UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OR

For the fiscal year ended

OR

For the transition period from _______________ to _______________

OR

Date of event requiring this shell company report _______________

Commission file number

(Exact name of Registrant specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

British Columbia,

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of Each Class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

The |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of business of the period covered by the annual report.

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Yes ☐

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of "accelerated filer," "large accelerated filer," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐ |

Accelerated Filer ☐ |

|

|

Emerging Growth Company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP ☐ |

|

Other ☐ |

|

|

by the International Accounting Standards Board ☒ |

|

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow: Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act):

Yes ☐ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Not applicable.

TABLE OF CONTENTS

FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F contains statements that constitute "forward-looking statements". Any statements that are not statements of historical facts may be deemed to be forward-looking statements. These statements appear in a number of different places in this Annual Report and, in some cases, can be identified by words such as "anticipates", "estimates", "projects", "expects", "contemplates", "intends", "believes", "plans", "may", "will" or their negatives or other comparable words, although not all forward-looking statements contain these identifying words. Forward-looking statements in this Annual Report may include, but are not limited to:

|

• |

the effect of COVID-19 and any other pandemics on the Company's workforce, business, operations and financial condition; |

|

|

|

|

• |

the Company's expectations regarding the achievement of clinical and regulatory milestones; |

|

|

|

|

• |

the executive compensation of the Company; |

|

|

|

|

• |

the composition of the board of directors (the "Board") and management of the Company; |

|

|

|

|

• |

the Company's expectations regarding its revenue, expenses and research and development operations; |

|

|

|

|

• |

the Company's anticipated cash needs and its needs for additional financing; |

|

|

|

|

• |

the Company's intention to grow the business and its operations; |

|

|

|

|

• |

expectations with respect to the success of its research and development of serotonergic therapeutics; |

|

|

|

|

• |

expectations regarding growth rates, growth plans and strategies of the Company; |

|

|

|

|

• |

expectations that new provisional patent applications and new regular patent applications will be filed in Q1 of 2022; |

|

|

|

|

• |

the Company's strategy with respect to the expansion and protection of its intellectual property; |

|

|

|

|

• |

the medical benefits, safety, efficacy, dosing and consumer acceptance of serotonergic therapeutics; |

|

|

|

|

• |

the Company's ability to comply with provincial, federal, local and regulatory agencies in the United States, Canada and other jurisdictions in which the Company operates; |

|

|

|

|

• |

the Company's competitive position and the regulatory environment in which the Company operates; |

|

|

|

|

• |

the Company's expected business objectives for the next 12 months; |

|

|

|

|

• |

the Company's plans with respect to the payment of dividends; |

|

|

|

|

• |

beliefs and intentions regarding the ownership of material trademarks and domain names used in connection with the design, production, marketing, distribution and sale of the Company's products and services; and |

|

|

|

|

• |

the Company's ability to obtain additional funds through the sale of equity or debt commitments. |

- 2 -

Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Although, the Company believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect, and the Company cannot assure that actual results will be consistent with these forward-looking statements. Given these risks, uncertainties and assumptions, prospective investors should not place undue reliance on these forward-looking statements. Whether actual results, performance or achievements will conform to the Company's expectations and predictions is subject to a number of known and unknown risks, uncertainties, assumptions and other factors, including those listed under Item 3.D "Risk Factors" which include:

|

• |

limited operating history; |

|

|

|

|

• |

the Company's actual financial position and results of operations may differ materially from the expectations of the Company's management; |

|

|

|

|

• |

the Company may be required to obtain and maintain certain permits, licenses, and approvals in the jurisdictions where its products or technologies are being researched, developed, or commercialized; |

|

|

|

|

• |

the Company may encounter substantial delays or difficulties with its clinical trial; |

|

|

|

|

• |

clinical trials are expensive, time consuming and difficult to design and implement; |

|

|

|

|

• |

the Company may not be successful in its efforts to identify, license or discover additional product candidates; |

|

|

|

|

• |

risks associated with the development of the Company's products which are at early stages of development; |

|

|

|

|

• |

there is no assurance that the Company will turn a profit or generate immediate revenues; |

|

|

|

|

• |

the continued operation of the Company as a going concern; |

|

|

|

|

• |

the Company's intellectual property and licenses thereto; |

|

|

|

|

• |

the Company may not achieve timelines for project development set out in this Annual Report; |

|

|

|

|

• |

the Company faces product liability exposure; |

|

|

|

|

• |

the Company has international operations, which subject the Company to risks inherent with operations outside of Canada; |

|

|

|

|

• |

exchange rate fluctuations between the U.S. dollar and the Canadian dollar; |

|

|

|

|

• |

changes to patent laws or the interpretation of patent laws; |

|

|

|

|

• |

the risk of patent-related or other litigation; |

|

|

|

|

• |

the Company may not be able to enforce its intellectual property rights throughout the world; |

|

|

|

|

• |

the lack of product for commercialization; |

|

|

|

|

• |

the lack of experience of the Company/management in marketing, selling, and distribution products; |

|

|

|

|

• |

the size of the Company's target market is difficult to quantify; |

|

|

|

|

• |

potentials for conflicts of interest for the Company's officers and directors; |

|

|

|

|

• |

in certain circumstances, the Company's reputation could be damaged; |

|

|

|

|

• |

negative operating cash flow; |

|

|

|

|

• |

need for additional financing; |

- 3 -

|

• |

uncertainty and discretion of use of proceeds; |

|

|

|

|

• |

the potential for a material weakness in the Company's internal controls over financial reporting; |

|

|

|

|

• |

difficulties with forecasts; |

|

|

|

|

• |

market price of Common Shares and volatility; and |

|

|

|

|

• |

dilution of Common Shares. |

Although management has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There is no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. These cautionary remarks expressly qualify, in their entirety, all forward-looking statements attributable to the Company or persons acting on the Company's behalf. The Company does not undertake to update any forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such statements, except as, and to the extent required by, applicable securities laws. Readers should carefully review the cautionary statements and risk factors contained in this Annual Report and other documents that the Company may file from time to time with the securities regulators.

