UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

For the fiscal year ended January 1 , 2023

OR

For the transition period from__________to __________

(Exact Name of Registrant as Specified in Charter)

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

(Address of Principal Executive Offices) (Zip Code)

(510 ) 695-2350

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| x | Accelerated filer | o | |||||||||

| Non-accelerated filer | o | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

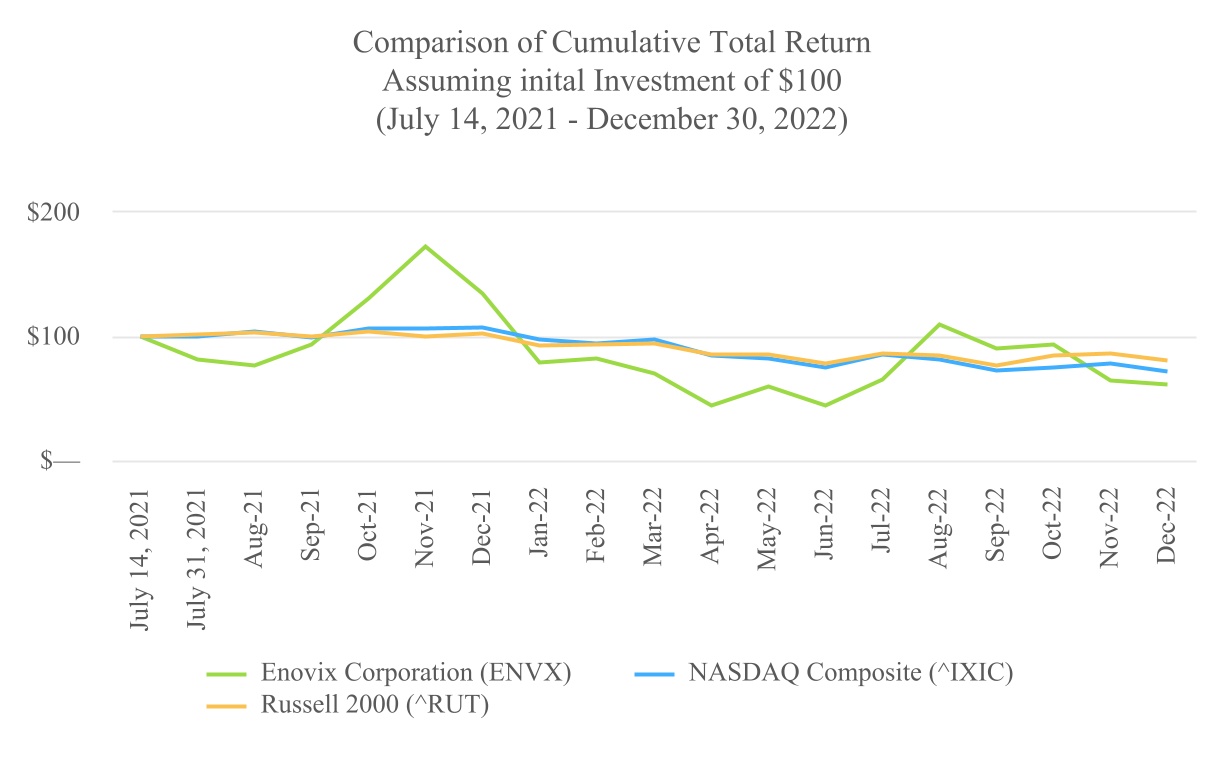

The aggregate market value of the voting and non-voting common equity held by non-affiliates on July 1, 2022 based on the closing price of the shares of common stock on such date as reported on The Nasdaq Global Select Market, was approximately $970.3 million. Shares of voting stock held by each officer, director and each person known by the registrant to beneficially own 10% of more of the registrant’s outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This assumption regarding affiliate status is not necessarily a conclusive determination for other purposes.

As of February 24, 2023, 157,780,082 shares of common stock, par value $0.0001 per share, were issued and outstanding.

Enovix Corporation

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended January 1, 2023

Table of Contents

| Page | ||||||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

Signatures | ||||||||

i

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. The statements contained in this Annual Report on Form 10-K that are not purely historical are forward-looking statements. Our forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Annual Report on Form 10-K may include, for example, statements about our:

•ability to build and scale our advanced silicon-anode lithium-ion battery, our production and commercialization timeline;

•ability to meet milestones and deliver on our objectives and expectations, the implementation and success of our products, technologies, business model and growth strategy, various addressable markets, market opportunity and the expansion of our customer base;

•ability to meet the expectations of new and current customers, our ability to achieve market acceptance for our products;

•financial performance, including revenue, expenses and projections thereof;

•ability to convert our revenue funnel to purchase orders and revenue;

•placement of equipment orders for our next-generation manufacturing lines, the speed of and space requirements for our next-generation manufacturing lines relative to our existing lines at Fab-1 in Fremont;

•factory sites and related considerations, including site selection, location and timing of build-out, and benefits thereof; and

•ability to attract and hire additional service providers, the strength of our brand, the build-out of additional production lines, our ability to optimize our manufacturing process, our future product development and roadmap and the future demand for our lithium-ion battery solutions.

The forward-looking statements contained in this Annual Report on Form 10-K are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in Part I, Item 1A of this Annual Report on Form 10-K, and include, but are not limited to, those summarized on the following page. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws and/or if and when management knows or has a reasonable basis on which to conclude that previously disclosed projections are no longer reasonably attainable.

1

SUMMARY RISK FACTORS

Below is a summary of material factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all of the risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and uncertainties that we face, can be found under Part I, Item 1A of this Annual Report on Form 10-K below.

•We will need to improve our energy density, which requires us to implement higher energy density materials for both cathodes and anodes, which we may not be able to do.

•We rely on a new and complex manufacturing process for our operations: achieving volume production involves a significant degree of risk and uncertainty in terms of operational performance and costs.

•We currently do not have manufacturing facilities to produce our lithium-ion battery cell in sufficient quantities to meet expected demand, and if we cannot successfully locate and bring additional facilities online, our business will be negatively impacted and could fail.

•We may not be able to source or establish supply relationships for necessary components or may be required to pay costs for components that are more expensive than anticipated, which could delay the introduction of our product and negatively impact our business.

•We may be unable to adequately control the costs associated with our operations and the components necessary to build our lithium-ion battery cells.

•If our batteries fail to perform as expected, our ability to develop, market and sell our batteries could be harmed.

•If we are unable to qualify new customers, our ability to grow revenue or improve our financial results could be harmed.

•If we are unable to develop our business and effectively commercialize our products as anticipated, we may not be able to generate revenues or achieve profitability.

•Operational problems with our manufacturing equipment subject us to safety risks which, if not adequately addressed, could have a material adverse effect on our business, results of operations, cash flows, financial condition or prospects.

•We may not be able to source or establish supply relationships for necessary components or may be required to pay costs for components that are more expensive than anticipated, which could delay the introduction of our product and negatively impact our business.

•The battery market continues to evolve and is highly competitive, and we may not be successful in competing in this industry or establishing and maintaining confidence in our long-term business prospects among current and future partners and customers.

