ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

PA |

||

(Address of principal executive offices) |

(Zip Code) | |

Title of each class |

Trading Symbol |

Name of each exchange on which registered | ||

| Large Accelerated Filer | ☐ | ☒ | ||||

Non-accelerated filer |

☐ | Smaller Reporting Company | ||||

| Emerging Growth Company | ||||||

Page |

||||||||

1 |

||||||||

ITEM 1. |

1 |

|||||||

ITEM 1A. |

19 |

|||||||

ITEM 1B. |

47 |

|||||||

ITEM 2. |

47 |

|||||||

ITEM 3. |

47 |

|||||||

ITEM 4. |

47 |

|||||||

48 |

||||||||

ITEM 5. |

48 |

|||||||

ITEM 6. |

50 |

|||||||

ITEM 7. |

50 |

|||||||

ITEM 7A. |

68 |

|||||||

ITEM 8. |

70 |

|||||||

ITEM 9. |

103 |

|||||||

ITEM 9A. |

103 |

|||||||

ITEM 9B. |

104 |

|||||||

ITEM 9C. |

104 |

|||||||

104 |

||||||||

ITEM 10. |

104 |

|||||||

ITEM 11. |

105 |

|||||||

ITEM 12. |

105 |

|||||||

ITEM 13. |

106 |

|||||||

ITEM 14. |

106 |

|||||||

106 |

||||||||

ITEM 15. |

106 |

|||||||

ITEM 16. |

109 |

|||||||

| • | “ ADG |

| • | “ CARB |

| • | “ CNG |

| • | “ CI |

| • | “ CWCs |

| • | “ D3 |

| • | “ D5 |

| • | “ EHS |

| • | “ EIA |

| • | “ EPA |

| • | “ Environmental Attributes |

| • | “ FERC |

| • | “ GHG |

| • | “ JSE |

| • | “ LCFS |

| • | “ LFG |

| • | “ LNG |

| • | “ PPAs |

| • | “ RECs |

| • | “ Renewable Electricity |

| • | “ RFS |

| • | “ RINs |

| • | “ RNG |

| • | “ RPS |

| • | “ RVOs |

| • | “ WRRFs |

| • | the impact of the ongoing COVID-19 pandemic on our business, financial condition and results of operations; |

| • | our ability to develop and operate new renewable energy projects, including with livestock farms; |

| • | reduction or elimination of government economic incentives to the renewable energy market; |

| • | delays in acquisition, financing, construction and development of new projects, including expansion plans into new areas such as agricultural waste; |

| • | disruptions in our supply chain due to transportation delays, travel restrictions, raw material cost increases and shortages, closures of businesses or facilities, and the associated costs and inflation related thereto; |

| • | the length of development and optimization cycles for new projects, including the design and construction processes for our renewable energy projects; |

| • | dependence on third parties for the manufacture of products and services; |

| • | the quantity, quality and consistency of our feedstock volumes from both landfill and livestock farm operations; |

| • | identifying suitable locations for new projects; |

| • | reliance on interconnections to distribution and transmission products for our Renewable Natural Gas and Renewable Electricity Generation segments; |

| • | our projects not producing expected levels of output; |

| • | the anticipated benefits of the Pico feedstock amendment and the Montauk Ag project in North Carolina and the anticipated completion of engine repairs and resumption of operations at the Security facility; |

| • | resolution of gas collection issues at the McCarty facility; |

| • | concentration of revenues from a small number of customers and projects; |

| • | dependence on our landfill operators; |

| • | our outstanding indebtedness and restrictions under our credit facility; |

| • | our ability to extend our fuel supply agreements prior to expiration; |

| • | our ability to meet milestone requirements under our PPAs; |

| • | existing regulations and changes to regulations and policies that effect our operations; |

| • | decline in public acceptance and support of renewable energy development and projects; |

| • | our expectations regarding Environmental Attributes; |

| • | our expectations regarding Environmental Attribute and commodity prices; |

| • | our expectations regarding the period during which we qualify as an emerging growth company under the Jumpstart Our Business Startup Act (“JOBS Act”); |

| • | our expectations regarding future capital expenditures, including for the maintenance of facilities; |

| • | our expectations regarding the use of net operating losses before expiration; |

| • | our expectations regarding more attractive CI scores by regulatory agencies for our livestock farm projects; |

| • | market volatility and fluctuations in commodity prices and the market prices of Environmental Attributes and the impact of any related hedging activity; |

| • | regulatory changes in federal, state and international environmental attribute programs; |

| • | profitability of our planned livestock farm projects; |

| • | sustained demand for renewable energy; |

| • | security threats, including cyber-security attacks; |

| • | the need to obtain and maintain regulatory permits, approvals and consents; |

| • | potential liabilities from contamination and environmental conditions; |

| • | potential exposure to costs and liabilities due to extensive environmental, health and safety laws; |

| • | impacts of climate change, changing weather patterns and conditions, and natural disasters; |

| • | failure of our information technology and data security systems; |

| • | increased competition in our markets; |

| • | continuing to keep up with technology innovations; |

| • | concentrated stock ownership by a few stockholders and related control over the outcome of all matters subject to a stockholder vote; and |

| • | the other risks and uncertainties detailed in the section titled “Risk Factors.” |

| • | Public health threats or outbreaks of communicable diseases could have a material effect on our operations and financial results. |

| • | Our renewable energy projects may not generate expected levels of output. |

| • | The concentration in revenues from five of our projects and geographic concentration of our projects expose us to greater risks of production interruptions from severe weather or other interruptions of production or transmission. |

| • | Our use and enjoyment of real property rights for our projects may be adversely affected by the rights of lienholders and leaseholders that are superior to those of the grantors of those real property rights to our projects. |

| • | Our projects are not able to insure against all potential risks and may become subject to higher insurance premiums. |

| • | We may face intense competition and may not be able to successfully compete. |

| • | Technological innovation may render us uncompetitive or our processes obsolete. |

| • | We may not be able to obtain long-term contracts for the sale of power produced by our projects on favorable terms and we may not meet certain milestones and other performance criteria under existing PPAs. |

| • | Our commercial success depends on our ability to identify, acquire, develop and operate individual renewable energy projects, as well as our ability to maintain and expand production at our current projects. |

| • | If there is insufficient demand for renewable energy, or if renewable energy projects do not develop or take longer to develop than we anticipate, we may be unable to achieve our investment objectives. |

| • | Acquisition, financing, construction and development of new projects and project expansions and conversions may not commence on anticipated timelines or at all. |

| • | Our fuel supply agreements with site hosts have defined contractual periods, and we cannot assure you that we will be able to successfully extend these agreements. |

| • | Our PPAs, fuel-supply agreements, RNG off-take agreements and other agreements contain complex price adjustments, calculations and other terms based on gas price indices and other metrics, the interpretation of which could result in disputes with counterparties that could affect our results of operations and customer relationships. |

| • | In order to secure contracts for new projects, we typically face a long and variable development cycle that requires significant resource commitments and a long lead time before we realize revenues. |

| • | We plan to expand our business in part through developing RNG recovery projects at landfills and livestock farms, but we may not be able to identify suitable locations or complete development of new projects. |

| • | Our dairy farm project has, and any future digester project will have, different economic models and risk profiles than our landfill facilities, and we may not be able to achieve the operating results we expect from these projects. |

| • | While we currently focus on converting methane into renewable energy, in the future we may decide to expand our strategy to include other types of projects. Any future energy projects may present unforeseen challenges and result in a competitive disadvantage relative to our more established competitors. |

| • | Any future acquisitions, investments or other strategic relationships that we make could disrupt our business, cause dilution to our stockholders or harm our business, financial condition or operating results. |

| • | Our revenues may be subject to the risk of fluctuations in commodity prices and pricing volatility of Environmental Attributes. |