The following discussion and analysis, prepared for the year ended September 30, 2021, is a review of our operations, current financial position and outlook and should be read in conjunction with our annual consolidated financial statements for the year ended September 30, 2021 and the notes thereto. We present our financial statements in Canadian dollars. All references to "C$" are to Canadian dollars and references to "US$" are to United States dollars. On September 30, 2021, the daily average exchange rate for the conversion of Canadian dollars into U.S. dollars as reported by the Bank of Canada was C$1.00 = US$0.79.

Not applicable.

Not applicable.

A. Selected financial data

The selected historical consolidated financial information set forth below has been derived from our financial statements for the fiscal years ended September 30, 2021, 2020, and the fiscal period from May 31, 2019 (date of incorporation) to September 30, 2019.

Consolidated Statement of Net Loss

| Year ended September 30, 2021 |

Year ended September 30, 2020 |

Period ended September 30, 2019 |

|||||||

| Revenues | $ | Nil | $ | Nil | $ | Nil | |||

| Gross Profit | $ | Nil | $ | Nil | $ | Nil | |||

| Net Loss | $ | 8,650,763 | $ | 480,377 | $ | 78,717 | |||

| Loss per Share - Basic and Diluted | $ | (0.96 | ) | $ | (0.13 | ) | $ | (0.04 | ) |

- 4 -

Consolidated Statement of Financial Position

| Year ended September 30, 2021 |

Year ended September 30, 2020 |

Period ended September 30, 2019 |

|||||||

| Cash and cash equivalents | $ | 19,760,015 | $ | 799,929 | $ | 79,991 | |||

| Current Assets | $ | 20,038,368 | $ | 878,216 | $ | 79,991 | |||

| Total Assets | $ | 20,040,368 | $ | 880,216 | $ | 81,991 | |||

| Current Liabilities | $ | 638,573 | $ | 150,923 | $ | 36,708 | |||

| Total Liabilities | $ | 638,573 | $ | 150,923 | $ | 36,708 | |||

| Shareholders' Equity (Deficit) | $ | 19,401,795 | $ | 729,293 | $ | 45,283 | |||

Our audited consolidated financial statements for the years ended September 30, 2021 and 2020 and the period from May 31, 2019 (date of incorporation) to September 30, 2019 are attached at the end of this Annual Report.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk Factors

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks, as well as the other information contained in this Annual Report, including our historical and pro forma financial statements and the financial statements and related notes included elsewhere in this Annual Report, before you decide to purchase our securities. Any one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our securities. Refer to "Forward-Looking Statements".

We may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks Related to the Business of the Company

We have a limited operating history and have not yet generated any revenues.

We have a very limited history of operations and is considered a start-up company, which makes evaluating our business and future prospects difficult. As such, we are subject to many risks common to such enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial and other resources and lack of revenues. There is no assurance that we will be successful in achieving a return on shareholders' investment and the likelihood of our success must be considered in light of our early stage of operations.

- 5 -

Our actual financial position and results of operations may differ materially from the expectations of our management.

Our actual financial position and results of operations may differ materially from our management's expectations. We have experienced some changes in our operating plans and certain delays in our plans. As a result, our revenue, net income and cash flow may differ materially from our expected revenue, net income and cash flow. The process for estimating our revenue, net income and cash flow requires the use of judgment in determining the appropriate assumptions and estimates. These estimates and assumptions may be revised as additional information becomes available and as additional analyses are performed. In addition, the assumptions used in planning may not prove to be accurate, and other factors may materially affect our financial condition or results of operations.

We may be required and have not yet obtained regulatory approvals, licenses, and permits in the jurisdictions where our products or technologies are being researched, developed or commercialized, which failure to obtain such regulatory approvals, licenses and permits will likely have a material adverse effect on our business, financial condition and results of operations.

We, or our service providers, may be required to obtain and maintain certain permits, licenses, and approvals in the jurisdictions where our products or technologies are being researched, developed, or commercialized. We have not obtained regulatory approval for any product candidate and it is possible that none of our existing product candidates or any future product candidates will ever obtain regulatory approval. There can be no assurance that we will be able to obtain or maintain any necessary licenses, permits, or approvals. Any material delay or inability to receive these items is likely to delay and/or inhibit our ability to conduct our business, and would have an adverse effect on its business, financial condition, and results of operations. In particular, we will require approval from the FDA (as defined herein) and equivalent organizations in other countries before any of our products can be marketed. There is no assurance that such approvals will be forthcoming. Furthermore, the exact nature of the studies these regulatory agencies will require is not known and can be changed at any time by the regulatory agencies, increasing the financing risk and potentially increasing the time to market we face, which could adversely affect our business, financial condition or results of operations.

We may encounter substantial delays or difficulties with our clinical trials, which could have a material adverse effect on our financial condition and results of operations.

We may not commercialize, market, promote or sell any product candidate without obtaining marketing approval from the FDA or comparable foreign regulatory authorities, and we may never receive such approvals. It is impossible to predict when or if any of our product candidates will prove effective or safe in humans and will receive regulatory approval. Before obtaining marketing approval from regulatory authorities for the sale of its product candidates, we must complete preclinical development and then conduct extensive clinical trials to demonstrate the safety and efficacy of our product candidates. Clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to outcome. A failure of one or more clinical trials can occur at any stage of testing. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that have believed their product candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain marketing approval of their products.

We may experience numerous unforeseen events prior to, during, or as a result of, clinical trials that could delay or prevent our ability to receive marketing approval or commercialize current and any future product candidates, including:

|

• |

delays in reaching a consensus with regulatory authorities on design or implementation of clinical trials; |

|

|

|

|

• |

regulators or institutional review boards, or IRBs (as defined herein), may not authorize us or its investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site; |

|

|

|

|

• |

delays in reaching agreement on acceptable terms with prospective clinical research organizations and clinical trial sites; |

- 6 -

|

• |

the number of patients required for clinical trials of our product candidates may be larger than we anticipate, enrollment in these clinical trials may be slower than we anticipate, patients may drop out of these clinical trials at a higher rate than we anticipate or fail to return for post-treatment follow-up or we may fail to recruit suitable patients to participate in a trial; |

|

|

|

|

• |

clinical trials of our product candidates may produce negative or inconclusive results; |

|

|

|

|

• |

imposition of a clinical hold by regulatory authorities as a result of a serious adverse event, concerns with a class of product candidates or after an inspection of our clinical trial operations, trial sites or manufacturing facilities; |

|

|

|

|

• |

occurrence of serious adverse events associated with the product candidate that are viewed to outweigh its potential benefits; |

|

|

|

|

• |

changes in regulatory requirements and guidance that require amending or submitting new clinical protocols; or |

|

|

|

|

• |

we may decide, or regulators may require us, to conduct additional clinical trials or abandon product development programs. |

Any inability to successfully complete preclinical and clinical development could result in additional costs to us or impair our ability to generate revenue. In addition, if we make manufacturing or formulation changes to our product candidates, we may need to conduct additional testing to bridge our modified product candidate to earlier versions. Clinical trial delays could also shorten any periods during which we may have the exclusive right to commercialize our product candidates, if approved, or allow competitors to bring competing drugs to market before us, which could impair our ability to successfully commercialize our product candidates and may harm our business, financial condition, results of operations and prospects.