•If we are unable to attract and retain key employees and qualified personnel, our ability to compete could be harmed.

•We are an early-stage company with a history of financial losses and expect to incur significant expenses and continuing losses for the foreseeable future.

•We may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

•We have been, and may in the future be, adversely affected by the global COVID-19 pandemic.

•We may not have adequate funds to acquire our next manufacturing facilities and build them out, and may need to raise additional capital, which we may not be able to do.

•We rely heavily on our intellectual property portfolio. If we are unable to protect our intellectual property rights, our business and competitive position would be harmed.

•We could face state-sponsored competition from overseas and may not be able to compete in the market on the basis of price.

2

•In the past, we have identified material weaknesses in our internal control over financial reporting. If we are unable to maintain an effective system of internal controls in the future, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect our business and stock price.

3

PART I

Item 1. Business

Company Overview

Enovix Corporation (the “Company,” “we,” “us,” “our” and “Enovix”) is on a mission to power the technologies of the future. We do this by designing, developing, manufacturing and commercializing next generation Lithium-ion, or Li-ion, battery cells that significantly increase the amount of energy density and storage capacity relative to conventional battery cells. Our battery’s mechanical design, or “architecture,” allows us to use high performance chemistries while enabling safety and charge time advantages.

The benefit of an enhanced battery for portable electronics is devices that have more power budget available to keep up with user preferences for more advanced features and more attractive form factors. The benefit of an advanced battery for Electric Vehicles (“EVs”) is a faster charging battery that reduces the cost per mile due to higher energy density.

Enovix was established in 2007 based on the premise that fundamentally altering battery performance would require a reinvention of the battery’s architecture. Our architecture allows us to use 100% active silicon and no graphite in the battery’s anode, which is the negative electrode that stores lithium ions when a battery is charged. The advantage of silicon over graphite is that it can theoretically store more than twice as much lithium as graphite, which increases a battery’s energy density and overall capacity. The battery industry has historically struggled to incorporate more than a small amount of silicon in the anode because silicon can swell and crack in conventional architectures, impacting safety and performance. By contrast, our architecture is designed to accommodate silicon’s swelling and apply stack pressure that alleviates the cracking problem.

We have devoted significant funds and resources to develop our battery’s architecture and the unique patterning and stacking assembly process for manufacturing our cells. This was done in conjunction with partnership and investment from several strategic partners in the solar and semiconductor industries. Since 2018, we have sampled batteries to multiple customers that have validated the performance of our products. In 2020, we started procuring equipment for our first production line (“Fab-1”). We recognized our first production revenue in the second quarter of 2022 from Fab-1.

Industry Background

Limited Innovation in Battery Technology for 30 Years

In 1991 Sony developed the first Li-ion battery for consumer electronics to power its newly invented handheld video recorder, which needed smaller and lighter batteries with more energy than those available at the time. The camcorder team, with years of experience in coating magnetic tapes, developed a battery based on that technology. Their architecture, sometimes referred to as a “Jelly Roll”, consists of an anode (A) in a long strip format, a long strip cathode (C) and two long strip separators (S), all on rolls, which are interleaved and then wound together into a Jelly Roll in this order: ASCSASCS…

The Jelly Roll is then placed in a hermetic package and filled with electrolyte, an organic liquid through which the lithium ions repeatedly travel back and forth between the battery’s anode and the cathode. During charging, the lithium ions cycle from the cathode (the positive electrode), through tiny holes in the separator, and into the anode (the negative electrode). This process is reversed when the battery is discharged. This basic construct of a Li-ion battery has remained unchanged for nearly 30 years.

Historically, advancements in battery performance have come primarily from improvements in the active cathode and anode materials of the battery. The process of new materials discovery, development, testing and qualification is by its nature a slow and arduous process and resulted in an anemic rate of battery improvement. At the same time, the electronic devices that these batteries power have dramatically increased their product features and energy requirements by capitalizing on the rapid and continuous electronic miniaturization provided by the semiconductor integrated circuit (“IC”) industry. This phenomenon, known as “Moore’s Law”, has resulted in electronic components doubling their transistor density (and thus the IC product features) about every two years. The disparity in improvement rates between ICs and batteries has forced the consumer devices industry to compromise the usable feature sets and the operating time between battery charges.

4

A Fundamentally Better Approach

We were founded by a team of individuals with expertise in three dimensional (“3D”) architectures learned from 25 years of experience in the manufacturing of hard disk drives (IBM) and semiconductor wafer probing systems (FormFactor). Rather than focusing solely on the materials inside the battery, we began development of a novel 3D physical battery design, one that could both improve the packing efficiency of the active materials in the battery as well as accommodate the use of a 100% active silicon anode.

Our founders conceived a completely different design for a battery. Rather than interleaving and winding long anode, cathode and separator strips into a Jelly Roll, our founders proposed an architecture in which many short anodes and cathodes were positioned side by side, with a separator between each anode-cathode pair.

This architecture allows for a more efficient use of the volume of the battery, in contrast to the Jelly Roll battery, in which significant volume is wasted at the corners and in gaps in the center of the battery, given the lack of precision of the winding process. This increase in volume efficiency alone improves the energy density of our batteries over a Jelly Roll cell.

Uniquely Enabling Silicon Anodes

Looking at a problem from a different perspective often yields new opportunities and solutions that would otherwise not be possible. This is the case with our 3D cell architecture. Rather than having long, wound electrodes that run parallel to the face of the battery, our cells have many small electrodes that are orthogonal to the largest face of the battery. This seemingly small difference has huge benefits. Specifically, our 3D cell architecture is well-suited to accommodate the use of a silicon anode and therefore capitalize on the higher energy density it provides, as described below.

Silicon has long been heralded as the next important anode material. Silicon anodes can theoretically store more than twice as much lithium than the graphite anode that is used in nearly all Li-ion batteries today (1800mAh/cm3 vs. 800mAh/ cm3). Once successfully integrated into a battery, silicon anodes are theoretically capable of increasing a Li-ion battery’s capacity by about 36% and a corresponding increase in energy density.

Silicon’s high energy density, however, creates four significant technical problems that must be solved:

•Formation expansion. “Formation” is the term for the first charging of the battery, when lithium moves from the cathode, through the separator, to the anode. When fully charged, a silicon anode can more than double in thickness, resulting in significant swelling that can physically damage the battery, causing failure.

•Formation efficiency. When first charged, a silicon anode can absorb and permanently trap as much as roughly 40% to 50% of the original lithium in the battery, reducing the battery’s capacity by about 50% to 60%.

•Cycle swelling. A silicon anode will swell and shrink when the battery is charged and discharged, respectively, causing damage to both the package and the silicon particles in the anode, which can crack, and further trap lithium on the fresh silicon surfaces exposed by the crack.

•Cycle life. Silicon particles can become electrically disconnected from the electrode when the silicon anode is in its shrunken state and can crack when the silicon anode is swollen, both of which can lower cycle life. In addition, when silicon particles become disconnected from the electrode, they are no longer able to accept lithium and neighboring particles must absorb the excess, causing over charging and further opportunities for physical damage.

