Exhibit 4.1

CONVERTIBLE NOTE

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE CONVERTIBLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. TRANSFER OF THESE SECURITIES AND THE SECURITIES INTO WHICH THESE SECURITIES ARE CONVERTIBLE IS PROHIBITED, EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S, PURSUANT TO REGISTRATION UNDER THE SECURITIES ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT. HEDGING TRANSACTIONS MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE SECURITIES ACT.

THIS SECURITY AND THE SECURITIES INTO WHICH THESE SECURITIES ARE CONVERTIBLE ARE FURTHER SUBJECT TO THE RESTRICTIONS ON TRANSFER SET FORTH IN SECTION 14 HEREOF, AND THIS SECURITY MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT IN COMPLIANCE THEREWITH.

LI-CYCLE HOLDINGS CORP.

CONVERTIBLE NOTE

| Issuance Date: May 31, 2022 |

|

Original Principal Amount: $200,000,000.00 |

| |

| (the “Issuance Date”) |

||||

FOR VALUE RECEIVED, Li-Cycle Holdings Corp., a company existing under the laws of the Province of Ontario, Canada (the “Company”), hereby promises to pay to the order of Glencore Ltd., a Swiss company having an office at 330 Madison Ave., New York, NY 10017, or its permitted assigns (the “Holder”) the amount set forth above as the Original Principal Amount (as increased or reduced pursuant to the terms hereof pursuant to PIK, redemption, conversion or otherwise in accordance with the terms of this Convertible Note, the “Principal”) when due, whether upon the Maturity Date, or upon acceleration, redemption or otherwise (in each case, in accordance with the terms hereof) and to pay interest (“Interest”) on any outstanding Principal at the applicable Interest Rate on each Interest Date until the same becomes due and payable, whether upon the Maturity Date or upon acceleration, conversion, redemption or otherwise (in each case in accordance with the terms hereof). This Convertible Note (including any convertible note issued in exchange, transfer or replacement hereof in accordance with Section 15, this “Note”) is issued pursuant to the note purchase agreement (the “Note Purchase Agreement”) dated as of May 5, 2022 between the Company and the Holder, as amended from time to time. Certain capitalized terms used herein are defined in Section 28. Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Note Purchase Agreement.

1

| 1. | PAYMENTS OF PRINCIPAL. On the Maturity Date, the Company shall pay to the Holder an amount in cash representing all outstanding Principal, together with all accrued and unpaid Interest (if any) on such Principal on the Maturity Date. |

| 2. | INTEREST; INTEREST RATE. |

| (a) | Interest on this Note shall (i) commence accruing on the Issuance Date, (ii) be computed on the basis of actual number of days in a 360-day year, and (iii) be payable in cash or PIK (as defined below) on the first Trading Day of each semi-annual period in which Interest accrues hereunder in respect of the interest accrued during the immediately preceding semi-annual period (each, an “Interest Date”) beginning on May 31, 2022 in accordance with the terms of this Note. All such Interest shall accrue at the Interest Rate. In the case of a conversion in accordance with Section 4, a redemption in accordance with Section 5 or any required payment upon a Change of Control Transaction or Event of Default, in each case, prior to the payment of Interest on an Interest Date, accrued and unpaid Interest on this Note as of the date of any such event shall be payable by way of inclusion of such Interest in the Conversion Amount or the Redemption Price, as applicable, on the applicable date of conversion or Redemption Date. |

| (b) | Subject to Applicable Law, if at any time required under the terms and conditions of this Note with respect to Interest due and payable hereunder, such amounts shall be paid in cash, or, at the option of the Company with no less than five (5) Business Days’ notice, prior to the applicable Interest Date, in writing to the Holder, may be paid in additional Notes (such amount to be paid in additional Notes hereunder, each, a “PIK Amount”). In the event any such PIK Amount is due hereunder, a new note shall be issued on the applicable Interest Date having the same terms as this Note (each, a “PIK”), except that the principal amount shall be equal to the PIK Amount and the issuance date of the new note shall be the applicable Interest Date. Notwithstanding the foregoing, Interest must be paid in cash in the event that shareholder approval would be required in order to issue the Common Shares upon conversion of such additional Notes in respect of any PIK Amount. |

| (c) | For purposes of the Interest Act (Canada), whenever any Interest under this Note is calculated using a rate based on a year of 360 days the rate determined pursuant to such calculation, when expressed as an annual rate, is equivalent to (i) the applicable rate based on a year of 360 days (ii) multiplied by the actual number of days in the calendar year in which the period for which such Interest is payable (or compounded) ends, and (iii) divided by 360. The principle of deemed reinvestment of interest does not apply to any Interest calculation under this Note and the rates of Interest stipulated in this Note are intended to be nominal rates and not effective rates or yields. |

2

| (d) | If any provision of this Note or of any of the other Transaction Documents would obligate the Company to make any payment of Interest or any other amount payable to the Holder in an amount or calculated at a rate which would be prohibited by Applicable Law or would result in a receipt by the Holder of interest at a criminal rate (as such terms are construed under the Criminal Code (Canada)) then, notwithstanding such provisions, such amount or rate shall be deemed to have been adjusted with retroactive effect to the maximum amount or rate of interest, as the case may be, as would not be so prohibited by Applicable Law or so result in a receipt by the Holder of interest at a criminal rate, such adjustment to be effected, to the extent necessary, as follows: firstly, by reducing the amount or rate of interest required to be paid to the Holder under the applicable Transaction Document, and thereafter, by reducing any fees, commissions, premiums and other amounts required to be paid to the Holder which would constitute “interest” for purposes of Section 347 of the Criminal Code (Canada). |

| 3. | TAX WITHHOLDING. The Company shall be entitled to deduct and withhold any applicable taxes or similar charges (including without limitation interest, penalties or similar amounts in respect thereof) imposed or levied by or on behalf of the Canadian government or of any province or territory thereof or any authority or agency therein or thereof or by any state, local or foreign tax law having power to tax, including pursuant to the Income Tax Act (Canada) (the “Tax Act”), from any payment to be made on or in connection with this Note (including in connection with a conversion, redemption or repayment of this Note), the Company remits such withheld amount to such government authority or agency and files all required forms in respect thereof and, at the same time, provides copies of such remittance and filing to the Holder, the amount of any such deduction or withholding will be considered an amount paid in satisfaction of the Company’s obligations under this Note. |

| 4. | CONVERSION OF NOTE. This Note shall be convertible, in whole or in part, into validly issued, fully paid and non-assessable Common Shares, on the terms and conditions set forth in this Section 4. |

| (a) | Holder Conversion Right. The Holder shall be entitled at its option at any time to convert all or a portion of the Conversion Amount into validly issued, fully paid and non-assessable Common Shares at the Conversion Rate. To convert any Conversion Amount into Common Shares on any Trading Day (the date of such conversion, a “Conversion Date”), the Holder shall deliver, for receipt by no earlier than 4:00 p.m. New York time, and no later than 11:59 p.m., New York time, on the Conversion Date, a copy of an executed notice of conversion in the form attached hereto as Exhibit I (the “Holder Conversion Notice”) to the Company, which Holder Conversion Notice shall set forth (i) the Conversion Amount, (ii) the detailed calculation of the accrued and unpaid Interest included in the Conversion Amount as of the Conversion Date, and (iii) the detailed calculation of the number of Common Shares required to be delivered in respect of such Holder Conversion Notice. |

| (b) | [Reserved]. |

| (c) | Mechanics of Conversion. |

3

| (i) | Satisfaction of Conversion. Any conversion in accordance with this Section 4 shall be deemed satisfied upon delivery of the appropriate number of Common Shares to the Holder by the end of the third Trading Day after a Holder Conversion Notice is delivered (the “Conversion Share Delivery Deadline”). For greater certainty, the day that the Holder Conversion Notice is delivered does not count as a Trading Day. The Person or Persons entitled to receive the Common Shares issuable upon a conversion of this Note shall be treated for all purposes as the record holder or holders of such Common Shares on the Conversion Date. |