Additionally, if the results of our clinical trials are inconclusive or if there are safety concerns or serious adverse events associated with product candidates, we may:

|

• |

be delayed in obtaining marketing approval, if at all; |

|

|

|

|

• |

obtain approval for indications or patient populations that are not as broad as intended or desired; |

|

|

|

|

• |

obtain approval with labeling that includes significant use or distribution restrictions or safety warnings; |

|

|

|

|

• |

be subject to additional post-marketing testing requirements; |

|

|

|

|

• |

be required to perform additional clinical trials to support approval or be subject to additional post-marketing testing requirements; |

|

|

|

|

• |

be subject to the addition of labeling statements, such as warnings or contraindications; |

|

|

|

|

• |

be sued; or |

|

|

|

|

• |

experience damage to its reputation. |

Our product development costs will also increase if we experience delays in testing or obtaining marketing approvals. We do not know whether any of our preclinical studies or clinical trials will begin as planned, need to be restructured or be completed on schedule, if at all.

Further, we, the FDA or an IRB may suspend our clinical trials at any time if it appears that we or our collaborators are failing to conduct a trial in accordance with regulatory requirements, such as the FDA's current GCP (as defined herein), that we are exposing participants to unacceptable health risks, or if the FDA finds deficiencies in our INDs (as defined herein), or in the conduct of these trials. Therefore, we cannot predict with any certainty the schedule for commencement and completion of future clinical trials. If we experience delays in the commencement or completion of our clinical trials, or if we terminate a clinical trial prior to completion, the commercial prospects of our product candidates could be negatively impacted, and our ability to generate revenues from our product candidates may be delayed.

- 7 -

Clinical trials are expensive, time consuming and difficult to design and implement, which could have a material adverse effect on our business, financial condition or results of operations.

Our product candidates will require clinical testing before we can submit an NDA (as defined herein) for regulatory approval. We cannot predict with any certainty if or when we might submit an NDA for regulatory approval for any of our product candidates or whether any such NDA will be approved by the FDA. Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. For instance, the FDA may not agree with our proposed endpoints for any future clinical trial of our product candidates, which may delay the commencement of our clinical trials. The clinical trial process is also time consuming. Furthermore, failure can occur at any stage, and we could encounter problems that cause us to abandon or repeat clinical trials, which could have a material adverse effect on our business, financial condition or results of operations.

We may not be successful in our efforts to identify, license or discover additional product candidates, which may have a material adverse effect on our business and could potentially cause us to cease operations.

Although a substantial amount of our effort will focus on the continued research and pre-clinical testing, potential approval and commercialization of our existing product candidates, the success of our business also depends in part upon our ability to identify, license or discover additional product candidates. Our research programs or licensing efforts may fail to yield additional product candidates for clinical development for a number of reasons, including but not limited to the following:

|

• |

our research or business development methodology or search criteria and process may be unsuccessful in identifying potential product candidates; |

|

• |

we may not be able or willing to assemble sufficient resources to acquire or discover additional product candidates; |

|

• |

our product candidates may not succeed in pre-clinical or clinical testing; |

|

• |

our product candidates may be shown to have harmful side effects or may have other characteristics that may make the products unmarketable or unlikely to receive marketing approval; |

|

• |

competitors may develop alternatives that render our product candidates obsolete or less attractive; |

|

• |

product candidates we develop may be covered by third parties' patents or other exclusive rights; |

|

• |

the market for a product candidate may change during our program so that such a product may become unreasonable to continue to develop; |

|

• |

a product candidate may not be capable of being produced in commercial quantities at an acceptable cost, or at all; and |

|

• |

a product candidate may not be accepted as safe and effective by patients, the medical community or third-party payors. |

If any of these events occurs, we may be forced to abandon our development efforts to identify, license or discover additional product candidates, which would have a material adverse effect on our business and could potentially cause us to cease operations. Research programs to identify new product candidates require substantial technical, financial and human resources. We may focus our efforts and resources on potential programs or product candidates that ultimately prove to be unsuccessful.

- 8 -

There is no assurance that we will turn a profit or generate immediate revenues.

There is no assurance as to whether we will be profitable, earn revenues, or pay dividends. We have incurred and anticipate that we will continue to incur substantial expenses relating to the development and initial operations of our business. The payment and amount of any future dividends will depend upon, among other things, our results of operations, cash flow, financial condition, and operating and capital requirements. There is no assurance that we pay any future dividends, if at all, and, if dividends are paid, there is no assurance with respect to the amount of any such dividends.

We have a going concern risk, which if we are unable to generative positive cash flows and/or obtain additional financing sufficient to fund continued activities and acquisitions, may materially adversely affect our financial condition and results of operations as well as our ability to continue operations.

Our continued operation as a going concern is dependent upon our ability to generate positive cash flows and/or obtain additional financing sufficient to fund continuing activities and acquisitions. While we continue to review our operations in order to identify strategies and tactics to increase revenue streams and financing opportunities, there is no assurance that we will be successful in such efforts; if we are not successful, we may be required to significantly reduce or limit operations, or no longer operate as a going concern. It is also possible that operating expenses could increase in order to grow the business. If we do not start generating and significantly increase revenues to meet these increased operating expenses and/or obtain financing until our revenues meet these operating expenses, our business, financial condition and operating results could be materially adversely affected. We cannot be sure when or if we will ever achieve profitability and, if we do, we may not be able to sustain or increase that profitability.

We may not be able to adequately protect and maintain our intellectual property and licenses, which could result in a material adverse effect to our business, financial condition and results of operations.