Left unaddressed, these four problems have limited the practical application of silicon anodes in conventional lithium-ion battery cells. Our 3D cell architecture uniquely solves these four technical problems to enable 100% active silicon anodes.

Problem 1 — Formation expansion

In a conventional graphite anode, lithium atoms slip into the vacant spaces between the graphite layers, forming LiC6, resulting in very little graphite anode swelling during cycling (<10%). In a silicon anode, however, lithium atoms form a lithium-silicon alloy that does not have such vacant spaces, forming Li15Si4. While this alloying process results in an increased ability to store lithium, it also causes significant expansion of the anode material during charging, creating high pressure within the battery (1,500 psi).

5

If a silicon anode were used in a conventional battery architecture, the pressure of anode swelling would act on the large face of the battery, creating a force as large as 1.7 tons for a battery in a 50mm x 30mm x 3mm size battery. This force is analogous to a car standing on top of a cell phone sized battery.

By contrast, when silicon anodes are used in our 3D cell architecture, the anodes do not face the largest side of the battery; instead the anodes face a short side of the battery. Because these anode faces are small in area, this same 1,500 psi pressure, therefore, creates a force of only 210 pounds in the same size battery.

To manage these 210 pounds of force, we invented a very thin (50-micron) stainless steel constraint system to surround the battery. This constraint system limits the battery from swelling and growing in size. Moreover, the constraint system keeps the anode and cathode materials under constant compression, maintaining excellent particle-to-particle connection.

Problem 2 — Formation Efficiency

The first time a Li-ion battery is charged or formed, some of the lithium is permanently trapped in undesired side-reactions and surface layers on the anode and cathode particles. These losses proportionately reduce the capacity of the battery by removing lithium.

During formation of a conventional Li-ion battery with a graphite anode, approximately 5% of the lithium from a lithium cobalt oxide cathode will get permanently trapped in the graphite anode, never to return to the cathode.

A silicon anode, by contrast, has a formation efficiency of roughly 50% to 60%, meaning that about 40% to 50% of the lithium is trapped in the silicon anode during formation and is no longer available for repeated cycling, reducing the battery’s capacity in half.

Our 3D cell architecture uniquely enables a practical solution to this problem. Our cell assembly process has an added step called “pre-lithiation,” in which a thin lithium source is placed on top of the cell, within the package. By electrochemically coupling this lithium source to the electrodes, additional lithium can be dosed into the cell, replenishing the lithium lost during formation. Moreover, additional lithium beyond the initial replenishment can be dosed, providing a reservoir of lithium to a) counteract the normal lithium consumption that occurs in every battery during its life and b) provide the proper voltage balance to keep the minimum discharge voltage in the regime to be useful for devices.

The physical process by which the added lithium moves into the battery is called diffusion. The time required for lithium atoms to diffuse is proportional to the square of the diffusion distance. In a conventional battery architecture, the length of the electrode can be on the order of dozens of millimeters resulting in a pre-lithiation process that could take weeks to accomplish if a thin lithium source were placed on top of the cell. In our 3D cell architecture, however, the lithium is required to travel a short distance, which can be accomplished in hours.

Problems 3 & 4 — Swelling and Cycle Life

When conventional Li-ion batteries with graphite anodes are cycled (charged and discharged), they exhibit a modest amount of cyclic swelling (<10%). Silicon anodes, by contrast, can swell by 20%, or more. The continuous swelling and shrinking during charging and discharging can fracture the anode silicon particles and/or electrically disconnect them and limit cycle life to less than 100 cycles, which is not commercially viable in many applications. Additionally, any swelling in the cell over its lifetime must be accommodated by larger cavity volume, effectively reducing the practical energy density of the cell.

Our unique structural constraint system applies a uniform engineered pressure on the silicon particles within the anode, limiting their fracture and maintaining electrical contact between them for an extended number of cycles. Cycle swelling is thus kept under 2%, outperforming even conventional graphite anodes. Our cells that have been cycled over 500 times show minimal expansion of the electrodes by contrast.

By addressing swelling, our 3D cell architecture with its constraint system is designed to enable silicon anodes to achieve the commercial cycling standard of 500 complete charge/discharge cycles to 80% remaining capacity with improvements planned on our roadmap. A complete charge/discharge cycle is where the battery is charged all the way to 4.35V and then discharged to 2.7V.

6

Benefits of Our Advanced Li-ion Battery

IoT – The Internet-of-Things (“IoT”) market includes many types of devices powered by a Li-ion battery, including wearables, health/wellness devices, camera-based devices, location trackers, portable networking devices, augmented reality/virtual reality devices (“AR/VR”), and computing accessories, among others. Products in this market are often power budget constrained due to size. There is also a constant appetite in this market for power-hungry features such as sensors, high-speed connectivity, and utilization of artificial intelligence (“AI”) processing.

Mobile — The Li-ion battery also provided the increase in energy density needed for cell phones to evolve from their original “brick-size” into today’s sleek, sophisticated smartphone. Energy requirements continue to become more demanding as device OEMs seek to launch power-hungry 5G cell phones with on-board AI. Just as it was 30 years ago, a significant increase in battery energy density will enable mobile device designers to continue improving user experience, functionality and battery life in smaller devices.

In enterprise markets such as Land Mobile Radio (“LMR”), used by police and first responders, increased energy density can be leveraged to reduce product size and weight, while simultaneously enabling new features.

Computing — The Li-ion battery can also be credited for helping to usher in an era of portable PC computing. In 2020, laptops, tablets and hybrids (detachable tablets) were estimated to outship traditional desktop PCs by nearly 5-to-1 according to market-watcher IDC. As a result, users are demanding higher performance from their portable PCs. Ultimately users want “always on, all day” battery life, similar to that which they experience with their cell phones. Increased energy density is needed for this task, along with enabling more power-hungry features.

Electric Vehicles — According to BloombergNEF's Electric Vehicle Outlook 2022, the number of EVs will grow from 6.6 million in 2021 to 20.6 million in 2025. Replacing internal combustion engine vehicles with EVs can reduce emissions that contribute to smog and climate change, but mass adoption of EVs hinges on lower cost vehicles and faster charging times that resemble the gas station experience of filling up quickly. At scale, higher energy density is a key enabler of lowering battery cost as a higher number of watt hours are spread over the cost of the materials. Our cell architecture has been designed for the use of low-cost commodity silicon anode materials as opposed to heavily engineered silicon materials in order to drive toward a lower cost cell on a watt hours basis at scale. Our cell architecture also allows for enhanced thermal performance relative to conventional cells, enabling fast charging. We have demonstrated 0-80% charging in 5.2 minutes on 0.27Ah test cells with EV-class cathodes.

Producing Our Battery

In addition to designing our battery, we also develop the advanced manufacturing processes needed to produce our batteries in high volume and at low cost.

We use the conventional Li-ion battery cell manufacturing techniques for process such as electrode coating, cell packaging, test and aging. We then use our own proprietary tools on steps such as cell assembly where we laser pattern and stack the electrodes and then apply a stainless steel constraint.

