As filed with the Securities and Exchange Commission on December 8, 2021

Registration No. 333-261324

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

TO

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 7373 | 85-3343695 |

424 Townsend Street

San Francisco, California 94107

(415) 671-9628

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Richard Hawwa

Chief Financial Officer

Embark Technology, Inc.

424 Townsend Street

San Francisco, California 94107

(415) 671-9628

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Rachel W. Sheridan, Esq. | Siddhartha Venkatesan |

Approximate date of commencement of proposed sale of the securities to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (the “Securities Act”) check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered |

| Amount to be |

| Proposed maximum |

| Proposed maximum |

| Amount of |

| |||

Class A common stock(2)(3) | 255,315,168 | $ | 7.43(4) | $ | 1,920,642,185(4) | $ | 178,044 | |||||

Warrants(2) | 9,353,330 | $ | 1.38(5) | $ | 12,907,596(5) | $ | 1,197 | |||||

Class A Common stock(2)(7) | 22,486,667 | $ | 11.50(6) | $ | 258,596,671(6) | $ | 23,972 | |||||

Class A Common Stock(2)(8) | 87,078,981 | $ | 7.55 | $ | 657,446,307 | $ | 60,946 | |||||

Total | $ | 2,849,592,759 | $ | 264,158(9) | ||||||||

(1) | In connection with the consummation of the Business Combination in the prospectus forming part of this registration statement (the “prospectus”), Northern Genesis Acquisition Corp. II (“NGA”), a Delaware corporation was renamed “Embark Technology, Inc.” (“Embark Technology”), as further described in the prospectus. All securities being registered were or will be issued by Embark Technology. |

(2) | Pursuant to Rule 416(a) of the Securities Act, there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

(3) | The number of shares of common stock being registered represents the sum of (a) 183,422,675 shares of common stock issued in connection with the Merger described herein, (b) 20,000,000 shares of common stock issued to certain qualified institutional buyers and accredited investors in private placements consummated in connection with the Business Combination, (c) 1,342,353 shares of common stock reserved for issuance upon the exercise of options to purchase common stock and (d) 50,550,140 shares of common stock reserved for issuance upon the settlement of restricted stock units. |

(4) | Estimated solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the Class A ordinary shares of Embark Technology on the Nasdaq Global Market (the “Nasdaq”) (i) for the 58,227,789 shares of Class A common stock included pursuant to this Amendment No. 1, on December 3, 2021 (such date being within five business days of the date that this Amendment No. 1 was first filed with the SEC) and (ii) for the 197,087,379 shares of Class A common stock included in the initial filing of this registration statement, November 18, 2021 ($7.55 per share) (such date being within five business days of the date that this registration statement was first filed with the SEC. This calculation is in accordance with Rule 457(c) of the Securities Act. |

(5) | Estimated solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the warrants of Embark Technology on the Nasdaq on November 18, 2021 (such date being within five business days of the date that this registration statement was first filed with the SEC). This calculation is in accordance with Rule 457(c) of the Securities Act. |

(6) | Calculated pursuant to Rule 457(g) under the Securities Act, based on the exercise price of the warrants. |

(7) | Reflects the shares of common stock that may be issued upon exercise of outstanding warrants, with each warrant exercisable for one share of common stock, subject to adjustment, for an exercise price of $11.50 per share. |

(8) | Represents shares of Class A common stock issuable upon conversion (on a one-for-one basis) of shares of Embark Class B common stock issued as part of the merger consideration. |

(9) | The registrant previously paid $224,054 of the registration fee with the initial filing of this registration statement. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED DECEMBER 8, 2021

PROSPECTUS FOR

255,315,168 SHARES OF CLASS A COMMON STOCK

9,353,330 WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK

22,486,667 SHARES OF CLASS A COMMON STOCK UNDERLYING WARRANTS

AND 87,078,981 SHARES OF CLASS A COMMON STOCK UNDERLYING SHARES OF CLASS B COMMON STOCK

OF

EMBARK TECHNOLOGY, INC.

This prospectus relates to from time to time (i) the resale of an aggregate of 183,422,675 shares of Class A common stock, par value $0.0001 per share (the “Class A common stock”), of Embark Technology, Inc., a Delaware corporation (“Embark Technology”), issued in connection with the Merger (as defined below) by certain of the selling shareholders named in this prospectus (each a “Selling Shareholder” and, collectively, the “Selling Shareholders”), (ii) the resale of 20,000,000 shares of Class A common stock issued in the PIPE Financing (as defined below) by certain of the Selling Shareholders, (iii) the issuance by us and resale of 1,342,353 shares of common stock reserved for issuance upon the exercise of options to purchase Class A common stock, (iv) the issuance by us and resale of 50,550,140 shares of Class A common stock reserved for issuance upon the settlement of restricted stock units, (v) the resale of 9,353,330 warrants to purchase Class A common stock, 2,000,000 of which were issued in connection with the cancellation of certain loans from the Sponsor and 666,664 of which were issued in connection with the PIPE Financing, (vi) the issuance of 22,486,667 shares of Class A common stock in respect of warrants to purchase Class A common stock, (vii) the resale 9,353,330 shares of Class A common stock issuable in respect of warrants to purchase Class A common stock, and (viii) the issuance by us and resale of 87,078,981 shares of Class A common stock issuable upon conversion of shares of Class B common stock.

On November 10, 2020, we consummated the transactions contemplated by that certain Agreement and Plan of Merger, dated as of June 22, 2021 (the “Merger Agreement”), by and among Northern Genesis Acquisition Corp. II, a Delaware corporation (“NGA”), NGAB Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of NGA (“Merger Sub”), and Embark Trucks Inc., a Delaware corporation (“Embark”). In connection with the Business Combination NGA was renamed “Embark Technology, Inc.” As contemplated by the Merger Agreement, Merger Sub merged with and into Embark, the separate corporate existence of Merger Sub ceased and Embark survived as a wholly owned subsidiary of Embark Technology (the “Merger” and, together with the related transactions contemplated by the Merger Agreement, the “Business Combination”).

We are registering (i) the resale of shares of Class A common stock and warrants as required by our amended and restated registration rights agreement, dated as of November 10, 2021 (the “Registration Rights Agreement”), entered into by and among Embark Technology, Northern Genesis Sponsor II LLC, a Delaware limited liability company (the “Sponsor”), and certain former stockholders of Embark, (ii) the resale of shares of Class A common stock as required by the subscription agreements entered into with certain qualified institutional buyers and accredited investors that purchased shares of Class A common stock in private placements consummated in connection with the Business Combination and (iii) the issuance by us of Class A common stock, in accordance with the Warrant Agreement, dated as of January 12, 2021, by and among NGA and Continental Stock Transfer & Trust Company entered in connection with NGA’s initial public offering.

We are also registering the (i) resale of shares of Class A common stock held by certain of our affiliates and (ii) the issuance and resale of shares of common stock reserved for issuance upon the exercise of options to purchase shares of common stock and the settlement of restricted stock units, in each case, held by certain of our current and former employees.

We will receive the proceeds from any exercise of the warrants for cash, but not from the resale of the shares of Class A common stock or warrants by the Selling Shareholders.

We will bear all costs, expenses and fees in connection with the registration of the shares of Class A common stock and warrants. The Selling Shareholders will bear all commissions and discounts, if any, attributable to their respective sales of the shares of Class A common stock and warrants.

Our shares of common stock are listed on The Nasdaq Stock Market LLC under the symbol “EMBK.” On December 7, 2021, the closing sale price of shares of our Class A common stock was $8.50. Our warrants are listed on The Nasdaq Stock Market LLC under the symbol “EMBKW.” On December 7, 2021, the closing sale price of our warrants was $1.49.