| (ii) | Return of Note. Following a conversion of this Note in accordance with this Section 4, the Holder shall as soon as practicable and in no event later than two (2) Business Days after such conversion and at its own expense, surrender this Note to a nationally recognized overnight delivery service for delivery to the Company (or an indemnification undertaking with respect to this Note in the case of its loss, theft or destruction as contemplated by Section 15(b)). If this Note is physically surrendered for conversion and the outstanding Principal of this Note is greater than the Principal portion of the Conversion Amount being converted, then the Company shall as soon as practicable and in no event later than two (2) Business Days after receipt of this Note and at its own expense, issue and deliver to the Holder (or its designee) a new Note (in accordance with Section 15(d)) representing the outstanding Principal not converted. |

| (iii) | The Company shall not issue any fraction of a Common Share upon any conversion. If the conversion would result in the issuance of a fraction of a Common Share, the Company shall round such fraction of a Common Shares down to the nearest whole share. |

| (d) | Market Regulation. The Company shall only issue Common Shares upon conversion of this Note or otherwise pursuant to the terms of this Note to the extent the issuance of such Common Shares would not exceed the aggregate number of Common Shares that the Company may issue without violating the rules or regulations of any Eligible Market on which the Common Shares are then listed (including without limitation Section 312.03(c) of the NYSE Listed Company Manual), except that such limitation shall not apply in the event that the Company (i) obtains the approval of its shareholders as required by the applicable rules of any Eligible Market on which the Common Shares are then listed for issuances of Common Shares in excess of such amount or (ii) obtains a written opinion from counsel to the Company that such approval is not required. In the event that shareholder approval is required with respect to the issuance of Common Shares upon conversion of this Note (or otherwise pursuant to the terms of this Note) under the rules or regulations of any Eligible Market on which the Common Shares are then listed, as contemplated by clause (i) above, the Company shall use its reasonable best efforts to promptly obtain such approval. For the avoidance of doubt, the Company’s non-compliance with the limitations contained in this Section 4(d) shall not constitute an Event of Default or breach of this Note by the Company, and the Company shall not have any liability under this Note resulting therefrom. |

4

| (e) | Antitrust and Foreign Investment Laws. The Company shall only issue Common Shares upon conversion of this Note or otherwise pursuant to the terms of this Note to the extent the issuance of such Common Shares would not exceed the aggregate number of Common Shares that the Company may issue without violating the U.S. Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the “HSR Act”) or any antitrust laws of other jurisdictions or any foreign investment laws applicable in connection with the issuance of the Common Shares upon conversion of this Note, except that such limitation shall not apply in the event that (i) the Holder (and, if applicable, the Company) obtains the necessary regulatory approvals as required by any applicable antitrust laws or foreign investment laws or (ii) the Holder (and, if applicable, the Company) obtains a written opinion from counsel to the Holder (or, in the case of the Company, counsel to the Company) that such approval(s) are not required. For the avoidance of doubt, the Company’s non-compliance with the limitations contained in this Section 4(e) shall not constitute an Event of Default or breach of this Note by the Company, and the Company shall not have any liability under this Note or otherwise resulting therefrom, but in the event that conversion of this Note requires any filing or approval under the HSR Act or any applicable antitrust laws of any other jurisdiction and any foreign investment laws the Holder and, if applicable, the Company shall endeavor to make such filings and obtain such approval in accordance with, and subject to the limitations set forth in, Section 5(h) of the Note Purchase Agreement. |

| 5. | OPTIONAL REDEMPTION BY THE COMPANY. |

| (a) | Redemption Right. The Company shall be entitled to redeem (an “Optional Redemption”) all, but not less than all, of this Note at any time for a cash purchase price (the “Optional Redemption Price”) equal to the sum of: |

| (i) | 100% of the Principal; plus |

| (ii) | all accrued and unpaid Interest on this Note as of the Redemption Date (as defined below). |

| (b) | Mechanics of Redemption. |

| (i) | Optional Redemption Notice. To exercise its redemption right pursuant to this Section 5, the Company shall deliver to the Holder, a copy of an executed notice of redemption in the form attached hereto as Exhibit II (when used in connection with a redemption pursuant to this Section 5, the “Optional Redemption Notice”), which Optional Redemption Notice shall set forth (i) the Optional Redemption Price and (ii) detailed calculations of the Principal plus accrued and unpaid Interest included in the Optional Redemption Price as of the Redemption Date. |

5

| (ii) | Satisfaction of Redemption. Any redemption on a Redemption Date in accordance with this Section 5 shall be deemed satisfied upon payment of the Optional Redemption Price in cash to the Holder by the end of the third Trading Day after the Optional Redemption Notice is delivered. For greater certainty, the day that the Optional Redemption Notice is given shall not count as a Trading Day. |

| (iii) | Return of Note. Following a redemption of this Note in accordance with this Section 5, the Holder shall as soon as practicable and in no event later than two (2) Business Days after receipt of the Optional Redemption Price and at its own expense surrender this Note to a nationally recognized overnight delivery service for delivery to the Company (or an indemnification undertaking with respect to this Note in the case of its loss, theft or destruction as contemplated by Section 15(b)). |

| (iv) | Conversion Prior to Redemption. Holder may convert this Note at its option pursuant to Section 4(a) hereof at any time after receipt of an Optional Redemption Notice and prior to payment of the Optional Redemption Price. |

| (c) | Warrants. |

| (i) | The Company shall not issue an Optional Redemption Notice under Section 5(b)(i) unless the Company has prior to the issuance of the Optional Redemption Notice obtained shareholder approval, to the extent required, under Applicable Law and, for the avoidance of doubt, rules and regulations of any Eligible Market, to issue the Holder the number of Redemption Warrants (as defined herein) as contemplated by Section 5(c)(ii) and the number of Common Shares on exercise of such Redemption Warrants. |

| (ii) | Provided the Holder has not elected to convert this Note in whole into Common Shares in accordance with Section 5(b)(iv) following receipt of an Optional Redemption Notice, the Company shall issue to the Holder, on the date of redemption of this Note, a number of share warrants of the Company (the “Redemption Warrants”) entitling the Holder to acquire a number of Common Shares equal to the Principal redeemed divided by the then applicable Conversion Price and expiring on the Maturity Date. The initial exercise price of the Redemption Warrants will be equal to the applicable Conversion Price as of the date of redemption of this Note. The form of Warrant certificate for such Redemption Warrants is attached hereto as Exhibit III. The Holder shall have the right to reasonably request that the Company deliver, upon issuance of the Redemption Warrants, customary opinions of counsel, in form and substance substantially as set forth in Exhibit D to the Note Purchase Agreement. |

6

| 6. | RIGHTS UPON EVENT OF DEFAULT. |

| (a) | Events of Default. Each of the following events shall constitute an “Event of Default”: |

| (i) | default in any payment of interest on this Note when due and payable that has continued for a period of thirty (30) days; |

| (ii) | default in the payment of Principal when due and payable on the Maturity Date, upon Optional Redemption by the Company or upon declaration of acceleration hereunder; |

| (iii) | failure by the Company to comply with its obligation to convert this Note in accordance with this Note upon exercise of the Holder’s conversion right in accordance with the terms hereof and such failure continues for a period of five (5) Business Days; |

| (iv) | failure by the Company to comply with its obligation to redeem the Note upon a Change of Control Transaction that has continued for a period of ten (10) days; |

| (v) | failure by the Company for sixty (60) days after written notice from the Holder has been received by the Company to comply with any of its other agreements contained in this Note, the Note Purchase Agreement or the Registration Rights Agreement; |

