The clean energy transition in the U.S. has been further supported through government legislation. In 1983, California pioneered the renewable portfolio standards (“”). Today, 30 states, Washington D.C. and three U.S. territories have adopted RPS with 21 of these states and Washington D.C. having additional credit multipliers, carve-outs, or both for certain energy technologies. Overall, U.S. federal policy has begun to shift in favor of curbing fossil fuel production and increasing support for clean energy transition. Further in support of this movement, President Biden’s administration has put forth various legislations, which if passed, are anticipated to include a stand-alone battery storage investment tax credit (“”), EV and EV charging infrastructure tax incentives and further solar PV ITC extension. These policy tailwinds serve to further support market expansion of clean energy and electrification. Nevertheless, we believe we are already competitive without government subsidies, with levelized cost of energy (“LCOE”) for solar reaching attractive rates as compared to traditional generation.

RPS

ITC

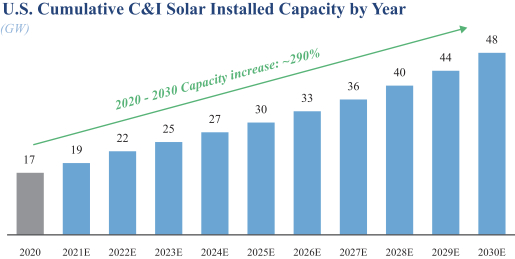

Current renewable assets and generation methods in the U.S. are insufficient to meet the increasing demand for renewable energy. We believe it will be necessary to rapidly increase the scale and scope of renewable generation assets and portfolios in the U.S. in order to meet the various targets and commitments set by corporations and governments. We believe Altus is well equipped to help meet this demand through our position as an attractive partner for developers (e.g. due to our ability to source deals and our strategic asset financing structure) that allow us to create portfolios of assets. Our partnerships, in combination with our market-leading financing, allow us to develop and acquire assets that we expect will aid in the clean energy transition.

Source: Wood Mackenzie (“”) - Annual Commercial Solar Asset Ownership Ranking as of December 31, 2020.

WoodMac

1.

410 MW is comprised of (a) operating and mechanically complete, (b) near-term construction expected to be completed by year-end

2021 and (c) near-term acquisitions expected to be consummated by year-end

2021. We are one of the largest independent C&I solar platforms based on Company Owned MWs as illustrated above. We currently have 347 MW of operating and mechanically complete assets with an additional 63 MW in near-term construction and acquisition assets we expect to be mechanically complete by

year-end

2021. We have experienced a growth in C&I customers of around 60% and in residential customers of around 95% (compound annual growth rate) between 2015 and 2020. We currently operate in 16 states, three of which we have entered since 2019. We are currently pursuing over 45 distinct projects across those 16 states, including but not limited to, opportunities related to greenfield solar, storage and EV charging projects and potential acquisitions of project development rights from early stage developers and operating projects from existing owners. These 45 opportunities have the potential to comprise a 900+ MW pipeline. We believe our robust and actionable pipeline is the result of our attractive positioning as a partner for third party acquisitions. We are often the preferred sponsor among institutional partners divesting operating solar portfolios. In addition, we have a national developer base with local expertise, which is beneficial in many markets where we are active. Park Avenue Solar Solutions (“”), our wholly-owned

PASS

in-house

construction company provides expertise in asset development that aids the success of our pipeline projects. We believe that 282