Investing in shares of our common stock or warrants involves risks that are described in the “Risk Factors” section beginning on page 5 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. No one has been authorized to provide you with information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

i

TRADEMARKS

This document contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of it by, any other companies.

ii

SELECTED DEFINITIONS

Unless otherwise stated in this prospectus or the context otherwise requires, references

| ● | “2021 Plan” are to our 2021 Incentive Award Plan; |

| ● | “Business Combination” are to the Merger and the related transactions contemplated by the Merger Agreement; |

| ● | “Bylaws” are to our bylaws dated as of November, 10, 2021; |

| ● | “Class A common stock” are to are to Embark Technology Class A common stock, par value $0.0001 per share; |

| ● | “Class B common stock” are to Embark Technology Class B common stock, par value $0.0001 per share, issued to the Embark Founders in connection with the Business Combination; |

| ● | “Closing” are to the closing of the Business Combination; |

| ● | “Closing Date” are to the closing date of the Business Combination; |

| ● | “common stock” are to Embark Technology’s shares of Class A common stock and Class B common stock; |

| ● | “Company,” “we,” “us” and “our” are to NGA prior to the Business Combination or, following the name change, Embark Technology, Inc., as applicable; |

| ● | “Continental” are to Continental Stock Transfer & Trust Company; |

| ● | “DGCL” are to the General Corporation Law of the State of Delaware; |

| ● | “Embark” are to Embark Trucks Inc. prior to the Business Combination; |

| ● | “Embark Awards” are to Embark Options and Embark RSUs; |

| ● | “Embark common stock” are to shares of Embark common stock, par value $0.00001 per share; |

| ● | “Embark Founders” are to Alex Rodrigues and Brandon Moak (or, in each case, a Permitted Trust); |

| ● | “Embark Holders Support Agreement” are to the Company Holders Support Agreement, dated June 22, 2021, by and among NGA, Embark and certain stockholders of Embark, as amended and modified from time to time; |

| ● | “Embark Options” are to options to purchase shares of Embark common stock; |

| ● | “Embark Restricted Stock Awards” are to restricted shares of Embark common stock; |

| ● | “Embark RSUs” are to restricted stock units based on shares of Embark common stock; |

| ● | “Embark Stockholders” are to the stockholders of Embark and holders of Embark Awards prior to the Business Combination; |

| ● | “Embark Technology” are to Embark Technology, Inc. and prior to the Business Combination and its name change to Northern Genesis Acquisition Corp. II; |

iii

| ● | “Embark Technology Charter” are to the second amended and restated certificate of incorporation of Embark Technology in effect of the date of this prospectus; |

| ● | “ESPP” are to our 2021 Employee Stock Purchase Plan; |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| ● | “Exchange Ratio” are the quotient obtained by dividing (i) the quotient of (A) $4,250,000,000 (plus the amount by which certain expenses of NGA exceeds $32,000,000) divided by (B) $10 by (ii) the aggregate fully-diluted number of shares of Embark common stock issued and outstanding immediately prior to the Merger (excluding any unvested equity awards); |

| ● | “Founder Shares” are to the 10,350,000 shares of NGA Common Stock purchased by the Sponsor in a private placement prior to the NGA IPO, subject to certain forfeitures immediately prior to Closing agreed to by Sponsor in the Sponsor Support Agreement; |

| ● | “Forward Purchase Agreements” are to the forward purchase agreements entered into, or amended and restated, by NGA on April 21, 2021; |

| ● | “FPA PIPE Investors” are to the PIPE Investors participating in the PIPE Financing pursuant to the terms of the Forward Purchase Agreements (together with their permitted transferees); |

| ● | “GAAP” are to accounting principles generally accepted in the United States of America; |

| ● | “HSR Act” are to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended; |

| ● | “IPO registration statement” are to the Registration Statements on Form S-1 (File Nos. 333-251639 and 333-252056) filed by NGA in connection with its initial public offering, which became effective on January 12, 2021; |

| ● | “IRS” are to the U.S. Internal Revenue Service; |

| ● | “JOBS Act” are to the Jumpstart Our Business Startups Act of 2012; |

| ● | “L4” are to high automation driving, which provides for self-driving with no driver present within certain defined use cases, such as semi-truck driving between transfer points in certain regions in the United States, based on the commonly accepted standards published by SAE International; |

| ● | “Merger” are to the merger of Merger Sub with and into Embark, with Embark surviving the merger as a wholly owned subsidiary of Embark Technology (formerly NGA); |

| ● | “Merger Agreement” are to the Agreement and Plan of Merger dated June 22, 2021 by and among NGA, Embark and Merger Sub; |

| ● | “Minimum Cash Condition” are to the Trust Amount and the PIPE Financing Amount and the amount of any cash investments made into Embark after the date of the Merger Agreement and prior to the Closing Date which remain on Embark’s balance sheet at Closing, in the aggregate, being greater than $295 million; |

| ● | “Nasdaq” are to The Nasdaq Stock Market LLC; |

| ● | “NGA” are to Northern Genesis Acquisition Corp. II prior to the Business Combination; |

| ● | “NGA Board” are to the board of directors of NGA prior to the Business Combination; |

iv

| ● | “NGA Common Stock” are to NGA’s shares of common stock, par value $0.0001 per share, issued and outstanding, prior to the Business Combination, including the public shares and the Founder Shares; |

| ● | “NGA Bylaws” are to the bylaws of NGA in effect immediately before the closing of the Business Combination; |

| ● | “NGA Charter” are to the Amended and Restated Certificate of Incorporation of NGA in effect immediately before the closing of the Business Combination; |

| ● | “NGA IPO” are to NGA’s initial public offering that was consummated on January 15, 2021; |

| ● | “NGA Organizational Documents” are to the NGA Charter and the NGA Bylaws; |

| ● | “NGA units” and “units” are to the units of NGA, each unit representing one NGA share of common stock and one-third of one redeemable warrant, that were offered and sold by NGA in its initial public offering and registered pursuant to the IPO registration statement (less the number of units that have been separated into the underlying public shares and underlying warrants upon the request of the holder thereof); |

| ● | “Nasdaq” are to the Nasdaq Global Market; |

| ● | “Permitted Trust” are to the definition set forth in the Embark Technology Charter; |

| ● | “Person” are to any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, joint venture, joint stock company, governmental authority or instrumentality or other entity of any kind; |

| ● | “PIPE Financing” are to the purchase of shares of Class A common stock pursuant to the Subscription Agreements, and the purchase of shares of Class A common stock and warrants pursuant to the Forward Purchase Agreements; |

| ● | “PIPE Financing Amount” are to the aggregate gross purchase price received by NGA prior to or substantially concurrently with Closing for the shares and warrants in the PIPE Financing; |

| ● | “PIPE Investors” are to those certain investors participating in the PIPE Financing pursuant to the Subscription Agreements or the Forward Purchase Agreements; |

| ● | “private placement warrants” are to the redeemable warrants that were purchased by the Sponsor in connection with the IPO and certain working capital warrants acquired in connection with the Closing; |

| ● | “pro forma” are to giving pro forma effect to the Business Combination; |

| ● | “public shares” are to the shares of NGA Common Stock (including those that underlie the units) that were offered and sold by NGA in its initial public offering and registered pursuant to the IPO registration statement or the shares of our Class A common stock issued as a matter of law upon the conversion thereof following the Business Combination, as context requires; |

| ● | “public stockholders” are to holders of public shares, whether acquired in the NGA IPO or acquired in the secondary market; |

| ● | “public warrants” are to the redeemable warrants (including those that underlie the units) that were offered and sold by NGA in its initial public offering and registered pursuant to the IPO registration statement or to the redeemable warrants of Embark Technology issued as a matter of law upon the conversion thereof following the Business Combination, as context requires; |

| ● | “redemption” are to each redemption of public shares for cash pursuant to NGA Organizational Documents; |

v

| ● | “Registration Rights Agreement” are to the Registration Rights Agreement entered into at Closing, by and among Embark Technology, the Sponsor and certain former stockholders of Embark; |

| ● | “Sarbanes Oxley Act” are to the Sarbanes-Oxley Act of 2002; |

| ● | “SEC” are to the United States Securities and Exchange Commission; |

| ● | “Securities Act” are to the Securities Act of 1933, as amended; |

| ● | “Sponsor” are to Northern Genesis Sponsor II LLC, a Delaware limited liability company; |