| • | We are exposed to the risk of failing to meet our contractual commitments to sell RINs from our production. |

| • | We may be unable obtain, modify, or maintain the regulatory permits, approvals and consents required to construct and operate our projects. |

| • | Negative attitudes toward renewable energy projects from the U.S. government, other lawmakers and regulators, and activists could adversely affect our business, financial condition and results of operations. |

| • | Revenue from any projects we complete may be adversely affected if there is a decline in public acceptance or support of renewable energy, or regulatory agencies, local communities, or other third parties delay, prevent, or increase the cost of constructing and operating our projects. |

| • | Existing regulations and policies, and future changes to these regulations and policies, may present technical, regulatory and economic barriers to the generation, purchase and use of renewable energy, and may adversely affect the market for credits associated with the production of renewable energy. |

| • | Our business is subject to the risk of climate change and extreme or changing weather patterns. |

| • | Our business could be negatively affected by security threats, including cybersecurity threats and other information technology-related disruptions. |

| • | Failure of third parties to manufacture quality products or provide reliable services in a timely manner could cause delays in developing and operating our projects, which could damage our reputation, adversely affect our partner relationships or adversely affect our growth. |

| • | Our projects rely on interconnections to distribution and transmission facilities that are owned and operated by third parties, and as a result, are exposed to interconnection and transmission facility development and curtailment risks. |

| • | We are dependent upon our relationships with Waste Management and Republic Services for the operation and maintenance of landfills on which several of our RNG and Renewable Electricity projects operate. |

| • | We have significant customer concentration, with a limited number of customers accounting for a substantial portion of our revenues. |

| • | Our fuel supply agreements with site hosts have defined contractual periods, and we cannot assure you that we will be able to successfully extend these agreements. |

| • | Our senior credit facility contains financial and operating restrictions that may limit our business activities and our access to credit. |

| • | We may be required to write-off or impair capitalized costs or intangible assets in the future or we may incur restructuring costs or other charges, each of which would harm our earnings. |

| • | Our ability to use our U.S. net operating loss carryforwards to offset future taxable income may be subject to certain limitations. |

| • | We also face risks related to our common stock, being a controlled company, being an emerging growth company, and risks generally applicable to publicly-traded companies. |

ITEM 1. |

BUSINESS. |

| • | In May 2021, Montauk acquired a privately-held entity in North Carolina through a newly formed wholly-owned subsidiary, Montauk Ag Renewables, LLC (“Montauk Ag”), and its associated technologies and assets (the “Asset Acquisition”). We subsequently secured U.S. patent protection on certain related technology. |

| • | We believe the technology acquired from the Montauk Ag Renewables acquisition opens new feedstock opportunities in the agricultural sector for the development of additional RNG projects nationwide. |

| • | We continued to optimize our existing assets and project portfolio to maximize our return on those investments. |

| • | Montauk continues to evaluate the conversion of electricity projects to RNG, which have higher economic value. |

| • | We enhanced our focus on monetizing value-added service offerings to third parties, leveraging Montauk’s expertise in operating renewable energy projects. |

Renewable Electricity Generation | ||||||

Site |

COD (1) |

Capacity (MW) |

Source | |||

| Bowerman Irvine, CA |

2016 | 23.6 | Landfill | |||

| Security Houston, TX |

2003 | 3.4 | Landfill | |||

| AEL Sand Spring, OK |

2013 | 3.2 | Landfill | |||

| Total Capacity (MW) |

30.2 | |||||

| Renewable Natural Gas | ||||||

Site |

COD(1) |

Capacity (MMBtu/ day) (2) |

Source | |||

| Rumpke Cincinnati, OH |

1986 | 7,271 | Landfill | |||

| Atascocita Humble, TX |

2002*/ 2018 | 5,570 | Landfill | |||

| McCarty Houston, TX |

1986 | 4,415 | Landfill | |||

| Apex Amsterdam, OH |

2018 | 2,673 | Landfill | |||

| Monroeville Monroeville, PA |

2004 | 2,372 | Landfill | |||

| Valley Harrison City, PA |

2004 | 2,372 | Landfill | |||

| Galveston Galveston, TX |

2019 | 1,857 | Landfill | |||

| Raeger Johnston, PA |

2006 | 1,857 | Landfill | |||

| Shade Cairnbrook, PA |

2007 | 1,857 | Landfill (3) | |||

| Coastal Plains Alvin, TX |

2020 | 1,775 | Landfill | |||

| Southern Davidsville, PA |

2007 | 928 | Landfill | |||

| Pico Jerome, ID |

2020 | 903 | Livestock (Dairy) | |||

| Total Capacity (MMBtu/day) |

33,850 | |||||

|

= Renewable Natural Gas Project | |

|

= Renewable Electricity Project |

| (1) | “COD” refers to the commercial operation date of each site. |

| (2) | This is equivalent to the project’s design capacity and assumes inlet methane content of 56% for all sites other than Pico, which assumes inlet methane content of 62%, and process efficiency of 91%. |

| (3) | All of our landfill sites are accepting waste except our Shade site. Our Shade site is closed to accepting new waste, but is currently expected to continue to generate a commercial level of RNG for an additional ten years. Our operating RNG projects have an average expected remaining useful life of approximately 19 years. |

| Site |

Location |

Capacity* | ||

| Rumpke | Cincinnati, OH | 7,271 MMBtu/day | ||

| Atascocita | Humble, TX | 5,570 MMBtu/day | ||

| McCarty | Houston, TX | 4,415 MMBtu/day | ||

| Apex | Amsterdam, OH | 2,673 MMBtu/day | ||

| Monroeville | Monroeville, PA | 2,372 MMBtu/day | ||

| Valley | Harrison City, PA | 2,372 MMBtu/day | ||

| Galveston | Galveston, TX | 1,857 MMBtu/day | ||

| Raeger Mountain | Johnstown, PA | 1,857 MMBtu/day | ||

| Shade | Cairnbrook, PA | 1,857 MMBtu/day | ||

| Coastal Plains | Alvin, TX | 1,775 MMBtu/day | ||

| Southern | Davidsville, PA | 928 MMBtu/day | ||

| Pico | Jerome, ID | 903 MMBtu/day | ||

| Total | 33,850 MMBtu/day | |||

| * | Assumes inlet methane content of 56% for all sites other than Pico, which assumes inlet methane content of 62%, and process efficiency of 91%. |

| Site |

Location |

Capacity(1) | ||

| Bowerman Power | Irvine, CA | 23.6 MW | ||

| Security | Cleveland, TX | 3.4 MW | ||

| Tulsa/AEL | Sand Springs, OK | 3.2 MW | ||

| Pico(2) | Jerome, ID | 2.3 MW | ||

| Total | 32.5 MW | |||

| (1) | Assumes inlet methane content of 56% and process efficiency of 91%, |

| (2) | Beginning in October 2020, we began reporting the result of operations of Pico within RNG, but Pico continues to generate Renewable Electricity. |

| Fuel Supply Agreement Expiration Dates |

Current Sites as of December 31, 2021 |

% of 2021 Total RNG Production |

||||||

| Within 0-5 years |

3 | 6.7 | % | |||||

| Between 6-15 years |

0 | 0 | % | |||||

| Greater than 15 years |

9 | 93.3 | % | |||||

| Fuel Supply Agreement Expiration Dates |

Current Sites as of December 31, 2021 |

% of 2021 Total Renewable Electricity Production |

||||||

| Within 0-5 years |

1 | 0 | % | |||||

| Between 6-15 years |

0 | 0 | % | |||||

| Greater than 15 years(1) |

2 | 100.0 | % | |||||

| (1) | Our Pico project continues to generate both RNG and Renewable Electricity and is accounted for above in the RNG Projects summary. |

| • | Staggered employee shifts to increase social distancing; |

| • | Enhanced disinfecting and cleaning regimes; |

| • | Deployed hands-free temperature screening devices; |

| • | Required facial coverings consistent with applicable public health requirements; |