Standard Li-ion battery production involves: 1) electrode fabrication, 2) cell assembly and 3) battery packaging and formation.

Electrode Fabrication — Sony developed and commercialized the first Li-ion battery in 1991 to meet the power requirements of its new handheld camcorder. Sony’s battery division adapted its existing magnetic recording tape production equipment to make batteries: 1) to mix chemical anode and cathode slurries, 2) to coat them onto metal foil current collectors, 3) to “calender” (flatten) the surface, 4) to slit the coated metal foil into electrode sheets and 5) to roll them up for packaging in cylindrical metal cans. While there have been process improvements over the years, electrodes for conventional Li-ion batteries are still fabricated using this standard method developed almost 30 years ago.

Cell Assembly — Li-ion cells were initially assembled by winding electrodes and separators into a naturally cylindrical Jelly Roll configuration, packaged in a cylindrical metal can. While some Li-ion batteries still use cylindrical metal cans, low-profile portable electronic devices require thinner, flatter cell formats, like the flat Jelly Roll described earlier. Li-ion cell assembly first addressed this need with a wind-and-flatten process introduced in the early 1990s. Today, it is common to wind the Jelly Roll onto a flat–rather than round–metal form. In 1995, cut-and-stack cell assembly improved spatial efficiency, but it is slow, expensive and imprecise. We have developed a more precise roll-to-stack cell assembly process to enable a silicon anode that increases Li-ion cell energy density and maintains high cycle life.

7

Wind-and-Flatten Cell Assembly — Wind-and-flatten cell assembly, introduced in the early 1990s, essentially flattens the cylindrical Jelly Roll into a thin, flat package for use in portable electronic devices such as laptop computers and mobile phones. The wind-and-flatten electrode assembly can be packaged in a metal case, but it is most often packaged in a polymer pouch for portable electronic device applications. It can also be produced in larger formats, with welded aluminum housings for electric powertrains in EVs.

Cut-and-Stack Cell Assembly — Cut-and-stack cell assembly was introduced in 1995. Instead of winding and flattening, electrodes and separators are cut (or punched) into sheets, which are stacked horizontally. Cut-and-stack assembly provides better spatial efficiency than Jelly Roll wind-and-flatten assembly because the volume lost in the core is eliminated and space at the outside edges is reduced. Cut-and-stack cells are used in consumer, military and EV applications.

Enovix Roll-to-Stack Cell Assembly — We have designed proprietary tools, produced for us by precision automated equipment suppliers, which incorporate patented methods and processes to achieve precise laser patterning and high-speed roll-to-stack cell assembly. These tools are “drop-in” replacements for either the wind-and-flatten tools or the cut-and-stack tools in standard Li-ion production processes.

Our precision roll-to-stack assembly has been designed to be a more precise, faster and less expensive version of standard cut-and-stack cell assembly. Instead of cutting or punching, electrodes and separators are laser patterned and stacked into 3D cell architecture. An in-line laser precisely patterns the electrodes and separators, which are then fed directly to a high-speed stacking tool. The laser patterning and high-speed stacking of electrodes and separators in our proprietary 3D cell architecture provides more precise and automatic layer alignment and better spatial efficiency than conventional cut-and-stack cell assembly that typically require slow, optical alignment of each layer.

Battery Packaging and Formation — Our 3D Silicon™ Lithium-ion battery uses the same battery packaging and formation process as a conventional Li-ion battery–with one exception. The first cycle formation efficiency of a graphite anode is about 90% to 95%. The first cycle formation efficiency of a silicon anode is only about 50% to 60%. The pre-lithiation process of the 3D Silicon™ Lithium-ion battery overcomes the first-cycle formation efficiency issue, while preserving all the other benefits of silicon over graphite for anodes.

Our Products

Our product strategy is to develop battery “nodes” that share the same set of active materials and mechanical design and then build batteries at different sizes to accommodate customer requirements based on these nodes. Our product roadmap consists of future nodes at higher levels of energy density based on both materials and design innovation. Our goal is to drive energy density improvements at a faster rate than the Li-ion battery industry’s track record and introduce higher performing battery nodes over time.

We have historically built and sampled standard size batteries that have broad application within specific end markets such as wearables, mobile devices, laptops and AR eyewear. We have also launched custom battery designs with customers that require a unique set of dimensions to accommodate the battery cavity in their device.

In the second quarter of 2022, we began production in Fab-1 of a standard battery cell sized for wearable devices such as a smartwatch and other IoT devices. In 2023, we intend to begin production in Fab-1 of a standard battery cell sized for mobile devices such as smartphones. And by the end of 2023, we intend to install a new higher speed pilot line (“Agility Line”) in Fab-1 to produce custom size batteries more quickly for customer qualification and focus on custom cell development.

Our Competitive Strengths

100% Active Silicon Maximizes Anode Energy Density and Battery Capacity — Conventional Li-ion battery architecture only allows small amounts of silicon to be blended with graphite in the anode, limited by swelling. Our proprietary Enovix 3D cell architecture enables use of silicon without graphite to achieve 100% active silicon anode.

Full-Depth of Discharge Cycle Life — To date, the delivered capacity of 100% active silicon Li-ion batteries comprising low-cost commodity silicon anode materials drastically decreases within the first 100 cycles, thus limiting their market adoption. We have internally built and verified battery cells based on our proprietary 3D cell architecture with an integrated structural constraint capable of 500 cycles, opening mass-market opportunities. With further enhancements, we expect to increase cycle life to 1,000 cycles or more.

8

Architecture Enables Safety Innovation — Our architecture enables multiple parallel cell-to-busbar connections, which allow us to apply a resistor at the busbar junction that can be utilized to regulate current flux in the event of an internal short. Our BrakeFlowTM system is designed to limit a shorted area from overheating and inhibits thermal runaway.

Architecture Enables Fast Charge — We have demonstrated a 0-80% state-of-charge in 5.2 minutes and a 0-98% state-of-charge in just under 10 minutes on 0.27Ah test cells. This fast charging is enabled by the fact that heat only has to travel a small distance from the center of our electrodes to the stainless steel constraint on the exterior.

Leverage Existing Supply Chain — Our cell architecture has been designed to use common, widely available materials as opposed to exotic, highly engineered materials that are commonly devised in the industry to increase energy density. We believe this supplies us with a long-term cost advantage at scale as our manufacturing costs improve.

Customer Tested in Multiple Form Factors — We have sampled pilot-production cells in four different sizes to over 35 mobile computing customers as part of product development programs. Applications cover a range of portable electronic products, including wearables, mobile handsets and laptop computers.

Mass-Market Commercialization — We have begun to generate product revenue in the portable electronic device market and have shipped batteries from our production line to over 25 OEMs.

Practical Path to EV Market — We will initially validate our silicon anode Li-ion battery technology and production process in the quality-conscious, high-volume portable electronic device market. This will help mitigate technology and production risks as we scale up our production process for the EV market.