| ● | “Sponsor Support Agreement” are to that certain Support Agreement, dated June 22, 2021, by and among the Sponsor, NGA and Embark, as amended and modified from time to time; |

| ● | “Subscription Agreements” are to the subscription agreements pursuant to which (together with the Forward Purchase Agreements) the PIPE Financing will be consummated; |

| ● | “Sunset Date” are to the date on which all outstanding shares of Class B Common Stock have been converted into Class A Common Stock; |

| ● | “Trigger Date” are to the date that is the earlier of (i) the second anniversary of the effective date of the Embark Technology Charter or (ii) the first anniversary of the first date on which the last sales price of the Class A Common Stock has equalled or exceeded $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like following effective date of the Embark Technology Charter) for any twenty trading days (whether or not consecutive) within any 30-day trading period commencing at least one hundred fifty (150) days following the effective date of the Embark Technology Charter |

| ● | “Trust Account” are to the trust account established at the consummation of the NGA IPO and maintained by Continental, acting as trustee; |

| ● | “Trust Amount” are to the amount of cash available in the trust account as of the Closing, after deducting the amount required to satisfy NGA’s obligations to its stockholders (if any) that exercise their redemption rights; and |

| ● | “warrants” are to private placement warrants and public warrants. |

Additionally, unless the context otherwise requires, references in this prospectus to the “Company,” “we,” “us” or “our” refer to the business of Embark, which became the business of Embark Technology and its subsidiaries following the Closing.

vi

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements that are forward-looking and as such are not historical facts. This includes, without limitation, statements regarding the financial position, business strategy and the plans and objectives of management for future operations. These statements constitute projections, forecasts and forward- looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this prospectus, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements in this prospectus and in any document incorporated by reference in this prospectus may include, for example, statements about:

| ● | our public securities’ potential liquidity and trading; |

| ● | our ability to raise financing in the future; |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| ● | the impact of the regulatory environment and complexities with compliance related to such environment; |

| ● | factors relating to the business, operations and financial performance of Embark Technology and its subsidiaries, including: |

| ● | the impact of the COVID-19 pandemic; |

| ● | the ability of Embark Technology to maintain an effective system of internal controls over financial reporting; |

| ● | the nature of autonomous driving as an emerging technology; |

| ● | Embark’s limited operating history; |

| ● | the acceptance of Embark’s technology by users and stakeholders in the freight transportation industry; |

| ● | the expected success of Embark’s business model, including its ability to maintain and develop customer relationships; |

| ● | the ability of Embark to maintain a successful manufacturer-agnostic approach to its technology; |

| ● | the ability of Embark to achieve and maintain profitability in the future; |

| ● | other factors detailed under the section entitled “Risk Factors.” |

These forward-looking statements are based on information available as of the date of this prospectus and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

vii

SUMMARY OF THE PROSPECTUS

This summary highlights selected information from this prospectus and may not contain all of the information that is important to you in making an investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” See also the section entitled “Where You Can Find Additional Information.”

Unless context otherwise requires, references in this prospectus to the “Company,” “we,” “us” or “our” refer to the business of Embark, which became the business of Embark Technology following the Closing.

Our Company

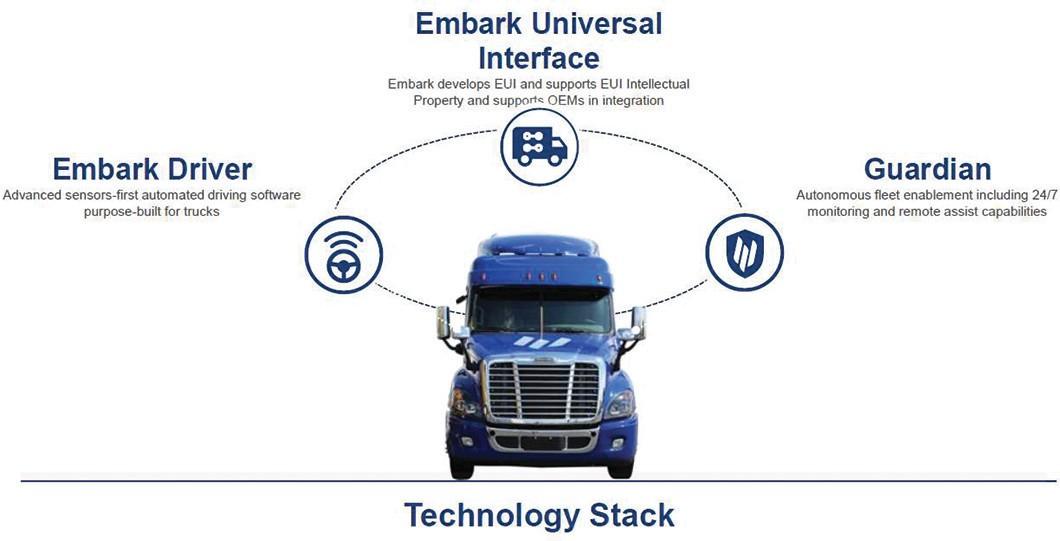

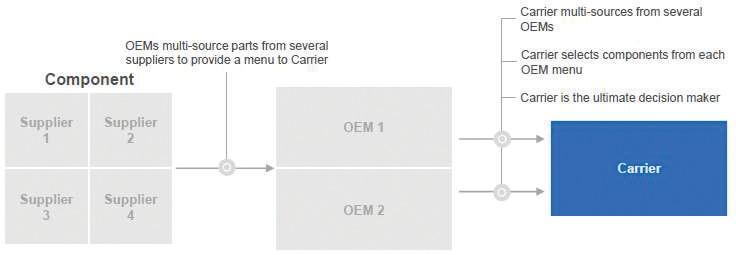

Embark develops technologically advanced autonomous driving software for the truck freight industry and offers a carefully constructed business model that is expected to provide the industry with the most attractive path to adopting autonomous driving. Specifically, Embark has developed a Software as a Service (“SaaS”) platform designed to interoperate with a broad range of truck OEM platforms, forgoing complicated and logistically challenging truck building or hardware manufacturing operations in favor of focusing on a superior driving technology. At scale, domestic shippers and carriers will be able to access Embark technology via a subscription software license selected as an option at the time they specify the build of new semi-trucks.

Headquartered in San Francisco, California and backed by leading Silicon Valley venture capital firms, Embark’s history as the industry’s longest running autonomous truck driving program is replete with technological firsts that include, but are not limited to:

| ● | the first coast-to-coast autonomous truck drive, |

| ● | the first to reach 100,000 autonomous miles on public roads, |

| ● | the first to successfully open autonomous transfer points for human- autonomous vehicle (“AV”) handoff. |

Embark’s founding team includes roboticists and its broader team includes numerous computer scientists, many with advanced degrees and experience at other leading robotics and autonomous vehicle companies and academic programs.