| • | Quarantined and contact traced employees; |

| • | Implemented work-from-home flexibility for applicable employees; and |

| • | Strongly encouraged all our employees to become fully vaccinated against COVID-19. |

| Name |

Age |

Position | ||||

| Sean F. McClain |

47 | President and Chief Executive Officer, Director | ||||

| Kevin A. Van Asdalan |

44 | Chief Financial Officer and Treasurer | ||||

| James A. Shaw |

50 | Vice President of Operations | ||||

| Scott Hill |

55 | Vice President of Business Development | ||||

| John Ciroli |

51 | Vice President, General Counsel and Secretary | ||||

| Sharon Frank |

65 | Vice President of Environmental, Health and Safety | ||||

ITEM 1A. |

RISK FACTORS. |

| • | reductions in state-based Environmental Attribute premiums associated with reduced volumes in the transportation sector; |

| • | new “shelter-in-place” orders, quarantines or similar orders, which may reduce our operating effectiveness or the availability of personnel necessary to conduct our business activities; |

| • | disruptions in our supply chain due to transportation delays, travel restrictions, raw material cost increases and shortages, closures of businesses or facilities, and the associated costs and inflation related thereto; |

| • | delays in construction and other capital expenditure projects, regulatory approvals and collections of our receivables for the services we perform; |

| • | attempts by customers to cancel or delay projects or for customers or subcontractors to invoke force majeure clauses in certain contracts resulting in a decreased or delayed demand for our products and services; |

| • | the inability of a significant portion of our workforce, including our management team, to work as a result of illness or government restrictions; and |

| • | reduced ability to access capital and limited availability of credit or financing upon acceptable terms or at all. |

| • | affect the availability of qualified personnel; |

| • | reduce our ability to access capital and limited availability of credit or financing upon acceptable terms or at all; |

| • | affect our ability to accurately forecast demand for our products; and |

| • | cause other unpredictable events. |

| • | regulatory changes that affect the demand for or supply of Environmental Attributes and the prices thereof, which could have a significant effect on the financial performance of our projects and the number of potential projects with attractive economics; |

| • | changes in energy commodity prices, such as natural gas and wholesale electricity prices, which could have a significant effect on our revenues; |

| • | changes in pipeline gas quality standards or other regulatory changes that may limit our ability to transport RNG on pipelines for delivery to third parties or increase the costs of processing RNG to allow for such deliveries; |

| • | changes in the broader waste collection industry, including changes affecting the waste collection and biogas potential of the landfill industry, which could impede the LFG resource that we currently target for our projects; |

| • | substantial construction risks, including the risk of delay, that may arise due to forces outside of our control, including those related to engineering and environmental problems, as a result of inclement weather or labor disruptions; |

| • | operating risks and the effect of disruptions on our business, including the effects of global health crises such as the COVID-19 pandemic, weather conditions, catastrophic events such as fires, explosions, earthquakes, droughts and acts of terrorism, and other force majeure events on us, our customers, suppliers, distributors and subcontractors; |

| • | the ability to obtain financing for a project on acceptable terms or at all and the need for substantially more capital than initially budgeted to complete projects and exposure to liabilities as a result of unforeseen environmental, construction, technological or other complications; |

| • | entering into markets where we have less experience, such as our projects for biogas recovery at livestock farms; |

| • | the need for substantially more capital to complete projects than initially budgeted and exposure to liabilities as a result of unforeseen environmental, construction, technological or other complications; |

| • | failures or delays in obtaining desired or necessary land rights, including ownership, leases, easements, zoning rights and building permits; |

| • | a decrease in the availability, pricing and timeliness of delivery of raw materials and components, necessary for the projects to function; |

| • | obtaining and keeping in good standing permits, authorizations and consents from local city, county, state and U.S. federal governments as well as local and U.S. federal governmental organizations; |

| • | penalties, including potential termination, under short-term and long-term contracts for failing to deliver RNG in accordance with our contractual obligations; |

| • | unknown regulatory changes RNG which may increase the transportation cost for delivering under contracts in place; |

| • | the consent and authorization of local utilities or other energy development off-takers to ensure successful interconnection to energy grids to enable power sales; and |

| • | difficulties in identifying, obtaining and permitting suitable sites for new projects. |

| • | cost-effectiveness of renewable energy technologies as compared with conventional and competitive technologies; |

| • | performance and reliability of renewable energy products as compared with conventional and non-renewable products; |

| • | fluctuations in economic and market conditions that impact the viability of conventional and competitive alternative energy sources; |

| • | increases or decreases in the prices of oil, coal and natural gas; |

| • | continued deregulation of the electric power industry and broader energy industry; and |

| • | availability or effectiveness of government subsidies and incentives. |

| • | difficulties in identifying, obtaining and permitting suitable sites for new projects; |

| • | failure to obtain all necessary rights to land access and use; |

| • | assumptions with respect to the cost and schedule for completing construction; |

| • | assumptions with respect to the biogas potential, including quality, volume, and asset life, for new projects; |

| • | the ability to obtain financing for a project on acceptable terms or at all; |

| • | delays in deliveries or increases in the prices of equipment; |

| • | permitting and other regulatory issues, license revocation and changes in legal requirements; |

| • | increases in the cost of labor, labor disputes and work stoppages; |

| • | failure to receive quality and timely performance of third-party services; |

| • | unforeseen engineering and environmental problems; |

| • | cost overruns; |

| • | accidents involving personal injury or the loss of life; and |

| • | weather conditions, global health crises such as the COVID-19 pandemic, catastrophic events, including fires, explosions, earthquakes, droughts and acts of terrorism, and other force majeure events. |

| • | the purchase prices we pay could significantly deplete our cash reserves or result in dilution to our existing stockholders; |

| • | we may find that the acquired companies or assets do not improve our customer offerings or market position as planned; |

| • | we may have difficulty integrating the operations and personnel of the acquired companies; |

| • | key personnel and customers of the acquired companies may terminate their relationships with the acquired companies as a result of or following the acquisition; |

| • | we may experience additional financial and accounting challenges and complexities in areas such as tax planning and financial reporting; |

| • | we may experience delays in construction and development or regulatory approvals impacting of our Pico or Montauk Ag development cycle; |

| • | we may incur additional costs and expenses related to inflation, complying with additional laws, rules or regulations in new jurisdictions; |

| • | we may assume or be held liable for risks and liabilities (including for environmental-related costs) as a result of our acquisitions, some of which we may not discover during our due diligence or adequately adjust for in our acquisition arrangements; |

| • | our ongoing business and management’s attention may be disrupted or diverted by transition or integration issues and the complexity of managing geographically diverse enterprises; |

| • | we may incur one-time write-offs or restructuring charges in connection with an acquisition; |

| • | we may acquire goodwill and other intangible assets that are subject to amortization or impairment tests, which could result in future charges to earnings; and |

| • | we may not be able to realize the cost savings or other modeled financial benefits we anticipated. |

| • | as of the end of each fiscal quarter, a fixed charge coverage ratio (meaning as of any date of determination, the ratio of (a) Consolidated EBITDA (as defined in the Amended Credit Agreement) for the applicable measuring period ending on such date of determination, minus taxes paid in cash during such period, minus Tax Distributions (as defined in the Amended Credit Agreement) made on a consolidated basis (other than the excluded entities) during such period, minus consolidated maintenance capital expenditures (other than the excluded entities) during such period, to (b) Fixed Charges (as defined in the Amended Credit Agreement) for such period) of at least 1.20 to 1.00; and |

