US SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 1-A

REGULATION A OFFERING CIRCULAR UNDER THE SECURITIES ACT OF 1933

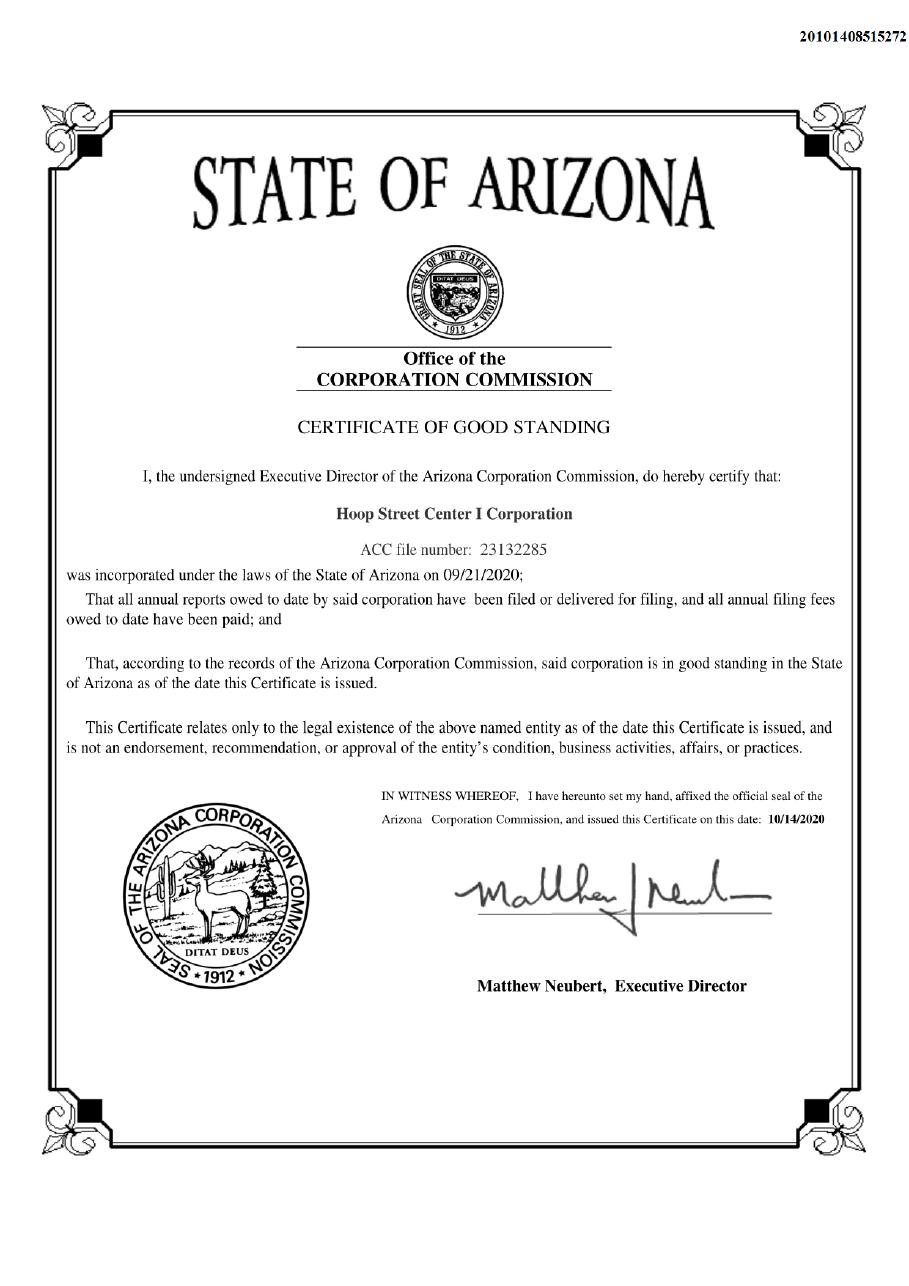

Hoop Street Center I Corporation

(Exact name of issuer as specified in its charter)

20715 S 184TH PLACE

QUEEN CREEK, AZ 85142

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

85-3101177

IRS Employer Identification Number

This Preliminary Offering Circular shall only be qualified upon order of Commission unless a subsequent amendment is filed indicating the intention to become qualified by operation of terms of Regulation A.

This Preliminary Offering Circular is following the offering circular format described in Part II of Form 1-A.

PART II - PRELIMINARY OFFERING CIRCULAR – FORM 1-A: TIER 2

Dated: ___, 2020

PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

HOOP STREET CENTER I CORPORATION

20715 S 184TH PLACE

QUEEN CREEK, AZ 85142

(801) 615-0880

www.hoopstreet.com

1,000,000 Shares of Preferred Stock at $50.00 per Share

Minimum Investment: 1 Share ($50.00)

Maximum Offering: $50,000,000.00

See The Offering – Page 10 and Securities Being Offered – Page 46 For Further Details

None of the Securities Offered Are Bing Sold By Present Security Holders

This Offering Will Commence Upon Qualification of this Offering by

the Security and Exchange Commission and Will Terminate 180 days from

the date of qualification by the Security And Exchange Commission,

Unless Extended or Terminated Earlier By The Issuer.

| 2 |

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD, NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PLEASE REVIEW ALL RISK FACTORS ON PAGES PAGE 11 THROUGH PAGE 26 BEFORE MAKING AN INVESTMENT IN THIS COMPANY. AN INVESTMENT IN THIS COMPANY SHOULD ONLY BE MADE IF YOU ARE CAPABLE OF EVALUATING THE RISKS AND MERITS OF THIS INVESTMENT AND IF YOU HAVE SUFFICIENT RESOURCES TO BEAR THE ENTIRE LOSS OF YOUR INVESTMENT, SHOULD THAT OCCUR. THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Because these securities are being offered on a “best efforts” basis, the following disclosures are hereby made:

| Price to Public | Proceeds to Company (1) | Proceeds to Other Persons (2) | ||||||||

| Per Share | $ | 50.00 | $ | 50.00 | None | |||||

| Minimum Investment | $ | 50.00 | $ | 50.00 | None | |||||

| Maximum Offering | $ | 50,000,000 | $ | 50,000,000 | None | |||||

| (1) | Does not reflect payment of expenses of this offering, which are estimated to not exceed $150,000.00 and which include, among other things, legal fees, accounting costs, reproduction expenses, due diligence, marketing, consulting, administrative services other costs of blue sky compliance, and actual out-of-pocket expenses incurred by the Company selling the Shares. This amount represents the proceeds of the offering to the Company, which will be used as set out in “USE OF PROCEEDS TO ISSUER.” |

| (2) | There are no finder’s fees or other fees being paid to third parties from the proceeds other than those disclosed below. See “PLAN OF DISTRIBUTION.” |

| 3 |

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS, BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLD, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

This offering (the “Offering”) consists of Preferred Stock (the “Shares” or individually, each a “Share”) that is being offered on a “best-effort” basis, which means that there is no guarantee that any minimum amount will be sold. The Shares are being offered and sold by Hoop Street Center I Corporation, an Arizona Corporation (“Hoop Street Center I Corporation” or the “Company”). There are 1,000,000 Shares being offered at a price of $50.00 per Share with a minimum purchase of one (1) Share per investor. The Shares are being offered on a best effort basis to an unlimited number of accredited investors and an unlimited number of non-accredited investors only by the Company through its website. The maximum aggregate amount of the Shares offered is $50,000,000.00 (the “Maximum Offering”). There is no minimum number of Shares that needs to be sold in order for funds to be used by the Company in accordance with the procedure set out in “USE OF PROCEEDS TO ISSUER.”