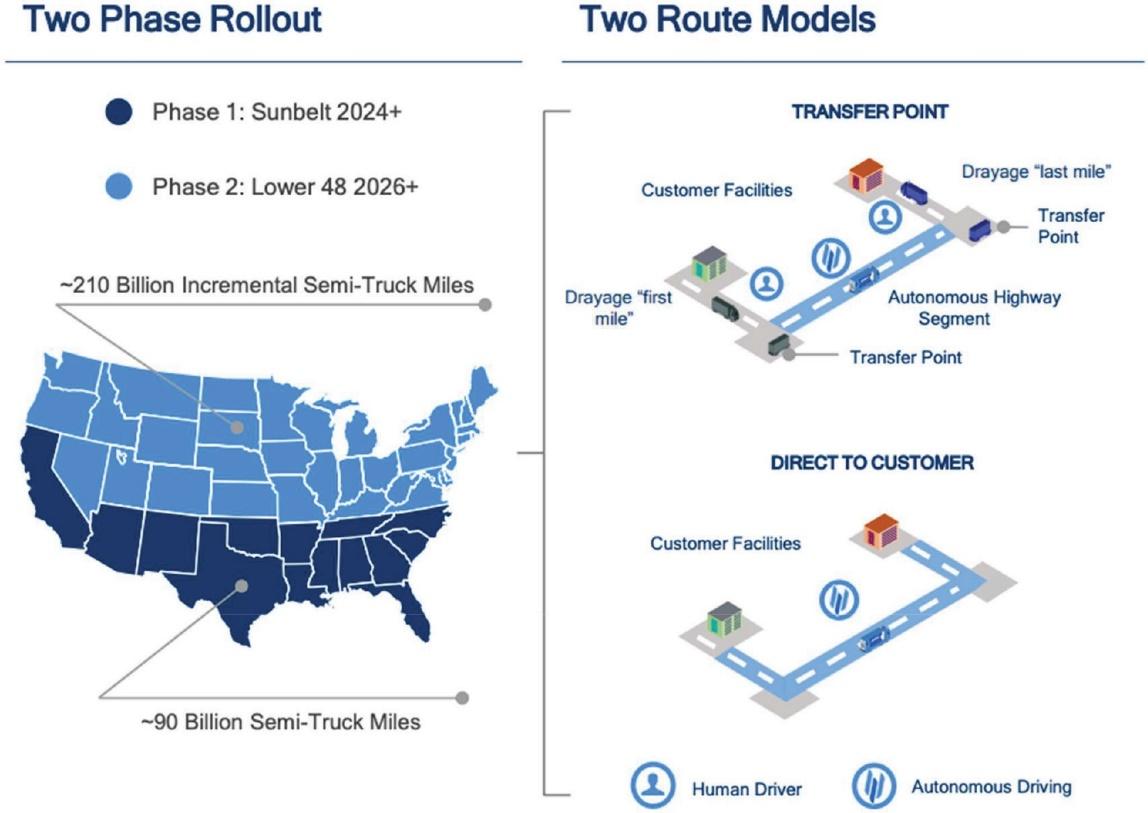

Embark has also spent considerable time and effort refining its business model. Embark is initially deploying its leading-edge technology in a very focused manner, targeting freight highway miles between transfer points located next to metropolitan areas in the lower “Sunbelt” region of the United States ( the “U.S.”), leaving the “last mile” of driving to and from the transfer points to the industry’s highly skilled human drivers. Embark’s strategy is distinct from other industry players which seek to provide more complicated “end to end” autonomous driving that would entirely displace human drivers and potentially place these companies in competition with the industry’s carriers. Unlike those competitors, Embark anticipates working with the industry’s existing players to help them bring autonomous driving technology to market on their own terms. In addition, Embark believes its solution will be the safest and most reliable in the industry because of its disciplined geographic focus and emphasis on software development, which stands in contrast to Embark’s competitors that focus on multiple domestic markets simultaneously, manufacturing autonomous trucks and/or competing directly with semi-truck OEMs or legacy carriers.

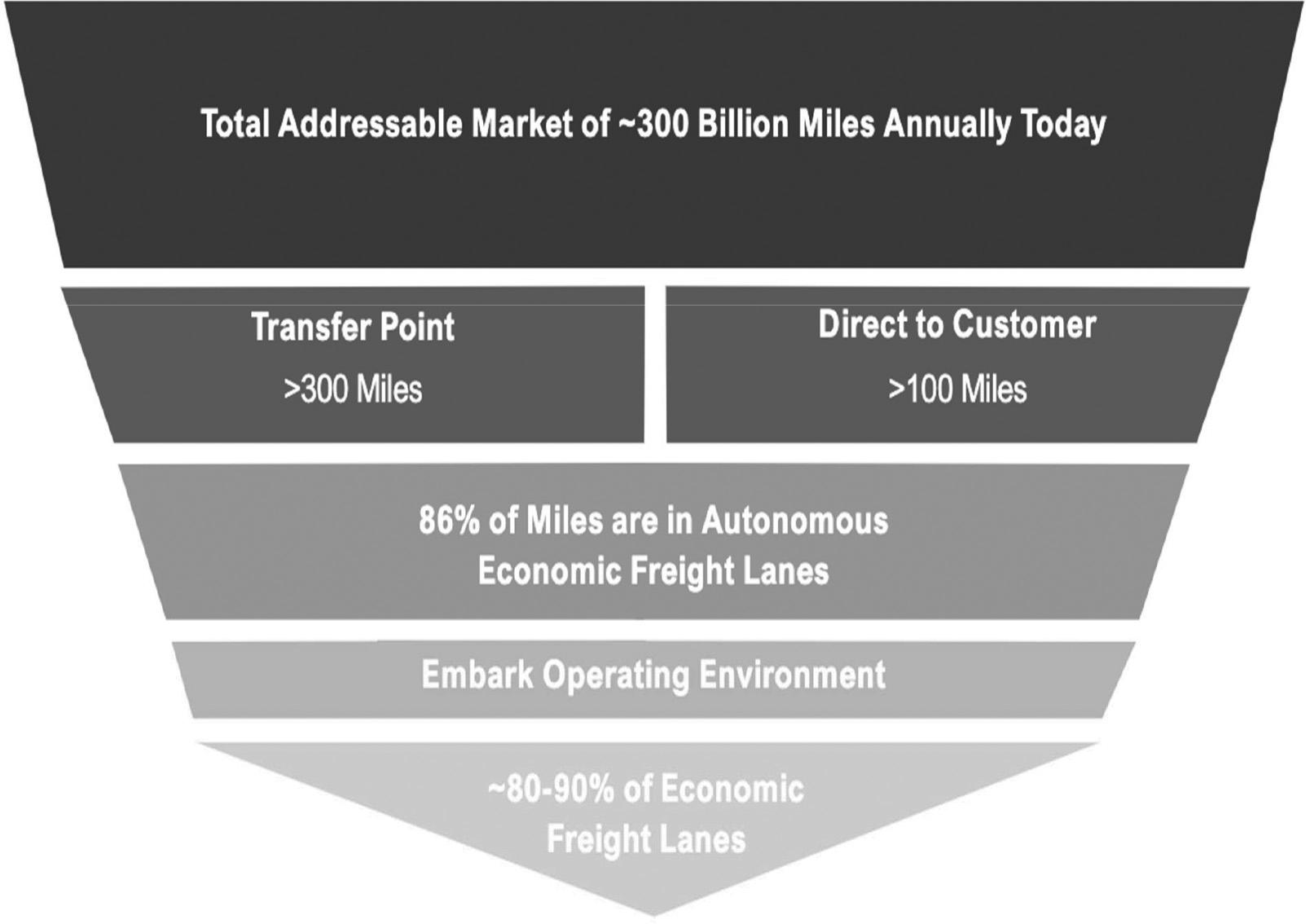

1

Embark’s business model focus does not come at any significant commercial expense for Embark’s stockholders because the serviceable market Embark is targeting is significant. Embark currently targets the rapidly growing $700 billion U.S. truck freight market, and its initial commercial phase targets 236 billion serviceable miles within this market. The industry has had to face significant pressures from the growth of e-commerce and the well-documented shortage of skilled drivers, and therefore has powerful incentives to adopt autonomous driving solutions to both improve capacity and reduce costs. In addition, Embark’s cooperative model has already had traction with many of the industry’s leading shippers and carriers. In short, Embark believes the freight truck market is poised for a dramatic sea change that will result in an industry that is more profitable, less polluting and provides a more humane lifestyle for its skilled drivers thanks to autonomous driving technology. Embark is the best positioned company in the industry to lead this transformation.