| • | as of the end of each fiscal quarter, a total leverage ratio (meaning as of any date of determination, the ratio of (a) Funded Debt (as defined in the Amended Credit Agreement) on a consolidated basis (other than the excluded entities) on such date to (b) Consolidated EBITDA (as defined in the Amended Credit Agreement) for the four preceding fiscal quarters then ending, all as determined on a consolidated basis in accordance with GAAP of not more than 3.50 to 1.00 as of the end of any fiscal quarter from December 31, 2021 through June 29, 2023, 3.25 to 1.00 as of the end of any fiscal quarter from June 30, 2023 through June 29, 2024, and 3.00 to 1.00 as of the end of any fiscal quarter from June 30, 2024 and thereafter. |

| • | actual or anticipated fluctuations in our operating results due to factors related to our businesses; |

| • | success or failure of our business strategies; |

| • | our quarterly or annual earnings or those of other companies in our industries; |

| • | our ability to obtain financing as needed; |

| • | announcements by us or our competitors of significant acquisitions or dispositions; |

| • | changes in accounting standards, policies, guidance, interpretations or principles; |

| • | the failure of securities analysts to cover our common stock; |

| • | changes in earnings estimates by securities analysts or our ability to meet those estimates; |

| • | the operating and stock price performance of other comparable companies; |

| • | investor perception of our company or our industry; |

| • | overall market fluctuations; |

| • | results from any material litigation or government investigation; |

| • | changes in senior management or key personnel; |

| • | changes in laws and regulations (including energy, environmental and tax laws and regulations) affecting our business; |

| • | natural disasters, health-related crises, and weather conditions disrupting our business operations; |

| • | the trading volume of our common stock; |

| • | changes in capital gains taxes and taxes on dividends affecting stockholders; |

| • | identification of material weaknesses or otherwise failing to maintain effective internal controls; and |

| • | changes in the anticipated future growth rate of our business. |

| • | a board that is composed of a majority of “independent directors,” as defined under the Nasdaq rules; |

| • | a compensation committee that is composed entirely of independent directors; and |

| • | director nominations that are made, or recommended to the full board of directors, by its independent directors, or by a nominations/governance committee that is composed entirely of independent directors. |

ITEM 1B. |

UNRESOLVED STAFF COMMENTS. |

ITEM 2. |

PROPERTIES. |

ITEM 3. |

LEGAL PROCEEDINGS. |

ITEM 4. |

MINE SAFETY DISCLOSURES. |

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

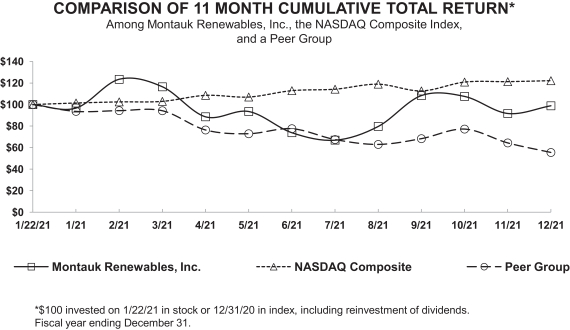

1/22/21 |

1/21 |

2/21 |

3/21 |

4/21 |

5/21 |

6/21 |

7/21 |

8/21 |

9/21 |

10/21 |

11/21 |

12/21 |

||||||||||||||||||||||||||||||||||||||||

| Montauk Renewables, Inc. |

100.00 | 96.72 | 123.43 | 116.49 | 88.62 | 93.54 | 73.87 | 66.92 | 79.65 | 108.29 | 107.52 | 91.71 | 98.84 | |||||||||||||||||||||||||||||||||||||||

| NASDAQ Composite |

100.00 | 101.44 | 102.47 | 102.95 | 108.55 | 106.98 | 112.92 | 114.26 | 118.92 | 112.66 | 120.88 | 121.28 | 122.18 | |||||||||||||||||||||||||||||||||||||||

| Peer Group |

100.00 | 93.65 | 94.33 | 94.26 | 76.36 | 72.87 | 77.55 | 67.46 | 62.92 | 68.28 | 77.19 | 64.34 | 55.44 | |||||||||||||||||||||||||||||||||||||||

ITEM 6. |

RESERVED |

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

| • | Regulatory or policy initiatives, including the federal RFS program and state-level low-carbon fuel programs in states such as California and Oregon, that drive demand for RNG and its derivative Environmental Attributes (as further described below). |

| • | Efficiency, mobility and capital cost flexibility in RNG operations enable it to compete successfully in multiple markets. Our operating model is nimble, as we commonly use modular equipment; our RNG processing equipment is more efficient than its fossil-fuel correlates. |

| • | Demand for compressed natural gas (“CNG”) from natural gas-fueled vehicles. The RNG we create is pipeline-quality and can be used for transportation fuel when converted to CNG. CNG is commonly used by medium-duty fleets that are close to fueling stations, such as city fleets, local delivery trucks and waste haulers. |

| • | Regulatory requirements, market pressure and public relations challenges increase the time, cost and difficulty of permitting new fossil fuel-fired facilities. |

| • | Impact of Higher Selling, General and Administrative Expenses Prior to the Commencement of a Project’s Operation: We incur significant expenses in the development of new RNG projects. Further, the receipt of RINs is delayed, and typically does not commence for a period of four to six months after the commencement of injecting RNG into a pipeline, pending final registration approval of the project by the EPA and then the subsequent completion of a third-party quality assurance plan certification. During such time, the RNG is either physically or theoretically stored and later withdrawn from storage to allow for the generation of RINs. |

| • | Shifts in Revenue Composition for Projects from New Fuel Sources: As we expand into livestock farm projects, our revenue composition from Environmental Attributes will change. We believe that livestock farms offer us a lucrative opportunity, as the value of LCFS credits for dairy farm projects, for example, are |

a multiple of those realized from landfill projects due to the significantly more attractive CI score of livestock farms. |

| • | Incurrence of Expenses Associated with Pursuing Prospective Projects That Do Not Come to Fruition: We incur expenses to pursue prospective projects with the goal of a site host accepting our proposal or being awarded a project in a competitive bidding process. Historically, we have evaluated opportunities which we decided not to pursue further due to the prospective project not meeting our internal investment thresholds or a lack of success in a competitive bidding process. To the extent we seek to pursue a greater number of projects or bidding for projects becomes more competitive, our expenses may increase. |

| • | Renewable Natural Gas Revenues: off-take counterparties as consideration for such counterparties using the RNG as a transportation fuel. We monetize a portion of our RNG production under fixed-price and counterparty sharing agreements, which provide floor prices in excess of commodity indices and sharing percentages of the monetization of Environmental Attributes. Under these sharing arrangements, we receive a portion of the profits derived from counterparty monetization of the Environmental Attributes in excess of the floor prices. These arrangements are currently set to expire during 2022 and we are in negotiations to replace these arrangements. |

| • | Renewable Electricity Generation Revenues: |

| • | Corporate Revenues: |

| • | A 2021 cold weather event impacted our Atascocita, Galveston, McCarty, and Coastal Plains facilities located in Texas. Production at these facilities was temporarily idled due to the loss of power from February 14 through February 20, 2021 and force majeure events were declared by certain of our counter-parties or by us for the period February 12 through February 22, 2021 related to these weather events. Operations at these facilities have subsequently resumed. |

| • | The landfill host at our McCarty facility recently changed its wellfield collection system which has contributed to elevated nitrogen in the feedstock received by our facility. Additionally, the landfill host modified the wellfield bifurcation approach which has impacted the quantity of feedstock received at the facility. We are working with the landfill host but have currently experienced lower volumes of feedstock available to be processed at the McCarty facility. We expect lower than historical volumes through 2022. |

| • | Our Pico facility has resumed operations and we expect all ramp up activities to be completed by the second quarter of 2022. Our improvement project has impacted the timeline related to modeling the CI Score pathway model. 2022 production will be stored until CARB completes its CI Score Pathway. We do not currently expect to receive LCFS credit revenue on 2022 production until 2023. |