The Shares are being offered pursuant to Regulation A to Section 3(b) of the Securities Act of 1933, as amended, for Tier 2 offering. The Shares will only be issued to purchasers who satisfy the requirements set forth in Regulation A. The offering is expected to expire on the first of (i) all of the Shares offered are sold; or (ii) the close of business 180 days from the date of qualification by the Commission, unless sooner terminated or extended by the Company’s CEO. Pending each issuance of Share, the Company shall conduct a background check for a review of Know Your Customer (KYC) procedures and Anti-Money Laundering (AML) laws to comply with the requirements set forth in Regulation A. When a purchaser does not meet such requirements, funds will be promptly refunded without interest, for sales that are not realized. All funds collected through the website (https://www.hoopstreet.com) (the “Website”) shall be held only in a non-interest bearing bank account. Upon conducting a successful background check for the purchaser, funds will be immediately available for use in the operation of the Company’s business in a manner consistent with the “USE OF PROCEEDS TO ISSUER” in this Offering Circular.

| 4 |

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS OR AFFILIATES AS INVESTMENT, ILLEGAL, FINANCIAL OR TAX ADVICE.

BEFORE INVESTING IN THIS OFFERING, PLEASE REVIEW ALL DOCUMENTS CAREFULLY, ASK ANY QUESTIONS OF THE COMPANY’S MANAGEMENT THAT YOU WOULD LIKE ANSWERED AND CONSULT YOUR OWN COUNSEL, ACCOUNTANT, AND OTHER PROFESSIONAL ADVISORS AS TO LEGAL, TAX, AND OTHER RELATED MATTERS CONCERNING THIS INVESTMENT.

NASAA UNIFORM LEGEND

FOR RESIDENTS OF ALL STATES: THE PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE NOT BEEN REGISTERED UNDER ANY STATE SECURITIES LAWS (COMMONLY CALLED “BLUE SKY” LAWS).

IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| 5 |

NOTICE TO FOREIGN INVESTORS

IF THE PURCHASER LIVES OUTSIDE THE UNITED STATES, IT IS THE PURCHASER’S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE THE UNITED STATES IN CONNECTION WITH ANY PURCHASE OF THE SECURITIES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER REQUIRED LEGAL OR OTHER FORMALITIES., THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF THE SECURITIES BY ANY FOREIGN PURCHASER.

Forward-Looking Statement Disclosure

This Form 1-A, Offering Circular, and any documents incorporated by reference herein or therein contain forward-looking statements and are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this Form 1-A, Offering Circular, and any documents incorporated by reference are forward-looking statements. Forward-looking statements give the Company’s current reasonable expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance, and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. The forward-looking statements contained in this Form 1-A, Offering Circular, and any documents incorporated by reference herein or therein are based on reasonable assumptions the Company has made in light of its industry experience, perceptions of historical trends, current conditions, expected future developments, and other factors it believes are appropriate under the circumstances. As you read and consider this Form 1-A, Offering Circular, and any documents incorporated by reference, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (many of which are beyond the Company’s control), and assumptions. Although the Company believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect its actual operating and financial performance and cause its performance to differ materially from the performance anticipated in the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect or change, the Company’s actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements. Any forward-looking statement made by the Company in this Form 1-A, Offering Circular or any documents incorporated by reference herein speaks only as of the date of this Form 1-A, Offering Circular or any documents incorporated by reference herein. Factors or events that could cause our actual operating and financial performance to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as may be required by law.

| 6 |

About This Form 1-A and Offering Circular

In making an investment decision, you should rely only on the information contained in this Form 1-A and Offering Circular. The Company has not authorized anyone to provide you with information different from that contained in this Form 1-A and Offering Circular. We are offering to sell and seeking offers to buy the Shares only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this Form 1-A and Offering Circular is accurate only as of the date of this Form 1-A and Offering Circular, regardless of the time of delivery of this Form 1-A and Offering Circular. Our business, financial condition, results of operations, and prospects may have changed since that date. Statements contained herein as to the content of any agreements or other documents are summaries and, therefore, are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other documents. The Company will provide the opportunity to ask questions of and receive answers from the Company’s management concerning terms and conditions of the Offering, the Company, or any other relevant matters and any additional reasonable information to any prospective investor prior to the consummation of the sale of the Shares. This Form 1-A and Offering Circular do not purport to contain all of the information that may be required to evaluate the Offering, and any recipient hereof should conduct its own independent analysis. The statements of the Company contained herein are based on information believed to be reliable. No warranty can be made as to the accuracy of such information or that circumstances have not changed since the date of this Form 1-A and Offering Circular. The Company does not expect to update or otherwise revise this Form 1-A, Offering Circular, or other materials supplied herewith. The delivery of this Form 1-A and Offering Circular at any time does not imply that the information contained herein is correct as of any time subsequent to the date of this Form 1-A and Offering Circular. This Form 1-A and Offering Circular are submitted in connection with the Offering described herein and may not be reproduced or used for any other purpose.

| 7 |

TABLE OF CONTENTS

| 8 |

OFFERING SUMMARY, PERKS, AND RISK FACTORS

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in the Offering Circular and/or incorporated by reference in this Offering Circular. For full offering details, please (1) thoroughly review this Form 1-A with the Securities and Exchange Commission (2) thoroughly review this Offering Circular, and (3) thoroughly review any attached document to our documents referenced in this Form 1-A and Offering Circular.

| Type of Stock Offering: | Preferred Stock |

| Price Per Share: | $50.00 |

| Minimum Investment: | $50.00 per investor (1 Share of Preferred Stock) |

| Maximum Offering: | $50,000,000 The Company will not accept investments greater than the Maximum Offering Amount. |

| Maximum Shares Offered: | 1,000,0000 Shares of Preferred Stock |

| Use of Proceeds: | See the description in the section entitled “USE OF PROCEEDS TO ISSUE” on page 27 herein. |

| Voting Rights: | The Shares do not have any voting rights. |

| Length of Offering: | Shares will be offered on a continuous basis until either (1) the maximum number of Share are sold; (2) 180 days from the date of qualification by the Commission, (3) if Company in its sole discretion extends the offering beyond 180 days from the date of qualification by the Commission, or (4) the Company in its sole discretion withdraws this Offering. |

The Company will provide the following perquisites (“perks”) to investors in this offering, in addition to the Shares purchased, at each level of investment defined below, after a subscription for investments is accepted and after Shares are issued to the investor.

