UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ______ to ______.

Commission file number 001-39711

(Exact name of registrant as specified in its charter)

(State of incorporation) | (I.R.S. Employer Identification No.) | |||||||

(Address of Principal Executive Offices) | (Zip Code) | |||||||

(650 ) 294-8463

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||

☒ | Smaller reporting company | ||||||||||

Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant (formerly known as Reinvent Technology Partners Z) as of June 30, 2021, the last business day of the registrant's most recently completed second fiscal quarter, was $228 million based upon the closing price for the registrant’s Class A ordinary shares reported by the New York Stock Exchange on such date. The registrant had outstanding 566,266,370 shares of common stock as of March 2, 2022.

DOCUMENTS INCORPORATED BY REFERENCE

1

TABLE OF CONTENTS

| Page | ||||||||

| Cautionary Note Regarding Forward Looking Statements | ||||||||

| PART I | ||||||||

| Item 1. | Business | |||||||

| Item 1A. | Risk Factors | |||||||

| Item 1B. | Unresolved Staff Comments | |||||||

| Item 2. | Properties | |||||||

| Item 3. | Legal Proceedings | |||||||

| Item 4 . | Mine Safety Disclosures | |||||||

| PART II | ||||||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | |||||||

| Item 6. | [Reserved] | |||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Result of Operations | |||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||||||

| Item 8. | Financial Statements and Supplementary Data | |||||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |||||||

| Item 9A. | Controls and Procedures | |||||||

| Item 9B. | Other information | |||||||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |||||||

| PART III | ||||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | |||||||

| Item 11. | Executive Compensation | |||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||||

| Item 14. | Principal Accountant Fees and Services | |||||||

| PART IV | ||||||||

| Item 15. | Exhibit and Financial Statement Schedules | |||||||

| Item 16. | Form 10–K Summary | |||||||

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K of Hippo Holdings Inc. (“Hippo,” the “Company,” “we,” “us,” and “our” contains statements that are forward-looking and as such are not historical facts. This includes, without limitation, statements regarding the financial position, business strategy and the plans and objectives of management for our future operations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this Annual Report on Form 10-K, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Annual Report on Form 10-K may include, for example, statements about:

•our future results of operations and financial condition and our ability to attain profitability;

•our ability to grow our business and, if such growth occurs, to effectively manage such growth;

•customer satisfaction and our ability to attract, retain, and expand our customer base;

•our ability to maintain and enhance our brand and reputation;

•our business strategy, including our diversified distribution strategy and our plans to expand into new markets and new products;

•the effects of seasonal trends on our results of operations;

•our expectations about our book of business, including our ability to cross-sell and to attain greater value from each customer;

•our ability to compete effectively in our industry;

•our ability to maintain reinsurance contracts and our near- and long-term strategies and expectations with respect to cession of insurance risk;

•our ability to utilize our proprietary technology;

•our ability to underwrite risks accurately and charge profitable rates;

•our ability to leverage our data, technology and geographic diversity to help manage risk;

•our ability to protect our intellectual property;

•our ability to expand our product offerings or improve existing ones;

•our ability to attract and retain personnel, including our officers and key employees;

•potential harm caused by misappropriation of our data and compromises in cybersecurity;

•potential harm caused by changes in internet search engines’ methodologies;

•our expected use of cash on our balance sheet, our future capital needs and our ability to raise additional capital;

•fluctuations in our results of operations and operating metrics;

•our ability to receive, process, store, use and share data, and compliance with laws and regulations related to data privacy and data security;

•our ability to stay in compliance with laws and regulation that currently apply, or become applicable, to our business both in the United States and internationally;

•our inability to predict the lasting impacts of COVID-19 to our business in particular, and the global economy generally;

•our public securities’ liquidity and trading; and

•other factors detailed in the section titled “Risk Factors” in this Annual Report on Form 10-K.

These forward-looking statements are based on information available as of the date of this Annual Report on Form 10-K, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of

3

any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

SUMMARY RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those described in Part I Item 1A. “Risk Factors” in this Annual Report on Form 10-K. You should carefully consider these risks and uncertainties, together with all of the other information contained in this Annual Report, when investing in our common stock. The principal risks and uncertainties affecting our business include the following:

•We have a history of net losses and we may not achieve or maintain profitability in the future.

•Our success and ability to grow our business depend on retaining and expanding our customer base. If we fail to add new customers or retain current customers, our business, revenue, operating results, and financial condition could be harmed.

•The “Hippo” brand may not become as widely known as incumbents’ or other competitors’ brands or the brand may become tarnished.

•Denial of claims or our failure to accurately and timely pay claims could materially and adversely affect our business, financial condition, results of operations, and our reputation.

•Our limited operating history makes it difficult to evaluate our current business performance, implementation of our business model, and our future prospects.

•We may not be able to manage our growth effectively.

•Intense competition in the segments of the insurance industry in which we operate could negatively affect current financials and our ability to attain or increase profitability.

•Reinsurance may be unavailable, including at current coverage, limits, or pricing, which may limit our ability to write new or renew existing business. Furthermore, reinsurance subjects our insurance company subsidiaries to counterparty credit and performance risk and may not be adequate to protect us against losses, each of which could have a material effect on our results of operations and financial condition.

•Failure to maintain our risk-based capital at the required levels could adversely affect the ability of our insurance company subsidiaries to maintain regulatory authority to conduct our business.

•Failure to maintain our financial strength ratings could adversely affect the ability of our insurance company subsidiaries to conduct our business as currently conducted.

•If we are unable to underwrite risks accurately and charge competitive yet profitable rates to our customers, our business, results of operations, and financial condition will be adversely affected.

•Our proprietary technology, which relies on third-party data, may not operate properly or as we expect it to.

•Our technology platform may not operate properly or as we expect it to operate.

•Our future success depends on our ability to continue to develop and implement our technology and to maintain the confidentiality of this technology.

•New legislation or legal requirements may affect how we communicate with our customers, which could have a material adverse effect on our business model, financial condition, and results of operations.

•We rely on external data and our digital platform to collect and evaluate information that we utilize in producing, pricing, and underwriting our insurance policies (in accordance with the rates, rules, and forms filed with our regulators, where required), managing claims and customer support, and improving business processes. Any legal or regulatory requirements that might restrict our ability to collect or utilize this data or our digital platform, or an outage by a data vendor, could thus materially and adversely affect our business, financial condition, results of operations, and prospects.

•We depend on search engines, content based online advertising, and other online sources to attract consumers to our website, which may be affected by third-party interference beyond our control. In addition, our producer and partner distribution channels are significant sources of new customers and could be impacted by third-party interference or other factors. As we grow, our customer acquisition costs may increase.

4

•We may require additional capital to grow our business, which may not be available on terms acceptable to us or at all.

•Interruptions or delays in the services provided by our providers of third-party technology platforms or our internet service providers could impair the operability of our website and may cause our business to suffer.

•Security incidents or real or perceived errors, failures, or bugs in our systems or website could impair our operations, result in loss of customers’ personal information, damage our reputation and brand, and harm our business and operating results.

•Misconduct or fraudulent acts by employees, agents, claims vendors, or third parties may expose us to financial loss, disruption of business, regulatory assessments, and reputational harm.

•Our success depends, in part, on our ability to establish and maintain relationships with quality and trustworthy service professionals.