Our success will depend in part on our ability to protect and maintain our intellectual property rights and our licenses. No assurance can be given that the license or rights used by us will not be challenged, invalidated, infringed or circumvented, nor that the rights granted thereunder will provide competitive advantages to us. It is not clear whether the pending patent applications will result in the issuance of patents. There is no assurance that we will be able to enter into licensing arrangements, develop or obtain alternative technology in respect of patents issued to third parties that incidentally cover its production processes. Moreover, we could potentially incur substantial legal costs in defending legal actions which allege patent infringement or by instituting patent infringement suits against others. Our commercial success also depends on us not infringing patents or proprietary rights of others and not breaching any license granted to us. There can be no assurance that we will be able to maintain such licenses that we may require to conduct our business or that such licenses have been obtained at a reasonable cost. Furthermore, there can be no assurance that we will be able to remain in compliance with our licenses. Consequently, there may be a risk that such licenses may be withdrawn with no compensation or penalties to us.

Our inability to achieve timelines for publicly disclosed projects may result in material adverse effects on our business, financial condition and results of operations.

Our business is dependent on a number of key inputs and their related costs including raw materials and supplies related to our operations, as well as electricity, water and other utilities. Any significant interruption or negative change in the availability or economics of the supply chain for key inputs could materially impact the business, financial condition operating results, and timelines for our project development. Any inability to secure required supplies and services or to do so on appropriate terms could have a materially adverse impact on the business, financial condition, operating results, and timelines for our project development.

- 9 -

We may need additional capital for future operations and if we are not able to secure any required capital, we may be forced to curtail or discontinue our operations.

It is possible that costs associated with the operating our business will exceed our projections depending on the timing of future operating and capital expenses. Assuming our existing funds sustain our operations for next 12 months, we believe that we may thereafter require additional capital for additional product development, sales and marketing operations, other operating expenses and for general corporate purposes to fund growth in our Company's markets. We do not know how much additional funding we may require. We may therefore be required to seek other sources of financing in the future, which sources (assuming we are able to locate such alternative sources of financing) may be on terms less favorable to us than those of our previous securities offerings. Any additional equity financing may be dilutive to shareholders, and debt financing, if available, may involve restrictive covenants. If additional funds are raised through the issuance of equity securities, the percentage ownership of our shareholders will be reduced, shareholders may experience additional dilution in net book value per share, or such equity securities may have rights, preferences or privileges senior to those of the holders of the Common Shares. If adequate funds are not available on acceptable terms, we may be unable to develop or enhance our products and services, take advantage of future opportunities or respond to competitive pressures, any of which could have a material adverse effect on our business, financial condition and operating results, or we may be forced to curtail or cease our operations.

We may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

The risk of product liability is inherent in the research, development, manufacturing, marketing and use of pharmaceutical products. Product candidates and products that we may commercially market in the future may cause, or may appear to have caused, injury or dangerous drug reactions, and expose us to product liability claims. These claims might be made by patients who use the product, healthcare providers, pharmaceutical companies, corporate collaborators or others selling such products. If our product candidates during clinical trials were to cause adverse side effects, we may be exposed to substantial liabilities. Regardless of the merits or eventual outcome, product liability claims or other claims related to our product candidates may result in:

|

• |

decreased demand for our products due to negative public perception; |

|

|

|

|

• |

injury to our reputation; |

|

|

|

|

• |

withdrawal of clinical trial participants or difficulties in recruiting new trial participants; |

|

|

|

|

• |

initiation of investigations by regulators; |

|

|

|

|

• |

costs to defend or settle related litigation; |

|

|

|

|

• |

a diversion of management's time and resources; |

|

|

|

|

• |

substantial monetary awards to trial participants or patients; |

|

|

|

|

• |

product recalls, withdrawals or labeling, marketing or promotional restrictions; |

|

|

|

|

• |

loss of revenues from product sales; and |

|

|

|

|

• |

the inability to commercialize any of product candidates, if approved. |

We intend to obtain clinical trial insurance once a clinical trial is initiated. However, the insurance coverage may not be sufficient to reimburse us for any expenses or losses we may suffer. Insurance coverage is becoming increasingly expensive, and, in the future, we, or any of our collaborators, may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts or at all to protect against losses due to liability. Even if our agreements with any future collaborators entitle us to indemnification against product liability losses, such indemnification may not be available or adequate should any claim arise. Our inability to obtain sufficient product liability insurance at an acceptable cost to protect against product liability claims could prevent or inhibit the commercialization of our product candidates. If a successful product liability claim or a series of claims is brought against us for uninsured liabilities or in excess of insured liabilities, our assets may not be sufficient to cover such claims and our business operations could be impaired.

- 10 -

Should any of the events described above occur, this could have a material adverse effect on our business, financial condition and results of operations.

Health and safety issues related to our products may have a material adverse effect on our business and results of operations.

Health and safety issues related to our products may arise that could lead to litigation or other action against us or to regulation of certain of our product components. We may be required to modify our products and may also be required to pay damages that may reduce our profitability and adversely affect our financial condition. Even if these concerns prove to be baseless, the resulting negative publicity could affect our ability to market certain of our products and, in turn, could harm our business and results from operations.

We have international operations, which subjects us to risks inherent with operations outside of Canada.

We have international operations and may seek to obtain market approvals in foreign markets that we deem could generate significant opportunities. However, even with the cooperation of a commercialization partner, conducting drug development in foreign countries involves inherent risks, including, but not limited to: difficulties in staffing, funding and managing foreign operations; different and unexpected changes in regulatory requirements; export restrictions; tariffs and other trade barriers; different reimbursement systems; economic weaknesses or political instability in particular foreign economies and markets; compliance with tax, employment, immigration and labour laws for employees living or travelling abroad; supply chain and raw materials management; difficulties in protecting, acquiring, enforcing and litigating intellectual property rights; fluctuations in currency exchange rates; and potentially adverse tax consequences.

If we were to experience any of the difficulties listed above, or any other difficulties, our international development activities and our overall financial condition may suffer and cause it to reduce or discontinue our international development and market approval efforts.

Exchange rate fluctuations between the U.S. dollar and the Canadian dollar may negatively affect our earnings and cash flows.