| • | Quality of Biogas: |

| • | RNG Production from Our Growth Projects: |

| • | Project Operating and Maintenance Expenses: |

| • | Royalties, Transportation, Gathering and Production Fuel Expenses: |

| • | General and Administrative Expenses: |

| • | Depreciation and Amortization: |

| • | Impairment Loss: |

| • | Transaction Costs: |

| • | Production Volumes: |

| • | Production of Environmental Attributes: |

| • | Average realized price per unit of production: |

(in thousands, unless otherwise indicated) |

For the year ended December 31, |

|||||||||||||||

2021 |

2020 |

Change |

Change% |

|||||||||||||

Revenues |

||||||||||||||||

Renewable Natural Gas Total Revenues |

$ | 131,803 | $ | 83,236 | $ | 48,567 | 58.3 | % | ||||||||

Renewable Electricity Generation Total Revenues |

$ | 15,449 | $ | 16,665 | $ | (1,216 | ) | (7.3 | )% | |||||||

RNG Metrics |

||||||||||||||||

CY RNG production volumes (MMBtu) |

5,688 | 5,746 | (58 | ) | (1.0 | )% | ||||||||||

Less: Current period RNG volumes under fixed/floor-price contracts |

(1,596 | ) | (2,009 | ) | 413 | (20.5 | )% | |||||||||

Plus: Prior period RNG volumes dispensed in current period |

353 | 266 | 87 | 32.7 | % | |||||||||||

Less: Current period RNG production volumes not dispensed |

(372 | ) | (353 | ) | (19 | ) | 5.4 | % | ||||||||

Total RNG volumes available for RIN generation(1) |

4,073 | 3,650 | 423 | 11.6 | % | |||||||||||

RIN Metrics |

||||||||||||||||

Current RIN generation ( x 11.727)(2) |

47,758 | 42,809 | 4,949 | 11.8 | % | |||||||||||

Less: Counterparty share (RINs) |

(5,124 | ) | (4,701 | ) | (423 | ) | 9.0 | % | ||||||||

Plus: Prior period RINs carried into CY |

110 | 1,330 | (1,220 | ) | (91.7 | )% | ||||||||||

Less: CY RINs carried into next CY |

(140 | ) | (99 | ) | (41 | ) | 41.4 | % | ||||||||

Total RINs available for sale(3) |

42,604 | 39,339 | 3,265 | 8.3 | % | |||||||||||

Less: RINs sold |

(42,604 | ) | (39,335 | ) | (3,269 | ) | 8.3 | % | ||||||||

RIN Inventory |

0 | 3 | (3 | ) | (100.0 | )% | ||||||||||

RNG Inventory (volumes not dispensed for RINs)(4) |

372 | 352 | 20 | 5.7 | % | |||||||||||

Average Realized RIN price |

$ | 1.91 | $ | 1.31 | $ | 0.60 | 45.8 | % | ||||||||

Operating Expenses |

||||||||||||||||

Renewable Natural Gas Operating Expenses |

$ | 65,046 | $ | 50,092 | $ | 14,954 | 29.9 | % | ||||||||

Operating Expenses per MMBtu (actual) |

$ | 11.44 | $ | 8.72 | $ | 2.72 | 31.2 | % | ||||||||

Renewable Electricity Generation Operating Expenses |

$ | 12,177 | $ | 11,555 | $ | 622 | 5.4 | % | ||||||||

$/MWh (actual) |

$ | 66.56 | $ | 62.13 | $ | 4.43 | 7.1 | % | ||||||||

Other Metrics |

||||||||||||||||

Renewable Electricity Generation Volumes Produced (MWh) |

183 | 186 | (3 | ) | (1.6 | )% | ||||||||||

Average Realized Price $/MWh (actual) |

$ | 84.45 | $ | 89.60 | $ | (5.15 | ) | (5.7 | )% | |||||||

| (1) | RINs are generated in the month that the gas dispensed to generate RINs, which occurs the month after the gas is produced. Volumes under fixed/floor-price arrangements generate RINs which we do not self-market. |

| (2) | One MMBtu of RNG has the same energy content as 11.727 gallons of ethanol, and thus may generate 11.727 RINs under the RFS program. |

| (3) | Represents RINs available to be self-marketed by us during the reporting period. |

| (4) | Represents gas production which has not been dispensed to generate RINs. |

(in thousands, except per share data) |

For the year ended December 31, |

|||||||||||||||||||

2021 |

2020 |

Change |

Change% |

|||||||||||||||||

Total operating revenues |

$ | 148,127 | $ | 100,383 | $ | 47,744 | 47.5 | % | ||||||||||||

Operating Expenses: |

||||||||||||||||||||

Operating and maintenance expenses |

49,477 | 43,463 | 6,014 | 13.8 | % | |||||||||||||||

General and administrative expenses |

42,552 | 16,594 | 25,958 | 156.4 | % | |||||||||||||||

Royalties, transportation, gathering and production fuel |

28,683 | 18,284 | 10,399 | 56.9 | % | |||||||||||||||

Depreciation and amortization |

22,869 | 22,117 | 752 | 3.4 | % | |||||||||||||||

Gain on insurance proceeds |

(332 | ) | (3,934 | ) | 3,602 | (91.6 | )% | |||||||||||||

Impairment loss |

1,191 | 278 | 913 | 328.4 | % | |||||||||||||||

Transaction costs |

352 | — | 352 | 0 | % | |||||||||||||||

Total operating expenses |

$ | 144,792 | $ | 96,802 | $ | 47,990 | 49.6 | % | ||||||||||||

Operating profit |

$ | 3,335 | $ | 3,581 | $ | (246 | ) | (6.9 | )% | |||||||||||

Other expenses: |

3,702 | 4,974 | (1,272 | ) | (25.6 | )% | ||||||||||||||

Income tax expense (benefit) |

4,161 | (5,996 | ) | 10,157 | (169.4 | )% | ||||||||||||||

Net (loss) income |

$ | (4,528 | ) | $ | 4,603 | $ | (9,131 | ) | (198.4 | )% | ||||||||||

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

Net (loss) income |

$ |

(4,528 |

) |

$ |

4,603 |

|||

Depreciation and amortization |

22,869 |

22,117 |

||||||

Interest expense |

2,928 |

4,339 |

||||||

Income tax expense (benefit) |

4,161 |

(5,996 |

) | |||||

Consolidated EBITDA |

25,430 |

25,063 |

||||||

Impairment loss(1) |

1,191 |

278 |

||||||

Transaction costs |

352 |

— |

||||||

Loss on extinguishment of debt |

154 |

— |

||||||

Net loss on sale of assets |

822 |

320 |

||||||

Non-cash hedging charges |

— |

388 |

||||||

Adjusted EBITDA |

$ |

27,949 |

$ |

26,049 |

||||

(1) |

For the year ended December 31, 2021, we recorded an impairment of $626 related to a landfill host request to decommission a previously converted RNG site. We were previously contractually obligated to maintain this facility. Additionally, we impaired $421 related to disposal of machinery at our Rumpke facility. For year ended December 31, 2020, we recorded an impairment of $278 termination of a development agreement related to our Pico project. |

December 31, 2021 |

December 31, 2020 |

|||||||

Term Loans |

$ |

80,000 |

$ |

30,000 |

||||

Revolving Credit Facility |

— |

36,697 |

||||||

Debt before debt issuance costs |

$ |

80,000 |

$ |

66,697 |

||||

• |

a Total Leverage Ratio (as defined in the Amended Credit Agreement) of not more than 3.50 to 1.00 as of the end of any fiscal quarter from December 31, 2021 through June 29, 2023, 3.25 to 1.00 as of the end of any fiscal quarter from June 30, 2023 through June 29, 2024, and 3.00 to 1.00 as of the end of any fiscal quarter from June 30, 2024 and thereafter.; and |