| (vi) | (A) any “Event of Default” (howsoever defined) under the 2021 Convertible Note, or (B) default by the Company or any subsidiary of the Company with respect to any mortgage, agreement or other instrument under which there may be outstanding, or by which there may be secured or evidenced, any indebtedness for money borrowed of $100,000,000 or more (or its foreign currency equivalent) in the aggregate of the Company or such subsidiary, whether such indebtedness now exists or shall hereafter be created, (1) resulting in such indebtedness becoming or being declared due and payable prior to its stated maturity date or (2) constituting a failure to pay the principal of any such debt when due and payable (after the expiration of all applicable grace periods) at its stated maturity, upon required repurchase, upon declaration of acceleration or otherwise, and in the cases of clauses (1) and (2), such acceleration shall not have been rescinded or annulled or such failure to pay or default shall not have been cured or waived, or such indebtedness is not paid or discharged, as the case may be, within thirty (30) days after written notice of such default to the Company by the Holder; |

| (vii) | one or more final, non-appealable judgments or orders is rendered against the Company or any subsidiary of the Company, which requires the payment in money by the Company or any subsidiary of the Company, individually or in the aggregate, of an amount (net of amounts covered by insurance or bonded) in excess of $150,000,000, and such judgment or judgments have not been satisfied, stayed, paid, discharged, vacated, bonded, annulled or rescinded within thirty (30) days after the later of (A) the date on which the right to appeal thereof has expired if no such appeal has commenced, and (B) the date on which all rights to appeal have been extinguished; |

7

| (viii) | commencement by the Company or a Significant Subsidiary of a voluntary case or other proceeding seeking liquidation, reorganization or other relief with respect to the Company or a Significant Subsidiary or their respective debts under any bankruptcy, insolvency or other similar law now or hereafter in effect or seeking the appointment of a trustee, receiver, liquidator, custodian or other similar official of the Company or a Significant Subsidiary or any substantial part of their respective property, or shall consent to any such relief or to the appointment of or taking possession by any such official in an involuntary case or other proceeding commenced against it, or shall make a general assignment for the benefit of creditors; |

| (ix) | an involuntary case or other proceeding having been commenced against the Company or a Significant Subsidiary seeking liquidation, reorganization or other relief with respect to the Company or a Significant Subsidiary or their respective debts under any bankruptcy, insolvency or other similar law now or hereafter in effect or seeking the appointment of a trustee, receiver, liquidator, custodian or other similar official of the Company or a Significant Subsidiary or any substantial part of their respective property, and such involuntary case or other proceeding shall remain undismissed and unstayed for a period of thirty (30) consecutive days; or |

| (x) | the Common Shares cease to be listed on an Eligible Market. |

| (b) | Notice of Default; Accelerated Redemption Right. Upon the occurrence of a Default with respect to this Note the Company shall within three (3) Business Days deliver written notice thereof (a “Default Notice”) to the Holder that includes (i) a reasonable description of the applicable Default, (ii) a certification as to whether, in the opinion of the Company, such Default is capable of being cured and, if applicable, a reasonable description of any existing plans of the Company to cure such Default and (iii) a certification as to the date the Default occurred and, if cured on or prior to the date of such Default Notice, the applicable Event of Default Right Expiration Date (as defined below). At any time after the earlier of (A) the Holder’s receipt of a Default Notice and the subsequent occurrence of an Event of Default and (B) the Holder becoming aware of an Event of Default and ending (such ending date, the “Event of Default Right Expiration Date”) on the twentieth (20th) Trading Day after the later of (x) the date such Default is cured and (y) the Holder’s receipt of a Default Notice and the subsequent occurrence of an Event of Default, the Holder may require the Company to redeem (unless such Event of Default has been cured on or prior to |

8

| the Event of Default Right Expiration Date) all or any portion of this Note by delivering written notice thereof (the “Event of Default Redemption Notice”) to the Company, which Event of Default Redemption Notice shall indicate the portion of this Note the Holder is electing to require the Company to redeem. Each portion of this Note subject to redemption by the Company pursuant to this Section 6(b) shall be redeemed by the Company for a cash purchase price equal to the Forced Redemption Price. Any redemption upon an Event of Default in accordance with this Section 6(b) shall not constitute an election of remedies by the Holder, and all other rights and remedies of the Holder shall be preserved. |

| (c) | Satisfaction of Accelerated Redemption. The Company’s obligation to redeem in accordance with this Section 6 shall be deemed satisfied upon payment of the Forced Redemption Price in cash to the Holder by the end of the fifth Trading Day after the Event of Default Redemption Notice is given. For greater certainty, the day that the Event of Default Redemption Notice is given does not count as a Trading Day. |

| (d) | Return of Note. Following a redemption of this Note in accordance with this Section 6, the Holder shall as soon as practicable and in no event later than two (2) Business Days after receipt of the Forced Redemption Price and at its own expense surrender this Note to a nationally recognized overnight delivery service for delivery to the Company (or an indemnification undertaking with respect to this Note in the case of its loss, theft or destruction as contemplated by Section 15(b)). |

| (e) | In addition to the foregoing: |

| (i) | Automatic Acceleration. If an Event of Default set forth in Section 6(a)(viii) or Section 6(a)(ix) occurs, then the Principal of, and all accrued and unpaid interest and Make-Whole Amount on, this Note will immediately become due and payable without any further action or notice by any Person. |

| (ii) | Optional Acceleration. If an Event of Default (other than an Event of Default set forth in Section 6(a)(viii) or Section 6(a)(ix)) occurs and is continuing, then the Holder may, by notice to the Company, declare the Principal, and all accrued and unpaid Interest on, this Note to become due and payable immediately. |

| (iii) | Rescission of Acceleration. Notwithstanding anything to the contrary in this Note, the Holder, by notice to the Company, may rescind any acceleration of this Note and its consequences if (A) such rescission would not conflict with any judgment or decree of a court of competent jurisdiction; and (B) all existing Events of Default (except the non-payment of Principal of, or Interest on, this Note that has become due solely because of such acceleration) have been cured or waived. No such rescission will affect any subsequent Default or impair any right consequent thereto. |

9

| 7. | RIGHTS UPON CHANGE OF CONTROL TRANSACTION. |

| (a) | Mandatory Redemption upon Change of Control Transaction. Upon the consummation of a Change of Control Transaction, the Company shall redeem all, but not less than all, of this Note remaining outstanding and unconverted at such time for a cash purchase price equal to the Forced Redemption Price (a “Mandatory Redemption”). |

| (b) | Mechanics of Redemption. |

| (i) | Redemption Notice. Upon a redemption by the Company pursuant to this Section 7, the Company shall deliver to the Holder, a copy of an executed notice of redemption in the form attached hereto as Exhibit II (when used in connection with a redemption pursuant to this Section 7, the “CoC Redemption Notice”) to the Holder, which CoC Redemption Notice shall, for greater certainty, set forth (i) the Forced Redemption Price and (ii) calculations of the accrued and unpaid Interest and Make-Whole Amount included in the Forced Redemption Price as of the Redemption Date. |

| (ii) | Satisfaction of Redemption. Any redemption on a Redemption Date in accordance with this Section 7 shall be deemed satisfied upon payment of the Forced Redemption Price in cash to the Holder by the end of the third Trading Day after the CoC Redemption Notice is given. For greater certainty, the day that the CoC Redemption Notice is given does not count as a Trading Day. |

| (iii) | Return of Note. Following a redemption of this Note in accordance with this Section 7, the Holder shall as soon as practicable and in no event later than two (2) Business Days after receipt of the Forced Redemption Price and at its own expense surrender this Note to a nationally recognized overnight delivery service for delivery to the Company (or an indemnification undertaking with respect to this Note in the case of its loss, theft or destruction as contemplated by Section 15(b)). |

| (iv) | Conversion Prior to Redemption. Holder may convert this note at its option pursuant to Section 4(a) hereof at any time after receipt of a CoC Redemption Notice and prior to payment of the Forced Redemption Price. |

| 8. | ADJUSTMENTS. |

| (a) | If and whenever, at any time after the Issuance Date and prior to the Maturity Date, the Company shall: (i) subdivide or re-divide its outstanding Common Shares into a greater number of Common Shares; (ii) reduce, combine or consolidate the outstanding Common Shares into a smaller number of Common Shares; (iii) issue options, rights, warrants or similar securities to the holders of |