Home Grown IP — Unlike many advanced battery startups, which have licensed core technology from government or academic research laboratories, we have developed and own all of our intellectual property. We received our first patents in 2012.

Process Driven Innovation — Our battery development is occurring at the frontier of science, where process innovations are evolving rapidly. Since even minor process changes can have an immense impact on battery performance, the value of co-locating and coupling the research and development (“R&D”) and manufacturing at the same location (Fremont, California) is critical to our technology development strategy.

Research and Development

We conduct R&D at our headquarters facility in Fremont, California. Our R&D programs are focused on driving improvements in the performance and cost of our 3D cell architecture.

Current R&D activities include the following:

Energy Density and Capacity — Increase the energy density and capacity of batteries by increasing the percent by volume of active cathode material.

Cycle Life and Temperature — Improve the cycle life and high and low temperature performance of batteries by developing new electrolyte chemistries.

Safety — Improve battery safety by developing techniques to regulate current flux in the event of a battery short and limit overheating to inhibit thermal runaway.

Anodes and Cathodes — Develop batteries with next-generation anodes and cathodes that increase energy density.

Cost and Throughput — Develop toolsets and processes to produce batteries with lower cost and higher manufacturing throughput.

Larger (“EV”) Size — Develop electrode and electrolyte chemistries in batteries with silicon anodes which, when scaled up to EV-size cells, meet or exceed EV performance requirements.

Manufacturing and Supply Chain

We manufacture Li-ion batteries at our Fremont, California, headquarters. At this location we develop, assemble and test our finished products. We are currently evaluating options for a second manufacturing location (“Fab-2”) to produce our Li-ion cells with the design points of our next generation equipment in mind.

9

We source materials for our batteries from third party suppliers globally. We have executed master supply agreements with the majority of our suppliers and have identified or are qualifying second sources for many of our battery materials. We seek second sources for materials that are high cost or where a risk to supply has been identified. On long-lead items we intend to keep safety stock on hand to mitigate interruptions to supply.

Intellectual Property

We operate in an industry in which innovation, investment in new ideas and protection of our intellectual property rights are critical for success. We protect our technology through a variety of means, including through patent, trademark, copyright and trade secrets laws in the U.S. and similar laws in other countries, confidentiality agreements and other contractual arrangements. As of January 1, 2023, we had 45 issued U.S. patents, 96 issued foreign patents, 34 pending U.S. patent applications and 108 pending foreign counterpart patent applications. Our issued patents start expiring in 2028.

We continually assess the need for patent protection for those aspects of our technology that we believe provide significant competitive advantages. A majority of our patents relate to battery architectures, secondary batteries, and related structures and materials.

With respect to proprietary know-how that is not patentable and processes for which patents are difficult to enforce, we rely on trade secret protection and confidentiality agreements to safeguard our interests. We believe that many elements of our secondary battery manufacturing processes involve proprietary know-how, technology or data that are not covered by patents or patent applications, including technical processes, test equipment designs, algorithms and procedures.

We own or have rights to various trademarks and service marks in the U.S. and in other countries, including Enovix and the Enovix design mark. We rely on both registration of our marks as well as common law protection where available.

All of our research and development personnel have entered into confidentiality and proprietary information agreements with us. These agreements address intellectual property protection and require our employees to assign to us all of the inventions, designs and technologies they develop during the course of employment with us.

We also require our customers and business partners to enter into confidentiality agreements before we disclose any sensitive aspects of our technology or business plans. As part of our overall strategy to protect our intellectual property, we may take legal actions to prevent third parties from infringing or misappropriating our intellectual property or from otherwise gaining access to our technology.

For more information regarding the risks related to our intellectual property, including the above referenced intellectual property proceedings, see Part I, Item 1A of this Annual Report on Form 10-K.

Competition

The Li-ion battery supplier market is highly competitive, with both large incumbent suppliers and emerging new suppliers.

Prospective competitors of ours include major manufacturers currently supplying the mobile device, EV and BESS industries, mobile device and automotive OEMs and potential new entrants to the industry. Incumbent suppliers of Li-ion batteries include Amperex Technology Ltd., Panasonic Corporation, Samsung SDI, Contemporary Amperex Technology Co. Ltd. and LG-Energy Solution Ltd. They supply conventional Li-ion batteries and in some cases are seeking to develop silicon anode Li-ion batteries. In addition, because of the importance of EVs, many automotive OEMs are researching and investing in advanced Li-ion battery efforts including battery development and production.

There are also several emerging companies investing in developing improvements to conventional Li-ion batteries or new technologies for Li-ion batteries, including silicon anodes and solid-state architectures. Some of these companies have developed relationships with incumbent battery suppliers, auto OEMs and consumer electronics brands. These companies are also exploring new chemistries for electrodes, electrolytes and additives.

Our ability to compete successfully will rely on factors both within and outside our control, including broader economic and industry trends. Factors within our control include driving competitive pricing, cost, energy density, safety and cycle life.

10

We believe that our ability to compete against this set of competitors will be driven by a number of factors, including product performance, cost, reliability, product roadmap, customer relationships and ability to scale manufacturing. We believe we will compete well on each of these factors based on advanced battery innovation to date and the ability to continue to design, develop and produce higher performing products for the customers served in our targeted markets.

Government Regulation and Compliance

Our business activities are global and are subject to various federal, state, local, and foreign laws, rules and regulations. For example, there are various government regulations pertaining to battery safety, transportation of batteries, use of batteries in cars, factory safety, and disposal of hazardous materials. In addition, substantially all of our import and export operations are subject to complex trade and customs laws, export controls, regulations and tax requirements such as sanctions orders or tariffs set by governments through mutual agreements or unilateral actions. Further, the countries into which our products are imported or are or will be manufactured may from time to time impose additional duties, tariffs or other restrictions on our imports or adversely modify existing restrictions. Our manufacturing facility in Fremont, California has been established as a foreign trade zone through qualification with U.S. Customs, and materials received in a foreign trade zone are not subject to certain U.S. duties or tariffs until the material enters U.S. commerce. While we may benefit from the adoption of a foreign trade zone by reduced duties, deferral of certain duties and tariffs and reduced processing fees, which help us realize a reduction in duty and tariff costs, the operation of our foreign trade zone requires compliance with applicable regulations and continued support of U.S. Customs with respect to the foreign trade zone program. Changes in export controls, tax policy or trade regulations, the disallowance of tax deductions on imported merchandise, or the imposition of new tariffs on imported products, could have an adverse effect on our business and results of operations.

Privacy and Security Laws

We are or may become subject to stringent and changing U.S. and foreign laws, regulations, rules, contractual obligations, policies and other obligations related to privacy and data security. Our actual or perceived failure to comply with such obligations could lead to regulatory investigations or actions, litigation, fines and penalties, disruptions of our business operations, reputational harm, loss of revenue or profits, loss of customers or sales, and other adverse business consequences.