• |

as of the end of each fiscal quarter, a Fixed Charge Coverage Ratio (as defined in the Amended Credit Agreement) of not less than 1.2 to 1.0. |

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

Net cash flows provided by operating activities |

$ |

42,879 |

$ |

28,684 |

||||

Net cash flows used in investing activities |

(19,474 |

) |

(15,987 |

) | ||||

Net cash flows provided by (used in) financing activities |

8,649 |

(1,500 |

) | |||||

Net increase in cash and cash equivalents |

32,054 |

11,197 |

||||||

Restricted cash, end of period |

347 |

567 |

||||||

Cash and cash equivalents and restricted, end of period |

53,613 |

21,559 |

||||||

ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

Page |

||||||

Montauk Renewables, Inc. |

||||||

Audited Consolidated Financial Statements |

||||||

71 |

||||||

72 |

||||||

73 |

||||||

74 |

||||||

75 |

||||||

76 |

||||||

(in thousands): |

As of December 31, |

|||||||

2021 |

2020 |

|||||||

| ASSETS |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | $ | ||||||

| Accounts and other receivables, net |

||||||||

| Related party receivable |

— |

|||||||

| Prepaid expenses and other current assets |

||||||||

| Assets held for sale |

— |

|||||||

| |

|

|

|

|||||

| Total current assets |

$ | $ | ||||||

| Non-current restricted cash |

$ | $ | ||||||

| Property, plant & equipment, net |

||||||||

| Goodwill and intangible assets, net |

||||||||

| Deferred tax assets |

||||||||

| Operating lease right-of-use |

||||||||

| Other assets |

||||||||

| |

|

|

|

|||||

| Total assets |

$ |

$ |

||||||

| |

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ AND MEMBER’S EQUITY |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | $ | ||||||

| Accrued liabilities |

||||||||

| Current portion of operating lease liability |

||||||||

| Current portion of derivative instruments |

||||||||

| Current portion of long-term debt |

||||||||

| |

|

|

|

|||||

| Total current liabilities |

$ | $ | ||||||

| Long-term debt, less current portion |

$ | $ | ||||||

| Non-current portion of operating lease liability |

||||||||

| Non-current portion of derivative instruments |

||||||||

| Asset retirement obligation |

||||||||

| Other liabilities |

||||||||

| |

|

|

|

|||||

| Total liabilities |

$ | $ | ||||||

| Member’s equity |

$ | — |

$ | |||||

| Common stock , $ |

— |

|||||||

| Treasury stock , at cost, |

( |

) | — |

|||||

| Additional paid-in capital |

— |

|||||||

| Retained deficit |

( |

) | — |

|||||

| |

|

|

|

|

|

|

|

|

| Total stockholders’ member’s equity |

||||||||

| |

|

|

|

|||||

| Total liabilities and stockholders’ and member’s equity |

$ |

$ |

||||||

| |

|

|

|

|||||

(in thousands except per share values): |

For the year ended December 31, |

|||||||||||

2021 |

2020 |

2019 |

||||||||||

| Total operating revenues |

$ | $ | $ | |||||||||

| Operating expenses: |

||||||||||||

| Operating and maintenance expenses |

$ | $ | $ | |||||||||

| General and administrative expenses |

||||||||||||

| Royalties, transportation, gathering and production fuel |

||||||||||||

| Depreciation and amortization |

||||||||||||

| Gain on insurance proceeds |

( |

) | ( |

) | — | |||||||

| Impairment loss |

||||||||||||

| Transaction costs |

— | |||||||||||

| |

|

|

|

|

|

|||||||

| Total operating expenses |

$ | $ | $ | |||||||||

| Operating profit |

$ | $ | $ | |||||||||

| Other expenses (income): |

||||||||||||

| Interest expense |

$ | $ | $ | |||||||||

| Loss on extinguishment of debt |

— | — | ||||||||||

| Net loss on sale of assets |

||||||||||||

| Other (income) expense |

( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|||||||

| Total other expenses |

$ | $ | $ | |||||||||

| (Loss) income before income taxes |

$ | ( |

) | $ | ( |

) | $ | |||||

| Income tax expense (benefit) |

( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|||||||

| Net (loss) income |

$ | ( |

) | $ | $ | |||||||

| |

|

|

|

|

|

|||||||

| Loss per share: |

||||||||||||

| Basic |

$ |

( |

) |

|||||||||

| Diluted |

$ |

( |

) |

|||||||||

| Weighted-average common shares outstanding |

||||||||||||

| Basic |

||||||||||||

| Diluted |

||||||||||||

Common Stock |

Treasury Stock |

Member’s Equity |

Additional Paid-in Capital |

Retained Deficit |

Total Equity |

|||||||||||||||||||||||||||

Shares |

Amount |

Shares |

Amount |

|||||||||||||||||||||||||||||

| Balance at December 31, 2018 |

— |

$ |

— |

— |

$ |

— |

$ |

$ |

— |

$ |

— |

$ |

||||||||||||||||||||

| Net income |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||

| Stock-based compensation |

— |

— |

— |

— |

||||||||||||||||||||||||||||

| Dividends |

— |

— |

— |

— |

( |

) |

— |

— |

( |

) | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at December 31, 2019 |

— |

— |

— |

— |

$ |

$ |

— |

$ |

— |

$ |

||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||

| Stock-based compensation |

— |

— |

— |

— |

— |

— |

||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at December 31, 2020 |

— |

$ |

— |

— |

$ |

— |

$ |

— |

— |

$ |

||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Effect of reorganization transactions |

— | — | ( |

) | — | — | ||||||||||||||||||||||||||

| IPO common stock |

— | — | — | — | ||||||||||||||||||||||||||||

| Treasury stock |

— | — | ( |

) | — | — | — | ( |

) | |||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | ( |

) | ( |

) | ||||||||||||||||||||||

| Stock-based compensation |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at December 31, 2021 |

$ |

$ |

( |

) |

$ |

$ |

$ |

( |

) |

$ |

||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

(in thousands): |

For the year ended December 31, |

|||||||||||

2021 |

2020 |

2019 |

||||||||||

Cash flows from operating activities: |

||||||||||||

Net (loss) income |

$ | ( |

) | $ | $ | |||||||

Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||

Depreciation, depletion and amortization |

||||||||||||

Provision (benefit) for deferred income taxes |

( |

) | ( |

) | ||||||||

Loss on extinguishment of debt |

— | — | ||||||||||

Stock-based compensation |

||||||||||||

Related party receivables |

— | — | ||||||||||

Gain on property insurance proceeds |

( |

) | ( |

) | — | |||||||

Derivative mark-to-market |

( |

) | ||||||||||

Net (gain) |

( |

) | ||||||||||

Loss on earn-out liability increase |

— | — | ||||||||||

Accretion of asset retirement obligations |

( |

) | ||||||||||

Amortization of debt issuance costs |

||||||||||||

Equity (income) of nonconsolidated investments |

— | — | ( |

) | ||||||||

Impairment loss |

||||||||||||

Accounts and other receivables and other current assets |

( |

) | ( |

) | ||||||||

Accounts payable and other accrued expenses |

( |

) | ||||||||||

Net cash provided by operating activities |

$ | $ | $ | |||||||||

Cash flows from investing activities |

||||||||||||

Capital expenditures |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

Asset acquisitions |

( |

) | — | — | ||||||||

Cash collateral deposits, net |

( |

) | — | |||||||||

Proceeds from sale of equity method investments |

— | — | ||||||||||

Proceeds from insurance recovery |

||||||||||||

Proceeds from sale of assets |

— | — | ||||||||||

Net cash used in investing activities |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