10

| all of the outstanding Common Shares; or (iv) issue Common Shares or securities convertible into Common Shares to the holders of all of the outstanding Common Shares by way of a dividend or distribution; the number of Common Shares issuable upon conversion of this Note on the date of the subdivision, re-division, reduction, combination or consolidation or on the record date for the issue of options, rights, warrants or similar securities or on the record date for the issue of Common Shares or securities convertible into Common Shares by way of a dividend or distribution, as the case may be, shall be adjusted so that the Holder shall be entitled to receive the kind and number of Common Shares or other securities of the Company which it would have owned or been entitled to receive after the happening of any of the events described in this Section 8(a) had this Note been converted immediately prior to the happening of such event or any record date with respect thereto. Any adjustments made pursuant to this Section 8(a) shall become effective immediately after the effective time of such event retroactive to the record date, if any, for such event. |

| (b) | If and whenever at any time after the Issuance Date and prior to the Maturity Date, there is a reclassification of the Common Shares or a capital reorganization of the Company other than as described in Section 8(a) or a consolidation, amalgamation, arrangement, binding share exchange, merger of the Company with or into any other Person or other entity or acquisition of the Company or other combination pursuant to which the Common Shares are converted into or acquired for cash, securities or other property; or a sale or conveyance of the property and assets of the Company as an entirety or substantially as an entirety to any other Person (other than a direct or indirect wholly-owned subsidiary of the Company) or other entity or a liquidation, dissolution or winding-up of the Company (in any of the foregoing cases, that is not a Change of Control Transaction), the Holder, if it has not exercised its right of conversion prior to the effective date of such reclassification, capital reorganization, consolidation, amalgamation, arrangement, merger, share exchange, acquisition, combination, sale or conveyance or liquidation, dissolution or winding-up, upon the exercise of such right thereafter, shall be entitled to receive and shall accept, in lieu of the number of Common Shares then sought to be acquired by it, such amount of cash or the number of shares or other securities or property of the Company or of the Person or other entity resulting from such merger, amalgamation, arrangement, acquisition, combination or consolidation, or to which such sale or conveyance may be made or which holders of Common Shares receive pursuant to such liquidation, dissolution or winding-up, as the case may be, that the Holder would have been entitled to receive on such reclassification, capital reorganization, consolidation, amalgamation, arrangement, merger, share exchange, acquisition, combination, sale or conveyance or liquidation, dissolution or winding-up, if, on the record date or the effective date thereof, as the case may be, the Holder had been the registered holder of the number of Common Shares sought to be acquired by it and to which it was entitled to acquire upon the exercise of its conversion right at the Conversion Price. |

11

| (c) | If, and whenever at any time after the Issuance Date and prior to the Maturity Date, the Company shall issue Additional Shares of Common Stock, without consideration or for a consideration per share less than Fair Market Value as of the date of issue thereof, then the Conversion Price shall be reduced, concurrently with such issue, to a price (calculated to the nearest one-hundredth of a cent) determined in accordance with the following formula: |

CP2 = CP1* (A + B) ÷ (A + C).

For purposes of the foregoing formula, the following definitions shall apply:

| (i) | “CP2” shall mean the Conversion Price in effect immediately after such issue of Additional Shares of Common Stock; |

| (ii) | “CP1” shall mean the Conversion Price in effect immediately prior to such issue of Additional Shares of Common Stock; |

| (iii) | “A” shall mean the number of Common Shares outstanding immediately prior to such issue of Additional Shares of Common Stock (treating for this purpose as outstanding all Common Shares issuable upon exercise of options outstanding immediately prior to such issue or upon conversion or exchange of securities or notes convertible into Common Shares outstanding immediately prior to such issue); |

| (iv) | “B” shall mean the number of Common Shares that would have been issued if such Additional Shares of Common Stock had been issued at a price per share equal to CP1 (determined by dividing the aggregate consideration received by the Company (as determined in good faith by the Company’s board of directors) in respect of such issue by CP1); and |

| (v) | “C” shall mean the number of such Additional Shares of Common Stock issued in such transaction. |

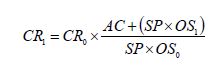

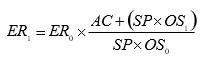

| (d) | If the Company or any of its subsidiaries makes a payment in respect of a tender offer or exchange offer for Common Shares (other than solely pursuant to an odd-lot tender offer pursuant to Rule 13e-4(h)(5) under the 1934 Act), and the value (determined as of the Expiration Time by the Company’s board of directors) of the cash and other consideration paid per Common Share in such tender or exchange offer exceeds the last reported sale price per Common Share on the Trading Day immediately after the last date (the “Expiration Date”) on which tenders or exchanges may be made pursuant to such tender or exchange offer (as it may be amended), then the Conversion Rate will be increased based on the following formula: |

12

where:

| CR0 | =the Conversion Rate in effect immediately before the close of business on the last Trading Day of the Tender/Exchange Offer Valuation Period for such tender or exchange offer; |

| CR1 | =the Conversion Rate in effect immediately after the close of business on the last Trading Day of the Tender/Exchange Offer Valuation Period; |

| AC | =the aggregate value (determined as of the time (the “Expiration Time”) such tender or exchange offer expires by the Company’s board of directors) of all cash and other consideration paid for Common Shares purchased or exchanged in such tender or exchange offer; |

| OS0 | =the number of Common Shares outstanding immediately before the Expiration Time (including all Common Shares accepted for purchase or exchange in such tender or exchange offer); |

| OS1 | =the number of Common Shares outstanding immediately after the Expiration Time (excluding Common Shares accepted for purchase or exchange in such tender or exchange offer); and |

| SP | =the average of the last reported sale prices per Common Shares over the ten (10) consecutive Trading Day period (the “Tender/Exchange Offer Valuation Period”) beginning on, and including, the Trading Day immediately after the Expiration Date; |

provided, however, that the Conversion Rate will in no event be adjusted down pursuant to this Section 8(d), except to the extent provided in the immediately following paragraph. Notwithstanding anything to the contrary in this Section 8(d), if the Conversion Date for this Note to be converted occurs during the Tender/Exchange Offer Valuation Period for such tender or exchange offer, then, solely for purposes of determining the Conversion Price for such conversion, such Tender/Exchange Offer Valuation Period will be deemed to consist of the Trading Days occurring in the period from, and including, the Trading Day immediately after the Expiration Date to, and including, such Conversion Date. To the extent such tender or exchange offer is announced but not consummated (including as a result of the Company being precluded from consummating such tender or exchange offer under applicable law), or any purchases or exchanges of Common Shares in such tender or exchange offer are rescinded, the Conversion Rate will be readjusted to the Conversion Rate that would then be in effect had the adjustment been made on the basis of only the purchases or exchanges of Common Shares, if any, actually made, and not rescinded, in such tender or exchange offer.

