals. Only Proposal No. 2 is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on this proposal.

How are votes counted?

With respect to the election of directors (Proposal No. 1), you may vote “FOR” or “WITHHOLD” with respect to each nominee. Votes that are “WITHHELD” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director because directors are elected by plurality voting. Broker non-votes will have no effect on the outcome of Proposal No. 1.

With respect to the ratification of our independent registered public accounting firm (Proposal No. 2), you may vote “FOR,” “AGAINST” or “ABSTAIN.” Abstentions are counted as a vote “AGAINST” this proposal. There are no broker non-votes with respect to Proposal No. 2, as brokers are permitted to exercise discretion to vote uninstructed shares on this proposal.

With respect to the advisory (non-binding) vote to approve named executive officer compensation (Proposal No. 3), you may vote “FOR,” “AGAINST” or “ABSTAIN.” Abstentions are counted as a vote “AGAINST” this proposal. Broker non-votes will have no effect on the outcome of Proposal No. 3.

If you sign and submit your proxy card without providing voting instructions, your shares will be voted in accordance with the recommendation of the Board with respect to each of the Proposals.

How does the Board recommend that I vote?

Our Board recommends that you vote your shares:

| ● | “FOR” each of the Class III director nominees set forth in this Proxy Statement; |

| ● | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024; and |

| ● | “FOR” the advisory (non-binding) vote on the approval of our named executive officer compensation. |

Who will count the vote?

Our independent inspector of elections, Broadridge Financial Services, Inc. (“Broadridge”) will tabulate votes cast by proxy or electronically during the meeting. We will report the final voting results in a Form 8-K filed with the Securities and Exchange Commission (“SEC”) within four business days after the Annual Meeting.

How do I vote my shares without attending the Annual Meeting?

If you are a stockholder of record, you may vote by authorizing a proxy to vote on your behalf at the Annual Meeting. Specifically, you may authorize a proxy:

| ● | By Internet—You may submit your proxy by going to www.proxyvote.com and by following the instructions on how to complete an electronic proxy card. You will need the 16-digit number included on your Notice of Internet Availability or your proxy card in order to vote by Internet. |

| ● | By Telephone—You may submit your proxy by dialing 1-800-690-6903 and by following the recorded instructions. You will need the 16-digit number included on your Notice of Internet Availability or on your proxy card in order to vote by telephone. |

|

9 |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

| ● | By Mail—If you have received a proxy card, you may vote by mail by signing and dating the enclosed proxy card where indicated and by returning the card in the postage-paid envelope provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. |

Internet and telephone voting facilities will close at 11:59 p.m., Eastern Time, on June 4, 2024, for the voting of shares held by stockholders of record as of the Record Date. Proxy cards with respect to shares held of record must be received no later than June 4, 2024.

If you hold your shares in street name, you may submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your bank, broker or other nominee on how to submit voting instructions.

How do I attend and vote my shares at the Virtual Annual Meeting?

This year’s Annual Meeting will be a completely “virtual” meeting of stockholders. You may attend the Annual Meeting via the Internet. Any stockholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/BMBL2024. If you virtually attend the Annual Meeting you can vote your shares electronically, and submit your questions during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/BMBL2024. A summary of the information you need to attend the Annual Meeting and vote via the Internet is provided below:

| ● | instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/BMBL2024; |

| ● | assistance with questions regarding how to attend and participate via the Internet will be provided at www.virtualshareholdermeeting.com/BMBL2024 on the day of the Annual Meeting; |

| ● | stockholders may vote and submit questions while attending the Annual Meeting via the Internet; and |

| ● | you will need the 16-digit number that is included in your proxy card or the instructions that accompanied your proxy materials in order to enter the Annual Meeting and to vote during the Annual Meeting. |

Will I be able to participate in the online Annual Meeting on the same basis I would be able to participate in a live annual meeting?

The Annual Meeting will be held in a virtual-only meeting format and will be conducted via live audio webcast. The online meeting format for the Annual Meeting will facilitate full and equal participation by all our stockholders from any place in the world at little to no cost, while allowing us to support the health and well-being of our stockholders and employees.

We designed the format of the online Annual Meeting to ensure that our stockholders who attend our Annual Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting and to enhance stockholder access, participation and communication through online tools. We plan to take the following steps to provide for such an experience:

| ● | providing stockholders with the ability to submit appropriate questions up to 60 minutes in advance of the meeting; |

| ● | providing stockholders with the ability to submit appropriate questions real-time via the meeting website, limiting questions to one per stockholder unless time otherwise permits; and |

| ● | answering as many questions submitted in accordance with the meeting rules of conduct as appropriate in the time allotted for the meeting. |

How do I vote online during the Annual Meeting?