•We may be unable to prevent, monitor, or detect fraudulent activity, including policy acquisitions or payments of claims that are fraudulent in nature.

•We are periodically subject to examinations by our primary state insurance regulators, which could result in adverse examination findings and necessitate remedial actions.

•We are subject to laws and regulations concerning our collection, processing, storage, sharing, disclosure, and use of customer information and other sensitive data, and our actual or perceived (or alleged) failure to comply with data privacy and security laws and regulations could damage our reputation and brand and harm our business and operating results.

•We employ third-party licensed data, software, technologies, and intellectual property for use in our business, and the inability to maintain or use these licenses, or errors or defects in the data, software, technologies, and intellectual property we license could result in increased costs or reduced service levels, which would adversely affect our business, financial condition, and results of operations.

•Failure to protect or enforce our intellectual property rights could harm our business, results of operations, and financial condition.

•Our services utilize third-party open source software components, which may pose particular risks to our proprietary software, technologies, products, and services in a manner that could negatively affect our business.

•We may be unable to prevent or address the misappropriation of our data.

•We rely on the experience and expertise of our founder, senior management team, highly-specialized insurance experts, key technical employees, and other highly skilled personnel.

•If our customers were to claim that the policies they purchased failed to provide adequate or appropriate coverage, we could face claims that could harm our business, results of operations, and financial condition.

•We may become subject to claims under Israeli law for remuneration or royalties for assigned invention rights by our Israel-based contractors or employees, which could result in litigation and adversely affect our business.

•Our company culture has contributed to our success and if we cannot maintain this culture as we grow, our business could be harmed.

•Our exposure to loss activity and regulation may be greater in states where we currently have more of our customers or where we are domiciled.

•Our product development cycles are complex and subject to regulatory approval, and we may incur significant expenses before we generate revenues, if any, from new or expansion of or changes to existing products.

•Our success depends upon the continued growth in the use of the internet for purchasing of insurance products.

•New lines of business or new products and services may subject us to additional risks.

•Litigation and legal proceedings filed by or against us and our subsidiaries, key vendors, joint ventures, or investments could have a material adverse effect on our business, results of operations, and financial condition.

•Claims by others that we infringed their proprietary technology or other intellectual property rights could result in litigation which is expensive to support, and if resolved adversely, could harm our business.

•If we are unable to make acquisitions and investments, or if we are unable to successfully integrate them into our business, our business, results of operations, and financial condition could be adversely affected.

5

•We may not be able to utilize a portion of our net operating loss carryforwards (“NOLs”) to offset future taxable income, which could adversely affect our net income and cash flows.

•Our expansion strategy will subject us to additional costs and risks and our plans may not be successful.

•We are subject to payment processing risk.

•We are exposed to risk through our captive reinsurer, RH Solutions Insurance Ltd., which takes a share of the risk underwritten of affiliated and non-affiliated insurance carriers for business written through MGA.

•We are exposed to risk through our admitted and non-admitted insurance carriers, which underwrite insurance on behalf of our MGA and other non-affiliated general agents and managing general agents.

•The insurance business, including the market for homeowners’ insurance, is historically cyclical in nature, and we may experience periods with excess underwriting capacity and unfavorable premium rates, which could adversely affect our business.

•Our actual incurred losses may be greater than our loss and loss adjustment expense reserves, which could have a material adverse effect on our financial condition and results of operations.

•We are subject to extensive insurance industry regulations.

•A regulatory environment that requires rate increases and product forms to be approved and that can dictate underwriting practices and mandate participation in loss sharing arrangements may adversely affect our results of operations and financial condition.

•State insurance regulators impose additional reporting requirements regarding enterprise risk on insurance holding company systems, with which we must comply as an insurance holding company.

•The increasing adoption by states of cybersecurity regulations could impose additional compliance burdens on us and expose us to additional liability.

•The COVID-19 pandemic has caused disruption to our operations and may continue to negatively impact our business, key metrics, or results of operations in numerous ways that remain unpredictable.

•Severe weather events and other catastrophes, including the effects of climate change, global pandemics, and terrorism, are inherently unpredictable and may have a material adverse effect on our financial results and financial condition.

•We expect our results of operations to fluctuate on a quarterly and annual basis. In addition, our operating results and operating metrics are subject to seasonality and volatility, which could result in fluctuations in our quarterly revenues and operating results or in perceptions of our business prospects.

•An overall decline in economic activity could have a material adverse effect on the financial condition and results of operations of our business.

•Our results of operations and financial condition may be adversely affected due to limitations in the analytical models used to assess and predict our exposure to catastrophe losses.

•Our insurance company subsidiaries are subject to minimum capital and surplus requirements, and failure to meet these requirements could subject us to regulatory action.

•Our insurance company subsidiaries are subject to assessments and other surcharges from state guaranty funds and mandatory state insurance facilities, which may reduce our profitability.

•Performance of our investment portfolio is subject to a variety of investment risks that may adversely affect our financial results.

•Unexpected changes in the interpretation of our coverage or provisions, including loss limitations and exclusions in our policies, could have a material adverse effect on our financial condition and results of operations.

•There may not be an active trading market for our common stock, which may make it difficult to sell shares of our common stock, and there can be no assurance that the Company will be able to comply with the continued listing standards of such exchange.

•The market price of our common stock and warrants may be highly volatile, which could cause the value of your investment to decline.

•If securities or industry analysts do not publish or cease publishing research or reports about us, our business, or our markets, or if they adversely change their recommendations or publish negative reports regarding our business or our stock, our stock price and trading volume could materially decline.

•Some provisions of our Organizational Documents Certificate of Incorporation and Bylaws and Delaware law may have anti-takeover effects that could discourage an acquisition of us by others, even if an acquisition would be beneficial to our stockholders, and they may prevent attempts by our stockholders to replace or remove our current management.

6

•Applicable insurance laws may make it difficult to effect a change of control.

•Our Certificate of Incorporation designates the Court of Chancery of the State of Delaware as the exclusive forum for certain litigation that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us.

•Claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us and may reduce the amount of money available to us.

•Taking advantage of the reduced disclosure requirements applicable to “emerging growth companies” may make our common stock less attractive to investors.

•Failure to establish and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and stock price.

•We depend on the ability of our subsidiaries to transfer funds to us to meet our obligations, and our insurance company subsidiaries’ ability to pay dividends to us is restricted by law.

•We do not currently expect to pay any cash dividends.

•The requirements of being a public company, including compliance with the reporting requirements of the Exchange Act, the requirements of the Sarbanes-Oxley Act and the Dodd-Frank Act, and the listing standards of NYSE, may strain our resources, increase our costs, and divert management’s attention, and we may be unable to comply with these requirements in a timely or cost-effective manner. In addition, key members of our management team have limited experience managing a public company.

•Sales of a substantial number of shares of our common stock by our existing stockholders in the public market could cause our stock price to fall.

•Warrants are exercisable for Hippo Holdings Inc. common stock, which increases the number of shares eligible for future resale in the public market and could result in dilution to our stockholders.

•We may redeem the unexpired warrants prior to their exercise at a time that is disadvantageous to you, thereby making your warrants worthless.

•Our warrants are accounted for as liabilities and the changes in value of our warrants could have a material effect on our financial results.

7

PART I

ITEM 1. BUSINESS

Our Vision and Mission

Hippo’s Vision: To protect the joy of homeownership.

Hippo’s Mission: To deliver intuitive and proactive protection for homeowners by combining the power of technology with a human touch.