13

| (e) | If, and whenever at any time after the Issuance Date and prior to the Maturity Date, the Company shall make or issue, or fix a record date for the determination of holders of Common Shares entitled to receive (and subsequently make or issue), a dividend or other distribution payable in cash or other property not involving Common Shares or securities convertible into Common Shares (which is the subject of Section 8(a)), then and in each such event the Holder of this Note shall receive, and shall accept, upon the conversion of this Note into Common Shares, a dividend or other distribution of such cash or other property in an amount equal to the amount of such cash or other property as it would have received if this Note had been converted into Common Shares on the date of such event. |

| (f) | On the occurrence of any reclassification of, or other change in, the outstanding Common Shares or any other event which is not a Change of Control Transaction or addressed in Section 8(a), 8(b), 8(c), 8(d) or 8(e) (each, an “Unanticipated Event”), the parties will, in good faith, make such further adjustments and changes and take all necessary actions, subject to the approval of the Holder, so as to ensure that the Holder receives, upon the conversion of this Note occurring at any time after the date of the occurrence of the Unanticipated Event, such shares, securities, rights, cash or property that the Holder would have received if, immediately prior to the date of such Unanticipated Event, the Holder had been the registered holder of the number of Common Shares to which the Holder would be entitled upon the conversion of this Note into Common Shares. |

| (g) | The adjustments provided for in Sections 8(a), 8(b), 8(c), 8(d), 8(e) and 8(f) are cumulative and will be made successively whenever an event referred to therein occurs. |

| (h) | If at any time a question or dispute arises with respect to the adjustments provided for in Sections 8(a), 8(b), 8(c), 8(d), 8(e) or 8(f), such question or dispute will be conclusively determined by a firm of nationally recognized chartered professional accountants appointed by the Company (who may be the auditors of the Company) and acceptable to the Holder. Such accountants shall have access to all necessary records of the Company and any such determination will be binding upon the Company and the Holder. |

| (i) | The Company shall, from time to time immediately after the occurrence of any event which requires an adjustment or re-adjustment as provided in Sections 8(a), 8(b), 8(c), 8(d), 8(e) or 8(f), deliver a certificate of the Company to the Holder specifying the nature of the event requiring the same and the amount of the necessary adjustment (or, in the case of Section 8(e), entitlement to cash or other property upon conversion) and setting forth in reasonable detail the method of calculation and the facts upon which such calculation is based, and, if reasonably required by the Holder, such certificate and the amount of the adjustment specified therein shall be verified by an opinion of a firm of nationally recognized chartered professional accountants appointed by the Company (who may be the auditors of the Company) and acceptable to the Holder. |

14

| (j) | Notwithstanding anything to the contrary in Sections 8(a), 8(b), 8(c), 8(d), 8(e) or 8(f), if the Holder would otherwise be entitled to receive, upon the exercise of its right of conversion, any property (including cash) or securities that would not constitute “prescribed securities” for the purposes of clause 212(1)(b)(vii)(E) of the Tax Act as it applied immediately before January 1, 2008 (“Ineligible Consideration”), the Holder shall not be entitled to receive such Ineligible Consideration and the Company or the successor or acquiror, as the case may be, shall have the right (at the sole option of the Company or the successor or acquiror, as the case may be) to deliver to the Holder “prescribed securities” for the purposes of clause 212(1)(b)(vii)(E) of the Tax Act as it applied immediately before January 1, 2008 with a market value (as conclusively determined by the board of directors of the Company) equal to the market value of such Ineligible Consideration. |

| 9. | HOLDER CONSENT RIGHT OVER DEBT INCURRENCE. |

The Company agrees that it shall not incur additional Indebtedness without the consent of the Holder, which consent shall not be unreasonably withheld, conditioned or delayed, other than:

| (a) | Indebtedness incurred during any rolling 12-month period that does not exceed $75,000,000 individually or in the aggregate; |

| (b) | Indebtedness incurred in the ordinary course of business, including trade payables and intercompany debt; |

| (c) | Indebtedness incurred in connection with any agreement entered into with the DOE Loans Program Office; or |

| (d) | Indebtedness incurred in connection with any agreement entered into with the Export Development Canada Project Finance and Sustainable Development Technology Canada. |

| 10. | COVENANTS |

| (a) | Covenant to Pay. The Company will pay or cause to be paid all the Principal of, the Redemption Price for, Interest on, and other amounts due with respect to, this Note on the dates and in the manner set forth in this Note. |

| (b) | Amendments to 2021 Convertible Note. If, on or after the date of issuance of the 2021 Convertible Note, any term of the 2021 Convertible Note has been or is amended or modified in a manner that is favorable to the holder thereof, the Company shall simultaneously offer to amend or modify this Note to reflect similar terms and, if Holder accepts such offer, the Company shall promptly effect such amendment or modification. |

15

| (c) | Corporate Existence. Subject to Section 7, until the Reference Date, the Company shall do or cause to be done, at its own cost and expense, all things necessary to preserve and keep in full force and effect its corporate existence in accordance with the organizational documents (as the same may be amended from time to time) of the Company. |

| (d) | Stay, Extension and Usury Laws. To the extent that it may lawfully do so, the Company (i) agrees that it will not at any time insist upon, plead, or in any manner whatsoever claim or take the benefit or advantage of, any stay, extension or usury law (wherever or whenever enacted or in force) that may affect the covenants or the performance of this Note; and (ii) expressly waives all benefits or advantages of any such law and agrees that it will not, by resort to any such law, hinder, delay or impede the execution of any power granted to the Holder by this Note, but will suffer and permit the execution of every such power as though no such law has been enacted. |

| (e) | Payment of Taxes. Until the Reference Date, the Company shall pay or discharge or cause to be paid or discharged, before the same shall become delinquent, all material taxes, assessments and governmental charges (including withholding taxes and any penalties, interest and additions to taxes) levied or imposed upon it or its properties except (i) where the failure to effect such payment or discharge is not adverse in any material respect to the Holder or (ii) where such taxes are being contested in good faith and by appropriate negotiations or proceedings and with respect to which appropriate reserves have been taken in accordance with applicable accounting standards. |

| 11. | VOTING RIGHTS. The Holder shall have no voting rights as the holder of this Note, except as required by Applicable Law (including the Business Corporations Act (Ontario)). |

| 12. | ADDITIONAL COVENANTS. Until the Reference Date, the Company shall comply with those covenants as set forth in Section 5 of the Note Purchase Agreement and the Registration Rights Agreement. |

| 13. | AMENDING THE TERMS OF THIS NOTE. The prior written consent of the Holder shall be required for any change, modification, waiver or amendment to this Note. Any change, amendment, modification or waiver so approved shall be binding upon all existing and future holders of this Note. |

| 14. | TRANSFER. |

| (a) | The Company shall maintain a register (the “Register”) for the recordation of the name and address of the Holder and the principal amount of this Note and Interest accrued and unpaid thereon (the “Registered Note”). The entries in the Register shall be conclusive and binding for all purposes absent manifest error. The Company shall treat the Holder for all purposes (including the right to receive payments of Principal and Interest hereunder) as the owner hereof |

16

| notwithstanding notice to the contrary, however, that upon its receipt of a written request to assign, transfer or sell all or part of the Registered Note by the Holder to a Permitted Transferee, the Company shall record the information contained therein in the Register and issue one or more new Registered Notes in the same aggregate principal amount as the principal amount of the surrendered Registered Note to the designated assignee or transferee pursuant to Section 15; provided, however, that the Company will not register any assignment, transfer or sale of this Note not made in accordance with Regulation S or pursuant to registration under the 1933 Act or an available exemption therefrom. Notwithstanding anything to the contrary set forth in this Section 14, following conversion of any portion of this Note in accordance with the terms hereof, the Holder shall not be required to physically surrender this Note to the Company unless (A) the full Conversion Amount represented by this Note is being converted (in which event this Note shall be delivered to the Company following conversion thereof as contemplated by Section 4(c)) or (B) the Holder has provided the Company with prior written notice (which notice may be included in a Holder Conversion Notice) requesting reissuance of this Note upon physical surrender of this Note. If the Company does not update the Register to record the Principal, Interest converted and/or paid (as the case may be) and the dates of such conversions and/or payments (as the case may be), then the Register shall be automatically deemed updated to reflect such occurrence on the Business Day immediately prior to such occurrence. |

| (b) | This Note may not be offered, sold, assigned or transferred (including through hedging or derivative transactions) by the Holder other than to one or more Permitted Transferees in accordance with the provisions of Regulation S of the 1933 Act or pursuant to registration under the 1933 Act or an available exemption therefrom and by registration of such assignment or sale on the Register. Notwithstanding the foregoing, upon the occurrence of an Event of Default pursuant to Section 6(a) (in the case of 6(a)(v), only in the event of material breaches) and for so long as such Event of Default is continuing and has not been cured or waived, the Holder may offer, sell, assign or transfer this Note (including through hedging or derivative transactions) to any person in accordance with applicable law, and the Register shall be deemed updated to reflect such offer, sale, assignment, transfer, hedge or derivative transaction on the date of such offer, sale, assignment, transfer, hedge or derivative transaction. |

| 15. | REISSUANCE OF THIS NOTE. |

| (a) | Transfer. If this Note is to be transferred in accordance with the terms hereof, the Holder shall surrender this Note to the Company, whereupon the Company will forthwith issue and deliver upon the order of the Holder a new Note (in accordance with Section 15(d)), registered as the Holder may request, representing the outstanding Principal being transferred by the Holder and, if less than the entire outstanding Principal is being transferred, a new Note (in accordance with Section 15(d)) to the Holder representing the outstanding Principal not being transferred. The Holder and any assignee, by acceptance of this Note, acknowledge and agree that, by reason of the provisions of this Note following conversion or redemption of any portion of this Note, the outstanding Principal represented by this Note may be less than the Principal stated on the face of this Note. |