For a $50,000 investment, you will receive one-thousand (1000) Shares of Preferred Stock and:

| ● | 25% discount off our instore and online shop, | |

| ● | 25% discount in Hoop Street restaurants and bars at all facilities, | |

| ● | 25% discount off on lifetime membership at Hoop Street |

| 9 |

For a $50,000 investment, you will receive two-thousand (2000) Shares of Preferred Stock and:

| ● | 50% discount off our instore and online shop, | |

| ● | 50% discount in Hoop Street restaurants and bars at all facilities, | |

| ● | 50% discount off on lifetime membership at Hoop Street |

Please note that some of these perks may be limited in capacity due to their availability. Please check www.hoopstreet.com to find out what is available before you invest.

| Common Stock Outstanding (1) (2) | 3,000,000 Shares |

| Preferred Stock Outstanding | 1,000,000 Shares |

| Preferred Stock in this Offering | 1,000,000 Shares |

| Stock to be outstanding after the offering (3) | 5,000,000 Shares |

| (1) | All shares of Common Stock are held by the Hoop Street, LLC, which are owned and operated by its members. |

| (2) | There are only two classes of stock in the Company at present – Common Stock and Preferred Stock. |

| (3) | The total number of Shares of Preferred Stock assumes that the maximum number of Shares is sold in this offering. |

| 1. | The Company believes that is has a strong economic prospect by virtue of the following dynamics of the industry: |

| 2. | Founders believe that the trends for growth in the basketball entertainment industry in the Southwestern Sector of the United States are favorable. |

| 3. | Basketball entrainment center is a new and unique concept that has not been introduced in the U.S. The basketball entertainment center combines great social sport with fine finning and a sports bar. |

| 4. | Founders believe that the basketball entertainment center is an unserved industry, and launching such a unique venture will create many opportunities in the State of Arizona. |

Despite Founder’s beliefs, there is no assurance that Hoop Street Center I Corporation, will be profitable, or that management’s opinion of the industry’s favorable dynamics will not be outweighed in the future by unanticipated losses, adverse regulatory developments, and other risks. Investors should carefully consider the various risk factors below before investing in the Shares.

| 10 |

The purchase of the Company’s Common Stock involves substantial risks. You should carefully consider the following risk factors in addition to any other risks associated with this investment. The Shares offered by the Company constitute a highly speculative investment, and you should be in an economic position to lose your entire investment. The risks listed do not necessarily comprise all those associated with an investment in the Shares and are not set out in any particular order of priority. Additional risks and uncertainties may also have an adverse effect on the Company’s business and your investment in the Shares. An investment in the Company may not be suitable for all recipients of this Offering Circular. You are advised to consult an independent professional adviser or attorney who specializes in investments of this kind before making any decision to invest. You should consider carefully whether an investment in the Company is suitable in light of your personal circumstances and the financial resources available to you.

The discussions and information in this Offering Circular may contain both historical and forward-looking statements. To the extent that the Offering Circular contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of the Company’s business, please be advised that the Company’s actual financial condition, operating results, and business performance may differ materially from that projected or estimated by the Company in forward-looking statements. The Company has attempted to identify, in context, certain of the factors it currently believes may cause actual future experience and results may differ from the Company’s current expectations. Before investing, you should carefully read and carefully consider the following risk factors:

Risk Relating to the Company and Its Business

This is a very young company.

The Company is a start-up with no operating history, and there can be no assurance that the Company’s proposed plan of business can be realized in the manner contemplated and, if it cannot be, shareholders may lose all or a substantial part of their investment. There is no history upon which an evaluation of its past performance and future prospects in the hospitality and entertainment industry can be made. Statistically, most start-up companies fail.

| 11 |

The Company’s affiliated entities have no prior performance record.

Just as the Company is a new entrant in the market, its affiliate, and other subsidiaries owned by the Company do not have a track record of involvement in hospitality and entertainment that investors my assess. Even if an affiliate of the Company did have such prior experience, that experience would not be indicative of its future performance.

The success of the Company’s business is dependent on purchasing large parcels of land at favorable prices.

The Company is a capital-intensive operation and required the purchase of large parcels of land prior to construction. As of the date of this Offering Circular, the Company has not purchased land for the first facility. Further, the Company does not know whether it will be able to obtain purchase terms that are favorable. Finally, if this Offering does not raise enough capital to purchase the land and begin construction, the Company will need to procure external financing for the purchase of the land and/or construction of the facility.

Success in the hospitality and entertainment industry is highly unpredictable, and there is no guarantee that the Company’s content will be successful in the market.

The Company’s success will depend on the popularity of its hospitality and entertainment facilities, Consumer, tastes, trends, and preferences frequently change and are notoriously difficult to predict. If the company fails to anticipate further consumer preferences in the hospitality and entertainment business, it’s business and financial performance will likely suffer. Hospitality and entertainment are fiercely competitive. The Company may not be able to develop facilities that will become profitable. The Company may also invest in facilities that end up losing money. Even if one of its facilities is successful, the Company may lose money in others.

The Company may not be able to attract and retain individuals interested in annual membership at its facilities and attract drop-in/daily memberships, which could harm its business, financial conditions, and results of operations.

The Company’s success depends on its ability to:

| ● | Attract individuals interested in paying for annual memberships, | |

| ● | Attract individuals interested in paying for daily memberships, | |

| ● | Attract consistent suite rentals, | |

| ● | Provide dining and leisure experiences that members are interested in paying for, | |

| ● | Maintain or increase revenues generated from corporate events, | |

| ● | Maintain or increase revenues generated from food and beverage sales, and | |

| ● | Maintain or increase revenues generated from retail sales. |

| 12 |

Changes in consumer financial conditions, leisure testes, and preferences, particularly those affecting the popularity of basketball and other social and demographic trends, could adversely affect its business. Significant periods where attrition rates exceed enrolment rates or where facilities usage is below historical levels would have a material adverse effect on its business, result of operations and financial conditions. If the Company cannot attract new members, retain its existing members, its financial conditions and results of operations could be harmed.

The Company operates in a highly competitive market.

The Company’s facilities will compete on a local and regional level with restaurants and other business, dining, and social clubs. The number and variety of competitors in this business will vary based on the location and setting of each facility. Some facilities may be situated in intensely competitive upscale urban areas characterized by frequent innovations in the products and services offered by competing restaurants and other business, dining, and social clubs. In addition, in most regions, the competitive landscape in the constant flux as new restaurants other social and meeting venues open or expand their amenities. As a result of these characteristics, the supply in a given region may exceed the demand for such facilities, and an increase in the number of quality of restaurants and other social and meeting venues, or the products and services they provide, in such region could significantly impact the ability of the Company’s properties to attract and retain members, which could harm their business and results of operations.

Competition in the “alternative venues for recreational pursuits” industry could have a material adverse effect on the company’s business and results of operations.

The Company facilities compete on a local and regional level with alternative venues for recreational pursuits. The Company’s results of operations could be affected by the availability of and demand for alternative venues for recreational pursuits, such as multi-use sports and athletic centers. In addition, member-owned and individual privately-owned clubs may be able to create a perception of exclusivity that the company has difficulty replicating. To the extent these alternatives succeed in diverting actual or prospective members away from the company’s facilities or affects its membership rates, the company’s business and results of operations could be harmed.

Customer complaints or litigation on behalf of our customers or employees may adversely affect our business, results of operations, or financial condition.

The Company’s business may be adversely affected by legal or governmental proceedings brought by or on behalf of their customers or employees. Regardless of whether any claims against the company are valid or whether they are liable, claims may be expensive to defend and may divert time and money away from operations and hurt our financial performance. A judgment significantly in excess of their insurance coverage or not covered by insurance could have a material adverse effect on the company’s business, results of operations, or financial condition. Also, adverse publicity resulting from these allegations may materially affect the company.

| 13 |

The Company’s insurance coverage may not be adequate to cover all possible losses that it could suffer, and its insurance costs may increase.