Risk Factors

Embark’s business is subject to numerous risks and uncertainties, including those highlighted in the section entitled “Risk Factors” immediately following this prospectus summary, that represent challenges that Embark Technology faces in connection with the successful implementation of its strategy and the growth of its business. In particular, the following considerations, among others, may offset its competitive strengths or have a negative effect on its business strategy, which could cause a decline in the price of shares of Class A common stock or warrants and result in a loss of all or a portion of your investment:

| ● | Autonomous driving is an emerging technology and involves significant risks and uncertainties. |

| ● | Embark has a limited operating history and an unproven business model in a new market and faces significant challenges as its industry is rapidly evolving. |

| ● | Embark’s technology may raise safety or other automation-related concerns causing it to fail to gain acceptance from users and other stakeholders in the freight transportation industry. |

| ● | Embark’s autonomous driving technology and related hardware and software could have undetected defects, errors or bugs in hardware or software. |

| ● | The operation of autonomous semi-trucks may be unfamiliar to Embark’s users and other road users. |

| ● | Embark operates in a highly competitive market and some market participants have substantially greater resources. Embark competes against a large number of both established competitors and new market entrants. |

| ● | Disruptions to the trucking industry, including changes in transportation and shipping infrastructure, could adversely impact Embark’s business and operating results. |

| ● | Embark’s business model depends on acceptance of its technology by third-party carriers and shippers and Embark’s existing relationships with key business partners. |

| ● | Embark relies on third-party suppliers and because some of the key components in Embark’s systems come from limited or sole sources of supply, Embark is susceptible to supply shortages, long lead times for components, and supply changes, or system unavailability, any of which could disrupt its supply chain and could delay deliveries of Embark’s products to users. |

| ● | Embark’s approach of creating a manufacturer-agnostic product exposes it to the risk of exclusive competitor partnerships and other challenges that limit integration of its technology to products of multiple OEMs. |

| ● | Embark is an early stage company with a history of losses, and expects to incur significant expenses and continuing losses for the foreseeable future. |

| ● | Embark expects to engage in resource-intensive R&D and commercialization activities for the foreseeable future, which may require it to raise additional funds and these funds may not be available to Embark on attractive terms when it needs them, or at all. |

| ● | Embark may be subject to risks associated with potential future strategic alliances, partnerships, investments or acquisitions, all of which could divert management’s attention, result in Embark incurring significant costs or operating |

2

| difficulties and dilution to its stockholders, disrupt its operations and adversely affect its business, results of operations or financial condition. |

| ● | The forecast of Embark’s operating and financial results relies in large part upon assumptions and analyses developed by its management team. If these assumptions or analyses prove to be incorrect, Embark’s actual operating results may be materially different from its forecasted results. |

| ● | Embark depends on the experience and expertise of its senior management team, technical engineers, and certain key employees. |

| ● | Embark has experienced rapid growth in recent periods and expects to continue to invest in its growth for the foreseeable future. If Embark fails to manage its growth effectively, it may be unable to execute its business plan, maintain high levels of service, or adequately address competitive challenges. |

| ● | Embark’s management team has limited experience managing a public company. |

| ● | Embark may be subject to breach of contract, product liability or warranty claims and other legal proceedings in the ordinary course of business that could result in significant direct or indirect costs, including reputational harm, increased insurance premiums or the need to self-insure. |

| ● | OEMs and their suppliers may experience significant delays in the manufacture and launch of Embark- enabled autonomous semi-trucks, which could harm Embark’s business and prospects. |

| ● | If Embark’s autonomous vehicle technologies fail to perform as expected, are inferior to those of its competitors, or are perceived as less safe or more expensive than those of its competitors or non- autonomous vehicles, Embark’s financial performance and prospects would be adversely impacted. |

| ● | The Embark Founders are expected to have control over all stockholder decisions because they control a substantial majority of Embark’s voting power through “high vote” voting stock. |

| ● | Pandemics and epidemics, including the ongoing COVID-19 pandemic, natural disasters, terrorist activities, political unrest, and other outbreaks could have a material adverse impact on Embark’s business. |

| ● | Embark has identified deficiencies that together constitute a material weakness in its internal control over financial reporting as of December 31, 2019 and 2020. If Embark fails to develop and maintain an effective system of internal control over financial reporting, it may not be able to accurately report its financial results in a timely manner, which may adversely affect investor confidence in Embark. |

| ● | Embark has not historically been required to establish and maintain public company-quality internal control over financial reporting. |

| ● | Embark holds no patents on its products, and it may not be successful in its planned patent applications. Embark employs proprietary technology (know-how) and information that may be difficult to protect. |

| ● | Embark may become subject to litigation brought by third parties claiming infringement, misappropriation or other violation by Embark of their intellectual property rights. |

| ● | Embark utilizes open source software, which may pose particular risks to its proprietary software, technologies, products, and services in a manner that could harm its business. |

| ● | Embark is exposed to, and may be adversely affected by, interruptions to its information technology systems and networks and sophisticated cyber-attacks. |

| ● | Embark collects, processes, transmits, and stores personal information in connection with the operation of its business and is subject to various data privacy and consumer protection laws. |

| ● | Embark operates in a highly regulated industry and increased costs of compliance with, or liability for violation of, existing or future regulations could have a materially adverse effect on Embark’s business. |

3

| ● | The trucking industry is subject to economic, business and regulatory factors that are largely beyond Embark’s and its partners’ control, any of which could have a material adverse effect on the operations of its partners and ultimately on Embark. |

Accounting Treatment

The Business Combination was accounted for as a reverse recapitalization, in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Under the guidance in ASC 805, Embark Technology was treated as the “acquired” company for financial reporting purposes. Accordingly, the Business Combination will be treated as the equivalent of Embark issuing stock for the net assets of Embark Technology, accompanied by a recapitalization whereby no goodwill or other intangible assets are recorded. Operations prior to the Business Combination will be those of Embark.

Corporate Information

We incorporated under the name “Northern Genesis Acquisition Corp. II” on September 25, 2020 as a Delaware corporation for purposes of effecting a merger, share exchange, assed acquisition, share purchase, reorganization or similar business combination with one or more businesses. On November 10, 2021, we changed our name to “Embark Technology, Inc.” in connection with the closing of the Business Combination.

Our principal executive office is located at 424 Townsend Street, San Francisco, CA 94107. Our telephone number is (415) 671-9628. Our website address is www.embarktrucks.com. Information contained on our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

Emerging Growth Company

Section 102(b)(1) of the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a registration statement under the Securities Act declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. We have elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of Embark Technology’s financial statements with those of another public company that is neither an emerging growth company nor an emerging growth company that has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.

We will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) following the fifth anniversary of the Closing of NGA’s initial public offering, (b) in which we have total annual gross revenue of at least $1.07 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date on which we have issued more than $1.00 billion in non-convertible debt securities during the prior three-year period. References herein to “emerging growth company” have the meaning associated with it in the JOBS Act.

4

RISK FACTORS

An investment in Embark Technology involves a high degree of risk and uncertainty. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this prospectus, including the financial statements and the related notes appearing elsewhere in this prospectus, before making an investment decision. Additional risks and uncertainties, that Embark does not presently consider to be material or of which Embark is not presently aware, also may become important factors that affect the business, results of operations or financial condition of Embark, or the likelihood or effects of the Business Combination, that may materially and adversely affect the trading price of Embark Technology’s Class A common stock and warrants. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

References in this section to "Embark," or the "Company" are to Embark Trucks, Inc. prior to the Business Combination and to Embark Technology, Inc., following the Business Combination.

Risks Related to Embark’s Technology, Business Model, and Industry

Autonomous driving is an emerging technology and involves significant risks and uncertainties.

Embark’s autonomous vehicle technology is highly dependent on internally-developed technology as well as on partnerships with third parties that could include semi-truck OEMs, carriers and other suppliers. Embark develops and integrates its autonomous driving technology and works with OEMs and other suppliers to develop autonomous driving technology hardware.

While Embark’s autonomous driving technology, including the Embark Universal Interface, Embark Driver and Embark Guardian is designed to be compatible with all major OEM platforms, Embark does not control many aspects of semi-truck production. The timely development and performance of its autonomous driving programs is dependent on the materials, cooperation, and quality delivered by OEMs and other production stakeholders. Embark’s technology is designed to interface with systems and components outside of its design and production control, including those related to braking, steering and gear shifting. There can be no assurance that those applications can be developed and validated at the high reliability standard required L4 autonomous driving in a cost-effective and timely manner. Embark’s dependence on OEMs exposes it to the risk that components manufactured by OEMs or other suppliers could contain defects that would cause Embark’s autonomous driving technology to not operate as intended.