Our functional currency is the Canadian dollar. We may incur expenses in Canadian Dollars and U.S. dollars. As a result, we are exposed to the risks that the Canadian dollar may devalue relative to the U.S. Dollar, or, if the Canadian dollar appreciates relative to the U.S. Dollar, that the inflation rate in Canada may exceed such rate of devaluation of the Canadian dollar, or that the timing of such devaluation may lag behind inflation in Canada. We cannot predict any future trends in the rate of inflation in Canada or the rate of devaluation, if any, of the Canadian dollar against the U.S. Dollar.

If patent laws or the interpretation of patent laws change, our competitors may be able to develop and commercialize our discoveries.

Important legal issues remain to be resolved as to the extent and scope of available patent protection for biopharmaceutical products and processes in Canada and other important markets outside Canada, such as Europe or the United States. As such, litigation or administrative proceedings may be necessary to determine the validity, scope and ownership of certain of ours and others' proprietary rights. Any such litigation or proceeding may result in a significant commitment of resources in the future and could force us to do one or more of the following: cease selling or using any of our future products that incorporate a challenged intellectual property, which would adversely affect our revenue; obtain a license or other rights from the holder of the intellectual property right alleged to have been infringed or otherwise violated, which license may not be available on reasonable terms, if at all; and redesign our future products to avoid infringing or violating the intellectual property rights of third parties, which may be time-consuming or impossible to do. In addition, changes in patent laws in Canada and other countries may result in allowing others to use our discoveries or develop and commercialize our products. We cannot provide assurance that the patents we obtain will afford us significant commercial protection.

- 11 -

We may not be able to enforce our intellectual property rights throughout the world. This risk is exacerbated because we expect that one or more of our product candidates will be manufactured and used in a number of foreign countries.

The laws of foreign countries may not protect intellectual property rights to the same extent as the laws of Canada. Many companies have encountered significant problems in protecting and defending intellectual property rights in certain foreign jurisdictions. This risk is exacerbated for us because we expect that future product candidates could be manufactured, and used in a number of foreign countries.

The legal systems of some countries, particularly developing countries, do not favor the enforcement of patents and other intellectual property protection, especially those relating to life sciences. This could make it difficult to stop the infringement or other misappropriation of our intellectual property rights. For example, several foreign countries have compulsory licensing laws under which a patent owner must grant licenses to third parties. In addition, some countries limit the enforceability of patents against third parties, including government agencies or government contractors. In these countries, patents and trade secrets may provide limited or no benefit.

Most jurisdictions in which we intend to apply for patents have patent protection laws similar to those of Canada, but some of them do not. For example, we may do business in the future in countries that may not provide the same or similar protection as that provided in Canada. Additionally, due to uncertainty in patent protection law, we have not filed applications in many countries where significant markets exist.

Proceedings to enforce patent rights in foreign jurisdictions could result in substantial costs and divert our efforts and attention from other aspects of our business. Accordingly, efforts to protect intellectual property rights in such countries may be inadequate. In addition, changes in the law and legal decisions by courts in Canada, the U.S., and foreign countries may affect our ability to obtain adequate protection for our technology and the enforcement of our intellectual property.

The lack of product for commercialization would have a material adverse effect on our business, financial condition and results of operations.

We cannot successfully develop, manufacture and distribute our products, or if we experience difficulties in the development process, such as capacity constraints, quality control problems or other disruptions, we may not be able to develop market-ready commercial products at acceptable costs, which would adversely affect our ability to effectively enter the market. A failure by us to achieve a low-cost structure through economies of scale or improvements in cultivation and manufacturing processes would have a material adverse effect on our commercialization plans and our business, prospects, results of operations and financial condition.

Failure to develop new and innovative products may have a material adverse effect on our business.

Our success will depend, in part, on our ability to develop, introduce and market new and innovative products. If there is a shift in consumer demand, we must meet such demand through new and innovative products or else our business will fail. Our ability to develop, market and produce new products is subject to us having substantial capital. There is no assurance that we will be able to develop new and innovative products or have the capital necessary to develop such products.

The lack of experience of our management in marketing, selling, and distributing products may have a material adverse effect on our business and financial condition.

Our management's lack of experience in marketing, selling, and distributing our products could lead to poor decision-making, which could result in cost-overruns and/or the inability to produce the desired products. Although our management intends to hire experienced and qualified staff, this inexperience could also result in our inability to consummate revenue contracts or any contracts at all. Any combination of the aforementioned may result in the failure of our business and a loss of investment.

-12 -

The size of our target market is difficult to quantify, and investors will be reliant on their own estimates on the accuracy of market data.

Because the industry in which we operate is in a nascent stage with uncertain boundaries, there is a lack of information about comparable companies available for potential investors to review in deciding whether to invest in us and, few, if any, established companies whose business model we can follow or upon whose success we can build. Accordingly, investors will have to rely on their own estimates in deciding about whether to invest in us. There can be no assurance that our estimates are accurate or that the market size is sufficiently large for our business to grow as projected, which may negatively impact our financial results.

You may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. federal courts may be limited because we are incorporated under the laws of the Province of British Columbia, a substantial portion of our assets are in Canada and some of our executive officers and directors reside outside the United States

We are organized pursuant to the laws of the Province of British Columbia under the Business Corporations Act (British Columbia) (the "BCBCA"). Two of our four officers, our auditor and all but two directors reside outside the United States. In addition, a substantial portion of their assets and our assets are located outside of the United States. As a result, you may have difficulty serving legal process within the United States upon us or any of these persons. You may also have difficulty enforcing, both in and outside of the United States, judgments you may obtain in U.S. courts against us or these persons in any action, including actions based upon the civil liability provisions of U.S. federal or state securities laws. Furthermore, there is substantial doubt as to the enforceability in Canada against us or against any of our directors, officers and the expert named in this Annual Report who are not residents of the United States, in original actions or in actions for enforcement of judgments of U.S. courts, of liabilities based solely upon the civil liability provisions of the U.S. federal securities laws. In addition, shareholders in British Columbia companies may not have standing to initiate a shareholder derivative action in U.S. federal courts. As a result, our public shareholders may have more difficulty in protecting their interests through actions against us, our management, our directors or our major shareholders than would shareholders of a corporation incorporated in a jurisdiction in the United States.

We continue to sell shares for cash to fund operations, capital expansion, mergers and acquisitions that will dilute our current shareholders.