Whether you are a stockholder of record, or you hold your shares through a broker, bank or other nominee (also referred to as holding your shares in “street name”), you may vote your shares by attending the Annual Meeting

|

10 |

2024 Proxy Statement |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

online and following the on-screen voting instructions. You will need the 16-digit number that is included in your

proxy card or the instructions that accompanied your proxy materials in order to enter the Annual Meeting and to vote during the Annual Meeting.

What if during the check-in time or during the meeting I have technical difficulties or trouble accessing the virtual meeting website?

If you encounter any technical difficulties with the virtual meeting website on the meeting day, please call the technical support number that will be posted on the virtual meeting log in page. Technical support will be available starting at 11:45 a.m. Eastern Time on Wednesday, June 5 and until the meeting has finished.

What does it mean if I receive more than one Notice of Internet Availability or proxy card on or about the same time?

It generally means you hold shares registered in more than one account. To ensure that all your shares are voted, please vote once for each Notice of Internet Availability or proxy card you receive.

May I change my vote or revoke my proxy?

Yes. Whether you have voted by Internet, telephone or mail, if you are a stockholder of record, you may change your vote and revoke your proxy by:

| ● | voting by Internet or telephone at a later time than your previous vote and before the closing of those voting facilities at 11:59 p.m., Eastern Time, on June 4, 2024; |

| ● | submitting a properly signed proxy card, which has a later date than your previous vote, and that is received no later than June 4, 2024; |

| ● | attending the virtual Annual Meeting and voting in person; or |

| ● | delivering a written statement to that effect to the Secretary of the Company at the Company’s principal executive offices, provided such statement is received no later than June 4, 2024. |

If you hold shares in street name, please refer to information from your bank, broker or other nominee on how to revoke or submit new voting instructions.

Could other matters be decided at the Annual Meeting?

As of the date of this Proxy Statement, we do not know of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Annual Meeting for consideration and you are a stockholder of record and have submitted a proxy, the named proxies will have the discretion to vote on those matters for you.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by our directors, officers or employees of the Company (for no additional compensation) in person or by telephone, e-mail or facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

What is “householding” and how does it affect me?

SEC rules permit companies and intermediaries, such as brokers, to satisfy delivery requirements for proxy statements and notices with respect to two or more stockholders sharing the same address by delivering a single copy of the Notice of Internet Availability (or a single set of Proxy Materials, if you requested a printed copy) addressed to those stockholders. This process, which is commonly referred to as “householding”, reduces printing

|

11 |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

costs and postage fees and helps protect the environment as well. Some brokers household materials, delivering a single Notice of Internet Availability or, if applicable, a single set of Proxy Materials to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent.

If, at any time, you no longer wish to participate in householding and would prefer to receive a separate copy of the Notice of Internet Availability or, if applicable, a separate set of Proxy Materials, or if you are receiving duplicate copies of these materials and wish to have householding apply, please notify your broker. You may also call Broadridge at (866) 540-7095 or write to: Broadridge Financial Solutions, Inc., Householding Department, 51 Mercedes Way, Edgewood, New York 11717, and include your name, the name of your broker or other nominee, and your account number(s). You can also request prompt delivery of a copy of the Notice of Internet Availability or, if applicable, a set of Proxy Materials by contacting Bumble Investor Relations at ir@team.bumble.com.

What is the mailing address of the Company’s principal executive offices?

Our mailing address is 1105 West 41st Street, Austin, TX 78756.

|

12 |

2024 Proxy Statement |

|

The Board of Directors and Certain Governance Matters

|

Our Board of Directors directs and oversees the management of our business and affairs and has three standing committees: the Audit and Risk Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. In addition, from time to time, the Board of Directors, in its discretion, establishes special committees for specific purposes.

Director Independence and Independence Determinations

Under our Corporate Governance Guidelines and Nasdaq Stock Market (“Nasdaq”) rules, a director is not independent unless our Board of Directors affirmatively determines that he or she does not have a material relationship with us or any of our subsidiaries (either directly or as a partner, stockholder or officer of an organization that has a relationship with us or any of our subsidiaries).

