SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

(Address of principal executive offices)

+

info@steakholderfoods.com

|

Title of each class

|

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

|

The

|

|

|

|

|

|

||

|

Ordinary shares, no par value per share

|

|

____

|

The Nasdaq Stock Market LLC*

|

|

|

|

|

|

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

|

|

|

Emerging growth company

|

|

U.S. GAAP ☐

|

International Accounting Standards Board ☒

|

Other ☐

|

| 3 | ||

|

|

|

|

| 3 | ||

| 3 | ||

| 3 | ||

| 28 | ||

| 43 | ||

| 44 | ||

| 49 | ||

| 65 | ||

| 67 | ||

| 67 | ||

| 68 | ||

| 75 | ||

| 76 | ||

|

|

|

|

| 78 | ||

|

|

|

|

| 78 | ||

| 78 | ||

| 78 | ||

| 79 | ||

| 79 | ||

| 79 | ||

| 80 | ||

| 80 | ||

| 80 | ||

| 80 | ||

| 81 | ||

| 81 | ||

| 81 | ||

| 82 | ||

|

|

|

|

| 82 | ||

| 82 | ||

| 83 | ||

|

|

|

|

| 84 | ||

|

• |

references to “Steakholder Foods,”

the “Company,” “us,” “we” and “our” refer to Steakholder Innovation Ltd. (formerly MeaTech

MT Ltd. and MeaTech Ltd.) from its inception until the consummation of the January 2020 merger described herein, and Steakholder Foods

Ltd. (formerly MeaTech 3D Ltd.) (the “Registrant”), an Israeli company, thereafter, unless otherwise required by the context;

|

|

• |

references to “ordinary shares,”

“our shares” and similar expressions refer to the Registrant’s ordinary shares, no nominal (par) value per share;

|

|

• |

references to “ADS” refer to

the American Depositary Shares listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “STKH,” each representing

ten ordinary shares of the Registrant; |

|

• |

references to “dollars,” “U.S.

dollars” and “$” are to United States Dollars; |

|

• |

references to “NIS” are to New

Israeli Shekels, the currency of the State of Israel; |

|

• |

references to the “Companies Law”

are to Israel’s Companies Law, 5759-1999, as amended; and |

|

• |

references to the “SEC” are

to the United States Securities and Exchange Commission. |

| • |

our estimates regarding our expenses, future revenue, capital requirements and needs

for additional financing; |

| • |

our expectations regarding the success of our cultured meat manufacturing technologies

we are developing, which will require significant additional work before we can potentially launch commercial sales; |

| • |

our research and development activities associated with technologies for cultured

meat manufacturing, including three-dimensional meat production, which involves a lengthy and complex process; |

| • |

our expectations regarding the timing for the potential commercial launch of our

cultured meat technologies; |

| • |

our ability to successfully manage our planned growth, and any future acquisitions,

joint ventures, collaborations or similar transactions; |

| • |

the competitiveness of the market for our cultured meat technologies; |

| • |

our ability to enforce our intellectual property rights and to operate our business

without infringing, misappropriating, or otherwise violating the intellectual property rights and proprietary technology of third parties;

|

| • |

our ability to predict and timely respond to preferences for alternative proteins

and cultured meats and new trends; |

| • |

our ability to attract, hire and retain qualified employees and key personnel; and

|

| • |

other risks and uncertainties, including those listed in “Item 3. —Key

Information—Risk Factors.” |

|

ITEM

1. |

IDENTITY OF DIRECTORS,

SENIOR MANAGEMENT AND ADVISERS |

|

ITEM

2. |

OFFER STATISTICS AND

EXPECTED TIMETABLE |

|

ITEM

3. |

KEY INFORMATION

|

| • |

We expect to continue incurring significant losses for the

foreseeable future. |

| • |

We will require substantial additional funds to complete our

research and development activities. |

| • |

There is substantial doubt as to whether we can continue as

a going concern. |

| • |

Raising additional capital may cause dilution to our existing

shareholders or restrict our operations. |

| • |

We have a limited operating history to date. |

| • |

The research and development associated with cultured meat

manufacturing is a lengthy process. |

| • |

We intend to engage in future acquisitions, joint ventures

or collaborations, which may not be successful. |

| • |

We may not be able to successfully manage our planned growth,

and if the market does not grow as we expect, we may not achieve sustainable revenues. |

| • |

Business or economic disruptions may have an adverse impact

on our business. |

| • |

We are an early-stage company with an unproven business model.

|

| • |

We may suffer reputational harm due to issues with products

manufactured by our licensees. |

| • |

Failure to improve our technologies may adversely affect our

ability to continue to grow. |

| • |

We may face difficulties if we expand our operations into new

geographic regions. |

| • |

Consumer preferences for alternative proteins in general are

difficult to predict and may change. |

| • |

We have no manufacturing experience or resources, and we may

have issues in obtaining raw materials. |

| • |

Litigation or legal proceedings, government investigations

or other regulatory enforcement actions could subject us to civil and criminal penalties or otherwise expose us to significant liabilities.

|

| • |

We expect that a small number of customers will account for

a significant portion of our revenues, and we may be exposed to the credit risks of our customers. |

| • |

If we are unable to attract and retain qualified employees,

our ability to implement our business plan may be adversely affected, and we may not be able to enforce covenants not to compete under

applicable employment laws. |

| • |

Insurance policies may not fully cover the risk of loss to

which we are exposed. |

| • |

Our business, reputation and operations could suffer in the

event of information technology system failures or a cybersecurity incident. |

| • |

Food safety and food-borne illness incidents may materially

adversely affect our business. |

| • |

Products utilizing our technologies will be subject to regulations

that could adversely affect our business and results of operations. |

| • |

Any changes in, or failure by our supplier to comply with,

applicable laws, regulations or policies could adversely affect our business. |

| • |

If we are unable to obtain and maintain our intellectual property

rights, we may not be able to compete effectively in our markets. |

| • |

Intellectual property rights of third parties could adversely

affect our ability to successfully commercialize our products and may prevent or delay our development and commercialization. |

| • |

Patent policy and rule changes could increase uncertainties

and costs. |

| • |

We may be involved in lawsuits to protect or enforce our or

third party intellectual property rights. |

| • |

Our articles of association provide that unless we consent

to an alternate forum, the federal district courts of the United States shall be the exclusive forum of resolution of any claims arising

under the Securities Act. |

| • |

Political, economic and military conditions in Israel could

have an adverse impact on our business. |

| • |

We are exposed to fluctuations in currency exchange rates.

|

| • |

Enforcing a U.S. judgment against us and our executive officers

and directors, or asserting U.S. securities law claims in Israel, may be difficult. |

| • |

Our articles of association provide that unless we consent

otherwise, the competent courts of Tel Aviv, Israel shall be the sole and exclusive forum for substantially all disputes between the Company

and its shareholders under the Companies Law and the Israeli Securities Law. |

| • |

Your rights and responsibilities as our shareholder will be

governed by Israeli law, which may differ in some respects from the rights and responsibilities of shareholders of U.S. corporations.

|

| • |

Our articles of association and Israeli law could prevent a

takeover that shareholders consider favorable and could also reduce the market price of our ADSs. |

| • |

The ADS price may be volatile, and you may lose all or part

of your investment. |

| • |

We have never paid dividends on our share capital, nor do we

intend to pay dividends for the foreseeable future. |

| • |

ADS holders may not receive the same distributions or dividends

as those we make to the holders of our ordinary shares. |

| • |

ADS holders do not have the same rights as our shareholders.