The Company has not yet acquired insurance. It may not be able to acquire insurance policies that cover all types of losses and liabilities. Additionally, once the Company acquires insurance, there can be no assurance that its insurance will be sufficient to cover the full extent of all of its losses or liabilities for which it is insured. Further, insurance policies expire annually, and the Company cannot guarantee that it will be able to renew insurance policies on favorable terms, or at all. In addition, if it, or other leisure facilities, sustain significant losses or make significant insurance claims, then its ability to obtain future insurance coverage at commercially reasonable rates could be materially adversely affected. If the Company’s insurance coverage is not adequate, or it becomes subject to damages that cannot by law be insured against, such as punitive damages or certain intentional misconduct by their employees, this could adversely affect the Company’s financial condition or results of operations.

The Company may not be able to operate its facilities, or obtain and maintain licenses and permits necessary for such operation, in compliance with laws, regulations, and other requirements, which could adversely affect its business, results of operations, or financial condition.

Each facility is subject to licensing and regulation by alcoholic beverage control, amusement, health, sanitation, safety, building code, and fire agencies in the state, county and/or municipality in which the facility is located.

Each facility is required to obtain a license to sell alcoholic beverages on the premises from a state authority and, in certain locations, county and municipal authorities. Typically, licenses must be renewed annually and may be revoked or suspended for cause at any time. In some states, the loss of a license for a cause with respect to one facility may lead to the loss of licenses at all facilities in that state and could make it more difficult to obtain additional licenses in that state. Alcoholic beverage control regulations relate to numerous aspects of the daily operations of each facility, including minimum age of patrons and employees, hours of operation, advertising, wholesale purchasing, inventory control, and handling and storage and dispensing of alcoholic beverages. The failure to receive or retain a liquor license or any other required permit or license, in a particular location, or to continue to qualify for, or renew licenses, could have a material adverse effect on operations and the company’s ability to obtain such a license or permit in other locations.

| 14 |

The Company may be subject to “dram shop” statutes in states where its facilities may be located. These statutes generally provide a person injured by an intoxicated person the right to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated individual. Recent litigation against restaurant chains has resulted in significant judgments and settlements under dramshop statutes. Because these cases often seek punitive damages, which may not be covered by insurance, such litigation could have an adverse impact on the Company’s business, results of operations, or financial condition.

As a result of operating certain entertainment games and attractions, including skill-based games that offer redemption prizes, the Company is subject to amusement licensing and regulation by the states, counties, and municipalities in which its facilities are to be located. These laws and regulations can vary significantly by state, county, and municipality and, in some jurisdictions, may require the company to modify their business operations or alter the mix of redemption games and simulators that they offer.

Moreover, as more states and local communities implement legalized gambling, the laws and corresponding enabling regulations may also be applicable to the Company’s redemption games, and regulators may create new licensing requirements, taxes or fees, or restrictions on the various types of redemption games the company offers. Furthermore, other states, counties, and municipalities may make changes to existing laws to further regulate legalized gaming and illegal gambling. Adoption of these laws, or adverse interpretation of existing laws, could cause the company to modify its plans for its facilities, and if the Company creates facilities in these jurisdictions, it may be required to alter the mix of games, modify certain games, limit the number of tickets that may be won by a customer from a redemption game, change the mix of prizes that the Company may offer or terminate the use of specific games, any of which could adversely affect the Company’s operations. If the Company fails to comply with such laws and regulations, the Company may be subject to various sanctions and/or penalties and fines or may be required to cease operations until it achieves compliance, which could have an adverse effect on the Company’s business and financial results.

The illiquidity of real estate may make it difficult for the Company to dispose of one or more of our properties or negatively affect its ability to profitably sell such properties and access liquidity.

The Company may, from time to time, decide to dispose of one or more of its real estate assets. Because real estate holdings generally are relatively illiquid, the company may not be able to dispose of one or more real estate assets on a timely basis. In some circumstances, sales may result in investment losses, which could adversely affect the company’s financial condition. The illiquidity of its real estate assets could mean that it continues to operate a facility that management has identified for disposition. Failure to dispose of a real estate asset in a timely fashion, or at all, could adversely affect the company’s business, financial condition, and results of operations.

| 15 |

The Company’s development and growth strategy depends on its ability to fund, develop, and open new entertainment venues and operate them profitably.

A key element of the Company’s growth strategy is to develop and open basketball entertainment venues. The Company has identified a number of locations for potential future entertainment basketball venues and is still in the process of identifying and analyzing potential locations. The Company’s ability to fund, develop and open these venues on a timely and cost-effective basis, or at all, is dependent on a number of factors, many of which are beyond its control, including but not limited to our ability to:

| ● | Find quality locations. | |

| ● | Reach acceptable agreements regarding the lease or purchase of locations, and comply with our commitments under our lease agreements during the development and construction phases. | |

| ● | Comply with applicable zoning, licensing, land use, and environmental regulations. | |

| ● | Raise or have available an adequate amount of cash or currently available financing and mortgage terms for construction and opening costs. | |

| ● | Adequately complete construction for operations. | |

| ● | Timely hire, train, and retain the skilled management and other employees necessary to meet staffing needs. | |

| ● | Obtain, for an acceptable cost, required permits and approvals, including liquor licenses; and | |

| ● | Efficiently manage the amount of time and money used to build and open each new venue. |

If the Company succeeds in opening entertainment basketball facilities on a timely and cost-effective basis, the company may nonetheless be unable to attract enough customers to these new venues because potential customers may be unfamiliar with its venue or concept, entertainment and menu options might not appeal to them, and the company may face competition from other food and leisure venues.

The Company’s development and construction of the first facility depends on its ability to obtain favorable mortgage financing.

The Company intends to secure mortgage financing to fund up to 80% of its first facility and plans to use this debt financing to develop and construct subsequent facilities. There is no guarantee that the company will be able to obtain financing on favorable terms. In the event that the Company is unable to obtain such financing, it may limit the Company’s ability to effectuate its plans and will increase the costs and expenses of the company, thereby negatively impacting its financial prospects.

| 16 |

The Company depends on a small management team and may need to hire more people to be successful.

The success of the Company is dependent upon management in order to conduct its operations and execute its business plan; however, the Company relies on the skills, connections, and experiences of the executives and key personnel. The Company has not entered into employment agreements with the executives and key personnel. There is no guarantee that the executives and key personnel will agree to terms and execute employment agreements that are favorable to the Company. If any of the executives and key personnel discontinue working for the Company. Further, there is no assurance that the Company will be able to identify, hire, and retain the right people for the various key positions.

Key Man Risk.

The Company’s founders and key personnel are serial entrepreneurs. It is likely that some, if not all, of the founders and key personnel may exit the business within the next three years. In the event one or more of the founders and/or key personnel exit the business, the Company may experience the following:

| ● | Financial loss; | |

| ● | A disruption to the Company’s future projects; | |

| ● | Damage to the brand; and | |

| ● | Potentially supporting a competitor. |

The Company will require a general manager, who has not yet been hired.

There is no way to be certain that the general manager of the Company, once appointed, will be able to execute the same vision. If an appropriate person is not identified and hired, the Company will not succeed, and since its performance will depend on that person’s performance, it is possible that other subsidiaries will be more successful than the Company.

The Company has engaged in certain transactions with Related Persons.

Please see the section of this Offering Circular entitled “Interest of Management and Others in Certain Related-Party Transactions and Agreements.”

Changes in Employment Laws or Regulation could harm the Company’s performance.