Our Corporate Governance Guidelines define an “independent” director in accordance with Nasdaq Rule 5605(a)(2). In addition, members of the Audit and Risk Committee and the Compensation Committee are subject to the additional independence requirements of applicable SEC rules and Nasdaq listing standards. Our Corporate Governance Guidelines require our Board of Directors to review the independence of all directors at least annually, after taking into consideration the recommendation of the Nominating and Corporate Governance Committee.

In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the objective tests set forth in the Nasdaq independence definition, our Board of Directors will determine, considering all relevant facts and circumstances, whether such relationship is material.

Our Board of Directors has affirmatively determined that each of Ms. Mather, Ms. Atchison, Mr. Bromberg, Ms. Griffin, Ms. Hsiao, Mr. Korngold, Ms. Morgan, Ms. Steele and Ms. Thomas-Graham qualifies as an independent director under Nasdaq listing standards, including with respect to committee service. In addition, our Board of Directors has affirmatively determined that each of Ms. Atchison, Ms. Steele and Ms. Thomas-Graham is “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which pertains to service on our Audit and Risk Committee, and that each of Mr. Korngold, Ms. Steele and Ms. Thomas-Graham is “independent” for purposes of Section 10C(a)(3) of the Exchange Act, which pertains to service on our Compensation Committee. In making these determinations, our Board broadly considers all relevant facts and circumstances, including detailed written information provided by each director regarding each director’s business and personal activities as they may relate to the Company and our management. There are no family relationships among any of our directors or executive officers.

Executive Sessions

In accordance with our Corporate Governance Guidelines, our non-management members of the Board meet in executive session, without management present, at least twice a year (and at such other times as they deem appropriate). If the non-management directors include directors who have not been determined to be independent, the independent directors shall separately meet in a private session at least twice a year (and at such other times as they deem appropriate) that excludes management and directors who have not been determined to be independent. In addition, our independent directors that are not affiliated with our Sponsor meet from time to time in a private session that excludes management and any Sponsor-affiliated directors. The Lead Director, or in her absence a director designated by the non-management or independent directors, as applicable, will preside at the executive sessions. During 2023, the non-management directors held four executive sessions following each of four regularly scheduled Board meetings, and the independent directors that are not affiliated with our Sponsor held two separate executive sessions.

|

13 |

THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS

Board and Committee Self-Evaluations

In accordance with our Corporate Governance Guidelines, the Board, acting through the Nominating and Corporate Governance Committee, conducts a self-evaluation at least annually to determine whether it and its committees are functioning effectively. Such evaluation may include consideration of the individual performance of directors serving on our Board. The Nominating and Corporate Governance Committee also periodically considers the mix of skills and experience that each director brings to the Board to assess whether the Board has the necessary tools to perform its oversight function effectively.

Leadership Structure

In January 2024, as contemplated by our leadership succession plan, Lidiane S. Jones became our Chief Executive Officer and a director on our Board and Whitney Wolfe Herd, our Founder, transitioned from her role as Chief Executive Officer to Executive Chair of our Board. In connection with this transition, Ann Mather became our Lead Director after serving as our Chair since March 2020. We believe this leadership structure best serves the interest of Bumble and its stockholders, allowing our Board to continue to benefit from Ms. Wolfe Herd’s exceptional industry knowledge, passion, and history with our Company as the Founder, and Ms. Mather’s continued independent leadership and extensive financial, operational and corporate governance expertise, while leveraging Ms. Jones’s extensive leadership experience with technology companies to focus on business strategy and execution.

This leadership structure is consistent with our Corporate Governance Guidelines, which do not impose a policy on whether the roles of Chairperson and Chief Executive Officer should be separate and, if the roles are to be separate, whether the Chairperson should be selected from the independent directors.

Communications with the Board

As described in our Corporate Governance Guidelines, stockholders and other interested parties who wish to communicate with the chairperson of any of the Audit and Risk, Compensation or Nominating and Corporate Governance Committees, the Lead Director, or to the non-management or independent directors as a group, may do so by addressing such communications or concerns to the Company’s Chief Legal Officer at Bumble Inc., 1105 West 41st Street, Austin, Texas 78756, who will forward such communications to the appropriate party. Such communications may also be sent by email to clo@team.bumble.com. Communications may be made confidentially or anonymously.