Our Company

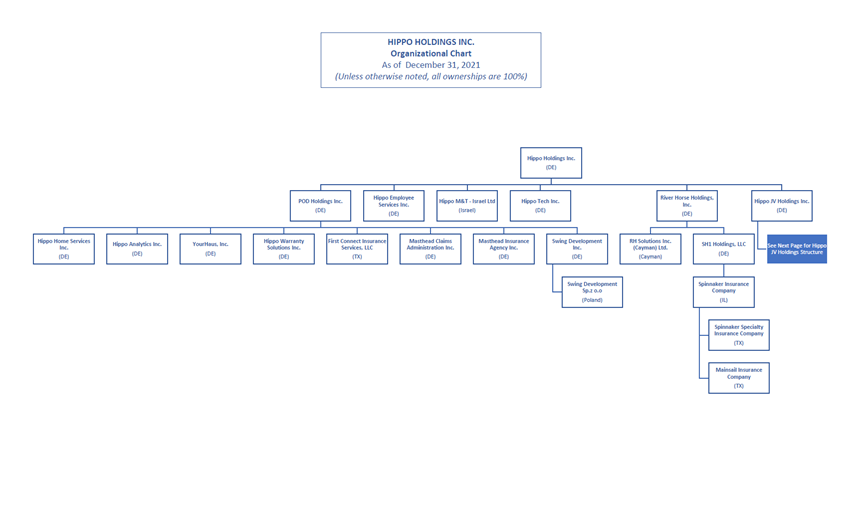

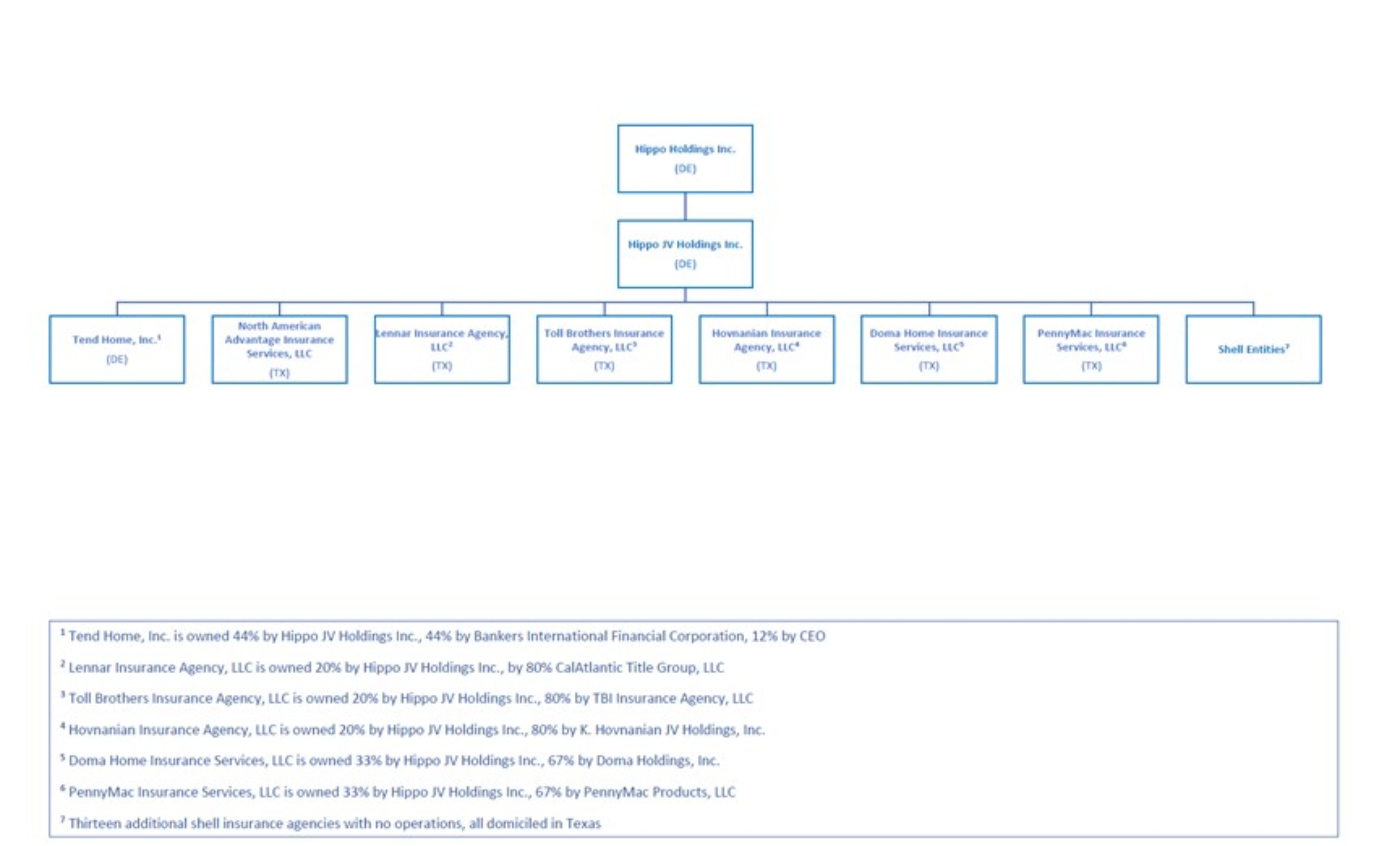

In August 2021, Hippo Enterprises Inc., a Delaware corporation (“Old Hippo”), and Reinvent Technology Partners Z, a Cayman Islands exempted company and special purpose acquisition company (“RTPZ”), completed a merger and other transactions pursuant to which a subsidiary of RTPZ was merged with and into Old Hippo and Old Hippo survived as a wholly owned subsidiary of RTPZ (collectively, we refer to these transactions as the “Business Combination”). In connection with the Business Combination, RTPZ changed its name to Hippo Holdings Inc. See Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Part II, Item 8. “Financial Statements and Supplementary Data” for more information.

Hippo is a different kind of home protection company, built from the ground up to provide a new standard of care and protection for homeowners. Our goal is to make homes safer and better protected so customers spend less time worrying about the burdens of homeownership and more time enjoying their homes and the life within. Harnessing real-time data, smart home technology, and a growing suite of home services, we have created an integrated home protection platform.

The home insurance industry has long been defined by century-old incumbents that deliver a passive, high-friction experience to policyholders. Constrained by outdated captive-agent distribution models, large bases of existing customers, legacy technology, and strong incentives not to disrupt their businesses, the industry has not seen meaningful innovation in decades. The result is a flawed customer experience that creates a transactional, adversarial relationship — one that pits insurance companies and their “policyholders” against each other in a zero-sum game. The outcome of this misalignment is an experience that is out of touch with the needs of modern homeowners.

Modern technology provides an opportunity to transform the $110 billion U.S. home insurance industry, enabling advancements and efficiencies across the customer lifecycle. We believe there is significant opportunity in this market, expected to reach nearly $140 billion by 2025 (according to industry data from William Blair & Company) for a digital-first, customer-centric company like Hippo.

Hippo harnesses technology and data to refocus the home insurance experience around the customer’s needs at every stage of the relationship. We seek to facilitate an active partnership with our customers to help prevent losses, which in turn creates better results for Hippo. The result is a win-win.

•We make Hippo policies fast and easy to buy.