There are privacy and data security laws to which we are or may in the future be subject. Federal, state, local, and foreign jurisdictions in which we operate have adopted privacy and data security laws and regulations which may impose significant compliance obligations. For example, the California Consumer Privacy Act of 2018, as amended by the California Privacy Rights Act of 2020 (“CPRA”) (collectively, “CCPA”) imposes different obligations on covered businesses, including affording privacy rights to consumers, business representatives and employees who are California residents. The CCPA requires covered businesses to provide specific disclosures to California residents in privacy notices and provides such individuals with certain privacy rights to their personal data. The CCPA provides for administrative fines of up to $7,500 per violation and allows private litigants affected by certain data breaches to recover significant statutory damages. Further, CPRA significantly amended the CCPA, including by expanding consumers’ rights over their personal data and creating a new regulatory agency to implement and enforce the law. Other states, such as Virginia and Colorado, have also passed comprehensive privacy laws, and similar laws are being considered in several other states, as well as at the federal and local levels. These developments further complicate compliance efforts and increase legal risk and compliance costs for us and the third parties upon whom we rely.

Outside the United States, an increasing number of laws, regulations, and industry standards may govern data privacy and security. For example, the European Union’s General Data Protection Regulation (“EU GDPR”) is wide-ranging in scope and applies to companies established in the European Economic Area (“EEA”) and to companies established outside the EEA that process personal data in connection with the offering of goods or services to data subjects in the EEA or the monitoring of the behavior of data subjects in the EEA. The EU GDPR grants certain rights to natural persons physically present in the EEA. Companies subject to the EU GDPR may be required to give data subjects greater control over their personal data, comply with transparency obligations, establish a lawful basis and purpose for data processing, maintain documentation, protect the security and confidentiality of the personal data, notify individuals and/or supervisory authorities of data breaches, and impose privacy and data security requirements onto data processors in connection with the processing of personal data. The EU provides for enforcement actions, and authorizes the imposition of penalties for noncompliance which can result in fines of up to the greater of 20 million euros or 4% of

11

annual global revenue or private litigation related to processing of personal data brought by classes of data subjects or consumer protection organizations authorized at law to represent their interests.

The EU GDPR, CCPA, and other laws exemplify the obligations our business may have in responding to the evolving regulatory environment related to personal data. Our compliance costs and potential liability may increase with this scattered regulatory environment.

Human Capital

Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and new employees. The principal purposes of our equity incentive plans are to attract, retain and motivate our people through the granting of equity-based compensation awards, in order to increase stockholder value and our success by motivating such individuals to perform to the best of their abilities and achieve our objectives. As of January 1, 2023, we employed 335 full-time employees and one part-time employee, based primarily in our headquarters in Fremont CA.

Culture and Benefits

Our people are truly our greatest asset. We strive to live up to our Core Values every day: integrity, respect, innovation, resilience, excellence and customer focus. Employees carry these Core Values with them on their access badge. Our team at Enovix is comprised of a diverse group of dedicated technicians, engineers, scientists, and business professionals who are all driven to create a better, low-carbon world through innovation in energy storage. We could not be where we are today without the dedication of our workforce, and we prioritize pathways for career development, employee feedback and competitive compensation and benefits packages, employee stock purchase plan, paid time off, team building events and talent development opportunities to ensure we continue to maintain and grow our workforce.

In 2022, we formally began our Diversity, Equity, Inclusion and Accessibility (“DEIA”) program as part of our larger Environmental, Social and Governance (“ESG”) initiative. In our first year, we focused on training and community building. We brought in an expert and rolled out a DEIA training program for our managers which covered 1) an introduction to DEIA 2) understanding bias and the impact of bias at work and 3) how to foster an inclusive culture. Additionally, we kicked off our Women in Leadership quarterly speaker series providing learning and team building opportunities for women at Enovix. We also joined two nonprofit organizations to provide additional training and networking opportunities for employees.

Building a company where everyone feels that they belong is a priority at Enovix. Our Core Values are reinforced in new hire training and everyday interactions.

Corporate Information

Our principal executive offices are located at 3501 W. Warren Avenue, Fremont, CA 94538 and our telephone number is (510) 695-2350.

Available Information

We file or furnish periodic reports and amendments thereto, including our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, proxy statements and other information with the Securities and Exchange Commission (“SEC”). In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically. Copies of our Annual Report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and any amendments to such reports are also made available, free of charge, on our investor relations website at https://ir.enovix.com as soon as reasonably practicable after we electronically file or furnish such information with the SEC. The information posted on our website is not incorporated by reference into this Annual Report on Form 10-K.

Item 1A. Risk Factors

RISK FACTORS

Investing in our securities involves a high degree of risk. Before you make a decision to buy our securities, you should carefully consider the risks and uncertainties described below together with all of the other information contained in this Annual Report on Form 10-K, including our financial statements and related notes and in the section

12

titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” If any of the events or developments described below were to occur, our business, prospects, operating results and financial condition could suffer materially, the trading price of our securities could decline and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks Related to Our Manufacturing and Scale-Up

We will need to improve our energy density, which requires us to implement higher energy density materials for both cathodes and anodes, which we may not be able to do.

Our roadmap to improve our energy density requires us to implement higher energy density materials for both cathodes and anodes. To successfully use these materials, we will have to optimize our cell designs including, but not limited to formulations, thicknesses, geometries, materials, chemistries and manufacturing tolerances and techniques. It could take us longer to incorporate these new materials, or we might not be able to achieve every cell performance specification required by customers. Further, we will need to make improvements in packaging technology to achieve our energy density roadmap. These improvements may not be possible, could take longer or be more difficult than forecasted. This could reduce the performance or delay the availability of products to customers. In addition, we have not yet achieved every specification for all of the products we plan to produce in our first year of commercial production. The failure to achieve all of these specifications or adequately address each of these other challenges could impact the performance of our cells or delay the availability of these products to our customers.

We rely on a new and complex manufacturing process for our operations: achieving volume production involves a significant degree of risk and uncertainty in terms of operational performance and costs.

Although we have developed our Li-ion battery technology, we rely heavily on a new and complex manufacturing process for the production of our lithium-ion battery cells, all of which has not yet been qualified to operate at large-scale manufacturing volumes. To meet our projected future demand, we believe we need to increase our manufacturing throughput and yield metrics. Meeting our goals will be a multi-quarter endeavor and we have experienced delays in meeting these goals to date. For example, during the third quarter of 2022, metrology limitations of our first generation (“Gen1”) manufacturing equipment inhibited our ability to isolate the source of equipment variabilities, thus delaying ramping our manufacturing output. We may experience further delays improving manufacturing yield, throughput and equipment availability.

In addition, the final technical and board design approval for our second generation (“Gen2”) manufacturing equipment may not occur as planned in the first quarter of the current fiscal year 2023 and it may take longer than expected to install, qualify and release the Gen2 line at Fab-2 and make further modifications to the Gen1 equipment to achieve our goals for throughput and yield. It may also take longer than anticipated to install our Gen2-compatible pilot line (“Agility Line”).