Various federal and state labor laws govern the Company’s relationship with our employees and affect operating costs. These laws may include minimum wage requirements, overtime pay, healthcare reform, and the implementation of various federal and state healthcare laws, unemployment tax rates, workers’ compensation rates, citizenship requirements, union membership, and sales taxes. A number of factors could adversely affect our operating results, including additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, changing regulations from the National Labor Relations Board, and increased employee litigation, including claims relating to the Fair Labor Standards Act.

| 17 |

The Company’s bank accounts will not be fully insured.

The Company’s regular bank accounts for this Offering each have federal insurance that is limited to a certain amount of coverage. It is anticipated that the account balances in each account may exceed those limits at times. In the event that any of the Company’s banks should fail, the Company may not be able to recover all amounts deposited in these bank accounts.

If we are unable to protect our intellectual property effectively, we may not be able to operate our business, which would impair our ability to compete.

The names and/or logos of Company brands (whether owned by the Company or licensed to us) may be challenged by holders of trademarks who file opposition notices or otherwise contest trademark applications by the Company for its brands.

Similarly, domains owned and used by the Company may be challenged by others who contest the ability of the Company to use the domain name or URL. Such challenges could have a material adverse effect on the Company’s consolidated financial results as well as your investment.

Computer, website, or information system breakdown could affect the Company’s business.

Computer, website and/or information system breakdowns as well as cybersecurity attacks could impair the Company’s ability to service its customers, leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on the Company’s consolidated financial results as well as your investment.

A data security breach could expose the Company to liability and protracted and costly Litigation, and could adversely affect the Company’s reputation and operating revenues.

To the extent that the Company’s activities involve the storage and transmission of confidential information, the Company and/or third-party processors will receive, transmit, and store confidential customer and other information. Encryption software and the other technologies used to provide security for storage, processing, and transmission of confidential customer and other information may not be effective to protect against data security breaches by third parties. The risk of unauthorized circumvention of such security measures has been heightened by advances in computer capabilities and the increasing sophistication of hackers. Improper access to the Company’s or these third parties’ systems or databases could result in the theft, publication, deletion, or modification of confidential customer and other information. A data security breach of the systems on which sensitive account information is stored could lead to fraudulent activity involving the Company’s products and services, reputational damage, and claims or regulatory actions against us. If the Company issued in connection with any data security breach, the Company could be involved in protracted and costly litigation. If unsuccessful in defending that litigation, the Company might be forced to pay damages and/or change the Company’s business practices or pricing structure, any of which could have a material adverse effect on the Company’s operating revenues and profitability. The Company would also likely have to pay fines, penalties and/or other assessments imposed as a result of any data security breach.

| 18 |

Limitation on director liability.

The Company may provide for the indemnification of directors to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability of directors to the Company and its shareholders for monetary damages for certain breaches of fiduciary duty. Such indemnification may be available for liabilities arising in connection with this Offering. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Risk Relating to this Offering and Investment

The payment of accrued dividends is paid out of the Company’s reserved funds for the foreseeable future.

As soon as the Company receives proceeds from this Offering, and it is legally permissible, the Company intends to pay dividends to investors. The dividend will initially be paid to investors out of the Company’s reserved funds, as opposed to its revenues. Payment of the dividends and the establishment of the reserve fund will reduce the capital the Company has to develop and begin operations in its basketball entertainment facility. These reserved funds will be held in a segregated bank account maintained at a financial intuition mutually decided by the Board of Directors. Some of the reserved funds in the dividend reserve account will be the proceeds from this Offering. (See “USE OF PROCEEDS TO ISSUER”). It is not certain when, if at all, the company will be able to make dividends payments to investors out of the company’s revenues.

Distributions will only be made if permitted under Arizona law, which is subject to change, and in the sole discretion of the Board of Directors.

Dividends may be paid out of “surplus” even in the absence of profits. Under section 154, “surplus” may be defined by the Board of Directors, in their sole discretion, but generally may not be less than the par value of the shares issued. Accordingly, most of the proceeds of this Offering may be considered surplus. However, Arizona law is subject to change, and the company cannot guarantee that dividend payments will always be permitted under Arizona Law.

| 19 |

The tax treatment of dividends may vary, and distributions to shareholders may be taxed as capital gains.

The distributions made pursuant to the Preferred Stock dividend provisions will be taxable as dividends to shareholders only to the extent of current and accumulated earnings and profits. To the extent the Company does not have current and accumulated earnings and profits, the distributions will be treated as a non-taxable return of capital to the extent of the shareholder’s adjusted basis. If distributions still exceed the amount of adjusted basis, such excess would be considered as capital gains income to the shareholder, who will generally be subject to federal (and possibly state) income tax on such gains at a rate that depends upon the shareholder’s holding period with respect to the shares in question, among other factors. Since the tax treatment of any distributions may vary according to the financial performance of the Company, as well as the particular circumstances of the investor, investors should consult their own tax advisers and should further not assume that the distributions will be subject to the same tax treatment from year to year.

The company is responsible for certain administrative burdens relating to taxation.

Federal Law requires that the Company report annually all distributions to shareholders on Form 1099-DIV. The Company is responsible for ensuring that the extent to which such distributions constitute a distribution of earnings and profits is correctly identified on form 1099-DIV. This reporting requirement adds to the administrative burdens of the Company.

The Offering price has been arbitrarily set by the Company.

The offering price of the Shares has been arbitrarily established by the Company based upon its present and anticipated financial needs and bears no relationship to the Company’s present financial condition, asset, book value projected earnings, or any other generally accepted valuation criteria. The offering price of Share may not be indicative of the value of the Shares or the Company, now or in the future.

Investors in this Offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement and claims where the forum selection provision is applicable, which could result in less favorable outcomes to the plaintiff(s) in any such action.

Investors in this Offering will be bound by the Subscription Agreement, which includes a provision under which investors waive the right to a jury trial of any claim they may have against the Company arising out of or relating to the Subscription Agreement, including any claim under the federal securities laws. Further, the Court of Chancery in Arizona is a non-jury trial court, and therefore, those claims will not be adjudicated by a jury.

| 20 |

If the Company opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To the Company’s knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated by a federal court. However, the Company believes that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of Arizona, which governs the Subscription Agreement, in the Court of Chancery in the State of Arizona. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party knowingly, intelligently, and voluntarily waived the right to a jury trial. The Company believes that this is the case with respect to the subscription agreement. Investors should consult legal counsel regarding the jury waiver provision before entering into the subscription agreement.

If an investor brings a claim against the Company in connection with matters arising under the Subscription Agreement, including claims under federal securities laws, an investor may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against the company. If a lawsuit is brought against the Company under the Subscription Agreement, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the subscription agreement with a jury trial. No condition, stipulation, or provision of the Subscription Agreement serves as a waiver by any holder of common shares or by us of compliance with any substantive provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when the shares are transferred, the transferee is required to agree to all the same conditions, obligations, and restrictions applicable to the shares or to the transferor with regard to ownership of the shares that were in effect immediately prior to the transfer of the shares of Preferred Stock, including but not limited to the Subscription Agreement.

There is no current market for the Company’s shares.

There is no formal marketplace for the resale of our securities. Shares of the Company’s may eventually be traded to the extent any demand and/or trading platform(s) exists. However, there is no guarantee there will be demand for the shares or a trading platform that allows you to sell them. The Company does not have plans to apply for or otherwise seek trading or quotation of its Preferred Stock on an over-the-counter market. It is also hard to predict if the company will ever be acquired by a bigger company. Investors should assume that they may not be able to liquidate their investment or pledge their shares as collateral for some time.

| 21 |

The Company has made assumptions in its projections and in forward-looking statements that may not be accurate.