In addition, Embark’s autonomous driving technology may be implemented to complement the infrastructure used by its shipper and/or carrier partners, and an appropriate implementation will require the cooperation of these partners. A failure of a shipper or carrier partner to provide required information, resources or other support may slow or compromise aspects of its technology either in the implementation phase or operationally.

Although Embark believes that its algorithms, data analysis and processing, and artificial intelligence technology are promising, it cannot assure you that its technology will achieve the necessary reliability for L4 autonomy at commercial scale. For example, Embark is always improving its technology in terms of handling non-compliant driving behavior by other cars on the road as well as other real world conditions. There can be no assurance that Embark’s data analytics and artificial intelligence could predict every single potential issue that may arise during the operation of its technology.

Embark currently directly operates a small R&D fleet of trucks to further develop its autonomous driving technology and demonstrate its technology. To date, all of Embark’s autonomous miles driven have been “driver in.” There can be no assurance that Embark will successfully transition to “driver out” operations on its expected schedule or that its R&D fleet will successfully develop and/or prove out its autonomous driving technology.

Embark has a limited operating history and an unproven business model in a new market and faces significant challenges as its industry is rapidly evolving. Its prospects may be considered speculative and any failure to commercialize its strategic plans would have an adverse effect on its operating results and business, harm its reputation and could result in substantial liabilities that exceed its resources.

Embark commenced operations in 2016 and launched its Partner Development Program in April 2021, a program to bring together leading shippers and carriers to work on autonomous trucking technology. Embark’s business model relies on the adoption of its autonomous vehicle technology by its partner carriers and the continued cooperation of OEMs with its universal interface. While Embark believes this model is an efficient way to develop and implement its technology, its business model is unproven and there can

5

be no assurance that an alternative model adopted by its competitors in the autonomous vehicle space will not prove superior. In addition, the market for autonomous vehicle technology is rapidly evolving.

You should consider Embark’s business and prospects in light of the risks and challenges it faces as a new entrant into a novel industry, including, among other things, with respect to its ability to:

| ● | navigate an evolving and complex regulatory environment and product liability regime; |

| ● | design, outfit, and produce safe, reliable, and quality L4 autonomous semi-trucks equipment with its OEM partners on an ongoing basis; |

| ● | improve and enhance its software and autonomous technology; |

| ● | design, and develop software and technology in a timely manner; |

| ● | establish and expand its user base among shippers and carrier partners; |

| ● | successfully market its other products and services; |

| ● | properly price its products and services; |

| ● | improve and maintain operational efficiency; |

| ● | maintain a reliable, secure, high-performance, and scalable technology infrastructure; |

| ● | attract, retain, and motivate talented employees; |

| ● | enter into successful strategic relationships with carriers, OEMs and shippers; |

| ● | protect its intellectual property; |

| ● | keep its technology secure and compliance with data privacy and cybersecurity requirements; |

| ● | anticipate and adapt to changing market conditions, including technological developments and changes in competitive landscape; and |

| ● | build a well-recognized and respected brand. |

If Embark fails to address any of these risks and challenges, its business may be materially and adversely affected and Embark may be forced to alter its business model in ways that are difficult to predict, including by providing direct service to shippers or reevaluating its relationships with OEMs. There are also a number of additional challenges to L4 autonomous driving, many of which are not within Embark’s control, including market acceptance of autonomous driving, governmental licensing requirements, concerns regarding data security and privacy, actual and threatened litigation (whether or not a judgment is rendered against Embark), and any general negative perceptions regarding autonomous vehicle technology due to safety, security, job displacement or other reasons. There can be no assurance that the market will accept Embark’s technology, in which case its future business, results of operations and financial condition could be adversely affected.

To implement Embark’s business plan additional capital may be required beyond the amount raised to date. Furthermore, the implementation of a new business model (or an alternative business model) in an evolving industry poses a number of challenges, many of which are beyond Embark’s control, including unknown future challenges and opportunities, substantial risks and expenses in the course of entering new markets and undertaking marketing activities. The likelihood of Embark’s success must be considered in light of these risks, expenses, complications, delays, and the competitive environment in which it operates. There is, therefore, substantial uncertainty as to whether Embark’s business plan will prove successful, and it may not be able to generate significant revenue, raise additional capital, or operate profitably. Embark will continue to encounter risks and difficulties frequently experienced by early stage commercial companies, including scaling up infrastructure and headcount, and may encounter unforeseen expenses,

6

difficulties, or delays in connection with its growth. While Embark’s business model is designed to be minimally capital intensive, there can be no assurance that its expectation regarding future capital requirements will be correct.

Embark’s technology may raise safety or other automation-related concerns causing it to fail to gain acceptance from users and other stakeholders in the freight transportation industry.

Demand for autonomous driving technology depends to a large extent on general, economic, political, and social conditions in a given market. The market opportunities Embark is pursuing are at an early stage of development, and it is difficult to predict user demand or adoption rates for its solutions, or the future growth of the markets in which Embark operates. Despite the fact that the automotive industry has engaged in considerable effort to research and test L2 and L3 autonomous cars, Embark technology targeting L4 autonomous semi-trucks requires significant investment and may never be commercially successful on a large scale, or at all. Embark relies on its existing partnerships with carriers and shippers, as well as its ability to develop new partnerships, to implement its autonomous vehicle technology. If carriers fail to embrace Embark’s technology or cost pressure and current labor markets change in the future, its technology may not become adopted by enough carriers to make Embark’s business model commercially viable. In addition, Embark may rely on OEM manufacturer adoption of certain software and/or hardware requirements to operate profitably which may not occur, or occur in part or on a longer time frame than Embark anticipates.

Further, even if Embark succeeds in operating at commercial scale, because of the disruptive nature of its business to the freight transportation industry, key industry participants may not accept its technology, may develop competing services or may otherwise seek to subvert its efforts. For example, autonomous semi- trucks might displace individual semi-truck drivers and small fleet owners. Labor unions, workforce activists, regulators or political leaders may also raise concerns about autonomous semi-trucks displacing drivers or otherwise negatively affecting employment opportunities, as has been the case in other industries that have been subject to automation. This has in the past resulted, and could in the future result, in negative publicity, lobbying efforts to U.S. local, state, and federal, lawmaking authorities, or equivalent authorities in the foreign jurisdictions in which Embark seeks to do business, to implement legislation or regulations that make it more difficult to operate its business or boycotts of it or its users. While Embark is primarily focused on the domestic U.S. market, any future operations in foreign jurisdictions would require Embark to address complex, evolving and unique regulatory regimes and implicate political questions regarding the national interest of such countries in their domestic shipping industry. Any such occurrences could materially harm Embark’s future business.

Additionally, regulatory, safety, and reliability issues, or the perception thereof, many of which are outside of Embark’s control, could also cause the public or its potential partners and users to lose confidence in autonomous solutions in general. The safety of such technology depends in part on user interaction and users, as well as other drivers, pedestrians, other obstacles on the roadways or other unforeseen events. For example, there have been several crashes involving automobiles using other autonomous driving technology resulting in death or personal injury, including both fully autonomous vehicles and vehicles where autopilot features are engaged. Even though these incidents were unrelated to Embark’s technology, such cases resulted in significant negative publicity and, in the future, could result in suspension or prohibition of self- driving vehicles. If safety and reliability issues for autonomous driving technology cannot be addressed properly, Embark’s business, prospects, operating results, and financial condition could be materially harmed.

Embark’s autonomous driving technology and related hardware and software could have undetected defects, errors or bugs in hardware or software which could create safety issues, reduce market adoption, damage its reputation with current or prospective users, result in product recalls or other actions, or expose it to product liability and other claims that could materially and adversely affect its business.