17

| (b) | Lost, Stolen or Mutilated Note. Upon receipt by the Company of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Note (as to which a written certification and the indemnification contemplated below shall suffice as such evidence), and, in the case of loss, theft or destruction, of any indemnification undertaking by the Holder to the Company in customary and reasonable form and, in the case of mutilation, upon surrender and cancellation of this Note, the Company shall execute and deliver to the Holder a new Note (in accordance with Section 15(d)) representing the outstanding Principal. |

| (c) | Note Exchangeable for Different Denominations. This Note is exchangeable, upon the surrender hereof by the Holder at the principal office of the Company, for a new Note or Notes (in accordance with Section 15(d) and in principal amounts of at least $5,000,000) representing in the aggregate the outstanding Principal of this Note, and each such new Note will represent such portion of such outstanding Principal as is designated by the Holder at the time of such surrender. |

| (d) | Issuance of New Notes. Whenever the Company is required to issue a new Note pursuant to the terms of this Note, such new Note (i) shall be of like tenor with this Note, (ii) shall represent, as indicated on the face of such new Note, the Principal remaining outstanding (or in the case of a new Note being issued pursuant to Section 15(a) or Section 15(c), the Principal designated by the Holder which, when added to the principal represented by the other new Notes issued in connection with such issuance, does not exceed the Principal remaining outstanding under this Note immediately prior to such issuance of new Notes), (iii) shall have an issuance date, as indicated on the face of such new Note, which is the same as the Issuance Date of this Note, (iv) shall have the same rights and conditions as this Note, and (v) shall represent accrued and unpaid Interest from the Issuance Date. |

| 16. | REMEDIES, CHARACTERIZATIONS, OTHER OBLIGATIONS, BREACHES AND INJUNCTIVE RELIEF. The remedies provided in this Note shall be cumulative and in addition to all other remedies available under this Note and any of the other Transaction Documents at law or in equity (including a decree of specific performance and/or other injunctive relief), and nothing herein shall limit the Holder’s right to pursue actual and consequential damages for any failure by the Company to comply with the terms of this Note. No failure on the part of the Holder to exercise, and no delay in exercising, any right, power or remedy hereunder shall operate as a waiver thereof; nor shall any single or partial exercise by the Holder of any right, power or remedy preclude any other or further exercise thereof or the exercise of any other right, power or remedy. In addition, the exercise of any right or remedy of the Holder at law or equity or under this Note or any of the documents shall not be deemed to be an election of Holder’s rights |

18

| or remedies under such documents or at law or equity. The Company covenants to the Holder that there shall be no characterization concerning this instrument other than as expressly provided herein. Amounts set forth or provided for herein with respect to payments, conversion and the like (and the computation thereof) shall be the amounts to be received by the Holder and shall not, except as expressly provided herein, be subject to any other obligation of the Company (or the performance thereof). The Company acknowledges that a breach by it of its obligations hereunder will cause irreparable harm to the Holder and that the remedy at law for any such breach may be inadequate. The Company therefore agrees that, in the event of any such breach or threatened breach, the Holder shall be entitled, in addition to all other available remedies, to seek specific performance and/or temporary, preliminary and permanent injunctive or other equitable relief from any court of competent jurisdiction in any such case without the necessity of proving actual damages and without posting a bond or other security. The Company shall provide all information and documentation to the Holder that is reasonably requested by the Holder to enable the Holder to confirm the Company’s compliance with the terms and conditions of this Note. |

| 17. | PAYMENT OF COLLECTION, ENFORCEMENT AND OTHER COSTS. If (a) this Note is placed in the hands of an attorney for collection or enforcement or is collected or enforced through any legal proceeding or the Holder otherwise takes action to collect amounts due under this Note or to enforce the provisions of this Note or (b) there occurs any bankruptcy, reorganization, receivership of the Company or other proceedings affecting the Holder’s rights and involving a claim under this Note, then the Company shall pay the costs incurred by the Holder for such collection, enforcement or action or in connection with such bankruptcy, reorganization, receivership or other proceeding, including attorneys’ fees and disbursements. The Company expressly acknowledges and agrees that no amounts due under this Note shall be affected, or limited, by the fact that the purchase price paid for this Note was less than the original Principal amount hereof. |

| 18. | CONSTRUCTION; HEADINGS. This Note shall be deemed to be jointly drafted by the Company and the initial Holder and shall not be construed against any such Person as the drafter hereof. The headings of this Note are for convenience of reference and shall not form part of, or affect the interpretation of, this Note. Unless the context clearly indicates otherwise, each pronoun herein shall be deemed to include the masculine, feminine, neuter, singular and plural forms thereof. The terms “including,” “includes,” “include” and words of like import shall be construed broadly as if followed by the words “without limitation.” The terms “herein,” “hereunder,” “hereof” and words of like import refer to this entire Note instead of just the provision in which they are found. Unless expressly indicated otherwise, all section references are to sections of this Note. |

| 19. | FAILURE OR INDULGENCE NOT WAIVER. No failure or delay on the part of the Holder in the exercise of any power, right or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such power, right or privilege preclude other or further exercise thereof or of any other right, power or privilege. No waiver shall be effective unless it is in writing and signed by an authorized representative of the waiving party. |

19

| 20. | DISPUTE RESOLUTION. |

| (a) | Submission to Dispute Resolution. |

| (i) | In the case of a dispute relating to a Conversion Price or the arithmetic calculation of a Conversion Rate, the Optional Redemption Price or the Forced Redemption Price (as the case may be) (including a dispute relating to the determination of any of the foregoing), the Company or the Holder (as the case may be) shall submit the dispute to the other party via electronic mail or otherwise (A) if by the Company, within five (5) Business Days after the occurrence of the circumstances giving rise to such dispute or (B) if by the Holder within five (5) Business Days after the Holder learned of the circumstances giving rise to such dispute. If the Holder and the Company are unable to promptly resolve such dispute relating to such Conversion Price or the arithmetic calculation of such Conversion Rate or such Redemption Price (as the case may be), at any time after the second (2nd) Business Day following such initial notice by the Company or the Holder (as the case may be) of such dispute to the Company or the Holder (as the case may be), then the Company shall select an independent, reputable investment bank acceptable to the Holder, acting reasonably, to resolve such dispute and the Company shall promptly send written confirmation of such joint selection to the Holder. |

| (ii) | The Holder and the Company shall each deliver to such investment bank (A) a copy of the initial dispute submission so delivered in accordance with the first sentence of this Section 20 and (B) written documentation supporting its position with respect to such dispute, in each case, no later than 5:00 p.m., New York time, by the fifth (5th) Business Day immediately following the date on which the Company provided notice to the Holder of the joint selection of such investment bank (the “Dispute Submission Deadline”) (the documents referred to in the immediately preceding clauses (A) and (B) are collectively referred to herein as the “Required Dispute Documentation”) (it being understood and agreed that if either the Holder or the Company fails to so deliver all of the Required Dispute Documentation by the Dispute Submission Deadline, then the party who fails to so submit all of the Required Dispute Documentation shall no longer be entitled to (and hereby waives its right to) deliver or submit any written documentation or other support to such investment bank with respect to such dispute and such investment bank shall resolve such dispute based solely on the Required Dispute Documentation that was delivered to such investment bank prior to the Dispute Submission Deadline). Unless otherwise agreed to in writing by both the Company and the Holder or otherwise requested by such investment bank, neither the Company nor the Holder shall be entitled to deliver or submit any written documentation or other support to such investment bank in connection with such dispute (other than the Required Dispute Documentation). Any and all communications between the |