Board Committees and Meetings

Each of the Audit and Risk Committee, the Compensation Committee and the Nominating and Corporate Governance Committee operates under a charter that has been approved by our Board of Directors. The composition and responsibilities of each committee are described below. Our Board of Directors may also establish from time to time any other committees that it deems necessary or desirable. Members serve on these committees until their resignation or until otherwise determined by our Board of Directors.

The following table summarizes the current membership of each of the Audit and Risk, Compensation and Nominating and Corporate Governance Committees.

|

|

Audit and Risk Committee |

Compensation Committee |

Nominating and Corporate Governance Committee | |||

|

R. Lynn Atchison

|

|

|

| |||

| Amy M. Griffin |

|

|

| |||

| Jonathan C. Korngold |

|

|

| |||

| Ann Mather |

|

|

| |||

| Jennifer B. Morgan |

| |||||

| Elisa A. Steele |

|

|

||||

| Pamela A. Thomas-Graham |

|

|

||||

| KEY |

|

Chairperson |

|

Member |

|

14 |

2024 Proxy Statement |

THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS

All directors are expected to make their best effort to attend all meetings of the Board and meetings of the committees of which they are members. During the year ended December 31, 2023, the Board held six meetings, the Audit and Risk Committee held five meetings, the Compensation Committee held four meetings and the Nominating and Corporate Governance Committee held five meetings. During fiscal year 2023, all of our directors attended at least 75% of the meetings of the Board and committees during the time in which he or she served as a member of the Board or such committee.

Audit and Risk Committee

Each of Mses. Atchison, Steele and Thomas-Graham has been determined to be “independent,” consistent with our Audit and Risk Committee charter, Corporate Governance Guidelines, SEC rules and Nasdaq listing standards applicable to boards of directors in general and audit committees in particular. Our Board of Directors has also determined that each of Mses. Atchison, Steele and Thomas-Graham is “financially literate” within the meaning of the listing standards of the Nasdaq. In addition, our Board of Directors has determined that Ms. Atchison qualifies as an audit committee financial expert as defined by applicable SEC regulations.

The duties and responsibilities of the Audit and Risk Committee are set forth in its charter, which may be found on the “Governance—Corporate Governance” section of our investor relations website at https://ir.bumble.com, and include assisting the Board of Directors in overseeing the following:

| ● | the quality and integrity of our financial statements, as well as oversight of our accounting and financial reporting processes and financial statement audits; |

| ● | the effectiveness of our control environment, including internal controls over financial reporting; |

| ● | our compliance with legal and regulatory requirements applicable to financial statements and accounting and financial reporting processes; |

| ● | the independent registered public accounting firm’s qualifications, performance and independence; |

| ● | the effectiveness of our risk management processes, particularly with respect to financial risk exposure; |

| ● | the performance of our internal audit function; and |

| ● | our technology security and data privacy programs. |

For additional information on the Audit and Risk Committee’s role and its oversight of the independent auditor during 2023, see “Report of the Audit Committee.”

Nominating and Corporate Governance Committee

Each of Mses. Mather, Griffin and Morgan has been determined to be “independent” as defined by our Corporate Governance Guidelines and Nasdaq listing standards.

The duties and responsibilities of the Nominating and Corporate Governance Committee are set forth in its charter, which may be found on the “Governance—Corporate Governance” section of our investor relations website at https://ir.bumble.com, and include the following:

| ● | identifying individuals qualified to become directors, consistent with the criteria approved by the Board of Directors, from time to time, and selecting, or recommending that our Board of Directors select, the director nominees for each annual meeting of stockholders or to fill vacancies or newly created directorships that may occur between such meetings; |

| ● | developing and recommending to the Board of Directors a set of corporate governance principles applicable to us and assisting the Board of Directors in complying with them; |

| ● | overseeing the evaluation of the Board of Directors; |

| ● | recommending members of the Board of Directors to serve on committees of the Board of Directors and evaluating the functions and performance of such committees; |

| ● | overseeing and approving the Chief Executive Officer continuity planning process; and |

| ● | otherwise taking a leadership role in shaping the corporate governance of the Company. |

|

15 |

THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS

With respect to director compensation, our Nominating and Corporate Governance Committee reviews and recommends to the full Board of Directors the form and amount of director compensation, as well as makes recommendations regarding director’s and officer’s indemnification and insurance matters.

Compensation Committee

Each of Ms. Steele, Mr. Korngold and Ms. Thomas-Graham has been determined to be “independent” as defined by our Corporate Governance Guidelines and Nasdaq listing standards applicable to boards of directors in general and compensation committees in particular.