|

| • |

ADS holders may be subject to limitations on transfer of their

ADSs. |

| • |

We follow certain home country corporate governance practices

instead of certain Nasdaq and Exchange Act requirements. |

| • |

If we are a “passive foreign investment company”

for U.S. income tax purposes, there may be adverse tax consequences to U.S. investors. |

| • |

If we are a controlled foreign corporation, there could be

adverse U.S. income tax consequences to certain U.S. holders. |

| • |

our progress with current research and development activities;

|

| • |

the number and characteristics of any products or manufacturing

processes we develop or acquire; |

| • |

the expenses associated with our marketing initiatives;

|

| • |

the timing, receipt and amount of milestone, royalty and other

payments from future customers and collaborators, if any; |

| • |

the scope, progress, results and costs of researching and developing

future products or improvements to existing products or manufacturing processes; |

| • |

any lawsuits related to our products or commenced against us;

|

| • |

the expenses needed to attract, hire and retain skilled personnel;

|

| • |

the costs associated with being a public company in the United

States; and |

| • |

the costs involved in preparing, filing, prosecuting, maintaining,

defending and enforcing intellectual property claims, including litigation costs and the outcome of such litigation. |

| • |

increased operating expenses and cash requirements; |

| • |

the assumption of additional indebtedness or contingent liabilities;

|

| • |

assimilation of operations, intellectual property and products

of an acquired company, including difficulties associated with integrating new personnel; |

| • |

the diversion of our management’s attention from our

existing programs and initiatives in pursuing such a strategic merger or acquisition; |

| • |

retention of key employees, the loss of key personnel, and

uncertainties in our ability to maintain key business relationships; |

| • |

risks and uncertainties associated with the other party to

such a transaction, including the prospects of that party and their existing technologies; and |

| • |

our inability to generate revenue from acquired technologies

or products sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance

costs. |

| • |

collaborators may not perform or prioritize their obligations

as expected; |

| • |

collaborators may not pursue development and commercialization

of any of our cultured meat manufacturing technologies or may elect not to continue or renew development or commercialization, changes

in the collaborators’ focus or available funding, or external factors, such as an acquisition, that divert resources or create competing

priorities; |

| • |

collaborators may provide insufficient funding for the successful

development or commercialization of our cultured meat manufacturing technologies; |

| • |

collaborators could independently develop, or develop with

third parties, products or technologies that compete directly or indirectly with our products or cultured meat manufacturing technologies

if the collaborators believe that competitive products are more likely to be successfully developed or can be commercialized under terms

that are more economically attractive than ours; |

| • |

cultured meat manufacturing technologies developed in collaborations

with us may be viewed by our collaborators as competitive with their own products or technologies, which may cause collaborators to cease

to devote resources to the development or commercialization of our products; |

| • |

a collaborator with marketing and distribution rights to one

or more of our products or technologies that achieve regulatory approval may not commit sufficient resources to the marketing and distribution

of any such product; |

| • |

disagreements with collaborators, including disagreements over

proprietary rights, contract interpretation or the preferred course of development of cultured meat manufacturing technologies, may cause

delays or termination of the research, development or commercialization of such technologies, may lead to additional responsibilities

for us with respect to such technologies, or may result in litigation or arbitration, any of which would be time-consuming and expensive;

|

| • |

collaborators may not properly maintain, protect, defend or

enforce our intellectual property rights or may use our proprietary information in such a way as to invite litigation that could jeopardize

or invalidate our intellectual property or proprietary information or expose us to potential litigation; |

| • |

disputes may arise with respect to the ownership of intellectual

property developed pursuant to our collaborations; |

| • |

collaborators may infringe, misappropriate or otherwise violate

the intellectual property rights of third parties, which may expose us to litigation and potential liability; |

| • |

collaborations may be terminated for the convenience of the

collaborator and, if terminated, the development of our cultured meat manufacturing technologies may be delayed, and we could be required

to raise additional capital to pursue further development or commercialization of the cultured meat manufacturing technologies;

|

| • |

future relationships may require us to incur non-recurring

and other charges, increase our near- and long-term expenditures, issue securities that dilute our existing shareholders, or disrupt our

management and business; and |

| • |

we could face significant competition in seeking appropriate

collaborators, and the negotiation process is time-consuming and complex. |

| • |

Israeli corporate law regulates mergers and requires that a

tender offer be effected when more than a specified percentage of shares in a company are purchased; |

| • |

Israeli corporate law requires special approvals for certain

transactions involving directors, officers or significant shareholders and regulates other matters that may be relevant to these types

of transactions; |

| • |

Israeli corporate law does not provide for shareholder action

by written consent for public companies, thereby requiring all shareholder actions to be taken at a general meeting of shareholders;

|

| • |

our articles of association divide our directors into three

classes, each of which is elected once every three years; |

| • |

our articles of association generally require a vote of the

holders of a majority of our outstanding ordinary shares entitled to vote present and voting on the matter at a general meeting of shareholders

(referred to as simple majority), and solely the amendment of the provision relating to the removal of members of our board of directors,

require a vote of the holders of 65% of our outstanding ordinary shares entitled to vote at a general meeting; |

| • |

our articles of association provide that director vacancies

may be filled by our board of directors. |

| • |

changes in the prices of our raw materials or the products manufactured in factories

using our technologies; |

| • |

the trading volume of the ADSs; |

| • |

general economic, market and political conditions, including negative effects on

consumer confidence and spending levels that could indirectly affect our results of operations; |

| • |

actual or anticipated fluctuations in our financial condition and operating results,

including fluctuations in our quarterly and annual results; |

| • |

announcements by us or our competitors of innovations, other significant business

developments, changes in distributor relationships, acquisitions or expansion plans; |

| • |

announcement by competitors or new market entrants of their entry into or exit from

the alternative protein market; |

| • |

overall conditions in our industry and the markets in which

we intend to operate; |

| • |

market conditions or trends in the packaged food sales industry

that could indirectly affect our results of operations; |

| • |

addition or loss of significant customers or other developments

with respect to significant customers; |

| • |

adverse developments concerning our manufacturers and suppliers;

|

| • |

changes in laws or regulations applicable to our products or

business; |

| • |

our ability to effectively manage our growth and market expectations

with respect to our growth, including relative to our competitors; |

| • |

changes in the estimation of the future size and growth rate

of our markets; |

| • |

announcements by us or our competitors of significant acquisitions,

strategic partnerships, joint ventures or capital commitments; |

| • |

additions or departures of key personnel; |

| • |

competition from existing products or new products that may

emerge; |

| • |

issuance of new or updated research or reports about us or

our industry, or positive or negative recommendations or withdrawal of research coverage by securities analysts; |

| • |

variance in our financial performance from the expectations

of market analysts; |

| • |

our failure to meet or exceed the estimates and projections

of the investment community or that we may otherwise provide to the public; |

| • |

fluctuations in the valuation of companies perceived by investors

to be comparable to us; |

| • |

disputes or other developments related to proprietary rights,

including patents, and our ability to obtain intellectual property protection for our products; |

| • |

litigation or regulatory matters; |

| • |

announcement or expectation of additional financing efforts;

|

| • |

our cash position; |

| • |

sales and short-selling of the ADSs; |

| • |

our issuance of equity or debt; |

| • |

changes in accounting practices; |

| • |

ineffectiveness of our internal controls; |

| • |

negative media or marketing campaigns undertaken by our competitors or lobbyists

supporting the conventional meat industry; |

| • |

the public’s response to publicity relating to the health aspects or nutritional

value of products to be manufactured in factories using our technologies; and |

| • |

other events or factors, many of which are beyond our control. |

|

ITEM 4. |

INFORMATION ON THE COMPANY

|

| • |

Environmental:

At least 18% of the greenhouse gases entering the atmosphere today are from the livestock industry. Research shows that the expected environmental

footprint of cultivated meat includes approximately 78% to 96% fewer greenhouse gas emissions, 63%-95% less land use, 51% to 78% less

water use, and 7% to 45% less energy use than conventionally-produced beef, lamb, pork and poultry. This suggests that the environmental

consequences of switching from large-scale, factory farming to lab-grown cultivated meat could have a long-term positive impact on the

environment. |

| • |

Mitigating

and reducing of health risks: Another potential benefit of cultivated meat is that its growth environment is designed to be less

susceptible to biological risk and disease, through standardized, tailored production methods consistent with controlled manufacturing

practices that are designed to contribute to improved nutrition, health and wellbeing. Therefore, cultivated meat reduces the risk

of new diseases and future pandemics. Plant-based and cultivated meats are expected to be insusceptible to animal diseases and should

therefore not contribute to pandemic risk because they do not require the use of live animals. Moreover, cultivated meat does not require

antibiotics during its production and therefore will not contribute to antibiotic resistance. |

| • |

Cost:

While the precise economic value of harvested cells has yet to be determined, the potential to harvest large numbers of cells from a small

number of live donor animals gives rise to the possibility of considerably higher returns than traditional agriculture, with production

cycles potentially measured in months rather than years. By comparison, raising a cow for slaughter generally takes an average of 18 months,

over which period 15,400 liters of water and 7 kilograms of feed will be consumed for every kilogram of beef produced. While the original

cultivated burger is thought to have cost around $330 thousand, consulting firm CE Delft estimates that economies of scale combined with

technological improvements will bring the cost of cultivated meat down to less than $8 per kilogram by 2035. |

| • |

Animal

Suffering: More and more people are grappling with the ethical question of whether humanity should continue to slaughter animals

for food. There is a growing trend of opposition to the way animals are raised for slaughter, often in small, confined spaces with unnatural

feeding patterns. In many cases, such animals suffer terribly throughout their lives. This consideration is likely a factor in many consumers

choosing to incorporate more flexitarian, vegetarian and vegan approaches to their diets in recent years. |

| • |

Alternate

Use of Natural Resources: Eight percent of the world’s freshwater supply and one third of croplands are currently used to

provide for livestock. The development of cultivated meat is expected to free up many of these natural resources, especially in developing

economies where they are most needed. |

| • |

Food Waste:

The conventional meat industry’s largest waste management problem relates to the disposal of partially-used carcasses, which are

usually buried, incinerated, rendered or composted, with attendant problems such as land, water or air pollution. Cultivated meat offers

a potential solution for this problem, with only the desired cuts of meat being produced for consumption and only minimal waste product

generated with no leftover carcass. |

| • |

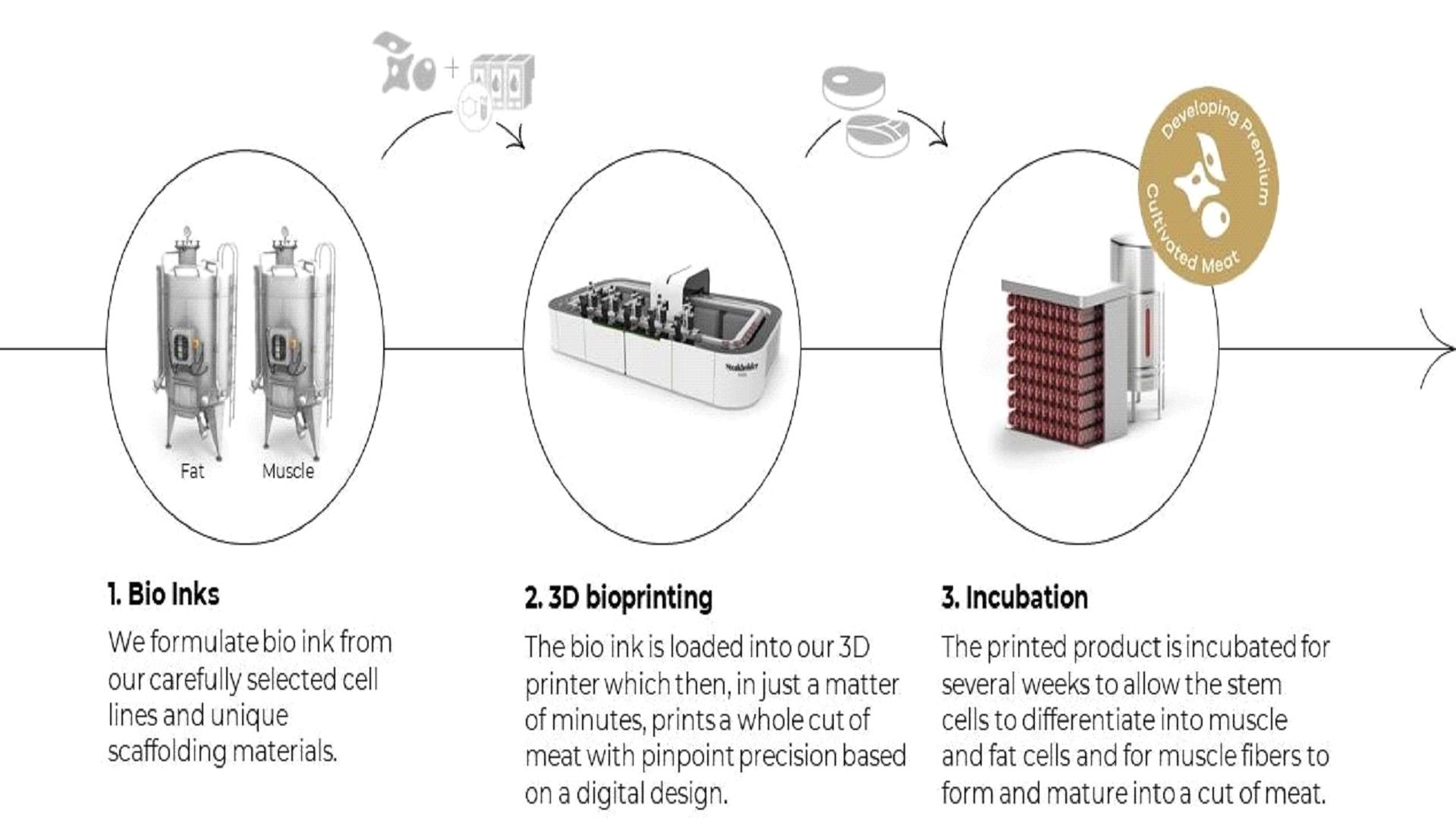

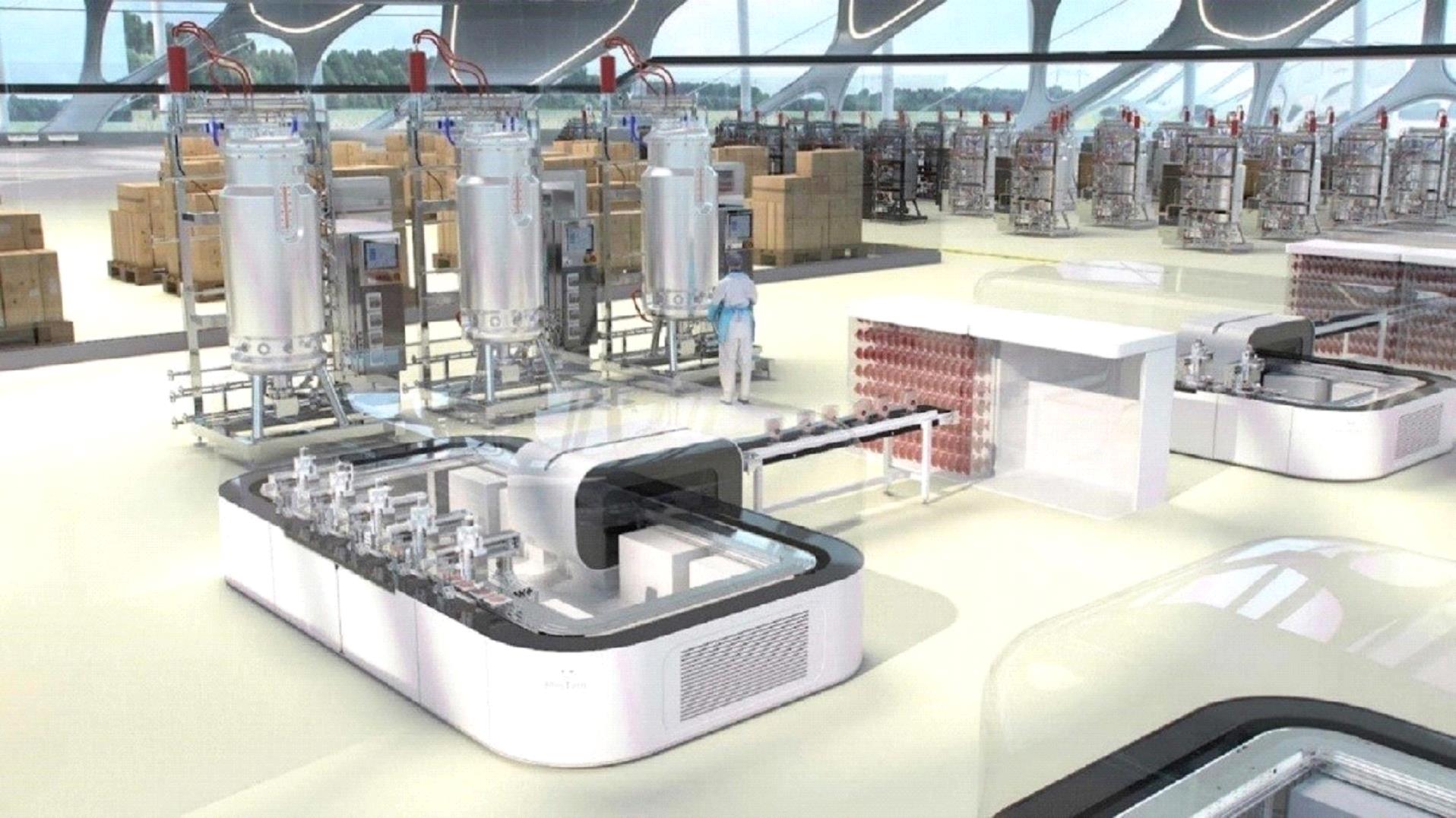

Commercialize

our technologies for use in consumer and business markets. We intend to commercialize our three-dimensional bio-printing capabilities,