There is no guarantee that we will be able to achieve our business objectives. Our continued development will require additional financing. The failure to raise such capital could result in the delay or indefinite postponement of current business objectives or us going out of business. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable to us.

If additional funds are raised through issuances of equity or convertible debt securities, existing shareholders could suffer significant dilution. Our articles permit the issuance of an unlimited number of Common Shares, and shareholders will have no pre-emptive rights in connection with such further issuance. Our directors have discretion to determine the price and the terms of issue of further issuances. In addition, from time to time, we may enter into transactions to acquire assets or the shares of other companies. These transactions may be financed wholly or partially with debt, which may temporarily increase our debt levels above industry standards. Any debt financing secured in the future could involve restrictive covenants relating to capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may require additional financing to fund our operations to the point where it is generating positive cash flows. Negative cash flow may restrict our ability to pursue our business objectives.

If you purchase our Common Shares in an offering, you will experience substantial and immediate dilution, because the price that you pay may be substantially greater than the net tangible book value per share of our Common Shares that you acquire. This dilution is due in large part to the fact that our earlier investors will most likely have paid substantially less than the offering price which you may pay if you purchase our Common Shares.

- 13 -

Our officers and directors may be engaged in a range of business activities resulting in conflicts of interest, which may have a material adverse effect on our operations.

We may be subject to various potential conflicts of interest because some of our officers and directors may be engaged in a range of business activities. In addition, our executive officers and directors may devote time to their outside business interests, so long as such activities do not materially or adversely interfere with their duties to us. In some cases, our executive officers and directors may have fiduciary obligations associated with these business interests that interfere with their ability to devote time to our business and affairs and that could adversely affect our operations. These business interests could require significant time and attention of our executive officers and directors.

In addition, we may become involved in other transactions which conflict with the interests of our directors and officers who may from time to time deal with persons, firms, institutions or companies with which we may be dealing, or which may be seeking investments similar to those desired by us. The interests of these persons could conflict with ours. In addition, from time to time, these persons may be competing with us for available investment opportunities. Conflicts of interest, if any, will be subject to the procedures and remedies provided under applicable laws. In particular, if such a conflict of interest arises at a meeting of our directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In accordance with applicable laws, our directors are required to act honestly, in good faith and in our best interests.

In certain circumstances, our reputation could be damaged, which may have a material adverse effect on our financial performance, financial condition, cash flows and growth prospects.

Damage to our reputation can be the result of the actual or perceived occurrence of any number of events, and could include any negative publicity, whether true or not. The increased usage of social media and other web-based tools used to generate, publish and discuss user-generated content and to connect with other users has made it increasingly easier for individuals and groups to communicate and share opinions and views regarding us and our activities, whether true or not. Although we believe that we operate in a manner that is respectful to all stakeholders and that we take care in protecting our image and reputation, we do not ultimately have direct control over how we are perceived by others. Reputation loss may result in decreased investor confidence, increased challenges in developing and maintaining community relations and an impediment to our overall ability to advance our projects, thereby having a material adverse impact on financial performance, financial condition, cash flows and growth prospects.

We have negative operating cash flow.

Our business has incurred losses since its inception. Although we expect to become profitable, there is no guarantee that will happen, and we may never become profitable. We currently have a negative operating cash flow and may continue to have a negative operating cash flow for the foreseeable future. To date, we have not generated any revenues and a large portion of our expenses are fixed, including expenses related to facilities, equipment, contractual commitments and personnel. As a result, we expect our net losses from operations to improve. Our ability to generate additional revenues and potential to become profitable will depend largely on our ability to manufacture and market our products and services. There can be no assurance that any such events will occur or that the Company will ever become profitable. Even if we do achieve profitability, we cannot predict the level of such profitability. If we sustain losses over an extended period of time, we may be unable to continue our business.

Our forward-looking statements may prove to be inaccurate.

Investors should not place undue reliance on forward-looking statements. By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties, of both general and specific nature, that could cause actual results to differ materially from those suggested by the forward-looking statements or contribute to the possibility that predictions, forecasts or projections will prove to be materially inaccurate. Additional information on the risks, assumptions and uncertainties can be found in this Annual Report under the heading "Forward-Looking Statements".

- 14 -

If we have a material weakness in our internal controls over financial reporting, investors could lose confidence in the reliability of our financial statements, which could result in a decrease in the value of its securities.

One or more material weaknesses in our internal controls over financial reporting could occur or be identified in the future. In addition, because of inherent limitations, our internal controls over financial reporting may not prevent or detect misstatements, and any projections of any evaluation of effectiveness of internal controls to future periods are subject to the risk that controls may become inadequate because of changes in conditions or that the degree of compliance with our policies or procedures may deteriorate. If we fail to maintain the adequacy of our internal controls, including any failure or difficulty in implementing required new or improved controls, our business and results of operations could be harmed, we may not be able to provide reasonable assurance as to our financial results or meet our reporting obligations and there could be a material adverse effect on the price of our securities.

Difficulties with forecasts.

We must rely largely on our own market research to forecast sales as detailed forecasts are not generally obtainable from other sources at this early stage of the biotechnology industry dedicated to the discovery of serotonergic therapeutics. A failure in the demand for its products and services to materialize as a result of competition, technological change or other factors could have a material adverse effect on our business, results of operations and financial condition.

COVID-19 may materially and adversely affect our business and financial results.

Our business could be materially and adversely affected by health epidemics in regions where we conduct research and development activities.

In December 2019, a novel strain of COVID-19 was reported in China. Since then, COVID-19 has spread globally. On March 11, 2020, the World Health Organization (WHO) declared the outbreak of COVID-19 as a "pandemic", or a worldwide spread of a new disease. Many countries around the world, including Canada, the United States and most countries in Europe, have imposed quarantines and restrictions on travel and mass gatherings to slow the spread of the virus, and have closed non-essential businesses.

The COVID-19 pandemic and any other health epidemics have the potential to cause significant disruption in the operations of the laboratories upon whom we rely, including laboratories situated in various parts of the United States and Europe. We are reliant on the continued operations of such laboratories. The regulations imposed by governments in response to the COVID-19 pandemic may cause laboratories to operate at limited occupancy rates, which may slow the rate at which research and development activities can be conducted. We may not have control over the protocols adopted in response to the COVID-19 pandemic by such laboratories in response to the regulations imposed by the governments in the regions in which they operate. The effects of such protocols and/or regulations may negatively impact productivity, disrupt our business and delay our research and development timelines, as well as potentially impact our financial condition and result of operations. The magnitude of these potential effects is uncertain and will depend, in part, on the length and severity of the COVID-19 pandemic and the restrictions imposed by governments in response.