The duties and responsibilities of the Compensation Committee are set forth in its charter, which may be found on the “Governance—Corporate Governance” section of our investor relations website at https://ir.bumble.com, and include the following:

| ● | overseeing our executive compensation policies and practices; |

| ● | reviewing and approving, or recommending to the Board of Directors, matters related to the compensation of our Chief Executive Officer and our other executive officers, including annual base salary, bonus and equity-based incentives and other benefits; |

| ● | overseeing administration and monitoring of our incentive and equity-based compensation plans; and |

| ● | broadly overseeing matters relating to the attraction, motivation, development and retention of qualified individuals. |

Our Compensation Committee makes the final determination regarding the annual compensation of our Chief Executive Officer and our other executive officers, taking into consideration, among other things, each individual’s performance and contributions to the Company. As part of the Compensation Committee’s compensation setting process, the Chief Executive Officer will make recommendations to the Compensation Committee regarding compensation for executive officers other than herself, and the Compensation Committee may also invite other Company employees from time to time to make presentations, provide financial or other background information or advice or to otherwise participate in meetings. Our Chief Executive Officer and other executive officers do not participate in the determination of their own respective compensation or the compensation of directors.

The Compensation Committee currently retains the independent compensation consulting firm Semler Brossy (“Semler”) to advise the Compensation Committee in its review of senior executive compensation. In July 2023, the Compensation Committee assessed the independence of Semler and determined that the firm’s work for the Committee did not raise any conflicts of interest.

Board Attendance at Annual Stockholders’ Meeting

All directors are expected to make their best effort to attend any meeting of stockholders. Of the ten directors serving at the time, eight members of our Board attended our 2023 Annual Meeting of Stockholders held virtually in 2023.

Compensation Committee Interlocks and Insider Participation

Other than Whitney Wolfe Herd, no member of our Board of Directors was at any time during the last completed fiscal year one of our officers or employees. During 2023, none of the members of our Compensation Committee has at any time been one of our executive officers or employees. None of our executive officers currently serves, or has served during the last completed fiscal year, as a member of the board of directors or compensation committee (or other committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our Board of Directors or Compensation Committee. We are party to certain transactions with affiliates of Blackstone described in “Transactions with Related Persons.”

|

16 |

2024 Proxy Statement |

THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS

Corporate Governance Guidelines

Our commitment to good corporate governance is reflected in our Corporate Governance Guidelines, which describe our Board of Directors’ views and policies on a wide range of governance topics. These Corporate Governance Guidelines are reviewed from time to time by our Nominating and Corporate Governance Committee and, to the extent deemed appropriate in light of emerging practices, revised accordingly, upon recommendation to and approval by our Board of Directors.

Our Corporate Governance Guidelines and other corporate governance information are available on the “Governance—Corporate Governance” section of our investor relations website at https://ir.bumble.com.

Code of Conduct and Supplemental Code of Ethics for Senior Financial Officers

We have adopted a Code of Conduct, which sets forth the standards for ethical conduct, that applies to all of our directors, officers and employees. The Code of Conduct, which is available on our website at https://ir.bumble.com and on our intranet sites, sets forth our policies and expectations on a number of topics, including compliance with laws, conflicts of interest, use of our assets, business conduct and fair dealing, as well as our commitment to providing a safe, inclusive and supportive workplace environment free from harassment. As part of our compliance and ethics program, new employees receive training regarding the Code of Conduct, and current employees receive supplemental training on an annual basis. The Code of Conduct provides a number of avenues to report openly, or anonymously (in the case of employees), any accounting allegation, compliance allegation (including non-compliance with applicable legal and regulatory requirements or the Code of Conduct), or retaliatory act, including through the telephone hotlines or website managed by EthicsPoint, our outside independent service provider, or by email to our Chief Legal Officer or our Audit and Risk Committee, in each case at the telephone numbers and email addresses listed in the Code of Conduct.

We have also adopted a Supplemental Code of Ethics for Senior Financial Officers that applies to our Chief Executive Officer and all senior financial officers, including the Chief Financial Officer and principal accounting officer. The Supplemental Code of Ethics, which is available on our website at https://ir.bumble.com and on our intranet sites, addresses matters specific to those senior financial positions in the Company, including responsibility for the disclosures made in our filings with the SEC, reporting obligations with respect to certain matters and a general obligation to promote honest and ethical conduct within the Company. The senior financial officers are also required to comply with the Code of Conduct.