20

| Company, on the one hand, and the Holder, on the other hand, and such investment bank shall be made in writing and a copy provided simultaneously to the Company and the Holder and no meeting between such investment bank and the Company or the Holder shall take place unless each of the Company and the Holder are in attendance. |

| (iii) | The Company and the Holder shall cause such investment bank to determine the resolution of such dispute and notify the Company and the Holder of such resolution no later than ten (10) Business Days immediately following the Dispute Submission Deadline. The fees and expenses of such investment bank shall be shared equally between the Company and the Holder, and such investment bank’s resolution of such dispute shall be final and binding upon all parties absent manifest error. |

| 21. | NOTICES; CURRENCY; PAYMENTS. |

| (a) | Notices. Any notices, consents, waivers or other communications required or permitted to be given under the terms of this Note must be in writing and will be deemed to have been delivered: (i) upon receipt by the recipient, when delivered personally; (ii) upon receipt by the recipient, when sent by electronic mail (provided that such sent email is kept on file (whether electronically or otherwise) by the sending party and the sending party does not receive an automatically generated message from the recipient’s email server that such e-mail could not be delivered to such recipient); or (iii) one (1) Business Day after deposit with an overnight courier service with next day delivery specified, in each case, properly addressed to the party to receive the same. The addresses and e-mail addresses for such communications shall be: |

If to the Company:

Li-Cycle Holdings Corp.

207 Queen’s Quay West, Suite 590

Toronto, Ontario M5J 1A7

Attention: Ajay Kochhar

Email: ajay.kochhar@li-cycle.com

with a copy (which shall not constitute notice) to:

Freshfields Bruckhaus Deringer LLP

601 Lexington Avenue, 31st Floor

New York, New York 10022

Attention: Paul M. Tiger, Andrea M. Basham

Email: Paul.Tiger@Freshfields.com

Andrea.Basham@Freshfields.com

21

If to the Holder:

Glencore Ltd.

330 Madison Ave.

New York, NY 10017

Attention: Legal Department

Email: legalnotices@glencore-us.com

with a copy to:

Glencore International AG

Baarermattstrasse 3

CH – 6340 Baar

Switzerland

Attention: General Counsel

Email: general.counsel@glencore.com

with a copy (which shall not constitute notice) to:

Weil, Gotshal & Manges LLP

767 5th Avenue

New York, NY 10153

Attention: Heather Emmel, David Avery-Gee

Email: Heather.emmel@weil.com

David.Avery-Gee@weil.com

or to such other address or e-mail address and/or to the attention of such other Person as the recipient party has specified by written notice given to each other party five (5) days prior to the effectiveness of such change. Written confirmation of receipt (A) given by the recipient of such notice, consent, waiver or other communication, (B) mechanically or electronically generated by the sender’s e-mail containing the time and date or (C) provided by an overnight courier service shall be rebuttable evidence of personal service, receipt by e-mail or receipt from an overnight courier service in accordance with clauses (i), (ii) or (iii) above, respectively.

| (b) | The Company shall provide the Holder with prompt written notice of all actions taken pursuant to this Note, including in reasonable detail a description of such action and the reason therefore. Without limiting the generality of the foregoing, the Company will give written notice to the Holder (i) within three (3) Business Days after any adjustment of the Conversion Price, setting forth in reasonable detail, and certifying, the calculation of such adjustment and (ii) at least fifteen (15) days prior to the date on which the Company closes its books or takes a record (A) with respect to any dividend or distribution upon the Common Shares, (B) with respect to any grant, issuances, or sales of any or rights to purchase shares, warrants, securities or other property to holders of Common Shares or (C) for determining rights to vote with respect to any Change of Control Transaction, dissolution or liquidation, provided in each case that any material non-public information in any such notice shall be made known to the public prior to or in conjunction with such notice being provided to the Holder. |

22

| (c) | Calculation of Time. When computing any time period in this Note, the following rules shall apply: |

| (i) | the day marking the commencement of the time period shall be excluded but the day of the deadline or expiry of the time period shall be included; |

| (ii) | for time periods measured in Business Days, any day that is not a Business Day shall be excluded in the calculation of the time period; and, if the day of the deadline or expiry of the time period falls on a day which is not a Business Day, the deadline or time period shall be extended to the next following Business Day; |

| (iii) | for time periods measured in Trading Days, any day that is not a Trading Day shall be excluded in the calculation of the time period; and, if the day of the deadline or expiry of the time period falls on a day which is not a Trading Day, the deadline or time period shall be extended to the next following Trading Day; |

| (iv) | if the end date of any deadline or time period in this Note refers to a specific calendar date and that date is not a Business Day, the deadline or time period shall be extended to the next Business Day following the specific calendar date; and |

| (v) | when used in this Note the term “month” shall mean a calendar month. |

| (d) | Currency. Unless otherwise specified or the context otherwise requires all dollar amounts referred to in this Note are in United States Dollars (“U.S. Dollars”). |

| (e) | Payments. Whenever any payment of cash is to be made by the Company to any Person pursuant to this Note, unless otherwise expressly set forth herein, such payment shall be made in U.S. Dollars by wire transfer of immediately available funds. Whenever any amount expressed to be due by the terms of this Note is due on any day which is not a Business Day, the same shall instead be due on the next succeeding day which is a Business Day. |

| 22. | CANCELLATION. After all Principal, accrued and unpaid Interest, the Make-Whole Amount, if any, and other amounts at any time owed on this Note have been paid in full, this Note shall automatically be deemed canceled, shall be surrendered to the Company for cancellation and shall not be reissued. |

| 23. | WAIVER OF NOTICE. To the extent permitted by law, the Company hereby irrevocably waives demand, notice, presentment, protest and all other demands and notices in connection with the delivery, acceptance, performance, default or enforcement of this Note, the Note Purchase Agreement and the Registration Rights Agreement. |

23

| 24. | GOVERNING LAW. All questions concerning the construction, validity, enforcement and interpretation of this Note shall be governed by the internal laws of the State of New York, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of New York or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of New York. The Company hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in The City of New York, Borough of Manhattan, for the adjudication of any dispute hereunder or in connection herewith or under any of the other Transaction Documents or with any transaction contemplated hereby or thereby, and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is brought in an inconvenient forum or that the venue of such suit, action or proceeding is improper. Each party hereby irrevocably waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof to such party at the address for such notices to it under this Note and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. Nothing contained herein shall be deemed or operate to preclude a Holder from bringing suit or taking other legal action against the Company in any other jurisdiction to collect on the Company’s obligations to a Holder or to enforce a judgment or other court ruling in favor of a Holder. EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY ACTION OR PROCEEDING ARISING OUT OF, IN CONNECTION WITH OR RELATING TO THIS NOTE IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES, AND THEREFORE EACH SUCH PARTY HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT SUCH PARTY MAY HAVE TO A TRIAL BY JURY IN RESPECT OF SUCH ACTION OR PROCEEDING. EACH PARTY CERTIFIES AND ACKNOWLEDGES THAT: (A) NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF SUCH ACTION OR PROCEEDING, SEEK TO ENFORCE THE FOREGOING WAIVER; (B) IT UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER; (C) IT MAKES THIS WAIVER VOLUNTARILY AND (D) IT HAS BEEN INDUCED TO ENTER INTO THIS NOTE BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS PARAGRAPH. |

| 25. | SEVERABILITY. If any provision of this Note is prohibited by law or otherwise determined to be invalid or unenforceable by a court of competent jurisdiction, the provision that would otherwise be prohibited, invalid or unenforceable shall be deemed amended to apply to the broadest extent that it would be valid and enforceable, and the invalidity or unenforceability of such provision shall not affect the validity of the remaining provisions of this Note so long as this Note as so modified continues to express, without material change, the original intentions of the parties as to the subject matter hereof and the prohibited nature, invalidity or unenforceability of the provision(s) in question does not substantially impair the respective expectations or reciprocal obligations of the parties or the practical realization of the benefits that would otherwise be conferred upon the parties. The parties will endeavor in good faith negotiations to replace the prohibited, invalid or unenforceable provision(s) with a valid provision(s), the effect of which comes as close as possible to that of the prohibited, invalid or unenforceable provision(s). |