The discussions and information in this Offering Circular may contain both historical and “forward-looking statements,” which can be identified by the use of forward-looking terminology including the terms “believes,” “anticipates,” “continues,” “expects,” “intends,” “may,” “will,” “would,” “should,” or, in each case, their negative or other variations or comparable terminology. You should not place undue reliance on forward-looking statements. These forward-looking statements include matters that are not historical facts. Forward-looking statements involve risk and uncertainty because they relate to future events and circumstances. Forward-looking statements contained in this Offering Circular, based on past trends or activities, should not be taken as a representation that such trends or activities will continue in the future. To the extent that the Offering Circular contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of the Company’s business, please be advised that the Company’s actual financial condition, operating results, and business performance may differ materially from that projected or estimated by the Company. The Company has attempted to identify, in context, certain of the factors it currently believes may cause actual future experience and results to differ from its current expectations. The differences may be caused by a variety of factors, including but not limited to adverse economic conditions, lack of market acceptance, reduction of consumer demand, unexpected costs and operating deficits, lower sales and revenues than forecast, default on leases or other indebtedness, loss of suppliers, loss of supply, loss of distribution and service contracts, price increases for capital, supplies and materials, inadequate capital, inability to raise capital or financing, failure to obtain customers, loss of customers and failure to obtain new customers, the risk of litigation and administrative proceedings involving the Company or its employees, loss of government licenses and permits or failure to obtain them, higher than anticipated labor costs, the possible acquisition of new businesses or products that result in operating losses or that do not perform as anticipated, resulting in unanticipated losses, the possible fluctuation and volatility of the Company’s operating results and financial condition, adverse publicity and news coverage, inability to carry out marketing and sales plans, loss of key executives, changes in interest rates, inflationary factors, and other specific risks that may be referred to in this Offering Circular or in other reports issued by us or by third-party publishers.

Risks Related to Certain Conflicts of Interest

There are conflicts of interest between the Company, its management, and its affiliates.

Hoop Street, LLC is the parent company of Hoop Street Center I Corporation, and currently holds all of the issued Common Stock of the Hoop Street Center I Corporation, and owns other Operating Subsidiaries; therefore, it is likely that conflicts of interest will arise between the affiliates.

| 22 |

The Company may witness conflicts of interest due to the shared:

| ● | Use of time, | |

| ● | Use of human capital, and | |

| ● | Competition regarding the acquisition of properties and other assets. |

The interests of Company, its subsidiaries, and other affiliates may conflict with shareholder’s interests.

The Company’s Certificate of Incorporation, Bylaws, and Arizona Law provide company management with broad powers and authority, which may result in one or more conflicts of interest between the shareholder’s interest and those of the executives, officers, and directors of the Company its Subsidiaries and affiliates. Potential conflicts include, but are not limited to:

| ● | The Company, its subsidiaries, and its affiliates will not be required to disgorge any profits or fees or other compensation they may receive from any other business they own separate from the Company, and the shareholder will not be entitled to receive or share in any of the profits, return, fees or compensation from any other business owned and operated by the majority shareholders, executives and directors and their affiliates for their own benefit. | |

| ● | The Company may engage its Subsidiaries and other affiliated companies to perform services, and determination for the terms of those services will not be conducted at arms’ length negotiation; and | |

| ● | The Company’s executives, officers, and directors are not required to devote all of their time and efforts to the affairs of the Company. |

There are conflicts of interest between the company and some of the members of the Board of Directors.

Ernest Hemple, the CEO of the Company, is also a member of the Board of Directors. It is likely that conflicts of interest may arise between the Company and the board member. Such conflicts of interest may include, but are not limited to, the following:

| ● | Determining whether something is in the best interest of the company or the online platform on which the company is listing the Preferred Stock. | |

| ● | Whether to keep the Offering open or to close it. | |

| ● | Use of time. | |

| ● | Payment to the online platform. |

| 23 |

The Company and Hoop Street, LLC, intend to share some services.

The Company and Hoop Street, LLC will share the following services:

| ● | Intellectual Property which includes any and all intellectual property or proprietary rights under any jurisdiction, including without limitation: (a) the marks; (b) inventions, discoveries and ideas, whether patentable or not, and all patents, patent disclosures, patent registrations, and applications thereof; (c) published and unpublished works of authorship, whether copyrightable or not (including without limitation databases and other compilations of information), copyrights and copyrightable works, registrations and applications thereof, and rights in data and databases; (c) trade secrets, know-how, and other confidential information; (d) all moral rights in the foregoing (that is, the right to claim authorship of or object to the modification of any work); and (e) all other intellectual property rights, in each case whether registered or unregistered and including all applications for, and renewals, extensions, restorations, and reinstatements of, such rights, and all similar or equivalent rights or forms of protection provided by applicable law in any jurisdiction throughout the world. | |

| ● | Licensing for the use of the name and brand identity, internal transactions incorporating products and services, fee sharing, cost allocations, and financing activities can create inefficiency, financial exposures, and reporting risk. This arrangement could result in potential actual or perceived conflicts of interest. |

IN ADDITION TO THE RISKS LISTED ABOVE, BUSINESSES ARE OFTEN SUBJECT TO RISKS NOT FORESEEN OR FULLY APPRECIATED BY THE MANAGEMENT. IT IS NOT POSSIBLE TO FORESEE ALL RISKS THAT MAY AFFECT THE COMPANY. MOREOVER, THE COMPANY CANNOT PREDICT WHETHER THE COMPANY WILL SUCCESSFULLY EFFECTUATE THE COMPANY’S CURRENT BUSINESS PLAN. EACH PROSPECTIVE PURCHASER IS ENCOURAGED TO CAREFULLY ANALYZE THE RISKS AND MERITS OF AN INVESTMENT IN THE SECURITIES AND SHOULD TAKE INTO CONSIDERATION WHEN MAKING SUCH ANALYSIS, AMONG OTHER FACTORS, THE RISK FACTORS DISCUSSED ABOVE.

The term “dilution” refers to the reduction (as a percentage of the aggregate Shares outstanding) that occurs for any given share of stock when additional Shares are issued. If all of the Shares in this offering are fully subscribed and sold, the Shares offered herein will constitute approximately 20% of the total shares of stock of the Company. The Company anticipates that subsequent to this offering, the Company may require additional capital, and such capital may take the form of Preferred Stock, other stock or securities or debt convertible into stock. Such further fundraising will further dilute the percentage ownership of the Share sold herein the Company.

| 24 |

We are offering a Maximum Offering of up to $50,000,000 in Shares of our Preferred Stock. The offering is being conducted on a best-effort basis without any minimum number of shares or the amount of proceeds required to be sold.

We intend to market the Shares of our Preferred Stock through online and offline means. Online marketing may take the form of contacting potential investors through electronic media and posting our Offering Circular or “testing the waters” materials on an online investment platform.

We will initially use our existing website (www.hoopstreet.com) to provide notification of the Offering. Persons who desire information will be furnished with this Preliminary Offering Circular via download 24 hours per day, 7 days per week on the Website.

You will be required to complete a subscription agreement in order to invest. The subscription agreement includes a representation to the effect that, if you are not an “accredited investor” as defined under securities law, you are investing an amount that does not exceed the greater of 10% of your annual income or 10% of your net worth, as described in the subscription agreement.