Embark’s autonomous driving technology is highly technical and very complex, and has in the past and may in the future experience defects, errors or bugs at various stages of development. Embark may be unable to timely correct problems to its partners’ and users’ satisfaction. Additionally, there may be undetected errors or defects especially as it introduces new systems or as new versions are released. These risks are particularly significant in the freight transport market given the high potential value of each load, as any such errors or defects could result in costly delays or losses, leading to the delay or prevention of the adoption of autonomous driving technology in trucks.

There can be no assurance that Embark will be able to detect and fix any defects in its products prior to their sale to or installation for customers. Errors or defects in Embark’s products may only be discovered after they have been tested, commercialized, and deployed. If that is the case, Embark may incur significant additional development costs and product recall, repair or replacement costs, or liability for personal injury or property damage caused by such errors or defects, as these issues could

7

result in claims against it. Embark’s reputation or brand may be damaged as a result of these problems and users may be reluctant to use its services, which could adversely affect its ability to retain existing users and attract new users, and could materially and adversely affect its financial results.

In addition, Embark could face material legal claims for breach of contract (e.g. with one or more of its partners), product liability, tort or breach of warranty, or be required to indemnify others, as a result of these problems. Any such lawsuit may cause irreparable damage to Embark’s brand and reputation. In addition, defending a lawsuit, regardless of its merit, could be costly and may divert management’s attention and adversely affect the market’s perception of Embark and its services. Additionally, Embark is operating in an emerging market with an undefined insurance liability framework and evolving expectations regarding indemnifications obligations. As the market terms for indemnification and insurance are established, they may develop in ways that are adverse to Embark. Embark’s business liability insurance coverage could prove inadequate with respect to a claim and future coverage may be unavailable on acceptable terms or at all. These product-related issues could result in claims against Embark and its business could be materially and adversely affected.

The operation of autonomous semi-trucks may be unfamiliar to Embark’s users and other road users.

Embark has developed Embark Driver and Embark Guardian to automate Embark’s carrier partners’ semi-trucks but there can be no assurance that its technology will be perceived to be comparable to non- autonomous semi-trucks by carriers, other drivers or regulators. Embark’s proprietary artificial intelligence (“AI”) and machine vision capabilities are specifically engineered to interface with all major semi-truck OEMs and meet the demands of commercial trucks. In certain instances, these protections may cause the vehicle to behave in ways that are unfamiliar to drivers of non-autonomous driving trucks. For example, semi- trucks equipped with Embark’s L4 technology may adhere to safety rules in a stricter manner than some human drivers may be accustomed to.

Furthermore, there can be no assurance that Embark’s carrier partners will be able to properly adapt to the different operation processes for Embark’s L4 autonomous semi-trucks or that its Embark Universal Interface will continue to be compatible with semi-truck OEMs. For example, carriers may not be able to adapt their business processes to address activities such as the dispatching of trucks, pre-trip inspections, remote monitoring, and rescuing of trucks. Any accidents resulting from such failure to inspect, operate or maintain Embark’s L4 autonomous semi-trucks properly could harm its brand and reputation, result in adverse publicity, and product liability claims, and have a material adverse effect on its business, prospects, financial condition, and operating results.

Embark operates in a highly competitive market and some market participants have substantially greater resources. Embark competes against a large number of both established competitors and new market entrants.

The market for autonomous trucking and freight transport solutions is highly competitive. Many companies are seeking to develop autonomous trucking and delivery solutions. Competition in these markets is based primarily on technology, innovation, quality, safety, service, strategy, reputation, and price. Embark’s future success will depend on its ability to further develop and protect its technology in a timely manner and to stay ahead of existing and new competitors. Embark’s competitors in this market are working towards commercializing autonomous driving technology and may have substantial financial, marketing, research and development, and other resources. Some examples of Embark’s competitors include TuSimple, Waymo, Aurora, and Kodiak.

In addition, the carriers Embark serves operate in a competitive environment and face competition from other trucking companies that use autonomous or non-autonomous trucks, railroads, and air carriers. Traditional shipping fleets and other carriers operating with human drivers are still the predominant operators in the market. Because of the long history of such traditional freight transport companies serving the freight market, there may be many constituencies in the market that would resist a shift towards autonomous freight transport, which could include lobbying and marketing campaigns on a scale that Embark may not be able to successfully oppose, particularly because Embark’s technology will replace human- driven long haul semi-truck miles. In addition, the market leaders in the automotive industry (including the OEMs Embark has designed its technology to interface with) may start, or have already started, pursuing large scale deployment of autonomous vehicle technology on their own. These companies may have more operational and financial resources than Embark. Embark cannot guarantee that it will be able to effectively compete with them. Embark does not know how close these competitors are to commercializing autonomous driving systems.

Furthermore, although Embark believes that its technology is on the leading edge of autonomous vehicle development, many established and new market participants have entered or have announced plans to enter the autonomous vehicle market. Most of the existing participants have significantly greater financial, manufacturing, marketing, and other resources than Embark does and may be

8

able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale, and support of their products. New entrants may develop or leverage disruptive technology to commercialize their offerings more quickly than Embark. If existing competitors or new entrants are able to commercialize earlier than expected, Embark’s competitive advantage could be adversely affected.

Disruptions to the trucking industry, including changes in transportation and shipping infrastructure, could adversely impact Embark’s business and operating results.

Embark’s business and financial performance are affected by the health of the U.S. truck freight industry, which is reliant on infrastructure maintained by third parties and is affected by risks that are largely out of the control of industry participants.

Embark’s partners may experience capacity constraints due to increased demand for transportation services and decaying highway infrastructure. The 2015 FAST Act highway law that provided funding for infrastructure improvements was set to expire in September 2020, but was extended for an additional year. Bills that would provide significant federal funding to improve and maintain the nation’s deteriorating infrastructure have not been passed. Poor infrastructure conditions and roadway congestion could slow service times, reduce operating efficiency and increase maintenance expense for truck operators. Some states have taken infrastructure funding measures into their own hands and have explored or instituted road- usage programs, truck-only tolling, congestion pricing, and fuel tax increases. In addition, risks including harsh weather or natural disasters, such as hurricanes, tornadoes, fires and floods, global pandemics and acts of terrorism could further damage existing infrastructure. Damage or further deterioration of highway infrastructure could negative impact Embark’s partners and ultimately Embark’s business and operating results by increasing costs associated with truck freight. Similarly, a failure of continued investment in highway infrastructure or a redirection of government investment into rail or ocean freight infrastructure could negatively impact the truck freight industry and ultimately Embark.

Risks Related to Embark’s Dependence on Third Parties

Embark’s business model depends on acceptance of its technology by third-party carriers and shippers including through attracting new customers and retaining existing customers and Embark’s existing relationships with key business partners are subject to non-binding agreements which may be cancelled in the future. Business collaboration with partners is subject to risks, and these relationships may not lead to significant revenue. Any adverse change in Embark’s cooperation partners, including the cancellation of existing agreements, or failure to attract and retain customers could harm its business.

Embark does not intend to operate its own freight shipping network and Embark does not produce or sell complete semi-trucks. Accordingly, Embark’s business model depends on carriers and shippers specifying its technology into their new semi-trucks and OEMs continuing to be willing to allow Embark’s technology to be incorporated to their vehicles. The strategic business relationships are and will continue to be an important factor in the growth and success of Embark’s business. Embark has alliances and partnerships with certain such companies in the trucking and automotive industry to help Embark in its efforts to continue to enhance its technology, commercialize its solutions, and drive market acceptance. Embark has growing partnerships with leading carriers, such as Werner Enterprises, Bison Transport and certain shippers such as AB Inbev and will continue to cultivate these partnerships while establishing new ones in the future. There can be no assurance that these relationships will continue or that Embark’s efforts to develop new partnership will be successful. In addition, Embark will also need to identify and negotiate additional relationships with other third parties, such as those who can provide service centers, maintenance, refueling, roadside service, towing, sensor support, and financing services in connection with the build out of Embark’s Transfer Hub network or other aspects of its business. While Embark is pursuing partnerships with truck facility operators and expects to partner with other facility owners and real estate developers to build out its Transfer Hub network, there can be no assurance that these partnerships will continue or prove successful. Embark may not be able to successfully identify and negotiate definitive agreements with these third parties to provide the services Embark would require on terms that are attractive or at all, which would cause Embark to incur increased costs to develop and provide these capabilities.