To the knowledge of our management as of the date hereof, COVID-19 does not present, at this time, any specific known impacts to us in relation to our timelines, business objectives or disclosed milestones related thereto. We rely on third parties to process and manufacture our products.

Risks Related to Our Common Shares

Our executive officers and directors beneficially own approximately 42.66% of our common shares.

As of December 23, 2021, our executive officers and directors beneficially own, in the aggregate, approximately 42.66% of our common shares, which includes shares that our executive officers and directors have the right to acquire pursuant to warrants and stock options which have vested. As a result, they are able to exercise a significant level of control over all matters requiring shareholder approval, including the election of directors, amendments to our Articles and approval of significant corporate transactions. This control could have the effect of delaying or preventing a change of control of our Company or changes in management and will make the approval of certain transactions difficult or impossible without the support of these shareholders.

- 15 -

The continued sale of our equity securities will dilute the ownership percentage of our existing shareholders and may decrease the market price for our common shares.

Our Notice of Articles authorizes the issuance of an unlimited number of Common Shares. Our Board of Directors has the authority to issue additional shares of our capital stock to provide additional financing in the future. The issuance of any such Common Shares may result in a reduction of the book value or market price of our outstanding Common Shares. Given our lack of revenues, we will likely have to issue additional equity securities to obtain working capital we require in the future. Our efforts to fund our intended business plans will therefore result in dilution to our existing shareholders. If we do issue any such additional Common Shares, such issuance also will cause a reduction in the proportionate ownership and voting power of all other shareholders. As a result of such dilution, if you acquire Common Shares your proportionate ownership interest and voting power could be decreased. Furthermore, any such issuances could result in a change of control or a reduction in the market price for our Common Shares.

Additionally, we had 1,025,807 stock options and 3,961,704 warrants outstanding as of December 23, 2021. The exercise price of some of these options and warrants is below our current market price, and you could purchase shares in the market at a price in excess of the exercise price of our outstanding warrants or options. If the holders of these options and warrants elect to exercise them, your ownership position will be diluted and the per share value of the Common Shares you have or acquire could be diluted as well. As a result, the market value of our Common Shares could significantly decrease as well.

The market price of our Common Shares may be volatile and may fluctuate in a way that is disproportionate to our operating performance.

Securities of companies with a small market capitalization have experienced substantial volatility in the past, often based on factors unrelated to the companies' financial performance or prospects. These factors include macroeconomic developments in North America and globally, as well as market perceptions of the attractiveness of particular industries. Factors unrelated to the Company's performance that may affect the price of the Common Shares include the following: the extent of analytical coverage available to investors concerning our business may be limited if investment banks with research capabilities do not follow us; lessening in trading volume and general market interest in the Common Shares may affect an investor's ability to trade significant numbers of Common Shares; the size of our public float may limit the ability of some institutions to invest in Common Shares; and a substantial decline in the price of the Common Shares that persists for a significant period of time could cause the Common Shares, if listed on an exchange, to be delisted from such exchange, further reducing market liquidity. As a result of any of these factors, the market price of the Common Shares at any given point in time may not accurately reflect our long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. We may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management's attention and resources.

The market price of the Common Shares is affected by many other variables which are not directly related to our success and are, therefore, not within our control. These include other developments that affect the breadth of the public market for the Common Shares, the release or expiration of lock-up or other transfer restrictions on the Common Shares, and the attractiveness of alternative investments. The effect of these and other factors on the market price of the Common Shares is expected to make the Common Share price volatile in the future, which may result in losses to investors.

Our stock price is expected to be volatile and will be drastically affected by governmental and regulatory regimes and other factors outside of our control. We cannot fully predict the results of our operations expected to take place in the future. The results of these activities will inevitably affect our decisions related to future operations and will likely trigger major changes in the trading price of the Company shares.

- 16 -

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make a gain on your investment.

We have never paid any cash or stock dividends and we do not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding in the future, our funding sources may prohibit the payment of any dividends. Because we do not intend to declare dividends, any gain on your investment will need to result from an appreciation in the price of our Common Shares. There will therefore be fewer ways in which you are able to make a gain on your investment.

FINRA sales practice requirements may limit your ability to buy and sell our Common Shares, which could depress the price of our shares.

Financial Industry Regulation Authority ("FINRA") rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements may make it more difficult for broker-dealers to recommend that their customers buy our Common Shares, which may limit your ability to buy and sell our Common Shares, have an adverse effect on the market for our Common Shares and, thereby, depress their market prices.

Our Common Shares have been thinly traded, and you may be unable to sell at or near ask prices or at all if you need to sell your Common Shares to raise money or otherwise desire to liquidate your shares.

From February 8, 2021, our Common Shares have been trading on the Canadian Securities Exchange where they are "thinly-traded", meaning that the number of persons interested in purchasing our Common Shares at or near bid prices at any given time was relatively small or non-existent. This could be due to a number of factors, including that we are relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and might be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our Common Shares until such time as we became more seasoned. As a consequence, there may be periods of several days or more when trading activity in our common shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. Broad or active public trading market for our Common Shares may not develop or be sustained.

We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies.

We are a foreign private issuer within the meaning of the rules under the Exchange Act. As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

|

• |

we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

|

|

|

|

• |

for interim reporting we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

|

• |

we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

|

|

|

|

• |

we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

- 17 -

|

• |

we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and |

|

• |

we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any "short-swing" trading transaction. |

Our shareholders may not have access to certain information they may deem important and are accustomed to receive from U.S. reporting companies.

As an "emerging growth company" under applicable law, we will be subject to lessened disclosure requirements. Such reduced disclosure may make our common shares less attractive to investors.

For as long as we remain an "emerging growth company", as defined in the JOBS Act, we will elect to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" and including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports, exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. Because of these lessened regulatory requirements, our shareholders would be left without information or rights available to shareholders of more mature companies. If some investors find our Common Shares less attractive as a result, there may be a less active trading market for such securities and their market prices may be more volatile.