Cash flows from financing activities: |

||||||||||||

Borrowings of long-term debt |

$ | $ | $ | |||||||||

Repayments of long-term debt |

( |

) | ( |

) | ( |

) | ||||||

Debt issuance costs |

( |

) | — | ( |

) | |||||||

Debt extinguishment costs |

( |

) | — | — | ||||||||

Proceeds from initial public offering |

— | — | ||||||||||

Treasury stock purchase |

( |

) | — | — | ||||||||

Related party receivable |

( |

) | — | — | ||||||||

Class B shareholder repurchase |

— | — | ( |

) | ||||||||

Net cash provided by (used in) financing activities |

$ | $ | ( |

) | $ | ( |

) | |||||

Net increase or decrease in cash and cash equivalents and restricted cash |

$ | $ | $ | ( |

) | |||||||

Cash and cash equivalents and restricted cash at beginning of year |

$ | $ | $ | |||||||||

Cash and cash equivalents and restricted cash at end of year |

$ | $ | $ | |||||||||

Reconciliation of cash, cash equivalents, and restricted cash at end of year: |

||||||||||||

Cash and cash equivalents |

$ | $ | $ | |||||||||

Restricted cash and cash equivalents-current |

||||||||||||

Restricted cash and cash equivalents-non-current |

||||||||||||

| $ | $ | $ | ||||||||||

Supplemental cash flow information: |

||||||||||||

Cash paid for interest (net of amounts capitalized) |

||||||||||||

Cash paid (refunded) for income taxes |

( |

) | ||||||||||

| Buildings and improvements |

||||

| Machinery and equipment |

||||

| Gas mineral rights |

| Interconnection |

||

| Customer contracts |

||

| Emissions allowances |

||

| Land use rights |

Year Ended December 31, 2021 |

||||||||||||

Goods transferred at a point in time |

Goods Transferred over time |

Total |

||||||||||

| Major Goods/Service Line: |

||||||||||||

| Natural Gas Commodity |

$ | $ | $ | |||||||||

| Natural Gas Environmental Attributes |

— | |||||||||||

| Electric Commodity |

— | |||||||||||

| Electric Environmental Attributes |

— | |||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| Operating Segment: |

||||||||||||

| RNG |

$ | $ | $ | |||||||||

| REG |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

Year Ended December 31, 2020 |

||||||||||||

Goods transferred at a point in time |

Goods Transferred over time |

Total |

||||||||||

| Major Goods/Service Line: |

||||||||||||

| Natural Gas Commodity |

$ | $ | $ | |||||||||

| Natural Gas Environmental Attributes |

— | |||||||||||

| Electric Commodity |

— | |||||||||||

| Electric Environmental Attributes |

— | |||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| Operating Segment: |

||||||||||||

| RNG |

$ | $ | $ | |||||||||

| REG |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

Year Ended December 31, 2019 |

||||||||||||

Goods transferred at a point in time |

Goods transferred over time |

Total |

||||||||||

| Major Goods/Service Line: |

||||||||||||

| Natural Gas Commodity |

$ | $ | $ | |||||||||

| Natural Gas Environmental Attributes |

— | |||||||||||

| Electric Commodity |

— | |||||||||||

| Electric Environmental Attributes |

— | |||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| Operating Segment: |

||||||||||||

| RNG |

$ | $ | $ | |||||||||

| REG |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Accounts receivables |

$ | $ | ||||||

| Other receivables |

||||||||

| Reimbursable expenses |

||||||||

| |

|

|

|

|||||

| Accounts and Other Receivables, Net |

$ | |

$ | |

||||

| |

|

|

|

|||||

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Land |

$ | $ | — | |||||

| Buildings and improvements |

||||||||

| Machinery and equipment |

||||||||

| Gas mineral rights |

||||||||

| Construction work in progress |

||||||||

| |

|

|

|

|||||

| Total |

||||||||

| Less: Accumulated depreciation and amortization |

( |

( |

) | |||||

| |

|

|

|

|||||

| Property, Plant & Equipment, Net |

$ | $ | ||||||

| |

|

|

|

|||||

Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Goodwill |

$ | $ | ||||||

| Intangible assets with indefinite lives: |

||||||||

| Emissions allowances |

$ | $ | ||||||

| Land use rights |

||||||||

| |

|

|

|

|||||

| Total intangible assets with indefinite lives: |

$ | $ | ||||||

| |

|

|

|

|||||

| Intangible assets with finite lives: |

||||||||

| Interconnection, net of accumulated amortization of $ |

$ | |||||||

| Customer contracts, net of accumulated amortization of $ |

$ | |||||||

| |

|

|

|

|||||

| Total intangible assets with finite lives: |

$ | $ | ||||||

| |

|

|

|

|||||

| Total Goodwill and Intangible Assets |

$ |

$ |

||||||

| |

|

|

|

|||||

Customer Contracts |

Inter- Connections |

|||||||

| Year Ending |

||||||||

| 2022 |

$ | $ | ||||||

| 2023 |

||||||||

| 2024 |

||||||||

| 2025 |

||||||||

| 2026 |

||||||||

| Thereafter |

||||||||

Year ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Asset retirement obligations—beginning of year |

$ | $ | $ | |||||||||

| Accretion expense |

( |

) | ||||||||||

| New asset retirement obligations |

||||||||||||

| Decommissioning |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Asset retirement obligations—end of year |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

Year Ended December 31, |

||||||||||||||

| Derivative Instrument |

Location |

2021 |

2020 |

2019 |

||||||||||

| Commodity Contracts: |

||||||||||||||

| Realized Natural Gas |

Gas commodity sales | $ | $ | $ | ||||||||||

| Unrealized Natural Gas |

Other income | ( |

) | |||||||||||

| Interest Rate Swaps |

Interest expense | ( |

) | ( |

) | |||||||||

| |

|

|

|

|

|

|||||||||

| Net gain (loss) |

$ | $ | ( |

) | $ | |||||||||

| |

|

|

|

|

|

|||||||||

December 31, 2021 |

||||||||||||||||

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||

| Interest rate swap derivative liabilities |

$ | $ | ( |

) | $ | $ | ( |

) | ||||||||

| Asset retirement obligations |

( |

) | ( |

) | ||||||||||||

| Pico earn-out liability |

( |

) | ( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| $ | $ | ( |

) | $ | ( |

) | $ | ( |

) | |||||||

| |

|

|

|

|

|

|

|

|||||||||

December 31, 2020 |

||||||||||||||||

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||

| Current commodity derivative asset |

$ | $ | ( |

) | $ | $ | ( |

) | ||||||||

| Asset retirement obligations |

( |

) | ( |

) | ||||||||||||

| Pico earn-out liability |

( |

) | ( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| $ | $ | ( |

) | $ | ( |

) | $ | ( |

) | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Year ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Accrued expenses |

$ | $ | ||||||

| Payroll and related benefits |

||||||||

| Royalty |

||||||||

| Utility |

||||||||

| Other |

||||||||

| |

|

|

|

|||||

| Accrued Liabilities |

$ | $ | ||||||

| |

|

|

|

|||||

Year ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Term Loans |

$ | $ | ||||||

| Revolving credit facility |

||||||||

| Less: current principal maturities |

( |

) | ( |

) | ||||

| Less: debt issuance costs (on long-term debt) |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Long-term Debt |

$ | $ | ||||||

| Current Portion of Long- term Debt |

||||||||

| |

|

|

|

|||||

$ |

$ |

|||||||

| |

|

|

|

|||||

| Year Ending |

Amount |

|||

| 2022 |

$ | |||

| 2023 |

||||

| 2024 |

||||

| 2025 |

||||

| 2026 |

||||

| |

|

|||

| Total |

$ | |||

| |

|

|||

Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Current expense (benefit): |

||||||||||||

| Federal |

$ |

$ |

$ |

|||||||||

| State |

( |

) |

||||||||||

| |

|

|

|

|

|

|||||||

$ |

( |

) |

$ |

$ |

||||||||

| |

|

|

|

|

|

|||||||

| Deferred expense (benefit): |

||||||||||||

| Federal |

$ |

$ |

( |

) |

$ |

( |

) | |||||

| State |

( |

) |

( |

) | ||||||||

| |

|

|

|

|

|

|||||||

$ |

$ |

( |

) |

$ |

( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Income Tax Expense (Benefit) |