Collaboration with these third parties is subject to risks, some of which are outside Embark’s control. Third parties may be unwilling to deepen a contractual partnership beyond the exploratory stage, may include onerous provisions or demand exclusivity or pricing concessions that would negatively impact Embark’s business model or growth. Embark could experience delays to the extent its partners do not meet agreed upon timelines or experience capacity constraints. Embark could also experience disagreement in budget or funding for any joint development project, including its Transfer Hubs. There is also a risk of other potential disputes with partners in the future, including with respect to intellectual property rights. Embark’s ability to successfully commercialize could also be adversely affected by perceptions about the quality of its partners’ trucks.

9

If Embark’s existing partner agreements were to be terminated, Embark may be unable to enter into new agreements on terms and conditions acceptable to Embark. Failure to obtain replacement partners or agreements could delay adoption of Embark’s technology or build out of its Transfer Hub network. Any of the foregoing could adversely affect Embark’s business, results of operations, and financial condition.

Embark relies on third-party suppliers and because some of the key components in Embark’s systems come from limited or sole sources of supply, Embark is susceptible to supply shortages, long lead times for components, and supply changes, or system unavailability, any of which could disrupt its supply chain and could delay deliveries of Embark’s products to users. In addition, any inability of Embark to adequately forecast supply and demand for its products or the manufacturing capacity of its suppliers and partners could result in a variety of inefficiencies in its business and hinder its ability to generate revenue.

Many of the components that are used to outfit semi-trucks with Embark’s autonomous technology are sourced from third-party suppliers. Component parts sourced from third parties include cameras, radars, LiDARs and GPS systems. Embark does not have any experience in managing a large supply chain to manufacture and deliver products at scale. In addition, some of the components come from limited or sole sources of supply. Embark is also dependent on its suppliers’ production timeline for supplying automotive- grade LiDAR at scale. Embark is therefore subject to the risk of shortages and long lead times in the supply of these components and the risk that its suppliers discontinue or modify components used in its technology. In addition, Embark’s agreements with its third party suppliers are non-exclusive and it is reasonably foreseeable that OEM relationships with such suppliers will be non-exclusive in the future. Embark’s suppliers may dedicate more resources to other companies, including Embark’s competitors. Embark may in the future experience component shortages and price fluctuations of certain key components and materials, and the predictability of the availability and pricing of these components may be limited. Component shortages or pricing fluctuations could be material in the future. In the event of a component shortage, supply interruption, product defect or material pricing change from suppliers of these components, Embark may not be able to develop alternate sources in a timely manner or at all in the case of sole or limited sources.

In addition, Embark uses the services of certain software suppliers in its technology, such as cloud hosting providers, that Embark relies upon to meet its uptime, data security and other commercial commitments. Developing alternate sources of supply for these components or systems may be time- consuming, difficult, and costly and Embark may not be able to source these services on terms that are acceptable to it, or at all, which may undermine Embark’s ability to meet its requirements or to fill user orders in an appropriate manner.

Any interruption or delay in the supply of any of these parts, components or services, or the inability to obtain these parts, components or services from alternate sources at acceptable prices and within a reasonable amount of time, would adversely affect Embark’s ability to meet scheduled technology deliveries to users. This could adversely affect Embark’s relationships with its users and could cause delays in its ability to expand its operations. If Embark is unable to source necessary components for its Embark Universal Interface in quantities sufficient to meet its requirements on a timely basis, or is unable to ensure that OEMs are able to source Embark Universal Interface components, Embark will not be able to have sufficient ability to ensure user demand is met, which may result in users using competitive services instead of Embark’s.

Embark’s approach of creating a manufacturer-agnostic product exposes it to the risk of exclusive competitor partnerships and other challenges that limit integration of its technology to products of multiple OEMs.

While Embark designed its platform, the Embark Universal Interface, with the aim to access the broadest market by allowing carriers and shippers to utilize Embark’s services while still maintaining their OEM of choice, this aim of universality means that Embark’s relationships with OEMs are neither binding nor exclusive. If a competitor chooses to sign an exclusivity agreement with an OEM that prevents Embark from outfitting those manufacturer’s semi-trucks, Embark’s ability to reach production commitments at the intended breadth will be materially and adversely affected. Embark’s potential inability to ensure a particular OEM’s trucks are outfitted with Embark technology may materially and adversely impact its value proposition to shippers’ and carriers’ that utilize or may wish to utilize that OEM’s semi-trucks.

If a competitor comes to a preferential agreement with an OEM that requires the OEM preferentially manufacture semi-trucks for the competitor over Embark-equipped customers, this will put Embark at a competitive disadvantage in terms of its ability to fulfill orders in a timely manner. This will expose Embark to additional risks from manufacturer bottlenecks and component shortages. Any potential delay or interruption in Embark’s ability to ensure demand is met may lead its customers to seek a competitor instead. If

10

changing market conditions dictate Embark to pursue exclusivity or preferential agreements with an OEM manufacturer, there can be no assurance that Embark will be successful in doing so.

OEMs operate in a highly competitive industry that pushes OEMs to constantly make changes to their products. Although, Embark believes that its product can be successfully integrated to semi-trucks of multiple OEMs, changes made by OEMs to their products and other unforeseen technological developments might limit integration of Embark’s platform to products of multiple OEMs or make such integration more difficult. Furthermore, Embark’s model exposes it to differing requirements among OEMs which may require it to expend more resources than competitors that work with a single OEM. Such technological developments may have material and adverse effects of Embark’s business, results of operations, and financial condition.

Embark depends on an international supply chain that is subject to risk of foreign regulatory requirements and trade policy.

Many of the components that Embark requires for outfitting its trucks are sourced from international third-party suppliers. Changes in global political, regulatory and economic conditions, or in laws and policies governing foreign trade, manufacturing, development, and investment in the territories or countries where Embark currently purchases components, could adversely affect its business. The United States has recently instituted or proposed changes in trade policies that include the negotiation or termination of trade agreements, the imposition of higher tariffs on imports into the United States, economic sanctions on individuals, corporations or countries, and other government regulations affecting trade between the United States and other countries. A number of other nations have proposed or instituted similar measures directed at trade with the United States in response. As a result of these developments, there may be greater restrictions and economic disincentives on international trade that could adversely affect Embark’s business. For example, such changes could adversely affect the automotive market, and Embark’s ability to access key components. It may be time-consuming and expensive for Embark to alter its business operations to adapt to or comply with any such changes, and any failure to do so could have a material adverse effect on its business, financial condition and results of operations.

Risks Related to Embark’s Financial Position and Need for Additional Capital

Embark is an early stage company with a history of losses, and expects to incur significant expenses and continuing losses for the foreseeable future.

Embark incurred net losses of $15.3 million and $21.5 million for the years ended December 31, 2019 and 2020, respectively and has not recognized revenue to date. Embark has successfully shipped freight for shippers and carriers to utilizing its technology and Transfer Hub network but there is no guarantee that Embark’s partnership model will get traction, grow or otherwise be successful or achieve sufficient scale for commercial viability. Embark’s potential profitability is dependent upon a number of factors, many of which are beyond its control.

Embark expects the rate at which it will incur losses to be significantly higher in future periods as Embark:

| ● | designs, develops, manufactures and implements its Embark Universal Interface; |

| ● | seeks to achieve and commercialize full L4 autonomy for its Embark-equipped semi-trucks; |

| ● | expands its design, development, maintenance, and repair capabilities; |

| ● | responds to competition in the autonomous driving market and from traditional freight transportation providers; |

| ● | responds to evolving regulatory developments in the nascent autonomous vehicle market; |

| ● | increases its sales and marketing activities; and |