With incumbent carriers, buying home insurance is an arduous task built around the carrier’s needs, not the customer’s. The process burdens customers with long phone calls, requiring customers to answer up to 60 confusing questions without any online buying capability. Using advanced data approaches, our proprietary underwriting engine allows Hippo to provide a quote in just 60 seconds (and a fully bound policy in less than 5 minutes) and delivers them via omni-channel distribution that meets consumers wherever they shop for insurance.

•Our policies are designed for the modern homeowner.

Unlike the outdated policies of traditional insurers which force people to pay for coverage they don’t need, Hippo policies are designed for modern lives, offering coverage for crucial items like home office equipment and water back-up. Our modern coverage means that Hippo customers are less likely to encounter unexpected holes in coverage in the event of a loss, a primary source of frustration with other carriers’ claims experience.

8

•We have designed a proactive, human approach to claims, enabled by technology.

Hippo uses live data to anticipate major events, enabling our claims team to reach out in advance of major weather events with comforting advice and information. When a customer does need to file a claim, a Hippo Claims Concierge guides that customer through the process, easing anxiety and improving satisfaction.

Beyond a core insurance experience that is simple, intuitive, and human, we focus our resources on Hippo’s true promise: better outcomes for homeowners. We have created an integrated home protection platform, which offers a growing suite of proactive features designed to prevent loss and provide greater peace of mind.

•We have pioneered what we believe is the most widely adopted Smart Home program in the industry.

We include smart home devices from trusted and reputable vendors to detect water, fire, and theft, and offer premium discounts to customers who use them. Real-time alerts from smart home devices help customers quickly identify and resolve issues before they grow into major losses.

•We proactively help our customers maintain and protect their homes.

We offer on-demand maintenance advice through Hippo Home Care, through its virtual home concierge service, and access to annual home check-ups and maintenance. We also use advanced technology and data to assess new risks outside the home and consider underwriting adjustments.

This partnership is designed to create a virtuous cycle. By making homes safer, we help deliver better risk outcomes and increase customer loyalty, which improves our unit economics and customer lifetime value (“LTV”). This enables us to invest in expanding our product offering, customer value proposition, and marketing programs, which helps attract more customers to the Hippo family. This growth generates more data and insights to fuel further innovation in our product experience and improved underwriting precision. The result is even safer homes and more loyal customers. We believe this virtuous cycle, combined with our significant existing scale, deep partnerships, and compelling unit economics, will propel Hippo to become a trusted household name synonymous with proactive home protection.

9

Aligned Interest: When our Customers Win, We Win

Our Industry / Opportunity

With $110 billion in annual premiums, the U.S. home insurance industry is a deeply fragmented market with only one carrier accounting for more than 10% of the total market share (according to William Blair & Company). This fragmentation in the market sets the stage for positive traction from new entrants — this is not a winner-take-all industry.

The U.S. home insurance industry has attractive customer dynamics and growth characteristics. According to the Insurance Information Institute, home insurance customers remain with their selected carrier for an average of 8-10 years — more than double the length of time of renters or auto insurance customers. Additionally, home insurance customers average $1,200 in annual premiums, providing insurers with a compelling recurring revenue opportunity. Multiple factors contribute to a strong growth outlook for the industry, including the high rate of new home construction, population growth, increasingly complex homes, and rising labor and material costs.

Despite these industry tailwinds, we believe customers’ needs are not being met. Today’s insurance policies often include coverage for items that modern homeowners do not own, such as fur coats, pewter bowls and paper stock and bond certificates, and exclude coverage for common claim categories such as water-backup, home office equipment and other electronics. Homeowners’ lives and properties have evolved, but too often their coverages have not kept pace. This set-it-and-forget-it mentality in underwriting can mean that while insurers collect premiums, homeowners discover gaps in coverage only after a loss. Even if consumers proactively recalibrate coverage over time, they are still constrained by outdated policy designs.

We believe the market is poised for rapid transformation with trends emerging in big data, technology, and underwriting that will allow better assessment of home insurance risk resulting in more accurate pricing, proliferation of application programming interfaces (“APIs”), and meeting the rising customer expectations for personalized and real-time products. We believe the COVID-19 pandemic has only accelerated this change, increasing homeowner adoption of digital channels and growing demands on the use of their spaces.

10

Barriers to Entry

New entrants who work to rebuild the customer experience, with technology, new data and nimble changes, will be better positioned to serve today’s homeowners. For the right company, the opportunity is enormous. However, new entrants must overcome high barriers to entry:

•Significant initial capital requirements to support insurance risk, challenges finding cost-effective reinsurance without an underwriting track record, expensive off-the-shelf policy and claims management systems, or resource-intensive investment in developing a proprietary tech stack

•Complicated and fragmented regulatory landscape with a unique set of rules from each state

•Significant resource investment in tech and infrastructure to access, collect and validate insurance-related data, in addition to the development of multiple customized APIs

•Difficulty accessing distribution networks, built upon a legacy, agent-based distribution, or resource-intensive process of creating and scaling new, alternative customer acquisition channels

We believe incumbents face multiple challenges in responding to the ongoing transformation and meeting customer needs, including channel conflict, data stability and veracity (stemming from unverified customer-supplied data), and too much reliance on aging and siloed technology. And with the agent population shrinking (according to McKinsey & Company research), incumbents may find it harder to access new customers who increasingly choose digital, direct-to-consumer channels.

This leads to incumbents potentially facing a dilemma being forced to choose between maintaining the stability of their current books of business or investing in the innovation that would drive further growth and value to homeowners. We believe they are generally choosing the former. We believe well-positioned new entrants have an opportunity to rise to the challenge and capitalize on growth opportunities more quickly.

We are confident that Hippo’s vision, technology, and innovative approach are positioned to create the change the industry and homeowners need.

The Hippo Business Approach

Hippo set out to solve what it saw as a flawed customer experience in home insurance and deliver intuitive and proactive protection for homeowners by combining the power of technology with a human-touch and empathy.

We started by rebuilding the home insurance experience around the customer’s needs, at every stage of the relationship.

•We make insurance easy to buy: Hippo provides a quote in under 60 seconds and allows customers to purchase a policy in about 5 minutes. Rather than rely solely on customer-provided information, we prefill the application based on a variety of trusted data sources, which allows us to better assess and price the risk at the point of purchase.

•We designed our policies for the modern homeowner: Hippo designed the home insurance policy to offer coverage for items that homeowners expect (such as appliances, home office equipment, and the service line between the house and the street) and limit coverage for obsolete items (such as fur coats, crypts, and mausoleums). We implement granular pricing at the peril (or hazard) level, based on the most current data on risks. This, combined with our broadly adopted Smart Home program, means that we can offer what we believe to be superior coverage compared to standard policies at a better rate on average.

•We crafted a proactive, tech-enabled claims experience, focused on a live, white-glove approach: Hippo strives to be there to support customers at their time of need, and we designed our claims processes to reflect that objective.

•Proactive, technology-enabled approach: We aspire to be there for our customers as soon as the need arises, if possible before they even reach out to us for support. We use live data to help identify major events like fires or storms. When we suspect that our customers’ homes may be impacted, our Claims Concierge team reaches out proactively to help ensure the safety of our customer, their families and their homes. We firmly believe in prioritizing the well-being of our

11

customers and addressing damage to the home quickly, hopefully before things deteriorate or repair costs escalate. If we are effective, customers benefit from superior service in resolving claims, and we gain from better insurance outcomes by mitigating costs and increased customer loyalty.

