Embark’s Business Model and Go-To-Market Strategy

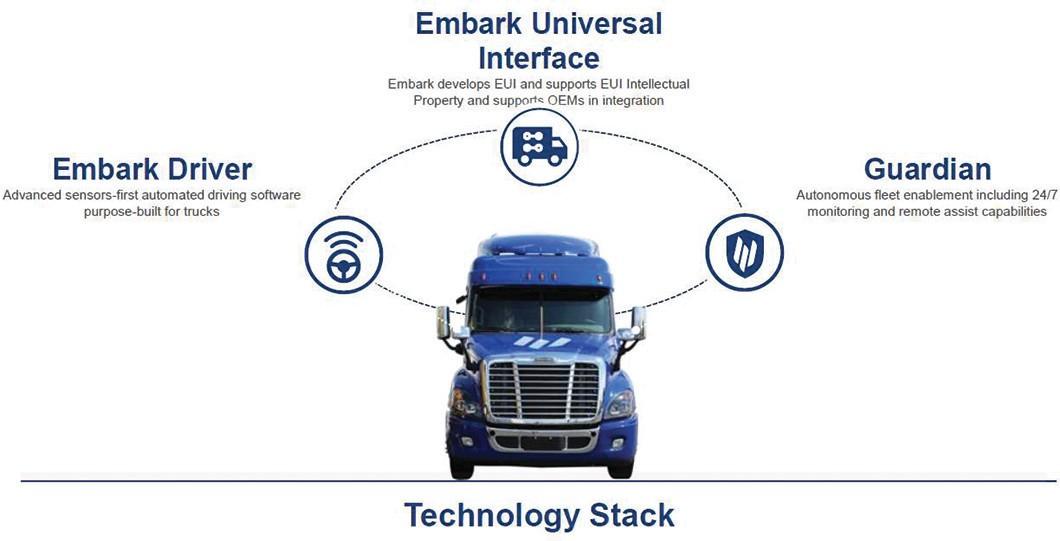

Embark’s business model offers meaningful operational savings to carriers and shippers and collaborates rather than competes with carriers. To date, while not generating any revenue, Embark has completed hundreds of hauls with many major companies and has leveraged that experience into designing its business model and commercialization plans. Embark intends to make its technology available as a SaaS subscription on an OEM platform-agnostic basis, meaning that carriers will be able to subscribe to the Embark software for any new vehicles from any truck brand in their fleets. Embark believes this model will deliver compelling benefits across the entire trucking ecosystem by:

| ● | Improving economics and alleviating driver shortages for carriers; |

| ● | Increasing fuel economy, reducing emissions and improving reliability, sustainability and safety for shippers; |

| ● | Providing an attractive cost of entry to autonomous vehicle technology without disrupting shippers’ or carriers’ truck preferences or supply chains; |

| ● | Permitting Embark to focus on its area of expertise — autonomous driving development — while the rest of the ecosystem can specialize on the areas they excel in, including logistics and manufacturing. |

SaaS Focus

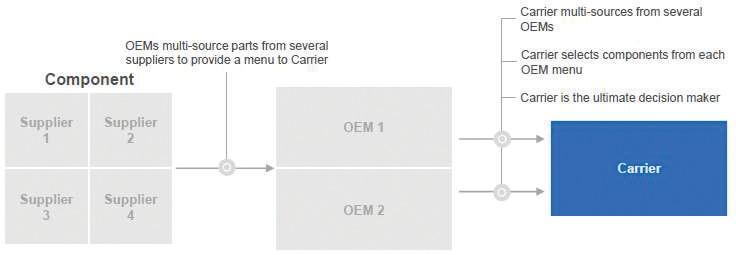

Embark partners with carriers and private fleets, who will pay a per-mile license fee for Embark’s software, variable based on distance. In return, carriers and private fleets realize significant per-mile savings offered by the Embark Driver. This software focus is expected to allow Embark to scale rapidly by leveraging significant investments by carriers in trucks. Carrier investment significantly outpaces the resources of any single AV trucking player and Embark estimates that the top 100 carriers spend over $12 billion on new trucks annually based on an assumed 25% annual fleet turnover and an average truck price of $125,000.

In addition, by partnering with carriers as a software provider rather than competing with them by running its own freight network, Embark is able to leverage the expertise of its carrier partners while focusing on developing and maintaining state-of-the-art software. Furthermore, Embark expects to benefit from compelling SaaS economics including high margins, recurring revenues and economies of scale due to the increased demand for truck freight.

Embark may also seek revenue via ancillary channels, such as specialized hardware, maintenance and other services required as necessary to support its SaaS license model. Embark’s commercial model does not rely on revenue generated from OEMs and Embark has not entered into any agreement with an OEM to date that would provide for a revenue share for vehicles sold with Embark’s technology.

47