while also customizing bio-inks to enable the production of products based on a wide range of species in accordance with the needs of

our partners and customers. We also intend to provide ingredients to business customers for use in consumer products in order to help

meet the growing demand for sustainable, slaughter-free cultivated meat products. For example, manufacturers of meat alternatives, such

as vegetarian sausages, may choose to include our cultivated fat biomass in their products in order to deliver the signature meaty flavors,

aromas and textures of the meat that is otherwise provided by the conventional meat of species such as chicken, beef and pork. We believe

that this combination has the potential to unlock a new level of meat experience. |

| • |

Perfect

the development of our cultivated meat manufacturing technology and processes. We intend to continue developing and refining

our processes, procedures and equipment until we are in a position to commercialize our technologies, whether by manufacturing final products

for consumers (B2B2C models) or ingredients for industrial use, as well as in outlicensing (B2B models). We are continuing to tackle

the technological challenges involved in scaling up both our biological and printing processes to industrial-scale levels. |

| • |

Develop additional alternative

proteins to meet growing industry demand. There are substantial technological challenges inherent in expanding our offering beyond

our current cultivated beef technologies to additional alternative proteins and cell lines. However, we believe that our experience,

know-how and intellectual property portfolio form an excellent basis from which to surmount such challenges. In January 2023, we announced

a collaboration with Singaporean cultivated seafood developer, Umami Meats, to develop 3D-printed structured eel and grouper products

pursuant to a grant from the Singapore-Israel R&D Foundation. The initiative is being funded by a grant from the Singapore-Israel

Industrial R&D Foundation (SIIRD), a cooperation between Enterprise Singapore (ESG) and the Israel Innovation Authority (IIA). The

collaboration aims to develop a scalable process for producing structured cultivated fish products and will involve the use of our newly-developed

technology for mimicking the flaky texture of cooked fish which was the subject of a recent patent application. |

| • |

Acquire

synergistic and complementary technologies and assets. We intend to optimize our processes and diversify our product range

to expand the cultivated meat technologies upon which marketable products can be based. We intend to accomplish this through a combination

of internal development, acquisitions and collaborations, with a view to complementing our own processes and diversifying our product

range along the cultivated meat production value chain in order to introduce cultivated products to the global market as quickly as possible.

See also “- Additional Technologies” below. |

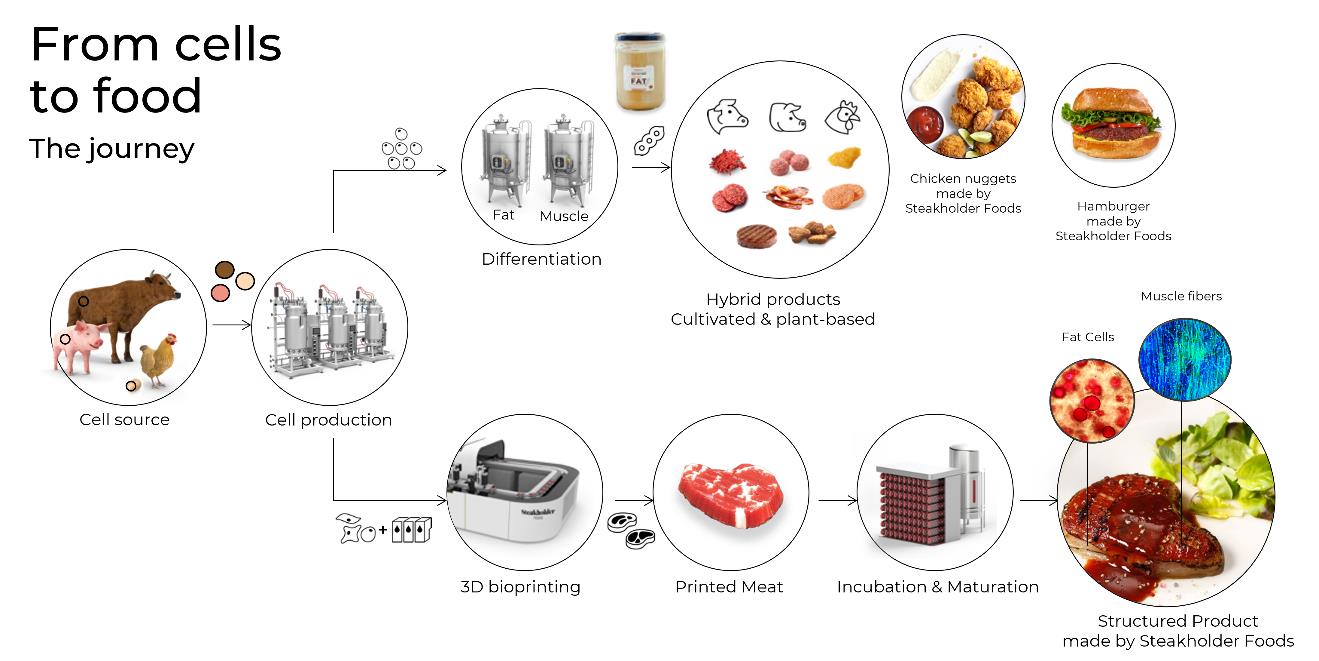

| • |

Fully-plant-based meat-like offerings that are already commercially

available but lack the organoleptic properties of meat, primarily flavor, aroma, texture and color; |

| • |

Hybrid meat products of the type that we are developing, which

combines real cultivated fat with plant-based protein to offer meatier products with enhanced organoleptic properties; |

| • |

Unstructured meat products, such as hamburgers and minced meat;

|

| • |

Thee-dimensional, printed, hybrid, structured products such as hybrid steaks,

chicken breast and fish fillets (“ready to cook”); and |

| • |

Fully-cultivated structured meat products, such as 3D-printed

steaks. |

| • |

Replacing expensive, animal-derived components in cell growth

media with chemical replacements, including through in-house production, with a view to completing animal-free growth media and bio-ink

by the first half of 2023; |

| • |

Cell line optimizations, such as through high-throughput analyses

of evolved isolates; |

| • |

Bioprocess optimization and media recycling; |

| • |

Upscaled growth factor production, such as through hollow fiber

bioreactors; and |

| • |

Long-term market optimization as a result of expected increased

demand. |

|

Name |

Jurisdiction of Incorporation |

Parent |

% Ownership (direct or otherwise) |

|||||

|

Steakholder Foods USA, Inc.

|

Delaware, U.S. |

Steakholder Foods Ltd. |

100 |

% | ||||

|

Steakholder Innovation Ltd.