Each of our Code of Conduct and our Supplemental Code of Ethics for Senior Financial Officers qualifies as a “code of ethics,” as defined in Item 406(b) of Regulation S-K. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of our code of ethics on our website. The information contained on, or accessible from, our website is not part of this Proxy Statement. Our Code of Conduct is available free of charge upon request to our Chief Legal Officer at 1105 West 41st Street, Austin, TX 78756.

Oversight of Risk Management

The Board has broad oversight of risk management related to us and our business while delegating certain specific risk oversight responsibilities to its committees. The Board oversees our risk management activities through a combination of processes, including direct engagement with management.

The Audit and Risk Committee represents the Board by periodically reviewing our accounting, reporting and financial practices, including the integrity of our financial statements, the surveillance of administrative and financial controls, the review of related person transactions, our compliance with legal and regulatory requirements and the effectiveness of our risk management processes, particularly with respect to financial and operational risk exposures. Through its regular meetings with management, including the finance, legal and internal audit functions, the Audit and Risk Committee reviews and discusses all significant areas of our business and summarizes for the Board all areas of risk and the appropriate mitigating factors.

|

17 |

THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS

The Compensation Committee monitors risks associated with the design and administration of our compensation programs, including our incentive-based compensation programs, to promote an environment that does not encourage unnecessary and excessive risk-taking by our employees, including our senior executives. In view of this oversight and based on an assessment conducted by management working with the Compensation Committee’s independent consultant, we do not believe that our employee compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company. See “Compensation Discussion and Analysis—Risk and Executive Compensation” for a complete description.

The Nominating and Corporate Governance Committee assists the Board by overseeing and evaluating programs and risks associated with Board organization, membership and structure, corporate governance and overall Board effectiveness. Our Nominating and Corporate Governance Committee is also responsible for reviewing and advising on material ESG topics and assist the Board with respect to its oversight of our programs related to such matters.

In addition, our Board receives periodic detailed operating performance reviews from management. Our Chief Information Security Officer provides quarterly updates to the Audit and Risk Committee, as well as an annual report to the Board, regarding a range of cybersecurity activities while maintaining the confidentiality, integrity and availability of information, including user information under our custody. Our information security management system takes a risk-based approach to cybersecurity and consists of various programs, including secure software development, operational security, vulnerability management and security education. Our threat detection capabilities include automated 24/7 detection and alerting with automated response protocols designed to support rapid analysis and enrichment for security analysts who are guided by a formally documented Incident Response Plan in the event of a breach. Our Head of Privacy and Data Protection Officer provide periodic reports to the Audit and Risk Committee regarding Bumble’s data privacy and compliance activities (required by applicable laws, including the General Data Protection Regulation (“GDPR”) and any U.S. state-specific privacy laws), which are designed to protect and safeguard our users’ data through comprehensive, documented privacy impact assessment procedures, as well as through dedicated privacy incident monitoring and reporting. For further information related to our cybersecurity strategy, risk management and governance, please refer to “Item 1C—Cybersecurity” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

The Board also receives periodic updates from management on environmental, social, and governance-related activities to review and guide Bumble’s larger ESG strategy. In addition, Board members participate in “Lunch & Learn” sessions from time to time, where they have an opportunity to do a deeper analysis of select ESG topics.

Oversight of Compliance

The Chief Legal Officer oversees our compliance programs. The Chief Legal Officer’s duties include: regularly updating the Audit and Risk Committee on the effectiveness of our compliance programs, providing periodic reports to the Board, and working closely with our various compliance functions to promote coordination and sharing of best practices across these functions.

Disclosure Committee

We have established a Disclosure Committee to assist in fulfilling our obligations to maintain disclosure controls and procedures and to coordinate and oversee the process of preparing our periodic securities filings with the SEC. This committee is composed of members of management and is chaired by our Chief Financial Officer.