We incur significant costs as a result of being a public company, which costs will grow after we cease to qualify as an "emerging growth company."

We incur significant legal, accounting and other expenses as a public company that we did not incur as a private company. The Sarbanes-Oxley Act, as well as rules subsequently implemented by the SEC and Nasdaq, impose various requirements on the corporate governance practices of public companies. We are an "emerging growth company", as defined in the JOBS Act, and will remain an emerging growth company until the earlier of : (1) the last day of the fiscal year (a) following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the U.S. Securities Act, (b) in which we have total annual gross revenue of at least US$1.07 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common shares that is held by non-affiliates exceeds US$700 million as of the prior June 30th; and (2) the date on which we have issued more than US$1.0 billion in non-convertible debt during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act in the assessment of the emerging growth company's internal control over financial reporting and permission to delay adopting new or revised accounting standards until such time as those standards apply to private companies.

Compliance with these rules and regulations increases our legal and financial compliance costs and makes some corporate activities more time-consuming and costlier. After we are no longer an emerging growth company, we expect to incur significant expenses and devote substantial management effort toward ensuring compliance with the requirements of Section 404 and the other rules and regulations of the SEC. For example, as a public company, we have been required to increase the number of independent directors and adopt policies regarding internal controls and disclosure controls and procedures. We have incurred additional costs in obtaining director and officer liability insurance. In addition, we incur additional costs associated with our public company reporting requirements. It may also be more difficult for us to find qualified persons to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these rules and regulations, and we cannot predict or estimate with any degree of certainty the amount of additional costs we may incur or the timing of such costs.

- 18 -

Summary

We were incorporated on May 31, 2019, under the laws of the Province of British Columbia, Canada, under the name "1210954 B.C. Ltd." On March 6, 2020, we changed our name to "Bright Minds Biosciences Inc."

Our head office is located at 19 Vestry Street, New York, NY 10013.

Additional information related us is available on SEDAR at www.sedar.com and on our website at https://brightmindsbio.com/. We do not incorporate the contents of our website or of www.sedar.com into this Annual Report. Information on our website does not constitute part of this Annual Report. In addition, the U.S. Securities and Exchange Commission (the "SEC") maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC which can be viewed as www.sec.gov.

Our registered and records office is located at Suite 1500, 1055 West Georgia Street, P.O. Box 11117, Vancouver, British Columbia, Canada, V6E 4N7.

A. History and development of the Company

We are a biotechnology company dedicated to developing therapeutics to improve the lives of patients with severe and life-altering diseases, which was incorporated on May 31, 2019 under the laws of British Columbia, Canada.

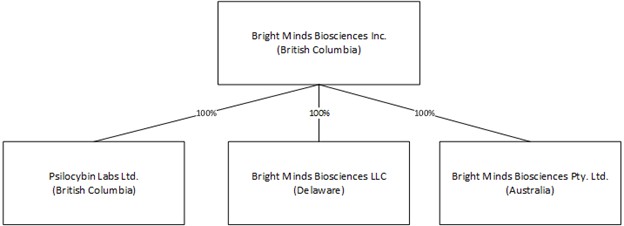

We have three subsidiaries: PsilocybinLabs Ltd., a company incorporated under the laws of British Columbia, Canada, Bright Minds Biosciences LLC, a limited liability company formed pursuant to the laws of Delaware, and Bright Minds Bioscience Pty. Ltd., a company formed pursuant to the laws of Australia.

B. Business Overview

Overview

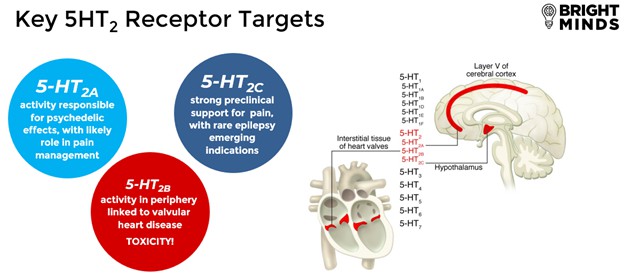

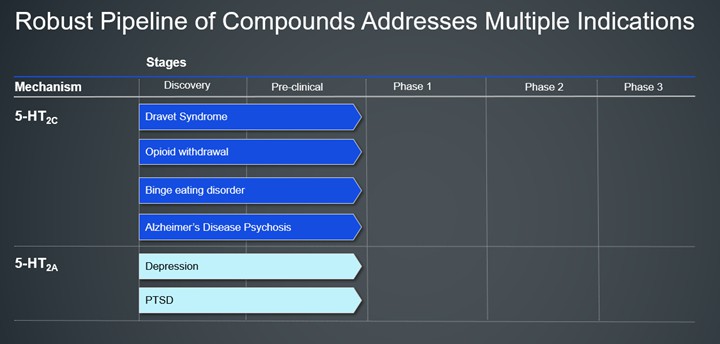

Bright Minds is a biotechnology company dedicated to developing therapeutics to improve the lives of patients with severe and life-altering diseases. Bright Minds is creating new chemical entities as targeted therapeutic agents for treatment of disorders where a serotonin (5-HT) receptor (either 5-HT2A, 5-HT2C or 5-HT2A/C) driven mechanism is the underlying pathology. These targeted neurocircuit disorders include neuropsychiatric, neurodegenerative, neuroinflammatory, and pain disorders. Examples of these diseases include 5-HT2C disorders like pediatric epilepsies (Dravet syndrome, Lennox-Gastaut syndrome, and Tuberous Sclerosis Complex), Alzheimer’s disease psychosis and dementia related psychosis tobacco, opiate, and cocaine addiction, binge eating disorder, alcoholism, 5-HT2A receptor disorders like depression, post-traumatic stress disorder (PTSD), and 5-HT2A/C neuropathic pain syndromes including cluster headaches, and chemotherapy induced peripheral neuropathy.

By leveraging the extensive drug discovery experience of the Bright Minds team, the Company continues to create a pipeline of 5-HT agonists with designer drug characteristics. The Bright Minds compounds are also biased agonists designed to have less receptor desensitization and tolerance to drug effects. The Company's goal is to develop molecules that achieve selectivity for specific 5-HT2A and 5-HT2C receptor subtypes, while avoiding the valvulopathy related to 5-HT2B receptor agonist activity.

- 19 -

Principal Products