|

Israel |

Steakholder Foods Ltd. |

100 |

% | ||||

|

Steakholder Foods Europe BV

|

Belgium |

Steakholder Foods Ltd. |

100 |

% | ||||

|

Peace of Meat BV

|

Belgium |

Steakholder Foods Europe BV |

100 |

% | ||||

|

ITEM

4A. |

UNRESOLVED STAFF COMMENTS |

|

|

ITEM

5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

| • |

employee-related expenses, such as salaries and share-based

compensation; |

| • |

expenses relating to outsourced and contracted services, such

as external laboratories and consulting, research and advisory services; |

| • |

supply and development costs; |

| • |

expenses, such as materials, incurred in operating our laboratories

and equipment; and |

| • |

costs associated with regulatory compliance. |

|

Year Ended December 31, |

||||||||

|

2022 |

2021 |

|||||||

|

Operating expenses: |

||||||||

|

Research and development expenses

|

$ |

9,801 |

$ |

7,594 |

||||

|

Marketing expenses

|

3,044 |

1,628 |

||||||

|

General and administrative expenses

|

6,937 |

8,010 |

||||||

|

Impairment loss |

15,577 |

- |

||||||

|

Loss from operations

|

$ |

35,359 |

$ |

17,232 |

||||

|

Finance income

|

4,878 |

509 |

||||||

|

Finance expense

|

286 |

1,299 |

||||||

|

Finance expense (income), net |

(4,592 |

) |

790 |

|||||

|

Net loss

|

$ |

30,767 |

$ |

18,022 |

||||

| • |

to the extent that we no longer qualify as a foreign private

issuer, (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions

from the requirement to hold a non-binding advisory vote on executive compensation, including golden parachute compensation; |

| • |

an exemption from the auditor attestation requirement in the

assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; and |

| • |

an exemption from compliance with the Critical Audit Matters

requirement that the Public Company Accounting Oversight Board has adopted regarding a supplement to the auditor’s report providing

additional information about the audit and the financial statements. |

|

Year Ended December 31, |

||||||||

|

2022 |

2021 |

|||||||

|

Net cash used in operating activities

|

$ |

(14,253 |

) |

$ |

(13,951 |

) | ||

|

Net cash used in investing activities

|

(3,533 |

) |

(9,191 |

) | ||||

|

Net cash provided by financing activities

|

5,572 |

28,865 |

||||||

|

Net increase (decrease) in cash and cash equivalents |

$ |

(12,214 |

) |

$ |

5,723 |

|||

| • |

the progress and costs of our research and development activities;

|

| • |

the costs of development and expansion of our operational infrastructure;

|

| • |

the costs and timing of developing technologies sufficient

to allow food production equipment manufacturers and food manufacturers to product products compliant with applicable regulations;

|

| • |

our ability, or that of our collaborators, to achieve development

milestones and other events or developments under potential future licensing agreements; |

| • |

the amount of revenues and contributions we receive under future

licensing, collaboration, development and commercialization arrangements with respect to our technologies; |

| • |

the costs of filing, prosecuting, enforcing and defending patent

claims and other intellectual property rights; |

| • |

the costs of contracting with third parties to provide sales

and marketing capabilities for us or establishing such capabilities ourselves, once our technologies are developed and ready for commercialization;

|

| • |

the costs of acquiring or undertaking development and commercialization

efforts for any future products or technology; |

| • |

the magnitude of our general and administrative expenses; and

|

| • |

any additional costs that we may incur under future in- and

out-licensing arrangements relating to our technologies and futures products. |

|

ITEM 6.

|

DIRECTORS, SENIOR MANAGEMENT

AND EMPLOYEES |

|

Name |

Age |

Position | ||

|

Executive Officers:

|

||||

|

Arik Kaufman

|

42 |

Chief Executive Officer | ||

|

Guy Hefer

|

41 |

Chief Financial Officer* | ||

|

Dan Kozlovski

|

38 |

Chief Technologies Officer | ||

|

Non-Employee Directors: |

||||

|

Yaron Kaiser

|

45 |

Chairman of the Board of Directors

| ||

|

David Gerbi(1)(2)(3)

|

43 |

Director | ||

|

Eli Arad(1)(2)(3)

|

50 |

Director | ||

|

Sari Singer(1)(2)(3)

|

43 |

Director |

| (1) |

Member of the Audit Committee |

| (2) |

Member of the Compensation Committee |

| (3) |

Independent director as defined under Nasdaq Marketplace Rule

5605(a)(2) and SEC Rule 10A-3(b)(1). |

|

Name and Principal Position

|

Salary(1)

|

Bonus(2)

|

Equity-Based

Compensation(3) |

Other

Compensation(4) |

Total |

|||||||||||||||

|

(USD in thousands)

|

||||||||||||||||||||

|

Mr. Arik Kaufman |

||||||||||||||||||||

|

Chief Executive Officer

|

$ |

235 |

$ |

- |

$ |

88 |

$ |

8 |

$ |

331 |

||||||||||

|

Mr. Guy Hefer(5)

|

||||||||||||||||||||

|

Chief Financial Officer

|

210 |

34 |

83 |

- |

327 |

|||||||||||||||

|

Mr. Dan Kozlovski

|

||||||||||||||||||||

|

Chief Technologies Officer

|

201 |

42 |

51 |

- |

294 |

|||||||||||||||

|

Mr. Yaron Kaiser |

||||||||||||||||||||

|

Chairman of the Board

of Directors |

161 |

- |

62 |

8 |

231 |

|||||||||||||||

|

Mr. Steven H. Levin

(6) |

||||||||||||||||||||

|

Former Chairman of the

Board of Directors(5)

|

$ |

57 |

$ |

- |

$ |

108 |

$ |

- |

$ |

165 |

||||||||||

| (1) |

Salary includes the officer’s gross salary plus payment by us of social benefits

on behalf of the officer. Such benefits may include payments, contributions and/or allocations for savings funds (e.g., Managers’

Life Insurance Policy), pension, severance, risk insurance (e.g., life, or work disability insurance), payments for social security and

tax gross-up payments, vacation, medical insurance and benefits, convalescence or recreation pay and other benefits and perquisites consistent

with our policies. |

| (2) |

Represents annual bonuses paid in 2022 with respect to 2021. |

| (3) |

Represents the equity-based compensation expenses, based on the options’ fair

value on the grant date, calculated in accordance with applicable accounting guidance for equity-based compensation. For a discussion

of the assumptions used in reaching this valuation, see Note 10(B) to our annual consolidated financial statements included elsewhere

in this prospectus. |

| (4) |

Represents consulting services provided prior to commencement of the aforementioned

current position. |

| (5) |

Mr. Hefer will step down from his position as Chief Financial Officer on March 23,

2023, at which time Mr. Eitan Noah, our current Vice President of Finance, will assume the role of Chief Financial Officer. |

| (6) |

Mr. Levin resigned his position as Chairman on January 24, 2022. |

| • |

the Class I directors are Messrs. Eli Arad and David Gerbi and their respective

terms will expire at the Company’s annual general meeting of shareholders to be held in 2026; |

| • |

the Class II director is Ms. Sari Singer and her term will

expire at the Company’s annual general meeting of shareholders to be held in 2024; and |

| • |

the Class III director is Mr. Yaron Kaiser his term will

expire at the Company’s annual general meeting of shareholders to be held in 2025. |

|

|

• |

the office holder’s relatives (spouse,

siblings, parents, grandparents, descendants, spouse’s descendants and the spouses of any of these people); or |

|

|

• |

any company in which the office holder or

his or her relatives holds 5% or more of the shares or voting rights, serves as a director or general manager or has the right to appoint

at least one director or the general manager. |

|

|

• |

a transaction other than in the ordinary

course of business; |

|

|

• |

a transaction that is not on market terms;

or |

|

|

• |

a transaction that may have a material impact

on the company’s profitability, assets or liabilities. |

|

|

• |

a majority of the shares held by shareholders

who have no personal interest in the transaction and are voting at the meeting must be voted in favor of approving the transaction, excluding

abstentions; or |

|

|

• |

the shares voted by shareholders who have

no personal interest in the transaction who vote against the transaction represent no more than 2% of the voting rights in the company.