Securities Trading Policy

The Company’s Securities Trading Policy requires executive officers and directors to consult the Company’s Chief Legal Officer prior to engaging in transactions involving the Company’s securities. See “Compensation Discussion and Analysis—Risk and Executive Compensation—Securities Trading Policy and Hedging” for a complete description.

|

18 |

2024 Proxy Statement |

THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS

Controlled Company Exception

In connection with our IPO, our Principal Stockholders entered into a stockholders agreement, described in “Transactions with Related Persons,” and beneficially own approximately 89.0% of the combined voting power of our Class A and Class B common stock as of April 8, 2024, the Record Date. As a result, we are a “controlled company” within the meaning of the Nasdaq corporate governance standards. Under these corporate governance standards, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance standards, including the requirements (1) that a majority of our Board of Directors consist of independent directors, (2) that our Board of Directors have a compensation committee that consists entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities and (3) that our director nominations be made, or recommended to our full Board of Directors, by our independent directors or by a nominations committee that consists entirely of independent directors and that we adopt a written charter or Board resolution addressing the nominations process. Although we are not relying on the exemptions from these corporate governance requirements, if we do rely on such exemptions in the future, our stockholders will not have the same protections afforded to stockholders of companies that are subject to these corporate governance requirements. In the event that we cease to be a “controlled company” and our shares continue to be listed on Nasdaq, we will be required to comply with these provisions within the applicable transition periods.

|

19 |

|

Environmental, Social and Governance Matters

|

We are committed to responsible environmental, social and governance (“ESG”) practices. We believe our efforts to build sustainable business practices naturally align with our values, business strategy and risk management efforts and that these efforts serve our stakeholders, including our team members, users, suppliers, business partners, investors and our communities throughout the world.

Community Impact

Bumble is a community-driven company, working to make the internet a safer and more empowering place for women and members of underrepresented communities. We partner with nonprofits to amplify their work, pursue environmental sustainability practices that reflect our values and proactively engage in advocacy efforts to make the internet safer.

Public policy and advocacy: Our public policy work, advocacy and government engagements are guided by our Company values—most critically, kindness. At Bumble, we are committed to advocating for greater internet accountability, combating toxicity and loneliness and passing laws that help make our society safer—both online and in real life.

Since 2019, we have worked in the United States, first in Texas and more recently in Virginia and California, to develop and advocate for state-level legislation that would establish a deterrent to, and penalties for, sending unsolicited lewd photos. In 2021, we launched a campaign in the United Kingdom calling on the government to criminalize cyberflashing, which was realized in the Online Safety Act that passed in October 2023. In 2022, we furthered our efforts to criminalize cyberflashing in the European Union. Our work focused on capturing a ban on cyberflashing and the non-consensual sharing of deepfake pornographic content or nudes in the first EU-wide Directive to Combat Violence Against Women and Domestic Violence, which was agreed upon by EU institutions in early 2024.

We have worked more broadly to highlight the abuse and harassment women face online, particularly through intimate image abuse and tech-facilitated violence. Bumble is a member of the Advisory Group to the Global Partnership for Action on Gender-Based Online Harassment and Abuse, which is a multi-stakeholder partnership that aims to better prioritize, understand, prevent and address the growing scourge of technology-facilitated gender-based violence. Our policy advocacy has contributed to global discussions around the future of the internet and regulatory considerations around online harms.

We also focus on developing and innovating responsible AI that will help our community create healthy and equitable relationships. In 2023, Bumble partnered with Partnership on AI, a nonprofit coalition committed to responsible use of AI technologies, to help create a first-of-its-kind framework for the ethical and responsible development, creation and sharing of synthetic media – also known as AI-generated media. This framework is a set of guiding recommendations for those creating, sharing, and distributing AI-generated media. We’ve also developed company-wide Principles of Responsible AI to ensure that our AI strategy is guided by our values and central mission to create healthy and equitable relationships. We have an AI committee consisting of cross-functional, high-level leaders who work on our commitment to advance the responsible use of AI whilst keeping pace with evolving tech.

Environmental sustainability: In 2021, we announced a pledge to establish a net zero carbon footprint by 2025, focused on our scope 1 and scope 2 emissions, as well as scope 3 emissions related to our cloud computing facilities and data centers. In 2022, we began working with a carbon accounting vendor to support our carbon accounting activities and to help us track and manage our emissions.

In recent years, we have prioritized working with providers who rely on renewable energy sources like wind and solar to power their data centers. Many of our hosting and cloud services providers already employ a renewable energy footprint and have reported achievement of carbon neutrality. Carbon neutrality is a key selection criterion

|

20 |

2024 Proxy Statement |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE MATTERS

as we evaluate any additional hosting and cloud solutions for our data centers. We are continually looking for ways to improve our practices and make them more sustainable.

Impact Giving: In 2023, we continued to invest philanthropic dollars in organizations that align with our mission of empowering women and underrepresented communities with the goal of creating a world where all relationships are healthy and equitable. We also stepped up in response to events around the globe, including providing philanthropic support to affiliates of the International Federation of Red Cross and Red Crescent Societies, which provide humanitarian aid to those impacted by the conflict in the Middle East, and continuing to support reproductive rights in the United States.