The Company intends to perform the following administrative and technology-related functions in connection with this offering:

| 1. | Accept investor data through the Company’s highly secure website developed by a reputable technology company. |

| 2. | Review and process information from potential investors, including but not limited to running reasonable background checks for anti-money laundering (“AML”), IRS tax fraud identification, and USA PATRIOT Act purposes, and gather and review responses to customer identification information. |

| 3. | Review subscription agreements received from prospective investors to confirm they are complete; |

| 4. | Reject inconsistent, incorrect, or otherwise flagged (e.g., for underage or AML reasons) subscriptions; |

| 5. | Company will maintain data in the form of book-entry data for managing investors (investor relationships management “IRM”) and record keeping; |

| 6. | Keep investors details and data confidential and not disclose to any third party except as required by regulators or by law (e.g., as needed for AML); and |

| 7. | Comply with any required FINRA filings, including filings required under Rule 5110 for the offering. |

| 25 |

| 1. | Go to www.hoopstreet.com, click on the “Invest Now” button; |

| 2. | Download this Offering Circular; |

| 3. | Complete the Investment Form along with the Subscription Agreement; |

| 4. | Transfer funds by check, wire, credit card or debit cards or ACH transfer directly to the Company’s bank account; |

| 5. | Once background checks for Anti-Money Laundering (“AML”) and Know Your Customer (“KYC”) are completed, and the Subscription Agreement is duly executed, the respective Shares of the Company shall be issued to the investor. |

The Company maintains the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. The Company maintains the right to accept subscriptions below the minimum investment amount or minimum per share investment amount in its discretion. All monies from rejected subscriptions will be returned by the Company to the investor, without interest or deductions.

The Company will engage a third-party agent to undertake due diligence in relation to each prospective investor as regards background checks for AML and KYC identification. The agent shall take appropriate steps, in compliance with applicable AML, anti-terrorism and KYC laws and regulations, to establish and document the identity of each prospective investor.

This is an offering made under “Tier 2” of Regulation A, and the shares will not be listed on a registered national securities exchange upon qualification. Therefore, the shares will be sold only to a person if the aggregate purchase price paid by such person is no more than 10% of the greater of such person’s annual income or net worth, not including the value of his primary residence, as calculated under Rule 501 of Regulation D promulgated under Section 4(a)(2) of the Securities Act of 1933, as amended. In the case of sales to fiduciary accounts (Keogh Plans, Individual Retirement Accounts (IRAs) and Qualified Pension/Profit Sharing Plans or Trusts), the above suitability standards must be met by the fiduciary account, the beneficiary of the fiduciary account, or by the donor who directly or indirectly supplies the funds for the purchase of the shares. Investor suitability standards in certain states may be higher than those described in this Form 1-A and/or Offering Circular. These standards represent minimum suitability requirements for prospective investors, and the satisfaction of such standards does not necessarily mean that an investment in the Company is suitable for such persons. Different rules apply to accredited investors.

Each investor must represent in writing that he/she/it meets the applicable requirements set forth above and in the Subscription Agreement, including, among other things, that (i) he/she/it is purchasing the shares for his/her/its own account and (ii) he/she/it has such knowledge and experience in financial and business matters that he/she/it is capable of evaluating without outside assistance the merits and risks of investing in the shares, or he/she/it and his/her/its purchaser representative together have such knowledge and experience that they are capable of evaluating the merits and risks of investing in the shares.

| 26 |

The Company intends to engage one or more media partners to perform the following marketing and lead generation in connection with this offering:

| 1. | Design, implement and execute marketing and lead generation programs. |

| 2. | Conduct market research to identify the target audience. |

| 3. | Place advertising on television, radio, print media, and the internet and leverage social media and influencer marketing to generate leads. |

| 4. | Participate in trade shows, fairs, and other forums that give an opportunity to showcase the benefits of investing with our brand. |

| 5. | Identify prospects, qualify, and forward qualified leads. |

The Company has estimated to pay compensation to the media partner(s) at a rate of up to $50.00 per qualified lead.

The Use of Proceeds is an estimate based on the Company’s current business plan. We may find it necessary or advisable to reallocate portions of the net proceeds reserved for one category to another or to add additional categories, and we will have broad discretion in doing so.

The maximum gross proceeds from the sale of the Shares in this Offering are $50,000,000. The net proceeds from the offering, assuming it is fully subscribed, are expected to be approximately $49,750,000 after the payment of $250,000 as media partner fees, but before printing, mailing, marketing, legal and accounting costs, and other compliance and professional fees that may be incurred. The estimate of the budget for offering costs is an estimate only, and the actual offering costs may differ from those expected by management.

| 27 |

Management of the Company has wide latitude and discretion in the use of proceeds from this Offering. Ultimately, the management of the Company intends to use a substantial portion of the net proceeds for general working capital. At present, management’s best estimate of the use of proceeds, at various funding milestones, is set out in the chart below. However, potential investors should note that this chart contains only the best estimates of the Company’s management based upon information available to them at the present time and that the actual use of proceeds is likely to vary from this chart based upon circumstances as they exist in the future, various needs of the Company at different times in the future, and the discretion of the Company’s management at all times.

A portion of the proceeds from this Offering may be used to compensate or otherwise make payments to officers or directors of the issuer. The officers and directors of the Company may be paid salaries and receive benefits that are commensurate with similar companies, and a portion of the proceeds may be used to pay these ongoing business expenses.

| $ | 5,000,000 | $ | 10,000,000 | $ | 25,000,000 | $ | 50,000,000 | |||||||||

| Cost of Land | 750,000 | 1,000,000 | 2,500,000 | 5,000,000 | ||||||||||||

| Construction | 2,750,000 | 6,000,000 | 15,000,000 | 30,000,000 | ||||||||||||

| Working Capital | 450,000 | 900,000 | 2,250,000 | 4,500,000 | ||||||||||||

| Marketing | 375,000 | 750,000 | 1,875,000 | 3,750,000 | ||||||||||||

| Furniture & Fixtures | 240,000 | 480,000 | 960,000 | 1,920,000 | ||||||||||||

| Utilities | 175,000 | 350,000 | 875,000 | 1,750,000 | ||||||||||||

| Computer and Software | 18,000 | 30,000 | 50,000 | 70,000 | ||||||||||||

| Licenses | 5,000 | 5,000 | 5,000 | 5,000 | ||||||||||||

| Offering Expenses | 50,000 | 100,000 | 250,000 | 500,000 | ||||||||||||

| Other | 187,000 | 385,000 | 1,235,000 | 2,505,000 | ||||||||||||

| TOTAL | 5,000,000 | 10,000,000 | 25,000,000 | 50,000,000 |

The Company reserves the right to change the use of proceeds set out herein based on the needs of the ongoing business of the Company and the discretion of the Company’s management. The Company may relocate the estimated use of proceeds among the various categories or for other use if management deems such a reallocation to be appropriate.