•Depending on the claim, our Claims Concierge team may use remote (virtual) inspection technology to expedite the claims handling process and, if possible, complete a claim remotely. When a specialist needs to visit the home, we leverage a network of vetted partners whom we work to quickly deploy, seeking to offer our customers full resolution as opposed to just an inspection. This network of trusted partners allows us to save on inspection costs when these partners also perform the work to resolve the issue, benefit from economies of scale in material purchases, and work to ensure quality repair work which reduces the probability of a repeat claim. This approach is designed to align everyone’s incentives and works to drive the best outcome and as fast a resolution as possible.

•Human attention from live Claims Concierges: We believe that a customer calling about damage to their home, often a very complicated and stressful situation, needs to speak to a human who can be relied upon for help. Our Claims Concierge team eliminates the often-inefficient use of bots or automation, as well as other burdensome processes. Our claims professionals are experienced in both claims handling and customer service. Once a claim is submitted, a Claims Concierge is assigned to the claim and focuses first on ensuring customer safety and alleviating stress. We seek to have the same Claims Concierge remain the key point of contact for the customer throughout the life of the claim.

Building a home insurance experience that is simple, intuitive, and human was just the beginning. Hippo’s real promise is to ultimately create better outcomes for homeowners. We have created an integrated home protection platform through a growing suite of proactive features and offerings that create meaningful touchpoints throughout the life of a policy.

•We employ continuous risk reevaluation and underwriting: Hippo reassesses risk throughout the life of a policy. We work to uncover changes to the home and proactively reach out to the customer to recommend an update to their policy (for example, increasing liability coverage with the addition of a pool) or to offer a discount (if, for example, an old roof is replaced with a new one). Our goal is to ensure that our customers always have adequate protection for the right price.

•We deploy what we believe is the most widely adopted Smart Home program in the U.S. home insurance space: Through our Smart Home program, Hippo customers can opt to receive kits that include devices that help mitigate damage from water, fire and theft. These kits come with filed and approved premium discounts at a state level. We partner with the key players in the smart home space to offer our customers these complimentary kits, as well as professionally-monitored kits. We continue to innovate our Smart Home program to more deeply integrate it with home insurance.

•We help customers maintain their homes: Hippo is playing an increasingly active role in helping homeowners maintain their homes. Every Hippo customer has access to Hippo Home Care, which offers a virtual home concierge service. Customers can reach out at any time to ask for remote support with questions or issues pertaining to their homes. If the Hippo Home Care representative is unable to help resolve an issue remotely, he or she can recommend a local professional for in-home services. Moreover, Hippo Home Care has been building a proactive home maintenance offering: homeowners can consult with home professionals about specific home care and maintenance questions, or opt for broader virtual checkups focused on key systems around the home.

This suite of proactive offerings is designed to allow Hippo to help customers better protect their homes and reduce losses over time. This enables better pricing across all of Hippo’s services, further enhancing the customer value proposition and attracting even more customers to Hippo. That, in turn, generates more data and insights that inform further home protection innovation. This is the principle our business is built upon: when our customers win, Hippo wins.

12

We have built an omni-channel distribution approach which is designed to allow customers to purchase however they want and provides Hippo differentiated access to a positively selected customer base.

We seek to allow customers to buy our policies however they want: online, over the phone, or through an agent. Hippo is not tied to captive agent distribution channels in the way legacy carriers can be, and we seek to leverage this to our advantage in establishing a diverse set of distribution channels:

•Direct to consumer: We offer our customers digital purchasing options as well as online management of their account. Creating such a fast and accurate online experience required developing advanced policy and claims management systems, which we benefit from across many areas.

•Insurance partners (agents / producers): This channel includes sales through traditional insurance agents and other insurance companies agency affiliates. We offer these partners what we believe is a truly differentiated experience: a dedicated producer portal that enables agents to benefit from the same efficiency and accuracy that our online, direct-to-consumer customers enjoy. Our platform is integrated with standard industry tools so agents can leverage the streamlined Hippo experience as part of their normal workflows. This technological foundation allows our producers to focus on valuable tasks rather than on time-consuming tasks like filing forms. We developed thorough onboarding and training processes, as well as marketing assets and playbooks, for this important channel. We see increasingly strong results at a partner level, with Hippo gaining more and more consideration from insurance partners as we continuously augment our investment and innovation in this area.

•Non-insurance partners: This is our fastest growing channel. We partner and integrate with players across the real estate and financial services ecosystems, including national players such as home builders, smart home technology providers, mortgage originators, mortgage servicers, title companies, and realtors. Our portfolio of customized APIs and deep partner integrations enable us to offer customers the best and most efficient home insurance solutions in a contextually relevant way. For example:

•Home builders — we developed an insurance policy for new home construction, as well as a technology product that integrates with builders’ sales systems. These integrations allow us to offer the builder’s customers a simple, personalized insurance product precisely when their customers are in the market for a policy. These policies are heavily tailored to the customer’s property and can be easily purchased online or through our partner agency. Through these partnerships, we are able to access positively selected properties with a fundamentally better risk profile than those associated with older homes. The result is a potentially smoother home purchase experience and higher customer satisfaction for our builder partners.

•Smart home providers — we have been developing proprietary integrations with the leading providers of smart home and security systems to offer their customers better home insurance coverage with meaningful premium discounts. Moreover, these benefits are also available to our partners’ customers if they purchase insurance from Hippo.

Technological, operational and economic moats

Our Technology + Insurance Approach

“Insurtech” is made of two words: Insurance and Technology. We are marrying the best of both worlds to create a superior customer experience with superior business results.

Our full-stack technology systems have been built from the ground up, leveraging the experience of professionals with significant home insurance expertise. We take a similar approach when it comes to the collection and use of available data. In particular, we use machine learning to analyze the large amounts of data we collect, which enables us to draw key insights and learnings about our customers and potential risks to the homes we insure. For example, we considered multiple providers of aerial imagery to support our underwriting processes, and from such data we have been able to determine which sources would be best suited to inform variables like the status of a home’s roof or the presence and size of a swimming pool based on the performance of our book of business over time (including, for example, the type and nature of losses associated with risks in specific areas). Through experience, we have learned that not all data are equally valuable and that each situation requires a unique data approach to achieve the desired outcome. Many data sources provide insight into similar home systems, and our

13

experience and scale have enabled us to utilize our data integrations to achieve accurate views of risk. We believe this provides us a significant advantage over many players in the space.

Beyond the use of data, we believe our use of technology gives us additional advantages over incumbents (who depend on legacy systems) and new entrants with less experience in the space. Examples include:

•Offering a fast and accurate online purchase flow that meets modern consumers’ expectations

•Integrating smart home activation status into our policy management system

•Quickly deploying rate changes in any state or region upon regulatory approval

•Creating sophisticated feedback loops between internal teams to ensure cross-pollination (for example, fast underwriting improvements based on claims insights)

•Developing proprietary, channel-specific technology to integrate Hippo’s offerings into partners’ platforms and streamlining their go-to-market efforts

In short, Hippo seeks to digitize operational aspects of the home insurance buying process. This approach creates lasting advantages that enable advancements across business growth, proactive home project, and user experience.