24

| 26. | MAXIMUM PAYMENTS. Without limiting Section 8(d) of the Note Purchase Agreement, nothing contained herein shall be deemed to establish or require the payment of a rate of interest or other charges in excess of the maximum permitted by Applicable Law. In the event that the rate of interest required to be paid or other charges hereunder exceed the maximum permitted by such Applicable Law, any payments in excess of such maximum shall be credited against amounts owed by the Company to the Holder and thus refunded to the Company. |

| 27. | RANKING; SUBORDINATION. The Company, for itself, its successors and assigns, covenants and agrees, and the Holder likewise covenants and agrees by its acceptance of this Note, that the obligations of the Company to make any payment on account of the principal of and interest on this Note shall be subordinate and junior in right of payment and upon liquidation to the Company’s obligations to the holders of all Senior Debt of the Company now existing or hereinafter assumed. |

| 28. | CERTAIN DEFINITIONS. For purposes of this Note, the following terms shall have the following meanings: |

| (a) | “1933 Act” means the U.S. Securities Act of 1933, as amended, and the rules and regulations thereunder. |

| (b) | “1934 Act” means the U.S. Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder. |

| (c) | “2021 Convertible Note” means the unsecured convertible note issued by the Company to Spring Creek Capital, LLC pursuant to a note purchase agreement on September 29, 2021. |

| (d) | “Additional Shares of Common Stock” shall mean all Common Shares or securities or notes convertible or exchangeable for Common Shares issued by the Company after the Issuance Date, other than (1) the following Common Shares and (2) Common Shares deemed issued pursuant to the following options and securities or notes convertible into or exchangeable for Common Shares: |

| (i) | Common Shares or securities or notes convertible into or exchangeable for Common Shares issued by way of a dividend or distribution that is covered by Section 8(a); |

| (ii) | Common Shares or securities or notes convertible into or exchangeable for Common Shares issued to employees or directors of, or consultants or advisors to, the Company or any of its subsidiaries, whether issued before or after the Issuance Date, pursuant to any option or incentive plan of the Company adopted by the board of directors of the Company (or any predecessor governing body); and |

25

| (iii) | Common Shares or securities or notes convertible into or exchangeable for Common Shares issued upon the exercise of options or warrants or Common Shares issued upon the conversion or exchange of securities or notes convertible into or exchangeable for Common Shares (including this Note (and any Note issued as PIK hereunder)) which are outstanding as of the date hereof, in each case provided such issuance is pursuant to the terms of such option or warrants or securities or notes convertible into or exchangeable for Common Shares. |

| (e) | “Affiliate” means, in relation to any Person (the “first named person”), any other Person that controls, is controlled by or is under common control with the first named person; provided that, for greater certainty, the Company is not an Affiliate of the Holder or any of its subsidiaries for the purposes of this Note. |

| (f) | “Applicable Law” means all laws (statutory or common), rules, ordinances, regulations, grants, concessions, franchises, licenses, orders, directives, judgments, decrees, and other governmental restrictions, including permits and other similar requirements, whether legislative, municipal, administrative or judicial in nature, having application, directly or indirectly, to the Company, and includes the rules and policies of any stock exchange upon which the Company has securities listed or quoted. |

| (g) | “Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in New York City or the City of Toronto are authorized or required by law to remain closed; provided, however, for clarification, commercial banks shall not be deemed to be authorized or required by law to remain closed due to “stay at home”, “shelter-in-place”, “non-essential employee” or any other similar orders or restrictions or the closure of any physical branch locations at the direction of any governmental authority so long as the electronic funds transfer systems (including for wire transfers) of commercial banks in New York City or the City of Toronto generally are open for use by customers on such day. |

| (h) | “Change of Control Transaction” means any of the following events: (i) a “person” or “group” (within the meaning of Section 13(d)(3) of the Exchange Act), other than the Company or one or more employee benefit plans of the Company, files any report with the SEC indicating that such person or group has become the direct or indirect “beneficial owner” (as defined below) of Common Shares representing more than fifty percent (50%) of the Company’s then outstanding Common Shares (other than Common Shares held by the Company as treasury stock or owned by a subsidiary of the Company); (ii) the consummation of (A) any sale, lease or other transfer, in one transaction or a series of transactions, of all or substantially all of the assets of the Company, taken as a whole, to any Person; or (B) any transaction or series of related transactions in |

26

| connection with which (whether by means of merger, consolidation, amalgamation, arrangement, share exchange, combination, reclassification, recapitalization, acquisition, liquidation or otherwise) more than fifty percent (50%) of the outstanding Common Shares (other than Common Shares held by the Company as treasury stock or owned by a subsidiary of the Company) are exchanged for, converted into, acquired for, or constitute solely the right to receive, other securities, cash or other property (other than a subdivision or combination, or solely a change in par value, of the Common Shares); provided, however, that any merger, consolidation, amalgamation, arrangement, share exchange or combination of the Company pursuant to which the Persons that directly or indirectly “beneficially owned” (as defined below) all classes of the Company’s common equity immediately before such transaction directly or indirectly “beneficially own,” immediately after such transaction, more than fifty percent (50%) of all classes of common equity of the surviving, continuing or acquiring company or other transferee, as applicable, or the parent thereof, in substantially the same proportions vis-à-vis each other as immediately before such transaction will be deemed not to be a Change of Control Transaction pursuant to this clause (ii); (iii) the Company’s shareholders approve any plan or proposal for the liquidation or dissolution of the Company; or (iv) the Common Shares cease to be listed on any Eligible Market. For the purposes of this definition, whether a Person is a “beneficial owner” and whether shares are “beneficially owned” will be determined in accordance with Rule 13d-3 under the Exchange Act. |

| (i) | “Common Shares” means (i) the Company’s common shares, (ii) any share capital into which such common shares shall have been changed or any share capital resulting from a reclassification of such common shares and (iii) for purposes of Section 8(a)(iv) only, the common shares or other securities of any of the Company’s subsidiaries in addition to the common shares of the Company. |

| (j) | “Conversion Amount” means the sum of (i) the portion of the Principal to be converted with respect to which this determination is being made; and (ii) all accrued and unpaid Interest with respect to such portion of the Principal, if any. |

| (k) | “Conversion Price” means, as of any Conversion Date or other date of determination, $9.95 per Common Share, subject to adjustment as provided herein. |

| (l) | “Conversion Rate” means the number of Common Shares issuable upon conversion of any Conversion Amount pursuant to Section 4(a) determined by dividing (i) $1,000 by (ii) the Conversion Price. |

| (m) | “Default” means any event that is (or, after notice, passage of time or both, would be) an Event of Default. |

| (n) | “Eligible Market” means the New York Stock Exchange, the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the Toronto Stock Exchange, the TSX Venture Exchange, the Canadian Securities Exchange or the OTC US Market so long as, in the case of the OTC US Market only, the market capitalization of the Company is $150,000,000 or more. |

27