Overview

Hoop Street Center I Corporation is an early stage hospitality and entertainment company devoted to the development and operation of basketball and entertainment centers in the Southwestern of the United States. The Company will purchase the land and manage zoning, entitlement, design, construction, and operation of the planned facilities.

| 28 |

Hoop Street, LLC, is the parent company of Hoop Street Center I Corporation and holds all of the issued Common Stock of the Company. In addition, Hoop Street, LLC owns two subsidiaries: Hoop Street Manufacturing, LLC, an Arizona limited liability company that acts as a manufacturing company for basketball chutes and equipment, Hoop Street Real Estate Holdings, LLC, an Arizona limited liability company that owns the land and the building where our entertainment center(s) sit (collectively hereinafter referred as “Operating Subsidiaries”). For purposes of this Offering Circular, “Hoop Street Center I Corporation” or the “Company” or “we” or “our” will refer to Hoop Street Center I Corporation, Hoop Street Manufacturing, LLC, and Hoop Street Real Estate Holdings, LLC in the collective.

Principal Products and Services

Currently, the Company is at the initial stages of development. The Company has started its search for the purchase of land for Phase I Construction of its first basketball entertainment facility in Arizona. The Company believes that it will take approximately 18 months after the land purchase to complete Phase I Construction. Upon completion of Phase I Construction, the relevant facility will be operational.

Location and size of each facility

The Company considers the following factors when determining the locations and size of each facility.

| ● | Large and mid-size populations within metropolitan areas | |

| ● | University communities with a population of at least 100,000 | |

| ● | Millennial populations within and outside the trade market | |

| ● | The proximity to major highway, interstate access other larger entertainment facilities, restaurant, and recreations attractions | |

| ● | Ongoing growth trends in the selected area | |

| ● | Proximity of select populations bases including university students, types of housing developments, and employment rates |

| 29 |

| ● | Whether a local government is cooperative and favors the development of leisure facilities | |

| ● | Cost of land | |

| ● | Availability and the potential threat of competitor facilities within the vicinity | |

| ● | Favorable mortgage/lender terms and relationships |

Financing the facilities

The Company intends to purchase the land for Phase I Construction with a combination of the following:

| ● | The proceeds of this Offering (see “Use of Proceeds”) | |

| ● | Mortgage financing provided by banks, private equity funds, lending-REITs and/or other financial institutions |

Sourcing the facilities

The Company has engaged in various regional and national real estate brokerages to potential source sites. We have sourced two properties that we believe may become our first location. The Company anticipates that it may acquire this land, depending on access to capital or financing, in the first half of 2021.

Facility design and construction

The Company has not yet sourced quotes for the construction and design of its first facility.

Management of the facility

Hoop Street, LLC, will oversee the management of all of its subsidiaries and affiliates and will directly employ management teams and staff to operate all of Hoop Street Center I Corporation locations.

The Experience

The Company intends to offer customers a fun, entertainment, high-quality food, creative menus, unique beverages, basketball, and thoughtfully designed suites to aid in superior customer experience.

The Company intends to build each facility with the following specifications:

| ● | 60-100 climate-controlled. The suites offer comfortable seating, special computer tracking to monitor basketball gaming and ball tracking, and large screen monitors to watch sports | |

| ● | Multiple indoor/outdoor bars | |

| ● | Restaurants | |

| ● | VIP Member, “Select Suites.” | |

| ● | Family-friendly restrooms and changing areas | |

| ● | Child care, play areas for kids | |

| ● | Multiple meeting and conference rooms |

| 30 |

| ● | State-of-the-art basketball academy and training center | |

| ● | Range of amusement options such as arcades, gaming consoles, soft play areas, and games based on virtual and augmented reality |

Market Sector

Hoop Street Center I Corporation intends to participate in the recreational sporting and entertainment facilities market. We believe this market to be young, fast-growing, and under-served. This market overlaps three growing, highly profitable markets: the basketball market, the recreation/sporting entertainment sector, and the food and beverage portion of the hospitality industry. Hoop Street Center I Corporation will be competing for revenues from customer spending in each of these three sectors.

Target Audience

| ● | The company will have five primary target audiences: | |

| ● | Avid basketball players, | |

| ● | Families looking for a fun experience for their kids and friends, | |

| ● | Businesses wanting team building, business gatherings, incentive rewards, and corporate event venues with food and entertainment, | |

| ● | Experience Seekers, Millennials, Gen-Xers, Boomers seeking unique, fun night/weekend entertainment, and | |

| ● | Get together/Fundraiser planners – looking for unique locations for parties, celebrations, and fund-raising events – may also be sold through “group sales” programs. |

Operations

Hoop Street Center I Corporation intends to provide a realistic basketball experience so that it can better appeal to avid and moderate players. Climate-controlled semi-private suites and incorporate comfortable seating, ball return system, equipment storage, gaming, and media displays. In addition to hospitality, entertainment, events, and family fun, the Company plans to appeal to a wide demographic. The Company believes that it will be able to leverage the following advantages:

| ● | Realistic Basketball Experience: | |||

| ○ | Skill-based gaming and simulated basketball | |||

| ● | The basketball chute consists of a ball return system, state of the art basketball backboard that moves to create a shot from anywhere in the half-court area as well as skill-based gaming | |||

| 31 |

| ● | Superior Technology: | |||

| ○ | Radar technology allows players to measure their ball flight and spin | |||

| ○ | Stats for each player and the ability to track improvements over time | |||

| ○ | Ability to simulate play on famous arenas | |||

| ○ | Video shot analysis | |||

| ○ | Gaming and data analytics that can be shared with others on social media | |||

| ● | Enhanced Guest Experiences: | |||

| ○ | VIP Member concierge and hosts | |||

| ○ | VIP Member Select Suites | |||

| ○ | Men’s and Women’s member locker rooms | |||

| ○ | Improved digital experiences for guest engagement before, during, and after onsite visits | |||

| ○ | Online reservation system | |||

| ○ | Onsite games including pinball, pool, and corn hole | |||

| ○ | Onsite and post-visit engagement and social sharing | |||

| ● | Interactive Games and Contests: | |||

| ○ | Ability for customers to compete against other suites and customers with 3-point shooting, H-O-R-S-E, and other skill-based games. | |||

| ○ | A software application which will allow players to satisfy their desire to play an NBA legends, and the ability to get more shots off then anywhere else. | |||

| ● | Women Designed Programs and Coaching: These include learn-to-play days and women-only events and leagues. | |||

| ● | Beginner Player Designed Programs and Coaching: These include learn-to-play days and beginner player events and leagues. | |||

| ● | Upgraded Amenities: These include the following: | |||

| o | Luxury Bathrooms | |||

| o | Child care | |||

| o | Business networking zones | |||

| o | Conference rooms | |||

| o | Free high-speed Wi-Fi | |||

| o | Family restrooms and changing areas | |||

| ● | Healthy and Localized Menus: chef-inspired authentic healthy menu offerings, farm to table sourcing, localized craft beers and select menu items to appeal to regional customers’ tastes, seasonality and lifestyles. | |||

| 32 |

Support from Hoop Street LLC

Hoop Street Center I Corporation entered into a Management Services Agreement with Hoop Street, LLC, on September 21, 2020 (the “Management Services Agreement”). Under that agreement, Hoop Street, LLC, will manage Hoop Street Center I Corporation and allow Hoop Street Center I Corporation to use certain Intellectual Property and business concepts. Hoop Street Center I Corporation will incur direct and indirect capitalized costs and overhead expenses. Some of these costs will be exclusive to Hoop Street Center I Corporation while other costs will be shared among Hoop Street Center I Corporation and other Operating Subsidiaries.

Direct capitalized costs, and overhead expenses will be paid by Hoop Street Center I Corporation directly (e.g., salaries, board of directors and board of advisor fees, employee benefits, and general administrative costs).