Our Vertically Integrated Insurance Capabilities

The insurance operation we have built provides us with end-to-end capabilities and flexibility to move fast, innovate and seek to offer the best value to our customers. In that sense, it also allows us to control our own destiny in how we grow and operate.

As we grow at the state and national levels, our systems have the ability to adjust our policies and rates in a fast and efficient manner. Our actuaries and underwriters leverage data and our in-house technology solutions to continuously optimize our coverage and work to provide customers the best product possible at the right price.

We have invested in industry-leading sales and customer service organizations, modeled after the best teams across a variety of business sectors. We have equipped them with dedicated tech tools and training that allow them to focus on what matters most.

In 2020, we continued our vertical integration through the acquisition of our largest insurance carrier partner, Spinnaker Insurance Company. Our structure now allows us to balance risk retention with reinsurance capacity in a more flexible manner, not just for Hippo’s core business but also for third-party programs supported by Spinnaker. This also allows us to maintain a capital-light model while retaining risk in a way that aligns our interests with the reinsurance market and also to retain carrier economics. Most importantly, the acquisition enables faster growth and reduced time to market for new offerings, regulatory filings and rate adjustments.

Our Diversified Distribution Strategy

Hippo’s established, diverse distribution channels are designed to allow customers to buy however and wherever they want. We have built channel-specific proprietary technology and bespoke business models to support this strategy. Developing unique technological solutions for partners such as home builders, loan servicers, other insurance companies, and smart home technology providers allows us to not only integrate into other scaled platforms, but to also support our partners’ businesses and achieve great results alongside them and establish deeper relationships with these partners.

Our Smart Home Program

We have deployed what we believe is the most widely adopted Smart Home program in the U.S. home insurance space, which is currently available in almost all the states where we operate. Under our program, customers may opt in to receive a complimentary smart home self-monitoring system or choose to upgrade to a professionally monitored system when they buy a policy through Hippo. These systems include sensors that can detect smoke, carbon monoxide, water, and motion. Overall, our Smart Home program has experienced high customer adoption:

14

•The majority of eligible customers opt into the program

•The vast majority of the customers opting into the program activate their kits

•Customers who keep their kits active receive meaningful premium discounts

In achieving such wide adoption and activation, we have essentially built a platform that enables us to increasingly focus on risk mitigation and loss ratio improvement, especially as we continue to build out this program (for example, as we evaluate new options such as adding behavior-based discounts and professional monitoring offers).

Hippo Customer Experience

Hippo’s goal is to make homes safer and better protected so customers can enjoy their homes and lives, knowing that we are committed to preserving their properties. Starting with our dedicated sales staff, who streamline the purchase and onboarding experience down from days to minutes, we aim to make every lead and customer touchpoint efficient, transparent and clear.

Our proactive approach, including real-time alerts to homeowners, is designed to help protect our customers and their families. We have also developed an industry leading Claims Concierge service, assigning one, dedicated Concierge for customers filing a claim. We strive to handle each claim with empathy, forethought, and care that can only be provided by a human touch.

Our approach to customer experience and insurance brings our values to the forefront, helping customers protect the joy of homeownership. By better meeting the needs of our customers, we expect our LTV to benefit from increased customer retention and satisfaction.

Our Technology and Architecture

Technology Approach

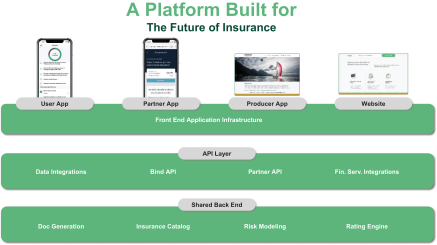

Hippo built its technology infrastructure, strategy and team to drive better outcomes for homeowners. Our technology is the driving force behind our ability to grow rapidly while managing risk, proactively supporting our customers, pioneering modern insurance and home protection products, and building solutions and services based on our insights quickly and effectively.

Our purpose-built, full-stack approach starts with modern infrastructure and agile software systems. These systems enable us to capture, clean, and analyze data at scale, derive powerful insights, and create meaningful offerings for our customers and partners with speed and efficiency. In a manner consistent with our regulatory filings, we pair this technology with proprietary insurance expert systems, powered by augmented intelligence, to

15

scale our capabilities across actuarial, underwriting, claims, coverages, and fraud prevention. Together, these systems enable us to deploy an intelligent and simple purchase experience that is customized by distribution channel, readily launch new states and partners, and deliver proactive solutions to customers like predicted weather alerts and real-time policy updates. Our technology enables us to iterate quickly and deploy products or features in days that might take an incumbent, relying on legacy systems, months or even years.

In short, Hippo largely digitizes the home insurance process. This fact creates lasting advantages that enable advancements across business growth, proactive home protection, and user experience.

•Rapid growth across diverse channels.

We have built our systems to scale rapidly and dynamically adapt to growth opportunities across the home insurance landscape. Our proprietary engine employs a constantly-expanding knowledge base alongside dynamic rules and machine learning algorithms to address the ever-changing factors of proactive risk management. This approach enables us to personalize coverage for a specific customer’s needs proactively and automatically. Through adaptable APIs, we can deploy this capability across an ever-increasing number of channels, partners, and geographies quickly. As we accumulate knowledge from additional domains and data sources to fuel our Augmented Intelligence engine, insights are seamlessly deployed across Hippo’s integrated system, ensuring a consistent and unified experience across all distribution points. Additionally, we believe our ability to segment risks based on home characteristics allows us to more efficiently market and price than our competitors.

•Risk prevention and proactive home protection.

Hippo’s technology is at the heart of our ability to better protect homes. Our process of ongoing underwriting, delivered through advanced algorithms analyzing a vast array of data sources to support Hippo’s offering limits to help protect our customers. We also access differentiated and proprietary data sources. We have deployed hundreds of thousands of sensor kits that monitor temperature, water leaks, door and window opening, and more. Our wide distribution and customer activation of smart home kits could in the future allow us to collect aggregated and anonymized home health data, which is synthesized to support our approach and value-added home protection offerings. We also innovate new approaches to home protection. For example, in launching Hippo Home Care in early 2021, we gained the ability to assemble predictive data from in-home checkups, including inventory of appliances and drivers of malfunctions of key systems in the home. We have scaled up our Hippo Home Care operation through a

16

Virtual Home Concierge service, in which we leverage mobile device communications to remotely support our customers with in-home services. As new approaches create additional data sets, we can more effectively partner with our customers to help them understand, predict and prevent potential losses. In turn, the data we collect will feed into our data science pipeline and trains our models.

•Better experiences throughout the customer journey.

Hippo harnesses technology and data to deliver intuitive and frictionless experiences for customers at every phase of the insurance journey. In the purchase phase, we use advanced, verified data sources so that customers are not burdened with dozens of questions, enabling a simple and fast purchase experience. Through our partnerships, we can automatically provide electronic proof of insurance to mortgage lenders to save customers potential headaches at closing. With our builder partners, the customized Hippo policy can be purchased by a homeowner in a completely integrated process. Our integrated systems approach also benefits the customer in other ways. For example, Hippo Customer Support specialists and our Claims Concierge can access relevant policy and property information, as well as past claims, to efficiently manage the process to provide the best customer experience. Additionally, third-party partners, like inspectors or contractors, can be dispatched to the home, paid and tracked digitally.