|

|

|

• |

an amendment to the articles of association;

|

|

|

• |

an increase in the company’s authorized

share capital; |

|

|

• |

a merger; and |

|

|

• |

the approval of related party transactions

and acts of office holders that require shareholder approval. |

|

|

• |

financial liability that was imposed upon

him in favor of another person pursuant to a judgment, including a compromise judgment or an arbitrator’s award approved by a court;

|

|

|

• |

reasonable litigation expenses, including

attorneys’ fees paid by an officeholder following an investigation or proceeding conducted against him by an authority authorized

to conduct such investigation or proceeding, and which ended without the filing of an indictment against him and without any financial

obligation being imposed on him as an alternative to a criminal proceeding, or which ended without the filing of an indictment against

him but with the imposition of a financial obligation as an alternative to a criminal proceeding for an offense which does not require

proof of mens rea or in connection with a financial sanction; |

|

|

• |

reasonable litigation expenses, including

attorneys’ fees paid by the officeholder or which he was required to pay by a court, in a proceeding filed against him by the Company

or on its behalf or by another person, or in criminal charges from which he was acquitted, or in criminal charges in which he was convicted

of an offense which does not require proof of mens rea; |

|

|

• |

a financial obligation imposed on the officeholder

for the benefit of all of the parties damaged by the violation of an administrative proceeding; |

|

|

• |

expenses incurred by an officeholder in

connection with an Administrative Proceeding conducted in his regard, including reasonable litigation expenses, and including attorneys’

fees; |

|

|

• |

expenses incurred by an officeholder in

connection with a proceeding under the Antitrust Law, 5748-1988 and/or in connection with it (a “Proceeding Under the Antitrust

Law”), conducted regarding him, including reasonable litigation expenses, and attorneys' fees; and |

|

|

• |

any other liability or expense in respect

of which it is permitted or shall be permitted by Law to indemnify an officeholder. |

|

|

• |

Breach of the duty of care to the Company

or to any other person; |

|

|

• |

Breach of the fiduciary duty to the Company,

provided that the officeholder acted in good faith and had reasonable grounds to assume that his act would not adversely affect the Company’s

best interests; |

|

|

• |

financial liability imposed upon him in

favor of another person; |

|

|

• |

financial liability imposed on the officeholder

for the benefit of all of the parties damaged by the violation of an administrative proceeding; |

|

|

• |

expenses incurred or to be incurred by an

officer in connection with an Administrative Proceeding, including reasonable litigation expenses, and including attorneys’ fees;

|

|

|

• |

Expenses incurred or to be incurred in connection

with a proceeding under the Antitrust Law, including reasonable litigation expenses, and including attorneys’ fees; and |

|

|

• |

any other event in respect of which it is

permitted and/or shall be permitted by Law to insure the liability of an officeholder. |

|

|

• |

a breach of the duty of loyalty, except

for indemnification and insurance for a breach of the duty of loyalty to the company to the extent that the office holder acted in good

faith and had a reasonable basis to believe that the act would not prejudice the company; |

|

|

• |

a breach of duty of care committed intentionally

or recklessly, excluding a breach arising out of the negligent conduct of the office holder; |

|

|

• |

an act or omission committed with intent

to derive illegal personal benefit; or |

|

|

• |

a fine, monetary sanction or forfeit levied

against the office holder. |

|

Shares Beneficially Owned |

||||||||

|

Name of Beneficial Owner |

Number |

Percentage(1)

|

||||||

|

Directors and executive

officers |

||||||||

|

Arik Kaufman(2)

|

491,600 |

* |

||||||

|

Guy Hefer(3)

|

333,330 |

* |

||||||

|

Dan Kozlovski(4)

|

133,340 |

* |

||||||

|

Yaron Kaiser(5)

|

3,003,610 |

1.7 |

% | |||||

|

David Gerbi(6)

|

218,510 |

* |

||||||

|

Eli Arad(7)

|

167,010 |

* |

||||||

|

Sari Singer(8)

|

168,460 |

* |

||||||

|

All directors and executive

officers as a group (7 persons) |

4,515,860 |

2.6 |

% | |||||

| * |

Less than one percent (1%). |

| (1) |

Based on 172,071,117 Ordinary Shares outstanding as of March

22, 2023. |

| (2) |

Consists of 283,270 Ordinary Shares and options to purchase

208,330 Ordinary Shares exercisable within 60 days of the date of this annual report, with an exercise price of $0.519. These options

expire on March 16, 2026. |

| (3) |

Consists of options to purchase 187,500 Ordinary Shares exercisable

within 60 days of the date of this annual report, with an exercise price of NIS 3.49 ($0.96), expiring on March 24, 2025, and options

to purchase 145,830 Ordinary Shares exercisable within 60 days of the date of this annual report, with an exercise price of $0.716, expiring

on July 20, 2025. |

| (4) |

Consists of options to purchase 133,340 Ordinary Shares exercisable

within 60 days of the date of this annual report, with an exercise price of NIS 1.90 ($0.52). These options expire on August 5, 2024.

|

| (5) |

Consists of 1,435,280 Ordinary Shares based on information

provided to us by Mr. Kaiser, options to purchase 116,660 Ordinary Shares exercisable within 60 days of the date of this annual report,

with an exercise price of $0.519, expiring on March 16, 2026, restricted share units vesting into 111,670 Ordinary Shares within 60 days

of the date of this annual report, and performance share units that may vest into 1,340,000 Ordinary Shares within 60 days of this annual

report if their associated performance targets are met during such period. |

| (6) |

Consists of 96,450 Ordinary Shares, RSUs vesting into 7,490

Ordinary Shares within 60 days of the date of this annual report and options to purchase 114,570 Ordinary Shares within 60 days of the

date of this annual report with an exercise price of $0.716. These options expire on July 20, 2025. |

| (7) |

Consists of 44,950 Ordinary Shares, RSUs vesting into 7,490

Ordinary Shares within 60 days of the date of this annual report and options to purchase 114,570 Ordinary Shares within 60 days of the

date of this annual report with an exercise price of $0.716. These options expire on July 20, 2025. |

| (8) |

Consists of 44,910 Ordinary Shares, RSUs vesting into 8,980 Ordinary Shares within 60 days of the date of this annual report and

options to purchase 114,570 Ordinary Shares within 60 days of the date of this annual report with an exercise price of $0.716. These options

expire on July 20, 2025. |

|

ITEM 7.

|

MAJOR SHAREHOLDERS AND

RELATED PARTY TRANSACTIONS |

|

Ordinary Shares Beneficially

Owned |

||||||||

|

Name of Beneficial Owner

|

Number |

Percentage |

||||||

|

5%

or greater shareholders |

||||||||

|

Shimon Cohen

|

12,175,320 |

(2) |

7.1 |

% | ||||

|

ITEM 8. |

FINANCIAL INFORMATION |

|

ITEM 9. |

THE OFFER AND LISTING |

|

ITEM 10. |

ADDITIONAL INFORMATION |

| • |

an individual who is a citizen or resident of the United States,

|

| • |

a domestic corporation (or other entity taxable as a corporation);

|

| • |

an estate the income of which is subject to United States federal

income taxation regardless of its source; or |

| • |

a trust if (1) a court within the United States is able to

exercise primary supervision over the trust’s administration and one or more United States persons have the authority to control

all substantial decisions of the trust or (2) a valid election under the Treasury regulations is in effect for the trust to be treated

as a United States person. |

| • |

such gain is effectively connected with your conduct of a trade

or business in the United States (or, if required by an applicable income tax treaty, the gain is attributable to a permanent establishment

or fixed base that such holder maintains in the United States); or |

| • |

you are an individual and have been present in the United States

for 183 days or more in the taxable year of such sale or exchange and certain other conditions are met. |

|

ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURE ON MARKET RISK |

|

ITEM 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

|

Persons depositing or

withdrawing ordinary shares or ADS holders must pay |

|

For: |

|

$5.00 (or less) per 100 ADSs (or portion

of 100 ADSs) |

|

Issuance of ADSs, including issuances resulting

from a distribution of ordinary shares or rights or other property Cancellation of ADSs for the purpose of withdrawal, including if the

deposit agreement terminates |

|

|

|

|

|

$.05 (or less) per ADS |

|

Any cash distribution to ADS holders

|

|

|

|

|

|

A fee equivalent to the fee that would be

payable if securities distributed to you had been ordinary shares and the ordinary shares had been deposited for issuance of ADSs

|

|

Distribution of securities distributed to

holders of deposited securities (including rights) that are distributed by the depositary to ADS holders |

|

|

|

|

|

$.05 (or less) per ADS per calendar year

|

|

Depositary services |

|

|

|

|

|

Registration or transfer fees |

|

Transfer and registration of ordinary shares

on our share register to or from the name of the depositary or its agent when you deposit or withdraw ordinary shares |

|

|

|

|

|

Expenses of the depositary |

|

Cable, telex and facsimile transmissions

(when expressly provided in the deposit agreement) Converting foreign currency to U.S. dollars |