As a mission-driven company that cares deeply about the world we live in, we continue to invest in, and provide resources to, organizations that help make a positive impact. We deepened our partnership with the National Domestic Violence Hotline (“The Hotline”), completing the first phase of a groundbreaking volunteer pilot program for Bumble employees to respond to non-crisis inbounds to The Hotline’s online chat system. During Domestic Violence Awareness Month, we sponsored and members of our team attended the National Conference on Domestic Violence, supporting the work of survivor advocates across the country. For International Women’s Day, we partnered with Vital Voices Global Partnership to highlight the work of eight emerging women leaders in the social impact space, providing funding for their missions and sponsoring a training program to scale the impact of their work.

We relaunched our innovative in-app Moves Making Impact program to support causes deeply aligned with our mission. The causes this program supports include: Healthy and Safer Relationships, supporting The Hotline’s work helping people experiencing abuse and shifting power back to survivors; Equity for Women, through Vital Voices’ entrepreneurship program, which supports women-led organizations solving the world’s greatest challenges; and Save the Bees, a project of the National Geographic Society helping women and underrepresented scientists conserve and protect important pollinators. We also continue to support organizations that build equity in our communities. Our 2023 Pride campaign, focused on allyship, increased our support of LGBTQ+ organizations both in the United States and around the globe. We continue to instill our mission into opportunities for our employees, users and the community at large, to make all relationships healthy and equitable.

User Safety

Bumble app was created to address a gap in dating spaces and prioritize women. We take a safety-by-design approach and view safety as a collective responsibility. To ensure a positive and empowering experience for our users, Bumble has pioneered industry-leading systems, processes and policies. We place a premium on prevention, offer trauma-informed support to users and continue to evolve our tools as we learn more about the needs of our community.

Below are a few examples of the steps we are taking to strengthen the safety of our community:

Safety & wellbeing center: We have in-app resource hubs on Bumble and Badoo that allow our users to stay informed about safety features, find tools and resources to educate them on how to date safely and confidently, as well as have a direct line to report any concerns to our safety team. We also connect users to resources from external experts, including suicide crisis lines, intimate partner violence and sexual assault hotlines, and LGBTQ+ support lines. In 2023, we continued to add localized resources for key markets, and new content hubs for digital consent and romance scams.

In 2021, we introduced our machine learning technology to proactively detect harmful, text-based content in over 100 languages across our apps. This technology enables us to proactively detect and remove a majority of users who violate our Community Guidelines before users report them. We also developed our proprietary tool, Private Detector, that automatically detects, blurs and warns our users when they may be in receipt of a lewd photo. We then empower users to decide if they would like to view the photo, or report the sender to us for sexual harassment. We work to make this reporting process simple, so that we can keep our entire community safer. During 2022, Bumble’s Data Science team wrote a white paper explaining the technology behind this tool, and, in order to foster a safer web experience for all, we made an open-sourced version of this technology available on Github.

|

21 |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE MATTERS

Industry-first safety initiative for assault survivors: We continue our work with CHAYN, a survivor-led nonprofit based in the United Kingdom, on an industry-first initiative that provides complimentary online trauma support to users who report sexual assault or relationship abuse. The program, Bloom, was piloted on Bumble in 2021 and expanded to Badoo in 2022 and Fruitz in 2023.

Dedicated, secure reporting pathways: In 2023, Bumble expanded our partnership with Kodex, a secure information-sharing portal Bumble uses to communicate with law enforcement agencies worldwide. Together, we introduced a dedicated referral pathway for those at non-government and charitable organizations who work directly with victim-survivors to report abusive or dangerous users to our Member Safety team. Through this process, they’ll receive a warning from Bumble and, when appropriate, can even be removed from the app and banned from creating new accounts, creating a safer environment for our users and community.

AI innovation: In 2023, we launched Deception Detector™ as part of our ongoing commitment to our community to ensure that connections made on our apps are genuine and reflect our mission to encourage healthy and equitable relationships. Deception Detector™ harnesses AI to help identify spam, scam or fake profiles before our community sees them. The model introduces a fast and reliable machine learning-based approach to assess the authenticity of profiles on our platform. We use these innovative technologies in combination with dedicated human support to prioritize maintaining a safe and empowering community.