Architecture

Our Technology Architecture approach follows the company’s proactive, customer-first strategy by taking a three-horizon view: enabling swift feature development for customer and partner needs; creating a scalable platform that works to anticipate future needs; and setting the capability framework for innovation.

•Our agile development teams are able to design, deliver and iterate to build product features our customers and partners desire. We have built a flexible and adaptable software architecture and engineering teams to effectively innovate and implement new ideas. This is combined with an agile, iterative approach to experimentation and analytics, working to make sure that we continuously improve our knowledge of what customers want.

•Our underlying software architecture and platform are designed to support future expansion and growth. We are creating data models, algorithms, learning engines, knowledge graphs and cloud platforms that are all intended to support a future set of goals — more ambitious partnerships, wider distribution channels, and larger numbers of customers. By anticipating future growth with a blueprint of technology capabilities and technical platforms, we are proactively preparing for the next step-change in our company’s growth trajectory.

•We are keeping the pace of innovation high by investing in research and development of underlying technologies and capabilities that seek to change how the market operates in protecting homeowners. We launch tests with partners, look at new and proprietary data sources, offer additional virtual and in-home services, expand the boundaries of expectations on preventative measures, and try out new techniques for customer support and service. All of these are part of our innovation culture and supported by the technology infrastructure to build, experiment, measure, iterate.

Technology is only just beginning to transform the home insurance industry. Hippo’s unified and integrated systems ensure that, even as homeowners’ needs shift and grow, we will continue to set new standards for customer experience, modern insurance and joyful homeownership.

17

Our Economic Model

There are four key components to our economic model. First, as a managing general agent (“MGA”), we manage the entire customer-facing experience, including sales and marketing, underwriting, policy issuance and administration, and claims administration. In exchange for these services, we earn recurring commissions and fees associated with the policies we sell. While we have underwriting authority and responsibility for administering policies and claims, we do not take the bulk of the risk associated with the Hippo policies on our own balance sheet. Rather, we work with a diversified panel of highly rated insurance and reinsurance companies who pay us commissions in exchange for the opportunity to take that risk on their own balance sheets.

We also earn commission income as a licensed insurance agency selling non-Hippo policies to our customers. Today, we earn agency commission income when we cross sell automobile policies to our homeowners customers, when a customer seeking homeowners insurance is an area where Hippo policies are unavailable, in which case we place them with another carrier, or when a particular home does not meet our underwriting criteria, in which case we also place these customers with another carrier when possible. As we broaden our product offerings, we expect to distribute additional types of insurance offered by other carriers, which will contribute to growth in this element of our economic model. Commission income on these policies recur as the policies renew allowing us to earn margin relative to our customer acquisition cost.

We earn income in a third way, using our carriers platforms to offer insurance-as-a-service to other MGAs. The economic benefits to Hippo of providing this service extend beyond profit margins on these premiums and include capital efficiency benefits as the diversity of insurance offered allows Hippo to more efficiently manage its regulatory capital requirements through recognition of diversification benefits. Given our diverse portfolio of homeowners insurance, the regulatory capital we are required to set aside for premiums generated by these third parties is lower than these parties would need to set aside if they were to provide their own capital.

Finally, we earn margin on premiums we retain on policies we issue after ceding the majority of the insurance risk to our panel of high quality, reinsurance partners, some of whom have made multi-year commitments. We cede the majority of risk associated with these policies as part of our long-term capital-light strategy. And though the quantum of risk we cede in any year will fluctuate with reinsurance market pricing, we anticipate our long-term strategy will include cession of the majority of the insurance risk we generate.

Looking towards the future, we anticipate generating additional economic benefits through our offering of value-added services such as monitoring and home maintenance.

18

Our Asset-Light Capital Strategy

We have always pursued an asset-light capital strategy to support the growth of our business. Even though we acquired Spinnaker, a licensed carrier, in 2020, we generally retain only as much risk on our balance sheet as is necessary to secure attractive terms from the reinsurers who bear the risk of the policies we sell. Those reinsurers usually require that companies like Hippo retain some risk to ensure alignment of interests. For policies written in 2021, we retained approximately 12% of the risk associated with Hippo homeowners policies on our own balance sheet and expect to see this increase modestly over time.

This strategy also helps support our growth: third-party reinsurance helps decrease the statutory capital required to support new business growth. As a result, we are able to grow at an accelerated pace with lower capital investments upfront. We have a successful track record of securing strong reinsurance treaties, providing a solid foundation for a long-term, sustainable model.

Growth Strategy

As we grow, we expect to remain focused on the homeowners space and on making homes safer and better protected. Beyond growing our core product, we plan to grow vertically into adjacent insurance offerings as well as non-insurance areas, towards an all-inclusive home protection platform:

Core Product Growth

We are focused on the U.S. market, where the homeowners insurance industry represents $110 billion in annual premiums, growing at approximately $4.5-5 billion annually (according to William Blair & Company). Our product portfolio includes: standalone homes, condos, investment properties, and new home construction, and each of these is its own unique insurance product. Hippo has so far introduced its products in 37 states, covering over 80% of the US population.

We believe expanding our core business alone in this market represents a significant opportunity. For perspective, our market share is currently less than 1% of the US home insurance market. We plan to increase our penetration in the states where we already offer our homeowners insurance product. In parallel we plan to continue launching new states in 2022. We are at the same time building our brand and raising awareness among homeowners throughout the country. We will continue enhancing our direct-to-consumer capabilities, while expanding our relationships with new and existing partners.

19

Adjacent Insurance Offerings

We plan to offer additional insurance products to further protect and support homeowners in the US market. Where we feel we can create differentiated offerings leveraging our capabilities and assets, we will build such new products much the same way we did our modern homeowners insurance product. We may also leverage partners to offer best of breed solutions in our capacity as an agent.

We also expect to expand the portfolio of third-party programs that Spinnaker supports as a carrier. With the scalable assets we have built to support Hippo’s growth, we believe we are well-positioned to offer ancillary services across distribution, support and other areas to grow these programs.

Adjacent Non-Insurance Offerings

We are deepening our relationships with homeowners by offering broader home protection services to complement our core insurance products. We have built the first, integrated insurance and home protection platform with our Smart Home program and home maintenance offerings, including virtual home services and remote support. We plan to expand these offerings to include additional protection products such as Home Warranty and innovative solutions tied to home inspections that streamline home transactions. Such products and services can introduce additional sources of recurring revenue and non-risk-based revenue, accelerating capital efficient growth.

Competition

We face competition from established national brand names that offer competing products. These more established competitors have advantages such as brand recognition, greater access to capital, breadth of product offering, and scale of resources. We also face competition from select and new insurtechs that offer digital platforms. However, the market is fragmented, with just one carrier over 10% market share according to William Blair & Company. This allows for multiple large and growing players to coexist with differentiated products and approaches.

Hippo’s distinctive customer experience, vertical focus on complete home protection, and purpose-built, full stack technology infrastructure differentiate our model from our larger and smaller competitors alike. Though incumbents collect vast amounts of data, we believe their legacy systems are not as flexible and dynamic as our integrated technology. Our full stack system allows us to better implement data into our business model and realize the benefits in underwriting, claims, and profitability. This system also enables us to deploy Hippo’s proprietary quoting and underwriting engine (via API) across Hippo’s diversified distribution channels and partners to gain market share.

We believe our strategy to deliver the first all-in home protection platform is unique and differentiated and that our competitive advantages across smart home, technology, and distribution will make it difficult for competitors — old or new — to emulate our approach.