The work required to develop these processes and integrate equipment into the production of our lithium-ion battery cells, including achieving our goals for throughput and yield, is time intensive and requires us to work closely with developers and equipment providers to ensure that it works properly for our unique battery technology. Such equipment may not arrive on schedule or may not be functioning as designed when it does arrive. This integration work will involve a significant degree of uncertainty and risk, and we have not in the past and may not in the future be able to achieve our goals for throughput and yield. Further, the integration work may result in the delay in the scaling up of production or result in additional cost to our battery cells, particularly if we encounter issues with performance or if we are unable to customize products for certain of our customers. Even after each of our Gen2 manufacturing line and Agility Line is installed, we expect that certain customers may require up to several months to complete technology qualification of the Gen2 line and/or the Agility Line before accepting product that is manufactured at high volume on the Gen2 line, if at all.

Our Fremont pilot line and our large-scale Gen1 and Gen2 manufacturing lines require large-scale machinery. Such machinery has in the past suffered, and is likely to in the future suffer, unexpected malfunctions from time to time and will require repairs and spare parts to resume operations, which may not be available when needed.

In addition, unexpected malfunctions of our production equipment have in the past significantly affected, and may in the future significantly affect, the intended operational efficiency. The people needed to remedy these malfunctions may not be readily available. Because this equipment has not previously been used to build lithium-ion battery cells, the

13

operational performance and costs associated with this equipment can be difficult to predict and may be influenced by factors outside of our control, such as, but not limited to, failures by suppliers to deliver necessary components of our products in a timely manner and at prices and volumes acceptable to us, environmental hazards and remediation, difficulty or delays in obtaining governmental permits, damages or defects in systems, industrial accidents, fires, seismic activity and other natural disasters. Further, we have in the past experienced power outages at our facilities, and if these outages are more frequent or longer in duration than expected it could impact our ability to manufacture batteries in a timely manner.

Even if we are able to successfully complete development of and modify, as necessary, this new and complex manufacturing process, we may not be able to produce our lithium-ion batteries in commercial volumes in a cost-effective manner.

We currently do not have manufacturing facilities to produce our lithium-ion battery cell in sufficient quantities to meet expected demand, and if we cannot successfully locate and bring an additional facility online, our business will be negatively impacted and could fail.

Currently, we are continuing to build-out our manufacturing facility in Fremont, California. Even if we are able to overcome the challenges in designing and refining our manufacturing process, this manufacturing facility is anticipated to only have two manufacturing lines and only one of such manufacturing lines will include a packaging line. We expect these two manufacturing lines will be sufficient to produce batteries in commercial scale, but not in high enough volumes to meet our expected customer demand. We are in the process of locating additional facilities which, if we are able to overcome the challenges in designing and refining our manufacturing process, will have multiple lines to produce commercial volumes of our lithium-ion batteries to meet our expected customer demands. However, we have not yet located a suitable facility and, even if we are able to do so, there is no guarantee that our manufacturing process will scale to produce lithium-ion batteries in quantities sufficient to meet demand. Further, even if we are able to locate such a facility, there is no guarantee that we will be able to lease or acquire such a facility on commercially reasonable terms or at all.

Even if we overcome the manufacturing challenges and achieve volume production of our lithium-ion battery, if the cost, performance characteristics or other specifications of the battery fall short of our or our customers’ targets, our sales, product pricing and margins would likely be adversely affected.

We may not be able to source or establish supply relationships for necessary components or may be required to pay costs for components that are more expensive than anticipated, which could delay the introduction of our product and negatively impact our business.

We rely on third-party suppliers for components necessary to develop and manufacture our lithium-ion batteries, including key supplies, such as our anode, cathode and separator materials. We are collaborating with key suppliers but have not yet entered into agreements for the supply of volume production quantities of these materials. If we are unable to enter into commercial agreements with these suppliers on beneficial terms, or these suppliers experience difficulties ramping up their supply of materials to meet our requirements, or these suppliers experience any delays in providing or developing the necessary materials, or these suppliers cease providing or developing the necessary materials, we could experience delays in delivering on our timelines. For example, cathode material vendors are transitioning from lithium cobalt oxide (“LCO”) to nickel cobalt manganese (“NCM”) or other chemistries due to EV adoption, and this has resulted in a downward trend of LCO supply and production. While we do not expect this to affect our near-term supply of LCO, it has induced us to identify a new LCO vendor.

The unavailability of any equipment component could result in delays in constructing the manufacturing equipment, idle manufacturing facilities, product design changes and loss of access to important technology and tools for producing and supporting our lithium-ion batteries production, as well as impact our capacity. Moreover, significant increases in our production or product design changes by us may in the future require us to procure additional components in a short amount of time. We have faced in the past, and may face suppliers who are unwilling or unable to sustainably meet our timelines or our cost, quality and volume needs, or to do so may cost us more, which may require us to replace them with other sources, which may further impact our timelines and costs. While we believe that we will be able to secure additional or alternate sources for most of our components, there is no assurance that we will be able to do so quickly or at all. Any inability or unwillingness of our suppliers to deliver necessary product components at timing, prices, quality and volumes that are acceptable to us could have a material impact on our business, prospects, financial condition, results of operations and cash flows.

14

Our business depends on the continued supply of certain materials for our products and we expect to incur significant costs related to procuring materials required to manufacture and assemble our batteries. The cost of our batteries depends in part upon the prices and availability of raw materials such as lithium, silicon, nickel, cobalt, copper and/or other metals. The prices for these materials fluctuate and their available supply has been, and may continue to be, unstable depending on market conditions and global demand for these materials, including as a result of increased global production of EVs and energy storage products, recent inflationary pressures, supply chain disruption caused by the COVID-19 pandemic and war or other armed conflicts, including Russia’s invasion of Ukraine. We also have experienced a need for expedited freight services associated with supply chain challenges, resulting in higher logistics costs. Moreover, we may not be able to negotiate purchase agreements and delivery lead-times for such materials on advantageous terms. In addition, several large battery companies are developing and manufacturing key supplies such as cathode material on their own, and as a result such supplies may be proprietary to these companies. Reduced availability of these materials or substantial increases in the prices for such materials has increased, and may continue to increase, the cost of our components and consequently, the cost of our products. There can be no assurance that we will be able to recoup increasing costs of our components, including as a result of recent inflationary pressures, by increasing prices, which in turn would increase our operating costs and negatively impact our prospects.

Any disruption in the supply of components or materials could temporarily disrupt production of our batteries until an alternative supplier is able to supply the required material. Changes in business conditions, unforeseen circumstances, governmental changes, labor shortages, the effects of the COVID-19 pandemic and other factors beyond our control or which we do not presently anticipate, could also affect our suppliers’ ability to deliver components to us on a timely basis.

Currency fluctuations, trade barriers, trade sanctions, export restrictions, tariffs, embargoes or shortages and other general economic or political conditions may limit our ability to obtain key components for our lithium-ion batteries or significantly increase freight charges, raw material costs and other expenses associated with our business, which could further materially and adversely affect our results of operations, financial condition and prospects. For example, our factory is located in Fremont, California and our products require materials and equipment manufactured outside the country, including the PRC. If tariffs are placed on these materials and equipment, it could materially impact our ability to obtain materials on commercially reasonable terms.