|

|

|

|

|

Taxes and other governmental charges the

depositary or the custodian have to pay on any ADSs or ordinary shares underlying ADSs, such as stock transfer taxes, stamp duty or withholding

taxes |

|

As necessary |

|

|

|

|

|

Any charges incurred by the depositary or

its agents for servicing the deposited securities |

|

As necessary |

|

ITEM 13. |

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

|

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE

OF PROCEEDS |

|

ITEM

15. |

CONTROLS AND PROCEDURES |

| A. |

Disclosure Controls and Procedures

|

| B. |

Management’s Annual Report on Internal

Control over Financial Reporting |

| C. |

Attestation Report of the Registered

Public Accounting Firm |

| D. |

Changes in Internal Control over Financing

Reporting |

|

ITEM 16. |

[RESERVED] |

|

ITEM 16A. |

AUDIT COMMITTEE FINANCIAL EXPERT |

|

ITEM

16B. |

CODE OF ETHICS |

|

ITEM

16C. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

|

|

Year ended December 31,

|

|||||||

|

|

2022 |

2021 |

||||||

|

|

USD, in thousands |

|||||||

|

|

||||||||

|

Audit fees(1)

|

295 |

336 |

||||||

|

Tax fees(2)

|

25 |

3 |

||||||

|

Total |

320 |

339 |

||||||

|

(1) |

Audit fees consist of fees billed or expected

to be billed for the annual audit services engagement and other audit services, which are those services that only the external auditor

can reasonably provide, and include the Company audit; statutory audits; comfort letters and consents; attest services; and assistance

with and review of documents filed with the TASE and SEC. |

|

|

|

|

(2) |

Tax fees include fees billed for tax compliance

services that were rendered during the most recent fiscal year, including the preparation of original and amended tax returns and claims

for refund; tax consultations, such as assistance and representation in connection with tax audits and appeals, tax advice related to

mergers and acquisitions, transfer pricing, and requests for rulings or technical advice from taxing authority; tax planning services;

and expatriate tax planning and services. |

| ITEM 16D. |

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

| ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

|

| ITEM 16F. |

CHANGE IN REGISTRANT’S

CERTIFYING ACCOUNTANT |

| ITEM 16G. |

CORPORATE GOVERNANCE

|

| • |

Quorum. As permitted

under the Companies Law, pursuant to our articles of association, the quorum required for an ordinary meeting of shareholders consists

of at least two shareholders present in person or by proxy who hold or represent between them at least 25% of the voting power of our

shares (and, with respect to an adjourned meeting, generally one or more shareholders who hold or represent any number of shares), instead

of 33 1/3% of the issued share capital provided under Nasdaq Listing Rule 5260(c). |

| • |

Shareholder Approval. Although

the Nasdaq Listing Rules generally require shareholder approval of equity compensation plans and material amendments thereto, we follow

Israeli practice, which is to have such plans and amendments approved only by the board of directors, unless such arrangements are for

the compensation of chief executive officer or directors, in which case they also require the approval of the compensation committee and

the shareholders. In addition, rather than follow the Nasdaq Listing Rules requiring shareholder approval for the issuance of securities

in certain circumstances, we follow Israeli law, under which a private placement of securities requires approval by our board of directors

and shareholders if it will cause a person to become a controlling shareholder (generally presumed at 25% ownership) or if: (a) the securities

issued amount to 20% or more of our outstanding voting rights before the issuance; (b) some or all of the consideration is other than

cash or listed securities or the transaction is not on market terms; and (c) transaction will increase the relative holdings of a shareholder

that holds 5% or more of our outstanding share capital or voting rights or will cause any person to become, as a result of the issuance,

a holder of more than 5% of our outstanding share capital or voting rights. |

| • |

Executive Sessions. While

the Nasdaq Listing Rules require that “independent directors,” as defined in the Nasdaq Listing Rules, must have regularly

scheduled meetings at which only “independent directors” are present. Israeli law does not require, nor do our independent

directors necessarily conduct, regularly scheduled meetings at which only they are present. |

| ITEM 16H. |

MINE SAFETY DISCLOSURE |

| ITEM 16I. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

| ITEM 17. | FINANCIAL STATEMENTS |

| ITEM 18. |

FINANCIAL STATEMENTS |

|

Financial Statements of Steakholder Foods Ltd.

|

Page

|

|

Report of Independent Registered Public Accounting Firm (PCAOB ID No.

|

F-2

|

|

Consolidated Financial Statements:

|

|

|

F-3

|

|

|

F-4

|

|

|

F-5

|

|

|

F-6

|

|

|

F-7

|

|

December 31

|

December 31

|

||||||||||

|

2022

|

2021

|

||||||||||

|

USD thousands

|

USD thousands

|

||||||||||

|

Current assets

|

|||||||||||

|

Cash and cash equivalents

|

4

|

|

|

||||||||

|

Other investment

|

6

|

|

|

||||||||

|

Restricted deposits

|

|

|

|||||||||

|

Receivables

|

5

|

|

|

||||||||

|

Total current assets

|

|

|

|||||||||

|

Non-current assets

|

|||||||||||

|

Restricted deposits

|

|

|

|||||||||

|

Other investment

|

6

|

|

|

||||||||

|

Right-of-use asset

|

19

|

|

|

||||||||

|

Intangible assets

|

16

|

|

|

||||||||

|

Fixed assets, net

|

7

|

|

|

||||||||

|

Total non-current assets

|

|

|

|||||||||

|

Total Assets

|

|

|

|||||||||

|

Current liabilities

|

|||||||||||

|

Trade payables

|

|

|

|||||||||

|

Other payables

|

8

|

|

|

||||||||

|

Current maturities of lease liabilities

|

19

|

|

|

||||||||

|

Derivative instrument

|

9B

|

|

|

|

|||||||

|

Total current liabilities

|

|

|

|||||||||

|

Non-current liabilities

|

|||||||||||

|

Long-term lease liabilities

|

19

|

|

|

||||||||

|

Total non-current liabilities

|

|

|

|||||||||

|

Capital

|

|||||||||||

|

Share capital and premium on shares

|

|

|

|||||||||

|

Capital reserves

|

|

|

|||||||||

|

Currency translation differences reserve

|

(

|

)

|

|

||||||||

|

Accumulated deficit

|

(

|

)

|

(

|

)

|

|||||||

|

Total capital

|

|

|

|||||||||

|

Total liabilities and capital

|

|

|

|||||||||

F - 3

|

Year ended

December 31,

|

Year ended

December 31,

|

Year ended

December 31,

|

|||||||||||||

|

2022

|

2021

|

2020

|

|||||||||||||

|

USD thousands, except share data

|

USD thousands, except share data

|

USD thousands, except share data

|

|||||||||||||

|

Research and development expenses

|

11

|

|

|

|

|||||||||||

|

Marketing expenses

|

12

|

|

|

|

|||||||||||

|

General and administrative expenses

|

13

|

|

|

|

|||||||||||

|

Impairment loss |

16

|

|

|

|

|||||||||||

|

Public listing expenses

|

|

|

|

||||||||||||

|

Operating loss

|

|

|

|

||||||||||||

|

Financing income

|

14

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||

|

Financing expenses

|

14

|

|

|

|

|||||||||||

|

Total financing (income) expenses

|

(

|

)

|

|

(

|

)

|

||||||||||

|

Loss for the period

|

|

|

|

||||||||||||

|

Capital reserve for financial assets at fair value that will not be transferred to profit or loss

|

|

|

|

||||||||||||

|

Currency translation differences loss (income) that might be transferred to profit or loss over ILS

|

|

(

|

)

|

(

|

)

|

||||||||||

|

Currency translation differences loss (income) that might be transferred to profit or loss over EUR

|

|

|

|

||||||||||||

|

Total comprehensive loss for the period

|

|

|

|

||||||||||||

|

Loss per ordinary share, no par value (USD)

|

|||||||||||||||

|

Basic and diluted loss per share (USD)

|

|

|

|

||||||||||||

|

Weighted-average number of shares outstanding - basic and diluted

|

21

|

|

|

|

|||||||||||

F - 4

|

Share

capital

and

premium on shares

|

Fair value

of

financial assets

reserve

|

Transactions

with related

parties

reserve

|

Currency

translation

differences

reserve

|

Share-based

payments

reserve

|

Accumulated

deficit

|

Total

|

||||||||||||||||||||||

|

USD thousands

|

||||||||||||||||||||||||||||

|

Balance as at January 1, 2022

|

|

(

|

)

|

|

|

|

(

|

)

|

|

|||||||||||||||||||

|

Share-based payments

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Issuance of shares and warrants, net