Our Values and People

As of December 31, 2021, we had a total of 621 employees, of which 598 were located in the United States and 23 located internationally. We engage temporary workers and independent contractors when necessary in connection with a particular project, to meet increases in demand or to fill vacancies while recruiting a permanent employee. None of our employees are currently represented by a labor union or are covered by a collective bargaining agreement with respect to his or her employment. To date we have not experienced any work stoppages, and we consider our relationship with our employees to be good. Our people team is focused on identifying and retaining top talent and building a world class organization. We use recognition and rewards including compensation and equity to attract and retain our talent.

Seasonality

We have experienced in the past, and expect to continue to experience, seasonal fluctuations in our revenues and resulting fluctuations in our rate of growth as a result of insurance spending patterns. Specifically, our revenues may be proportionately higher in our third fiscal quarter due to the seasonality of when homeowners purchase and move into new homes, which historically occurs at higher rates in the months of July, August and

20

September. As our business expands and matures, other seasonality trends may develop and the existing seasonality and customer behavior that we experience may change.

Additionally, seasonal weather patterns impact the level and amount of claims we receive. These patterns include hurricanes, wildfires, and coastal storms in the fall, cold weather patterns and changing home heating needs in the winter, and tornados and hailstorms in the spring and summer. The mix of geographic exposure and products within our customer base impacts our exposure to these weather patterns and as we diversify our base of premium such that our exposure more closely resembles the industry exposure, we should see the impact of these events on our business more closely resemble the impact on the broader industry.

Data Privacy and Protection Laws

Since we receive, use, transmit, disclose and store personal data, we are subject to numerous state and federal laws and regulations that address privacy, data protection and the collection, storing, sharing, use, transfer, disclosure and protection of certain types of data. In the U.S., insurance companies are subject to the privacy provisions of the federal Gramm-Leach-Bliley Act and the National Association of Insurance Commissioners (“NAIC”) Insurance Information and Privacy Protection Model Act, to the extent adopted and implemented by various state legislatures and insurance regulators. The regulations implementing these laws require insurance companies to disclose their privacy practices to consumers, allow customers to opt-in or opt-out, depending on the state, of the sharing of certain personal information with unaffiliated third parties, and maintain certain security controls to protect their information. Additionally, we are subject to the Telephone Consumer Protection Act which restricts the making of telemarketing calls and the use of automatic telephone dialing systems. Violators of these laws face regulatory enforcement action, substantial civil penalties, injunctions, and in some states, private lawsuits for damages.

Privacy and data security regulation in the U.S. is rapidly evolving. For example, California recently enacted the California Consumer Privacy Act (“CCPA”), which came into force in 2020. The CCPA and related regulations give California residents expanded rights to access and request deletion of their personal information, opt out of certain personal information sharing, and receive detailed information about how their personal information is used and shared. The CCPA allows for the California Attorney General to impose civil penalties for violations, as well as providing a private right of action for certain data breaches. California voters also recently passed the California Privacy Rights Act (“CPRA”), which will take effect on January 1, 2023. The CPRA significantly modifies the CCPA, including by imposing additional obligations on covered companies and expanding California consumers’ rights with respect to certain personal information. In addition to increasing our compliance costs and potential liability, the CCPA’s restrictions on “sales” of personal information may restrict our use of cookies and similar technologies for advertising purposes. The CCPA excludes information covered by Gramm-Leach-Bliley Act, the Driver’s Privacy Protection Act, the Fair Credit Reporting Act, and the California Financial Information Privacy Act from the CCPA’s scope, but the CCPA’s definition of “personal information” is broad and may encompass other information that we maintain. The CCPA likely marked the beginning of a trend toward more stringent privacy legislation in the U.S., and multiple states have enacted or proposed similar laws. For example, in 2020, Nevada enacted SB 220 which restricts the “selling” of personal information and, in 2021, Virginia passed the Consumer Data Protection Act (“CDPA”) which is set to take effect on January 1, 2023 and grant new privacy rights for Virginia residents. In addition, California voters approved the November 2020 ballot measure which will enact the CPRA, substantially expanding the requirements of the CCPA. As of January 1, 2023, the CPRA will give consumers the ability to limit use of precise geolocation information and other categories of information classified as “sensitive”. There is also discussion in Congress of new comprehensive federal data protection and privacy law to which we likely would be subject if it is enacted.

Various regulators are interpreting existing state consumer protection laws to impose evolving standards for the online collection, use, dissemination and security of other personal data. Courts may also adopt the standards for fair information practices which concern consumer notice, choice, security and access. Consumer protection laws require us to publish statements that describe how we handle personal information and choices individuals may have about the way we handle their personal data. If such information that we publish is considered untrue, we may be subject to government claims of unfair or deceptive trade practices, which could lead to significant liabilities and consequences. Furthermore, violating consumers’ privacy rights or failing to take appropriate steps to keep consumers’ personal data secure may constitute unfair acts or practices in or affecting commerce.

21

Insurance Regulation

Hippo is subject to extensive regulation, primarily at the state level. These laws are generally intended to protect the interests of purchasers or users of insurance (which regulators refer to as policyholders), rather than the holders of securities we issue.

The method, extent, and substance of such regulation vary by state but are generally set out in statutes, regulations and orders that establish standards and requirements for conducting the business of insurance and that delegate authority for the regulation of insurance to a state agency. These laws, regulations and orders have a substantial impact on our business and relate to a wide variety of matters including insurer solvency and statutory surplus sufficiency, reserve adequacy, insurance company licensing, examination, investigation, agent and adjuster licensing, agent and broker compensation, policy forms, rates, and rules, the nature and amount of investments, claims practices, trade practices, participation in shared markets and guaranty funds, transaction with affiliates, the payment of dividends, underwriting standards, withdrawal from business, statutory accounting methods, data privacy and data security regulation, corporate governance, internal and external risk management, moratoriums (including of lawful actions), and other matters. In addition, state legislatures and insurance regulators continue to examine the appropriate nature and scope of state insurance regulations, including adopting new laws and regulations, and reinterpreting existing ones.

As part of an effort to strengthen the regulation of the financial services market, the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) was enacted in 2010. Dodd-Frank created the Federal Insurance Office (“FIO”) within the U.S. Department of the Treasury (“Treasury”). The FIO monitors the insurance industry, provides advice to the Financial Stability Oversight Council (“FSOC”), represents the U.S. on international insurance matters, and studies the current regulatory system. Additional regulations or new requirements may emerge from the activities of various regulatory entities, including the Federal Reserve Board, FIO, FSOC, the NAIC, and the International Association of Insurance Supervisors (“IAIS”), that are evaluating solvency and capital standards for insurance company groups. In addition, the NAIC adopts and will continue to adopt model laws and regulations that will be adopted by various states. We cannot predict whether any specific state or federal measures will be adopted to change the nature or scope of the regulation of insurance or what effect any such measures would have on Hippo.

Spinnaker, and its subsidiaries’s ability to pay dividends without regulatory notice or in the case of certain dividends, regulatory approval, is restricted by Illinois and Texas law. Additionally, Spinnaker in the future may become commercially domiciled in additional jurisdictions depending on the amount of premiums written in those states. The laws of these other jurisdictions contain similar limitations on the payment of dividends by insurance companies that are domiciled in that state, and such laws may be more restrictive than Illinois and Texas.