$ |

$ |

( |

) |

$ |

( |

) | |||||

| |

|

|

|

|

|

|||||||

Year ended December 31, |

||||||||

2021 |

2020 |

|||||||

| Deferred tax assets: |

||||||||

| Net operating los s carry forwards |

$ | $ | ||||||

| Federal tax credits |

||||||||

| Book reserves |

||||||||

| Intangible asset amortization |

||||||||

| Other |

||||||||

| |

|

|

|

|||||

| Total Deferred Tax Assets |

||||||||

| Less: valuation allowance |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net deferred tax assets |

$ | $ | ||||||

| |

|

|

|

|||||

| Deferred tax liabilities: |

||||||||

| Property depreciation |

$ | ( |

) | $ | ( |

) | ||

| Stock compensation |

|

|

( |

) |

|

|

— |

|

| |

|

|

|

|||||

| Total deferred tax liabilities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net Deferred Tax Assets |

$ |

$ |

||||||

| |

|

|

|

|||||

Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Tax provision at federal statutory rate of 21% |

$ | ( |

) | $ | ( |

) | $ | |||||

| State tax provision |

( |

) | ( |

) | ||||||||

| Non-controlling interests |

— | — | ||||||||||

| Permanent differences |

— |

— |

| |||||||||

| Stock compensation |

|

|

|

|

|

|

— |

|

|

|

— |

|

| 162(m) Compensation limitation |

— |

— |

| |||||||||

| Valuation allowance |

( |

) | ||||||||||

| Production tax credit |

( |

) | ( |

) | ( |

) | ||||||

| Return to provision |

( |

) | ( |

) | ( |

) | ||||||

| Impact of MEC partnership dissolution |

— |

( |

) | — | ||||||||

| Deferred tax adjustments |

( |

) | — | |||||||||

| Other |

— | ( |

) | |||||||||

| |

|

|

|

|

|

|||||||

| Total Income Tax Expense (Benefit) |

$ |

$ |

( |

) |

$ |

( |

) | |||||

| |

|

|

|

|

|

|||||||

Grant Date |

||||

| Risk-free interest rate |

% | |||

| Expected volatility |

% | |||

| Expected option life (in years) |

||||

| Grant-date fair value |

$ | |||

Restricted Shares |

Restricted Stock Units |

Options |

||||||||||||||||||||||

Number of Shares |

Weighted Average Grant Date Fair Value |

Number of Shares |

Weighted Average Grant Date Fair Value |

Number of Shares |

Weighted Average Exercise Price |

|||||||||||||||||||

| End of period—December 31, 2020 |

— |

$ |

— |

— |

$ |

— |

— |

$ |

— |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Beginning of period—January 1, 2021 |

$ | $ | $ | |||||||||||||||||||||

| Granted |

||||||||||||||||||||||||

| Vested |

( |

) | — | — | ||||||||||||||||||||

| Forfeited |

— | — | ( |

) | ||||||||||||||||||||

| Exercised |

— | — | — | — | — | — | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| End of period—December 31, 2021 |

$ |

$ |

$ |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Options |

Restricted Stock |

|||||||||||||||

Number of Shares |

Weighted Average Exercise Price |

Number of Shares |

Weighted Average Grant Date Fair Value |

|||||||||||||

| End of period—December 31, 2019 |

$ |

$ |

||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Beginning of period—January 1, 2020 |

$ | $ | ||||||||||||||

| Granted |

— | — | ||||||||||||||

| Forfeited |

( |

) | — | — | ||||||||||||

| Exercised |

( |

) | — | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| End of period—December 31, 2020 |

$ |

$ |

||||||||||||||

| Vested and exercisable—December 31, 2020 |

$ |

$ |

||||||||||||||

For the year ended December 31, 2021 |

||||||||||||||||

RNG |

REG |

Corporate |

Total |

|||||||||||||

| Total Revenue |

$ | $ | $ | $ | ||||||||||||

| Net Income (Loss) |

( |

) | ( |

) | ( |

) | ||||||||||

| EBITDA |

( |

) | ||||||||||||||

| Adjusted EBITDA(1) |

( |

) | ||||||||||||||

| Total Assets |

||||||||||||||||

| Capital Expenditure |

||||||||||||||||

| (1) | 2021 EBITDA Reconciliation |

For the year ended December 31, 2021 |

||||||||||||||||

RNG |

REG |

Corporate |

Total |

|||||||||||||

| Net Income (loss) |

$ | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||||

| Depreciation and amortization |

||||||||||||||||

| Interest expense |

— | — | ||||||||||||||

| Income tax expense (benefit) |

— | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| EBITDA |

$ | $ | $ | ( |

) | $ | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Impairment loss |

— | |||||||||||||||

| Net loss of sale of assets |

— | — | ||||||||||||||

| Transaction Costs |

— | — | ||||||||||||||

| Loss on extinguishment of debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ | $ | $ | ( |

) | $ | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

For the year ended December 31, 2020 |

||||||||||||||||

RNG |

REG |

Corporate |

Total |

|||||||||||||

| Total Revenue |

$ | $ | $ | $ | ||||||||||||

| Net Income (Loss) |

( |

) | ( |

) | ||||||||||||

| EBITDA |

( |

) | ||||||||||||||

| Adjusted EBITDA(2) |

( |

) | ||||||||||||||

| Total Assets |

||||||||||||||||

| Capital Expenditure |

||||||||||||||||

(2) |

2020 EBITDA Reconciliation |

For the year ended December 31, 2020 |

||||||||||||||||

RNG |

REG |

Corporate |

Total |

|||||||||||||

| Net Income (loss) |

$ | $ | ( |

) | $ | ( |

) | $ | ||||||||

| Depreciation and amortization |

||||||||||||||||

| Interest expense |

— | — | ||||||||||||||

| Income tax expense (benefit) |

— | ( |

) | ( |

) | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| EBITDA |

$ | $ | $ | ( |

) | $ | ||||||||||

| Impairment loss |

— | — | ||||||||||||||

| Net loss of sale of assets |

— | |||||||||||||||

| Non-cash hedging charges |

— | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

$ | $ | $ | ( |

) | $ | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

For the year ended December 31, 2019 |

||||||||||||||||

RNG |

REG |

Corporate |

Total |

|||||||||||||

| Total Revenue |

$ | $ | $ | $ | ||||||||||||

| Net Income (Loss) |

( |

) | ( |

) | ||||||||||||

| EBITDA |

( |

) | ||||||||||||||

| Adjusted EBITDA(3) |

( |

) | ||||||||||||||

| Total Assets |

||||||||||||||||

| Capital Expenditure |

||||||||||||||||

| (3) | 2019 EBITDA Reconciliation |

For the year ended December 31, 2019 |

||||||||||||||||

RNG |

REG |

Corporate |

Total |

|||||||||||||

| Net Income (loss) |

$ | $ | ( |

) | $ | ( |

) | $ | ||||||||

| Depreciation and amortization |

||||||||||||||||

| Interest expense |

— | |||||||||||||||

| Income tax expense (benefit) |

— | ( |

) | ( |

) | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| EBITDA |

$ | $ | $ | ( |

) | $ | ||||||||||

| Impairment loss |

— | |||||||||||||||

| Transaction Cost |

||||||||||||||||

| Equity gain of nonconsolidated investments |

( |

) | — | — | ( |

) | ||||||||||

| Net loss (gain) of sale of assets |

( |

) | — | |||||||||||||

| Non-cash hedging charges |

— | — | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

$ | $ | $ | ( |

) | $ | ||||||||||

| |

|

|

|

|

|

|