Any of the foregoing could materially and adversely affect our results of operations, financial condition and prospects.

We may be unable to adequately control the costs associated with our operations and the components necessary to build our lithium-ion battery cells.

We will require significant capital to develop and grow our business and expect to incur significant expenses, including those relating to raw material procurement, leases, sales and distribution as we build our brand and market our batteries, and general and administrative costs as we scale our operations. Our ability to become profitable in the future will not only depend on our ability to successfully market our lithium-ion batteries and services, but also to control our costs. A large fraction of the cost of our battery, like most commercial batteries, is driven by the cost of component materials like anode and cathode powder, separator, pouch material, current collectors, etc. It also includes machined parts that are part of the package. We have assumed based on extensive discussions with vendors, customers, industry analysts and independent research, target costs at startup of production and an assumed cost reduction over time. These estimates may prove inaccurate and adversely affect the cost of our batteries.

If we are unable to cost-efficiently manufacture, market, sell and distribute our lithium-ion batteries and services, our margins, profitability and prospects would be materially and adversely affected. We have not yet produced any lithium-ion battery cells at significant volume, and our forecasted cost advantage for the production of these cells at scale, compared to conventional lithium-ion cells, will require us to achieve certain goals in connection with rates of throughput, use of electricity and consumables, yield and rate of automation demonstrated for mature battery, battery material and manufacturing processes, that we have not yet achieved and may not achieve in the future. We are planning on improving the productivity and reducing the cost of our production lines relative to the first line we have built. In addition, we are planning continuous productivity improvements going forward. If we are unable to achieve these targeted rates or productivity improvements, our business will be adversely impacted.

15

Risks Related to Our Customers

Our relationships with our current customers are subject to various risks which could adversely affect our business and future prospects.

Our customers’ products are typically on a yearly or longer refresh cycles. If we miss qualification timing by even a small amount, the impact to our production schedule, revenue and profits could be large. While we intend to pass all qualification criteria, some field reliability risks remain such as cycle life, long-term high-temp storage capacity and swelling, etc. While we have product wins for which we are designing custom products for specific customers, we do not have volume production commitments for each of these products. Should we not be able to convert these design wins into orders for volume production, our financial performance would be impacted. Batteries are known in the market to have historically faced risk associated with safety, and therefore customers can be reluctant to take risks on new battery technologies. Since no new battery technology analogues to our technology have entered the market for thirty years, it may be difficult for us to overcome customer risk objections. If unanticipated problems arise, it may raise warranty costs and adversely affect revenue and profit.

In addition, one of our customers has exclusive rights to purchase our batteries for use in the augmented reality and virtual reality space through 2024, which could limit our ability to sell batteries to other customers in this space, which may limit our ability to grow our business in the augmented reality and virtual reality space through 2024.

If our batteries fail to perform as expected, our ability to develop, market and sell our batteries could be harmed.

We have experienced a limited number of returns of batteries that have failed to perform as expected. As commercial production of our lithium-ion battery cells increases, our batteries have in the past and may in the future contain defects in design and manufacture that may cause them to not perform as expected or that may require repairs, recalls and design changes. Our batteries are inherently complex and incorporate technology and components that have not been used for other applications and that may contain defects and errors, particularly when first introduced. We have a limited frame of reference from which to evaluate the long-term performance of our lithium-ion batteries. There can be no assurance that we will be able to detect and fix any defects in our lithium-ion batteries prior to the sale to potential consumers. If our batteries fail to perform as expected, we could lose design wins and customers may delay deliveries, terminate further orders or initiate product recalls, each of which could adversely affect our sales and brand and could adversely affect our business, prospects and results of operations.

Our 3D cell architecture is different than others and may behave differently in certain customer use applications that we have not evaluated. This could limit our ability to deliver to certain applications, including, but not limited to action cameras, portable gaming and smartwatches built for children. In addition, we have limited historical data on the performance and reliability of our batteries over time, and therefore it could fail unexpectedly in the field resulting in significant warranty costs or brand damage in the market. In addition, the electrodes and separator structure of our battery is different from traditional lithium-ion batteries and therefore could be susceptible to different and unknown failure modes leading our batteries to fail and cause a safety event in the field, which could further result in the failure of our end customers’ products as well as the loss of life or property. Such an event could result in severe financial penalties for us, including the loss of revenue, cancellation of supply contracts and the inability to win new business due to damage in the market. In addition, some of our supply agreements require us to fund some or all of the cost of a recall and replacement of end products affected by our batteries.

Our future growth and success depend on our ability to qualify new customers.

Our growth will depend in large part on our ability to qualify new customers. We have invested heavily in qualifying our customers and plan to continue to do so. We are in the very early stages of growth in our existing markets, and we expect to substantially raise brand awareness by connecting directly with our customers. We anticipate that these activities will lead to additional deliveries, and, as a result, increase our base of our qualified customers. An inability to attract new customers would substantially impact our ability to grow revenue or improve our financial results.

Our future growth and success depend on our ability to sell effectively to large customers.

Our potential customers are manufacturers of products that tend to be large enterprises and organizations, including the U.S. military. Therefore, our future success will depend on our ability to effectively sell our products to such large customers. Sales to these end-customers involve risks that may not be present (or that are present to a lesser extent) with sales to smaller customers. These risks include, but are not limited to, increased purchasing power and leverage held by

16

large customers in negotiating contractual arrangements with us and longer sales cycles and the associated risk that substantial time and resources may be spent on a potential end-customer that elects not to purchase our solutions.

Large organizations often undertake a significant evaluation process that results in a lengthy sales cycle. In addition, product purchases by large organizations are frequently subject to budget constraints, multiple approvals and unanticipated administrative, processing and other delays. Finally, large organizations typically have longer implementation cycles, require greater product functionality and scalability, require a broader range of services, demand that vendors take on a larger share of risks, require acceptance provisions that can lead to a delay in revenue recognition and expect greater payment flexibility. All of these factors can add further risk to business conducted with these potential customers.

We may not be able to accurately estimate the future supply and demand for our batteries, which could result in a variety of inefficiencies in our business and hinder our ability to generate revenue. If we fail to accurately predict our manufacturing requirements, we could incur additional costs or experience delays.

It is difficult to predict our future revenues and appropriately budget for our expenses, and we may have limited insight into trends that may emerge and affect our business. We anticipate being required to provide forecasts of our demand to our current and future suppliers prior to the scheduled delivery of products to potential customers. Currently, there is no historical basis for making judgments on the demand for our batteries or our ability to develop, manufacture and deliver batteries, or our profitability in the future. If we overestimate our requirements, our suppliers may have excess inventory, which indirectly would increase our costs. If we underestimate our requirements, our suppliers may have inadequate inventory, which could interrupt manufacturing of our products and result in delays in shipments and revenues. Many factors will affect the demand for our batteries. For example, most of the end products in which our batteries are expected to be used are manufactured in the PRC. If the political situation between the PRC and the United States were to deteriorate, it could prevent our customers from purchasing our batteries.