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Exercise of options

|

|

(

|

)

|

|

||||||||||||||||||||||||

|

Other comprehensive loss

|

|

|

|

(

|

)

|

|

|

(

|

)

|

|||||||||||||||||||

|

Loss for the period

|

|

|

|

|

|

(

|

)

|

(

|

)

|

|||||||||||||||||||

|

Balance as at December 31, 2022

|

|

(

|

)

|

|

(

|

)

|

|

(

|

)

|

|

||||||||||||||||||

|

Balance as at January 1, 2021

|

|

(

|

)

|

|

|

|

(

|

)

|

|

|||||||||||||||||||

|

Share-Based Payment

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Issuance of shares and warrants, net

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Exercise of options

|

|

(

|

)

|

|

||||||||||||||||||||||||

|

Other comprehensive income

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Loss for the period

|

|

|

|

|

|

(

|

)

|

(

|

)

|

|||||||||||||||||||

|

Balance as at December 31, 2021

|

|

(

|

)

|

|

|

|

(

|

)

|

|

|||||||||||||||||||

|

Balance as at January 1, 2020

|

|

|

|

|

|

(

|

)

|

|

||||||||||||||||||||

|

Share-Based Payment

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Reverse acquisition

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Issuance of shares and warrants, net

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Exercise of options - Investors

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Exercise of options – Share-Based Payment

|

|

(

|

)

|

|

||||||||||||||||||||||||

|

Other comprehensive income (loss)

|

|

(

|

)

|

|

|

|

|

|

||||||||||||||||||||

|

Loss for the year

|

|

|

|

|

|

(

|

)

|

(

|

)

|

|||||||||||||||||||

|

Balance as at December 31, 2020

|

|

(

|

)

|

|

|

|

(

|

)

|

|

|||||||||||||||||||

F - 5

|

Year ended

December 31, 2022

|

Year ended

December 31, 2021

|

Year ended

December 31, 2020

|

||||||||||

|

USD thousands

|

USD thousands

|

USD thousands

|

||||||||||

|

Cash flows - operating activities

|

||||||||||||

|

Net Loss for the period

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Adjustments:

|

||||||||||||

|

Depreciation and amortization

|

|

|

|

|||||||||

|

Change in fair value of derivative

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Change in fair value of other investment

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Changes in net foreign exchange expenses

|

(

|

)

|

|

|

||||||||

|

Interest expense over lease liabilities

|

|

|

|

|||||||||

|

Interest income over short term deposits

|

(

|

)

|

|

|

||||||||

|

Share-based payment expenses

|

|

|

|

|||||||||

|

Impairment loss on intangible asset

|

|

|

|

|||||||||

|

Impairment loss on fixed asset

|

|

|

|

|||||||||

|

Public listing expenses

|

|

|

|

|||||||||

|

Changes in asset and liability items:

|

||||||||||||

|

Decrease (increase) in receivables

|

|

(

|

)

|

|

||||||||

|

Increase (decrease) in trade payables

|

|

(

|

)

|

|

||||||||

|

Increase in other payables

|

|

|

|

|||||||||

|

Net cash used in operating activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Cash flows - investment activities

|

||||||||||||

|

Acquisition of fixed assets

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Increase in restricted deposit

|

|

(

|

)

|

(

|

)

|

|||||||

|

Loan provided

|

|

(

|

)

|

|

||||||||

|

Proceeds on account of other investment*

|

|

|

|

|||||||||

|

Interest received over short term deposits

|

|

|

|

|||||||||

|

Acquisition of other investments, net of cash acquired

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net cash used in investing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Cash flows - financing activities

|

||||||||||||

|

Proceeds from issuance of shares and warrants

|

|

|

|

|||||||||

|

Issuance costs

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Repayment of liability for lease

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Repayment of interest over liability of lease

|

(

|

)

|

(

|

)

|

(

|

) | ||||||

|

Proceeds on account of capital issuance

|

|

|

|

|||||||||

|

Proceeds from exercise of share options

|

|

|

|

|||||||||

|

Proceeds with regard to derivative

|

|

|

|

|||||||||

|

Net cash from financing activities

|

|

|

|

|||||||||

|

Increase (decrease) in cash and cash equivalents

|

(

|

)

|

|

|

||||||||

|

Effect of exchange differences on cash and cash equivalents

|

(

|

)

|

(

|

)

|

|

|||||||

|

Cash and cash equivalents at the beginning of the period:

|

|

|

|

|||||||||

|

Cash balance and cash equivalents at end of period

|

|

|

|

|||||||||

|

Non-cash activities

|

||||||||||||

|

Purchase of fixed assets yet to be paid

|

|

|

|

|||||||||

|

Issue of shares and options against intangible asset

|

|

|

|

|||||||||

F - 6

| A. |

Reporting entity

|

| B. |

Material events in the reporting period

|

| (1) |

On July 5, 2022, the Company consummated a securities purchase agreement. For details, see Note 9A.

|

| (2) |

Change in interest curves and inflation expectations

|

F - 7

Steakholder Foods Ltd

| C. |

Going Concern

|

The Company’s management expects that the Company will continue to generate losses and negative cash flows from operations for the foreseeable future. On January 9, 2023, the Company consummated a securities purchase agreement with gross proceeds of approximately USD

| D. |

Definitions:

|

|

(1)

|

The Company - Steakholder Foods Ltd.

|

|

(2)

|

The Group – The Company and its subsidiaries, Steakholder Innovation Ltd. (formerly known as MeaTech Ltd.), Steakholder Foods Europe BV, Peace of Meat BV (hereafter “Peace Of Meat”) and Steakholder Foods USA, Inc.

|

|

(3)

|

Related Party - Within its meaning in IAS 24 (2009), “Related Party Disclosures”.

|

|

(4)

|

USD - United States Dollar

|

|

(5)

|

NIS – New Israeli Shekel

|

|

(6)

|

EUR – Euro

|

|

(7)

|

ADS – American Depositary Shares

|

|

(8)

|

GBP - British Pound Sterling

|

|

(9)

|

CPI – Consumer price index

|

F - 8

Steakholder Foods Ltd

| A. |

Statement of compliance with IFRS

The financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board.

The financial statements were authorized for issue by the company’s board of directors on April 4, 2023. |

| B. |

Functional currency and presentation currency

The New Israeli Shekel ("NIS") is the currency that represents the primary economic environment in which the Company and its Israeli subsidiary operate, and is therefore the functional currency of their operations. The Euro is the currency that represents the primary economic environment in which the Company’s European subsidiaries operate, and is therefore the functional currency of their operations. Nonetheless, for reporting purposes, the consolidated financial statements, which were prepared on the basis of the functional currencies, were translated into US Dollars, which the Company selected as its presentation currency, as its securities are traded on the Nasdaq Capital Markets, and in order to make the Company’s financial statements more accessible to U.S.-based investors.

Assets and liabilities were translated at the exchange rate of the end of the period; expenses and income were translated at the exchange rate at the time they were generated. Exchange rate differentials generated due to such translation are attributed to the Currency translation differences reserve.

|

|

Currency

|

USD - ILS

|

USD - EUR

|

||||||||||||||||||

|

Period

|

2022

|

2021

|

2020

|

2022

|

2021

|

|||||||||||||||

|

December 31

|

|

|

|

|

|

|||||||||||||||

|

Year Average

|

|

|

|

|

|

|||||||||||||||

| C. |

Basis of Measurement:

The financial statements have been prepared on the historical cost basis except for provisions.

For further information regarding the measurement of these liabilities, see Note 3 regarding significant accounting policies.

|

| D. |

Operating Cycle:

The Company’s operating cycle is one year.

|

| E. |

Use of estimates and judgments:

The Company’s operating cycle is one year.

Use of estimates.

The preparation of financial statements in conformity with IFRS requires the Company’s management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

|

F - 9

Steakholder Foods Ltd

| E. |

Use of estimates and judgments (cont.):

|

|